信用证下汇票样本

- 格式:docx

- 大小:164.99 KB

- 文档页数:4

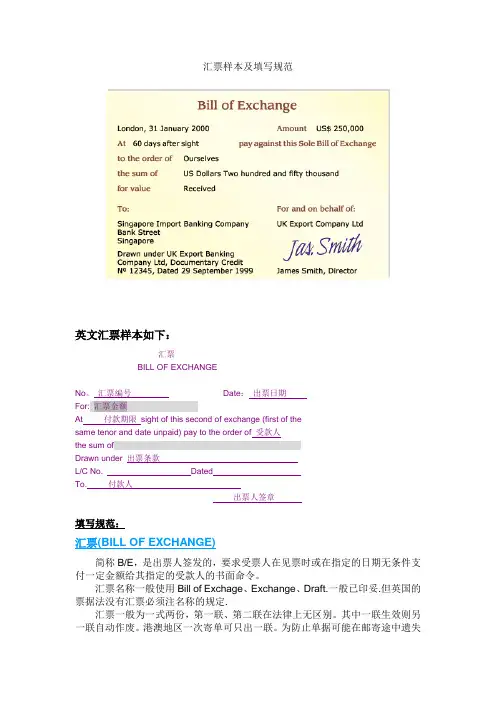

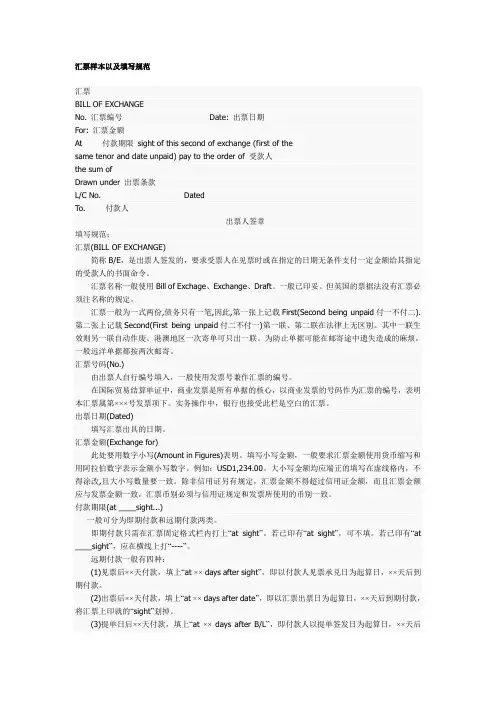

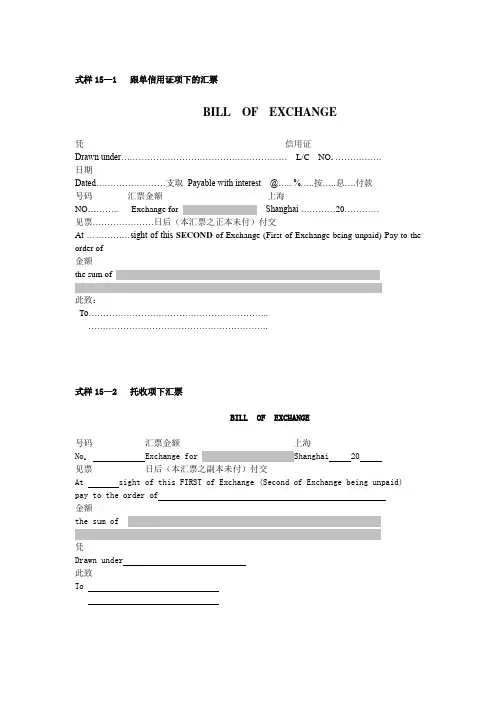

汇票样本及填写规范英文汇票样本如下:汇票BILL OF EXCHANGENo。

汇票编号Date:出票日期For: 汇票金额At 付款期限sight of this second of exchange (first of thesame tenor and date unpaid) pay to the order of 受款人the sum ofDrawn under 出票条款L/C No. DatedTo. 付款人出票人签章填写规范:汇票(BILL OF EXCHANGE)简称B/E,是出票人签发的,要求受票人在见票时或在指定的日期无条件支付一定金额给其指定的受款人的书面命令。

汇票名称一般使用Bill of Exchage、Exchange、Draft.一般已印妥.但英国的票据法没有汇票必须注名称的规定.汇票一般为一式两份,第一联、第二联在法律上无区别。

其中一联生效则另一联自动作废。

港澳地区一次寄单可只出一联。

为防止单据可能在邮寄途中遗失造成的麻烦,一般远洋单据都按两次邮寄。

汇票号码(No.)由出票人自行编号填入,一般使用发票号兼作汇票的编号.在国际贸易结算单证中,商业发票是所有单据的核心,以商业发票的号码作为汇票的编号,表明本汇票属第×××号发票项下.实务操作中,银行也接受此栏是空白的汇票。

