北大MBA统计学案例库

- 格式:ppt

- 大小:2.49 MB

- 文档页数:38

素材一(4组)2012年10月10日傲游哈哈用户“中正平和”发表笑话:“中国式过马路”,就是“凑够一撮人就可以走了,和红绿灯无关”。

2012年10月11日,网友“这个绝对有意思”在微博发消息称:“中国式过马路,就是凑够一撮人就可以走了,和红绿灯无关。

”微博同时还配了一张行人过马路的照片,虽然从照片上看不到交通信号灯,但有好几位行人并没有走在斑马线上,而是走在旁边的机动车变道路标上,其中有推着婴儿车的老人,也有电动车、卖水果的三轮车。

这条微博引起了不少网友的共鸣,一天内被近10万网友转发。

网友纷纷跟帖“太形象了”、“同感”、“在济南就是这样”,还有网友惭愧地表示,自己也是“闯灯大军”中的一员。

素材二(3)在2014年炎热的夏天,一桶冰水当头倒下,微软的比尔盖茨、Facebook的扎克伯格跟桑德博格、亚马逊的贝索斯、苹果的库克全都不惜湿身入镜,这些硅谷的科技人,飞蛾扑火似地牺牲演出,其实全为了慈善。

冰桶挑战全称为“ALS冰桶挑战赛”(ALS Ice Bucket Challenge),要求参与者在网络上发布自己被冰水浇遍全身的视频内容,然后该参与者便可以要求其他人来参与这一活动。

活动规定,被邀请者要么在24小时内接受挑战,要么就选择为对抗“肌肉萎缩性侧索硬化症”捐出100美元。

该活动旨在是让更多人知道被称为渐冻人的罕见疾病,同时也达到募款帮助治疗的目的。

目前“ALS冰桶挑战赛”在全美科技界大佬、职业运动员中风靡。

目前已扩散至中国,科技界大佬纷纷响应。

素材三(7)2014年11月8日,在香港举行的LGBT(男、女同性恋者以及双性恋者和跨性别者)大游行,近万人参加。

人数比去年多了一倍。

媒体发布了照片,这些主流叙事之外的“他者”,穿着色彩鲜艳的衣服,骄傲地展示着。

参与了游行的D妈妈,在博客上写下这么一段话:“孩子在我眼里,仍然和过去一样健康正常,一样优秀聪明。

经过两年多的学习和沟通,我终于清楚地知道:孩子没有错,我也没有错,和我们一样,是大自然造就的,不需要改变,也不需要都和异性恋一样结婚生孩子等等,只需要按照自己的心愿,和自己喜欢的人生活享受情感就好。

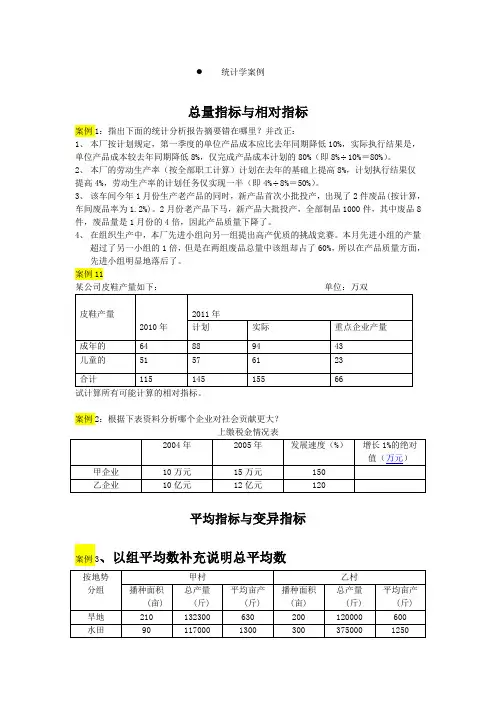

统计学案例总量指标与相对指标案例1:指出下面的统计分析报告摘要错在哪里?并改正:1、本厂按计划规定,第一季度的单位产品成本应比去年同期降低10%,实际执行结果是,单位产品成本较去年同期降低8%,仅完成产品成本计划的80%(即8%÷10%=80%)。

2、本厂的劳动生产率(按全部职工计算)计划在去年的基础上提高8%,计划执行结果仅提高4%,劳动生产率的计划任务仅实现一半(即4%÷8%=50%)。

3、该车间今年1月份生产老产品的同时,新产品首次小批投产,出现了2件废品(按计算,车间废品率为1.2%)。

2月份老产品下马,新产品大批投产,全部制品1000件,其中废品8件,废品量是1月份的4倍,因此产品质量下降了。

4、在组织生产中,本厂先进小组向另一组提出高产优质的挑战竞赛。

本月先进小组的产量超过了另一小组的1倍,但是在两组废品总量中该组却占了60%,所以在产品质量方面,先进小组明显地落后了。

案例11试计算所有可能计算的相对指标。

案例2:根据下表资料分析哪个企业对社会贡献更大?平均指标与变异指标案例3、以组平均数补充说明总平均数案例4:某单位有10个人,其中1人月工资为10万元,9人每人月工资为1000元。

该单位职工月平均工资为10900元。

即:)(109001091000100000元=⨯+你认为这个平均数有代表性吗?如果缺乏代表性应如何改正?案例5:以下是各单位统计分析报告的摘录1、 本局所属30个工厂,本月完成生产计划的情况是不一致的。

