安永-财务管理最佳实践-管理报告

- 格式:ppt

- 大小:531.50 KB

- 文档页数:18

现代营销上旬刊2024.05面对新形势、新挑战,国有企业需在构建新发展格局、推动高质量发展的总体目标下,不断提升核心竞争力。

一、国有企业财务管控模式发展历程国有企业在不同阶段,面临着不同的问题和任务,财务管控模式也在持续改进(见图1)。

图1 国有企业改革历程2003年,国务院成立国有资产监督委员会,开启“管资产和管人、管事相结合”的国资监管时代。

在这个阶段,以央企为代表的大型国有企业迅速崛起。

随着规模扩大、业务扩展、组织扩充,这些国有企业逐步走向集团化,普遍建立依托各职能条线、以“纵向、垂直”为主要特点的集中型集团管控模式。

这种管控方式特点是集中资源、集中力量办大事,但同时也存在决策流程长、效率下降、基层企业活力不足等问题。

近年来,国资监管模式从“管资产”向“管资本”转变,组建国有资本投资运营公司,旨在通过进一步对国资监管机制、国有企业功能定位、国资布局、所有制等多方面进行深化改革,重新释放国有企业活力、提升国有企业业绩。

不同于“一业为主”的国有企业产业集团,业务相对多元的国有资本投资公司肩负着通过资本运作推动产业转型升级、优化国资布局和提升产业竞争力的使命,是国有企业向“管资本”转型的典型代表。

随着业务持续扩张和混改加速,产业规模越来越大,地域分布越来越广,业务体系越来越复杂。

从“中枢系统”到“神经末梢”,如何确保管得住且管得好,找到“灵活”与“管控”的平衡,是国有企业在新一轮改革发展和管控模式探索中面对的核心问题。

国有企业“管资本”的基本逻辑是通过监管防范风险,守住底线,通过放权赋能有效激发经营活力。

在这个监管逻辑下,国有资本投资公司的转型及管控模式改革聚焦于转变总部职能,逐步形成总部“管资本”与二级平台“管资产”的管控格局。

从目前主要的国有资本投资公司实践看,集团总部作为资本运作层,更加突出在战略引领、资本运作、风险管理等方面的功能定位,并在以资本为纽带、以产权为基础行使股东权利的基础上,进一步厘清总部作为资本运作平台“管资本”与二级平台作为经营实体“管资产”的关系,不断探索建立职能管控和法人治理相结合的“治理型”协同管控机制。

5焦点·前沿浅谈数字化时代的互联网技术在财务管理中的应用发展文/林生星在数字化时代,互联网技术在财务管理中的应用发展中呈现显著的影响。

本文探讨了云计算、大数据、区块链和人工智能等技术在财务管理中的应用,并通过具体的实践案例进行了解析。

这些互联网技术使企业能够更有效地处理财务数据,提高审计的效率和准确性,同时也带来了更好的风险管理和决策支持。

通过分析这些技术及其在财务管理中的应用,本文为进一步挖掘互联网技术在财务管理领域的潜力提供了基础。

随着科技的进步,云计算、大数据、区块链和人工智能等互联网技术日益普及,深度融入企业的各个业务环节,尤其在财务管理方面,带来了前所未有的转变和优势。

这些技术不仅改善了财务数据的收集、处理和分析流程,还提高了财务决策的效率和精确度,有力地支持了企业的核心运营和战略规划。

然而,如何在实践中有效应用这些技术,充分发挥其潜力,又避免可能的风险,是一大挑战。

本文将针对这一问题,深入探讨云计算、大数据、区块链和人工智能等技术在财务管理中的具体应用,并通过案例分析,揭示其在财务管理领域的价值和潜力。

互联网技术的种类及其在财务管理中的应用一、云计算在财务管理中的应用在数字化时代,云计算已经成为一门重要的技术,正在改变财务管理的方式。

云计算提供了安全、灵活、可扩展的解决方案,使企业可以访问和管理自己的财务数据。

云计算的核心优势在于无须投入大量资金购买和维护硬件,这减少了设备维护的复杂性和成本。

以此为基础,财务管理通过云计算实现了高效和自动化。

例如,一些复杂的财务流程,如预算编制和预测、财务报告、账单处理、审计和合规等,都可以通过云计算平台进行自动化处理。

这不仅提高了工作效率,也减少了错误的可能性,从而提高了财务管理的准确性和质量。

此外,云计算也带来了更好的数据安全和隐私保护。

通过使用云计算,企业可以确保其财务数据的安全,因为数据存储在云端,并通过加密保护。

与此同时,云计算还可以提供实时备份和恢复服务,确保数据的连续性和可恢复性。

安永咨询企业风险分析报告1. 简介本报告为安永咨询针对XXX公司进行的企业风险分析报告,旨在帮助公司全面了解和评估当前面临的各种风险,并提出相应的风险管理和控制建议,以确保公司可持续发展。

