外贸英语函电实验报告 信用证的申请

- 格式:doc

- 大小:120.50 KB

- 文档页数:10

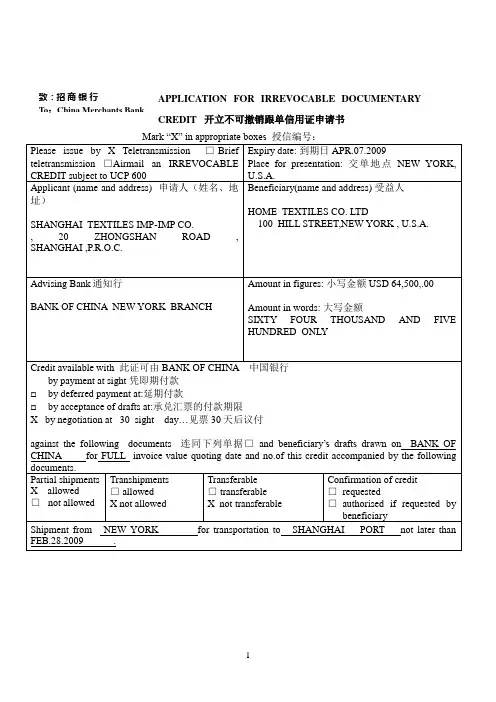

APPLICATION FOR IRREVOCABLE DOCUMENTARY

CREDIT 开立不可撤销跟单信用证申请书

This page is an integral part of the application which consists of the first page, the second page and attachment(s), if any.

CONTRACT NO.: 123456

To be continued on the second page.

DOCUMENTARY CREDIT

page and attachment(s), if any.

申请单位(签章):上海纺织品进出口公司

联系电话:

3

联系人:

2009 年 2 月 4 日

开证行给付款行、承兑行或议付行的指示:

当收到该证项下相符单据时,(开证行)保证在两个工作日内按贵行指令付款。

扣除我行USD80.00的偿付费用。

所有单据应由偿付行于三个工作日内通过快件形式一次发给我们,费用由受益人承担。

请根据以上内容开出SWIFT信用证。

4。

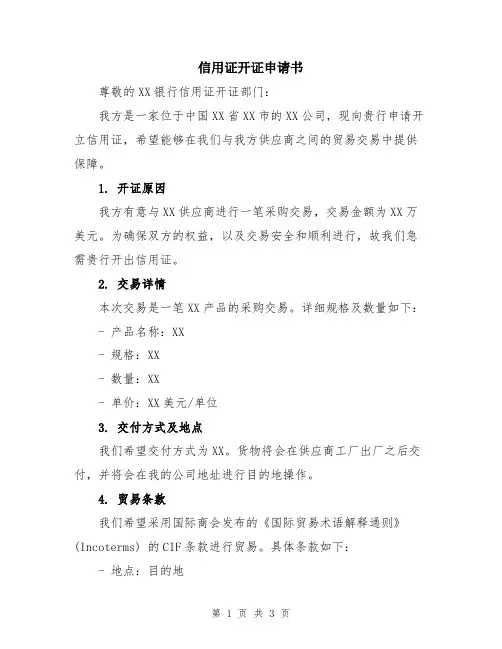

信用证开证申请书尊敬的XX银行信用证开证部门:我方是一家位于中国XX省XX市的XX公司,现向贵行申请开立信用证,希望能够在我们与我方供应商之间的贸易交易中提供保障。

1. 开证原因我方有意与XX供应商进行一笔采购交易,交易金额为XX万美元。

为确保双方的权益,以及交易安全和顺利进行,故我们急需贵行开出信用证。

2. 交易详情本次交易是一笔XX产品的采购交易。

详细规格及数量如下:- 产品名称:XX- 规格:XX- 数量:XX- 单价:XX美元/单位3. 交付方式及地点我们希望交付方式为XX。

货物将会在供应商工厂出厂之后交付,并将会在我的公司地址进行目的地操作。

4. 贸易条款我们希望采用国际商会发布的《国际贸易术语解释通则》(Incoterms) 的CIF条款进行贸易。

具体条款如下:- 地点:目的地- 运输方式:XX- 封装:符合国际运输标准的适用包装- 负责包装的费用和风险,供应商负责包装的费用和风险,并进行适当的包装- 运输保险:由卖方支付商品的保险费用,并且可以向卖方索赔5. 付款条件我们希望采用即期付款方式进行支付。

