CFA一级考试分析串讲1

- 格式:docx

- 大小:13.75 KB

- 文档页数:2

CFA一级考试分析串讲1-综合分析CFA第一级考试最重要的四个科目的准备重点及方向,这四个科目加起来的比重超过三分之二,所以考生一定要将准备时间的三分之二花在这四科上面。

FSA and Corporate Finance财报分析所占的比重约在23%,从单一科目来讲,这部分是最大科目,考生不仅不能忽略,更要精通。

要想在财报分析中拿高分,就必须对考试的范围每一点都下工夫。

了解每一项财务比率,了解每一个会计处理原则的改变对相关比率的影响,了解分析师重新调整会计科目以符合公司的真实价值或营运状况,对相关财务比率的影响。

公司财务管理与大学修的差不多,要掌握三大决策:投资、融资及股利。

如何计算资金成本,并运用净现值、内部报酬率及回收期选择投资案为一大重点。

融资对公司之利弊及最适资本结构的几派理论、股利政策与公司成长率之关系及股利变动对股价之影响等主题务必了解。

Asset Valuation证券市场部份比较零碎,但不困难,常考的内容包括各种指数之计算及成份、三种效率市场假说的理论及代表的含意、信心指数及融资余额等技术指针。

股票评价则以现金流量折现法去计算股票价值是必考的题型,其中又以固定成长率的Gordon成长模型及多阶段成长模型题目最为常见,考生只要多加练习,在这部份得分并不难。

Quantitative Methods这部分考30题,是最好拿分的部分。

CFA的数量分析考的比大学的统计学还简单,而且多了一些和统计学比较没有关系的观念,如连续复利的观念,随机变量分配的型态,有效年利率(Effective Annual Rate)的计算方式,夏普指数(Sharpe Ratio)、罗伊获利保本指数等(Roy’s Safety First Criterion)。

当然大部分的考题还是会集中在机率概念、平均数及标准差,分配型态(二项式分配或常态分配等)、信赖区间、假设检定及回归分析等。

其中常态分配的应用是数量分析的核心,而善用计算器的统计及时间价值的功能是统计拿高分的二大法门。

全球最大的CFA(特许金融分析师)培训中心总部地址:上海市虹口区花园路171号A3幢高顿教育电话:400-600-8011网址: 微信公众号:gaoduncfa 1CFA 考试一级考经分享11年六月的时候我看到网上很多地方都贴有CFA 的帖子,最早我知道CFA 是一个猫的协会,后来才知道还是金融分析师的缩写,去招聘网站一搜,我靠,全是这门证书的身影,心想,估计挺难的,但是想想,当下社会貌似也就金融行业最赚钱,我也是个随波逐流的人,根本对自己的生活没有什么定向,就混混日子感觉也挺满足的。

七月份的时候在17CFA 论坛里面认识了管理员之后,我也从一无所知的入门菜鸟,变成了半个CFA 专家,我敢肯定不止一个人在她那里受教过,当时她说最好天天四个小时的有效读书时间,我想,这不是扯淡呢嘛,天天白天要上班,晚上有时候还要跟朋友出去玩什么的,因为生活没有重心,没有目标,我也就选择随遇而安,当时我已经报名了,然后就天天随便看几眼书,到考前一个月,我的书(notes )才看完四分之三,然后就着急了,感觉上时间不够了,然后就随便去找习题了,直接啃题算了,就像考中国的考试一样的复习,我觉得应该差不多吧,结果考完之后我就骂娘了,CFA 协会整这么细的题目挠蛋啊,各种看不懂,就知道肯定没过,之后的一个月我都不愿意到群里闪现,因为我没过,后来就潜水了,之后很多新人进群,然后就看着这些新人问跟我当时差不多的问题,管理员照旧是一点点的逐个帮人回答,是我我早就烦了,然后后来看着有人天天的写自己的学习进度给管理员报告,她就对着大家喊加油,最终我还是选择继续考了,因为大家看起来都挺上进的,我不能落下。

之后我就跟着群里的几个人的读书进度,一起赶,周末有时候手机都关机了,三月份初的时候把notes 啃完一遍,当时再看一遍的时候我就发现我当时看的时候有多么的白痴了,根本什么都没理清,还怨CFA 协会出题有问题,根本就是我弄清楚这些东西,然后看第二遍的时候,我把大纲理出来,然后先想大纲的具体内容,然后在核对自己的记忆跟想法是否与notes 对应的是相符的,不求每个都精细,但是至少我知道这部分内容里面的所有纲要,一级概念,弄通的时候,顺便把课后习题弄了一遍,这时候已经接近四月的下旬了,利用一周的时间我又把课后的习题看了一遍,自我总结了一遍,之后我到论坛上下了mock 和sample (包括历年的)。

实战过程里摸索出的CFA level1考题精髓要点请注意,这一篇不是通常意义上的考后感,而是实战过程里摸索出的CFA level1考题精髓要点,目的就是为了与各位CFA考友分享,积攒自身RP,相信各位在备考的路上一定能起到事半功倍的作用,很快明了CFA level1的考点分布情况。

之前学校的研究生foundation course中的AFM(Accounting for Managers)对这个科目里的一些知识略有介绍。

这一科目一共有4个Session(7,8,9,10)Session 7 主要讲的IFRS 和U.S. GAAP在不同情况下的区别,还有各种statements的元素构成。

Session 8 就是集中在Income statement, Balance Sheet, Cash flow statement 和各种Ratio analysis。

这一章节需要注意知识点是Revenue & Expense recognition, Basic and Dilute EPS, Goodwill;Trading, Holding to maturity and Available for sale securities, 然后cash flow statement中重点要会Direct & Indirect method, 以及两者之间的相互转化。