2. 风险评估2.1 市场风险目前,XXX公司所处市场竞争激烈,市场份额失去了一部分,竞争对手推出了一系列类似产品并以更低的价格吸引了部分客户。

此外,行业监管政策的变化也给公司的运营带来了一定压力。

建议:1. 加强市场调研,了解市场需求并快速反应;2. 提升产品研发能力,不断创新,提供符合市场需求的产品;3. 加强与政府监管部门的合作,了解和遵守相关政策,降低运营风险。

2.2 经营风险目前,公司内部管理不规范,存在组织结构不明确、员工流失率高等问题。

此外,公司对外部环境的变化反应较慢,无法及时调整业务策略,导致经营效率低下。

建议:1. 完善组织结构,明确各部门的职责和权限;2. 加强人力资源管理,提升员工福利待遇和培训机会,降低员工流失率;3. 建立灵活的经营机制,及时调整业务策略以适应市场变化。

2.3 操作风险XXX公司目前存在操作风险较高的问题,生产流程不规范,存在设备故障率高、原材料供应不稳定等问题;同时,安全管理不到位,存在安全事故的隐患。

建议:1. 提升生产流程规范性,加强设备维护和管理,降低故障率;2. 寻求多元化供应商,建立稳定的原材料供应链;3. 建立健全的安全管理制度,加强对员工的安全教育和培训。

2.4 财务风险公司财务状况不稳定,流动资金不足,经营现金流压力较大。

同时,存在对外担保过多的情况,承担了较高的财务风险。

建议:1. 加强财务管理,提高财务数据分析和预测能力;2. 优化资金结构,降低债务压力,提升流动资金状况;3. 合理控制担保风险,谨慎承担对外担保。

3. 总结通过对XXX公司的风险评估,我们发现公司目前面临的市场风险、经营风险、操作风险和财务风险均存在一定的挑战。

为了确保公司的可持续发展,我们提出了相应的风险管理和控制建议,如加强市场调研与产品研发、完善组织架构与人力资源管理、提升操作规范与安全管理、优化财务管理与资金结构等。

国有企业财务管理转型升级存在的问题分析及对策中国经济经过几十年的疾驰发展虽然取得了巨大成就,但其结构长期不合理的矛盾也日益突出,想要实现“两个一百年”的奋斗目标就必须完成经济转型、产业结构升级;而国有企业作为国民经济支柱同样也面临许多发展困境,为应对错综复杂的经营形势只有不断探究自身转型升级之路,才得以谋求可持续发展;在这样的大背景下,财务管理作为企业经营管理的重要支撑力量,也迫切需要转型。

一、国有企业财务管理转型的重要意义(一)财务管理转型是国有企业战略转型的有效支撑国有企业想要尽快破解产业发展困境,加快转型升级步伐,需要各部门各体系结合公司总体战略的定位,加强与公司总体规划的衔接与协同,充分发挥好一盘棋的体系合力。

财务工作作为企业经济运行的枢纽中心,贯穿在企业经济业务的整个过程,是企业总体工作至关重要的组成部分,对公司整体经济运行发挥着重要的调节和指导作用。

加速财务管理的转型升级,势必成为助推国有企业战略转型升级、二次创业战略落地的有效支撑。

(二)财务管理变革创新助力经营业务高质量发展企业的价值源于业务,而财务是企业重要的支撑部门,所以现代财务管理理念越来越讲求“业财融合”,要求财务转型,财务人员走向业务发展的前端,同业务人员一同研究和探索业务流程,更多地嵌入到企业其他相关领域、层次和环节当中,利用好管理会计的工具方法,不断优化业财融合模式,以满足对企业发展的全方位要求。

做好业财融合,有助于全面了解企业组织业务运营的情况,并且在对业务活动实施全面监控过程中及时发现运营遇到的问题和瓶颈,做好有效的资源配置,从而提升财务管理水平,实现组织目标最大化,助力企业经营高质量发展。

(三)财务管理转型升级确保企业安全发展良好的财务管理内部控制体系可保证业务活动的有效进行,保护企业资产的安全和完整,防止、发现以及纠正错误和舞弊,保证会计信息质量真实、合法和完整。

财务部门是企业风险防控的重要防线,对风险的理解和识别,财务人员具有得天独厚的优势,他们出于职业本能往往对风险更加敏感,更能透过业务表象看到其经济本质,特别是业财融合后财务管理转型到业务前端,能深入企业具体业务流程,参与企业重大项目决策,将风险管控从事后管控向业务过程延伸,从而更及时更清晰地发现问题,提早进行风险预警,做好事前规划,帮助企业制定出更有针对性、更加切合实际的风险防范措施,充分发挥财务管理职能,完善风险控制机制,强化风险源头控制,加强业务监督检查,从而较全面地提高国有企业的风险防范能力,降低企业经营风险,维护企业经济效益,确保安全发展,为企业长远发展营造环境、提供有利条件,提高财务管理实效性。

