外贸合同中常见词汇的翻译

- 格式:doc

- 大小:72.50 KB

- 文档页数:19

外贸合同术语大全中英文1. Party A: 甲方2. Party B: 乙方3. Seller: 卖方4. Buyer: 买方5. Goods: 商品6. Product Description: 商品描述7. Quantity: 数量8. Unit Price: 单价9. Total Amount: 总金额10. Payment Terms: 付款条件11. Delivery Terms: 交货条件12. Inspection: 检验13. Acceptance: 验收14. Warranty: 保修15. Force Majeure: 不可抗力16. Arbitration: 仲裁17. Governing Law: 管辖法律18. Confidentiality: 保密性19. Intellectual Property Rights: 知识产权20. Indemnity: 补偿中文翻译:1. Party A: 甲方2. Party B: 乙方3. Seller: 卖方4. Buyer: 买方5. Goods: 商品6. Product Description: 商品描述7. Quantity: 数量8. Unit Price: 单价9. Total Amount: 总金额10. Payment Terms: 付款条件11. Delivery Terms: 交货条件12. Inspection: 检验13. Acceptance: 验收14. Warranty: 保修15. Force Majeure: 不可抗力16. Arbitration: 仲裁17. Governing Law: 管辖法律18. Confidentiality: 保密性19. Intellectual Property Rights: 知识产权20. Indemnity: 补偿。

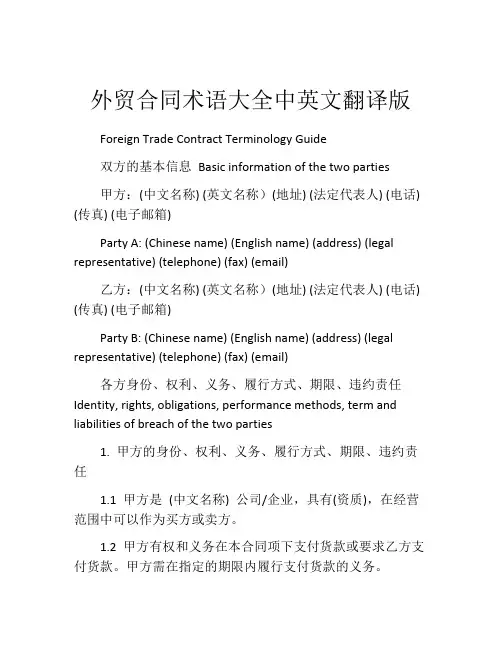

外贸合同术语大全中英文翻译版Foreign Trade Contract Terminology Guide双方的基本信息Basic information of the two parties甲方:(中文名称) (英文名称)(地址) (法定代表人) (电话) (传真) (电子邮箱)Party A: (Chinese name) (English name) (address) (legal representative) (telephone) (fax) (email)乙方:(中文名称) (英文名称)(地址) (法定代表人) (电话) (传真) (电子邮箱)Party B: (Chinese name) (English name) (address) (legal representative) (telephone) (fax) (email)各方身份、权利、义务、履行方式、期限、违约责任Identity, rights, obligations, performance methods, term and liabilities of breach of the two parties1. 甲方的身份、权利、义务、履行方式、期限、违约责任1.1 甲方是(中文名称) 公司/企业,具有(资质),在经营范围中可以作为买方或卖方。

