- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

• EVA: Economic Value Added • Value added to shareholders by management during a given year • To measure the effects of managerial actions • EVA = After-tax operating profit - After-tax cost of total capital

P0= D0(1+g)/(Ks-g) • P0 the expected price of the stock today • D0 dividend the stockholder

expects to receive today

• Ks required return rate • g expected growth rate

15

11

Original situation

8

0 0.5

1.0

1.5

2.0

SINOTRUST

20

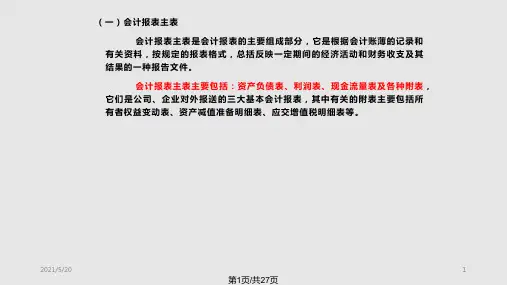

MBA基础培训

会计报表和财务管理

CAPM Model & SML(6)

Required Rate of Return (%)

kM = 18%

18 kM = 15%

15

8

After increase

in risk aversion SML2

Stock

Beta

America Online

2.10

Bally Entertainment

1.55

Microsoft Corp

1.20

General Electric

1.15

Procter & Gamble

1.05

Coca-Cola

1.00

Heinz

0.90

Empire District Electric 0.55

Net FA Total Assets

1997

7,282 632,160 1,287,360 1,926,802 1,202,950 263,160 939,790 2,866,592

1996

57,600 351,200 715,200 1,124,000 491,000 146,200 344,800 1,468,800

investors =(Shares outstanding)(Stock Price)

-Total common equity

SINOTRUST

11

MBA基础培训

• MVA Example

MVA & EVA (2)

会计报表和财务管理

Coca-Cola in 1995

Market value of Equity:$69b

a portfolio consisting of all stocks

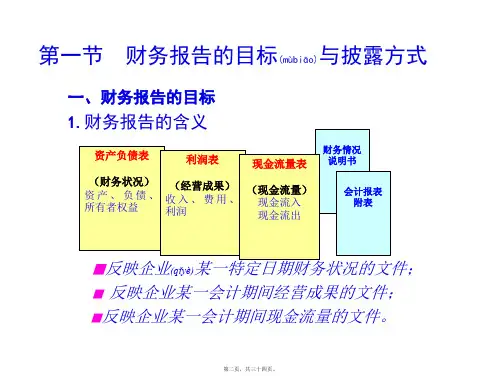

会计报表和财务管理

SINOTRUST

16

MBA基础培训

CAPM Model & SML(2)

会计报表和财务管理

Beta(bi): • A measure of the extent to which the returns on a given

• Expense control • Asset utilization • Debt utilization

SINOTRUST

8

MBA基础培训

Du Pont Equations

会计报表和财务管理

• ROA=Profit margin*Total assets turnover • ROE=ROA*Equity multiplier • ROE=(Profit margin)(Total asset turnover)(Equity multiplier)

Net cash provided by ops.

(519,936)

116,960 378,560 353,600

(280,960) (572,160)

(523,936)

SINOTRUST

6

MBA基础培训

会计报表和财务管理

Statement of Cash Flows (1997)

L-T INVESTING ACTIVITIES Investment in fixed assets

会计报表和财务管理

SINOTRUST

14

MBA基础培训

MVA & EVA (5)

会计报表和财务管理

• Security analysts: The stock prices track EVA far more closely than other factorsn

SINOTRUST

15

MBA基础培训

CAPM Model & SML(1)

• CAPM Capital Asset Pricing Model • SML The Security Market Line • SML Equation Required return On Stock I= Risk-free rate + (Market risk premium)(Stock’s beta) OR Ki=KRF+(KM-KRF)bi Note: KM,required rate of return on

Total common equity:$8b MVA: $61b EPS: $8.63

GM in 1995 Market value of Equity: $69b Total common equity:$87b

MVA: $18b

EPS: $0.79

SINOTRUST

12

MBA基础培训

MVA & EVA (3)

Total equity Total L&E

1997 524,160 720,000 489,600 1,733,760 1,000,000 460,000 (327,168) 132,832 2,866,592

1996 145,600 200,000 136,000 481,600 323,432 460,000 203,768 663,768 1,468,800

= EBIT (1-Corporate tax rate)- After-tax cost of total capital

Total capital includes:

Long-term debt,preferred stock, and common equity

会计报表和财务管理

SINOTRUST

SINOTRUST

5

MBA基础培训

Statement of Cash Flow(1997)

会计报表和财务管理

OPERATING ACTIVITIES

Net income Add (sources of cash):

Depreciation Increase in Accts. Payable Increase in accruals Subtract (uses of cash): Increase in Accts.Receivable Increase in inventories

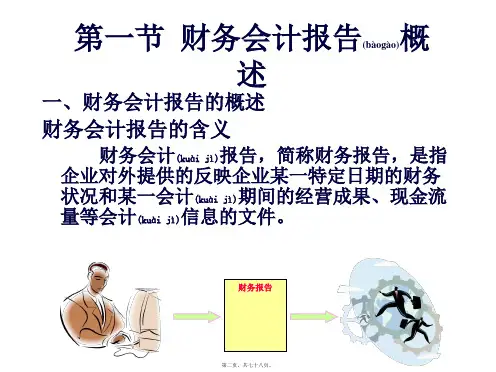

MBA基础培训

会计报表和财务管理

会计报表和财务管理(PPT 29 页)

SINOTRUST

1

MBA基础培训

会计报表和财务管理

SINOTRUST

2

MBA基础培训

会计报表和财务管理

Balance Sheet: Assets

Cash AR Inventories

Total CA Gross FA Less: Deprec.

(711,950)

FINANCING ACTIVITIES Increase in notes payable Increase in long-term debt Payment of cash dividends Net cash from financing

NET CHANGE IN CASH

=Net income/sales*sales/Total Assets*Total assets/Common equity

SINOTRUST

9

MBA基础培训

The other key ratios

• P/E ratio = The market price of stock /EPS • EPS = Earnings/The shares outstanding • What is your idea?

13

MBA基础培训

MVA & EVA (4)

EVA case study • CSX Corporation in 1988, stock price $28 • BU:Locomotive,containers,trailer,railcars • EVA approach lost $70M • Selling off, increasing volume • Till 1993, stock price $82.5

SINOTRUST

680,000 116,960 6,524,960 (690,560) 176,000 (866,560) (346,624) (519,936)

1996

3,432,000 2,864,000

340,000

18,900 3,222,900

209,100

62,500 146,600

58,640 87,960

SINOTRUST

3

MBA基础培训

会计报表和财务管理

Balance Sheet:Liabilities and Equity

Accts payable Notes payable Accruals