Ratio analysis中需要注意ROE中Basic & Extended DuPont equation以及四大Ratio: Activity, Liquidity, Solvency and Profitability ratios。

Session 9 这部分是个硬骨头,真的不好啃,知识点也是灰常灰常集中。

ⅰ. Inventories这一小节中,需要懂得inventory valuation method 在IFRS和GAAP两种准则下的库存定价方式,然后是FIFO/LIFO对报表中四大ratio的影响,接下来就要熟练地将基于LIFO会计假设的报表数据转化成基于FIFO 的情况,了解LIFO reserve 和LIFO liquidation。

CFA考试《CFA一级》历年真题精选01(附详解)1、Ian O’Sullivan, CFA, is the owner and sole employee of two companies, a public relations firm and a financial research firm. The public relations firm entered into a contract with Mallory Enterprises to provide public relations services, with O’Sullivan receiving 40,000 shares of Mallory stock in payment for his services. Over the next 10 days, the public relations firm issued several press releases that discussed Mallory’s excellent growth prospects. O’Sullivan, through his financial research firm, also published a research report recommending Mallory stock as a “buy.”According to the CFA Institute Standards of Professional Conduct, O’Sullivan is most likely required to disclose his ownership of Mallory stock in the:【单选题】A.press releases only.B.research report only.C.both the press release and the research report.正确答案:C答案解析:“Guidance for Standards I-VII”, CFA InstituteC is correct because members should disclose all matters that reasonably could be expected to impair the member’s objectivity. Standard I (B), Standard VI (A).2、Other factors held constant, the reduction of a company’s average accounts payables due to suppliers offering less trade credit will most likely:【单选题】A.reduce the operating cycle.B.increase the operating cycle.C.not affect the operating cycle.正确答案:C答案解析:"Financial Analysis Techniques," Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFAPayables are not part of the operating cycle calculation. Operating cash cycle includes inventory and accounts receivable.3、In a sales-driven pro forma analysis, net income grows from $1.2 million to $1.26 million. Assuming a dividend payout ratio of 40%, the increase in retained earnings is closest to (in $ millions):【单选题】A.0.720.B.0.756.C.1.260.正确答案:B答案解析:“Financial Statement Analysis,”Pamela Peterson Drake4、The slope of the security market line (SML) represents the portion of an asset’s expected return attributable to:【单选题】A.total risk.B.market risk.C.diversifiable risk.正确答案:B答案解析:“Portfolio Risk and Return Part II,”Vijay SingalB is correct. The slope of the SML is the market risk premium, E(Rm) –Rf. It represents the return of the market less the return of a risk-free asset. Thus, the slope represents the portion of expected return that reflects compensation for market or systematic risk.5、Jenny Hein, CFA, is a research analyst covering a mining industry.Hein hasprepared a research report on one mining company based on research from a varietyof sources and other analysts.Hein combines these materials to form her ownopinion and completes the report without acknowledge her sources in her report.Then Hein distributes the report to her clients.Has Jenny most likely violated theStandards of Professional Conduct?【单选题】A.No.B.Yes, by failing to cite the work of others in her report.C.Yes, by failing to have reasonable basis for her opinion.正确答案:B答案解析:因为Hein在研究报告中引用了别人的研究成果,对此必须注明出处,题目中并没有说她没有合理的证据,把其他分析师的研究加入其自己的研究报告,只要指明出处并不违反专业行为标准。

根据CFA一级考试知识点完全总结

CFA(Chartered Financial Analyst)一级考试是全球金融行业的专业证书之一。

本文将对CFA一级考试的知识点进行完全总结,以帮助考生更好地准备考试。

1. 伦理和职业标准

- 了解CFA协会的职业行为准则和道德标准。

- 掌握伦理决策框架,能够应对各类道德冲突。

2. 投资工具

- 研究各类金融资产,包括股票、债券、衍生品等。

- 理解投资组合和资产分配的重要性。

3. 金融市场

- 熟悉各类金融市场的特点和运作机制。

- 理解市场指数和指数基金的概念,以及其在投资中的运用。

4. 估值和分析

- 掌握财务报表分析的基本原则和方法。

- 研究估值模型,包括股票估值和债券估值等。

5. 公司财务

- 理解公司财务管理的基本概念。

- 掌握财务决策的原则和方法。

6. 加权平均成本资本(WACC)

