金融市场与机构10.docx

- 格式:docx

- 大小:19.69 KB

- 文档页数:13

金融市场与机构中远集团资产证券化一、引言在国内已成功实施的资产证券化项目有:中远集团航运收入资产证券化、中集集团应收帐款资产证券化、珠海高速公路未来收益资产证券化。

其中中远集团通过资产证券化融资渠道获得的资金约5.5亿美元左右,珠海高速公路约2亿美元左右,中集集团为8000万美元左右。

在这三个资产证券化案例中,都是由外资投资银行担任证券化项目的主承销商。

目前还未有国内证券公司实质性地运作过资产证券化项目,我国证券公司关于资产证券化积累的经验和知识还处于初步阶段,还需要借鉴和学习国内投资银行的经验。

本文是作者与中远集团资产证券化项目参与人交流后,获得的一些新的经验和体会。

二、中远集团基本介绍中远集团是以国际航运为主业,集船务代理、货运代理、空运代理、码头仓储、内陆集疏运、贸易、工业、金融、保险、房地产开发、旅游、劳务输出、院校教育等业务于一体的大型企业集团,是国家确定的56家大型试点企业集团之一。

中远集团在全国各地都有自己的企业和网点,其中在广州、上海、青岛、大连、天津等地的远洋运输企业已经成为具有相当实力的地区性公司。

此外,中远集团在世界38个国家和地区设有自己的代理机构或公司,在全球150多个国家和地区的1100多个港口设有自己的代理,已经形成了一个以北京为中心,以香港、美国、德国、日本、澳大利亚和新加坡为地区分中心的跨国经营网络。

三、中远集团融资方式介绍1.商业票据中国远洋运输(集团)总公司一直在美国资本市场连续发行商业票据,发行的商业票据最长期限为270天,通过组建银团进行分销,并且以信用证作为发行的商业票据担保。