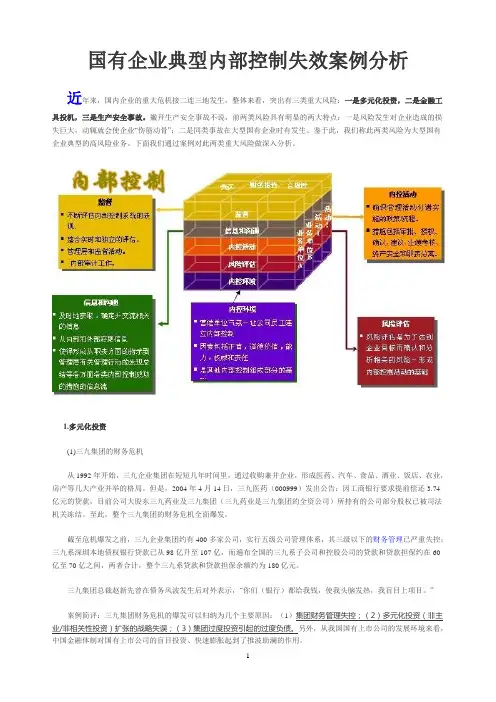

国有企业典型内部控制失效案例分析近年来,国内企业的重大危机接二连三地发生,整体来看,突出有三类重大风险:一是多元化投资,二是金融工具投机,三是生产安全事故。

撇开生产安全事故不说,前两类风险具有明显的两大特点:一是风险发生对企业造成的损失巨大,动辄就会使企业“伤筋动骨”;二是同类事故在大型国有企业时有发生。

鉴于此,我们称此两类风险为大型国有企业典型的高风险业务。

下面我们通过案例对此两类重大风险做深入分析。

1.多元化投资(1)三九集团的财务危机从1992年开始,三九企业集团在短短几年时间里,通过收购兼并企业,形成医药、汽车、食品、酒业、饭店、农业,房产等几大产业并举的格局。

但是,2004年4月14日,三九医药(000999)发出公告:因工商银行要求提前偿还3.74亿元的贷款,目前公司大股东三九药业及三九集团(三九药业是三九集团的全资公司)所持有的公司部分股权已被司法机关冻结。

至此,整个三九集团的财务危机全面爆发。

截至危机爆发之前,三九企业集团约有400多家公司,实行五级公司管理体系,其三级以下的财务管理已严重失控;三九系深圳本地债权银行贷款已从98亿升至107亿,而遍布全国的三九系子公司和控股公司的贷款和贷款担保约在60亿至70亿之间,两者合计,整个三九系贷款和贷款担保余额约为180亿元。

三九集团总裁赵新先曾在债务风波发生后对外表示,“你们(银行)都给我钱,使我头脑发热,我盲目上项目。

”案例简评:三九集团财务危机的爆发可以归纳为几个主要原因:(1)集团财务管理失控;(2)多元化投资(非主业/非相关性投资)扩张的战略失误;(3)集团过度投资引起的过度负债。

另外,从我国国有上市公司的发展环境来看,中国金融体制对国有上市公司的盲目投资、快速膨胀起到了推波助澜的作用。

(2)华源集团的信用危机华源集团成立于1992年,在总裁周玉成的带领下华源集团13年间总资产猛增到567亿元,资产翻了404倍,旗下拥有8家上市公司;集团业务跳出纺织产业,拓展至农业机械、医药等全新领域,成为名副其实的“国企大系”。

