会计学原理(英文) principle of accounting

- 格式:ppt

- 大小:711.50 KB

- 文档页数:34

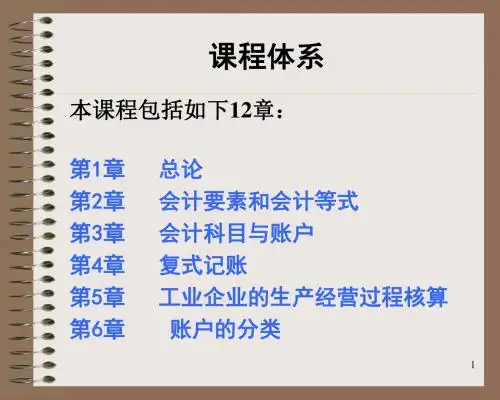

《会计学原理(英文)》教学大纲王燕祥编写工商管理专业课程教学大纲610 目录Chapter 1 Accounting in Action 第一章会计实践活动 (613)学习目标 (613)Teaching and homework hours 教学与作业时间 (613)Reading and References 学生必读和参考书目 (613)Chapter 2 The Recording Process 第二章记录过程 (615)学习目标 (615)Teaching and homework hours 教学与作业时间 (615)Reading and References 学生必读和参考书目 (615)Chapter 3 Adjusting the Accounts 第三章调整账户 (617)学习目标 (617)Teaching and homework hours 教学与作业时间 (617)Reading and References 学生必读和参考书目 (617)Chapter 4 Completion of the Accounting Cycle 第四章完成会计循环 (619)学习目标 (619)Teaching and homework hours 教学与作业时间 (619)Reading and References 学生必读和参考书目 (619)Chapter 5 Accounting for Merchandising Operations 第五章商品经营活动的会计核算 (621)学习目标 (621)Teaching and homework hours 教学与作业时间 (621)Reading and References 学生必读和参考书目 (621)Chapter 6 Inventories 第六章存货 (623)学习目标 (623)Teaching and homework hours 教学与作业时间 (624)Reading and References 学生必读和参考书目 (624)Chapter 7 Accounting Information Systems 第七章会计信息系统 (626)学习目标 (626)Teaching and homework hours 教学与作业时间 (626)Reading and References 学生必读和参考书目 (626)Chapter 8 Internal Control and Cash 第八章内部控制和现金 (628)学习目标 (628)Teaching and homework hours 教学与作业时间 (628)Reading and References 学生必读和参考书目 (628)Chapter 9 Accounting for Receivables 第九章应收款项的会计核算 (630)学习目标 (630)Teaching and homework hours 教学与作业时间 (630)Reading and References 学生必读和参考书目 (630)Chapter 10 Plant Assets, Natural Resources, and Intangible Assets 第十章厂场资产、自然资源和无形资产 (632)会计学原理(英文)学习目标 (632)Teaching and homework hours 教学与作业时间 (632)Reading and References 学生必读和参考书目 (633)Chapter 11 Current Liabilities and Payroll Accounting 第十一章流动负债和工资的核算 (634)学习目标 (634)Teaching and homework hours 教学与作业时间 (634)Reading and References 学生必读和参考书目 (634)Chapter 12 Accounting Principles 第十二章会计原则 (636)学习目标 (636)Teaching and homework hours 教学与作业时间 (636)Reading and References 学生必读和参考书目 (636)Chapter 13 Accounting for Partnerships 第十三章合伙企业的会计核算 (638)学习目标 (638)Teaching and homework hours 教学与作业时间 (638)Reading and References 学生必读和参考书目 (638)Chapter 14 Corporations: Organization and Capital Stock Transactions 第十四章公司:组织和股本交易 (640)学习目标 (640)Teaching and homework hours 教学与作业时间 (640)Reading and References 学生必读和参考书目 (640)Chapter 15 Corporations: Dividends, Retained Earnings, and Income Reporting 第十五章股利、保留盈余和收益报告 (642)学习目标 (642)Teaching and homework hours 教学与作业时间 (642)Reading and References 学生必读和参考书目 (642)Chapter 16 Long-Term Liabilities 