麦肯锡案例分析2 - 医药公司案例分析 PharmaCo Case Study

- 格式:ppt

- 大小:1.72 MB

- 文档页数:10

麦肯锡咨询案例分析报告麦肯锡咨询(McKinsey & Company)是世界上最具影响力的咨询公司之一,为全球各行业的企业提供战略与管理咨询服务。

本文将以麦肯锡咨询的一项案例为基础,对其分析方法和解决方案进行详细探讨,以展示麦肯锡咨询在案例解决过程中的专业能力和价值。

案例背景该案例是关于一家汽车制造公司的市场战略问题。

该公司在全球市场的竞争力逐渐下降,市场份额不断萎缩。

麦肯锡咨询受雇于该公司,负责分析问题并提供有效的解决方案。

问题分析麦肯锡咨询首先对汽车制造行业的整体趋势进行了深入研究,分析了市场竞争、行业变化、技术创新等方面的因素。

根据市场数据和行业趋势,麦肯锡咨询确定了该公司面临的核心问题:低竞争力和市场份额下降。

解决方案基于对问题的深入理解,麦肯锡咨询提出了以下解决方案:1. 战略定位重塑麦肯锡咨询建议该公司重新审视自身的战略定位,并基于市场趋势进行调整。

为了提高竞争力,该公司应该寻找新的增长机会,如拓展新兴市场、战略合作等,并进行相应的市场定位和品牌建设。

2. 产品创新与技术升级在现今汽车制造行业中,技术创新和产品升级是提高竞争力的重要途径。

麦肯锡咨询建议该公司加大对研发和创新的投入,推出更具竞争力的产品,并通过技术升级提高产品的附加值。

3. 渠道优化汽车销售渠道对于市场份额和品牌影响力的提升至关重要。

麦肯锡咨询建议该公司与经销商合作,并对销售渠道进行优化,提高市场覆盖率和销售效率,并加强与终端消费者的沟通与关系管理。

4. 成本优化成本控制是提高竞争力和市场份额的重要手段之一。

麦肯锡咨询建议该公司对其生产成本进行全面分析,从供应链、制造工艺等多个方面寻找降低成本的机会,并加强内部管理以提高效率。

结果评估麦肯锡咨询根据提出的解决方案,对可能产生的效果进行了评估。

通过市场调研和数据分析,麦肯锡咨询得出结论:如果该公司能够成功实施提出的解决方案,其竞争力和市场份额将得到显著提升。

结论本案例分析展示了麦肯锡咨询在解决战略问题上的高水平和专业能力。

麦肯锡兵败实达关于实达连年亏损被ST 与两年前麦肯锡兵败实达的事件屡见报端,随着麦肯锡中国区副总裁吴亦斌和实达副总裁贾红兵在中央电视台谈话节目中同台对峙,人们的兴趣更被掀至高峰,非常可惜的是,节目中两人对两年前的合作及这次合作引发的后果都是点到即止。

麦肯席如何兵败实达?让我们来看看这件事情的前前后后。

实达请兵麦肯锡1998年实达集团与麦肯锡签署协议,请麦肯锡对实达现有营销及销售体系作出评价,并针对集团的硬件产业设计一个面向二十一世纪、向国际化公司运行机制靠拢的市场营销及销售组织体系。

这种花费重金援请国际“外脑”进行企业咨询的做法在当时国内IT 界还是首次。

据了解,这次咨询的题目是《建立高绩效的市场营销及销售组织体系》,实际整个事情早有较长的来源。

实达向来比较重视三个方向的事情,一是技术,即在终端产品上形成自己的核心技术;二是销售策略上,重视销售,面对市场;三是以人为本,重视人力资源的管理。

实达认为这三方面正是知识经济条件下IT 企业必须完成的三件事.从1996 年起的两年半时间,实达一直在探索自身销售体系的出路。

实达自成立后一直在考虑建立营销中心,在1996、1997 年甚至都已挂起营销中心的牌子,但在当时还没有从市场概念来做这件事情。

因为从创建到1998 年很长一段时间以来,实达的观念是做市场太虚,做销售拿单子比较实在,因此虽然建立起营销中心,也是光说不练、始终没有动作起来的一个空架子。

1997 年底实达集团建立了子分公司平台,是由于在现实中发现只要出一个产品就多出一个公司来,而想把分公司的行政资源、管理资源和财务资源整合起来,面对所有产品,但这一平台仍没有直接参予经营,产品还是分公司各做各的。

