Chapter 1 Foreign Exchange & Exchange Rate(国际金融国家级课程上海金融学院)

- 格式:ppt

- 大小:755.50 KB

- 文档页数:47

银行英语会话(MP3+中英字幕) 第3课:兑换外币Foreign ExchangeLesson 3 Foreign Exchange兑换外币Key Sentences重点句型Today's exchange rate of RMB to USD is 812 RMB yuan equal to 100 US dollars.今天的汇率是812元人民币兑100美元.What kind of foreign currency have you got?What's the exchange rate today?您持有什么外币?今天的汇率是多少?What kind of currency do you want to change?您想换哪一种外币?Please keep check the money and keep the exchange memo.Sorry you've filled a wrong account number Please refill it.请点清钞票,保存好水单.抱歉,您的账户不对,请重新填写.What is the equivalent of five dollars in RMB yuan?五美元相当于人民币多少元?We list the exchange rate issued by the People's Bank of China every morning.我们是根据每天早上中国银行发布的汇率挂牌的.What are you going to convert,bank notes or traveller's checks?你要兑换什么,是现钞还是旅行支票?Dialogue 1 A:Excuse me.B:Can I help you?对话1 劳驾.您要什么服务?A:I want to change some US dollars into RMB.我想把美元换成人民币.B:Of course.当然行.We are an authorized foreign exchange bank and can change them for you.我们是指定经营外汇业务的银行.能够为您兑换.How much do you want to change?您要换多少?A:Let me see.Fifty US dollars.B:Very well,sir.让我想想,五十美金.好的,先生.Notes I want to change some US dollars into RMB.我想把美元换成人民币.动词change译为兑换或换成零钱,例如 Where can I change my dollars for pounds?请问我可在哪儿将美元兑换成英镑。

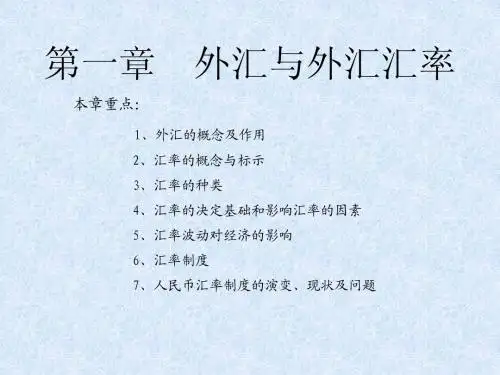

Syllabus of International Economics and Trade Names of Main Courses:1.International Clearance2.International Finance3.A Brief Introduction of International Trade4.International Trade Practice5.Customs Clearance Practices6.Management and Practice of Multinational Company7.Business Correspondence8.Trade negotiations9.Western EconomicsSyllabus of International FinanceFor: International Economics and TradeTotal Class Hours: 54Aims:This course introduces students to International Finance and equips them with basic concepts, and methods to study and analyze international economic issues and problems. It will lay a hard foundation for on Finance study and work in the future.Prerequisites:1.To understand properties, tasks and its researching targets; its system,structure overall2.To grasp basic concepts and theories, basic principles and methods,and development of international finance3.To learn to apply theories and principles to practice and analyzefinancial problems and specific cases with relevant theories.Teaching Mode:Lectures and case studyCourse Contents:Chapter one Foreign Currency and Exchange Rate1.1Definition and categories of currency1.2Definition, exchange quotation and categories of currency Rate1.3Currency basis and main factors affecting it1.4Function of currency changes to economyKey points and Difficulties:Exchange Quotation; main factors and functions of currency and currency changeChapter Two Currency System and Exchange Control2.1 Categories of currency system2.2 Fixed exchange rate and floating exchange rate2.3 History and purpose of exchange control2.4 Measures of exchange control2.5 Functions of exchange control2.6 Evolution and contents of foreign currency management in China2.7 RMB exchange rate system and its theoretical parityKey points and difficulties:Fixed exchange rate system and floating exchange rate system; pegging exchange rate, exchange control, complex exchange rate system, evasion, and arbitrage and Currency convertibilityChapter Three Foreign Exchange Market and Foreign Exchange Transactions3.1W hat is foreign exchange market3.2M ajor international markets and their transaction systems3.3T ransaction means3.3.1Spot transactions and forward transactions3.3.2Arbitrage trading and arbitrage trading3.3.3Swap3.3.4Foreign exchange futures and optionsKey points and difficulties:Foreign exchange market, foreign transaction, spot transaction and forward transaction; arbitrage trading and arbitrage trading, swap, foreign exchange futures and optionsChapter Four Foreign Exchange Risk Management4.1 What is exchange risk4.2 Causes and measures of exchange risk4.3 Enterprise Foreign exchange risk management approaches4.4 Bank Foreign exchange risk management approachKey points and difficulties:Recognize and measure all kinds of risks of foreign exchange and management approachesChapter Five International balance of payments5.1 What is international balance of payments5.2 Economic functions fo balance of payments5.3 Imbalance of international payments and its function5.4 Adjustment methods of imbalance of international paymentsKey points and difficulties:International balance of payments and its preparing methods; causes of imbalance and its functions to economy and adjustment methodsChapter Six International Reserves6.1 What are international reserves6.2 Management principles and policy options of international reserves 6.3 international reserves management in ChinaKey points and difficulties:International reserves, international liquidity, foreign exchange reserves, SDR; management principles and its functions,management principles in ChinaChapter Seven International Financial Markets7.1 What are international financial markets7.2 Classifications of international financial markets7.2.1 Foreign exchange market7.2.2 Money market7.2.3 Capital markets7.3 What are money markets in Europe7.4 Financial derivatives market7.4.1 Financial futures markets and futures trading rules7.4.2 Financial options market and options trading rulesKey points and difficulties:International financial markets, foreign exchange market, money markets, capital markets, money markets in Europe, offshore financial markets, financial derivatives; differences between offshore financial markets and traditional financial markets; financial derivatives trading rules and its supervision.Chapter Eight International Capital Flows8.1 What is international capital flows8.2 Benefits and risks of international capital flows8.3 International debt and its measurement index8.4 Causes and solutions of international debt crisis8.5 International capital flows and financial crisis in developing countries Key points and difficulties:Categories, contents and features of international capital flows; benefits and risks of international capital