第十六章长期负债 (644)学习目标 (644)Teaching and homework hours 教学与作业时间 (644)Reading and References 学生必读和参考书目 (644)Chapter 17 Investments 第十七章投资 (646)学习目标 (646)Teaching and homework hours 教学与作业时间 (646)Reading and References 学生必读和参考书目 (646)Chapter 18 The Statement of Cash Flows 第十八章现金流量表 (648)学习目标 (648)Teaching and homework hours 教学与作业时间 (648)Reading and References 学生必读和参考书目 (648)Chapter 19 Financial Statement Analysis 第十九章财务报表分析 (650)学习目标 (650)Teaching and homework hours 教学与作业时间 (650)Reading and References 学生必读和参考书目 (650)Chapter 20 Managerial Accounting 第二十章管理会计 (652)611工商管理专业课程教学大纲612 学习目标 (652)Teaching and homework hours 教学与作业时间 (652)Reading and References 学生必读和参考书目 (652)Chapter 21 Job Order Cost Accounting 第二十一章分批成本法 (654)学习目标 (654)Teaching and homework hours 教学与作业时间 (654)Reading and References 学生必读和参考书目 (654)Chapter 22 Process Cost Accounting 第二十二章分步成本法 (656)学习目标 (656)Teaching and homework hours 教学与作业时间 (656)Reading and References 学生必读和参考书目 (657)Chapter 23 Cost-V olume-Profit Relationships 第二十三章本量利分析 (658)学习目标 (658)Teaching and homework hours 教学与作业时间 (658)Reading and References 学生必读和参考书目 (659)Chapter 24 Budgetary Planning 第二十四章编制预算 (660)学习目标 (660)Teaching and homework hours 教学与作业时间 (660)Reading and References 学生必读和参考书目 (660)Chapter 25 Budgetary Control and Responsibility Accounting 第二十五章预算控制和责任会计 662 学习目标 (662)Teaching and homework hours 教学与作业时间 (662)Reading and References 学生必读和参考书目 (662)Chapter 26 Performance Evaluation through Standard Costs 第二十六章利用标准成本进行业绩评价 (664)学习目标 (664)Teaching and homework hours 教学与作业时间 (664)Reading and References 学生必读和参考书目 (664)Chapter 27 Incremental Analysis and Capital Budgeting 第二十七章增量分析和资本预算 (666)学习目标 (666)Teaching and homework hours 教学与作业时间 (667)Reading and References 学生必读和参考书目 (667)会计学原理(英文)Chapter 1 Accounting in Action第一章会计实践活动STUDY OBJECTIVESAfter studying this chapter you should be able to:1.Explain what accounting is.2.IDENTIFY THE USERS AND USES OF ACCOUNTING.3.UNDERSTAND WHY ETHICS IS A FUNDAMENTAL BUSINESS CONCEPT.4.EXPLAIN THE MEANING OF GENERALLY ACCEPTED ACCOUNTING PRINCIPLESAND THE COST PRINCIPLE.5.EXPLAIN THE MEANING OF THE MONETARY UNIT ASSUMPTION AND THE ECONOMIC ENTITY ASSUMPTION.6.STATE THE BASIC ACCOUNTING EQUATION AND EXPLAIN THE MEANING OF ASSETS, LIABILITIES, AND OWNER’S EQUITY.7.ANALYZE THE EFFECT OF BUSINESS TRANSACTIONS ON THE BASIC ACCOUNTING EQUATION.8.Understand what the four financial statements are and how they are prepared.学习目标学完本章之后,学生应该能够达到以下目标:1.解释什么是会计。

