【重磅】公司法学习法笔记(全英)-CORPORATE MARKETS LAW-哈佛大学法学院完整版

- 格式:pdf

- 大小:408.50 KB

- 文档页数:52

自考公司法重点笔记一、公司法概述公司法是规定公司的设立、组织、活动、解散及其他对内对外关系的法律规范的总称。

理解公司法,首先要明白公司的概念和特征。

公司具有独立的法人地位,这意味着它能以自己的名义从事民事活动,享有权利并承担义务。

公司的财产与股东的个人财产相分离,股东对公司的债务通常只以其出资额为限承担有限责任。

公司法的调整对象包括公司内部的组织管理关系,如股东与公司之间、股东与股东之间的关系;还包括公司外部的交易关系,如公司与其他市场主体之间的关系。

二、公司的分类(一)按照公司的信用基础,可分为人合公司、资合公司与人合兼资合公司。

人合公司主要依靠股东个人的信用,如无限公司;资合公司则更看重公司的资本,如股份有限公司;而人合兼资合公司兼具两者特点,像有限责任公司。

(二)依据公司的控制与依附关系,分为母公司和子公司。

母公司通过持有子公司的一定股份或通过协议等方式,对子公司进行控制。

子公司具有独立的法人地位,但在经营决策等方面受母公司影响。

(三)根据公司的组织系统,可分为总公司和分公司。

总公司对分公司的业务、资金等进行统一管理,分公司不具有独立法人地位,其民事责任由总公司承担。

三、公司的设立(一)设立条件1、股东或发起人符合法定人数。

有限责任公司的股东人数通常为50 人以下;股份有限公司的发起人人数为 2 人以上 200 人以下。

2、有符合公司章程规定的全体股东认缴的出资额或股本总额。

3、公司章程是公司设立的重要文件,应当载明公司的名称、住所、经营范围、注册资本、股东的姓名或名称、出资方式、出资额和出资时间等重要事项。

4、有公司名称,建立符合有限责任公司或股份有限公司要求的组织机构。

5、有公司住所,即公司主要办事机构所在地。

(二)设立程序1、订立发起人协议(股份有限公司)或制定公司章程(有限责任公司)。

2、申请名称预先核准。

3、股东出资。

股东可以用货币出资,也可以用实物、知识产权、土地使用权等可以用货币估价并可以依法转让的非货币财产作价出资。

2022-2023中级会计考试-公司法笔记公司法概述公司法是指对公司组织、运营和管理等内容进行规定的法律制度。

它主要包括以下方面:1. 公司的定义和分类:公司是指由股东按照法律规定组织并向公司股东提供有限责任的企业形式。

根据公司所面向的股东群体和公司的性质不同,可以将公司分为股份有限公司、有限责任公司等不同类型。

2. 公司组织形式:公司可以通过股权、有限合伙、有限责任合伙等形式进行组织。

其中,股份有限公司是最典型的公司组织形式,它以股东持有的股份为依据进行组织管理。

3. 公司的权益结构:公司的权益结构包括股东权益和债权人权益。

股东权益是指股东根据所持有的股份享有的权益,包括股东的投票权、收益权和控制权等。

债权人权益是指公司债权人根据债权享有的权益,包括优先受偿权、出资权益和决策权等。

4. 公司的运营与管理:公司的运营与管理包括公司治理、内部控制和财务报告等方面。

公司治理是指公司通过内部组织和规章制度保障股东权益的一种制度安排。

内部控制是指公司为了保障资产安全和有效运营而建立的组织措施和制度。

财务报告是公司根据会计准则和法律规定编制的反映公司财务状况和经营情况的报表。

公司法的重要原则1. 公司独立法人原则:公司具有独立的法人地位,有独立的财产和责任承担能力。

公司和其股东之间具有独立的法律关系。

2. 公司责任有限原则:公司股东的责任仅限于其出资额,不对公司债务承担无限连带责任。

3. 公平、公正、公开原则:公司应当遵循公平、公正、公开的原则进行运营和决策,保障股东权益和债权人权益。

4. 直接行使权益原则:股东应当直接行使其权益,不得代理或转让其权益,除非有法律规定或公司章程规定。

公司法相关知识点1. 公司设立和登记程序:公司的设立需要经过一系列的程序,包括选择公司类型、起草公司章程、申请注册登记等。

2. 公司组织架构:公司的组织架构包括股东大会、董事会和监事会等机构。

股东大会是公司的最高权力机构,董事会是公司的执行机构,监事会是公司的监督机构。

公司法总论第一章公司法概述第一节公司法的定义、性质和精髓一、公司法的定义P 1二、公司法的性质P 2—31、公司法兼具组织法和活动法的双重性质,以组织法为主;2、公司法兼具实体法和程序法的双重性质,以实体法为主;3、公司法兼具强制法和程序法的双重性质,以强制法为主;4、公司法兼具国内法和国际法的双重性质,以国内法为主;三、公司法的精髓P 3--41、确认股东财产和公司财产分离,使公司具有独立的财产权利;2、确认股东承担有限责任;3、确认公司具有法律上独立人格;第二节公司的定义和法律特征一、公司的定义:是依据公司法律规定组织、成立和从事活动的,以营利为目的且兼顾社会P 5 利益的,具有法律资格的企业。

二、公司的法律特征:P 5--101、合法性:基本要素为资本、章程和机关;2、营利性;3、独立性:权利能力(经营范围、转投资和作保证人的限制);行为能力;侵权行为能力;三、公司和其他企业的区别:P 10--121、公司和个人独资企业的区别:个人独资企业:由自然人独自出资,独自经营,所营利利润都归自己享有,风险也由其独自承担。

2、公司和合伙企业的区别:合伙企业:是若干自然人、法人和其他经济组织联合出资建立、合伙人经营的组织体,由参加合伙的人共同协商经营的。

3、公司和集团企业的区别:集团企业:指已资本为主要联接纽带,以母子公司为主体,以集团章程为共同行为规范的母公司、子公司、参股公司及其他成员企业或机构共同组成的具有一定规模的企业法人联合体。

集团企业的条件:母公司注册资本在5000万以上;至少有5家子公司;母子公司注册资本至少一个亿;第三节公司的分类一、现行法律上的分类P 12—151、按公司是否发行股份和参与投资人数的多少,分为股份有限公司(2人以上)、有限责任公司(50人以下)和独资公司;2、按公司与公司之间的控制依附关系,分为母公司和子公司;分公司:公司依照法定程序在其住所外设立的以本公司名义进行经营活动,并由本公司承受其民事责任的分支机构。

英国公司法(CompanyLaw)第一章注册公司的法律特征作者:明月孤岑文章来源:竹月斋发表于2006年10月12日阅读1685人次推荐级别:☆Company Law: Fundamental Principles, (2nd ed.) Stephen Griffin LLB, PITMAN Publishing, 1996THE LEGAL CHARACTERISTICS OF A REGISTERED COMPANY本章主要讲述了注册公司的基本法律特征及其发展的历史。

