1755 【差分约束】Cashier Employment(出纳员的雇佣)

- 格式:doc

- 大小:74.50 KB

- 文档页数:12

雇员流动成本计算公式详析默洛尼卫生洁具(中国)人力资源经理丁亚铭我们首先来回忆一下前文提到的雇员流动成本的两个常用公式。

说明:1.离职雇员的全年工资收入指雇员全年的税前工资和奖金或佣金。

2.企业为雇员投入的福利成本主要指企业为雇员投入的底子养老保险、住房公积金、掉业基金和医疗保险以及工伤保险和生育保险等,额度相当于离职雇员全年工资收入的50%-70%摆布。

每个城市征缴的比例或每个企业因自身的原因所列支的福利成本比例会有所不同。

3.目前相当一局部企业其实并没有将奖金或佣金收入列入福利的征缴范围,为此,计算时可按企业的实际情况操作。

4.损耗率要按照具体的岗位来确定。

按照多种资料显示,一个职位流动成本的损耗率占离职雇员全年工资收入和福利成本之和的25%--250%之间。

企业应按照职位的具体情形来确定一个比较合理的损耗率。

5.应用本公式计算企业总的流动成本,简单的方法是将企业全年的离职岗位按岗位的类别〔发卖或办公室职员〕或工资等级〔如研究开发工程师与IT部分的工程师可能在同一个工资等级〕进行归类,在应用上述公式计算比较典型的岗位或工资等级岗位后直接乘于每个岗位类别内或同一工资等级内的离职人数,最后相加得出企业总的流动成本。

否那么,要应用每个岗位的具体工资收入、损耗率等来计算出每个岗位的流动成本,最后相加得出企业总的流动成本。

6.本公式的长处是便利、简单,缺乏是计算出的流动成本会显得较为粗略,受工资和损耗率的影响较大。

接下来,我们来详细介绍一下流动成本计算的第二个公式。

公式二是依据流动成本的五个模型〔见本报在6月9日颁发的“企业利润的无形杀手--雇员流动成本〞的介绍〕及有关实际操作综合而成。

由于本公式对流动成本进行了成本分类,并在成本分类背后详列了具体的细分科目,因此,最终得出的计算成果要比公式一精确、可靠得多。

为了更好理解公式二,现对公式二中每个成本类别背后的常用成本科目进行细分并提供有关说明和参数,供人力资源工作人员包罗企业其他打点人员使用。

解题报告:Cashier Employment题目来源:PKU 1275解法或类型:Difference Constraints作者:Li HaoyuanCashier EmploymentTime Limit:1S Memory Limit:1000KDescriptionA supermarket in Tehran is open 24 hours a day every day and needs a number of cashiers to fit its need. The supermarket manager has hired you to help him, solve his problem. The problem is that the supermarket needs different number of cashiers at different times of each day (for example, a few cashiers after midnight, and many in the afternoon) to provide good service to its customers, and he wants to hire the least number of cashiers for this job.The manager has provided you with the least number of cashiers needed for every one-hour slot of the day. This data is given as R(0), R(1), ..., R(23): R(0) represents the least number of cashiers needed from midnight to 1:00 A.M., R(1) shows this number for duration of 1:00 A.M. to 2:00 A.M., and so on. Note that these numbers are the same every day. There are N qualified applicants for this job. Each applicant i works non-stop once each 24 hours in a shift of exactly 8 hours starting from a specified hour, say ti (0 <= ti <= 23), exactly from the start of the hour mentioned. That is, if the ith applicant is hired, he/she will work starting from ti o'clock sharp for 8 hours. Cashiers do not replace one another and work exactly as scheduled, and there are enough cash registers and counters for those who are hired.You are to write a program to read the R(i) 's for i=0..23 and ti 's for i=1..N that are all, non-negative integer numbers and compute the least number of cashiers needed to be employed to meet the mentioned constraints. Note that there can be more cashiers than the least number needed for a specific slot.InputThe first line of input is the number of test cases for this problem (at most 20). Each test case starts with 24 integer numbers representing the R(0), R(1), ..., R(23) in one line (R(i) can be at most 1000). Then there is N, number of applicants in another line(0 <= N <= 1000), after which come N lines each containing one ti (0 <= ti <= 23). There are no blank lines between test cases.OutputFor each test case, the output should be written in one line, which is the least number of cashiers needed.If there is no solution for the test case, you should write No Solution for that case. Sample Input11 0 1 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 152322110Sample Output1SourceTehran 2000解题思路:拿到题目,想到的最简单的算法是枚举,但是一看数据规模,这个算法立刻就被打入无底深渊。

出纳岗位职责英文描述A cashier plays a crucial role in ensuring the smooth financial transactions of a company. They are responsible for handling cash, credit, and debit card transactions while providing excellent customer service. This role requires strong attention to detail, accuracy, and the ability to work efficiently in a fast-paced environment.Responsibilities:1. Cash Handling: The primary responsibility of a cashier is to handle cash transactions accurately. They must count cash at the beginning and end of their shift to ensure the register's balance. This includes accepting cash payments, providing change, and processing refunds accurately.2. Credit/Debit Cards: Cashiers should be proficient in processing credit and debit card payments. They must familiarize themselves with the electronic payment systems used by the company and ensure the secure processing of transactions. This includes verifying card signatures, checking identification when necessary, and processing transactions using the provided technology.3. Customer Service: Cashiers are often the first point of contact for customers, so providing excellent customer service is essential. They should greet customers with a friendly and professional attitude, answer any questions or concerns, and provide assistance when needed. Cashiers should aim to create a positive shopping experience forcustomers by ensuring their satisfaction.4. Product Knowledge: Cashiers should have a good understanding of the products or services offered by the company. This enables them to provide accurate information to customers, answer their queries, and suggest additional products or services that may be of interest. Product knowledge helps in upselling and enhancing the customer's overall experience.5. Records and Reports: Cashiers are responsible for maintaining accurate records of cash transactions throughout their shift. This includes maintaining a daily log of all sales, voided transactions, and refunds. Cashiers may also be required to generate reports on a daily or weekly basis, summarizing the cash and card transactions. Attention to detail is crucial in maintaining accurate records and reports.6. Security: Cashiers are entrusted with handling cash, so they must be vigilant and ensure the security of the payments they receive. They should follow established procedures to minimize the risk of theft or fraud. Cashiers should also be aware of counterfeit currency and promptly inform the supervisor if any suspicious activities are observed.7. Cash Register Maintenance: Cashier duties also include taking care of the cash register or point-of-sale system. This includes replenishing cash in the register when necessary, ensuring all scanning and weighing equipment is working correctly, and reporting any technical issues to theappropriate department.8. Teamwork: Cashiers often work as part of a team, especially during busy periods. They should be able to collaborate with other cashiers and store staff to ensure a smooth and efficient checkout process. Being proactive and offering assistance to colleagues when needed is highly valued in this role.Requirements:- High school diploma or equivalent qualification is usually required.- Previous cashier or customer service experience is preferred.- Excellent numerical skills and ability to handle cash accurately.- Strong attention to detail and highly organized.- Good communication and interpersonal skills.- Ability to work in a fast-paced environment and handle multiple transactions simultaneously.- Familiarity with electronic payment systems and cash registers.- Basic computer skills and familiarity with relevant software.- Honest, trustworthy, and able to maintain confidentiality.A cashier's role requires a balance of technical skills in handling cash and card transactions, along with exceptional customer service skills. Cashiers contribute to creating a positive shopping experience for customers by ensuring efficient and accurate financial transactions.。

薪酬管理外文文献翻译The existence of an agency problem in a corporation due to the separation of ownership and control has been widely studied in literatures. This paper examines the effects of management compensation schemes on corporate investment decisions. This paper is significant because it helps to understand the relationship between them. This understandings allow the design of an optimal management compensation scheme to induce the manager to act towards the goals and best interests of the company. Grossman and Hart (1983) investigate the principal agency problem. Since the actions of the agent are unobservable and the first best course of actions can not be achieved, Grossman and Hart show that optimal management compensation scheme should be adopted to induce the manager to choose the second best course of actions. Besides management compensation schemes, other means to alleviate the agency problems are also explored. Fama and Jensen (1983) suggest two ways for reducing the agency problem: competitive market mechanisms and direct contractual provisions. Manne (1965) argues that a market mechanism such as the threat of a takeover provided by the market can be used for corporate control. "Ex-post settling up" by the managerial labour market can also discipline managers and induce them to pursue the interests of shareholders. Fama (1980) shows that if managerial labour markets function properly, and if the deviation of the firm's actual performancefrom stockholders' optimum is settled up in managers' compensation, then the agency cost will be fully borne by the agent (manager).The theoretical arguments of Jensen and Meckling (1976) and Haugen and Senbet (1981), and empirical evidence of Amihud andLev (1981), Walking and Long (1984), Agrawal and Mandelker (1985), andBenston (1985), among others, suggest that managers' holding of common stock and stock options have an important effect on managerial incentives. For example, Benston finds that changes in the value of managers' stock holdings are larger than their annual employment income. Agrawal and Mandelker find that executive security holdings have a role in reducing agency problems. This implies that the share holdings and stock options of the managers are likely to affect the corporate investment decisions. A typical management scheme consists of flat salary, bonus payment and stock options. However, the studies, so far, only provide links between the stock options and corporate investment decisions. There are few evidences that the compensation schemes may have impacts on thecorporate investment decisions. This paper aims to provide a theoretical framework to study the effects of management compensation schemes on the corporate investment decisions. Assuming that the compensation schemes consist of flat salary, bonus payment, and stock options, I first examine the effects of alternative compensation schemes on corporate investment decisions under all-equity financing. Secondly, I examine the issue in a setting where a firm relies on debt financing. Briefly speaking, the findings are consistent with Amihud and Lev's results.Managers who have high shareholdings and rewarded by intensive profit sharing ratio tend to underinvest.However, the underinvestment problem can be mitigated by increasing the financial leverage. The remainder of this paper is organised as follows. Section II presents the model. Section HI discusses the managerial incentives under all-equity financing. Section IV examines the managerial incentives under debt financing. Section V discusses the empirical implications and presents the conclusions of the study.I consider a three-date two-period model. At time t0, a firm is established and goes public. There are now two kinds of owners in the firm, namely, the controlling shareholder and the atomistic shareholders. The proceeds from initial public offering are invested in some risky assets which generate an intermediate earnings, I, at t,. At the beginning, the firm also decides its financial structure. A manager is also hired to operate the firm at this time. The manager is entitled to hold a fraction of the firm's common stocks and stock options, a (where0<a<l), at the beginning of the first period. At time t,, the firm receives intermediate earnings, denoted by I, from the initial asset. At the same time, a new project investment is available to the firm. For simplicity, the model assumes that the firm needs all the intermediate earnings, I, to invest in the new project. If the project is accepted at t,, it produces a stochastic earnings Y in t2, such that Y={I+X, I-X}, with Prob[Y=I+X] = p and Prob[Y=I-X] = 1-p, respectively. The probability, p, is a uniform density function with an interval rangedfrom 0 to 1. Initially, the model also assumes that the net earnings, X, is less than initial investment, I. This assumption is reasonable since most of the investment can not earn a more than 100% rate of return. Later, this assumption is relaxed to investigate the effect of the extraordinarily profitable investment on the results. For simplicity, It is also assumed that there is no time value for the money and no dividend will be paid before t2. If the project is rejected at t,, the intermediate earnings, I, will be kept in the firm and its value at t2 will be equal to I. Effects of Management Compensation Schemes on Corporate Investment Decision Overinvestment versus UnderinvestmentA risk neutral investor should invest in a new project if it generates a positiexpected payoff. If the payoff is normally or symmetrically distributed, tinvestor should invest whenever the probability of making a positive earninggreater than 0.5. The minimum level of probability for making an investment the neutral investor is known as the cut-off probability. The project will generzero expected payoff at a cut-off probability. If the investor invests only in tprojects with the cut-off probability greater than 0.5, then the investor tendsinvest in the less risky projects and this is known as the underinvestment. Ifinvestor invests the projects with a cut-off probability less than 0.5, then tinvestor tends to invest in more risky projects and this is known as thoverinvestment. In the paper, it is assumed that the atomistic shareholders risk neutral, the manager and controlling shareholder are risk averse.It has been argued that risk-reduction activities are considered as managerial perquisites in the context of the agency cost model. Managers tend to engage in these risk-reduction activities to decrease their largely undiversifiable "employment risk" (Amihud and Lev 1981). The finding in this paper is consistent with Amihud and Lev's empirical result. Managers tend to underinvest when they have higher shareholdings and larger profit sharing percentage. This result is independent of the level of debt financing. Although the paper can not predict themanager's action when he has a large profit sharing percentage and the profit cashflow has high variance (X > I), it shows that the manager with high shareholding will underinvest in the project. This is inconsistent with the best interests of the atomistic shareholders. However, the underinvestment problem can be mitigated by increasing the financial leverage.The results and findings in this paper provides several testable hypotheses forfuture research. If the managers underinvest in the projects, the company willunderperform in long run. Thus the earnings can be used as a proxy forunderinvestment, and a negative relationship between earningsandmanagement shareholdings, stock options or profit sharing ratiois expected.As theunderinvestment problem can be alleviated by increasing the financialleverage, a positiverelationship between earnings and financial leverage isexpected.在一个公司由于所有权和控制权的分离的代理问题存在的文献中得到了广泛的研究。