1.2 甲方有权和义务在本合同项下支付货款或要求乙方支付货款。

甲方需在指定的期限内履行支付货款的义务。

1.3 甲方应按照本合同规定的履行方式履行各项义务,包括但不限于(列举)。

1.4 若甲方未按照本合同规定的时间和方式履行各项义务,乙方有权要求甲方承担违约责任。

2. 乙方的身份、权利、义务、履行方式、期限、违约责任2.1 乙方是(中文名称) 公司/企业,在经营范围中可以作为买方或卖方。

2.2 乙方有权和义务在本合同项下提供货物或要求甲方提供货物。

乙方需在指定的期限内履行提供货物的义务。

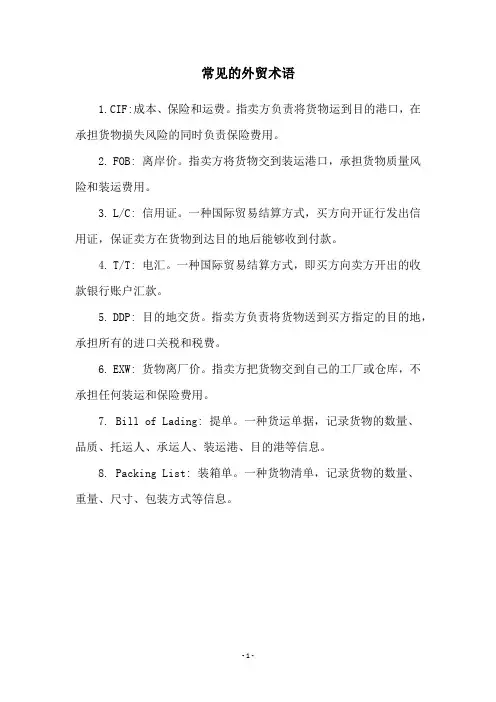

常见的外贸术语

1.CIF:成本、保险和运费。

指卖方负责将货物运到目的港口,在承担货物损失风险的同时负责保险费用。

2. FOB: 离岸价。

指卖方将货物交到装运港口,承担货物质量风险和装运费用。

3. L/C: 信用证。

一种国际贸易结算方式,买方向开证行发出信用证,保证卖方在货物到达目的地后能够收到付款。

4. T/T: 电汇。

一种国际贸易结算方式,即买方向卖方开出的收款银行账户汇款。

5. DDP: 目的地交货。

指卖方负责将货物送到买方指定的目的地,承担所有的进口关税和税费。

6. EXW: 货物离厂价。

指卖方把货物交到自己的工厂或仓库,不承担任何装运和保险费用。

7. Bill of Lading: 提单。

一种货运单据,记录货物的数量、

品质、托运人、承运人、装运港、目的港等信息。

8. Packing List: 装箱单。

一种货物清单,记录货物的数量、

重量、尺寸、包装方式等信息。

- 1 -。

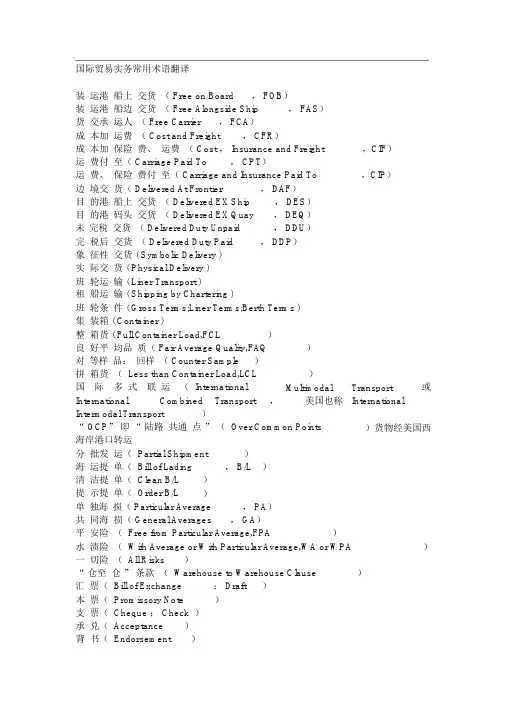

国际贸易实务常用术语翻译装运港船上交货( Free on Board , FOB)装运港船边交货( Free Alongside Ship , FAS)货交承运人( Free Carrier , FCA)成本加运费( Cost and Freight , CFR)成本加保险费、运费( Cost , Insurance and Freight ,CIF)运费付至( Carriage Paid To , CPT)运费、保险费付至( Carriage and Insurance Paid To ,CIP)边境交货( Delivered At Frontier , DAF)目的港船上交货( Delivered EX Ship , DES)目的港码头交货( Delivered EX Quay , DEQ)未完税交货( Delivered Duty Unpaid , DDU)完税后交货( Delivered Duty Paid , DDP)象征性交货 ( Symbolic Delivery )实际交货 ( Physical Delivery )班轮运输 ( Liner Transport )租船运输 ( Shipping by Chartering )班轮条件 ( Gross Terms;Liner Terms;Berth Terms )集装箱 ( Container )整箱货 ( Full Container Load,FCL )良好平均品质( Fair Average Quality,FAQ )对等样品;回样( Counter Sample )拼箱货( Less than Container Load,LCL )国际多式联运( International Multimodal Transport 或International Combined Transport ,美国也称International Intermodal Transport )“ OCP”即“陆路共通点”( Over Common Points )货物经美国西海岸港口转运分批发运( Partial Shipment )海运提单( Bill of Lading , B/L )清洁提单( Clean B/L )提示提单( Order B/L )单独海损( Particular Average , PA)共同海损( General Averages , GA)平安险( Free from Particular Average,FPA )水渍险( With Average or With Particular Average,WA or WPA )一切险( All Risks )“仓至仓”条款( Warehouse to Warehouse Clause )汇票( Bill of Exchange ; Draft )本票( Promissory Note )支票( Cheque ; Check )承兑( Acceptance )背书( Endorsement )空白背书( Blank Endorsement )托收(Collection )付款交单( Documents against Payment , D/P )承兑交单( Documents against Acceptance , D/A )信用证( Letter of Credit,L/C )跟单信用证( Documentary Credit )不可撤销信用证( Irrevocable Letter O f Credit )保兑信用证( Confirmed Letter of Credit )开证申请人( Applicant )开证行( Issuing Bank )通知行( Advising Bank )受益人( Beneficiary )议付银行( Negotiating Bank )不可抗力( Force Majeure )仲裁(Arbitration )询盘(Inquiry )发盘(Offer )还盘(Counter Offer )接受(Acceptance )保险单(Insurance Policy)独家经销(Sole Distribution)产地说明书(Certificate of Origin)招标(Invitation to Tender)投标( Submission of Tender)富不贵只能是土豪,你可以一夜暴富,但是贵气却需要三代以上的培养。

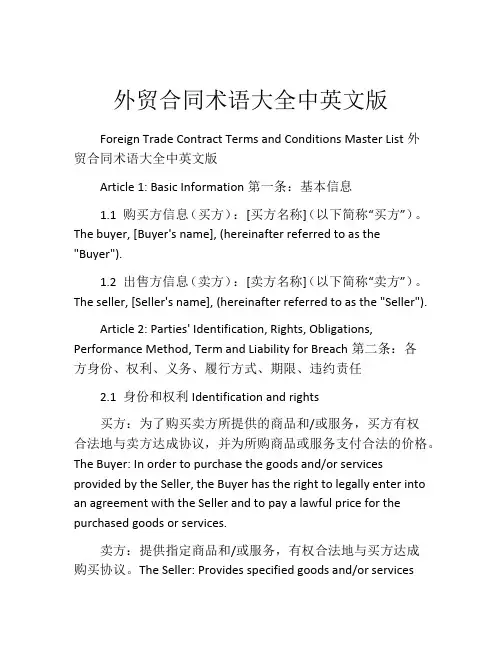

外贸合同术语大全中英文版Foreign Trade Contract Terms and Conditions Master List外贸合同术语大全中英文版Article 1: Basic Information第一条:基本信息1.1 购买方信息(买方):[买方名称](以下简称“买方”)。

The buyer, [Buyer's name], (hereinafter referred to as the "Buyer").1.2 出售方信息(卖方):[卖方名称](以下简称“卖方”)。

The seller, [Seller's name], (hereinafter referred to as the "Seller").Article 2: Parties' Identification, Rights, Obligations, Performance Method, Term and Liability for Breach第二条:各方身份、权利、义务、履行方式、期限、违约责任2.1 身份和权利Identification and rights买方:为了购买卖方所提供的商品和/或服务,买方有权合法地与卖方达成协议,并为所购商品或服务支付合法的价格。

The Buyer: In order to purchase the goods and/or services provided by the Seller, the Buyer has the right to legally enter into an agreement with the Seller and to pay a lawful price for the purchased goods or services.卖方:提供指定商品和/或服务,有权合法地与买方达成购买协议。

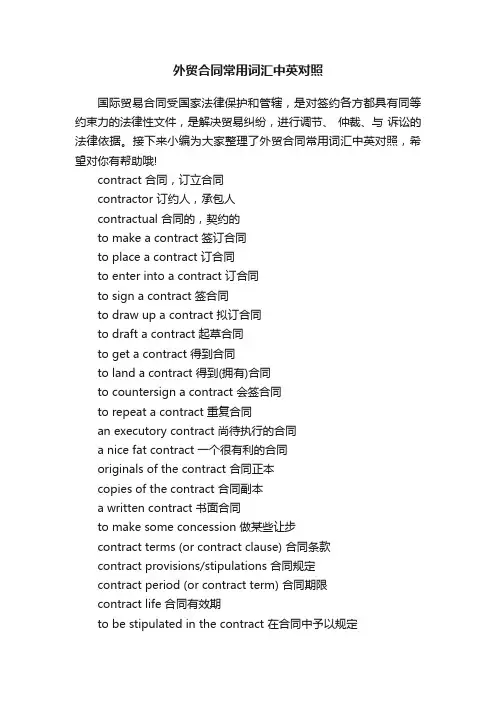

外贸合同常用词汇中英对照国际贸易合同受国家法律保护和管辖,是对签约各方都具有同等约束力的法律性文件,是解决贸易纠纷,进行调节、仲裁、与诉讼的法律依据。

接下来小编为大家整理了外贸合同常用词汇中英对照,希望对你有帮助哦!contract 合同,订立合同contractor 订约人,承包人contractual 合同的,契约的to make a contract 签订合同to place a contract 订合同to enter into a contract 订合同to sign a contract 签合同to draw up a contract 拟订合同to draft a contract 起草合同to get a contract 得到合同to land a contract 得到(拥有)合同to countersign a contract 会签合同to repeat a contract 重复合同an executory contract 尚待执行的合同a nice fat contract 一个很有利的合同originals of the contract 合同正本copies of the contract 合同副本a written contract 书面合同to make some concession 做某些让步contract terms (or contract clause) 合同条款contract provisions/stipulations 合同规定contract period (or contract term) 合同期限contract life 合同有效期to be stipulated in the contract 在合同中予以规定to be laid down in the contract 在合同中列明to bring a contract into effect 使合同生效to come into effect 生效to go (enter)into force 生效to cease to be in effect/force 失效to carry out a contract 执行合同to execute/implement/fulfil/perform a contract 执行合同cancellation of contract 撤消合同breach of contract 违反合同to break the contract 毁约to cancel the contract 撤消合同to tear up the contract 撕毁合同to approve the contract 审批合同to honour the contract 重合同to annual the contract 废除合同to terminate the contract 解除合同to alter the contract 修改合同to abide by the contract 遵守合同to go back on one's words 反悔to be legally binding 受法律约束to stand by 遵守non-payment 拒不付款to secure one's agreement 征得...的同意Additional Words and Phrasescontract price 合约价格contract wages 合同工资contract note 买卖合同(证书)contract of employment 雇佣合同contract of engagement 雇佣合同contract of carriage 运输合同contract of arbitration 仲裁合同contract for goods 订货合同contract for purchase 采购合同contract for service 劳务合同contract for future delivery 期货合同contract of sale 销售合同contract of insurance 保险合同contract sales 订约销售contract law 合同法to ship a contract 装运合同的货物contractual dispute 合同上的争议a long-term contract 长期合同a short-term contract 短期合同contract parties 合同当事人contractual practice/usage 合同惯例contractual claim 根据合同的债权contractual liability/obligation 合同规定的义务contractual income 合同收入contractual specifications 合同规定contractual terms & conditions 合同条款和条件contractual guarantee 合同规定的担保contractual damage 合同引起的损害contractual-joint-venture 合作经营,契约式联合经营completion of contract 完成合同execution of contract 履行合同performance of contract 履行合同interpretation of contract 解释合同expiration of contract 合同期满renewal of contract 合同的续订。

