美联储2008年资产负债表

- 格式:docx

- 大小:18.85 KB

- 文档页数:3

2008年以来美国经济刺激计划一揽表一、量化宽松货币政策(美国联邦储备委员会)㈠第一轮:2009年3月美联储在2008年12月将联邦基金利率降至零至0.25%的历史低位,并从2009年3月起推行第一轮量化宽松的货币政策,美联储通过购买1.7万亿美元的中长期国债、抵押贷款支持证券等将资产负债表迅速扩大,力图用这种注入流动性的方式来刺激经济增长。

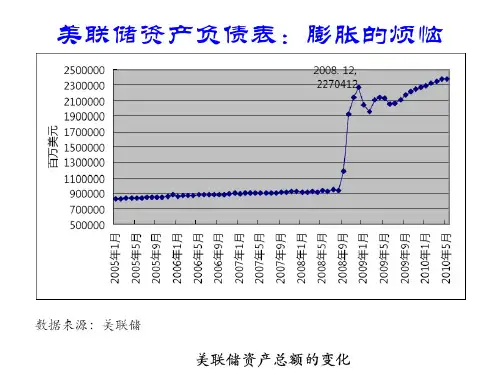

美联储在第一轮量化宽松中,将其资产负债表由8800亿美元扩大至 2 .3万亿美元,此举稳定住了金融市场,拯救了银行业,但是对就业、消费的帮助却不大。

2008 年11 月25 日,美联储宣布,将购买政府支持企业(简称GSE)房利美、房地美、联邦住房贷款银行与房地产有关的直接债务,还将购买由两房、联邦政府国民抵押贷款协会(Ginnie Mae) 所担保的抵押贷款支持证券(MBS)。

2009 年3 月18 日,机构抵押贷款支持证券2009 年的采购额最高增至1.25 万亿美元,机构债的采购额最高增至2000 亿美元。

此外,为促进私有信贷市场状况的改善,联储还决定在未来六个月中最高再购买3000 亿美元的较长期国债证券。

2009 年11 月4 日,美联储在结束利率会议后发表的政策声明中宣布,决定总计购买1.25 万亿美元的机构抵押贷款支持证券和价值约1750 亿美元的机构债。

后者略低于联储早先公布的2000 亿美元。

美联储由此小幅缩减了首轮定量宽松政策的规模。

美联储指出,机构债采购额度的减少与近来的采购速度以及市场可获取的机构债数量有限有关。

美联储还首次宣布,这些证券和机构债的采购预计将在2010 年第一季结束前完成。

2010 年4 月28 日,美联储在利率会议后发表的声明中未再提及购买机构抵押贷款支持证券和机构债的问题。

这标志着联储的首轮定量宽松政策正式结束。

首轮定量宽松总计为金融系统及市场提供了1.725 万亿美元流动性。

㈡第二轮:2010年11月3日自2010年4月份美国的经济数据开始令人失望,进入步履蹒跚的复苏以来,美联储一直受压于需要推出另一次的量化宽松:第二次量化宽松(QE2)。

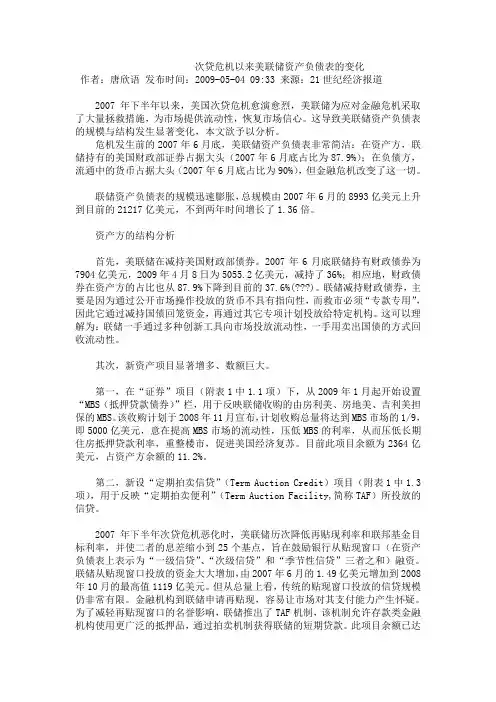

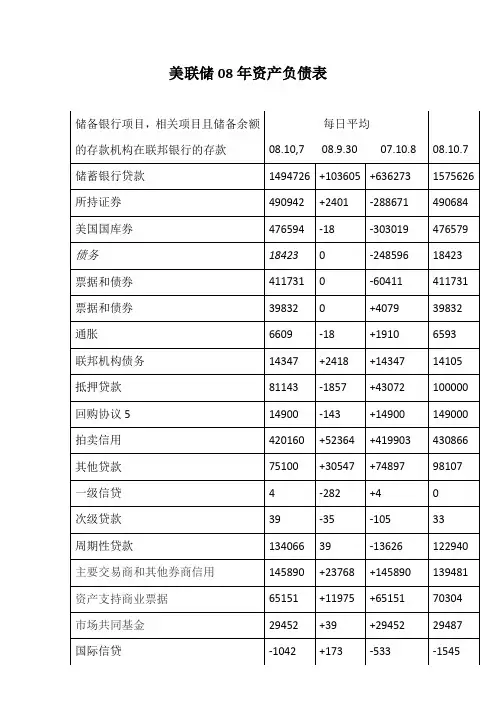

次贷危机以来美联储资产负债表的变化作者:唐欣语发布时间:2009-05-04 09:33 来源:21世纪经济报道2007年下半年以来,美国次贷危机愈演愈烈,美联储为应对金融危机采取了大量拯救措施,为市场提供流动性,恢复市场信心。

这导致美联储资产负债表的规模与结构发生显著变化,本文欲予以分析。

危机发生前的2007年6月底,美联储资产负债表非常简洁:在资产方,联储持有的美国财政部证券占据大头(2007年6月底占比为87.9%);在负债方,流通中的货币占据大头(2007年6月底占比为90%),但金融危机改变了这一切。

联储资产负债表的规模迅速膨胀,总规模由2007年6月的8993亿美元上升到目前的21217亿美元,不到两年时间增长了1.36倍。

资产方的结构分析首先,美联储在减持美国财政部债券。

2007年6月底联储持有财政债券为7904亿美元,2009年4月8日为5055.2亿美元,减持了36%;相应地,财政债券在资产方的占比也从87.9%下降到目前的37.6%()。

联储减持财政债券,主要是因为通过公开市场操作投放的货币不具有指向性,而救市必须“专款专用”,因此它通过减持国债回笼资金,再通过其它专项计划投放给特定机构。

这可以理解为:联储一手通过多种创新工具向市场投放流动性,一手用卖出国债的方式回收流动性。

其次,新资产项目显著增多、数额巨大。

第一,在“证券”项目(附表1中1.1项)下,从2009年1月起开始设置“MBS(抵押贷款债券)”栏,用于反映联储收购的由房利美、房地美、吉利美担保的MBS。

该收购计划于2008年11月宣布,计划收购总量将达到MBS市场的1/9,即5000亿美元,意在提高MBS市场的流动性,压低MBS的利率,从而压低长期住房抵押贷款利率,重整楼市,促进美国经济复苏。

目前此项目余额为2364亿美元,占资产方余额的11.2%。

第二,新设“定期拍卖信贷”(Term Auction Credit)项目(附表1中1.3项),用于反映“定期拍卖便利”(Term Auction Facility,简称TAF)所投放的信贷。

