宏观经济学 Intermediate_Macroeconomics_Lecture9

- 格式:pdf

- 大小:463.78 KB

- 文档页数:9

中级宏观经济学课程教学大纲课程名称:中级宏观经济学/ Intermediate Macroeconomics课程代码:06236602课程类型:专业/必修总学时数:48学分:3先修课程:(初级)微观经济学、(初级)宏观经济学、微积分、概率统计开课单位:经济管理学院适用专业:经济学一、课程的性质、目的和任务《中级宏观经济学》是经济学专业学生在高年级阶段要学习的专业基础拓展课程之一。

本课程是在(初级)宏观经济学的基础上,通过模型与实际案例相结合的方式向学生介绍中级水平的宏观经济学的主要理论和相关经济政策。

该课程将使学生进一步了解西方主流宏观经济理论及其分析方法,提高对宏观经济现象的认识和分析能力,尝试并运用所学分析工具分析当前国际和国内的一些宏观经济问题;同时为学习其他经管类课程提供宏观经济理论方面的支持和帮助。

二、教学内容及教学基本要求1.导论及宏观经济的数据:了解宏观经济学关注的问题及其数据;理解宏观经济学的研究方法;掌握宏观经济学的研究内容、研究方法、GDP、CPI、失业率的衡量。

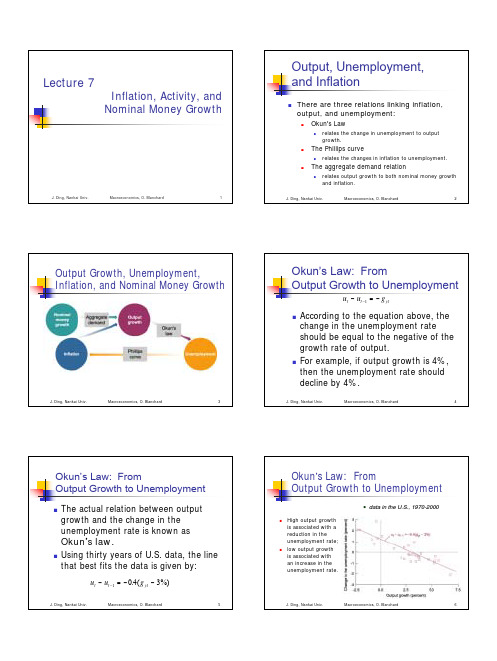

教学重点与难点:宏观经济学、真实GDP,通货膨胀率,失业率,市场出清,灵活变动的价格及粘性价格,GDP, CPI, 国民收入核算,劳动力,劳动力参与率,奥肯定律,GDP 平减指数2.长期中的经济:了解价格具有伸缩性的长期中的经济现象及理论;理解国民收入的基本模型、劳动市场和自然失业率、货币与物价水平、以及开放经济的宏观经济学;掌握生产函数、物品和劳务需求的决定、消费、需求、政府购买、物品和劳务的供求平衡,失业的类型、工资刚性、效率工资,货币的职能、类型、货币数量论、名义利率与实际利率、通货膨胀的社会成本、超级通货膨胀、古典二分法,小型开放经济中的储蓄与投资、名义与实际汇率。

教学重点与难点:规模收益不变、真实工资、边际产品、消费函数、边际消费倾向、挤出、通货膨胀、货币供给、货币政策、中央银行、公开市场操作、货币交易速度,货币需求函数、货币数量论、名以及真实利率、费雪方程、古典二分法,货币中性、净出口、资本净流出、名义汇率、真实汇率、购买力平价、自然失业率、摩擦失业、结构失业、工资刚性、效率工资。

中国海洋大学本科生课程大纲一、课程介绍1.课程描述CFA中级宏观经济学是在初级宏观经济学课程的基础上,结合微积分等数学工具,进一步深入讲授CFA中级宏观经济基本理论和分析方法,更加全面、系统地阐述CFA中级宏观经济理论的框架体系与发展演变。