flowsChapter Nine International Settlement9.1N otes and documents in international settlement9.2M eans of international settlementKey points and difficulties:Categories and definitions of notes and documents in international settlement; different settlement means and usage; general business credit, standby letters of credit and bank guaranteeChapter Ten International Monetary Systems10.1 What are international monetary systems10.2 International monetary system10.2.1 International gold standard10.2.2 Bretton Woods system10.2.3 Jamaica monetary system10.3 Regional monetary system10.3.1 Effect of European Monetary System and European Monetary Union on economy10.4 Functions of European financial institutions in international monetary systemKey points and difficulties:International gold standard, Bretton Woods system, Jamaica monetary system, European Monetary Union, Euro; requirements of developing countries to international monetary system; History of Euro and its functions to world economyChapter Eleven International Finance Theory11.1 International balance of payments theory11.2 Exchange Rate Theory11.3 Theory of international capital flowsKey points and difficulties:Typical views on international balance of payments theory, such as Mercantilism’ theory of the balance of trade, Hume’s Price-cash flow mechanism; Purchasing power parity, psychological exchange, Export of capital, Capital input, Theory of capital controlsClass hour allocation:5 hours per chapter(4 hours for Chapter 11 only), totally 54 hours.Main references:Biaoru, C. (1990). Introduction of International Finance. Shanghai: Huadong Normal University Press.Obstfeld, P. R. K. M. (1998). International Economics. Beijing: Renmin University of China Press.Salvatore, D. (1998). International Economics. Beijing: Qinghua University Press.Shunian, L. (1995). International Finance. Beijing: International Business and Economics University Press.Xiang, T., & Yulu, C. (1996). International Finance and Management.Beijing: Renmin University of China Press.Syllabus of Introduction of International TradeFor: International Economics and TradeTotal Class Hours: 72Aims:This course introduces students to International trade and its theories and policies, and equips them with basic theories, viewpoints and methods to analyze international economic issues and trade problems. It will lay a hard foundation for on Finance study and work in the future.Courses contents:Part One Basis of International TradeChapter One Summary of international tradeAims and requirements:This chapter focuses on the researching objects, means and contents of international trade; students are required to master the basic concepts and the whole frame of international trade system.Key points and difficulties: researching objects, contents and basic conceptsChapter Two International Division of Labor and International Trade Aims and requirements:This chapter mainly touches on the relation between internationaldivision of labor and international trade; students are required to know factors causing labor division and different features of it at different stages; interactive relation between labor division and international trade. Key points and difficulties: main factors affecting international labor division.Chapter Three International Labor Division and World MarketAims and requirements:Students are required to know production and development of world market, systems and main features of world market and makeup and manifestations of price of world market.Key points and difficulties:Current world market systemChapter Four International Trade and Economic GrowthAims and requirements:Students are required to know the growing role of international trade in economy and the interactive relation between international trade and economic growth.Key points and difficulties:Economic growth’s effect to balance of international tradeChapter Five International Trade and Economic StructureAims and requirements:Studens are required to know the interactive relation between international trade and economic structure.Key points and difficulties:Infant industries and their protectionChapter Six Strategic Model of International TradeAims and requirements:Students are required to know the definition of Export and import substitution strategy and the main factors and selection principles affecting Export and import substitution strategyKey points and difficulties:Import substitution strategy and its theoretical basis, Export-oriented strategyPart Two International Trade TheoriesChapter Seven Classical International Trade ModelAims and requirements:Students are required to grasp the main theories of Mercantilism, absolute cost theory, comparative cost theory and Dornbush Fisher Samuelson Model.Key points and difficulties:Ricardo - Krugman modelChapter Eight Neoclassical International Trade ModelAims and requirements:Students are required to know Equilibrium open economy, mutual needs theory, factor endowment theory and Leontief MysteryKey points and difficulties:Mutual needs theory and factor endowment theoryChapter Nine Imperfect Competition Model of International TradeAims and requirements:Students are required to master scale economy and international trade, intraindustrial international trade, imperfect competitive market and International Competitive AdvantageKey points and difficulties:Intraindustrial international tradeChapter Ten Dynamic International Trade ModelAims and requirements:Students are required to master product life cycle theory, technological gap theory, technology spillover and “scientific” model and neoclassicaltheory.Key points and difficulties:Product life cycle theory and technological gap theoryChapter Eleven New Elements Model of International TradeAims and requirements:Students are required to know human capital and international trade; R&D and international trade, information and international trade, systems and international trade.Key points and requirements:Human capital and international tradeChapter Twelve Model of International Factor MobilityAims and requirements:Students