98年6 月实达又提出了一个区域子公司运作方案,想通过区域考核来调动人员,让他们从经济角度整合所有产品来一起销售。

因此,可以说从96年到98年两年多的时间里,实达一直在探索自己的销售体系,但一直没走出来。

麦肯锡咨询案例案例背景麦肯锡咨询是全球领先的管理咨询公司之一,成立于1926年,总部位于美国纽约。

麦肯锡咨询以其卓越的咨询服务和广泛的行业影响力而闻名,为全球各地的企业和政府机构提供战略管理、组织变革、运营优化等咨询服务。

本文将介绍一则麦肯锡咨询的案例,探讨他们如何帮助一家传统制造业企业实现转型升级。

案例分析公司背景案例中的公司是一家传统制造业企业,成立于上世纪80年代,主要生产汽车零部件。

然而,随着行业竞争的加剧和技术的不断进步,该公司面临着市场份额下降和盈利能力下滑的困境。

为了保持竞争优势并实现持续增长,该公司决定寻求麦肯锡咨询的帮助来进行企业转型。

问题诊断麦肯锡咨询团队首先与公司的高层管理人员进行了深入的交流和访谈,以了解公司目前面临的问题和挑战。

经过问题诊断后,他们提出了以下几个核心问题:1.市场份额下滑:公司的产品市场份额逐渐被竞争对手侵占,需要重新找到增长点。

2.成本控制不力:公司的生产成本高于行业平均水平,需要优化生产流程和降低成本。

3.技术更新滞后:公司的技术水平相对滞后,需要加大对研发和创新的投入。

解决方案麦肯锡咨询团队根据问题诊断的结果,制定了以下解决方案来帮助该公司实现转型升级:1.市场战略优化:麦肯锡咨询团队通过市场调研和竞争对手分析,帮助公司重新定义市场定位和目标客户群体,并制定相应的市场营销策略。

他们提出了一系列新产品开发的建议,以满足市场需求并增加市场份额。

2.成本优化计划:麦肯锡咨询团队与公司的生产团队合作,进行了全面的生产线分析和成本结构分析。

他们提出了一系列优化建议,包括降低原材料采购成本、提高生产效率、优化物流和仓储管理等。

这些措施帮助公司降低了生产成本,提高了盈利能力。

3.技术创新引入:麦肯锡咨询团队建议公司加大对研发和创新的投入,以提高产品的技术含量和附加值。

他们与公司的研发团队合作,共同制定了技术创新计划,包括引进新的技术设备、培养技术人才等。

通过技术创新,公司能够提供更具竞争力的产品,并跟上市场的发展趋势。

麦肯锡案例分析【篇一:麦肯锡案例分析】1.类型介绍 (1)?????????????????? 什么是case interview?一般来说,case interview主要针对咨询公司面试而言。

也有一些公司如dell二面会用一些小case来考察面试者的应变能力、考虑问题的全面性以及逻辑分析能力。

咨询公司的case interview可以分成两个部分,一开始先是warm-up。

在这一部分,你可能需要自我介绍,然后大致回答一下面试官针对简历以及个人选择提出的一些问题。

接下来才是真正的case interview。

简而言之,case interview就是现场对一个商业问题进行分析的面试。

但是和大多数其他面试不同,这是一个互动的过程。

你的面试官会给你提出一个business issue,并且会让你给出分析和意见。

而你的任务是向面试官有逻辑的提出一些问题以使得你能够对这个business issue有更全面,更细致的了解,并且通过系统的分析最后给出建议。

一般而言,case interview是没有绝对正确的答案的。

面试官看重的不是答案,而是从面试过程当中你表现出来的分析能力和创造力。

对于大学毕业,没有工作经验的学生来说,大多数情况下case不会很难,也不会需要你对那个行业有系统的了解。

case interview一般是一对一的,一轮会有两个case interview,由两个不同的面试官来负责,每个interview持续45分钟,包括10-15分钟的warm-up以及一些behavior questions,剩下的30分钟就是讨论case。

10-15分钟的warm-up一般用英文,case可能是英文,也有可能是中文,不同的公司以及不同的面试官对语言是有不同的偏好的。

(2)?????????????????? 为什么使用case interview?由于咨询师在工作上的不少时间都是在和客户以及同事进行相互的沟通,同时咨询工作本身的特点要求咨询师必须具备一系列的特质才能够成功。

麦肯锡案例分析【篇一:麦肯锡案例分析】1.类型介绍 (1)?????????????????? 什么是case interview?一般来说,case interview主要针对咨询公司面试而言。