- 研究WACC的计算方法和应用。

- 掌握WACC在投资决策中的重要性和作用。

7. 宏观经济学

- 熟悉宏观经济学理论和实践。

- 掌握经济增长、通货膨胀、失业等宏观经济指标的计算和解读。

8. 风险管理

- 理解风险管理的基本概念和方法。

- 研究风险度量和风险管理工具。

9. 金融衍生品

- 掌握金融衍生品的种类和特点。

- 研究期权、期货等衍生品的定价和交易策略。

以上是根据CFA一级考试的知识点进行的完全总结,希望能对考生们有所帮助。

祝愿大家都能在考试中取得好成绩!。

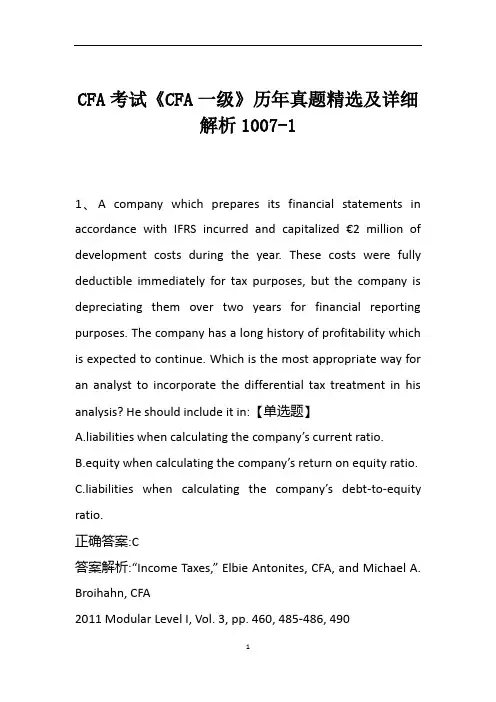

CFA考试《CFA一级》历年真题精选及详细解析1007-11、A company which prepares its financial statements in accordance with IFRS incurred and capitalized €2 million of development costs during the year. These costs were fully deductible immediately for tax purposes, but the company is depreciating them over two years for financial reporting purposes. The company has a long history of profitability which is expected to continue. Which is the most appropriate way for an analyst to incorporate the differential tax treatment in his analysis? He should include it in:【单选题】A.liabilities when calculating the company’s current ratio.B.equity when calculating the company’s return on equity ratio.C.liabilities when calculating the company’s debt-to-equity ratio.正确答案:C答案解析:“Income Taxes,” Elbie Antonites, CFA, and Michael A. Broihahn, CFA2011 Modular Level I, Vol. 3, pp. 460, 485-486, 490Study Session 9-38-iAnalyze disclosures relating to deferred tax items and the effective tax rate reconciliation, and discuss how information included in these disclosures affects a company’s financial statements and financial ratios.The different treatment for tax purposes and financial reporting purposes is a temporary difference and would create a deferred tax liability. Deferred tax liabilities should be classified as debt if they are expected to reverse with subsequent tax payments. The long history of profitability implies the company will likely be paying taxes in the following years and hence an analyst could reasonably expect the temporary difference to reverse. Under IFRS all deferred tax liabilities are non-current and therefore do not affect the current ratio.2、According to the International Accounting Standards Board’s Conceptual Framework for Financial Reporting, the two fundamental qualitative characteristics that make financial information useful are best described as:【单选题】A.timeliness and accrual accounting.B.understandability and verifiability.C.relevance and faithful representation.正确答案:C答案解析:“Financial Reporting Standards,” Elaine Henry, CFA, Jan Hendrik van Greuning, CFA, and Thomas R. Robinson, CFA 2013 Modular Level I, Vol. 3, Reading 24, Section 5.2Study Session 7-24-dDescribe the International Accounting Standards Board’s conceptual framework, including the objective and qualitative characteristics of financial statements, required reporting elements, and constraints and assumptions in preparing financial statements.C is correct. Relevance and faithful representation are the two fundamental qualitative characteristics that make financial information useful according to the IASB Conceptual Framework.3、An analyst does research about cash flow and gathers the following information(in thousands) about a company.Based on the information above, cash paid to suppliers ( in thousands) in 2011is closest to:【单选题】A.$ 11 443B.$ 13 221C.$ 15 651正确答案:A答案解析:$ 14 436 - ( $ 5 980 - $ 3 876) - ( $ 7 321 - $ 6 432 ) = $ 144 36 - $ 2 104 - $ 889 =$ 11 443。

cfa一级ethics部分摘要:1.CFA 一级伦理部分概述2.CFA 一级伦理部分的核心概念3.CFA 一级伦理部分的重要性4.如何准备CFA 一级伦理部分正文:CFA(Chartered Financial Analyst)一级伦理部分是CFA 考试三个级别中的第一个级别。

