公司金融课后题答案CHAPTER18

- 格式:docx

- 大小:36.36 KB

- 文档页数:34

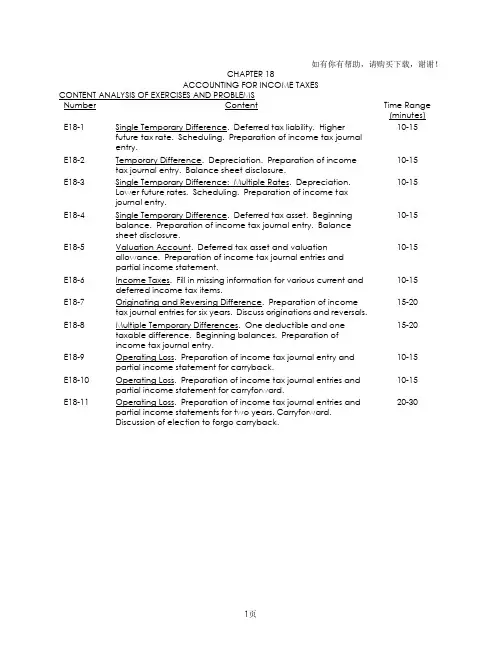

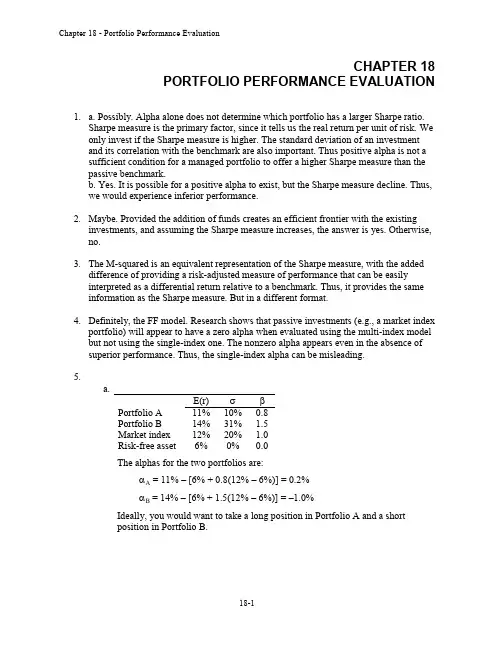

CHAPTER 18ACCOUNTING FOR INCOME TAXESCONTENT ANALYSIS OF EXERCISES AND PROBLEMSNumber Content Time Range(minutes)10-15E18-1 Single Temporary Difference. Deferred tax liability. Higherfuture tax rate. Scheduling. Preparation of income tax journalentry.10-15E18-2 Temporary Difference. Depreciation. Preparation of incometax journal entry. Balance sheet disclosure.10-15E18-3 Single Temporary Difference: Multiple Rates. Depreciation.Lower future rates. Scheduling. Preparation of income taxjournal entry.10-15E18-4 Single Temporary Difference. Deferred tax asset. Beginningbalance. Preparation of income tax journal entry. Balancesheet disclosure.10-15E18-5 Valuation Account. Deferred tax asset and valuationallowance. Preparation of income tax journal entries andpartial income statement.10-15E18-6 Income Taxes. Fill in missing information for various current anddeferred income tax items.15-20E18-7 Originating and Reversing Difference. Preparation of incometax journal entries for six years. Discuss originations and reversals.15-20E18-8 Multiple Temporary Differences. One deductible and onetaxable difference. Beginning balances. Preparation ofincome tax journal entry.10-15E18-9 Operating Loss. Preparation of income tax journal entry andpartial income statement for carryback.10-15E18-10 Operating Loss. Preparation of income tax journal entries andpartial income statement for carryforward.E18-11 Operating Loss. Preparation of income tax journal entries and20-30 partial income statements for two years. Carryforward.Discussion of election to forgo carryback.Number Content Time Range(minutes)15-20E18-12 Intraperiod Tax Allocation. Year-end journal entry. Incomestatement. Statement of retained earnings.15-20E18-13 Intraperiod Income Taxes. Calculation. Journal entry. Incomestatement.15-25E18-14 Intraperiod Tax Allocation. Income tax liability. Extraordinaryloss, loss from discontinued component, gain on disposal,change in depreciation method, prior period error. Incomestatement disclosure. Statement of retained earnings.10-15E18-15 Balance Sheet Disclosure. Presentation of income taxdisclosures.10-15E18-16 Change in Tax Rates. Correction of deferred tax liability.Calculation of amount and preparation of journal entry.10-20P18-1 Temporary and Permanent Differences. Identification andindication of result for various examples.P18-2 Definitions. Matching of terms with definitions related to current5-10 and deferred tax items.P18-3 Multiple Temporary Differences. Estimated warranty expense,15-20 depreciation. Preparation of income tax journal entry andpartial income statement. Balance sheet disclosure.20-30P18-4 Interperiod Tax Allocation: Change in Rate. Warranty expense,depreciation, rent receipts, gross profit. Preparation of incometax journal entry and condensed income statement.Balance sheet disclosures.25-35P18-5 Interperiod Tax Allocation. Computation of taxable incomegiven various information. Preparation of income tax journalentry. Discussion of permanent differences.P18-6 Interperiod Tax Allocation: Change in Rate. Computation of20-40 taxable income. Preparation of income tax journal entry andcondensed income statement.25-40P18-7 Deferred Tax Liability: Depreciation. Depreciation schedule,deferred tax liability schedule. Preparation of income taxjournal entry. Explanation of change in deferred tax liability.P18-8 Deferred Tax Liability: Depreciation. Depreciation schedule,25-40 deferred tax liability schedule. Preparation of income taxjournal entries and lower portions of income statements.Presentation of balance sheet disclosures.30-40P18-9 Deferred Taxes: Multiple Rates. One taxable and deductibledifference. Higher future tax rate. Scheduling. Preparation ofincome tax journal entry and lower portion of incomestatement. Preparation of income tax journal entries.Number Content Time Range(minutes)30-45P18-10 Operating Loss. Preparation of income statement and journalentries for two years. Carryback and carryforward. Valuationallowance.30-45P18-11 Operating Loss. Preparation of income statement and journalentries for two years. Carryback and carryforward. Novaluation account.25-35P18-12 Balance Sheet Reporting and Tax Rate Changes. Balancesheet disclosures. Correction of deferred tax items. Preparationof income tax journal entry. Computation of income taxexpense.30-40P18-13 Comprehensive: Intraperiod and Interperiod Tax Allocation.Allocation schedule. Preparation of income tax journal entry,partial income statement, statement of retained earnings.Balance sheet disclosures.30-40P18-14 Comprehensive: Interperiod and Intraperiod Tax Allocation.Preparation of income tax journal entry, partial incomestatement, statement of retained earnings. Balance sheetdisclosures.P18-15 Comprehensive: Operating Loss and Temporary Difference.30-45 Income taxes payable, schedules of deferred tax information,income tax journal entry, partial income statement, notedisclosure.ANSWERS TO QUESTIONSQ18-1 The objective of financial reporting is to provide useful information to decision makers about companies. This information is intended to enable investors to makebuy-hold-sell decisions. The overall objective of the Internal Revenue Code is toobtain funds, in an equitable manner, in order to operate the federal government.The Internal Revenue Code is also sometimes used to stimulate and regulate theeconomy.Q18-2 The five groups of possible differences between pretax financial income and taxable income (or between income tax expense and income taxes payable) are as follows:1. Permanent differences. Items of revenue or expense that a corporation reports forfinancial accounting purposes that it never reports for income tax purposes.2. Temporary differences. Items of revenue or expense that a corporation reports forfinancial accounting purposes in one period and for income tax purposes in anearlier or later period.。

