信贷基本词汇英汉对照

- 格式:doc

- 大小:92.50 KB

- 文档页数:18

金融常用词汇的中英文对照及注解中文翻译详细解释SEC美国证券交易监督委员会(美国证监会)美国国会成立的政府委员会,负责监督证券市场及保障投资者的利益。

除此之外,委员会也负责监督美国的企业收购项目。

美国证监会由五名委员所组成。

美国证监会的法规旨在鼓励全面公开披露,以及保障投资公众,不会因为证券市场的欺诈或操控行为而蒙受损失。

一般来说,大部分美国发行都必须在美国证监会注册S&P标准普尔从风险的角度,对股票、企业及市政债券评定等级的机构。

此外,标准普尔也始创及追踪标准普尔指数,并发表多种金融及投资报告S&P500标准普尔500一个包含500种股票的指数,股票的选择根据市场规模、流通性及行业组别代表性。

这是一个按市场价值比重调整的指数,每种股票在指数的比重与其市场价值成正比SPV特殊功能公司 1.也称为 "不可能破产的公司" ,其业务限于对特定资产进行收购及融资。

特殊功能公司一般是一家子公司,基于其资产/负债结构与法律地位,即使母公司破产,特殊功能公司的责任仍然不受影响2.指一家可作为掉期及其他信贷敏感衍生工具的交易方,也称为 "衍生工具公司"Safe Harbor避风港1.在信誉良好情况下减低或取消负债的法律条款2.抗鲨条款(阻止不受欢迎收购的条款)的一种,目标公司收购一项表现恶劣的资产,以减低本身的吸引力,作为摫芊绺蹟3.会计方法的一种,旨在避开法律或税务监管,并可更简易地根据税务规则的准确条文预测税务结果Sales Per Share每股销售额计算过去12个月每股总收入的比率。

计算方法为一个财政年度的总收入除以该年度加权已发行股票数目Sales Tax销售税对零售货品或服务销售价格征收的税项Sales to Cash Flow Ratio 销售额与现金流比率衡量公司销售额相对现金流表现的比率计算方法为:每股销售额 ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄每股现金流Salvage Value残值资产在有用寿命结束时出售可获得的预计价值Samurai Bond武士债券由日本以外公司在东京发行的日元债券Scarcity 稀有基本经济问题,人类有无穷欲望但资源却有限。

1.现金业务:cash business2.转账业务:transfer business3.汇兑业务:currency exchange business4.委托收款:commission receivables5.发放贷款:loans6.贷款收回:loan recovery7.贷款展期:loan extension8.办理银行汇票:apply for bank drafts9.收息:interest10托收:collection其他相关:帐目编号account number存户depositor存款单pay-in slip存款单a deposit form自动存取机a banding machine存款deposit存款收据deposit receipt私人存款private deposit存单certificate deposit存折deposit book信用卡credit card本金principal透支overdrafts overdraw双签a counter sign背书to endorse背书人endorser兑现to cash兑付to honor a cheque拒付to dishonor a cheque止付to suspend payment支票cheque ,check支票本cheque book记名支票order cheque不记名支票bearer cheque横线支票crossed cheque空白支票blank chequerubber cheque 空头支票cheque stub, counterfoil 票根cash cheque 现金支票traveler's cheque 旅行支票cheque for transfer 转帐支票outstanding cheque 未付支票canceled cheque 已付支票forged cheque 伪支票Bandar's note 庄票,银票banker 银行家president 行长savings bank 储蓄银行Chase Bank 大通银行National City Bank of New York 花旗银行Hongkong Shanghai Banking Corporation 汇丰银行Chartered Bank of India, Australia and China 麦加利银行Banque de I'IndoChine 东方汇理银行central bank, national bank, banker's bank 中央银行bank of issue, bank of circulation 发行币银行commercial bank 商业银行,储蓄信贷银行member bank, credit bank 储蓄信贷银行discount bank 贴现银行exchange bank 汇兑银行requesting bank 委托开证银行issuing bank, opening bank 开证银行advising bank, notifying bank 通知银行negotiation bank 议付银行confirming bank 保兑银行paying bank 付款银行associate banker of collection 代收银行consigned banker of collection 委托银行clearing bank 清算银行local bank 本地银行domestic bank 国内银行overseas bank 国外银行unincorporated bank 钱庄branch bank 银行分行trustee savings bank 信托储蓄银行trust company 信托公司financial trust 金融信托公司unit trust 信托投资公司trust institution 银行的信托部credit department 银行的信用部commercial credit company(discount company) 商业信贷公司(贴现公司)neighborhood savings bank, bank of deposit 街道储蓄所credit union 合作银行credit bureau 商业兴信所self-service bank 无人银行land bank 土地银行construction bank 建设银行industrial and commercial bank 工商银行bank of communications 交通银行mutual savings bank 互助储蓄银行post office savings bank 邮局储蓄银行mortgage bank, building society 抵押银行industrial bank 实业银行home loan bank 家宅贷款银行reserve bank 准备银行chartered bank 特许银行corresponding bank 往来银行merchant bank, accepting bank 承兑银行investment bank 投资银行import and export bank (EXIMBANK) 进出口银行joint venture bank 合资银行money shop, native bank 钱庄credit cooperatives 信用社clearing house 票据交换所public accounting 公共会计business accounting 商业会计cost accounting 成本会计depreciation accounting 折旧会计computerized accounting 电脑化会计general ledger 总帐subsidiary ledger 分户帐cash book 现金出纳帐cash account 现金帐journal, day-book 日记帐,流水帐bad debts 坏帐investment 投资surplus 结余idle capital 游资economic cycle 经济周期economic boom 经济繁荣economic recession 经济衰退economic depression 经济萧条economic crisis 经济危机economic recovery 经济复苏inflation 通货膨胀deflation 通货收缩devaluation 货币贬值revaluation 货币增值international balance of payment 国际收支favourable balance 顺差adverse balance 逆差hard currency 硬通货soft currency 软通货international monetary system 国际货币制度the purchasing power of money 货币购买力money in circulation 货币流通量note issue 纸币发行量national budget 国家预算national gross product 国民生产总值public bond 公债stock, share 股票debenture 债券treasury bill 国库券。