CFA 考试旨在为投资专业人员提供全面的知识和技能,使他们能够在投资管理领域取得成功。

伦理部分在CFA 考试中占有重要地位,因为它为候选人提供了在金融行业中遵循道德和职业行为的必要知识。

CFA 一级伦理部分主要涉及三个核心概念:职业道德、专业行为和法律法规。

职业道德是指在履行职责时遵循的道德原则和价值观,它要求候选人展示诚信、公正、透明和尊重。

专业行为是指在履行职责时遵循的行为准则,它要求候选人具备专业能力、勤勉尽责和审慎决策。

法律法规是指在履行职责时需要遵守的法律和规定,它要求候选人了解相关法律法规,并确保其行为符合法律规定。

CFA 一级伦理部分的重要性在于,它为候选人提供了在金融行业中遵循道德和职业行为的基础。

随着金融行业的不断发展和风险加剧,伦理和职业行为对于投资专业人员来说变得越来越重要。

在金融行业中,遵循职业道德和法律法规不仅可以保护投资者的利益,还可以提高整个行业的声誉和信誉。

要想成功通过CFA 一级伦理部分,候选人需要掌握核心概念,理解相关法律法规,并能够在实际工作中运用这些知识。

为了准备CFA 一级伦理部分,候选人可以参考CFA Institute 提供的官方教材和模拟试题,参加培训课程,以及与同行进行讨论和交流。

通过这些准备措施,候选人可以提高自己的知识水平和应试能力,为通过CFA 一级伦理部分奠定坚实的基础。

总之,CFA 一级伦理部分是CFA 考试中至关重要的一个部分,它为投资专业人员提供了遵循职业道德和法律法规的基础。

要想成功通过这一部分,候选人需要掌握核心概念,理解相关法律法规,并能够在实际工作中运用这些知识。

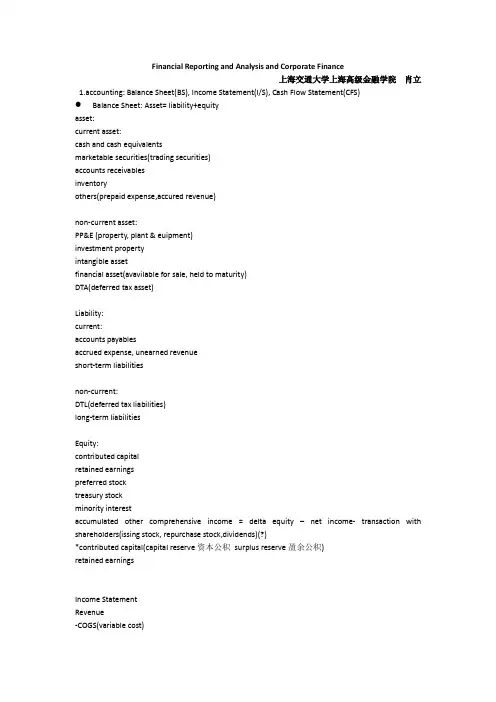

Financial Reporting and Analysis and Corporate Finance上海交通大学上海高级金融学院肖立1.accounting: Balance Sheet(BS), Income Statement(I/S), Cash Flow Statement(CFS)Balance Sheet: Asset= liability+equityasset:current asset:cash and cash equivalentsmarketable securities(trading securities)accounts receivablesinventoryothers(prepaid expense,accured revenue)non-current asset:PP&E (property, plant & euipment)investment propertyintangible assetfinancial asset(avavilable for sale, held to maturity)DTA(deferred tax asset)Liability:current:accounts payablesaccrued expense, unearned revenueshort-term liabilitiesnon-current:DTL(deferred tax liabilities)long-term liabilitiesEquity:contributed capitalretained earningspreferred stocktreasury stockminority interestaccumulated other comprehensive income = delta equity –net income- transaction with shareholders(issing stock, repurchase stock,dividends)(?)*contributed capital(capital reserve资本公积surplus reserve盈余公积)retained earningsIncome StatementRevenue-COGS(variable cost)=gross profit-selling expense, admistrative expense, financial expense(fixed cost)-depreciation/amortization-unusual or infrequent items=operating income/EBIT (EBITDA = EBIT + depreciation +amortization)-interest expense=EBT- income tax=net income from continued operations+/- income from discontinued operations+/- extraordinary items(only GAAP)+/- gain or losses from continued and discontinued operations=net incomeCash Flow Statement: CFO CFI CFFGAAP:-CFO:●payment from client and purchase to supplier●buy or sell trading securities●interest or dividend received, interest paid, tax paid●payment or money to others-CFI:●purchase or sell PP&E●purcase or sell financial securities other than trading securities●make loans to others(principal received or loans made to others)-CFF:●principal amount that lend from others (debt issued, or principal paid) ●issurance of stock (proceeds got or payment to reacquire)●dividend paid to othersIFRS:dividend, interest paid to others CFF or CFOdividend, interest received by others CFI or CFO2.recognition of asset/liablity(BS)(1)4个容易混淆的科目:(BS)●unearned revenue liability●prepaid expense asset●accured revenue asset●accured expense liability(2)physical asset and financial asset(BS, CFS)●physical asset: PP&E, inventory, investment property, intangible asset●financial asset: current asset or non-current asset? how to value them?what cash flow?⏹trading secutiry:current, fair value, CFO⏹available for sale:non-current, fair value, CFI⏹held to maturity:non-current,bond, amotized cost,CFI(3)value measurement会计计量属性(BS)●carrying value= book value账面价值●historical cost历史成本●replacement cost重置成本●recoverable value(NRV, net realizable value)可变现净值●PV of future cash flows现值●fair value公允价值3. recognition of revenue: (I/S)房地产企业签长期合同用的收入确认方法:●percentage of completion method●completed contract method分期:●installment sales●cost recovery method以物以物:●barter4.recognition of expense: (I/S)(1)COGS(variable cost):the matching principle(I/S)phase costs(fixed cost):not tied to revenue generation, such as administrative cost(2) relationship of COGS and inventory expense and Inventory expense recognition(I/S)-FIFO-LIFO-weighted average cost(考得不多)-special identification*LIFO VS FIFO? LIFO only allowed in GAAP. LIFO will result in……model: rising price, LIFO will result in higher COGS, lower inventory, lower net profit, lowertax(motivation), lower asset, lower equity, lower current asset, lower working capital = CA – CL, lower current ratio, quick ratio not change(3) depreciation expense recognition(I/S)-straight line: depreciation= histocial cost-residual value/years to depreciate-accelerated depreciation (DDB: double declining balance method) = 2(cost-accumulated depreciation)/years to depreciate-why different method?matching principle(4)amortization expense recognition(I/S)intangible assests with definite lives: straight-line amortizationwith indefinite lives: not amortized, instead they must be tested for impairment at least annually5.calculation of EPS(I/S)basic EPS=net income –preferred stock dividends/weighted average number of shares of common stock outstanding(时间加权)diluted EPS=net inome –preferred stock dividends+ convertible preferred dividends + convertible debt interest(1-t)/weighted average shares + shares from conversion of convertible preferred shares/debt/options*treasury stock method: for option/warrants exercise, firms will use the funds from options to buy back stocks, so net number of shares from options = (market price –exercise price)/market price * number of convertible shares