完成计划90%的有3个,完成96%的有5个,完成102%的有10个,完成110%的有8个,完成120%的有4个。

平均全局生产计划完成程度为104.33%。

即:304%1208%11010%1025%963%90⨯+⨯+⨯+⨯+⨯=104.33%2、 本厂开展增产节约运动以后,产品成本月月下降,取得显著的成绩,根据财务部门的报告,1 月份开支总成本15000元,平均单位产品成本为15元,2月份开支总成本25000元,平均单位产品成本下降为10元,3月份开支总成本45000元,平均单位产品成本仅8元。

大作业课程名称《统计学》专业名称:任课教师:班级:学号:姓名:上课时间:大作业完成时间:114号百--拼购业务月饼销售状况分析目录一、分析目的 (3)二、数据来源 (3)三、分析结果 (4)1、成功订单统计表中的信息有个别不能确认 (4)2、运营商消费分布 (4)3、终端分布情况 (5)4、地域消费情况 (5)5、拼购月饼呼入趋势分析 (5)6、全天呼入趋势时间分布分析 (7)7、每日消费情况分析 (8)8、各月饼品牌的销售情况 (9)9、产品销售排名 (11)10、订单状态分析 (15)11、用户购买消费排行 (16)12、用户消费习惯预测 (18)13、订单反应时长分析 (18)一、分析目的●了解近期月饼销售的整体情况;●评估拼购业务的流程是否顺畅;●能准确把握业务变化趋势,明晰变化原因;●提升114拼购联盟的话务量;●根据交叉分析,为拼购产品确定提供数据支撑;●提升业务收入;●对市场营销活动提供数据支撑;二、数据来源1、呼入数据统计表共统计呼入数据1119条。

2、成功订单统计表共统计成功订单记录175条。

三、分析结果1、成功订单统计表中的信息有个别不能确认需要明确各时间点的工作步骤;发现问题:到货时间早于订购时间。

2、运营商消费分布移动用户占比最高,其次电信用户。

3、终端分布情况拼购用户还是以手机终端为主。

4、地域消费情况主要消费集中在本地。

5、拼购月饼呼入趋势分析可以发现随着业务推广以及节日日期的临近,呼入话务量呈明显上升趋势;拼购活动结束前又有一波上涨;6、全天呼入趋势时间分布分析由此我们可以发现,每日首次呼入时段为7:00-8:00,呈上升趋势;每日的话务高峰时段为9:00-16:00;每日16:00-23:00呈下降趋势;同呼入频次的时间分布图对比后,可以发现时长趋势与之基本吻合;总结:可以优化业务推广时间;优化高峰时段的专业坐席服务。

7、每日消费情况分析总结:消费金额主要受购买数量影响,同消费次数关系不大。

物流管理案例WDM≈沃尔玛+戴尔+麦当劳仅仅在2003年刚刚过去一半的时间里,IT零售卖场领域相继有百脑汇郑州店、赛博青岛店、赛博昆明店、阿波罗、赛博中关村店等因经营不善、选址失利等原因,或败走麦城、歇业整顿,或撤出商圈、另谋新址。

据中关村的一位电脑卖场老总向记者透露,北京多数电脑卖场的亏损都在百万以上。

然而,就在不久前,英特尔和爱普生全球总裁、惠普家用电脑事业部总裁却频频光顾一家位于南京的IT超级卖场,着实让这家IT产品零售商受宠若惊。

事实上,这家IT卖场企业目前已成为国内独家经营企业面积最大、独家经营品种最大的IT专业零售连锁企业。

这家名为“宏图三胞”的大经销商,其实早已在华东地区的IT 渠道中声名雀起,而其迅速崛起的最大卖点就是由其总裁袁亚非创立并应用到IT终端零售经营中的“WDM”营销模式,即融合了沃尔玛(Walmart)的规模采购平价销售模式、戴尔(Dell)电脑的定制生产和直销模式,以及麦当劳(McDonlad's)的标准化服务于一体的专业连锁经营模式。

“WDM”能实现1+1+1>3吗?2001年,当袁亚非在深圳第一次体验沃尔玛的时候,他被这种新型超市的繁荣场面震惊了。

“齐刷刷的三十几个收银通道排的全是人,当时我就奇怪了:它卖的多是中国货,国内哪个商场没有?凭什么就能卖成这个样子?”怀着这样的疑问,他当时就买了一本《富甲天下》(沃尔玛创始人的自传),回去以后就慢慢研究。

研究它的物流中心、配送中心、全球采购、快速反应机制、高效运输等,并设想着“什么时候卖电脑也能通过这种方式卖成这个样子”。

其时,袁亚非已在做着电脑销售的生意,但总是做不大。

后来他明白了为什么电脑销售一条街的销售总是做不大,原因之一就是对人的依赖性太强了,“你看珠江路的sales,既懂得市场又要懂技术还要知道货源……这样一天做下来相当的累,做不了几个单子不说,还难保服务质量。

”于是他想到了连锁经营。

然而实现连锁经营需要雄厚的资金支持和完善的物流、信息管理系统以及专业的管理团队来支持,并不是你想选择什么模式就能做什么模式的,在人们都争着去抢食“连锁经营”这块香喷喷的“汉堡包”的时候,你能否把它咽下去好好消化显然是一个问题。