经济金融术语中英文对照D (2)E (3)F (3)G (5)J (8)K (10)L (11)M (12)N (13)P (13)Q (14)R (15)W (15)X (16)Y (18)Z (19)D打白条 issue IOU大额存单 certificate of deposit(CD)大额提现 withdraw deposits in large amounts大面积滑坡 wide-spread decline大一统的银行体制(all-in-one)mono-bank system呆账(请见“坏账”) bad loans呆账准备金 loan loss reserves(provisions)呆滞贷款 idle loans贷款沉淀 non-performing loans贷款分类 loan classification贷款限额管理 credit control;to impose credit ceiling贷款约束机制 credit disciplinary(constraint)mechanism代理国库 to act as fiscal agent代理金融机构贷款 make loans on behalf of other institutions 戴帽贷款 ear-marked loans倒逼机制 reversed transmission of the pressure for easing monetary condition道德风险 moral hazard地区差别 regional disparity第一产业 the primary industry第二产业 the secondary industry第三产业 the service industry;the tertiary industry 递延资产 deferrable assets订货不足 insufficient orders定期存款 time deposits定向募集 raising funds from targeted sources东道国(请见“母国”) host country独立核算 independent accounting短期国债 treasury bills对冲操作 sterilization operation;hedging对非金融部门债权 claims on non-financial sector多种所有制形式 diversified ownershipE恶性通货膨胀 hyperinflation二级市场 secondary marketF发行货币 to issue currency发行总股本 total stock issue法定准备金 required reserves;reserve requirement法人股 institutional shares法人股东 institutional shareholders法治 rule of law房地产投资 real estate investment放松银根 to ease monetary policy非现场稽核 off-site surveillance(or monitoring)非银行金融机构 non-bank financial institutions非赢利性机构 non-profit organizations分税制 assignment of central and local taxes;tax assignment system分业经营segregation of financial business (services);division of business scope based on the type of financial institutions风险暴露(风险敞口) risk exposure风险管理 risk management风险意识 risk awareness风险资本比例 risk-weighted capital ratios风险资本标准 risk-based capital standard服务事业收入 public service charges;user's charges扶贫 poverty alleviation负增长 negative growth复式预算制double-entry budgeting;capital and current budgetary accountG改革试点 reform experimentation杠杆率 leverage ratio杠杆收购 leveraged buyout高息集资 to raise funds by offering high interest个人股 non-institutional shares根本扭转 fundamental turnaround(or reversal)公开市场操作 open market operations公款私存 deposit public funds in personal accounts公用事业 public utilities公有经济 the state-owned sector;the public sector公有制 public ownership工业成本利润率 profit-to-cost ratio工业增加值 industrial value added供大于求 supply exceeding demand;excessive supply鼓励措施 incentives股份合作企业 joint-equity cooperative enterprises股份制企业 joint-equity enterprises股份制银行 joint-equity banks固定资产贷款 fixed asset loans关税减免 tariff reduction and exemption关税减让 tariff concessions关税优惠 tariff incentives;preferential tariff treatment规范行为 to regularize(or standardize)…behavior规模效益 economies of scale国计民生 national interest and people's livelihood国家对个人其他支出 other government outlays to individuals 国家风险 country risk国际分工 international division of labor国际收支 balance of payments国有独资商业银行 wholly state-owned commercial banks国有经济(部门) the state-owned(or public)sector国有企业 state-owned enterprises(SOEs)国有制 state-ownership国有资产流失 erosion of state assets国债回购 government securities repurchase国债一级自营商 primary underwriters of government securities 过度竞争 excessive competition过度膨胀 excessive expansionH合理预期 rational expectation核心资本 core capital合资企业 joint-venture enterprises红利 dividend宏观经济运营良好 sound macroeconomic performance宏观经济基本状况 macroeconomic fundamentals宏观调控 macroeconomic management(or adjustment)宏观调控目标 macroeconomic objectives(or targets)坏账 bad debt还本付息 debt service换汇成本unit export cost;local currency cost of export earnings汇兑在途 funds in float汇兑支出 advance payment of remittance by the beneficiary's bank汇率并轨 unification of exchange rates活期存款 demand deposits汇率失调 exchange rate misalignment混合所有制 diversified(mixed)ownership货币政策态势 monetary policy stance货款拖欠 overdue obligations to suppliers过热J基本建设投资 investment in infrastructure基本经济要素 economic fundamentals基本适度 broadly appropriate基准利率 benchmark interest rate机关团体存款 deposits of non-profit institutions机会成本 opportunity cost激励机制 incentive mechanism积压严重 heavy stockpile;excessive inventory挤提存款 run on banks挤占挪用 unwarranted diversion of(financial)resources(from designated uses)技改投资 investment in technological upgrading技术密集型产品 technology-intensive product计划单列市 municipalities with independent planning status 计划经济 planned economy集体经济 the collective sector加大结构调整力度 to intensify structural adjustment加工贸易 processing trade加快态势 accelerating trend加强税收征管稽查 to enhance tax administration加权价 weighted average price价格放开 price liberalization价格形成机制 pricing mechanism减亏 to reduce losses简化手续 to cut red tape;to simplify(streamline)procedures 交投活跃 brisk trading缴存准备金 to deposit required reserves结构扭曲 structural distortion结构失调 structural imbalance结构性矛盾突出 acute structural imbalance结构优化 structural improvement(optimization)结汇、售汇 sale and purchase of foreign exchange金融脆弱 financial fragility金融动荡 financial turbulence金融风波 financial disturbance金融恐慌 financial panic金融危机 financial crisis金融压抑 financial repression金融衍生物 financial derivatives金融诈骗 financial fraud紧缩银根 to tighten monetary policy紧缩政策 austerity policies;tight financial policies经常账户可兑换 current account convertibility经济特区 special economic zones(SEZs)经济体制改革 economic reform经济增长方式的转变 change in the main source of economic growth(from investment expansion to efficiency gains)经济增长减速 economic slowdown;moderation in economic growth 经济制裁 economic sanction经营自主权 autonomy in management景气回升 recovery in business activity境外投资 overseas investment竞争加剧 intensifying competition局部性金融风波 localized(isolated)financial disturbance 迹象 signs of overheatingK开办人民币业务 to engage in RMB business可维持(可持续)经济增长 sustainable economic growth可变成本 variable cost可自由兑换货币 freely convertible currency控制现金投放 control currency issuance扣除物价因素 in real terms;on inflation-adjusted basis库存产品 inventory跨国银行业务 cross-border banking跨年度采购 cross-year procurement会计准则 accounting standardL来料加工 processing of imported materials for export离岸银行业务 off-shore banking(business)理顺外贸体制 to rationalize foreign trade regime利率杠杆的调节作用 the role of interest rates in resource allocation利润驱动 profit-driven利息回收率 interest collection ratio联行清算 inter-bank settlement连锁企业 franchise(businesses);chain businesses良性循环 virtuous cycle两极分化growing income disparity;polarization in income distribution零售物价指数 retail price index(RPI)流动性比例 liquidity ratio流动资产周转率/流通速度 velocity of liquid assets流动资金贷款 working capital loans流通体制 distribution system流通网络 distribution network留购(租赁期满时承租人可购买租赁物) hire purchase垄断行业 monopolized industry(sector)乱集资 irregular(illegal)fund raising乱收费 irregular(illegal)charges乱摊派 unjustified(arbitrary)leviesM买方市场 buyer's market卖方市场 seller's market卖出回购证券 matched sale of repo贸易差额 trade balance民间信用 non-institutionalized credit免二减三 exemption of income tax for the first two years ofmaking profit and 50% tax reduction for thefollowing three years明补 explicit subsidy明亏 explicit loss名牌产品 brand products母国(请见“东道国”) home countryN内部控制 internal control内部审计 internal audit内地与香港 the mainland and Hong Kong内债 domestic debt扭亏为盈 to turn a loss-making enterprise into a profitable one扭曲金融分配 distorted allocation of financial resources 农副产品采购支出 outlays for agricultural procurement农村信用社 rural credit cooperatives(RCCs)P泡沫效应 bubble effect泡沫经济 bubble economy培育新的经济增长点 to tap new sources of economic growth 片面追求发展速度 excessive pursuit of growth平衡发展 balanced development瓶颈制约 bottleneck(constraints)平稳回升 steady recovery铺底流动资金 initial(start-up)working capital普遍回升 broad-based recovery配套改革 concomitant(supporting)reforms配套人民币资金 lQ企业办社会 enterprises burdened with social responsibilities 企业集团战略 corporate group strategy企业兼并重组 company merger and restructuring企业领导班子 enterprise management企业所得税 enterprise(corporate)income tax企业效益 corporate profitability企业资金违规流入股市 irregular flow of enterprise funds into the stock market欠税 tax arrears欠息 overdue interest强化税收征管 to strengthen tax administration强制措施 enforcement action翘尾因素 carryover effect切一刀 partial application清理收回贷款 clean up and recover loans(破产)清算 liquidation倾斜政策 preferential policy区别对待 differential treatment趋势加强 intensifying trend全球化 globalization权益回报率 returns on equity(ROE)缺乏后劲 unsustainable momentumR绕规模贷款 to circumvent credit ceiling人均国内生产总值 per capita GDP人均收入 per capita income人民币升值压力 upward pressure on the Renminbi(exchange rate)认缴资本 subscribed capital软贷款 soft loans软预算约束 soft budget constraint软着陆 soft landingocal currency funding of…W外部审计 external audit外国直接投资 foreign direct investment (FDI)外汇储备 foreign exchange reserves外汇调剂 foreign exchange swap外汇占款 the RMB counterpart of foreign exchange reserves;the RMB equivalent of offcial foreign exchange holdings外向型经济 export-oriented economy外债 external debt外资企业 foreign-funded enterprises完善现代企业制度 to improve the modern enterprise system 完税凭证 tax payment documentation违法经营 illegal business委托存款 entrusted deposits稳步增长 steady growth稳健的银行系统 a sound banking system稳中求进 to make progress while ensuring stability无纸交易 book-entry(or paperless/scriptless)transaction 物价监测 price monitoringX吸纳流动性 to absorb liquidity稀缺经济 scarcity economy洗钱 money laundering系统内调度 fund allocation within a bank系统性金融危机 systemic financial crisis下岗工人 laid-off employees下游企业 down-stream enterprises现场稽核 on-site examination现金滞留(居民手中) cash held outside the banking system 乡镇企业 township and village enterprises(TVEs)消费物价指数 consumer price index(CPI)消费税 excise(consumption)tax消灭财政赤字to balance the budget;to eliminate fiscal deficit销货款回笼 reflow of corporate sales income to the banking system销售平淡 lackluster sales协议外资金额 committed amount of foreign investment新经济增长点 new sources of economic growth新开工项目 new projects;newly started projects新增贷款 incremental credit; loan increment; credit growth; credit expansion新增就业位置 new jobs;new job opportunities信贷规模考核 review the compliance with credit ceilings信号失真 distorted signals信托投资公司 trust and investment companies信息不对称 information asymmetry信息反馈 feedback(information)信息共享系统 information sharing system信息披露 information disclosure信用扩张 credir expansion信用评级 credit rating姓“资”还是姓“社”pertaining to socialism or capitalism;socialist orcaptialist行政措施 administrative measures需求膨胀 demand expansion; excessive demand虚伪存款 window-dressing deposits削减冗员 to shed excess labor force寻租 rent seeking迅速反弹 quick reboundY养老基金 pension fund一刀切universal application;non-discretionary implementation一级市场 primary market应收未收利息 overdue interest银行网点 banking outlets赢利能力 profitability营业税 business tax硬贷款(商业贷款) commercial loans用地审批 to grant land use right有管理的浮动汇率 managed floating exchange rate证券投资 portfolio investment游资(热钱) hot money有市场的产品 marketable products有效供给 effective supply诱发新一轮经济扩张 trigger a new round of economic expansion 逾期贷款 overdue loans;past-due loans与国际惯例接轨to become compatible with internationally accepted与国际市场接轨 to integrate with the world market预算外支出(收入) off-budget (extra-budgetary) expenditure (revenue)预调 pre-emptive adjustment月环比 on a month-on-month basis; on a monthly basisZ再贷款 central bank lending在国际金融机构储备头寸 reserve position in international financial institutions在人行存款 deposits at (with) the central bank在途资金 fund in float增加农业投入 to increase investment in agriculture增势减缓 deceleration of growth;moderation of growthmomentum增收节支措施revenue-enhancing and expenditure control measures增长平稳 steady growth增值税 value-added tax(VAT)涨幅偏高 higher-than-desirable growth rate;excessive growth 账外账 concealed accounts折旧 depreciation整顿 retrenchment;consolidation政策工具 policy instrument政策性业务 policy-related operations政策性银行 policy banks政策组合 policy mix政府干预 government intervention证券交易清算 settlement of securities transactions证券业务占款 funding of securities purchase支付困难 payment difficulty支付能力 payment capacity直接调控方式向 to increase the reliance on indirect policy instruments间接调控方式转变职能转换 transformation of functions职业道德 professional ethics指令性措施 mandatory measures指令性计划 mandatory plan;administered plan制定和实施货币政策 to conduct monetary policy;to formulate and implement monetary policy滞后影响 lagged effect中介机构 intermediaries中央与地方财政 delineation of fiscal responsibilities分灶吃饭重点建设 key construction projects;key investment project周期谷底 bottom(trough)of business cycle周转速度 velocity主办银行 main bank主权风险 sovereign risk注册资本 registered capital逐步到位 to phase in;phased implementation逐步取消 to phase out抓大放小 to seize the big and free the small(to maintain close oversight on the large state-ownedenterprises and subject smaller ones to market competition)专款专用 use of funds as ear-marked转贷 on-lending转轨经济 transition economy转机 turnaround转折关头 turning point准财政赤字 quasi-fiscal deficit准货币 quasi-money资本不足 under-capitalized资本充足率 capital adequacy ratio资本利润率 return on capital资本账户可兑换 capital account convertibility资不抵债 insolvent;insolvency资产负债表 balance sheet资产负债率liability/asset ratio;ratio of liabilities to assets资产集中 asset concentration资产贡献率 asset contribution factor资产利润率 return on assets (ROA)资产质量 asset quality资产组合 asset portfolio资金成本 cost of funding;cost of capital;financing cost资金到位 fully funded (project)资金宽裕 to have sufficient funds资金利用率 fund utilization rate资金缺口 financing gap资金体外循环 financial disintermediation资金占压 funds tied up自筹投资项目 self-financed projects自有资金 equity fund综合国力 overall national strength(often measured by GDP)综合效益指标 overall efficiency indicator综合治理 comprehensive adjustment(retrenchment);over-haul 总成交额 total contract value总交易量 total amount of transactions总成本 total cost最后贷款人 lender of last resort。

housing mortgage loan 住房抵押贷款individual business house loan 个人商业用房贷款

house refurbishing loan. 房屋装修贷款individual housing loans 个人住房贷款housing loans on own account 自营性住房贷款

housing loans on authorization 委托住房贷款

individual combined housing loans 个人住房组合贷款

auto loans汽车消费贷款

loan for refurbishing house 家居装修贷款consumer durables loan 大额耐用消费品贷款

personal loan secured by CDs/treasury bonds 个人存单/国库债券的质押贷款

individual consumption loan 个人消费信贷individual unsecured loan 个人信用贷款consumption credit for individual clients 个人消费信贷业务

individual consumption loan 个人消费信贷

secured loan 抵押放款(担保放款) small amount private loans 小额贷款industrial loan 工业贷款 agricultural loan 农业贷款