of options6.Other things in I/S(1)Non-recurring items●discontinued operation: management has decided to dispose of but not has done yet, arereported net of tax, after income from continuing operations●unusual or infrequent items: gains or losses from sales of part of business or impairments,write-offs, write-downs, and restructuring costs, are reported before tax, included in income before continuing operations●extraordinary items: only in GAAP and reported net of tax, after income from continuingoperations, including losses from an expropriation, gains or losses from early retirement of debt, losses from natural disasters(2)Comprehensive incomecomprehensive income= net income + other comprehensive income,other comprehensive income includes:●gains or losses from foreign currency translation●unrealized gain or loss from sale of available for sale secutities●unrealized gain or loss from cash flow hedged deravative trading●adjustment of minimum pension liability(3)change in accouting principle(GAAP->IFRS) retrospective application需要向前调整change in accounting estimate(eg. residual value, years to depreciate) just need prospective change只要未来报表调整correct a wrong accounting method(eg. DDB wrong) needs prior-pediod adjustment需要往前调整一期7. Inventory(BS)(1)inventory carrying value(BS)IFRS: inventory carrying value = min(cost, NRV),NRV stands for net realizable value = selling price-selling cost-completion cost-write down ok? ok! loss in the income statement-write up(reversal) ok? ok! decrease COGS, cannot write up more than its previous write downGAAP: inventory carrying value = min(cost, market),market = replacement cost between [NRV – normal profit margin, NRV]write down ok?ok! loss in the income statementwrite up ok? no reversal!*Exception: agriculture industry, ore-mining industry inventory’s carrying value can be more than historical costs, both in IFRS and GAAP(2)delta inventory = purchase - COGS(3)periodic and perpetual inventory system(?)periodic: carrying value reviewed monthlyperpetual: carrying value reviewed continuously8.Long-lived Assets(BS)(1)capitalize vs expense(BS, I/S, CFS)-difference? the same behavior, but different accounting behavior-influence what cash flow?●capitalize CFI outflow, higher asset, higher equity (relative to expensed), higherdepreciation/amortization,第一年net income higher,之后lower●expense CFO outflow, 第一年net income lower,之后higher(2)tangible assets and intangible assests(BS, I/S)●tangible assets: property, plant and euipment(PP&E), investment property(generate rentalincome or capital appreciation)●intangible assets: identifiable or unidentifiable⏹identifiable: amortization. it can separate from the firm, it can arise from a legal right and ithas measurable worth.⏹unidentifiable: test for impairment at least annually. it cannot separate from the firm.e.g. goodwill, trademark(that can extend its effectiveness at minimum cost)*goodwill: from M&A or internally generated●M&A: capitalize, value= acquisition cost – fair value of equity●internally generated: expense(3)intangible asset: R&D expenseIFRS GAAPresearch cost expense expensedevelopment cost captialize expense*Exception: Software R&D.●for sales: after determining technology feasibility, development cost expensed -> capitalized bothin IFRS and GAAP●for own use: all capitalize in GAAP and not change in IFRS(4)carrying value of PP&E(BS): cost or revaluation modelGAAP: only cost modelIFRS: cost or revaluation model(后者很少用)cost model: carrying value = historical cost – accumulated depreciation – impairmentrevaluation model: carrying value = fair value – accumulated depreciation,●if increase or >historical cost, increased value in “revaluation surplus”●if decrease or<historical cost, decreased value in “income statement”*upward revaluation cause equity increase, asset increase, depreciation increase, profitability decrease(5)impairment of PP&E(BS)IFRS:●when to test for impairment? Annually or condition changes.●what condition to impairment? recovable price < carrying value,recovable price = max(NRV, value in use),NRV stands for net realizable value= fair value – selling cost,可变现净值value in use= PV of future cash flows现值●carrying value after impairment? recovable price●allow reversal? yes, but cannot exceed the original carrying valueGAAP:●when to test for impairment? Only condition changes.●what condition to impairment? future undiscounted cash flow < carrying value,●carrying value after impairment? fair value (if not available, use discounted future cash flow)●allow reversal? no!(6)carrying value of investment property(BS): cost model or fair value modelGAAP: no specific definition of investment propertyIFRS: cost model of fair value model●cost model: like that of PP&E●fair value model: different from revaluation. revaluation: increased value in “revaluation surplus”,fair value: increased value in “income statement”(7)DTA, DTLincome taxes = tax payable + delta DTL – delta DTA当期利润表(FS) 当期计税基础(tax)●income taxes对应accounting profit, tax payable(?)对应taxable income●why difference?