国际金融中英文版复习资料

- 格式:doc

- 大小:250.66 KB

- 文档页数:33

TEST BANKThis part of the Instructor's Manual presents a test bank of true/false statements, multiple choice questions, and, where appropriate, additional problems. The problems are similarto those in the text and may be used for additional assignments or test questions.Chapter 1THE ROLE OF FINANCIAL MARKETSTRUE/FALSEF 1. The power to create money is given by the Constitution to the Federal Reserve.F 2. Since M-2 excludes time deposits, M-2 is a less comprehensive measure of the money supply than M-1.T 3. When individuals withdraw cash from checking accounts, the money supply is unaffected.F 4. The yield curve relates risk and interest rates.T 5. During most historical periods, the yield curve has been positively sloped.T 6. A negatively sloped yield curve is associated with the anticipation that interest rates will decline.F 7. Only paper can perform the function of money.T 8. Stocks and bonds are an alternative to money as astore of value.T 9. What serves for money in France may not be money in another country.F 10. The U.S. Treasury creates most of the nation's money supply.F 11. When individuals deposit cash in a demand deposit, the money supply is reduced.F 12. M-1 includes savings accounts in commercial banks.T 13. A positively-sloped yield curve forecasts the interest rates will rise.F 14. Since investors prefer short-term securities tolonger-term securities, the yield curve is always positively sloped.MULTIPLE CHOICEa 1. M-1 includes coins, currency, and .a. demand depositsb. savings accountsc. certificates of depositd. time depositsb 2. The power to create money is given by the Constitution toa. state governmentsb. Congressc. the Federal Reserved. commercial banksc 3. The term structure of interest rates relatesa. risk and yieldsb. yields and bond ratingsc. term and yieldsd. stock and bond yieldsb 4. The term structure of interest rates indicates thea. relationship between risk and yieldsb. relationship between the time and yieldsc. the difference between borrowing and lendingd. the difference between the yield (interest rate)on government and corporate debtc 5. Money serves asa. a substitute for equityb. a precaution against inflationc. a medium of exchanged. a risk-free liabilityc 6. An asset is liquid if it is easilya. converted into cashb. marketedc. converted into cash without lossd. soldd 7. M-2 includes1. demand deposits2. savings accounts3. small certificates of deposita. 1 and 2b. 2 and 3c. 1 and 3d. all three。

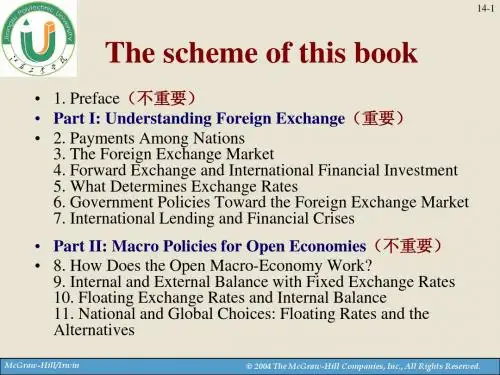

前言学弟学妹们,当你们看到这篇复习资料的时候, 学长已经在文档上传的当天上午参加了国际金融的考试, 本复习资料主要针对对象为成都信息工程学院(CUIT)英语系大三学生, 且立足教材也基于托马斯·A ·普格尔(Thomas A. Pugel)先生所著国际金融英文版·第15版, 其他版本或者相似教材也可作为参考, 本资料的整理除了参考维基百科,百度百科以及MBA 智库百科,当然最重要的是我们老师的课件. 为了帮助同学们顺利通过考试, 当然是拿到高分, 希望此资料能够帮助你们节省时间, 达到高效复习的效果.外国语学院2011级,陈爵歌(Louis) 2014年1月6日晚于宿舍 Chapter 2Transnationality Index (跨国化指数)(TNI ) is a means of ranking multinational corporations that is employed by economists and politicians. (反映跨国公司海外经营活动的经济强度,是衡量海外业务在公司整体业务中地位的重要指标) Foreign assets to total assets(外国资产占总资产比)Foreign sales to total sales(海外销售占总销售)Foreign employees to total employees(外籍雇员占总雇员)跨国化指数的构成联合国跨国公司与投资司使用的跨国化指数由三个指标构成:国外资产对公司总资产的百分比;国外销售对公司总销售的百分比;国外雇员人数对公司雇员总人数的百分比关于TNI 的计算公式:International Economic Integration( 国际经济一体化)International economic integration refers to the extent and strength of real -sector and financial -sector linkages among national economies.(国际经济一体化是指两个或两个以上的国家在现有生产力发展水平和国际分工的基础上,由政府间通过协商缔结条约,让渡一定的国家主权,建立两国或多国的经济联盟,从而使经济达到某种程度的结合以提高其在国际经济中的地位)Real Sector(实际经济部门): The sector of the economy engaged in the production and sale of goods and services(指物质的、精神的产品和服务的生产、流通等经济活动。

《国际金融学》复习要点第一篇:《国际金融学》复习要点《国际金融学》复习要点1、经常项目2、全球失衡3、国际收支4、J型曲线效应5、外汇储备6、错误与遗漏7、汇率8、马歇尔-勒纳条件9、国际收支失衡调节的政策性措施主要有哪些?10、明斯基金融危机理论的主要内容是什么?11、什么是哈伯格条件?12、国际收支调节理论中乘数论的主要内容是什么?13、国际收支调节理论中的吸收论的主要内容是什么?14、大卫﹒休谟的价格-铸币流动机制是什么?15、三代金融危机理论的主要内容是什么?16、第三代货币危机理论中的道德风险论的主要内容是什么?17、国际收支失衡的原因有哪些?18、什么是马歇尔-勒纳条件?19、谈谈你对全球失衡问题的看法?20、谈谈你对“这次不一样”综合症的看法?21、简述美国次债危机和欧洲主权债务危机的联系和区别有哪些?22、你认为通过人民币汇率的单边升值能否改善我国的国际收支失衡?第二篇:国际金融学2014年7月末外汇市场上人民币对美元的汇率为: 即期汇率6.1510/20,3个月远期点数为14/12.现有一家中国出口商向美国出口价值100万美元的玩具,3个月后收到货款.问题: 1.中国出口商在这一交易中会面临什么样的外汇风险?2.该中国出口商可以采取哪些措施来管理其外汇风险?3.随着人民币汇率浮动的增加,中国的外向型企业都会面临哪些外汇风险,应该如何管理这些风险?答:可以选择做外汇掉期交易,对冲外汇风险。

以前人民币汇率波动率在正负2%,中国央行倾向于人民币市场化,波动区间有望加大,8月人民币连贬,打开了人民币贬值空间,德国商业银行预测,至2015年底,人民币兑美元将触及6.55,至2016年底目标则看至6.9。

如果人民币贬值,则利好中国对外贸易,如果升值,则利空中国对外贸易。

假定一家中国进口商向美国进口价值1000万美元的机器设备,3个月后支付美元。

若中国进口商预测3个月后USD/CNY将升值到6.2028/38。

Chapter 5错误!未指定书签。

THE FEDERAL RESERVETRUE/FALSEF 1. The power to create money is given by the Constitution to theFederal Reserve.创造货币的权力是宪法赋予美联储T 2. When corporations retire (pay off) loans from commercial banks, excess reserves are increased.当企业退休从商业银行(支付)的贷款,超额准备金增加。