国际公司金融课后习题答案--第十八章第十八章课后习题参考答案1. 谈谈税收在经济中的作用。

税收在市场经济中主要起资源配置作用,通过税收政策和税收制度,在不同部门之间对各种资源进行配置,并在这一过程中影响个人和公司的经济活动。

首先,税收的变动会直接或间接地影响商品价格,从而影响商品的供求状况。

其次,税收影响经济结构,不同的税收政策对不同产品、不同行业、不同地区、不同企业组织形式都会产生影响。

通过影响商品价格以及经济结构,税收政策使各种资源在不同部门、不同地区间流动,而这些流动带来的影响意味着国际公司将不得不就此做出相应的经营决策。

这表明税收在经济中的作用最终会通过不同的渠道影响国际公司的经营。

2. 国际税收体系中的税收中性是指什么?对于税收中性,当前流行的国际税收理论中大体有两种观点:一是资本输出中性,二是资本输入中性。

所谓资本输出中性,就是税收不应影响投资者在国内、国外投资地点的选择,也不应影响投资者在各不同国家之间的选择,从而能使资本在世界范围内得到有效配置。

资本输入中性则认为,不同国籍的纳税人在同一国家从事投资活动,应享受相同的税收待遇。

3. 重复征税对于国际公司经营有什么弊端?从法律角度看,国际重复征税导致从事跨国投资和其他各种经济活动的纳税人相对于从事国内投资和其他各种经济活动的纳税人承受更为沉重的税收负担,从而违背了税收中立和税负公平的税法原则。

从经济角度看,国际重复征税造成税负不公致使跨国纳税人处于不利的竞争地位,势必挫伤其从事跨国经济活动的积极性,从而阻碍国际间资金、技术和人员的正常流动和交往。

4. 出现国际重复征税的原因是什么?应如何解决?国际重复征税的出现,最根本的原因是税收管辖权出了问题。

甲国根据自己的税法,认为对一项收入应由自己征税;乙国则认为应由乙国征税,于是纳税管辖权出现了重合,两国都向同一项收入征收所得税,国际重复征税就出现了。

各国为了避免重复征税,会通过一定方式对国际公司已缴国外所得税进行抵免,从而消除或减轻这种不利影响。

最新《公司金融学》全本课后习题参考答案《公司金融》课后习题参考答案各大重点财经学府专业教材期末考试考研辅导资料第一章导论第二章财务报表分析与财务计划第三章货币时间价值与净现值第四章资本预算方法第五章投资组合理论第六章资本结构第七章负债企业的估值方法第八章权益融资第九章债务融资与租赁第十章股利与股利政策第十一章期权与公司金融第十二章营运资本管理与短期融资第一章导论1.治理即公司治理(corporate governance),它解决了企业与股东、债权人等利益相关者之间及其相互之间的利益关系。

融资(financing),是公司金融学三大研究问题的核心,它解决了公司如何选择不同的融资形式并形成一定的资本结构,实现企业股东价值最大化。

估值(valuation),即企业对投资项目的评估,也包括对企业价值的评估,它解决了企业的融资如何进行分配即投资的问题。

只有公司治理规范的公司,其投资、融资决策才是基于股东价值最大化的正确决策。

这三个问题是相互联系、紧密相关的,公司金融学的其他问题都可以归纳入这三者的范畴之中。

2.对于上市公司而言,股东价值最大化观点隐含着一个前提:即股票市场充分有效,股票价格总能迅速准确地反映公司的价值。

于是,公司的经营目标就可以直接量化为使股票的市场价格最大化。

若股票价格受到企业经营状况以外的多种因素影响,那么价值确认体系就存在偏差。

因此,以股东价值最大化为目标必须克服许多公司不可控的影响股价的因素。

第二章财务报表分析与财务计划1.资产负债表;利润表;所有者权益变动表;现金流量表。

资产= 负债+ 所有者权益2.我国的利润表采用“多步式”格式,分为营业收入、营业利润、利润总额、净利润、每股收益、其他综合收益和综合收益总额等七个盈利项目。

3.直接法是按现金收入和支出的主要类别直接反映企业经营活动产生的现金流量,一般以利润表中的营业收入为起算点,调整与经营活动有关项目的增减变化,然后计算出经营活动现金流量。

公司具备哪些特征?大企业为何大多选择公司制?公司是以资本联合为基础,以营利为目的,依照法律规定的条件和法律规定的程序设立,具有法人资格的企业组织。

公司的基本特征在于是:1. 公司是资本的联合而形成的经济组织。

2.公司具有法人资格。

3.公司股东承担有限责任。

4.公司是以营利为目的的。

5.公司实行所有权与经营权分离。

6.公司依照法律设立和运行,是规范化程序较高的企业组织形式。

7.公司是永续存在的企业组织形式。

大企业选择公司制的原因:1、有利于形成一个产权明晰,权责明确,管理科学的现代公司制度,从而推动企业规模化、规范化、专业化的建设与发展。

2、可以实现所有权和经营权分离,实现企业发展决策的科学化、民主化,能避免由于组织的庞大,一个人知识、能力不足而导致决策的失误3、公司讲究的是团队精神,形成的是整体合力,发挥的是“拳头”优势。

只有部门齐全、分工细致的规模化的公司才能提供系统的服务,满足客户“一站式”、“一条龙”服务的需要。

4、可以使管理职业化、专业化,提高了管理的层次与水平,有利于树立服务品牌,使企业高效率运转和扩张。

同时,这种机制不仅有利于调节内部责权利关系,而且能够组织协调企业的整体行动,参与市场竞争。

5、公司制有利于形成投资主体多元化,有利于资本的积累,可以吸纳国家、组织和个人出资,任何所有制性质的主体均能够成为企业的出资者或股东。

6、公司制企业的产权结构决定了股东不能够直接对企业的运行施加影响,从而可以较大幅度地降低服务成本7、公司制企业的责任有限化成为降低企业经营风险的最佳手段。

公司制企业由于采取有限责任和股权可转让的形式,因而除破产等极少数特殊原因外,一般不会发生因股东更迭而导致企业解体的情况,这就使得企业能够步入可持续发展之路。

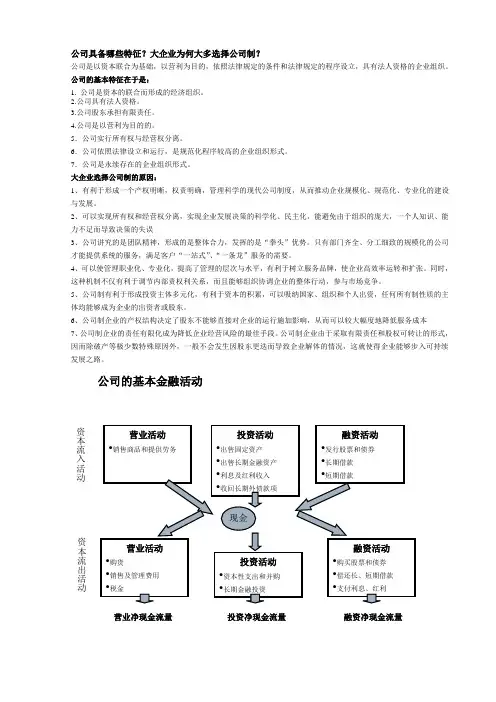

公司的基本金融活动营业净现金流量 投资净现金流量 融资净现金流量 资本流入活动资本流出活动如何理解公司价值最大化作为公司金融目标的合理性?企业价值不等于账面资产的总价值,它取决于企业潜在或预期获利能力。