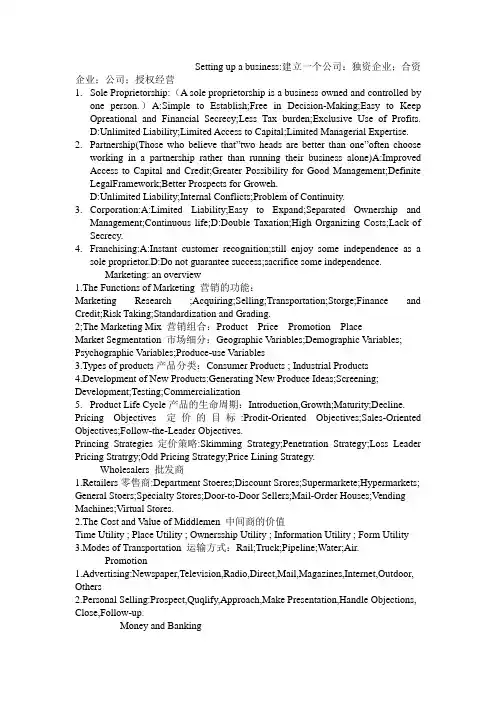

Setting up a business:建立一个公司:独资企业;合资企业;公司;授权经营1.Sole Proprietorship:(A sole proprietorship is a business owned and controlled byone person.)A:Simple to Establish;Free in Decision-Making;Easy to Keep Opreational and Financial Secrecy;Less Tax burden;Exclusive Use of Profits.D:Unlimited Liability;Limited Access to Capital;Limited Managerial Expertise. 2.Partnership(Those who believe that”two heads are better than one”often chooseworking in a partnership rather than running their business alone)A:Improved Access to Capital and Credit;Greater Possibility for Good Management;Definite LegalFramework;Better Prospects for Groweh.D:Unlimited Liability;Internal Conflicts;Problem of Continuity.3.Corporation:A:Limited Liability;Easy to Expand;Separated Ownership andManagement;Continuous life;D:Double Taxation;High Organizing Costs;Lack of Secrecy.4.Franchising:A:Instant customer recognition;still enjoy some independence as asole proprietor.D:Do not guarantee success;sacrifice some independence.Marketing: an overview1.The Functions of Marketing 营销的功能:Marketing Research ;Acquiring;Selling;Transportation;Storge;Finance and Credit;Risk Taking;Standardization and Grading.2;The Marketing Mix 营销组合:Product Price Promotion PlaceMarket Segmentation 市场细分:Geographic Variables;Demographic Variables; Psychographic Variables;Produce-use Variables3.Types of products产品分类:Consumer Products ; Industrial Products4.Development of New Products:Generating New Produce Ideas;Screening; Development;Testing;Commercialization5.Product Life Cycle产品的生命周期:Introduction,Growth;Maturity;Decline. Pricing Objectives 定价的目标:Prodit-Oriented Objectives;Sales-Oriented Objectives;Follow-the-Leader Objectives.Princing Strategies定价策略:Skimming Strategy;Penetration Strategy;Loss Leader Pricing Stratrgy;Odd Pricing Strategy;Price Lining Strategy.Wholesalers 批发商1.Retailers零售商:Department Stoeres;Discount Srores;Supermarkete;Hypermarkets; General Stoers;Specialty Stores;Door-to-Door Sellers;Mail-Order Houses;Vending Machines;Virtual Stores.2.The Cost and Value of Middlemen 中间商的价值Time Utility ; Place Utility ; Ownersship Utility ; Information Utility ; Form Utility 3.Modes of Transportation 运输方式:Rail;Truck;Pipeline;Water;Air.Promotion1.Advertising:Newspaper,Television,Radio,Direct,Mail,Magazines,Internet,Outdoor, Others2.Personal Selling:Prospect,Quqlify,Approach,Make Presentation,Handle Objections, Close,Follow-up.Money and Banking1.Money:portability,divisibility,stability,durability,acceptability.Printed paper纸币,metal coins硬币2.what does money do?medium of exchange,a store of value,a unit of account3.Types of Money钱的分类:M-1:currency,demand deposits,and other checkabledeposits现金,活期存款,支票存款;Time deposits定期存款。

出纳岗位职责英文回答:As a dedicated Cashier, I am responsible for a wide range of duties that ensure the smooth and efficient flow of financial transactions within the organization. My primary role is to handle cash, checks, and credit card payments, ensuring accuracy and compliance with established procedures.One of my key responsibilities is to provide exceptional customer service. I greet customers with a warm and friendly demeanor, addressing their inquiries and resolving any issues promptly and professionally. I am proficient in using various payment systems and point-of-sale (POS) devices, ensuring seamless transactions and minimizing wait times.To maintain the integrity of financial records, I meticulously record all transactions in the appropriateaccounting system. I prepare daily cash reports,reconciling cash drawers and comparing them to sales records. This attention to detail ensures the accuracy and validity of financial data.Furthermore, I am responsible for the safekeeping of cash and other valuables. I adhere to strict security protocols, including counting and verifying cash regularly, maintaining secure storage, and reporting any discrepancies or suspicious activities. I am also trained in handling currency exchange and foreign transactions, providing assistance to customers and ensuring compliance with relevant regulations.In addition to my core responsibilities, I am proactive in identifying and implementing process improvements to enhance efficiency and reduce errors. I participate in regular training and development programs to stay abreast of industry best practices and technological advancements.I am committed to maintaining a professional and ethical demeanor, upholding the organization's values and reputation.中文回答:作为一名尽职尽责的出纳,我负责一系列的工作职责,以确保组织内财务交易的顺畅和高效流动。

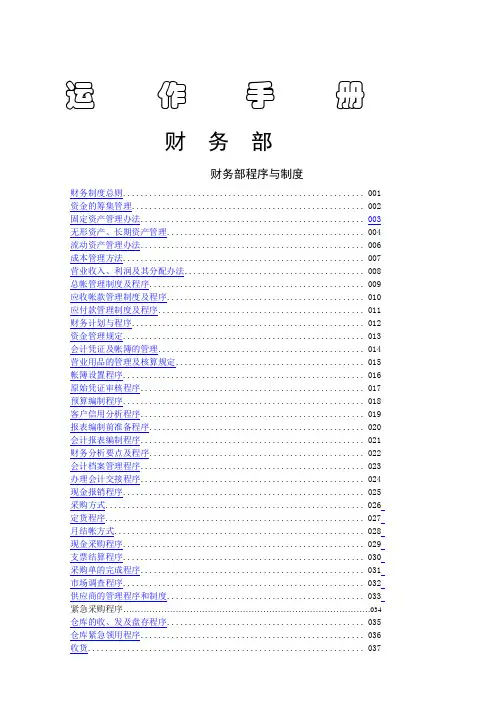

运作手册财务部财务部程序与制度财务制度总则 (001)资金的筹集管理 (002)固定资产管理办法 (003)无形资产、长期资产管理 (004)流动资产管理办法 (006)成本管理方法 (007)营业收入、利润及其分配办法 (008)总帐管理制度及程序 (009)应收帐款管理制度及程序 (010)应付款管理制度及程序 (011)财务计划与程序 (012)资金管理规定 (013)会计凭证及帐簿的管理 (014)营业用品的管理及核算规定 (015)帐簿设置程序 (016)原始凭证审核程序 (017)预算编制程序 (018)客户信用分析程序 (019)报表编制前准备程序 (020)会计报表编制程序 (021)财务分析要点及程序 (022)会计档案管理程序 (023)办理会计交接程序 (024)现金报销程序 (025)采购方式 (026)定货程序 (027)月结帐方式 (028)现金采购程序 (029)支票结算程序 (030)采购单的完成程序 (031)市场调查程序 (032)供应商的管理程序和制度 (033)紧急采购程序 (034)仓库的收、发及盘存程序 (035)仓库紧急领用程序 (036)收货 (037)食品及饮料存货----定价,标志与与贮藏 (038)食品及饮料存货—永续记录 (039)发货、申请领货管理 (040)标准存货 (041)食品及饮料存货—实地盘存程序 (042)食品及饮料存货—餐饮盘存的会计计期间 (043)其他存货—废品或不再使用的项目 (044)食品成本控制程序 (045)食品标准成本计算程序 (046)食品标准成本核算程序 (047)餐饮招待费用程序 (048)菜肴的产销核对程序 (049)酒水标准成本制作程序 (050)饮料成本控制程序 (051)饮料销售还原表建立程序 (052)鲜活食品价格的制订程序 (053)干货水果等验收程序 (054)鲜活食品验收单据填写程序 (055)成本控制部制度 (056)收银员管理制度与程序 (057)审计员管理制度与程序 (058)现金管理制度与程序 (059)收银员有关规定 (060)付款方式的有关规定 (061)收银印章使用的有关规定 (062)转帐支票授理程序 (063)客人离店时间的控制程序 (064)房租减免的内部控制程序 (065)夜间稽核工作程序 (066)信贷政策 (067)预算编制程序 (068)客人损坏酒店财物处理程序 (069)第三方信用卡结帐 (070)员工招待 (071)退还客人的余额 (072)现金短缺/盈余程序 (073)外流资产处理程序 (074)财务部表格培训员每周培训回顾 (075)预收款收据 (076)杂项单 (077)交款袋投入保险箱登记本 (078)调拨单 (079)收银员交款袋 (080)钥匙专用袋 (081)杂项调整单 (082)宴请申请单 (083)折扣单 (084)差旅费报销单 (085)C 目的OBJECTIVE:C 执行程序PROCEDURES:第一章总则第一条为了规定酒店的财务管理,加强财务监督,维护投资者和债权人的合法权益,根据新颁布的财务制度及《旅游、饮食服务企业财务制度》,特制定本办法。