2008年

9月17日美联储公开市场委员会(FOMC)决定维持联邦基金基准利率2%不变美政府正式接管AIG 美联储提供850亿拯救AIG

9月15日雷曼申请美史上最大破产保护债务逾6130亿

美元

9月14日美国银行14日与美国第三大投资银行美林证券已达成协议,将以约440亿美元收购后者

9月7日美国联邦住房金融管理局将出面接管房利美和房地美

3月16日

美联储决定,将贴现率由3.5%下调至3.25%,并为初级交易商创设新的贴现窗口融资工具。

3月12日

美联储宣布,将扩大证券借贷项目,向其一级交易商出

亿美元的国

债。

1月31日美联储将联邦基金利率下调50个基点,至3.0%,将贴现率下调0.5%,至

3.5%。

1月30日瑞士银行宣布,受高达140亿美元的次贷资产冲减拖累,去年第四季度预计出现约114亿美元亏损。

1月22日美联储宣布将联邦基金利率下调75基点至3.50%,隔夜拆借利率下调75基点至

4.00%

1月17日美林公司第四季度亏损98.3亿美元,每股由同比的2.41亿收益转而亏损12.01

美元。

1月15日花旗宣布,该行四季度亏损98.3亿美元,并表示将通过公开发行及私人配售方式筹资125亿

美元。

中央银行的资产负债表与货币政策∗——中国和美国的比较 一、引 言近几十年来,纵观世界各国,许多奉行自由市场经济的国家在遭遇到经济金融危机时,政府都无一例外地出手,采取各种措施对危机进行控制和救助,市场无形之手总会向政府有形之手做出让步。

美国的中央银行--美国联邦储备系统(简称美联储)现任主席伯南克(Bernanke ,2008)认为,要准确地评估危机管理的效果有多大是非常困难的, 但有一点可以肯定, 即如果没有中央银行的介入, 危机要严重得多,影响也会深远得多。

金融危机会导致经济萧条,中央银行一般采取宽松的货币政策应对,常规的方法有:第一、中央银行作为最后贷款人,通过公开市场操作、再贴现或再贷款,向金融机构提供流动性援助。

在金融市场发达的国家,中央银行应对危机的常规手段主要是通过参与市场供求运作,提供短期的流动性。

一般来说,中央银行为了最大限度地降低在流动性供给过程中其所承受的风险,会要求借入资金的金融机构提供合格资产作为抵押。

最后贷款人是现代中央银行的一个重要职责, 中央银行随时准备为出现流动性短缺的银行体系注入高能货币。

第二、降低利率和法定存款准备金率。

(1)中央银行可以降低贴现利率或再贷款利率。

有能力调控的短期利率有隔夜同业拆借利率、证券市场回购利率和逆回购利率等,通过公开市场业务引导货币市场利率接近中央银行的目标利率。

以美国为例,联邦基金率是指美国同业拆借市场的利率,也是基准利率,其最主要的是隔夜拆借利率。

美联储瞄准并调节同业拆借利率就能直接影响商业银行的资金成本,并且将同业拆借市场上的资金余缺传递给工商企业,进而影响消费、投资和国民经济。

作为同业拆借市场的最大的参加者,其作用机制应该是这样的:美联储降低其拆借利率,商业银行之间的拆借就会转向商业银行与美联储之间,因为向美联储拆借的成本低,整个市场的拆借利率都将随之下降。