出票日期(Dated)填写汇票出具的日期。

汇票金额(Exchange for)此处要用数字小写(Amount in Figures)表明.填写小写金额,一般要求汇票金额使用货币缩写和用阿拉伯数字表示金额小写数字。

例如:USD1,234.00。

大小写金额均应端正的填写在虚线格内,不得涂改,且大小写数量要一致.除非信用证另有规定,汇票金额不得超过信用证金额,而且汇票金额应与发票金额一致,汇票币别必须与信用证规定和发票所使用的币别一致.付款期限(at ____sight.。

.)一般可分为即期付款和远期付款两类。

信用证及票据翻译学院:年级:专业:学号:姓名:一.信用证样本(日本信用证样本)Name of Issuing Bank Place and date of issue The Mitsui Bank Ltd., Tokyo, 3 March, 1999.15 Marunouche 3-Chome, Tokyo Japan To: China National Animal Byproducts This Credit is advised through Imp. And Exp. Corp. Tianjin Branch Bank of China, Tianjin66 Yentai Street, Tianjin, China. Dear Sirs, By order and for account of Tokyo Keyboard Distributers, 12-14 Monmachi 3-Chome, Tokyo, Japan. we hereby issue an Irrevocable Documentary Credit No. 901026 for USD5600.00 (say US dollars five thousand six hundred only ) to expire on 30 June, 1999 in China available with any bank in China by negotiation against beneficiary's draft(s) at sight drawn on us and the documents detailed herein, marked with 'X';(1).Commercial Invoice in triplicate(2).Pull set 2/2 originals clean on board marine Bills of Lading made out to order and blank endorsed marked freight prepaid notifying Tokyo Keyboard Distributers, 12-14 Monmachi 3-Chome, Tokyo, Japan.(3).Paking List in triplicate(4).Certificate of Origin in China(5).Insurance Policy or Certificate covering All risks and war risks for 110% of the invoice value stipulating claim, if any, to be payable in currency of the draft.(6).Certificate of Weight in triplicate(7).Certificate of Analysis in triplicate Evidencing shipment of 1600PCS Footballs GBW32P, water proof USD3.5/PC C.I.F. Tokyo from Tianjin port to Yokyo not later than 16 June ,1999 Partial shipment allowed Transhipment not allowed Documents to be presented within 15 days after the date of the transport documents but within the validity of the credit. We hereby engage with drawers and /or bona fide holders that drafts drawn and negotiated in conformity with the terms of Credit will be fully honoured on presentation.Instructions to the advising bank:Please advise the Credit to the beneficiary:without adding your confirmation adding your confirmation adding your confirmation if requested by the beneficiary The number and the date of the Credit and the name of our bank must be quoted on all drafts required.Please acknowledge receipt Reimbursement:The negotiating bank is authorized to claim reimbursement on The Mitsui Bank Ltd., New York by telex. All drafts and documents must be sent to us by airmail. Yours faithfullyThe Mitsui Bank Ltd., TokyoSignature(s)日本信用证翻译:开证行银行:开证地点和日期三菱银行1999年3月3日,东京日本东京15 Marunouche 3-Chome 本信用证通过中国银行天津分行至:(受益人)中国畜产品进出口公司传递通知天津分公司中国天津烟台路66号亲爱的先生:应开证申请人东京键盘配件公司(地址:日本东京12-14 Monmachi 3-Chome)的要求,我们在此开立编号为901026的不可撤销跟单信用证,金额为5600美元(大写:五千六美元整),信用证到期日为中国时间1999年6月30日,凭受益人出具给我方的即期汇票以及如下所列的单据通过中国任何银行以议付方式兑现,用'X'标记:(1).商业发票一式三份。