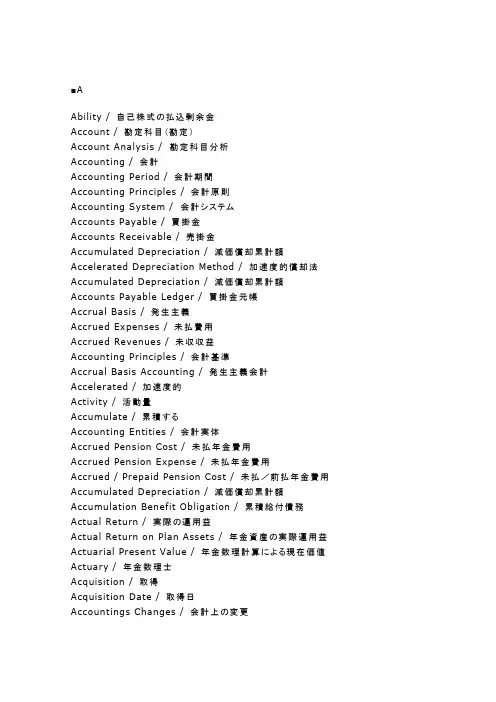

■AAbility / 自己株式の払込剰余金Account / 勘定科目(勘定)Account Analysis /勘定科目分析Accounting / 会計Accounting Period / 会計期間Accounting Principles / 会計原則Accounting System /会計システムAccounts Payable / 買掛金Accounts Receivable / 売掛金Accumulated Depreciation / 減価償却累計額Accelerated Depreciation Method / 加速度的償却法Accumulated Depreciation / 減価償却累計額Accounts Payable Ledger / 買掛金元帳Accrual Basis / 発生主義Accrued Expenses / 未払費用Accrued Revenues / 未収収益Accounting Principles / 会計基準Accrual Basis Accounting / 発生主義会計Accelerated / 加速度的Activity / 活動量Accumulate / 累積するAccounting Entities / 会計実体Accrued Pension Cost / 未払年金費用Accrued Pension Expense / 未払年金費用Accrued / Prepaid Pension Cost / 未払/前払年金費用Accumulated Depreciation / 減価償却累計額Accumulation Benefit Obligation / 累積給付債務Actual Return / 実際の運用益Actual Return on Plan Assets / 年金資産の実際運用益Actuarial Present Value / 年金数理計算による現在価値Actuary / 年金数理士Acquisition / 取得Acquisition Date / 取得日Accountings Changes / 会計上の変更Adjusted Trial Balance / 修正後残高試算表Adjusting Entry / 決算整理仕訳Adjustment / 決算整理Advertising Expense / 広告宣伝費Add / 加算Additions / 受入Administrative Expenses / 一般管理費Additional Paid-in Capital / 資本剰余金Additional Minimum Liability / 追加最小負債Adjusted Trial Balance / 決算整理後試算表Adjustment, Amendment / 修正Additional Paid-in Capital – Common Stock / 普通株式の払込剰余金Adjusted Retroactively / 遡及的修正Additional Paid-in Capital-shock Options Outstanding / 払込剰余金–未行使株式購入選択権Affiliated Group / 関連会社グループAging / 年齢調べAllowance for Uncollectible Accounts / 貸倒引当金Allocation / 配分American Institute of Certified Public Accountants / 米国公認会計士協会Amortization Expense / 償却費Amortization / 償却Amortization of Prior Service Cost / 過去勤務原価の償却Amortize / 償却するAmortized Cost / 償却後のコストAnnual Report / 年次報告書Annual / 年間のAnnuity Due (Annuity in Advance) / 期首(先払い)年金Annual Payments / 毎月の支払額Appropriated Retained Earnings / 優先株式の払込剰余金Appropriated Retained Earnings / 処分済利益剰余金Arm’s Length Transaction / 公正な取引Assets / 資産Asset Gain Deferred / 資産運用益の繰延At Contract Completion / 工事完成時点Audit / 監査Average unit cost / 総平均単価Average Cost / 平均単価Average Method / 平均法Average Rate of Return on Plan Assets / 年金資産の運用益の平均利率Average Remaining Service period / 平均残存勤務期間Available-for-Sale Securities / その他の(売却可能な)有価証券Average Market Price / 平均市場価格■BBalance Sheet / 貸借対照表Bankruptcy / 倒産Bad Debt Expense / 貸倒損失(貸倒引当金繰入額)Bank Reconciliation Schedule / 銀行勘定調整表Bank Statement / 銀行残高証明書Bankruptcy / 破産Basic Earnings Per Share / 基本的一株当たり利益Base-Year Cost / 基準年度ベースの価格による原価Bargain Purchase Option / 割安価格でのリース資産購入選択権Beginning Inventory / 期首棚卸資産Beginning of Year / 期首Beginning Balance / 期首残高Benefits / 給付金の支払いBeginning Balance of Retained Earnings Originally Reported / 修正前の期首残高Beneficiary / 保険金受取人Billings / 請求Billings on Long-Term Contracts / 長期請求契約の請求Bookkeeping / 簿記Buy, Purchase / 購入Bonds Payable / 社債Bond Discount / 社債のディスカウント(社債発行差金)Bond Premium / 社債のプレミアム(社債発行差金)Bond Investment / 投資社債Bonds / 社債Book Value / 簿価Break-Even Point / 損益分岐点Budget / 予算Buy, Purchase / 購入Buy, Purchase / 購入Business Combinations / 企業結合■CCarry Back / 繰戻Carry Forward / 繰延Cash / 現金Cash Ledger / 現金元帳Cash Payment / 支払Cash Receipt / 入金Cash Basis / 現金主義Cash Basis Accounting / 現金主義会計Capital Budget / 資本予算Capital Expenditures / 資本的支出Capital Stock / 資本金Capitalize / 資産計上Carrying Amount, Book Value / 簿価Cash Budget / 資金予算Cash Dividend / 現金配当Cash Equivalents / 現金等価物Cash Inflows / 資金の流入Cash Outflows / 資金の流出Carrying Value, Book Value / 簿価Capital Lease / キャピタルリースCash Dividends / 現金配当Capital Structure / 資本構成Cash Collection / 現金の回収Ceiling / 上限Chart of Accounts / 勘定科目表Changes in Accounting Estimates / 会計上の見積もりの変更Change in Reporting Entity / 報告主体の変更Changes in Accounting Principle / 会計処理の変更Claims / 請求権Closing / 締切Common Stock / 資本金Company / 会社Compensation / 報酬Composed Interest / 複利Consistency / 継続性Contra account / 相殺勘定Contribution Margin / 貢献利益Controller / コントローラーConversion Costs / 加工費Convertible Bonds / 転換社債Cost Accounting / 原価計算Cost Allocation / 原価配賦Cost of Goods Sold / 売上原価Cost / 取得原価Cost Center / コストセンターCost of Capital / 資本コストCost of Goods Available for Sale / 販売可能商品の原価Cost of Goods Sold / 売上原価Conservatism / 保守主義Cost, Acquisition Cost / 取得原価Cost-Volume-Profit / CVP分析Copyright / 著作権Compensated Absences / 有給休暇Compensation / 補償・報酬Contingencies / 偶発事象Contingent Liabilities / 偶発債務Compounding Feature, Compound Interest / 複利Contract Rate / 契約利率Contributions / 資金の払込みCollection / 回収Contingent Rentals / 偶発賃貸料Contract / 契約Collectibility / 回収の可能性Common Stockholder / 普通株式Compensation Expense / 報酬費Contra Stockholders’ Equity Items / 株主持分のマイナス勘定Contributed Capital / 拠出資本Conversation / 転換Convertible Preferred Stock / 転換優先株Cost Method / 原価法Commercial Paper / コマーシャルペーパーContra Account / マイナス勘定Convertible Bonds / 転換社債Consideration / 対価Consolidations / 連結Cost of Registering and Issuing Equity Securities / 株式の登録および発行にかかる費用Cost of the Investment / 投資額Consolidated Financial Statements / 連結財務諸表Consolidated Balance Sheet / 連結貸借対照表Comparative Financial Statements / 比較財務諸表Common Shares Outstanding / 発行済普通株式数Converted / 転換されたCompleted-Contract Method / 工事完成基準Consigned Goods / 委託販売Consignee / 受託者Consignment / 委託販売Consignment Sales Revenue / 委託販売収益Consignor / 委託者Construction Revenue / 建設収益Construction in Expenses / 建設費用Contract Price / 契約価額Costs to Date / 累計原価Construction in Progress / 建設仮勘定Credit / 貸方Credit Balance / 貸方残Current Assets / 流動資産Current Liabilities / 流動負債Current Year / 当年度Current Year Cost / 期末ベースの価格による原価Cumulavive / 累積的Cumulative Effect of a Change in Accounting Principle / 会計処理の変更による累積的影響額Customer / 顧客・得意先Cumulative Unrecognized Net Loss or Gain / 累積未計上損失額または利益額Current Assets / 流動資産Current Cost / 現在原価Current Liabilities / 流動負債Current Period / 当期Current Tax Liability / 当期税負債Cumulative Preferred Stock / 累積優先株Current Portion / 当期分Cumulative Effect of a Change in Accounting Principle / 会計処理の変更による累積的影響額Current Activity / 当期の活動量■DDate / 日付Damages / 損害賠償Debit / 借方Decrease / 減少Decision Making / 意思決定Depreciation / 減価償却Debit Balance / 借方残Denominator / 分母Depletion / 減耗償却Deposit / 預入Deposits in transit / 未達預金Depreciation Expense / 減価償却費Delivery / 引き渡すDepreciation Method / 減価償却の方法Deferred Pension Cost / 繰延年金費用Defined Benefit Pension Plan / 給付金建年金費用Deficiency / 欠陥Dealer / 卸業者Defer / 繰延べDeferred Taxes / 税効果会計Deferred Tax Liability / 繰延税負債Deduct / 控除するDeductions / 所得控除Deferred / 繰延べるDeferred Compensation Expense / 繰延報酬費Debt Securities / 債券Delivering / 発送Deferred Portion / 繰延分Denominator / 分母Deferred Installment Gross Profit / 繰延割賦売上利益Determinable / 分かっている・決定可能であるDeferred Tax Asset / 繰延税資産Differences / 差異Direct Costs / 直接費Direct-Labor Costs / 直接労務費Direct-Material Costs / 直接材料費Direct Financing Lease / 直接金融型リースDisbursement / 支払Disclosure / 開示Discount Rate / 割引率Discontinued Operations / 非継続事業項目Disposal Date / 処分日Discount / ディスカウントDiscount Issue / ディスカウント発行(割引発行)Dividends / 配当金Dividend Income / 配当利益Dividends Payable / 未払配当金Direct Approach / 直接法Direct Control / 直接支配Direct Cost / 直接費Differential / 差額Diluted Basis Earnings Per Share / 希薄化後一株あたり利益Dilutive / 希薄性のあるDiscontinued Operations / 非継続事業項目Discount on Note Payable / 借入金のディスカウントDiscount on Note Receivable / 貸付金のディスカウントDouble-Entry Bookkeeping / 複式簿記Double-Declining Balance / 二倍定率法Dollar Value LIFO / ドル価値後入先出法Double Declining Balance Method / 二倍定率法Due / 満期During Construction / 工事の間■EEarning Per Share / 一株当たりの利益Economic Value Added / 経済的付加価値Effective Interest Method / 実効利息法Effective Rate / 実効利子率Efficiency Variance / 能率差異Eliminating Entry / 消去仕訳Employees / 従業員Employee / 従業員Employer / 雇用主Ending Balance / 期末残高Ending Inventory / 期末棚卸資産End of Year / 期末Entity / 実体Equipment / 設備Equity / 株式Equity financing / 株式発行による資本調達Equity Method / 持分法Equivalent / 等しいEquivalent Units / 換算量Error Correction / 過年度損益項目Estate Tax / 相続税Estimated Gain / 見積利益Estimated Tax Payments / 予定納税Estimated Loss / 見積損失Estimate / 見積るEstimated Warranty Expense / 製品保証費Estimated Cost to Complete / 工事完成までの見積原価Estimated Profit / 見積利益Expected Return / 予想運用益Excess / 超過分Exclusions / 非課税Executory Cost / 履行費用Exercise Date / 行使する日Expected Cost / 予定原価Expected Useful Life 予想耐用年数Expenditures / 支出Expenses / 費用Extraordinary Items / 特別損益項目Exercise / 行使Exercise Price / 権利行使価格Expected Profit / 予想利益■FFace Value / 額面Fair Value of Plan Assets / 年金資産の公正価値Fair Market Value of Leased Assets / リース資産の公正市場価格Fair Market Value / 公正市場価格Face Value of Bonds / 社債の額面Fair Value / 時価Face Value, Par / 額面Face Value, Face Amount / 額面Favorable Expense Variance / 有利費用差異Free Rent / 賃貸料無料Financial Accounting /財務会計Financial Budget / 財務予算Financial Institutions / 金融機関Financial statements / 財務諸表Financial Position / 財政状態Financing Activities / 財務活動Finished goods / 完成品First-in, First-out : FIFO / 先入先出法Fiscal year / 会計年度Fixed Assets / 固定資産Fixed Cost / 固定費Flexible Budget / 変動予算Floor / 下限Foreign Currency Transactions / 外貨建取引Foreign Currency Transaction Gain / 為替差益Foreign Currency Transaction Loss / 為替差損For a Given Accounting Period / 一会計年度Foreign Currency Losses / 為替差損Foreign Tax Credit / 外国税額控除Freight-in / 仕入運賃Freight-out / 販売運賃Freight / 運賃Future Value / 将来価値Future Value of an Amount / 現在の一定額の将来価値Future Value oh an Ordinary Annuity / 期末年金の将来価値Future Deductible / 将来控除Future Taxable / 将来課税■GGain / 利益Gain and Loss from Sale of Equipment / 設備の売却損益Gain or Loss / 利益または損失Gain on Equity Securities / 持分有価証券益Gain on sale of plant / 固定資産売却益Generally Accepted Accounting Principles (GAAP) / 一般に公正妥当と認められた会計原則General Ledger / 総勘定元帳Gift Tax / 贈与税Goods / 商品Goods Available for Sale / 販売可能な商品原価Goodwill / 営業権Gross Income / 総所得Gross Margin / 売上総利益Gross Profit / 総利益法Gross Profit Percentage / 総利益率Gross Sales / 総売上高Grant Date / 付与日Gross Profit realized on Installment / 割賦実現売上利益Guarantee / 保証するGuaranteed Residual Value / 保証残高価値■HHeld-to-Maturity Securities / 償還まで保有する債券Highly Liquid / 流動性が高いHistrical cost / 取得原価■I“If Converted”Method / 転換仮定方式Improvement / 改良Implicit Interest Rate / リース契約利子率Imprest system / 定額前渡システムIncentives / インセンティブIncome manipulation / 利益操作Income Statement / 損益計算書Income summary account / 損益勘定Income Tax / 所得税Increase / 増加Indirect costs / 間接費Indirect Manufacturing Costs / 製造間接費Insurance Expense / 支払保険料Intangible assets / 無形資産Interest / 利息Interest Expense / 支払利息Interest Revenue / 受取利息Interim Financial Statements / 中間財務諸表Invest Money / 投資Inventory / 棚卸資産Inventory Turnover / 在庫回転率Investment Center / 投資センターInvestments / 投資Invoice / 請求書Inventory Cost / 棚卸資産の取得原価Inventory Valuation Methods / 棚卸資産の評価方法Intangible Asset / 無形固定資産Income Taxes Payable / 未払法人税Income Tax / 法人税Income before Income Taxes / 税引前当期純利益Interest Payable / 未払利息Interest Receivable / 未収利息Income from Continuing Operations / 継続事業利益Intangible Assets / 無形固定資産Inventoriable Costs / 棚卸原価Infrequent in Occurrence / 発生の頻度が低いInsurance/ 保険Inventory Valuation / 棚卸資産の評価方法Interest Payment Date / 利払日Investor / 投資家Initiation / 開始Interest on Projected Benefit Obligation / 予測給付債務の利息Inception / 開始Interest Rate / 利子率Interest Income / 利息収入Income from Investment / 投資利益Intent / 意志Investment Cost / 投資コストInvesting Activities / 投資活動Indirect Control / 間接支配Investment / 投資Intercompany / 連結会社間Intercompany Transactions / 連結会社間取引Investment in Stock 株式投資Income from Continuing Operations / 継続事業利益Income Tax Rate / 法人税率Installment Accounts Receivable / 割賦売掛金Installment Cost of Goods Sold / 割賦売上原価Installment Sales / 割賦販売Installation / 取り付け費Incremental Borrowing Rate / 限界借入利子率Issue Date / 発行日Issue Price / 発行価額Issuer / 発行者Issue, Issuance / 発行Issuing Stock / 株式の発行■JJob-order Costing / 個別原価計算Joint Costs / 結合原価Joint Products / 連産品Journal / 仕訳帳Journal Entry / 仕訳Just-in-time Production System / ジャストインタイム生産システム■KKey Performance Indicators / 重要業績指標■LLabor Time Tickets / 作業時間票Land / 土地Last-in, First-out : LIFO / 後入先出法Layers / 増加額Lawsuit,Litigation / 訴訟Ledger / 元帳Lend Money / 融資Less / 減算Lease / リースLease Bonus / リースボーナスLease Obligation / リース負債Lease Term / リース期間Lease Asset / リース資産Leasehold Improvements / リース物件改良費Lessee / 賃借人Lessor / 賃貸人Lease Receivable / 未収賃貸料Leased Equipment / 貸出し設備Liabilities / 負債Liability from Litigation / 訴訟による負債Liability / 負債Life Insurance Premium Income / 支払生命保険料Liability for Compensated Absence / 有給休暇引当金Loan / 貸付金Local Currency / 現地通貨Long-Term Construction Contracts / 長期請負工事Long-Term Investments / 長期投資Long-Term liabilities / 固定負債Loss on abandonment of equipment / 備品廃棄損Loss on Disposal of Discontinued Division / 非継続事業の処分で生じた損失Loss/Gain on Foreign Currency Exchange / 為替差損益Loss on sale of plant / 固定資産売却損Loss from Early Extinguishment of Bond / 社債の早期償還の損失Loss on Disposal / 処分による損失Loss Contingency / 偶発損失Loss from Litigation / 訴訟による損失Loss / 損失Loss on Equity Securities / 持分有価証券損Loss/Gain on Sale of Fixed Assets / 固定資産売却損益Loss from Operations of Discontinued Division / 非継続事業の営業から生じた損失Lower of Cost or Market / 低価法■MMachine / 機械Management / 経営Managerial Accounting / 管理会計Manufacturer / 製造業Margin of Safety / 安全余裕率Marginal Cost / 限界利益Market Value / 時価Market Rate / 市場利子率Market-Related Value / 市場関連価格Markdowns / 値下Markups / 値上Matching principle / 対応の原則Maturity Date / 満期Maturity Value / 