宏观经济学曼昆第七版第5章(2013)

- 格式:pdf

- 大小:430.84 KB

- 文档页数:27

Macroeconomics, 7e (Blanchard)Chapter 5: Goods and Financial Markets. The IS-LM Model5.1 The Goods Market and the IS Relation1) The IS curve representsA) the single level of output where the goods market is in equilibrium.B) the single level of output where financial markets are in equilibrium.C) the combinations of output and the interest rate where the money market is in equilibrium.D) the combinations of output and the interest rate where the goods market is in equilibrium.E) none of the aboveAnswer: DDiff: 12) The IS curve will shift to the right when which of the following occurs?A) an increase in the money supplyB) an increase in government spendingC) a reduction in the interest rateD) all of the aboveE) none of the aboveAnswer: BDiff: 23) Which of the following occurs as the economy moves leftward along a given IS curve?A) An increase in the interest rate causes investment spending to decrease.B) An increase in the interest rate causes money demand to increase.C) An increase in the interest rate causes a reduction in the money supply.D) A reduction in government spending causes a reduction in demand for goods.E) An increase in taxes causes a reduction in demand for goods.Answer: ADiff: 24) During 2008 in the United States, consumer confidence fell significantly. Which of the following will occur as a result of this reduction in consumer confidence?A) The LM curve will shift up.B) The LM curve will shift down.C) The IS curve will shift rightward.D) The IS curve will shift leftward.E) The IS curve will shift rightward, and the LM curve will shift up.Answer: DDiff: 25) Suppose policy makers decide to reduce taxes. This fiscal policy action will cause which of the following to occur?A) The LM curve shifts and the economy moves along the IS curve.B) The IS curve shifts and the economy moves along the LM curve.C) Both the IS and LM curves shift.D) Neither the IS nor the LM curve shifts.E) Output will change causing a change in money demand and a shift of the LM curve. Answer: BDiff: 26) Suppose fiscal policy makers implement a policy to reduce the size of a budget deficit. Based on the IS-LM model, we know with certainty that the following will occur as a result of this fiscal policy action.A) Investment spending will decrease.B) Investment spending will increase.C) There will be no change in investment spending.D) Investment spending may increase, decrease, or not change.E) none of the aboveAnswer: DDiff: 37) For this question, assume that investment spending depends only on the interest rate and no longer depends on output. Given this information, a reduction in government spendingA) will cause investment to decrease.B) will cause investment to increase.C) may cause investment to increase or to decrease.D) will have no effect on output.E) will cause a reduction in output and have no effect on the interest rate.Answer: BDiff: 38) Suppose investment spending is not very sensitive to the interest rate. Given this information, we know thatA) the IS curve should be relatively flat.B) the IS curve should be relatively steep.C) the LM curve should be relatively flat.D) the LM curve should be relatively steep.E) neither the IS nor the LM curve will be affected.Answer: BDiff: 29) Explain the determinants of investment. Include in your answer an explanation of how a change in each determinant affects investment.Answer: Investment depends on the level of sales/output and on the interest rate. As output changes, the demand for goods will change and firms will change investment so that their capacity changes with the level of economic activity (and demand). I also depends on the interest rate. As the interest rate rises, the cost of borrowing rises. Firms will cut back on investment as borrowing costs rise.Diff: 210) What is the IS relation? Explain why IS curve is downward sloping.Answer: The IS relation shows the combinations of the interest rate and the level of output that are consistent with equilibrium in the goods market. An increase in the interest rate leads to a decline in output. Consequently, the IS curve is downward sloping.Diff: 211) Graphically derive the IS curve from the goods market equilibrium.Answer: Suppose the initial equilibrium in the goods market is at point A with interest rate i. Suppose now that the interest rate increases from its initial value i to a higher value i'. The increase in the interest rate decreases investment. The decrease in investment leads to a decrease in output. Now the new equilibrium point is at A', with a higher value of i and lower value of Y. After we plot the combinations of i and Y when the goods market is in equilibrium, we can connect these two points (A and A') to get a downward sloping IS curve.Diff: 25.2 Financial Markets and the LM Relation1) For each interest rate, the LM curve illustrates the level of output whereA) the goods market is in equilibrium.B) inventory investment equals zero.C) money supply equals money demand.D) all of the aboveE) none of the aboveAnswer: CDiff: 22) The LM curve shifts down (or, equivalently, to the right) when which of the following occurs?A) an increase in taxesB) an increase in outputC) an open market sale of bonds by the central bankD) an increase in consumer confidenceE) none of the aboveAnswer: EDiff: 23) Which of the following statements is consistent with a given (i.e., fixed) LM curve?A) A reduction in the interest rate causes investment spending to increase.B) A reduction in the interest rate causes money demand to decrease.C) A reduction in the interest rate causes an increase in the money supply.D) An increase in output causes an increase in demand for goods.E) An increase in output causes an increase in money demand.Answer: EDiff: 24) In late 2007 and early 2008, the U.S. Federal Reserve pursued expansionary monetary policy. Which of the following will occur as a result of this monetary policy action?A) The LM curve shifts down.B) The LM curve shifts up.C) The IS curve shifts rightward as the interest rate falls.D) The IS curve shifts leftward as the interest rate increases.E) none of the aboveAnswer: ADiff: 25) Suppose the demand for money is not very sensitive to the interest rate. Given this information, we know thatA) the IS curve should be relatively flat.B) the IS curve should be relatively steep.C) the LM curve should be relatively flat.D) the LM curve should be relatively steep.E) neither the IS nor the LM curve will be affected.Answer: DDiff: 36) Which of the following is the definition for the real supply of money?A) The stock of money measured in terms of goods, not dollars.B) The stock of high powered money only.C) The real value of currency in circulation only.D) The actual quantity of money, rather than the officially reported quantity.E) The ratio of the real GDP to the nominal money supply.Answer: ADiff: 17) First, define the LM curve. Second, explain why it has its particular shape.Answer: The LM curve illustrates the combinations of the interest rate and level of output that maintain financial market equilibrium. The curve is upward sloping because as income increases, money demand will rise. This increase in money demand will cause an excess demand for money and an excess supply of bonds. Bond prices will fall and the interest rate will increase until equilibrium is restored.Diff: 25.3 Putting the IS and the LM Relations Together1) Suppose the economy is currently operating on both the LM curve and the IS curve. Which of the following is true for this economy?A) Production equals demand.B) The quantity supplied of bonds equals the quantity demanded of bonds.C) The money supply equals money demand.D) Financial markets are in equilibrium.E) all of the aboveAnswer: EDiff: 12) Suppose the economy is operating on the LM curve but not on the IS curve. Given this information, we know thatA) the goods market is in equilibrium and the money market is not in equilibrium.B) the money market and bond markets are in equilibrium and the goods market is not in equilibrium.C) the money market and goods market are in equilibrium and the bond market is not in equilibrium.D) the money, bond and goods markets are all in equilibrium.E) neither the money, bond, nor goods markets are in equilibrium.Answer: BDiff: 23) Suppose the current level of output and the interest rate are such that the economy is operating on neither the IS nor LM curve. Which of the following is true for this economy?A) Production does not equal demand.B) The money supply does not equal money demand.C) The quantity supplied of bonds does not equal the quantity demanded of bonds.D) Financial markets are not in equilibrium.E) all of the aboveAnswer: EDiff: 24) An increase in the money supply will cause an increase in which of the following variables?A) outputB) investmentC) consumptionD) all of the aboveE) none of the aboveAnswer: DDiff: 25) Suppose there is an increase in consumer confidence. Which of the following represents the complete list of variables that must increase in response to this increase in consumer confidence?A) consumptionB) consumption and investmentC) consumption, investment and outputD) consumption and outputE) consumption, output and the interest rateAnswer: EDiff: 26) Suppose there is a fiscal contraction. Which of the following is a complete list of the variables that must decrease?A) consumptionB) consumption and investmentC) consumption and outputD) consumption, output and the interest rateE) consumption, output and investmentAnswer: CDiff: 27) We know with certainty that a tax increase must cause which of the following?A) an increase in investmentB) a reduction in investmentC) no change in investmentD) none of the aboveAnswer: DDiff: 28) A fiscal contraction will tend to cause which of the following to occur?A) a reduction in the interest rate and a reduction in investmentB) a reduction in the interest rate and an upward shift in the LM curveC) a reduction in the interest rate and an ambiguous effect on investmentD) no change in output if the Fed simultaneously pursues contractionary monetary policy Answer: CDiff: 29) An increase in the money supply must cause which of the following?A) a leftward shift in the IS curveB) a reduction in the interest rate and ambiguous effects on investmentC) an increase in investment and a rightward shift in the IS curveD) no change in the interest rate if investment is independent of the interest rateE) no change in output if investment is independent of the interest rateAnswer: EDiff: 110) An increase in consumer confidence will tend to cause which of the following to occur?