2000年2月2日中远集团的商业票据续发签字仪式在纽约顺利举行,成为中远集团进入新千年后的第一个融资项目。

意大利锡耶纳银行、美洲银行、花旗银行、美国第一银行和大通银行等多家美国主要银行和中国银行、中国交通银行的代表出席了这一仪式,并在有关合约上签字。

2.资产支持证券在东南亚金融危机的冲击下,商业票据融资渠道的融资功能大大减弱,中远集团于1997年一次发行3亿美元的资产支持证券,发行期限为7年。

金融市场与机构近年来,金融市场与机构的快速发展引起了人们的关注。

金融市场是一种经济交换机制,其基本功能是为个人和机构提供交易金融产品和投资工具的场所。

而金融机构是指提供金融服务,在金融市场上起中介和调节作用的机构。

金融市场和机构为经济发展提供了重要的支持,成为现代经济的重要组成部分。

一、金融市场的种类金融市场的种类非常多,主要包括证券市场、货币市场和衍生品市场。

证券市场是指股票和债券的市场,主要分为一级市场和二级市场。

货币市场是短期借款和贷款市场,包括银行同业拆借市场、商业票据市场和短期国库券市场。

衍生品市场是指通过衍生品合约交易的市场,包括期货市场、期权市场和远期市场。

二、金融机构的分类金融机构也非常多样化,一般可分为银行类金融机构、非银行类金融机构和金融服务类机构。

银行类金融机构主要包括商业银行、投资银行等,是金融市场上最具代表性的机构之一。

非银行类金融机构包括保险公司、证券公司、信托公司等,相对于银行类机构而言规模较小,但所提供的金融服务同样具有重要作用。

金融服务类机构则是提供多种金融服务和产品的中介机构,如金融咨询公司、担保公司等。

三、金融市场和机构的作用金融市场和机构在现代经济中发挥着至关重要的作用。

一方面,金融市场是资本市场的重要组成部分,可以为企业提供融资渠道,为投资者提供投资机会,为风险管理者提供投资组合的分散化手段。

另一方面,金融机构也是经济繁荣发展的基础,它们通过吸收储户的存款和提供贷款等方式,支持着经济活动的展开。

四、未来金融市场和机构发展趋势在数字化时代的背景下,未来金融市场和机构发展趋势将更加多样化和复杂化。

首先,金融科技领域的发展将为金融市场和机构带来前所未有的机遇,比如移动支付、互联网金融、区块链等技术将大大改变金融行业的面貌。

其次,金融监管的趋严将对金融市场和机构的运作带来影响,金融机构将需要更加注重合规和风险管理,以避免潜在的合规风险。

\end{document}。

金融市场与机构随着社会经济的不断发展,金融市场与机构在现代经济中扮演着重要的角色。

金融市场是指各种金融工具的买卖地点,金融机构则是进行金融业务的组织。

本文将对金融市场与机构进行细致的探讨,以期帮助读者更好地了解金融领域的运作机制。

1. 金融市场金融市场是金融机构和投资者进行金融交易的场所,它具有多样化的形式,包括股票市场、债券市场、外汇市场、货币市场等。

不同类型的金融市场有着不同的功能和特点。

1.1 股票市场股票市场是指供股票交易的市场。

在股票市场上,公司可以通过发行股票来筹集资金,同时个人和机构投资者可以通过购买和交易股票来实现投资收益。

股票市场的波动对于经济的稳定和企业的发展都有着重要的影响。

1.2 债券市场债券市场是指供债券交易的市场。

债券是借款人发行的一种具有债权性质的金融工具,债券市场的发展能够提供企业和政府筹集资金的途径。

债券的购买和交易可以为投资者提供固定的利息收益。

1.3 外汇市场外汇市场是指供外汇交易的市场。

外汇交易是不同国家的货币进行兑换的行为,外汇市场的波动对于全球经济的稳定和国际贸易的发展都有着重要的影响。

外汇市场通常比较活跃且交易规模巨大。

1.4 货币市场货币市场是指供短期资金融通和短期借贷的市场。

货币市场包括银行间市场和非银行机构市场,其中银行间市场是各银行之间进行短期融资和投资的市场,非银行机构市场包括商业票据市场和短期融资券市场等。