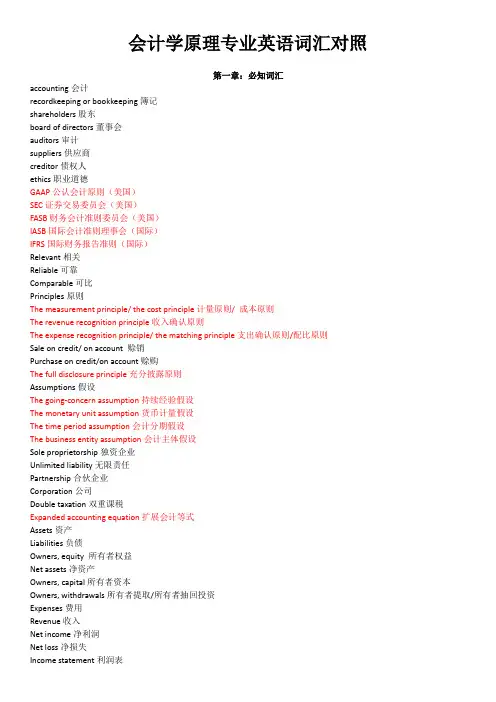

会计学原理专业英语词汇对照第一章:必知词汇accounting会计recordkeeping or bookkeeping簿记shareholders股东board of directors董事会auditors审计suppliers供应商creditor债权人ethics职业道德GAAP公认会计原则(美国)SEC证券交易委员会(美国)FASB财务会计准则委员会(美国)IASB国际会计准则理事会(国际)IFRS国际财务报告准则(国际)Relevant相关Reliable可靠Comparable可比Principles原则The measurement principle/ the cost principle计量原则/ 成本原则The revenue recognition principle收入确认原则The expense recognition principle/ the matching principle支出确认原则/配比原则Sale on credit/ on account 赊销Purchase on credit/on account赊购The full disclosure principle充分披露原则Assumptions假设The going-concern assumption持续经验假设The monetary unit assumption货币计量假设The time period assumption会计分期假设The business entity assumption会计主体假设Sole proprietorship独资企业Unlimited liability无限责任Partnership合伙企业Corporation公司Double taxation双重课税Expanded accounting equation扩展会计等式Assets资产Liabilities负债Owners, equity 所有者权益Net assets净资产Owners, capital所有者资本Owners, withdrawals所有者提取/所有者抽回投资Expenses费用Revenue收入Net income净利润Net loss净损失Income statement利润表Statement of owners, equity所有者权益表/所有者权益变动表Balance sheet资产负债表Statement of cash flows现金流量表第二章:必知词汇(上文有的不再重复)Accounting books/books会计帐簿Source documents原始凭证Account账户General ledger总分类账Ledger分类账Account receivable应收账款Note receivable应收票据Prepaid accounts/ prepaid expenses预付账款/待摊费用Account payable应付账款Note payable应付票据Unearned revenue预收账款Accrued liabilities应计负债Increase增加Decrease减少Chart of accounts会计科目表T-account T形账户Debit借方(Dr.)Credit贷方(Cr.)Account balance账户余额Normal balance正常余额Double entry accounting 复式记账法Journalizing登记日记账Journal日记账General journal普通日记账Journal entry日记账分录Posting过账Balance column account三栏式账户PR(posting reference)过账索引Trial balance试算平衡表Unadjusted statements调整前的财务报表必记口诀:有借必有贷,借贷必相等。