也有一些公司如dell二面会用一些小case来考察面试者的应变能力、考虑问题的全面性以及逻辑分析能力。

咨询公司的case interview可以分成两个部分,一开始先是warm-up。

在这一部分,你可能需要自我介绍,然后大致回答一下面试官针对简历以及个人选择提出的一些问题。

接下来才是真正的case interview。

简而言之,case interview就是现场对一个商业问题进行分析的面试。

但是和大多数其他面试不同,这是一个互动的过程。

你的面试官会给你提出一个business issue,并且会让你给出分析和意见。

而你的任务是向面试官有逻辑的提出一些问题以使得你能够对这个business issue有更全面,更细致的了解,并且通过系统的分析最后给出建议。

一般而言,case interview是没有绝对正确的答案的。

面试官看重的不是答案,而是从面试过程当中你表现出来的分析能力和创造力。

对于大学毕业,没有工作经验的学生来说,大多数情况下case不会很难,也不会需要你对那个行业有系统的了解。

case interview一般是一对一的,一轮会有两个case interview,由两个不同的面试官来负责,每个interview持续45分钟,包括10-15分钟的warm-up以及一些behavior questions,剩下的30分钟就是讨论case。

10-15分钟的warm-up一般用英文,case可能是英文,也有可能是中文,不同的公司以及不同的面试官对语言是有不同的偏好的。

(2)?????????????????? 为什么使用case interview?由于咨询师在工作上的不少时间都是在和客户以及同事进行相互的沟通,同时咨询工作本身的特点要求咨询师必须具备一系列的特质才能够成功。

麦肯锡结构化战略思维案例应用解析

麦肯锡结构化战略思维是一种解决问题的框架,其核心在于将复杂的问题进行分解,使其变得更容易理解和解决。

以下是这种思维模式在案例中的应用解析:

案例:某零售企业希望提升销售额

1. 明确问题:首先,要明确问题的本质。

这里的主题是提升销售额,关键问题是找到提升销售额的方法。

2. 分析问题:其次,利用结构化战略思维对问题进行分析。

可以从产品、价格、促销、地点等方面进行分析,找出可能影响销售额的因素。

3. 提出假设:基于分析,提出可能的解决方案。

例如,增加产品种类、调整价格、举办促销活动、改变店铺位置等。

4. 实施方案:根据提出的假设,制定实施计划并执行。

例如,进行A/B测

试以确定最佳的促销策略。

5. 评估结果:最后,评估实施的方案是否有效,是否真正提升了销售额。

如果方案有效,则可以继续执行;如果无效,则需要进行调整。

在这个案例中,麦肯锡结构化战略思维的应用使得提升销售额的问题得以分解和解决。

首先明确问题,然后分析问题,提出可能的解决方案,实施方案,

最后评估结果。

这样的流程使得复杂的问题变得更容易解决,提高了解决问题的效率和质量。

以上内容仅供参考,更多麦肯锡案例分析可以咨询管理咨询专业人士了解。

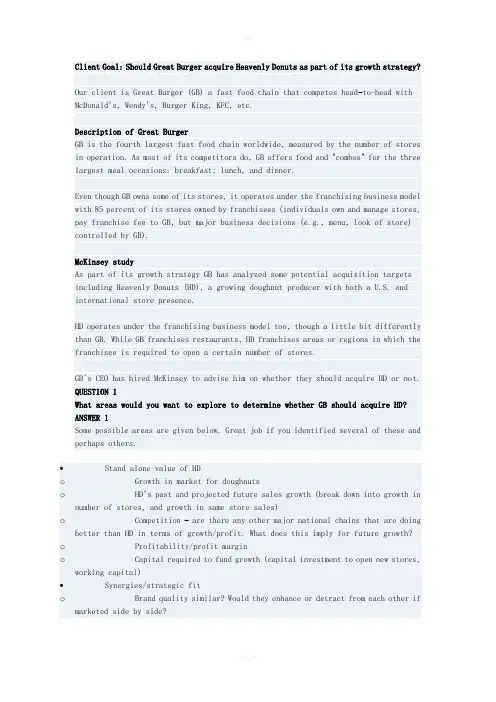

Client Goal: Should Great Burger acquire Heavenly Donuts as part of its growth strategy?Our client is Great Burger (GB) a fast food chain that competes head–to-head with McDonald's, Wendy's, Burger King, KFC, etc.Description of Great BurgerGB is the fourth largest fast food chain worldwide, measured by the number of stores in operation. As most of its competitors do, GB offers food and "combos" for the three largest meal occasions: breakfast, lunch, and dinner.Even though GB owns some of its stores, it operates under the franchising business model with 85 percent of its stores owned by franchisees (individuals own and manage stores, pay franchise fee to GB, but major business decisions (e.g., menu, look of store) controlled by GB).McKinsey studyAs part of its growth strategy GB has analyzed some potential acquisition targets including Heavenly Donuts (HD), a growing doughnut producer with both a U.S. and international store presence.HD operates under the franchising business model too, though a little bit differently than GB. While GB franchises restaurants, HD franchises areas or regions in which the franchisee is required to open a certain number of stores.GB's CEO has hired McKinsey to advise him on whether they should acquire HD or not.QUESTION 1What areas would you want to explore to determine whether GB should acquire HD?ANSWER 1Some possible areas are given below. Great job if you identified several of these and perhaps others.∙Stand alone value of HDo Growth in market for doughnutso HD's past and projected future sales growth (break down into growth in number of stores, and growth in same store sales)o Competition – are there any other major national chains that are doing better than HD in terms of growth/profit. What does this imply for future growth?o Profitability/profit margino Capital required to fund growth (capital investment to open new stores, working capital)∙Synergies/strategic fito Brand quality similar? Would they enhance or detract from each other if marketed side by side?o How much overlap of customer base? (very little overlap might cause concern that brands are not compatible, too much might imply little room to expand sales by cross-marketing)o Synergies (Hint: do not dive deep on this, as it will be covered later) ∙Management team/cultural fito Capabilities/skills of top, middle managemento Cultural fit, if very different, what percent of key management would likely be able to adjust∙Ability to execute merger/combine companieso GB experience with mergers in past/experience in integrating companies o Franchise structure differences. Detail “dive” into franchising structures. Would these different structures affect the deal? Can we manage two different franchising structures at the same time?The team started thinking about potential synergies that could be achieved by acquiring HD. Here are some key facts on GB and HD.Exhibit 1Stores GB HDTotal5,000 1,020North America3,500 1000Europe1,000 20Asia400 0Other100 0Annual growth in stores10% 15%Financials GB HDTotal store sales$5,500m $700mParent company revenue$1,900m $200mKey expenses (% sales)Cost of sales51% 40%Restaurant operatingcosts 24% 26%Restaurant property & equipment costs 4.6% 8.5%Corporate general & administrative costs 8% 15%Profit as % of sales6.3% 4.9%Sales/stores$1.1m $0.7mIndustry average$0.9m $0.8mQUESTION 2What potential synergies can you think of between GB and HD?ANSWER 2We are looking for a few responses similar to the ones below:∙Lower costso Biggest opportunity likely in corporate selling, general, and administrative expenses (SG&A) by integrating corporate managemento May be some opportunity to lower food costs with larger purchasing volume on similar food items (e.g., beverages, deep frying oil), however overlaps may be low as ingredients are very differento GB appears to have an advantage in property and equipment costs which might be leveragable to HD (e.g., superior skills in lease negotiation)∙Increase revenueso Sell doughnuts in GB stores, or some selected GB products in HD stores o GB has much greater international presence thus likely has knowledge/skills to enable HD to expand outside of North Americao GB may have superior skills in identifying attractive locations for stores as its sales per store are higher than industry average, whereas HD's is lower than industry average; might be able to leverage this when opening new HD stores to increase HD average sales per storeo Expand HD faster than it could do on own–GB, as a larger company with lower debt, may have better access to capitalQUESTION 3The team thinks that with synergies, it should be possible to double HD’s U.S. market share in the next 5 years, and that GB’s access to capital will allow it to expand the number of HD stores by 2.5 times. What sales per store will HD require in 5 years in order for GB to achieve these goals? Use any data from Exhibit 1 you need, additionally, your interviewer would provide the following assumptions for you:∙Doughnut consumption/capita in the U.S. is $10/year today, and is projected to grow to $20/year in 5 years.∙For ease of calculation, assume U.S. population is 300m.ANSWER 3You should always feel free to ask your interviewer additional questions to help you with your response.Possible responses might include the following:∙Market share today: $700M HD sales (from Exhibit 1) ÷ $3B U.S. market ($10 x 300M people) = 23% (round to 25% for simplicity sake)∙U.S. market in 5 years = $20 x 300 = $6B∙HD sales if double market share: 50% x $6B = $3B∙Per store sales: $3B/2.5 (1000 stores) = $1.2MDoes this seem reasonable?∙Yes, given it implies less than double same store sales growth and per capita consumption is predicted to double.QUESTION 4One of the synergies that the team thinks might have a big potential is the idea of increasing the businesses' overall profitability by selling doughnuts in GB stores.How would you assess the profitability impact of this synergy?ANSWER 4Be sure you can clearly explain how the assessment you are proposing would help to answer the question posed.Some possible answers include:∙Calculate incremental revenues by selling doughnuts in GB stores (calculate how many doughnuts per store, times price per doughnut, times number of GB stores)∙Calculate incremental costs by selling doughnuts in GB stores (costs of production, incremental number of employees, employee training, software changes, incremental marketing and advertising, incremental cost of distribution if we cannot produce doughnuts in house, etc.)∙Calculate incremental investments. Do we need more space in each store if we think we are going to attract new customers? Do we need to invest in store layout to have in-house doughnut production?∙If your answer were to take into account cannibalization, what would be the rate of cannibalization with GB offerings? Doughnut cannibalization will be higher with breakfast products than lunch and dinner products, etc.∙One way to calculate this cannibalization is to look at historic cannibalization rates with new product/offering launchings within GB stores∙Might also cannibalize other HD stores if they are nearby GB store–could estimate this impact by seeing historical change in HD’s sales when competitor doughnut store opens nearbyQUESTION 6You run into the CEO of GB in the hall. He asks you to summarize McKinsey’s perspective so far on whether GB should acquire HD. Pretend the interviewer is the CEO–what would you say?ANSWER 6You may have a slightly different list. Whatever your approach, we love to see candidates come at a problem in more than one way, but still address the issue as directly and practically as possible.Answers may vary, but here is an example of a response:∙Early findings lead us to believe acquiring HD would create significant value for GB, and that GB should acquire HDo Believe can add $15 thousand in profit per GB store by selling HD in GB stores. This could mean $50 million in incremental profit for North American stores (where immediate synergies are most likely given HD has little brand presence in rest of world)o We also believe there are other potential revenue and cost synergies that the team still needs to quantify∙Once the team has quantified the incremental revenues, cost savings, and investments, we will make a recommendation on the price you should be willing to pay ∙We will also give you recommendations on what it will take to integrate the two companies in order to capture the potential revenue and cost savings, and also to manage the different franchise structures and potentially different cultures of GB and HD谢谢观看! 欢迎您的下载,资料仅供参考,如有雷同纯属意外。