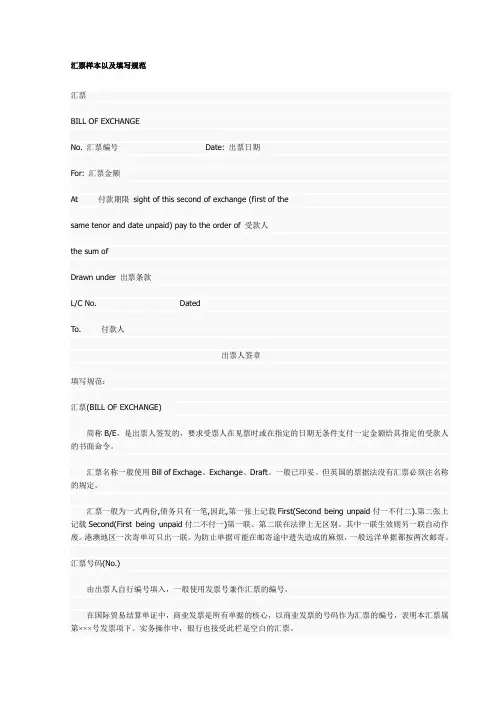

汇票样本以及填写规范汇票BILL OF EXCHANGENo. 汇票编号Date: 出票日期For: 汇票金额At 付款期限sight of this second of exchange (first of thesame tenor and date unpaid) pay to the order of 受款人the sum ofDrawn under 出票条款L/C No. DatedTo. 付款人出票人签章填写规范:汇票(BILL OF EXCHANGE)简称B/E,是出票人签发的,要求受票人在见票时或在指定的日期无条件支付一定金额给其指定的受款人的书面命令。

汇票名称一般使用Bill of Exchage、Exchange、Draft。

一般已印妥。

但英国的票据法没有汇票必须注名称的规定。

汇票一般为一式两份,债务只有一笔,因此,第一张上记载First(Second being unpaid付一不付二).第二张上记载Second(First being unpaid付二不付一)第一联、第二联在法律上无区别。

其中一联生效则另一联自动作废。

港澳地区一次寄单可只出一联。

为防止单据可能在邮寄途中遗失造成的麻烦,一般远洋单据都按两次邮寄。

汇票号码(No.)由出票人自行编号填入,一般使用发票号兼作汇票的编号。

在国际贸易结算单证中,商业发票是所有单据的核心,以商业发票的号码作为汇票的编号,表明本汇票属第×××号发票项下。

实务操作中,银行也接受此栏是空白的汇票。

出票日期(Dated)填写汇票出具的日期。

汇票金额(Exchange for)此处要用数字小写(Amount in Figures)表明。

填写小写金额,一般要求汇票金额使用货币缩写和用阿拉伯数字表示金额小写数字。

例如:USD1,234.00。

大小写金额均应端正的填写在虚线格内,不得涂改,且大小写数量要一致。

除非信用证另有规定,汇票金额不得超过信用证金额,而且汇票金额应与发票金额一致,汇票币别必须与信用证规定和发票所使用的币别一致。

汇票样本以及填写规范汇票BILL OF EXCHANGENo. 汇票编号Date: 出票日期For: 汇票金额At 付款期限sight of this second of exchange (first of thesame tenor and date unpaid) pay to the order of 受款人the sum ofDrawn under 出票条款L/C No. DatedTo. 付款人出票人签章填写规范:汇票(BILL OF EXCHANGE)简称B/E,是出票人签发的,要求受票人在见票时或在指定的日期无条件支付一定金额给其指定的受款人的书面命令。

汇票名称一般使用Bill of Exchage、Exchange、Draft。

一般已印妥。

但英国的票据法没有汇票必须注名称的规定。

汇票一般为一式两份,债务只有一笔,因此,第一张上记载First(Second being unpaid付一不付二).第二张上记载Second(First being unpaid付二不付一)第一联、第二联在法律上无区别。