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: ADiff: 111) Assume that investment does not depend on the interest rate. A reduction in government spending will cause which of the following for this economy?A) no change in the interest rateB) no change in outputC) no change in investmentD) an increase in investmentE) none of the aboveAnswer: EDiff: 312) Assume that investment does not depend on the interest rate. A reduction in the money supply will cause which of the following for this economy?A) no change in the interest rateB) no change in outputC) a reduction in investmentD) an increase in investmentAnswer: BDiff: 313) For this question, assume that investment spending depends only on output and no longer depends on the interest rate. Given this information, an increase in the money supplyA) will cause investment to decrease.B) will cause investment to increase.C) will cause a reduction in the interest rate.D) will have no effect on output or the interest rate.E) will cause an increase in output and have no effect on the interest rate.Answer: CDiff: 314) A reduction in consumer confidence will likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: BDiff: 215) An increase in the reserve deposit ratio, θ, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: CDiff: 216) A Fed purchase of securities will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: DDiff: 217) A reduction in the aggregate price level, P, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: DDiff: 218) An increase in the aggregate price level, P, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: CDiff: 219) The IS curve will not shift when which of the following occurs?A) a reduction in government spendingB) a reduction in the interest rateC) a reduction in consumer confidenceD) all of the aboveE) none of the aboveAnswer: BDiff: 120) Which of the following best defines the IS curve?A) the combinations of i and Y that maintain equilibrium in the goods marketB) illustrates the effects of changes in i on investmentC) illustrates the effects of changes in i on desired money holdings by individualsD) the combinations of i and Y that maintain equilibrium in financial marketsAnswer: ADiff: 121) Which of the following best defines the LM curve?A) the combinations of i and Y that maintain equilibrium in the goods marketB) illustrates the effects of changes in i on investmentC) illustrates the effects of changes in i on desired money holdings by individualsD) the combinations of i and Y that maintain equilibrium in financial marketsAnswer: DDiff: 122) Based on our understanding of the IS-LM model that takes into account dynamics, we know that a reduction in the money supply will causeA) an immediate drop in Y and immediate increase in i.B) an immediate increase in i and no initial change in Y.C) a gradual increase in i and gradual reduction in Y.D) none of the aboveAnswer: BDiff: 223) Based on our understanding of the IS-LM model that takes into account dynamics, we know that a reduction in government spending will causeA) an immediate drop in Y and immediate increase in i.B) an immediate reduction in i and no initial change in Y.C) a gradual reduction in i and gradual reduction in Y.D) a gradual reduction in i and an immediate reduction in Y.Answer: CDiff: 224) Based on our understanding of the IS-LM model that takes into account dynamics, we know that an increase in the money supply will causeA) an immediate increase in i and no initial change in Y.B) an immediate decrease in i and no initial change in Y.C) a gradual decrease in i and gradual increase in Y.D) none of the aboveAnswer: BDiff: 225) Based on our understanding of the IS-LM model that takes into account dynamics, we know that an increase in government spending will causeA) a gradual increase in i and gradual increase in Y.B) an immediate increase in Y and immediate drop in i.C) an immediate increase in i and no initial change in Y.D) a gradual increase in i and an immediate increase in Y.Answer: ADiff: 226) An increase in government spending will likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: ADiff: 227) A reduction in the reserve depos it ratio, θ, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: DDiff: 228) If government spending and taxes increase by the same amount,A) the IS curve does not shiftB) the IS curve shift leftwardC) the IS curve shifts rightwardD) the LM curve shifts downwardAnswer: CDiff: 229) If government spending and taxes decrease by the same amount,A) the IS curve does not shift.B) the IS curve shift leftward.C) the IS curve shifts rightward.D) the LM curve shifts downward.Answer: BDiff: 230) Which of the following triggered the U.S. recession of 2001?A) decline in investment demandB) decline in consumption demandC) increase in budget deficitD) increase in trade deficitAnswer: ADiff: 231) The IS curve will shift to the left when which of the following occurs?A) a reduction in the money supplyB) a reduction in government spendingC) an increase in the interest rateD) all of the aboveE) none of the aboveAnswer: BDiff: 232) Which of the following occurs as the economy moves rightward along a given IS curve?A) A reduction in the interest rate causes investment spending to decrease.B) A reduction in the interest rate causes money demand to increase.C) A reduction in the interest rate causes