高宏课件Chapter1SolowGrowthModel

- 格式:ppt

- 大小:89.00 KB

- 文档页数:20

高级宏观经济学第一章索洛增长第一节经济增长的事实与研究的主要问题一、典型事实(Stylized facts)经济学的研究是“实事求是”的。

卡尔多(Kaldor,1963)列出了经济增长的程式化事实:1、人均产出持续增长,且增长率未出现下降趋势;2、人均物质资本持续增长;3、资本回报率近乎稳定;4、物质资本一产出比近乎稳定;5、劳动和物质资本在产出中所占的份额近乎稳定;6、人均产出增长率在各国间差距很大。

相对于人类历史而言,持续的、快速增长(现代增长)只是最近一两百年才有的事。

事实6与跨国数据基本吻合。

事实1、2、4、5与发达国家的数据基本一致,但并不适合于更广大的发展中国家,事实3描述的似乎主要是英国的经历。

其它大部分国家真实收益率是下降的。

值得注意的是,在不同的时代,人们关注的主要事实是不同的。

卡尔多事实主要是为稳态增长(或平衡增长)提供事实依据。

当前,跨国与跨地区收入差异这一事实受到经济学家们的重视。

二、经济增长研究的主要问题增长理论要’解释世界各国的贫富差距;各国差距是否有缩小的趋势;经济增长速度的差异;决定一个国家经济增长速度的主要因素;穷国如何才能追上富国。

Romer(2006,p1)指出,现代经济增长理论主要解决如下两个问题:1、什么解释了经济的增长,或经济长期增长的驱动因素是什么?2、为什么一些国家如此之富裕,而另一些则如此之贫穷?经济增长理论研究的是长期中的经济问题。

长期与短期的主要差别在于:价格是否可以灵活变动;资源是否充分利用。

研究长期问题,很多在短期中有重要影响的因素可以忽略:需求波动、货币。

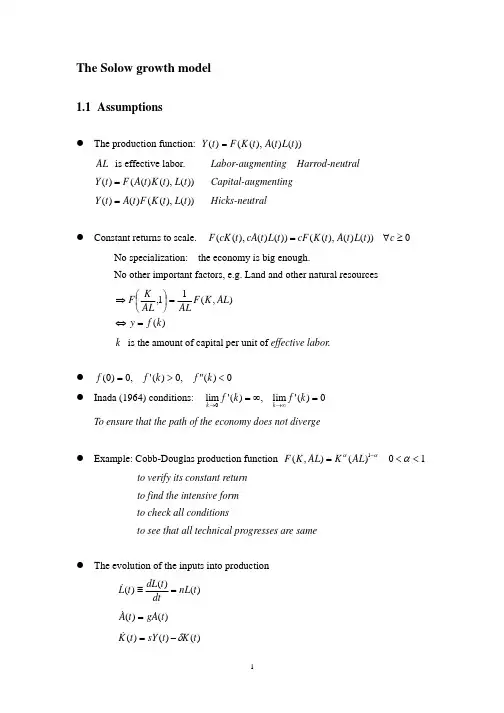

第二节 Solow 模型的基本假定Solow 模型与Ramsey 模型主要探讨储蓄在经济增长中的作用,即:仅仅s 的提高能不能推动长期的增长?s 的跨国差异能不能解释人均产出的差异?然而,我们的基本结论是:s 只能解释部分事实,而不能解释全部(甚至是大部分)事实。

