北大金融学课件(英文版)第5章(4课时)

- 格式:ppt

- 大小:2.04 MB

- 文档页数:7

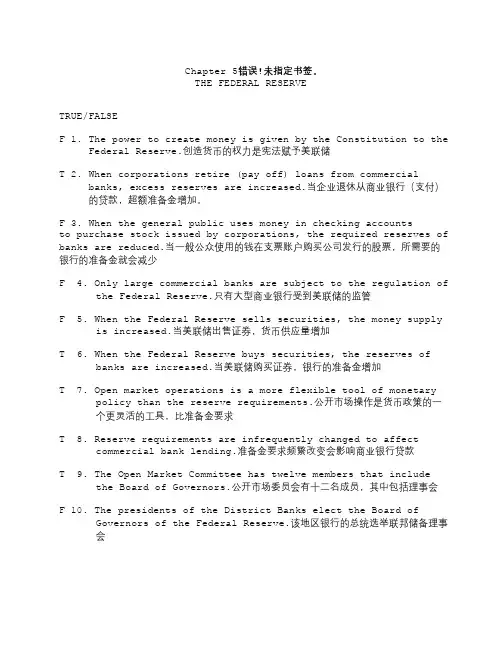

Chapter 5错误!未指定书签。

THE FEDERAL RESERVETRUE/FALSEF 1. The power to create money is given by the Constitution to theFederal Reserve.创造货币的权力是宪法赋予美联储T 2. When corporations retire (pay off) loans from commercial banks, excess reserves are increased.当企业退休从商业银行(支付)的贷款,超额准备金增加。