北大MBA管理学案例库(8)目标管理某机床厂从1981年开始推行目标管理:为了充分发挥各职能部门的作用,充分调动一千多名职能部门人员的积极性,该厂首先对厂部和科室实施了目标管理。

经过一段时间的试点后,逐步推广到全厂各车间、工段和班组。

多年的实践表明,目标管理改善了企业经营管理,挖掘了企业内部潜力,增强了企业的应变能力,提高了企业素质,取得了较好的经济效益。

按照目标管理的原则,该厂把目标管理分为三个阶段进行。

第一阶段:目标制订阶段1.总目标的制订。

该厂通过对国内外市场机床需求的调查,结合长远规划的要求,并根据企业的具体生产能力,提出了19××年”三提高”、”三突破”的总方针。

所谓”三提高”,就是提高经济效益、提高管理水平和提高竞争能力;”三突破”是指在新产品数目、创汇和增收节支方面要有较大的突破。

在此基础上,该厂把总方针具体比、数量化,初步制订出总目标方案,并发动全厂员工反复讨论、不断补充,送职工代表大会研究通过,正式制定出全厂19××年的总目标。

2.部门目标的制订。

企业总目标由厂长向全厂宣布后,全厂就对总目标进行层层分解,层层落实。

各部门的分目标由各部门和厂企业管理委员会共同商定,先确定项目,再制订各项目的指标标准:其制订依据是厂总目标和有关部门负责拟定、经厂部批准下达的各项计划任务,原则是各部门的工作目标值只能高于总目标中的定量目标值,同时,为了集中精力抓好目标的完成,目标的数量不可太多。

为此,各部门的目标分为必考目标和参考目标两种。

必考目标包括厂部明确下达目标和部门主要的经济技术指标;参考目标包括部门的日常工作目标或主要协作项目:其中必考目标一般控制在2-4项,参考目标项目可以多一些。

目标完成标准由各部门以目标卡片的形式填报厂部,通过协调和讨论最后由厂部批准。

3.目标。

北大MBA管理学案例库比特丽公司的分权管理比特丽公司是美国一家大型联合公司,总部设在芝加哥,下属有450个分公司,经营着9干多种产品,其中许多产品-如克拉克棒糖,乔氏中国食品等,都是名牌产品。

公司每年的销售额达90多亿美元。

多年来,比特丽公司都采用购买其他公司来发展自己的积极进取战略,因而取得了迅速的发展。

公司的传统做法是:每当购买一家公司或厂家以后,一般都保持其原来的产品,使其成为联合公司一个新产品的市场;另一方面是对下属各分公司都采用分权的形式。

允许新购买的分公司或工厂保持其原来的生产管理结构,这些都不受联合公司的限制和约束。

由于实行了这种战略,公司变成由许多没有统一目标,彼此又没有什么联系的分公司组成的联合公司。

1976年,负责这个发展战略的董事长退休以后,你--德姆就是在这种情况下被任命为董事长。

新董事长德姆的意图是要使公司朝着他新制定的方向发展。

根据他新制定的战略,德姆卖掉了下属56个分公司,但同时又买下了西北饮料工业公司。

据德姆的说法,公司除了面临发展方向方面的问题外,还面临着另外两个主要问题:一个是下属各分公司都面临着向社会介绍并推销新产品的问题,为了刺激各分公司的工作,德姆决定采用奖金制,对下属干得出色的分公司经理每年奖励1万美元。

但是,对于这些收入远远超过l万元的分公司经理人员来说,1万元奖金恐怕起不了多大的刺激作用。

另一个面临的更严重的问题是,在维持原来的分权制度下,应如何提高对增派参谋人员必要性的认识,应如何发挥直线与参谋人员的作用问题。

德姆决定要给下属每个部门增派参谋人员,以更好地帮助各个小组开展工作。

但是,有些管理人员则认为只增派参谋人员是不够的,有的人则认为,没有必要增派参谋人员,可以采用单一联络人联系几个单位的方法,即集权管理的方法。

公司专门设有一个财务部门,但是这个财务部门根本就无法控制这么多分公司的财务活动,因此造成联合公司总部甚至无法了解并掌握下属部门支付支票的情况等等。

北大MBA财务管理分析案例库(003)北大MBA会计学案例库成本与市价孰低法某公司采用成本与市价孰低发对短期投资进行计价。

该公司1992年12月31日短期投资余额未400,000元,证券跌价准备余额未20,000元。

1991年12月31日短期投资种类及相关资料如下:成本市价证券跌价准备A公司股票200,000.00190,000.0010,000.00B公司股票100,000.0090,000.0010,000.00C公司股票200,000.00204,000.000.00合计500,000.0020,000.001992年B公司股票以91,000元售出,售家和按市价调整后的账面数之差被计入"证券出售利得"。

1992年12月31日的市价情况如下:市价 A公司 199,000.00C公司 205,000.00问题:(1)该公司运用成本与市价孰低法对短期投资计价,是以单个证券为基础还是以总价为基础?(2)运用成本与市价孰低法的主要理论基础是什么?该公司运用这一规则合理吗?(3)该公司对出售C公司股票的会计处理正确吗?(4)该公司于1992年12月31日还需要做什么分录,以反映有价证券市价的变化?阳澄湖公司以下是阳澄湖公司1996年发生的部分经济业务:(1)因为火灾物品贱卖(fire sale ),价值140,000元的设备以110,000元的价格购入。