As part of the interview process, we will ask you to discuss a business problem. As you work through the business case with your interviewer, you will also become better informed about our firm and the kinds of problems we solve.Most candidates enjoy the cases and the business issues they raise. Your approach to the case and the insights you reach will give you an opportunity to demonstrate your problem solving abilities and help us get a sense of your potential. The following questions are addressed in this section:Why we use case studiesHow you should approach the problemWhat we are looking forCase study tipsSome common mistakesIf you want to practice, please try our on-line case study.Why We Use Case StudiesYour ability to deal creatively with complex or ambiguous problems in unfamiliar businesses, to structure your thinking, and to reach sensible conclusions with the available facts in a short time is a critical skill as a consultant.Since no particular background or set of qualifications necessarily prepares you to do this, we've come to rely upon the case study as an integral part of our interview process. The case study gives us an opportunity to see how you think about problems and whether you can reach a well-supported conclusion.Back to TopHow You Should Approach the ProblemThe cases you discuss in each of your interviews will be different. Generally, they are based on the interviewer's professional experiences and will usually describe situations with which you are notfamiliar. For example, your cases might focus on deciding how a company should react to a new competitor or determining what attributes a company should look for in seeking a joint-venture partner.In addressing the case, it is important that you take a logical, well-structured approach and reach a reasoned conclusion. At a minimum, you should be sure that you:Understand the underlying problem and the question. Ask for clarification on points that you feel are unclear.Break the problem down into a logical structure. There may be several issues to be addressed in order to reach a conclusion.Address the issues one at a time. Focus on the most important issues first. Your interviewer may not expect you to get through all of them in the allotted time.Address important issues, not just ones you feel comfortable with. Candidates often focus too much on their own area of expertise rather than the important issues (for example, accountants focusing on the financial aspects of new product development without mentioning customers).Test your emerging hypotheses. Keep coming back to check that you are addressing the question you were asked.Request additional information. As you build an understanding of the problem, there may be more information that you need.Reach a conclusion. Synthesize your thoughts concisely and develop a recommendation.Back to TopWhat We Are Looking ForIn most instances there is no right answer to the problem. It is critical that you demonstrate your ability to think in a structured way and that you reach a reasoned conclusion that is supported by the evidence. Listen carefully to the scenario; if you miss critical information, it can affect your ability to solve the problem.During the case study, we look for evidence of your ability on a number of dimensions — logical reasoning, creativity, quantitative skills, business judgment (not business knowledge), pragmatism, and an ability to structure problem solving. We also look for evidence of intellectual curiosity and enthusiasm for typical consulting issues.It is equally important for us to get a sense that you are comfortable with our working style —learning from the emerging facts and developing revised hypotheses as more information becomes available. You should be receptive to new information and use it to push your thinking forward. When you are asked a question, you should refer back to any relevant information that's already been discussed, rather than answering it in isolation.Back to TopCase Study TipsListen to the problem. Make sure you are answering the question that you have been asked.Begin by setting a structure. Think of four to five sub-questions that you need to answer before you can address the overall issue.Stay organized. Finish one key question and arrive at a point of view before you go on to the next.Communicate your train of thought clearly. If you have considered some alternatives and rejected them, tell the interviewer what and why.Step back periodically. Summarize what you have learned and what the implications appear to be.Ask for additional information when you need it. But make sure that the interviewer knows why you need the information.Watch for cues from the interviewer.Don’t fixate on "crackin g the case." It is much more important to demonstrate a logical thought process than to arrive at the solution.Use business judgment and common sense.Relax and enjoy the process —think of the interviewer as a teammate in a problem-solving process and the case as a real client problem that you need to explore and then solve.Back to TopSome Common MistakesMisunderstanding the question or answering the wrong question.Proceeding in a haphazard fashion. For example, not identifying the major issues that need to be examined or jumping from one issue to another.Asking a barrage of questions without explaining to the interviewer why you need the information.Force-fitting familiar business frameworks to every case question, whether they are relevant or not, or misapplying a relevant business framework that you do not really understand, rather than simply using common sense.Failing to synthesize a point of view even if you don’t have time to talk through all the key issues, be sure to synthesize a point of view based on where you ended up.出师表两汉:诸葛亮先帝创业未半而中道崩殂,今天下三分,益州疲弊,此诚危急存亡之秋也。

