API Manufacturing

- 格式:doc

- 大小:51.00 KB

- 文档页数:8

质量管理体系纲要用于石油和天然气行业的生产制造组织A P I Q 1 规范2013年6月,第9版生效日期:2014年6月1日质量管理体系纲要用于石油和天然气行业的生产制造组织1范围对于按照石油天然气行业产品规范的制造产品或提供有关制造过程的组织,本规范规定了质量管理体系的最低要求。

本规范规定了组织的质量管理体系要求,来证明其有能力持续提供满足顾客和法律法规要求的可靠的产品和制造有关过程。

如果组织执行本规范规定的活动,可以不对这些活动做删减声明。

由于组织的客观因素,本规范某些要求不能适用时,这些要求可以被删减。

当删减时,应进行删减声明。

此外,删减不能影响组织提供满足顾客和法律法规要求的产品和有关服务的能力或责任。

删减仅限于下列章节:5.4设计和开发5.7.1.2服务5.7.1.5生产和服务过程的确认5.7.5顾客财产5.8试验、测量和监视设备的控制本规范中质量管理体系要求规定的章节要求和文件格式与服务提供和产品相关的服务使用(A P I Q2)一致。

标记“N O T E”的信息不是要求,但提供了理解或阐述了相关要求的指南信息。

2引用标准本规范的应用中下列引用文件是不可缺少的。

引用文件的最新版本(包括修正版)适用为:I S O9000,质量管理体系——基础和术语3术语,定义和缩写3.1术语和定义作为本规范的目的,I S O9000给出的术语和定义以及下列定影应适用。

当I S O9000和本规范的术语定义相同时,应适用下列定义。

3.1.1接收准则a c c e p t a n c e c r i t e r i a对过程或产品性能的可接受性所规定的限制。

3.1.2接收检验a c c e p t a n c e i n s p e c t i o n通过监视和测量验证产品符合规定的要求。

3.1.3校准c a l i b r a t i o n与已知准确度的标准进行的对比与调整。

3.1.4收集c o l l e c t i o n获得、收集和/或系统化满足4.5要求的适用信息的过程。

20170913ECA新闻:API起始物料----ICHQ11新问答文件13.09.2017API starting materials - New Q&A document forICH Q11API起始物料----ICH Q11新问答文件The selection of a starting material for thesynthesis of an active substance and its justification is often one of themost crucial steps in the approval process. Assessors at regulatory agencies ofthe EU member states have to evaluate whether the data provided sufficientlyjustify the selection. The criteria for this are outlined in the 2012 ICH Q11 guideline - however, not in a sufficiently precisemanner. This resulted in questions and additional demands by the agencies,thereby delaying the approval processes. In order to establish a commonunderstanding in regards to the information on starting materials in module 3(section 3.2.S.2.2) for assessors as well as applicants, the ICH published thefinal version (step 4) of its Q&A documentfor ICH Q11 on 6 September of this year. The ICH had already announced the Q&Adocument in a concept paper for ICH Q11 at the end of 2014.活性物质起始物料的选择及其论证是批准过程中通常是最关键的环节之一。