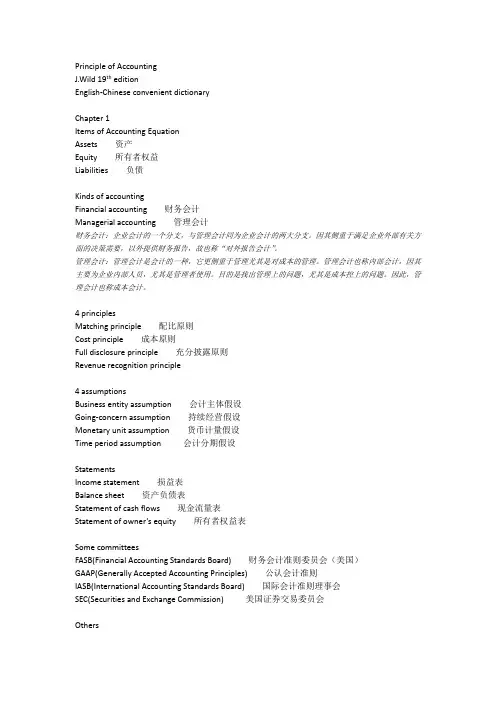

Principle of AccountingJ.Wild 19th editionEnglish-Chinese convenient dictionaryChapter 1Items of Accounting EquationAssets 资产Equity 所有者权益Liabilities 负债Kinds of accountingFinancial accounting 财务会计Managerial accounting 管理会计财务会计:企业会计的一个分支,与管理会计同为企业会计的两大分支。

因其侧重于满足企业外部有关方面的决策需要,以外提供财务报告,故也称“对外报告会计”。

管理会计:管理会计是会计的一种,它更侧重于管理尤其是对成本的管理。

管理会计也称内部会计,因其主要为企业内部人员,尤其是管理者使用。

目的是找出管理上的问题,尤其是成本控上的问题。

因此,管理会计也称成本会计。

4 principlesMatching principle 配比原则Cost principle 成本原则Full disclosure principle 充分披露原则Revenue recognition principle4 assumptionsBusiness entity assumption 会计主体假设Going-concern assumption 持续经营假设Monetary unit assumption 货币计量假设Time period assumption 会计分期假设StatementsIncome statement 损益表Balance sheet 资产负债表Statement of cash flows 现金流量表Statement of owner’s equity 所有者权益表Some committeesFASB(Financial Accounting Standards Board) 财务会计准则委员会(美国)GAAP(Generally Accepted Accounting Principles) 公认会计准则IASB(International Accounting Standards Board) 国际会计准则理事会SEC(Securities and Exchange Commission) 美国证券交易委员会OthersCommon stock 普通股股票Ethics 伦理External users 外部使用者Internal users 内部使用者Chapter 2~4Compound journal entry 复合分录T-account T型账户Posting reference (PR) column 过账根据栏Interim financial statements 期中财务报表LedgerLedger 分类账General ledger 总分类账Subsidiary ledger 辅助分类账(chpt7)AdjustingAdjusting entry 调整分录。

Jiangxi University of Finance and EconomicsSchool of International Trade and Economics SYLLABUSCourse Title: Principles of AccountingCourse Code: 02016Semester: 142Class No.: AE1Credits: 6Teaching Hours: 64Class Times: Tuesday 8:00am-9:40am, Friday 10:20am-12:00pm Prerequisites: NoneLecturer's InformationName: Dr. Ling JiangEmail : ljiang@Course Description and ObjectivesThis is an introductory financial accounting course. In today's economy, basic accountingknowledge is useful to students of various disciplines, especially those who are in the businessfield. This course is an opportunity of gaining an understanding of the many details ofoperation of a business entity from a financial information perspective. The focus is on thepreparation of corporate financial statements and interpreting the information by simple analyses.It is a prerequisite to more advanced accounting and business courses.Learning OutcomesUpon completion of the course, a student should achieve the following learning outcomes:Understand the operation of the accounting cycle.Understand how to account for business transactions.Understand how to prepare financial statements.Understand how to analyze a business entity's financial condition and operating results by usingfinancial statement information.Develop accounting-related critical thinking, problem solving, and ethical reasoning skills.1Teaching MethodsTeaching methods include formal lecture, group work, individual exercise, and class discussion.AssessmentFinal Examination 50%20% Mid-Term Examination10% Test 110% Test 210% Homework assignments, attendance, and class participation100%TotalTo obtain a passing grade, a student should achieve at least 60% in total.Tests and ExaminationsTests and Examinations will be held when the related learning content has been completed. Test1 covers chapters 1-4, Mid-Term Exam covers chapter 1-7, Test2 covers chapters 8-11, and theFinal Exam will focus on chapters 8-14, plus limited coverage on chapters 1-7. Homework, Attendance, and Class ParticipationIn-class exercises are opportunities to put chapter knowledge to practice. These can includegroup work, individual exercises, and case discussions. Homework problems are assigned toprovide additional exercises.Your InputYou will be expected to:Participate actively in group work, individual exercises, and class discussions. Complete homework assignments, and submit printed copies when they are due. Review textbook chapters, PowerPoint slides, and other study materials.Course outlineChapter 1 Accounting in BusinessChapter 2 Analyzing and Recording Transactions2Chapter 3 Adjusting Accounts and Preparing Financial StatementsChapter 4 Completing the Accounting CycleChapter 5 Accounting for Merchandising OperationsChapter 6 Inventories and Cost of SalesChapter 7 Accounting Information SystemChapter 8 Cash and Internal ControlsChapter 9 Accounting for ReceivablesChapter 10 Plant Assets, Natural Resources, and IntangiblesChapter 11 Current Liabilities and Payroll AccountingChapter 12 Long-Term LiabilitiesChapter 13 Investments and International OperationsChapter 14 Accounting for CorporationsTextbookJohn J. Wild, Ken W. Shaw, and Barbara Chiappetta, “Fundamental Accounting Principles,”21stedition, revised by Xuegang Cui and Qing Rao, English language reprint edition, McGraw-HillEducation (Asia) Co. and China Renmin University Press, 2013.Tentative Schedule34。