満期額Manufacturer / 製造会社Market Price, Market Value / 市場価格Maturity / 満期Merchandise / 商品Method / 方法Measurement Date / 測定日Medical Expense / 医療費Merger / 吸収合併Minimum Lease Payments / 最低リース支払額Minority Interest / 少数株式持分Moving-Average / 移動平均法Moving Expense / 転勤費用Multiple-Step Income statement / 区分損益計算書Municipal Bond Interest Income / 地方債利息収入■NNet balance / 正味残高Net Book Value / 簿価Net Income / 当期純利益Net Loss / 当期純損失Net of Tax / 税引後Net-present-value Method / 正味現在価値法Net Realizable Value / 正味実現可能価額Net sales / 純売上高Net Unrealized Gain and Loss / 未実現利益(損失)Net Cash Flows / 純資金収支額Noncurrent Liabilities / 固定負債Normal Profit / 正常利益Nonphysical / 形のないNo Important Uncertainties / 重要な不確実性がないNonrefundable / 払戻しにならないNormal Selling Price / 通常の売値Noncurrent Assets / 固定資産Nonconvertible / 転換不可能Noncash Transaction / 現金以外の取引Noninterest-Bearing 無利息No par value / 無額面Notes / 借入・貸付の証明書Notes Payable / 借入金Notes Receivable / 貸付金Not sufficient funds checks / 不渡り小切手Number of Units / 個数Numerator / 分子■OObligation / 債務Officer / 会社の役員Officer’s Salaries / 役員報酬On Account / 掛取引One Year Rule / 一年基準On Credit / 信用取引Organizational Expenditure / 創立費Operating Results / 経営成績Opening inventory / 期首在庫Operating Cycle Rule / 正常営業循環基準Operating Expenses / 営業費用Operating Income / 営業利益Operating Lease / オペレーティングリースOperating Results / 経営成績Operating cycle / 営業サイクルOption Price / 購入選択権の価格Option Shares / 購入選択権の株数Operation Activities / 営業活動Opportunity Cost / 機会原価Organization costs / 創立費Original Issuance / 株式の発行時Other Expenses / 営業外費用Other Revenues / 営業外収益Outstanding checks / 未決済小切手Outstanding deposits / 未達預金Outstanding Stock / 流通している株式Outstanding / 流通、発行済Overstated / 過大計上Owners / 所有者■PPaid / 支払ったPar / 額面Parent company / 親会社Par Issue / 額面発行Participating Preferred Stock / 参加優先株Par Value, Face Value / 額面Par Value Method / 額面法Patent / 特許権Pension / 年金Pension Cost / 年金原価Pension Expense / 年金費用Pension Fund / 年金基金Pension Plan / 年金制度Percentage-of-Completion / 工事進行基準Percent of completion / 完成度合Period / 期間Periodic inventory system / 棚卸計算法Perpetual inventory system / 継続記録法Permanent Differences / 永久的差異Petty cash / 小口現金Phase-out Period / 段階的除去期間Physical inventory count / 実地棚卸Plan Assets, Pension Assets / 年金資産Plug / 差額Point-in-time / 一定時点Pooling Accounting Method, Pooling of Interests / 持分プーリング法Portion of Gain Recognized / 一部利益を認識するPosting / 転記Preferential Rights / 優先的な権利Preferred Dividends / 優先株式配当金Preferred Stock / 優先株式Preferred Stockholder / 優先株主Premium / 社債発行差額Premium Issue / 割増発行Prepaid Expenses / 前払費用Prepaid Rent / 前払賃貸料Present Value / 現在価値Present Value of a Future Amount / 将来の一定額の現在価値Present Value of an Annuity Due / 期首年金の現在価値Present Value of an Ordinary Annuity / 期末年金の現在価値Pretax Financial (Book) Income / 税引前利益Principal / 元本Prior Service Cost / 過去勤務原価Probable / 発生の可能性が高いProceeds / 現金受取額Process Costing / 総合原価計算Producing / 生産Product Costs / 製品コストProductive Output / 生産高比例法Product Warranty / 製品保証Profit / 利益Profit Center / 利益センターProfit Plan / 利益計画Profit Recognition / 利益認識Profit Recognized in Previous Periods / 前期までに認識した利益Pro Forma Amounts / 仮の金額Projected Benefit Obligation / 予測給付債務Property / 資産Property, Plant, and Equipment / 有形固定資産Prospectively / 将来的にPromissory notes / 約束手形Purchase Accounting Method / パーチェス法Purchase allowances / 仕入値引Purchase discounts / 仕入割引Purchase Ledger / 仕入元帳Purchase Price / 購入代価Purchase returns / 仕入戻しPurchases / 仕入■QQuarterly Statements / 四半期報告書Quantity Variance / 数量差異■RRange / 範囲Ratio / 比率Raw materials / 材料Real Property Tax / 固定資産税Realization / 実現Realization Principle / 実現主義Realized Loss / 実現損失Realized Profit / 実現利益Reasonably Estimable / 合理的に見積れるReasonably Possible / 可能性があるReceived / 受け取ったRecognition of Sales / 売上の認識Recognize / 認識するRecord / 記入するRefundable / 払戻しになるRemaining Lease Term / 残余リース期間Remote / 可能性がほとんどないRent / 家賃Rent Expense / 支払家賃Rent Payable / 未払家賃Rent Receivable / 未収家賃Rent Revenue / 受取家賃Replacement Cost / 再調達原価Repurchase / 買戻しResidual Value / 残存価値Resold / 再売却Resources 資源Responsibility Center / 責任センターRestate / 修正Results of Operations / 経営成績Retained Earnings / 利益剰余金Retail inventory method / 売価還元法Return on Investment / 投下資本利益率Retroactive Effect / 遡及的影響Revenue Expenditures / 収益的支出Revenues / 収益Reversing entries / 反対仕訳Royalties / ロイヤリティ■SSalaries Expense / 給料Salaries Payable / 未払給料Sales / 売上Sales allowances / 売上値引Sales Budget / 売上予算Sales Commission / 販売手数料Sales discount / 売上割引Sales Forecast / 売上予測Sale-Leaseback / セールリースバックSales Ledger / 売上元帳Sales returns / 売上戻りSales Transaction / 商品売買Sales-Type-Lease / 販売型リースSalvage Value / 残存価額Scrap value / 残存価額Security / 有価証券Security Deposits / 保証金Self-correcting errors / 自動修正される誤謬Sell at par / 額面発行Seller-Lessee / 売主-賃借人Selling Cost / 販売に要するコストSelling Expenses / 販売費Selling Price / 販売価額Serial Bonds / 連続償還社債Service Cost / 勤務原価Service life / 耐用年数Service Period / サービス期間Service Revenue / サービス収益Settle / 解決するSettlement Date / 決済日Settlement Rate / 決済利率Short-Term / 短期Sick Pay / 病気中の賃金の支払いSignificant Influence / 重要な影響力Single interest / 単利Single-Step Income Statement / 無区分式損益計算書Solely for Cash / 現金取引Sold / 販売したSolvency / 支払能力Special Accounts / 特殊勘定Specific Identification / 個別法Spot Rate / 当日為替レートStandard Cost / 標準原価Stated Rate / 表面利率Statement of Cash Flows / キャッシュフロー計算書Statement of Retained Earnings / 利益剰余金計算書Step-down Method / 階梯式配賦法Stock / 株式Stock Dividends / 株式配当Stock Options / 株式購入選択権Stock Splits / 株式分割Stockholder / 株主Stockholders’ Equity / 資本Straight-Line / 定額法Straight-Line Method / 定額法Subsidiary Company / 子会社Subsidiary Ledger / 補助元帳Sum-of-the-Years’ Digits / 級数法Sunk Cost / 埋没原価■TT-account T-account / T勘定Tangible Assets / 有形固定資産Tax / 税金Taxable Income / 課税所得Tax Computation / 税額計算Tax Credits / 税額控除Tax Expense Current / 当期法人税Tax Expense Deferred / 繰延法人税Tax Rate / 税率Temporary Differences / 一時的差異Term Bonds / 一括償還社債Testing / 試用運転費Third Party / 第三者Time Value of Money / 貨幣の時間価値Time Value of Money Tables / 貨幣の時間価値表Title / 所有権Total / 合計Total Assets / 資産合計Total Costs / 総原価Total Current Assets / 流動資産合計Total Current Liabilities / 流動負債合計Total Expect Costs, Total Estimated Costs / 見積総原価Total Expenses / 費用合計Total Liabilities / 総負債額Total Liabilities and Stockholders’ Equity / 負債及び資本合計Total Revenues / 収益合計Total Stockholders’ Equity / 資本合計To the Extent Possible / 可能な限りTrade discount / 業者割引Trademark / 商標権Trading Securities / 短期的な売買を想定する有価証券Transaction / 取引Transfer / 移転Transfer of the Title / 所有権の移転Transportation Fringes / 通勤手当Transportation in / 引取運賃Treasury Bills / 米国財務省短期証券Treasury Stock / 自己株式“Treasury Stock”Method / 自己株式方式Trial Balance / 試算表■UUnadjusted Trial Balance / 修正前残高試算表Unappropriated Retained Earnings / 未処分利益剰余金Uncollectible accounts / 回収不能債権Unearned Interest / 未経過利息Unearned Profit, Deferred Gain, Unearned Gain / 前受利益Unearned Rent / 前受家賃Unearned Rent Revenue / 前受家賃Unearned Revenues / 前受収益Unemployment Compensation / 失業保険Unfavorable Expense Variance / 不利費用差異Unguaranteed Residual Value / 無保証残存価値Unit Cost / 単価Unrealized Loss on Equity Securities / 持分有価証券未実現損Unrealized Profit / 未実現利益Unusual in Nature / 性質が異常Unusual or Infrequent Items / 性質が異常または発生の頻度が低い項目Usage methods / 生産高比例法Useful Life / 耐用年数■VValuation / 評価Valuation Account / 評価勘定Valuation Method / 評価方法Variable Budget / 変動予算Variable Cost / 変動費Variables / 変数Variances / 差異Voucher / 証憑■WWarehousing / 倉庫代Warrant / 新株引受権、ワラントWarranty Liability / 製品保証引当金Weighted Average / 加重平均Weighted-Average / 総平均法Withdrawals / 引出Work-in-process / 仕掛品Work Sheet / 精算表Write Off / 償却するbあ行IFRS・英文会計税務用語●IASC財団IASC Foundation●IRSThe Internal Revenue Service●預け金deposits paid●圧縮記帳deferred tax reserves / reduction entry●圧縮記帳積立金reserve for reduction entry●アドプションadoption●アメリカ合衆国内国歳入庁IRSThe Internal Revenue Service ●売上割戻引当金provision for sales rebates●一時所得occasional income●移動平均法moving-average method●医療費控除medical deduction●印鑑登録証明書certificate of registered seal●印紙税stamp tax●青色申告の承認申請書application for filling form tax returns ●イファースIFRSs●受取手形notes receivable●受取配当金dividends income●受取利息interest income●売上計上モレunderstatement of sales margin, currently taxable●売上計上モレ認容understatement of sales margin, currently taxable in the previous year, currently deductible●売上原価cost of sales●売上債権の増減額decrease (increase) in notes and accounts receivable-trade●売掛金accounts receivable-trade●営業活動によるキャッシュ・フローnet cash provided by (used in) operating activities●営業債権trade receivables●営業債務trade payables●親会社a parent company●親会社株式stocks of parent companyか行IFRS・英文会計税務用語●買掛金accounts payable-trade●会員権membership●開業費business commencement expenses●外形標準課税size-based taxation●会計上の見積もりaccounting estimates●会計方針accounting policies●外国為替レート変動の影響The Effects of Changes in Foreign Exchange Rates●外国税額控除foreign tax credit●解釈指針interpretation●解釈指針委員会SIC : Standing Interpretations Committee●開発費償却amortization of development expenses●加算to add to taxable income●貸倒引当金allowance for doubtful accounts●貸倒引当金繰入超過額excess allowance for doubtful accounts●貸倒引当金戻入額reversal of allowance for doubtful accounts●貸倒損失bad debt loss●カスタマー・ロイヤルティ・プログラムCustomer Loyalty Programmers●課税所得taxable income●課税取引taxable transactions●合併差益merger gain●合併法人the surviving company●可能性が高いprobable●株券share certificates●株式会社kabushikigaisha (joint-stock corporation)●株式交付費stock issuance cost●株式報酬Share-based Payment●株主資本shareholders' equity●株主名簿register of shareholders●借入費用Borrowing Costs●仮受消費税等suspense receipt of consumption taxes●仮払金suspense payments●仮払経理tentative payment based on estimated amount●為替換算調整勘定foreign currency translation adjustment●簡易課税制度simplified tax system●関係会社売掛金accounts receivable from subsidiaries and affiliates-trade●関係会社株式stocks of subsidiaries and affiliates●関係会社短期借入金short-term loans payable to subsidiaries and affiliates●関係会社長期借入金long-term loans payable to subsidiaries and affiliates●関連会社affiliated companies●関連会社に対する投資Investments in Associates●関連当事者についての開示Related Party Disclosures●機械及び装置machinery and equipment●企業会計基準委員会ASBJ(Accounting Standards Board of Japan)●企業結合Business Combinations●基準諮問会議The Standards Advisory Council●規則主義rules-based●基礎控除basis deduction●寄附金控除contribution deduction●キャッシュ・フロー計算書statement of cash flows●給与支払事務所等の開始等届出書tax report for commencement of payroll●給与所得employment income●給与所得控除employment income deduction●教育訓練費の税額控除tax credit for staff training expenses●共同支配企業Jointly Controlled Entities●共同支配投資企業による非貨幣性資産の拠出Non-Monetary Contributions by Ventures ●銀行勘定調整表bank reconciliation●均等割equalization tax●勤労学生控除working student deduction●金融資産financial assets●金融商品financial instruments●金融商品に関する開示の改善Improving Disclosures about Financial Instruments●金融負債financial liabilities●偶発資産contingent assets●偶発債務contingent liabilities●組込デリバティブEmbedded Derivatives●組込デリバティブの再査定Reassessment of Embedded Derivatives●区(市町村)民税ward (municipal) tax●区(市町村)民税ward (municipal) inhabitant tax●繰延税金資産deferred income tax assets●繰延税金資産deferred income tax liabilities●繰延資産deferred assets●繰延ヘッジ損益deferred gains or losses on hedges●継続関与continuing involvement●継続企業going concern●契約にリースが含まれているか否かの判断Determining whether an Arrangement contains a Lease●原価差異cost variance●減価償却資産の償却方法の届出書application for depreciation method of depreciable fixed assets●減価償却累計額accumulated depreciation●現金及び現金同等物cash and cash equivalents●現金主義cash basis●現在価値present value●現在原価current cost / replacement cost●健康保険health insurance●健康保険・厚生年金保険の新規適用届report of the new application for health insurance / welfare pension insurance●健康保険・厚生年金保険の被保険者資格取得届report of insured person for health insurance / welfare pension●現在の債務present obligation●原材料raw materials●源泉所得税の納期の特例の承認に関する申請書application for payment of withholding income tax on a semiannual●源泉所得税の納付書payment slip for withholding income tax●源泉徴収義務obligation to withholding income tax●源泉徴収義務者an employer who is obliged to withholding income tax●源泉徴収対象to be subject to withholding income tax●原則主義principles-based●減損impairment●現物出資contribution in kind●交際費損金不算入額entertainment expenses, not deductible (excess entertainment expenses) ●工事契約Construction Contracts●厚生年金保険料welfare insurance premium●構築物structures●公的年金控除額deduction for government pensions●後発事象Events After the Reporting Period●鉱物資源の探査及び評価Exploration for and Evaluation of Mineral Resources●顧客からの資産の移転Transfers of Assets from Customers●国外源泉所得foreign source income●国際会計基準委員会(IASC)財団The International Accounting Standards Committee Foundation●国際会計基準審議会IASB : International Accounting Standards Board●国際財務報告解釈指針委員会IFRIC : International Financial Reporting Standards●国際財務報告基準IFRSs : International Financial Reporting Interpretations Committee●国際財務報告基準の初度適用First-time Adoption of International Financial Reporting Standards●国内源泉所得domestic source income●固定資産除却損loss on retirement of noncurrent assets●固定資産税fixed assets tax●固定資産廃棄損loss on abandonment of noncurrent assets●固定資産売却損loss on sales and retirement of noncurrent assets●固定負債noncurrent liabilities●個別法specific identification method●雇用保険料employee insurance premium●コンバージェンスconvergenceさ行IFRS・英文会計税務用語●財産目録Breakdown of assets and liabilities●財政状態計算書statement of financial position●最終仕入原価法most recent purchase method●財務諸表の作成及び表示に関する概念フレームワーク。