McKiney On line case studyTo step through this case example,we will give you some information,ask a question,and then,when you are ready,give you a sample answer. We hope that the exercise will give you a sense of the flow of a case interview. (Please note,you can stop this exercise and pick up where you left off later. Your cookies must be on to use this feature).In this exercise,you will answer a series of questions as the case unfolds. We provide our recommended answers after each question,with which you can compare your own answers. We want to emphasize that most questions in a case study do not have a single right answer. In a live case interview,we are more interested in your explanation of how you arrived at your answer,not just the answer itself. An interviewer can always assess different but equally valid ways of approaching an issue,and then bring you back to the particular line of inquiry that he or she wants to pursue.You should also keep in mind that in a live case,there will be far more interaction with the interviewer than this exercise allows. For example,you will have the opportunity to ask clarifying questions.Finally,a live case interview would typically be completed in 30 - 45 minutes,depending on how the case evolves. In this on-line exercise,there is no time limit. There are eight questions in this on-line case study. This case study is designed to roughly simulate one during your interview,so you will not be able to skip ahead to the next question until you have answered the one you are on. You can refresh yourmemory of previous answers by clicking the highlighted Q&A links to the left. To print the answer,click on the print icon that appears in the TOP RIGHT corner. At the end,you can print the entire on-line case study at once.The caseQuestion 1Client Goal:Double the number of recruits while maintaining their quality with minimal increase in resources expendedOur client recruits graduating college seniors for entry-level positions in locations around the world. It currently hires and places 500 graduates per year but would like to triple in size over the next ten years while maintaining quality. Assume that the increase must all come from hiring graduating seniors. (In an actual case,you may not be given this and other assumptions unless you ask.)The client's current recruiting budget is $2 million annually,and while it is in a strong financial position,it would like to spend as few additional resources as possible on recruiting. McKinsey is advising the client on what steps it will need to take in orderto meet its growth targets,while staying within its budget constraints.Q1:What levers does the organization have at its disposal to achieve its growth goal?A:Some possible levers are given below. It's terrific if you identified several of these and perhaps some others.•Attract more applicants at the same cost•Review the list of campuses targeted (e.g.,optimize resource allocation across schools). The review may result in adding certainhigher potential campuses and eliminating other ones that appear tohave more limited potential.•Review recruiting approach at each campus (e.g.,optimizecost-effectiveness of messages and approaches at each school).•Extend offers to a higher percentage of applicants while maintaining quality(e.g.,reduce the number of people who are turned down who would haveperformed equally well in the job)•Improve acceptance rates among offerees (e.g.,better communicate the benefits of the job relative to alternatives or improve the attractiveness of the job relative to alternatives)Question 2For the remainder of the discussion we'd like to focus on the two specific levers involving attracting more applicants at the same cost.•Review the list of campuses targeted (e.g.,optimize resource allocation across schools). The review may result in adding certain higher potentialcampuses and eliminating other ones that appear to have more limitedpotential.•Review recruiting approach at each campus (e.g.,optimizecost-effectiveness of messages and approaches at each school).Please note that if you identified different but equally valid levers,the interviewer would be able to assess them. But for the purpose of this case study,we are going to focus on these two levers.Q2:How would you initially approach determining whether the client can increase hiring by adjusting the list of campuses targeted?What sort of analysis would you want to conduct and why?A:You might take the following approach,where we've outlined two avenues of analysis:•Estimate the hiring potential across schools•Analyze the number of hires by school over the last several years•Develop a comprehensive list of schools that meet our requirements and a minimum set of standards for recruits•Survey seniors at these schools to determine interest in anentry-level position with the client•Consider the size of the graduating class at each school,determine how that class might be segmented (e.g.,each class could besegmented by discipline or segmented based on career interests inresponse to the survey),then calculate the size of each segment •Estimate the optimal cost-per-hire across schools•Compare the current cost-per hire across schools•Identify opportunities to decrease the cost-per-hire at each school Helpful TipYou may have a slightly different list. Whatever your approach,we love to see candidates come at a problem in more than one way,but still address the issue as directly and practically as possible. In giving the answer,it's useful if you are clear about how the results of the analysis would help to answer the original question posed.Question 3Twenty-five percent of the annual recruiting budget is spent on candidates (i.e.,attracting,assessing,and getting them to accept). Twenty percent of hires are categorized as "most expensive" and have an average cost-per-hire of $2,000.Q3:What is the average cost-per-hire of all other candidates?Remember that the client hires 500 students per year and its annual recruiting budget is $2 million (information that we hope you noted earlier).A:The answer is $750 per hire (or less than half the cost-per-hire of the "most expensive" candidates).Amount spent on the less expensive candidates:25% of $2 million budget = $500,000 spent on candidates20% of 500 student = 100 students categorized as "most expensive"100 x $2,000 cost-per-hire = $200,000 spent on "most expensive" hires$500,000 recruiting budget - $200,000 = $300,000 remaining for all other hires The number of less expensive candidates:500 hires - 100 = 400 "other hires"Cost-per-hire of the less expensive candidates:$300,000/400 =$750 per hireHelpful TipWhile you may find that doing a straightforward math problem in the context of an interview is a bit tougher,you can see that it is just a matter of breaking the problem down. We are looking for both your ability to set the analysis up properly and then to do the math in real time.Question4Q:In order to decide whether to reduce costs at the least efficient schools (i.e.,those with an average cost per hire of $2,000),what else would you want to know?A:Some of the possible answers are given below.Basic questions:•What are the components of costs at these schools (why is it so expensive to recruit there)?