a reduction in the money supply.D) An increase in government spending causes a reduction in demand for goods.E) A reduction in taxes causes a reduction in demand for goods.Answer: ADiff: 233) When the central bank pursues contractionary monetary policy, we that this policy will result in an increase in the interest rate, a reduction in investment, a reduction in demand, and a lower level of equilibrium output. Explain what happens to the position of the IS curve as the central bank pursues contractionary monetary policy.Answer: Changes in the interest rate do cause changes in investment, demand, and output. However, they do not cause shifts of the IS curve. Changes in the interest rate cause movements along the IS curve.Diff: 234) A fiscal expansion (e.g. a tax cut) will result in an increase in income, an increase in money demand, and an increase in the equilibrium interest rate in financial markets. Explain what happens to the position of the LM curve as policy makers pursue expansionary fiscal policy. Answer: The fiscal expansion will cause an increase in output. However, changes in Y only cause movements along the LM curve. The effects of changes in Y on the interest rate are embedded in the shape of the LM curve.Diff: 2IS curve.Answer: A Fed sale of bonds will cause a reduction in H and a reduction in the money supply. This will cause an excess demand for money and the interest rate must increase to restore money market equilibrium. The LM curve will shift up as a result of this to reflect the now higher interest rate. The IS curve does not shift as a result of this. We would simply observe a movement along the IS curve.Diff: 236) Explain in detail what effect a reduction in government spending will have on: (1) the LM curve; and (2) the IS curve.Answer: A reduction in taxes will cause an increase in disposable income and an increase in consumption. The rise in C will cause an increase in demand and the equilibrium level of output in the goods market will be higher. This is reflected in a rightward shift in the IS curve. Goods market events such as this will not cause a shift in the LM curve (only a movement along it). Diff: 237) Based on your understanding of the IS-LM model, graphically illustrate and explain what effect a reduction in consumer confidence will have on output, the interest rate, and investment. Answer: A reduction in consumer confidence will cause a reduction in consumption and, therefore, a reduction in demand and a leftward shift in the IS curve. As Y decreases, money demand will decrease causing the interest rate to fall. The effects on I are ambiguous. The lower Y will cause I to fall while the lower interest rate will cause I to increase.Diff: 238) Based on your understanding of the IS-LM model, graphically illustrate and explain what effect a monetary expansion will have on output, the interest rate, and investment.Answer: An increase in M will cause the LM curve to shift down and the interest rate to fall. As the interest rate falls, firms will increase investment causing an increase in demand and subsequent increase in output. So, the interest rate will fall and Y will rise. I will be higher due to the rise in Y and drop in the interest rate.Diff: 239) Increases in the budget deficit are believed to cause reductions in investment. Based on your understanding of the IS-LM model, will a fiscal policy action that causes a reduction in the budget deficit cause an increase in investment? Explain.Answer: A policy that causes a reduction in the budget deficit will have an ambiguous effect on investment. Output will fall which will tend to depress I. However, the interest rate will also fall which will tend to increase I. I could increase, decrease, or remain unchanged.Diff: 2the IS curve.Answer: A Fed purchase of bonds will cause an increase in H and an increase in the money supply. This will cause an excess supply of money and the interest rate must decline to restore money market equilibrium. The LM curve will shift down as a result of this to reflect the now lower interest rate. The IS curve does not shift as a result of this. We would simply observe a movement along the IS curve.Diff: 241) Explain in detail what effect an increase in government spending will have on: (1) the LM curve; and (2) the IS curve.Answer: An increase in government spending will cause an increase in demand and the equilibrium level of output in the goods market will be higher. This is reflected in a rightward shift in the IS curve. Goods market events such as this will not cause a shift in the LM curve (only a movement along it).Diff: 25.4 Using a Policy Mix1) Suppose there is a simultaneous fiscal expansion and monetary expansion. We know with certainty thatA) output will increase.B) output will decrease.C) the interest rate will increase.D) the interest rate will decrease.E) both output and the interest rate will increase.Answer: ADiff: 22) Suppose there is a simultaneous fiscal expansion and monetary contraction. We know with certainty thatA) output will increase.B) output will decrease.C) the interest rate will increase.D) the interest rate will decrease.E) both output and the interest rate will increase.Answer: CDiff: 23) For this question, assume that investment spending depends only on output and no longer depends on the interest