国际贸易合同常用术语1. FOB(Free on Board)FOB就像是在港口的一场交接仪式。

比如说,我是一个中国的卖家,要把一批玩具卖给美国的买家。

货物在上海港越过船舷之前,所有的风险和费用都是我的,一旦越过船舷,就像接力棒交到了买家手里,之后的风险和费用就归他啦。

这时候卖家就只需要负责把货物送到船上,就完成了自己的主要任务。

嘿,是不是挺有趣的?2. CIF(Cost, Insurance and Freight)CIF这个术语啊,就像是一个贴心的大礼包。

想象一下,你是个做服装出口的商人。

你不但要承担货物的成本,还要负责买保险,把货物运到目的港的运费也得你来掏。

这就好比你给买家准备了一个装满东西的包裹,从货物的价值、运输安全到送货上门的路费,你全包了。

多划算的事儿啊,对买家来说,就像天上掉馅饼一样呢!3. CFR(Cost and Freight)CFR有点像简化版的CIF哦。

打个比方,我朋友小王是做家具出口的。

他用CFR 术语的时候,只需要管货物成本和运到目的港的运费,保险这块就交给买家自己去操心了。

这就像你去餐厅吃饭,有的套餐包含饮料,有的套餐不包含,CFR就是那个不包含保险这杯“饮料”的套餐。

买家要是觉得自己能搞定保险,那就选CFR呗。

4. EXW(Ex Works)5. FCA(Free Carrier)FCA就像一场灵活的接力赛起点。

假如我是卖水果的老张,有国外订单。

如果我们约定在我的仓库交货,那我只要把水果准备好,交给承运人,比如来拉货的卡车司机,我的任务就完成了。

不管这个司机是买家找的还是我找的,只要水果交到他手上,就像接力棒传出去了,后面的事儿就和我没多大关系了。

这种方式比FOB更灵活呢,你说是不是?6. CPT(Carriage Paid To)CPT啊,就像是给货物买了一张到目的地的车票。

想象一下,你是卖电子产品的小赵。

你用CPT术语的话,你不但要把货物交给承运人,还要支付把货物运到指定目的地的运费。

外贸合同专业术语1. “FOB(Free on Board)离岸价”这个术语可太重要啦!就像你在海边卖鱼,鱼一上船,责任就开始转移啦。

比如说,我和一个外国客户做海鲜生意,合同上写着FOB上海港。

那就是说,货物在上海港越过船舷的时候,风险就从我这儿转到客户那儿了。

哇塞,要是不懂这个,万一出点啥岔子,那可就亏大了啊!2. “CIF(Cost, Insurance and Freight)到岸价”这CIF就像一个贴心的大礼包。

你想想啊,成本、保险费、运费都包在里头了。

我有个朋友做家具外贸的,他和欧洲客户签的CIF合同。

他得负责把货物运到对方指定港口,还得给货物买保险呢。

这就好比你送朋友一个包裹,不仅要把东西送到,还得给包裹上个保险,保它一路平安。

3. “L/C(Letter of Credit)信用证”信用证啊,那可是外贸里的“定心丸”。

就好比你去参加一场很重要的比赛,这个信用证就是你的参赛资格证。

我之前和一个中东客户做生意,他们那边要求必须用L/C付款。

这就是银行出面担保,只要我按照合同要求发货,就能拿到钱。

要是没有这个,我心里得多慌感觉就像走在钢丝上,没个保障。

4. “INCOTERMS(国际贸易术语解释通则)”这就像是外贸合同的“武林秘籍”啊。

里面涵盖了各种各样的术语规则。

比如说,不同的交货地点、风险转移的时间等等。

我刚入行的时候,看到这个就头疼,觉得像天书一样。

但是后来发现,要是不懂这个,在外贸圈里就像个没头的苍蝇乱撞。

5. “Bill of Lading(提单)”提单就像货物的“身份证”和“通行证”。

我有次给美国客户发货,这个提单可不能少。

它既能证明货物属于谁,又能让货物顺利上船、上岸。

要是弄丢了,哎那就像把自己孩子的出生证明给弄丢了一样,麻烦大了去了。

6. “Customs Clea rance(清关)”清关就像货物出国或者回国的“安检”。

我认识一个做服装外贸的同行,他的货在国外清关的时候出了问题。

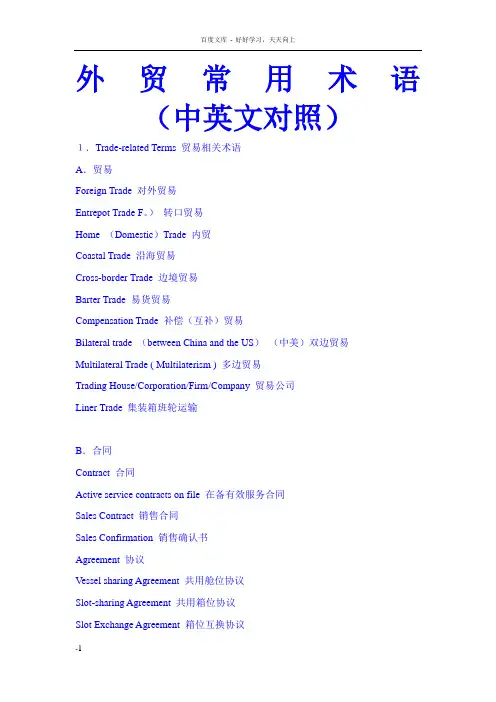

外贸常用术语(中英文对照)1.Trade-related Terms 贸易相关术语A.贸易Foreign Trade 对外贸易Entrepot Trade F。

)转口贸易Home (Domestic)Trade 内贸Coastal Trade 沿海贸易Cross-border Trade 边境贸易Barter Trade 易货贸易Compensation Trade 补偿(互补)贸易Bilateral trade (between China and the US)(中美)双边贸易Multilateral Trade ( Multilaterism ) 多边贸易Trading House/Corporation/Firm/Company 贸易公司Liner Trade 集装箱班轮运输B.合同Contract 合同Active service contracts on file 在备有效服务合同Sales Contract 销售合同Sales Confirmation 销售确认书Agreement 协议Vessel sharing Agreement 共用舱位协议Slot-sharing Agreement 共用箱位协议Slot Exchange Agreement 箱位互换协议Amendment 修正合同Appendix 附录Quota 配额C.服务合同Service Contract as provided in the Shipping Act of 1984,a contract betweena shipper (or a shippers association)and an ocean carrier(or conference)in which the shipper makes a commitmentto provide a certain minimum quantity of cargo or freight revenueover a fixed time period,and the ocean common carrier orconference commits to a certain rate or rate schedules as wellas a defined service level (such as assured space,transit time,port rotation or similar service features)。

