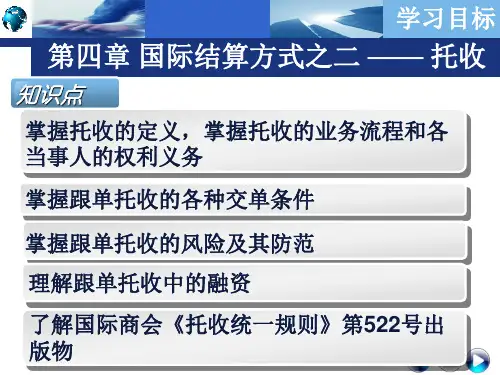

第四章国际结算方式托收

- 格式:pdf

- 大小:3.76 MB

- 文档页数:84

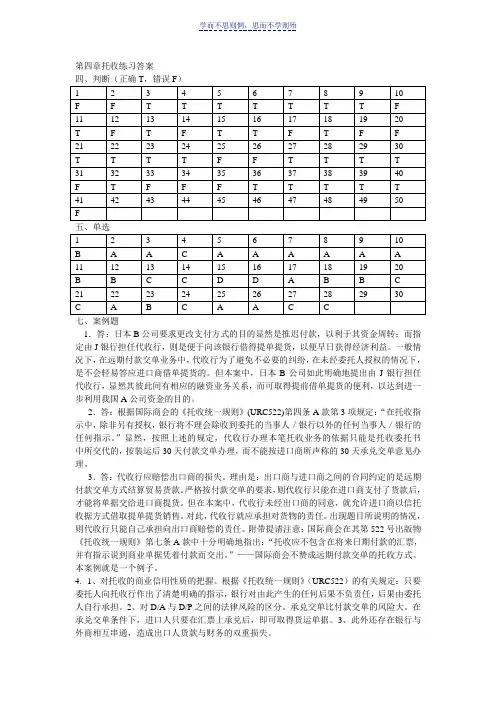

第四章托收练习答案五、单选七、案例题1.答:日本B公司要求更改支付方式的目的显然是推迟付款,以利于其资金周转;而指定由J银行担任代收行,则是便于向该银行借得提单提货,以便早日获得经济利益。

一般情况下,在远期付款交单业务中,代收行为了避免不必要的纠纷,在未经委托人授权的情况下,是不会轻易答应进口商借单提货的。

但本案中,日本B公司如此明确地提出由J银行担任代收行,显然其彼此间有相应的融资业务关系,而可取得提前借单提货的便利,以达到进一步利用我国A公司资金的目的。

2.答:根据国际商会的《托收统一规则》(URC522)第四条A款第3项规定:“在托收指示中,除非另有授权,银行将不理会除收到委托的当事人/银行以外的任何当事人/银行的任何指示。