本课程要求学生掌握基本的经济学模型构建方法,并通过各类习题加深对CFA中级宏观经济理论的理解,建立起经济学的基本思维框架,学会运用所学经济理论认识、分析全球现实经济问题。

CFA Intermediate Macroeconomics is an in-depth teaching of the intermediate macroeconomics basic theories and analytical methods in CFA,which is based on the basic macroeconomics courses and combined with calculus and other mathematical tools. It expounds the framework system and the development evolution of CFA intermediate macroeconomic theories comprehensively and systematically. This course requires students to master basic economic model building methods and deepen their understanding of CFA intermediate macroeconomic theories through various exercises, so as to establish the basic thinking framework of economics and improve their ability to understand, analyze and solve global economic problems with economic theory.2.设计思路本课程在内容上主要从中级宏观经济理论部分展开讲授。

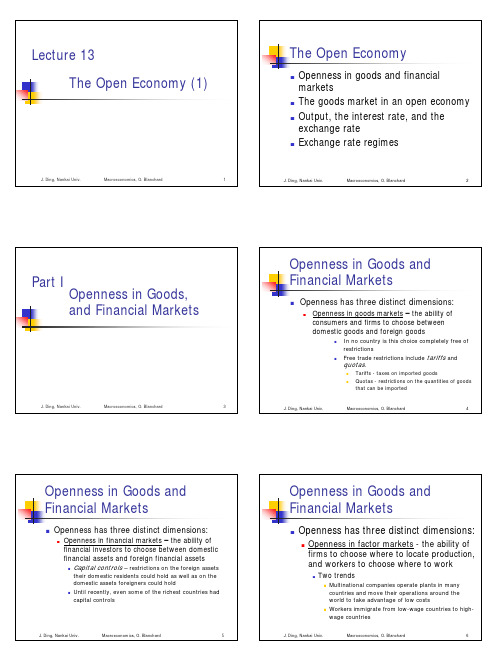

Macroeconomics----------------------------------------------------------------------------------------------------------------------Part I IntroductionChapter 1 The Science of Macroeconomics【Mainpoints】1.Exogenous Variables and Endogenous VariablesExample: The total quantity and price level of pizza in a country.Exogenous variables are given in a model. [aggregate income, price of materials]Endogenous variables are what a model explains. [price level and total quantity of pizza]2.Flexible Price and Sticky PriceFlexible price: easy to adjust, in short run.Sticky price: hard to adjust, in long run.===========================================Chapter 2 The Data of Macroeconomics【Mainpoints】1.GDP(1) Real GDP and Nominal GDP, GDP deflator(2) economy's income = economy's expenditure(3) GDP = C + G + I + NX2.CPI(1) CPI measures the price of a basket of goods(2) CPI = ∑P m Q / ∑P n Q(3) difference between GDP deflator and CPI3. The Unemployment Rate(1) Labour Force = Number of Unemployment + Number of Employment(2) Unemployment Rate = Number of Unemployment / Labour Force × 100%---------------------------------------------------------------------------------------------------------------------- Part II Classical Theory: The Economy in the Long Run ---- Flexible Price Chapter 3 National Income: Where It Comes From and Where It Goes【Mainpoints】1.Total Production(1) Production Function: Y = F(L,K)(2) constant returns to scale: zY = zF(L,K)2. National Income Distribution(1) Factor Prices ---- Labour:MPL = F(L+1,K) - F(L,K)ΔProfit = ΔRevenue - ΔCost = MPL×P - WIn order to maximize profit, make ΔProfit = 0. So MPL=W/P, Real WageLabour Income = MPL×L(2) Factor Prices ---- CapitalMPK = F(L,K+1) - F(L,K)ΔProfit = ΔRevenue - ΔCost = MPK×P - RIn ordet to maximize profit, make ΔProfit= 0 . So MPK=R/P, Real Rental Price ofCapitalCapital Income = MPK×K3)The Cobb-Douglas Production FunctionLabour Income = MPL×L = (1-α)YCapital Income = MPK×K = αY→F(K,L) = AKαL(1-α) , A measures the productivity of the available technology3.Total Demand1)Consumption:Determined by disposable incomeC=C(Y-T)Marginal Propensity to ConsumeMPC=C(Y-T+1)-C(Y-T)2)Investment:Determined by interest rateI=I(r)When r is high, investors will give upinvestment because