F 3. When the general public uses money in checking accountsto purchase stock issued by corporations, the required reserves of banks are reduced.当一般公众使用的钱在支票账户购买公司发行的股票,所需要的银行的准备金就会减少F 4. Only large commercial banks are subject to the regulation ofthe Federal Reserve.只有大型商业银行受到美联储的监管F 5. When the Federal Reserve sells securities, the money supplyis increased.当美联储出售证券,货币供应量增加T 6. When the Federal Reserve buys securities, the reserves of banks are increased.当美联储购买证券,银行的准备金增加T 7. Open market operations is a more flexible tool of monetary policy than the reserve requirements.公开市场操作是货币政策的一个更灵活的工具,比准备金要求T 8. Reserve requirements are infrequently changed to affect commercial bank lending.准备金要求频繁改变会影响商业银行贷款T 9. The Open Market Committee has twelve members that include the Board of Governors.公开市场委员会有十二名成员,其中包括理事会F 10. The presidents of the District Banks elect the Board ofGovernors of the Federal Reserve.该地区银行的总统选举联邦储备理事会F 11. The federal funds rate is the interest rate the FederalReserve charges banks when they borrow reserves.联邦基金利率是利率联邦储备银行收费时,他们借入储备F 12. If the Treasury borrows from the Federal Reserve, thelending capacity of banks is reduced.如果财政部从美联储借,银行的放贷能力降低T 13. If the Treasury sells debt that is purchased by corporations and uses the funds to purchase military equipment, theexcess reserves of the banking system are not affected.如果财政部出售债券是由公司购买并使用的资金购买军事装备,多余的银行体系储备不受影响T 14. Deflation is a period of declining prices.通货紧缩是一个时期价格下跌F 15. During a period of recession, the Fed sells securities.在衰退期,美联储出售证券T 16. The Consumer Price Index (CPI) is a measure of inflation.居民消费价格指数( CPI)是衡量通货膨胀的T 17. The Federal Reserve is independent of the U.S. Treasury and is owned by commercial banks.美联储是独立于美国财政部,由商业银行所拥有F 18. The President of the United States appoints the Federal OpenMarket Committee.美国总统任命的联邦公开市场委员会F 19. Since the reserves of commercial banks earn interest, thereis an incentive to hold excess reserves.由于商业银行的准备金赚取利息,还有持有超额准备金的奖励T 20. Open market operations is a more flexible tool of monetary policy than the discount rate.公开市场操作是货币政策的一个更灵活的工具比贴现率T 21. Commercial banks may buy and sell reserves in the federal funds market.商业银行可以在联邦基金市场上购买和出售储备T 22. If the Treasury issues new bonds that are purchased by the general public, the money supply is reduced if the Treasurydeposits the funds in the Federal Reserve.如果财政部发布了由广大市民购买新的债券,货币供应量减少,如果国库存款资金在美联储F 23. Recession is a period of falling prices.经济衰退是一个时期的价格下跌F 24. When commercial banks grant loans to the public, theirtotal reserves are reduced.当商业银行发放贷款的市民,他们的总储量减少MULTIPLE CHOICEa 1. Withdrawing cash from a checking account does not decrease 从支票帐户提取现金不减少a. the money supply货币供应量b. demand deposits活期存款c. total reserves总储量d. excess reserves超额准备金d 2. Excess reserves are affected by超额准备金受1. reserve requirements准备金要求2. the repayment of existing bank loans现有偿还银行贷款3. cash withdrawals现金提款d. 1, 2, and 3b 3. When commercial banks grant loans,当商业银行发放贷款a. the money supply is reduced货币供应量减少b. the money supply is increased货币供应量增加c. total reserves increase总储量增加d. total reserves decrease总储量减少b 4. If deposits are withdrawn from a commercial bank, it mayobtain reserves by如果存款从商业银行撤出,它可能是由获得储备a. acquiring an asset收购资产b. borrowing in the federal funds market在联邦基金市场借款c. lending funds in the federal funds market在联邦基金市场资金d. liquidating a liability清算负债a 5. When a commercial bank receives a cash deposit,当商业银行收到的现金存款1. its required reserves increase其所需的储备增加2. its required reserves decrease其所需的储备减少3. its total reserves increase其总储量增加4. its total reserves decrease其总储量减少a. 1 and 3b 6. Commercial banks lend excess reserves for one day in the商业银行放贷超额储备为一天中的a. stock market股市b. federal funds market联邦基金市场c. reserves market储备市场d. over-the-counter market过?的?柜台市场b 7. The Federal Reserve increases reserves by美国联邦储备局增加储备a. selling securities出售证券b. buying securities买证券c. raising reserve requirements提高存款准备金率d. raising the discount rate提高贴现率b 8. The Federal Reserve美国联邦储备委员会a. is part of the U.S. Treasury是美国财政部的一部分b. is owned by member banks由成员银行拥有c. is the nation's largest commercial bank是全国最大的商业银行d. lends funds to corporations借出资金的公司b 9. By lowering the discount rate, the Federal Reserve通过降低贴现率,美联储a. discourages commercial banks from lending鼓励商业银行从贷款b. encourages commercial banks to borrow reserves鼓励商业银行借入储备c. discourages depositors from withdrawing funds鼓励存户提款d. contracts the money supply收缩货币供应量d 10. The purpose of the Federal Reserve is to美联储的目的是a. finance government operations金融政府运作b. protect investors from bank failures保护投资者免受银行倒闭c. protect deposits from bank failures保护存款银行倒闭d. control the supply of money and credit控制货币信贷总量c 11. The structure of the Federal Reserve includes美联储的结构包括1. all commercial banks各商业银行2. the twelve district banks在12家地方银行3. the Board of Governors 理事会c. 2 and 3c 12. The members of the Board of Governors area. elected by the member banksb. appointed by the Senatec. appointed by the President of the United Statesd. elected by the Federal Open Market Committeec 13. During a period of recession, a federal government surplusshould retire debt oweda. the Federal Reserveb. commercial banksc. the general publicd. the Federal Deposit Insurance Corporationa 14. The Federal Reserve may contract the money supply by1. selling securities2. buying securities3. raising reserve requirements4. lowering reserve requirementsa. 1 and 3b. 1 and 4c. 2 and 3d. 2 and 4理事会的成员是由成员银行推选由参议院任命由美国总统任命联邦公开市场委员会选举产生在衰退期,联邦政府的盈余应该退休欠下的债美联储商业银行广大市民美国联邦存款保险公司美联储可能通过收缩货币供应量出售证券买证券提高存款准备金率降低准备金要求如果联邦政府经营赤字,并从商业银行借入,总存款不受影响总存款增加超额准备金减少超额准备金均有所下降d 15. If the federal government runs a deficit and borrows fromcommercial banks,1. total deposits are not affected2. total deposits are increased3. excess reserves are reduced4. excess reserves are decreaseda. 1 and 3b. 1 and 4c. 2 and 3d. 2 and 4c 16. If the federal government runs a deficit and finances thedeficit by borrowing from the Federal Reserve,1. the reserves of commercial banks are reduced2. the reserves of commercial banks are increased3. the required reserves of commercial banks areincreased4. the required reserves of commercial banks arereduceda. 1 and 3b. 1 and 4c. 2 and 3d. 2 and 4b 17. Anticipation of inflation discourages1. saving2. borrowing3. lending4. purchasing goodsa. 1 and 2b. 1 and 3c. 2 and 3d. 3 and 4b 18. If the federal government runs a surplus,a. expenditures exceed taxesb. receipts exceed disbursementsc. debt must be issuedd. the Federal Reserve buys bondsb 19. Recession is a period ofa. declining pricesb. declining employmentc. declining unemploymentd. rising interest ratesb 20. The Board of Governorsa. manages the nation's stock of goldb. has the substantive control over the money supplyc. controls the U. S. Treasuryd. is appointed by the U. S. Treasurera 21. If commercial banks grant loans,a. the money supply is increasedb. total reserves are increasedc. excess reserves are increasedd. the money supply is reducedd 22. Commercial banks may borrow reserves from each other in thea. reserves marketb. stock marketc. bank marketd. federal funds marketa 23. By selling securities to the general public, the FEDa. reduces the money supplyb. raises commercial banks' depositsc. increases the money supplyd. increases banks' excess reservesa 24. The tools of monetary policy includea. open market operationsb. the purchase of corporate stockc. the federal government deficitd. taxationb 25. If the federal government runs a deficit,a. taxes exceed expendituresb. expenditures exceed taxesc. receipts exceed taxesd. taxes exceed revenuesb 26. Anticipation of inflation encouragesa. lendingb. borrowingc. retiring debtd. savingc 27. During a period of recession the Federal Reserve1. increases the federal funds rate2. buys government securities3. sells government securities4. lowers the federal funds area. 1 and 2b. 1 and 3c. 2 and 4d. 3 and 4SUPPLEMENTARY QUESTIONS1. If the reserve requirement for demand deposits is 10 percent,what is the maximum change in the money supply that thebanking system can create ifa. the Federal Reserve puts $1,000,000 of new reserves inthe banking systemb. $1,000,000 in cash is deposited in checking accountsc. General Motors borrows $1,000,000 from an insurancecompany?Answers:a. new excess reserves: $1,000,000maximum possible expansion in the money supply:$1,000,000/.1 = $10,000,000b. new excess reserves: $1,000,000 - 100,000 = $900,000maximum possible expansion in the money supply:$900,000/.1 = $9,000,000c. new excess reserves: $0maximum possible expansion in the money supply:$0/.1 = $0(Borrowing from the non-bank public does not affect thebanking system's ability to create new money.)2. What is the effect on (1) demand deposits, (2) requiredreserves, and (3) excess reserves of banks given thefollowing transactions?a. The general public builds up its holdings of cash bywithdrawing funds in checking accounts.b. After Christmas the general public deposits cash in checkingaccounts in commercial banks. (How may seasonal changes in the public's need for cash alter banks' ability to lend?)c. Corporations borrow from commercial banks.d. State and local governments issue debt securities that arepurchased by commercial banks.e. Homeowners borrow from commercial banks to finance homeimprovements. (Are there any differences on the expansion ofthe money supply in questions (c), (d), and (e)?)f. A bank in California with excess reserves lends these fundsthrough the federal funds market to a bank in Maine that hasinsufficient reserves.g. Corporations issue short-term securities that are purchased bythe general public.h. Corporations retire (i.e., pay off) loans from commercial banks.i. The Federal Reserve buys Treasury bills that are sold by thegeneral public.j. The Federal Reserve raises the discount rate, and banks retire debt owed the Federal Reserve.k. The Federal Reserve raises the reserve requirement on demand deposits.l. The Treasury borrows from the banks to finance payments.m. The federal government runs a deficit and borrows the funds from the general public.n. The federal government runs a deficit and borrows the funds from the Federal Reserve.Answers:a. Demand deposits - lowerRequired reserves - lowerExcess reserves - lowerb. Demand deposits - higherRequired reserves - higherExcess reserves - higherThese two questions illustrate that a seasonal flow of deposits into or out of the banking system will affect the reserves of the banking system. Unless the banks are able to find liquidity elsewhere (e.g., the Federal Reserve), such seasonal changes in reserves may produce fluctuations in the supply of credit.c. Demand deposits - higherRequired reserves - higherExcess reserves - lowerd. Demand deposits - higherRequired reserves - higherExcess reserves - lowere. Demand deposits - higherRequired reserves - higherExcess reserves - lowerThese three questions illustrate that from the viewpoint of the banking system, it does not matter if the banks acquire debt issued by firms, governments, or households. To acquire the debt, the banks must have excess reserves. After they have used their excess reserves, the money supply is expanded, and the excess reserves become required reserves.f. Demand deposits - no changeRequired reserves - no changeExcess reserves - no changeUnlike in the previous questions, the lending of excess reserves from one bank to another does not in the aggregate increase or decrease the reserves of the banking system.g. Demand deposits - no changeRequired reserves - no changeExcess reserves - no changeLoans between members of the non-bank general public do not affect banks' reserves and thus do not affect their capacity to lend.h. Demand deposits - lowerRequired reserves - lowerExcess reserves - higherWhile the creation of new loans uses the banks' excess reserves and creates new money, the retiring of loans from commercial banks reduces demand deposits and restores excess reserves (i.e., increases excess reserves).i. Demand deposits - higherRequired reserves - higherExcess reserves - higherj. Demand deposits - no changeRequired reserves - no changeExcess reserves - lowerk. Demand deposits - no changeRequired reserves - higherExcess reserves - lowerQuestions j and k illustrate two major monetary tools, the reserve requirement and the discount rate. Notice that changing the discount rate and the reserve requirements do not in themselves change demand deposits. Their impact is on reserves, and theeffect of this impact may lead to a change in the supply of money. l. Demand deposits - higherRequired reserves - higherExcess reserves - lowerm. Demand deposits - no changeRequired reserves - no changeExcess reserves - no changen. Demand deposits - increaseRequired reserves - increaseExcess reserves - increaseDuring a period of inflation, a policy that contracts the money supply and the capacity of banks to lend is desirable. Theopposite situation would apply during a recession. If there were a deficit during a period of recession, it is desirable to increase the money supply and the capacity of the banks to lend. Hence n is better than m.。