(2)降低商业银行上缴中央银行的法定存款准备金率。

目的是放松融资条件,为商业银行提供成本更低和数量更多的资金,由此来支持经济成长。

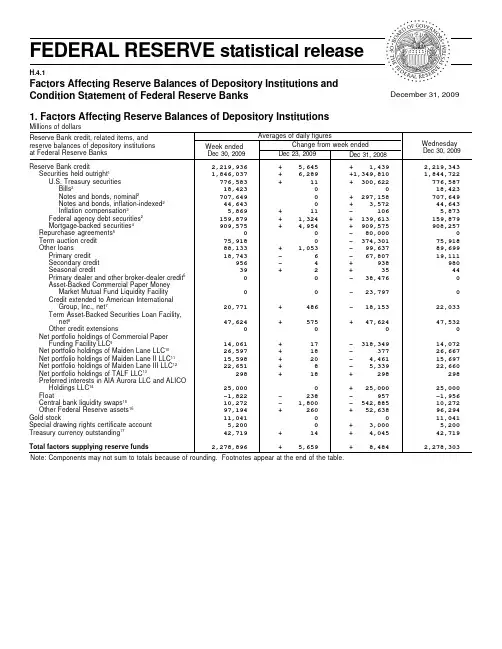

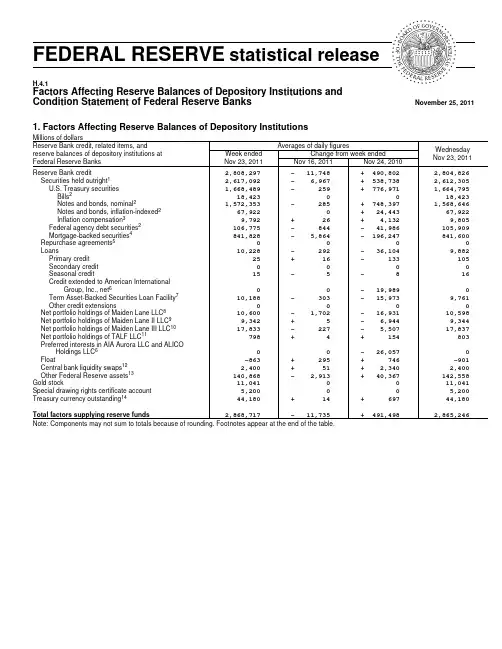

FEDERAL RESERVE statistical releaseH.4.1Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve BanksNovember 25, 20111. Factors Affecting Reserve Balances of Depository InstitutionsMillions of dollarsAverages of daily figuresWednesday Nov 23, 2011Week ended Nov 23, 2011Change from week ended Nov 16, 2011Nov 24, 2010Reserve Bank credit, related items, andreserve balances of depository institutions at Federal Reserve BanksReserve Bank credit2,808,297- 11,748+ 490,802 2,804,826Securities held outright 12,617,092- 6,967+ 538,738 2,612,305U.S. Treasury securities 1,668,489- 259+ 776,971 1,664,795Bills 218,423 0 0 18,423Notes and bonds, nominal 21,572,353- 285+ 748,397 1,568,646Notes and bonds, inflation-indexed 2 67,922 0+ 24,443 67,922Inflation compensation 39,792+ 26+ 4,132 9,805Federal agency debt securities 2 106,775- 844- 41,986 105,909Mortgage-backed securities 4 841,828- 5,864- 196,247 841,600Repurchase agreements 5 0 0 0 0Loans10,228- 292- 36,104 9,882Primary credit 25+ 16- 133 105Secondary credit 0 0 0 0Seasonal credit15- 5- 8 16Credit extended to American InternationalGroup, Inc., net 60 0- 19,989 0Term Asset-Backed Securities Loan Facility 7 10,188- 303- 15,973 9,761Other credit extensions0 0 0 0Net portfolio holdings of Maiden Lane LLC 8 10,600- 1,702- 16,931 10,598Net portfolio holdings of Maiden Lane II LLC 9 9,342+ 5- 6,944 9,344Net portfolio holdings of Maiden Lane III LLC 10 17,833- 227- 5,507 17,837Net portfolio holdings of TALF LLC 11798+ 4+ 154 803Preferred interests in AIA Aurora LLC and ALICOHoldings LLC 6 0 0- 26,057 0Float-863+ 295+ 746 -901Central bank liquidity swaps 12 2,400+ 51+ 2,340 2,400Other Federal Reserve assets 13 140,868- 2,913+ 40,367 142,558Gold stock11,041 0 0 11,041Special drawing rights certificate account 5,200 0 0 5,200Treasury currency outstanding 1444,180+ 14+ 697 44,180Total factors supplying reserve funds 2,868,717- 11,735+ 491,4982,865,246Note: Components may not sum to totals because of rounding. Footnotes appear at the end of the table.1. Factors Affecting Reserve Balances of Depository Institutions (continued)Millions of dollarsAverages of daily figuresWednesday Nov 23, 2011Week ended Nov 23, 2011Change from week ended Nov 16, 2011Nov 24, 2010Reserve Bank credit, related items, andreserve balances of depository institutions at Federal Reserve BanksCurrency in circulation 141,058,836+ 1,217+ 84,532 1,062,585Reverse repurchase agreements 1591,329- 2,353+ 34,451 84,779Foreign official and international accounts 91,329- 2,353+ 34,451 84,779Others0 0 0 0Treasury cash holdings105- 6- 88 102Deposits with F.R. Banks, other than reserve balances 141,766+ 66,453- 93,126 157,366Term deposits held by depository institutions 5,055+ 5,055+ 5,055 5,055U.S. Treasury, General Account44,347+ 14,561+ 14,956 34,535U.S. Treasury, Supplementary Financing Account 0 0- 199,960 0Foreign official 1,197+ 1,044- 1,574 124Service-related2,505 0+ 139 2,505Required clearing balances2,505 0+ 139 2,505Adjustments to compensate for float 0 0 0 0Other88,662+ 45,794+ 88,259 115,147Funds from American International Group, Inc. assetdispositions, held as agent 60 0- 26,774 0Other liabilities and capital 1671,385+ 1,476- 1,66671,086Total factors, other than reserve balances,absorbing reserve funds1,363,420+ 66,786- 2,672 1,375,918Reserve balances with Federal Reserve Banks1,505,297- 78,521+ 494,1691,489,328Note: Components may not sum to totals because of rounding.1.Includes securities lent to dealers under the overnight securities lending facility; refer to table 1A.2.Face value of the securities.pensation that adjusts for the effect of inflation on the original face value of inflation-indexed securities.4.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of the underlying mortgages.5.Cash value of agreements.6.As a result of the closing of the American International Group, Inc. (AIG) recapitalization plan on January 14, 2011, the credit extended to AIGwas fully repaid and the Federal Reserve’s commitment to lend any further funds was terminated. In addition, the Federal Reserve Bank of New York (FRBNY) has been paid in full for its preferred interests in AIA Aurora LLC and ALICO Holdings LLC. The funds from AIG asset dispositions that FRBNY held as agent were the source of repayment of the credit extended to AIG, as well as a portion of theFRBNY’s preferred interests in ALICO Holdings LLC. The remaining FRBNY preferred interests in ALICO Holdings LLC and AIA Aurora LLC, valued at approximately $20 billion, were purchased by AIG through a draw on the Treasury’s Series F preferred stock commitment and then transferred by AIG to the Treasury as consideration for the draw on the available Series F funds.7.Includes credit extended by the Federal Reserve Bank of New York to eligible borrowers through the Term Asset-Backed Securities Loan Facility.8.Refer to table 4 and the note on consolidation accompanying table 9.9.Refer to table 5 and the note on consolidation accompanying table 9.10.Refer to table 6 and the note on consolidation accompanying table 9.11.Refer to table 7 and the note on consolidation accompanying table 9.12.Dollar value of foreign currency held under these agreements valued at the exchange rate to be used when the foreign currency is returnedto the foreign central bank. This exchange rate equals the market exchange rate used when the foreign currency was acquired from the foreign central bank.13.Includes other assets denominated in foreign currencies, which are revalued daily at market exchange rates, and the fair value adjustmentto credit extended by the FRBNY to eligible borrowers through the Term Asset-Backed Securities Loan Facility. Before the closing of theAIG recapitalization plan on January 14, 2011, included accrued dividends on the FRBNY’s preferred interests in AIA Aurora LLC and ALICO Holdings LLC.14.Estimated.15.Cash value of agreements, which are collateralized by U.S. Treasury securities, federal agency debt securities, and mortgage-backed securities.16.Includes the liabilities of Maiden Lane LLC, Maiden Lane II LLC, Maiden Lane III LLC, and TALF LLC to entities other than the Federal ReserveBank of New York, including liabilities that have recourse only to the portfolio holdings of these LLCs. Refer to table 4 through table 7 and the note on consolidation accompanying table 9. Also includes the liability for interest on Federal Reserve notes due to U.S. Treasury. Refer to table 8and table 9.Sources: Federal Reserve Banks and the U.S. Department of the Treasury.1A. Memorandum ItemsMillions of dollars Averages of daily figuresWednesday Nov 23, 2011Week ended Nov 23, 2011Change from week ended Nov 16, 2011Nov 24, 2010Memorandum itemMarketable securities held in custody for foreignofficial and international accounts 1 3,456,703+ 2,992+ 115,286 3,449,645U.S. Treasury securities 2,738,558+ 5,785+ 130,247 2,729,927Federal agency securities 2 718,144- 2,794- 14,962 719,718Securities lent to dealers 11,294- 35+ 2,823 10,779Overnight facility 311,294- 35+ 2,823 10,779U.S. Treasury securities9,980- 199+ 2,480 9,478Federal agency debt securities1,313+ 163+ 3421,301Note: Components may not sum to totals because of rounding.1.Face value of the securities. Includes U.S. Treasury STRIPS and other zero-coupon bonds at face value and mortgage-backed securities at originalface value.2.Includes debt and mortgage-backed securities.3.Fully collateralized by U.S. Treasury securities.2. Maturity Distribution of Securities, Loans, and Selected Other Assets and Liabilities, November 23, 2011Millions of dollars Within 15days 16 days to 90 days 91 days to 1 year Over 1 year to 5 years Over 5 years to 10 years Over 10years All Remaining maturityLoans 1121 0 4,023 5,738 0 ... 9,882U.S. Treasury securities 2Holdings17,469 27,168 99,696 674,996 633,612 211,854 1,664,795Weekly changes- 3,520+ 12,299- 17,308- 17,256+ 29,251- 14,508- 11,041Federal agency debt securities 3Holdings0 5,092 21,534 60,790 16,146 2,347 105,909Weekly changes- 1,588+ 681+ 1,088- 1,769 0 0- 1,588Mortgage-backed securities 4Holdings0 0 0 12 22 841,565 841,600Weekly changes0 0 0 0 0- 383- 383Asset-backed securities held byTALF LLC 50 0 0 0 0 0 0Repurchase agreements 6 0 0 ... ... ... ... 