公司在一定意义上可以被看作是一个虚构的实体,它只不过是其管理者和员工按照团体模式经营的一种方式或手段。

依照大陆法系的分类,这种观点似乎可以被看作是法人拟制说。

但是在法律上,按照公司法的规定注册的公司,这种虚构的本质在这种程度上被忽视了,从公司成立之日起,它就是一个公司实体。

正因为如此,注册公司是一个独立的法律主体,它像一个自然人那样享有权利和承担义务。

这是公司的第一个重要的特征。

除此之外,大量的公司都具有有限责任的特点。

公司的有限责任分为股份的有限和保证的有限。

(除有特别说明,本书将主要讲股份的有限。

)有限责任是指公司股东一旦(以股票的名义价值)完全出资认购了所持有的股份,他就不再对公司的债务承担任何责任。

公司的成立导致了公司和其股东地位的分离。

因此,公司的存在不再依赖于其成员的存在于否。

成立这样一个公司最大的好处是股东的有限责任,但最大的缺点是商业隐私的缺失。

与合伙不同,注册公司必须满足许多关于披露信息的要求。

公司的概念产生于19世纪中期,但在此之前,就已存在现代公司的前身。

首先产生的是特许公司。

从17世纪起,随着世界船舶贸易的发展,特许的股份公司产生了。

股份公司是一个通过王室特许产生的,有着复杂形式的合伙企业。

特许状通常授予其在特定贸易中的垄断权。

这种公司虽然也具有独立的法律身份,但是除非特许状有特殊规定,这种企业的成员没有任何形式的有限责任。

00227公司法自考重点笔记公司法是一门关于公司组织和管理的法律学科,涵盖了公司的设立、组织、运营、监管等方面内容。

学习公司法是在理解和掌握公司法律制度的基础上,进一步了解和熟悉我国的公司法规定和实务操作。

一、公司的定义和分类公司是指由外部股东出资,成立并独立存在的法人组织。

根据公司的性质和组织形式的不同,可以将公司分为有限责任公司和股份有限公司两种类型。

有限责任公司是指股东以其所持有的股份为限,对公司的债务承担有限责任的公司。

股份有限公司是指股东以其所持有的股份为限,对公司的债务承担有限责任,股份可自由转让的公司。

二、公司的设立和登记公司的设立需要进行企业名称预先核准、签订公司章程、缴足注册资本、组织发起人会议、进行公司登记等一系列程序。

其中,企业名称预先核准是为了避免重名或与已有企业名称相似,公司章程是制定公司内部管理的基本规定,注册资本是成立公司必须满足的资金要求。

公司登记的目的是向社会公示该公司的基本情况和法律地位。

三、公司组织结构和股东权益公司的组织结构包括股东大会、董事会和监事会。

股东大会是公司的最高权力机构,负责决定公司的经营方针和重要事项。

董事会是股东大会的执行机构,负责公司的日常经营管理。

监事会是负责对董事会的监督,确保公司的合法性和规范运作。

股东的权益包括出席和表决权、收益权、知情权和监督权等。

股东的出席和表决权是股东对公司决策的参与和表决的权利。

股东的收益权是股东从公司经营活动中分享利润的权利。

股东的知情权是股东对公司经营情况和财务状况的了解权。

股东的监督权是股东对公司经营情况和管理层的监督和追究权。

四、公司的经营和监管公司的经营活动包括筹建期的准备事项和运营期的日常经营。

筹建期主要包括注册资本的实缴、办理开业手续、购置设备等准备工作。

运营期主要包括公司经营业务、财务会计管理、人力资源管理等日常经营工作。

公司的监管主要包括外部监管和内部监管。

外部监管包括政府监管机构对公司的法律合规性的监督和检查。

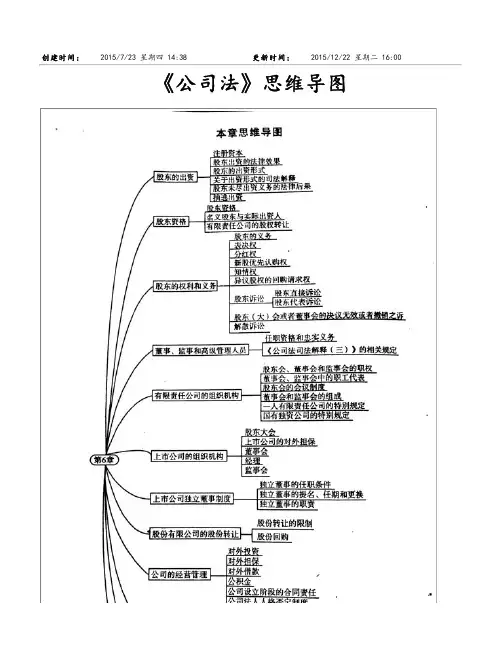

创建时间:2015/7/23 星期四 14:38更新时间:2015/12/22 星期二 16:00《公司法》思维导图(六)依照本法第一百五十一条的规定,对董事、高级管理人员提起诉讼;(七)公司章程规定的其他职权。

二、股东会的会议制度1. 有限责任公司的股东会会议制度1. 会议通知——召开股东会会议,应当于会议召开15日前通知全体股东;但是,公司章程另有规定或者全体股东另有约定的除外。

2. 首次股东会议——由出资最多的股东召集和主持3. 以后的股东会议——有限责任公司设立董事会的,股东会会议由董事会召集,董事长主持;董事长不能履行职务或者不履行职务的,由副董事长主持;副董事长不能履行职务或者不履行职务的,由半数以上董事共同推举一名董事主持。

有限责任公司不设董事会的,股东会会议由执行董事召集和主持。

董事会或者执行董事不能履行或者不履行召集股东会会议职责的,由监事会或者不设监事会的公司的监事召集和主持;监事会或者监事不召集和主持的,代表十分之一以上表决权的股东可以自行召集和主持。

4. 临时股东会—— 股东会会议分为定期会议和临时会议。

定期会议应当依照公司章程的规定按时召开。

代表十分之一以上表决权的股东,三分之一以上的董事,监事会或者不设监事会的公司的监事提议召开临时会议的,应当召开临时会议。

5. 表决——股东会会议由股东按照出资比例行使表决权;但是,公司章程另有规定的除外。

6. 特别决议——股东会的议事方式和表决程序,除本法有规定的外,由公司章程规定。

股东会会议作出修改公司章程、增加或者减少注册资本的决议,以及公司合并、分立、解散或者变更公司形式的决议,必须经代表三分之二以上表决权(即全部表决权的2/3)的股东通过。

有限责任公司变更为股份有限公司时,折合的实收股本总额不得高于公司净资产额。

有限责任公司变更为股份有限公司,为增加资本公开发行股份时,应当依法办理。

7. 会议记录——股东会应当对所议事项的决定作成会议记录,出席会议的股东应当在会议记录上签名。

第二章公司法第一节公司法概述一、公司的含义和特征公司是依法成立的,有独立的法人财产,享有法人财产权的企业法人。

公司以其全部财产对公司的债务承担责任。

有限责任公司的股东以其认缴的出资额为限对公司承担责任;股份有限公司的股东以其认购的股份为限对公司承担责任。

公司的基本特征包括股东对公司债务承担有限责任、社团性、营利性。

法人人格否认制度,公司股东滥用股东权利给公司或者其他股东造成损失的,应当依法承担赔偿责任;公司股东滥用公司法人独立地位和股东有限责任人,逃避债务,严重损害公司债权人利益的,应当对公司债务承担连带责任;股东滥用法人制度,给债权人造成损害的,债权人可以申请法院裁定让股东承担责任,但须举证证明股东有滥用法人人格制度的行为。

二、公司的分类1、以公司股东的责任范围为标准分类以公司股东的责任范围为标准,即以公司股东是否对公司债务承担责任为标准,可将公司分为无限责任公司、两合公司、股份两合公司、股份有限公司和有限责任公司,这是最主要的公司分类。

2、以公司股份转让方式为标准分类以公司股份转让方式为标准,即以公司股份是否可以自由转让和流通为标准,可将公司分为封闭式公司与开放式公司。

3、以公司的信用基础为标准分类以公司的信用基础为标准,即以公司的交易信用来源和责任承担依据为标准,可将公司分为人合公司、资合公司及人合兼资合公司。

4、以公司之间的关系为标准分类以公司之间的关系为标准,即以公司之间在财产上、人事上、责任承担上的相互关系为标准,可将公司分为总公司与分公司、母公司与子公司。

三、公司基本制度1、公司章程公司章程是公司的“宪法”,是由约束公司、法人代表人、股东、董事及董事会、监事及监事会、经理等高级管理人员等主体行为的基本规则。

公司法的私法性的表现之一就是公司章程能自主决定公司很多的行为规则。

有限责任公司章程应当载明下列事项:①公司名称和住所;②公司经营范围;③公司注册资本;④股东的姓名或者名称;⑤股东的出资方式、出资额和出资时间;⑥公司的机构及其产生办法、职权、议事规则;⑦公司法定代表人;⑧股东会会议认为需要规定的其他事项。