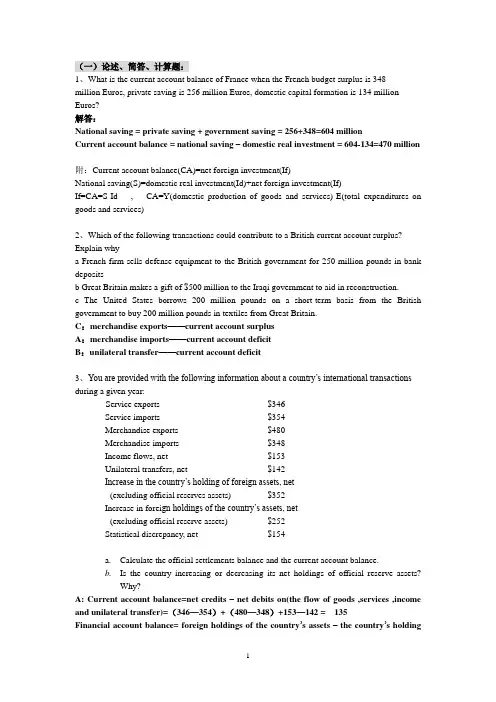

(一)论述、简答、计算题:1、What is the current account balance of France when the French budget surplus is 348million Euros, private saving is 256 million Euros, domestic capital formation is 134 million Euros?解答:National saving = private saving + government saving = 256+348=604 millionCurrent account balance = national saving – domestic real investment = 604-134=470 million附:Current account balance(CA)=net foreign investment(If)National saving(S)=domestic real investment(Id)+net foreign investment(If)If=CA=S-Id , CA=Y(domestic production of goods and services)-E(total expenditures on goods and services)2、Which of the following transactions could contribute to a British current account surplus? Explain whya French firm sells defense equipment to the British government for 250 million pounds in bank depositsb Great Britain makes a gift of $500 million to the Iraqi government to aid in reconstruction.c The United States borrows 200 million pounds on a short-term basis from the British government to buy 200 million pounds in textiles from Great Britain.C:merchandise exports——current account surplusA:merchandise imports——current account deficitB:unilateral transfer——current account deficit3、You are provided with the following information about a country’s international transactions during a given year:Service exports $346Service imports $354Merchandise exports $480Merchandise imports $348Income flows, net $153Unilateral transfers, net $142Increase in the country’s holding of foreign assets, net(excluding official reserves assets) $352Increase in forei gn holdings of the country’s assets, net(excluding official reserve assets) $252Statistical discrepancy, net $154a.Calculate the official settlements balance and the current account balance.b.Is the country increasing or decreasing its net holdings of official reserve assets?Why?A: Current account balance=net credits – net debits on(the flow of goods ,services ,income and unilateral transfer)=(346—354)+(480—348)+153—142 = 135Financial account balance= foreign holdings of the country’s assets – the country’s holdingof foreign assets =—352 + 252 = —100So, official settlement balance(B)=CA balance + financial account balance= 135 —100=35B: Current account balance = 132—8+153—142=135B = CA + FA = 135 + (—100)= 35B + OR + Statistical discrepancy = 0OR = —1894、For each case below, state whether the euro has appreciated or depreciated and give an exampleof an event that could cause the change in the exchange rate.a.The spot rate goes from 450 euros/Mexican peso to 440 euros/Mexican peso.b.The spot rate goes from 0.011 Mexican pesos/euro to 0.006 Mexican pesos/euro.c.The spot rate goes from 1.48 euros/British pound to 1.51 euros/British pound.d.The spot rate goes from 0.73 British pounds/euro to 0.75 British pounds/euro.A: indirect quotation, euro appreciatedB: direct quotation, euro depreciatedC: indirect quotation, euro depreciatedD: direct quotation, euro appreciated5、What are the two forms of interbank foreign exchange trading? Compare and contrasthe similarities and differences of the two forms.Form 1 Interbank trading is conducted directly between the traders at different banksForm 2 Interbank trading are conducted through foreign exchange brokerSimilarities: Both are making the foreign exchange trades.Differences:①Form1,the traders know to whom they are quoting exchange rates for possible。

1.Hedging: a position exposed to rate risk, is the act of reducing or eliminating a net asset net liability position in the foreign currency.套期保值:一种风险暴露的位置,是减少或消除外币净资产或净负债状况的行为。

2.Speculating: is the act of takinga net asset position (long) or a net liability position (short)in some asset class, here a foreign currency.推测:在某些资产类别中,以净资产位置(长)或净负债位置(短)的行为,这是一种外币。

3.Hedging using forward foreign exchange4.Speculating using forward foreign exchange5.Relative PurchasingPower Parity: posits that the difference between c hanges over time inproduct-pri c e levels in t wo countries will be offset by the change in t he exchange rate over thistime.相对购买力平价:假定之间的变化在两个国家在产品价格水平的差异会抵消汇率的变化超过这个时间。

6.Relative PPPP provides some strong predictions about exchange-rate trends, especially inthe long term:相对购买力平价提供了一些强有力的预测有关汇率的趋势,尤其是在长期:7.Countries with relatively low inflation rates have currencies whose values tend to appreciatein the foreign exchange market.相对较低的通胀率国家的货币,其价值趋向于在外汇市场上升值。