are required to master international capital flow model, international factor and goods mobility and international technology mobility model.Key points and difficulties:International capital flow modelPart Three International Trade PolicyChapter Thirteen Introduction of International Trade PolicyAims and requirements:Students are required to know the evolution of international trade, options of international trade policy and its features, to lay a basis for future study.Chapter Fourteen Tariff MeasuresAims and requirements:Students are required to grasp rate of tariff protection and tariff effects models and know of tariff, tariff system and types of tariffKey points and difficulties:Tariff effects modelChapter Fifteen Non-tariff MeasuresAims and requirements:Students are required to grasp analysis of non-tariff effects and know types of non-tariff measures and its basic featuresKey points and difficulties:Analysis of non-tariff measure effectsChapter Sixteen Export Promotion and Export ControlAims and requirements:Students are required to grasp measures of export promotion and knowhow to analyze the economic effects export promotion and export control. Key points and difficulties:Measures of export promotionChapter Seventeen Strategic Trade PolicyAims and requirements:Students are required to know the theoretical basis of strategic trade policy, basic model and its applicationKey points and difficulties:Theoretical basis of strategic trade policyChapter Eighteen Political Economy of Trade PolicyAims and requirements:Students are required to know trade policy and political factors, rent-seeking and trade policy; game and coordination in international trade policy.Key points and difficulties:Trade policy and political factorPart Four International Trade TopicsChapter Nineteen World Trade Organization and International Trade Aims and requirements:Students are required to grasp the principles and main functions of WTO; know features of GATT related with WTO, analyze the relation among WTO, world trade and China.Key points and difficulties:Principles and functions of WTOChapter Twenty Regional Economic Integration and International Trade Aims and requirements:Students are required to know main content and forms, interactive relation and models of regional economic integrationKey points and difficulties:Models of regional economic integrationChapter Twenty One International Investment and TradeAims and requirements:Students are required to learn the main content and forms, interactive relation and theories of international investmentKey points and difficulties:International investment theoryChapter Twenty Two Transnational Corporation and International Trade Aims and requirements:Students are required to know general features of transnational corporation, major features of management and its effect on macro economyKey points and difficulties:Management of transnational corporationChapter Twenty Three International Trade in ServiceAims and requirements:Students are required to general features of transnational corporation, major features of management and its effect on macro economyKey points and difficulties:Models of international trade in serviceChapter Twenty Four International Trade PatternsAims and requirements:Students are required to know trade features of developed countries and developing countries; to know international economic order and trade patterns and their adjustments.Key points and difficulties:International economic order and trade patterns, and their adjustments.\Main referenceSalvatore, D. (1998). International Economics. Beijing: QingHua University Press.Xian, C. (1998). International Trade Shanghai Lixin Accounting Publishing HouseXinlei, S. (2001). Theories and Policies of International Economics.Chengdu: Southwestern University of Finance and Economics Press.Syllabus of International Trade PracticeFor: International economics and tradeTotal class hours: 36International Trade Practice is a backbone course of specialty of Trade Economics,and it is a course of studying the procedure of international exchange of commodities, and it also have characteristics of foreign activities. The task of this course is: In terms of practice and law, analyzing and studying various kinds of methods of international exchange of commodities, summarizing foreign practical experiences in order to carry out the principles and policies of foreign trade of our country, not only can guarantee the best economic benefits, but also can handle affairs according to the international practice, and make our basic methods can be generally accepted for the international community. Through this course students are required to master basic theories, knowledge and basic skill of the foreign trade business, understand the trade procedure of imports and exports and grasp the method and skill of drafting sales contract clauses.Part One International Trade TermsChapter One International Trade TermsAims:Trade term is the key content of this course. It requires students tograsp the explanations for 13 trade terms of INCO terms 2000 through studying, especially the definitions, characteristic and applications of some important trade term.Key points:The coverage of INCO terms 2000; the meaning of FOB, CFR, CIF, FCA ,CPT, CIP, shipment contract, Symbol Delivery, the varieties of trade term.Teaching difficulties:The same points and different points of FOB, CFR, CIF and the difference among FCA, CPT, CIP, summary of trade terms, choosing of trade terms.Teaching contentLaws and practices for sales of international cargo, the main content of sales contracts, general procedure of sale-goods and main content of this course.Part Two International Sale of GoodsChapter Two Name, Quality and PackingAims:This chapter requires students to study and grasp the importance concluding the quality clause and basic method in the sales contract through this Section, and grasp how to stipulate quantity clauses, andstudy the basic content of the packaging clause, and grasp the general description about the goods on the whole.Key