cost of loan is higherthan rate of return.3) Government PurchasesG vs T, measures government budget5. Equilibrium (in a closed economy)(1) Market of Goods and ServicesY=C(Y-T)+I(r)+G(2) Market of Loanable FundsS=Y-C(Y-T) - G = I(r)investment is crowded out ===========================================Chapter 4 Money and Inflation【Mainpoints】1.Concept of Money(1) Funtions of Money: 1) Store of Value. Example: You can hold your money and trade itfor goods and services at some time in the future.2) Unit of Account. Example: In store people use money to showprice.3) Medium of Exchage. Example: People use money as tool toexchange goods.(2) Types of Money: 1) Fiat Money. No value, example: Paper Money.2) Commodity Money. With value, example: Gold and Silver.(3) Control of Money: 1) Institution: Central Bank. Example: Deutsche Bundesbank2) Method: Open-Markt Operation. Example: Buy governmentbonds to increase money supply.2.The Quantity Theory of Money(1) Quantity Equation: MV=PT →MV=PYQuantity Theory of Money: MV=PY(2) Real Money Balances: M/P , measured in quantity of goods and services.The Money Demand Function: (M/P)d = L(Y,i) = M/P← Money Supply. Y↑, d↑; i↑,d↓(3) Money and Inflation: ΔM% + ΔV% = ΔP% + ΔY% So M↑, P↑3.Inflation and Interest Rate(1) Fisher Equation: i = r + π===========================================Chapter 5 The Open Economy【Mainpoints】1.International Trade in a Samll Open Economy(1) View of goods and capital flow: NX = Y- (C+G+I)(2) View of capital flow: NX = Y-C-G-I = S-I= S-I(r*)r* is World Interes Rate(3) Trade Policies: 1) Domestic Fiscal Policy, influenceG↑,T↓→S↓→NX↓2) Fiscal Policy Abroad, influenceG e↑, T e↓→S e↓→r*↑→NX↑3) Shift in investment demand. Example: Government provides aninvestment tax credit2.Exchange Rates(1) Nominal Exchange Rates(e) and Real Exchange Rates(ε)Nominal exchange rates are measured in currency. Example: 100 yen / 1 dollarReal exchage rates are measured in goods and services. Example: 2 Japan Car / 1 USA car ε = e × (P/P*) , P* means price level of foreign countries.(2) The Real Exchange Rates and Trade Balance:NX = NX(ε)ε↓, P/P*↓, means domestic goods and servicesare cheaper than abroad. NX↑When NX(ε) = S - I, ε is equilibrium real ex.rate.(3) Trade Policies: 1) Domestic Fiscal Policy:G↑,T↓ → S↓(Expansionary Fiscal Policy)2) Fiscal Policy Abroad:G e↑, T e↓→S e↓→r*↑→I↓3) Shift in investment demand.4) Shift in NX(ε) Example: Protectionist Trade Policies(4) Inflation and nominal exchange rates:e = ε × (P*/P) → Δe%= Δε% + (π* - π)(5) PPP(Purchasing-Power Parity): 1 Dollar can buy the same quantity of wheat in anycountry.===========================================Chapter 6 Unemployment【Mainpoints】1.Natual Rate of Unemployment(1) Concept: The rate of unemployment which the economy get closed to in the long run.(2) Calculation: L-Labour Froce, E-Number of Employed, U-Number of Unemployed, f-rate of job fiding, s-rate of job seperating.L=E+U, fU=sE → U/L=1/(1+f/s)2.Causes for Unemployment(1) Frictional Unemployment:Unemployed people need time to find jobs.e.g. sectoral shift, unemploymetn insurance.