loan office 贷款处

interest-free loans 无息贷款 special-purpose loan 专项贷款。

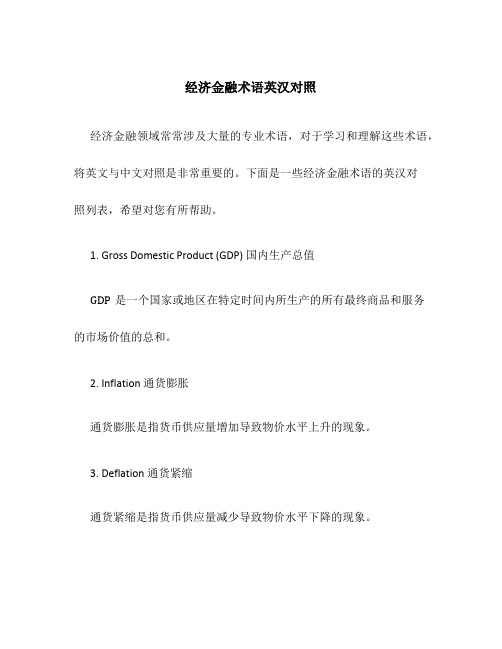

经济金融术语英汉对照经济金融领域常常涉及大量的专业术语,对于学习和理解这些术语,将英文与中文对照是非常重要的。

下面是一些经济金融术语的英汉对照列表,希望对您有所帮助。

1. Gross Domestic Product (GDP) 国内生产总值GDP是一个国家或地区在特定时间内所生产的所有最终商品和服务的市场价值的总和。

2. Inflation 通货膨胀通货膨胀是指货币供应量增加导致物价水平上升的现象。

3. Deflation 通货紧缩通货紧缩是指货币供应量减少导致物价水平下降的现象。

4. Interest Rate 利率利率是指借贷资金所产生的利息与本金之间的比率。

5. Exchange Rate 汇率汇率是指一种货币与另一种货币之间的兑换比率。

6. Stock Market 股票市场股票市场是指买卖股票的场所,也是企业融资的重要途径。

7. Bond 债券债券是一种证券,表示借款人向债权人承诺在一定期限内支付利息和本金。

8. Foreign Direct Investment (FDI) 外商直接投资外商直接投资是指一个国家的企业在另一个国家的企业中进行的长期投资。

9. Taxation 税收税收是政府从个人和企业获得财政收入的一种方式。

10. Budget Deficit 预算赤字预算赤字是指政府支出超过收入的情况,需要通过借贷或印钞等方式来弥补。

11. Trade Surplus/Trade Deficit 贸易顺差/贸易逆差贸易顺差指一个国家的出口额大于进口额,贸易逆差则相反。

12. Monetary Policy 货币政策货币政策是由中央银行制定和执行的调控货币供应量和利率水平的政策。

13. Fiscal Policy 财政政策财政政策是由政府制定和执行的调控财政支出和税收的政策。

14. Central Bank 央行央行是一个国家的货币发行和货币政策的实施机构。

15. Market Economy 市场经济市场经济是一种以市场配置资源和决定价格的经济体制。

信贷基本词汇英汉对照信贷基本词汇英汉对照2M method 2M法3M method 3M法A scores A值Accounting convention 会计惯例Accounting for acquisitions 购并的会计处理Accounting for debtors 应收账款核算Accounting for depreciation 折旧核算Accounting for foreign currencies 外汇核算Accounting for goodwill 商誉核算Accounting for stocks 存货核算Accounting policies 会计政策Accounting standards 会计准则Accruals concept 权责发生原则Achieving credit control 实现信用控制Acid test ratio 酸性测试比率Actual cash flow 实际现金流量Adjusting company profits 企业利润调整Advance payment guarantee 提前偿还保金Adverse trading 不利交易Advertising budget 广告预算Advising bank 通告银行Age analysis 账龄分析Aged debtors analysis 逾期账款分析Aged debtors’exception report 逾期应收款的特殊报告Age d debtors’exception report 逾期账款特别报告Aged debtors’report 逾期应收款报告Aged debtors’report 逾期账款报告All—monies clause 全额支付条款Amortization 摊销Analytical questionnaire 调查表分析Analytical skills 分析技巧Analyzing financial risk 财务风险分析Analyzing financial statements 财务报表分析Analyzing liquidity 流动性分析Analyzing profitability 盈利能力分析Analyzing working capital 营运资本分析Annual expenditure 年度支出Anticipating future income 预估未来收入Areas of financial ratios 财务比率分析的对象Articles of incorporation 合并条款Asian crisis 亚洲(金融)危机Assessing companies 企业评估Assessing country risk 国家风险评估Assessing credit risks 信用风险评估Assessing strategic power 战略地位评估Assessment of banks 银行的评估Asset conversion lending 资产转换贷款Asset protection lending 资产担保贷款Asset sale 资产出售Asset turnover 资产周转率Assets 资产Association of British Factors and Discounters 英国代理人与贴现商协会Auditor's report 审计报告Aval 物权担保Bad debt 坏账Bad debt level 坏账等级Bad debt risk 坏账风险Bad debts performance 坏账发生情况Bad loans 坏账Balance sheet 资产负债表Balance sheet structure 资产负债表结构Bank credit 银行信贷Bank failures 银行破产Bank loans.availability 银行贷款的可获得性Bank status reports 银行状况报告Bankruptcy 破产Bankruptcy code 破产法Bankruptcy petition 破产申请书Basle agreement 塞尔协议Basle Agreement 《巴塞尔协议》Behavorial scoring 行为评分Bill of exchange 汇票Bill of lading 提单BIS 国际清算银行BIS agreement 国际清算银行协定Blue chip 蓝筹股Bonds 债券Book receivables 账面应收账款Borrowing money 借人资金Borrowing proposition 借款申请Breakthrough products 创新产品Budgets 预算Building company profiles 勾画企业轮廓Bureaux (信用咨询)公司Business development loan 商业开发贷款Business failure 破产Business plan 经营计划Business risk 经营风险thermocouple pyrometer 热电偶高温计Buyer credits 买方信贷Buyer power 购买方力量Buyer risks 买方风险CAMPARI 优质贷款原则Canons of lending 贷款原则Capex 资本支出Capital adequacy 资本充足性Capital adequacy rules 资本充足性原则Capital commitments 资本承付款项Capital expenditure 资本支出Capital funding 资本融资Capital investment 资本投资Capital strength 资本实力Capital structure 资本结构Capitalization of interest 利息资本化Capitalizing development costs 研发费用资本化Capitalizing development expenditures 研发费用资本化Capitalizing interest costs 利息成本资本化Cascade effect 瀑布效应Cash assets 现金资产Cash collection targets 现金托收目标Cash cycle 现金循环周期Cash cycle ratios 现金循环周期比率Cash cycle times 现金循环周期时间Cash deposit 现金储蓄Cash flow adjustments 现金流调整Cash flow analysis 现金流量分析Cash flow crisis 现金流危机Cash flow cycle 现金流量周期Cash flow forecasts 现金流量预测Cash flow lending 现金流贷出Cash flow profile 现金流概况Cash flow projections 现金流预测Cash flow statements 现金流量表Cash flows 现金流量Cash position 现金头寸Cash positive JE现金流量Cash rich companies 现金充足的企业Cash surplus 现金盈余Cash tank 现金水槽Cash-in-advance 预付现金Categorized cash flow 现金流量分类CE 优质贷款原则CEO 首席执行官Chairman 董事长,总裁Chapter 11 rules 第十一章条款Charge 抵押Charged assets 抵押资产Chief executive officer 首席执行官Collateral security 抵押证券Collecting payments 收取付款Collection activitv 收款活动Collection cycle 收款环节Collection procedures 收款程序Collective credit risks 集合信用风险Comfortable liquidity positi9n 适当的流动性水平Commercial mortgage 商业抵押Commercial paper 商业票据Commission 佣金Commitment fees 承诺费Common stock 普通股Common stockholders 普通股股东Company and its industry 企业与所处行业Company assets 企业资产Company liabilities 企业负债Company loans 企业借款Competitive advantage 竞争优势Competitive forces 竞争力Competitive products 竞争产品Complaint procedures 申诉程序Computerized credit information 计算机化信用信息Computerized diaries 计算机化日志Confirmed letter of credit 承兑信用证Confirmed letters of credit 保兑信用证Confirming bank 确认银行Conservatism concept 谨慎原则Consistency concept 一贯性原则Consolidated accounts 合并报表Consolidated balance sheets 合并资产负债表Contingent liabilities 或有负债Continuing security clause 连续抵押条款Contractual payments 合同规定支出Control limits 控制限度Control of credit activities 信用活动控制Controlling credit 控制信贷Controlling credit risk 控制信用风险Corporate credit analysis 企业信用分析Corporate credit controller 企业信用控制人员Corporate credit risk analysis 企业信用风险分析Corporate customer 企业客户Corporate failure prediction models 企业破产预测模型Corporate lending 企业贷款Cost leadership 成本领先型Cost of sales 销售成本Costs 成本Country limit 国家限额Country risk 国家风险Court judgments 法院判决Covenant 贷款保证契约Covenants 保证契约Creative accounting 寻机性会计Credit analysis 信用分析Credit analysis of customers 客户信用分析Credit analysis of suppliers 供应商的信用分析Credit analysis on banks 银行信用分析Credit analysts 信用分析Credit assessment 信用评估Credit bureau reports 信用咨询公司报告Credit bureaux 信用机构Credit control 信贷控制Credit control activities 信贷控制活动Credit control performance reports 信贷控制绩效报告Credit controllers 信贷控制人员Credit cycle 信用循环Credit decisions 信贷决策Credit deterioration 信用恶化Credit exposure 信用敞口Credit granting process 授信程序Credit information 信用信息Credit information agency 信用信息机构Credit insurance 信贷保险Credit insurance advantages 信贷保险的优势Credit insurance brokers 信贷保险经纪人Credit insurance limitations 信贷保险的局限Credit limits 信贷限额Credit limits for currency blocs 货币集团国家信贷限额Credit limits for individual countries 国家信贷限额Credit management 信贷管理Credit managers 信贷经理Credit monitoring 信贷监控Credit notes 欠款单据Credit period 信用期Credit planning 信用计划Credit policy 信用政策Credit policy issues 信用政策发布Credit proposals 信用申请Credit protection 信贷保护Credit quality 信贷质量Credit rating 信用评级Credit rating agencies 信用评级机构Credit rating process 信用评级程序Credit rating system 信用评级系统Credit reference 信用咨询Credit reference agencies 信用评级机构Credit risk 信用风险Credit risk assessment 信用风险评估Credit risk exposure 信用风险敞口Credit risk insurance 信用风险保险Credit risk.individual customers 个体信用风险Credit risk:bank credit 信用风险:银行信用Credit risk:trade credit 信用风险:商业信用Credit scoring 信用风险评分Credit scoring model 信用评分模型Credit scoring system 信用评分系统Credit squeeze 信贷压缩Credit taken ratio 受信比率Credit terms 信贷条款Credit utilization reports 信贷利用报告Credit vetting 信用审查Credit watch 信用观察Credit worthiness 信誉Creditor days 应付账款天数Cross-default clause 交叉违约条款Currency risk 货币风险Current assets 流动资产Current debts 流动负债Current ratio requirement 流动比率要求Current ratios 流动比率Customer care 客户关注Customer credit ratings 客户信用评级Customer liaison 客户联络Customer risks 客户风险Cut-off scores 及格线Cycle of credit monitoring 信用监督循环Cyclical business 周期性行业Daily operating expenses 经营费用Day’s sales outstanding 收回应收账款的平均天数Debentures 债券Debt capital 债务资本Debt collection agency 债务托收机构Debt issuer 债券发行人Debt protection levels 债券保护级别Debt ratio 负债比率Debt securities 债券Debt service ratio 还债率Debtor days 应收账款天数Debtor's assets 债权人的资产Default 违约Deferred payments 延期付款Definition of leverage 财务杠杆率定义Deposit limits 储蓄限额Depositing money 储蓄资金Depreciation 折旧Depreciation policies 折旧政策Development budget 研发预算Differentiation 差别化Direct loss 直接损失Directors salaries 董事薪酬Discretionary cash flows 自决性现金流量Discretionary outflows 自决性现金流出Distribution costs 分销成本Dividend cover 股息保障倍数Dividend payout ratio 股息支付率Dividends 股利Documentary credit 跟单信用证DSO 应收账款的平均回收期Duration of credit risk 信用风险期Eastern bloc countries 东方集团国家EBITDA 扣除利息、税收、折旧和摊销之前的收益ECGD 出口信贷担保局Economic conditions 经济环境Economic cycles 经济周期Economic depression 经济萧条Economic growth 经济增长Economic risk 经济风险Electronic data interchange(EDI) 电子数据交换Environmental factors 环境因素Equity capital 权益资本Equity finance 权益融资Equity stake 股权EU countries 欧盟国家EU directives 欧盟法规EUlaw 欧盟法律Eurobonds 欧洲债券European parliament 欧洲议会European Union 欧盟Evergreen loan 常年贷款Exceptional item 例外项目Excessive capital commitments 过多的资本承付款项Exchange controls 外汇管制Exchange-control regulations 外汇管制条例Exhaust method 排空法Existing competitors 现有竞争对手Existing debt 未清偿债务Export credit agencies 出口信贷代理机构Export credit insurance 出口信贷保险Export factoring 出口代理Export sales 出口额Exports Credit Guarantee Department 出口信贷担保局Extending credit 信贷展期External agency 外部机构External assessment methods 外部评估方式External assessments 外部评估External information sources 外部信息来源Extraordinary items 非经常性项目Extras 附加条件Facility account 便利账户Factoring 代理Factoring debts 代理收账Factoring discounting 代理折扣Factors Chain International 国际代理连锁Failure prediction scores 财务恶化预测分值FASB (美国)财务会计准则委员会Faulty credit analysis 破产信用分析Fees 费用Finance,new business ventures 为新兴业务融资Finance,repay existing debt 为偿还现有债务融资Finance,working capital 为营运资金融资Financial assessment 财务评估Financial cash flows 融资性现金流量Financial collapse 财务危机Financial flexibility 财务弹性Financial forecast 财务预测Financial instability 财务的不稳定性Financial rating analysis 财务评级分析Financial