2. 金融机构金融机构是指提供各种金融服务的组织,包括商业银行、证券公司、保险公司、基金公司等。

金融机构在金融体系中起着承担风险、进行中介调剂和提供金融服务的重要作用。

2.1 商业银行商业银行是最常见的金融机构之一,它主要从事储蓄、贷款、支付结算等业务。

商业银行不仅是个人和企业的储蓄和贷款渠道,也是货币政策的传导机制之一。

商业银行在金融市场的运作中起着至关重要的作用。

2.2 证券公司证券公司是提供证券交易和投资咨询服务的机构。

证券公司扮演着中介机构的角色,帮助客户进行证券买卖、资金融通以及进行投资咨询。

金融市场和机构金融市场和机构是现代经济运行中不可或缺的重要组成部分。

金融市场是指各种金融资产买卖和交易活动地点,而金融机构则是参与金融市场活动的各类机构。

本文将介绍金融市场和机构的定义、分类和功能。

金融市场金融市场是指各类金融资产交易活动的场所,它提供了企业和个人进行资金融通和风险管理的机制。

金融市场通常分为两类:一级市场和二级市场。

一级市场是指金融资产首次公开发行的市场,也称为发行市场。

在一级市场中,企业和政府机构可以通过发行债券或股票等金融工具融资。

投资者可以直接从一级市场购买这些金融工具,使企业或政府机构获得所需的资金。

二级市场是指那些已经发行的金融资产进行二次交易的市场,也称为交易市场。

在二级市场中,投资者可以通过交易所或场外交易机构进行股票、债券和其他金融资产的买卖。

二级市场的交易价格通常由市场供求关系决定,反映了投资者对金融资产的评估和预期。

金融市场的发展和运行离不开金融机构的参与和支持。

下面将介绍一些常见的金融机构。

银行银行是金融体系中最为重要和常见的金融机构之一。

它们提供存款、贷款和其他金融服务,为个人和企业提供资金的融通和管理。

银行通过吸收存款来获取资金,然后将这些资金重新投放给需要贷款的个人和企业。

银行还可以提供支付服务、信用卡发行、外汇交易等金融服务。

证券公司是金融市场中专门从事证券业务的机构。

它们以经纪人的身份,为投资者提供证券买卖、资产管理和投资咨询等服务。

证券公司可以在证券交易所上市,也可以通过场外交易进行交易。

证券公司的主要收入来自交易佣金和管理费用。

保险公司保险公司是从事保险业务的金融机构,它们通过向被保险人提供保险保障,转移风险并为保险理赔提供资金支持。

保险公司的主要业务包括人身保险和财产保险。

在人身保险中,保险公司向被保险人提供寿险、医疗保险等保险产品。

在财产保险中,保险公司向被保险人提供车险、房屋保险等产品。

期货公司是从事期货交易的机构,它们为投资者提供期货买卖、保证金管理等服务。

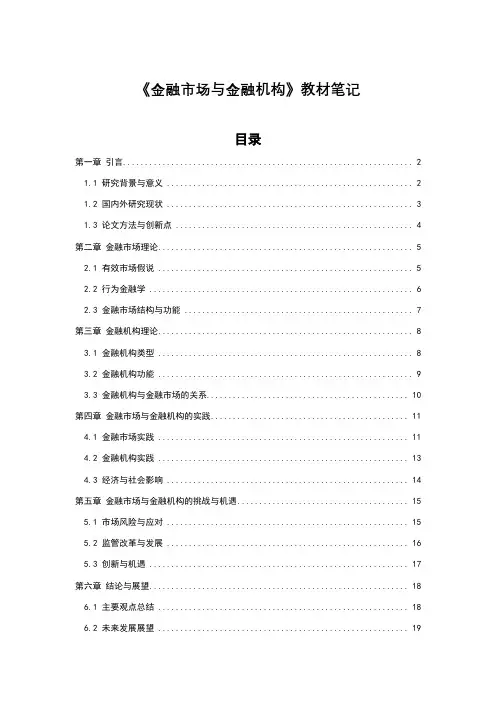

《金融市场与金融机构》教材笔记目录第一章引言 (2)1.1 研究背景与意义 (2)1.2 国内外研究现状 (3)1.3 论文方法与创新点 (4)第二章金融市场理论 (5)2.1 有效市场假说 (5)2.2 行为金融学 (6)2.3 金融市场结构与功能 (7)第三章金融机构理论 (8)3.1 金融机构类型 (8)3.2 金融机构功能 (9)3.3 金融机构与金融市场的关系 (10)第四章金融市场与金融机构的实践 (11)4.1 金融市场实践 (11)4.2 金融机构实践 (13)4.3 经济与社会影响 (14)第五章金融市场与金融机构的挑战与机遇 (15)5.1 市场风险与应对 (15)5.2 监管改革与发展 (16)5.3 创新与机遇 (17)第六章结论与展望 (18)6.1 主要观点总结 (18)6.2 未来发展展望 (19)重要阅读文献 (20)《金融市场与金融机构》教材笔记第一章引言1.1 研究背景与意义金融市场在现代经济体系中占据着举足轻重的地位,作为资金融通的关键平台,其对经济发展的推动作用不可忽视。