points:Choosing the methods of descript quality correctly, using chipping mark, more and short clause and neutral packing.Teaching Difficulties:Related stipulations about quantity clause of ConversionChapter Three Transport of International GoodsAims:This Section is emphasis the modes of transport,how to stipulate the shipment clause in the contract,how to deal with the shipment document, especially the ocean transportation.Key points:Mode of ocean transport, related documents, clause, accounting the freight of line transportTeaching difficulties:Nature of B/L, kinds of B/L, stipulations about partial shipment and transshipment in UCP500Chapter Four Insurance of International GoodsAims:This Section tells mainly that transports the range that the cargo insurance gives cover for by sea, our country transports cargo insurance risk and such contents as the clause and transportation insurance practice of cargoes imported and exported, etc. by sea.Key points:Related knowledge about insurance of ocean transportTeaching difficulties:Decision of insurance amount, Choice of insurance averageChapter Five Price of International GoodsAims:Through the studying of this chapter, student can grasp the price of the imported and exported goods correctly, adopting various kinds of and fix a price for the method rationally, selecting the favorable pricing currency for use, using relevant commission and discount properly, and ordering the price clause in the contract.Key points:Accounting the commission and discount, exchange the price. Teaching difficulties:Choice to the method of accounting the priceChapter Six Collection and PaymentAims:This chapter mainly introduces the process of international settlement, such as means of payment, payment time, payment place, etc. Among them the L/C and its related issues are discussed in great details. This Section is a key Section of this book.Key points:Draft, L/C, International Factor and Choice of payment instruments. Teaching difficulties:Transferable L/C, relationship of 3 periods of L/C, Usance L/ C payable at sight.Chapter Seven Inspection, Claim, Arbitration and Force Majeure Aims:This chapter mainly introduces inspection, claim, arbitration, Force Majeure and related knowledge in international merchandise trade.Key points:Choosing the time and the place of inspection, deciding the claim party, stipulating the claim clause, judgment of Force Majeure matter, forms and functions of arbitration, results of arbitrationTeaching difficulties:Commencement and termination of Force MajeurePart Three Trade Negotiation and Contract PreparationChapter Eight Export Business Negotiation and Conclusion of ContractAims:This Section tells the general procedures of business negotiation, the basically contents and establishment of contract, etc.Key points:This Section is key on offer and accept, effective time, whether to revocable or withdraw.Teaching difficulties:Stipulations about offer and accept in ConventionChapter Nine Performance of Import and Export ContrastAims:This chapter mainly talks about the main steps in the general process in performance of the contract and its related issues that should be pay close attention to.Key points:The key points of Urging establishment of L/C, notices of verify the L/C Teaching difficulties:Auditing of credit amount and Export bill purchasePart Four International Trade FormsChapter Ten International Trade FormsAims:This chapter mainly tells about the concept and characteristic of various trade forms; main contents of various trade agreement; and issues of using various trade forms.Key points:Distribution, Sole Distribution, Solo Agent or Exclusive Agent, Consignment, Fairs and Sales, Invitation to Tender and Submission, Auction, Processing tradeTeaching difficulties:The Comparison of Sole Distribution and Solo Agent, differences of processing with imported material and supplied material.Main reference:Baifu, W. (1996). Textbook of Import and Export Trade Practice.Shanghai: Shanghai People's Press.Xiaoxian, L. (1994). International Trade Practice. Beijing University Press of International Business and Economics.Yongyou, Y. (1999). International Trade Practice. Wuhan: Hubei People's Press.。

Foreign exchange and foreign trade Foreign exchange:Foreign exchange is the abbreviation of “international remittance and exchange”. Nowadays, it becomes necessary in international economy.The necessary conditions of foreign exchange:Firstly, it should be the instrument expressed in foreign currency. Secondly, it must be authorized and free to make payments and exchange into other methods of paying(paper currency, notes, checks)The functions of foreign exchange:It is the way to make international payments.It can promote the international contract and enlarge international economic cooperation.It can balance the international fund’s supplying and demanding.It can measure the economic position of the countries.Foreign exchange rateDefinition: the residents will exchange currency of his own country into it of the country where he travels or buys things. The proportion of the exchanging is the foreign exchange rate.Foreign exchange rate is also the fund which can be used to do business. And it also has its own price, that means we can use some currency to express the price of the other currency.Buying rate (buying price) is the rate used in the occasion when banks buy the exchange from the other banks or clients. While on the contrast, it is called selling rate (selling price)Direct quotation(giving quotation) means we use amounts of foreign currency to be the standard to calculate how much domestic currency we should pay. When we use this method, the buying rate will be the lower rate of the exchanging while the selling rate will be higher rate.Indirect quotation (receiving quotation) means in the contract of direct quotation, it uses amounts of domestic currency to be the standard to calculate how much foreign currency we will receive. When we use it, the buying rate will be the higher rate of exchanging while the selling rate will be the lower one.Floating exchange rateThere are many factors which influence the exchange rate. Generallyspeaking, the changing of economic strength and the economy policies of the countries are the primary cause of the development tendency of exchange rate.英本五班曹彦君1170210058。