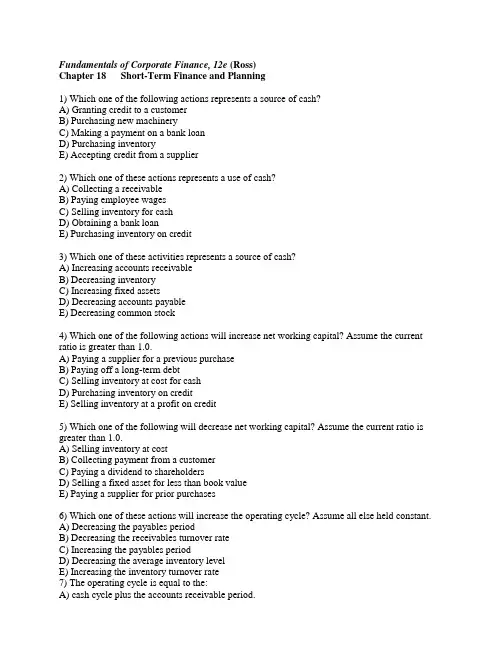

Fundamentals of Corporate Finance, 12e (Ross)Chapter 18 Short-Term Finance and Planning1) Which one of the following actions represents a source of cash?A) Granting credit to a customerB) Purchasing new machineryC) Making a payment on a bank loanD) Purchasing inventoryE) Accepting credit from a supplier2) Which one of these actions represents a use of cash?A) Collecting a receivableB) Paying employee wagesC) Selling inventory for cashD) Obtaining a bank loanE) Purchasing inventory on credit3) Which one of these activities represents a source of cash?A) Increasing accounts receivableB) Decreasing inventoryC) Increasing fixed assetsD) Decreasing accounts payableE) Decreasing common stock4) Which one of the following actions will increase net working capital? Assume the current ratio is greater than 1.0.A) Paying a supplier for a previous purchaseB) Paying off a long-term debtC) Selling inventory at cost for cashD) Purchasing inventory on creditE) Selling inventory at a profit on credit5) Which one of the following will decrease net working capital? Assume the current ratio is greater than 1.0.A) Selling inventory at costB) Collecting payment from a customerC) Paying a dividend to shareholdersD) Selling a fixed asset for less than book valueE) Paying a supplier for prior purchases6) Which one of these actions will increase the operating cycle? Assume all else held constant.A) Decreasing the payables periodB) Decreasing the receivables turnover rateC) Increasing the payables periodD) Decreasing the average inventory levelE) Increasing the inventory turnover rate7) The operating cycle is equal to the:A) cash cycle plus the accounts receivable period.B) inventory period plus the accounts receivable period.C) inventory period plus the accounts payable period.D) accounts payable period minus the cash cycle.E) accounts payable period plus the accounts receivable period.8) Which one of the following will decrease the operating cycle?A) Decreasing the inventory turnover rateB) Decreasing the accounts payable periodC) Increasing the accounts receivable turnover rateD) Increasing the accounts payable periodE) Increasing the accounts receivable period9) The operating cycle describes how a product:A) is priced.B) is sold.C) moves through the current asset accounts.D) moves through the production process.E) generates a profit.10) Which one of these affects the length of the cash cycle but not the operating cycle?A) Inventory periodB) Accounts payable periodC) Both the accounts receivable and inventory periodsD) Accounts receivable periodE) Both the accounts receivable and the accounts payable periods11) Which one of these will decrease the cash cycle, all else held constant?A) Increasing the accounts receivable turnover rateB) Decreasing the accounts payable periodC) Increasing the inventory periodD) Decreasing the inventory turnover rateE) Increasing the accounts receivable period12) A decrease in which one of the following will increase the cash cycle, all else held constant?A) Payables turnoverB) Days sales in inventoryC) Operating cycleD) Inventory turnover rateE) Accounts receivable period13) Metal Designs historically produced products for inventory. Now, they only produce a product when an actual order is received from a customer. All else equal, this change will:A) increase the operating cycle.B) lengthen the accounts receivable period.C) shorten the accounts payable period.D) decrease the cash cycle.E) decrease the inventory turnover rate.14) Which one of these statements is correct? Assume all else held constant.A) A decrease in the accounts receivable turnover rate decreases the cash cycle.B) The cash cycle is equal to the operating cycle minus the inventory period.C) A negative cash cycle is preferable to a positive cash cycle.D) A decrease in the accounts payable period shortens the cash cycle.E) The cash cycle plus the accounts receivable period is equal to the operating cycle.15) Which one of the following statements is correct concerning the cash cycle?A) The longer the cash cycle, the more likely a company will need external financing.B) Increasing the accounts payable period increases the cash cycle.C) Accepting a supplier's discount for early payment decreases the cash cycle.D) The cash cycle can exceed the operating cycle if the payables period is equal to zero.E) Offering early payment discounts to customers will tend to increase the cash cycle.16) Which one of the following actions will tend to increase the inventory period?A) Discontinuing all slow-selling merchandiseB) Selling obsolete inventory below cost just to get rid of itC) Buying raw materials only as needed for the manufacturing processD) Producing goods on demand versus for inventoryE) Increasing inventory selection to attract more customers17) Which one of the following actions will tend to increase the accounts receivable period from its current 14 days?A) Tightening the standards for granting credit to customersB) Refusing to grant additional credit to any customer who pays lateC) Increasing the finance charges applied to all customer balances outstanding over 30 daysD) Granting discounts for cash salesE) Eliminating the discount for early payment by credit customers18) An increase in which one of the following is an indicator that an accounts receivable policy is becoming more restrictive?A) Bad debtsB) Accounts receivable turnover rateC) Accounts receivable periodD) Credit salesE) Operating cycle19) Assume all else held constant. If you pay your suppliers three days sooner, then:A) your payables turnover rate will decrease.B) you may require additional funds from other sources to fund the cash cycle.C) the cash cycle will decrease.D) your operating cycle will decrease.E) the accounts receivable period will decrease.20) Which one of the following will increase the accounts payable period, all else held constant?A) A decrease in the inventory periodB) An increase in the ending accounts payable balanceC) An increase in the cash cycleD) A decrease in the operating cycleE) An increase in the accounts payable turnover rate21) Which one of the following managers determines which customers must pay cash and which can charge their purchases?A) Purchasing managerB) Credit managerC) ControllerD) Production managerE) Payables manager22) Which one of the following managers determines when a supplier will be paid?A) ControllerB) Payables managerC) Credit managerD) Purchasing managerE) Production manager23) The length of time between the purchase of inventory and the receipt of cash from the sale of that inventory is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.24) The length of time that elapses between the day at item of inventory is purchased and the day that item sells is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.25) The length of time between the sale of inventory and the collection of the payment for that sale is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.26) The length of time between the day an item is purchased from a supplier until the day that supplier is paid for that purchase is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.27) Central Supply paid off an accounts payable for a toboggan it had purchased on credit three weeks ago. The time period between today and the day Central Supply will receive cash from the sale of this toboggan is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.28) Costs that increase as a firm acquires additional current assets are called ________ costs.A) carryingB) shortageC) orderD) safetyE) trading29) Costs that decrease as a company acquires additional current assets are called ________ costs.A) carryingB) shortageC) debtD) equityE) payables30) A firm with a flexible short-term financial policy will:A) maintain a low balance in accounts receivables.B) only have minimal amounts, if any, invested in marketable securities.C) invest heavily in inventory.D) have low cash balances.E) have tight restrictions on granting credit to customers.31) Which one of these is indicative of a short-term restrictive financial policy?A) Purchasing inventory on an as-needed basisB) Granting credit to all customersC) Investing heavily in marketable securitiesD) Maintaining a large accounts receivable balanceE) Keeping inventory levels high32) If a company adheres to a restrictive short-term financial policy, then they will generally have:A) little, if any, investment in marketable securities.B) low inventory turnover rates.C) liberal credit terms for customers.D) few, if any, stockouts.E) high cash balances.33) The Lumber Mart recently replaced its management team. As a result, they are implementinga restrictive short-term financial policy in place of the