金融市场的存在,使得资金能够在供求双方之间高效流动,从而优化资源配置,促进经济增长。

在此背景下,金融机构扮演着至关重要的角色,它们不仅作为金融交易的中介,提供资金融通服务,更在风险管理、资产配置等方面发挥着核心功能。

金融市场的复杂性和动态性要求对其进行深入研究。

市场的波动、政策的变化以及投资者行为的多样性,都影响着金融市场的稳定性和发展方向。

金融机构作为市场的主要参与者,其运营策略、风险管理能力和创新能力,直接关系到金融市场的整体表现。

因此,探讨金融市场与金融机构的内在联系及其对经济的影响,对于理解现代经济运行规律具有重要意义。

随着全球金融市场的日益融合,金融机构之间的竞争也日趋激烈。

如何在这样的市场环境中保持竞争优势,实现可持续发展,是金融机构面临的重要课题。

通过对金融市场和金融机构的深入研究,可以为金融机构提供有针对性的发展策略和建议,进而推动整个金融行业的健康发展。

中远集团资产证券化一、引言在国内已成功实施的资产证券化项目有:中远集团航运收入资产证券化、中集集团应收帐款资产证券化、珠海高速公路未来收益资产证券化。

其中中远集团通过资产证券化融资渠道获得的资金约5.5亿美元左右,珠海高速公路约2亿美元左右,中集集团为8000万美元左右。

在这三个资产证券化案例中,都是由外资投资银行担任证券化项目的主承销商。

目前还未有国内证券公司实质性地运作过资产证券化项目,我国证券公司关于资产证券化积累的经验和知识还处于初步阶段,还需要借鉴和学习国内投资银行的经验。

本文是作者与中远集团资产证券化项目参与人交流后,获得的一些新的经验和体会。

二、中远集团基本介绍中远集团是以国际航运为主业,集船务代理、货运代理、空运代理、码头仓储、内陆集疏运、贸易、工业、金融、保险、房地产开发、旅游、劳务输出、院校教育等业务于一体的大型企业集团,是国家确定的56家大型试点企业集团之一。

中远集团在全国各地都有自己的企业和网点,其中在广州、上海、青岛、大连、天津等地的远洋运输企业已经成为具有相当实力的地区性公司。

此外,中远集团在世界38个国家和地区设有自己的代理机构或公司,在全球150多个国家和地区的1100多个港口设有自己的代理,已经形成了一个以北京为中心,以香港、美国、德国、日本、澳大利亚和新加坡为地区分中心的跨国经营网络。

三、中远集团融资方式介绍1.商业票据中国远洋运输(集团)总公司一直在美国资本市场连续发行商业票据,发行的商业票据最长期限为270天,通过组建银团进行分销,并且以信用证作为发行的商业票据担保。

2000年2月2日中远集团的商业票据续发签字仪式在纽约顺利举行,成为中远集团进入新千年后的第一个融资项目。

意大利锡耶纳银行、美洲银行、花旗银行、美国第一银行和大通银行等多家美国主要银行和中国银行、中国交通银行的代表出席了这一仪式,并在有关合约上签字。

2.资产支持证券在东南亚金融危机的冲击下,商业票据融资渠道的融资功能大大减弱,中远集团于1997年一次发行3亿美元的资产支持证券,发行期限为7年。

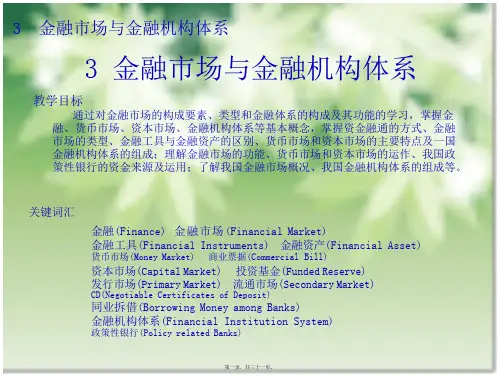

金融市场与金融机构讲义概述金融市场与金融机构是金融领域的两个核心要素。

金融市场是指进行金融资产买卖和金融衍生品交易的场所,金融机构是进行金融中介业务的机构,包括银行、证券公司、保险公司等。

本讲义将介绍金融市场与金融机构的基本概念、特点、功能和发展趋势。

一、金融市场1.1 金融市场的定义与分类金融市场是指资金和金融产品进行交易的场所。

根据交易对象的不同,金融市场可以分为货币市场、债券市场、股票市场、外汇市场和衍生品市场等。

1.2 金融市场的特点与功能金融市场具有流动性高、信息透明、价格发现、风险管理等特点。

其主要功能包括资源配置、风险管理、信息传递和价值评估等。

1.3 金融市场的发展趋势随着科技的进步和金融创新的推进,金融市场的发展趋势呈现出数字化、全球化、多元化和市场化等特点。

二、金融机构2.1 金融机构的定义与分类金融机构是指从事金融中介业务的机构。

按业务性质和功能可以分为银行、证券公司、保险公司、信托公司等。

2.2 金融机构的特点与功能金融机构具有资金融通、风险管理、信息中介和金融创新等特点。

其主要功能包括存款贷款、证券发行、保险业务和资产管理等。

2.3 金融机构的发展趋势随着金融市场的发展和监管政策的变化,金融机构的发展趋势呈现出专业化、国际化、多元化和科技化等特点。

三、金融市场与金融机构的互动关系3.1 金融市场与金融机构的合作关系金融市场和金融机构之间存在紧密的合作关系,金融机构依赖金融市场进行融资和资金配置,金融市场依赖金融机构提供金融产品和服务。