•What opportunities exist to reduce costs?•How much cost savings would result from implementing each of the opportunities?•What consequences would implementing each of these opportunities have on recruiting at the least efficient schools?Questions demonstrating further insight:•Why is the cost lower at more efficient schools,and are there best practices in resource management that can be applied to the least efficient schools?•If we reduce costs at the least efficient schools,what will we do with the cost savings (i.e.,what would be the benefit of spending the money elsewhere vs.where it is currently being spent)?Helpful TipWe would not expect anyone to come up with all of these answers,but we hope some of your answers head in the same direction as ours. Yours may bring some additional insights. In either case,be sure that you can clearly explain how your question will bring you closer to the right decision.Question 5The McKinsey team conducts some analysis that indicates that increasing spending on blanket advertising (e.g.,advertisements/flyers on campus) does not yield any significant increase in hires.Q5:Given that increased blanket advertising spending seems to be relatively ineffective,and the client doesn't want to increase overall costs,what might be some other ideas for increasing the candidate pool on a specific campus?A:We are looking for at least a couple of answers like the ones given below:•Improve/enhance recruiting messages (e.g.,understand target candidate group,refocus message on this group,understand competitive dynamic on campus)•Utilize referrals (e.g.,faculty,alumni)•Come up with creative ways to target specific departments/clubs of the school•Rethink advertising spending - while increasing blanket ad spending doesn't seem to work,advertising might still be the most efficient and effective way to increase the number of candidates if it is deployed in a more systematic,targeted wayHelpful TipThis question is a good one for demonstrating creativity because there's a long list of possible ideas. Additional insights into how a given idea would be approached and how much it would cost are helpful.Question 6For simplicity's sake,let's say we've conducted market research and found that there are two types of people on each campus,A and B. Historically,our client has also used two types of recruiting messages in its advertising. The first,called "See the World," gets one percent of type A students to apply,but three percent of type B students. The second,called "Pathway to Leadership," gets five percent of Type A students to apply,but only two percent of type B students.The chart below lists the breakdown of types A and B students at some of our major campuses,and the message our client is using on campus.Q6:Assuming there's no difference between the costs of each message,what can you tell me from this information?A:According to these numbers,the client should use the "Pathway to Leadership" message across all four universities. The "See the World" message is preferable onlyif more than 80% of the students at a given university are of type B.Helpful TipAn even more insightful response would mention that the ultimate answer depends on the cost of each message,whether the cost increases depending on the number of students at the campus,and how interested we are in students of Type A vs. Type B (e.g.,will one type be more likely than the other to get an offer and to be successful on the job). One could imagine using both messages on some campuses if the additional cost were justified by the resulting increase in hires.Question7University 4 graduates 1,000 seniors each year.Q7:How many new candidates might be generated by changing the recruiting message at University 4 to Pathway to Leadership?A:The answer is 20 candidates (i.e.,an increase of over 100%).Number of each type of student at University 4:1,000 seniors x 60% = 600 Type A students1,000 seniors x 40% = 400 Type B studentsCandidates attracted be See the World message:(1% x 600) + (3% x 400) = 18 candidatesCandidates attracted by Pathway to Leadership message:(5% x 600) + (2% x 400) = 38 candidatesIncrease in candidates resulting from change in message:38 - 18 = 20 more candidates (an increase of over 100%)Question8Q8:What sort of next steps should we tell our client we'd like to take based on what we have discussed today?A:The ability to come to a logical,defensible synthesis based on the information available at any point in an engagement is critical to the work we do. Even though we'd consider ourselves to be very early in the overall project at this point in the case,we do want to be able to share our current perspective. The ideal answer would include the following points:FINDINGS•There appears to be an opportunity to significantly increase total applicants of the same quality that we are getting today at the same or reduced cost:•Increasing blanket advertising is ineffective and costly,but changing the advertising message on some campuses could increaseapplicants significantly without increasing costs. At one of thecampuses we've looked at,University 4,the number of applicantswould go up more than 100 percent•The cost-per-hire varies dramatically from school to school. This suggests that there may be opportunities to reduce costs in certainplaces or reallocate resources more efficientlyNEXT STEPS•We plan to explore further ideas for increasing quality applications by changing the mix of schools,beginning with a more detailed review of the opportunities to reduce costs at certain schools•After looking at levers to increase total applicants,we will be analyzing opportunities to improve the offer rate (i.e.,ensure we're not turning down quality applicants) and to increase the acceptance rate•We will examine additional methods for attracting more applications from our current campuses (e.g.,referrals,clubs) in addition to assessing the impact of improved messaging on campus。