”显然,按照上述的规定,代收行办理本笔托收业务的依据只能是托收委托书中所交代的,按装运后30天付款交单办理,而不能按进口商所声称的30天承兑交单意见办理。

3.答:代收行应赔偿出口商的损失。

理由是:出口商与进口商之间的合同约定的是远期付款交单方式结算贸易货款。

严格按付款交单的要求,则代收行只能在进口商支付了货款后,才能将单据交给进口商提货。

但在本案中,代收行未经出口商的同意,就允许进口商以信托收据方式借取提单提货销售。

对此,代收行就应承担对货物的责任。

出现题目所说明的情况,则代收行只能自己承担向出口商赔偿的责任。

附带提请注意:国际商会在其第522号出版物《托收统一规则》第七条A款中十分明确地指出:“托收应不包含在将来日期付款的汇票,并有指示说到商业单据凭着付款而交出。

”——国际商会不赞成远期付款交单的托收方式。

本案例就是一个例子。

4.1、对托收的商业信用性质的把握。

根据《托收统一规则》(URC522)的有关规定:只要委托人向托收行作出了清楚明确的指示,银行对由此产生的任何后果不负责任,后果由委托人自行承担。

2、对D/A与D/P之间的法律风险的区分。

承兑交单比付款交单的风险大。

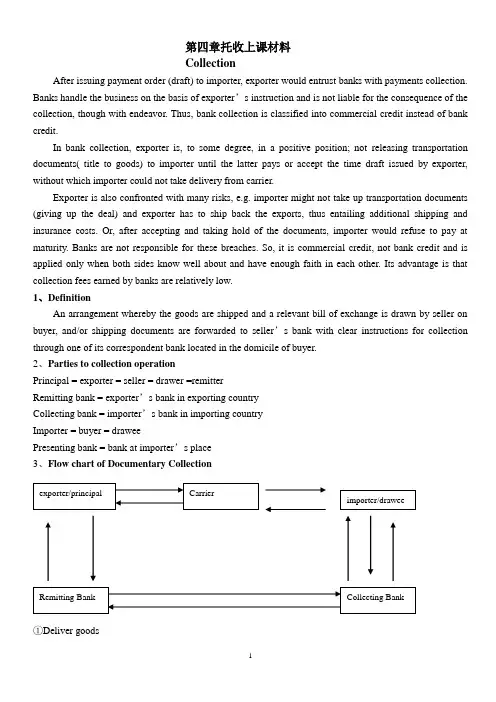

第四章托收上课材料CollectionAfter issuing payment order (draft) to importer, exporter would entrust banks with payments collection. Banks handle the business on the basis of exporter’s instruction and is not liable for the consequence of the collection, though with endeavor. Thus, bank collection is classified into commercial credit instead of bank credit.In bank collection, exporter is, to some degree, in a positive position; not releasing transportation documents( title to goods) to importer until the latter pays or accept the time draft issued by exporter, without which importer could not take delivery from carrier.Exporter is also confronted with many risks, e.g. importer might not take up transportation documents (giving up the deal) and exporter has to ship back the exports, thus entailing additional shipping and insurance costs. Or, after accepting and taking hold of the documents, importer would refuse to pay at maturity. Banks are not responsible for these breaches. So, it is commercial credit, not bank credit and is applied only when both sides know well about and have enough faith in each other. Its advantage is that collection fees earned by banks are relatively low.1、DefinitionAn arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by seller on buyer, and/or shipping documents are forwarded to seller’s bank with clear instructions for collection through one of its correspondent bank located in the domicile of buyer.2、Parties to collection operationPrincipal = exporter = seller = drawer =remitterRemitting bank = exporter’s bank in exporting countryCollecting bank = importer’s bank in importing countryImporter = buyer = draweePresenting bank = bank at importer’s place3、Flow chart of Documentary Collection①Deliver goods②B/L③Documents and Instructions (Application)④Rept.⑤Collection Order or Instruction & docs.⑥Present⑦Pay⑧Release Documents D/A or D/P⑨Credit Advice or Debit Authorization⑩Hand in B/L((11))Deliver goods4、Delivering documents = Delivering goodsBuyer must take delivery of goods with bill of Lading (B/L), which is receipt issued by carrier when receiving goods delivered by seller for transportation. Importer must take delivery of goods against it. Without B/L, buyer could not get the goods at the carrier. For sight payment, only when buyer pay the sight draft drawn by seller would collecting bank release documents(B/L) to buyer. For time bill, only when buyer accepts time draft drawn by seller would collecting bank release documents to importer.(1)Documents against documents D/A①Time draft &other docs+application②Collection order& time draft & docs③Present time draft for acceptance④Accepted draft⑤docs= goods(The risk is that buyer would not pay after taking the goods,thoughgoods have been taken away.)⑥Present accepted draft for payment(Collecting bank keeps accepteddraft for exporter and at maturity, presents it for payment.)⑦pay(2)Document against payment D/P at sight①Sight draft& other docs,etc②Collection Order & sight Draft and docs③Presents for payment (Only one presentment for payment )(So, it is demanded that payment must be made on first presentation.)④Pay after checking (Importer would try to delay payment to wait the arrival of goods ) ⑤docs(3)Documents against payment at tenor D/P at tenor①Time draft & other docs ,application ②Collection order& time draft and other docs ③Present time draft for acceptance ④No docs after acceptance⑤pay (After payment at maturity, buyer gets documents.) ⑥docs(4)Documents against time promissory note made by buyer①Apply Docs.②Collection order & docs demanding time promissory note made by buyer(The risk is that buyer would not pay after taking the goods.)③Advise and demanding documents against time promissory note made by importer.④Time promissory note⑤docs⑥(Collecting bank keeps promissory note for seller and at maturity, presents it for payment.)Present timePromissory Note for payment⑦pay5、Presenting bank①ion&documents②Collection order&documents③Forwarddocuments④present6、In case of needCase of need might be seller’s close friend or agency in importing country, who would arrangeshipping back the goods or selling the goods to other buyer in importing country.①Documents (Application)②Collection Order and documents(In case of need, look for XXX)③present④refuse⑤present⑥Pay & take over docs.Exporter might have mentioned “case of need”on the draft when issuing it if exporter expects the possibility of importer’s dishonor.7、Types of collection(1): Documentary Collection①Deliver goods②B/L③Commercial docs+ financial Instrument OR not+ Application④Collection Order & docs,esp. transporting documents + bill of exchange or not⑤D/A or D/P ⑤present⑥Pay⑦Hand in B/L⑧Deliver goodsDocuments are released to importer against his payment or acceptance/Sometimes, importer pays against commercial documents, e.g. commercial invoice without financial draft to avoid stamp duty. (2): Clean Collection①Send sample ②Rept.