3.2 金融市场与金融机构的监管关系金融市场和金融机构都需要受到监管机构的监管,以保证市场的稳定和金融机构的安全运营。

3.3 金融市场与金融机构的影响关系金融市场和金融机构之间的变化和发展会相互影响,市场的波动和金融机构的危机都会对双方产生影响。

四、金融市场与金融机构的发展问题与对策4.1 金融市场发展问题与对策金融市场发展过程中可能存在信息不对称、市场垄断和风险管理等问题,需要通过完善市场机制、深化金融改革和加强监管等途径来解决。

Chapter 10The Bond MarketMultiple Choice Questionspared to money market securities, capital market securities have(a)more liquidity.(b)longer maturities.(c)lower yields.(d)less risk.Answer: B2.(I) Securities that have an original maturity greater than one year are traded in capital markets.(II) The best known capital market securities are stocks and bonds.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C3.(I) Securities that have an original maturity greater than one year are traded in money markets.(II) The best known money market securities are stocks and bonds.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: D4.(I) Firms and individuals use the capital markets for long-term investments. (II) The capitalmarkets provide an alternative to investment in assets such as real estate and gold.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C——5.The primary reason that individuals and firms choose to borrow long-term is to reduce the risk thatinterest rates will _________ before they pay off their debt.(a)rise(b)fall(c)become more volatile(d)become more stableAnswer: A6. A firm that chooses to finance a new plant by issuing money market securities(a)must incur the cost of issuing new securities to roll over its debt.(b)runs the risk of having to pay higher interest rates when it rolls over its debt.(c)incurs both the cost of reissuing securities and the risk of having to pay higher interest rates onthe new debt.(d)is more likely to profit if interest rates rise while the plant is being constructed.Answer: C7.The primary reason that individuals and firms choose to borrow long-term is to(a)reduce the risk that interest rates will fall before they pay off their debt.(b)reduce the risk that interest rates will rise before they pay off their debt.(c)reduce monthly interest payments, as interest rates tend to be higher on short-term thanlong-term debt instruments.(d)reduce total interest payments over the life of the debt.Answer: B8. A firm will borrow long-term(a)if the extra interest cost of borrowing long-term is less than the expected cost of rising interestrates before it retires its debt.(b)if the extra interest cost of borrowing short-term due to rising interest rates does not exceedthe expected premium that is paid for borrowing long term.(c)if short-term interest rates are expected to decline during the term of the debt.(d)if long-term interest rates are expected to decline during the term of the debt.Answer: A9.The primary issuers of capital market securities include(a)the federal and local governments.(b)the federal and local governments, and corporations.(c)the federal and local governments, corporations, and financial institutions.(d)local governments and corporations.Answer: Bernments never issue stock because(a)they cannot sell ownership claims.(b)the Constitution expressly forbids it.(c)both (a) and (b) of the above.(d)neither (a) nor (b) of the above.Answer: A欢迎下载123——11.(I) The primary issuers of capital market securities are federal and local governments, andcorporations. (II) Governments never issue stock because they cannot sell ownership claims.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C12.(I) The primary issuers of capital market securities are financial institutions.(II) The largest purchasers of capital market securities are corporations.(a) (I) is true, (II) false.(b) (I) is false, (II) true.(c) Both are true.(d) Both are false.Answer: D13. The distribution of a firm’ s capital between debt and equity is its(a)leverage ratio.(b)liability structure(c)acid ratio.(d)capital structure.Answer: D14.The largest purchasers of capital market securities are(a)households.(b)corporations(c)governments.(d)central banks.Answer: A15.Individuals and households frequently purchase capital market securities through financialinstitutions such as(a)mutual funds.(b)pension funds.(c)money market mutual funds.(d)all of the above.(e)only (a) and (b) of the above.Answer: E16.(I) There are two types of exchanges in the secondary market for capital securities: organizedexchanges and over-the-counter exchanges. (II) When firms sell securities for the very first time, the issue is an initial public offering.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C欢迎下载124——17.