ratios 财务比率Financial risk 财务风险Financial risk ratios 财务风险比率Fitch IBCA 惠誉评级Fitch IBCA ratings 惠誉评级Fixed assets 固定资产Fixed charge 固定费用Fixed charge cover 固定费用保障倍数Fixed costs 固定成本Floating assets 浮动资产Floating charge 浮动抵押Floor planning 底价协议Focus 聚焦Forced sale risk 强制出售风险Foreign exchange markets 外汇市场Forfaiting 福费廷Formal credit rating 正式信用评级Forward rate agreements 远期利率协议FRAs 远期利率协议Fund managers 基金经理FX transaction 外汇交易GAAP 公认会计准则Gearing 财务杠杆率Geographical spread of markets 市场的地理扩展Global target 全球目标Going concern concept 持续经营原则Good lending 优质贷款Good times 良好时期Government agencies 政府机构Government interference 政府干预Gross income 总收入Guarantee of payment 支付担保Guaranteed loans 担保贷款Guarantees 担保High credit quality 高信贷质量High credit risks 高信贷风险High default risk 高违约风险High interest rates 高利率High risk regions 高风险区域Highly speculative 高度投机High-risk loan 高风险贷款High-value loan 高价值贷款Historical accounting 历史会计处理Historical cost 历史成本IAS 国际会计准则IASC 国际会计准则委员会IBTT 息税前利润ICE 优质贷款原则Idealliquidity ratios 理想的流动性比率Implied debt rating 隐含债务评级Importance of credit control 信贷控制的重要性Improved products 改进的产品 IImproving reported asset values 改善资产账面价值In house assessment 内部评估In house credit analysis 内部信用分析In house credit assessments 内部信用评估In house credit ratings 内部信用评级Income bonds 收入债券Income statement 损益表Increasing profits 提高利润Increasing reported profits 提高账面利润Indemnity clause 赔偿条款Indicators of credit deterioration 信用恶化征兆Indirect loss 间接损失Individual credit transactions 个人信用交易Individual rating 个体评级Industrial reports 行业报告Industrial unrest 行业动荡Industry limit 行业限额Industry risk 行业风险Industry risk analysis 行业风险分析Inflow 现金流入Information in financial statements 财务报表中的信息In-house credit ratings 内部信用评级Initial payment 初始支付Insolvencies 破产Institutional investors 机构投资者Insured debt 投保债务Intangible fixed asset 无形固定资产Inter-company comparisons 企业间比较Inter-company loans 企业间借款Interest 利息Interest cost 利息成本Interest cover ratio 利息保障倍数Interest cover test 利息保障倍数测试Interest holiday 免息期Interest payments 利息支付Interest rates 利率Interim statements 中报(中期报表)Internal assessment methods 内部评估方法Internal financing ratio 内部融资率Internal Revenue Service 美国国税局International Accounting Standards Committee 国际会计准则委员会International Accounting Standards(IAS) 国际会计准则International Chamber of Commerce 国际商会International credit ratings 国际信用评级International Factoring Association 国际代理商协会International settlements 国际结算Inventory 存货Inverse of current ratio 反转流动比率Investment analysts 投资分析人员Investment policy 投资政策Investment risk 投资风险Investment spending 投资支出Invoice discounting 发票贴现Issue of bonds 债券的发行Issued debt capital 发行债务资本Junk bond status 垃圾债券状况Just-in-time system(JIT) 适时系统Key cash flow ratios 主要现金流量指标Labor unrest 劳动力市场动荡Large.scale borrower 大额借贷者Legal guarantee 法律担保Legal insolvency 法律破产Lending agreements 贷款合约Lending covenants 贷款保证契约Lending decisions 贷款决策Lending proposals 贷款申请Lending proposition 贷款申请Lending transactions 贷款交易Letters of credit 信用证Leverage 财务杠杆率LIBOR 伦敦同业拆借利率Lien 留置Liquid assets 速动资产Liquidation 清算Liquidation expenses 清算费Liquidity 流动性Liquidity and working capital 流动性与营运资金Liquidity ratios 流动比率Liquidity run 流动性危机Liquidity shortage 流动性短缺Loan covenants 贷款合约Loan guarantees 贷款担保Loan principal 贷款本金Loan principal repayments 贷款本金偿还Loan review 贷款审查London Inter-bank Offered Rate 伦敦同业拆借利率Long’term debt 长期负债Long-term funding 长期融资Long-term risk 长期风险Management 管理层Marginal lending 边际贷款Marginal trade credit 边际交易信贷Market surveys 市场调查Marketing 市场营销Markets 市场Matching concept 配比原则Material adverse-change clause 重大不利变动条款Maximum leverage level 最高财务杠杆率限制Measurement and judgment 计量与判断Measuring risk 风险计量Medium-term loan 中期贷款Microcomputer modelling 计算机建模Minimum current ratio requirement 最低流动比率要求Minimum leverage ratio 最低举债比率Minimum net worth 最低净值Minimum net-worth requirement 最低净值要求Minimum risk asset ratio 最低风险资产比率thermocouple pyrometer 热电偶高温计Monitoring activity 监管活动Monitoring credit 信用监控Monitoring customer credit limits 监管客户信贷限额Monitoring risks 监管风险Monitoring total credit limits 监管全部信贷限额Monthly reports 月报Moody's debt rating 穆迪债券评级Mortgage 抵押mpr’oving balance sheet 改善资产负债表Multiple discriminate analysis 多元分析National debt 国家债务NCI 无信贷间隔天数Near-cash assets 近似于现金的资产Negative cash flow 负现金流量Negative net cash flow 负净现金流量Negative operational cash flows 负的经营性现金流量Negative pledge 限制抵押Net book value 净账面价值Net cash flow 净现金流量Net worth test 净值测试New entrants 新的市场进人者No credit interval 无信贷间隔天数Non-cash items 非现金项目Non-core business 非核心业务Non-operational items 非经营性项目Obtaining payment 获得支付One-man rule 一人原则Open account terms 无担保条款Operating leases 经营租赁Operating profit 营业利润Operational cash flow 营性现金流量Operational flexibility ~营弹性Optimal credit 最佳信贷Order cycle 订货环节Ordinary dividend payments 普通股股利支付Organization of credit activities 信贷活动的组织Overdue payments 逾期支付Over-trading 过度交易Overview of accounts 财务报表概览·Parent company 母公司PAT 税后利润Payment in advance 提前付款Payment obligations 付款义务Payment records 付款记录Payment score 还款评分PBIT 息税前利润PBT 息后税前利润Percentage change 百分比变动Performance bonds 履约保证Personal guarantees 个人担保Planning systems 计划系统Pledge 典押Points-scoring system 评分系统Policy setting 政策制定Political risk 政治风险Potential bad debt 潜在坏账Potential credit risk 潜在信用风险Potential value 潜在价值Predicting corporate failures 企业破产预测Preference dividends 优先股股息Preferred stockholders 优先股股东Preliminary assessment 预备评估Premiums 溢价Primary ratios 基础比率Prior charge capital 优先偿付资本Priority cash flows 优先性现金流量Priority for creditors 债权人的清偿顺序Priority payments 优先支付Product life cycle 产品生命周期Product market analysis 产品市场分析Product range 产品范围Products 产品Professional fees 专业费用Profit 利润Profit and loss account 损益账户Profit margin 利润率Profitability 盈利能力Profitability management 盈利能力管理Profitability ratios 盈利能力比率Promissory notes 本票Property values 所有权价值Providers of credit 授信者Provision accounting 准备金会计处理Prudence concept 谨慎原则Public information 公共信息Public relations 公共关系Purpose of credit ratings 信用评级的目的Purpose of ratios 计算比率的目的Qualitative covenants 定性条款Quantitative covenants 定量条款Query control 质疑控制Quick ratio 速动比率Rating exercise 评级实践Rating process for a company 企业评级程序Ratio analysis 比率分析Ratio analyst weaknesses ~L率分析的缺陷Real insolvency 真实破产Real sales growth 实际销售收入增长率Realization concept 实现原则Receivables 应收账款Recession 衰退Reducing debtors 冲减应收账款Reducing profits 冲减利润Reducing provisions 冲减准备金Reducing reported profits 冲减账面利润Reducing stocks 减少存货Registrar of Companies 企业监管局Regulatory risk 监管风险Releasing provisions 冲回准备金Relocation expenses 费用再分配Reminder letters 催缴单Repayment on demand clause 即期偿还条款Replacement of principal 偿还本金Report of chairman 总裁/董事长报告Reserve accounting 准备金核算Residual cash flows 剩余现金流量Restricting bad debts 限制坏账Restrictions on secured borrowing 担保借款限制Retention-of-title clauses 所有权保留条款Revenues 总收入Risk analysis reports 风险分析报告Risk and banks 风险与银行Risk and companies 风险与企业Risk and Return 风险与回报Risk capital 风险资本Risk-reward 风险回报Risk-weighted assets 风险加权资产ROCE 资本收益率Romapla clauses “一手交钱一手交货”条款Sales 销售额Secondary ratios 分解比率Secure methods of payment 付款的担保方式Secured assets 担保资产Secured creditors 有担保债权人Secured loans 担保贷款Securities and Exchange Commission (美国)证券交易委员会Security guarantees 抵押担保Security of payment 付款担保Security general principles 担保的一般原则Segmentation 细分Setting and policing credit limits 信用限额的设定与政策制定Settlement discount (提前)结算折扣Settlement terms 结算条款Share price 股价Short-term borrowing 短期借款Short-term creditors 短期负债Short-term liabilities 短期债务Short-termism 短期化SIC 常务诠释委员会Significance of working capital 营运资金的重要性Single credit customer 单一信用客户Single ratio analysis 单一比率分析Size of credit risk 信用风险的大小Slow stock turnover 较低的存货周转率Sources of assessments 评估信息来源Sources of credit information 信用信息来源Sources of risk 风险来源Sovereign rating 主权评级Specialist agencies 专业机构Specific debt issue 特别债券发行Speculative 投机性Speculative grades 投机性评级Split rating 分割评级Spot rate 现价(即期比率)Spreadsheets 电子数据表Staff redundancies 员工遣散费Standard and Poor 标准普尔Standard security clauses 标准担保条款Standard&Poor's 标准普尔Standby credits 备用信用证Standing Interpretations Committee 证券交易委员会Standing starting credit limits 持续更新信用限额Statistical analysis 统计分析Statistical techniques 统计技巧Status reports (企业)状况报告Stock valuations 存货核算Stocks 股票Straight line depreciation method 直线折旧法Strategic positioning 战略定位Suplus assets 盈余资产Suplus rating 盈余评级Supplier power 供应商的力量Supply chain 供应链Support rating 支持评级Swap agreement 换合约Swaps 互换SWOT analysis SWOT分析Symptoms of failure questionnaires 企业破产征兆调查表Takeovers 收购Tax payments 税务支付Technical insolvency 技术破产Technology and change 技术进步Term loan 定期贷款Term of borrowing 借款期限Third party guarantees 第三方担保Tier 1 capital 一类资本Tier 2 capital 二类资本Total credit limit 整体信用限额Total current assets 流动资产总额Trade companies 贸易企业Trade credit 商业信用Trade creditors 应付账款Trade cycle 商业循环Trade cycle times 商业循环周期Trade debt 应收账款Trade debtors 贸易债权人Trade Indemnity 贸易赔偿Trade references 贸易参考Trade-off 协定Trading outlook 交易概况Trading profit 营业利润Traditional cash flow 传统现金流量Triple A 三AUCP 跟单信用证统一惯例Uncovered dividend 未保障的股利Uniform Customs&Practice 跟单信用证统一惯例Unpaid invoices 未付款发票Unsecured creditors 未担保的债权人Usefulness of liquidity ratios 流动性比率的作用Uses of cash 现金的使用Using bank risk information 使用银行风险信息Using financial assessments 使用财务评估thermocouple pyrometer 热电偶高温计Using ratios 财务比率的运用Using retention-of-title clauses 使用所有权保留条款Value chain 价值链Value of Z scores Z值模型的价值Variable costs 变动成本Variable interest 可变利息Variety of financial ratios 财务比率的种类Vetting procedures 审查程序Volatitle revenue dynamic 收益波动Volume of sales 销售量Warning signs of credit risk 信用风险的警示Working assets 营运资产working capital 营运资本Working capital changes 营运资本变化额Working capital management 营运资本管理working capitalratios 营运资本比率Write-downs 资产减值Write-offs 勾销Z score assessments Z值评估z score models z值模型Z scores z值Z scoring Z值评分系统。