③Delivery advice(①,②, ③,Post receipt is sent to buyer’s country together with sample by post office.) ④Hand in Delivery adv.⑤sample (④,⑤, Importer takes the advice to post office and get sample against it.) ⑥Only draft+Application⑦Collection Order& draft (Payment must be made through bank ) ⑧Present draft ⑨PayDividend warrant and time promissory note can also be used in clean collection (3): Direct Collection①Sign long terms contract with bank (Omit a tache, save much time )②Prenumbered presigned collection order③Deliver goods④B/L⑤Fill in collection order and forward documents and collection order directly to(As if it is sent by remitting bank whose responsibility is the same as under documentary collection.)⑥D/A or D/P (⑥present)⑦Pay⑧Hand in B/L⑨Deliver goods8、Collection order = Collection Instruction①Application filled in by exporter②Collection Order filled in by remitting bank[①, ②They are the same in contents, for remitting bank carry out order given by exporter (principal).]Specimen of collection orderPlease Collect the Under-mentioned Foreign Bill and /or Documents①Draft &other docs②Collection order& time draft & docs (Banks endeavor to collect for principals, but not responsible for unfavorable results.)③pay④docs(2)Bank’s responsibility①Banks must act upon the instructions given by principals②Banks check the documents received against order to see if there is any missingThe principal must be informed of any documents missing.③Banks are not responsible for examining the contents of documents, e.g. any discrepancies between docs.Sight bill: presentation for paymentTime bill: presentation for acceptance, then, presentation for payment10、Risks for exporter(1)Risks for exporter under documentary collection①Refuse to pay or accept time draft on some small inadvertent infraction of the sales contract.②Demand deep cut down of price, or refuse to accept the goods.③A heavy storage charge, fire insurance, demurrage and great expenses and time delay if court action is taken.(2)Risks for exporter under term payment①At the maturity of draft, importer refuses to pay②The excuse might be defective quality and ask for cut down of price or not having foreign exchange approved by authority.(3)Summary of possible reasons for dishonor①Economic reasons:e.g. defective quality of goods, short of flowing capital, downturn ofmarket, bankruptcy of importer,etc.②Political reasons: war, turbulence, foreign exchange control, having not got import license,etc.③The credit risk of importer (fraud) etc.(4)Protection for exporter ——Credit investigationFinancial credit and operational style of importerMarket trend of importing countryWhether import license or foreign exchange has been approved by relative authority.Whether political situation in importing country is steadyWhether a case of need could be found once dishonor happens, who could help handle returned goods, e.gwarehousing and insuring the goods, arranging shipmentof returned goods, finding another buyer for exporter, etc.Exporter could find an agency (usu.banks) to aid the investigation.To buy export credit insurance at government agency(e.g. import/export bank).Have direct control over documents, esp. the transporting documents,e.g. the consignee should be “to t he order of shipper, or collecting bank (with consent of collecting bank)”, which could be endorsed to importer only when payment is made.If it is non-negotiable transport document (e.g. airway bill), collecting bank should be the consignee who could issue delivery order to importer after the payment.(5)Example, Hedging OperationOn July 20,2000 an I/E corporation of China expected to receive €200 millions in 3 months and the spot rate of €is RMB7.6450, and 3-month forward rate is 7.6250 ~ 7.6630. As €has been weak against USD, to protect against the risk of €’s devaluation, the corporation signed a 3-month forward contract with Bank of China. After July 20, €devalued from USD0.91 all the way to USD 0.83. On Oct. 23, when the settlement was made € depreciated to RMB6.9570.Question: If the corporation was not engaged inhedging operation, how much loss would it suffer? And what is the percentage of the loss to the total amount of the contract?Answer :11、(1)Risks for importer under collection①Might be fraudulent documents.②Might be defective or dummy or not the model ordered by importer③Late shipment,and miss the optimal selling seasons.④In advance payment , can not inspect goods beforehand.⑤Dishonor would ruin importer’s reputation.(2)Protection for importerInvestigate exporter’s reputation and deal only with Credit worthy exporters.If it is time payment, payment time can be XX days/months after Bill of Lading date, which means that earlier delivery,earlier payment.Choose the most the favorable procedure of documents delivery basing on the credit standing, financial capability, market trend.e.g. if price is going high, use D/P. If price is going down,use D/A.Use D/P at tenor as possible as you can to confirm if goodsarrive at the harbor of your country.12、(1)Bill purchased under Documentary CollectionBank’s financing to exporterThere is no payment guarantee from collecting bank. So, remitting bank provide the service only for credit worthy client s.