其中一联生效则另一联自动作废。

港澳地区一次寄单可只出一联。

为防止单据可能在邮寄途中遗失造成的麻烦,一般远洋单据都按两次邮寄。

汇票号码(No.)由出票人自行编号填入,一般使用发票号兼作汇票的编号。

在国际贸易结算单证中,商业发票是所有单据的核心,以商业发票的号码作为汇票的编号,表明本汇票属第×××号发票项下。

实务操作中,银行也接受此栏是空白的汇票。

出票日期(Dated)填写汇票出具的日期。

汇票金额(Exchange for)此处要用数字小写(Amount in Figures)表明。

填写小写金额,一般要求汇票金额使用货币缩写和用阿拉伯数字表示金额小写数字。

例如:USD1,234.00。

大小写金额均应端正的填写在虚线格内,不得涂改,且大小写数量要一致。

除非信用证另有规定,汇票金额不得超过信用证金额,而且汇票金额应与发票金额一致,汇票币别必须与信用证规定和发票所使用的币别一致。

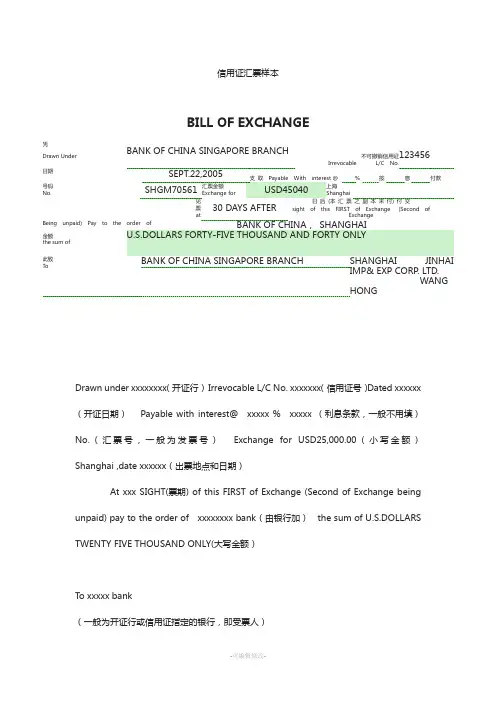

信用证汇票样本BILL OF EXCHANGE凭 Drawn UnderBANK OF CHINA SINGAPORE BRANCH不可撤销信用证 123456IrrevocableL/C No.日期SEPT.22,2005支 取 Payable With interest @%按息付款号码 No.SHGM70561汇票金额 Exchange forUSD45040上海 Shanghai见票 30 DAYS AFTER日 后 (本 汇 票 之 副 本 未 付) 付 交 sight of this FIRST of Exchange (Second ofatExchangeBeing unpaid) Pay to the order ofBANK OF CHINA, SHANGHAI金额U.S.DOLLARS FORTY-FIVE THOUSAND AND FORTY ONLYthe sum of此致BANK OF CHINA SINGAPORE BRANCHSHANGHAIJINHAIToIMP& EXP CORP. LTD.WANGHONGDrawn under xxxxxxxx(开证行) Irrevocable L/C No. xxxxxxx(信用证号)Dated xxxxxx (开证日期) Payable with interest@ xxxxx % xxxxx (利息条款,一般不用填) No. ( 汇 票 号 , 一 般 为 发 票 号 ) Exchange for USD25,000.00 ( 小 写 金 额 ) Shanghai ,date xxxxxx(出票地点和日期)At xxx SIGHT(票期) of this FIRST of Exchange (Second of Exchange being unpaid) pay to the order of xxxxxxxx bank(由银行加) the sum of U.S.DOLLARS TWENTY FIVE THOUSAND ONLY(大写金额)To xxxxx bank (一般为开证行或信用证指定的银行,即受票人)-可编辑修改-票人)。

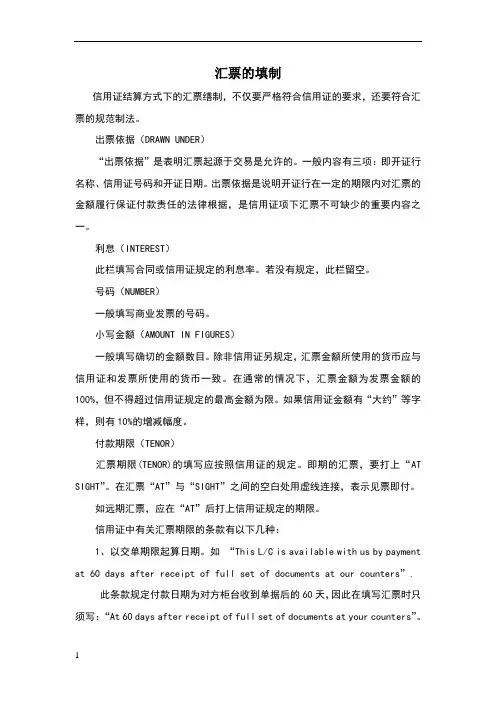

汇票的填制信用证结算方式下的汇票缮制,不仅要严格符合信用证的要求,还要符合汇票的规范制法。

出票依据(DRAWN UNDER)“出票依据”是表明汇票起源于交易是允许的。

一般内容有三项:即开证行名称、信用证号码和开证日期。

出票依据是说明开证行在一定的期限内对汇票的金额履行保证付款责任的法律根据,是信用证项下汇票不可缺少的重要内容之一。

利息(INTEREST)此栏填写合同或信用证规定的利息率。

若没有规定,此栏留空。

号码(NUMBER)一般填写商业发票的号码。

小写金额(AMOUNT IN FIGURES)一般填写确切的金额数目。

除非信用证另规定,汇票金额所使用的货币应与信用证和发票所使用的货币一致。

在通常的情况下,汇票金额为发票金额的100%,但不得超过信用证规定的最高金额为限。

如果信用证金额有“大约”等字样,则有10%的增减幅度。

付款期限(TENOR)汇票期限(TENOR)的填写应按照信用证的规定。

即期的汇票,要打上“AT SIGHT”。

在汇票“AT”与“SIGHT”之间的空白处用虚线连接,表示见票即付。

如远期汇票,应在“AT”后打上信用证规定的期限。

信用证中有关汇票期限的条款有以下几种:1、以交单期限起算日期。

如“This L/C is available with us by payment at 60 days after receipt of full set of documents at our counters”.此条款规定付款日期为对方柜台收到单据后的60天,因此在填写汇票时只须写:“At 60 days after receipt of full set of documents at your counters”。