常用制药及GMP英文缩写第一篇:常用制药及GMP英文缩写ISO(International Organization for Standardization):国际标准化组织日常办事机构是中央秘书处,设在瑞士日内瓦WHO(World Health Organization):世界卫生组织是联合国属下的专门机构,国际最大的公共卫生组织,总部设于瑞士日内瓦PIC/S(Pharmaceutical Inspection Convention/Pharmaceutical Inspection Cooperation Scheme):国际医药品稽查协约组织由欧洲自由贸易区(EFTA)组建ICH(International Conference on Harmonization of Technical Requirements for Registration of Pharmaceuticals for Human Use):人用药物注册技术要求国际协调会由欧盟(EU)、欧洲制药工业协会联合会(EFPIA)、日本厚生省(MHW)、日本制药工业协会(JPMA)、美国FDA、美国药物研究生产联合会(PRMA)等机构组成WHO、EFTA、加拿大卫生保健局(CHPB)为观察员ISPE(International Society for Pharmaceutical Engineering):国际制药工程协会是致力于培训制药领域专家并提升制药行业水准的世界最大的非盈利性组织之一,在美国坦帕州设有全球总部,在布鲁塞尔设有欧洲总部,亚洲总部在新加坡HHS(United States Department of Health and Human Services):美国卫生及公共服务部(美国卫生部)FDA(Food and Drug Administration):美国食品药品监督管理局(HHS下属机构)PDA(Parenteral Drug Association):美国注射剂协会EPA (Environmental Protection Agency):美国国家环境保护局CDER(Center for Drug Evaluation and Research):FDA药物评价与研究中心EMEA(The European Agency for the Evaluation of Medicinal Products):欧洲药物评审组织MHW(Ministry of Health and Welfare):日本厚生省,现改为厚生劳动省MHLW(Ministry of Health, Labor and Welfare),负责医疗卫生和社会保障的主要部门 D&B(Dun & Bradstreet):邓白氏公司DUNS(DataUniversal Numbering System):邓白氏公司提供的唯一的公司代号,用于信用评级等在SMF文件中会用到GMP(Good Manufacturing Practice):药品良好生产规范cGMP(Current Good Manufacture Practices):动态药品生产管理规范,即现行的GLP(Good Laboratory Practice):药物非临床研究质量管理规范,及优良实验室规范GSP(Good Supplying Practice):药品经营质量管理规范,及良好的药品供应规范GAP(Good Agricultural Practice for Chinese Crude Drugs):中药材生产质量管理规范GDP(Good Documentation Practice):良好文件管理GEP (Good Engineering Practice):工程设计规范GAMP(Good Automated Manufacturing Practice):优良自动化生产规范USP(united states pharmacopeia):美国药典EP (European Pharmacopeia):欧洲药典JP(Japanese Pharmacopoeia):日本药典CFR(Code of Federal Regulations):美国联邦法律CFR 21 Part 11(Code of Federal Registry Part11):联邦法规法律标题21第11部分CEP/COS(Certificate of Suitability to the monographs of European Pharmacopoeia):欧洲药典适应性认证证书CEP认证,COS证书CTD(Common Technical Document):国际注册用常规技术文件CTD文件是国际公认的文件编写格式,用来制作一个向药品注册机构递交的结构完善的注册申请文件EHS(Environment、Health、Safety):环境-健康-安全管理体系HACCP(Hazard Analysis and Critical Control Point):(保健食品)危害分析和关键控制点REACH(REGULATION concerning the Registration, Evaluation, Authorization and Restriction of Chemicals):欧盟规章《化学品注册、评估、许可和限制》,欧盟建立的,并于2007年6月1日起实施的化学品监管体系 ICH-Q1A:新原料药和制剂的稳定性试验ICH-Q1B:稳定性试验:新原料药和制剂的光稳定性试验ICH-Q1C:稳定性试验:新剂型的要求ICH-Q1D:新原料药和制剂的稳定性试验的括号法和矩阵法设计ICH-Q1E:稳定性数据的评价ICH-Q1F:气候带Ⅲ和Ⅳ注册申请的稳定性数据 ICH-Q2A:分析步骤验证:正文ICH-Q2B:分析步骤验证:方法学ICH-Q3A:原料药中的杂质 ICH-Q3B:新制剂中的杂质ICH-Q3C:杂质;残留溶剂的指导原则 ICH-Q4:药典ICH-Q4A:药典的同一化ICH-Q4B:各地区使用的药典正文评估和建议ICH-Q5A:来源于人或动物细胞系的生物技术产品的病毒安全性评价ICH-Q5B:生物技术产品的质量:rDNA衍生蛋白质产品生产细胞的表达构建体分析ICH-Q5C:生物技术产品的质量:生物制品/生物技术产品的稳定性试验ICH-Q5D:用于生物技术产品及生物制品生产的细胞基质的来源和鉴定 ICH-Q5E:生物技术产品/生物制品在工艺变更时的可比性ICH-Q6A:质量标准新原料药和制剂的检测以及可接受标准:化学物质ICH-Q6B:质量标准:生物技术产品及生物制品的检测方法和可接受标准ICH-Q7:原料药良好制造规范(ICH-Q7A的新版)ICH-Q7A:原料药的GMP规范 ICH-Q8:药物研发指南 ICH-Q9:质量风险管理ICH-Q10(PQS):药物质量体系QA(Quality Assurance):质量保证QC(Quality Control):质量控制QRM(Quality Risk Management):质量风险管理IPC (InproceicsQuality Control):制程品质控制/中控OOS(Out of Specification):检验结果超标 OOT(Out of Trend):超趋势结果OOL(Out of Limit):超出极限的结果,如温湿度等OOE (Out of Expectation):超期望结果SAL(SterilityAssuranceLevel):无菌保证水平灭菌后微生物的存活概率的负对数,要求≥6SAL=−lg存活率=F0D−lgN0D值:杀灭90%的微生物所需要的时间,D值越大,微生物死亡越难,D值与细菌的耐热性成正比Z值:指灭菌时间减少到原来的10%所需要升高的温度或是相同的灭菌时间内杀死99%的微生物所需要提高的温度F值:为一定温度下,给定Z值所产生的灭局效果与参比温度T0下给定Z值所产生的灭菌效果相同时所相当的时间F值用于干热灭菌F0值:为一定温度下,Z值为10℃产生的灭菌效果与120℃,Z 值为10℃时产生的灭菌效果相当的时间,t分钟内的灭菌效果相当于120℃下灭菌F0分钟的效果F0被称为标准灭菌时间,用于热压灭菌LRV:除菌过滤的对数下降值LRV=lgN0-lgN SOP(Standard Operation Procedure):标准操作规程 DMF(Drug Master File):药品主文件 SMF(Site Master File):工厂主文件URS(User Requirement Specification):用户需求标准FS (Functional Specification):功能标准DS(Design Specification):设计标准 DQ(Design Qualification):设计确认IQ(Installation Qualification):安装确认OQ(Operational Qualification):运行确认PQ(Performance Qualification):性能确认 RQ(Requalification):再确认CAPA(Corrective Action & Preventive Action):纠正预防系统,Q10的四大要素之一QbD(Quality byDesign):质量源于设计COA(Certificate of Analysis):分析证书/检验报告书/检验报告单 BPR(Batch Production Record):批生产记录API(Active Pharmaceutical Ingredients):药物活性成分,通常指的原料药 PMC(Product Material Control):生产物料控制PC 生产控制;MC物料控制CMC(Chemistry and manufacture control):生产和化学控制APR(Annual Products Review):年度质量回顾 KPI(Key Performance Indicators):关键业绩指标P&ID(Piping and Instrument Diagram):工艺管道仪表流程图 PFD(Process Flow Diagram):工艺流程图 UFD(Utility Flow Diagram):公用工程流程图CIP(Cleaning in Place):原位清洗(全自动,如针剂配制系统)WIP(Washing in Place):在线清洁(半自动,需要手动的拆卸,如流化床)SIP(Sterilization in Place):在线灭菌WFI (Water for Injection):注射用水HVAC(Heating Ventilation Air Conditioning):供热空气调节净化系统 HEPA(High Efficiency Particulate Air Filter):高效过滤器DOP:为邻苯二甲酸二辛酯,HEPA检漏用的气溶胶PAO:聚-α-烯烃,HEPA检漏用的气溶胶 IBC(IntermediateBulkContainer):中型散装容器BFS(Blowing Filling and Sealing):吹-灌-封PAT (Process Analytical Technology):过程分析技术PLC (Programmable Logic Controller):可编程逻辑控制CPP (Critical Process Parameters):关键工艺参数FBD(Fluid Bed Dryer):流化床AHU(Air Handling Unit):空气处理单元SAT (SiteAcceptance T est):现场验收测试 FAT(Factory Acceptance Test):工厂验收测试第二篇:GMP英文缩写1.AQAI(Automated Quality Assurance Inspection Equipment):在线自动质量保证检查设备 2.API(Active Pharmaceutical Ingredient):活性药物物质即原料药 3.ANDA(Abbreviated New Drug Application):简化新药申请 4.ADR(Adverse Drug Reaction):不良反应5.BSE(Bovine Spongiform Encephalopathy):疯牛病6.BPCS(Business Planning and Control System):业务计划及控制系统7.BIA(Business impact assessment): 商业影响评估8.cGMP(current Good Manufacturing Practice):现行药品生产质量管理规范 CD(China Certification Committee for Drugs):中国药品认证委员会10.CIP(Cleaning In Place):在线清洁11.CV(Concurrent Validation):同步验证12.CDER(Center for Drug Evaluation and Research): 药品研究与评价中心13.COA(Certificate Of Analysis):分析报告单14.CFR(Code of Federal Regulation):(美国)联邦法规15.CDC(Centers for Disease Control and Prevention):疾病预防控制中心16.COS / CEP(Certificate of Suitability for European Pharmacopeia):欧洲药典适用性证书D(Certification Committee for Drugs):药品认证管理中心18.CPMP(Committee for Proprietary Medicinal Products): 欧洲专利药品委员会19.CTD(Common Technical Document):通用技术文件20.CDC(Centers for Disease Control and Prevention): 疾病预防控制中心21.GMP(Good Manufacturing Practice):药品生产质量管理规范22.ICH(International Conference on Harmonization of Technical Requirements for Registration ofPharmaceuticals for Human Use):人用药品注册技术要求国际协调会 23.EU(European Union):欧洲联盟24.EFPIA(European Federation of Pharmaceutical Industries Associations):欧洲制药工业协会联合会25.MHW(Ministry of Health and Welfare,Japan):日本厚生省26.JPMA(Japan Pharmaceutical Manufacturers Association):日本制药工业协会27.FDA(US Food and Drug Adminiistration):美国食品与药品管理局28.PRMA(Pharmaceutical Research and Manufacturers of America):美国药物研究和生产联会29.WHO(World Health Organization):世界卫生组织30.IFPMA(International Federation of Pharmaceutical Manufacturers Associations):国际制药工业协会联合会31.TQC(Tota lQuality Control),TQM(Total Quality Management): 全面质量管理32.PDCA(Plan,Do,Check,Action):计划执行检查处理33.QA(Quality Assurance):质量保证 34.QC(Quality Control):质量控制 35.QS(Quality System):质量体系36.QM(Quality Management): 质量管理37.SOP(Standard Operating Procedure): 标准操作规程38.SMP(Standard Management Procedure):标准管理程序39.SOR(Standard Operating Record): 标准操作记录 40.GEP(Good Engineering Practice):工程设计规范41.HVAC(Heating Ventilation and Air Conditioning):空调净化系统42.DQ(Design Qualification):设计确认43.IQ(Installation Qualification):安装确认44.OQ(Operational Qualification):运行确认 45.PQ(Performance Qualification):性能确认46.OOS(Out-Of-Specification):检验结果偏差,有别于偏差47.PFDS(Process Flow Diagrams):工艺流程图48.MRA(cMutual Reognition Agreements): 现场检查多边认同协议 49.DMF(Drug Master File):药物主文件50.EDMF(European Drug Master File)欧盟药物主文件51.EDQM(European Directorate for Quality Medicines): 欧洲药品质量管理局 52.ORA(Office of Regulatory Affairs):药政事务办公室53.GGPs(Good Guidance Practices): 优良指南规范54.MOA(Method Of Analysis):分析方法 55.VMP(Validation Master Plan):验证主计划 56.VP(Validation Protocol):验证方案57.MSDS(Material Safety Data Sheet):物料安全技术说明书58.NDA(New Drug Application):新药申请59.OTC(Over-the-counter):非处方60.INN(International Nonproprietary Name):国际非专有名称P(the united state pharmacopeia): 美国药典62.NF(National Formulary):(美国)国家药品集63.GAP(Good Agricultural Practice):中药材种植管理规范64.GCP(Good Clinical Practice):药物临床试验质量管理规范65.GLP(Good Laboratory Practice):药物实验室管理规范66.GSP(Good Supply Practice):药品经营质量管理规范67.GUP(Good Use Practice):药品使用质量管理规范 68.SM(Starting Material):起始物料69.PMF(Plant Master File);SMF(Site Master File):工厂主文件70.EDL(List of Essential Drugs): 基本药物目录 71.PI(Package Insert):说明书72.PCT(Patent Cooperation Treaty): 专利合作条约73.PPAC(Patent Protection Association of China):中国专利保护协会 74.PIC(Person In Charge):负责人75.PDS(Pharmaceutical Development Services):整体新药研发机构 76.SPC(Summary of Product Characteristics):产品特性摘要第三篇:GMP常见英文缩写(本站推荐)GMP常见英文缩写AQAI(Automated Quality Assurance Inspection Equipment):在线自动质量保证检查设备 API(Active Pharmaceutical Ingredient):活性药物物质,即原料药 ANDA(Abbreviated New Drug Application):简化新药申请ADR(Adverse Drug Reaction):不良反应BSE(BovineSpongiform Encephalopathy):疯牛病BPCS(Business Planning and Control System):业务计划及控制系统 BIA(Business impact assessment): 商业影响评估cGMP(current Good Manufacturing Practice):现行药品生产质量管理规范 CCCD(China Certification Committee for Drugs):中国药品认证委员会CIP(Cleaning In Place):在线清洁CV(Concurrent Validation):同步验证CDER(Center for Drug Evaluation and Research): 药品研究与评价中心COA(Certificate Of Analysis):分析报告单CFR(Code of Federal Regulation):(美国)联邦法规CDC(Centers for Disease Control and Prevention):疾病预防控制中心COS/ CEP(Certificate of Suitability for European Pharmacopeia):欧洲药典适用性证书 CCD(Certification Committee for Drugs):药品认证管理中心CPMP(Committee for Proprietary Medicinal Products): 欧洲专利药品委员会 CTD(Common Technical Document):通用技术文件CDC(Centers for Disease Control and Prevention): 疾病预防控制中心 GMP(Good Manufacturing Practice):药品生产质量管理规范ICH(International Conference on Harmonization of Technical Requirements for Registration of Pharmaceuticals for Human Use):人用药品注册技术要求国际协调会 EU(European Union):欧洲联盟EFPIA(European Federation of PharmaceuticalIndustries Associations):欧洲制药工业协会联合会MHW(Ministry of Health and Welfare,Japan):日本厚生省JPMA(Japan Pharmaceutical Manufacturers Association):日本制药工业协会 FDA(US Food and Drug Adminiistration):美国食品与药品管理局PRMA(Pharmaceutical Research and Manufacturers ofAmerica):美国药物研究和生产联合会WHO(World Health Organization):世界卫生组织IFPMA(International Federation of Pharmaceutical Manufacturers Associations): 国际制药工业协会联合会TQC(Total Quality Control),TQM(Total Quality Management): 全面质量管理PDCA(Plan,Do,Check,Action):计划,执行,检查,处理QA(Quality Assurance):质量保证QC(Quality Control):质量控制QS(Quality System):质量体系 QM(Quality Management): 质量管理SOP(Standard Operating Procedure): 标准操作规程SMP(Standard Management Procedure):标准管理程序SOR(Standard Operating Record): 标准操作记录GEP(Good Engineering Practice):工程设计规范HVAC(Heating Ventilation and Air Conditioning):空调净化系统DQ(Design Qualification):设计确认IQ(Installation Qualification):安装确认OQ(Operational Qualification):运行确认PQ(Performance Qualification):性能确认OOS(Out-Of-Specification):检验不合格;超标 PFDS(Process Flow Diagrams):工艺流程图MRA(cMutual Reognition Agreements): 现场检查多边认同协议 DMF(Drug Master File): EDMF(European Drug Master File)欧盟药物主文件EDQM(European Directorate for Quality Medicines): 欧洲药品质量管理局 ORA(Office of Regulatory Affairs):药政事务办公室GGPs(Good Guidance Practices): 优良指南规范MOA(Method Of Analysis):分析方法VMP(Validation Master Plan):验证主计划VP(Validation Protocol):验证方案MSDS(Material Safety Data Sheet):物料安全技术说明书NDA(New Drug Application):新药申请OTC(Over-the-counter):非处方INN(International Nonproprietary Name)国际非专有名称USP(the united state pharmacopeia): 美国药典NF(National Formulary):(美国)国家药品集GAP(Good Agricultural Practice):中药材种植管理规范GCP(Good Clinical Practice):药物临床试验质量管理规范 GLP(Good Laboratory Practice):药物实验室管理规范GSP(Good Supply Practice):药品经营质量管理规范 GUP(Good Use Practice):药品使用质量管理规范 SM(Starting Material):起始物料PMF(Plant Master File);SMF(Site Master File):工厂主文件EDL(List of Essential Drugs): 基本药物目录 PI(Package Insert):说明书PCT(Patent Cooperation Treaty): 专利合作条约PPAC(Patent Protection Association of China):中国专利保护协会 PIC(Person In Charge):负责人PDS(Pharmaceutical Development Services): 整体新药研发机构 SPC(Summary of Product Characteristics):产品特性摘要第四篇:英文缩写GM(General Manager)总经理VP(Vice President)副总裁FVP(First Vice President)第一副总裁AVP(Assistant Vice President)副总裁助理CEO(Chief Executive Officer)首席执行官COO(Chief Operations Officer)首席运营官CFO(Chief Financial Officer)首席财务官CTO(Chief Technology Officer)首席技术官HRD(Human Resource Director)人力资源总监OD(Operations Director)运营总监MD(Marketing Director)市场总监OM (Operations Manager)运作经理PM(Production Manager生产经理、Product Manager产品经理、Project Manager项目经理)注:这里面变化比较多,要结合谈话时的背景来判断究竟是指哪种身份)BM(Branch Manager)部门经理DM(District Manager)区域经理RM(Regional Manager)区域经理President 总裁Vice-President 副总裁Assistant VP 副总裁助理Executive Marketing Director 市场行政总监General Manager 总经理Branch Manager部门经理Product Manager 产品经理Project Manager 项目经理Regional Manager 区域经理Production Manager 生产经理Transportation Manager 运输经理Applications Programmer 应用软件程序员Computer Operator 电脑操作员Computer Operations Supervisor 电脑操作主管Hardware Engineer 硬件工程师Computer T echnician 电脑技术MIS Manager 管理信息系统部经理Developmental Engineer 开发工程师Operations Analyst 操作分析Director of Information Services 信息服务主管LAN Administrator 局域网管理员Systems Analyst 系统分Manager of Network Administration 网络管理经理Systems Engineer 系统工程师Product Support Manager 产品支持经理Systems Programmer 系统程序员VP Sales 销售副总裁VP Marketing 市场副总裁Senior Account Manager 高级客户经理Telemarketing Director 电话销售总监Sales Administrator 销售主管Telemarketer 电话销售员Regional Sales Manager 地区销售经理Tele-Interviewer 电话调查员Regional AccountManager 地区客户经理Salesperson 销售员Sales Representative 销售代表Merchandising Manager 采购经理Sales Manager 销售经理Marketing Consultant 市场顾问Sales Executive 销售执行者Marketing Assistant 市场助理Sales Assistant 销售助理Marketing and Sales Director 市场与销售总监Retail Buyer 零售采购员Market Research Analyst 市场调查分析员Manufacturer’s Representative 厂家代Purchasing Agent 采购代理Assistant Account Executive 客户管理助理Marketing Manager 市场经理Advertising Manager 广告经理Marketing Intern 市场实习Advertising Coordinator 广告协调员Marketing Director 市场总监Advertising Assistant 广告助理Account Manager 客户经理Account Representative 客户代表Accounting Payable Clerk 应付帐款文员Accounting Assistant 会计助理Accounting Manager 会计经理AccountsReceivable Clerk 应收帐款文员Accounting Clerk 会计文员Certified Public Accountant 注册会计师Senior Accountant 高级会计Chief Financial Officer 首席财务官Audit Manager 审计经理Collections Officer 收款负责人Auditor 审计师Junior Accountant 初级会计Loan Administrator 贷款管理员Management Accountant 管理会计Billing Clerk 票据文员Billing Supervisor 票据管理员Bookkeeper 档案管理Staff Auditor 审计员Bookkeeping Clerk 档案管理助理Budget Analyst 预算分析Tax Accountant 税务会计Credit Analyst 信用分析Credit Manager 信用管理经理Vice-President of Administration and Finance 财务行政副总裁Financial Analyst 财务分析Vice-President of Finance 财务副总裁Financial Consultant 财务顾问Financial Manager 财务经理Financial Planner 财务计划员VP HR 人力资源副总裁Assistant VP HR 人力资源副总裁助理HR Director 人力资源总监Compensation &Benefit Manager 薪酬福利经理Staffing Manager 招聘经理Training Manager 培训经理Benefits Coordinator 员工福利协调员Employer Relations Representative 员工关系代表Payroller 工资专员Training Coordinator 培训协调Training Specialist 培训专员HR Supervisor(Training)培训主管Vice-President of Administration 行政副总裁Administrative Director 行政总监Office Manager 办公室经理File Clerk 档案管理员Administration Assistant 行政助理Receptionist 接待员General Office Clerk 办公室文员Secretary 秘书Order Entry Clerk 订单输入文员Operator 接线员Typist 打字员公司部门:总公司Head Office分公司Branch Office营业部Business Office人事部 Personnel Department人力资源部 Human Resources Department总务部 General Affairs Department财务部General Accounting Department销售部 Sales Department国际部International Department广告部 Advertising Department企划部Planning Department研发部 Research and Development Department(R&D)秘书室 Secretarial Pool销售相关名词:KA:Key Accounts(原:主要客户)大卖场,大型连锁DM:DeliverMessageDirectMail 宣传单张POP:Point of the purchase(原:据点上的购买)店头广告PDCA:Plan,Do,Check,Action 计划、实施、检核、措施为管理循环的简称4PS:Product,Price,Place,Promotion 行销组合4p(产品价格通路促销)4CS:Consumer needs,Costs,Convienience,Communication行销组合4c(顾客需求顾客接受的成本便利性沟通)MINI:Mininum 小SWOT:trength,Weakness,Opportunity,Threat(优势弱势机会问题)为内外环境分析的一个工具USP:Unique Special Point 独特点FAB:Feature,Advantage,Benefit 产品特性,利益,功效推销法POD:Product Of Difference 产品的卖点SP:Sales Promotion 促销AD:Advertisement 广告NP:News Paper 报纸杂志PR:Public Relation 公共关系Store Check:Store Audit(偏于量的终端调查)终端调查,铺市率调查(可见度)FGD:Focus Group Discuss 座谈会(市调一种)Outdoor:户外GRP: Gross Rating Point(媒介用语)毛评点;总收视点3A:Avalible,Able,Adsire买得到,买得起,乐得买A&U:Attitude and Usage 消费态度和行为(市场调查)TG:端架SKU:单品CPM:每一百万个使用者会有几次抱怨(Complaint per Million)CRM:客户关系管理(Customer Relationship Management)JIT: 即时管理(Just In Time)KM:知识管理(Knowledge Management)LTC:最小总成本法(Least Total Cost)LUC:最小单位成本(Least Unit Cost)SO:订单(Sales Order)销售中的4P:产品(Product)、价格(Price)、通路(Place)、促销(Promotion)销售中的4C:消费者(Consumer)、成本(Cost)、方便(Convenience)、Inventory Control Manager 库存管理经理Regional Manager 区域经理Executive Marketing Director 市场行政总监Warehouse Manager 仓库经理Manager(Non-Profit and Charities)非盈利性慈善机构管理Cashier 出纳员Buyer 采购员Clerk/Receptionist 职员/接待员Civil Engineer 土木工程师Clerk Typist & Secretary 文书打字兼秘书Marketing Representative 销售代表Simultaneous Interpreter 同传公司英文标识总公司Head Office分公司Branch Office 营业部Business Office人事部 Personnel Department人力资源部Human Resources Department 总务部General Affairs Department财务部General Accounting Department 销售部Sales Department 促销部Sales Promotion Department 国际部 International Department 出口部Export Department进口部Import Department 公共关系Public Relations Department 广告部Advertising Department 企划部Planning Department 产品开发部Product Development Department 研发部Research and Development Department(R&D)艺术类词汇:服装设计师Fashion Designer电影摄制助理Film Production Assistant画面设计师Graphic Designer 装饰设计师Interior Designer制片协调员Production Coordinator男演员/女演员Actor/Actress艺术总监Art Director舞蹈教练Choreographer喜剧演员Comedian舞蹈家 Dancer摄影师 Photographer服务行业词汇: 办案员Case Worker城市规划者Urban Planner临床医学家Therapist社会工作者Social Worker心理学家Psychologist客户服务经理 Customer Service Manager客户服务代表 Customer Service Representative健康俱乐部经理Health Club Manager厨师Chef美容师Cosmetologist发型师Hairstylist 教育词汇:校长Principal外语教师 Foreign Language Teacher银行词汇:工商银行 ICBC: Industrial and Commercial Bank of China中国银行 BOC: Bank of China建设银行CCB: China Construction Bank农业银行ABOC: Agriculture Bank of China交通银行BOCM: Bank of Communication招商银行CMB: China Merchant Bank民生银行 CMBC: China Minsheng Banking Group,.Ltd光大银行 CEB: China Everbright Bank华夏银行 Huaxia Bank中信银行 ChinaCitic Bank广东发展银行Guangdong Development Bank深圳发展银行Shenzhen Development Bank上海浦东发展银行SPDB: Shanghai Pudong Development Bank兴业银行 CIB: China Industrial Bank Co., Ltd.MPV是指多用途汽车(multi-Purpose Vehicles),从源头上讲,MPV是从旅行轿车逐渐演变而来的,它集旅行车宽大乘员空间、轿车的舒适性、和厢式货车的功能于一身,一般为单厢式结构,即多用途车。