信用证常用术语信用证常用术语We insist on a letter of credit.我们坚持用信用证方式付款。

As I've said, we require payment by L/C.我已经说过了,我们要求以信用证付款。

We still intend to use letter of credit as the term of payment.我们仍然想用信用证付款方式。

We always require L/C for our exports.我们出口一向要求以信用证付款。

L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

We pay by L/C for our imports.进口我们也采用信用证汇款。

Our terms of payment is confirmed and irrevocable letter of credit.我们的付款条件是保兑的不可撤消的信用证。

You must be aware that an irrevocable L/C gives the exporter the additional protection of banker's guarantee.你必须意识到不可撤消信用证为出口商提供了银行担保。

Is the wording of "confirmed" necessary for the letter of credit?信用证上还用写明“保兑”字样吗?For payment we require 100% value, irrevocable L/C in our favour with partial shipment allowed clause available by draft at sight.我们要求用不可撤消的、允许分批装运、金额为全部货款、并以我方为抬头人的信用证,凭即期汇票支付。

信贷基本词汇英汉对照(2)-译国译民翻译公司Financial flexibility 财务弹性Financial forecast 财务预测Financial instability 财务的不稳定性Financial rating analysis 财务评级分析Financial ratios 财务比率Financial risk 财务风险Financial risk ratios 财务风险比率Fitch IBCA 惠誉评级Fitch IBCA ratings 惠誉评级Fixed assets 固定资产Fixed charge 固定费用Fixed charge cover 固定费用保障倍数Fixed costs 固定成本Floating assets 浮动资产Floating charge 浮动抵押Floor planning 底价协议Focus 聚焦Forced sale risk 强制出售风险Foreign exchange markets 外汇市场Forfeiting 福费廷Formal credit rating 正式信用评级Forward rate agreements 远期利率协议FRAs 远期利率协议Fund managers 基金经理FX transaction 外汇交易GAAP 公认会计准则Gearing 财务杠杆率Geographical spread of markets 市场的地理扩展Global target 全球目标Going concern concept 持续经营原则Good lending 优质贷款Good times 良好时期Government agencies 政府机构Government interference 政府干预Gross income 总收入Guarantee of payment 支付担保Guaranteed loans 担保贷款Guarantees 担保High credit quality 高信贷质量High credit risks 高信贷风险High default risk 高违约风险High interest rates 高利率High risk regions 高风险区域Highly speculative 高度投机High-risk loan 高风险贷款High-value loan 高价值贷款Historical accounting 历史会计处理Historical cost 历史成本IAS 国际会计准则IASC 国际会计准则委员会IBTT 息税前利润ICE 优质贷款原则Ideal liquidity ratios 理想的流动性比率Implied debt rating 隐含债务评级Importance of credit control 信贷控制的重要性Improved products 改进的产品 IImproving reported asset values 改善资产账面价值In house assessment 内部评估In house credit analysis 内部信用分析In house credit assessments 内部信用评估In house credit ratings 内部信用评级Income bonds 收入债券Income statement 损益表Increasing profits 提高利润Increasing reported profits 提高账面利润Indemnity clause 赔偿条款Indicators of credit deterioration 信用恶化征兆Indirect loss 间接损失Individual credit transactions 个人信用交易Individual rating 个体评级Industrial reports 行业报告Industrial unrest 行业动荡Industry limit 行业限额Industry risk 行业风险Industry risk analysis 行业风险分析Inflow 现金流入Information in financial statements 财务报表中的信息In-house credit ratings 内部信用评级Initial payment 初始支付Insolvencies 破产Institutional investors 机构投资者Insured debt 投保债务Intangible fixed asset 无形固定资产Inter-company comparisons 企业间比较Inter-company loans 企业间借款Interest 利息Interest cost 利息成本Interest cover ratio 利息保障倍数Interest cover test 利息保障倍数测试Interest holiday 免息期Interest payments 利息支付Interest rates 利率Interim statements 中报(中期报表)Internal assessment methods 内部评估方法Internal financing ratio 内部融资率Internal Revenue Service 美国国税局International Accounting Standards Committee 国际会计准则委员会International Accounting Standards(IAS) 国际会计准则International Chamber of Commerce 国际商会International credit ratings 国际信用评级International Factoring Association 国际代理商协会International settlements 国际结算Inventory 存货Inverse of current ratio 反转流动比率Investment analysts 投资分析人员Investment policy 投资政策Investment risk 投资风险Investment spending 投资支出Invoice discounting 发票贴现Issue of bonds 债券的发行Issued debt capital 发行债务资本Junk bond status 垃圾债券状况Just-in-time system(JIT) 适时系统Key cash flow ratios 主要现金流量指标Labor unrest 劳动力市场动荡Large.scale borrower 大额借贷者Legal guarantee 法律担保Legal insolvency 法律破产Lending agreements 贷款合约Lending covenants 贷款保证契约Lending decisions 贷款决策Lending proposals 贷款申请Lending proposition 贷款申请Lending transactions 贷款交易Letters of credit 信用证Leverage 财务杠杆率LIBOR 伦敦同业拆借利率Lien 留置Liquid assets 速动资产Liquidation 清算Liquidation expenses 清算费Liquidity 流动性Liquidity and working capital 流动性与营运资金Liquidity ratios 流动比率Liquidity run 流动性危机Liquidity shortage 流动性短缺Loan covenants 贷款合约Loan guarantees 贷款担保Loan principal 贷款本金Loan principal repayments 贷款本金偿还Loan review 贷款审查London Inter-bank Offered Rate 伦敦同业拆借利率Long’ term debt 长期负债Long-term funding 长期融资Long-term risk 长期风险Management 管理层Marginal lending 边际贷款Marginal trade credit 边际交易信贷Market surveys 市场调查Marketing 市场营销Markets 市场Matching concept 配比原则Material adverse-change clause 重大不利变动条款Maximum leverage level 最高财务杠杆率限制Measurement and judgment 计量与判断Measuring risk 风险计量Medium-term loan 中期贷款Microcomputer modeling 计算机建模Minimum current ratio requirement 最低流动比率要求Minimum leverage ratio 最低举债比率Minimum net worth 最低净值Minimum net-worth requirement 最低净值要求Minimum risk asset ratio 最低风险资产比率Monitoring activity 监管活动Monitoring credit 信用监控Monitoring customer credit limits 监管客户信贷限额Monitoring risks 监管风险Monitoring total credit limits 监管全部信贷限额Monthly reports 月报Moody's debt rating 穆迪债券评级Mortgage 抵押improving balance sheet 改善资产负债表Multiple discriminate analysis 多元分析National debt 国家债务NCI 无信贷间隔天数Near-cash assets 近似于现金的资产Negative cash flow 负现金流量Negative net cash flow 负净现金流量Negative operational cash flows 负的经营性现金流量Negative pledge 限制抵押Net book value 净账面价值Net cash flow 净现金流量Net worth test 净值测试New entrants 新的市场进人者No credit interval 无信贷间隔天数Non-cash items 非现金项目Non-core business 非核心业务Non-operational items 非经营性项目Obtaining payment 获得支付One-man rule 一人原则Open account terms 无担保条款Operating leases 经营租赁Operating profit 营业利润Operational cash flow 营性现金流量Operational flexibility ~营弹性Optimal credit 最佳信贷Order cycle 订货环节Ordinary dividend payments 普通股股利支付Organization of credit activities 信贷活动的组织Overdue payments 逾期支付Over-trading 过度交易Overview of accounts 财务报表概览·Parent company 母公司PAT 税后利润Payment in advance 提前付款Payment obligations 付款义务Payment records 付款记录Payment score 还款评分PBIT 息税前利润PBT 息后税前利润Percentage change 百分比变动Performance bonds 履约保证Personal guarantees 个人担保Planning systems 计划系统Pledge 典押Points-scoring system 评分系统Policy setting 政策制定Political risk 政治风险Potential bad debt 潜在坏账Potential credit risk 潜在信用风险Potential value 潜在价值Predicting corporate failures 企业破产预测Preference dividends 优先股股息Preferred stockholders 优先股股东Preliminary assessment 预备评估Premiums 溢价Primary ratios 基础比率Prior charge capital 优先偿付资本Priority cash flows 优先性现金流量Priority for creditors 债权人的清偿顺序Priority payments 优先支付Product life cycle 产品生命周期Product market analysis 产品市场分析Product range 产品范围Products 产品Professional fees 专业费用Profit 利润Profit and loss account 损益账户Profit margin 利润率Profitability 盈利能力Profitability management 盈利能力管理Profitability ratios 盈利能力比率Promissory notes 本票Property values 所有权价值Providers of credit 授信者Provision accounting 准备金会计处理Prudence concept 谨慎原则Public information 公共信息Public relations 公共关系Purpose of credit ratings 信用评级的目的Purpose of ratios 计算比率的目的Qualitative covenants 定性条款Quantitative covenants 定量条款Query control 质疑控制Quick ratio 速动比率Rating exercise 评级实践Rating process for a company 企业评级程序Ratio analysis 比率分析Ratio analyst weaknesses ~L率分析的缺陷Real insolvency 真实破产Real sales growth 实际销售收入增长率Realization concept 实现原则Receivables 应收账款Recession 衰退Reducing debtors 冲减应收账款Reducing profits 冲减利润Reducing provisions 冲减准备金Reducing reported profits 冲减账面利润Reducing stocks 减少存货Registrar of Companies 企业监管局Regulatory risk 监管风险Releasing provisions 冲回准备金Relocation expenses 费用再分配Reminder letters 催缴单Repayment on demand clause 即期偿还条款Replacement of principal 偿还本金Report of chairman 总裁/董事长报告Reserve accounting 准备金核算Residual cash flows 剩余现金流量Restricting bad debts 限制坏账Restrictions on secured borrowing 担保借款限制Retention-of-title clauses 所有权保留条款Revenues 总收入Risk analysis reports 风险分析报告Risk and banks 风险与银行Risk and companies 风险与企业Risk and Return 风险与回报Risk capital 风险资本Risk-reward 风险回报Risk-weighted assets 风险加权资产ROCE 资本收益率Romapla clauses “一手交钱一手交货”条款Sales 销售额Secondary ratios 分解比率Secure methods of payment 付款的担保方式Secured assets 担保资产Secured creditors 有担保债权人Secured loans 担保贷款Securities and Exchange Commission (美国)证券交易委员会Security guarantees 抵押担保Security of payment 付款担保Security general principles 担保的一般原则Segmentation 细分Setting and policing credit limits 信用限额的设定与政策制定Settlement discount (提前)结算折扣Settlement terms 结算条款Share price 股价Short-term borrowing 短期借款Short-term creditors 短期负债Short-term liabilities 短期债务Short-termism 短期化SIC 常务诠释委员会Significance of working capital 营运资金的重要性Single credit customer 单一信用客户Single ratio analysis 单一比率分析Size of credit risk 信用风险的大小Slow stock turnover 较低的存货周转率Sources of assessments 评估信息来源Sources of credit information 信用信息来源Sources of risk 风险来源Sovereign rating 主权评级Specialist agencies 专业机构Specific debt issue 特别债券发行Speculative 投机性Speculative grades 投机性评级Split rating 分割评级Spot rate 现价(即期比率)Spreadsheets 电子数据表Staff redundancies 员工遣散费Standard and Poor 标准普尔Standard security clauses 标准担保条款Standard&Poor's 标准普尔Standby credits 备用信用证Standing Interpretations Committee 证券交易委员会Standing starting credit limits 持续更新信用限额Statistical analysis 统计分析Statistical techniques 统计技巧Status reports (企业)状况报告Stock valuations 存货核算Stocks 股票Straight line depreciation method 直线折旧法Strategic positioning 战略定位Surplus assets 盈余资产Surplus rating 盈余评级Supplier power 供应商的力量Supply chain 供应链Support rating 支持评级Swap agreement 换合约Swaps 互换SWOT analysis SWOT分析Symptoms of failure questionnaires 企业破产征兆调查表Takeovers 收购Tax payments 税务支付Technical insolvency 技术破产Technology and change 技术进步Term loan 定期贷款Term of borrowing 借款期限Third party guarantees 第三方担保。