《会计学原理》课程教学大纲课程代码:ABGS0380课程中文名称:会计学原理英文英文名称:Accounting Principles课程性质:必修课程学分数:3课程学时:48授课对象:信息管理与信息系统本课程的前导课程:管理学一、课程简介《初级会计学》课程是会计学、财务管理专业学生学习会计学知识的入门课程,该课程重点讲解会计学的基本原理以及在企业当中会计职能展开的基本方法和程序。

要求学生明确会计的基本职能和特点,掌握会计核算的基本原理和方法,认识到做好会计工作对加强经济管理,提高经济效益的重要意义。

《基础会计》是一门实用性很强的课程,学习时要着重掌握会计核算各种基本原理和方法,既要知其然,又要知其所以然。

既学会独立操作整个账务处理程序,又理解其中的基本理论,学习《初级会计学》为进一步学习其它会计课程和财务管理课程打下坚实的基础。

二、教学基本内容和要求(一)总论课程教学内容:会计的基本概念:会计的产生和发展,会计职能,会计特点,会计的含义。

会计对象:会计对象的一般要求,企业经营资金运动过程。

会计的目的与任务:会计的目的,会计的任务。

会计假设:会计主体,持续经营,会计分期,货币计量。

会计的一般原则:客观性原则,相关性原则,可比性原则,一贯性原则,及时性原则,明晰性原则,权责发生制原则,配比性原则,谨慎性原则,实际成本原则,划分收益性支出和资本性支出的原则,重要性原则,实质重于形式原则。

会计的基本方法(会计核算的方法):设置账户,复式记账,填制和审核凭证,登记账簿,成本计算,财产清查,财务会计报告。

课程的重点、难点:本章重点:会计的涵义、会计假设、会计的一般原则、会计的基本方法。

本章难点:会计假设、会计的一般原则。

课程教学要求:了解会计的基本概念;理解会计概念框架各概念之间的逻辑关系,尤其是每项会计假设和原则的含义,以及如何将经济活动信息转化成会计语言的方法体系;掌握会计基本概念框架。