①Sight or time bill & full set of original Bill of Lading and apply for discounting the bill. ②Discounted amount③Collection Order & docs④Credit Advice or Debit Authorization ⑤Docs ⑥Pay ⑦Present(2)Discounting bill under documentary collectionThe payee on the draft is normally the discounting bank,e.g.13、Trust Receipt under D/P at tenor (1)This is Bank’s financingto importer①Time draft& other docs②Collection order & time draft and other docs ③Present time draft for acceptance ④Acceptance& IOU=T/R ⑤docs(④, ⑤ Importer borrows B/L and other documents by writing a Trust Receipt (T/R),usu. with permission of exporter.)⑥Accepted Bill &T/R ⑦pay(⑥, ⑦After selling the goods importer retires the bill with the money.) (2)The obligation of trustee, explanation of some points ①Not to put the goods in pledge to other personsthat is; trustee cannot pledge the goods to other banks for credit.②To settle claims of the collecting bank before liquidation in case of the trustee ’s bankruptcy.If trustee goes bankrupt, the entrusted goods would not joint the liquidation or entruster has first lien over the entrusted goods.③Entrusted goods should be stored and booked separately from other goods and can be examined by entruster any time.④Money from sale of entrusted goods should go directly to entruster ’s account. (3)Risks for collecting bank in T/R financingTrust Receipt does not prevent trustee from selling goods to (a third party) someone who buys the goods for value and without notice of trust (the goods does not belong to trustee). If trustee runs away with the money, the entruster could not sue the third party. Laws protects the purchaser in good faith.So, entruster usu. demands that a guarantor (usu. a bank) should sign the T/R in addition to trustee ’s signature.The principal presents an application for collection accompanied by draft and documents to the remitting bank for collection.An application for collection shows as follows:Commercial documents surrendered are below:B/L in triplicate, two originals and one copyInvoice in triplicate, two originals and one copyInsurance policy in duplicate, one original and one copyCertificate of origin in duplicate, One original and one copyPacking list in duplicate, One original and one copyCollection instructions are given below:Deliver documents against paymentRemit the proceeds by airmailAirmail advice of paymentCollection charges outside China from drawee, waive if refused by him.Airmail advice of non-payment with reasonsProtest waivedWhen collected, please credit proceeds to principal’s account with remitting bank. Remitting bank complete a collection instruction in accordance with principal’s application to add other requirements as follows:Ref No. OC2576459Date: 15 July,2000Please collect and remit proceeds to Bank of China, New York for credit of our account with them under their advice to usPlease produce a collection instruction attaching draft and documents to be forwarded to the collecting bank, Banque du Paris, Paris.Collection InstructionORIGINALTO:_________________ Date:_______Our Ref. No_______Dear Sirs,Please follow instruction marked”x”□Deliver documents against payments/acceptance.□Remit the proceeds by airmail/cable.□Airmail/cable advice of payment/acceptance.□Collect charges outside_____ from drawee,waive if refuse by him.□Collect interest for delay in payment____days after sight at____% per annum.□Airmail/cable advice of non-payment/non-acceptance with reasons.□Protest for non-payment/non-acceptance.□Protest waived.□When accepted, please advise us giving due date.□When collected, please credit our account with___.□Please collect and remit proceeds to ____for credit of our account with them under their advice to us. □Please collect proceeds and authorize us by airmail/cable to debit your account with us.Special InstructionsThis collection is subject to Uniform Rules for collection(1995 Revision) ICC Publication No.522Authorized signature(s)TRUST RECEIPTTO:__________ ________,________Received from the said bank a full set of shipping document evidencing the merchandise having an invoice value of______say______ as follows:And in consideration of such delivery in trust ,the undersigned hereby undertakes to land, pay customs duty and/or other charges or expenses ,store, hold and sell and deliver to purchasers the merchandise specified herein ,and to receive the proceeds as trustee for the said bank , and the undersigned promises and agrees not to sell the said merchandise or any part thereof on credit , but only for cash for a total amount not less than the invoice value specified above unless otherwise authorized by the said bank in writing.The undersigned further acknowledges assents and agrees that in the event the whole or any part of the merchandise specified herein is sold or delivered to a purchaser or purchaser any proceeds derived or to be derived from such sale or delivery shall be considered the property or the said bank and the undersigned hereby grants to be said bank full authority to collect such proceeds directly from the purchaser or purchaser without reference to the undersigned.The guarantor, as another undersigned, guarantees to the said bank the faith and proper fulfillment of the terms and conditions of the trust receipt.Guaranteed by: signed by:_____________ _______________________ ___________。