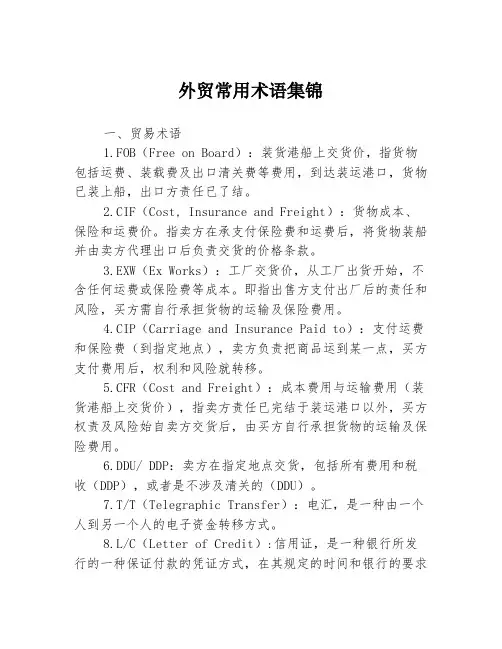

外贸常用术语集锦一、贸易术语1.FOB(Free on Board):装货港船上交货价,指货物包括运费、装载费及出口清关费等费用,到达装运港口,货物已装上船,出口方责任已了结。

2.CIF(Cost, Insurance and Freight):货物成本、保险和运费价。

指卖方在承支付保险费和运费后,将货物装船并由卖方代理出口后负责交货的价格条款。

3.EXW(Ex Works):工厂交货价,从工厂出货开始,不含任何运费或保险费等成本。

即指出售方支付出厂后的责任和风险,买方需自行承担货物的运输及保险费用。

4.CIP(Carriage and Insurance Paid to):支付运费和保险费(到指定地点),卖方负责把商品运到某一点,买方支付费用后,权利和风险就转移。

5.CFR(Cost and Freight):成本费用与运输费用(装货港船上交货价),指卖方责任已完结于装运港口以外,买方权责及风险始自卖方交货后,由买方自行承担货物的运输及保险费用。

6.DDU/ DDP:卖方在指定地点交货,包括所有费用和税收(DDP),或者是不涉及清关的(DDU)。

7.T/T(Telegraphic Transfer):电汇,是一种由一个人到另一个人的电子资金转移方式。

8.L/C(Letter of Credit):信用证,是一种银行所发行的一种保证付款的凭证方式,在其规定的时间和银行的要求下付款。

9.B/L(Bill of Lading):提单,是国际贸易中确认货运合同、证明运载人的货物交接文件。

10.海运费(Sea Freight):在国内外贸易中,运输海运货物所产生的运输费用。

二、贸易条款1.FOB(Free on Board):装运港船上交货价。

2.CIF(Cost, Insurance and Freight):成本、保险费和运费。

3.EXW(Ex Works):工厂交货价。

4.CIP(Carriage and Insurance Paid to):支付运费和保险费(到指定地点)。

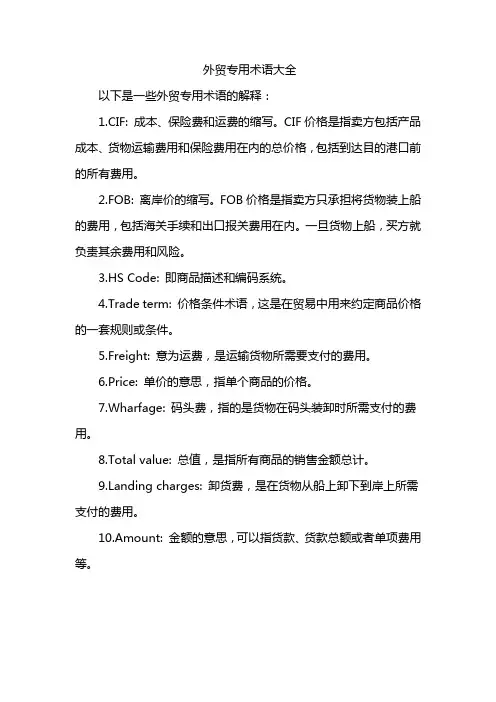

外贸专用术语大全

以下是一些外贸专用术语的解释:

1.CIF: 成本、保险费和运费的缩写。

CIF价格是指卖方包括产品成本、货物运输费用和保险费用在内的总价格,包括到达目的港口前的所有费用。

2.FOB: 离岸价的缩写。

FOB价格是指卖方只承担将货物装上船的费用,包括海关手续和出口报关费用在内。

一旦货物上船,买方就负责其余费用和风险。

3.HS Code: 即商品描述和编码系统。

4.Trade term: 价格条件术语,这是在贸易中用来约定商品价格的一套规则或条件。

5.Freight: 意为运费,是运输货物所需要支付的费用。

6.Price: 单价的意思,指单个商品的价格。

7.Wharfage: 码头费,指的是货物在码头装卸时所需支付的费用。

8.Total value: 总值,是指所有商品的销售金额总计。

nding charges: 卸货费,是在货物从船上卸下到岸上所需支付的费用。

10.Amount: 金额的意思,可以指货款、货款总额或者单项费用等。

国际贸易中实用英汉对照国际贸易是各国之间进行经济交流与合作的重要方式。

在国际贸易中,英语作为一种通用的商务语言,在跨国贸易中扮演着重要的角色。

为了方便各国商务人士的交流与合作,下面列举了一些国际贸易中常见的英汉对照词汇与术语。

1. 商品和货物英语中文commodity 商品goods 货物product 产品export 出口import 进口trade 贸易shipment 运输invoice 发票packing list 装箱单bill of lading 提单certificate of origin 原产地证书customs declaration 报关单inspection certificate 检验证书insurance 保险freight 运费tariff 关税quota 配额embargo 禁运2. 付款和结汇英语中文payment 付款remittance 汇款letter of credit 信用证bill of exchange 汇票T/T (Telegraphic Transfer) 电汇L/C (Letter of Credit) 信用证D/P (Documents against Payment) 货到付款D/A (Documents against Acceptance) 承兑交单cash 现金bank transfer 银行转账currency exchange 货币兑换exchange rate 汇率3. 贸易方式和合作英语中文international trade 国际贸易domestic trade 国内贸易foreign trade 外贸import and export 进出口joint venture 联营wholly-owned subsidiary 独资子公司distributor 经销商agent 代理商trade fair 贸易展览会trade deficit 贸易逆差trade surplus 贸易顺差free trade agreement 自由贸易协定customs clearance 清关trade barrier 贸易壁垒dumping 倾销anti-dumping measures 反倾销措施intellectual property rights 知识产权patent 专利trademark 商标copyright 版权4. 运输和物流英语中文transportation 运输logistics 物流shipping 航运freight forwarding 货运代理container 集装箱warehouse 仓库storage 存储distribution 分销customs clearance 清关shipping company 货运公司freight forwarder 货运代理人shipping agent 代理人air freight 空运sea freight 海运land transportation 陆运express delivery 快递运输tracking number 运输追踪号packaging 包装insurance coverage 保险覆盖customs declaration 报关transshipment 转运supply chain 供应链inventory control 库存控制just-in-time (JIT) delivery 按需交付以上是国际贸易中常见的一些英汉对照词汇和术语。