flexible policy under which they had been operating. Which one of the following should the employees expect as a result of this policy change?A) Increasing monthly sales as compared to the prior yearB) Greater inventory selectionC) Fewer out-of-stock occurrencesD) Loss of credit customersE) More liberal credit terms34) A flexible short-term financial policy:A) increases the need for long-term financing.B) minimizes net working capital.C) avoids bad debts by only selling items for cash.D) maximizes fixed assets and minimizes current assets.E) is most appropriate when carrying costs are high and shortage costs are low.35) A flexible short-term financial policy:A) maximizes cashouts.B) increases shortage costs due to frequent cash-outs.C) tends to decrease sales as compared to a restrictive policy.D) incurs more carrying costs than a restrictive policy.E) requires only a minimum investment in current assets.36) Shortage costs are least associated with:A) stockouts and cashouts.B) lost customer goodwill.C) disruptions of production schedules.D) inventory ordering costs.E) opportunity costs incurred by high levels of working capital.37) The optimal investment in current assets for an active company occurs at the point where:A) both shortage costs and carrying costs equal zero.B) shortage costs are equal to zero.C) carrying costs are equal to zero.D) carrying costs exceed shortage costs.E) shortage costs and carrying costs are equal.38) A company:A) with a restrictive financing policy secures sufficient long-term financing to fund all its assets.B) with a flexible financing policy frequently invests in marketable securities.C) with a flexible financing policy tends to use short-term financing on an ongoing basis.D) will tend to avoid short-term financing under both restrictive and flexible financing policies.E) with seasonal sales must select flexible financing policies.39) Which one of the following statements is correct?A) Seasonal needs are financed with short-term loans when companies adhere to a flexible financing policy.B) A flexible financing policy tends to increase the risk of encountering financial distress.C) Long-term interest rates tend to be less volatile than short-term rates.D) Most companies tend to finance inventory with long-term debt.E) Short-term interest rates are generally higher than long-term rates.40) Which one of these best describes a characteristic of a flexible financing policy?A) All of a company's assets are financed with long-term debt.B) Only long-term assets are financed with long-term debt.C) Short-term financing will be used to finance seasonal peaks.D) Inventory is purchased with cash.E) Low levels of inventory are maintained.41) With a compromise financial policy companies will:A) borrow only long-term funds and refuse any loans that require compensating balances.B) borrow short-term funds and also invest in marketable securities.C) finance all of their assets with various short-term loans.D) finance their seasonal asset peaks with short-term debt and the remainder of their assets with equity.E) finance half of their fixed assets with long-term debt and half with short-term debt.42) Assume each month has 30 days and a company has a 30-day accounts receivable period. During the second calendar quarter of the year, that company will collect payment for the sales it made during which of the following months?A) February, March, and AprilB) April, May and JuneC) December, January, and FebruaryD) January, February, and MarchE) March, April, and May43) The Harvester collects 55 percent of sales in the month of sale, 40 percent of sales in the month following the month of sale, and 5 percent of sales in the second month following themonth of sale. During the month of April, they will collect:A) 55 percent of February sales.B) 5 percent of April sales.C) 40 percent of March sales.D) 5 percent of March sales.E) 40 percent of February sales.44) Timko has a 90-day collection period and produces seasonal merchandise. Sales are lowest during the first calendar quarter of a year and the highest during the third quarter. The company maintains a relatively steady level of production which means that its cash disbursements are fairly equal in all quarters. This company is most apt to face a cash-out situation in:A) the first quarter.B) the second quarter.C) the third quarter.D) the fourth quarter.E) any quarter with equal probabilities of occurrence.45) Summertime Adventures is a seasonal firm that enjoys its highest sales during July and August. The company purchases inventory one month before it is sold and pays for its purchases 60 days after the invoice date. Which one of the following statements is supported by this information?A) Inventory purchases will be highest during the months of July and August.B) Inventory purchases will be highest during the months of May and June.C) Payments to suppliers will be highest during the months of June and July.D) Payments to suppliers will be highest during the months of July and August.E) Payments to suppliers will be highest during the months of August and September.46) Which one of the following combinations is most apt to cause a company that is generally financially sound to have a negative net cash inflow for a particular quarter?A) Low fixed expenses and level monthly salesB) A one-time asset purchase and approaching high seasonal salesC) Highly seasonal sales and a flexible financing policyD) A flexible financing policy and level monthly salesE) A large cash sale and low fixed expenses47) Which one of the following statements is correct concerning a company's cash balance?A) Most firms attempt to maintain a zero cash balance at all times.B) The cumulative cash surplus shown on a cash budget is equal to the ending cash balance plus the minimum desired cash balance.C) On a cash balance report, the cumulative cash surplus at the end of May is used as June's beginning cash balance.D) A cumulative cash deficit indicates a borrowing need.E) The ending cash balance must equal the minimum desired cash balance.48) A cumulative cash deficit indicates a company:A) has at least a short-term need for external funding.B) is facing long-term financial distress.C) will go out of business within the year.D) is capable of funding all of its needs internally.E) is using its cash wisely.49) Steve has estimated the cash inflows and outflows for his hardware store for next year. The report that he has prepared recapping these cash flows is called a:A) pro forma income statement.B) sales projection.C) cash budget.D) receivables analysis.E) credit analysis.50) Taylor Supply has made an agreement with its bank that allows it to borrow up to $10,000 at any time over the next year. This arrangement is called a(n):A) floor loan.B) open loan.C) compensating balance.D) line of credit.E) bank note.51) Money deposited by a borrower with a bank in a low or non-interest-bearing account as a condition of a loan agreement is called a:A) compensating balance.B) secured credit deposit.C) letter of credit.D) line of cash.E) pledge.52) Brustle's Pottery either factors or assigns all of its receivables to other firms. This is known as:A) accounts receivable financing.B) pledged financing.C) capital funding.D) daily funding.E) capital financing.53) Rose's Gift Shop borrows money on a short-term basis by pledging its inventory as collateral. This is an example of a(n):A) debenture.B) line of credit.C) banker's acceptance.D) working loan.E) inventory loan.54) The most common way to finance a temporary cash deficit is with a:A) long-term secured bank loan.B) short-term secured bank loan.C) short-term issue of corporate bonds.D) long-term unsecured bank loan.E) short-term unsecured bank loan.55) The primary difference between a line of credit and a revolving credit arrangement is the:A) type of collateral used to secure the loan.B) length of the credit period.C) fact that the line of credit is a secured loan and the revolving credit arrangement is unsecured.D) fact that the line of credit is an unsecured loan and the revolving credit arrangement is secured.E) loan's classification as either a committed or a non-committed loan.56) A compensating balance:A) is required when a company acquires any bank financing other than a line of credit.B) is often used by banks as a means of rewarding their best credit customers.C) decreases the cost of short-term bank financing.D) only applies to zero-interest rate loans.E) may be required even if a company never borrows funds.57) High Point Hotel (HPH) has $218,000 in accounts receivable. To finance a major purchase, the company assigns these receivables to Cross Town Bank. Which one of the following statements correctly describes this transaction?A) HPH will