具体方式如下:- 货物交付后立即通知付款- 付款金额将通过贵行向供应商开立的信用证进行支付6. 有效期及开证行确认我们希望信用证的有效期为XX天,并且期望贵行能够在XX 天内确认开证。

7. 其他条款为保证交易的顺利进行,我们希望信用证中包含以下条款:- 承兑行:XX银行或与贵行相对应的合作行- 运输文件要求:我们要求供应商提供以下文件以完成交易:- 提货单- 发票- 装箱单- 保险单8. 贵行服务优势我方选择贵行开立信用证是基于贵行信誉良好以及专业的信用证服务。

我们相信贵行能够提供高质量的服务,并且具备丰富的经验和专业知识来确保本次交易的顺利进行。

附件:供应商报价及合同在此,我方诚挚地请求贵行能够尽快开立信用证,以确保本次交易的顺利进行。

如有任何进一步的信息或文件需要提供,请随时与我方联系。

信用证申请英文邮件范文1Dear Sir,Thank you for your mail of March 15, containing your acceptance of our offer for 400 Model PT-250 typewriters.We ask that you promptly open an irrevo-cable L/C in our favor, valid until April 2.Upon receiving your L/C, we will promptly complete shipment arrangements of your order. We will of course, notify you when we have completed the shipment.We are looking forward to your early and favorable reply.Sincerely yours,BOT Company尊敬的先生:感谢贵方3月15日来信表示接受我方对400台PT-250型号打字机的报价。

我方请你方立即以我方为受益人开具不可撤销信用证,有效期到4月2日。

我方收到你方的信用证就会立即安排装运你方订单货物。

我方定会通知你方完成装运的时间。

我方期待你方尽早回复。

BOT公司敬上信用证申请英文邮件范文2Dear Sir,Thank you for your mail of March 16. Complying with your request for opening an irrevocable L/C, we have instructed Industrial and Commercial Bank of China to open a credit for 100,000 in your favor, valid until April 2. Please inform us when the order is executed.Thank you for your cooperation.Sincerely yours,ABC Company尊敬的先生:非常感谢贵方3月16日的来信。

Credit Letter Application Template[Your Company Letterhead][Your Address][City, State, Zip Code][Email Address][Phone Number][Date][Recipient's Name][Recipient's Title][Recipient's Company][Recipient's Address][City, State, Zip Code]Subject: Credit Letter ApplicationDear [Recipient's Name],I am writing to request the issuance of a [type of credit letter] in favor of [beneficiary's name] for the export of [description of goods/services] from [country of origin] to [country of destination]. The details of the transaction are as follows:1. Contract Number: [Contract Number]2. Contract Date: [Contract Date]3. Exporter: [Exporter's Name]4. Importer: [Importer's Name]5. Description of Goods/Services: [Description of Goods/Services]6. Quantity: [Quantity]7. Unit Price: [Unit Price]8. Total Amount: [Total Amount]9. Payment Terms: [Payment Terms]10. Shipment Date: [Shipment Date]We kindly request the issuance of a [type of credit letter] in the amount of [total amount] to ensure the payment to [exporter's name] upon the presentation of the required documents comply with the terms and conditions of the contract.The credit letter should be valid for [validity period] and payable at [payable bank/branch]. We request the beneficiary to present the following documents to the issuing bank:1. Signed Commercial Invoice2. Packing List3. Weight Memo4. Certificate of Quantity/Weight5. Insurance Policy/Certificate6. Air Waybill/Ocean Bill of Lading7. Beneficiary's Certificate of Cable/Telex Dispatch8. Any other documents as per the contract terms and conditionsPlease find enclosed the necessary documentation for the issuance of the credit letter. We kindly request you to issue the credit letter at your earliest convenience and send it to the following address:[Your Company's Address][City, State, Zip Code]Thank you for your attention to this matter. We look forward to hearing from you soon.Sincerely, [Your Name] [Your Title] [Your Company]。