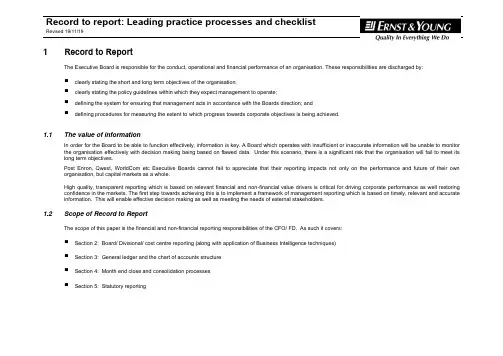

1 Record to ReportThe Executive Board is responsible for the conduct, operational and financial performance of an organisation. These responsibilities are discharged by:▪clearly stating the short and long term objectives of the organisation;▪clearly stating the policy guidelines within which they expect management to operate;▪defining the system for ensuring that management acts in accordance with the Boards direction; and▪defining procedures for measuring the extent to which progress towards corporate objectives is being achieved.1.1 The value of informationIn order for the Board to be able to function effectively, information is key. A Board which operates with insufficient or inaccurate information will be unable to monitor the organisation effectively with decision making being based on flawed data. Under this scenario, there is a significant risk that the organisation will fail to meet its long term objectives.Post Enron, Qwest, WorldCom etc Executive Boards cannot fail to appreciate that their reporting impacts not only on the performance and future of their own organisation, but capital markets as a whole.High quality, transparent reporting which is based on relevant financial and non-financial value drivers is critical for driving corporate performance as well restoring confidence in the markets. The first step towards achieving this is to implement a framework of management reporting which is based on timely, relevant and accurate information. This will enable effective decision making as well as meeting the needs of external stakeholders.1.2 Scope of Record to ReportThe scope of this paper is the financial and non-financial reporting responsibilities of the CFO/ FD. As such it covers:▪Section 2: Board/ Divisional/ cost centre reporting (along with application of Business Intelligence techniques)▪Section 3: General ledger and the chart of accounts structure▪Section 4: Month end close and consolidation processes▪Section 5: Statutory reportingThe paper does not cover the reporting responsibilities of other Operational Executives (eg. Sales, Logistics, CRM, Marketing, HR etc).2 Management reporting2.1 The purpose of management informationThe purpose of management information is to:▪monitor progress against corporate objectives and plans▪identify actions required where actual performance is at variance with expectationThe Board Report is a key component in the management reporting hierarchy, collating information across an organisation. The Board Report combines the various operational activities through the common and objective medium of finance (be it sterling, dollars etc). A good Board Report will ultimately drive decision making and actions, assisting the organisation to achieve its short-term and long term objectives.As such the Board Report should provide all the necessary information to support the Board in fulfilling its responsibilities. In doing so it should be:▪Externally focused-Market opportunities-Threats-Competition▪Forward looking-Driving vision-Aligning operations to strategy-Refining strategy as required▪Challenging to the management team-Driving performance-Questioning the status quo-Understanding and managing risks2.2 Management reporting & operational reportingManagement reporting is a broad term which may mean different things to different people. It is, therefore, necessary to understand the distinction between:▪management reporting as used by key Executives and senior management. These reports are used to drive decision making and measure whether or not corporate objectives are being met. This type of reporting needs to be salient, relevant, covering both financial and non financial criteria▪management reporting as used for day to day operational purposes. Examples include cost centre reports, headcount analysis, call centre performance etc.These reports are data driven and enable managers to review delivery of their current responsibilities. These reports should be standard in their presentation and delivered within minimal intervention or overhead. This type of reporting is described as “operational reporting”The focus of this paper is the Executive style management reporting2.3 Design principles in Management ReportingIt is recognised that every company will have differing information needs for running that corporation. As such every company will have different management reporting needs. It is, however, necessary when reviewing or developing report content to have in place core design principles. These should include:▪delivery of information which meets the needs of key decision makers within the organisation▪delivery of timely, relevant and accurate information which meets the needs of the Business as well as Finance▪delivery of information not data, based on the philosophy of “less is more” (salient, concise reporting of information vs delivery of significant volumes of numeric and other data)▪“one version of the truth” which delivers consistency of information across the whole organisation (see Section 2.4 below)▪use of lead as well as lag indicators (eg. for customer satisfaction, service downtime may be a lead indicator, customer churn a lag indicator)▪incorporation of operational KPIs as well as core financial measures▪application of a balance score card approach, ensuring consideration is given to financial, operational, people/staff and customer perspectives.▪application of exception reporting techniques, with significant variances being highlighted▪action orientated reporting, in terms of commentary and reviewdynamic in nature. The content and format of reports needs to be reviewed and refreshed to ensure they keep pace with changes in the Business2.4Overview of the cascade of informationThe management reporting strategy should be based on a cascade of information from the Board down (ie. from Board to Divisions to Business Units and ultimately cost centres). This is represented below:In delivering this cascade of information it is necessary to ensure consistency of information from the Board through to the cost centres. This is based on the principle of “one version of the truth”. It ensures, for example, that the results of Division X as presented to the Division X MD are the same as those being reviewed by the Group CFO. As well as consistency in content there should also be consistency in the look and feel of reports to ensure Executives and management can negotiate them with ease.Group ReportDivisional Management ReportsBusiness Unit ReportsOperational/ Cost Centre ReportsDefinition of content needs to be “top down”. The CFO/ Board should define the Board Report content such that it meets thei r needs. It also needs to be consistent with corporate strategy and subsequently used to monitor performance and drive business performance. The needs of the Board should then be cascaded down to Divisions, Business Units and ultimately cost centres. This ensur es corporate strategy is translated into operational delivery. This can be contrasted with the “bottom up” content driven approach, where cost centre reporting cascades up to bespoke Business Unit and Division reports. When agg regated at the Board level this is usually characterised by excel consolidations, significant data volumes and the need to refer to inconsistent Division reports.2.5 The use of Key Performance Indicators (KPIs)Management reports should contain performance information relating to the key operational issues as well as financial measures. This is important as changes in operational measures tend to be lead indicators on future financial performance (eg. network build is behind schedule – cash flow savings in the short term, slower sales growth in the longer term).The CFO/ Board should agree on the KPIs presented in the report. General principles on KPIs are:-▪availability: frequency & accuracy▪relevance: alignment to critical success factors▪acceptance: level of use in the organisation/ industry▪topical: relevance to specific strategic initiativesWhen establishing financial and operational measures for inclusion in management reports, this needs to be done with an understanding of remuneration and reward