rate. Given this information, an increase in government spendingA) will cause investment to decrease.B) will cause investment to increase.C) may cause investment to increase or to decrease.D) will have no effect on output.E) will cause an increase in output and have no effect on the interest rate.Answer: BDiff: 34) A reasonable dynamic assumption for the IS-LM model is thatA) the economy is always on both the IS and LM curves.B) the economy is always on the IS curve, but moves only slowly to the LM curve.C) the economy is always on the LM curve, but moves only slowly to the IS curve.D) the money market is quick to adjust, but the bond market adjusts more slowly.E) adjustment to the new IS-LM equilibrium is instantaneous after an LM shift, but not after an IS shift.Answer: CDiff: 25) Under the reasonable dynamic assumptions discussed in the text, a monetary contraction should result inA) an immediate rise in the interest rate, and no further interest rate changes.B) an immediate rise in the interest rate, and then a fall in the interest rate over time.C) an immediate rise in the interest rate, and then a further rise over time.D) a very gradual but steady rise in the interest rate to its new equilibrium level.E) no change in the interest rate initially, and then a sudden rise to its new equilibrium value. Answer: BDiff: 26) For this question, assume that investment spending depends only on the interest rate and no longer depends on output. Given this information, a reduction in the money supplyA) will cause investment to decrease.B) will cause investment to increase.C) may cause investment to increase or to decrease.D) will have no effect on output.E) will cause a reduction in output and have no effect on the interest rate.Answer: ADiff: 37) Suppose there is a Fed purchase of bonds and simultaneous tax cut. We know with certainty that this combination of policies must causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: CDiff: 28) Suppose there is a simultaneous Fed sale of bonds and increase in consumer confidence. We know with certainty that these two simultaneous events will causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: ADiff: 29) Suppose there is a simultaneous central bank purchase of bonds and increase in taxes. We know with certainty that this combination of policies must causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: BDiff: 210) Suppose there is a simultaneous central bank sale of bonds and tax increase. We know with certainty that this combination of policies must causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: DDiff: 211) First, briefly explain what is meant by the policy mix. Second, explain what effect different policy mixes might have on the level of output, investment, and the interest rate.Answer: The policy mix refers to the possible combinations of monetary (exp. or contr.) and fiscal (exp. or contr.) that can be simultaneously implemented. There are a number of different answers that could be given to the latter part of the question. The effects on output, the interest rate, and investment will depend on the type of mix.Diff: 212) Use the IS-LM model to answer this question. Suppose there is a simultaneous increase in government spending and reduction in the money supply. Explain what effect this particular policy mix will have on output and the interest rate. Based on your analysis, do we know with certainty what effect this policy mix will have on investment? Explain.Answer: In this case, the LM curve shifts up and the IS curve shifts to the right. The interest rate will clearly be higher. The effects on output depend on the relative magnitude of the two policies. The effects on I are also ambiguous. If output falls, I will be lower. However, it is possible that output will rise here which creates the ambiguity.Diff: 213) Use the IS-LM model to answer this question. Suppose there is a simultaneous increase in taxes and reduction in the money supply. Explain what effect this particular policy mix will have on output and the interest rate. Based on your analysis, do we know with certainty what effect this policy mix will have on investment? Explain.Answer: In this case, the LM curve shifts up and the IS curve shifts to the left. In this case, output will clearly fall. What happens to the interest rate depends on the relative magnitude of the two policies. The effects on I are again ambiguous.Diff: 214) Use the IS-LM model to answer this question. Suppose there is a simultaneous increase in government spending and increase in the money supply. Explain what effect this particular policy mix will have on output and the interest rate. Based on your analysis, do we know with certainty what effect this policy mix will have on investment? Explain.Answer: In this case, the LM curve shifts down and the IS curve shifts to the right. The output will clearly be higher. The effects on interest rate depend on the relative magnitude of the two policies. The effects on I are also ambiguous. If interest rate falls, I will be higher. However, it is possible that interest rate will rise here which creates the ambiguity.Diff: 25.5 How does the IS-LM Model Fit the Facts?1) Empirically it takes nearly ________ years for monetary policy to have its full effect on output.A) 2B) 1C) 3D) 4Answer: ADiff: 1。