国际金融复习资料英文版International Finance Revision Material - English VersionInternational finance is a field of study that deals with money management and economic activities that take place between nations. It is a crucial component of global trade, as it enables businesses and individuals to conduct transactions across borders and make decisions that impact the world economy. This revision material aims to provide an overview of the fundamental concepts and principles of international finance.1. Exchange RatesExchange rates refer to the value of one currency expressed in terms of another currency. Exchange rates play a significant role in international finance because they affect the competitiveness of a country's exports and also the cost of imports. There are different types of exchange rates, including the fixed exchange rate system, the floating exchange rate system, and the managed floating exchange rate system.2. Balance of PaymentsThe balance of payments is a record of all financial transactions between a country and the rest of the world. It comprises the current account, the capital account, and the financial account. The current account records transactionsrelated to trade in goods and services, while the capital account records transactions related to capital flows, such as foreign investment. The financial account records transactions related to the purchase and sale of financial assets.3. International Capital MarketsInternational capital markets are financial markets where individuals, institutions, and governments can buy and sell financial assets across national borders. Examples of international capital markets include the foreign exchange market, the bond market, and the stock market. These markets facilitate the flow of capital across borders, allowing investors to diversify their portfolios and businesses to access funding from global sources.4. International Monetary SystemThe international monetary system is the framework within which countries conduct transactions and manage their currencies. There are different international monetary systems in history, including the gold standard, the Bretton Woods system, and the floating exchange rate system. The current international monetary system is a managed floating exchange rate system, where exchange rates are determined by market forces but may be influenced by government intervention.5. International TradeInternational trade refers to the exchange of goods and services across borders. International trade is essential foreconomic growth and development because it allows countries to access resources and markets that they do not have domestically. However, international trade can also create imbalances in trade flows, leading to trade deficits or surpluses.6. International Negotiations and AgreementsInternational negotiations and agreements are crucial for maintaining stability and promoting cooperation in international finance. Examples of international negotiations and agreements include the World Trade Organization (WTO), the International Monetary Fund (IMF), and the European Union (EU). These organizations facilitate international trade, promote stable exchange rates, and provide financial assistance to countries in need.In conclusion, understanding the fundamental concepts and principles of international finance is crucial for anyone interested in global trade and economics. This revision material provides a broad overview of the topics covered in international finance and is a useful resource for students, researchers, and professionals in the field. By familiarizing themselves with these concepts, individuals can make informed decisions about international finance and contribute to the stability and growth of the global economy.。

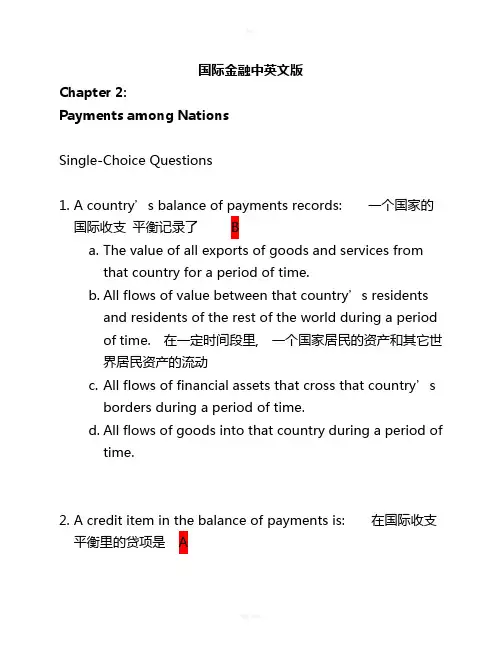

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records: 一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services fromthat country for a period of time.b.All flows of value between that country’s residentsand residents of the rest of the world during a periodof time. 在一定时间段里, 一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country’sborders during a period of time.d.All flows of goods into that country during a period oftime.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid. 一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to aforeigner.3.Every international exchange of value is entered into the balance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay. 一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the following items is always recorded as a positive entry?D 在国际收支中, 下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country. 国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments: 在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors andomissions.7.Which of the following capital transactions are entered as debits in the U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项? Ba.A U.S. resident transfers $100 from his account atCredit Suisse in Basel (Switzerland) to his account at aSan Francisco branch of Wells Fargo Bank.b.A French resident transfers $100 from his account atWells Fargo Bank in San Francisco to his Credit Suisseaccount in Basel. 一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A U.S. resident sells his IBM stock to a French resident.d.A U.S. resident sells his Credit Suisse stock to a Frenchresident.8.An increase in a nation's financial liabilities to foreign residents is a: 一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.Which of the following is considered a capital inflow? 下列哪项被视为资本流入 Aa.A sale of U.S. financial assets to a foreign buyer. 美国一金融资产卖给一外国买家b.A loan from a U.S. bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S. buyer.d.A U.S. citizen’s repayment of a loan from a foreignbank.11.In a country’s balance of payments, which of the following transactions are debits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners aredecreased. 外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residentsare decreased.c.Assets owned by domestic residents are sold tononresidents.d.Securities are sold by domestic residents tononresidents.12.The role of ___D_______ is to direct one nation’s savings into another nation’s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows 资金流13.The net value of flows of goods, services, income, and unilateral transfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.The net value of flows of financial assets and similar claims (excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the U.S. balance of payments includes: 美国国家收支表中的金融帐包括: Ba.Everything in the current account.b.U.S. government payments to other countries for theuse of military bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.AU.S. resident increasing her holdings of a foreign financial asset causes a: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account. 美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S. financial asset causes a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18. A deficit in the current account: 经常帐户中的赤字 Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasingimports.19.In September, 2005, exports of goods from the U.S. decreased $3.3 billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. This increased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account. 经常帐户d.Unilateral transfers.20.Which of the following would contribute to a U.S. current account surplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reductionon imported goods.b.The United States cuts back on American militarypersonnel stationed in Japan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in theUnited States.21.Which of the following transactions is recorded in the financial account?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobilesfrom the United States.c.A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by theChinese to play an exhibition game in Beijing, China.22.If a British business buys U.S. government securities, how will this be entered in the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是? Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increase inU.S. assets held by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decrease inU.S. assets held by foreigners.23.In the balance of payments, the statistical discrepancy or error term is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum ofall credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-paymentsdeficit.d.Obtain an accurate account of a balance-of-paymentssurplus.24.Official reserve assets are: 官方储备资产是Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments andthat are recognized by governments as fullyacceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.Which of the following constitutes the largest component of the world’s international reserve assets? 下列哪项构成了世界国际储备资产的大部份? Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies. 外汇(币)26.The net accumulation of foreign assets minus foreign liabilities is: 海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment. 国外投资净值 foreign deficit.27. A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise andservice trade, international income payments andreceipts and international transfers.28.The ___C_______ measures the sum of the current account balance plus the private capital account balance.官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.If the overall balance is in __A________, there is an accumulation of official reserve assets by the country or a decrease in foreign official reserve holdings of the country's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOT equal to? 以下哪项不等同于现金帐 Da.The difference between domestic product anddomestic expenditure.b.The difference between national saving and domesticinvestment. foreign investment.d.The difference between government saving andgovernment investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows are credits. 资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, and gifts is the current account balance. (T)商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims is the private current account balance. 金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets are now foreign exchange assets, financial assets denominated in a foreign currency that is readily acceptable in international transactions. (T) 大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35. A country's financial account balance equals the country's net foreign investment.一个国家的金融帐差额相当于一个国家的净国外投资36. A country has a current account deficit if it is saving more than it is investing domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of the capital account balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38. A nation's international investment position shows its stock of international assets and liabilities at a moment in time. (T) 一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39. A nation is a borrower if its current account is in deficit during a time period. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40. A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41. A transaction leading to a foreign resident increasing her holdings of a U.S. financial asset will be recorded as a debit on the U.S. financial account. 如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay. 贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often used in official reserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the difference between domestic product and national expenditure.(T) 经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government were buying more goods and services than they wereproducing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

经济学:是研究一个社会如何决定生产,怎样生产和怎样分配的一门社会学科。

Economics:The study of how society decides what gets produced and how, and who gets what.微观经济学:研究个体经济单位如个人、企业的行为决策。

Microeconomics :The branch of economics that studies the behavior of individual decision-making units such as households and business firms.宏观经济学:研究所有的个人、企业作为总体货总量时的行为决策。

Macroeconomics :The branch of economics that studies the aggregate, or total, behavior of all households and firms.金融:研究金融体系如何协调并融通借贷资金,以及金融中介在此过程中进行的资金创造。

Finance:The study of how the financial system coordinates and channels the flow of funds from lenders to borrowers—and vice versa—and how new funds are created by financial intermediaries during the borrowing process.放松管制:废除或逐步撤销现有的管制。

Deregulation:The removing or phasing out of existing regulations.货币:可以接受且通常用来交换商品和服务的交换工具。

Money:Something acceptable and generally used as payment for goods and services.储蓄:收入中未被消费的部分。