常用国际贸易术语中英文对照A.A.R=againstallrisks担保全险,一切险A.B.No.=AcceptedBillNumber进口到单编号A/C=Account账号AC.=Acceptance承兑acc=acceptance,accepted承兑,承诺a/c.A/C=account帐,帐户ackmt=acknowledgement承认,收条[/color]a/d=afterdate出票后限期付款(票据)ad.advt.=advertisement广告adv.=advice通知(书)adval.=Advalorem(accordingtovalue)从价税A.F.B.=AirFreightBill航空提单Agt.=Agent代理商AI=firstclass一级AM=Amendment修改书A.M.T.=AirMailTransfer信汇Amt.=Amount额,金额A.N.=arrivalnotice到货通知A.P.=accountpayable应付账款A/P=AuthoritytoPurchase委托购买a.p.=additionalpremiun附加保险费A.R.=AccountReceivable应收款Art.=Article条款,项A/S=accountsales销货清单a/s=aftersight见票后限期付款asstd.=Assorted各色俱备的att,.attn.=attention注意av.,a/v=average平均,海损a/v=avista(atsight)见票即付经贸常用词缩写(D)、(E)DD/A=documentsagainstacceptance,承兑后交付单=documentsforacceptance,=documentsattached,备承兑单据=depositaccount存款账号d/a=daysafteracceptance承兑后……日付款D.A.=Debitadvice付款报单D/D,D.=Demanddraft,documentarydraft即期汇票,跟单汇票d/d=day’sdate(daysafterdate)出票后……日付款d.f.,d.fet.=deadfreight空载运费(船)Disc.=Discount贴现;折扣DLT=DayLetterTelegram书信电D/N=debitnote借方通知D/O=deliveryorder卸货通知书D/P=documentsagainstpayment付款后交付单据Dr.=debitdebter借方,债务人d/s.=days’sight见票后……日付款。

常用国际贸易词汇的中英文对照随着全球化的加速推进,国际贸易的重要性也越来越凸显。

作为一个国际贸易从业者,熟悉国际贸易中的常用词汇是非常重要的。

下面就让我们来了解一下常用国际贸易词汇的中英文对照。

1. 进口——import2. 出口——export3. 关税——tariff4. 税率——tax rate5. 关税代理——tariff agency6. 保险——insurance7. 海关——customs8. 运输——transportation9. 货运代理——freight forwarder10. 货运单据——shipping documents11. 发票——invoice12. 支付方式——payment method13. 基本价格——base price14. 建议零售价格——suggested retail price15. 交货期——delivery time16. 修改时间——modification time17. 条件——term18. 报价——quotation19. 目的地——destination20. 装箱——packing21. 开立信用证——opening a letter of credit22. 信用证——letter of credit23. 总金额——total amount24. 票据——bill of exchange25. 经济衰退——recession26. 泰然处之——stoic27. 订单——order28. 保修——warranty29. 报关费——customs clearance fee30. 税费——tax fee以上就是常用国际贸易词汇的中英文对照,这些词汇对于国际贸易从业者而言是非常重要的,熟练掌握这些词汇对于开展国际贸易,进行海外采购等方面都将有益处。

另外,对于留学生而言,如果想在国外开展实习等相关领域的工作,了解这些词汇也将是极有帮助的。

外贸术语翻译1.shipping marks 运输标志 1.一式两份in duplicate2.documentary L/C 跟单信用证 2.形式发票pro forma invoice3.take delivery of 提货 3.执行订单carry out an orde4.FPA 平安险 4.承保人(保险人)Insurer5.ocean bill of lading 海运提单 5.向某人下订单book/place an order with sb6.date of shipment 装运期 6. 建立业务关系establish business relations7.sight L/C 即期信用证7.供你方参考for your reference8. for our file 供我方存档8.随后的修改9. shipping advice 装运通知9.状况良好in good condition10. lodge a claim 索赔10.检验证书inspection certificate11. payment terms 付款条件11.以……为条件Subject to…12. survey report鉴定报告12.最低价bottom price13. short weight 短装13.海运提单ocean bill of lading14. port of destination 目的港14.商品检验局Commodity Inspection Bureau15. additional risk 额外风险15.发票金额invoice value16.invoice value 发票金额16. 适合海运的包装seaworthy packing17.equality and mutual benefit 平等互利17.装运须知shipping instruction18.Internatinal Chamber of Commerce 国际商会18.会签countersign19.in the market for 想买;想卖19. 合理的价格reasonable price20.at Seller’s Option 20. 清洁提单clean B/L21.draw on sb. 向某人开立汇票21.装箱单packing list22.insurance policy保险单22.仲裁裁决arbitration award23.in good condition状况良好23.鉴于;考虑到in consideration of …/in view of24.in FCL container整集装箱装运24.解决索赔settle a claim25.for one’s account由某人负担(费用) 25.不可撤销信用证Irrevocable L/C。

涉外合同专业词汇

1. “Offer(要约)” ,比如说你看到一件超级喜欢的衣服,你跟店员说“我愿意用这个价格买它”,这就有点像发出了一个 Offer 呀!

2. “Acceptance(承诺)” ,那当店员说“好呀,卖给你”,这就是做出了 Acceptance 嘛,交易就达成啦!

3. “Consideration(对价)” ,就像你买东西给了钱,钱就是Consideration 呀,双方都有付出和收获呢!

4. “Term(条款)” ,合同里那些规定,像什么交货时间、付款方式,这都是 Term 呀,不遵守可不行嘞!

5. “Breach(违约)” ,假如对方没按合同的 Term 来做,那就是Breach 啦,得承担后果哟!

6. “Remedy(救济)” ,对方违约后你可以采取一些办法来挽回损失,这就是 Remedy 呀,可不能让自己吃亏!

7. “Force Majeure(不可抗力)” ,哎呀,像那种突然发生的大灾难,没办法控制的,这就是 Force Majeure 呀,有些情况就可以免责呢!

8. “Jurisdiction(管辖权)” ,要是万一有纠纷,得知道由谁来管吧,这就是 Jurisdiction 的重要性呀!

9. “Arbitration(仲裁)” ,不想去法院打官司,通过仲裁来解决问

题也不错呀,这也是解决纠纷的一种方式呢!