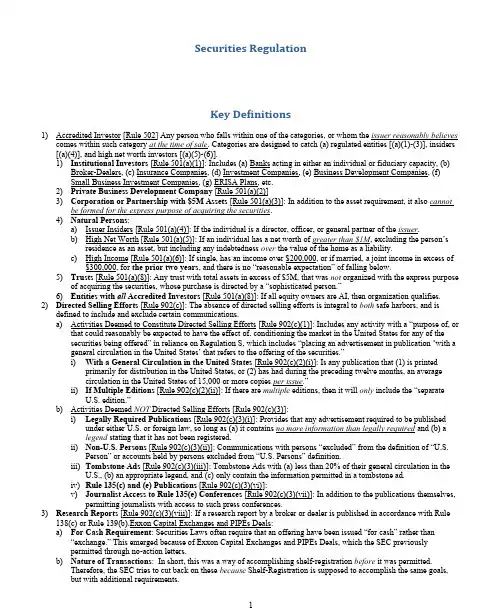

Securities RegulationKey Definitions1)Accredited Investor [Rule 502] Any person who falls within one of the categories, or whom the issuer reasonably believescomes within such category at the time of sale. Categories are designed to catch (a) regulated entities [(a)(1)-(3)], insiders [(a)(4)], and high net worth investors [(a)(5)-(6)].1)Institutional Investors [Rule 501(a)(1)]: Includes (a) Banks acting in either an individual or fiduciary capacity, (b)Broker-Dealers, (c) Insurance Companies, (d) Investment Companies, (e) Business Development Companies, (f)Small Business Investment Companies, (g) ERISA Plans, etc.2)Private Business Development Company [Rule 501(a)(2)]3)Corporation or Partnership with $5M Assets [Rule 501(a)(3)]: In addition to the asset requirement, it also cannotbe formed for the express purpose of acquiring the securities.4)Natural Persons:a)Issuer Insiders [Rule 501(a)(4)]: If the individual is a director, officer, or general partner of the issuer.b)High Net Worth [Rule 501(a)(5)]: If an individual has a net worth of greater than $1M, excluding the person’sresidence as an asset, but including any indebtedness over the value of the home as a liability.c)High Income [Rule 501(a)(6)]: If single, has an income over $200,000, or if married, a joint income in excess of$300,000, for the prior two years, and there is no “reasonable expectation” of falling below.5)Trusts [Rule 501(a)(8)]: Any trust with total assets in excess of $5M, that was not organized with the express purposeof acquiring the securities, whose purchase is directed by a “sophisticated person.”6)Entities with all Accredited Investors [Rule 501(a)(8)]: If all equity owners are AI, then organization qualifies.2)Directed Selling Efforts [Rule 902(c)]: The absence of directed selling efforts is integral to both safe harbors, and isdefined to include and exclude certain communications.a)Activities Deemed to Constitute Directed Selling Efforts [Rule 902(c)(1)]: Includes any activity with a “purpose of, orthat could reasonably be expected to have the effect of, conditioning the market in the United States for any of the securities being offered” in reliance on Regulation S, which includes “placing an advertisement in publication ‘with a general circulation in the United States’ that refers to the offering of the securities.”i)With a General Circulation in the United States [Rule 902(c)(2)(i)]: Is any publication that (1) is printedprimarily for distribution in the United States, or (2) has had during the preceding twelve months, an averagecirculation in the United States of 15,000 or more copies per issue.”ii)If Multiple Editions [Rule 902(c)(2)(ii)]: If there are multiple editions, then it will only include the “separate U.S. edition.”b)Activities Deemed NOT Directed Selling Efforts [Rule 902(c)(3)]:i)Legally Required Publications [Rule 902(c)(3)(i)]: Provides that any advertisement required to be publishedunder either U.S. or foreign law, so long as (a) it contains no more information than legally required and (b) alegend stating that it has not been registered.ii)Non-U.S. Persons [Rule 902(c)(3)(ii)]: Communications with persons “excluded” from the definition of “U.S.Person” or accounts held by persons excluded from “U.S. Persons” definition.iii)Tombstone Ads [Rule 902(c)(3)(iii)]: Tombstone Ads with (a) less than 20% of their general circulation in the U.S., (b) an appropriate legend, and (c) only contain the information permitted in a tombstone ad.iv)Rule 135(c) and (e) Publications [Rule 902(c)(3)(vi)]:v)Journalist Access to Rule 135(e) Conferences [Rule 902(c)(3)(vii)]: In addition to the publications themselves, permitting journalists with access to such press conferences.3)Research Reports [Rule 902(c)(3)(viii)]: If a research report by a broker or dealer is published in accordance with Rule138(c) or Rule 139(b).Exxon Capital Exchanges and PIPEs Deals:a)For Cash Requirement: Securities Laws often require that an offering have been issued “for cash” rather than“exchange.” This emerged because of Exxon Capital Exchanges and PIPEs Deals, which the SEC previouslypermitted through no-action letters.b)Nature of Transactions: In short, this was a way of accomplishing shelf-registration before it was permitted.Therefore, the SEC tries to cut back on these because Shelf-Registration is supposed to accomplish the same goals, but with additional requirements.i)Exxon Capital Exchange → Debt : In order to reach markets quickly, the Issuer of debt would issue notes througha Private Placement, which is exempt from registration under Sec. Act § 4(a)(2). These instruments, however, arehighly illiquid because they are privately held (Restricted Securities), and therefore the Issuer subsequentlyregisters an identical class of notes with the SEC, then exchanges its outstanding non-registered notes for thenewly issued registered notes. Achieves access to the market when desired without registration.ii)PIPEs Deal → Equity : Similar deal but with Equity instead ofc)Continued Use: An Exxon Capital Exchange or a PIPEs deal would still be used if the Issuer failed to satisfy therequirements for a shelf-registration under Rule 415, which would occur if either (a) Non-Public Issuer, if the Issuer is not public, (b) Non-Timely with Filings, is in a 12-month penalty box for not timely filing reports, or (c)Insufficient Float, lacks the public float requirements.4)Free Writing Prospectus (“FWP”) [Rule 405]:a)Generally: A Free Writing Prospectus is “any written communication,” which includes “graphic communications,”that constitutes “an offer to sell or a solicitation of an offer to buy” securities that is made by means other than (1) a prospectus satisfying the requirements of § 10(a) or another 10(b) prospectus [e.g. Rule 430 and Rule 431]; (2) , and(3) communications that are excluded from the definition of Prospectus under § 2(a)(10)(a).b)Requirements → Rule 433: A FWP will be deemed to satisfy the requirements of Sec. Act § 5(b)(1) by qualifying asa Sec. Act § 10(b) Prospectus only if the Prospectus complies with the requirements of Rule 433. If it does not, thenthe communication will violate Sec. Act § 5(b)(1).c)When it May be Used → Depends on Issuer [Rules 163 & 164]: WKSIs are permitted to use FWPs during the QuietPeriod under Rule 163. Under Rule 164, almost all other issuers, save excluded and ineligible issuers, are permitted to rely on the rule during the Waiting Period.5)Ineligible Issuer [Rule 405]: Issuers that are subject to “problems” described below are prohibited from relying on anumber of provisions of the Securities Laws as they become “ineligible issuers.” Defined to include:a)Missed Filing Reporting Issuer: If the Issuer is a reporting issuer that failed to file all materials required to be filedduring the past Twelve Months, other than certain information required under Form 8-K, then they are ineligible. This though does not have a timeliness requirement, so they can file late and still satisfy.b)Blank Check, Penny Stock, and Shell Companies: If the Issuer has qualified at any point in the prior three years asone of these, then they are ineligible.i)Blank Check Company [Rule 419(a)(2)]: Is a company that (i) Development Stage—a company that has “nospecific business plan” or “has indicated that its business plan is to engage in a merger or acquisition with anunidentified company,” and (ii) Penny Stock—is issuing “penny stock,” as defined in Rule 3a51-1.ii) Shell Company [Rule 405]: A company, other than an asset-backed issuer, that has (1) operations, either none or nominal, and (2) Assets, either none or nominal, solely of cash or cash equivalents, or cash and cashequivalents and only nominal other assets.iii)Penny Stock Issuer [Rule 3a51-1]: Any issuer of securities other than securities exceeding the requirements set forth in Rule 3a51-1. These are normally for low value, low capital firms, as the issuer must exceed (A) certainasset or income minimums, (B) operating history or market value of securities, (C) greater than $4/share value,etc.c)Limited Partnership: If it is a limited partnership that is offering and selling its securities other than through a FirmCommitment Underwriting.d)Bankruptcy and Insolvency: If the Issuer within the past three years has become insolvent or filed for bankruptcy,then it is ineligible, provided that if it was involuntary, ineligibility occurs at a special determination date and that the three years only starts to run after they filed an annual report after emerging from bankruptcy.e)Felony/Misdemeanor: If in the past three years the Issuer was convicted of felonies specified in Exch. Act § 15(b)(4)(B)(i)-(iv).f)Adverse Government Action: If in the past three years, the Issuer was the subject of an adverse government action,be it administrative or judicial, that subjects them to either (A) prohbiitions on certain conduct such as violating anti-fraud provisions of securities laws, (B) requires cease-decist violating securities laws, (C)6)Qualified Institutional Buyer Defined [Rule 144A(a)(1)]: QIBs are any of the following entities, acting on its own accountor for the account of another QIB [Note: this precludes “sophistication by proxy” as under Rule 506, because can only purchase for someone else and count as a QIB if purchasing for another QIB].a)Catchall Institutions → $100M in Securities [Rule 144(a)(1)(i)]: Insurance company, investment company,employee benefit plan, trust fund, business development company, 501(c)(3) organization, corporation, partnership, investment advisor.i)NOTE: You can create a corporation for the express purpose of buying 144A securities (unlike Reg D).b)Dealers Generally → $10M in Securities [Rule 144A(a)(1)(ii)]: Dealers, if acting on their own or a QIBs account,that owns $10M investments in securities not affiliated with the dealer.i)Unsold Allotments → Not Counted : Provides that any securities being held as part of an unsold allotment do notcount as being “owned” by such dealerc)Dealer Riskless Principal Transactions for QIBs [Rule 144A(a)(1)(iii)]: Dealers qualify as QIBs when engaged inriskless principal transactions for QIBs.i)Riskless Principal Transaction [Rule 144A(a)(5)]:A transaction in which a dealer buys a security from any personand makes a simultaneous offsetting sale of such security to a QIB.d)Registered Investment Companies → $100M in Securities [Rule 144A(a)(1)(iv)]: Any investment company that ispart of a family of investment companies, meaning it has the same advisor for multiple funds or affiliate funds, which owns in the aggregate $100M in non-affiliated issuer’s securities.e)Owners are QIBs [Rule 144A(a)(1)(v)]: Any entity, such as a corporation, where all equity owners are QIBs, that actfor either their own account or for the account of other QIBs.f)Banks → $25M Independent Net Worth [Rule 144A(a)(1)(vi)]: Banks must have, in addition to owning $100M insecurities of non-affiliated issuers, must have at least $25M in independent net worth from such securities.7)Seasoned Issuer [Rule 433(b)(1)]:a)Seasoned Issuers are Issuers that are (1) Reporting Issuers, meaning subject to the Exch. Act § 13 and 15 reportingrequirements, (2) Form S-3 Eligible, and (3) NOT an Ineligible Issuer.8)Substantial U.S. Market Interest (“SUSMI”) [Rule 902(j)]: There are different standards for determining if there is a“substantial U.S. market interest” in an issuer’s securities depending on whether the securities are equity or debt securities.a)Equity SUSMI [Rule 902(j)(1)]:There is SUSMI with respect to an issuer’s equity securities if eitheri)U.S. Market is Largest Market [Rule 902(j)(1)(i)]: The U.S. market is the largest market for the class ofsecurities in the last fiscal year.ii)De Minimis Traded on non-U.S. Exchange [Rule 902(j)(1)(ii)]: Twenty percent (20%) or more of all trading in the class of securities took place in, on or through the facilities of securities exchanges, and less than fifty-fivepercent (55%) of such trading took place in/through the facilities of security markets of a single country.b)Debt SUSMI [Rule 902(j)(2)]: There is SUSMI with respect to an issuer’s equity securities if all of the following aresatisfied—i)>300 Aggregate U.S. Debt Holders [Rule 902(j)(2)(i)]: There are, in the aggregate, 300 or more U.S. personswho are record holders of the issuer’s debt securities.ii)U.S. Debt Holders have $1B or 20% [Rule 902(j)(2)(ii)-(iii)]: If U.S. persons hold at least $1B of and 20% of,(1) the principle amount outstanding of its debt securities PLUS (2) the greater of liquidation preferences on parvalue of its securities described in Rule 902(a)(1), PLUS, (3) the principle amount or principle balance of itssecurities described in Rule 902(a)(2).iii)Commercial Paper → Ignored [Rule 902(j)(3)]: for purposes of these debt calculations, securities exempted under the commercial paper exemption are not included.9)Well Known Seasoned Issuer (“WKSI”) [Rule 405 , P129 ]: There are three ways for an Issuer to become a WKSI underRule 405.a)Always Required → Form S-3 Registrant Requirements [Para. (1)(i)] → P584:i)US company andii)Reporting company(1)Issuers with a class of securities listed on an exchange (Sec 12 (b) of the Exchange Act) or(2)Issuers having both total assets exceeding $10 million and a class of equity securities held by 500 or morepeople (Sec 12(g) of the Exchange Act) or(3)Issuers with outstanding securities sold pursuant to 1934 Act registration statement (Sec 15(d) of theExchange Act) → = file registration for a class of securities with SEC→ eg. Registered public debt offering iii)Has reported for at least 12 monthsiv)timely filing the reports and no defaults during prior yearb)In addition, the Issuer must satisfy one of the following options.i)Opt. One → $700M Public Float [Para. (1)(i)(A)]: Within 60-Days of the Determination Date, must have a“worldwide market value of its outstanding voting and non-voting common equity held by non-affiliates of $700million or more.”ii)Opt. Two → within 60-Days of the Determination Date, the issuer must have issued $1B in non-convertible securities, other than equity (debt or preferred stock), in the last 3-Years, “in primary offerings for cash, notexchange, registered under the Act.” [excludes PIPEs and Exxon Capital Exchanges] +Only Registering Non-Convertible Non-Equity [Para. (1)(i)(B)(2)] → (must only register “nonconvertible securities, other thancommon equity, and full and unconditional guarantees.”)iii)Opt. Three → within 60-Days of the Determination Date, the issuer must have issued $1B in non-convertible securities, other than equity (debt or preferred stock), in the last 3-Years, “in primary offerings for cash, notexchange, registered under the Act.” [excludes PIPEs and Exxon Capital Exchanges] + Form S-3 TransactionRequirements [Para (1)(i)(B)(2)] → (the market value of the voting and nonvoting common equity held by non-affiliates of the issuer is more than $75 million)c)Determination Date [Para. (2)]: Determination Date is the later of either (i) Shelf-Registration Filing, the filing ofthe most recent shelf registration statement; or (ii) Shelf-Registration Amendment, time of the most recentamendment to a shelf-registration statement; or (iii) Most Recent Form 10-K Filing, if there is not a Shelf-Registration, then it is the most recent Form 10-K filing date.Coverage of Securities Regulations: Definition of “Security”“Every sale of a security in the United States must be registered or exempt.”1)Jurisdictional Question : Whether or not something is a security determines whether securities laws apply. If it is not asecurity, the Securities and Exchange Commission has no jurisdiction to regulate its sale. If an instrument is deemed a “security,” then the major regulations are applicable.2)Statutory Definitions of “Security” [Sec. Act § 2(a)(1); Exch. Act § 3(a)(10)]: The two major statutes set forth nearlyidentical definitions of what constitutes a security.a)Unless Context Provides: Both statutes have a proviso that the listed instruments will count as securities “Unless thecontext otherwise requires.” In short, even if something technically is called one of the following instruments, context may deem that it is not appropriately called a security.b)Specific Listing of Instruments: Expressly provides that any “note,” “stock,” “bond,” and “debenture” will bedeemed a security.c)Catchall Provision: "Evidence of indebtedness," "certificate of interest or participation in any-profit sharingagreement," "investment contract," and any "instrument commonly known as 'security.'”d)Key Difference—Commercial Paper:3)How to determine whether an Interest is a Security : In examining an instrument, must examine whether it will be deemeda security as either traditional common stock, a note, or as an investment contract.a)Traditional Common Stock [Landereth] (p. 6)i)Label: Under Landereth, an instrument labeled as a “stock” will be deemed a security if it possesses the “usualcharacteristics” associated with common stock.(1)If mere label (but none of the characteristics in (ii), the court may apply the Howe Catchall analysis)ii)Usual Characteristics: These usual characteristics of a stock include (1) the right to receive dividends, (2) negotiability, (3) the ability to pledge or hypothecate the security, (4) voting rights in proportion to the number ofshares owned, and (5) the capacity to appreciate in value.b)Traditional Note Test [Reeves]: Under Reeves, an instrument labeled as a “note” is presumptively a security,however, this presumption may be rebutted in two circumstances.i)Precluded List : First, courts utilizing the Reeves analysis have identified certain “notes” that are, by their nature,not appropriately regulated by the securities laws. If an instrument falls on this list, then it is similarly excludedfrom being treated as a security.(1) A note delivered in consumer financing;(2) A note secured by a home mortgage;(3) A short-term note secured by a lien on a small business or some of its assets;(4) A note evidencing a character loan to a bank customer;(5)Short-term notes secured by an assignment of accounts receivable;(6) A note formalizing an open-account debt incurred in the ordinary course of business; and(7)Notes evidencing loans by commercial banks for current operations..ii)Individual Analysis : Second, even if not already excluded based on the foregoing list a note may still be excluded.In determining whether note rebuts the presumption of being a security, Courts will examine (1) the partiesmotivations, (2) the plan of distribution of the instrument, (3) the expectations of the investing public, and (4) theexistence of a risk reducing factor which renders securities regulations unnecessary.c)Investment Contract Test [Howe]: Under the catchall Howe Investment Contract Test, an instrument will be deemeda security if (1) there is an investment of money, (2) made with the expectations of profits, (3) originating from acommon enterprise, (4) where profits are derived “solely,” meaning “predominantly,” from the efforts of others.i)Investment of Money→ Self Explanatoryii)Expectation of Profit→ Contrast “cash profits” from “consumption motive.”iii)Common Enterprise(1)Horizontal Commonality (Available in All Circuits—7th takes only it): Pooling of investment funds plusshared profits and losses (i.e. interdependency of the investors).(2)Strict Vertical Commonality (Available in 5th, 2nd, 9th Cir): The investment must be tied to the promoter’ssuccess(3)Broad Vertical Commonality (Available only in 5th): The investment need not be tied to the investor’sperformance at allTraditional Common Stock: “Usual Characteristics” Test1) Introduction : Stock is one of the expressly enumerated categories of securities listed in both Sec. 2(a)(1) and Sec. 3(a)(10).Therefore, there is a specific test for determining whether2)Usual Stock Characteristics Test : An investment instrument labeled as a “stock” by the promoter will qualify as a Sec. 2(a)(1) stock, and therefore render the instrument a security, provided that it carries the “significant characteristics typicallyassociated with stock.a)Critical Characteristics: These usual characteristics of a stock include (1) the right to receive dividends, (2)negotiability, (3) the ability to pledge or hypothecate the security, (4) voting rights in proportion to the number ofshares owned, and (5) the capacity to appreciate in value.i)Landreth Timber Company v. Landreth – The “Timber!” Case [Page 295](1)Landreth family owned all of the outstanding stock of a lumber business. While they were attempting to selltheir controlling shares, a fire broke out. Potential investors were advised of the damage, but told the millwould be rebuilt and modernized. Purchaser acquired 100% of the stock, but rebuilding costs greatlyexceeded expectations. Purchasers sued.(2)Court noted that here the stock bore all the traditional characteristics of a stock, and furthermore it was soldin the context of a transaction typically covered by securities laws, the sale of a stock in a corporation.Therefore, the investor would reasonably believe that this was covered by the securities laws.b)Mere Label as Stock is Insufficient: If a security is labeled a stock, but it does not bear these critical characteristics,then it will not be deemed a security as a “stock.” The court may, however, analyze whether it is a security under the general catchall test for securities.i)United Housing Foundation, Inc. v. Forman – The “Co-Op City” Case [Page 270](1)Defendant sold shares in a non-profit corporation to individuals so that they could live in a non-profit co-op.The shares at issue did not have proportionate voting, as management was based on a per-apartment bases,there were no dividends, the shares were not freely alienable, there were no dividends, and the shares wouldbe sold at the end of occupation at the same price that they paid for them initially(2)Court determined that this was not a “stock” as the name would suggest, and therefore proceeded to analyzeit under the Howe test (eventually determining it was not an investment contract either).3)Power of Formalism : The investment will be deemed to be a security under this test, even if it would not be deemed asecurity under the general catchall investment contract analysis.a)Landreth Timber Company v. Landreth – The “Timber!” Case [Page 295]i)Compare the result here with that in Steinhardt (LPs) and Monsanto (LLCs), where the question would haveturned on passivity (or reliance upon the “efforts of others”). Here, they were acquiring 100% of the stock, so itwould not have been considered a security under Howe.ii)Court noted that the Howe test was designed to govern the catchall provisions at the end of Sec. 2(a)(1), but to find that this should be applied to all securities would ignore the fact that the statute expressly enumerated certaintypes of securities before the general catchall provision. Therefore, the mere fact that something would not beconsidered under another test did not mean that it should be relevant to the stock inquiry.Notes: “Family Resemblance” Test1)Introduction : The label “note” is expressly included in the definitions in § 2(a)(1) and §3(a)(10); however, unlikeconventional stock which has a core set of critical characteristics, notes embrace a wide variety of financial instruments that are issued for wildly different purposes, not all of which are fit for regulation as securities. Therefore, a different test is required.a){Reeves v. Ernst & Young – The “Note by any Other Name” Case [Page 301]i)Farmer’s Cooperative (“The Co-Op”) issued promissory notes payable on demand by the holder in order tosupport its general business operations. Notes were uncollateralized and uninsured. Notes were advertised in TheCo-Op’s Newsletter, and stated that though they were uninsured, there were more than $11,000,000 in assetsstanding behind the investment. The Co-Op eventually floundered, leaving 1,600 bondholders holding the bill for$10 million in worthless notes.ii)Quote: “While common stock is the quintessence of a security, and investors therefore justifiably assume that a sale of stock is covered by the Securities Acts, the same cannot be said of notes which are used in a variety ofsettings, not all of which involve investments. Thus, the phrase ‘any note’ should not be interpreted to meanliterally ‘any note,’ but must be understood against the backdrop of what Congress was attempting toaccomplish in enacting the Securities Acts.”}{}means 讲过但不重要。