理论的不成功促进了其它模型,特别是内生增长模型的发展(实际上,新古典增长理论的不成功使得经济增长研究几乎停滞了20年,而后才有了新的或内生增长理论的发展)。

Lecture 1 The Solow Growth Model Romer(2001), Advanced Macroeconomics, Chapter 1 Blanchard, Olivier J., 2nd edition, Macroeconomics, Prentice Hall曼昆,《宏观经济学》,人民大学,2000年巴罗,萨拉伊马丁,《经济增长》,中国社会科学出版社,2000年Some Basic Facts about Economic Growth Assumptions of One-Sector Growth Models The Dynamics of the ModelThe Impact of a Change in the Saving Rate The Speed of ConvergenceThe Solow Model and the Central Questions of Growth TheoryEmpirical Applications一、Some Basic Facts about EconomicGrowth: the stylized facts of growth 1. Economic growth through deep time(F2)2. The stylized facts✓ 0,>>y L Y (F3)✓ o k L K >> ,(F4)✓ tcons Y K Y K tan ,==(F5)✓ tcons YP YWt cons YP t cons KP tan 1,tan ,tan =-====ρ3. international differences in the standard of living (F6)4. The Solow growth modelThe ultimate objective of research on economic growth is to determine whether there are possibilities for raising overall growth or bringing standards of living in poor countries closer to those in the worldleaders.The Solow model is the starting point for almost all analyses of growth.The principal conclusion of the Solow model is that the accumulation ofphysical capital cannot account for either the vast growth over time in output per person or the cast geographic differences in output per person. The model treats other potential sources of differences in real incomes as either exogenous and thus not explained by the model.( in the case of technological progress) or absent altogether(in the case of positive externalities from capital).二、 Basic assumptions of one-sectorgrowth models1. Input and Output),(t t t t L A K F Y1) Labor-augmenting or Harrod-neutral),(t t t t L K A F Y = capitalaugmenting),(t t t t L K F A Y = Hicks-ueutral2) The ratio of capital to output, K/Y, eventually settles down 3) Constant returns to scale (first-degree homogeneity)✓ The economy is big enough that the gains from specialization have been exhausted.✓ Inputs other than capital, labor, and knowledge are relatively unimportant. 4) intensive form :)()1,(t t k f ALK F ALY y ===✓ The amount of output per unit of effective labor depends only on the quantity of capital per unit of effective labor, and not on the overall size of theeconomy.✓ output per worker)(k Af ALY AL Y ==5) Assumptions 0)0(=f 0,0<''>'f f)(lim )(lim 0='∞='∞→→k f k f k k ( Inada conditions)✓ The path of the economy does not diverge✓ Cobb-Douglas functionαα==kALK k f )()(2. the evolution of the input into production1) Labor and knowledge grow at constant rates:nt L L nL L eL L t tt ntt +=⇔=⇔=00ln )ln(gtL A gA A eA A t tt gtt +=⇔=⇔=00ln )ln(2) Investment and capital formationtt t t t sY S I dtdK dtdK I S G I T S =====+=+t t tK sY Kδ-=三、 The simple dynamics of growth model1. The Harrod-Domar model1) The fixed-coefficients productionfunction⎥⎦⎤⎢⎣⎡αυ=t t t L K Y ,min2) Saving, investment, and the warranted rate of growthυ==s I Y3) Labor force growth:g n Y +=4) The Harrod-Domar condition:υ=+s g n2. The Solow model1) Cobb-Douglas function(F7)kk y ALK AL YK Y k k MPk kMPkkALY y AL K Y )(1)1()(0)(211===υ<-αα=∂∂>α====-α-ααα-α2) The dynamics of kg yLY k f LeK f LeY EY y E K F Y eL E gtgtt t t tg n t +=======+ )()()(),()(0O ne way: actual and break-even investmentk g n k sf k dtdk tt)()(δ++-==0)()(>⇒δ++>kk g n k sf t , k is rising0)()(>⇒δ++<k k g n k sf t , k is falling 0)()(>⇒δ++=k k g n k sf t, k is constant*)(*)(k g n k sf δ++=T he second way: speedk g n k sf k dtdk tt)()(δ++-==)()()ln(δ++-=g n kk sf dt k d t t)(**)(δ++=g n k k sf)()ln(1δ++-=-αg n skdtk d tt)]([)ln()()ln(1δ++-⨯α=α==-ααg n skdtk d dtk dlin dty d tt t t3) the balanced growth path*************)(*k A L K y A L Y y k Y K k L A K Y L A Y k f y t tt t t t t t t t t t t t ======**)(k sgn k f ++δ=nLL g n II CC KK Y Y =>+==== 0)()()()(====ALIAL C AL K AL Yg LIL C L K L Y ====)()()()()]()([)()()),((t t t t t tt t t t t t t k f k k f A k f L K k f A dL L A K F d w '-='-==)()),((t t t t t k f dKL A K F d r '==t t t t t Y K r L w =+tt tt t t L K L k f k k f A K k f L w K r S S ⋅'-⋅'==*)](**)([**)(*)](**)([**)(k f k k f k k f '-⋅'=(constant)The Solow model implies that, regardless of its starting point, the economy converges to a balanced growth path --- a situation where each variable of the model is growing at a constant rate. On the balanced growth path, the growth rate of output per worker is determined solely by the rate of technological progress.四、 The impact of a change in the savingrateThe division of the government ’spurchanses between consumption and investment goods, the division of its revenues between taxed and borrowing, and its tax treatments of saving andinvestment are all likely to affect the fraction of output that is invested.1. the impact on output(F24,F25)A change in the saving rate has a level effect but not a growth effec t: it changes the economy’s balanced growth path, and thus the level of output per worker at any point in time, but it does not affect the growth rate of output per worker in the balanced growth path.In the Solow model only changes in the rate of technological progress have growth effects; all other changes have only level effects .2. saving and consumption (welfare) )()()()1(t t t t k sf k f k f s c -=-=*)(*)(*)(*)(*)()1(*);(**k g n k f k sf k f k f s c s k k δ++-=-=-== sg n s k g n g n s k f s c ∂δ∂δ++-δ'=∂∂),,,(*)](),,,(*([*if )(),,,(*(δ++>δ'g n g n s k f , 0*>∂∂s c if )(),,,(*(δ++<δ'g n g n s k f , 0*<∂∂s c if )(),,,(*(δ++=δ'g n g n s k f ,0*=∂∂s c the golden-rule level of the capital stock: Consumption is at its maximum possible level among balanced growth paths . δ++=δ'=g n g n s k f MPK )),,,(*(Quantitative Implications1. The effect of s on output in the long run s g n s k k f s y ∂δ∂'=∂∂),,,(**)(*),,,(*)()),,,(*(δδ++=δg n s k g n g n s k sf0*)()(*)(*>'-δ++=∂∂k f s g n k f s k ?*)()(*)(*)(*k f s g n k f k f sy '-δ++'=∂∂*)](/*)(*[1*)(/*)(***k f k f k k f k f k s y y s'-'=∂∂⋅ *)(/*)(*k f k f k 'is the elasticity ofoutput with respect to capital at *k k =. Denoting this by *)(k K α*)(1*)(**k k s y y sK K α-α=∂∂⋅If markets are competitive and there are no externalities, *)(/*)(*k f k f k ' is the share of total income that goes to capital on the balanced growth path. 31*)(≈αk K 21**=∂∂⋅⇒s y y sA 10% increase in the saving rate (from20% of output to 22%) raises output per worker in the long run by about 5% relative to the path it would have followed.Significant changes in saving have only moderate effects on the level of output on the balanced growth path.2. The speed of convergence1) One way)()(δ++-==γg n k k sf k k k k k f )(资本的平均产品。