0Central bank liquidity swaps 75521,8480 0 0 0 2,400Reverse repurchase agreements 6 84,779 0 ... ... ... ... 84,779Term deposits 0 5,055 0.........5,055Note: Components may not sum to totals because of rounding.. . . Not applicable.1.Excludes the loans from the Federal Reserve Bank of New York (FRBNY) to Maiden Lane LLC, Maiden Lane II LLC, MaidenLane III LLC, and TALF LLC. The loans were eliminated when preparing the FRBNY’s statement of condition consistent with consolidation under generally accepted accounting principles.2.Face value. For inflation-indexed securities, includes the original face value and compensation that adjusts for the effect of inflation on theoriginal face value of such securities.3.Face value.4.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of theunderlying mortgages.5.Face value of asset-backed securities held by TALF LLC, which is the remaining principal balance of the underlying assets.6.Cash value of agreements.7.Dollar value of foreign currency held under these agreements valued at the exchange rate to be used when the foreign currency is returned tothe foreign central bank. This exchange rate equals the market exchange rate used when the foreign currency was acquired from the foreign central bank.3. Supplemental Information on Mortgage-Backed SecuritiesMillions of dollarsWednesdayAccount nameNov 23, 2011Mortgage-backed securities held outright1 841,600 Commitments to buy mortgage-backed securities2 40,500 Commitments to sell mortgage-backed securities2 0Cash and cash equivalents3 61.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of theunderlying mortgages.2.Current face value. Generally settle within 180 days and include commitments associated with outright transactions, dollar rolls, and coupon swaps.3.This amount is included in other Federal Reserve assets in table 1 and in other assets in table 8 and table 9.4. Information on Principal Accounts of Maiden Lane LLCMillions of dollarsWednesdayAccount nameNov 23, 2011Net portfolio holdings of Maiden Lane LLC1 10,598Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 7,523Accrued interest payable to the Federal Reserve Bank of New York2 750Outstanding principal amount and accrued interest on loan payable to JPMorgan Chase & Co.3 1,3781.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in anorderly market on the measurement date. Revalued quarterly. This table reflects valuations as of September 30, 2011. Any assets purchased after this valuation date are initially recorded at cost until their estimated fair value as of the purchase date becomes available.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent withconsolidation under generally accepted accounting principles. Refer to the note on consolidation accompanying table 9.3.Book value. The fair value of these obligations is included in other liabilities and capital in table 1 and in other liabilities and accrued dividends intable 8 and table 9.Note: On June 26, 2008, the Federal Reserve Bank of New York (FRBNY) extended credit to Maiden Lane LLC under the authority of section 13(3)of the Federal Reserve Act. This limited liability company was formed to acquire certain assets of Bear Stearns and to manage those assetsthrough time to maximize repayment of the credit extended and to minimize disruption to financial markets. Payments by Maiden Lane LLC fromthe proceeds of the net portfolio holdings will be made in the following order: operating expenses of the LLC, principal due to the FRBNY, interestdue to the FRBNY, principal due to JPMorgan Chase & Co., and interest due to JPMorgan Chase & Co. Any remaining funds will be paid to the FRBNY.5. Information on Principal Accounts of Maiden Lane II LLCMillions of dollarsWednesdayAccount nameNov 23, 2011Net portfolio holdings of Maiden Lane II LLC1 9,344Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 6,368Accrued interest payable to the Federal Reserve Bank of New York2 560Deferred payment and accrued interest payable to subsidiaries of American International Group, Inc.3 1,1021.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in anorderly market on the measurement date. Revalued quarterly. This table reflects valuations as of September 30, 2011. Any assets purchased after this valuation date are initially recorded at cost until their estimated fair value as of the purchase date becomes available.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent withconsolidation under generally accepted accounting principles. Refer to the note on consolidation accompanying table 9.3.Book value. The deferred payment represents the portion of the proceeds of the net portfolio holdings due to subsidiaries of AmericanInternational Group, Inc. in accordance with the asset purchase agreement. The fair value of this payment and accrued interest payable are included in other liabilities and capital in table 1 and in other liabilities and accrued dividends in table 8 and table 9.Note: On December 12, 2008, the Federal Reserve Bank of New York (FRBNY) began extending credit to Maiden Lane II LLC under the authorityof section 13(3) of the Federal Reserve Act. This limited liability company was formed to purchase residential mortgage-backed securities from the U.S. securities lending reinvestment portfolio of subsidiaries of American International Group, Inc. (AIG subsidiaries). Payments by Maiden Lane II LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of Maiden Lane II LLC, principal due tothe FRBNY, interest due to the FRBNY, and deferred payment and interest due to AIG subsidiaries. Any remaining funds will be shared by the FRBNY and AIG subsidiaries.6. Information on Principal Accounts of Maiden Lane III LLCMillions of dollarsWednesdayAccount nameNov 23, 2011Net portfolio holdings of Maiden Lane III LLC1 17,837Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 9,406Accrued interest payable to the Federal Reserve Bank of New York2 679Outstanding principal amount and accrued interest on loan payable to American International Group, Inc.3 5,5231.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in anorderly market on the measurement date. Revalued quarterly. This table reflects valuations as of September 30, 2011. Any assets purchased after this valuation date are initially recorded at cost until their estimated fair value as of the purchase date becomes available.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent withconsolidation under generally accepted accounting principles. Refer to the note on consolidation accompanying table 9.3.Book value. The fair value of these obligations is included in other liabilities and capital in table 1 and in other liabilities and accrued dividends intable 8 and table 9.Note: On November 25, 2008, the Federal Reserve Bank of New York (FRBNY) began extending credit to Maiden Lane III LLC under the authorityof section 13(3) of the Federal Reserve Act. This limited liability company was formed to purchase multi-sector collateralized debt obligations(CDOs) on which the Financial Products group of American International Group, Inc. (AIG) has written credit default swap (CDS) contracts. Inconnection with the purchase of CDOs, the CDS counterparties will concurrently unwind the related CDS transactions. Payments by Maiden LaneIII LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of Maiden Lane III LLC, principal dueto the FRBNY, interest due to the FRBNY, principal due to AIG, and interest due to AIG. Any remaining funds will be shared by the FRBNY andAIG.7. Information on Principal Accounts of TALF LLCMillions of dollarsWednesdayAccount nameNov 23, 2011Asset-backed securities holdings1 0Other investments, net 803Net portfolio holdings of TALF LLC 803Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 0Accrued interest payable to the Federal Reserve Bank of New York2 0Funding provided by U.S. Treasury to TALF LLC, including accrued interest payable3 1091.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in an orderlymarket on the measurement date.