麦肯锡咨询案例麦肯锡(McKinsey)是全球最知名的管理咨询公司之一,其咨询服务涵盖了战略规划、组织管理、运营优化、市场营销等多个领域。

在麦肯锡的案例中,我们可以看到许多成功企业的经验和教训,这些案例不仅对于企业管理者具有启发意义,也对于学习管理咨询的人们有着重要的借鉴作用。

首先,我们可以看到麦肯锡在战略规划方面的案例。

在这些案例中,麦肯锡通常会帮助客户分析市场环境、竞争对手、内部资源和能力,从而制定出符合企业实际情况的战略规划方案。

例如,麦肯锡曾经帮助一家汽车制造商分析市场趋势,找到了新的增长点,并提出了相应的战略调整方案,帮助客户成功应对了市场变化,实现了业绩的提升。

其次,麦肯锡在组织管理方面也有许多成功的案例。

在这些案例中,麦肯锡通常会帮助客户优化组织结构、流程和人才管理,提升企业的执行力和组织效率。

例如,麦肯锡曾经帮助一家传统制造企业进行了组织架构调整,优化了生产流程和人员配置,从而提高了生产效率,降低了成本,实现了可持续发展。

此外,麦肯锡在运营优化方面也有许多成功的案例。

在这些案例中,麦肯锡通常会帮助客户分析生产流程、供应链管理、库存控制等方面的问题,提出相应的优化方案。

例如,麦肯锡曾经帮助一家零售企业优化了供应链管理,减少了库存周转周期,提高了资金利用效率,帮助客户实现了盈利能力的提升。

最后,麦肯锡在市场营销方面也有许多成功的案例。

在这些案例中,麦肯锡通常会帮助客户分析市场需求、竞争格局、消费者行为等方面的问题,制定相应的营销策略。

例如,麦肯锡曾经帮助一家互联网企业进行了市场定位和产品定位的调整,帮助客户找到了新的增长点,实现了市场份额的提升。

总的来说,麦肯锡的案例涵盖了战略规划、组织管理、运营优化、市场营销等多个领域,这些案例不仅对于企业管理者具有启发意义,也对于学习管理咨询的人们有着重要的借鉴作用。

通过学习这些案例,我们可以更好地理解管理咨询的方法和技巧,提升自己的管理能力,实现个人和企业的持续发展。