公司法学读书笔记公司法学是研究公司法律制度和公司组织形式的学科。

以下是关于公司法学的一些读书笔记:1. 公司法的定义和目的:公司法是研究公司组织形式、公司权责和公司内外部关系的法律学科。

其目的是规范和保护公司和股东的权益,促进企业的健康发展和经济的繁荣。

2. 公司类型和法律要素:公司可以分为有限责任公司和股份有限公司等不同类型。

公司法的法律要素包括公司的组织形式、股东的权利和义务、公司治理结构、公司资本结构和公司业务等。

3. 公司组织形式和登记注册:公司可以通过设立、合并、分立和清算等方式进行组织和变更。

公司必须按照法律规定进行登记注册,并遵守公司法规定的程序和要求。

4. 公司权责和内部关系:公司的权责包括公司经营权、公司财产权、股东权益和董事会权力等。

公司内部关系包括公司董事会和股东大会等机构的组织和运行,以及股东之间和董事与股东之间的权利、义务和责任等。

5. 公司治理和监管:公司治理是指公司决策、执行和监督机制的建立和实施。

公司法对公司治理进行了规定,包括董事会的组成和职责、监事会的监督功能和股东大会的决策权等。

同时,监管机构如证券监管机构和财务会计机构等对公司进行监督和管理。

6. 公司股权和股东权益:公司股权是指股东对公司财产和收益的所有权。

股东权益包括股东持有的公司股份的权利和利益,如权益分红、股东决策权和决策参与权等。

7. 公司破产和债权人权益保护:公司破产是指公司无法偿还债务或无法继续经营的情况。

公司法对公司破产进行了规定,保护债权人的权益,包括债权人的申报权、清偿顺序和破产程序等。

以上是关于公司法学的一些读书笔记,涵盖了公司的组织形式、股东权益、公司治理和监管等方面的内容。

通过深入研究和学习,可以更好地理解和应用公司法的相关知识。

公司法笔记第十一章公司破产一、基本概念【公司破产】是指公司作为债务人不能清偿到期债务,为保护多数债权人的利益,使之能得到公平满足而设置的一种诉讼程序。

【破产法】是调整债务人不能清偿到期债务时,对其宣告破产,并强制执行其全部财产,使各债权人得到公平受偿,或者与债权人达成和解协议进行整顿过程中所发生的各种关系的法律规范。

【破产界限】又称破产原因或破产事实,是指法院在何种情况下可宣告债务人破产的状态,也是法院判断是否宣告债务人破产的标准和理由。

【清偿不能】是指企业法人欠缺清偿能力,即对于已到清偿期限,而且已受清偿请求之债务的全部或主要部分,处于全面地、长期地不能清偿之财产状态。

【破产债权】是指债权人所享有的能够依据国家强制力通过破产程序从债务企业的财产中受到清偿的权利。

【债权人会议】是由法院或者由法院指定的债权人会议主席召集的,由全体债权人参加并行使债权和破产处理参与权的临时性决议机构。

【破产财产】是依照破产法的规定宣告破产时,为了满足所有破产债权人的共同需要而组织管理起来的破产企业的全部财产。

【破产清算组】是在债务人被宣告破产后管理处分财产的权利被剥夺,其所有的财产构成破产财产,而由法院组织成立的对破产财产进行管理处分的临时性机构。

【和解】是在债权人申请债务人破产的情况下,由债务人与全体债权人就企业整顿和延期清偿债务或者减少债务数额等达成协议,从而中止破产程序的一种制度。

【整顿】是债务人为履行其与债权人会议达成的和解协议,在人民法院的监督和上级主管部门的主持下,采取必要措施恢复生机,以最终清偿债务,免遭破产的一种制度。

【破产宣告】是受理破产案件的法院,依法裁定和宣布债务人破产的一项程序。

【破产清算】是破产宣告后,清算组在有关当事人的参加下,对破产企业的财产依法进行接管、清理、估价、处理和分配,了结破产企业债务的活动与程序。

【破产责任】是指有关责任人违反企业破产法律所应承担的法律责任。

二、基本理论1.公司破产的法律特征(1)公司作为债务人不能清偿到期债务。

《公司法》完整笔记指定教材:顾功耘主编:《公司法》,北京大学出版社,2000年11月第二版。

定价:18.00元。

总论第一章公司法概述第一节公司法的定义与性质一、公司法的定义所谓公司法,是规定各种公司的设立、组织活动和解散以及其他与公司组织有关的对内对外关系的法律规范的总称。

狭义的公司法和广义的公司法狭义的公司法仅指冠以“公司法”之名的一部法律。

广义的公司法包括一切有关公司的法律、行政法规、规章以及最高司法机关的司法解释。

公司法理论研究的对象通常是广义的公司法二、公司法的性质1、公司法兼具组织法和活动法的双重性质,以组织法为主2、公司法兼具实体法和程序法的双重性质,以实体法为主3、公司法兼具强制法和任意法的双重性质,以强制法为主4、公司法兼具国内法和涉外法的双重性质,以国内法为主第二节公司的定义与法律特征一、公司的定义按一般定义,西方国家的公司是指依法定程序设立的,以营利为目的的社团法人。

这一定义可以分解成三层意思:1、公司是法人,即公司是以法定条件和法定程序成立的具有权利能力和行为能力的民事组织。

2、公司是社团法人,即公司是两个或两个以上股东共同出资经营的法人组织。

3、公司是营利社团法人,即公司股东出资办公司的目的在于以最少的投资获取最大限度的利润。

在我国,公司是依照公司法律规定组织、成立和从事活动的,以营利为目的的且兼顾社会利益的,具有法人资格的企业。

二、公司的法律特征1、合法性2、营利性3、独立性第三节公司的分类一、现行法律上的分类1、按公司是否发行股份和参与投资人数的多少,可将公司分为股份有限公司、有限责任公司和独资公司。

股份有限公司:股东须有5人以上,全部资本分为等额股份,股东以其所持股份为限对公司承担责任,公司以其全部资产对公司的债务承担责任。

有限责任公司:股东人数为50人以下,股东以其出资额为限对公司承担责任,公司以其全部资产对公司的债务承担责任。

独资公司:股东仅为一人,股东以其投入的资本金额为限对公司承担责任,公司以其全部资产对公司的债务承担责任。

公司法读书笔记

一、公司的定义和分类

《公司法》将公司定义为具有法人资格的企业法人,其分类主要包括有限责任公司和股份有限公司两种形式。

这两种公司在股东责任、股份转让和公司管理结构上有所不同。

二、股东的权利和义务

股东作为公司的所有者,享有利润分配、重大决策投票、选举管理层等权利。

股东需遵守法律、履行出资义务,并对公司的债务承担有限责任。

三、公司治理结构

《公司法》规定了公司的基本治理结构,包括股东大会、董事会(或执行董事)和监事会(或监事)。

每个机构在公司中扮演不同的角色,并负责不同的管理和监督职责。

四、公司的设立和登记

公司设立需要符合法定条件,包括最低注册资本、股东人数等,并需经过工商行政管理部门的审批和登记。

五、公司的财务和会计

《公司法》对公司的财务管理和会计制度提出了明确要求,强调会计记录的真实性、合法性和完整性。

六、公司解散和清算

公司可能因多种原因解散,如股东决议、法定期限届满、破产等。

解散后,需进行清算,处理公司债务并分配剩余资产。

七、重大问题及对策

对于公司法中的一些重要议题,如股东权益保护、公司治理、利润分配政策等,应深入分析并提出合理的管理对策。

八、案例分析

通过分析具体的案例,可以更深刻理解《公司法》的适用及其在实践中的运作。

九、法律变更与趋势

关注《公司法》的最新修订和相关法律政策的变化,理解其背后的经济和法律趋势。

法学读书笔记-----公司法1.公司的汉语语源在汉语中,“公”含有无私、共同的意思,“司”是指主持、管理。

公司作为中国土生土度的词,最早出自孔子的《大同》《列词传》“公者,数人之财,司者,运转之意”①。

二者合在一起,则是众人无私主持及管理共同事务的意思。

我国台湾学者曾考证“公司”一词连用最早出自《庄子·则阳》“积弊而为高,合小而为大,合并而为公之道,是谓公司”,(据笔者查阅,庄子原文为“是故丘山积卑而为高,江河合水而为大,大人合并而为公”,并无“是谓公司”之语,而史际春教授在查考庄子《杂篇·则阳第二十五》中原话后指出此处的“公”系用以解释包容、协调天地阴阳万物的“道”,而非指世俗人事文中并无“公”、“司”二字之合用,“公司”一词为“公班衙”的英文“Company”及荷兰文“Compagnie”之音和义结合的译名),但至少在17世纪以前,我国古汉语极少将公司一词连用,对公司一词也无约定俗成的含义。

我国大陆学者多认为,国人在商事方面组织意义使用“公司”一词,是在17世纪开始的。

最早在我国南方沿海在区流行起来,最初有“公班衙”、“公班卫”、“康邦尼”等多种译称,后来逐渐被统称为“公司”②。

目前所知文献中最早出现的“公司”字样,是康熙23年(1684)年福建总督王国安上奏康熙皇帝,报告在厦门扣押了原反清的郑成功政权属下要员的两艘大船,内载“公司货物”若干③。

目前公司定义所见最早者为清代学者魏源成书于鸦片战争以后道光年间的《筹海篇四议款》④云“西洋互市广东者十余国,皆散商无公司,惟英吉利有之。

公司者,数十商辏资营运,出则通力合作,归则计本均分,其局大而联;散商者,各出己赀,自运自售,利害皆一人独当之,其势专而散”⑤2.公司的历史起源(1)世界①《公司由来》,/view/093cbc74f46527d3240ce0d7.html②冯果《公司法要论》P1③/view/093cbc74f46527d3240ce0d7.html④冯果《公司法要论》P1⑤/Info.aspx?ModelId=1&Id=28774关于公司的起源有种说法,一是古罗马起源说。