我觉得这些涉外合同专业词汇真的很重要啊,搞清楚它们能让我们在涉外交易中更加明白自己的权利和义务,避免很多麻烦呢!。

外贸术语大全(中英对照)价格条件术语价格术语trade term (price term)运费freight单价price码头费wharfage总值total value卸货费landing charges金额amount关税customs duty净价net price印花税stamp duty含佣价price including commission港口税portdues回佣return commission装运港portof shipment折扣discount,allowance卸货港port of discharge批发价wholesale price目的港portof destination零售价retail price进口许口证inportlicence现货价格spot price出口许口证exportlicence期货价格forward price现行价格(时价)current price prevailingprice国际市场价格world (International)Marketprice离岸价(船上交货价)FOB-free on board成本加运费价(离岸加运费价)C&F-cost and freight到岸价(成本加运费、保险费价)CIF-cost,insurance and freight 国际贸易术语出口信贷export credit出口津贴export subsidy商品倾销dumping外汇倾销exchange dumping优惠关税special preferences保税仓库bonded warehouse贸易顺差favorable balance of trade贸易逆差unfavorable balance of trade进口配额制import quotas自由贸易区free trade zone对外贸易值value of foreign trade国际贸易值value of international trade普遍优惠制generalized system of preferences-GSP 最惠国待遇most-favored nation treatment-MFNT交货条件术语交货delivery轮船steamship(缩写S.S)装运、装船shipment租船charter (the chartered shep)交货时间time of delivery定程租船voyage charter;装运期限time of shipment定期租船time charter托运人(一般指出口商)shipper,consignor收货人consignee班轮regular shipping liner驳船lighter舱位shipping space油轮tanker报关clearance of goods陆运收据cargo receipt提货to take delivery of goods空运提单airway bill正本提单original B\L选择港(任意港)optional port选港费optional charges选港费由买方负担optional charges to be borne by the Buyers 或optional charges for Buyers’ account一月份装船shipment during January 或January shipment一月底装船shipment not later than Jan.31st.或shipment on or before Jan.31st.一/二月份装船shipment during Jan./Feb.或Jan./Feb. shipment在......(时间)分两批装船shipment during....in two lots在......(时间)平均分两批装船shipment during....in two equal lots分三个月装运in three monthly shipments分三个月,每月平均装运in three equal monthly shipments立即装运immediate shipments即期装运prompt shipments收到信用证后30天内装运shipments within 30 days after receipt of L/C不允许分批装船partial shipment not allowed / partial shipment not permitted允许分批装船partial shipment not unacceptable交易磋商、合同签订订单indent订货;订购book; booking电复cable reply实盘firm offer递盘bid; bidding递实盘bid firm还盘counter offer发盘(发价) offer发实盘offer firm询盘(询价)inquiry;enquiry指示性价格price indication速复reply immediately参考价reference price习惯做法usual practice交易磋商business negotiation不受约束without engagement业务洽谈business discussion限**复subject to reply **限* *复到subject to reply reaching here ** 有效期限time of validity有效至**: valid till **购货合同purchase contract销售合同sales contract购货确认书purchase confirmation销售确认书sales confirmation一般交易条件general terms and conditions以未售出为准subject to prior sale需经卖方确认subject to sell er’s confirmation需经我方最后确认subject to our final confirmation交易方式INT (拍卖auction)寄售consignment招标invitation of tender投标submission of tender一般代理人agent总代理人general agent代理协议agency agreement累计佣金accumulative commission补偿贸易compensation trade(或抵偿贸易)compensating/compensatory trade (又叫:往返贸易)counter trade来料加工processing on giving materials来料装配assembling on provided parts独家经营/专营权exclusive right独家经营/包销/代理协议exclusivity agreement独家代理sole agency; sole agent; exclusive agency; exclusive agent 品质条件品质quality原样original sample规格specifications复样duplicate sample说明description对等样品countersample标准standard type参考样品reference sample商品目录catalogue封样sealed sample宣传小册pamphlet公差tolerance货号article No.花色(搭配)assortment样品sample 5%增减5% plus or minus代表性样品representative sample大路货(良好平均品质)fair average quality外贸平台- 实惠网()整理资料系列最新外贸平台实惠网 火热推出-自主B2C店铺,所有精品店铺模板目前完全免费,实惠网官方外贸群:112301572;博客交流:)更多外贸资料,欢迎访问实惠网外贸论坛()。