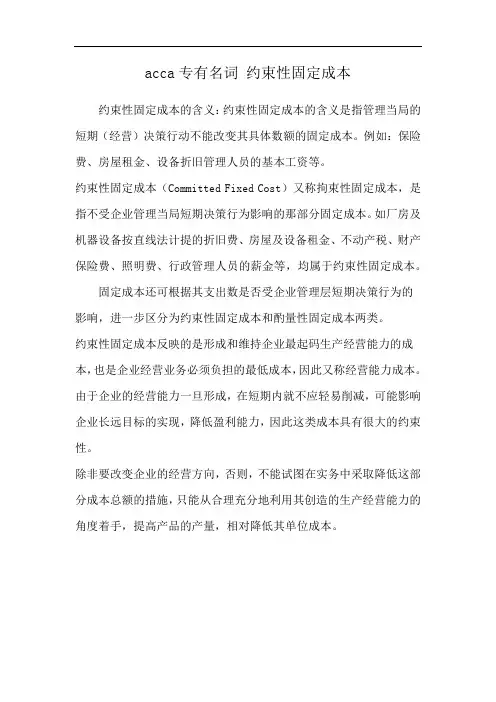

acca专有名词约束性固定成本

约束性固定成本的含义:约束性固定成本的含义是指管理当局的短期(经营)决策行动不能改变其具体数额的固定成本。

例如:保险费、房屋租金、设备折旧管理人员的基本工资等。

约束性固定成本(Committed Fixed Cost)又称拘束性固定成本,是指不受企业管理当局短期决策行为影响的那部分固定成本。

如厂房及机器设备按直线法计提的折旧费、房屋及设备租金、不动产税、财产保险费、照明费、行政管理人员的薪金等,均属于约束性固定成本。

固定成本还可根据其支出数是否受企业管理层短期决策行为的

影响,进一步区分为约束性固定成本和酌量性固定成本两类。

约束性固定成本反映的是形成和维持企业最起码生产经营能力的成本,也是企业经营业务必须负担的最低成本,因此又称经营能力成本。

由于企业的经营能力一旦形成,在短期内就不应轻易削减,可能影响企业长远目标的实现,降低盈利能力,因此这类成本具有很大的约束性。

除非要改变企业的经营方向,否则,不能试图在实务中采取降低这部分成本总额的措施,只能从合理充分地利用其创造的生产经营能力的角度着手,提高产品的产量,相对降低其单位成本。

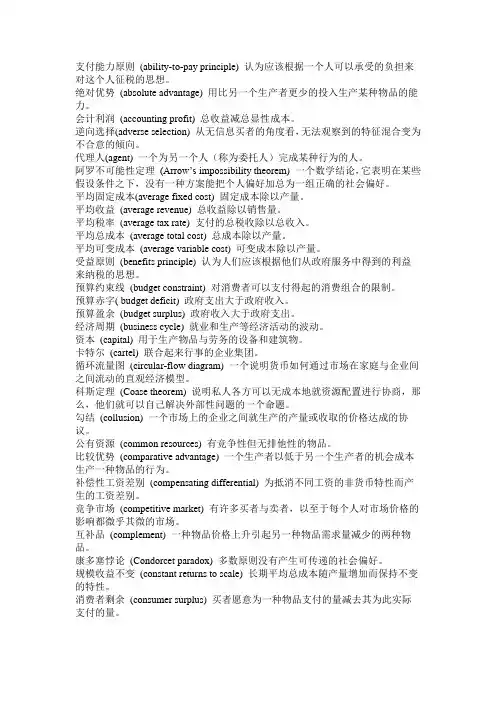

支付能力原则(ability-to-pay principle) 认为应该根据一个人可以承受的负担来对这个人征税的思想。

绝对优势(absolute advantage) 用比另一个生产者更少的投入生产某种物品的能力。

会计利润(accounting profit) 总收益减总显性成本。

逆向选择(adverse selection) 从无信息买者的角度看,无法观察到的特征混合变为不合意的倾向。

代理人(agent) 一个为另一个人(称为委托人)完成某种行为的人。

阿罗不可能性定理(Arrow’s impossibility theorem) 一个数学结论,它表明在某些假设条件之下,没有一种方案能把个人偏好加总为一组正确的社会偏好。

平均固定成本(average fixed cost) 固定成本除以产量。

平均收益(average revenue) 总收益除以销售量。

平均税率(average tax rate) 支付的总税收除以总收入。

平均总成本(average total cost) 总成本除以产量。

平均可变成本(average variable cost) 可变成本除以产量。

受益原则(benefits principle) 认为人们应该根据他们从政府服务中得到的利益来纳税的思想。

预算约束线(budget constraint) 对消费者可以支付得起的消费组合的限制。

预算赤字( budget deficit) 政府支出大于政府收入。

预算盈余(budget surplus) 政府收入大于政府支出。

经济周期(business cycle) 就业和生产等经济活动的波动。

资本(capital) 用于生产物品与劳务的设备和建筑物。

卡特尔(cartel) 联合起来行事的企业集团。

循环流量图(circular-flow diagram) 一个说明货币如何通过市场在家庭与企业间之间流动的直观经济模型。

科斯定理(Coase theorem) 说明私人各方可以无成本地就资源配置进行协商,那么,他们就可以自己解决外部性问题的一个命题。

Minimum Wages and Employment论文总结1.论文动机本文主要研究的是最低工资率的变化这项政策对雇用率的影响,尤其是对商店企业层面的雇用率影响。

从政府角度,本论文的研究可以为以后采取类似措施提供参考,是否能达到政策预期的目的;从企业角度,可以分析该项政策对自身企业是否有影响,以及行业内部是如何针对措施做出反映,利于企业改变经营策略。

关于这个问题,Richard A.Lester(1960,1964)的传统经济理论预测:最低工资的上升会使处于完全竞争市场的雇主削减雇佣量。

Lawrence F.Katz和Krueger (1992)、Card(1992)、Stephen Machin和Alan Manning(1994)也得到了相似的结论。

在研究过程中,还参考了Katz和Krueger(1992)针对麦当劳餐厅研究的结论,以及一些估计结果与本文的估计结果作比较,推测出结论。

为了研究这个问题,本文主要采用的是双重差分的方法,以实验组合对照组之差来消除经济周期所带来的影响,以提升最小工资法案生效前后各项指标之差来消除原有的组别之间的差距,在克服了系统性差异和内生性后,进行回归分析,这就是双重差分。

这样做到好处是可以避免时间等其他因素对实验组结果产生影响。

2.实证研究策略(1)样本选择本文的样本选择非常严谨,选择新泽西作为实验组不仅符合实验要求,而且可以剔除很多的外生因素。

原因有三个:首先,新泽西当时的经济和政治环境,失业率在上升。

可以排除经济上涨趋势可能掩盖更高的最低工资所产生的效果。

其次,新泽西州和宾夕法尼亚的地理位置,导致新泽西既是一个独立体又和宾夕法尼亚经济环境、雇佣周期模式类似,可以作为对比,并且剔除周期效应。

第三,收集了上涨之前(1992.2-3)和上涨之后的7-8个月(1992.11-12)的数据,我们拥有企业的完全的信息并且在我们的分析中考虑关门企业的雇佣量的变化。

我们因此在平均雇佣量的基础上衡量最低工资的所有影响,并且不仅仅是它对现存公司的影响。

regular employment 香港雇佣类型-回复什么是常规雇佣(Regular Employment)?在香港,常规雇佣是指根据劳动法和雇佣协议,雇主与雇员之间达成的具有固定工作时间、薪资制度和福利保障的雇佣关系。