WHO guidelines on the transfer of technologyin pharmaceutical manufacturing WHO制药生产技术转移指南Background背景1. Introduction介绍2. Scope范围3. Glossary术语4. Due diligence and gap assessments尽职调查和差距评估5. Organization and management组织和管理6. Quality management and quality risk management质量管理和质量风险管理7. Documentation文件8. Premises厂房9. Equipment and instruments设备和仪器10. Qualification and validation确认与验证11. Product life cycle and project management principles产品生命周期和项目管理原则12. Phases of a technology transfer project技术转移项目阶段Phase I: Project initiation阶段1:项目启动Phase II: Project proposal阶段2:项目计划•Establishing a team•建立团队•Risk assessment•风险评估•Project plan•项目计划•Control strategy•控制策略Phase III: Project transfer阶段3项目转移•Production: transfer (processing, packaging)•生产:转移(工艺、包装)•Starting materials•起始物料•Active pharmaceutical ingredients•活性药物成分•Excipients•辅料•Information on process and finished pharmaceutical products information•关于工艺和药物成品的信息•Packaging•包装•Quality control: analytical method transfer•质量控制:分析方法转移•Cleaning•清洁Phase IV: Project review阶段4:项目回顾References参考文献Further reading拓展阅读Abbreviations缩略语Appendix 1. Example of documentation commonly required for the transferof technology附录1. 技术转移通常需要的文件示例Appendix 2. Example of possible experimental designs and acceptancecriteria for analytical testing附录2. 分析测试可能的实验设计和接受标准示例1. Introduction介绍1.1. Production and control procedures, validation and otherrelated activities may be transferred from one site to another site prior toobtaining a marketing authorization. In some cases, this transfer takes placeafter the approval of, for example, a product, by a regulatory authority. Thistransfer can be, for example, from drug discovery to product development; toclinical trials; or to full-scale commercialization and commercial batchmanufacturing; cleaning and validation.在获得上市许可之前,生产和控制程序、验证和其他相关活动可能从一个场所转移到另一个查场所。