A Chapter 4F 1. A financial intermediary transfers funds from borrowersto lenders by creating claims on itself.金融中介机构通过建立自身债权转让从借款人的资金贷款T 2. When cash is deposited in a checking account, thereserves of commercial banks are increased.当现金存入支票帐户时,商业银行的准备金增加F 3. When funds are deposited in a savings account, the excess reserves of banks are unaffected.当资金存入储蓄账户中,银行的超额准备金不受影响F 4. Large certificates of deposit in units of $500,000 are insured by FDIC.存款50万元的单位大证由美国联邦存款保险公司的保险保障T 5. In general, banks prefer loans that stress liquidityand safety.一般情况下,银行更喜欢强调流动资金贷款和安全性T 6. Savings and loan associations are a major source of mortgage funds.储蓄和贷款协会是抵押贷款资金的主要来源F 7. Insurance companies are a major source of loans to individuals.保险公司是个人贷款的主要来源T 8. Money market mutual funds invest in short-term securities like U.S. Treasury bills.货币市场共同基金投资于如美国国库券的短期证券F 9. An increase in interest rates tends to reduce theearnings of money market mutual funds.在利率上升往往会降低货币市场共同基金的收益T 10. A pension plan that invests in the stock of IBM orVerizon does not perform the function of a financial intermediary.投资于IBM或Verizon公司的股票的退休金计划不执行金融中介的功能F 11. Investments in money market mutual funds are insured up to $100,000 by the federal government.在货币市场共同基金投资是投保高达10万美元的联邦政府T 12. A financial intermediary creates claims on itself, when it accepts depositors' funds.金融中介机构建立自身债权,当它接受存款人的资金F 13. If a firm issues securities that are sold to a commercial bank, individuals' savings are directly transferred to the firm. 。

国际金融中英文版国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了Ba.The value of all exports of goods and services from that country for a period of time.b.All flows of value between that country‟s residents and residents of the rest of theworld during a period of time在一定时间段里一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country‟s borders during a period of time.d.All flows of goods into that country during a period of time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是Aa. An item for which the country must be paid.一个国家必须收取的条款b. An item for which the country must pay.c. Any imported item.d. An item that creates a monetary claim owed to a foreigner.3.Every international exchange of value is entered into the balance-of-payments accounts__________ time(s). 每一次国际等价交换都记进国际收支帐户2次Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是Ba. An item for which the country must be paid.b. An item for which the country must pay.一个国家必须支付的条款c. Any exported item.d. An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the following items is always recorded as a positive entry? D在国际收支中下列哪个项目总被视为有利条项a. Changes in foreign currency reserves.b. Imports of goods and services.c. Military foreign aid supplied to allied nations.d. Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments: 在收支平衡中所有贷项的总和Ba. Equals the overall balance.b. Equals the sum of all credit items.等于所有借项的总和c. Equals …compensating‟ transactions.d. Equals the sum of credit items minus errors and omissions.7.Which of the following capital transactions are entered as debits in the U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba. A U.S. resident transfers $100 from his account at Credit Suisse in Basel (Switzerland) to his account at a San Francisco branch of Wells Fargo Bank.b. A French resident transfers $100 from his account at Wells Fargo Bank in San Francisco to his Credit Suisse account in Basel.一个法国居民在旧金山的Fargo Bank 用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c. A U.S. resident sells his IBM stock to a French resident.d. A U.S. resident sells his Credit Suisse stock to a French resident.8.An increase in a nation's financial liabilities to foreign residents is a: 一个国家对另一个国家金融负债的增加是一种Ca. Reserve inflow.b. Reserve outflow.c. Capital inflow.资本流入d. Capital outflow.9___A_______ are money-like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them.官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a. Official international reserve assets官方国际储备资产b. Unofficial international reserve assetsc. Official domestic reserve assetsd. Unofficial domestic reserve assets10.Which of the following is considered a capital inflow? 下列哪项被视为资本流入Aa. A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b. A loan from a U.S. bank to a foreign borrower.c. A purchase of foreign financial assets by a U.S. buyer.d. A U.S. citizen‟s repayment of a loan from a foreign bank.11.In a country‟s balance of payments, which of the following transactions aredebit?一个国家的收支平衡表中,哪个交易属于借项?Aa. Domestic bank balances owned by foreigners are decreased.外国人拥有的国内银行资产的下降b. Foreign bank balances owned by domestic residents are decreased.c. Assets owned by domestic residents are sold to nonresidents.d. Securities are sold by domestic residents to nonresidents.12.The role of ___D_______ is to direct one nation’ ssavings into another nation‟s investments:资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a. Merchandise trade flowsb. Services flowsc. Current account flowsd. Capital flows资金流13.The net value of flows of goods, services, income, and unilateral transfers is called the: 商品服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba. Capital account.b. Current account.经常账目(户)c. Trade balance.d. Official reserve balance.14.The net value of flows of financial assets and similar claims (excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫Aa.Financial account.金融帐b. Current account.c. Trade balance.d. Official reserve balance.15.The financial account in the U.S. balance of payments includes: 美国国家收支表中的金融帐包括:Ba. Everything in the current account.b. U.S. government payments to other countries for the use of military bases.美政府采用其它国家军事基地所需支付款项c. Profits that Nissan of America sends back to Japan.d. New U.S. investments in foreign countries.16.AU.S. resident increasing her holdings of a foreign financial asset causes a: 一个美国居民增持一外国金融资产会引起Da. Credit in the U.S. current account.b. Debit in the U.S. current account.c. Credit in the U.S. capital account.d. Debit in the U.S. capital account.美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S. financial asset causes a: 一个美国居民增持本国一金融资产会引起Ca. Credit in the U.S. current account.b. Debit in the U.S. current account.c. Credit in the U.S. capital account.美国资本帐的贷帐d. Debit in the U.S. capital account.18.A deficit in the current account: 经常帐户中的赤字Aa. Tends to cause a surplus in the financial account.会导致金融帐中的盈余b. Tends to cause a deficit in the financial account.c. Has no relationship to the financial account.d. Is the result of increasing exports and decreasing imports.19. In September, 2005, exports of goods from the U.S. decreased $3.3 billion to $73.4 billion,and imports of goods increased $3.8 billion to $144.5 billion. This increased the deficitin:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca. The balance of payments.b. The financial account.c. The current account.经常帐户d. Unilateral transfers.20.Which of the following would contribute to a U.S. current account surplus? 以下哪项有助于美国现金帐的盈余?Ba.The United States makes a unilateral tariff reduction on imported goods.b.The United States cuts back on American military personnel stationed in Japan.美国削减在日本的军事人员c. U.S. tourists travel in large numbers to Asia.d. Russian vodka becomes increasingly popular in the United States.21.Which of the following transactions is recorded in the financial account?以下哪个交易会被当作金融帐Aa. Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b. A Chinese businessman imports Ford automobiles from the United States.c. A U.S. tourist spends money on a trip to China.d. The New York Yankees are paid $10 million by the Chinese to play an exhibition game in Beijing, China.22.If a British business buys U.S. government securities, how will this be entered in the balanceof payments? 如果一英国商人购买了美国政府的债,那么这个交易在收支平衡表中会被当作是?Ca. It will appear in the trade account as an import.b. It will appear in the trade account as an export.c. It will appear in the financial account as an increase in U.S. assets held by foreigners.会被当作是外国人所有的美国资产增长d. It will appear in the financial account as a decrease in U.S. assets held by foreigners.23.In the balance of payments, the statistical discrepancy or error term is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致Aa. Ensure that the sum of all debits matches the sum of all credits.b. Ensure that imports equal the value of exports.c. Obtain an accurate account of a balance-of-payments deficit.d. Obtain an accurate account of a balance-of-payments surplus.24.Official reserve assets are: 官方储备资产是Ba. The gold holdings in the nation’s central bank.b. Money like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them.官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可c. Government T-bills and T-bonds.d. Government holdings of SDR’s25. Which of the following constitutes the largest component of the world‟s international reserve assets? 下列哪项构成了世界国际储备资产的大部份?Da. Gold.b. Special Drawing Rights.c. IMF Reserve Positions.d. Foreign Currencies.外汇(币)26.The net accumulation of foreign assets minus foreign liabilities is: 海外净资产的积累减去外债等于Ca. Net official reserves.b. Net domestic investment.c. Net foreign investment.国外投资净值d. Net foreign deficit.27.A country experiencing a current account surplus: 一个国家经历经常帐户的盈余Ba. Needs to borrow internationally.b. Is able to lend internationally.