F 3. When the general public uses money in checking accountsto purchase stock issued by corporations, the required reserves of banks are reduced.当一般公众使用的钱在支票账户购买公司发行的股票,所需要的银行的准备金就会减少F 4. Only large commercial banks are subject to the regulation ofthe Federal Reserve.只有大型商业银行受到美联储的监管F 5. When the Federal Reserve sells securities, the money supplyis increased.当美联储出售证券,货币供应量增加T 6. When the Federal Reserve buys securities, the reserves of banks are increased.当美联储购买证券,银行的准备金增加T 7. Open market operations is a more flexible tool of monetary policy than the reserve requirements.公开市场操作是货币政策的一个更灵活的工具,比准备金要求T 8. Reserve requirements are infrequently changed to affect commercial bank lending.准备金要求频繁改变会影响商业银行贷款T 9. The Open Market Committee has twelve members that include the Board of Governors.公开市场委员会有十二名成员,其中包括理事会F 10. The presidents of the District Banks elect the Board ofGovernors of the Federal Reserve.该地区银行的总统选举联邦储备理事会F 11. The federal funds rate is the interest rate the FederalReserve charges banks when they borrow reserves.联邦基金利率是利率联邦储备银行收费时,他们借入储备F 12. If the Treasury borrows from the Federal Reserve, thelending capacity of banks is reduced.如果财政部从美联储借,银行的放贷能力降低T 13. If the Treasury sells debt that is purchased by corporations and uses the funds to purchase military equipment, theexcess reserves of the banking system are not affected.如果财政部出售债券是由公司购买并使用的资金购买军事装备,多余的银行体系储备不受影响T 14. Deflation is a period of declining prices.通货紧缩是一个时期价格下跌F 15. During a period of recession, the Fed sells securities.在衰退期,美联储出售证券T 16. The Consumer Price Index (CPI) is a measure of inflation.居民消费价格指数( CPI)是衡量通货膨胀的T 17. The Federal Reserve is independent of the U.S. Treasury and is owned by commercial banks.美联储是独立于美国财政部,由商业银行所拥有F 18. The President of the United States appoints the Federal OpenMarket Committee.美国总统任命的联邦公开市场委员会F 19. Since the reserves of commercial banks earn interest, thereis an incentive to hold excess reserves.由于商业银行的准备金赚取利息,还有持有超额准备金的奖励T 20. Open market operations is a more flexible tool of monetary policy than the discount rate.公开市场操作是货币政策的一个更灵活的工具比贴现率T 21. Commercial banks may buy and sell reserves in the federal funds market.商业银行可以在联邦基金市场上购买和出售储备T 22. If the Treasury issues new bonds that are purchased by the general public, the money supply is reduced if the Treasurydeposits the funds in the Federal Reserve.如果财政部发布了由广大市民购买新的债券,货币供应量减少,如果国库存款资金在美联储F 23. Recession is a period of falling prices.经济衰退是一个时期的价格下跌F 24. When commercial banks grant loans to the public, theirtotal reserves are reduced.当商业银行发放贷款的市民,他们的总储量减少MULTIPLE CHOICEa 1. Withdrawing cash from a checking account does not decrease 从支票帐户提取现金不减少a. the money supply货币供应量b. demand deposits活期存款c. total reserves总储量d. excess reserves超额准备金d 2. Excess reserves are affected by超额准备金受1. reserve requirements准备金要求2. the repayment of existing bank loans现有偿还银行贷款3. cash withdrawals现金提款d. 1, 2, and 3b 3. When commercial banks grant loans,当商业银行发放贷款a. the money supply is reduced货币供应量减少b. the money supply is increased货币供应量增加c. total reserves increase总储量增加d. total reserves decrease总储量减少b 4. If deposits are withdrawn from a commercial bank, it mayobtain reserves by如果存款从商业银行撤出,它可能是由获得储备a. acquiring an asset收购资产b. borrowing in the federal funds market在联邦基金市场借款c. lending funds in the federal funds market在联邦基金市场资金d. liquidating a liability清算负债a 5. When a commercial bank receives a cash deposit,当商业银行收到的现金存款1. its required reserves increase其所需的储备增加2. its required reserves decrease其所需的储备减少3. its total reserves increase其总储量增加4. its total reserves decrease其总储量减少a. 1 and 3b 6. Commercial banks lend excess reserves for one day in the商业银行放贷超额储备为一天中的a. stock market股市b. federal funds market联邦基金市场c. reserves market储备市场d. over-the-counter market过?的?柜台市场b 7. The Federal Reserve increases reserves by美国联邦储备局增加储备a. selling securities出售证券b. buying securities买证券c. raising reserve requirements提高存款准备金率d. raising the discount rate提高贴现率b 8. The Federal Reserve美国联邦储备委员会a. is part of the U.S. Treasury是美国财政部的一部分b. is owned by member banks由成员银行拥有c. is the nation's largest commercial bank是全国最大的商业银行d. lends funds to corporations借出资金的公司b 9. By lowering the discount rate, the Federal Reserve通过降低贴现率,美联储a. discourages commercial banks from lending鼓励商业银行从贷款b. encourages commercial banks to borrow reserves鼓励商业银行借入储备c. discourages depositors from withdrawing funds鼓励存户提款d. contracts the money supply收缩货币供应量d 10. The purpose of the Federal Reserve is to美联储的目的是a. finance government operations金融政府运作b. protect investors from bank failures保护投资者免受银行倒闭c. protect deposits from bank failures保护存款银行倒闭d. control the supply of money and credit控制货币信贷总量c 11. The structure of the Federal Reserve includes美联储的结构包括1. all commercial banks各商业银行2. the twelve district banks在12家地方银行3. the Board of Governors 理事会c. 2 and 3c 12. The members of the Board of Governors area. elected by the member banksb. appointed by the Senatec. appointed by the President of the United Statesd. elected by the Federal Open Market Committeec 13. During a period of recession, a federal government surplusshould retire debt oweda. the Federal Reserveb. commercial banksc. the general publicd. the Federal Deposit Insurance Corporationa 14. The Federal Reserve may contract the money supply by1. selling securities2. buying securities3. raising reserve requirements4. lowering reserve requirementsa. 1 and 3b. 1 and 4c. 2 and 3d. 2 and 4理事会的成员是由成员银行推选由参议院任命由美国总统任命联邦公开市场委员会选举产生在衰退期,联邦政府的盈余应该退休欠下的债美联储商业银行广大市民美国联邦存款保险公司美联储可能通过收缩货币供应量出售证券买证券提高存款准备金率降低准备金要求如果联邦政府经营赤字,并从商业银行借入,总存款不受影响总存款增加超额准备金减少超额准备金均有所下降d 15. If the federal government runs a deficit and borrows fromcommercial banks,1. total deposits are not affected2. total deposits are increased3. excess reserves are reduced4. excess reserves are decreaseda. 1 and 3b. 1 and 4c. 2 and 3d. 2 and 4c 16. If the federal government runs a deficit and finances thedeficit by borrowing from the Federal Reserve,1. the reserves of commercial banks are reduced2. the reserves of commercial banks are increased3. the required reserves of commercial banks areincreased4. the required reserves of commercial banks arereduceda. 1 and 3b. 1 and 4c. 2 and 3d. 2 and 4b 17. Anticipation of inflation discourages1. saving2. borrowing3. lending4. purchasing goodsa. 