●DTL?DTL: if income taxes > tax payable,计税的临时性少算;depreciation不一样,看asset value,若asset value in tax< asset value in FS,则形成DTL●DTA?DTA: if income taxes< tax payable,计税的临时性多算;depreciation不一样,看asset value,若asset value in tax> asset value in FS,则形成DTA9. Ratio for financial analysis(BS I/S) three categories:-Profitablity: revenue related or invested capital relatedrevenue related: (I/S)●gross margin=(revenue-COGS)/revenue*100%●EBIT margin=EBIT/revenue*100%●operating profit margin=operating profit/revenue*100%●net profit margin=net profit/revenue*100%invested capital related: (BS)●ROA=net profit/asset●ROE=net profit/equity●ROIC=EBIT(1-tax%)/(equity+liability),其中liability指的是融资性负债(银行借款、应付债券等),而非经营性负债(应付票据、预收收入)-asset management:(BS I/S)●accounts receivable turnover ratio, days of turnover: revenue/receivables●accounts of inventory turnover ratio, days of turnover: COGS/inventory●accounts of payable turnover ratio, days of turnover: purchase(COGS)/payables●cash conversion cycle= days of receivables + days of inventory – days of payables-financial leverage: liqudity or solvencyliquidity:(BS)●current ratio: CA/CL●quick ratio: CA-inventory/CL or cash+marketable securities+receivables/CL●cash ratio: cash and cash equivalents/CLsolvency:(BS)●financial leverage:A/E●debt-to-equity ratio:D/E●debt ratio:D/A●interest coverage ratio:EBIT/interest, EBITDA/interest-Dupont AnalysisROE=net income/equity=net income/revenue* revenue/asset* asset/equity=net profit margin* asset turnover * financial leverage10.Basics of financial reporting(1)footnotes, management discussion&analysis(MD&A), changes in equity statement, proxy statements●footnotes: accounting assumption and accounting estimates by the management, inventorydisclosure●MD&A: management’s forecasts and discussion about the future trend and past performance●changes in equity statement: delta equity●proxy statement: matters that require a shareholder vote, such as election of board members,compensation, management qualification, issurance of stock options, etc.(2)Journal entries, general ledger, trial balance●journal entries: recorded by date, or all transaction happened●general ledger: journal by account●trial balance: balance of each account(3)Fundamental characteristics and characterisitics to enhance fundamentals●fundamental characteristics: relevance and faithful representation●characteristics to enhance fundamentals: comparability, complete, neutral, variability, timely,understandable*vertical analysis: compare at the same FS, usually with one factor, e.g. revenuehorizontal analysis: compare with history performance(4)features of financial statements●fair presentation●accural basis:权责发生制●going concern basis:持续经营●consistency 一致性●materiality- free from misstatements●aggeration: similar items add together, no offseting of asset against liabilities(5)audit or assuarance opinion●unqualified无保留意见(clean)●qualified保留意见(need to explain exceptions)●adverse否定●disclaimer of opinion无法给出意见11. Cash flow statement, direct and indirect method, FCFF and FCFE(1)direct and indirect methoddirect: easyindirect: CFO = net income + depreciation/amortization –gain/+loss on disposal of assets –delta operating asset accounts(receivables, inventory, dta) + delta operating liability accounts(payables, dtl) (100 120CFI 20gain进入了net income,其实本不属于CFO)*dividend payable是属于CFF,不做加减(2)FCFF and FCFEFCFF {= CFO + interest(1-tax rate)- Capex} = net income + interest(1-tax rate)+ depreciation/amotization –Capex –delta working capital (EBIAT =EBIT*(1-tax rate)=net income + interset(1-tax rate) , delta WC= delta CA – delta CL)FCFE = CFO – Capex +net borrowing= net income + depreciation/amortization – gain/+loss on disposal of assets – Capex – delta working capital + net borrowing,net borrowing = debt issued – debt repaid12.WACC=Wd*Kd(1-tax rate)+Wps*Kps+Wce*Kce(1)cost of equityKce= d0(1+g)/P0 +g(2)cost of equity using CAPMkce=RFR+ b(Rm-RFR)(3)cost of preferred stockKps=Dps/P13.Capitla budgeting(1)NPV(2)IRR(3)payback period(4)profitablity index = PV/CF0 = 1+ NPV/CF014.two leverage: operating leverage and financial leverage(1)operating leverage: DOL= delta EBIT/delta sales= sales-TVC/sales-TVC-TF, 看一个公司控制fixed cost的水平,if there is no fixed cost, DOL=1Qobe=fixed cost/price-variable cost per unit(2)financial leverage: DFL=delta EPS/delta EBIT= EBIT/EBIT-interest,看一个公司控制interest expense 的水平,it there is no interest expense, DFL=1Qbe=(fixed cost+ interest cost)/price-variable cost per unitDTL=DOL*DFL15.pure play method(1)why this method?For lack of data, to estimate cost of projectcomparable company:Basset=Bequity /[1+(1-tax rate)*D/E]去杠杆化unleveredBproject=Basset*[1+(1-tax rate)*D/E]杠杆化leverage(2)calculation16.working capital management(1)primary source: cash balance, short-term funding, effective working capital management,●short-term funding from banks:⏹lines of credit⏹bank acceptance: for export firms, as promises from bank⏹factoring of receivables: sale of receivables at a discount to bank(2)secondary source●liquidity of long-lived assets●renegotiation of debt●filing for bankruptcy●reorganization17.several date about dividend and repurchase ways:(1)declaration date, ex-dividend date, holder-of-record date(2天后), payment date(2)repurchase ways:●repurchase in the open market:cheapest●tender offer: premium to market price●repurchase by direct negotiation: premium to market price(3)borrow funds to repurchase?cost of debt< earnings yield, increase EPS;cost of debt>earnings yield, decrease EPS.(4)repurchase will increase bookvalue?stock price<BVPS, increase,stock price>BVPS, decrease.。