所作分录为:借:机器设备140,000贷:现金110,000收入30,000(2)预计销售价格减去估计的销售成本(销售费用)后,成本为380,000元的商品存货在资产负债表中确认的金额为460,000元。

记录商品存货增值的会计分录是:借:商品存货80,000贷:收入80,000(3)公司总裁使用他自己的钱购买小帆船自用,所作会计分录如下:借:杂项费用80,000贷:收入80,000(4)1996年度房屋折旧为23,000元,因为房屋市价上涨过大,所以年底所作的计提折旧分录为:借:留存收益23,000贷:累计折旧--房屋23,000(5)以股票换入设备,股票总面值为70,000元,公平市价为300,000元,设备的公平市价不详,交换时所作的会计分录是:借:机器设备:70,000贷:股本70,000(6)收到顾客的购货定单,购买本公司商品16,000元。

统计学精品课程建设小组二○○六年十一月【案例一】全国电视观众抽样调查抽样方案一、调查目的、范围和对象1.1 调查目的准确获取全国电视观众群体规模、构成以及分布情况;获取这些观众的收视习惯,对电视频道和栏目的选择倾向、收视人数、收视率与喜爱程度,为改进电视频道和栏目、开展电视观众行为研究提供新的依据。

1.2 调查范围全国31个省、自治区、直辖市(港澳台除外)中所有电视信号覆盖区域。

1.3 调查对象全国城乡家庭户中的13岁以上可视居民以及4-12岁的儿童。

包括有户籍的正式住户也包括所有临时的或其他的住户,只要已在本居(村)委会内居住满6个月或预计居住6个月以上,都包括在内。

不包括住在军营内的现役军人、集体户及无固定住所的人口。

二、抽样方案设计的原则与特点2.1 设计原则抽样设计按照科学、效率、便利的原则。

首先,作为一项全国性抽样调查,整体方案必须是严格的概率抽样,要求样本对全国及某些指定的城市或地区有代表性。

其次,抽样方案必须保证有较高的效率,即在相同样本量的条件下,方案设计应使调查精度尽可能高,也即目标量估计的抽样误差尽可能小。

第三,方案必须有较强的可操作性,不仅便于具体抽样的实施,也要求便于后期的数据处理。

2.2 需要考虑的具体问题、特殊要求及相应的处理方法2.2.1 城乡区分城市与农村的电视观众的收视习惯与爱好有很大的区别。

理所当然地应分别研究,以便于对比。

最方便的处理是将他们作为两个研究域进行独立抽样,但代价是,这样做的样本点数量较大,调查的地域较为分散,相应的费用也就较高。

另一种处理方式是在第一阶抽样中不考虑区分城乡,统一抽取抽样单元(例如区、县),在其后的抽样中再区分城、乡。

这样做的优点是样本点相对集中,但数据处理较为复杂。

综合考虑各种因素,本方案采用第二种处理方式。

在样本区、县中,以居委会的数据代表城市;以村委会的数据代表农村。

2.2.2 抽样方案的类型与抽样单元的确定全国性抽样必须采用多阶抽样,而多阶抽样中设计的关键是各阶抽样单元的选择,其中尤以第一阶抽样单元最为重要。

管理数学I 习题二1. 用随机变量来描述掷一枚骰子的试验结果,并写出它的分布律。

解:令X 为掷一枚骰子的试验结果,则X 的取值为1,2,3,4,5,6。

并且X 取其中任2. 某试验成功的概率为p ,X 代表第二次成功之前试验失败的次数,写出X 的分布律。

答:X3答:不能,因为0.15+0.45+0.6 = 1.2 > 1。

4.产品有一、二、三等品和废品四种,一、二、三等品率和废品率分别为55%、25%、19%、1%,任取一件产品检验其质量等级,用随机变量X 表示检验结果,并写出其分布律和分布函数。

答: 分布函数为:⎪⎪⎪⎩⎪⎪⎪⎨⎧≤<≤<≤<≤<=xx x x x x F 4,143,99.032,8.021,55.01,0)(5.设某种试验成功的概率为0.7,现独立地进行10次这样的试验。

问是否可以用一个服从二项分布的随机变量来描述这10次试验中成功的次数?如何描述?请写出它的分布以及分布的数学期望和标准差。

答: 本题中实验的结果只有两种,成功,不成功,符合Bernoulli 实验的特征。

令X 为10次实验中成功的次数,显然X 的取值范围就是0,1,2 …,10,而且X 取k 的概率为:其中k 为0-10间的自然数。

显然可以用服从二项分布的随机变量来描述这10次实验中成功次数。

具体分布就是kn kk n p p C k X P --==)1()(数学期望 E(X) = n*p = 10*0.7 = 7 标准差 45.11.2)7.01(7.010)1(==-⨯⨯=-=p np σ6.如果你是一个投资咨询公司的雇员,你告诉你的客户,根据历史数据分析结果,企业A的平均投资回报比企业B 的高,但是其标准差也比企业 B 的大。

你应该如何回答客户提出的如下问题:(1) 是否意味着企业A 的投资回报肯定会比企业B 的高?为什么? (2) 是否意味着客户应该为企业A 而不是企业B 投资?为什么?答: (1) 平均投资回报反映的是长期的平均结果。