KeyChapter1I. Answer my questions1. International trade is business whose activities involve the crossing of national borders. It includes not only international trade and foreign manufacturing but also encompasses the growing services industry in areas such as transportation, tourism, banking, advertising, construction, retailing, wholesaling, and mass communications. It includes all business transactions that involve two or more countries. Such business relationship may be private or governmental.2. Sales expansion, resource acquisition and diversification of sales and supplies.3. To gain profit.4. To seej out foreign markets and procurement.5. There are four major forms which are the following:Merchandise exports and Imports, Service Exports and Imports, Investment and Multinational Enterprise.6. It is the account which is a summary statement of the flow of all international economic and financial transactions between one nation (eg.the United States ) and the rest of the world over some period of time, usually one year.7. Merchandise Exporting and Importing.8. Yes. There are great differences between them.1) direct investment takes place when control follows the investment. It usually means high commitment of capital, personnel, and technology abroad. It aims at gaining of foreign resources and foreign markets. Direct investment may often get higher foreign sales than exporting. And sometimes it involves two or more parties.2) While portfolio investments are not under control. And they are used primarilyfor financial purposes. Treasures of companies, for example, routinely more funds from one country to another to get a higher yield on short term investments.9. MNE is the abbreviation of the multinational enterprise. Its synonyms are NNC (the multinational corporation) and TNC (transnational corporation).10. Examples are travel, transport, fee, royalties, dividends and interest.11. The choice of forms is influenced by the objective being pursued and the environments in which the company must operate.12. It is limited by the number of people interested in a firm’s products and services and by customers’ capacity to make purchase.13. This is because at an early stage of international involvement these operations usually take the least commitme nt and least risk of a firm’s resources.14. Royalties means the payment for use of assets from abroad, such as for trademarks patens, copyrights, or other expertise under contract known as licencing agreements.Royalties are also paid franchising.15. It is a way of doing business in which one party (the franchiser) the use of a trademark that is an essential asset for the franchisers’ business.II Match each one on the left with its correct meaning on the right1. J2.A3.E4.B5.C6.D7.I8.G9.F 10.HIII Translate the following terms and phrases into Chinese1 购买力11 经济复苏;恢复2 潜在销售量12 经济衰退3 加价,涨价13 间接投资4 国内市场14 有形货物5 制成品15 有形进出口6 边际利润16 收入及支出;岁入及岁出7 市场占有率17 超额能力8 贸易歧视18 贸易中间人(商);经纪人9 时机选择19 全部包建的工程承包方式10 经销周期20 许可证协定IV Translate the following into English1. Trade is often the ‘engine’ of growt h. However oversimplified this metaphormay be, it does serve to underline the importance of foreign trade in the process of growth. A healthy expansion of exports may not always be sufficient condition for rapid and sustained growth, but a strong positive association between the two is clearly undeniable. Trade expansion contributes to economic growth in many ways. Among them are the benefits of specialization; the favorable effects of international competition on domestic economic efficiency; the increased capacity to pay for the imports required in development and more generally the stimulus to investment.2. International trade is the exchange of goods and services produced in one country for goods and services produced in another country. In addition to visible trade, which involves the import and export of goods and merchandise, there is also invisible trade, which involves the exchange of services between nations. Nations such as Greece and Norway have large maritime fleets and provide transportation service. This is a kind of invisible trade. Invisible trade can be as important to some nations as the export of raw materials or commodities is to others. In both cases, the nations earn the money to buy necessities.3. There exist different ways of conducting international business. Exclusive sale means the seller gives the overseas client the exclusive right of selling a particular product in a designated area within a specified period of time. In this kind of business transaction, the product is bought by the exclusive seller and therefore he should sell the product by himself, assuming sole responsibilities for his profit and loss. Exclusive sale is different from agency where only commission is involved. And difference exists between general contract and exclusive sales because the exclusive seller enjoys exclusive right in a particular area.4. There is no country in the world that can produce all the products it needs.Thus countries join in international division of labor for effective production and reproduction. Sometimes a country can buy goods and services from abroad on a barter basis. Barter means doing business by exchanging goods of one sort for goods of another sort without using money. Barter trade itself is not enough to meat a country’s imp ort needs. But as a form of international trade, it is still attractive in developing countries where foreign exchange is in short supply and inflow of foreign funds is far from sufficient to meet their obligations in external trade.I. Answer the following questions(Omited)II. Filling the blanks with the suitable words in the text:1.meeting/satisfying;2.agent, foreign/overseas;mission;4.own;5.setting;6.patent;7.profits;8.outlets;9.joint, venture; 10.subsidiaryIII.Translate