注意,信用证中的“OUR COUNTER”(我们的柜台),系指开证行柜台,而在实际制单中,应改为“YOUR”(你们的)的柜台,指单据到达对方柜台起算的60天了。

2、有的汇票是以装船日期为起算日期的。

式样15—1 跟单信用证项下的汇票BILL OF EXCHANGE凭信用证Drawn under…………………………………………………L/C NO. …………….日期Dated……………………支取Payable with interest @….. %…..按…..息….付款号码汇票金额上海NO………..Exchange for Shanghai …………20…………见票…………………日后(本汇票之正本未付)付交A t ……………sight of this SECOND of Exchange (First of Exchange being unpaid) Pay to the order of金额the sum of此致:T o……………………………………………………..……………………………………………………..式样15—2 托收项下汇票BILL OF EXCHANGE号码汇票金额上海No. Exchange for Shanghai 20见票日后(本汇票之副本未付)付交At sight of this FIRST of Exchange (Second of Exchange being unpaid) pay to the order of金额the sum of凭Drawn under此致To式样15—3 商业发票上海市×××进出口公司SHANGHAI ××× IMPORT & EXPORT CORPORATION27 CHUNGSHAN ROAD E .1 .SHANGHAI, CHINATEL:8621-65342517 FAX:8621-65724743COMMERCIAL INVOICETO: M/S. 号码No:定单或合约号码Sales Confirmation No.日期Date装船口岸目的地From To 信用证号数开证银行Letter of Credit No. Issued by上海市×××进出口公司We certify that the goods Shanghai ×××Import & Export Corporation are of Chinese origin. SHANGHAI, CHINA中国对外贸北BEIJING式样15—5 保险单中国人民保险公司THE PEOPLE’S INSURANCE COMPANY OF CHINA总公司设于北京一九四九年创立Head Office:BEIJING Established in 1949保险单号次NSURANCE POLICY No.SH02/304246 中国人民保险公司(以下简称本公司)This Policy of Insurance witnesses that The People’s Insurance Company of China (hereinafter called根据“the Company”),at the request of ---------------------------------------( 以下简称被保险人 ) 的要求,由被保险人向本公司缴付约定(hereinafter called “the Insured” ) and in consideration of the agreed premium paid to the Company by the的保险费,按照本保险单承保险别和背面所载条款与下列Insured, undertakes to insure the undermentioned goods in transportation subject to the conditions of this Policy条款承保下述货物运输保险,特立本保险单。