(二)账户与复式记账的基本原理课程教学内容:会计要素:会计要素定义,会计要素构成及各要素的定义。

《会计学原理(英文)》教学大纲王燕祥编写工商管理专业课程教学大纲610 目录Chapter 1 Accounting in Action 第一章会计实践活动 (613)学习目标 (613)Teaching and homework hours 教学与作业时间 (613)Reading and References 学生必读和参考书目 (613)Chapter 2 The Recording Process 第二章记录过程 (615)学习目标 (615)Teaching and homework hours 教学与作业时间 (615)Reading and References 学生必读和参考书目 (615)Chapter 3 Adjusting the Accounts 第三章调整账户 (617)学习目标 (617)Teaching and homework hours 教学与作业时间 (617)Reading and References 学生必读和参考书目 (617)Chapter 4 Completion of the Accounting Cycle 第四章完成会计循环 (619)学习目标 (619)Teaching and homework hours 教学与作业时间 (619)Reading and References 学生必读和参考书目 (619)Chapter 5 Accounting for Merchandising Operations 第五章商品经营活动的会计核算 (621)学习目标 (621)Teaching and homework hours 教学与作业时间 (621)Reading and References 学生必读和参考书目 (621)Chapter 6 Inventories 第六章存货 (623)学习目标 (623)Teaching and homework hours 教学与作业时间 (624)Reading and References 学生必读和参考书目 (624)Chapter 7 Accounting Information Systems 第七章会计信息系统 (626)学习目标 (626)Teaching and homework hours 教学与作业时间 (626)Reading and References 学生必读和参考书目 (626)Chapter 8 Internal Control and Cash 第八章内部控制和现金 (628)学习目标 (628)Teaching and homework hours 教学与作业时间 (628)Reading and References 学生必读和参考书目 (628)Chapter 9 Accounting for Receivables 第九章应收款项的会计核算 (630)学习目标 (630)Teaching and homework hours 教学与作业时间 (630)Reading and References 学生必读和参考书目 (630)Chapter 10 Plant Assets, Natural Resources, and Intangible Assets 第十章厂场资产、自然资源和无形资产 (632)会计学原理(英文)学习目标 (632)Teaching and homework hours 教学与作业时间 (632)Reading and References 学生必读和参考书目 (633)Chapter 11 Current Liabilities and Payroll Accounting 第十一章流动负债和工资的核算 (634)学习目标 (634)Teaching and homework hours 教学与作业时间 (634)Reading and References 学生必读和参考书目 (634)Chapter 12 Accounting Principles 第十二章会计原则 (636)学习目标 (636)Teaching and homework hours 教学与作业时间 (636)Reading and References 学生必读和参考书目 (636)Chapter 13 Accounting for Partnerships 第十三章合伙企业的会计核算 (638)学习目标 (638)Teaching and homework hours 教学与作业时间 (638)Reading and References 学生必读和参考书目 (638)Chapter 14 Corporations: Organization and Capital Stock Transactions 第十四章公司:组织和股本交易 (640)学习目标 (640)Teaching and homework hours 教学与作业时间 (640)Reading and References 学生必读和参考书目 (640)Chapter 15 Corporations: Dividends, Retained Earnings, and Income Reporting 第十五章股利、保留盈余和收益报告 (642)学习目标 (642)Teaching and homework hours 教学与作业时间 (642)Reading and References 学生必读和参考书目 (642)Chapter 16 Long-Term Liabilities 第十六章长期负债 (644)学习目标 (644)Teaching and homework hours 教学与作业时间 (644)Reading and References 学生必读和参考书目 (644)Chapter 17 Investments 第十七章投资 (646)学习目标 (646)Teaching and homework hours 教学与作业时间 (646)Reading and References 学生必读和参考书目 (646)Chapter 18 The Statement of Cash Flows 第十八章现金流量表 (648)学习目标 (648)Teaching and homework hours 教学与作业时间 (648)Reading and References 学生必读和参考书目 (648)Chapter 19 Financial Statement Analysis 第十九章财务报表分析 (650)学习目标 (650)Teaching and homework hours 教学与作业时间 (650)Reading and References 学生必读和参考书目 (650)Chapter 20 Managerial Accounting 第二十章管理会计 (652)611工商管理专业课程教学大纲612 学习目标 (652)Teaching and homework hours 教学与作业时间 (652)Reading and References 学生必读和参考书目 (652)Chapter 21 Job Order Cost Accounting 第二十一章分批成本法 (654)学习目标 (654)Teaching and homework hours 教学与作业时间 (654)Reading and References 学生必读和参考书目 (654)Chapter 22 Process Cost Accounting 第二十二章分步成本法 (656)学习目标 (656)Teaching and homework hours 教学与作业时间 (656)Reading and References 学生必读和参考书目 (657)Chapter 23 Cost-V olume-Profit Relationships 第二十三章本量利分析 (658)学习目标 (658)Teaching and homework hours 教学与作业时间 (658)Reading and References 学生必读和参考书目 (659)Chapter 24 Budgetary Planning 第二十四章编制预算 (660)学习目标 (660)Teaching and homework hours 教学与作业时间 (660)Reading and References 学生必读和参考书目 (660)Chapter 25 Budgetary Control and Responsibility Accounting 第二十五章预算控制和责任会计 662 学习目标 (662)Teaching and homework hours 教学与作业时间 (662)Reading and References 学生必读和参考书目 (662)Chapter 26 Performance Evaluation through Standard Costs 第二十六章利用标准成本进行业绩评价 (664)学习目标 (664)Teaching and homework hours 教学与作业时间 (664)Reading and References 学生必读和参考书目 (664)Chapter 27 Incremental Analysis and Capital Budgeting 第二十七章增量分析和资本预算 (666)学习目标 (666)Teaching and homework hours 教学与作业时间 (667)Reading and References 学生必读和参考书目 (667)会计学原理(英文)Chapter 1 Accounting in Action第一章会计实践活动STUDY OBJECTIVESAfter studying this chapter you should be able to:1.Explain what accounting is.2.IDENTIFY THE USERS AND USES OF ACCOUNTING.3.UNDERSTAND WHY ETHICS IS A FUNDAMENTAL BUSINESS CONCEPT.4.EXPLAIN THE MEANING OF GENERALLY ACCEPTED ACCOUNTING PRINCIPLESAND THE COST PRINCIPLE.5.EXPLAIN THE MEANING OF THE MONETARY UNIT ASSUMPTION AND THE ECONOMIC ENTITY ASSUMPTION.6.STATE THE BASIC ACCOUNTING EQUATION AND EXPLAIN THE MEANING OF ASSETS, LIABILITIES, AND OWNER’S EQUITY.7.ANALYZE THE EFFECT OF BUSINESS TRANSACTIONS ON THE BASIC ACCOUNTING EQUATION.8.Understand what the four financial statements are and how they are prepared.学习目标学完本章之后,学生应该能够达到以下目标:1.解释什么是会计。