在这种雇佣类型中,雇员被视为雇主的固定成员,享有法定的工作权益和福利。

第一部分:劳动法和雇佣协议在香港,劳动法是保护雇员权益的基石。

根据劳动法的规定,雇员享有工资支付、工作时间、年假、病假、产假、离职和解雇程序等基本权益。

劳动法的实施确保雇员在雇佣关系中得到公正对待。

另外,雇主和雇员之间的雇佣协议也是常规雇佣的重要组成部分。

雇佣协议是雇主和雇员之间达成的书面合同,明确规定工作职责、薪资水平、工作时间、离职通知期限以及其他关于雇佣关系的重要条款。

这个协议对双方具有法律约束力。

第二部分:工作时间和薪资制度在香港的常规雇佣中,工作时间是受到法律规定的。

根据劳动法,每周工作时间不得超过48小时,每天工作时间不得超过10小时。

此外,雇主必须按规定支付加班工资,以补偿雇员加班所付出的努力。

薪资制度是常规雇佣的核心。

在香港,雇佣协议中应明确约定实际工资、工资支付周期和支付方式。

通常,雇员会按月支付工资,但也有一些行业按周或按日支付工资。

此外,香港雇佣法还规定了最低工资水平,以确保雇员获得基本的经济保护。

随着社会经济的发展,香港的最低工资标准会定期进行调整,以适应生活成本的变化。

第三部分:福利保障在香港的常规雇佣中,雇主还必须为雇员提供一定的福利保障。

根据劳动法,雇主应当购买雇员工伤保险,以保障雇员在工作期间发生意外伤害时的经济赔偿。

此外,雇主还应为雇员购买社会保险,包括医疗保险和退休金等。

此外,雇主还可能提供其他福利待遇,如年终奖金、雇员旅游、员工股权激励计划等。

这些福利将根据雇主的政策和经济状况而有所不同。

第四部分:雇员权益保障在香港,雇员享有一系列的权益保障机制,以确保其在常规雇佣中的权益得到维护。

Bellman-Ford算法思想Bellman-Ford算法能在更普遍的情况下(存在负权边)解决单源点最短路径问题。

对于给定的带权(有向或无向)图G=(V,E),其源点为s,加权函数w是边集 E 的映射。

对图G运行Bellman-Ford算法的结果是一个布尔值,表明图中是否存在着一个从源点s可达的负权回路。

若不存在这样的回路,算法将给出从源点s到图G的任意顶点v的最短路径d[v]。

Bellman-Ford算法流程分为三个阶段:(1)初始化:将除源点外的所有顶点的最短距离估计值d[v]←+∞, d[s] ←0;(2)迭代求解:反复对边集E中的每条边进行松弛操作,使得顶点集V中的每个顶点v的最短距离估计值逐步逼近其最短距离;(运行|v|-1次)(3)检验负权回路:判断边集E中的每一条边的两个端点是否收敛。

如果存在未收敛的顶点,则算法返回false,表明问题无解;否则算法返回true,并且从源点可达的顶点v的最短距离保存在d[v]中。

算法描述如下:Bellman-Ford(G,w,s) :boolean //图G ,边集函数w ,s为源点1 for each vertex v∈V(G)do //初始化1阶段2 d[v]←+∞3 d[s] ←0; //1阶段结束4 for i=1 to |v|-1 do //2阶段开始,双重循环。

5 for each edge(u,v)∈E(G) do //边集数组要用到,穷举每条边。

6 If d[v]> d[u]+ w(u,v) then //松弛判断7 d[v]=d[u]+w(u,v) //松弛操作2阶段结束8 for each edge(u,v)∈E(G) do9 If d[v]> d[u]+ w(u,v) then10 Exit false11 Exit true下面给出描述性证明:首先指出,图的任意一条最短路径既不能包含负权回路,也不会包含正权回路,因此它最多包含|v|-1条边。

出纳的岗位职责英语描述The position of a cashier entails a range ofresponsibilities and duties within an organization. Cashiers are primarily responsible for managing financial transactions, ensuring accuracy, and providing excellent customer service. The following is a detailed description of the cashier's job responsibilities:1. Cash Handling: Cashiers are responsible for accepting cash payments from customers and accurately counting and verifying it. They must also make change and balance their cash drawer at the beginning and end of each shift.2. Point of Sale (POS) System: Cashiers operate the organization's POS system for processing customer transactions. They scan or enter merchandise and ensure that the correct prices are applied. They also process refunds and exchanges as necessary.4. Financial Documentation: Cashiers are responsible for maintaining accurate financial records. They create and issue receipts, invoices, and reconcile sales transactions. Cashiers also ensure that all financial transactions are properly recorded in the accounting system.5. Inventory Management: Cashiers play a role in managing the inventory of the organization. They monitor stock levels,notify the appropriate personnel when items need to be reordered, and ensure that shelves are adequately stocked. Cashiers also conduct periodic inventory counts to verify accuracy.6. Security and Fraud Prevention: Cashiers are responsiblefor safeguarding cash and ensuring the security of the work area. They follow proper cash handling procedures to minimize the risk of theft or fraud. Cashiers may also monitor security cameras to deter theft.9. Training and Development: Cashiers may assist in training new employees or providing guidance to team members. They stay updated on product knowledge, POS system updates, and changes in policies or procedures.10. Administrative Tasks: Cashiers may be responsible for performing various administrative tasks, such as filing documents, organizing records, and preparing reports. They must maintain confidentiality in handling sensitive information.。