structures. The two need to be consistent. Failure to do so will deliver conflicting messages. It is noted reward based measures will have the most powerful influence on day to day behaviours.2.6 Example contentAs noted above, each and very organisation will have their own needs a nd opinions, driving the look, feel and content of the management reports. A “leading practice” management report (Board Report, Division Report and cost centre report) is given, however, in Appendix 1. This report demo nstrates the leading practice principles highlighted above and is to be used for reference purposes only.In terms of content it includes:▪[Executive summary –A synopsis of performance is provided by KPIs accompanied by appropriate action orientated commentary. Use of data is limited to core data only▪Action plan –corrective actions specified with contingencies and sensitivity analysis showing best and worst case scenarios(usually in the form of commentary)▪Profit and Loss statement –P&L account showing period and cumulative positions with highlighted variances against budget. Any major variances should behighlighted and adequately explained. Trend analysis should be shown graphically and full year projections shown▪Projected outturn incorporated in P&L –Projected outturns recalculated each month on the basis of actual performance and action plans▪Cashflow –Actual and projected receipts and payments up to the year end▪Balance Sheet - position of working capital, assets and long term investments / debt.]2.7 Leading practice checklist2.8 Management reporting – process overviewManagement reporting - detailed process: production of management reports3 General ledger and chart of accounts3.1 Purpose of the General LedgerThe General Ledger is used capture financial data at transactional level with standard accounts in a standard record structure that accommodates multidimensional reporting.The general ledger should allow for the following;▪Consistent and accurate classification of accounting data▪Ease of transfer of financial data throughout the company▪Clear flow of financial data from source systems through multiple levels of consolidation▪Latitude for additional data elements3.2 Chart of accountsThe core structure underlying the general ledger is contained in the Chart of Accounts. Characteristics of a good chart of accounts are as follows:▪application of a common chart of accounts where possible,which facilitates consolidation and reconciliation across large organisations.▪well defined segments and group values for ease of reporting▪keep it simple – elimination of unnecessary segments, elimination of unnecessary detail within segments▪use of a thin general ledger structure with detailed data being held in the sub ledgers, data warehouse environments for analytical purposes▪ a structure consistent with the organisational structure (management and legal)▪ a structure which reflects appropriate levels of accountability within the organisation (ie cost centre structure cascades down to a decision making managerial positions and not beyond)Appendix 2 provides a detailed chart of accounts assessment and the application of “leading practice ”. In doin g so it reviews the structure of chart of accounts as well as the application of a common chart of accounts for a pan European company.3.3 General ledger overviewAn outline of the general ledger is summarised below. Figure [ ]: Outline of the General Ledger structureGeneral LedgerINVENTORY CONTROLFinancial and management reports are generated - drill down queries are performedCapital assets3.4 General ledger leading practice checklistThe following section provides a leading practice checklist for the general ledger. It should be used in conjunction with Appendix 2.4 Month end close4.1 What is Fast close?For a reporting environment to be effective there needs to be delivery of timely and relevant information. The longer the delay between operational transactions and report production, the less relevant the report will be from an information and decision making perspective. Consequently, month end close procedures are critical in the delivery of effective management reporting.Fast Close is an approach to deliver quicker management and financial reporting by improving month end close processes and enhancing the quality and relevance of the information provided.The first quartile benchmark for the production and distribution of management reports is 5 working days post month end. This can be achieved by:▪ensuring a focus is maintained on providing key decision makers with relevant information and setting materiality levels from a Group perspective▪ensuring all possible activities and postings are performed in advance of the month end close (eg. inter-company reconciliations)▪applying standard processes across the organisation and automating these as much as possibleIn doing so the timeliness of reporting improves, reducing the resources tied up in the month end cycle.4.2 To be processA high level process map for “leading practice” month end close is outlined below.4.3 Month end leading practice checklistThe following section provides a leading practice checklist for the month end close process.4.4 Group consolidation & reporting featuresThe key features of a group consolidation system are summarised below.Figure [ ]: Consolidation system4.5 Consolidation leading practice checklistThe following section provides a leading practice checklist for the consolidation process.5 Statutory reporting5.1 Statutory reporting requirementsNot surprisingly, given the diversity of development of business practices across Europe, statutory reporting requirements vary considerably country by country. The statutory requirements within a particular country will dictate:▪The topics of information to be disclosed (e.g. P&L, balance sheet, cash flow, fixed assets, director emoluments, pension liabilities)▪The accounting standards to be used in deriving the figures (e.g. UK GAAP, IAS)▪The timetable for publication (e.g. x months after year-end close in the UK)▪The language for publication of documents.In addition, in certain countries the business transactions must be reportable against a national standard chart of accounts. In some countries, this principle is extended to the insistence that all transactions are coded at source against a national standard chart of accounts.For multinational groups, subsidiaries will have a responsibility to provide statutory results within the country of registration (typically the country they are operating in), as well as having their results consolidated into the group results. In some cases, the multiple reporting requirements can cause significant complications in the preparation of statutory reports. For example, the Italian subsidiary of a joint UK-France owned group will need to have results prepared in all three formats, GAAPs and charts of accounts.This area of design leading practice, including full details of statutory design requirements by country, can be found in the ROI Chart of Accounts paper.Within an individual country, it is common for the organisation to consist of multiple legal entities, and for historic reasons or tax purposes the legal structure often does not match with the management reporting structure. In leading practice situations, transactional data is tagged with the relevant legal entity, to allow simple collation of results by legal entity for statutory reporting purposes. This ideal may not be practical in some cases, requiring the coding of AR / AP / payroll etc to both legal entity and management cost centre. There are also likely to be large single transactions, such as rent, insurance etc. that will need to be allocated across legal entities. As a result, the preparation of statutory reports will often require a significant amount of allocation of balances to legal entities before the consolidation process can begin.5.2 Leading practice timetableThe top quartile timetable from a recent survey of 250 European companies is shown in the figure below:5.3 Statutory reporting leading practice checklistThe following section provides a leading practice checklist for the statutory reporting process.。