(2) Structural Unemployment:Wage Rigidity. Wage is above the equlibrium level.e.g. Minimum-Wage Laws, Unions, Efficiency Wages.---------------------------------------------------------------------------------------------------------------------- Part III Growth Theory: The Economy in the Very Long Run ---- Solow Growth Model Chapter 7 Economic Growth I: Capital Accumulation and Population GrowthAssumption: Constant Return to Scale【Mainpoints】1.Capital Accumulation(1) Production Function per worker: zY=F(zK,zL)→Y/L=F(K/L,1)→y=f(k),MPK=f(k+1)-f(k)(2) Output and consumption per worker: y=c+i→c=(1-s)y→i=sy→i=sf(k)(3) The Steady State: Capital stock growth Δk = 0Δk=i-δk, δ is depreciation rate→Δk=sf(k)-δk=0→sf(k*)=δk*(4)Golden Rule level of capital: k*gold which maximizes cc=y-i→c=f(k)-sf(k)→c*=f(k*)-δk*→c max:MPK=δ2. Population Growth(at rate of n)(1) The Steady State:Δk=i-k(δ+n)→Δk=sf(k)-k(δ+n)=0→sf(k*)=(δ+n)k*(2) Golden Rule level of capital:k*gold, c=y-i→c max:MPK=δ+nChapter 8 Economic Growth I: Technology, Empirics, and Policy1.Technological Progress in the Solow ModelAssumption: Technology growth is a given exogenous variable g(1) Efficiency of Labour: Y=F(K,EL)(2) The Steady State: Δk=sf(k)-(g+n+δ)k=0→sf(k*)=(g+n+δ)k*(3) Golden Rule level of capital: k*gold , c=y-i→MPK=g+n+δ2.Endogenous Growth TheoryAssupmtion: Technolgy growth is a endogenous function g(μ), capital includes knowledge (1) 2 Sector Model: Y=F[K,(1-μ)EL], ΔE=g(μ)E, ΔK=sY-δK---------------------------------------------------------------------------------------------------------------------- Part IV Business Cycle Theory: The Economy in the Short Run ---- Sticky Price Chapter 9 Introduction to Economic Fluctuations【Key Concepts】Recession: A period of falling output and rising unemployment.Business Cycle: Short-run fluctuations in output and employment.【Mainpoints】1.GDP and unemployment(1) Okun's Law: ΔReal GDP%=3%-2×ΔUnemployment Rate(2) Leading Economic Indicators: Forecasts. Example: Average work time, Index of stock prices, Money Supply....2.Aggregate Demand and Aggregate Supply( P=P(Y))(1) The Quantity Theory of Money→AD: MV=PY→M/P=(M/P)d=kY(2) AS: SRAS---P=P, LRAS---Y=Y(3) From Short Run to Long Run: M changes AD, Y is unchanged inthe long run, but P in the long run changes. (A→B→C)(4) Shocks to AD and AP:1) Shocks to AD. Example: Credit Card makes V rise.Policy: Reduce the Money Supply.2) Shocks to AP. Example: A drought that destroys crops. Cartel. Union. etc. P↑Policy: Wait! Then price returns original level eventually(But it takes longtime). Or expand AD(But price level will be high in long period of time).===========================================Chapter 10 Aggregate Demand I: Building the IS-LM Model (Y-r)【Mainpoints】1.IS Curve(1) Good and Service Market→The Keynesian Cross: Y=C+I+G, PE=AE(2) IS curve:Y=C(Y-T)+I(r)+G 1) r↑→I↓→Y↓ 2) Fiscal Policy: G↑→Y↑→IS→, Governmetn-purchases multiplier, tax multiplier.2.LM Curve(1) Money Market→The Theory of Liquidity Peference: M/ P=L(r), M s=M d(2) LM Curve: M/P=L(r,Y). 