immediately receive $218,000 and will have no further obligation related to these receivables.B) HPH will receive some amount of cash immediately while maintaining full responsibility for any uncollected receivables.C) Cross Town Bank accepts full responsibility for the collection of the accounts receivables and, in exchange, immediately pays HPH a discounted value for its receivables.D) Cross Town Bank accepts full responsibility for collecting the accounts receivables and pays HPH a discounted price for the accounts collected after the normal collection period has elapsed.E) HPH receives the full amount of its receivables upon assignment but must reimburse Cross Town Bank for any uncollected account.58) Which one of the following statements is correct?A) The assignment of receivables involves selling accounts receivables at full price.B) Lines of credit frequently require a cleanup period.C) With maturity factoring, the borrower receives the loan amount immediately.D) Commercial paper is short-term financing offered to highly rated corporations by major banks.E) Credit card receivables funding is a relatively inexpensive method of borrowing on a short-term basis.59) Which type of arrangement is a hardware store most apt to use to finance its inventory?A) Accounts receivable assignmentB) Blanket inventory lienC) Trust receiptD) Commercial paperE) Field warehouse financing60) An orange grower is most apt to use which type of financing for its crop?A) Accounts receivable assignmentB) Blanket inventory lienC) Trust receiptD) Commercial paperE) Field warehouse financing61) All of the following are benefits derived from short-term financial planning with the exception of:A) having advance notice of when your firm should require external financing.B) knowing for certain what your cash balance will be six months in advance.C) knowing if excess funds should be available for investing.D) being able to determine the approximate extent of time for which a loan is required.E) having the ability to time capital expenditures in order to place the least financial burden possible on a firm.62) Auto Detailers has a book net worth of $29,700. Long-term debt is $4,800. Net working capital, other than cash, is $3,700 and fixed assets are $27,400. How much cash does the company have?A) $3,900B) $4,800C) $4,300D) $3,400E) $3,70063) New Products has sales of $749,500 and cost of goods sold of $368,600. Beginning inventory is $54,700 and ending inventory is $58,200. What is the length of the inventory period?A) 15.01 daysB) 17.89 daysC) 55.90 daysD) 90.53 daysE) 113.67 days64) Mid-Western Markets has sales of $1,389,400 and costs of goods sold of $892,700. Beginning inventory is $94,300 and ending inventory is $110,200. What is the inventory turnover rate?A) 8.73 timesB) 10.78 timesC) 13.59 timesD) 11.37 timesE) 12.64 times65) North Side Wholesalers has sales of $1,648,900. The cost of goods sold is equal to 71 percent of sales and the average inventory is $75,800. How many days on average does it take to sell the inventory?A) 28.30 daysB) 23.63 daysC) 20.48 daysD) 33.28 daysE) 21.68 days66) The Bear Rug has sales of $647,000. The cost of goods sold is equal to 66 percent of sales. Accounts receivable has a beginning balance of $53,400 and an ending balance of $49,600. How long on average does it take to collect the receivables?A) 12.56 daysB) 29.05 daysC) 18.58 daysD) 20.44 daysE) 19.17 days67) Morning Star has credit sales of $1,032,800, costs of goods sold of $662,350, average accounts receivable of $86,300, and average accounts payable of $92,600. On average, how long does it take Morning Star's credit customers to pay for their purchases?A) 11.97 daysB) 39.24 daysC) 30.50 daysD) 21.88 daysE) 19.56 days68) The Mountain Top Shoppe has sales of $828,000, average accounts receivable of $64,100 and average accounts payable of $72,700. The cost of goods sold is equivalent to 68 percent of sales. How long does it take The Mountain Top Shoppe to pay its suppliers?A) 69.31 daysB) 68.38 daysC) 47.13 daysD) 35.89 daysE) 36.97 days69) HG Livery Supply has a beginning accounts payable balance of $68,800 and an ending accounts payable balance of $72,700. Sales for the period were $942,800 and costs of goods sold were $534,200. What is the payables turnover rate?A) 7.55 timesB) 8.39 timesC) 7.02 timesD) 13.33 timesE) 12.85 times70) Bradley's has an inventory turnover rate of 7.6, a payables turnover rate of 11.4, and a receivables turnover rate of 12.6. How long is the operating cycle?A) 20.20 daysB) 76.99 daysC) 70.63 daysD) 30.13 daysE) 24.11 days71) Meryl Enterprises currently has an operating cycle of 76.4 days. The company is implementing some operational changes that are expected to increase the accounts receivable period by 2.2 days, decrease the inventory period by 5.3 days, and increase the accounts payable period by 1.5 days. What is the new operating cycle expected to be?A) 78.0 daysB) 74.8 daysC) 73.3 daysD) 79.5 daysE) 71.8 days72) On average, Furniture & More is able to sell its inventory in 54.2 days and takes 65.3 days on average to pay for its purchases. Its average customer pays with a credit card which allows the company to collect its receivables in 2.9 days. Given this information, what is the length of operating cycle?A) 57.1 daysB) 88.3 daysC) −8.2 daysD) 116.6 daysE) 122.4 days73) Interior Designs has an inventory period of 84.6 days, an accounts payable period of 43.2 days, and an accounts receivable period of 41.7 days. Management is considering an offer from their suppliers to pay within 10 days and receive a discount of 2 percent. If the new discount is taken, the accounts payable period is expected to decline by 30.4 days. What will be the new operating cycle given the change in the payables period?A) 95.9 daysB) 115.0 daysC) 97.4 daysD) 126.3 daysE) 139.1 days74) Metal Products Co. has an inventory period of 94.2 days, an accounts payable period of 40.4 days, and an accounts receivable turnover rate of 17.6. What is the length of the cash cycle?A) 71.40 daysB) 74.54 daysC) 96.28 daysD) 114.94 daysE) 108.28 days75) West Chester Automation has an inventory turnover of 9.1 and an accounts payable turnover of 10.6. The accounts receivable period is 32.8 days. What is the length of the cash cycle?A) 35.67 daysB) 38.48 daysC) 41.02 daysD) 46.47 daysE) 48.81 days76) Peterson's Antiquities currently has a 32.6-day cash cycle. Assume the company changes its operations such that it decreases its receivables period by 3.1 days, increases its inventory period by 1.8 days, and increases its payables period by 2.2 days. What will the length of the cash cycle be after these changes?A) 33.5 daysB) 36.1 daysC) 30.2 daysD) 29.1 daysE) 27.6 days77) Rossiter's currently has a cash cycle of 43.4 days. Assume the operations are changed such that the receivables period decreases by 2.6 days, the inventory period by increases by 1.3 days, and the payables period increases by 3.4 days. What will be the length of the cash cycle after these changes?A) 39.2 daysB) 45.5 daysC) 38.7 daysD) 41.3 daysE) 48.1 days78) AC Corporation has beginning inventory of $11,062, accounts payable of $8,010, and accounts receivable of $7,844. The end of year values are $11,362 for inventory, $7,898 foraccounts payable, and $8,029 for accounts receivable. Net sales are $109,100 and costs of goods sold are $56,220. How many days are in the cash cycle?A) 47.7 daysB) 80.2 daysC) 55.8 daysD) 97.9 daysE) 67.8 days79) Wake-Up Coffee has projected next year's quarterly sales at $960, $890, $980, and $1,050 for Quarters 1 to 4, respectively. Accounts receivable at the beginning of the year are $212 and the collection period is 18 days. What is the amount of the accounts receivable balance at the end of Quarter 2? Assume a year has 360 days.A) $212B) $207C) $178D) $184E) $16780) Tall Guys Clothing has a 30-day collection period. Sales for the next calendar year are estimated at $1,950, $2,100, $2,650 and $3,200, respectively, by quarter, starting with the first quarter of the year. Given this information, which one of the following statements is correct? Assume a year has 360 days.A) The Quarter 2 collections will be $2,000.B) The accounts receivable balance at the beginning of Quarter 4 will be $940.C) The Quarter 3 collections will be $2,375.D) The end of Quarter 4 accounts receivable balance will be $2,133.E) The Quarter 4 collections will be $3,017.81) Plant Mart has a beginning receivables balance on February 1 of $1,648. Sales for February through May are $2,670, $2,940, $3,820, and $4,450, respectively. The accounts receivable period is 15 days. What is the amount of the April collections? Assume a year has 360 days.A) $3,010B) $3,380C) $2,805D) $3,545E) $3,470。