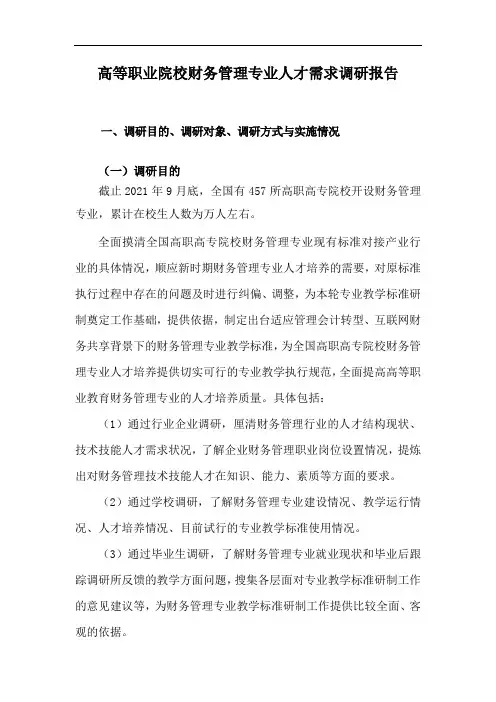

高等职业院校财务管理专业人才需求调研报告一、调研目的、调研对象、调研方式与实施情况(一)调研目的截止2021年9月底,全国有457所高职高专院校开设财务管理专业,累计在校生人数为万人左右。

全面摸清全国高职高专院校财务管理专业现有标准对接产业行业的具体情况,顺应新时期财务管理专业人才培养的需要,对原标准执行过程中存在的问题及时进行纠偏、调整,为本轮专业教学标准研制奠定工作基础,提供依据,制定出台适应管理会计转型、互联网财务共享背景下的财务管理专业教学标准,为全国高职高专院校财务管理专业人才培养提供切实可行的专业教学执行规范,全面提高高等职业教育财务管理专业的人才培养质量。

具体包括:(1)通过行业企业调研,厘清财务管理行业的人才结构现状、技术技能人才需求状况,了解企业财务管理职业岗位设置情况,提炼出对财务管理技术技能人才在知识、能力、素质等方面的要求。

(2)通过学校调研,了解财务管理专业建设情况、教学运行情况、人才培养情况、目前试行的专业教学标准使用情况。

(3)通过毕业生调研,了解财务管理专业就业现状和毕业后跟踪调研所反馈的教学方面问题,搜集各层面对专业教学标准研制工作的意见建议等,为财务管理专业教学标准研制工作提供比较全面、客观的依据。

(二)调研对象结合《全国财政职业教育教学指导委员会高职财经类专业教学标准建设工作方案》的要求,我们制定了《2021年高等职业院校财务管理专业调研工作安排》,要求财务管理专业标准各专家组成员须针对行业、企业、学校、毕业生四类对象进行调研,其中,要求每位成员所调研企业不少于5家,调研学校不少于2所(包括本校),调研毕业生不少于50人。

具体要求为:(1)调研5家以上本区域的企业,调研企业要具有先进企业的代表性且适合高职财务管理专业学生就业。

(2)调研本区域内2家(含本校)高职院校,被调研对象应在本区域内具有较强影响力。

(3)调研本校财务管理专业毕业生不少于50人,调研学生应为近三年毕业且从事财会相关工作的毕业生。

优秀审计案例

审计是一种重要的财务管理工具,可以帮助企业或组织发现潜在的风险和问题,提高财务稳定性和透明度。

以下是一些历史上的优秀审计案例:

1. 安然公司审计案例

安然公司是一家美国能源公司,因为财务造假和管理失误导致公司破产。

安然公司的审计师安永会计师事务所也因此受到了严厉的批评。

这个案例揭示了审计师在审计过程中需要更加严格的审查和监督,以确保财务报告的准确性和透明度。

2. 马达加斯加共和国审计案例

2002年,国际货币基金组织(IMF)对马达加斯加共和国进行了审计,发现了该国政府在财务管理方面存在严重问题。

审计报告揭示了政府在预算编制、财务报告和资金管理方面的不当行为,促使政府采取了一系列措施改进财务管理和监督。

3. 英国国家健康服务审计案例

英国国家健康服务(NHS)是一个庞大的公共医疗系统,每年花费数十亿英镑。

审计师对NHS进行了审计,发现了一些问题,如医疗设备的管理和维护、医疗

服务的质量和效率等。

审计报告促使NHS采取了一系列改进措施,提高了医疗服务的质量和效率。

4. 美国纽约证券交易所审计案例

纽约证券交易所(NYSE)是全球最大的证券交易所之一,每年交易额达数万亿美元。

审计师对NYSE进行了审计,发现了一些问题,如交易系统的安全性和透明度、交易员的行为规范等。

审计报告促使NYSE采取了一系列改进措施,提高了交易系统的安全性和透明度。

以上案例表明,审计是一种重要的财务管理工具,可以帮助企业或组织发现潜在的风险和问题,提高财务稳定性和透明度。

审计师需要在审计过程中严格审查和监督,确保财务报告的准确性和透明度。

国有企业典型内部控制失效案例分析2009-7-28近年来,国内企业的重大危机接二连三地发生,整体来看,突出有三类重大风险:一是多元化投资,二是金融工具投机,三是生产安全事故。

撇开生产安全事故不说,前两类风险具有明显的两大特点:一是风险发生对企业造成的损失巨大,动辄就会使企业“伤筋动骨”;二是同类事故在大型国有企业时有发生。

鉴于此,我们称此两类风险为大型国有企业典型的高风险业务。

下面我们通过案例对此两类重大风险做深入分析。

1.多元化投资(1)三九集团的财务危机从1992年开始,三九企业集团在短短几年时间里,通过收购兼并企业,形成医药、汽车、食品、酒业、饭店、农业,房产等几大产业并举的格局。

但是,2004年4月14日,三九医药(000999)发出公告:因工商银行要求提前偿还3.74亿元的贷款,目前公司大股东三九药业及三九集团(三九药业是三九集团的全资公司)所持有的公司部分股权已被司法机关冻结。

至此,整个三九集团的财务危机全面爆发。

截至危机爆发之前,三九企业集团约有400多家公司,实行五级公司管理体系,其三级以下的财务管理已严重失控;三九系深圳本地债权银行贷款已从98亿升至107亿,而遍布全国的三九系子公司和控股公司的贷款和贷款担保约在60亿至70亿之间,两者合计,整个三九系贷款和贷款担保余额约为180亿元。

三九集团总裁赵新先曾在债务风波发生后对外表示,“你们(银行)都给我钱,使我头脑发热,我盲目上项目。

”案例简评:三九集团财务危机的爆发可以归纳为几个主要原因:(1)集团财务管理失控;(2)多元化投资(非主业/非相关性投资)扩张的战略失误;(3)集团过度投资引起的过度负债。

另外,从我国国有上市公司的发展环境来看,中国金融体制对国有上市公司的盲目投资、快速膨胀起到了推波助澜的作用。

(2)华源集团的信用危机华源集团成立于1992年,在总裁周玉成的带领下华源集团13年间总资产猛增到567亿元,资产翻了404倍,旗下拥有8家上市公司;集团业务跳出纺织产业,拓展至农业机械、医药等全新领域,成为名副其实的“国企大系”。

国际财务报告准则核心工具国际财务报告准则更新2020年12月31日已发布的准则和解释目录引言2第一部分:2020年12月31日已发布的新公告4强制采用时间表4国际财务报告准则第17号——保险合同5业务的定义——对《国际财务报告准则第3号》的修订7利率基准改革——对《国际财务报告准则第9号》、《国际会计准则第39号》和《国际财务报告准则第7号》的修订8利率基准改革——第二阶段——对《国际财务报告准则第9号》、《国际会计准则第39号》、《国际财务报告准则第7号》、《国际财务报告准则第4号》和《国际财务报告准则第16号》的修订9重要性定义——对《国际会计准则第1号》和《国际会计准则第8号》的修订11新冠肺炎疫情相关租金减让——对《国际财务报告准则第16号》的修订12对《概念框架》的引用——对《国际财务报告准则第3号》的修订13不动产、厂场和设备:达到预定可使用状态前的收益——对《国际会计准则第16号》的修订13亏损合同——合同履约成本——对《国际会计准则第37号》的修订14投资者与其联营或合营企业之间的资产转让或投入——对《国际财务报告准则第10号》和《国际会计准则第28号》的修订14财务报告概念框架15对负债的流动或非流动分类——对《国际会计准则第1号》的修订16国际财务报告准则改进17第二部分:不纳入国际财务报告准则解释委员会2020年下半年度议程的事项18第三部分:国际会计准则理事会现行项目22引言按照国际财务报告准则进行报告的主体仍需持续面对新准则和解释的持续更新。