曼昆《宏观经济学》(第7版)重点章节及重点课后习题I 曼昆《宏观经济学》重点章节或知识点一、导言(第1、2章)1、宏观经济学科学(第1章)(1)宏观经济学。

掌握宏观经济学的研究对象、三个重要的宏观经济变量(宏观经济学的核心,后面所有章节都是围绕这三个变量展开的)、本书框架(有利于加深对宏观体系的认识)。

(2)价格黏性与伸缩性。

短期和长期,价格情形,也是不同学派分析的角度或出发点。

(3)宏观经济学与微观经济学的关系。

了解下即可。

2、宏观经济学的数据(第2章)(1)国内生产总值(GDP、国民收入,总产出)。

重点掌握:概念和内涵;核算中的特殊处理;名义GDP、实际GDP和GDP平减指数;GDP核算指标的缺陷和改进。

(2)国民收入核算。

重点掌握:国民收入核算三种方法的区别和联系,GDP与其他国民收入指标(GNP、NNP、NI、PI、PPI)的关系。

(3)消费者价格指数(CPI)。

重点掌握:CPI的含义。

CPI与GDP平减指数的关系。

说明:第1、2章比较基础,初级宏观看过的考生,可以直接看讲义,教材直接略过就行。

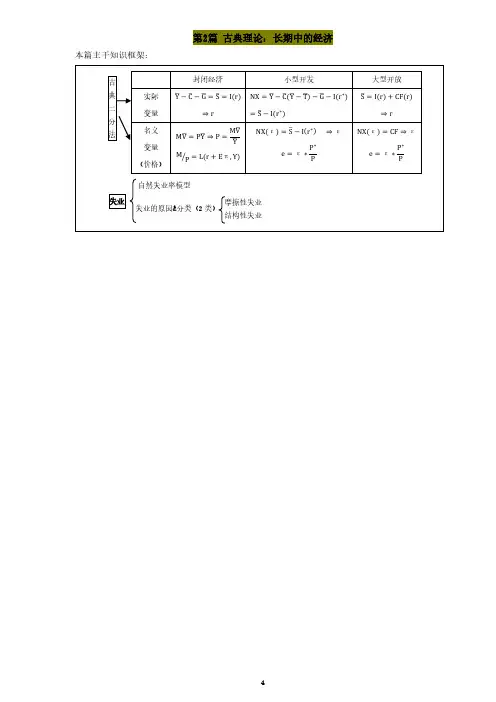

二、古典理论:长期中的经济(第3、4、5、6章)重点章节在4、5、6。

其中,最最重要的章节在第4章。

1、国民收入:源自何处,去向何方(第3章)(1)国民收入的分配。

重点掌握:企业对要素需求的决定,欧拉定理。

(2)柯布—道格拉斯生产函数(C-D函数)。

该函数的性质必须掌握。

(3)总供给与总需求的均衡。

重点掌握:产品市场和金融市场均衡的条件、利用储蓄和投资曲线分析问题。

2、货币与通货膨胀(第4章)(1)货币数量论。

重点掌握:数量方程式和货币数量论,表达式及二者的区别和联系;利用数量方程式来解释通货膨胀。

(12年真题)(2)通货膨胀与利率。

重点掌握:费雪效应与费雪方程。

(3)名义利率与货币需求。

重点掌握:货币需求函数,货币、价格与利率的关系。

(4)通货膨胀的社会成本。

重点掌握:预期通货膨胀的成本VS未预期到的通货膨胀的成本。

第2篇古典理论:长期中的经济本篇主干知识框架:第3章 国民收入:源自何处,去向何方(一般均衡模型)本章分析的出发点(教材图3-1)本章主干知识框架:3.1 什么决定了产品与服务的总生产(略) 3.2 国民收入如何分配给生产要素:新古典分配理论②对任何一种生产要素支付的价格都取决于该要素服务的供给和需求。

由于已假设供给是固定的,所以供给曲线是一条垂直线。

需求曲线向下倾斜。

两曲线的交点决定了均衡的要素价格。

为了理解要素价格和收入分配,必须考察生产要素的需求,为此我们从研究一个典型企业使用多少生产要素的决策问题开始。

②新古典分配理论,neoclassical theory of distribution.3.2.1 企业如何决策→要素需求→要素价格(一)竞争性企业面临的决策:利润=PF (K,L )−WL −RK假设企业是竞争性的,将产出和投入的价格都视为由市场条件决定(价格接受者)。

(二)MPL ↓⇒劳动需求曲线大多数生产函数具有边际产量递减的性质:在资本量不变的情况下,随着劳动量的增加,劳动边际产量递减。

企业多雇佣一单位劳动的利润变化是: ∆利润=P x MPL-W 。

竞争性企业对劳动的需求由下式决定:P x MPL=W 或者MPL=W/P (实际工资)为了使利润最大化,企业雇佣劳动,直到劳动的边际产量等于实际工资这一点为止。

由于MPL 随着L 增加而递减,故MPL 曲线向下倾斜。

企业雇用工人知道司机工资等于MPL 位置。

因此,MPL 曲线也就是企业的劳动需求曲线。

(三)资本MPK(↓)与资本需求:MPK=R/P (实际租赁价格) (四)总结:总之,竞争性的追求利润最大化的企业关于要素使用的决策都遵循着一个简单规划:企业需要每一种生产要素,直到该要素的边际产量减少到等于其实际要素价值为止。

3.2.2 国民收入的划分经济利润=Y −MPL ∗L −MPK ∗K 或,Y =MPL ∗L +MPK ∗K +经济利润经济利润有多少呢? 若生产函数具有规模报酬不变的性质,则经济利润必为零。

23章答案一、概念题1.微观经济学(microeconomics)答:微观经济学指研究家庭和企业如何做出决策,以及他们如何在市场上相互交易的经济学。

微观经济学以市场经济中的单个消费者(或称家户、家庭)和生产者(或称厂商、企业)为研究对象,通过分析他们的消费决策或生产决策,来说明消费品和生产要素的价格的决定及其变动,进而说明稀缺性的资源如何得到最有效的配置。

微观经济学的理论目的是为了论证亚当·斯密“看不见的手”原理,这只“看不见的手”就是价格机制。

因此,微观经济学又被称为价格理论。

微观经济学主要解决的问题可以概括为:生产什么、生产多少、如何生产、为谁生产。

其基本假设为:(1)经济行为个体是进行自由的、分散化决策的理性经济人,即消费者追求自身效用的最大化,生产者追求自身利润的最大化。

(2)完全竞争和完全信息。

微观经济学从这两个基本假定出发对上述问题的解决就构成了它的主要内容,具体地,它包括:① 供求规律;② 消费者行为理论,它构成消费品价格决定的需求方面;③ 生产者行为理论或厂商理论,它构成消费品价格决定的供给方面;④ 生产要素的价格决定理论或分配理论;⑤ 一般均衡理论;⑥ 福利经济学;⑦ 市场失灵和微观经济政策。