公司法重点整理笔记1、法人制度的价值:①独立的财产第一,公司财产均来自股东的出资。

股东一旦出资把自己的财产交给公司,就失去对这部分财产的所有权,取而代之的是股权。

该财产成为公司的独立财产。

第二,公司存续期间,股东无权抽回已属于公司的财产,公司要坚持资本真实的原则,不能减少其自有资本。

第三,与经营规模相适应的财产,公司在符合公司法的最低注册资本的规定外,属于特定行业的,要符合该行业有关法规所定的最低注册资本。

②独立承担民事责任第一,公司应以其全部财产承担责任,自主经营、自负盈亏。

第二,对法定代表人和代理人的经营活动承担民事责任第三,股东不对公司的债务直接承担责任第四,不能清偿到期债务,宣告破产2、有限责任制度的价值:两个主体,股东和公司两种权利,股权和所有权两种责任,股东以其出资额为限对公司承担有限责任和公司以其全部财产对公司债务承担责任。

3、揭开公司面纱是指在一些情形下,为保护公司之债权人,为了实现公平正义的目的,法院可否定股东与公司分别独立之人格,令股东直接负责清偿公司债务。

揭开公司面纱的适用条件:(1)公司设立合法,已取得法人资格(2)股东滥用控制权,进行了不当的行为。

(3)股东控制权的滥用,客观上损害了债权人利益或社会公共利益。

4、公司的目的:公司以营利为目的,具有营利性。

所谓以盈利为目的,是指公司必须从事经营活动,其经营活动的目的在于获取超出资本的利润并将其分配给投资者。

5、公司权利能力的限制:(1)性质上的限制(2)法律上的限制第一,对公司转投资方面的限制(15条、16条)第二、对公司提供担保行为的限制(16条)第三、对公司提供贷款方面的限制(3)目的上的限制,对公司经营范围的限制目的:保护股东、债权人的利益、维护交易安全6。

有限责任公司、股份有限公司、人合公司、资合公司的含义有限责任公司,是指股东以其出资额为限对公司承担责任,公司以全部财产对公司债务承担责任的企业法人。

股份有限公司,是指公司资本分为等额股份,股东以其所持所有股份对公司承担责任,公司以其全部财产对公司债务承担责任的企业法人。

“公司法”第一章笔记新旧公司法比较2005年10月27日修订,未修改原法条文仅占10%.1、引入公司法人人格否认制度:新增公司股东滥用公司法人独立地位和股东有限责任,逃避债务,严重损害公司债权人利益的,应当对公司债务承担连带责任。

2、增加股东有限公司可实行累积投票制的规定:新增股东大会选举董事、监事,可依照公司章程的规定或股东大会的决议,实行累积股票制。

累积投票制:指股东大会选举董事或监事时,每一股份拥有与应选项董事或监事人数相同的表决权,股东拥有的表决权可集中使用。

3、有限责任公司最低注册资本降至3万并可分期缴足:原法:有限公司的注册资本不得少于最低限额:以生产经营为主和以商品批发为主的公司50万元;以商业零售为主的公司30万元;科技开发、咨询、服务性公司为10万元。

注册资本要一次缴足。

新法:对上述规定作了三方面修改:取消了按照公司经营内容区分最低注册资本额的规定;允许公司按照规定的比例在2年内分期缴清出资,投资公司从宽规定可在5年内缴足;将最低注册资本额降至3万元。

4、股份有限公司注册资本最低限额降至500万元。

原法:最低1000万元。

新法:将限额降至500万元。

5、无形资产可占注册资本的70%:原法:以工业产权、非专利技术作价出资的金额不得超过有限公司注册资本20%.新法:全体股东的货币出资金额不得低于有限责任公司注册资本的30%.6、删去公司对外投资占公司净资产一定比例的限制。

原法:公司可向其他有限责任公司、股份公司投资,并以该出资额为限对所投资公司承担责任。

除国务院规定的投资公司和控股公司外,公司累计对外投资不得超过50%.新法:公司可以向其他企业投资,但除法律另有规定外,不得成为对所投资企业的债务承担连带责任的出资人。

7、增加股东诉讼的规定:新增董事、高级管理人员执行职务违反法律、行政法规、公司章程的规定,给公司造成损失的,股东可请求董事会(或执行董事)提起诉讼。

8、有限责任公司的股东可查阅公司财务会计账簿。

注册资本 registered capital有限责任公司limited liability company:认缴的出资额capital contributions股份有限公司 joint stock limited company:发起设立:全体发起人认购的股本总额;募集设立:实收股本总额发起设立的,全体发起人首次出资额不得低于注册资本的20%;募集设立的,发起人认购的股份不得低于公司股份总数的35%。

股东会议的召集董事会——执行懂事——监事会/监事——代表十分之一以上表决权的股东股东会议的主持董事长——副董事长——由半数以上董事共同推举一名董事主持—执行董事——监事会/监事——代表十分之一以上表决权的股东股东大会会议 (连续90日以上单独或合计持有10%以上股份的股东) 必须经代表三分之二以上表决权的股东通过的决议修改公司章程,增、减资,公司合并、分立、解散或者变更公司形式有限责任公司变更为股份有限公司时,折合的实收股本总额不得高于公司净资产额???(此处的公开发行是指上市过程中的那次公开发行)董、监、高转让股份的限制向公司申报所持本公司的股份及其变动情况;任职期间每年转让的股份不得超过所持本公司股份总数的25%;所持本公司股份自公司股票上市交易之日起一年内不得转让;离职半年内,不得转让所持本公司股份。

股东代表诉讼诉讼主体:有限责任公司的股东、股份有限公司连续180日以上单独或合计持有公司1%以上股份的股东诉讼前提:监事会或董事会受到股东书面请求后拒绝提起诉讼,或自受到请求之日起30日内未提起诉讼,或情况紧急、不立即起诉将会使公司利益受到难以弥补的损害以股东自己的名义为了公司的利益直接向法院起诉弥补亏损——提取法定公积金——任意公积金分红有限责任公司:按实缴出资比例分配股份有限公司:按股东持有的股份比例分配股权转让有限责任公司:股东之间可以相互转让;向股东以外的人转让应当经其他股东过半数同意对以下决议投反对票的股东可以要求公司以合理价格收购其股权:T751.连续5年不分配利润;2.公司合并、分立、转让主要财产的;3.公司章程规定的营业期限届满或其他解散事由出现,股东会议通过决议修改章程使公司存续的。

公司法学习笔记《公司法》学习笔记《公司法》是一部大法,与证券法一起构成了资本市场的法律基石。

所有与证券相关的从业者都应该学习并能加以熟练运用。

《公司法》看似文辞浅白,实则深奥无比。

本文试图从投行的角度来分享关于《公司法》的学习心得。

一、引子:关于浅白与深奥的举例例一:股东大会召开必须至少提前15日发出会议通知,那么,在网络通讯如此发达的现代社会,如何不能更短更有效率?我的理解是,除去众所周知的理由外还应基于以下考虑:1、给予不赞同提案却又无力改变投票结局的中小股东较为充分的卖出时间;2、防止舞弊,即利用股东无法获知会议通知或无法参会的时间差来左右投票结果。

例二:股份公司董事会成员数量为何规定5-19而非其他数字?我的理解是,这个问题应该结合股东单位长期投资的会计政策进行理解。

可见,读懂《公司法》并非易事,需要较多的知识经验储备,《公司法》借鉴了西方国家近三百年来的管理运作实践经验,可谓是智慧的结晶,对于看似浅白的条文都应该细致揣摩方能深入理解。

二、抓住有限责任的核心《公司法》的核心是有限责任,而承担无限责任的合伙企业和个人独资企业则由其他法律进行规定,股东承担何种责任是划分企业类型的标志。

有限责任是现代企业制度的核心,理解这个概念是阅读理解《公司法》的基础。

三、对比法学习《公司法》并非孤立存在,其与《民法》、《证券法》、《会计法》等等渊源深厚且相互印证,所以阅读时需要打好其他法律的基础。

《公司法》所调整的两类对象有限公司和股份公司,其实质是人与资合的区别,所以最有效的阅读方法是对比法,即详细比较两类公司的各种差异以深入理解法条的意义,以下通过改制实例来阐述对比学习方法。