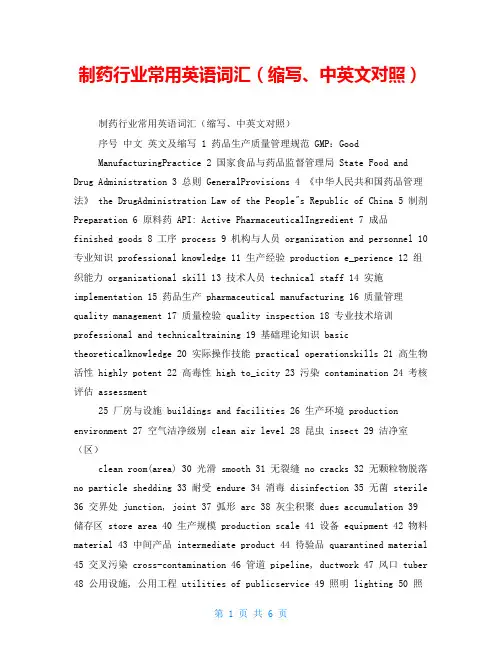

制药行业常用英语词汇(缩写、中英文对照)制药行业常用英语词汇(缩写、中英文对照)序号中文英文及缩写 1 药品生产质量管理规范 GMP:GoodManufacturingPractice 2 国家食品与药品监督管理局 State Food and Drug Administration 3 总则 GeneralProvisions 4 《中华人民共和国药品管理法》 the DrugAdministration Law of the People"s Republic of China 5 制剂Preparation 6 原料药 API: Active PharmaceuticalIngredient 7 成品finished goods 8 工序 process 9 机构与人员 organization and personnel 10 专业知识 professional knowledge 11 生产经验 production e_perience 12 组织能力 organizational skill 13 技术人员 technical staff 14 实施implementation 15 药品生产 pharmaceutical manufacturing 16 质量管理quality management 17 质量检验 quality inspection 18 专业技术培训professional and technicaltraining 19 基础理论知识 basic theoreticalknowledge 20 实际操作技能 practical operationskills 21 高生物活性 highly potent 22 高毒性 high to_icity 23 污染 contamination 24 考核评估 assessment25 厂房与设施 buildings and facilities 26 生产环境 production environment 27 空气洁净级别 clean air level 28 昆虫 insect 29 洁净室(区)clean room(area) 30 光滑 smooth 31 无裂缝 no cracks 32 无颗粒物脱落no particle shedding 33 耐受 endure 34 消毒 disinfection 35 无菌 sterile 36 交界处 junction, joint 37 弧形 arc 38 灰尘积聚 dues accumulation 39 储存区 store area 40 生产规模 production scale 41 设备 equipment 42 物料material 43 中间产品 intermediate product 44 待验品 quarantined material 45 交叉污染 cross-contamination 46 管道 pipeline, ductwork 47 风口 tuber 48 公用设施, 公用工程 utilities of publicservice 49 照明 lighting 50 照度 illumination 51 应急紧急情况 emergency 52 净化 purification, clean 53 微生物, 微生物学, 微生物 micro-organism,microbiology,microbiologic的 54 监测 monitoring 55 记录 record 56 天棚天花板 ceiling, roof 57 密封 seal 58 静压差 Static DifferentialPressure 59 温度 temperature 60 相对湿度 RH: Relative Humidity 61 低漏地漏 floor drainer 62 青霉素penicillin 63 分装室 separating room, fillingroom 64 相对负压 relative negativepressure 65 废气 waste gas,e_hausted air 66 β-内酰胺结构类药品 β-Lactasestructure drug, drugs of β-Lactic group 67 避孕药品 contraceptives 68 激素类 hormone 69 抗肿瘤类 anti-tumor, oncology 70 放射性药品 Radiopharmaceuticals 71 包装 packing, package 72 循环使用recycling 73 微粒 particles 74 辐射 radiation, irradiation 75 细菌bacteria 76 病毒 virus 77 细胞 cell 78 脱毒前后 pre and postdeto_ification 79 活疫苗与灭活疫苗 activevaccine/inactivatedvaccine 80 人血液制品 blood products 81 预防制品prevention products82 灌装 filling 83 中药 Chinesetraditional medicines 84 前处理pretreatment 85 提取 e_traction 86 浓缩 concentration 87 动物脏器viscera of animal,organ ofanimal 88 蒸、炒、炙、煅 ing, frying,sunburn, testing 89 炮制concocted 90 通风 ventilation 91 除烟 smoke removal 92 除尘 dust removal 93 降温设施 temperature-reducingestablishment,cooling 94 筛选 screening, sift 95 切片 slicing 96 粉碎 grinding 97 压缩空气 pressed air 98 惰性气体 noble gas 99 取样 Sling 100 称量室weighing room, dispensingroom 中药标本 Chinese herbalsle,e_emplar of TCM 102 检定鉴定 verification, identification 103 同位素 Isoe 104 设备 equipment 105 选型 model/type selection 106 耐腐蚀anticorrosion 107 吸附 adsorption, absorption 108 润滑剂, 润滑 lubricant, lubricate 109 冷却剂 coolant 110 流向 flow direction111 纯化水 PW: Purified Water 112 注射用水 WFI: Water for Injection 113 滋生 breeding 114 储罐 tank 115 死角 neglected portion 116 盲管blind pipe 117 纤维 fiber 118 疏水性 hydrophobicity 119 仪表instrumentation 120 量具 measuring tool 121 衡器 weighing instrument 122 精密度 precision 123 维修 maintenance 124 不合格 disqualified reject 125 物料 material 126 购买 purchasing 127 发放 releasing 128 产地 origin 129 入库 loading 130 固体 solid 131 液体 liquid 132 挥发性 volatile 133 净药材 medicine, TCM 134 麻醉药品 narcotics 135 精神药品 psychotropic drug 136 易燃 bustible 137 易爆 e_plosive 138 验收 acceptance 139 使用说明书instruction140 标签 label 141 卫生, 清洁/消毒 sanitation 142 车间, 辅房workshop 143 间隔时间 time interval 144 清洁剂 detergent 145 消毒剂disinfectant 146 废弃物 wastes 147 更衣室 changing room 148 工作服, work clothes 149 颗粒性物质, 颗粒剂 granules 150 耐药菌株 drug-resistantstrain 151 传染病 infectiousdisease 152 皮肤病 dermatitis 153 验证verification, validation 154 确认 qualification 155 安装 installation156 运行 running operation 157 性能 performance 158 原辅料 raw material and incipient 159 文件 document 160 投诉 plaint 161 报废 reject 162 品名product name 163 处方 preion, formula 164 技术参数 technicalparameter165 容器 container 166 半成品 semi-finished product,intermediate 167 申请 lication 168 稳定性 stability169 起草 draft 170 生产管理 production management,manufacturing control.171 事故 accident 172 混淆 mi_-up 173 喷雾 spray 174 合格证certificate 175 清场 clearance 176 质量管理 quality management 177 内控internal control,on-line test 178 滴定液 tartan 179 培养基 medium 180 有效期 validity, e_piry date,shelf life 181 产品销售与收回 product sales andrecovery/recall 182 投诉与不良反应报告 plaints and adversereaction 自检self-inspection 184 附则 schedule endi_ 185 平衡 balance 186 饮用水drinking water, potablewater 187 蒸馏法 distillation 188 离子交换法 ion e_change 189 反渗透法 RO: Reverse Osmosis 190 附加剂添加剂 additives 191 滞留 stranded resort 192 批 batch, lot 193 组分, 组成 ponent 194 无纤维脱落的过滤器 non-fiber-releasingfilter 195 活性成份 Active Ingredient 196 非活性成份 Inactive ingredient 197 中间产品 in-processproduct,intermediate product198 批号 batch number 199 药用物料 medicated feed 20__药用预混合料 medicated premi_ 201 质量控制部门 Quality control department 202 理论产量 Theoretical yield 203 实际产量 Actual yield 204 比率 Percentage, rate 205 验收标准可接受标准 Acceptance criteria 206 代表性样品 Representative sle 207 微粒状的 particulate 208 污染物contaminant 209 石棉 asbestos 210 诊断 diagnosis 211 缓解 mitigation 212 化学变化 chemical change 213 组分 ingredient, ponent 214 制备 fabricate preparation 215 复合 pound 216 混合 blend 217 加工 processing 218 浓度concentration 219 单位剂量 unit dose 220 药品包装容器 drug product containers 221 密封件, 封盖 closure 222 效价 Titer 223 纯度 purity 224 规格 strength 225 监督 supervise, monitor 226 实验室 laboratory 227 无菌操作 aseptic operation,sterileoperation 228 层流 laminar flow 229 湍流 turbulent air flow 230 空气过滤 air filtration 231 空气加热 air heating 232 预过滤器 profiler 233 排气系统 e_haust system 234 管件 plumbing 235 虹吸倒流 back-siphon age 236 污水 sewage 237 废料 refuse 238 盥洗设备 toilet facilities 239 空气干燥器 air drier 240 垃圾 trash 241 有机废料 organic waste 242 杀鼠剂rodenticides 243 杀昆虫剂 insecticides 244 杀真菌剂 fungicides 245 熏蒸剂 fumigating reagents 246 去垢剂 cleaning agents 247 消毒剂 sanitizing agents 248 滂沱剂 lubricant 249 自动化设备 automatic, mechanical,or electronic equipment 250 微型胶卷 microfilm 251 注射剂 injection 252 灭菌设备 sterilization equipment 253 无菌取样技术 aseptic sling techniques 254 显微镜 microscope 255 热, 内毒素 pyrogen, endoto_in 256 偏差 deviation 257 变更 change control 258 进料 charge-in 259 项目代码 item code 260 鉴别 identify 261 片剂 tablet 262 胶囊 capsule 263 颗粒剂 granule 264 溶解时间溶出时间 dissolution time 265 澄明度clarity 266 隔离系统 quarantinesystem, isolation system 267 返工reprocessing 268 发放 issuance, release 269 非处方药 OTC:over-the-counter 270 处方药 preed medicine 271 皮肤科药、牙粉、胰岛素、喉片dermatological,dentifrice,insulin, or throat lozenge product 272 保险包装 ter-resistant package 273 明胶硬胶囊 hard gelatin capsule 274 顺势治疗homeopathic 275 入库 warehousing 276 变质 deteriorate 277 准确性accuracy 278 灵敏性 sensitivity 279 特异性 specificity 280 重复性reproducibility, repeatability 281 变应原提取物 allergenic e_tracts 282 眼膏 ophthalmic ointment 283 粗糙或磨蚀物质 harsh or abrasivesubstances 284 控释制剂 controlled-releasedosage form 285 实验动物 laboratory animals 286 供应商 Supplier 287 光谱 spectrum 288 测量单位 units of measure 289 换算系数 conversion factors 290 试剂 reagent 291 安慰剂placebo 292 明确地 e_plicitly 293 取代 supersede 294 溶液 solution 295 批准 roval 296 (美国)食品药品监督管理局 FDA: Food and DrugAdministration 297 标准操作程序 SOP: StandardOperatingProcedure 298 质量保证 QA: Quality Assurance 299 质量控制QC:Quality Control 300 批生产记录 BPR: Batch ProductionRecord 301 批检验记录 BAR: Batch AnalysisRecord 302 工艺规程 PP: Process Procedure 303 健康,安全,环保 EHS: Environment,Health andSafe 304 美国联邦法规 CFR: Code of FederalRegulation 305 美国药典USP: The UnitedStatesPharmacopeia 306 欧洲药典 EP: European pharmacopeia 307 英国药典 BP: British pharmacopeia 308 药物主文件 DMF: Drug Master File 309 验证主计划 VMP: Validation MasterPlan 310 验证方案 VP: Validation Protocol 311 验证报告 : Validation Report 312 安装确认 IQ: Installation Qualification313 运行确认 OQ: Operation Qualification 314 性能确认 PQ: Performance Qualification 315 超出标准(限度) OOS: Out of Specification 316 冻干产品 freeze-dry product,lyophilizated product 317 工厂主述文件SMF: Site Master File。