China and India's State-Owned Reinsurers Adopt Divergent StrategiesFebruary 12, 2012The state-owned reinsurers of China and India have traveled different paths to expansion. With its recent investment in a Lloyd's syndicate, China Reinsurance Group is mapping an international course that leads to Europe, the Americas and Africa.In the year ahead, market observers expect the Chinese reinsurer to be more competitive and to "look outward" more than its Indian counterpart, with sufficient capital reserves and regulatory supports following its first overseas strategic partnership.China Reinsurance (Group) Corp. started operating a special-purpose Lloyd's syndicate this year by forming a strategic partnership with U.K.-based Catlin Group Ltd. to write reinsurance cover for an existing Catlin syndicate. The Chinese state-owned reinsurer earlier said it and Catlin would provide capital for Syndicate 2088, which will have a stamp capacity of about 50 million pounds (US$78.7 million)."As the biggest reinsurance company in China, China Re's strategy is to grow both in the home market and abroad, and to have a greater involvement in international markets," said Chairman Peiyu Li. Setting up Syndicate 2088 and the alliance with Catlin will be a "milestone" in China Re's international strategy, while the new venture will help the reinsurer to gain a better knowledge of Lloyd's and benefit from its worldwide network (Best's News Service, Nov. 8, 2011).It will also increase the company's experience of international reinsurance operations and management and help build a foundation for China Re to grow into an important player in the world reinsurance market, said Li. The company intends to continue its "internationalization" growth strategy by gradually setting up overseas representative offices and branches, and seeks to become a medium-size international reinsurer by 2015 (Best's News Service, Aug. 9, 2011).China Re's plan is to "focus on Asian market growth, with steady business participation in Europe and America, while gradually developing emerging markets like Latin America and Africa by leveraging on its strong capital base and positive international credit ratings," Li said.Currently, about two-thirds of China Re's international business is generated from traditional Asian markets, while the remaining one-third comes from mature markets like Europe and America. This compares with other regional reinsurers, such as Korean Re's business ratios of 43% from Asia and 23% from Europe and America; as well as Japan-based Toa Re's 24% from Asia and 74% from Europe and America, noted the Chinese reinsurer.To further expand in the international market, Li said China Re can either increase the ceding of part of its own reinsurance business to foreign reinsurers, or underwrite part of the ceded reinsurance business from overseas reinsurers in addition to establishing its own overseas branches or subsidiaries, or to expand through mergers and acquisitions.Different from relying on a foreign partner to tap further into the global market, India's state-owned reinsurer -- General Insurance Corporation of India -- entered the overseas market earlier than China Re by opening its own branch offices in London, Moscow, and most recently, Malaysia. It has also developed as a reinsurance solutions partner for the Afro-Asian region, and operated reinsurance programs in the South Asian Association for Regional Cooperation countries, Southeast Asia, the Middle East and Africa.During the fiscal year ending March 31, 2011, GIC Re reported year-on-year premium growth of 20% to 116.81 billion rupees (US$2.29 billion). Among the total, foreign business accounted for approximately 40.3%, down from 44.7% for the previous year, according to its annual report.In 2010, China Re noted premium income of less than 1.5 billion yuan (US$238 million) from overseas ceded reinsurance business, accounting for 6% of the group's total. Its premium income generated from reinsurance and insurance business during the year totaled 38.13 billion yuan, including 13.82 billion yuan from direct insurance and 24.31 billion yuan from reinsurance. The group had operating income of $38.8 billion in 2010, with total assets and pretax profits of 99.5 billion yuan and 3.06 billion, respectively.When focused on the primary insurance market, China and India are both growth markets, while the Chinese players again are better positioned for global growth, as limited local insurance business size and smaller domestic market base have curbed the Indian companies' expansion ambitions."The Indian insurance market itself is still way under-penetrated, more so than China, and there is still huge room for growth," said Sharon Khor, a Hong Kong-based partner and head of insurance for greater China at Accenture, an international consultant."Unlike China, the number of India's domestic insurers is still rather small, which is dominated by one mega government-owned insurer. Thus the probability of any local insurer in India looking outward is extremely low," noted Khor, who said Indian insurers and the state-owned reinsurer "will likely focus on their domestic market, instead of overseas expansion."Low insurance penetration, a vast population and rapid economic development, however, would continue to provide a largely untapped potential to be explored in India, such as traditional property, engineering and marine classes, liability, oil and energy, aviation, health and nuclear power, GIC Re's chairman and managing director Yogesh Lohiya said earlier (Best's News Service, June 29, 2010).Given the economic situation and the expectation of an insurance growth slowdown, particularly in 2012, Khor said Chinese insurers "will continue to stay focused on their core business in China in the near term," in addition to finding ways to sustain the growth momentum and improve operational productivity and efficiency.The domestic Chinese market still has growth opportunities, which means overseas expansion is "less compelling" where the markets may be more saturated and challenging, especially in the West. "I will not preclude the possibility of Chinese insurers investing in other emerging or developing markets, for example, in Southeast Asia and Africa, or even taking up a minority stake in a foreign financial institution entity in a matured market," said Khor. The China Insurance Regulatory Commission said Chinese insurance companies have steadily implemented a "going global" strategy in the past decade since China joined the World Trade Organization, which has helped them enhance their domestic and international competitiveness.The Beijing-based regulator expects the global financial environment will be positive in the mid to long term, and the domestic health insurance and pension markets will provide more opportunities to foreign insurers (Best's News Service, Dec. 20, 2011).Eight Chinese insurers have set up 27 operating units overseas, while six domestic insurers have established eight representative offices overseas. China Re was jointly founded by the Ministry of Finance of China and Central Huijin Investment Corp. with 15.09% and 84.91% stakes, respectively. It has paid up capital of 36.41 billion yuan.China Re currently has a Best's Financial Strength Rating of A (Excellent). GIC Re currently has a Best's Financial Strength Ratings of A- (Excellent).(By Rebecca Ng, Hong Kong news editor: Rebecca.Ng@)CHINA DAIL YIndia's trade deficit widens as import growth outpaces exportsUpdated: 2012-02-10 07:38NEW DELHI - India's trade deficit widened to a three-month high in January as import growth outpaced the climb in exports, the top bureaucrat in the commerce ministry said.Merchandise exports rose 10.1 percent to $25.4 billion last month from a year earlier, Commerce Secretary Rahul Khullar told reporters in New Delhi onThursday. Imports gained 20.3 percent to $40.1 billion, leaving a trade deficit of $14.7 billion, he said.A trade gap Khullar said may reach $160 billion in the current fiscal year threatens to revive pressure on the rupee after it tumbled the most in Asia last year. Europe's debt crisis has curbed overseas sales by nations from Thailand to China, and the Reserve Bank of India has signaled interest-rate cuts to shield growth providing inflation slows further."The slowdown in the industrialized nations is affecting demand for India's exports," N.R. Bhanumurthy, a New Delhi-based economist at the National Institute for Public Finance and Policy, said before the report. "That will put pressure on the rupee to weaken."The slowdown in Europe is weighing on exports, Khullar said, adding the current-account deficit may reach 3.5 percent of GDP in the 12 months through March. The next fiscal year will be a tough one for overseas sales, he said.India's government two days ago predicted the weakest economic expansion this year since 2009. GDP will probably rise 6.9 percent in the 12 months through March from a year earlier, it said. Asia's third-largest economy expanded 8.4 percent from 2010 to 2011.Growth has slowed after the reserve bank raised rates by a record amount from 2010 until October last year to fight price gains and as Europe's turmoil and policy gridlock deter investment.The central bank on Jan 24 cut the amount of deposits lenders need to set aside as reserves for the first time since 2009, seeking to ease a cash squeeze and bolster expansion. It left the repurchase rate at 8.5 percent for a second meeting.Thursday's report showed the climb in exports was the fastest in three months. At the same time, it fell short of the pace recorded each month from November 2009 through October 2011.India said it will step up trade with Iran even as international sanctions against the Persian Gulf state over its nuclear program are tightened.India, which buys about $9.5 billion of crude oil annually from Iran, plans to send a trade delegation to Teheran in a bid to boost exports of goods not covered by United Nations restrictions, Khullar told reporters in New Delhi on Thursday."If opportunities emerge" as other nations halt commerce with Iran "then we will snap them up", Khullar said. "We will be mounting a mission to Iran at theend of the month to promote our own exports."India will continue to buy Iranian oil and opposes sanctions on the Islamic Republic from anyone except the UN, Ranjan Mathai, India's foreign secretary, said on Jan 17.India will also keep exporting rice to Iran, its biggest buyer, as the two nations take steps to clear delayed payments and boost trade.The country will maintain shipments of basmati rice at 1 million tons a year, said Vijay Setia, president of the All India Rice Exporters Association.Iranian buyers defaulted on payments for as much as 200,000 tons of rice in the past few months, said Setia in a phone interview. India appointed UCO Bank to open letters of credit in rupees for trade with Iran and that may help exports to continue, he said.Export "terms will be re-written and business will continue", Setia said. Bloomberg News(China Daily 02/10/2012 page17)The second meeting of the Sino-Indian Strategic Economic Dialogue will be held in India in 2012 Securities Times, September 26 from the Development and Reform Commission was informed that the second meeting of the Sino-Indian Strategic Economic Dialogue willbe held in 2012 in India.Blue Book: China and India to carry out the Strategic Economic Dialogue to promote bilateral cooperation in the implementationReuters, January 4, 2012, jointly organized by the Chinese Academy of Social