四、找出所有微妙变化改制时国内企业A股IPO历程的必经之路(新设公司除外),在《公司法》颁布后,绝大多数改制行为都是由有限公司整体变更为股份公司的过程。

那么,改制前后股东权利义务会发生哪些微妙变化?1、限制了部分权利有限公司自然人股东死亡后其合法继承人可以继承股东资格,而股份公司无相应规定。

ADVANCED CORPORATE MARKETS LAWMarket Infrastructure Financial Directive = MIFIDTwo main areas: the global financial system and the EU capital market law.1.The global financial system – basic informationThere is a problem with respect to globalisation while studying law. It is easy to talk about global market or global economy, but the world “law” is strictly connected to a single state into borders. Law system is the opposite of globalisation by its definition itself.This is the starting point to understand why it is so difficult talking about globalisation and law together. Even in EU, where we do not have physical borders, if me, Italian citizen, buya car in France, that contract is governed by French law on the basis that I have signed thecontract in France. The same counts for a Frenchman that buys something in Italy.Otherwise, take the concept of real property: our concept of property does not exist legally in the same way in UK. In England they have the concept that all immovable property belongs to the crown. Even if you buy something immovable, it has to return to the crown by a hundred of years.In Italy you can divide property into shares. If you have full ownership of shares you can get eventual dividends. If you split and become “nudo proprietario”, you are not more entitled to the dividends. The one that takes the dividends is called “usufruttuario”. These are called “diritti reali di godimento”. But this idea is not spread abroad.Otherwise take marriage: in Italy you cannot be bigamous.Here you don’t have a principle called “stare decisis” if a judge in Italy makes a sentence, another judge is not bound to follow the sentence by judging another case. Following judges in Italy are not bound by precedent cases.In UK and USA, instead, the second judge is bound to follow the decision of the first one.All legal systems are different and valid in their state.In Italy we have Vatican City and San Marino republic that are two different states into the state. How could we talk about globalisation in terms of law?In globalisation the basic meaning should be “no borders”.In Italy, before 1942 (Italian civil code enacted), when someone committed a crime, apart from throwing him in jail, there was an optio n called “confino”. Sending someone to confino meant a place, like a small village, and you were there and you couldn’t go outside.Why cannot he be banned? Because the state has no powers outside, there should be international agreements.International law is basically the block of relations between the states, but international law is not globalisation. International is when a state tries to enter into an agreement with another state to found rules that are enforceable for both states.Imagine that nation and state mean the same thing. Inter + national = between + states.International has nothing to do with globalisation: in globalisation we do not have states.The image of globalisation is a globe without borders. International is a step away from globalisation, because international accepts the idea of borders and different nations.A good image of globalisation is financial capital market .In legal system we don’t have globalisation, but we have an exception: capital markets law is the only branch of law that is globalised. This happens because of:•Language →if you’re studying Italian private law in English and you find the world “contract”, you translate in Italian like “contratto”, but this in Italian law has aspecific meaning provided by Italian civil code. In order to find out what an Italiancontratto means I have to search for the civil code. Otherwise, the world contract inEnglish has a different meaning because it has a different definition.In capital markets there is the financial jargon, that is the same for everyone. It is stillEnglish, but to be understandable, you need specific economic knowledge (like “cap-and-floor”: speci fic financial meaning).“Upfront” = sort of payment at the beginning of the derivative contract.“Underline” = stocks or shares.•Sources of law (le fonti del diritto): in the normal legal system we have the hierarchy of the sources of law. For example, in Italy we have first Italian Constitution, thenthe law, then the regulations, the consuetudini (common practices). This list is inorder of importance.This is useful when we have the problem of inconsistency between the sources oflaw.The problem is when you have two inconsistent rules on the same level.When one is on the same level of the other, but it is more specific, the more specificwins and the more generic loses.Criteria: 1) the rule of higher grade shall amend or repeal the lower grade one2) The rule of lower rank cannot amend or repeal the higher grade one3) Two equal rules may change according to the chronological order4) The latest rule changes or repeals the previous one of the same gradeAnd if the inconsistency exists between two standards belonging to the same sources? It must be applied the “consecution”: the law enacted afterwards always prevails on the law enacted earlier.Do all legal systems have this kind of ranking? We have first law, then regulationsand last common practices.It would be impossible having a ranking like this into global law.How does it work if there is not ranking in the source of law?Which are the sources of the law?Example: if you owns more than a certain amount of shares of a listed company, youhave to declare to the public how many shares you have (in Italy this threshold is3%) → this disclosure rule exists in every law system in very similar terms.How is it possible having extremely similar rules in so many different markets whilethe meaning of property in Italy is different from the one in USA?How does capital markets work? Do they work according to economic and financialprinciples and hypothesis? It is a financial and economic issue, it has nothing to dowith law. Being economic and financial, it means that all capital markets into theworld would work according to financial and mathematical principles.According to the theorem of price discovering, we have a market where we havelisted shares, and then we have the world of information. There is a strong relationbetween prices and information. When the information is published, price maybe canchange. Otherwise, if the information is not published, the price does not move. Howfast will the information be incorporated by the price? In a perfect world the marketis efficient and the information is incorporated into the price very quickly. At thispoint, we need rules about how the information must be communicated by thecompanies to the market. Insider information are not yet published and should beused for judging the price of stock.Price discovering theory will drive all law makers in the law producing extremelysimilar rules→ price discovery theory is a reference.It is not an agreement, but a natural consequence. This is the first answer to theproblem of sources of law.La price discovery è un meccanismo finalizzato a determinare il prezzo di uno strumento finanziario partendo dalle informazioni a disposizione di ogni soggetto partecipante allo scambio. A loro volta i fattori informativi rilevanti si riflettono nelle schede di domanda e offerta dei partecipanti. Per un corretto processo di price discovery è pertanto necessario che l'informazione sia sui valori fondamentali del bene scambiato sia sulle condizioni dello scambio fluisca liberamente. Per tale motivo, un mercato concentrato, quanto meno dal punto di vista informativo, fornisce l'ambiente più adatto per una corretta price-discovery.I partecipanti al mercato hanno un naturale incentivo a cercare il miglior prezzo (il prezzo più basso per chi desidera acquistare e il prezzo più alto per chi desidera vendere) e ciò, in un mercato efficiente, conduce ad una unicità di prezzo mediante l’operare del meccanismo di arbitraggio.Huge amounts of public and not public organisations into finance: we need so manyinternational authorities into the financial community. Example: International Swapand Derivative Association (ISDA). All their guidelines are not binding, but they arestrongly followed by all the community. Even if they are not source of law, they arebest practice. This is why we have such a level of uniformity in terms of contracts.F/E – ISDA used by everybody.A taxonomy of the sources of law is expressly provided in art.1 of the Preliminary Dispositions of the Italian Civil Code. They are hierarchically ordered as follows:•Statutes→constitutional sources: the Constitution, constitutional laws and constitutional regional statutes.•Primary sources▪International treaties (with specific reference to antiterrorism treaties and NATO);sources of EU law with binding force (directive and regulations) and judgments ofthe European Court of Justice “declarative” of community law.▪Ordinary law (enacted by the parliament); regional statutes and regional laws;▪Acts having the force of law (in order, law decree and legislative decree) •Secondary regulations▪Government regulations; ministerial regulations; administrative regulations;prefectural regulations and of other local governments;▪The jurisprudence (in particular the judgements of higher courts);•UsagesThis list didn’t include the C onstitution, because the Civil Code was issued in 1942, while the Constitution in 1947.Could the global system work like our legal system? No: our legal system is strongly connected to the idea of state.Could the principle of inconsistency exist in the global financial system? It doesn’t properly exist: in this system there isn’t a sort of ranking in the sources of law. There are public financial institutions that public guidelines (sort of recommendation). These guidelines are not binding, butthey have an heavy weight because the authorities that issued them are very technical and specialised. The entire corps of these guidelines is a sort of set of rules.Global financial system is definitely different from an ordinary legal system for the idea of hierarchy, sources, law: completely detached from the idea of state, borders or frontiers.a.In GFS we find FINANCIAL PRODUCTS, that are the same for all systems(while in OLS we have contracts);b.MARKET (exchanges): not a single global market, but several very similarmarkets in each country. Rules of capital markets are identical (sort of law);NGUAGE: it’s the financial English (even in the same country there areno translations, but the native nouns);d.RULES: even if the rules in the different markets aren’t exactly the samethey are quite similar and rule the same subjects (i.e. each market has adisclosure rule).•Financial products: why can we talk about a global financial system in terms of law? The price discovery process (also called price discovery mechanism) is the process of determining the price of an asset in the marketplace through the interactions of buyers and sellers. The future and option markets serve all important functions of price discovery. The individuals with better information and judgement participate in these markets to take advantage of such information. When some new information arrives, perhaps some good news about the economy, for instance, the actions of speculators quickly feed their information into the derivatives market causing changes in prices of derivatives. These markets are usually the first ones to react as the transaction cost is much lower in these markets than in the spot market.Lex mercatoria (from the Latin for "merchant law"), often referred to as "the Law Merchant" in English, is the body of commercial law used by merchants throughout Europe during the medieval period.It evolved similar to English common law as a system of custom and best practice, which was enforced through a system of merchant courts along the main trade routes. It functioned as the international law of commerce. It emphasised contractual freedom and alienability of property, while shunning legal technicalities and deciding cases ex aequo et bono. A distinct feature was the reliance by merchants on a legal system developed and administered by them. States or local authorities seldom interfered, and did not interfere a lot in internal domestic trade. Under lex mercatoria trade flourished and states took in large amounts of taxation.Merchant world is similar to the global market: borders are enemy, a free space is needed to trade.2.The EU capital markets lawItalian law on capital markets is an execution of European law.At the EU we have heart harmonisation of capital markets law.In different states we have execution of regulations from EU.Main directive is MIFD2, then there are regulations and technical standards (these last are very specific rules). Directives are general rules, technical standards are issued by tech.entities and aim at giving very specific rules.1/1/2018 if a financial firm sells financial products to the public, they need to deliver a key- information document into which they have to show a ratio on risk performance about the product they are to sell. Level 1 is low risk, level 7 is very risky level. The math model is provided by the tech. standard and it is the same for everyone.Basically there are four pillars for the global financial system:•Language•Financial instruments (most important)•Sources•Master agreementsUsually the objective of the contract and the meaning of the contract are unique in the legal system. What are financial instruments? Into the markets, what is listed and exchanged is a financial instruments. There are many different kinds of financial instruments: derivative contracts, stocks, bonds…The object of a trade is a financial instrument. All set of rules, negotiation procedures… are all focused on financial instruments. Three big families: stocks, bonds or obligations, derivatives. We might ha