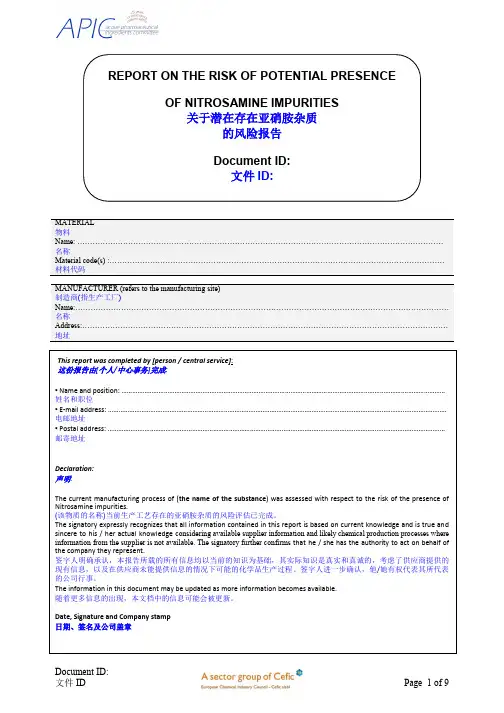

REPORT ON THE RISK OF POTENTIAL PRESENCEOF NITROSAMINE IMPURITIES关于潜在存在亚硝胺杂质的风险报告Document ID:文件ID:MATERIAL物料Name: ………………………………………………………………………………………………………………………………名称Material code(s) :……………………………………………………………………………………………………………………材料代码MANUFACTURER (refers to the manufacturing site)制造商(指生产工厂) Name:…………………………………………………………………………………………………………………………………名称Address:………………………………………………………………………………………………………………………………地址Document ID:文件ID Page 1 of 9Delete this page when issuing the letter.发信时删除此页。

Instructions when using this template.使用此模板时的说明。

1.Replace APIC logo by your company logo.将APIC的logo替换为贵公司的logo。

2.In the footer, replace CEFIC logo by “This document was prepared based onAPIC template”.在页脚,使用“此文件基于APIC模板编写”代替CEFIC logo。

3.In various places in the template, text appears in italics in square brackets, e.g. [Option1,Option 2, Option3].Keep the text that applies and remove the text that don’t apply to the situation which is being described.在模板的不同位置,有文字以斜体字出现在方括号内,例如[选项1,选项2,选项3]。

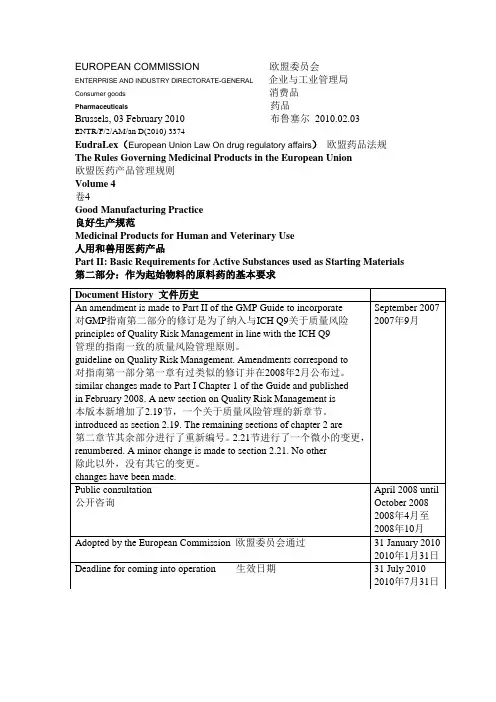

EUROPEAN COMMISSION 欧盟委员会ENTERPRISE AND INDUSTRY DIRECTORATE-GENERAL 企业与工业管理局Consumer goods 消费品Pharmaceuticals 药品Brussels, 03 February 2010 布鲁塞尔2010.02.03ENTR/F/2/AM/an D(2010) 3374EudraLex(European Union Law On drug regulatory affairs)欧盟药品法规The Rules Governing Medicinal Products in the European Union欧盟医药产品管理规则Volume 4卷4Good Manufacturing Practice良好生产规范Medicinal Products for Human and Veterinary Use人用和兽用医药产品Part II: Basic Requirements for Active Substances used as Starting Materials 第二部分:作为起始物料的原料药的基本要求Table of Contents目录1 Introduction1简介1.1 Objective1.1目的1.2 Regulatory Applicability1.2法规适用性1.3 Scope1.3范围2 Quality Management2质量管理2.1 Principles2.1原则2.2 Quality Risk Management2.2质量风险管理2.3 Responsibilities of the Quality Unit(s) 2.3质量部门的职责2.4 Responsibility for Production Activities 2.4生产活动的职责2.5 Internal Audits (Self-Inspection)2.5内部审计(自检)2.6 Product Quality Review2.6产品质量回顾3 Personnel3 人员3.1 Personnel Qualifications3.1 人员资质3.2 Personnel Hygiene3.2 人员卫生3.3 Consultants3.3 顾问4 Buildings and Facilities4 厂房设施4.1 Design and Construction4.1 设计和建造4.2 Utilities4.2 公用工程4.3 Water4.3 水4.4 Containment4.4 限制4.5 Lighting4.5 照明4.6 Sewage and Refuse4.6 废水废物4.7 Sanitation and Maintenance4.7 公共卫生及保养5 Process Equipment5 工艺设备5.1 Design and Construction5.1 设计和建造5.2 Equipment Maintenance and Cleaning5.2 设备的保养和清洁5.3 Calibration5.3 校验5.4 Computerized Systems5.4 计算机系统6 Documentation and Records6 文件和记录6.1 Documentation System and Specifications6.1 文件系统与规格标准6.2 Equipment Cleaning and Use Record6.2 设备清洁和使用记录6.3 Records of Raw Materials, Intermediates, API Labelling and Packaging Materials 6.3 原料、中间产品、原料药的标签和包装材料的记录6.4 Master Production Instructions (Master Production and Control Records)6.4 生产指令(生产和控制记录)6.5 Batch Production Records (Batch Production and Control Records)6.5批生产记录(批生产和控制记录)6.6 Laboratory Control Records6.6 实验室控制记录(批检验记录)6.7 Batch Production Record Review6.7批生产记录审核7 Materials Management7 物料管理7.1 General Controls7.1 控制通则7.2 Receipt and Quarantine7.2 接受和待检7.3 Sampling and Testing of Incoming Production Materials7.3 到货物料的取样和检测7.4 Storage7.4 贮存7.5 Re-evaluation7.5 再评估8 Production and In-Process Controls8 生产和过程控制8.1 Production Operations8.1 生产操作8.2 Time Limits8.2 时间限制8.3 In-process Sampling and Controls8.3 中控取样和控制8.4 Blending Batches of Intermediates or APIs8.4 中间产品和原料药的混批8.5 Contamination Control8.5 污染控制9 Packaging and Identification Labelling of APIs and Intermediates 9 中间产品和原料药的包装和贴签9.1 General9.1 总则9.2 Packaging Materials9.2 包装材料9.3 Label Issuance and Control9.3 标签放行和控制9.4 Packaging and Labelling Operations9.4 包装和贴签操作10 Storage and Distribution10 贮存和销售10.1 Warehousing Procedures10.1 入库程序10.2 Distribution Procedures10.2 销售程序11 Laboratory Controls11 实验室控制11.1 General Controls11.1 控制通则11.2 Testing of Intermediates and APIs11.2 中间产品和原料药的检测11.3 Validation of Analytical Procedures11.3 分析方法的验证11.4 Certificates of Analysis11.4 分析报告11.5 Stability Monitoring of APIs11.5 原料药的稳定性监测11.6 Expiry and Retest Dating11.6 失效和复检日期11.7 Reserve/Retention Samples11.7 留样12 Validation12 验证12.1 Validation Policy12.1 验证方针12.2 Validation Documentation12.2 验证文件12.3 Qualification12.3 确认12.4 Approaches to Process Validation12.4 工艺验证方法12.5 Process Validation Program12.5 工艺验证计划12.6 Periodic Review of Validated Systems12.6 验证系统的定期审核12.7 Cleaning Validation12.7 清洁验证12.8 Validation of Analytical Methods12.8 分析方法验证13 Change Control13 变更控制14 Rejection and Reuse of Materials14 物料的拒收和再利用14.1 Rejection14.1 拒收14.2 Reprocessing14.2 返工14.3 Reworking14.3 重新加工14.4 Recovery of Materials and Solvents14.4 物料和溶剂的回收利用14.5 Returns14.5 退回15 Complaints and Recalls15 投诉和召回16 Contract Manufacturers (including Laboratories)16 合同生产企业(包含实验室)17 Agents, Brokers, Traders, Distributors, Repackers, and Relabellers 17 代理商、经纪商、贸易商、经销商、重新包装商和重新贴签商17.1 Applicability17.1 适用性17.2 Traceability of Distributed APIs and Intermediates17.2 已销售中间产品和原料药的追踪17.3 Quality Management17.3 质量管理17.4 Repackaging, Relabelling and Holding of APIs and Intermediates 17.4 中间产品和原料药的重新包装、重新贴签和处理17.5 Stability17.5 稳定性17.6 Transfer of Information17.6 信息的传输17.7 Handling of Complaints and Recalls17.7 投诉和召回的处理17.8 Handling of Returns17.8 退货的处理18 Specific Guidance for APIs Manufactured by Cell Culture/Fermentation 18 用于细胞培养/发酵而得原料药的特殊指南18.1 General18.1 总则18.2 Cell Bank Maintenance and Recordkeeping18.2 细胞库的维护和记录保存18.3 Cell Culture/Fermentation18.3 细胞培养/发酵18.4 Harvesting, Isolation, and Purification18.4 收获、分离和精制18.5 Viral Removal/Inactivation Steps18.5 病毒除去/灭火步骤19 APIs for Use in Clinical Trials19 用于临床试验的原料药19.1 General19.1 总则19.2 Quality19.2 质量19.3 Equipment and Facilities19.3 设备设施19.4 Control of Raw Materials19.4 原料的控制19.5 Production19.5 生产19.6 Validation19.6 验证19.7 Changes19.7 变更19.8 Laboratory Controls19.8 实验室控制19.9 Documentation19.9 文件20 Glossary20 词汇表1 Introduction1 介绍This guideline was published in November 2000 as Annex 18 to the GMP Guide reflecting the EU’s agreement to ICH Q7A and has been used by manufacturers and GMP inspectorates on a voluntary basis. Article 46 (f) of Directive 2001/83/EC and Article 50 (f) of Directive 2001/82/EC; as amended by Directives 2004/27/EC and 2004/28/EC respectively, place new obligations on manufacturing authorisation holders to use only active substances that have been manufactured in accordance with Good Manufacturing Practice for starting materials. The directives go on to say that the principles of Good Manufacturing Practice for active substances are to be adopted as detailed guidelines. Member States have agreed that the text of former Annex 18 should form the basis of the detailed guidelines to create Part II of the GMP Guide.本指南已经在2000年11月以GMP指南附录18的形式公布过,它反应了欧盟对ICH Q7A的认可以,该指南已经被生产商和GMP检查员在自愿的原则下所使用。