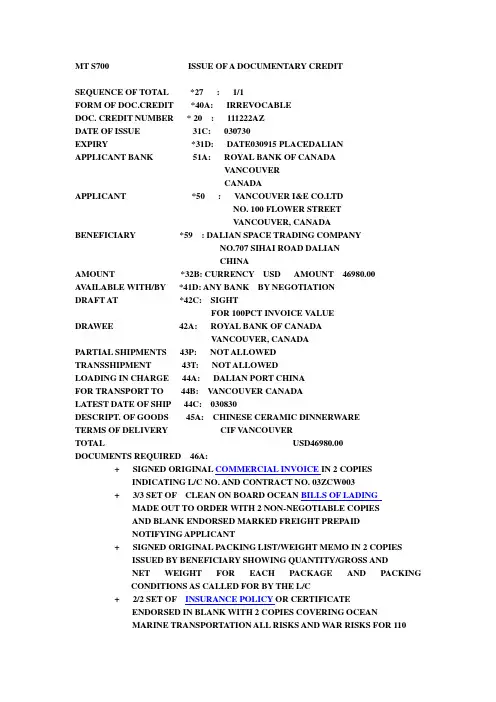

MT S700 ISSUE OF A DOCUMENTARY CREDITSEQUENCE OF TOTAL *27 : 1/1FORM OF DOC.CREDIT *40A: IRREVOCABLEDOC. CREDIT NUMBER * 20 : 111222AZDATE OF ISSUE 31C: 030730EXPIRY *31D: DATE030915 PLACEDALIANAPPLICANT BANK 51A: ROYAL BANK OF CANADAV ANCOUVERCANADAAPPLICANT *50 : V ANCOUVER I&E CO.LTDNO. 100 FLOWER STREETV ANCOUVER, CANADABENEFICIARY *59 : DALIAN SPACE TRADING COMPANYNO.707 SIHAI ROAD DALIANCHINAAMOUNT *32B: CURRENCY USD AMOUNT 46980.00A V AILABLE WITH/BY *41D: ANY BANK BY NEGOTIATIONDRAFT AT *42C: SIGHTFOR 100PCT INVOICE V ALUEDRAWEE 42A: ROYAL BANK OF CANADAV ANCOUVER, CANADAPARTIAL SHIPMENTS 43P: NOT ALLOWEDTRANSSHIPMENT 43T: NOT ALLOWEDLOADING IN CHARGE 44A: DALIAN PORT CHINAFOR TRANSPORT TO 44B: V ANCOUVER CANADALATEST DATE OF SHIP 44C: 030830DESCRIPT. OF GOODS 45A: CHINESE CERAMIC DINNERWARETERMS OF DELIVERY CIF V ANCOUVERTOTAL USD46980.00DOCUMENTS REQUIRED 46A:+ SIGNED ORIGINAL COMMERCIAL INVOICE IN 2 COPIESINDICATING L/C NO. AND CONTRACT NO. 03ZCW003+ 3/3 SET OF CLEAN ON BOARD OCEAN BILLS OF LADINGMADE OUT TO ORDER WITH 2 NON-NEGOTIABLE COPIESAND BLANK ENDORSED MARKED FREIGHT PREPAIDNOTIFYING APPLICANT+ SIGNED ORIGINAL PACKING LIST/WEIGHT MEMO IN 2 COPIES ISSUED BY BENEFICIARY SHOWING QUANTITY/GROSS ANDNET WEIGHT FOR EACH PACKAGE AND PACKINGCONDITIONS AS CALLED FOR BY THE L/C+ 2/2 SET OF INSURANCE POLICY OR CERTIFICATEENDORSED IN BLANK WITH 2 COPIES COVERING OCEANMARINE TRANSPORTATION ALL RISKS AND WAR RISKS FOR 110PCT INVOICE V ALUE SHOWING CLAIMS PAYABLE IN CANADAIN CURRENCY OF THE DRAFT+ BENEFICIARY’S CERTIFICATE COPY OF FAX DISPATCHED TO APPLICANT WITHIN 72 HOURS AFTER SHIPMENT INDICATINGCONTRACT NO., L/C NO., NAME OF VESSEL DETAILS OF SHIPMENT.+ BENEFICIA RY’S CERTIFICATE CERTIFYING THAT TWO NON-NEGOTIABLE COPIES OF B/L, INVOICE AND P/L HAVE BEENSENT TO APPLICANT AFTER SHIPMENT.+ DECLARATION OF NON-WOOD PACKING MATERIAL.+ ONE SET OF EXTRA PHOTOCOPY OF ORIGINAL B/L AND ORIGINAL INVOICE.ADDITIONAL COND. 47 A:+ FOR EACH DOCUMENTARY DISCREPANCY (IES) UNDERTHIS CREDIT, A FEE OF USD60.00 WILL BE DEDUCTEDFROM THE WHOLE PROCEEDS.DETAILS OF CHARGES 71 B:ALL BANKING CHARGES OUTSIDE THE ISSUING BANKINCLUDING THOSE OF REIBURSEMENT BANK ARE FORACCOUNT OF BENEFICIARY.PRESENTATION PERIOD 48 :DOCUMENTS TO BE PRESENTED WITHIN 15 DAYS AFTERTHE ISSUANCE OF THE SHIPPING DOCUMENTS BUTWITHIN THE V ALIDITY OF THE CREDIT.CONFIRMATION *49 : WITHOUTINSTRUCTION 78 :+ALL DOCUMENTS TO BE FORWARDED TO ROYAL BANKOF CANADA, V ANCOUVER CANADA IN ONE COVER BYDHL UNLESS OTHERWISSE STATED ABOVE.+ WE HEREBY UNDERTAKE THAT UPON RECEIPT OFTHE ORIGINAL DOCUMENTS IN COMPLIANCE WITHTHE TERMS OF THIS CREDIT. THE DRAFTS DRAWNUNDER WILL BE DULY HONORED.+ THIS CREDIT IS SUBJECT TO U.C.P. FOR DOCUMENTARYCREDIT, 1993 REVISION ICCP NO. 500.“ADVISE THROUGH” 57 D:THE BANK OF CHINA, DALIAN BRANCH。

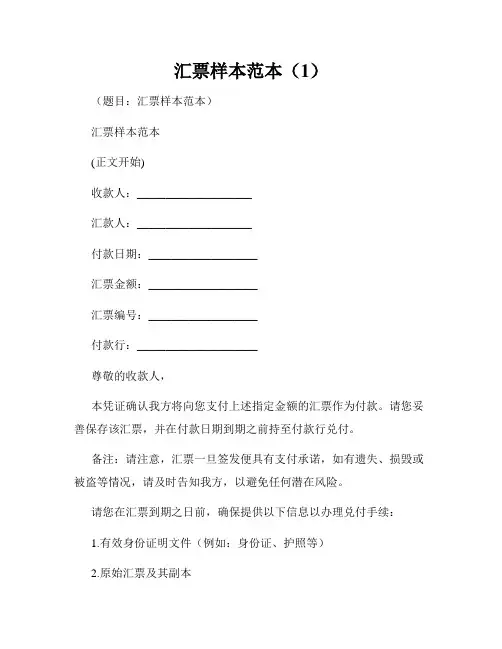

汇票样本范本(1)