【法语会计词汇】会计词汇_会计主管轮岗总结作为会计主管,我在过去的一段时间里轮岗到了不同的会计部门,积累了丰富的经验和知识。

以下是我在轮岗期间学到的一些会计词汇。

1. 资产负债表(bilan actif-passif):会计报表的一种,用于汇总公司的资产和负债,反映公司的财务状况。

2. 利润表(compte de résultat):会计报表的一种,用于汇总公司的收入和支出,计算公司的利润。

3. 现金流量表(tableau de flux de trésorerie):会计报表的一种,用于记录公司的现金流动情况,包括现金的来源和去向。

4. 库存(stock):公司持有的商品或材料的数量和价值。

5. 应收账款(créances clients):公司应收的客户欠款。

7. 折旧(dépréciation):用于衡量固定资产价值减少的过程。

8. 摊销(amortissement):将某项支出按照一定比例分配到多个会计期间的过程。

9. 利润率(taux de rentabilité):公司的利润与销售额之比,用于衡量公司的盈利能力。

10. 应计费用(charges à payer):已产生但尚未支付的费用。

12. 管理会计(comptabilité de gestion):用于帮助管理者做出决策的会计方法和技术。

13. 成本核算(analyse des coûts):计算和分析产品或服务的成本和利润。

14. 现金流量(flux de trésorerie):公司在一定时间内收到和支付的现金。

15. 固定资产(immobilisations corporelles):公司在生产经营中长期使用的资产。

16. 清算(liquidation):将公司的财产变现以偿还债务或分配股东权益的过程。

18. 管理费用(charges de gestion):公司运营中用于管理和行政支出的费用。

International Business Law TermsA Note on the Incoterms (国际贸易术语通则解释)Absolute Advantage( 亚当 .斯密的绝对优势理论)Acceptance with Modifications (对邀约做出修改、变更的承诺)Acceptance(承诺 /受盘)Act of State Doctrine (国家行为主义)Act of the Parties (当事人的行为)Administrative Management(经营管理)Advising and Confirming Letters of Credit(信用证的通知和确认)Agent for International Settlements (国际结算代理人)Agreement of the Parties (协议选择原则)Agriculture (农业协定)Alternative Dispute Resolution(ADR解决方式)Anticipatory Breach in Common Law(普通法上预期违约)Antidumping Authority(反倾销机构)Applicability of the CISG (CISG的适用范围)Application of Home State Labor Laws Extraterritorially(内国劳工法律域外适用)Applying for a Letter of Credit(信用证的申请)Approval of Foreign Investment Applications(外国投资申请的批准)Arbitrage (套汇)Arbitration Agreement and Arbitration Clauses(仲裁协议和合同中的仲裁条款)Arbitration Tribunals (仲裁机构)Artistic Property Agreements (文学艺术品产权协定)Assignment (合同权利转让)Attorney-General (法律总顾问)Automatic Dissolution(自动散伙)Average Clauses(海损条款)Avoidance (解除)Bank Deposits (银行储蓄)Bases of Income Taxation (所得税的征税依据/基础)Battle of the Forms (形式上的分歧/冲突)Bills of Lading(提单)Branch Banking (银行的分支机构)Business Form and Registered Capital (企业形式和注册资本)Business Forms(商业组织形式)Buyer's Remedies(买方可以采取的救济措施)Carriage of Goods by Air (航空货物运输)Carriage of Goods by Sea and Marine Cargo Insurance (海上货物运输及其保险)Carrier's Duties under a Bill of Lading(在提单运输方式下承运人的责任/义务)Carrier's Immunities (承运人责任/义务的豁免)Cartels (企业联合 /卡特尔 )Categories of Investment Projects (外国投资的项目类别)Charterparties (租船合同)Charterparties by Demise (光船出租合同)China's Fundamental Policies for Encouraging Foreign Investments (中国大陆鼓励外国投资的基本政策)Choosing the Governing Law (准据法的选择)CIF (cost, insurance and freight) (port of destination) (CIF成本\保险费加运费付至指定的目的港)Civil Law ( 民法法系 )Clearance and Settlement Procedures(交换和转让程序)Collection of Documentary Bills Through Banks(银行跟单托收)Commercial Arbitration(国际商事仲裁)Commodity Arrangements (初级产品 /农产品安排)Common Enterprise Liability (企业的一般责任)Common Law ( 普通法系 )Common Procedures in Handling Bills of Exchange(汇票处理的一般程序)Common Stock(股票)Company Taxpayers(公司 /法人企业纳税人)Comparative Advantage( 大卫 .李嘉图的比较优势理论)Comparison of Municipal Legal Systems( 内国法系的比较研究)Compensation for Winding up(清算补偿)Comprehensive Agreements (综合性的协定)Compulsory Licenses (强制许可)Computation of Income (收入计算)Conformity of Goods (与合同约定相符合的货物)Consent to the Jurisdiction of the Host State (给予东道国管辖权的许可/同意)Consideration in Common Law (英美法上的对价)Contemporary International Trade Law (当代国际贸易法)Contract Law for the International Sale of Goods (国际货物销售合同法)Contract Liability of the Agent(代理人的合同义务)Contract Liability of the Principal(委托人的合同义务)Contractual Issues Excluded from the Coverage of CISG (排除在 CISG 适用范围之外的合同问题)Copyrights (著作权 /版权)Council for Trade-Related Aspects of Intellectual Property Rights(与知识产权有关的理事会)Coverage of Tax Treaties (税收条约的覆盖范围)Creation of Agency(代理创立)Creditors of Partners (合伙人的债权人)Currency Crises: The Role of Monetary Policy (金融危机:货币政策的作用与地位)Currency Exchange Obligations of IMF Member States (国际货币基金组织成员国在外汇交易中的义务)Currency Exchange(外汇交易)Currency Support (资金 /财政援助)Custom(习惯)Customs Valuation (海关估价协定)Debt Securities (债券)Decision Making within the WTO(WTO内部决定作出机制)Deficiencies in the GATT 1947 Dispute Process (关税及贸易总协定 1947 争端解决程序的不足)Definite Sum of Money or Monetary Unit of Account(确定货币的总额或者计价的货币单位)Definition and Special Features (定义和特征)Delayed Bills of Lading (提单迟延)Denial of Justice (司法不公)Development Banks(发展银行)Direct Effect (直接效力)Direct Exporting( 直接出口 )Directors' and Officer's Duties to the Corporation (董事和经理 / 首席执行官对公司的义务)Dispute Settlement (争端的解决)Dissolution by Agreement (协议解散)Dissolution by Court Order(依法院令状散伙)Dissolution of the Partnership(散伙)Distribution of Earnings and Recovery of Investments(收入分配和投资回收)Distribution to Shareholders(红利分配权)Doctrine of Imputability (归责原则)Documentary Formalities (文本格式要求)Double Taxation Provision (双重征税的规定)Double Taxation (双重征税)Duress (胁迫行为)Duties of Agent and Principal(代理人和委托人的义务)Duties of Agent to Principal(委托人的义务)Duties of Principal to Agent(代理人、的义务)Duty of Care in Partnership Business (对合伙事务尽心看护义务)Duty of Loyalty and Good Faith(忠诚和诚信义务)Effectiveness of an Offer (邀约 /发盘的效力)Employment Laws in the European Union (欧洲联盟雇佣/ 劳工法)Employment Standards of the Organization for Economic Cooperation and Development (经济合作与发展组织雇佣 /劳工标准)Enforcement of Exchange Control Regulations of IMF Member States (国际货币基金组织成员国对外汇交易管理规则的履行)Enforcement of Foreign Arbitral Awards in the People's Republic of China (在中华人民共和国境内外国仲裁裁决的执行)Enforcement of Foreign Judgment(外国法院判决的执行)Enforcement of Partnership Rights and Liabilities(执行合伙事务的权利和责任)Enforcement of Securities Regulations Internationally(国际证券规则的执行)Environmental Regulation (环境规则)Escape Clause(免责条款)Euro-currency Deposits (欧洲货币储蓄)European Communities - Regime for the Importation, Sale, and Distribution of Bananas (欧洲共同体对于香蕉的进口、销售和分销的管理)European Union Law on Trade in Services (欧洲联盟关于服务贸易的法律)Exceptio non Adimpleti Contractus in Civil Law(大陆法上履行契约之抗辩权)Exceptions (例外)Exclusive Licenses (独占许可)Excuses for Non-performance(不履行的免责)Excuses for Nonperformance (不履行合同的抗辩/借口)Exemptions for New Members from IMF Member State Currency Exchange Obligations (国际货币基金组织新成员国在外汇交易中义务的免除)Export Restrictions ( 出口限制 )Exporting( 出口 )Expropriation (征收)Extraterritorial Application of U. S. Securities Laws(美国证券法域外的适用问题)Failure to Exhaust remedies (没有用尽法律救济)Fault and Causation(过错和因果关系)Finance Ministry (财政部)Finance of International Trade( 国际贸易的结算/ 支付 )Financing Foreign Trade (对外贸易的价金支付)FOB (free on hoard) (port of shipment) (FOB装运港船上交货)Force Majeure Clauses (不可抗力条款)Foreign Investment Guarantees(外国投资的担保)Foreign Investment Laws and Codes (外国投资法)Formal and Informal Application Process (正式和非正式申请程序)Formation of the Contract (合同的成立)Forsed Endorsements(虚假背书)Fraud Exception in Letters of Credit Transaction ( 信用证交易的欺诈例外)Frauds on Bills of Lading (提单欺诈)Fraudulent Misrepresentation (受欺诈的误解)Free Zones(保税区 /自由贸易区)Fundamental Breach(根本违约)GATS Schedules of Specific Commitments (服务贸易总协定减让表中的特别承诺)General Agreement on Trade in Services ( 服务贸易总协定)General Requirements and Rights of the Holder in Due Course (票据持有人的一般要求和权利)General Standards of Performance(履行的一般标准)Geographic Limitations (地区限制)Government Controls over Trade ( 政府对贸易的管制)Government Guarantees(政府担保)Governmental Interest (政府利益原则)Governmental Sources of Capital (官方资金)Grant Back Provisions (回授的规定)Home state Regulation of Multinational Enterprises (本国对跨国企业的管理)Host State Regulation of Multinational Enterprises (东道国对跨国企业的管理)Illegality and Incompetency (行为不合法性与主体不适当资格的认定)IMF "Conditionality"(国际货币基金组织的制约性)IMF Facilities (国际货币基金组织的机制)IMF Operations (国际货币基金组织的运作)IMF Quotas (国际货币基金的份额)Immunities of States from the Jurisdiction of Municipal Courts (国家豁免于内国法院的管辖权)Import-Licensing Procedures (进口许可证程序协定)Income Categories(收入分类)Income Tax Rates(所得税税率)Income Taxes(所得税)Independence Principles and Rule of Strict Compliance (信用证独立原则和单证严格相符规则)Indirect Exporting( 间接出口 )Industrial Property Agreements(保护工业产权的协定)Innocent Misrepresentation (因无知的误解)Inquiry (调查)Insider Trading Regulations (内幕交易规则)Insurance Cover (保险范围)Intellectual Property Right Law(知识产权法)International Center for the Settlement of Investment Disputes(解决投资争端国际中心)International Commercial Dispute Settlement(国际商事争端的解决)International Court of Justice(海牙联合国国际法院)International Factoring(国际保理)International Franchising( 国际特许经营权)International Labor Standards (国际劳工标准)International Licensing Agreement( 国际许可证协议)International Licensing Agreements(国际许可证协定)International Model Law( 国际示范法 )International Organizations( 国际组织 )International Persons(国际法主体)International Rules for the Interpretation of Trade Terms(国际贸易术语解释通则) International Trade Customs and Usages( 国际贸易惯例和习惯)International Treaties and Conventions( 国际条约和公约)International Tribunals(国际法庭)Interpreting of the CISG (CISG的解释)Invitation Offer(要约邀请/要约引诱/询盘)Involuntary Dissolution(非自愿解散)Issuance of Securities(证券发行)Jurisdiction and Venue(管辖权和法院地)Jurisdiction in Civil Cases (民事案件的管辖权)Jurisdiction in Criminal Cases (刑事案件的管辖权)Lack of Genuine Link (缺乏真实的联系)Lack of Nationality (无国籍)Lack of Standing (身份不明)Law Applicable to Letters of Credit(调整信用证的法律)Law of Foreign Investment Enterprises of China(中国的外商投资企业法)Law of the People's Republic of China on Chinese Foreign Contractual Joint Ventures (中华人民共和国中外合作企业法)Law of the People's Republic of China on Chinese Foreign Equity Joint Ventures (中华人民共和国中外合资企业法)Law of the People's Republic of China on Foreign Capital Enterprises (中华人民共和国外资企业法)Legal Characteristics (定义和法律特征)Legal Structure of the WTO(世界贸易组织的法律框架)Legal System of International Business( 国际商事的法律体系)Letters of Credit (L/C) (信用证)Liabilities of Makers, Drawers, Drawees, Endorsers and Accommodation Parties(票据制作人、出票人、付款人、背书人、代发人/担保人的责任)Liability for Environmental Damage(环境损害责任)Liability Limits(承运人责任/义务的限制)Licensing Regulations (许可证制度)Limitations on Foreign Equity (外国投资的资金比例限制)Limitations on the Excuses That Drawers and Makers Can Use to Avoid Paying Off a Billor Note 661 (票据制作人、出票人拒绝付款借口的限制)Liquidated Damages (约定的损害赔偿金)Liquidation(清算)Maintaining Monetary Value (维护币值稳定)精选文库Major Principles of GATT 1994(关税及贸易总协定1947 的主要原则)Marine Insurance Policies and Certificates(海运保险单和证书)Maritime Insurance (海运保险)Maritime Liens(留置权)Means of Delivery (根据交付方式)Mediation (调停 /调解)Membership (成员)Memorandums of Understanding (谅解备忘录)Methods of Investment Contribution (出资方式)Mini-trial(模拟审判方式)Miscellaneous Taxes (混杂的,各种各样的税)Misrepresentation (误解)Mixed Sales (混合销售)Modification of Foreign In vestment Agreements(外国投资协议的修改)Money and Banking( 货币与金融 )Monopoly Control Authority (反垄断机构)Most Significant Relationship (最密切联系原则)Most-favored-nation Treatment(最惠国待遇原则)Movement of Workers (劳工流动)Multilateral Investment Guaranty Programs (多边投资担保计划/安排)Multilateral Trade Agreements (多边贸易协定)Multilateral Trade Negotiations(多边贸易谈判)Multinational Enterprise (跨国企业)Municipal Legal Systems (内国法系)National Foreign Investment Policies (内国的外国投资政策)National Investment Guarantee Programs (内国/国家投资担保计划/安排)National Law( 国内法 )National Monetary Systems (国内金融 / 货币体系)National Treatment(国民待遇原则)Nationality Principle (国籍原则)Negligent (innocent) Misrepresentation (因疏忽的误解)Negotiability of Bills and Negotiability of Notes(可流通的汇票和可流通的本票)Negotiation ( 谈判,议付 )Noncompetition Clauses (限制竞争条款)Nondiscrimination (非歧视原则)Nonimputable Acts (免责行为)Nontariff Barriers to Trade( 非关税贸易壁垒)Nonwrongful Dissolution(非不法原因散伙)Objections (异议)Obligations of the Parties(当事人各方的义务)Obligations of the Seller and the Buyer(买卖双方的合同义务)Offer(要约/发盘)Operation of Law(法律的原因而终止)Operational Reviews (营业审查)Opting In and Out (加入和退出)Organization of the IMF (国际货币基金组织的机构)Overseas Private Investment Corporation (海外私人投资公司的案件)Parent Company(母公司)Passing of Property (产权的转移)Passing of Risk (风险的转移)Patents (专利权)Payable on Demand or at a Definite Time (付款要求或者在指定的付款时间)Payment of the Price(支付价款)Penalties for Noncompliance (对于不遵守法规的处罚)Perils and Losses(保险危险和损失)Persons Immune from Taxation (个人所得税的免除)Piercing the Corporate Veil (普通法上揭开公司的面纱/ 大陆法上公司人格否认原则)Place for Delivery (交付的地点)Post -Termination Relationship (代理终止后的有关问题)Powers during Winding up(合伙人在清算过程中的权力/权利)Practices and Usages(交易习惯和商业惯例)Preemption(先买权 /优先权)Preshipment Inspection (装运前检验协定)Price-Fixing (定价)Private Insurers(私人/商业保险)Private Sources of Capital (私人资金)Products Liability Laws (产品质量法)Promissory Notes (本票)Promoter of International Monetary Cooperation (国际金融合作的促进者)Protection of Natural Resources (自然资源的保护)Protection of Subsidiaries (分支机构的保护制度)Protection of Workers' Rights by the Council of Europe(欧洲理事会关于劳工权利的保护)Protection through Tariffs (关税保护)Proving Foreign Law (外国法的查明)Provisions Governing Trade in Services in the North American Free Trade Agreement (北美自由贸易区协定中关于服务贸易的规定)Quality Controls (质量控制)Quantity and Field-of-Use Restrictions (对数量和使用领域的限制)Recognition and Enforcement of Awards(仲裁裁决的承认和执行)Recognition of Foreign Judgments (外国裁决的承认)Refusal to Exercise Jurisdiction (拒绝执行管辖权)Regional and International Development Agencies (区域性和国际性发展机构)Regional Integration (区域联合)Regional Intergovernmental Regulations on Labor (区域性政府间关于劳工的规定)Regional Intergovernmental Regulations on Trade in Services (关于服务贸易的区域性政府间管理规则)Regional Monetary Systems (区域性金融体系)Regulation of Foreign Workers (外籍员工的的管理规定)Regulation of Pollution (防止污染规则)Relief (救济、赔偿)Remedies Available to Both Buyers and Sellers (买卖双方都可以采取的救济措施)Remedies for Breach of Contract (违反合同的救济)Requests for Specific Performance (要求继续 /特定履行)Residency Principle (居住地原则)Restrictions on Research and Development (对技术研究和发展的限制)Restrictions That Apply after the Expiration of Intellectual Property Rights (知识产权保护期满后应用的限制)Restrictions That Apply after the Expiration of the Licensing Agreement (知识产权使用许可合同期满后应用的限制)Right to Compensation(主张赔偿的权利)Rights and Duties (权利与义务)Rights and Responsibilities of Beneficiaries (收款人 /收益人的权利与义务)Rights and Responsibilities of the Account Party (付款人 /信用证帐户申请人的权利与义务)Rules of Origin (原产地规则)Rules of Private International Law (国际私法规则)Safeguards(保障措施协定)Sanitary and PhytosanitaryMeasures (卫生与植物卫生措施协定)Scope and Coverage of GATT 1947 and GATT 1994 (关税及贸易总协定1947 和 1994文本的调整范围)Screening Foreign Investment Applications (对外国投资申请的筛选/ 审查)Sectoral Limitations (行业 /部门限制)Securities and Exchange Commission (证券交易委员会)Securities Exchanges (证券交易所)Securities Regulations (证券规章)Seller's Obligations (卖方的义务)Seller's Remedies(卖方可以采取的救济措施)Settlement of Disputes between ILO Member States (国际劳工组织成员国之间争端的解决)Settlement of Disputes between Intergovernmental Organizations and Their Employees (政府间国际组织与它的雇员之间争端的解决)Settlement of Disputes in International Tribunals (在国际法庭解决争端)Settlement of Disputes in Municipal Courts(内国法院的争端解决途径)Settlement of Disputes through Diplomacy (通过外交途径解决争端)Settlement of Disputes through Municipal Courts(通过内国法院解决国际商事争端)Shareholders' Inspection and Information Rights (股东的监督和知情权)Shareholders' Lawsuits (股东的诉权)Shareholders' Meetings(股东会议 /大会)Shareholders' Rights and Liabilities(股东的权利和责任)Sharp Practices (欺诈行为)Signed by the Maker or Drawer (票据制作人或者出票人签名)Source Principle (税收发生来源原则)Sources of Corporate Financing (公司资本的来源)Sources of Foreign Investment Law of China(中国外国投资法的渊源)Sources of International Business Law( 国际商法的渊源)Sources of International Law (国际法的渊源)Sources of Investment (投资范围)Sovereign or State Immunity (国家主权豁免)Specialization( 国际分工专门化)Standard of Care(给予外国人的待遇/关照标准 )Start-Up Standards(设立标准)State Responsibility (国家责任)Statements and Conduct of the Parties(当事人的陈述和行为)Statutory Choice-of-Law Provisions(强制选择条款)Structure of the WTO ( WTO 的组织结构)Subordinate Business Structures(商业分支机构)Subsidies and Countervailing Measures (补贴与反补贴措施协定)Supervision of Foreign Investment (外国投资的监管)Supreme Court Decision (最高法院的裁决)Systems for Relief from Double Taxation(避免双重征税的救济体制)Takeover Regulations (接管 /收购规则)Taking Delivery (接受交付)Tariff-based Import Restriction(约束进口关税)Tariffs( 关税 )Tax Avoidance (避税)Tax Evasion (逃税)Tax Incentives ( 税收激励 )Tax Sparing (节税)Tax Treaties (税收条约)Taxation (税收)Taxpayers(纳税人)Technical Barriers to Trade (贸易的技术壁垒)Technology Transfer( 技术转让 )Termination of an Agency(代理的终止)Termination of Corporations(公司的终止)Territorial Restrictions (地区限制)The Acceptance(承诺/受盘)The Administrative Discretion of Screening Authorities(筛选/监管机构的管理权)The Anglo-American Common Law System(普通法系或者英美法系)The Applicable Procedure Law(应用的程序法)The Applicable Substantive Law (应用的实体法)The Bank for International Settlements (巴塞尔国际清算银行)The Bill of Exchange (汇票)The Board of Directors(董事会)The Bretton Woods System (布雷敦森林体系)The Business Form(商业组织形式)The Buyer's Right to Avoid the Contract (买方解除合同的权利)The Central Bank (中央银行)The Choice of Money (货币的选择)The Convention on Insider Trading (内幕交易的公约)The Drafting of the CISG(CISG的起草)the Economic Globalization(经济全球化)The Final Act Embodying the Results of the Uruguay Round of MultilateralTrade Negotiations (乌拉圭回合多边贸易谈判结果的最后文本)The Foreign Exchange Market (外汇交易市场)The Founding of GATT (关税及贸易总协定的成立)The Framework Agreement (协定的框架)The General Agreement on Tariffs and Trade (关税及贸易总协定)The Importance of the Separate Legal Identity of Juridical Entities (跨国企业作为拥有独立法律地位的实体之重要性)The International Labor Organization (国际劳工组织)The International Monetary Fund (国际货币基金组织)The International Standard( 国际待遇 /标准 )The International Transfer of Intellectual Property(工业产权的国际转让)The Islamic Law System (伊斯兰法系)The Law Governing Bills of Exchange(调整汇票的法律制度)The Law of Agency(国际商事代理法)The Making of International Law(国际法的构成)The National Standard( 国民待遇 /标准 )The Negotiation and Transfer of Bills and Notes (票据权利的转让和背书转让)The Obligations of Banks (银行的义务/责任)The Principal Characteristics (基本特征)The Role of Banks in Collecting and Paying Negotiable Instruments (银行在可流通票据的托收和付款中的角色)The Roman-Germanic Civil Law System( 大陆法系或者罗马日耳曼法系)The Scope of International Law in Actual Practice(实践中国际法的范围)The Subordinate Structure (分支结构)The Transfer of Money (货币转移)The Turning Over of Documents (交付与货物有关的单证)The Uruguay Round (乌拉圭回合)The Value of Money (币值)The World Trade Organization (WTO)(世界贸易组织)The WTO Agreement(WTO协定)Third Party Relations of the Principal and the Agent(与委托人和代理人有关的第三人)Third-Party Claims and Personal Injuries (第三方的权利和人身伤害)Third-Party Rights (Himalaya Clause) (第三方的权利---- 喜玛拉亚条款)Time Charterparties(定期租船合同)Time for Delivery(交付的时间)Time Limitations (时效)Trade Barriers (贸易壁垒)Trade in Goods( 货物贸易 )Trade Liberalization Through Cooperation(通过合作实现贸易自由化)Trade Policy Review (贸易政策评审机制)Trade Terms(贸易术语)Trademarks(商标权)Trade-Related Investment Measures (与贸易有关的投资措施协定)Trading in Securities(证券交易)Transactions Covered in CISG ( CISG 适用的交易范围)Transnational Organized Labor (有组织的跨境服务的劳工)Transparency(透明度 )Treaties and Conventions (条约和公约)Trial Court Decision (初等法院的裁决)Turnover Taxes (流转 /交易税)Tying Clauses (搭售条款)Unconditional Promise or Order to Pay (无条件的付款承诺和要求)Unfair Competition Laws (不正当竞争法)UNIDROIT Principles of International Commercial Contracts (PICC)( 国际统一私法协会国际商事合同通则 ,简称 PICC)精选文库United Nations Convention on Contracts for the International Sale of Goods (CISG)( 联合国国际货物销售合同公约 ,简称 CISG)Validity and Formation of International Sale of Contracts(国际货物销售合同的成立和效力)Visas(签证)Voyage Charterparties (航次租船合同)Waivers (让渡、放弃)Winding Up(合伙清算)World Intellectual Property Organization(世界知识产权组织)World Trade Organization Dispute Settlement Procedures (世界贸易组织争端解决机制)Wrongful Dissolution(不法原因散伙)WTO Antidumping Agreement(世界贸易组织反倾销协议)WTO Dispute Settlement Procedures (世界贸易组织的争端解决程序)--21。