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent with consolidationunder generally accepted accounting principles. Refer to the note on consolidation accompanying table 9.3.Book value. The fair value of these obligations is included in other liabilities and capital in table 1 and in other liabilities and accrued dividends in table 8and table 9.Note: On November 25, 2008, the Federal Reserve announced the creation of the Term Asset-Backed Securities Loan Facility (TALF) under the authority of section 13(3) of the Federal Reserve Act. The TALF is a facility under which the Federal Reserve Bank of New York (FRBNY) extends loans with a term of up to five years to holders of eligible asset-backed securities. The TALF is intended to assist financial markets in accommodating the credit needs of consumers and businesses by facilitating the issuance of asset-backed securities collateralized by a variety of consumer and business loans. The loans provided through the TALF to eligible borrowers are non-recourse, meaning that the obligation of the borrower can be discharged by surrendering the collateral to the FRBNY. The loans are extended for the market value of the security less an amount known as a haircut. As a result, the borrower bears the initial risk of a decline in the value of the security.TALF LLC is a limited liability company formed to purchase and manage any asset-backed securities received by the FRBNY in connection with the decision of a borrower not to repay a TALF loan. TALF LLC has committed, for a fee, to purchase all asset-backed securities received by the FRBNY in conjunction with a TALF loan at a price equal to the TALF loan plus accrued but unpaid interest. Losses on asset-backed securities held by TALF LLC will be offset in the following order: by the commitment fees collected by TALF LLC, by the interest received on investments of TALF LLC, by up to $4.3 billion in subordinated debt funding provided by the U.S. Treasury, and finally, by senior debt funding provided by the FRBNY. Payments by TALF LLC from the proceeds of its net portfolio holdings will be made in the following order: operating expenses of TALF LLC, principal due to the FRBNY, principal due to the U.S. Treasury, interest due to the FRBNY, and interest due to the U.S. Treasury. Any remaining funds will be shared by the FRBNY and the U.S. Treasury.8. Consolidated Statement of Condition of All Federal Reserve Banks Millions of dollarsEliminations from consolidationWednesdayNov 23, 2011Change sinceWednesdayNov 16, 2011WednesdayNov 24, 2010Assets, liabilities, and capitalAssetsGold certificate account 11,037 0 0 Special drawing rights certificate account 5,200 0 0 Coin 2,249- 33+ 158 Securities, repurchase agreements, and loans 2,622,187- 13,633+ 488,284 Securities held outright1 2,612,305- 13,011+ 525,086 U.S. Treasury securities 1,664,795- 11,041+ 763,557 Bills2 18,423 0 0 Notes and bonds, nominal2 1,568,646- 11,072+ 736,520 Notes and bonds, inflation-indexed2 67,922 0+ 23,046 Inflation compensation3 9,805+ 31+ 3,991 Federal agency debt securities2 105,909- 1,588- 42,269 Mortgage-backed securities4 841,600- 383- 196,203 Repurchase agreements5 0 0 0 Loans 9,882- 622- 36,803 Net portfolio holdings of Maiden Lane LLC6 10,598- 2- 16,952 Net portfolio holdings of Maiden Lane II LLC7 9,344+ 3- 6,947 Net portfolio holdings of Maiden Lane III LLC8 17,837+ 5- 5,507 Net portfolio holdings of TALF LLC9 803+ 9+ 156 Preferred interests in AIA Aurora LLC and ALICOHoldings LLC10 0 0- 26,057 Items in process of collection (83) 330+ 129+ 87 Bank premises 2,180- 1- 46 Central bank liquidity swaps11 2,400+ 51+ 2,340 Other assets12 140,373+ 3,824+ 40,235 Total assets (83) 2,824,537- 9,649+ 475,749 Note: Components may not sum to totals because of rounding. Footnotes appear at the end of the table.8. Consolidated Statement of Condition of All Federal Reserve Banks (continued) Millions of dollarsEliminations from consolidationWednesdayNov 23, 2011Change sinceWednesdayNov 16, 2011WednesdayNov 24, 2010Assets, liabilities, and capitalLiabilitiesFederal Reserve notes, net of F.R. Bank holdings 1,020,751+ 4,379+ 83,415 Reverse repurchase agreements13 84,779- 12,050+ 30,070 Deposits (0) 1,646,690- 3,085+ 391,424 Term deposits held by depository institutions 5,055+ 5,055+ 5,055 Other deposits held by depository institutions 1,491,829- 85,738+ 463,997 U.S. Treasury, General Account 34,535- 10,247+ 10,498 U.S. Treasury, Supplementary Financing Account 0 0- 199,960 Foreign official 124- 1- 2,886 Other (0) 115,147+ 87,845+ 114,720 Deferred availability cash items (83) 1,231- 335- 845 Other liabilities and accrued dividends14 17,161- 316- 25,477Total liabilities (83) 2,770,612- 11,408+ 478,587Capital accountsCapital paid in 26,963+ 880+ 171 Surplus 26,963+ 880+ 1,042 Other capital accounts 0 0- 4,050Total capital 53,925+ 1,759- 2,838 Note: Components may not sum to totals because of rounding.1.Includes securities lent to dealers under the overnight securities lending facility; refer to table 1A.2.Face value of the securities.pensation that adjusts for the effect of inflation on the original face value of inflation-indexed securities.4.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of theunderlying mortgages.5.Cash value of agreements, which are collateralized by U.S. Treasury and federal agency securities.6.Refer to table 4 and the note on consolidation accompanying table 9.7.Refer to table 5 and the note on consolidation accompanying table 9.8.Refer to table 6 and the note on consolidation accompanying table 9.9.Refer to table 7 and the note on consolidation accompanying table 9.10.As a result of the closing of the AIG recapitalization plan on January 14, 2011, the Federal Reserve Bank of New York has been paid in fullfor its preferred interests in AIA Aurora LLC and ALICO Holdings LLC. A portion of the preferred interests was redeemed by AIG with the funds from AIG asset dispositions that were held as agent by the Federal Reserve.11.Dollar value of foreign currency held under these agreements valued at the exchange rate to be used when the foreign currency is returned tothe foreign central bank. This exchange rate equals the market exchange rate used when the foreign currency was acquired from the foreign central bank.12.Includes other assets denominated in foreign currencies, which are revalued daily at market exchange rates and the fair value adjustment tocredit extended by the Federal Reserve Bank of New York (FRBNY) to eligible borrowers through the Term Asset-Backed Securities Loan Facility.Before the closing of the AIG recapitalization plan on January 14, 2011, included accrued dividends on the FRBNY’s preferred interests in AIA Aurora LLC and ALICO Holdings LLC.13.Cash value of agreements, which are collateralized by U.S. Treasury securities, federal agency debt securities, and mortgage-backed securities.14.Includes the liabilities of Maiden Lane LLC, Maiden Lane II LLC, Maiden Lane III LLC, and TALF LLC to entities other than the FederalReserve Bank of New York, including liabilities that have recourse only to the portfolio holdings of these LLCs. Refer to table 4 through table 7 and the note on consolidation accompanying table 9. Also includes the liability for interest on Federal Reserve notes due to U.S. Treasury. Before the closing of the AIG recapitalization plan on January 14, 2011, included funds from American International Group, Inc. asset dispositions, held as agent.H.4.110. Collateral Held against Federal Reserve Notes: Federal Reserve Agents’ AccountsMillions of dollarsWednesday Federal Reserve notes and collateralNov 23, 2011 Federal Reserve notes outstanding 1,191,154 Less: Notes held by F.R. Banks not subject to collateralization 170,402 Federal Reserve notes to be collateralized 1,020,751 Collateral held against Federal Reserve notes 1,020,751 Gold certificate account 11,037 Special drawing rights certificate account 5,200 U.S. Treasury, agency debt, and mortgage-backed securities pledged1,2 1,004,515 Other assets pledged 0 Memo:Total U.S. Treasury, agency debt, and mortgage-backed securities1,2 2,612,305 Less: Face value of securities under reverse repurchase agreements 72,579 U.S. Treasury, agency debt, and mortgage-backed securities eligible to be pledged 2,539,726 Note: Components may not sum to totals because of rounding.1.Includes face value of U.S. Treasury, agency debt, and mortgage-backed securities held outright, compensation toadjust for the effect of inflation on the original face value of inflation-indexed securities, and cash value of repurchaseagreements.2.Includes securities lent to dealers under the overnight securities lending facility; refer to table 1A.。