Sciences, Asia Pacific and the Global Institute for Strategic Studies, Social Sciences Documentation Publishing House, 2012"Asia-Pacific Development Report" conference "held in Beijing.The experts analyzed the overall development of the 2010-2011 Asia-Pacific region, predicted in 2012 the trend of development in the Asia-Pacific region, and officially released the 2012 Asia-Pacific Blue Book "Asia-Pacific Development Report (2012).The first meeting of the Sino-Indian Strategic Economic Dialogue held in Beijing on September 26, 2011, which is Asia's two neighbors on their own economic situation, macroeconomic policy and the related fields of industrial policy and pragmatic cooperation, the first exchange and dialogue. China-India relations go beyond the bilateral scope and is increasingly global and strategic significance of the strategic economic dialogue beyond the economic sphere, with the global strategic significance.The Blue Book points out, the context of major concern in India, the first meeting of the Sino-Indian Strategic Economic Dialogue is no doubt focus on resolving India's growing trade deficit in the trade imbalance gradually. However, China and India each other's economic situation and macroeconomic policy dialogue, bilateral "hot spot" into the more widely in relation to the development of each other within the framework of, and not a "stop-gap measures to treat the foot," the way to treat This is indeed an important symbol of the bilateral relations have entered a rational stage of development. At present, the world economic outlook is uncertain, the increased uncertainty in the international political situation, in the context of the United States as the representative of the Western developed countries, economic recovery difficult, as a close neighbor of the two emerging economies through the establishment of the strategic economic dialogue mechanism, strengthen The country's macroeconomic policy coordination, to jointly cope with the problems and challenges in each other's economic development, not only is timely and necessary.The Blue Book also pointed out that the pragmatic cooperation of China and India first strategic economic dialogue between China and India to build a platform, "Sino-US Strategic and Economic Dialogue" wasestablished in April 2009 compared to the former issue is still very limited, Many cooperation from the implementation of the "concept" to "practice".Moreover, the Strategic Economic Dialogue in China and India can develop into a "strategic economic dialogue", is also affected by many factors, but this is undoubtedly the direction of the bilateral efforts.Overall, the 2011 Sino-Indian relations is stable. Indian Navy to strengthen the presence of the South China Sea and India's involvement in the South China Sea disputes event also shows that since 2010 India's stance on China to show the hard-line trend in the further development. India hope to expand cooperation with China on development issues on the one hand, a positive but cautious attitude; the other hand, India has misgivings on the enhancement of the strength of China's development process, as well as the South Asian region. Can be predicted that India's ambivalence will continue to exist in the future for a long period of time, the stable development of and relations between the two countries have a certain impact. Tentatively for India, confrontational behavior, Indian scholars believe that the tough stance taken by India on the issue of close to its core interests seems to have paid off. However, this tentative confrontation is unwise. Hard-won good situation of the Sino-Indian good-neighborly and friendly relations. China's positive attitude to conform to the expectations of India, through the establishment of a strategic economic dialogue mechanism to solve the development problems facing each other, is based on efforts to safeguard the overall interests of a stable and healthy development of bilateral relations. In this regard, the Indian policy-makers should have a clear understanding. The two countries should not only effectively take care of each other's core concerns and do not want to own unreasonable demands imposed on the other side, this requires not only wisdom, skill, need to mind./Foreign Direct Investment in India’s Single and Multi-Brand RetailNew opportunities and developments lie in store for foreign retailersBy Chris Devonshire-Ellis and Ankit Shrivastava, Dezan Shira & AssociatesFeb. 2 – As India has liberalized its single brand retail industry to permit 100 percent foreign investment, we take a look at the regulatory issues and legal structures pertinent to establishing operations in this new dynamic market. That India should be well on the radar for foreign retailers was recently supported by A.T. Kearney, whose 2011 Global Retail Development Index ranks the nation as fourth globally.India’s retail industry is estimated to be worth approximately US$411.28 billion and is still growing, expected to reach US$804.06 billion in 2015. As part of the economic liberalization process set in place by the Industrial Policy of 1991, the Indian government has opened the retail sector to FDI slowly through a series of stepsIndia’s Per Capita Income Rises 16.9%Feb. 1 – India’s average income for the fiscal year 2010-2011 rose 16.9 percent to reach a US$1,000 average for the first time, according to data released by the Central Statistics Office thisweek.“Real GDP growth is outstripping population growth so per capita income has been on the rise,” stated D.K. Joshi, chief economist at Crisil.India Further Liberalizes FDI Policy, Drops Mandatory Lock-In PeriodJan. 26 –The Indian government is loosening its foreign direct investment regulations and is now allowing foreign investors the opportunity to repatriate their original investment before the expiration of a three-year lock-in period from the day it completes its minimum capitalization norm for the sector.While the Department of Industrial Policy and Promotion has expressed misgivings about the policy change, the government has contended that this restriction can be done away with if the investor offers an acceptable reason for not making the investment.India Trade Statistics for April-December 2011 Jan. 20 –India’s exports grew by 25.8 percent over the period running from April to December 2011, reaching a total of US$217.6 billion. The Ministry of Commerce informed that over that same time-frame, imports grew by 30.4 percent and were valued at US$350.9 billion, resulting in a negative trade balance of US$133.3 billion.The Ministry also informed that India’s exports for the month of December 2011 were US$25 billion and imports stood at US$37.8 billion – coming out to a negative trade balance of US$12.8 billion.India Sees Credit Rating UpgradeJan. 17 –Moody’s Investor Services has upgraded its rating on India’s long-term government bonds denominated in the domestic currency from Ba l to Baa 3 (from speculative to investment grade). The long-term country ceiling on the overseas currency bank deposits was also upgraded from Ba l to Baa 3 (from speculative to investment grade). Also, Moody’s had upgraded the short-term government bonds denominated in the domestic currency from NP(not prime) to P-3 (from speculative to investment grade). This short-term rating had been upgraded for the first time since it was newly assigned in 1998.India Allows 100% FDI in Single Brand Retail Jan. 11 – The Indian government on Tuesday agreed to allow 100 percent foreign ownership in single brand retail stores, paving the way for international businesses such as Starbucks, Ikea and Adidas to operate independently in the country without having to involve local partners. Foreign single brand retailers were previously limited to 51 percent ownership.Besides the entrance of new companies into the Indian market, the decision is also likely to result in several existing foreign players operating under tie-ups with Indian companies to convert their existing ventures into wholly-owned subsidiaries.External Commercial Borrowings in Chinese RenminbiSept. 29 –Taking into consideration the particular needs of the infrastructure sector, the existing external commercial borrowing(ECB) policy has been reviewed in discussions with the Government of India and it has been decided to permit Indian companies which are in the infrastructure sector –where “infrastructure” is defined under the existing guidelines on ECB – to avail of ECBs in Chinese renminbi (RMB), under the approval route, subject to a yearly cap of US$1 billion until further review.India Set to Overtake Japan as World’s Third Largest EconomySept. 20 – With Japan’s economy in the doldrums and expected to shrink following the devastating earthquake and tsunami that hit the country earlier this year, India’s 8 percent growth is likely to see it emerge as the world’s third largest economy this year, in purchasing power parity terms.India currently ranks fourth, with 2010 International Monetary Fund data showing that the Japanese economy was worth about US$4.31 trillion, with India close behind at US$4.06 trillion.ICBC Sets Up Shop in IndiaSept. 20 – China’s most valuable bank – Industrial and Commercial Bank of China (ICBC) –has become the first Chinese bank to establish itself in India. The bank is planning to start with an investment of US$100 million and aims to lend to corporations and cover sectors where Chinese companies have a presence such as power, telecom and infrastructure. The bank has set up an office in the Bandra-Kurla business district in central Mumbai and has appointed Sun Xiang as CEO for India.Indian Domestic Demand Halves Iron Ore ExportsAug. 22 – India’s iron ore exports fell for the first time last year and have further declined as a result of massive domestic demand. A government policy of promoting nationalism in resources is driving down India’s exports of the commodity and is helping to reduce international prices. To assist with getting enough ore into domestic redevelopment projects, India has raised freight rates and tariffs, including a quadrupling of export taxes for iron ore over the past 12 months. Exports have responded by declining 17 percent.India’s Updated 2011 Foreign Trade Statistics Dec. 7 –The value of India’s exports throughout October 2011 were recorded at US$19.87 billion, good for a 10.82 percent increase over the level of US$17.93 billion during October 2010. The increasing value of exports for the period of April-October this fiscal year was US$179.78 billion against US$123.17 billion over the same stage last year, recording growth of 45.96 percent.India’s monthly imports during October 2011 were recorded at US$39.51 billion, showing a development of 21.72 percent over the level of US$32.46 billion experienced in October last year. The swelling value of imports for the period of April-October this fiscal was US$273.47 billion as against US$208.82 billion over the same period last year, recording an increase of 30.96 percent.India’s Foreign Trade in June 2011ExportsAug. 5 –India’s exports through June 2011 were valued at US$29.21 billion, which was 46.45 percent superior to the level of US$19.94 billion seen in June 2010. On an expanded timeframe, the growing value ofexports for the period April-June 2011-12 was US$79.00 billion against US$54.22 billion over the same period a year earlier –good for a 45.71 percent increase.印度2011年最新对外贸易统计Posted on December 7, 2011 by India Briefing 12.7-2011年10月,印度出口总值创纪录的达到198亿7千万美元,同比2010年10月的179亿3千万美元,增幅达到10.82%。