商务英语单证实训答案信用证申请书Subject: Letter of Credit ApplicationDear Sir/Madam,I am writing to apply for a Letter of Credit for a business transaction between our company, [Company Name], and [Importing Company Name]. Our company is in the process of exporting [Product/Service] to [Importing Country], and we believe that the use of a Letter of Credit will ensure a secure and timely payment for both parties involved.To facilitate this transaction, we are providing the following details for your reference:1. Beneficiary: [Company Name]2. Applicant: [Importing Company Name]3. Issuing Bank: [Bank Name]4. Advising Bank: [Bank Name]5. Amount of Credit: [Currency and Amount]6. Expiry Date: [Date]7. Place of Expiry: [City, Country]8. Latest Shipment Date: [Date]9. Documents Required: [List of Documents]We understand the importance of complying with the terms and conditions of the Letter of Credit, and we assure you that all necessary documents will be submitted in a timely manner to facilitate the smooth execution of this transaction. We also request that the Letter of Credit be irrevocable and confirmed by a reputable bank to provide added security for both parties.We kindly request your prompt attention to this matter and appreciate your assistance in processing this application in a timely manner. If there are any additional requirements or information needed from our end, please do not hesitate to contact us.Thank you for your cooperation and we look forward to a successful business relationship.Yours sincerely,[Your Name][Title][Company Name]。

进口信用证申请书模板英文Dear Sir/Madam,We are writing to apply for an import letter of credit in order to facilitate our upcoming import transaction. The details of the transaction are as follows:- Seller: [Name of the seller]- Buyer: [Your company name]- Commodity: [Description of the commodity being imported]- Quantity: [Amount of the commodity being imported]- Price: [Price per unit of the commodity]- Delivery terms: [Delivery terms agreed upon with the seller]- Payment terms: [Terms of payment agreed upon with the seller]We kindly request that you issue a letter of credit in favor of the seller in accordance with the terms and conditions outlined in the proforma invoice provided by the seller. Please ensure that the letter of credit is irrevocable and transferable to ensure smooth execution of the transaction.We understand that all costs associated with the issuance of the letter of credit, including bank charges and fees, will be borne by us. We also commit to providing all necessary documents and complying with all terms and conditions stipulated in the letter of credit.We appreciate your prompt attention to this matter and look forward to your favorable response. Should you require any additional information or documentation, please do not hesitate tocontact us.Thank you for your cooperation. Yours sincerely,[Your company name]。

一、实验目的1. 了解信用证的基本概念、种类及作用;2. 掌握信用证的业务流程;3. 熟悉信用证的审核要点及风险防范措施。

二、实验背景随着国际贸易的发展,信用证作为一种重要的结算方式,被广泛应用于国际货物贸易中。

信用证能够有效降低交易风险,保障买卖双方的权益。

为了更好地理解和掌握信用证业务,我们进行此次实验。

三、实验内容1. 信用证的基本概念信用证(Letter of Credit,简称L/C)是一种由银行开立的,以书面形式承诺支付一定金额的书面文件。

信用证是国际贸易中的一种结算方式,它以买卖双方的合同为基础,由银行作为中介,保障买卖双方的权益。

2. 信用证的种类(1)按信用证的性质分类① 不可撤销信用证(Irrevocable L/C):开证行在信用证有效期内,未经受益人同意,不得擅自撤销或修改。

② 可撤销信用证(Revocable L/C):开证行可以在信用证有效期内,随时撤销或修改信用证。

(2)按信用证项下的货币种类分类① 按照货币种类分为:自由兑换货币信用证、非自由兑换货币信用证。

② 按照货币种类分为:单币种信用证、多币种信用证。

3. 信用证的作用(1)保障买卖双方的权益;(2)简化结算手续,提高结算效率;(3)降低交易风险,促进国际贸易发展。

4. 信用证的业务流程(1)买卖双方签订合同;(2)买方申请开证;(3)开证行开立信用证;(4)受益人审核信用证;(5)受益人准备单据;(6)受益人提交单据;(7)议付行审核单据;(8)议付行付款给受益人;(9)开证行付款给议付行。

5. 信用证的审核要点(1)审核信用证的真实性;(2)审核信用证的条款是否符合合同规定;(3)审核信用证的金额、有效期、交单期等要素;(4)审核信用证的单据种类及要求。

6. 信用证的风险防范措施(1)严格审查信用证的真实性;(2)加强对信用证的审核,确保信用证条款符合合同规定;(3)建立健全信用证业务管理制度;(4)加强对信用证业务的监督和检查。

一、实验目的通过本次实训,使学生掌握信用证的基本知识,了解信用证的业务流程,熟悉信用证各项条款,提高学生处理信用证业务的能力,为以后从事国际贸易工作打下坚实的基础。