以下内容原文FDA官网网址:/ForIndustry/UserFees/GenericDrugUserFees/ucm322629.htmGeneric Drug User Fee Cover Sheet and Payment Information仿制药费用封面页和支付信息The Generic Drug User Fee Amendments of 2012 authorizes FDA to assess and collect user fees for human generic drug applications, certain application supplements, and related manufacturers. Form FDA 3794, also known as the Generic Drug User Fee Cover Sheet or GDUFA Cover Sheet, is designed to collect the minimum necessary information to determine the total applicable user fee required and to help FDA track the user fee payments. Furthermore, FDA’s review of a generic drug submission cannot begin until all relevant user fee obligations have been satisfied.2012仿制药用户费用修正案赋予了FDA权利评估和收取人用仿制药申请、特定的申请增补和相关生产商用户费用。

为此FDA设计了3794表格,即GDUFA封面页,用于收集基本信息以决定总的用户费用,并帮助FDA跟踪用户费用的支付。

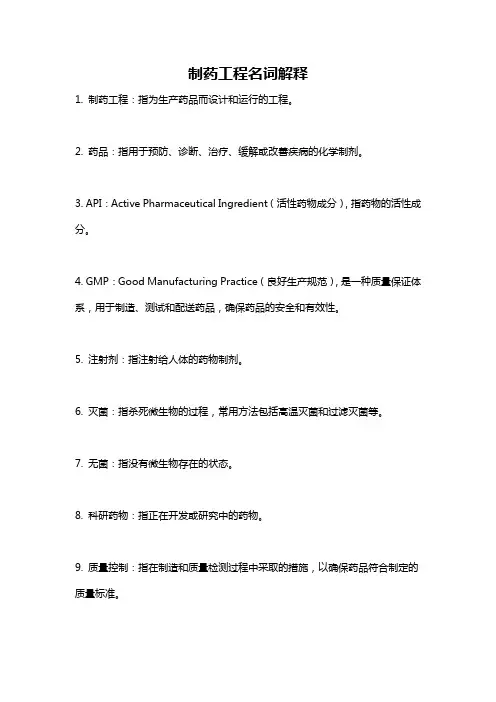

制药工程名词解释

1. 制药工程:指为生产药品而设计和运行的工程。

2. 药品:指用于预防、诊断、治疗、缓解或改善疾病的化学制剂。

3. API:Active Pharmaceutical Ingredient(活性药物成分),指药物的活性成分。

4. GMP:Good Manufacturing Practice(良好生产规范),是一种质量保证体系,用于制造、测试和配送药品,确保药品的安全和有效性。

5. 注射剂:指注射给人体的药物制剂。

6. 灭菌:指杀死微生物的过程,常用方法包括高温灭菌和过滤灭菌等。

7. 无菌:指没有微生物存在的状态。

8. 科研药物:指正在开发或研究中的药物。

9. 质量控制:指在制造和质量检测过程中采取的措施,以确保药品符合制定的质量标准。

10. 药品注册:指将新药申请注册并获得批准,使其能够合法地在市场上销售和使用的过程。

肿瘤项目递交nda流程相关法规肿瘤项目递交NDA(New Drug Application)是一个复杂的过程,涉及多个相关法规和指南。

以下是一些重要的法规和指南,以及它们在肿瘤项目递交NDA流程中的作用。

1. 《美国联邦食品、药品和化妆品法》(FD&C Act)FD&C Act将FDA(美国食品药品监督管理局)授权为美国唯一的药品监管机构。

在该法律的规定下,任何药品(包括肿瘤治疗药物)必须经过FDA的批准后才能在美国市场上销售。

该法案还规定了FDA的职责和权限,包括审批NDA,并确保药品的质量、安全和有效性。

2. 政府协调委员会(Government Coordinating Committee,GCC)GCC是由FDA、国立卫生研究院(National Institutes of Health,NIH)和其他联邦机构组成的协调机构。

对于某些肿瘤治疗药物,GCC可以提供有关数据和材料,以协助NDA的评估。

3. 《食品药品监督管理局指南》(FDA Guidance)FDA发布了多个指南来帮助公司在NDA递交过程中符合其要求。

这些指南涵盖了许多主题,例如药品研发、临床试验和药品评估。

一些与肿瘤项目相关的指南包括:- 活性药物成分(API)制造工艺验证指南:提供有关API生产过程验证的指导。

- 临床试验中的安全监测指南:概述了在临床试验期间监测安全的最佳实践。

- 肿瘤学药物评价的临床开发阶段指南:详细介绍了在肿瘤学领域内设计和执行临床试验的最佳实践。

4. 活性物质成分(API)制造质量规范(Current Good Manufacturing Practice,cGMP)cGMP是一套与药品生产质量有关的标准,旨在确保API的质量、安全和有效性。

在NDA递交过程中,公司需要提供API的cGMP证明以证明其质量和稳定性。

5. 预防性控制措施规范(Current Good Manufacturing Practice for Prevention of Contamination,cGMP)cGMP还包括一套与预防药品污染有关的标准,旨在确保产品在生产、包装和运输过程中不会受到污染。

发酵制备api工艺发酵制备API工艺一、引言API(Active Pharmaceutical Ingredient,活性药物成分)是指药物中具有治疗活性的成分,是药物的核心部分。

发酵制备API是指利用微生物发酵过程合成API的一种方法。

本文将介绍发酵制备API的工艺及其应用。

二、发酵制备API的原理发酵制备API的原理是利用微生物(如细菌、真菌等)在适宜的环境条件下进行代谢活动,产生API的前体物质,经过一系列的转化反应,最终得到纯净的API。

发酵过程中,微生物通过对底物的代谢,可产生多种代谢产物,其中包括目标API。

三、发酵工艺的步骤1. 选材:选择适宜的微生物菌株作为发酵产生API的工具。

选择菌株时需要考虑其代谢特性、生长速度、抗污染能力等因素。

2. 培养基配置:根据菌株的需求,配置适宜的培养基,包括碳源、氮源、微量元素等。

培养基的配方对发酵产物的质量和产量有重要影响。

3. 发酵罐的设计与操作:根据菌株的特性和发酵过程的需求,设计合适的发酵罐,包括容积、搅拌方式、通气方式等。

控制发酵罐内的温度、pH值、溶解氧等参数,保证最佳的发酵条件。

4. 发酵过程的监测与控制:通过监测发酵过程中的关键指标,如微生物生长曲线、底物消耗速率、产物积累速率等,及时调整发酵条件,提高API的产量和纯度。

5. 发酵液的分离与提取:发酵液中含有大量的微生物细胞和杂质,需要进行分离与提取。

常用的方法包括离心、过滤、萃取等。

6. API的纯化与结晶:通过一系列的分离和纯化步骤,得到目标API的纯品。

其中包括溶剂提取、色谱层析、结晶等。

四、发酵制备API的优势1. 可选择性强:通过选择不同的微生物菌株和培养条件,可合成多种不同结构的API。

2. 生产成本低:相比于化学合成方法,发酵制备API的原料来源广泛,成本较低。

3. 环境友好:发酵制备API的过程中不需要大量使用有机溶剂等有害物质,对环境污染较小。

4. 产物纯度高:发酵过程中微生物对底物的选择性强,产物纯度较高。

1. 目的本规范规定了用于石油和天然气工业的自由锻成型锻件的生产要求,作为生产过程的依据,以保证石油和天然气工业用自由锻件按照要求进行制造,确保产品质量符合要求。