(题目:汇票样本范本)

汇票样本范本

(正文开始)

收款人:____________________

汇款人:____________________

付款日期:___________________

汇票金额:___________________

汇票编号:___________________

付款行:_____________________

尊敬的收款人,

本凭证确认我方将向您支付上述指定金额的汇票作为付款。

请您妥善保存该汇票,并在付款日期到期之前持至付款行兑付。

备注:请注意,汇票一旦签发便具有支付承诺,如有遗失、损毁或被盗等情况,请及时告知我方,以避免任何潜在风险。

请您在汇票到期之日前,确保提供以下信息以办理兑付手续:

1.有效身份证明文件(例如:身份证、护照等)

2.原始汇票及其副本

3.与汇票有关的所有支持文件(如合同、协议等)

付款行将仔细核对您提供的信息,并根据我方支付指示进行资金划拨。

如所有手续顺利完成,您将收到指定金额的支付,以确保您的权益和支付安全。

请注意,如汇票到期日是非工作日或法定节假日,付款行将在下一个工作日继续办理付款。

感谢您对本次交易的配合和支持。

如有问题或需要进一步协助,请随时与我方联系。

再次感谢您的合作。

此致,

(您的姓名)

(您的职位或职务)

(您的联系方式)

(您的公司名称)。

信用证下汇票样本文件编码(GHTU-UITID-GGBKT-POIU-WUUI-8968)信用证汇票样本BILL OF EXCHANGE凭 Drawn Under日期BANK OF CHINA SINGAPORE BRANCH不可I撤rr销Le/v信Coc用aNb证ol.e123456SEPT.22,2005 支With取 inPtaeyraebslte @ % 按 息 付款号No码 .SHGM70561 汇 Efxocr票h金an额ge USD45040 上Sghh海aaniBoefingunpaid)Paytothe 见 票at or3d0erDAYBSANAKFTOEFRCH日IsNiAEg后,xhcth(Sa本HnoAgf付NeE汇Gx)HtcAhh付票I(iaSnseg之交ecoFnI副dRST本ofo未f金额The sum of此致BANK OF CHINA SINGAPORE BRANCHSHANGHAI JINHAI IMP&ToEXP CORP. LTD.HONGWANGDrawn under xxxxxxxx(开证行) Irrevocable L/C No. xxxxxxx(信用证号)Dated xxxxxx (开证日期) Payable with interest@ xxxxx % xxxxx (利息条款,一般 不用填)No.(汇票号,一般为发票号) Exchange for USD25,000.00(小写金额) Shanghai ,date xxxxxx(出票地点和日期) To xxxxx bank (一般为开证行或信用证指定的银行,即受票人)yyyyy CO.,LTD.(受益人,即 出票人)NO.(汇票号码) 二、汇票的制作——信用证项下汇票的制作Exchange for (小写金BI额LL)EOxFporEtXC-HACNiGtEy, Export – Country, 格式及必D要ra项wn目under((出1票)地BA点NK、O出F 票NE日W 期YO)RK (开证行详细名称) L/C NO. L-02-I-03437At((信汇用票证期号限码))sight of this FIRST of Exchange (Second ofExchange for (Amounts in Figures)USD 17,400.00Date July 30,2001 No. G379At **** sight of this first of Bill of Exchange (second being unpaid)Pay to the order ofBank of Chinathe sum ofL/C NumberL/C NumberDC HK0689DC HK0689Drawn underTHE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITEDToSignature and Company ChopTHE HONGKONG AND SHANGHAICHAMPION SKY CO., LTD.BANKING CORPORATIONLIMITED注: 见一不付二,付给....,这是汇票里规定的,一套汇票通常有两张,为避免寄时丢弃通常分两 次寄国外银行,其中任何一张有效另外一张即失效,即见到第一张不付第二张.。