所导致的变化由基本原则的重大修订到年度改进项目的少量变化不等。

它们将影响诸如确认、计量、列报和披露等不同会计领域。

某些变化的影响已超出了会计范畴,还可能影响很多主体的信息系统。

此外,这些变化还将影响商业决策,诸如合营安排的创建或特定交易的架构。

编制者的挑战在于了解未来所需面对的一切。

本刊的目的本刊概述了准则和解释(公告)即将发生的变化,还提供了若干现行项目的最新进展情况,但未提供有关这些主题的深度分析或讨论。

2024安永财务共享服务调查报告一、本文概述1、背景介绍 a. 财务共享服务的定义与发展 b. 安永对财务共享服务的关注a. 财务共享服务的定义与发展财务共享服务是一种新型的财务管理模式,它将企业分散在各个地区的财务部门整合在一起,通过信息技术和标准化流程来提高财务管理的效率和准确性。

这种模式起源于20世纪90年代的欧美国家,随着全球化的发展和信息技术的发展而逐渐普及。

财务共享服务能够降低企业的成本,提高企业的服务质量,从而为企业创造更多的价值。

b. 安永对财务共享服务的关注安永作为全球领先的专业服务公司,一直关注着财务共享服务的发展。

为了深入了解财务共享服务的现状和未来趋势,安永连续多年开展财务共享服务调查。

通过收集和分析全球范围内的大量数据,了解企业在实施财务共享服务过程中的挑战和成果,为企业在财务共享服务建设方面提供参考和建议。

2、报告目的与结构 a. 目的:探讨财务共享服务的发展趋势、挑战和机遇 b. 结构:调查结果概述、详细分析、结论与建议a. 目的:本报告旨在探讨财务共享服务的发展趋势、挑战和机遇。

通过对全球范围内的财务共享服务实践进行调查,我们希望了解当前的最佳实践、发展趋势以及面临的挑战,为企业提供有关财务共享服务的洞察和建议。

b. 结构:本报告分为以下几个部分:1、调查结果概述:我们将简要介绍调查的基本结果,包括财务共享服务的现状、业务流程的外包情况、技术的发展趋势等。

2、详细分析:我们将深入分析各个领域的调查结果,包括人员配置、业务流程、技术应用和创新实践等。

通过详细分析,我们可以更好地了解财务共享服务的优势和挑战。

3、结论与建议:我们将总结调查结果,提出针对企业的建议,包括如何优化财务共享服务、如何应对挑战以及如何利用机遇等。

通过以上结构,我们可以全面了解财务共享服务的现状和发展趋势,为企业提供实用的建议和指导。

二、财务共享服务的现状与趋势1、全球财务共享服务分布情况 a. 地区分布 b. 行业分布a. 地区分布根据2024安永财务共享服务调查报告,全球范围内的财务共享服务(Financial Shared Services,FSS)主要分布在以下几个地区:首先,亚洲地区已经成为全球财务共享服务的重要中心。

经典的财务管理宣传广告词篇一:最经典的财务管理方案(策划)伊吉康附件4:财务管理:第一部分规范财务管理制度:财务是公司的命脉,财务部门的建设分为岗位设置、岗位职责、业务流程三个方面。

根据公司管理需要,制订如下:(一)岗位设置:出纳一名。

往来会计一名。

资金预算会计一名。

总帐会计一名。

(二)岗位职责:各会计岗位除了完成如下相关岗位工作外,还要及时完成公司及财务主管交办的工作。

1. 出纳(1)责任范围:①日常零用现金的提取及其它现金收付。

②银行日常收付款业务的办理。

③月初核对上月总账中的银行存款账目,并编制余额调节表④每周末进行现金盘点,编制现金盘点表。

⑤应收及应付账款以外收付款业务的账务处理。

⑥应付及应收票据台账的登记。

⑦根据审核后的送货单及合同开据销售发票。

⑧会计凭证的及时打印。

⑨核对现金、银行存款、应付票据、其它应收款账目。

⑩工资的发放。

(2)工作要点:①出纳一般在收到主管审核传递的会计凭证后再收付款项,凭证附件不齐、审批签字不全的,应拒付。

②每月10日前上报银行存款余额调节电子表,每周末17:00上报本周现金盘点电子表。

③及时打印银行对账单、取回银行单据,交相关会计入账。

④根据主管审核的付款凭证支付货款,付款时收验收款方收据、对账单(经我方核签)、送货单、委托书、收款人身份证复印件,证件齐全方可付款。

⑤及时登记的应付票据台账电子档放入共享文件夹,供本部门主管和资金预算会计查询。

⑥发票的开据应以往来会计复核的送货单、对账单、合同以及经批准的开票申请表为依据,开具的发票经主管复核后方能交给业务人员寄出。

⑦超过500元的付款,要经主管点数后方可支付。

2. 往来会计(1)责任范围:①应收、应付账款的核对、挂帐。

②应收及应付账款收付款计划、应收账款追踪表的填报。

③复核市场部报表。

④月未抽盘仓库的资产盘点表。

⑤报价。

⑥核对应收账款、应付账款、原材料等账目。

(2)工作要点:①每月10日前根据采购送来的应付对账单,在总账中挂应付账款,挂账前核查对账单、发票、验收单、送货单、订单等单证齐全;审批签字手续完备;复核单证之间单价、数量、金额是否相符且计算无误。