国际结算习题第四章托收结算方式。

二、是非题1.托收是一种付款人主动向收款人支付货款的方式。

()【答案】×2.在托收业务中,银行的一切行为是按照托收委托书来进行的。

()【答案】√3.光票托收和跟单托收一样,都是用于贸易款项的收取。

()【答案】×4.托收因是借助银行才能实现货款的收付,所以托收是属于银行信用。

()【答案】×5.从理论上讲,承兑交单相比于付款交单对于买方更为便利,因为承兑交单中买方承兑后即可提货,往往可以不必自备资金而待转售所得的货款到期时付款。

()【答案】√6.托收业务中,代收行对于汇票上的承兑形式,只负责表面上完整和正确之责,不负签字的正确性,或签字人是否有权限签署之责。

()【答案】√7.委托人在出口托收申请书上可指定代收行,如不指定,委托行可自行选择它认为合适的银行作为代收行。

委托行由于使用其他银行的服务而发生的费用和风险,在前种情况下由委托人承担,在后种情况下由委托行承担。

()【答案】×8.托收业务中,只要选择合适的委托行和代收行,委托人收回货款就不成问题。

()【答案】×9.相比于付款交单,承兑交单一定是远期付款,对买方比较有利。

()【答案】√10.无论何种情况下,代收行同意进口商凭信托收据借货后产生的风险和后果都由出口商承担。

()【答案】×国际结算习题第一章国际结算概述单项选择题:1. 商品进出口款项的结算属于( C )A . 双边结算B . 多边结算C . 贸易结算D . 非贸易结算2. “汇款方式”是基于( B )进行的国际结算A . 国家信用B . 商业信用C . 公司信用D . 银行信用3. 实行多边结算需使用( D )A . 记账外汇B . 外国货币C . 黄金白银D . 可兑换货币4. 以下( C )反映了商业汇票结算的局限性A . 进、出口商之间业务联系密切, 相互信任;B . 进、出口商一方有垫付资金的能力;C . 进、出口货物的金额和付款时间不一致;D . 出口商的账户行不在进口国5. 当代国际结算信用管理的新内容涉及到( A )A . 系统信用和司法信用B . 员工信用和银行信用C . 公司信用和商业信用D . 银行信用和商业信用6. 以下( C )引起的货币收付,属于“非贸易结算”.A. 服务供应B . 资金调拨C . 设备出口D. 国际借贷7. ( B )不是纸币本位制度下使用多边结算方式必备的条件.A . 结算货币具有可兑换性B . 不实行资本流动管制C . 有关国家的商业银行间开立各种清算货币的账户D . 清算账户之间资金可以自由调拨8. 建国初我国对苏联和东欧国家的贸易使用( C )的方式A . 单边结算B . 多边结算C . 双边结算D .集团性多边结算9. 传统的国际贸易和结算中的信用主要是( D )两类。