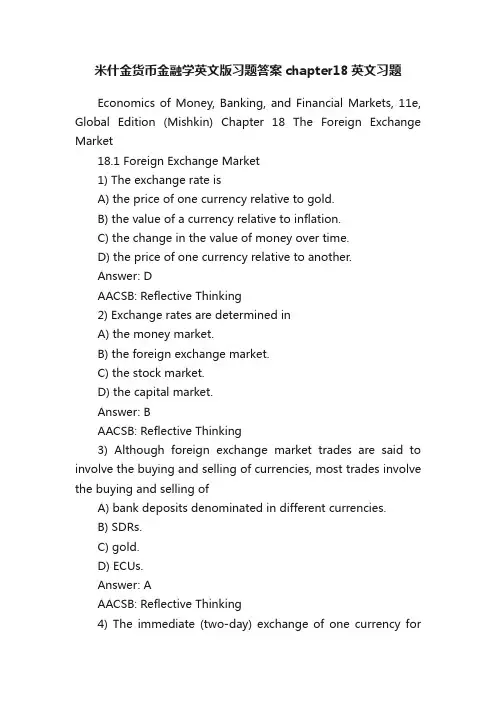

米什金货币金融学英文版习题答案chapter18英文习题Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 18 The Foreign Exchange Market18.1 Foreign Exchange Market1) The exchange rate isA) the price of one currency relative to gold.B) the value of a currency relative to inflation.C) the change in the value of money over time.D) the price of one currency relative to another.Answer: DAACSB: Reflective Thinking2) Exchange rates are determined inA) the money market.B) the foreign exchange market.C) the stock market.D) the capital market.Answer: BAACSB: Reflective Thinking3) Although foreign exchange market trades are said to involve the buying and selling of currencies, most trades involve the buying and selling ofA) bank deposits denominated in different currencies.B) SDRs.C) gold.D) ECUs.Answer: AAACSB: Reflective Thinking4) The immediate (two-day) exchange of one currency foranother is aA) forward transaction.B) spot transaction.C) money transaction.D) exchange transaction.Answer: BAACSB: Reflective Thinking5) An agreement to exchange dollar bank deposits for euro bank deposits in one month is aA) spot transaction.B) future transaction.C) forward transaction.D) deposit transaction.Answer: CAACSB: Reflective Thinking6) Today 1 euro can be purchased for $1.10. This is theA) spot exchange rate.B) forward exchange rate.C) fixed exchange rate.D) financial exchange rate.Answer: AAACSB: Reflective Thinking7) In an agreement to exchange dollars for euros in three months at a price of $0.90 per euro, the price is theA) spot exchange rate.B) money exchange rate.C) forward exchange rate.D) fixed exchange rate.Answer: CAACSB: Reflective Thinking8) When the value of the British pound changes from $1.25 to $1.50, the pound has ________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: CAACSB: Reflective Thinking9) When the value of the British pound changes from $1.50 to $1.25, then the pound has________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: BAACSB: Reflective Thinking10) When the value of the dollar changes from £0.5 to £0.75, then the British pound has________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: BAACSB: Reflective Thinking11) When the value of the dollar changes from £0.75 to £0.5, then the British pound has________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: CAACSB: Reflective Thinking12) When the exchange rate for the Mexican peso changes from 9 pesos to the U.S. dollar to 10 pesos to the U.S. dollar, then the Mexican peso has ________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: BAACSB: Reflective Thinking13) When the exchange rate for the Mexican peso changes from 10 pesos to the U.S dollar to 9 pesos to the U.S. dollar, then the Mexican peso has ________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: CAACSB: Reflective Thinking14) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 0.75 euros. Therefore, one euro would have purchased about ________ U.S. dollars.A) 0.75B) 1.00C) 1.33D) 1.75Answer: CAACSB: Analytical Thinking15) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 49.0 Indian rupees. Thus, one Indian rupee would have purchased about ________ U.S. dollars.A) 0.02B) 1.20C) 7.00D) 49.0Answer: AAACSB: Analytical Thinking16) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 1.15 Swiss francs. Therefore, one Swiss franc would have purchased about ________ U.S. dollars.A) 0.30B) 0.87C) 1.15D) 3.10Answer: BAACSB: Analytical Thinking17) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 3.33 Romanian new lei. Therefore, one Romanian new lei would have purchased about ________ U.S. dollars.A) 0.30B) 1.86C) 2.86D) 3.33Answer: AAACSB: Analytical Thinking18) If the U.S. dollar appreciates from 1.25 Swiss franc per U.S. dollar to 1.5 francs per dollar, then the franc depreciates from ________ U.S. dollars per franc to ________ U.S. dollars per franc.A) 0.80; 0.67B) 0.67; 0.80C) 0.50; 0.33D) 0.33; 0.50Answer: AAACSB: Analytical Thinking19) If the British pound appreciates from $0.50 per pound to $0.75 per pound, the U.S. dollar depreciates from ________ per dollar to ________ per dollar.A) £2; £2.5B) £2; £1.33C) £2; £1.5D) £2; £1.25Answer: BAACSB: Analytical Thinking20) If the Japanese yen appreciates from $0.01 per yen to $0.02 per yen, the U.S. dollar depreciates from ________ per dollar to ________ per dollar.A) 100¥; 50¥B) 10¥; 5¥C) 5¥; 10¥D) 50¥; 100¥Answer: AAACSB: Analytical Thinking21) If the dollar appreciates from 1.5 Brazilian reals per dollar to 2.0 reals per dollar, the real depreciates from ________ per real to ________ per real.A) $0.67; $0.50B) $0.33; $0.50C) $0.75; $0.50D) $0.50; $0.67E) $0.50; $0.75Answer: AAACSB: Analytical Thinking22) When the exchange rate for the British pound changes from $1.80 per pound to $1.60 per pound, then, holding everything else constant, the pound has ________ and ________ expensive.A) appreciated; British cars sold in the United States become moreB) appreciated; British cars sold in the United States become lessC) depreciated; American wheat sold in Britain becomes moreD) depreciated; American wheat sold in Britain becomes lessAnswer: CAACSB: Analytical Thinking23) If the dollar depreciates relative to the Swiss francA) Swiss chocolate will become cheaper in the United States.B) American computers will become more expensive in Switzerland.C) Swiss chocolate will become more expensive in the United States.D) Swiss computers will become cheaper in the United States.Answer: CAACSB: Analytical Thinking24) Everything else held constant, when a country's currencyappreciates, the country's goods abroad become ________ expensive and foreign goods in that country become ________ expensive.A) more; lessB) more; moreC) less; lessD) less; moreAnswer: AAACSB: Analytical Thinking25) Everything else held constant, when a country's currency depreciates, its goods abroad become ________ expensive while foreign goods in that country become ________ expensive.A) more; lessB) more; moreC) less; lessD) less; moreAnswer: DAACSB: Analytical Thinking。