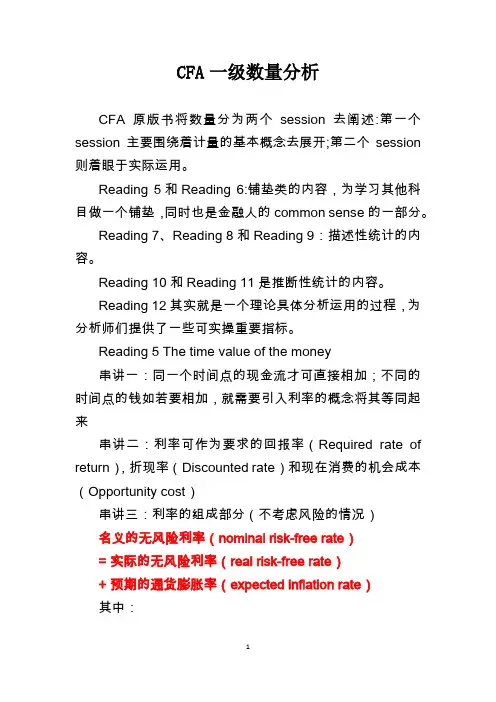

CFA一级数量分析CFA原版书将数量分为两个session去阐述:第一个session主要围绕着计量的基本概念去展开;第二个session 则着眼于实际运用。

Reading 5和Reading 6:铺垫类的内容,为学习其他科目做一个铺垫,同时也是金融人的common sense的一部分。

Reading 7、Reading 8和Reading 9:描述性统计的内容。

Reading 10和Reading 11是推断性统计的内容。

Reading 12其实就是一个理论具体分析运用的过程,为分析师们提供了一些可实操重要指标。

Reading 5 The time value of the money串讲一:同一个时间点的现金流才可直接相加;不同的时间点的钱如若要相加,就需要引入利率的概念将其等同起来串讲二:利率可作为要求的回报率(Required rate of return),折现率(Discounted rate)和现在消费的机会成本(Opportunity cost)串讲三:利率的组成部分(不考虑风险的情况)名义的无风险利率(nominal risk-free rate)=实际的无风险利率(real risk-free rate)+预期的通货膨胀率(expected inflation rate)其中:实际的无风险利率是在假定没有预期通货膨胀的情况下,单期贷款的理论利率。

注:T-bills(美国国债)的收益率,是名义的无风险利率,因为其预期的通货膨胀率不是0。

串讲四:利率的组成部分(考虑风险的情况)要求的回报率(Required interest rate on a security)= 名义的无风险利率(nominal risk-free rate)+ 违约风险溢价(Default risk premium)+ 流动性风险溢价(Liquidity risk premium)+ 到期风险溢价(Maturity risk premium)其中:违约风险溢价反映了借款人没有按期支付本息的风险流动性风险溢价反映了当出售某项投资时,获得的收入少于该投资公允价值的风险到期风险溢价之长期的债券波动性比短期的债券波动性要大。

CFA重点知识串讲-Corporate Finance公司金融Corporate Finance, 中文通常译作公司金融,或者公司理财。

在CFA一级考试中,它占比8%,难度系数在整个一级的学习科目中,为中等偏下,以理解为主。

虽然只有一个session,但包含6个主题,这构成了一个公司理财核心的三件事:钱从哪里来?钱怎么花?钱怎么分?这门课程告诉学员,一个公司,尤其是公司的高管是如何针对公司财务报表,使公司规划出最合适的资本结构,来获得资本的最优收益;在制定资本预算时,如何做出正确的现金流量估计和风险分析,从而作出正确的决定;如何在决定股利政策时,充分了解其中的资讯和意义;以及如何实现公司融资结构与投资结构的最优化并做出未来决策。

所以,这门课具有较强的实用性。

知识点一: Capital Budgeting 资本预算在众多的投资项目中,企业应当如何去做决策,这需要科学的方法论,由此衍生了资本预算理论的发展。

我们首先要了解的是资本预算的一般过程和资本预算的五大基本原则,以及在对一个项目进行评估的时候,几种主流评估方法:1)NPV (Net Present Value) 净现值法2)IRR (Internal Rate ofReturn) 内部收益率法3)Payback Period 投资回收期法4)Discounted Payback Period 贴现回收期法5)Average Accounting Rate of Return 平均会计收益率法6)Profitability Index 盈利性指数。

这其中,NPV和IRR深受大企业和学术研究的欢迎,也是考试的核心。

然而它们也有其各自优势与不足。

就NPV和IRR 的比较来说:(1)理论上看,净现值是最正确的方法,它考虑了所有的现金流情况,多个项目进行投资选择时,应该选择净现值最大的项目;(2)内部收益率法的最大优点就是以百分比的形式计算收益率,容易让人理解,但是存在多重解问题(即一个项目有可能出现两个IRR) 。

2020年度CFA一级重要知识点总结独家整理,请勿转载~职业伦理1.1The process for the enforcement of the Code and Standards1.2Primary Principles:(1)Fairness of the process to members and candidates(2)Confidentiality of the proceedings.1.3Disciplinary Review Committee has overall responsibility for the Professional Conductprogram and enforcement of the code and standards.1.4How to detectSelf-disclosureonannualProfessionalConductStatementsofinvolvementincivil litigationoracriminalinvestigation,orthatthemember orcandidateisthesubjectofawritten complaint.Written complaints about professional conduct received by the Professional Conduct staff.Evidence of misconduct by a member or candidate that the Professional Conduct staff received through public sources,such as a media article or broadcast.A report by a CFA exam proctor of a possible violation during the examination.发现有人违反,经过CFA调查后,一般会有三种处理方法:1)不处罚;2)发警告信;3)进行处罚(由轻到重依次为:privatecensor,public censor,timed suspension)1.5Hearing panelconsists of DRC members and CFAInstitute member volunteers affiliated with the DRC 1.6AMC vs.Code and standardsThe Asset Manager Code of Professional Conduct(AMC),which is designed,in part,to help asset managers comply with the regulations mandating codes of ethics forinvestment advisers.AMC was drafted specifically for firmsCode and Standards is aimed at individual investment professionals1.7Knowledge of law必须了解与工作直接相关(directly governing their work)的法律和规则,但不需要成为expert on compliance;总是遵守最严格的,但最低限度要遵守CFA Institute准则和标准;如果有传递关系,遵循最后一个生效的law or regulations;work(applicable)live Comply withMs→Live Ls Ls<Code→CodeLs→Live Ms Ms>Code→MsGuidance of compliance●如果你感觉(feel)有人违法,你必须consult for advice,but not exempt fromrequirements to compliance;●如果你知道(know)有人在违法,还可以采取分步骤的方法:向公司里的适当人员汇报(r e po r t);如果汇报后仍没有改进,则你必须与违法行为划清界限(d i sass o ci a te),甚至辞职;同时要进一步咨询以便采取进一步的行动;还可以(m a y c on s i d e r t o p e r s u a d e t o s t op)考虑劝说违法的人终止违法行为;(注:I fyou were a supervisor,how to do?)当发现有违法行为时,CFA Institute并不要求你向政府管理机构汇报。