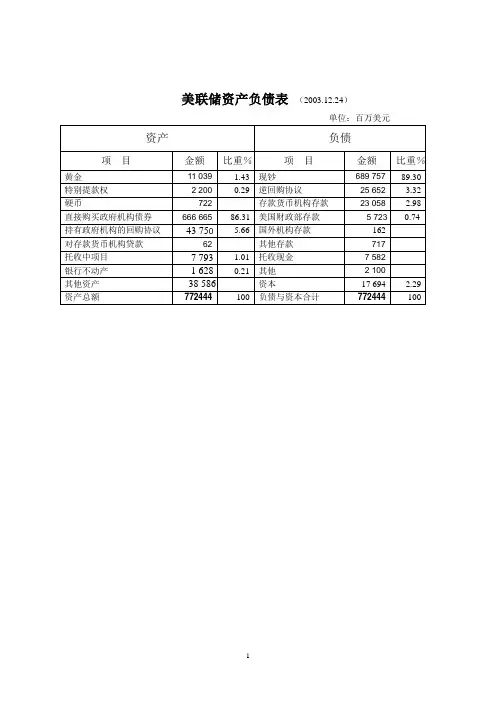

美联储资产负债表(2003.12.24)单位:百万美元美联储资产负债表(2008.12.24)* Net portfolio holdings of Commercial Paper Funding Facility LLC(以下项目标注相类似)Commercial Paper Funding Facility LLC is a limited liability company formed to purchase three-month U.S. dollar-denominated commercial paper from eligible issuers and thereby foster liquidity in short-term funding markets and increase the availability of credit for businesses and households.Maiden Lane LLC is the first holding company bearing the name that was created when JPMorgan Chase took over Bear Stearns in early 2008. The Federal Reserve Bank of New Y ork is the primary benefic iary of Maiden Lane LLC. It holds an asset portfolio that JPMorgan found too risky to assume in whole, and consequently the Federal Reserve Bank of New Y ork extended a $30 billion credit line to the limited liability company to facilitate the unwinding of these assets over time. Bloomberg, citing Bank of America analysts, reported on October 2, 2008, that the Federal Reserve might stand to lose $2 to $6 billion on the asset porfolio. A November 06, 2008, update by the Federal Reserve showed that the fair value of the assets was at $26.8 billion, meaning a book loss of $2 billion for the Federal Reserve.Maiden Lane II LLC is a limited liability company created when American International Group Inc(AIG) was taken over by the U.S. government in September 2008. Since AIG's subsidiarieshold a great many residential mortgage-backed securities that are very risky, Maiden Lane II LLC was formed to purchase these RMBS. On December 12, 2008, the Federal Reserve Bank of New Y ork began extending credit to Maiden Lane II LLC. On the Fed's Balance Sheet as of December 17, 2008, net portfolio holdings of Maiden Lane II LLC are 20,031 million dollarsMaiden Lane III LLC is a holding company created when American International Group Inc(AIG) was taken over by the U.S. government in September 2008. Similar to Maiden Lane II LLC, Maiden Lane III LLC aims to purchase multi-sector collateralized debt obligations (CDOs) on which the Financial Products group of AIG had written credit default swap contracts. On November 25, 2008, the Federal Reserve Bank of New Y ork began extending credit to Maiden Lane III LLC. As of December 17, 2008, The Federal Reserve's net portfolio holding of Maiden Lane III LLC is 19.656 billion dollars(Maiden Lane III LLC (ML III), a financing entity recently created by the Federal Reserve Bank of New Y ork (FRBNY) and AIG, has purchased an additional $16 billion in par amount of multi-sector collateralized debt obligations (Multi-Sector CDOs). As a result, the associated credit default swap contracts and similar instruments(CDS) written by AIG Financial Products Corp. (AIGFP) have been terminated. ML III`s purchases of CDOs, in conjunction with the termination of related CDS, have mitigated AIG's liquidity issues in connection with its CDS and similar exposures on Multi-Sector CDOs.)Reserve Balance with Federal Reserve Banks(in billions of dollars)Federal Reserve assets in billions of dollars. Source: Macroblog.。

一、资产类项目分析1.总资产增长率对比通过对美联储和中国人民银行近八年来总资产增长速度的统计,我们发现,中国人民银行的总资产增长率大部分年份为正值,说明中国人民银行的总资产基本上呈现不断增长的趋势,相比而言,美联储在2008年以外的年份里,总资产增长率较低,且时正时负,说明美联储的总资产增长态势不是很明显。

但是,值得注意的是,在2008年金融危机爆发之际,美联储总资产增长率在3、4季度迅速拉升,全年总资产增长率高于100%,相比而言,中国人民银行并没有表现出太大的变化来,依然保持以外的增长率在增长。

由统计数据可知,金融危机对于美国的冲击迫使美联储大幅度增加流动性供给,而我国由于金融危机冲击较小,得以保持较低的增长率。

2.美联储各类资产总额分析在金融危机之前,各项资产所占比例变化不大,但金融危机改变了这一切。

2007年下半年以来,美国次贷危机愈演愈烈,为市场提供流动性,恢复市场信心美联储为应对金融危机采取了大量拯救措施,从图表中我们可以清晰地看出在次贷危机期间各项资产都有一个较大的变化。

联储一手通过多种创新工具向市场投放流动性,一手用卖出国债的方式回收流动性。

1.在金融危机之后可以从国内信贷的结构变化看出,直接持有债券的比例大幅下降。

2.新资产项目显著增多、数额巨大。

可以在其他资产的变化中看出自从09年央行流动性互换的新项目被提出,在金融危机之后的恢复阶段,几乎占了所有的其他资产,为恢复期做出了巨大的贡献。

3.国内信贷变化分析从上图可以看出,美国资产的重头集中于国内信贷部分,自金融危机爆发至今,其国内信贷增长趋势与资产项目增长趋势极为相似,其中直接持有证劵部分的增长与国内信贷的增长有很大的相关性,分析原因如下:1.美国政府持续推行QE量化宽松政策。

扩大货币发行,减少银行压力,放松银根,来向市场注入大量的流动性以复苏经济。

在金融危机全面爆发之后,美联储通过一系列救市政策增加相当规模的基础货币供应,除去低利率效应,其中1.25万亿美元MBS、3000亿美元美国国债和1750亿美元机构证券就向市场直接注入1.725万亿美元。

金融危机以来美联储资产负债表演变综述隋晓静(中国海洋大学经济学院,山东青岛266100)摘要:为应对金融危机带来的剧烈市场动荡,在传统货币政策失灵的背景下,美联储采取了一系列非常规货币政策,使其资产负债表的规模和结构发生巨大变化。

随着宏观经济复苏,货币政策正常化被提上议程。

本文按时间顺序对美联储资产负债表相关研究进行总结和梳理,并依此探究未来的研究方向。

关键词:美联储;资产负债表;大规模资产购买;货币政策正常化中图分类号:F830文献标识码:A文章编号:1005-913X (2020)04-0089-03收稿日期:2020-02-12作者简介:隋晓静(1993-),女,山东烟台人,硕士研究生,研究方向:产业组织与产业结构。