2. 适用性本规范适用于石油和天然气工业用自由锻成型锻件的生产过程控制,其它用途的锻件生产过程控制也可参照使用。

3. 锻件规范等级(FSL)4. 参考文件下列参考文件凡是注日期的文件,只有注日期的版本适用于本文件。

凡是不注日期的参考文件,其最新版本(包括增补部分)适用于本文件。

API 6A 第20版井口装置及采油树设备规范API 20B 石油和天然气工业用自由锻成型锻件ASTM A105 管道部件用碳钢锻件标准规范文件号:API 20B产品制造规范生效日期2011年12月8日版本号:ASTM A182 高温用锻制或轧制合金钢和不锈钢管法兰、锻制配件、阀门及部件标准规范ASTM A29 热锻碳钢和合金钢棒材一般要求标准规范ASTM A350 要求缺口韧性试验的管道部件用碳钢和低合金钢锻件标准规范ASTM A434 热轧和冷加工调质处理的合金钢棒材标准规范ASTM A694 高压传输用管法兰、配件、阀门和零件用碳钢和合金钢锻件标准规范ASTM A705 时效硬化不锈钢锻件标准规范5. 名词术语5.1炉(冶炼炉)从同一炉最终熔炼出的材料,或对于重熔合金而言,为从同一根重熔锭块生产的原材料。

5.2自由锻造在平砧上或异形砧子间对金属进行热机械成形的过程,其不对金属流向有严格限制。

5.3热锻比(锻造比)每次热锻操作时横截面变化率。

例如,除了墩粗锻件外,可使用如下公式计算单次热锻操作时的热锻比。

热锻比=此处A f最终横截面面积A i最初横截面面积对于墩粗锻件,可使用如下公式计算单次热锻操作时的热锻比墩粗热锻比=此处A f最终横截面面积A i最初横截面面积h f最终锻件高度h i最初锻件高度总热锻压下量指从钢材(原材料)横截面到最终锻造横截面的锻造过程中,每个锻造工序的单个产品的压下量。

automatically authorise api orders -回复如何自动化授权API订单在当今数字化时代,企业和组织之间的数据集成和系统连接变得越来越重要。

为了实现更高效的业务流程和数据交换,许多企业选择使用应用程序编程接口(API)进行数据传输和交互。

然而,手动授权和管理API订单仍然是一项耗时且容易出错的任务。

因此,自动化授权API订单变得至关重要。

本文将一步一步回答如何实现自动化授权API订单的方法和步骤。

第一步:理解API订单授权在开始自动化授权API订单之前,首先需要明确了解API订单授权的概念。

API订单授权是指验证和授予访问API所需的权限和凭据。

通常,企业需要为每个API用户或服务生成令牌或密钥,以确保仅授予有权访问和使用API的个体。

授权API订单有助于保护数据的安全性和隐私,并确保只有授权人员可以访问和使用API。

第二步:选择适当的授权方法在自动化授权API订单之前,需要选择适当的授权方法。

有许多不同的授权方法可供选择,包括基于角色的访问控制(RBAC),基于OAuth的授权和令牌验证等。

根据组织的需求和业务场景,选择最适合的授权方法非常重要。

基于角色的访问控制(RBAC)是一种常用的授权方法,它基于用户角色和权限级别来授予对API的访问权限。

管理员可以在系统中创建不同的角色,并为每个角色指定不同的API访问权限。

这种方法提供了更细粒度的授权控制,并允许根据用户的角色调整和更新API访问权限。

OAuth是一种用于授权和认证的开放标准,它允许用户使用第三方应用程序来访问其保护的资源,而无需共享其凭据。

OAuth提供了一种安全且可靠的方法来授权API访问。

通过使用OAuth,用户可以在不直接共享其凭证的情况下授权第三方应用程序访问其API。

令牌验证是一种简单而有效的授权方法,它涉及为每个API用户生成唯一的令牌。

在每个API请求中,用户需要提供令牌作为身份验证凭据。

服务器会验证令牌的有效性,并授予请求访问API的权限。

药检员面试自我介绍英文回答:My name is [Your Name], and I am applying for the position of Drug Inspector. I have [Number] years of experience in the pharmaceutical industry, and I am confident that I have the skills and qualifications necessary to be successful in this role.I am responsible for conducting inspections of pharmaceutical manufacturing facilities to ensure that they are in compliance with current Good Manufacturing Practices (cGMPs). I have experience in conducting inspections of all types of pharmaceutical manufacturing facilities, including API manufacturers, drug product manufacturers, and contract manufacturing organizations.I am familiar with the relevant regulations and guidelines, and I have a strong understanding of the cGMPs and the principles of quality assurance. I am alsoproficient in the use of various inspection techniques and equipment.In my previous role, I was responsible for conducting a wide range of inspections, including pre-approval inspections, routine inspections, and for-cause inspections.I have also participated in several investigations of manufacturing deviations and product recalls.I am a highly motivated and results-oriented individual.I have excellent communication and interpersonal skills,and I am able to work effectively in a team environment. I am confident that I can use my skills and experience to bea valuable asset to your team.中文回答:我叫[您的姓名],我申请的是药检员的职位。