(I) Capital market securities fall into two categories: bonds and stocks. (II) Long-term bonds includegovernment bonds and long-term notes, municipal bonds, and corporate bonds.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: B18.The _________ value of a bond is the amount that the issuer must pay at maturity.(a)market(b)present(c)discounted(d)faceAnswer: D19.The _________ rate is the rate of interest that the issuer must pay.(a)market(b)coupon(c)discount(d)fundsAnswer: B20.(I) The coupon rate is the rate of interest that the issuer of the bond must pay.(II) The coupon rate is usually fixed for the duration of the bond and does not fluctuate with market interest rates.(a) (I) is true, (II) false.(b) (I) is false, (II) true.(c) Both are true.(d) Both are false.Answer: C21.(I) The coupon rate is the rate of interest that the issuer of the bond must pay. (II) The coupon rateon old bonds fluctuates with market interest rates so they will remain attractive to investors.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: A22.Treasury bonds are subject to _________ risk but are free of _________ risk.(a)default; interest-rate(b)default; underwriting(c)interest-rate; default(d)interest-rate; underwritingAnswer: C欢迎下载125——23.The prices of Treasury notes, bonds, and bills are quoted(a) as a percentage of the coupon rate.(b) as a percentage of the previous day’ s closing value.(c)as a percentage of $100 face value.(d)as a multiple of the annual interest paid.Answer: C24.The security with the longest maturity is a Treasury(a)note.(b)bond.(c)acceptance.(d)bill.Answer: B25.(I) To sell an old bond when interest rates have risen, the holder will have to discount the bond untilthe yield to the buyer is the same as the market rate. (II) The risk that the value of a bond will fall when market interest rates rise is called interest-rate risk.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C26.To sell an old bond when interest rates have _________, the holder will have to _________ theprice of the bond until the yield to the buyer is the same as the market rate.(a)risen; lower(b)risen; raise(c)fallen; lower(d)risen; inflateAnswer: A27.Most of the time, the interest rate on Treasury notes and bonds is _________ that on moneymarket securities because of _________ risk.(a)above; interest-rate(b)above; default(c)below; interest-rate(d)below; defaultAnswer: A28.(I) In most years the rate of return on short-term Treasury bills is below that on the 20-yearTreasury bond. (II) Interest rates on Treasury bills are more volatile than rates on long-termTreasury securities.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C欢迎下载126——29.(I) Because interest rates on Treasury bills are more volatile than rates on long-term securities, thereturn on short-term Treasury securities is usually above that on longer-term Treasury securities. (II)A Treasury STRIP separates the periodic interest payments from the final principal repayment.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: B30.Which of the following statements about Treasury inflation-indexed bonds is not true?(a)The principal amount used to compute the interest payment varies with the consumerprice index.(b)The interest payment rises when inflation occurs.(c)The interest rate rises when inflation occurs.(d)At maturity the securities pay the greater of face-value or inflation-adjusted principal.Answer: C31.The interest rates on government agency bonds are(a)almost identical to those available on Treasury securities since it is unlikely that thefederal government would permit its agencies to default on their obligations.(b)significantly higher than those available on Treasury securities due to their low liquidity.(c)significantly lower than those available on Treasury securities because agency interest paymentsare tax exempt.(d)significantly lower than those available on Treasury securities because the interest-rate risk onagency securities is lower than that on Treasury securities.Answer: B32.(I) Municipal bonds that are issued to pay for essential public projects are exempt from federaltaxation. (II) General obligation bonds do not have specific assets pledged as security or aspecific source of revenue allocated for their repayment.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C33.(I) Most corporate bonds have a face value of $1000, pay interest semi-annually, and can beredeemed anytime the issuer wishes. (II) Registered bonds have now been largely replaced bybearer bonds, which do not have coupons.