一、前言20世纪七十年代以来,美联储的货币政策一直是稳定宏观经济的重要工具。

金融危机前,美联储通过调整联邦基金利率目标范围来进行宏观经济调控。

但由于2007年次级抵押贷款市场的恶化导致信贷市场混乱,以及2008年底联邦基金利率目标下限达到零(Gertler 等,2015),无法进一步降低,这种传统的工具开始失效,美联储不得不使用非常规货币政策工具来复苏经济,即前瞻性指引和大规模资产购买(LSAPs )或称量化宽松(QE )政策。

LSAPs 对金融市场的影响力更大且持久,在刺激实体经济以及降低利率的不确定性方面更有效(Swanson ,2017)。

一系列非常规货币政策使得美联储资产负债表的规模与结构发生巨大变化,其重要性日益凸显,尤其在联邦基金利率目标下限为零的情况下,资产负债表的规模对于判断美联储的货币政策立场有重要作用(Eksi ,2017)。

美联储采取新的货币政策工具来达到其最大化就业和稳定物价的目的,非常规政策的实施收效显著,Powell (2017)认为货币政策宽松了近十年,美国经济已接近全面发展,劳动力市场前景良好,通货膨胀率处于其2%的目标下,应继续实施正常化计划。

美联储资产负债表变化对我国货币政策的溢出效应徐滢,肖迪(浙江工商大学金融学院,浙江杭州310000)摘要:美联储资产负债表的变化在一定程度上影响世界各国货币政策的走向,本文利用2007年2月—2019年12月美国与中国相关月度金融数据,建立TVP-VAR模型来分析美联储资产负债表的变化对中国货币政策的溢出效应。

研究发现,美联储扩表与缩表时对我国货币政策的溢出效应具有非对称性,并在不同时点具有不同的影响。

具体来说,美联储扩表时对我国银行间利率的影响要大于缩表时的影响,且不论缩表还是扩表均会导致我国M2增加,对汇率和我国央行资产负债表规模存在显著的长期负向冲击溢出效应。

关键词:美联储资产负债表;溢出效应;TVP-VAR模型DOI:10.3969/j.issn.1003-9031.2020.09.002中图分类号:F831.6文献标识码:A文章编号:1003-9031(2020)09-0011-11一、引言从2008年金融危机开始,美联储充分发挥了最后贷款人的角色,以各种非常规货币政策工具稳定市场流动性,避免金融机构由于风险厌恶导致的流动性短缺。

经过4轮QE,美国经济及失业率已呈现复苏的态势,美联储有必要奉行先发制人的政策,阻止由LSAP(大规模资产规模购买计划)政策导致滞留在银行的超额准备金引起通货膨胀。

2014年,美联储进行了先加基金项目:本文系浙江省自然科学一般项目“美联储资产负债表正常化对中国经济的外溢效应研究”(LY19G030002);浙江省教育厅科研一般项目“信息不对称假设下非正规金融融资替代效应研究”(Y201329797)阶段性成果。

收稿日期:2020-07-02作者简介:徐滢(1984-),女,浙江余姚人,经济学博士,浙江工商大学金融学院副教授;肖迪(1994-),男,湖南娄底人,浙江工商大学金融学院硕士研究生。