1 and 2b. 1 and 3c. 2 and 3d. 3 and 4b 18. If the federal government runs a surplus,a. expenditures exceed taxesb. receipts exceed disbursementsc. debt must be issuedd. the Federal Reserve buys bondsb 19. Recession is a period ofa. declining pricesb. declining employmentc. declining unemploymentd. rising interest ratesb 20. The Board of Governorsa. manages the nation's stock of goldb. has the substantive control over the money supplyc. controls the U. S. Treasuryd. is appointed by the U. S. Treasurera 21. If commercial banks grant loans,a. the money supply is increasedb. total reserves are increasedc. excess reserves are increasedd. the money supply is reducedd 22. Commercial banks may borrow reserves from each other in thea. reserves marketb. stock marketc. bank marketd. federal funds marketa 23. By selling securities to the general public, the FEDa. reduces the money supplyb. raises commercial banks' depositsc. increases the money supplyd. increases banks' excess reservesa 24. The tools of monetary policy includea. open market operationsb. the purchase of corporate stockc. the federal government deficitd. taxationb 25. If the federal government runs a deficit,a. taxes exceed expendituresb. expenditures exceed taxesc. receipts exceed taxesd. taxes exceed revenuesb 26. Anticipation of inflation encouragesa. lendingb. borrowingc. retiring debtd. savingc 27. During a period of recession the Federal Reserve1. increases the federal funds rate2. buys government securities3. sells government securities4. lowers the federal funds area. 1 and 2b. 1 and 3c. 2 and 4d. 3 and 4SUPPLEMENTARY QUESTIONS1. If the reserve requirement for demand deposits is 10 percent,what is the maximum change in the money supply that thebanking system can create ifa. the Federal Reserve puts $1,000,000 of new reserves inthe banking systemb. $1,000,000 in cash is deposited in checking accountsc. General Motors borrows $1,000,000 from an insurancecompany?Answers:a. new excess reserves: $1,000,000maximum possible expansion in the money supply:$1,000,000/.1 = $10,000,000b. new excess reserves: $1,000,000 - 100,000 = $900,000maximum possible expansion in the money supply:$900,000/.1 = $9,000,000c. new excess reserves: $0maximum possible expansion in the money supply:$0/.1 = $0(Borrowing from the non-bank public does not affect thebanking system's ability to create new money.)2. What is the effect on (1) demand deposits, (2) requiredreserves, and (3) excess reserves of banks given thefollowing transactions?a. The general public builds up its holdings of cash bywithdrawing funds in checking accounts.b. After Christmas the general public deposits cash in checkingaccounts in commercial banks. (How may seasonal changes in the public's need for cash alter banks' ability to lend?)c. Corporations borrow from commercial banks.d. State and local governments issue debt securities that arepurchased by commercial banks.e. Homeowners borrow from commercial banks to finance homeimprovements. (Are there any differences on the expansion ofthe money supply in questions (c), (d), and (e)?)f. A bank in California with excess reserves lends these fundsthrough the federal funds market to a bank in Maine that hasinsufficient reserves.g. Corporations issue short-term securities that are purchased bythe general public.h. Corporations retire (i.e., pay off) loans from commercial banks.i. The Federal Reserve buys Treasury bills that are sold by thegeneral public.j. The Federal Reserve raises the discount rate, and banks retire debt owed the Federal Reserve.k. The Federal Reserve raises the reserve requirement on demand deposits.l. The Treasury borrows from the banks to finance payments.m. The federal government runs a deficit and borrows the funds from the general public.n. The federal government runs a deficit and borrows the funds from the Federal Reserve.Answers:a. Demand deposits - lowerRequired reserves - lowerExcess reserves - lowerb. Demand deposits - higherRequired reserves - higherExcess reserves - higherThese two questions illustrate that a seasonal flow of deposits into or out of the banking system will affect the reserves of the banking system. Unless the banks are able to find liquidity elsewhere (e.g., the Federal Reserve), such seasonal changes in reserves may produce fluctuations in the supply of credit.c. Demand deposits - higherRequired reserves - higherExcess reserves - lowerd. Demand deposits - higherRequired reserves - higherExcess reserves - lowere. Demand deposits - higherRequired reserves - higherExcess reserves - lowerThese three questions illustrate that from the viewpoint of the banking system, it does not matter if the banks acquire debt issued by firms, governments, or households. To acquire the debt, the banks must have excess reserves. After they have used their excess reserves, the money supply is expanded, and the excess reserves become required reserves.f. Demand deposits - no changeRequired reserves - no changeExcess reserves - no changeUnlike in the previous questions, the lending of excess reserves from one bank to another does not in the aggregate increase or decrease the reserves of the banking system.g. Demand deposits - no changeRequired reserves - no changeExcess reserves - no changeLoans between members of the non-bank general public do not affect banks' reserves and thus do not affect their capacity to lend.h. Demand deposits - lowerRequired reserves - lowerExcess reserves - higherWhile the creation of new loans uses the banks' excess reserves and creates new money, the retiring of loans from commercial banks reduces demand deposits and restores excess reserves (i.e., increases excess reserves).i. Demand deposits - higherRequired reserves - higherExcess reserves - higherj. Demand deposits - no changeRequired reserves - no changeExcess reserves - lowerk. Demand deposits - no changeRequired reserves - higherExcess reserves - lowerQuestions j and k illustrate two major monetary tools, the reserve requirement and the discount rate. Notice that changing the discount rate and the reserve requirements do not in themselves change demand deposits. Their impact is on reserves, and theeffect of this impact may lead to a change in the supply of money. l. Demand deposits - higherRequired reserves - higherExcess reserves - lowerm. Demand deposits - no changeRequired reserves - no changeExcess reserves - no changen. Demand deposits - increaseRequired reserves - increaseExcess reserves - increaseDuring a period of inflation, a policy that contracts the money supply and the capacity of banks to lend is desirable. Theopposite situation would apply during a recession. If there were a deficit during a period of recession, it is desirable to increase the money supply and the capacity of the banks to lend. Hence n is better than m.。