就有能力向外放贷c. Must also have had a surplus in its "overall" balance.d. Spent more than it earned on its merchandise and service trade, international income payments and receipts and international transfers.28.The ___C_______ measures the sum of the current account balance plus the private capital account balance.官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a. Official capital balanceb. Unofficial capital balancec. Official settlements balance官方结算差额d. Unofficial settlements balance29.If the overall balance is in __A________, there is an accumulation of official reserve assetsby the country or a decrease in foreign official reserve holdings of the country's assets.如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=,OR:官方储备金额)a. Surplus盈余b. Deficitc. Balanced. Foreign hands30. Which of the following is the current account balance NOT equal to? 以下哪项不等同于经常项目Da. The difference between domestic product and domestic expenditure.b. The difference between national saving and domestic investment.c. Net foreign investment.d. The difference between government saving and government investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows are credits.资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, and gifts is the current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims is the private current account balance.金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets are now foreign exchange assets, financialassets denominated in a foreign currency that is readily acceptable in international transactions. (T)大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35.A country's financial account balance equals the country's net foreign investment.一个国家的金融帐差额相当于一个国家的净国外投资36.A country has a current account deficit if it is saving more than it is investing domestically. 一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of the capital account balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38.A nation's international investment position shows its stock of international assets and liabilities at a moment in time. (T)一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39.A nation is a borrower if its current account is in deficit during a time period. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40.A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41.A transaction leading to a foreign resident increasing her holdings of a U.S. financial asset will be recorded as a debit on the U.S. financial account.如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay.贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often used in official reserve transactions.黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the difference between domestic product and national expenditure.(T)经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government were buying more goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46你是提供以下信息,一个国家的国际交易,在一个特定年份:Service exports $346Service imports $354Merchandise exports $480Merchandise imports $348Income flows, net $153Unilateral transfers, net $142Increase in the country holding of foreign assets, net (excluding official reserves assets) $352 Increase in foreign holdings of the country assets, net (excluding official reserve assets) $252 Statistical discrepancy, net $154CA 余额: $346-354+480-348+153+142=$419;官方结算余额: $346-354+480-348+153+142+252-352+154=$473;Change in official reserve assets (net) =官方结算余额=$473Chapter 3:The Foreign Exchange MarketSingle-Choice Questions1.Foreign exchange is: D外汇交易是a. The act of trading different nations‟ monies.不用国家货币的交易b. The holdings of foreign currency.对不同货币的持有c. The act of importing foreign goods and services.d. Both (a) and (b) are correct.2.If the price of British pounds in terms of U.S. dollars is $1.80 per pound, then the price of U.S. dollars in terms of British pounds is:B如果英磅对美元的汇率是1比1.8,那么美元对英磅的汇率是1比0.555a. 1.80£per dollar.b. 0.555£per dollar.c. 0.90£per dollar.d. 3.60£per dollar.3. Suppose the exchange rate between the Japanese yen and the U.S. dollar is 100 yen per dollar. AJapanese stereo with a price of 60,000 yen will cost:B假设日元对美元的汇率是100比1,那么一台日元为60000的音响要花多少美元a.$1,667b.$600c.$6,000d.$1004. Suppose that a Korean television set that costs 600 won in Korea costs $400 in the United States. These prices suggest that the exchange rate between the won and the dollar is:Awon per dollarb.0.75 won per dollarc.$1.50 per wond.$3 per won5.Th e ___D_______ exchange rate is the price for “immediate” currency exchange.即时汇率是指外汇的即时价格a. Currentb. Forwardc. Futured. Spot6.The ___B_______ exchange rate is the price set now for an exchange that will take place sometime in the future.远期汇率是指由协议双方预订的将来会发生的汇率a. Currentb. Forwardc. Future spotd. Spot7.The foreign exchange market is:C外汇市场是指a. A single gathering place where traders shout buy and sell orders at each other.b. Located in New York.c. A grouping, by electronic means, of banks and traders who work at banks thatconduct foreign exchange trades.银行和交易者以电子方式集聚于一起进行外汇的买卖d. Located in London.8.___D_______ foreign exchange trading involves currency exchanges done between individuals and banks. 小额外汇交易(散户外汇交易)包含私人与银行间的外汇交易a. Interbankb. Consumerc. Intra-bankd. Retail9.The U.S. dollar is called a ____A______ because it is often used as an intermediary to accomplish trading between two other currencies.美元被称为周转货币,因为经常被用来完成其它两种货币的交易a. Vehicle currency周转货币(交易通货)b Main currencyc. Common currencyd. Primary currency10. Suppose that the exchange value of the British pound is $2 per pound while the exchangevalue of the Swiss franc is 50 cents per franc. From this we can conclude that the exchange rate between the pound and the franc is: Da. 1 franc per poundb. 2 francs per poundc. 3 francs per poundd. 4 francs per pound11.Which of the following is NOT a function of the interbank operations of the foreign exchange market? D下列哪一个不是外汇交易市场中银行间操作方式的一种?a. Provides a bank with a continuous stream of information on conditions in the foreign exchange market.b. Provides a bank the means to readjust its own position quickly and at low cost.c. Permits a bank to take on a position in a foreign currency quickly.d. Provides a bank with technological resources for use in foreign exchange trading.提供技术资源给一间银行,用来进行外汇交易12. Under the managed float system of exchange rates, a fall in the market price of a currencyis called:B在管理浮动汇率制度下,一种货币价格的下降被称为a. Devaluation.b. Depreciation.贬值c. Appreciation.d. Both (a) and (b).13.Interbank trading is conducted directly between ___A_______ or through the use of _________ that provide anonymity until the trade is complete and reduce search costs.银行间的交易是在交易者之间进行的或者通过经纪人提供操作直到交易结束.a. Traders; brokersb. Brokers; tradersc. Individual consumers; the governmentd. Individual consumers; brokers14. A country’s demand for foreign currency is derived from:一个国家对外汇的需求来自于(表示外国货币需求增加,本国货币流出)a. International transactions entering the debit column of its balance of payments accounts.国际交易进入到其收款帐户的借方栏里b. International transactions entering the surplus column of its balance of payments accounts.c. The country’s demand for currency to finance exports and capital inflows.d. The country’s demand for currency to finance its government’s compensating transactions.15. U.S. exports of goods and services will create a ___B_______ foreign currency and a ______ U.S. dollars. 美国商品与服务的出口会创造出外汇的供给以及美元的需求a. Demand for; supply ofb. Supply of; demand forc. Shortage of; demand ford. Supply of; shortage of16. U.S. imports of goods and services will create a ___A_______ foreign currency and a _____ U.S. dollars. 美国商品与服务的进口会创造出外汇的需求以及美元的供给a. Demand for; supply ofb. Supply of; demand forc. Shortage of; demand ford. Supply of; shortage of17. U.S. capital inflows will create a ____B______ foreign currency and a __________ U.S. dollars.美国资本流入会创造出外汇的供给和美元的需求a. Demand for; supply ofb. Supply of; demand forc. Shortage of; demand ford. Supply of; shortage of18. In a ____C______ exchange rate system there is no intervention by the government or central bankers. 浮动汇率制度里,政府与中央银行不得进行干涉a. Fixedb. Peggedc. Floatingd. Managed float19.As the value of the yen falls relative to the U.S. dollar:C如果日元对美元的汇率下降了,那么对日元的需求会上升a. Japanese goods become more expensive to U.S. consumers.b. The supply of dollars will fall.c. The demand for yen will rise.d. U.S. goods become less expensive to Japanese consumers.20.The demand curve for foreign currency slopes downward because as the exchange rate___A_______ the quantity demanded __________.外汇的需求曲线会下降是因为随着汇率的上升,需求量就下降a. Increases; decreasesb. Increases; increasesc. Decreases; decreasesd. Decreases; stays fixed21.Shifts in demand away from French products and toward U.S. products (caused by forces other than changes in the exchange rate) would result in extra attempts to ___C_______euros and __________ dollars. 如果法国商品的需求下降并转稳到美国商品身上(由外力而是汇率引起),会引起欧元的额外卖与美元的购入a. Buy; buyb. Sell; sellc. Sell; buyd. Buy; sell22.Other things equal, if American exports to Japan increase and American imports from Japan decrease, then under a floating exchange rate system, we would expect the dollar to:D其它条件一样的情况下,美国出口到日本的商品上升而美国进口日本的商品下降,在浮动汇率制度下,美元将对日元走强。