汇票信用证模板篇一:信用证下汇票填制样本实例教程信用证汇票样本BILL OF EXCHANGE凭Drawn Under日期号码 No.BANK OF CHINA SINGAPORE BRANCHSEPT.22,2005 SHGM70561汇票金额 Exchange for 见票 at支取 Payable With interest不可撤销信用证Irrevocable L/C No.12345630 DAYS AFTER@ % 按息付款上海Shanghai日后 (本汇票之副本未付) 付交1sight of this FIRST of Exchange(Second of ExchangeBeing unpaid) Pay to the order of 金额the sum of 此致 ToBANK OF CHINA, SHANGHAI-FIVE THOUSAND AND FORTY ONLYBANK OF CHINA SINGAPORE BRANCHSHANGHAI JINHAI IMP& EXP CORP. LTD.WANGHONGDrawn under xxxxxxxx(开证行) Irrevocable L/C No. xxxxxxx(信用证号)Dated xxxxxx (开证日期)Payable with interest@ xxxxx % xxxxx (利息条款,一般不用填)No.(汇票号,一般为发票号) Exchange for USD25,000.00(小写金额)Shanghai ,date xxxxxx(出票地点和日期)At xxx SIGHT(票期) of this FIRST of Exchange (Second of Exchange being unpaid) pay to the order of xxxxxxxxbank(由银行加) the sum of U.S.DOLLARS TWENTY FIVE THOUSAND ONLY(大写金额)To xxxxx bank(一般为开证行或信用证指定的银行,即受票人)yyyyy CO.,LTD.(受益人,即出票人)2二、汇票的制作——信用证项下汇票的制作注:见一不付二,付给....,这是汇票里规定的,一套汇票通常有两张,为避免寄时丢弃通常分两次寄国外银行,其中任何一张有效另外一张即失效,即见到第一张不付第二张.。

NATIONAL PARIS BANK24 MARSHALL AVE DONCASTER MONTREAL, CANADAWE ISSUE OUR IRREVOCABLE DOCUMENT ARY CREDIT NUMBER:TH2003 DATED OCT. 06, 2003IN FAVOUR OF: SUZHOU KNITWEAR AND MANUFACTURED GOODS INPORT AND EXPORT TRADE CORPORATION321, ZHOUGSHAN ROAD SUZHOU, CHINABY ORDER OF: YI YANG TRADING CORPORATION88 MARSHALL AVEDONCASTER VIC 3108CANADAFOR AN AMOUNT OF USD 89 705.50DATE OF EXPIRY: 15NOV03PALCE: IN BENEFICIARY’S COUNRTYAVAILABLE WITH ANY BANKBY NEGOTIATION OF BENEFICIARY’S DRAFT DRAWN ON USAT SIGHT IN MONTREALTHIS CREDIT IS TRANSFERABLEAGAINST DELIVERY OF THE FOLLOWING DOCUMENTS+COMMERCIAL INVOICES IN 5 COPIES+CANADA CUSTOMS INVOICES IN 6 COPIES+FULL SET OF NEGOTIABLE INSURANCE POLICY OR CERTIFICATE BLANK ENDORSED FOR 110 PERCENT OF INVOICE VALUE COVERING ALL RESKS+FULL SET OF ORIGINAL MARINE BILLS OF LADING CLEAN ON BOARD PLUS 2 NON-NEGOTIABLE COPIES MADE OUR OR ENDORSED TO ORDER OF NATIONAL PARIS BANK 24 MARSHALL VEDONCASTER MONTREAL,CANADA.+SPECIFICATION LIST OF WEIGHTS AND MEASURESIN 4 COPIES COVERING SHIPMENT OF COTTON TEATOWELS AS PER S/C ST303.FOR 1-300 SIZE 10 INCHES * 10 INCHES 16000 DOZ. AT USD 1.31/DOZ. 301-600 SIZE 20 INCHES 6000 DOZ. AT USD 2.51/DOZ. AND 601-900 SIZE 30 INCHES * 30 INCHES 11350 DOZ. AT USD 4.73/DOZ.CIF MONTREALFROM CHINESE PORT TO MONTREAL PORTNOT LETER THAN 31,OCT.03PARTIAL SHIPMENTS: ALLOWEDTRANSHIPMENT:ALLOWEDSPECIAL INSTRUCTIONS+ALL CHARGES IF ANY RELATED TO SETTLEMENTS ARE FOR ACCOUNT OF BENEFICIARY+IN CASE OF PRESENTATION OF DOCUMENTS WITH DISCREPANCY (IES) A CHARGE OF USD 55.00THIS CREDIT IS SUBJECT TO UCP FOR DOCUMENTARY CREDITS 1993 RECISION ICC PUBLICATION 500 AND IS THE OPERATIVE INSTRUMENTBILL OF EXCHANGENO. T03617 Date: OCT.24,2003FOR USD 89705.50At ****** Sight of THIS FIRST BILL OF EXCHANGE(First of the tenor and date being unpaid)Pay to BANK OF CHINA or order the sum ofDrawn under NATIONAL PARIS BANK (CANADA)MONTREALL/C NO. TH2003 Dated OCT.06,2003TO.NATIONAL PARIS BANK24 MARSHALL VEDONCASTER MONTREAL CANADASUZHOU KNITWEAR AND MANUFACTURED GOODSIMPORT & EXPORT TRADE CORPORATION。