信贷基本词汇英汉对照(2)-译国译民翻译公司Financial flexibility 财务弹性Financial forecast 财务预测Financial instability 财务的不稳定性Financial rating analysis 财务评级分析Financial ratios 财务比率Financial risk 财务风险Financial risk ratios 财务风险比率Fitch IBCA 惠誉评级Fitch IBCA ratings 惠誉评级Fixed assets 固定资产Fixed charge 固定费用Fixed charge cover 固定费用保障倍数Fixed costs 固定成本Floating assets 浮动资产Floating charge 浮动抵押Floor planning 底价协议Focus 聚焦Forced sale risk 强制出售风险Foreign exchange markets 外汇市场Forfeiting 福费廷Formal credit rating 正式信用评级Forward rate agreements 远期利率协议FRAs 远期利率协议Fund managers 基金经理FX transaction 外汇交易GAAP 公认会计准则Gearing 财务杠杆率Geographical spread of markets 市场的地理扩展Global target 全球目标Going concern concept 持续经营原则Good lending 优质贷款Good times 良好时期Government agencies 政府机构Government interference 政府干预Gross income 总收入Guarantee of payment 支付担保Guaranteed loans 担保贷款Guarantees 担保High credit quality 高信贷质量High credit risks 高信贷风险High default risk 高违约风险High interest rates 高利率High risk regions 高风险区域Highly speculative 高度投机High-risk loan 高风险贷款High-value loan 高价值贷款Historical accounting 历史会计处理Historical cost 历史成本IAS 国际会计准则IASC 国际会计准则委员会IBTT 息税前利润ICE 优质贷款原则Ideal liquidity ratios 理想的流动性比率Implied debt rating 隐含债务评级Importance of credit control 信贷控制的重要性Improved products 改进的产品 IImproving reported asset values 改善资产账面价值In house assessment 内部评估In house credit analysis 内部信用分析In house credit assessments 内部信用评估In house credit ratings 内部信用评级Income bonds 收入债券Income statement 损益表Increasing profits 提高利润Increasing reported profits 提高账面利润Indemnity clause 赔偿条款Indicators of credit deterioration 信用恶化征兆Indirect loss 间接损失Individual credit transactions 个人信用交易Individual rating 个体评级Industrial reports 行业报告Industrial unrest 行业动荡Industry limit 行业限额Industry risk 行业风险Industry risk analysis 行业风险分析Inflow 现金流入Information in financial statements 财务报表中的信息In-house credit ratings 内部信用评级Initial payment 初始支付Insolvencies 破产Institutional investors 机构投资者Insured debt 投保债务Intangible fixed asset 无形固定资产Inter-company comparisons 企业间比较Inter-company loans 企业间借款Interest 利息Interest cost 利息成本Interest cover ratio 利息保障倍数Interest cover test 利息保障倍数测试Interest holiday 免息期Interest payments 利息支付Interest rates 利率Interim statements 中报(中期报表)Internal assessment methods 内部评估方法Internal financing ratio 内部融资率Internal Revenue Service 美国国税局International Accounting Standards Committee 国际会计准则委员会International Accounting Standards(IAS) 国际会计准则International Chamber of Commerce 国际商会International credit ratings 国际信用评级International Factoring Association 国际代理商协会International settlements 国际结算Inventory 存货Inverse of current ratio 反转流动比率Investment analysts 投资分析人员Investment policy 投资政策Investment risk 投资风险Investment spending 投资支出Invoice discounting 发票贴现Issue of bonds 债券的发行Issued debt capital 发行债务资本Junk bond status 垃圾债券状况Just-in-time system(JIT) 适时系统Key cash flow ratios 主要现金流量指标Labor unrest 劳动力市场动荡Large.scale borrower 大额借贷者Legal guarantee 法律担保Legal insolvency 法律破产Lending agreements 贷款合约Lending covenants 贷款保证契约Lending decisions 贷款决策Lending proposals 贷款申请Lending proposition 贷款申请Lending transactions 贷款交易Letters of credit 信用证Monthly reports 月报Moody's debt rating 穆迪债券评级Mortgage 抵押improving balance sheet 改善资产负债表Multiple discriminate analysis 多元分析National debt 国家债务NCI 无信贷间隔天数Near-cash assets 近似于现金的资产Negative cash flow 负现金流量Negative net cash flow 负净现金流量Negative operational cash flows 负的经营性现金流量Negative pledge 限制抵押Net book value 净账面价值Net cash flow 净现金流量Net worth test 净值测试New entrants 新的市场进人者No credit interval 无信贷间隔天数Non-cash items 非现金项目Non-core business 非核心业务Non-operational items 非经营性项目Obtaining payment 获得支付One-man rule 一人原则Open account terms 无担保条款Operating leases 经营租赁Operating profit 营业利润Operational cash flow 营性现金流量Operational flexibility ~营弹性Optimal credit 最佳信贷Order cycle 订货环节Ordinary dividend payments 普通股股利支付Organization of credit activities 信贷活动的组织Overdue payments 逾期支付Over-trading 过度交易Overview of accounts 财务报表概览·Parent company 母公司PAT 税后利润Payment in advance 提前付款Payment obligations 付款义务Payment records 付款记录Payment score 还款评分PBIT 息税前利润PBT 息后税前利润Percentage change 百分比变动Performance bonds 履约保证Personal guarantees 个人担保Planning systems 计划系统Pledge 典押Points-scoring system 评分系统Policy setting 政策制定Political risk 政治风险Potential bad debt 潜在坏账Potential credit risk 潜在信用风险Potential value 潜在价值Predicting corporate failures 企业破产预测Preference dividends 优先股股息Preferred stockholders 优先股股东Preliminary assessment 预备评估Premiums 溢价Primary ratios 基础比率Prior charge capital 优先偿付资本Priority cash flows 优先性现金流量Priority for creditors 债权人的清偿顺序Priority payments 优先支付Product life cycle 产品生命周期Product market analysis 产品市场分析Product range 产品范围Products 产品Professional fees 专业费用Profit 利润Profit and loss account 损益账户Profit margin 利润率Profitability 盈利能力Profitability management 盈利能力管理Profitability ratios 盈利能力比率Promissory notes 本票Property values 所有权价值Providers of credit 授信者Provision accounting 准备金会计处理Prudence concept 谨慎原则Public information 公共信息Public relations 公共关系Purpose of credit ratings 信用评级的目的Purpose of ratios 计算比率的目的Qualitative covenants 定性条款Quantitative covenants 定量条款Query control 质疑控制Quick ratio 速动比率Rating exercise 评级实践Rating process for a company 企业评级程序Ratio analysis 比率分析Ratio analyst weaknesses ~L率分析的缺陷Real insolvency 真实破产Real sales growth 实际销售收入增长率Realization concept 实现原则Receivables 应收账款Recession 衰退Reducing debtors 冲减应收账款Reducing profits 冲减利润Reducing provisions 冲减准备金Reducing reported profits 冲减账面利润Reducing stocks 减少存货Registrar of Companies 企业监管局Regulatory risk 监管风险Releasing provisions 冲回准备金Relocation expenses 费用再分配Reminder letters 催缴单Repayment on demand clause 即期偿还条款Replacement of principal 偿还本金Report of chairman 总裁/董事长报告Reserve accounting 准备金核算Residual cash flows 剩余现金流量Restricting bad debts 限制坏账Restrictions on secured borrowing 担保借款限制Retention-of-title clauses 所有权保留条款Revenues 总收入Risk analysis reports 风险分析报告Risk and banks 风险与银行Risk and companies 风险与企业Risk and Return 风险与回报Risk capital 风险资本Risk-reward 风险回报Risk-weighted assets 风险加权资产ROCE 资本收益率Romapla clauses “一手交钱一手交货”条款Sales 销售额Secondary ratios 分解比率Secure methods of payment 付款的担保方式Secured assets 担保资产Secured creditors 有担保债权人Secured loans 担保贷款Securities and Exchange Commission (美国)证券交易委员会Security guarantees 抵押担保Security of payment 付款担保Security general principles 担保的一般原则Segmentation 细分Setting and policing credit limits 信用限额的设定与政策制定Settlement discount (提前)结算折扣Settlement terms 结算条款Share price 股价Short-term borrowing 短期借款Short-term creditors 短期负债Short-term liabilities 短期债务Short-termism 短期化SIC 常务诠释委员会Significance of working capital 营运资金的重要性Single credit customer 单一信用客户Single ratio analysis 单一比率分析Size of credit risk 信用风险的大小Slow stock turnover 较低的存货周转率Sources of assessments 评估信息来源Sources of credit information 信用信息来源Sources of risk 风险来源Sovereign rating 主权评级Specialist agencies 专业机构Specific debt issue 特别债券发行Speculative 投机性Speculative grades 投机性评级Split rating 分割评级Spot rate 现价(即期比率)Spreadsheets 电子数据表Staff redundancies 员工遣散费Standard and Poor 标准普尔Standard security clauses 标准担保条款Standard&Poor's 标准普尔Standby credits 备用信用证Standing Interpretations Committee 证券交易委员会Standing starting credit limits 持续更新信用限额Statistical analysis 统计分析Statistical techniques 统计技巧Status reports (企业)状况报告Stock valuations 存货核算Stocks 股票Straight line depreciation method 直线折旧法Strategic positioning 战略定位Surplus assets 盈余资产Surplus rating 盈余评级Supplier power 供应商的力量Supply chain 供应链Support rating 支持评级Swap agreement 换合约Swaps 互换SWOT analysis SWOT分析Symptoms of failure questionnaires 企业破产征兆调查表Takeovers 收购Tax payments 税务支付Technical insolvency 技术破产Technology and change 技术进步Term loan 定期贷款Term of borrowing 借款期限Third party guarantees 第三方担保。