智能制造,作为新一代制造业的核心竞争力,正在为企业提供更高效、灵活和可持续发展的解决方案。

而工业物联网和工业互联网则是智能制造领域重要的支撑技术之一。

在工业物联网与工业互联网的建设实践中,开放API(Application Programming Interface)的应用正发挥着重要的作用。

工业物联网和工业互联网旨在实现设备、系统及企业之间的无缝连接和协同作业,以提高生产效率和降低成本。

而在这个过程中,开放API的作用可以说至关重要。

首先,开放API能够实现信息的共享和交流。

在智能制造中,涉及到众多的设备、系统和平台,它们之间的信息交互是必不可少的。

通过开放API,不同设备和平台之间的数据可以实现共享和交流,从而促进设备之间的协同作业和智能化决策。

例如,工业机器人可以通过开放API获取其他设备的生产数据,根据实时数据进行智能调度和优化,提高生产效率和质量。

其次,开放API能够促进系统的集成和扩展。

在智能制造中,企业应用的系统可能是多样化的,涉及到生产计划、物料管理、质量控制等方面。

通过开放API,这些系统可以实现无缝集成和扩展,实现数据的互通互联。

这样一来,企业可以根据自身需求选择和搭配最适合的系统,实现个性化和定制化的生产管理。

同时,企业可以利用开放API,将外部的优质资源整合进来,实现资源共享和协同创新。

例如,企业可以利用开放API将供应商的信息整合进来,实现生产计划的实时调整和供应链的优化。

此外,开放API还可以为智能制造提供更广阔的应用场景。

通过开放API,企业可以将智能制造的技术和服务扩展到更多的领域,实现产业互联网的发展。

例如,通过开放API,智能制造技术可以与物流、金融、营销等领域进行深度融合,打造出更具竞争力的解决方案。

同时,通过开放API,企业可以将智能制造的技术和服务向外延伸,为其他企业和行业提供支持和合作机会,实现多方共赢。

例如,智能制造企业可以通过开放API与其他企业合作,将自己的生产资源和服务延伸到其他行业,实现更大范围的价值创造。

FeaturesAPI ManufacturingBy George Karris | August 22, 2005How will changes in India and China affect API outsourcing? Related FeaturesThe role of active pharmaceutical ingredient (API) manufacturers in the pharmaceutical industry supply chain is evolving in response to newfound demands from customers and growing pressures from global competitors. Increasingly, innovators (marketers of brand drugs, as opposed to generic drug companies) are looking beyond their usual group of closely-knit European suppliers. Meanwhile, traditional generic companies are looking to India and China for bulk actives, while specialty pharma companies have generated new demands for more specialized capabilities than those required by traditionalgenerics. In order to remain competitive, API manufacturers will need to attune themselves to this evolving landscape.Historically, innovators have relied on a small number of suppliers with which they work confidentially. Innovators frequently opt to perform the final stages of API synthesis themselves, outsourcing (at most) the production of late stage intermediates. While this pattern continues to predominate, innovators have begun to look beyond their current European suppliers to realize benefits from partnerships with Indian and Chinese API manufacturers. In many cases the opportunity to leverage existing European relationships with Indian process chemistry can create a more complex, but ultimately more responsive andcost-effective supply chain. A recent example, cited in the March 18, 2002 issue of Chemical &Engineering News, is Solvay's sourcing of eprosartan mesylate, an antihypertensive marketed under the brand name Teveten in the U.S.Solvay's first source for eprosartan is Lonza, a Swiss company known for high quality custom synthesis, and one that has long been known for supplying innovators. However, Solvay also performed process development work in India with a relatively obscure API manufacturer known as Dishman Pharmaceuticals and Chemicals, which ultimately ended up serving as a second source for Solvay. Solvay executives claimed that working in India helped the company achieve significant cost savings and, as a result, Dishman, a company that had one drug master file (DMF) as of 2001, is now a second source of an important new product.Several factors make India an attractive alternative for sourcing active ingredients. India has low development costs, complex synthesis capabilities, growing experience with cGMP compliance, and a large local dose market in which to gain experience. India is also known for having a large number of strong chemists, many with Ph.D.s from the U.S. and Europe, providing rapid, and creative, process development. With these resources, Indian companies can tackle complex syntheses in relatively short periods of time. Such responsive and well-staffed development teams have prompted Reddy-Cheminor, for example, to claim a development speed twice that of any U.S. or European company. Further, India's lax patent laws have resulted in strong domestic demand for many finished dose products, giving API and dose form manufacturers more experience with a product over a longer period of time than manufacturers in regulated countries. In fact, new drugs are often launched early, if not first, in India. Thus, India has established itself as a source for both complex synthetic activeingredients and finished dose form products in regulated and unregulated markets.China is also rapidly evolving into a viable source for key intermediates and actives. In the late 1980s and early 1990s, most Chinese factories were communist-controlled, and made large volumes of low cost drugs, with many focusing on fermentation products or simple synthetic compounds. Today, the climate in China is very different. This is a result of China's overall economic evolution and entrance into the World Trade Organization, which is expected to expose domestic manufacturers to significantly more competition. As a result, custom manufacturing, which was once illegal in China, is now seen as the most effective way to accelerate the learning curve to producing high quality pharmaceuticals for regulated markets. Both public and private factories are eager to work with western partners and gain the expertise necessary to meet their exact specifications and achieve goals of greater technical skill and increased profitability. Thus, factories are modernizing rapidly, purchasing both technology and expertise in the form of western consultants. However, it is worth noting that the Chinese tend to see custom manufacturing as a step towards achieving their own goals, and western companies are therefore advised to be extremely cautious regarding the transfer of intellectual property to China.As India and China have begun to offer higher quality APIs and intermediates for regulated markets, innovators have started to look to these countries for late stage intermediates, and in some cases have formed joint ventures with local manufacturers. More frequently, innovators use their traditional European custom manufacturers for the finished API or key intermediate, while these manufacturers rely on Indian and Chinese partners in turn for earlier stage intermediates. The especially risk-averse profile of innovator companies with regard to outsourcing suggests that high quality European bulk manufacturers are likely to continue supporting innovator companies for the foreseeable future, but they may increasingly partner with late stage intermediate suppliers in countries with lower development and production costs. DSM, for example, has a subsidiary in China, as do several other high quality custom manufacturers. Thus, China and India are playing a role in innovator outsourcing, both directly and indirectly.Generic pharmaceutical companies, on the other hand, have been far more eager to work directly with China and India, as the strategic sourcing of active ingredients is a necessity for profitability, whileintellectual property protection is less of a concern than it is for the patent holders. Manufacturers of generic oral solids, on average, have between 40 and 50% of their cost of goods sold tied up in raw material costs. In a highly contested market where the ability to offer a low price is critical, generic manufacturers seek competitive advantages by finding reliable bulk manufacturers who can deliver at a low cost.Historically, generic companies (and innovators) have sourced active ingredients from European manufacturers. However, European manufacturers have found themselves constrained by Supplementary Protection Certificates (SPCs) and other regulatory limitations, and have significantly higher R&D and production costs than those of India or China. Although European bulk manufacturers offer complex synthesis capabilities, strong process chemistry, creativity and expertise on par with (or superior to) those of Indian manufacturers, traditional generic companies are more likely to identify the lowest cost provider that meets their needs. Such "traditional" generic companies focus on blockbuster products and then compete with each other on price until only the companies with the very lowest cost basis can survive. For this reason, generic companies source from India fairly frequently, and are beginning to explore China as a source of bulk actives and intermediates as well.Indian companies have become quite proficient at manufacturing to FDA cGMPs, meeting the regulatory needs of U.S. generic companies, and marketing their bulk actives to a worldwide audience. Several of the leading Indian companies have extremely capable dose form manufacturers, with Reddy-Cheminor and Ranbaxy successfully competing in the U.S. generic market (on traditional generics as well as patent challenges and branded generics). Indian manufacturers have therefore proven their ability to take a product from API to finished dose form at a level of quality suitable for use in regulated markets. In the future, if this ability is combined with the low manufacturing costs available in China, there is the potential to create an extremely competitive force in the generic market of the future. An API manufacturer that combines the low R&D costs of India with the low manufacturing costs of China would produce active ingredients at an exceptional price. Further, if this API manufacturer were to vertically integrate with a dose form manufacturer, it would be able to supply generic products at a price unbeatable by competitors working in a more standardized way.Collaboration between Indian processchemists and Chinese manufacturers isalready beginning. For example, Enmarkof India has partnered with ZhejiangHisun Pharmaceutical in China, providingprocess chemists to work with Hisun'sR&D group on the synthesis of a keyintermediate for a high-value API. TheEnmark team has delivered advancedchemical synthesis capabilities, while Hisun (an FDA-inspected facility) is expected to deliver the intermediate at a cost that the two companies expect willallow them to be an attractive worldwide supplier. This is significant because previously, the intermediate was available only from a single, high-priced, Japanese source. Both Indian and Chinese companies expect this first project to set the stage for future collaborations. This example demonstrates that new, highly efficient, and extremely low cost API manufacturers may begin to surface as a result ofpartnerships between Indian and Chinese companies. For APImanufacturers, these partnerships create a newfound need to either try to compete with such companies on cost or, in contrast, provide anextremely high level of custom synthesis capabilities. Further, should such an API manufacturer combine with a traditional generic company supplying the U.S. market (perhaps one based in India), other generic companies will be hard pressed to compete. Thus, largepharmaceutical concerns that capitalize on Indian and Chinesestrengths may be in the best position to serve the global, traditional generic pharmaceutical market in the future by churning out highvolumes at low cost based on Indian chemistry and Chineseproduction.While the traditional generic and API industry is likely to be strained significantly by these changes, the generic industry is evolving andgenerating unique opportunities for API manufacturers willing to offer specialized services. The best generic companies are developingexpertise in patent challenges, unique formulations, and developing strengths in specific therapeutic categories —becoming specialtypharma companies rather than traditional generics. These strategically focused generics require far more innovative, dynamic and responsive bulk suppliers.The Waxman-Hatch Act's promise of 180 days of exclusivity for first successful generic patent challenges has resulted in specialty pharmaPhoto courtesy of RegisTechnologiescompanies investing heavily in being first to file and in circumventing patents. The need to be first to file requires specialty pharma companies look at developing products earlier than ever, and requires a great deal of confidential development work from API manufacturers supporting this development. For example, paragraph IV (patent challenge) Abbreviated New Drug Applications (ANDAs) for olanzapine were filed by Ivax, as well as Reddy-Cheminor and Par Pharmaceuticals, approximately 10 years prior to the expected 2011 patent expiry. The API manufacturers supporting these challenges were working to synthesize the active well before the patent challenges were filed, and long before demand for the active existed in regulated markets. The great expense that goes into a patent challenge means that API suppliers working in support of such challenges must be extremely reliable, sophisticated and capable of working on a highly confidential and exclusive basis.The API manufacturer's role in product development is also increasingly significant. As the timing of paragraph IV filings is critical, so is the need to maintain a low profile until the ANDA is ready. During the period before an ANDA is filed, it is essential for a specialty pharma company to remain secretive about the products and patents it is challenging. Leaking such information can potentially provide competitors with information on the status of an ANDA filing, and the details of a patent challenge strategy. Historically, the filing of DMFs has been a signal to the industry that an ANDA can be, or is about to be, filed. While the filing of a DMF (with most products) is likely to be an indication that an API manufacturer is ready to supply regulated markets, with certain products the filing of an early DMF is likely to indicate that a paragraph IV challenge is on the way. The most sophisticated partnerships between API manufacturers and specialty pharma companies are able to file DMFs just as they are to be reviewed within the ANDA, providing little or no warning to competitors as to the existence of their challenge until it has been filed. These tactics require extreme confidence that regulatory filings will be completed appropriately and on time, resulting in specialty pharma companies relying increasingly on a small group of experienced API sources, in a fashion similar to innovators.Further, the API manufacturer may play a critical role in the patent challenge process. Beyond the ability to creatively circumvent process patents, the creative development of active ingredients may become fundamental to the patent challenge itself. Anhydrous and mesylate versions of paroxetine are examples of patent challenges that are based on new syntheses and novel processes developed using theexpertise of API manufacturers. As patent challenges become more frequent, the capabilities to support such challenges will increasingly be in demand. And, given the level of competition surrounding being first to file, insight into the products API manufacturers are developing can provide an extremely useful piece of competitive intelligence. On the other hand, identifying bulk manufacturers able to support product development in secrecy becomes even more critical to specialty pharma companies.In addition to supporting patent challenges, API manufacturers are also supporting specialty pharma companies in a more traditional manner, by exclusively supplying difficult to source products. The role of active ingredients as a barrier to entry is well known, but more and more specialty pharma companies are looking to identify hard-to-source, niche products as a way to balance a portfolio subject to the volatility of patent challenges and branded generics.There are several forces combining to change the role of API manufacturers in the pharmaceutical industry: India has evolved into a viable source of active ingredients (and dose form products) for regulated markets that can offer strong process chemistry at a very low cost. China has begun the process of privatization and has become a more viable low cost supplier of intermediates and several bulk actives. Cutting edge generic companies have evolved into a new specialty pharma industry that places demands on API manufacturers increasingly akin to those of innovators. Based on these trends, the API industry is likely to evolve into three segments in accordance with the evolution of three primary customers for bulk actives.The first segment is the contract manufacturers who have historically worked closely with innovators and are likely to continue theseclose-knit relationships in the future. These manufacturers, who are largely European, are increasingly likely to look to India and China for intermediates, but are apt to manage final stages themselves. Innovators, while looking beyond traditional sources in some instances, are likely to maintain these relationships for the reliability and high quality service they provide. This is especially the case when products are pre-launch and/or early in their life cycles, as innovators are less likely to take any risks in API sourcing when production and quality control are most critical. As a product reaches the end of its life cycle, a greater number of sources for actives and/or intermediates may be evaluated, and innovators may look beyond their traditional suppliers. The second segment is comprised of API manufacturers that alignthemselves with the specialty pharma industry. Manufacturers that can support the unique needs of these customers—supporting patent challenges, synthesizing rare active ingredients, and working under contract—are finding a new niche where high value services are necessary.The third segment is the providers of more common, readily availablebulk actives, who have historically looked to support the genericindustry. This segment is likely to undergo a great deal of change in thefuture as Indian and Chinese collaboration builds. In fact, as such collaborations drive prices downward, it is difficult to imagine howEuropean API manufacturers will survive if they are not engaged inhigher value work with either innovators or specialty pharmacompanies. Competing in this segment will require producing highvolumes at low costs, and may force many API manufacturers to focuson niche products for which demand is too low to interestIndian/Chinese manufacturers.The role of active ingredient manufacturers in the pharmaceuticalindustry is rapidly changing and can be expected to evolve even morein the future. Biotechnology, for example, is still in its infancy, and maycreate fundamental changes both with finished products and thedefinition of an active ingredient. The pharmaceutical industry isconstantly in flux: changes in the complexity of pharmaceuticals,competitive pressures from India and China, and new developments inthe dose form markets due to new legislation all influence API manufacturers. As the pharmaceutical industry evolves, the mostsuccessful API manufacturers will be those that are able to quicklyadapt to industry needs and global pressures.- See more at: /issues/2002-09/view_features/api-manufacturing/#sthas h.XspHDBfR.dpuf。