第一题:饮料销售样本资料第二题:统一食品公司在新墨西哥州、亚利桑拿州、加利福尼亚洲开设了连锁超市。

最近该公司发动了一场声势浩大的广告宣传运动,宣称只要是统一食品公司的顾客,都可以享受该公司新的信用卡政策,可以用卡Visa结帐,也可以用Master-card卡付款,还可以用现金或个人支票。

这项措施是在试验的基础上形成的,旨在鼓励顾客扩大购买量。

试行一个月之后,在一个周末随机选取了100个顾客的样本,搜集了支付方式和购买金额(单位:美元)的数据(见下表)。

在此之前,大约有50%的人用现金支付购货款,另有一半的顾客使用了个人支票。

现金个人支票信用卡现金个人支票信用卡7.40 27.60 50.30 5.08 52.87 69.775.15 30.60 33.76 20.48 78.16 48.114.75 41.58 25.57 16.28 25.9615.10 36.09 46.24 15.57 31.078.81 2.67 46.13 6.93 35.381.85 34.67 14.44 7.17 58.117.41 58.64 43.79 11.54 49.2111.77 57.59 19.78 13.09 31.7412.07 43.14 52.35 16.69 50.589.00 21.11 52.63 7.02 59.785.98 52.04 57.55 18.09 72.467.88 18.77 27.66 2.44 37.945.91 42.83 44.53 1.09 42.693.65 55.40 26.91 2.96 41.1014.28 48.95 55.21 11.17 40.511.27 36.48 54.19 16.38 37.202.87 51.66 22.59 8.85 54.844.34 28.58 53.32 7.22 58.753.31 35.89 26.57 17.8715.07 39.55 27.89 69.22运用统计表与统计图的形式对样本资料进行处理,内容包括:(1)支付方式的频数及频率分布;(2)绘制支付方式的条形图;(3)编制各种支付方式下购买金额的频数及频率分布;(4)说明关于购买金额与支付方式的初步看法。