ve simple options, or futures, or weather derivatives…even the one of the bonds is a world by itself: clean, subordinated bonds…The definition of financial product for the Italian law is established in “Testo Unico della Finanza” (TUF) Art.1, comma 1, let. U: “"prodotti finanziari": gli strumenti finanziari e ogni altra forma di investimento di natura finanziaria; non costituiscono prodotti finanziari i depositi bancari o postali non rappresentati da strumenti finanziari.” (financial instruments and any other form of investment with financial nature; bank or postal deposits, that are not financial instruments, do not constitute financial products).Financial products are tradable on the market, throughout all the markets.In terms of law, it is really interesting that the nature of financial instruments does not depend on the legal system. It doesn’t matter if a future is regulated by Italian or American law, because the nature of the future is expressed in a mathematical way, so it is the same in all the world. It doesn’t employ juridical terms. This counts for futures, swa p derivatives, options…Many financial instruments are simply exactly the same in all the world. The consequence is that, if we don’t have a legal burden on the product, it can move around the world easily.In Civil Law countries, the law is based on typical contracts, many kind of contracts are regulated by the law.Instead, a contract of leasing didn’t exist in Italy into the ’80 →we had to import this kind of contract from USA and UK.Divide the contract in two big families: is it a kind of contract (tipico) already regulated by the law or for which exists something similar in the market? (like banking contract, compravendita, lo cazione…)? The first family is closed and only the lawmaker can add something to this list.The second family is the one of contratti atipici, not provided into the civil code, but they have to complain with one main principle to be valid: if someone invents a new contract that is not provided by the law, this contract has to comply with Italian mandatory rules, so basic principles. If the contract does not satisfy basic principle of the law, the contract is illegal.In the late ’80, we had this new contract of leasing, because some financial firms started making new business. When the parties went before the judge there was a problem: the judge must apply rules to the contract → what kind of rules will the judge apply to this new contract? There should be a matching between the type of contract and the set of rules. Otherwise, if it is a new contract, how can I find out which type of rules to apply? The judge found out that the leasing was half a contract of sale and half a rent. At the end of the period you can redeem the car by payment or give the car back. Actually, at the beginning you don’t buy the car, because its owners is the leasing company, formally. At the end, you have option to purchase the car. Do you need to apply rules for sale or rent? The judge thought that the most important part of the contract was the sale, so he had to regulate it with sale regulations.We didn’t create leasing contract: we imported it from common Law countries.With derivatives all this mess doesn’t take place: all these legal concepts have not to be applied to derivative markets. For what concerns financial instruments, like an interest rate swap, the international regulation is the same in all the world. The core part for the interest rate swap is the mathematical formula, not the legal nature: legal features don’t give shape to the product. There are not legal barriers.An interest rate swap is an agreement between two parties (known as counterparties) where one stream of future interest payments is exchanged for another based on a specified principal amount. Fixed amount of money is exchange for variable amount of money. An IRS is a popular and highly liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. They are used for hedging and speculating.This kind of contract was created by the financial system to allow the “money move” between banks without a physical move of the money. It is an exchange of banks’ needs and a financial transaction since the aim of the bank is speculating.Behind the concept of IRS there are not legal conce pt implied, there is not a peculiar legal system… so it is a contract according to what? When the IRS is listed on an exchange it is no more a contract but a product: it can be bought with an offer and it is not necessary to sign a product.We can say if a country “invented” a certain typical contract (USA, leasing), but this is impossible with derivative contracts: financial market invented them, maybe because it needed a determined type of contract.To build a proper financial system, we’d need judges and courts. We still have many local courts. The most important courts in the financial world are London, New York and Chicago.The Italian financial markets is capitalised as 700 billion of euros. Apple alone is worth 780 billion of euros. The financial instruments are regulated by contracts anyway: the 99% of the derivative contracts of the world are regulated by the same MASTER AGREEMENT. Then there are some attachments to it offering some specifications.The ISDA Master Agreement is the most commonly used master service agreement for OTC derivative transactions internationally. It is part of a framework of documents, designed to enable OTC derivatives to be documented fully and flexibly. The framework consists of a master agreement, a schedule, confirmations, definition booklets, and credit support documentation. The ISDA master agreement is published by the International Swaps and Derivatives Association.The master agreement is a document agreed between two parties that sets out standard terms that apply to all the transactions entered into between those parties. Each time that a transaction is entered into, the terms of the master agreement do not need to be re-negotiated and apply automatically.Although it is often viewed as a tool for banks and financial institutions, the Master Agreement is widely used by a wide variety of counterparties.Distinction between applicable law and jurisdiction. Applicable law is the law the parties have decided to apply to regulate the contract. Usually, if the parties belong to the same state, they’d choose the law of the country. Otherwise, when the counterparties are from different countries, according to MASTER AGREEMENT, you can choose between English or New York state law. Then there is the concept of value and jurisdiction.There is a principle, valid for all legal system, usually set into Latin: IURA NOVIT CURIA (the court knows the law). The point is that the court knows all laws that are applicable, not just Italian, if we are in Italy… Example: the parties choose English law, but they are Italians and they have to have their judgement in front of an Italian judge. Italian judge is in this case asked to apply English law. How is it possible that an Italian judge is going to apply English law? How could the judge be aware of the foreign law?The burden of the proof of the law is on the two parties: they have to provide the foreign law and demonstrate how it could be applied. Usually the Italian judge demands for an expert (consulente tecnico) that has to explain to him how to apply English law.The judges technically are not part of the global system, but we have in the world many cases of financial subjects judged in very similar ways. We had the same case because the product, interest rate swap, was the same, so we can compare all these cases.What is different? The applicable law, because Italian judge has to judge this case according to Italian applicable law… the difference is the specific rule applied by the judge, according to law traditions of the country.We can identify certain products whose content may differ under distinct regulations. On the contrary, we do not observe this with derivatives: to understand what a derivative product is, it is sufficient to understand its financial function, since its distinctive features have an economic and not a legal nature.Observing the use of certain financial terms in the market practices, we noted that, when a financial instrument or a transaction is mainly characterized by its financial content (rather than its regulation), such words are homogeneously used in different markets.On the contrary, when the regulation is what characterizes the instrument or the transaction, the same terms, used in different markets, may instead refer to different phenomena and, moreover, the meaning of the terms characterized by their legal discipline is often debated also within the same jurisdiction.Such phenomenon of alignment in derivatives, of the use of financial terms, is , in our opinion, the result of two major causes:1-The predominance of the financial content over the legal discipline, which facilitates the use of the same terms in different countries.2- A recurrent absence of a juridical system of origin. Indeed, such terms are generally not crafted by legislators or regulators, but come into being in the financial market praxis and activities, which often involve more than a market at a time. In this sense, we call such phenomenon the “stateless finance”, which is growing fast and it is contributing to develop a cross-border market where the players use the same language and often face the same problems.Division between the banking system as a system for financing firms and capital markets. 80% of money allowed to companies comes from banking system in Europe; while in USA it is much more common going public: asking money to the public instead of banks. As an example, in Italy we have crowdfunding rules.Share = scrip, equity or stocks.Two different worlds: the real one, with products, and the markets, with financial instruments.The focus of the capital markets is how the markets work and how is trading on financial markets. In the European Union law, the definition of financial instrument is any form of investment that has financial nature. Imagine that A purchases a house for two main reason: the first is that he just needs a house; the second is for making an investment: he is buying this house because he wants to resell it at a higher price to B. The first option is made by buying a single contract, a contract of salefrom the seller B. In the second option, we have the first contract by which A becomes owner of the real estate, and then we have a second contract to sell the property at a higher price. The second sale is not happening by change, but because it was thought as an investment. If we buy a house in order to resell making an investment, that’s an investment → it is not a question of change, it was thoughtlike this since t he very beginning. If you’re looking for a house where to live, part of the evaluation will be my personal needs and taste. In the second option, where I am looking for a house where to make an investment, my standards are different because I won’t take in to account personal taste. If a house is going to take much more value in the next six months, I’ll buy it because I’ll do a good investment: the house is an item and I do not have to like it.This is the basic concept for doing an investment. Anyway, this is the investment on a real item: how would we turn this real investment into financial investment? To turn this operation into financial market, the object of the operation should be a financial instrument.Imagine that there is a real estate company, whose business is investing into real estates. Imagine A buying shares of the company: the shares of the company follow the definition of financial instruments. Anyway, the object behind is always the same.The risk we are taking is connected to the same real estate market. The financial risk A’s taking with the shares is the same due to the business of the company, linked to the real estate market. Otherwise, this is a financial investment because A’s buying shares. In both cases the estate market works as underlying.On the other hand, there are new risks, like CFO information risks, or possibility that bad news drag down the prices of stocks. Even if the underlying of the investment is very similar, we are acquiring more risk, and at the same time we have the possibility of collecting much more money. Moreover, buying one single real estate, I bet all my money on it. If I buy a share of something, I bet just on that share of that real estate and I can diversify. If I pull together three different companies, I can constitute an investment fund and, if I buy a share of it, I am investing in three different companies.In the market you can even find funds of funds → invest in thousands of real estate companies.23/3/2017We have spotted some basic pillars in global financial system:•Language: financial type of English (stocks, bonds, derivatives) stuff that is usually listed on financial markets. Financial instruments are the same in all the countries of the world. Think about the meaning of property: we have a definition in our civil code that is different from the one in Commonwealth.The objects of a trade (financial instruments) are otherwise the same in all the world.The unique exception are shares. The rights of the shareholders are different in all the countries. For example, the rights of a USA shareholder are different from the rights of a shareholder according to Italian law.Think about a derivative contract (ex. interest rate swap): most of swap are regulated by standard contracts that are English. This is valid for options, futures, equity swap, foreign swaps, weather derivatives…Then we have another family of financial instruments: bonds (obbligazioni).•Sources of law: usually there is a hierarchy into the source of law:❖European Union Treaty + Italian Constitution❖Technical meaning of law: acts enacted by Italian parliament → legislative decree.。