the followings into English1). Economic activity began with the cavemen, who was economicallyself-sufficient. He did his own hunting, found his own shelter, and provided for his own needs. As primitive populations grew and developed, the principle of division of labor evolved. One person was more able to perform some activity than another, and therefore each person concentrated on what he did best. While one hunted, another fished. The hunter then traded his surplus to the fisherman, and each benefited from the variety of diet.In today’s complex economic world, neither individuals nor nations areself-sufficient nations are self-sufficient. Nations have utilized different economic resources; people have developed different skills. This is the foundation of international trade and economic activities.Foreign trade, the exchange of goods between nations, takes place for many reasons. The first, as mentioned above, is that no nation has all of the commodities than it needs. Raw materials are scattered around the world. Large deposits of copper are mined in Peru and Zaire, diamonds are mined in South Africa, and petroleum is recovered in Middle East. Countries that do not have these resources within their own boundaries must buy from countries that export them.Foreign trade also occurs because a country often does not have enough of a particular item to meet its needs. Although the United States is a major producer of sugar, it consumes more than it can produce internally and thus must import sugar. Third, one nation can sell some items at a lower cost than other countries. Japanhas been able to export large quantities of radios and television sets because it can produce them more efficiently than other countries. It is cheaper for the United States to buy these from Japan than to produce them domestically.Finally, foreign trade takes place because of innovation or style. Even though the United States produces more automobiles than any other country, it still imports large quantities of autos from Germany, Japan and Sweden, primarily because there is a market for them in the United States.2). The different kinds of trade nations engaged in are varied and complex, a mixture of visible and invisible trade. Most nations are more dependent on exports than on any other activity. The earnings from exports pay for the imports that they need and want. A nation’s balance of payment is a record of these complex transactions. By reflecting all of these transactions in monetary terms , a nation is able to combine the income it receives, for example, from exports, tourists expenditures, and immigrant remittances. This combined incomes is then spent on such items as manufactured goods from other countries, travel for its citizens to other countries, and the hiring of construction engineers.I. Translate the followings from Chinese into English:1 terms of payment2 written form of contract3 execution of the contract4 sales contract5 purchase confirmation6 terms of transaction7 trading partners 8 the setting up of a contract9 trade agreement 10 consignment contract11 the contract proper 12 extension of the contract13 the contracting parties 14 special clause15 general terms and conditionsII. Answer the following questions in English:1 A contract is an agreement which sets forth bind obligations of the relevant parties. And any part that fails to fulfill his contractual obligations may be sued and forced to make compensation.2 There are two parties of business contract negotiations: oral and written. The former refers to direct discussions abroad; written negotiations often begin with enquiries made by the buyers.3 A written contract is generally prepared and signed as the proof of the agreement and as the basis for its execution. A sales or purchase confirmation is less detailed than a contract, covering only the essential terms of the transaction. It is usually used for smaller deals or between familiar trade partners.4 The setting up of a contract is similar to that of a trade agreement or any othertype of formal agreements. It generally contains: 1) the title. The type of the contract is indicated in the title; 2) the contract proper. It is the main part of a contract; 3) the signature of the contracting parties indicating their status as the seller or the buyer; 4) the stipulations on the back of the contract and are equally binding upon the contracting parties.5 It generally contains the time of shipment, the mode of payment described in addition to an exact description of the goods including the quantity, quality, specifications, packing methods, insurance, commodity inspection, claims, arbitration and force majeure, etc.III. Translate the following into Chinese:合同是在双方达成协议的基础上制定的,而协议又是双方进行商务谈判的结果。

国际结算英⽂版课后练习答案Chapter One1. Fill in the blanks to complete each sentence.(1) local legal system, political, exchange risks(2) open account, advance payment, remittance and collection(3) letter of credit, bank guarantee(4) price terms, delivery terms(5) least/minimum, most/maximum(6) advance payment(7) open account(8) clean collection, documentary collection2. 略3. Translate the following terms into English.(1) settlement on bank credit(2) the potential for currency fluctuation(3) to clear the goods for export(4) to pay the insurance premium(5) to carry out export formalities(6) the major participants in international trade(7) the commodity inspection clause(8) to fulfill the obligation to deliver the goods(9)t he goods have passed over the ship’s rail(10)I nternational contract is concluded in a completely different context than domestic ones 4.Decide whether the following statements are true or false.(1) F (2) F (3) T (4) T (5) T(6) T (7) F (8) T (9) T (10) F5. Choose the best answer to each of the following statements(1)-(5) BCCBD (6)-(10) DACCC(11)-(15) BDDCD (16)-(20) DCACDChapter Two1. Fill in the blanks to complete each sentence.(1) barter(2) medium of exchange(3) expensive, risky(4) our(5) Vostro(6) vostro(7) nostro(8) specimen of authorized signatures, telegraphic test keys, terms and conditions, Swift authentic keys2. Define the following terms(1) Correspondent relationship 〖A bank having direct connection or friendly service relations with another bank.