How Financial Firms Decide on Technology,介绍国际大银行在决定对信息技术投资时的考虑要点和他们具体的实施过程;How Financial Firms Decide on TechnologyAbstractThe financial services industry is the major investor in information technologyIT in the . economy; the typical bank spends as much as 15% of non-intereste expenses on IT. A persistent finding of research into the performance of financial institutions is that performance and efficiency vary widely across institutions. Nowhere is this variability more visible than in the outcomes of the IT investment decisions in these institutions. This paper presents the results of an empirical investigation of IT investment decision processes in the banking industry. The purpose of this investigation is to uncover what, if anything, can be learned from the IT investment practices of banks that would help in understanding the cause of this variability in performance along with pointing toward management practices that lead to better investment decisions. Using PC banking and the development of corporate Internet sites as the case studies for this investigation, the paper reports on detailed field-based surveys of investment practices in several leading institutionsHow Financial Firms Decide on TechnologyPart One信息技术对金融服务业的影响正在增加,不仅仅表现在银行的15%无息开支上,而且对金融服务业的运做和战略也有很强的影响;一个对金融机构的长期研究表明,不同的机构的效率和表现也不同;其决定的因素有以下一些其中的一个因素就是对投资的决定和管理;SBS是一个失败的例子,但是成功的公司也不少;本文注重解答以下的问题:1.银行对IT投资的评估和管理过程2.在对IT的管理过程中,理论和实际操作的结合如何3.IT投资的管理和银行性能的关系如何IntroductionInformation technologyIT is increasingly critical to the operations of financial services firms. Today banks spend as much as 15% ofnon-interest expense on information technology. It is estimated that the industry will spend at least $ billion on IT in 1998, and financial institutions collectively account for the majority of IT investment in the . economy. In additon to being a large component of the cost structure, information technology has a strong influence on financial firms operatons and strategy. Few financial products and services exist that do not utilize computers at some point in the delivery process, and a firms'information systems place strong constraints on the type of products offered, the degree of customization possible and the speed at which firms can respond to competitive opportunities or threats.A persistent finding of research into the performance of financial institutions is that performance and efficiency varies widely across institutions, even after controlling for factors such as sizescale, product breadthscope, branching behavior and organizational form. stock versus mutual for insurers; banks versus saving & loans. Given the central role that technology plays in these institutions, at least some of this variation is likely to be due to variations in the use and effectiveness of IT investments. While some authors have argued that the value of IT investment has been insignificant, particularly in services, recent empirical work has suggested that IT investment, on average, is a productive investment. Perhaps more importantly, there appears to be substantial variation across firms; some firms have very high investments but are poor performers, while otheres invest less but appear to be much more successful. Brynjolfsson and Hitt found that as much as half the returns to IT investment are due to firm specific factors.One potentially important driver of differences in IT value, and of firm performance more broadly, is likely to be the decision and management peocessed for IT investments. Horror stories of bad IT investment decisions abound. Consider the example of the new strategic banking systemSBS at Banc OneAmerican Banker 1997. Banc One Corp. and Electronic Data Systems Corp. agreed last year to end their joint development of this retail banking system after spending an estimated $175 million on it. As stated in the American Banker article, SBS"was just so overwhelming andso complete that by the time they were getting to market, it was going to take too long to install the whole thing," said Alan Riegler, principal in Ernst & Young's financial services management consulting division. However, not all the stories are negative. New IT systems are playing a vital role in reshaping the delivery of financial services. For example, new computer-telephony integrationCTI technologies are transforming call center operations in financial institutions. By investing in technology, more and more institutions are moving operations from high-cost branch operations to the telephone channel,where the cost per transaction is one-tenth the cost of a teller interaction. This IT investment not only reduces the cost of serving existing customers, but also extends the reach of the institution beyond its traditional geographic boundaries.In this paper, we utilize detailed case studies of six retail banks to investigate several interrelated questions:1.What processes do banks utilize to evaluate and manage IT investments 2.How well do actual practices align with theoretical arguments about how ITinvestments shouldbe managed3.What impact does that management of IT investments have on performance How Financial Firms Decide on TechnologyPart TwoFor the first question, we develop a structured framework for cataloging IT investment practices and then populate this framework using a combination of surveys and semi-structured interviews. We then compare the results of this exercise with a synthesis of the literature on IT decision making to understanding how practices vary across firms and the extent to which this is consistent with "best practices" as described in previous literature. Finally, we will compare these processes to internal and external performance metrics to better understand which sets of practices appear to be most effective.To make these comparisons concrete, we examine both the general decision process as well as the specific processes used for two recent IT investment decisions :the adoption of computer-based home banking PC banking, and the development of the corporate web site. These decisions were chosen because they were recent and are related but provide some contrast; in particular, PC banking is a fairly well defined product innovation, while the corporate web presence is more of an infrastructure investment which is less well-defined in terms of objectives and business ownership.Overall, we find that while some aspects of the decision process are fairly similar across institutions and often conform to "best practice" as defined by previous literature, there are several areas where there is large variation in practice among the banks and between actual and theoretical best practice. Most banks have a strong and standardized project management for ongoing systems projects, and formal structures for insuring that line-managers and systems people are in contact at the initiation of technology projects. At the same time, many banks have relatively weak processesboth formal and informal for identifying new IT investment opportunities, allocating resources across organizational lines, and funding exploratory or infrastructure projects with long term or uncertain payoffs.The reminder of this paper is organized as follows. Section 2 describes the previous literature on performance of financial institutions and the effects of IT on performance. Section 3 describes the methods and data. Section 4 describes the current academic thinking on various components of the decision process and compares that to actual practices at the banks we visited. Section 5 describes the results of our in-depth study of PC banking projects and the summary, Section 6 contains a similar analysis for the Corporate Web Site and discussion and conclusion appear in Section 7.How Financial Firms Decide on TechnologyPart ThreePrevious LiteraturePerformance of Financial InstitutionsThere have been a number of studies that have examined the efficiency of the banking industry and the role of various factors such as corporate control structure type of board, directors, insider stock holdings, etc., economies of scale size, economies of scope product breadth, and branching strategy; see Berger, Kashyup and Scalise 1995 and Harker and Zenios forthcoming for a review of the banking efficiency literature. While there is substantial debate as to the role of these various factors, there is one unambiguous result: that most of the in efficiency of banks is not explained by the factors that have been considered in prior work. For example, Berger and Mester 1997 estimate that as much as 65-90% of thex-inefficiency remains unexplained after controlling for known drivers of performance. A similar story also appears in insurance where "x-efficiency" varies substantially across firms when size, scope, product