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: A欢迎下载127——34. The bond contract that states the lender’ s rights and privileges and the borrower’ s obligcalled the(a) bond syndicate.(b) restrictive covenant.(c) bond covenant.(d) bond indenture.Answer: D35. Policies that limit the discretion o f managers as a way of protecting bondholders’ interests are called(a)restrictive covenants.(b)debentures.(c)sinking funds.(d)bond indentures.Answer: A36.Typically, the interest rate on corporate bonds will be _________ the more restrictions are placed onmanagement through restrictive covenants, because _________.(a)higher; corporate earnings will be limited by the restrictions(b)higher; the bonds will be considered safer by bondholders(c)lower; the bonds will be considered safer by buyers(d)lower; corporate earnings will be higher with more restrictions in placeAnswer: C37.Restrictive covenants can(a)limit the amount of dividends the firm can pay.(b)limit the ability of the firm to issue additional debt.(c)restrict the ability of the firm to enter into a merger agreement.(d)do all of the above.(e)do only (a) and (b) of the above.Answer: D38.(I) Restrictive covenants often limit the amount of dividends that firms can pay the stockholders. (II)Most corporate indentures include a call provision, which states that the issuer has the right toforce the holder to sell the bond back.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C39.Call provisions will be exercised when interest rates _________ and bond values _________.(a)rise; rise(b)fall; rise(c)rise; fall(d)fall; fallAnswer: B欢迎下载128——40. A requirement in the bond indenture that the firm pay off a portion of the bond issue eachyear is called(a) a sinking fund.(b) a call provision.(c) a restrictive covenant.(d) a shelf registration.Answer: A41.(I) Callable bonds must have a higher yield than comparable noncallable bonds. (II) Convertible bondsare attractive to bondholders and sell for a higher price than comparable nonconvertible bonds.(a)(I) is true, (II) false.(b)(I) is false, (II) true.(c)Both are true.(d)Both are false.Answer: C42.Long-term unsecured bonds that are backed only by the general creditworthiness of theissuer are called(a)junk bonds.(b)callable bonds.(c)convertible bonds.(d)debentures.Answer: D43. A secured bond is backed by(a) the general creditworthiness of the borrower.(b) an insurance company’ s financial guarantee.(c)the expected future earnings of the borrower.(d)specific collateral.Answer: D44.Financial guarantees(a)are insurance policies to back bond issues.(b)are purchased by financially weaker security issuers.(c)lower the risk of the bonds covered by the guarantee.(d)do all of the above.(e)do only (a) and (b) of the above.Answer: D45.Corporate bonds are less risky if they are _________ bonds and municipal bonds are less risky ifthey are _________ bonds.(a)secured; revenue(b)secured; general obligation(c)unsecured; revenue(d)unsecured; general obligationAnswer: B欢迎下载129——46.Which of the following are true for the current yield?(a)The current yield is defined as the yearly coupon payment divided by the price of the security.(b)The formula for the current yield is identical to the formula describing the yield to maturity fora discount bond.(c)The current yield is always a poor approximation for the yield to maturity.(d)All of the above are true.(e)Only (a) and (b) of the above are true.Answer: A47.The nearer a bond’ s priceitsisparto value and the longer the maturity of the bond the more closely_________ approximates _________(a)current yield; yield to maturity.(b)current yield; coupon rate.(c)yield to maturity; current yield.(d)yield to maturity; coupon rate.Answer: A48.Which of the following are true for the current yield?(a)The current yield is defined as the yearly coupon payment divided by the price of the security.(b)The current yield and the yield to maturity always move together.(c)The formula for the current yield is identical to the formula describing the yield to maturity fora discount bond.(d)All of the above are true.(e)Only (a) and (b) of the above are true.Answer: E49.The current yield is a less accurate approximation of the yield to maturity the _________ the timeto maturity of the bond and the _________ the price is from/to the par value.(a)shorter; closer(b)shorter; farther(c)longer; closer(d)longer; fartherAnswer: B50.The current yield on a $6,000, 10 percent coupon bond selling for $5,000 is(a) 5 percent.(b)10 percent.(c)12 percent.(d)15 percent.Answer: C欢迎下载130——51.The current yield on a $5,000, 8 percent coupon bond selling for $4,000 is(a) 5 percent.(b)8 percent.