引言概述CFA(CharteredFinancialAnalyst)一级考试是金融领域从业人士的重要认证之一。

该考试涵盖了金融和投资管理领域的广泛知识,包括经济学、会计学、伦理和道德、投资工具和资产评估等方面。

本文将对CFA一级考试的主要知识点进行总结。

正文内容一、宏观经济学(MacroEconomics)1.经济增长:解释GDP(国内生产总值)增长和衰退的因素,如劳动力、资本、技术进步等。

2.通货膨胀:衡量和解释通货膨胀水平、影响因素和货币政策对通胀的影响。

3.失业:解释失业的类型、原因和经济政策对就业的影响。

4.国际贸易和资本流动:解释贸易平衡、国际收支、汇率和政府对贸易和资本流动的控制。

5.货币供应和利率:描述货币供应的类型、货币政策的工具和货币市场利率的计算。

二、投资工具(InvestmentTools)1.证券市场参与者:介绍证券市场中的各类参与者,如个人投资者、机构投资者、证券分析师等。

2.金融工具:解释不同种类的金融工具,如股票、债券、衍生品等,以及它们的特点和风险。

3.证券市场指数:解释不同类型的指数,如股票市场指数、债券市场指数,以及它们对市场表现的测量和跟踪。

4.估值方法:介绍企业估值的不同方法,如股票的市盈率、债券的折现现金流量法等。

5.投资组合理论:解释资产配置的概念、风险和回报之间的关系,以及现代投资组合理论的基本原则。

三、财务报告与分析(FinancialReportingandAnalysis)1.财务报表分析:解释财务报表的目的、使用者和分析方法,如财务比率分析、现金流分析等。

2.财务陈述分析:解读财务陈述中的各项指标,如利润表、资产负债表和现金流量表。

3.企业财务风险评估:评估企业的财务风险,如偿债能力、流动性风险和盈利能力等。

4.财务报表的质量和准确性:分析财务报表的质量和准确性,如重大会计政策选择和估计的合理性。

5.财务报表分析的限制:讨论财务报表分析的局限性,如不完整信息、公司治理问题等。

CFA一级考试分析串讲1-综合分析

第一级考试最重要的四个科目的准备重点及方向,这四个科目加起来的比重超过三分之二,所以考生一定要将准备时间的三分之二花在这四科上面。

FSA and Corporate Finance

财报分析所占的比重约在23%,从单一科目来讲,这部分是最大科目,考生不仅不能忽略,更要精通。

要想在财报分析中拿高分,就必须对考试的范围每一点都下工夫。

了解每一项财务比率,了解每一个会计处理原则的改变对相关比率的影响,了解分析师重新调整会计科目以符合公司的真实价值或营运状况,对相关财务比率的影响。

公司财务管理与大学修的差不多,要掌握三大决策: 投资、融资及股利。

如何计算资金成本,并运用净现值、内部报酬率及回收期选择投资案为一大重点。

融资对公司之利弊及最适资本结构的几派理论、股利政策与公司成长率之关系及股利变动对股价之影响等主题务必了解。

Asset Valuation

证券市场部份比较零碎,但不困难,常考的内容包括各种指数之计算及成份、三种效率市场假说的理论及代表的含意、信心指数及融资余额等技术指针。

股票评价则以现金流量折现法去计算股票价值是必考的题型,其中又以固定成长率的Gordon成长模型及多阶段成长模型题目最为常见,考生只要多加练习,在这部份得分并不难。

Quantitative Methods

这部分考30题,是最好拿分的部分。

CFA的数量分析考的比大学的统计学还简单,而且多了一些和统计学比较没有关系的观念,如连续复利的观念,随机变量分配的型态,有效年利率(Effective Annual Rate)的计算方式,夏普指数(Sharpe Ratio)、罗伊获利保本指数等(Roy’s Safety First Criterion)。

当然大部分的考题还是会集中在机率概念、平均数及标准差,分配型态(二项式分配或常态分配等)、信赖区间、假设检定及回归分析等。

其中常态分配的应用是数量分析的核心,而善用计算器的统计及时间价值的功能是统计拿高分的二大法门。

Ethical and Professional Standards

此科目的投资报酬率最低,但是这科不达到一定的成绩就不能通过一级考试。

要拿高分的密诀只有一个,那就是去买AIMR所指定的教科书: Standards of Practice Handbook。

将那本书的范例从头到尾全部看二遍,找出最有代表性的几个范例,特别是牵涉到多重违反及法条竞合的案例,自已一定要培养阅读题目时就能找出相关法条之违反的敏锐性。

反之,如果你对这一科没有把握,则考试的时候留在最后再做,没有人规定你答题的时候一定要从第一题开始答。

职业准则考试的重点包括:

分析师的独立客观(Independence and Objectivity)、对客户的公平对待(Fair Dealing)、研究报告的完整性(Research Report)。

当然,利益冲突的揭露(Disclosure of Conflicts to Employer and Clients)、对雇主的忠诚(Duty to Employer),和禁止内线交易(Prohibition against the Use of Nonpublic Material Information)也不会在未来几次的考试中缺席。

同时,去年6月才列入CFA考试的全球投资绩效报告准则(Global Investment Performance Standards)规范了资产管理公司在做绩效报告时应该谨守的方法原则,也一定是考试的重点。