〗(2) International settlements〖International settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them. 〗(3) Visible trade〖The exchange of goods and commodities between the buyer and the seller across borders.〗(4) Financial transaction〖International financial transaction covers foreign exchange market transactions, government supported export credits, syndicated loans, international bond issues, etc.〗(5). Vostro account〖Vostro account is an account held by a bank on behalf of a correspondent bank.〗3. Translate the following terms into English.(1) commercial credit(2) control documents(3) account relationship(4) cash settlement(5) financial intermediary(6) credit advice(7) agency arrangement(8) credit balance(9)reimbursement method(10) test key/code4.Decide whether the following statements are true or false.(1) T (2) F (3) F (4) T (5) F5. Choose the best answer to each of the following statements(1)-(5) BCDAD (6)-(10) BBDABChapter Three1. Define the following Terms:(1) Negotiable instrument〖“A negotiable instrument is a chose in action, the full and legal title to which is transferable by delivery of the instrument (po ssibly with the transferor’s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the transferee, providing the latter takes the instrument in good faith and for value.” 〗(2) Bill of exchange〖A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time,a sum certain in money, to or to the order of a specified person, or to bearer. 〗(3) Check〖A check is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer. 〗(4) Documentary bill〖It is a bill with shipping documents attached thereto. 〗(5) Crossing〖A crossing is in effect an instruction to the paying bank from the drawer or holder to pay the fund to a bank only. 〗2. Translate the following terms into English.(1) ⼀般划线⽀票〖generally crossed check〗(2) 特殊划线⽀票〖specially crossed check〗(3) 过期⽀票〖a check that is out of date〗(4) 未到期⽀票〖post dated check〗(5) ⼤⼩写⾦额〖amount in words〗(6) ⽩背书〖blank endorsement〗(7) 特别背书〖special endorsement〗(8) 限制性背书〖restrictive endorsement〗(9) 跟单汇票〖documentary bill〗(10) 即期汇票〖sight draft〗(11) 远期汇票〖usance/term bill〗(12) 承兑汇票〖acceptance bill〗(13) 可确定的未来某⼀天〖determinable future date〗(14) 光票〖clean bill〗(15) 流通票据〖negotiable instrument〗(16) 贴现⾏〖discounting house 〗(17) 商⼈银⾏〖merchant bank〗(18) ⽆条件的付款承诺〖unconditional promise of payment〗(19) 负连带责任〖jointly and severally responsible〗(20) 出票后90天付款〖payable 90 days after date〗3. Decide whether the following statements are true or false.(1) T (2) F (3) T (4) T (5) T(6) F (7) T (8) T (9) T (10) T(11) F (12) T (13) T (14) F (15) T(16) T (17) T (18) F (19) F (20) F4. Choose the best answer to each of the following statements(1)-(5) CACBC (6)-(10) BACBB(11)-(15) BDCCC (16)-(20) BBAAC5-7 略Chapter Four1. Fill in the blanks to complete each sentence.(1) beneficiary(2) payment order / mail advice / debit advice(3) the remittance amount is large / the transfer of funds is subject to a time limit / test key(4) sell it to his own bank for crediting his account(5) debits / credits(6) demand draft(7) act of dishonor(8) swiftness / reliability / safety / inexpensiveness(9) debiting remitting bank’s nostro account(10) delivery of the goods2. Define the following Terms.(1) International remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad by one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the re mitting bank’s overseas branch or its correspondent with a nostro account.(2) Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or its branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.(3) A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.(4) Demand draft transfer is a remittance method using a bank demand draft. It is a negotiable instrument drawn by one bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.(5) Cancellation of the reimbursement under mail transfer or telegraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.3. Translate the following terms into English.(1) 汇款通知单remittance advice (2) 汇出汇款outward remittance(3) 国际汇款单international money order (4) 往来账户current account(5) ⾃动⽀付系统automated payment system (6) 作为偿付in cover(7) 赔偿保证书letter of indemnity (8) 信汇通知书 mail advice(9) 汇票的不可流通副本non-negotiable copy of draft (10) ⾸期付款down payment4. Choose the best answer to each of the following statements(1)-(5) BCABD (6)-(10) BBBAAChapter Five1. Fill in the blanks to complete each sentence.(1) presenting bank(2) title documents / pays the draft / accepts the obligation to do so(3) legal / the exchange control authorities(4) the payment is made(5) open account / advance payment(6) Inward collection(7). the remitting bank(8) trust receipt(9) D/P at sight(10) documents, draft, and collection order2. Define the following terms(1) Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent banks located in the domicile of the buyer.(2) The case of need is the representative appointed by the principal to act as case of need in the event of non-acceptance and/or non-payment, whose power should be clearly and fully stated in the collection.(3) Documentary collection is a collection of financial instruments being accompanied by commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. Alternatively, the documentary collection is a payment mechanism that allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.(4) Outward collection is a banking business in which a bank acting as the remitting bank sends the draft drawn against an export with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer.(5) Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee.3. Translate the following terms into English.(1) 承兑交单acceptance against documents (2) 商业承兑汇票 trade acceptance(3) 需要时的代理⼈case of need (4) 出⼝押汇export bill purchased(5) 物权单据 title document (6) 以寄售⽅式on consignment(7) 直接托收direct collection (8) 货运单据shipping documents(9) 付款交单documents against payment (10) 远期汇票time/ tenor/term/ usance draft4. Choose the best answer to each of the following statements(1)-(5) ABCAB (6)-(10) ACAADChapter Six1. Define the following terms:(1) Letter of credit 〖The Documentary Credit or letter of credit is an undertaking issued by a bank for the account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with. 