1) Y↑,M d↑, r↑ 2)M s↑,r↓,LM←3. The Short-Run Equilibrium=========================================== Chapter 11 Aggregate Demand II: Applying the IS-LM Model (Y-P) 【Mainpoints】1.IS-LM Model as a Theroy of Aggregate Demand(1) Derivation: P↑,(M/P)s↓,r↑,LM↑→Y↓(2) Shift in AD: G,T,M→IS/LM→Y(3) In long run and short run: In long run Y<Y===========================================Chapter 12 The Open Economy Revisited: The Mundell-Fleming Model and the Exchange Rate Regime【Mainpoints】1.Mundell-Fleming Model(1) IS* Curve: Y=C(Y-T)+I(r*)+G+NX(ε) (2) LM* Curve: M/P=L(r*,Y)2.Under Floating Exchange Rates(1)Fiscal Policy:Shift IS*,ineffectual; Monetary Policy:Shift LM*; Trade Policy:Shift NX(ε)→IS* 3.Under Fixed Exchange Rates(1) Theory: Arbitrageur arbitrage so that M changes.(2)Fiscal Policy shifts IS*→LM*; Monetary Policy:Shift LM*, ineffectual; Trade Policy: ShiftNX(ε)→IS*→LM*4. Policy Choice: Impossible Trinity5. Mundell-Fleming Model in Short andLong RunChapter 13 AS and the Short-Run Tradeoff Between Inflation and Unemployment1.Aggregate Supply ModelY=Y+α(P-P e)2.Inflation, Unemployment and Phillips Curve(1)Y=Y+α(P-P e)→P-P-1=P e-P-1+1/α(Y-Y)+v→π=πe+β(μ-μn)+v [Okun's Law] v-supply shock(2) Sacrifice Ratio: π↓1%, GDP ↓ ? %----------------------------------------------------------------------------------------------------------------------Part V Macroeconomic Policy DebateChapter 14 Stabilization Policy1.Inside Lag and Outside Lag(1) Inside lag is the time between economy shock and the policy anction responds. Example: Policy makers need time to recognize a shock and react.(2) Outside lag is the time between a policy action and its influence on the economy. Example: Change in money supply and interest rate.===========================================Chapter 15 Government Debt and Budget Deficits1.The Traditional View of Government Debt(1) In the short run, T↓,C↑,S↓,r↑,I↓,lower steady-state K and a lower level of Y.(2) In the lo ng run, T↓,C↑,IS→,AD↑, finally Y=Y, P is higher.(3) In open economy, T↓,C↑,IS→, ε↑2.The Ricardian View of Government Debt(1) Ricardian Equivalence: Consumers are forward-looking.They think that government will raise tax at some point in the future, in order to afford budget. So they won't change consumption. --------------------------------------------------------------------------------------------------------------------- Part VI More on the Microeconomics Behind MacroeconomicsChapter 18 Money Supply, Money Demand and the Banking System1.Money Supply(1) Money Supply (M) = Currency (C) + Demand Deposits (D)(2) Reserves: The money that bank receive but don't lend out. Reserve-deposit ratio-rr1) 100% Reserve Banking. 1C→1D, M remains constant.2) Fractional-Reserve Banking. 1C→rrD+(1-rr)C, M increases. And (1-rr)C can be put into another bank, the process of money creation can be continued.(3) Money Supply Model: M=C+D.B(Monetary Base)=C+R [Control by Central Bank]→ M=(cr+1)/(cr+rr)×B=m×B [cr is currency-deposit ratio](4) Monetary Policy Tool: open-market operation, reserve requirements, discout rate[the rate that banks borrow from central bank].2.Money Demand(1) Quantity Theory: (M/P)d=L(i;Y)(2) Portfolio Theory: (M/P)d=L(r s,r b,πe,W) [r s-expected real return on stock, r b-expected real return on bonds, W-real wealth]。