Principles of Accounting实践教学指导书一、教学目的会计学基础是经济管理各专业的一门专业基础课。

会计学原理课程设计的主要目的,是要明确会计的意义和任务,认识做好会计工作的重要性,掌握会计的基本原理和方法。

通过课程设计,可以更好地将教材所涉及的基本理论、基本知识和操作方法,自觉地与现实的会计实践结合起来。

重视课程设计这一环节,可以使学生巩固所学内容,掌握从事会计工作的基本技能。

二、教学时间1.设计任务部署阶段:第一天由指导教师向学生介绍课程设计的目的意义,下达设计任务书,讲解设计进程安排和设计要求等。

2.实施设计阶段:第二天至第十三天集体进行课程设计,并在指导教师的指导下,按照课程设计进程进行设计(自行设计某公司可能发生的30笔业务;编制日记账;过账;编制资产负债表(Balance Sheet)和利润表(Income Statement)。

3.上交课程设计作业阶段:第十四天学生必须完成并上交课程设计作业。

4.成绩评定阶段:实习周结束以后指导教师对学生的课程设计作业逐一审阅,并评定相应成绩(五级分制),写出审阅意见。

三、教学内容1. 资产负债表的相关问题2. 会计记录和系统的相关问题3. 收入和货币资产的相关问题4. 费用测量法的相关问题5. 存货出售的成本的相关问题6. 非流动性资产和贬值的相关问题7. 责任和公平的相关问题8. 现金流转的相关问题9. 财务声明分析的相关问题四、教学要求1.在指导教师指导下进行设计,按时独立完成任务。