2.宏观经济学(macroeconomics)答:宏观经济学是与“微观经济学”相对而言的,指研究整体经济现象,包括通货膨胀、失业和经济增长的经济学。

宏观经济学以国民经济总体作为考察对象,研究经济生活中有关总量的决定与变动,解释失业、通货膨胀、经济增长与波动、国际收支与汇率的决定与变动等经济中的宏观整体问题,所以又称之为总量经济学。

宏观经济学的中心和基础是总供给—总需求模型。

具体来说,宏观经济学主要包括总需求理论、总供给理论、失业与通货膨胀理论、经济周期与经济增长理论、开放经济理论、宏观经济政策等内容。

对宏观经济问题进行分析与研究的历史十分悠久,但现代意义上的宏观经济学直到20世纪30年代才得以形成和发展起来。

曼昆的经济学原理第七版入门曼昆的经济学原理第七版是一本经济学入门教材,内容涵盖了经济学的基本原理和概念。

本文将围绕此书展开,介绍该书的主要内容和特点。

第一章:经济学原理与经济学思维本章介绍了经济学的定义和研究对象,强调了经济学思维的重要性。

经济学是一门研究人们如何利用稀缺资源来满足无限的需求的学科,经济学原理则是指导经济决策和行为的基本规律。

第二章:供给与需求本章介绍了供给和需求的基本概念和关系。

供给是指生产者愿意提供的商品或服务的数量,需求是指消费者愿意购买的商品或服务的数量。

供给和需求的平衡决定了市场价格和数量。

第三章:市场机制本章介绍了市场机制的作用和运行方式。

市场机制是指通过供求关系来调节资源配置和价格形成的一种自由市场机制。

市场机制能够有效地分配资源,提高经济效益。

第四章:弹性与供求本章介绍了价格弹性和收入弹性的概念和计算方法。

价格弹性是指商品需求或供给对价格变化的敏感程度,收入弹性是指商品需求对收入变化的敏感程度。

弹性分析有助于了解市场的灵活性和调节能力。

第五章:消费者、生产者和效率本章介绍了消费者和生产者的行为和决策过程,以及市场效率的概念和评价方法。

消费者和生产者的行为决定了市场供求关系,市场效率则是指在给定资源条件下实现最大福利的能力。

第六章:供给、需求和政府政策本章介绍了政府在市场经济中的角色和政策工具。

政府通过税收、补贴、价格管制等手段来影响市场供求关系,实现经济调控和公共利益。

第七章:市场结构本章介绍了不同市场结构的特点和运行机制。

市场结构包括完全竞争市场、垄断市场、垄断竞争市场和寡头垄断市场。

不同市场结构对供给、需求和价格形成有不同的影响。

第八章:劳动市场本章介绍了劳动力市场的特点和运行机制。

劳动力市场是指劳动力供给和需求的市场,劳动力市场的供求关系决定了劳动力的价格和就业情况。

第九章:资本市场本章介绍了资本市场的特点和运行机制。

资本市场是指资本供给和需求的市场,资本市场的运行对企业投资和融资活动起到重要作用。

第5章开放的经济跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

一、判断题1.名义汇率的变动都产生于物价变动,因此,通货膨胀率相对较高的国家,货币相对便宜。

()【答案】F【解析】由名义汇率的公式可知,名义汇率不仅和两国的物价水平有关,还和两国的实际汇率有关。

所以名义汇率的变动并不都取决于物价的变动。

但是后一句“通货膨胀率相对较高的国家货币相对便宜”是正确的。

2.当美国的进口大于出口时,它也必定向外国人购买了国内资产。

()【答案】F【解析】当美国的进口大于出口,则存在贸易逆差,此时的贸易余额小于0,由此可知,资本净流出小于0,也就是说,外国人购买的本国的资产大于本国人购买外国的资产。

此时,美国人并不一定向外国人购买了国内资产,但外国人必定向美国人购买了国内资产。

3.资本净流出的主要决定因素是名义汇率。

()【答案】F【解析】资本净流出的主要决定因素是实际利率。

4.在开放经济中,对可贷资金的需求来自国内投资和资本净流出。

()【答案】T【解析】储蓄=国内投资+资本净流出,可贷资金是国内产生的可用于资本积累的资源流量,无论是购买国内资本资产还是购买国外资本资产,这种购买都增加了可贷资金的需求。