更多资料请访问.(.....)Multiple Choice 词义选择要求:理解句子意思,掌握关键词。

Chapter 2: Careers in mercial Banking1.mercial banks are in the business of providing banking services to individuals, small businesses and large organizations.2.To be good in banking you need a broad understanding of business because your job will most likely involveinteracting with businesses.3.Banking is going through a period of tremendous consolidation with frequent mergers and layoffs.Chapter 5: Central Bank4.A central bank is responsible for the moary policy of a country or a group of member states.5.A central bank’s primary responsibility is to maintain the stability of the national currency and moarysupply, but more active duties include controlling loan interest rates.6.To enable open market operations,a central bank must hold foreign exchange reserves (usually in the form of government bonds) and official gold reserves.7.The central bank acts as an adviser to the government, particularly in the area of international finance.Chapter 6: The Foreign Exchange Market8.The foreign exchange market is a place to trade foreign exchange currency, or it is a place for the transaction of all foreign currency.9.A foreign exchange rate is the relative value between two currencies. In particular , it is the quantity of one currency required to buy or sell one unit of the other currency.10.An investor has to understand how to interpret currency quotes and other basic terminology of the Forex market before trading currencies with real money.Chapter 7: Business Financing11.Debt financing means borrowing money that is to be repaid over a period of time, usually with interest.12.Equity financing describes an exchange of money for a share of business ownership.13. A corporation is a separate legal entity that can be created only by pliance with state statutes.If you have too much debt, your business may be considered overextended and risky and 真的不掉线吗??、????????????14.unsafe investment.Chapter 8: Financial Statements15.Financial statements paint a picture of the transactions that flow through a business.16. A balance sheet, also known asa “statement of financial position” , reveals a pany’s assets, liabilities and owners’ equity ( worth).17.The ine statement (IS), also referred to as a profit and loss statement (P&L), shows a pany’s revenues and expenses for a given period of time.Chapter 9: Investments18.An investment can be defined as the mitment of funds to one or more assets that will be held over some future time period.19.Marketable securities are financial assets that are easily and cheaply tradable in organized markets.20.Underlying all investment decisions is the tradeoff between return and risk.Chapter 12: Stocks Basics21.Stock is a share in the ownership of a pany, so it represents a claim on the pany’s assets and earnings.22.An extremely important feature of stock is its limited liability, which means that, as an owner of a stock, you are not personally liable if the pany is not able to pay its debts.23.Taking on greater risk demandsa greater return on your investment.24.There are two main types of stocks: mon stock and preferred stock.25.Stock prices change every day as a result of market forces. Share prices change because of supply and demand.Term Translation 术语翻译要求:熟记下列术语,做到英汉互译。

【名词解释】【The Special Drawing Right (SDR)特别提款权】p 30The Special Drawing Right (SDR) is an international reserve asset created by the IMF to supplement existing foreign exchange reserves. (It serves as a unit of account for the IMF and is also the base against which some countries peg the exchange rate for their currencies。

【LIBOR 伦敦同业银行拆解率】p 33Eurocurrency Interest Rates:LIBORLIBOR(London Interbank Offered Rate)is the reference rate of interest in the Eurocurrency market, and is now the most widely accepted rate of interest used in standardized quotations, loan agreements or financial derivatives valuations。

LIBOR is officially defined by the British Bankers Association。

【Dollarization美元化】Dollarization – the use of the US dollar as the official currency of the country.只将美元用作官方通货。

【Eurodollar 欧洲美元】Eurodollar is one of the European currency types,which refers to the dollar deposits in banks outside the united states 是指存放在美国以外的银行中的美元存款,欧洲美元是欧洲货币的一种类型。