对有抄袭他人设计或找他人代做课程设计等行为者,成绩一律按零分记。

2.学生要有勤于思考、刻苦钻研的学习精神和严肃认真的工作态度。

3.课程设计结束后要提交课程设计作业作为成绩考核的主要依据。

4.严格遵守学习纪律,遵守作息时间,不得迟到、早退或旷课。

如因事、因病不能上课,须按学校管理规定办理请假手续。

凡未请假或未获准假擅自缺勤者,均按旷课论处。

5.学生要注意安全、爱护公物,搞好环境卫生。

《财务管理学》课程中英文简介Corporate Finance课程代码:040013A/040013B Course Code:040025A/040015A/040012B 040025A/040015A /040012B 040025A/040015A课程名称:财务管理学Course Name:Corporate Finance学时:48/32/80 Periods:48/32/80学分:3/2/5 Credits:3/2/5考核方式:考查/考试Assessment:Inspection/Examination先修课程:Preparatory Courses:成本管理会计学(上)MA1 Management AccountingⅠ本课程是国际会计专业方向的基础财务管理学课程,主要讲授的是财务经理在进行投资、筹资和日常营运管理过程中如何进行财务决策,才能实现股东财富最大化这一企业理财目标。

先修课程为管理会计基础(MA1)。

该课程主要包括以下内容:(1)财务管理学简介;(2)财务环境和其组成要素分析。

(3)证券估价。

(4)利息率和汇率的确定:利息率的影响因素和确定步骤、利率期限结构、风险溢价、汇率的影响因素、购买力平价理论和利率平价理论。

(5)战略决策——资本预算:主要讲授项目现金流的确定、资本预算方法和决策标准、内部报酬率法的优缺点分析、资本限额决策、资本预算决策中的风险分析。

(6)战略决策——资本成本:主要讲授资本结构、个别资本成本(包括债券、优先股、普通股)和综合资本成本的确定。

(7)经营决策——营运资本管理:主要讲授营运资本筹资决策、存货、应收帐款的管理。

(8)财务计划:主要讲授财务计划(或资金需求计划)的编制和分析。

Corporate Finance Fundamentals [FN1] is a fundamental course in managerial finance with an emphasis on the major decisions to be made by the financial executive of an organization. Topics introduced in FN1 include the following parts:Part 1 Introduction to the corporate finance; Part 2 The financial environment,including the financial system, the major intermediaries and the specialized markets; Part 3 Security valuation: Risk-free assets, including the interest rate as an opportunity cost, varying compound intervals and annuities; Part 4 The determinants of interest rates, including the determinants of interest rates, term structure effects; Part 5 Security valuation: Risk-adjusted discount rates, including the determinants of equity prices, the relationship between the price and the expected return; Part 6 Strategic decisions: Capital budgeting and cash flow estimation, including the capital budgeting process, estimating cash flows; Part 7 Strategic decisions: Capital budgeting evaluation criteria, including the NPV rule measures shareholder wealth, alternative capital budgeting criteria; Part 8 Financial planning, including Important elements in financial planning and the benefits of financial planning.《财务管理学》课程中英文简介Financial Management课程代码:040015A Course Code:040015A课程名称:财务管理学Course Name:Financial Management学时:80 Periods:80学分:5 Credits:5考核方式:考试Assessment:Examination先修课程:会计学基础Preparatory Courses:Accounting财务管理学是会计学和注册会计师专业的学科基础课,开设本课程的主要任务是加强学生对财务管理理论与实务的全面、深入了解,培养学生课堂讨论和课外阅读与写作的习惯,引导学生对有关现代企业财务管理问题进行思考,从而培养出适应市场经济需要的中级理财者。