mix, distribution strategy and other strategic variables are considered. It has been argued that one must get "inside the black box" of the bank ot consider the role of organizational, strategic and technological factors that may be missed in studies that rely heavily on public financial data.Information Technology and Business ValueEarly studies of the relationship between IT and productivity or other measures of performance were generally unable to determine the value of IT conclusively. Loveman 1994 and Strassmann 1990 ,using different data and analytical methods both found that the performance effects of computers were not statistically significant. Barus, Kriebel and Mukadopadhyay 1995, using the same data as Loveman, found evidence that IT improved some internal performance metrics such as inventory trunover, but could not tie these benefits to improvements in bottom line productivity. Although these studies had a number of disadvantages small samples, noisy data which yielded imprecise measures of IT effects, this lack of evidence combined with equally equivocal macroeconomic ananlyses by Steven Roach 1987 implicitly formed the basis for the "productivity paradox". As Robert Solow 1987 once remarked, "you can see teh computer age everywhere except in the productivity statistics."More recent work has found that IT investment is a substantial contributor to firm productivity, productivity growth and stock market valuation in a sample that contains a wide range of industries. Brynjolfsson and Hitt 1994,1996 and Lichtenberg 1995 found that IT investment had a positive and statistically significant contribution to firm output . Brynjolfsson and Yang 1997 found that the market valuation of IT capital was several times that of ordinary capital. Brynjolfsson and Hitt also found a strong relationship between IT and productivity growth and taht this relationship grows stronger as longer time periods are considered. Collectively ,these studies suggest that there is no productivity paradox, at least when the analysis is performed across industries using firm-level data. The differences between these results and earlier studies is probably due to the use of data taht was recent , more comprehensice ,and more disaggregated firm level rather than industry or economy level.Most previous sutdies have considered the effects of technology across firms in multiple industries, although a few studies have considered the role of technology in specifically in the banking industry. Steiner and Teixiera surveyed the banking industry and argued that while large investments in technology clearly had value,little of this value was being captured by the banks themselves; most of the benefits were being passed on to customers as a result of intense competition. Alpar and Kim examined the cost efficiency of banks overall and found that IT investment was associatied with greater cost efficiency although the effects were less evident when financial ratios were used as the outcome measure. Prasad and Harkere examined the relationship between technology investment and performance for 47 retail banks and found positive benefits of investments in IT staff.While these studies show a strong positive contribution of IT investment on average, they do not consider how this contribution or level of investment varies across firms. Brynjolfsson and Hitt found that "firm effects" can account for as much as half the contribution of IT found in these earlier studies. Recent results suggest that at least part of these differences can be explained by differences in organizational and strategic factors. Brynjolfsson and Hitt found that firms that use greater overall IT benefits. Bresnehan, Brynjolfsson and Hitt found a similar result for firms that have greater levels of skills and those that make greater investments in training and pre-employment screening for human capital . In addition,strategic factors also appear to affect the value of IT. Firms that invest in IT to create customer value . improve service, timeliness, convenience, variety have greater performance than firms that invest in IT to reduce costs.While these studies are begining to explore how the performance of IT investment varies across firm, particularly due to organizational and strategic factors, little attention has been paid to the technology decision making process.How Financial Firms Decide on TechnologyPart FourIT Investment DecisionsWhile there is no concise definition of "best practice" in IT investment decisions, there are a number of consistent arguments advanced in the IT management literature that can be synthesized into an understanding of the conventional wisdom.For the pruposes of discussion it is useful to subdivide the process of IT management into seven discrete, but interrelated processes. The first six processes are oriented around the proposal, development and management of IT projects, while the last process is about maintaining the capabilities of the IT function and its interrelationships with the rest of the business:of IT opportunitiesopportunitiesIT projectsmake-buy decisionIT projectsIT projectsand Develop the IT FunctionThis subdivision loosely corresponds to many of the major issues in IT management such as outsourcing, line management-IT alignment, software project management, and evaluating IT investments.In addition, this list loosely corresponds to frameworks for the management of IT. The primary difference is that this list views the IT management process as managing a stream of projects rather than focusing on the function of the IT department overall or the role of the CIO, the typical perspective in the previous literature. For example, a common framework used to align IT to business starategy, the critical success factorsCSF method, include three workshops: the first to identify and focus objectives, the second to decide and prioritize on systems investment, and the third to develop, deploy and reevaluate prototype systems. Boynton, Jacobs and Zmud1992 identify five critical IT management processes: setting strategic direction, establishing infrastructure systems, scanning technology, transferring technology and developing systems. Rockart, Earl and Ross1996 propose eight imperatives for the IT organization which can be grouped into managing the IT-business relationship, building and managing systems and infrastructure, managing vendors, and creating a high performance IT organization. Thus, while previous work has subdivided the process in different ways, collectively the studies cover all the seven processes we examine.We will discuss each of the individual points in detail below.Identificant of OpportunitiesHistorically, the IT function was primarily reactive, responding to requests by business units. A business unit. A business unit manager would identify a need for a new system or a repair/enhancement to an existing system and communicate this need to the IT function. The IT personnel would then evaluate the idea for technical feasibility and develop a project proposal include an initial determination of resource needs, cost, and delivery time. While this makes effective use of ITpersonnel in evaluating particular ideas, it provides only a limited role for IT personnel to aid in the identification of technology-based business opportunities.For that reason, some authors have suggested that the IT function should play a larger role in the identification of technological opportunities. For example, Davenport and Short 1990 emphasize that IT capabilities should inform business needs as well as the business units placing demandson the IT function. Fockart, Earl and Ross and Boynton, Jacobs and Zmud identify the role of "technology scanning" and "technology education" as an important component of a centralized IT department; they argue that information systems specialists should be reponsible for evalusting new technologies for business applicability since business units will generally lack the resources or the technological capability to perform these evaluations themselves. Moreover, central IT is best positioned to educate the end uses to make them good "custmers" of the central IT group.In the banking industry, IT may be able to play an additional role in coordinating technology. Because banks and other financial firms are often managed with largely autonomous business units for example, banks are often divided into product lines ---cash management, investment----or along customer segments---wholesale, commercial, retail only the central IT function will have a perspective over the porfolio of systems projects and capabilities. One critical role in this respect is the provision and development of the shared IT infrastructure . central