【差分约束】Cashier Employment(出纳员的雇佣)Time Limit:1000MS Memory Limit:65536KTotal Submit:2 Accepted:2Description出纳员的雇佣(cashier.pas/c/cpp)【问题描述】Tehran的一家每天24小时营业的超市,需要一批出纳员来满足它的需要。

超市经理雇佣你来帮他解决他的问题——超市在每天的不同时段需要不同数目的出纳员(例如:午夜时只需一小批,而下午则需要很多)来为顾客提供优质服务。

他希望雇佣最少数目的出纳员。

经理已经提供你一天的每一小时需要出纳员的最少数量——R(0), R(1), ...,R(23)。

R(0)表示从午夜到上午1:00需要出纳员的最少数目,R(1)表示上午1:00到2:00之间需要的,等等。

每一天,这些数据都是相同的。

有N人申请这项工作,每个申请者I在没24小时中,从一个特定的时刻开始连续工作恰好8小时,定义tI (0 <= tI <=23)为上面提到的开始时刻。

也就是说,如果第I个申请者被录取,他(她)将从tI 时刻开始连续工作8小时。

你将编写一个程序,输入R(I)(I = 0..23)和tI (I = 1..N),它们都是非负整数,计算为满足上述限制需要雇佣的最少出纳员数目。

在每一时刻可以有比对应的R(I)更多的出纳员在工作。

Input第一行为测试点个数(<= 20)。

每组测试数据的第一行为24个整数表示R(0),R(1),...,R(23)(R(I)<= 1000)。

接下来一行是N,表示申请者数目(0 <= N <= 1000),接下来每行包含一个整数tI (0 <= tI <= 23)。

两组测试数据之间没有空行。

Output对于每个测试点,输出只有一行,包含一个整数,表示需要出纳员的最少数目。

如果无解,你应当输出“No Solution”。

Sample Input11 0 1 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 152322110Sample Output1Hint本题数据不完整,请在本系统测试通过后到/problem?id=1275 提交完整测试!SourceTehran 2000解析1:题意: 一家24小时营业的超市,需要一批出纳员来满足它的需求,该超市在每天的不同时刻需要不同数目的出纳员来为顾客提供服务,现在给出一天里每一小时需要出纳员的最少数量……r[0],r[1],……r[23].r[0]表示从午夜到上午1:00需要出纳员的最少数目等等,每一天这些数据都是相同的,有n个人申请这项工作,每个申请者i在每天24小时中,从某一个特定的时刻开始连续工作恰好8小时,定义t[i(0<=t[i]<=23)为上面提到的开始时刻,也就是说,如果第i个申请者被录用,他将从t[i]时刻开始连续工作8小时.输入r[i]和t[i],计算为满足上述限制需要雇佣的最少出纳员数目.注意在每一时刻可以有比对应的r[i]更多的出纳员在工作.r[0……23]……每个时刻需要的出纳员数目t[0……23]……每个时刻应征的申请者数目求s[0……23]……s[i]表示0……i时刻雇佣的出纳员总数,s[i]-s[i-1]就是i时刻录用的出纳员数目,设s[-1]=0,sum为雇佣的所有出纳员总数,那么一个可行方案应该满足: s[i]-s[i-1]>=0 即在i时刻录用的出纳员数目大于或等于0s[i]-s[i-1]<=t[i] 即在i时刻录用的出纳员数目应该小于在i时刻申请者数目s[23]-s[-1]>=sums[i]-s[j]>=r[i] 此时i>j&&i=(j+8)%24 因为在0……j时刻雇佣的出纳员连续工作8个小时,此时i=j+8很显然需要重新雇佣出纳员且最小为r[i]s[j]-s[i]<=sum-r[i] 此时i<j&&i=(j+8)%24 因为j>i说明可能某一天雇佣的出纳员连续工作8个小时后到了下一天的i时刻,所以从i……j=16+i时刻需要雇佣的出纳员数目最大为sum-r[i]由于sum是未知的,所以可以根据上述约束条件来构造约束图,为方便建图,以0为起点,由于题目要求的是出纳员的最少数目,所以建图后用Bellman_Ford算法求解单源最长路,在这过程中枚举sum,如果途中不存在环且s[24]=sum,那么就找到了一个可行解.将约束条件整理如下:s[i]-s[i-1]>=0s[i-1]-s[i]>= -t[i] i=(1,2 (24)s[24]-s[0]>=sums[i]-s[j]>=r[i] i>j i=(j-1+8)%24+1s[i]-s[j]>=r[i]-sum i<j i=(j-1+8)%24+1Bellman_Ford算法求解最长路,在主程序中枚举sum,就可以得到需要雇佣的出纳员数目的最小值,也可以二分法求解.解析2:设num[ i ]为i时刻能够开始工作的人数,x[ i ]为实际雇佣的人数,设r[ i ]为i 时刻至少需要工作的人数,s[ I ]=x[ 1 ]+x[ 2 ]…+x[ I ]有如下关系:x[ I ]<=num[ I ]x[ I-7 ]+x[ I-6 ]+x[ I-5 ]+x[ I-4 ]+x[ I-3 ]+x[ I-2 ]+x[ I-1 ]+x[ I ]>=r[ I ]0<=s[ I ]-s[ I-1 ]<=num[ I ],1<=I<=24s[I]-s[ I-8 ]>=r[ I ], 8<=I<=24s[ I ]-s[ I+16 ]>=r[ I ]-sum,1<=I<=7s[0]=0s[24]-s[0]>=sum(冯威的论文少了这个条件,看了别人的解题报告,才发现。

想想也是,sum是枚举的当前最小值,s[24]是实际工作的工人,那么其一定大于sum)解析3:用s[i]表示从0时刻到i时刻雇的人的总数,t[i]是在i时刻来应聘的人,ans 为这一天雇佣的总人数,s[-1]=0,很容易得到两个约束:在i时刻的雇佣的人一定之能少于等于t[i],而且一定大于等于0(只是大于等于0,而不能说大于等于R[i] ,因为前面的时刻的人可以流下来到i时刻继续工作)。

就是一个人也不雇.0<=S[i]-s[i-1]<=t[i] => {s[i]-s[i-1] >=0 ; s[i-1]-s[i]>=-t[i]}最后一个小时雇的人肯定要大于等于ans,S[23]>=ans => s[23]-s[-1]>=ans;真正的8个小时的关系体现在这里:从j时刻雇佣的人工作到i时刻已经走了,那么在j+1时刻就必须雇佣大于等于R[i]个人 => s[i]-s[j]>=r[i] (i>j,i=(j+8)%24)&& s[i]-s[j]+ans>=r[i] (i<j,i=(j+8)%24)。

在这些不等式上面建立约束图,而ans事先不知道,先枚举。

如果存在正圈说明ans小了因为存在这样的路 w(0,8)=r[8] ,w(16,0)=r[0]-ans 中间的权时0 ,所以增大ans能避免正圈出现,也就是说如果ans=n的时候还出现正圈的话那么就无解了,二分就是根据这个单调关系写的但是没写出来….程序1:∙var k,sum,i,j,n,m,x,s:longint;∙ a:array[0..1000,1..3] of longint;∙ t,d,r:array[0..25] of longint;∙ can:boolean;∙∙procedure add(x,y,z:longint);∙begin∙ inc(s);∙ a[s,1]:=x; a[s,2]:=y; a[s,3]:=z;∙end;∙∙function Bellman_Ford:boolean;∙var i,j:longint;∙ flag:boolean;∙begin∙ for i:=1 to 24 do d[i]:=-1000000;∙ d[0]:=0;∙ for i:=0 to 24 do begin∙ flag:=true;∙ for j:=1 to s do∙ if d[a[j,2]]<d[a[j,1]]+a[j,3] then begin∙ d[a[j,2]]:=d[a[j,1]]+a[j,3]; flag:=false;∙ end;∙ if flag then break;∙ end;∙ for i:=1 to s do∙ if d[a[i,2]]<d[a[i,1]]+a[i,3] then exit(false);∙ if d[24]=sum then exit(true) else exit(false);∙end;∙∙begin∙ readln(n);∙ for k:=1 to n do begin∙ can:=true;∙ fillchar(a,sizeof(a),0);∙ for i:=1 to 24 do read(r[i]);∙ readln(m);∙ for i:=1 to m do begin∙ readln(x); inc(t[x+1]);∙ end;∙ for sum:=0 to m do begin∙ s:=0;∙ for i:=1 to 24 do begin∙ add(i-1,i,0);∙ add(i,i-1,-t[i]);∙ end;∙ for i:=8 to 24 do add(i-8,i,r[i]);∙ for i:=1 to 7 do add(i+16,i,r[i]-sum); ∙ add(0,24,sum);∙ if Bellman_Ford then begin∙ writeln(sum); can:=false; break;∙ end;∙ end;∙ if can then writeln('No Solution');∙ end;∙end.解析4:详细解释一下。

为避免负数,时间计数1~24。

令:R[i] i时间需要的人数(1<=i<=24)T[i] i时间应聘的人数(1<=i<=24)x[i] i时间录用的人数(0<=i<=24),其中令x[0]=0再设s[i]=x[0]+x[1]+……+x[i] (0<=i<=24),由题意,可得如下方程组:(1) s[i]-s[i-8]>=R[i] (8<=i<=24)(2) s[i]-s[16+i]>=R[i]-s[24] (1<=i<=7)(3) s[i]-s[i-1]>=0 (1<=i<=24)(4) s[i-1]-s[i]>=-T[i] (1<=i<=24)这个差分约束有个特殊的地方,(2)的右边有未知数s[24]。