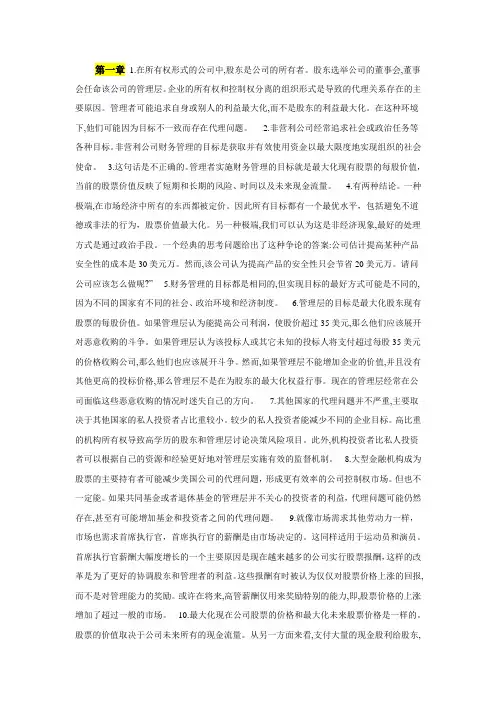

第一章 1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?” 5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险项目。

此外,机构投资者比私人投资者可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

公司金融第四版参考答案公司金融是一门研究企业财务管理和金融决策的学科,它涉及到公司的资金筹集、投资决策、资本结构和分红政策等方面。

对于学习者来说,参考答案是一个重要的学习工具,可以帮助他们更好地理解和应用所学的知识。

本文将为大家提供公司金融第四版的参考答案,帮助读者更好地掌握这门学科。

第一章:公司金融概述在公司金融的概述部分,主要介绍了公司金融的定义、目标和作用。

参考答案中提到,公司金融是指企业通过资金的筹集和运用,以实现企业目标并最大化股东财富的一门学科。

它对企业的经营决策和财务管理起着重要的指导作用。

第二章:公司金融环境在公司金融环境的部分,参考答案中涉及到了宏观经济环境、市场环境和法律环境对公司金融决策的影响。

它强调了宏观经济环境对企业经营和金融决策的重要性,以及市场环境和法律环境对企业的影响。

第三章:企业投资决策在企业投资决策的部分,参考答案中详细介绍了投资决策的基本原理和方法。

它强调了企业在进行投资决策时需要考虑的因素,如现金流量、风险和回报等,以及投资评价指标的应用。

第四章:资本预算在资本预算的部分,参考答案中提到了资本预算的概念和方法。

它介绍了资本预算的基本步骤,包括项目评估、项目选择和项目实施等,以及资本预算的风险分析和灵敏度分析。

第五章:资本结构与成本在资本结构与成本的部分,参考答案中涉及到了企业的资本结构和成本的决策。

它介绍了资本结构的理论和影响因素,以及资本成本的计算和决策。

第六章:分红政策在分红政策的部分,参考答案中提到了企业的分红政策和决策。

它介绍了不同的分红政策和方法,如现金分红和股票分红,以及分红决策的影响因素。

第七章:公司估值在公司估值的部分,参考答案中详细介绍了公司估值的方法和应用。

它强调了不同的估值方法,如贴现现金流量模型和市场多元回归模型,以及估值的实际应用。

第八章:公司并购与重组在公司并购与重组的部分,参考答案中涉及到了企业的并购与重组决策。

它介绍了并购与重组的类型和目的,以及并购与重组的过程和影响。

公司金融(财务管理)智慧树知到课后章节答案2023年下外交学院外交学院绪论单元测试1. What are not the most common type of firm in the United States and theworld?答案:partnerships ;corporations;limited partnerships第一章测试1.Stock markets provide liquidity for a firm's shares.答案:对2.Raising new capital by issuing bonds is an example of a commercial bankingactivity.答案:错3.Financial decisions require that you weigh alternatives in strictly monetaryterms.答案:错4.Corporations have come to dominate the business world through their abilityto raise large amounts of capital by sale of ownership shares to anonymous outside investors.答案:对5.Which of the following best describes why the Valuation Principle is a keyconcept in making financial decisions?答案:It shows how to make the costs and benefits of a decision comparable so that we can weigh them properly.6.Which of the following is typically the major factor in limiting the growth ofsole proprietorships?答案:The amount of money that can be raised by such firms is limited by the fact that the single owner must make good on all debts.7. A company that produces racing motorbikes has several models that sellwell within the motorcycle racing community and which are very profitable for the company. Despite having a profitable product, why must thiscompany take care to ensure that it has sufficient cash on hand to meet its obligations?答案:New models will require a lot of money to develop and bring to market before they generate any revenue.8. A factory owner wants his workers to produce as many widgets as they canso he pays his workers based on how many widgets they produce. However, in order to make sure that the workers do not rush and produce a largenumber of poorly made widgets, he checks the widgets at random duringvarious stages of their manufacture. If a defect is found in a widget, the pay of the entire section of the factory responsible for that defect is docked. How is this factory owner seeking to solve the agency conflict problem in this case?答案:by supplying incentives so the agents act in the way principal desires 9.What is the bid-ask spread?答案:the difference in price available for an immediate sale of a stock and the immediate purchase of the stock10.In the United States, publicly traded companies can choose whether or notthey wish to release periodic financial statements.答案:错第二章测试1.The Law of One Price states that if equivalent goods or securities are tradedsimultaneously in different competitive markets, they will trade for the same price in each market.答案:对2.In general, if an action increases a firm's value by providing benefits with avalue greater than any costs involved, then that action is good for the firm'sinvestors.答案:对3.To enable costs and benefits to be compared, they are typically convertedinto cash value at the time the benefit is received.答案:错4.Whenever a good trades in a competitive market, the price determines thevalue of the good.答案:对5.An elderly relative offers to sell you their used 1958 Cadillac Eldorado for$52,000. You note that very similar cars are selling on the open market for $87,000. You don't care for classic cars and would rather buy a new FordExplorer for $35,000. What is the net value of buying the Cadillac?答案:$35,000, since this is the difference between purchase and resale price of the Cadillac.6.The price of Alaska North Slope Crude Oil (ANS) is $71.75/bbl, and the priceof West Texas Intermediate Crude Oil (WTI) is $73.06/bbl.As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,150 bbl of Alaska North Slope (ANS) crude oil for 10,000 bbl of West TexasIntermediate (WTI) crude oil. Assuming you currently have 10,000 bbl ofWTI crude, what should you do?答案:Sell 10,000 bbl WTI crude on the market and use the proceeds topurchase and refine ANS crude.7. A wholesale food retailer is offered $15.60 per two-layer carton for 5000cartons of peaches. The wholesaler can buy peaches from their growers at$13.20 per carton. Shipping costs $2.40 per carton, for the first 1000 cartons, and $1.90 per carton for every carton over that. Will taking this opportunity increase the value of the wholesale food retailer?答案:Yes, the costs are $2000 less than the benefits.8.Which of the following best explains why market prices are useful to afinancial manager when performing a cost-benefit analysis?答案:They can be used to convert different services and commodities intoequivalent cash values which can be compared.9.Walgreens Company (NYSE: WAG) is currently trading at $48.75 on the NYSE.Walgreens Company is also listed on NASDAQ and assume it is currentlytrading on NASDAQ at $48.50. Does an arbitrage opportunity exist and, if so, how would you exploit it and how much would you make on a block trade of 100 shares?答案:Yes, buy on NASDAQ and sell on NYSE, make $25.10.The present value (PV) of a stream of cash flows is just the sum of the presentvalues of each individual cash flow.答案:对第三章测试1.Preference for cash today versus cash in the future in part determines netpresent value (NPV).答案:错2. Net present value (NPV) is the difference between the present value (PV) ofthe benefits and the present value (PV) of the costs of a project or investment.答案:对3.The Net Present Value rule implies that we should compare a project's netpresent value (NPV) to zero.答案:对4.When different investment rules give conflicting answers, then decisionsshould be based on the Net Present Value rule, as it is the most reliable and accurate decision rule.答案:对5.The present value (PV) of an investment is ________.答案:The present value (PV) of an investment is ________.6.Which of the following is NOT a limitation of the payback rule?答案:It is difficult to calculate.7. A manufacturer of video games develops a new game over two years. Thiscosts $830,000 per year with one payment made immediately and the other at the end of two years. When the game is released, it is expected to make$1.20 million per year for three years after that. What is the net present value (NPV) of this decision if the cost of capital is 10%?