processors, networks, software standards, etc.. Often these projects naturally span business units such that the only ral owner is the IT function; also they generally tend to be highly technical and thus the natural responsibility would also fall on the IT department.How Financial Firms Decide on TechnologyPart FiveEvaluating OppoutunitiesOnce a project is at least initially defined, there is a process by which the initial idea is converted into a proposal that can be evaluated by management for approval or rejection of funding.In the last ten years, it has become more or less standard practices to develop a business case or business plan for any substantial IT investment some small maintenance projects are simply done on request, although the content, sophistication and formality of this process varied substantially. The most typical of these project proposals assuming a mid-size to large project take the form of a business plan which includes a qualitiative description of the objectives, competitive environment, a description of the opportunity and, in some cases, an implementation plan. While the form of these plans varies widely, there are some general points of comparison.For the qualitative portion, the major issue is whether the plan explicitly addresses changes in the business environment, or is primarily inward focused. For minor systems enhancement projects with no strategic objective or even major investments that are not strategic such as year 2000 repairs, it makes sense for the plan to focus entirely on internal issues. However, to the extent that the investment is made for competitive reasons or is likely to spur a reaction from competitors, it is important to qualitatively evaluate whether the business environment will remain static and , if not, examine possible scenarios that are likely to occur. The assumption of a static business environment is a common decision bias that can particularly plague strategic IT investments; Clemens 1991 terms this the "trap of the vanishing status quo".For the quantative financial evaluation, most IT evaluation methods have their roots in traditional capital budgeting procedures such as discounted cash flow analysisDCF. However, while these techniques can work well for projects where costs and benefits ar well defined . purchasing off-the -shelf software in pursuit of operational cost savings, it is increasingly recognized that simple application of DCF approaches is not sufficient for IT investments. This is because much of the value of modern IT investments is likely to be difficult to quantify --such as revenue enhancements or cost savings through improved customer service, product variety, or timeliness. One commonly used stategy is to value non-quantifiable benefits atzero, although this strategy will systematically bias project evaluations to unnecessarily reject projects.Recognizing the limitation of the DCF approach, several alternative approaches have been proposed. One method is to base tghe case entirely on qualitative analysis; unfortunately, this approach often leads to hightly subjective judgements and is likely to err on the side of accepting bad projects. Kaplan, recognizing this problem in the context of evaluating computer integrated manufacturing CIM, proposed using a variant of DCF; a firm calculates the present value of the investment using all the components that can be quantified and then compares this prliminary value to the qualitative list of other benefits and costs. In other cases, where the evaluation is make difficult because of future uncertainties . market growth and acceptance; response of competitors decision trees or other types of probability based assessment tools may simplify investment decisios. Finally, for some types of investments or decisions for example, the decision whether to invest immediately or defer, advanced techniques such as real options can be applied.Although this discussion has focused primarily on evaluating the benefit part of the quantitative evaluation, there are other difficulties in estimating the cost of IT projects, particualarly those involving software development. Existing models such as COCOMO of function points estimation are known to improve the ability to predict project length, staffing requirements and total costs, although they are k own to be systmeatically off by as much as 400%. However, the accuracy of these estimates can also be improved later in the project when specifications are well defined or by customizing the models to the experience of a particular organization. However, despite the fact that these tools and approaches are readily available many firms still utilize "seat of the pants" estimants or lock in schedules and cost estimants before the projects are fully defined.How Financial Firms Decide on TechnologyPart SixApproving IT ProjectsOnce a project has been evaluated and a formal project proposal exists, there are a variety of mechanisms that are used to determine which projects should be funded. Most institutions have some form of committee structure, similar to capital budgeting committees, which is responsible for evaluating, modifying and approving projects.Most of the previous literature on the management of IT has focused on the so-called "IT steering committee" which is an executive level group, often comprised of the heads of business units or their direct reports. The objective of this committee is to ensure that IT strategy is aligned with business unit strategy, projects are coordinated across business units where there are possible synergies and to educate the business unit managers on the both the actual activities of the IT group and the potential IT opportunities.Make-Buy DecisionsOutsourcingAt the inception of any project, a firm has the choice of whether to utilize their internal resources in the IT department insource or utilize an outside vendor for any or all of a projectoutsourcing. While the market for outsourced services has existed since sale of the first corporate computers, the size of the outsourcing market has grown dramatically in recent years and is expected to grow substantially. In 1997 the market for information technology outsourcing has been estimated at $ billion in the . and at $90 billion worldwide. Growth estimates of this market range from 15% to 25%.In general , an outside firm may be advantaged in providing a service previously produced internally, because of economies of scale, scope or specialization. By aggregating demands for multiple clients, vendors can smooth variations in demand increasing capacity utilization and reducing risk, make investments that trade larger fixed costs for lower variable costs, and have stronger incentives to invest in cost-reducing technology. By narrowly focusing on technology, they may be better able to attract, hire , manage and retain high quality personnel due to better ability to tailor management practices, career paths and incentive structures toa specific activity. The value of these benefis is tempered by explicit and implicit costs of using the market or some intermediate form of governance rather than vertical integration. These problems manifest themselves in three types of risk: shirkingunder-performance in hard-to-measure tasks, poaching misappropriaiton of shared resources and opportunistic re-negotiation exploitation of bargaining disadvantages in ongoing relationships . Some authors have argued that in IT these risks are so severe that outsourcing has, overall, a poor value proposition. However , there are a number of very successful agreements and the growth in the market over the long term suggests that some economic benefits of outsourcing are present.In pratice, outsourcing can take many forms and the complexity of these arrangements is increasing. The simplest arrangement is the use of contract workers; the worker is not employed by the firm, but is managed more or less as if they were an employee. This pratice is so common in IT that the presence of contract employees is assumed to be a standard feature of IT departments. At the next level is selective outsourcing in which a firm outsources particular projects or parts of projects to an outside vendor. This is also quite common in software development and technical support activities, although any well-defined task could presumably be outsourced in this way. Finally, the firm may choose to outsource the entire IT function, a practice that began in the late 1980s and has continued today.Hitt, Lorin M., Frei, Frances X. and Patrick T. Harker. 1999 "HowFinancial Firms Decide on Technology," in Brookings/Wharton Paperson Financial Services:1999, Litan, Robert E. and Anthony M. Santomero,Eds. Washington, DC: Brookings Institution Press.。