5.如果一价定律不成立时,购买力平价就不存在。

()【答案】T【解析】购买力平价理论是一价定律在国际市场上的应用,是一种传统的汇率决定理论。

一价定律是购买力平价成立的基础。

6.人民币对美元的汇率下降,将使中国商品相对便宜,中国增加对美国商品的进口。

()【答案】F【解析】人民币对美元的汇率下降,说明一美元可以兑换到更多的人民币。

曼昆经济学原理第七版《曼昆经济学原理》第七版是一本经济学教材,由尼高拉斯·格里高利·曼昆(Nicholas Gregory Mankiw)编写。

本书主要包含了宏观经济学与微观经济学两部分内容,总共分为18章,以及一个附录。

作者在书中对经济学的基本原理进行了详细的阐述和说明。

第一章介绍了经济学的基本概念以及经济学家所研究的核心问题。

经济学家通过研究人们如何做出决策以及面对稀缺资源时如何分配这些资源来解决经济问题。

第二章主要介绍了供求模型。

供求关系是市场经济中最基本的原理,它决定了商品价格以及商品的数量。

作者通过对供求曲线的分析,解释了价格是由市场力量决定的这一观点。

第三章讨论了供求模型的一些扩展,如市场均衡的调整、供求曲线的移动以及价格弹性等。

价格弹性是指价格变动对市场需求或供应的敏感程度,对于理解市场的运作以及对政府政策的影响具有重要意义。

第四章介绍了消费者行为以及效用理论。

通过分析消费者的选择和预算约束条件,我们可以理解为什么人们在面对有限收入时会做出不同的消费选择。

第五章讨论了生产和成本的基本原理。

生产可能性边界是指在一定资源和技术条件下,一个国家可以生产的各种物品和服务的组合。

成本的概念包括固定成本和可变成本,它们决定了企业的生产决策。

第六章介绍了市场结构的基本概念和分类。

市场结构是指市场上的企业数量以及它们之间的竞争程度。

不同的市场结构对于企业行为和市场均衡的判断有重要影响。

第七章讨论了垄断市场和垄断定价。

垄断是指一个市场上只有一个卖方或者有严重限制卖方进入市场的情况。

垄断者通过设置价格和生产水平来追求最大利润。

第八章介绍了公司行为和市场结构的相互关系。

通过研究企业如何决定价格、生产和市场竞争等问题,我们可以更好地理解市场经济中企业的行为。

第九章讨论了劳动市场和工资决定。

劳动力是生产的基本要素之一,通过研究劳动力市场的运作和工资决定的原因,我们可以更好地理解劳动力市场的特点和问题。

曼昆经济学原理(微观)第七版第五章课后简答题总结生产成本:1、企业的平均总成本曲线在短期与长期中如何不同?为什么会不同?答:长期来看,企业可以调整在短期中固定的生产要素;比如企业可以扩大工厂规模。

结果就是,长期平均总成本曲线比起短期总成本曲线呈更加平坦的U形。

2、给规模经济与规模不经济下定义并解释二者产生的原因。

答:规模经济存在时,由于工人专业化的分工,长期平均总成本随着产量的上升而下降;规模不经济存在时,由于过大的组织内部员工的合作存在协调问题,长期平均总成本随着产量的上升而上升。

竞争市场上的企业:1、竞争企业如何决定其利润最大化的产量水平?解释原因答:利润最大化的企业设定的价格等于其边际成本。

如果价格高于边际成本,企业可以通过增加产量来增加利润,而如果价格低于边际成本,企业可以通过减少产量来提高利润。

2、一般而言,市场供给曲线是在短期中更富有弹性,还是在长期中更富有弹性?解释原因答:市场供给曲线通常在长期中更具有弹性。

在竞争市场中,因为进入与退出发生,直到价格等于平均总成本,所以供给的数量在长期的价格变动更为敏感。

3、你到镇里最好的餐馆点了一道40美元的龙虾。

吃了一半龙虾,你就感到非常饱了。

你的朋友想劝你吃完,因为你无法把它拿回家,而且“你已经为此花了钱”。

你应该怎么做?答:如果你已经点了晚餐,其成本就是沉没成本,所以这并不是一种机会成本。

所以说,晚餐的成本不应该影响你是否把它吃完的决定。

4、考虑一个竞争市场上的某个企业。

如果它的产量翻了一番,总收益会发生什么变动?答:总收益翻一番。

这是因为,在竞争市场上,价格并不受任何一个个别企业销售量影响。

5、你去你们的校园书店,并看到印有你们大学校徽的咖啡杯。

它值5美元,而你的评价是8美元,因此你买了它。

在你走回汽车的路上,你把这个杯子掉在地上摔成了碎片。

你应该再买一个呢,还是回家呢?为什么?答:你应该购买另一个咖啡杯,因为边际收益将大于边际成本。

打碎的杯子是沉没成本,而且无法弥补。