答案:$950,3498. A mining company plans to mine a beach for rutile. To do so will cost $14million up front and then produce cash flows of $7 million per year for five years. At the end of the sixth year the company will incur shut-down andclean-up costs of $6 million. If the cost of capital is 13.0%, then what is the MIRR for this project?答案:20%9. A farmer sows a certain crop. It costs $240,000 to buy the seed, prepare theground, and sow the crop. In one year's time it will cost $93,200 to harvest the crop. If the crop will be worth $350,000, and the interest rate is 7%, what is the net present value (NPV) of this investment?答案:$010.Firms should use the most accelerated depreciation scheme allowable.答案:对第四章测试1.Rational investors may be willing to choose an investment that has additionalrisk but does not offer additional reward.答案:错2.On average, stocks have delivered higher returns than bonds in the long run.答案:对3.We should use the arithmetic average return when we are trying to estimatean investment's expected return over a future horizon based on its pastperformance.答案:对4.Independent risks can be diversified by holding a large number ofuncorrelated assets with independent risks.答案:对5.Rational investors ________ fluctuations in the value of their investments.答案:are averse to6.Independent risk is more closely related to _______答案:unsystematic risk stock prices gave a realized return of 15%, 15%, -15%, and -15%over four successive quarters. What is the annual realized return for for the year?答案:-4.45%8.Ford Motor Company had realized returns of 20%, 30%, 30%, and 20% overfour quarters. What is the quarterly standard deviation of returns for Fordcalculated from this sample?答案:5.77%9.The probability mass between two standard deviations around the mean fora normal distribution is ________.答案:95%10.The market or equity risk premium can be estimated by computing thehistorical average excess return on the market portfolio.答案:对第五章测试1.The main advantages for a firm in going public are greater liquidity andbetter access to capital.答案:对2.Equity investors in a private company usually plan to realize a return ontheir investment by selling their stock when that company is acquired byanother firm or sold to the public in a public offering.答案:对3.Because the capital investment from angel investors is often large relative tothe amount of capital already in place at the firm, they typically receive asizable equity share in the business in return for their funds.答案:对4.The announcement of an SEO usually raises a stock's price.答案:错5.Which of the following best describes a limited partnership that specializesin raising money to invest in the private equity of young firms?答案:venture capital firms6.You founded your own firm three years ago. You initially contributed$200,000 of your own money and in return you received 3 million shares of stock. Since then, you have sold an additional 2 million shares of stock toangel investors. You are now considering raising capital from a venturecapital firm. This venture capital firm would invest $5 million and wouldreceive 4 million newly issued shares in return. Suppose you sold the 2million shares to the angel investor for $500,000. What was your percentage ownership in the company immediately following the angel investor'sinvestment?答案:60.0%7.Which of the following is an activity typically taken by an underwriter duringan IPO of a company?答案:all of the above8.Which of the following statements is FALSE?答案:The SEC requires that companies prepare a registration statement, a legal document that provides financial and other information about the company to investors, prior to an IPO. Company managers work closely with the underwriters to prepare this registration statement andsubmit it to the SEC.9.The chief advantage of debt financing over financing through raising equitycapital is that the former does not dilute the current owner's share of thebusiness.答案:对10. A bond that makes payments in a certain currency contains the risk ofholding that currency and so is priced according to the yields of similarbonds in that currency.答案:对第六章测试1.Financial managers prefer to choose the same debt level no matter whichindustry they operate in.答案:对2.Even if two firms operate in the same industry, they may prefer differentchoices of debt-equity ratios.答案:对3. A project's net present value (NPV) represents the value to the new investorsof a firm created by the project.答案:错4.The presence of financial distress costs can explain why firms choose debtlevels that are too low to exploit the interest tax shield.答案:对5.The relative proportions of debt, equity, and other securities that a firm hasoutstanding constitute its ________.答案:capital structure6.By adding leverage, the returns on a firm are split between debt holders andequity holders, but equity holder risk increases because ________.答案:interest payments have first priority7. A firm has a market value of equity of $30,000. It borrows $7500 at 8%. If theunlevered cost of equity is 15%, what is the firm's cost of equity capital?答案:16.75%8.Which of the following statements is FALSE?答案:The choice of capital structure does not change the value of a firm if the cost of equity is higher than the cost of debt.9.Assume that MM's perfect capital markets conditions are met and that youcan borrow and lend at the same 5% rate as Firm X. You have $5,000 of your own money to invest and you plan on buying Firm X stock. Using homemade (un)leverage you invest enough at the risk-free rate so that the payoff of your account will be the same as a $5,000 investment in Firm Y stock. The number of shares of Firm X stock you purchased is closest to ________.答案:41710.In a perfect capital market, when a dividend is paid, the share price drops bythe amount of the dividend when the stock begins to trade ex-dividend.答案:对。

目 录第1章 公司金融基本范畴1.2 课后习题详解第2章 公司金融的基本理念2.2 课后习题详解第3章 公司金融基本理论3.2 课后习题详解第4章 公司金融决策基础4.2 课后习题详解第5章 资本预算决策分析5.2 课后习题详解第6章 筹资决策分析6.2 课后习题详解第7章 股利分配决策7.2 课后习题详解第8章 公司金融战略与公司价值8.2 课后习题详解第9章 公司兼并与收购9.2 课后习题详解第10章 公司金融国际化10.2 课后习题详解1.2 课后习题详解1.有限责任公司和股份有限公司的区别是什么?股份有限公司这种公司组织形式的主要优点是什么?答:(1)有限责任公司和股份有限公司的区别①股东的数量不同。

有限责任公司的股东1~50人;而股份有限公司的股东则没有数量的限制,有的大公司达几十万人,甚至上百万人,但至少2人。

与有限责任公司不同,必须设立股东大会,股东大会是公司的最高权力机构。

②注册的资本不同。

有限责任公司要求的最低资本额较少;公司依据生产经营性质与范围不同,其注册资本数额标准也不尽相同。

③股本的划分方式不同。

有限责任公司的股份不必划为等额股份,其资本按股东各自所认缴的出资额划分;股份有限公司的股票必须是等额的,其股本的划分,数额较小,每一股金额相等。

④发起人筹集资金的方式不同。

有限责任公司只能由发起人集资,不能向社会公开募集资金,其股票不可以公开发行,更不可能上市交易;股份有限公司可以通过发起或募集设立向社会筹集资金,其股票可以公开发行并上市交易。

⑤股权转让的条件限制不同。

有限责任公司的股东可以依法自由转让其全部或部分股本;股东依法向公司以外人员转让股本时,必须有过半数股东同意方可实行;在转让股本的同等条件下,公司其他股东享有优先权。

股份有限公司的股东所拥有股票可以交易和转让,但不能退股。

⑥公司组织机构的权限不同。

有限责任公司股东人数少,组织机构比较简单,可只设立董事会而不设股东会或不设监事会,因此,董事会往往由股东个人兼任,机动性权限较大。