息后缩表的政策组合,发挥前瞻性指引政策的作用,稳定市场的情绪,避免经济不必要的波动。

For Release at4:30 P.M. Eastern timeOctober 9, 2008On October 8, 2008, the Federal Reserve Board announced that it had authorized the Federal Reserve Bank of New York to borrow securities from certain regulated U.S. insurance subsidiaries of the American International Group (AIG), under section 13(3) of the Federal Reserve Act. This transaction is economically equivalent to an extension of credit collateralized by the securities borrowed. The Board’s H.4.1 statistical release, “Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks,” reports the funds extended to AIG under this transaction with other lending to AIG in table 1 in the line “Other credit extensions.” In tables 3, 4, and 5, all of the lending to AIG is included in the item “Other loans.”Reserve Bank credit, related items, and reserve balances of depository institutions at Federal Reserve BanksReserve Bank credit1,494,726 + 103,605 + 636,273 1,575,626Securities held outright 490,942 + 2,401 - 288,671 490,684U.S. Treasury 1476,594 - 18 - 303,019 476,579Bills 218,423 0 - 248,596 18,423Notes and bonds, nominal 2411,731 0 - 60,411 411,731Notes and bonds, inflation-indexed 2 39,832 0 + 4,079 39,832Inflation compensation 3 6,609 - 18 + 1,910 6,593Federal agency 214,347 + 2,418 + 14,347 14,105Repurchase agreements 4 81,143 - 1,857 + 43,072 100,000Term auction credit 149,000 - 143 + 149,000 149,000Other loans420,160 + 52,364 + 419,903 430,866Primary credit 75,010 + 30,547 + 74,897 98,107Secondary credit 4 - 282 + 4 0Seasonal credit39 - 35 - 105 33Primary dealer and other broker-dealer credit 5 134,066 - 13,626 + 134,066 122,940Asset-backed commercial paper money market mutual fund liquidity facility 145,890 + 23,786 + 145,890 139,481Other credit extensions65,151 + 11,975 + 65,151 70,304Net portfolio holdings of Maiden Lane LLC 6 29,452 + 39 + 29,452 29,487Float-1,042 + 173 - 533 -1,545Other Federal Reserve assets 325,071 + 50,627 + 284,050 377,135Gold stock11,041 0 0 11,041Special drawing rights certificate account 2,200 0 0 2,200Treasury currency outstanding 738,745 + 14 + 92 38,745Total factors supplying reserve funds1,546,713 + 103,619 + 636,366 1,627,613Currency in circulation 7844,490 + 8,138 + 28,337 848,644Reverse repurchase agreements 894,343 + 6,434 + 59,994 77,349Foreign official and international accounts 76,486 + 5,719 + 42,137 77,349Dealers17,857 + 714 + 17,857 0Treasury cash holdings262 - 7 - 78 276Deposits with F.R. Banks, other than reserve balances442,151 + 137,497 + 430,844 479,629U.S. Treasury, general account7,910 - 719 + 3,531 5,544U.S. Treasury, supplementary financing account 405,771 + 139,690 + 405,771 459,246Foreign official 115 - 18 + 18 101Service-related7,717 - 1 + 1,247 7,717Required clearing balances7,717 - 1 + 1,247 7,717Adjustments to compensate for float 0 0 0 0Other20,637 - 1,456 + 20,275 7,021Other liabilities and capital 945,717 - 1,197 + 4,596 46,097Total factors, other than reserve balances,absorbing reserve funds1,426,963+ 150,865 + 523,693 1,451,994Reserve balances with Federal Reserve Banks 119,749 - 47,247+ 112,671175,619Averages of daily figuresNote: Components may not sum to totals because of rounding.1.Includes securities lent to dealers under the overnight and term securities lending facilities; refer to table 1A.2.Face value of the securities.pensation that adjusts for the effect of inflation on the original face value of inflation-indexed securities.4.Cash value of agreements.5. Includes credit extended through the Primary Dealer Credit Facility and credit extended to certain other broker-dealers.6. Fair value. Refer to table 2 and the note on consolidation accompanying table 5.7.Estimated.8.Cash value of agreements, which are collateralized by U.S. Treasury securities.9. Includes the liabilities of Maiden Lane LLC to entities other than the Federal Reserve Bank of New York, including liabilities that haverecourse only to the portfolio holdings of Maiden Lane LLC. Refer to table 2 and the note on consolidation accompanying table 5.Sources: Federal Reserve Banks and the U.S. Department of the Treasury.Change from week ended Wednesday Oct 8, 2008Week ended Oct 8, 2008 Oct 1, 2008 Oct 10, 2007Wednesday Oct 8, 2008H oldings U.S. Treasury securities 2Marketable securities held in custody for foreignofficial and international accounts 1 2,485,145 + 19,494 + 481,282 2,482,380U.S. Treasury 1,527,818 + 32,629 + 305,983 1,537,578Federal agency 957,327 - 13,135 + 175,299 944,802Securities lent to dealers 211,345- 44,456 + 208,289 217,504Overnight facility 220,002 - 2,234 + 16,946 25,658Term facility 3 191,343 - 42,222+ 191,343191,846H.4.11A. Memorandum Items, October 8, 2008Millions of dollars Averages of daily figuresWeek ended Oct 8, 2008Change from week ended Wednesday Oct 8, 2008 Oct 1, 2008 Oct 10, 2007Note: Components may not sum to totals because of rounding.1.Face value of the securities. Includes U.S. Treasury STRIPS and other zero-coupon bonds at face value.2.Fully collateralized by U.S. Treasury securities.3.Fully collateralized by U.S. Treasury securities, federal agency securities, and other highly rated debt securities.3. Maturity Distribution of Term Auction Credit, Other Loans, and Securities, October 8, 2008Millions of dollars Term auctioncreditWeeklychangesOther loans 1Repurchaseagreements 3Reverse repurchase agreements 3Note:Components may not sum to totals because of rounding. . . .Not applicable.1. Excludes the loan from the Federal Reserve Bank of New York to Maiden Lane LLC that was eliminated when preparing that Bank's statementof condition consistent with consolidation under generally accepted accounting principles. The loan to Maiden Lane LLC is designed to be repaid from the orderly liquidation of Maiden Lane LLC's portfolio holdings and does not have a fixed amortization schedule.2.Includes the original face value of inflation-indexed securities and compensation that adjusts for the effect of inflation on the original face valueof such securities.3.Cash value of agreements.Remaining maturity99,000 50,000 ... ... ... ... 149,000Within 15 days 16 days to 90 days 91 days to 1 year Over 1 year to 5 years Over 5 years to 10 years Over 10 years All212,462 128,865 19,240 70,299 ... ... 430,866 15,615 26,869 65,272 174,085 93,353 101,384 476,579 + 2,156 + 2,660 - 4,820 - 13 - 9 - 17 - 42 60,000 40,000 ... ... ... ... 100,000 77,349 0 ... ... ... ... 77,3492. Information on Principal Accounts of Maiden Lane LLCMillions of dollars Net portfolio holdings of Maiden Lane LLC 1Outstanding principal amount of loan extended by the Federal Reserve Bank of New York 2Accrued interest payable to the Federal Reserve Bank of New York 2Outstanding principal amount and accrued interest on loan payable to JPMorgan Chase & Co.329,487 28,820 186 1,1721. Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in anorderly market on the measurement date. Revalued quarterly. This table reflects valuations as of June 30, 2008.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York's statement of condition consistent withconsolidation under generally accepted accounting principles. Refer to the note on consolidation accompanying table 5.3.Book value. The fair value of these obligations is included in other liabilities and capital in table 1 and in other liabilities and accrued dividends intable 4 and table 5.Note: On June 26, 2008, the Federal Reserve Bank of New York (FRBNY) extended credit to Maiden Lane LLC under the authority of section 13(3)of the Federal Reserve Act. This limited liability company was formed to acquire certain assets of Bear Stearns and to manage those assets through time to maximize repayment of the credit extended and to minimize disruption to financial markets. Payments by Maiden Lane LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of the LLC, principal due to the FRBNY, interest due to the FRBNY, principal due to JPMorgan Chase & Co., and interest due to JPMorgan Chase & Co. Any remaining funds will be paid to the FRBNY.Memorandum itemAccount nameHoldings Federal agencysecuritiesWeeklychanges0 9,628 4,477 0 0 0 14,105 - 395 + 450 - 450 0 0 0 - 395Note: Components may not sum to totals because of rounding.1.Includes securities lent to dealers under the overnight and term securities lending facilities; refer to table 1A.2.Face value of the securities.pensation that adjusts for the effect of inflation on the original face value of inflation-indexed securities.4.Cash value of agreements, which are collateralized by U.S. Treasury and federal agency securities.5.Fair value. Refer to table 2 and the note on consolidation accompanying table 5.6.Includes assets denominated in foreign currencies and any exchange-translation assets, which are revalued daily at market exchange rates.7.Cash value of agreements, which are collateralized by U.S. Treasury securities.8.Includes any exchange-translation liabilities, which are revalued daily at market exchange rates.9. Includes the liabilities of Maiden Lane LLC to entities other than the Federal Reserve Bank of New York, including liabilities that have recourse only to the portfolio holdings of Maiden Lane LLC. Refer to the note on consolidation accompanying table 5.AssetsGold certificate account11,037 0 0Special drawing rights certificate account 2,200 0 0Coin1,522 + 13 + 379Securities, repurchase agreements, term auctioncredit, and other loans 1,170,550 + 37,907 + 340,769Securities held outright 490,684 - 437 - 288,924U.S. Treasury 1476,579 - 42 - 303,029Bills 218,423 0 - 248,596Notes and bonds, nominal 2411,731 0 - 60,411Notes and bonds, inflation-indexed 2 39,832 0 + 4,079Inflation compensation 3 6,593 - 42 + 1,899Federal agency 214,105 - 395 + 14,105Repurchase agreements 4 100,000 + 17,000 + 50,000Term auction credit 149,000 0 + 149,000Other loans430,866 + 21,344 + 430,693Net portfolio holdings of Maiden Lane LLC 5 29,487 + 40 + 29,487Items in process of collection (462)1,191 - 88 - 3,480Bank premises 2,170 + 3 + 67Other assets 6374,943 + 49,710 + 335,857Total assets(462)1,593,099 + 87,583 + 703,078LiabilitiesFederal Reserve notes, net of F.R. Bank holdings 811,692 + 7,713 + 31,944Reverse repurchase agreements 7 77,349 - 15,714 + 42,925Deposits(0)655,226 + 94,802 + 624,897Depository institutions183,314 + 4,023 + 157,776U.S. Treasury, general account5,544 + 266 + 1,378U.S. Treasury, supplementary financing account 459,246 + 114,773 + 459,246Foreign official 101 - 36 + 4Other(0) 7,021 - 24,224 + 6,492Deferred availability cash items(462) 2,736 - 33 - 1,977Other liabilities and accrued dividends 8,94,109 + 98 - 1,899Total liabilities (462)1,551,112 + 86,866 + 695,889Capital accounts Capital paid in 20,312 0 + 3,021Surplus18,523 + 3 + 3,085Other capital accounts3,153 + 715 + 1,083Total capital41,988+ 718+ 7,189H.4.14. Consolidated Statement of Condition of All Federal Reserve BanksMillions of dollarsChange sinceWednesday Oct 10, 2007Eliminations from consolidationWednesday Oct 8, 2008Wednesday Oct 1, 2008Assets, liabilities, and capital。