国际金融中英文版国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了Ba.The value of all exports of goods and services from that country for a period of time.b.All flows o f value between that country‟s residents and residents of the rest of the world during a period of time在一定时间段里一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country‟s borders during a period of time.d.All flows of goods into that country during a period of time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是Aa. An item for which the country must be paid.一个国家必须收取的条款b. An item for which the country must pay.c. Any imported item.d. An item that creates a monetary claim owed to a foreigner.3.Every international exchange of value is entered into the balance-of-payments accounts__________ time(s). 每一次国际等价交换都记进国际收支帐户2次Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是Ba. An item for which the country must be paid.b. An item for which the country must pay.一个国家必须支付的条款c. Any exported item.d. An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the following items is always recorded as a positive entry? D在国际收支中下列哪个项目总被视为有利条项a. Changes in foreign currency reserves.b. Imports of goods and services.c. Military foreign aid supplied to allied nations.d. Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments: 在收支平衡中所有贷项的总和Ba. Equals the overall balance.b. Equals the sum of all credit items.等于所有借项的总和c. Equals …compensating‟ transactions.d. Equals the sum of credit items minus errors and omissions.7.Which of the following capital transactions are entered as debits in the U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba. A U.S. resident transfers $100 from his account at Credit Suisse in Basel (Switzerland) to his account at a San Francisco branch of Wells Fargo Bank.b. A French resident transfers $100 from his account at Wells Fargo Bank in San Francisco to his Credit Suisse account in Basel.一个法国居民在旧金山的Fargo Bank 用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c. A U.S. resident sells his IBM stock to a French resident.d. A U.S. resident sells his Credit Suisse stock to a French resident.8.An increase in a nation's financial liabilities to foreign residents is a: 一个国家对另一个国家金融负债的增加是一种Ca. Reserve inflow.b. Reserve outflow.c. Capital inflow.资本流入d. Capital outflow.9___A_______ are money-like assets that are held by governments and that are recognized bygovernments as fully acceptable for payments between them.官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a. Official international reserve assets官方国际储备资产b. Unofficial international reserve assetsc. Official domestic reserve assetsd. Unofficial domestic reserve assets10.Which of the following is considered a capital inflow? 下列哪项被视为资本流入Aa. A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b. A loan from a U.S. bank to a foreign borrower.c. A purchase of foreign financial assets by a U.S. buyer.d. A U.S. citizen‟s repayment of a loan from a foreign bank.11.In a country‟s balance of payments, which of the following transactions are debit?一个国家的收支平衡表中,哪个交易属于借项?Aa. Domestic bank balances owned by foreigners are decreased.外国人拥有的国内银行资产的下降b. Foreign bank balances owned by domestic residents are decreased.c. Assets owned by domestic residents are sold to nonresidents.d. Securities are sold by domestic residents to nonresidents.12.The role of ___D_______ is to direct one nation’ ssavings into another nation‟s investments:资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a. Merchandise trade flowsb. Services flowsc. Current account flowsd. Capital flows资金流13.The net value of flows of goods, services, income, and unilateral transfers is called the: 商品服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba. Capital account.b. Current account.经常账目(户)c. Trade balance.d. Official reserve balance.14.The net value of flows of financial assets and similar claims (excluding official internationalreserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫Aa.Financial account.金融帐b. Current account.c. Trade balance.d. Official reserve balance.15.The financial account in the U.S. balance of payments includes: 美国国家收支表中的金融帐包括:Ba. Everything in the current account.b. U.S. government payments to other countries for the use of military bases.美政府采用其它国家军事基地所需支付款项c. Profits that Nissan of America sends back to Japan.d. New U.S. investments in foreign countries.16.AU.S. resident increasing her holdings of a foreign financial asset causes a: 一个美国居民增持一外国金融资产会引起Da. Credit in the U.S. current account.b. Debit in the U.S. current account.c. Credit in the U.S. capital account.d. Debit in the U.S. capital account.美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S. financial asset causes a: 一个美国居民增持本国一金融资产会引起Ca. Credit in the U.S. current account.b. Debit in the U.S. current account.c. Credit in the U.S. capital account.美国资本帐的贷帐d. Debit in the U.S. capital account.18.A deficit in the current account: 经常帐户中的赤字Aa. Tends to cause a surplus in the financial account.会导致金融帐中的盈余b. Tends to cause a deficit in the financial account.c. Has no relationship to the financial account.d. Is the result of increasing exports and decreasing imports.19. In September, 2005, exports of goods from the U.S. decreased $3.3 billion to $73.4 billion,and imports of goods increased $3.8 billion to $144.5 billion. This increased the deficitin:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca. The balance of payments.b. The financial account.c. The current account.经常帐户d. Unilateral transfers.20.Which of the following would contribute to a U.S. current account surplus? 以下哪项有助于美国现金帐的盈余?Ba.The United States makes a unilateral tariff reduction on imported goods.b.The United States cuts back on American military personnel stationed in Japan.美国削减在日本的军事人员c. U.S. tourists travel in large numbers to Asia.d. Russian vodka becomes increasingly popular in the United States.21.Which of the following transactions is recorded in the financial account?以下哪个交易会被当作金融帐Aa. Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b. A Chinese businessman imports Ford automobiles from the United States.c. A U.S. tourist spends money on a trip to China.d. The New York Yankees are paid $10 million by the Chinese to play an exhibition game in Beijing, China.22.If a British business buys U.S. government securities, how will this be entered in the balanceof payments? 如果一英国商人购买了美国政府的债,那么这个交易在收支平衡表中会被当作是?Ca. It will appear in the trade account as an import.b. It will appear in the trade account as an export.c. It will appear in the financial account as an increase in U.S. assets held by foreigners.会被当作是外国人所有的美国资产增长d. It will appear in the financial account as a decrease in U.S. assets held by foreigners.23.In the balance of payments, the statistical discrepancy or error term is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致Aa. Ensure that the sum of all debits matches the sum of all credits.b. Ensure that imports equal the value of exports.c. Obtain an accurate account of a balance-of-payments deficit.d. Obtain an accurate account of a balance-of-payments surplus.24.Official reserve assets are: 官方储备资产是Ba. The gold holdings in the nation’s central bank.b. Money like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them.官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可c. Government T-bills and T-bonds.d. Government holdings of SDR’s25. Which of the following constitutes the largest component of the world‟s international reserveassets? 下列哪项构成了世界国际储备资产的大部份?Da. Gold.b. Special Drawing Rights.c. IMF Reserve Positions.d. Foreign Currencies.外汇(币)26.The net accumulation of foreign assets minus foreign liabilities is: 海外净资产的积累减去外债等于Ca. Net official reserves.b. Net domestic investment.c. Net foreign investment.国外投资净值d. Net foreign deficit.27.A country experiencing a current account surplus: 一个国家经历经常帐户的盈余Ba. Needs to borrow internationally.b. Is able to lend internationally.就有能力向外放贷c. Must also have had a surplus in its "overall" balance.d. Spent more than it earned on its merchandise and service trade, international incomepayments and receipts and international transfers.28.The ___C_______ measures the sum of the current account balance plus the private capitalaccount balance.官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a. Official capital balanceb. Unofficial capital balancec. Official settlements balance官方结算差额d. Unofficial settlements balance29.If the overall balance is in __A________, there is an accumulation of official reserve assetsby the country or a decrease in foreign official reserve holdings of the country's assets.如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=,OR:官方储备金额)a. Surplus盈余b. Deficitc. Balanced. Foreign hands30. Which of the following is the current account balance NOT equal to? 以下哪项不等同于经常项目Da. The difference between domestic product and domestic expenditure.b. The difference between national saving and domestic investment.c. Net foreign investment.d. The difference between government saving and government investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows are credits.资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, and gifts is the current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims is the private current account balance.金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets are now foreign exchange assets, financial assets denominated in a foreign currency that is readily acceptable in internationaltransactions. (T)大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35.A country's financial account balance equals the country's net foreign investment. 一个国家的金融帐差额相当于一个国家的净国外投资36.A country has a current account deficit if it is saving more than it is investing domestically. 一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of the capital account balance plus thepublic current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38.A nation's international investment position shows its stock of international assets andliabilities at a moment in time. (T)一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39.A nation is a borrower if its current account is in deficit during a time period. (T) 在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40.A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41.A transaction leading to a foreign resident increasing her holdings of a U.S. financial asset will be recorded as a debit on the U.S. financial account.如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay.贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often used in official reserve transactions.黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the difference between domestic product and nationalexpenditure.(T)经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government were buying more goods and servicesthan they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多. 46你是提供以下信息,一个国家的国际交易,在一个特定年份:Service exports $346Service imports $354Merchandise exports $480Merchandise imports $348Income flows, net $153Unilateral transfers, net $142Increase in the country holding of foreign assets, net (excluding official reserves assets) $352Increase in foreign holdings of the country assets, net (excluding official reserve assets) $252Statistical discrepancy, net $154CA 余额: $346-354+480-348+153+142=$419;官方结算余额: $346-354+480-348+153+142+252-352+154=$473;Change in official reserve assets (net) =官方结算余额=$473Chapter 3:The Foreign Exchange MarketSingle-Choice Questions1.Foreign exchange is: D外汇交易是a. The act of trading different nations‟ monies.不用国家货币的交易b. The holdings of foreign currency.对不同货币的持有c. The act of importing foreign goods and services.d. Both (a) and (b) are correct.2.If the price of British pounds in terms of U.S. dollars is $1.80 per pound, then the price of U.S. dollars in terms of British pounds is:B如果英磅对美元的汇率是1比1.8,那么美元对英磅的汇率是1比0.555a. 1.80£per dollar.b. 0.555£per dollar.c. 0.90£per dollar.d. 3.60£per dollar.3. Suppose the exchange rate between the Japanese yen and the U.S. dollar is 100 yen per dollar. A Japanese stereo with a price of 60,000 yen will cost:B假设日元对美元的汇率是100比1,那么一台日元为60000的音响要花多少美元a.$1,667b.$600c.$6,000d.$1004. Suppose that a Korean television set that costs 600 won in Korea costs $400 in the UnitedStates. These prices suggest that the exchange rate between the won and the dollar is:Aa.1.5 won per dollarb.0.75 won per dollarc.$1.50 per wond.$3 per won5.The ___D_______ exchange rate is the price for “immediate” currency exchange. 即时汇率是指外汇的即时价格a. Currentb. Forwardc. Futured. Spot6.The ___B_______ exchange rate is the price set now for an exchange that will take place sometime in the future.远期汇率是指由协议双方预订的将来会发生的汇率a. Currentb. Forwardc. Future spotd. Spot7.The foreign exchange market is:C外汇市场是指a. A single gathering place where traders shout buy and sell orders at each other.b. Located in New York.c. A grouping, by electronic means, of banks and traders who work at banks that conduct foreign exchange trades.银行和交易者以电子方式集聚于一起进行外汇的买卖d. Located in London.8.___D_______ foreign exchange trading involves currency exchanges done between individuals and banks. 小额外汇交易(散户外汇交易)包含私人与银行间的外汇交易a. Interbankb. Consumerc. Intra-bankd. Retail9.The U.S. dollar is called a ____A______ because it is often used as an intermediary toaccomplish trading between two other currencies.美元被称为周转货币,因为经常被用来完成其它两种货币的交易a. Vehicle currency周转货币(交易通货)b Main currencyc. Common currencyd. Primary currency10. Suppose that the exchange value of the British pound is $2 per pound while the exchange value of the Swiss franc is 50 cents per franc. From this we can conclude that the exchange rate between the pound and the franc is: Da. 1 franc per poundb. 2 francs per poundc. 3 francs per poundd. 4 francs per pound11.Which of the following is NOT a function of the interbank operations of the foreign exchange market? D下列哪一个不是外汇交易市场中银行间操作方式的一种?a. Provides a bank with a continuous stream of information on conditions in the foreignexchange market.b. Provides a bank the means to readjust its own position quickly and at low cost.c. Permits a bank to take on a position in a foreign currency quickly.d. Provides a bank with technological resources for use in foreign exchange trading. 提供技术资源给一间银行,用来进行外汇交易12. Under the managed float system of exchange rates, a fall in the market price of a currencyis called:B在管理浮动汇率制度下,一种货币价格的下降被称为a. Devaluation.b. Depreciation.贬值c. Appreciation.d. Both (a) and (b).13.Interbank trading is conducted directly between ___A_______ or through the use of _________ that provide anonymity until the trade is complete and reduce search costs.银行间的交易是在交易者之间进行的或者通过经纪人提供操作直到交易结束.a. Traders; brokersb. Brokers; tradersc. Individual consumers; the governmentd. Individual consumers; brokers14. A country’s demand for foreign currency is derived from:一个国家对外汇的需求来自于(表示外国货币需求增加,本国货币流出)a. International transactions entering the debit column of its balance of payments accounts.国际交易进入到其收款帐户的借方栏里b. International transactions entering the surplus column of its balance of payments accounts.c. The country’s demand for currency to finance exports and capital inf lows.d. The country’s demand for currency to finance its government’s compensating transactions.15. U.S. exports of goods and services will create a ___B_______ foreign currency and a ______ U.S. dollars. 美国商品与服务的出口会创造出外汇的供给以及美元的需求a. Demand for; supply ofb. Supply of; demand forc. Shortage of; demand ford. Supply of; shortage of16. U.S. imports of goods and services will create a ___A_______ foreign currency and a _____ U.S. dollars. 美国商品与服务的进口会创造出外汇的需求以及美元的供给a. Demand for; supply ofb. Supply of; demand forc. Shortage of; demand ford. Supply of; shortage of17. U.S. capital inflows will create a ____B______ foreign currency and a __________ U.S.dollars.美国资本流入会创造出外汇的供给和美元的需求a. Demand for; supply ofb. Supply of; demand forc. Shortage of; demand ford. Supply of; shortage of18. In a ____C______ exchange rate system there is no intervention by the government or central bankers. 浮动汇率制度里,政府与中央银行不得进行干涉a. Fixedb. Peggedc. Floatingd. Managed float19.As the value of the yen falls relative to the U.S. dollar:C如果日元对美元的汇率下降了,那么对日元的需求会上升a. Japanese goods become more expensive to U.S. consumers.b. The supply of dollars will fall.c. The demand for yen will rise.d. U.S. goods become less expensive to Japanese consumers.20.The demand curve for foreign currency slopes downward because as the exchange rate___A_______ the quantity demanded __________.外汇的需求曲线会下降是因为随着汇率的上升,需求量就下降a. Increases; decreasesb. Increases; increasesc. Decreases; decreasesd. Decreases; stays fixed21.Shifts in demand away from French products and toward U.S. products (caused by forcesother than changes in the exchange rate) would result in extra attempts to ___C_______euros and __________ dollars. 如果法国商品的需求下降并转稳到美国商品身上(由外力而是汇率引起),会引起欧元的额外卖与美元的购入a. Buy; buyb. Sell; sellc. Sell; buyd. Buy; sell22.Other things equal, if American exports to Japan increase and American imports from Japan decrease, then under a floating exchange rate system, we would expect the dollar to:D其它条件一样的情况下,美国出口到日本的商品上升而美国进口日本的商品下降,在浮动汇率制度下,美元将对日元走强。