〗(2) Confirmed letter of credit 〖A credit that carries the commitment to pay by both the issuing bank and the advising bank. 〗(3) Revolving credit 〖A credit by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required. 〗(4) Confirming bank 〖A bank, usually the advising bank, which adds its undertaking to those of the issuing bank and assumes liability under the credit.〗(5) Applicant of the credit〖The applicant is always an importer or a buyer, who fills out and signs an application form, requesting the bank to issue a credit in favor of an exporter or a seller abroad.〗2. Translate the following terms or sentences into English.(1) 未授权保兑〖silent confirmation 〗(2) 有效地点为开证⾏所在地的柜台〖to expire at the counters of the issuing bank 〗(3) 凭代表物权的单据付款〖to pay against documents representing the goods〗(4) 信⽤证以银⾏信⽤代替了商业信⽤。

International Trade TheoriesChapter 1 Benefits of International TradeIn this chapter, we first explain the meaning of international trade, and then turn our attention to benefits from international trade.Definition of International TradeInternational trade, sometimes also called international business or simply foreign trade, occurs when a firm exports goods or services to consumers in another country. Nowadays when talking about international trade we do not just mean selling and buying goods on an international scale but also cross-border trade in services and carrying out of investment activities abroad.The Benefits or Gains from International TradeWhy do nations trade with each other? The answer is simple: Because we can receive benefits or make gains from it.Now let’s have a look at the chief benefits from international trade.(1) Helping to raise the living standards of the peopleTake the United States. A great deal of its high standard of living depends on international trade. Without international trade the United States cannot become a kingdom of automobiles because most of its oil is imported from abroad. Without international trade the United States can not have enough tin, tungsten and chromium for certain industrial process because the United States has no deposits of them. Remember no country is able to produce everything it needs. That is an important reason for trade.(2) Helping to upgrade a country’s modernizationForeign trade can help a nation make money in the form of foreign exchange which can be used to finance its purchases of high technology needed for upgrading its modernization and speeding up its industrialization process.(3) Helping to solve a country’s shortage of capitalA lot of world’s enterprises, esp. those of the developing nations, are in desperate need of capital, for their expansion, for employing workers, for buying raw materials, for purchasing advanced equipment and carrying out the R & D programes. Such a problem can be solved by attracting foreign investment through forming joint ventures.(4) Helping to solve unemployment problemsFor both developed nations and developing nations export trade can provide more employment opportunities. Without foreign trade some people will lose their jobs.(5) Helping to promote mutual understanding and friendship between tradingThrough foreign trade a country can know more about a country’s economic situation, legal system, culture and customs. Businessmen or foreign trade workers of different countries become friends by trading with one another.(6) Helping to boost a country’s competitiveness in the world marketIf a country’s business wants to gain market access to a foreign country, it must be able to compete with its rivals with high quality goods, attractive designing, and better after-sales service.(7) Helping a country to accelerate its overall economic growthHere is a case in point. In 1970 living standards in Ghana (well-known for its cocoa) and South Korea were roughly comparable. Ghana’s GNP per capita was $250, and South Korea’s was$260. By 1995, the situation had dramatically changed. South Korea had a GNP per capita of $ 9,700 while Ghana’s only $390, reflecting a vastly different economic growth rate. Between 1968 and 1995, the average annual growth rate in Ghana’s GNP was under 1.4%. In contrast, South Korea achieved a growth rate of about 9% annually in the same period of time. Why the sharp difference? Of course there is no easy answer because many factors affect a country’s growth. But one thing is certain, that is, The South Korean government implemented policies that encouraged companies to engage in international trade, while the actions of the Ghanaian government discouraged domestic producers from becoming involved in international trade. That is why some economists say foreign trade can be compared to the engine of economic growth.New Words1. cross-border 跨国境的2. tin 锡3. tungsten 铬4. chromium 钨5. deposit(s) 贮藏量6. to finance 为……提供资金7. to upgrade 使升级,提升8. vastly 巨大地9. industrialization 工业化10. firm 公司,企业11. modernization 现代化12. automobiles (美)汽车(常用auto)13. to boost 增加14. competitiveness 竞争力15. to accelerate 加快16. to implement 执行(政策等)Useful Phrases and Idiomatic Expressions1. on an international scale 在国际范围内2. a case in point 恰当的例子,例证3. to engage in 从事与4. to discourage sb. from doing sth. 不鼓励某人做某事,劝阻某人不做某事5. to be compared to 将……比作6. in the form of 以……形式,用……方式7. in contrast 相形之下8. to turn one’s attention to 将某人注意力转向ExercisesI. Answer the following questions:1. What is meant by international trade?2. What are the chief benefits from international trade?3. Give examples to show that no country is able to produce everything it needs.4. Does international trade have negative effects on a country’s economic development?II. Translate the following into English:1. 对外贸易可以给一国带来以下七个方面的好处:(1)通过对外贸易可以充分利用国外资源,协调发展它的国民经济;(2)通过与其他国家的贸易可以引进先进的技术设备,促进生产率的提高;(3)可以帮助它扩大资本的积累;(4)帮助一个国家进口国内无法生产的产品,更好满足国内人民的需求;(5)通过国际贸易可使一国参加国际分工;(6)通过国际贸易带动一国经济发展;(7)通过国际贸易发展对外经贸关系和扩大影响力。