(c)10 percent.(d)20 percent.(e)none of the above.Answer: C52.For a consol, the current yield is an _________ of the yield to maturity.(a)underestimate(b)overestimate(c)approximate measure(d)exact measureAnswer: D53.Which of the following are true of the yield on a discount basis as a measure of the interest rate?(a)It uses the percentage gain on the face value of the security, rather than the percentage gain onthe purchase price of the security.(b)It puts the yield on the annual basis of a 360-day year.(c)It ignores the time to maturity.(d)All of the above are true.(e)Only (a) and (b) of the above are true.Answer: E54.The formula for the measure of the interest rate called the yield on a discount basis ispeculiar because(a)it puts the yield on the annual basis of a 360-day year.(b)it uses the percentage gain on the purchase price of the bill.(c)it ignores the time to maturity.(d)both (a) and (b) of the above.(e)both (a) and (c) of the above.Answer: A55.The yield on a discount basis of a 180-day $1,000 Treasury bill selling for $950 is(a)10 percent.(b)20 percent.(c)25 percent.(d)40 percent.Answer: A欢迎下载131——56.The yield on a discount basis of a 90-day $1,000 Treasury bill selling for $950 is(a) 5 percent.(b)10 percent.(c)15 percent.(d)20 percent.(e)none of the above.Answer: D57.The yield on a discount basis of a 90-day $1,000 Treasury bill selling for $900 is(a)10 percent.(b)20 percent.(c)25 percent.(d)40 percent.Answer: D58.The yield on a discount basis of a 180-day $1,000 Treasury bill selling for $900 is(a)10 percent.(b)20 percent.(c)25 percent.(d)40 percent.Answer: B59.When an old bond ’ s market value is above its par value the bond is selling at a _________. Thisoccurs because the old bond’ s coupon rate is _________ theatescouponofnewr bonds withsimilar risk.(a) premium; below(b) premium; above(c) discount; below(d) discount; aboveAnswer: B欢迎下载132——True/False1.The primary issuers of capital market securities are local governments and corporations.Answer: FALSE2.Capital market securuties are less liquid and have longer maturities than money market securities.Answer: TRUEernments never issue stock because they cannot sell ownership claims.Answer: TRUE4.To sell an old bond when rates have risen, the holder will have to discount the bond until the yieldto the buyer is the same as the market rate.Answer: TRUE5.Most of the time, the interest rate on Treasury notes is below that on money market securitiesbecause of their low default risk.Answer: FALSE6.Municipal bonds that are issued to pay for essential public projects are exempt from federal taxation.Answer: TRUE7.Most municipal bonds are revenue bonds rather than general obligation bonds.Answer: FALSE8.Most corporate bonds have a face value of $1000, are sold at a discount, and can only be redeemedat the maturity date.Answer: FALSE9.Registered bonds have now been largely replaced by bearer bonds, which do not have coupons.Answer: FALSE10. A sinking fund is a requirement in the bond indenture that the firm pay off a portion of thebond issue each year.Answer: TRUE11.Debentures are long-term unsecured bonds that are backed only by the general creditworthiness ofthe issuer.Answer: TRUE12.In a leveraged buy out, a firm greatly increases its debt level by issuing junk bonds to finance thepurchase of another firm’ s stock.Answer: TRUE13. A financial guarantee ensures that the lender (bond purchaser) will be paid both principaland interest in the event the issuer defaults.Answer: TRUE14. The current yield on a bond is a good approximation of the bond’ s yield to maturity whenmatures in five years or less and its price differs from its par value by a large amount.Answer: FALSE欢迎下载133——Essay1.What is the purpose of the capital market? How do cpaital market securities differ frommoney market securities in their general characteristics?2.What is a bond indenture?3.What role do restrictive covenants play in bond markets?4.What is the difference between a general obligation and a revenue bond?5.What are Treasury STRIPS?6.What is a convertible bond? How does the convertibility feature affect the bond nd’ s price ainterest rate?7.What is a bond ’ s current yield? How does current yield differ from yield to maturity and whatdetermines how close the two values are?8.Distinguish between general obligation and revenue municipal bonds.9.What is a callable bond? How does the callability feature affect the bond’ s price and interest rate?.10.What types of risks should bondholders be aware of and how do these affect bond prices and yields?欢迎下载134。