信贷基本词汇英汉对照2M method 2M法3M method 3M法A scores A值Accounting convention 会计惯例Accounting for acquisitions 购并的会计处理Accounting for debtors 应收账款核算Accounting for depreciation 折旧核算Accounting for foreign currencies 外汇核算Accounting for goodwill 商誉核算Accounting for stocks 存货核算Accounting policies 会计政策Accounting standards 会计准则Accruals concept 权责发生原则Achieving credit control 实现信用控制Acid test ratio 酸性测试比率Actual cash flow 实际现金流量Adjusting company profits 企业利润调整Advance payment guarantee 提前偿还保金Adverse trading 不利交易Advertising budget 广告预算Advising bank 通告银行Age analysis 账龄分析Aged debtors analysis 逾期账款分析Aged debtors’exception report 逾期应收款的特殊报告Aged debtors’exception report 逾期账款特别报告Aged debtors’report 逾期应收款报告Aged debtors’report 逾期账款报告All—monies clause 全额支付条款Amortization 摊销Analytical questionnaire 调查表分析Analytical skills 分析技巧Analyzing financial risk 财务风险分析Analyzing financial statements 财务报表分析Analyzing liquidity 流动性分析Analyzing profitability 盈利能力分析Analyzing working capital 营运资本分析Annual expenditure 年度支出Anticipating future income 预估未来收入Areas of financial ratios 财务比率分析的对象Articles of incorporation 合并条款Asian crisis 亚洲(金融)危机Assessing companies 企业评估Assessing country risk 国家风险评估Assessing credit risks 信用风险评估Assessing strategic power 战略地位评估Assessment of banks 银行的评估Asset conversion lending 资产转换贷款Asset protection lending 资产担保贷款Asset sale 资产出售Asset turnover 资产周转率Assets 资产Association of British Factors and Discounters 英国代理人与贴现商协会Auditor's report 审计报告Aval 物权担保Bad debt 坏账Bad debt level 坏账等级Bad debt risk 坏账风险Bad debts performance 坏账发生情况Bad loans 坏账Balance sheet 资产负债表Balance sheet structure 资产负债表结构Bank credit 银行信贷Bank failures 银行破产Bank loans.availability 银行贷款的可获得性Bank status reports 银行状况报告Bankruptcy 破产Bankruptcy code 破产法Bankruptcy petition 破产申请书Basle agreement 塞尔协议Basle Agreement 《巴塞尔协议》Behavorial scoring 行为评分Bill of exchange 汇票Bill of lading 提单BIS 国际清算银行BIS agreement 国际清算银行协定Blue chip 蓝筹股Bonds 债券Book receivables 账面应收账款Borrowing money 借人资金Borrowing proposition 借款申请Breakthrough products 创新产品Budgets 预算Building company profiles 勾画企业轮廓Bureaux (信用咨询)公司Business development loan 商业开发贷款Business failure 破产Business plan 经营计划Business risk 经营风险Buyer credits 买方信贷Buyer power 购买方力量Buyer risks 买方风险CAMPARI 优质贷款原则Canons of lending 贷款原则Capex 资本支出Capital adequacy 资本充足性Capital adequacy rules 资本充足性原则Capital commitments 资本承付款项Capital expenditure 资本支出Capital funding 资本融资Capital investment 资本投资Capital strength 资本实力Capital structure 资本结构Capitalization of interest 利息资本化Capitalizing development costs 研发费用资本化Capitalizing development expenditures 研发费用资本化Capitalizing interest costs 利息成本资本化Cascade effect 瀑布效应Cash assets 现金资产Cash collection targets 现金托收目标Cash cycle 现金循环周期Cash cycle ratios 现金循环周期比率Cash cycle times 现金循环周期时间Cash deposit 现金储蓄Cash flow adjustments 现金流调整Cash flow analysis 现金流量分析Cash flow crisis 现金流危机Cash flow cycle 现金流量周期Cash flow forecasts 现金流量预测Cash flow lending 现金流贷出Cash flow profile 现金流概况Cash flow projections 现金流预测Cash flow statements 现金流量表Cash flows 现金流量Cash position 现金头寸Cash positive JE现金流量Cash rich companies 现金充足的企业Cash surplus 现金盈余Cash tank 现金水槽Cash-in-advance 预付现金Categorized cash flow 现金流量分类CE 优质贷款原则CEO 首席执行官Chairman 董事长,总裁Chapter 11 rules 第十一章条款Charge 抵押Charged assets 抵押资产Chief executive officer 首席执行官Collateral security 抵押证券Collecting payments 收取付款Collection activitv 收款活动Collection cycle 收款环节Collection procedures 收款程序Collective credit risks 集合信用风险Comfortable liquidity positi9n 适当的流动性水平Commercial mortgage 商业抵押Commercial paper 商业票据Commission 佣金Commitment fees 承诺费Common stock 普通股Common stockholders 普通股股东Company and its industry 企业与所处行业Company assets 企业资产Company liabilities 企业负债Company loans 企业借款Competitive advantage 竞争优势Competitive forces 竞争力Competitive products 竞争产品Complaint procedures 申诉程序Computerized credit information 计算机化信用信息Computerized diaries 计算机化日志Confirmed letter of credit 承兑信用证Confirmed letters of credit 保兑信用证Confirming bank 确认银行Conservatism concept 谨慎原则Consistency concept 一贯性原则Consolidated accounts 合并报表Consolidated balance sheets 合并资产负债表Contingent liabilities 或有负债Continuing security clause 连续抵押条款Contractual payments 合同规定支出Control limits 控制限度Control of credit activities 信用活动控制Controlling credit 控制信贷Controlling credit risk 控制信用风险Corporate credit analysis 企业信用分析Corporate credit controller 企业信用控制人员Corporate credit risk analysis 企业信用风险分析Corporate customer 企业客户Corporate failure prediction models 企业破产预测模型Corporate lending 企业贷款Cost leadership 成本领先型Cost of sales 销售成本Costs 成本Country limit 国家限额Country risk 国家风险Court judgments 法院判决Covenant 贷款保证契约Covenants 保证契约Creative accounting 寻机性会计Credit analysis 信用分析Credit analysis of customers 客户信用分析Credit analysis of suppliers 供应商的信用分析Credit analysis on banks 银行信用分析Credit analysts 信用分析Credit assessment 信用评估Credit bureau reports 信用咨询公司报告Credit bureaux 信用机构Credit control 信贷控制Credit control activities 信贷控制活动Credit control performance reports 信贷控制绩效报告Credit controllers 信贷控制人员Credit cycle 信用循环Credit decisions 信贷决策Credit deterioration 信用恶化Credit exposure 信用敞口Credit granting process 授信程序Credit information 信用信息Credit information agency 信用信息机构Credit insurance 信贷保险Credit insurance advantages 信贷保险的优势Credit insurance brokers 信贷保险经纪人Credit insurance limitations 信贷保险的局限Credit limits 信贷限额Credit limits for currency blocs 货币集团国家信贷限额Credit limits for individual countries 国家信贷限额Credit management 信贷管理Credit managers 信贷经理Credit monitoring 信贷监控Credit notes 欠款单据Credit period 信用期Credit planning 信用计划Credit policy 信用政策Credit policy issues 信用政策发布Credit proposals 信用申请Credit protection 信贷保护Credit quality 信贷质量Credit rating 信用评级Credit rating agencies 信用评级机构Credit rating process 信用评级程序Credit rating system 信用评级系统Credit reference 信用咨询Credit reference agencies 信用评级机构Credit risk 信用风险Credit risk assessment 信用风险评估Credit risk exposure 信用风险敞口Credit risk insurance 信用风险保险Credit risk.individual customers 个体信用风险Credit risk:bank credit 信用风险:银行信用Credit risk:trade credit 信用风险:商业信用Credit scoring 信用风险评分Credit scoring model 信用评分模型Credit scoring system 信用评分系统Credit squeeze 信贷压缩Credit taken ratio 受信比率Credit terms 信贷条款Credit utilization reports 信贷利用报告Credit vetting 信用审查Credit watch 信用观察Credit worthiness 信誉Creditor days 应付账款天数Cross-default clause 交叉违约条款Currency risk 货币风险Current assets 流动资产Current debts 流动负债Current ratio requirement 流动比率要求Current ratios 流动比率Customer care 客户关注Customer credit ratings 客户信用评级Customer liaison 客户联络Customer risks 客户风险Cut-off scores 及格线Cycle of credit monitoring 信用监督循环Cyclical business 周期性行业Daily operating expenses 经营费用Day’s sales outstanding 收回应收账款的平均天数Debentures 债券Debt capital 债务资本Debt collection agency 债务托收机构Debt issuer 债券发行人Debt protection levels 债券保护级别Debt ratio 负债比率Debt securities 债券Debt service ratio 还债率Debtor days 应收账款天数Debtor's assets 债权人的资产Default 违约Deferred payments 延期付款Definition of leverage 财务杠杆率定义Deposit limits 储蓄限额Depositing money 储蓄资金Depreciation 折旧Depreciation policies 折旧政策Development budget 研发预算Differentiation 差别化Direct loss 直接损失Directors salaries 董事薪酬Discretionary cash flows 自决性现金流量Discretionary outflows 自决性现金流出Distribution costs 分销成本Dividend cover 股息保障倍数Dividend payout ratio 股息支付率Dividends 股利Documentary credit 跟单信用证DSO 应收账款的平均回收期Duration of credit risk 信用风险期Eastern bloc countries 东方集团国家EBITDA 扣除利息、税收、折旧和摊销之前的收益ECGD 出口信贷担保局Economic conditions 经济环境Economic cycles 经济周期Economic depression 经济萧条Economic growth 经济增长Economic risk 经济风险Electronic data interchange(EDI) 电子数据交换Environmental factors 环境因素Equity capital 权益资本Equity finance 权益融资Equity stake 股权EU countries 欧盟国家EU directives 欧盟法规EUlaw 欧盟法律Eurobonds 欧洲债券European parliament 欧洲议会European Union 欧盟Evergreen loan 常年贷款Exceptional item 例外项目Excessive capital commitments 过多的资本承付款项Exchange controls 外汇管制Exchange-control regulations 外汇管制条例Exhaust method 排空法Existing competitors 现有竞争对手Existing debt 未清偿债务Export credit agencies 出口信贷代理机构Export credit insurance 出口信贷保险Export factoring 出口代理Export sales 出口额Exports Credit Guarantee Department 出口信贷担保局Extending credit 信贷展期External agency 外部机构External assessment methods 外部评估方式External assessments 外部评估External information sources 外部信息来源Extraordinary items 非经常性项目Extras 附加条件Facility account 便利账户Factoring 代理Factoring debts 代理收账Factoring discounting 代理折扣Factors Chain International 国际代理连锁Failure prediction scores 财务恶化预测分值FASB (美国)财务会计准则委员会Faulty credit analysis 破产信用分析Fees 费用Finance,new business ventures 为新兴业务融资Finance,repay existing debt 为偿还现有债务融资Finance,working capital 为营运资金融资Financial assessment 财务评估Financial cash flows 融资性现金流量Financial collapse 财务危机Financial flexibility 财务弹性Financial forecast 财务预测Financial instability 财务的不稳定性Financial rating analysis 财务评级分析Financial ratios 财务比率Financial risk 财务风险Financial risk ratios 财务风险比率Fitch IBCA 惠誉评级Fitch IBCA ratings 惠誉评级Fixed assets 固定资产Fixed charge 固定费用Fixed charge cover 固定费用保障倍数Fixed costs 固定成本Floating assets 浮动资产Floating charge 浮动抵押Floor planning 底价协议Focus 聚焦Forced sale risk 强制出售风险Foreign exchange markets 外汇市场Forfaiting 福费廷Formal credit rating 正式信用评级Forward rate agreements 远期利率协议FRAs 远期利率协议Fund managers 基金经理FX transaction 外汇交易GAAP 公认会计准则Gearing 财务杠杆率Geographical spread of markets 市场的地理扩展Global target 全球目标Going concern concept 持续经营原则Good lending 优质贷款Good times 良好时期Government agencies 政府机构Government interference 政府干预Gross income 总收入Guarantee of payment 支付担保Guaranteed loans 担保贷款Guarantees 担保High credit quality 高信贷质量High credit risks 高信贷风险High default risk 高违约风险High interest rates 高利率High risk regions 高风险区域Highly speculative 高度投机High-risk loan 高风险贷款High-value loan 高价值贷款Historical accounting 历史会计处理Historical cost 历史成本IAS 国际会计准则IASC 国际会计准则委员会IBTT 息税前利润ICE 优质贷款原则Idealliquidity ratios 理想的流动性比率Implied debt rating 隐含债务评级Importance of credit control 信贷控制的重要性Improved products 改进的产品IImproving reported asset values 改善资产账面价值In house assessment 内部评估In house credit analysis 内部信用分析In house credit assessments 内部信用评估In house credit ratings 内部信用评级Income bonds 收入债券Income statement 损益表Increasing profits 提高利润Increasing reported profits 提高账面利润Indemnity clause 赔偿条款Indicators of credit deterioration 信用恶化征兆Indirect loss 间接损失Individual credit transactions 个人信用交易Individual rating 个体评级Industrial reports 行业报告Industrial unrest 行业动荡Industry limit 行业限额Industry risk 行业风险Industry risk analysis 行业风险分析Inflow 现金流入Information in financial statements 财务报表中的信息In-house credit ratings 内部信用评级Initial payment 初始支付Insolvencies 破产Institutional investors 机构投资者Insured debt 投保债务Intangible fixed asset 无形固定资产Inter-company comparisons 企业间比较Inter-company loans 企业间借款Interest 利息Interest cost 利息成本Interest cover ratio 利息保障倍数Interest cover test 利息保障倍数测试Interest holiday 免息期Interest payments 利息支付Interest rates 利率Interim statements 中报(中期报表)Internal assessment methods 内部评估方法Internal financing ratio 内部融资率Internal Revenue Service 美国国税局International Accounting Standards Committee 国际会计准则委员会International Accounting Standards(IAS) 国际会计准则International Chamber of Commerce 国际商会International credit ratings 国际信用评级International Factoring Association 国际代理商协会International settlements 国际结算Inventory 存货Inverse of current ratio 反转流动比率Investment analysts 投资分析人员Investment policy 投资政策Investment risk 投资风险Investment spending 投资支出Invoice discounting 发票贴现Issue of bonds 债券的发行Issued debt capital 发行债务资本Junk bond status 垃圾债券状况Just-in-time system(JIT) 适时系统Key cash flow ratios 主要现金流量指标Labor unrest 劳动力市场动荡Large.scale borrower 大额借贷者Legal guarantee 法律担保Legal insolvency 法律破产Lending agreements 贷款合约Lending covenants 贷款保证契约Lending decisions 贷款决策Lending proposals 贷款申请Lending proposition 贷款申请Lending transactions 贷款交易Letters of credit 信用证Leverage 财务杠杆率LIBOR 伦敦同业拆借利率Lien 留置Liquid assets 速动资产Liquidation 清算Liquidation expenses 清算费Liquidity 流动性Liquidity and working capital 流动性与营运资金Liquidity ratios 流动比率Liquidity run 流动性危机Liquidity shortage 流动性短缺Loan covenants 贷款合约Loan guarantees 贷款担保Loan principal 贷款本金Loan principal repayments 贷款本金偿还Loan review 贷款审查London Inter-bank Offered Rate 伦敦同业拆借利率Long’term debt 长期负债Long-term funding 长期融资Long-term risk 长期风险Management 管理层Marginal lending 边际贷款Marginal trade credit 边际交易信贷Market surveys 市场调查Marketing 市场营销Markets 市场Matching concept 配比原则Material adverse-change clause 重大不利变动条款Maximum leverage level 最高财务杠杆率限制Measurement and judgment 计量与判断Measuring risk 风险计量Medium-term loan 中期贷款Microcomputer modelling 计算机建模Minimum current ratio requirement 最低流动比率要求Minimum leverage ratio 最低举债比率Minimum net worth 最低净值Minimum net-worth requirement 最低净值要求Minimum risk asset ratio 最低风险资产比率Monitoring activity 监管活动Monitoring credit 信用监控Monitoring customer credit limits 监管客户信贷限额Monitoring risks 监管风险Monitoring total credit limits 监管全部信贷限额Monthly reports 月报Moody's debt rating 穆迪债券评级Mortgage 抵押mpr’oving balance sheet 改善资产负债表Multiple discriminate analysis 多元分析National debt 国家债务NCI 无信贷间隔天数Near-cash assets 近似于现金的资产Negative cash flow 负现金流量Negative net cash flow 负净现金流量Negative operational cash flows 负的经营性现金流量Negative pledge 限制抵押Net book value 净账面价值Net cash flow 净现金流量Net worth test 净值测试New entrants 新的市场进人者No credit interval 无信贷间隔天数Non-cash items 非现金项目Non-core business 非核心业务Non-operational items 非经营性项目Obtaining payment 获得支付One-man rule 一人原则Open account terms 无担保条款Operating leases 经营租赁Operating profit 营业利润Operational cash flow 营性现金流量Operational flexibility ~营弹性Optimal credit 最佳信贷Order cycle 订货环节Ordinary dividend payments 普通股股利支付Organization of credit activities 信贷活动的组织Overdue payments 逾期支付Over-trading 过度交易Overview of accounts 财务报表概览·Parent company 母公司PAT 税后利润Payment in advance 提前付款Payment obligations 付款义务Payment records 付款记录Payment score 还款评分PBIT 息税前利润PBT 息后税前利润Percentage change 百分比变动Performance bonds 履约保证Personal guarantees 个人担保Planning systems 计划系统Pledge 典押Points-scoring system 评分系统Policy setting 政策制定Political risk 政治风险Potential bad debt 潜在坏账Potential credit risk 潜在信用风险Potential value 潜在价值Predicting corporate failures 企业破产预测Preference dividends 优先股股息Preferred stockholders 优先股股东Preliminary assessment 预备评估Premiums 溢价Primary ratios 基础比率Prior charge capital 优先偿付资本Priority cash flows 优先性现金流量Priority for creditors 债权人的清偿顺序Priority payments 优先支付Product life cycle 产品生命周期Product market analysis 产品市场分析Product range 产品范围Products 产品Professional fees 专业费用Profit 利润Profit and loss account 损益账户Profit margin 利润率Profitability 盈利能力Profitability management 盈利能力管理Profitability ratios 盈利能力比率Promissory notes 本票Property values 所有权价值Providers of credit 授信者Provision accounting 准备金会计处理Prudence concept 谨慎原则Public information 公共信息Public relations 公共关系Purpose of credit ratings 信用评级的目的Purpose of ratios 计算比率的目的Qualitative covenants 定性条款Quantitative covenants 定量条款Query control 质疑控制Quick ratio 速动比率Rating exercise 评级实践Rating process for a company 企业评级程序Ratio analysis 比率分析Ratio analyst weaknesses ~L率分析的缺陷Real insolvency 真实破产Real sales growth 实际销售收入增长率Realization concept 实现原则Receivables 应收账款Recession 衰退Reducing debtors 冲减应收账款Reducing profits 冲减利润Reducing provisions 冲减准备金Reducing reported profits 冲减账面利润Reducing stocks 减少存货Registrar of Companies 企业监管局Regulatory risk 监管风险Releasing provisions 冲回准备金Relocation expenses 费用再分配Reminder letters 催缴单Repayment on demand clause 即期偿还条款Replacement of principal 偿还本金Report of chairman 总裁/董事长报告Reserve accounting 准备金核算Residual cash flows 剩余现金流量Restricting bad debts 限制坏账Restrictions on secured borrowing 担保借款限制Retention-of-title clauses 所有权保留条款Revenues 总收入Risk analysis reports 风险分析报告Risk and banks 风险与银行Risk and companies 风险与企业Risk and Return 风险与回报Risk capital 风险资本Risk-reward 风险回报Risk-weighted assets 风险加权资产ROCE 资本收益率Romapla clauses “一手交钱一手交货”条款Sales 销售额Secondary ratios 分解比率Secure methods of payment 付款的担保方式Secured assets 担保资产Secured creditors 有担保债权人Secured loans 担保贷款Securities and Exchange Commission (美国)证券交易委员会Security guarantees 抵押担保Security of payment 付款担保Security general principles 担保的一般原则Segmentation 细分Setting and policing credit limits 信用限额的设定与政策制定Settlement discount (提前)结算折扣Settlement terms 结算条款Share price 股价Short-term borrowing 短期借款Short-term creditors 短期负债Short-term liabilities 短期债务Short-termism 短期化SIC 常务诠释委员会Significance of working capital 营运资金的重要性Single credit customer 单一信用客户Single ratio analysis 单一比率分析Size of credit risk 信用风险的大小Slow stock turnover 较低的存货周转率Sources of assessments 评估信息来源Sources of credit information 信用信息来源Sources of risk 风险来源Sovereign rating 主权评级Specialist agencies 专业机构Specific debt issue 特别债券发行Speculative 投机性Speculative grades 投机性评级Split rating 分割评级Spot rate 现价(即期比率)Spreadsheets 电子数据表Staff redundancies 员工遣散费Standard and Poor 标准普尔Standard security clauses 标准担保条款Standard&Poor's 标准普尔Standby credits 备用信用证Standing Interpretations Committee 证券交易委员会Standing starting credit limits 持续更新信用限额Statistical analysis 统计分析Statistical techniques 统计技巧Status reports (企业)状况报告Stock valuations 存货核算Stocks 股票Straight line depreciation method 直线折旧法Strategic positioning 战略定位Suplus assets 盈余资产Suplus rating 盈余评级Supplier power 供应商的力量Supply chain 供应链Support rating 支持评级Swap agreement 换合约Swaps 互换SWOT analysis SWOT分析Symptoms of failure questionnaires 企业破产征兆调查表Takeovers 收购Tax payments 税务支付Technical insolvency 技术破产Technology and change 技术进步Term loan 定期贷款Term of borrowing 借款期限Third party guarantees 第三方担保Tier 1 capital 一类资本Tier 2 capital 二类资本Total credit limit 整体信用限额Total current assets 流动资产总额Trade companies 贸易企业Trade credit 商业信用Trade creditors 应付账款Trade cycle 商业循环Trade cycle times 商业循环周期Trade debt 应收账款Trade debtors 贸易债权人Trade Indemnity 贸易赔偿Trade references 贸易参考Trade-off 协定Trading outlook 交易概况Trading profit 营业利润Traditional cash flow 传统现金流量Triple A 三AUCP 跟单信用证统一惯例Uncovered dividend 未保障的股利Uniform Customs&Practice 跟单信用证统一惯例Unpaid invoices 未付款发票Unsecured creditors 未担保的债权人Usefulness of liquidity ratios 流动性比率的作用Uses of cash 现金的使用Using bank risk information 使用银行风险信息Using financial assessments 使用财务评估Using ratios 财务比率的运用Using retention-of-title clauses 使用所有权保留条款Value chain 价值链Value of Z scores Z值模型的价值Variable costs 变动成本Variable interest 可变利息Variety of financial ratios 财务比率的种类Vetting procedures 审查程序Volatitle revenue dynamic 收益波动Volume of sales 销售量Warning signs of credit risk 信用风险的警示Working assets 营运资产working capital 营运资本Working capital changes 营运资本变化额Working capital management 营运资本管理working capitalratios 营运资本比率Write-downs 资产减值Write-offs 勾销Z score assessments Z值评估z score models z值模型Z scores z值Z scoring Z值评分系统。