二、实验内容本次实验主要围绕信用证的申请、开立、审核、修改、撤销、议付等环节进行。

三、实验步骤1. 信用证的申请(1)出口商与进口商签订合同,约定采用信用证支付。

(2)出口商向其开户银行提交信用证申请书。

(3)银行审核申请书,无误后向进口商的开户银行(通知行)发送信用证。

2. 信用证的开立(1)通知行收到信用证后,将其转交给进口商。

(2)进口商审核信用证,如无异议,签字确认。

(3)通知行将信用证寄回出口商的开户银行。

3. 信用证的审核(1)出口商的开户银行收到信用证后,对信用证的条款进行审核。

(2)审核内容包括:信用证的有效期、金额、汇票条款、单据条款、货物描述、装运条款等。

(3)如发现信用证条款与合同不符或存在潜在风险,应及时通知出口商。

4. 信用证的修改(1)出口商在装运货物前,如发现信用证条款与实际需要不符,可向其开户银行提出修改申请。

(2)银行审核修改申请,无误后向通知行发送修改通知。

(3)通知行将修改通知转交给进口商,进口商审核后签字确认。

5. 信用证的撤销(1)出口商在装运货物前,如因故无法履行合同,可向其开户银行提出撤销信用证申请。

(2)银行审核撤销申请,无误后向通知行发送撤销通知。

(3)通知行将撤销通知转交给进口商,进口商审核后签字确认。

6. 信用证的议付(1)出口商在装运货物后,按照信用证条款要求,准备相关单据。

(2)出口商将其开户银行提交单据,申请议付。

(3)银行审核单据,无误后支付货款。

四、实验结果与分析1. 实验结果通过本次实训,学生掌握了信用证的基本知识,熟悉了信用证的业务流程,能够独立处理信用证业务。

2. 实验分析(1)信用证是国际贸易中常用的支付方式,具有安全、便捷、灵活等特点。

(2)信用证的审核是保证交易顺利进行的关键环节,必须严格审核信用证条款,确保符合合同要求。

信用证实验报告信用证实验报告一、实验目的信用证是国际贸易中常用的支付方式,本次实验旨在通过模拟信用证的操作流程,了解信用证的基本原理和运作方式,并通过实际操作体验信用证的使用过程。

二、实验背景信用证是国际贸易中一种常见的支付方式,它是由买方(申请人)委托银行向卖方(受益人)开立的一种支付保障工具。

通过信用证,买卖双方可以在交易过程中减少风险,提高交易的安全性和可靠性。

三、实验过程1. 申请信用证在实验开始前,我们首先需要了解信用证的申请流程。

买方需要向自己的银行提交信用证申请,包括交易金额、受益人信息、货物描述等。

银行会根据买方的申请信息开立信用证。

2. 开立信用证银行在收到买方的信用证申请后,会对买方进行信用评估,并根据评估结果开立信用证。

信用证中会包括买方和卖方的基本信息、货物描述、支付条件等。

3. 发送信用证银行会将开立的信用证发送给卖方,卖方在收到信用证后,可以开始准备货物的交付。

4. 货物装运卖方根据信用证的要求,将货物装运至指定的目的地。

在装运货物前,卖方需要确保货物的质量和数量与信用证的要求相符。

5. 提交单据卖方在货物装运后,需要准备相关的单据,包括提单、发票、装箱单等,并将这些单据提交给银行。

银行会根据信用证的要求对单据进行审核。

6. 银行审核银行对卖方提交的单据进行审核,确保单据的真实性和合规性。

如果单据符合信用证的要求,银行会向买方支付货款。

7. 买方付款在银行支付货款后,买方需要按照信用证的要求向银行付款,以完成交易。

四、实验结果通过本次实验,我们深入了解了信用证的基本原理和操作流程。

信用证作为一种国际贸易支付工具,可以有效降低买卖双方的风险,提高交易的安全性和可靠性。

在实际操作中,我们需要注意信用证的要求,确保货物和单据的符合信用证的要求,以免影响交易的顺利进行。

五、实验心得通过本次实验,我对信用证的使用有了更深入的了解。

信用证在国际贸易中起到了重要的作用,可以有效保障买卖双方的权益。

一、实训背景随着全球化贸易的不断发展,信用证作为一种重要的国际贸易支付方式,被广泛应用于国际货物买卖中。

为了更好地理解和掌握信用证的申请流程,提高业务处理能力,我们进行了信用证申请的实训。

二、实训目的1. 熟悉信用证的基本概念和作用。

2. 掌握信用证申请的操作流程。

3. 了解申请信用证时需要注意的要点。

4. 提高在国际贸易中运用信用证的能力。

三、实训内容1. 信用证基础知识(1)信用证的定义:信用证是银行(开证行)应买方的申请,向卖方(受益人)开出的,保证在卖方提交符合信用证条款的单据后,按信用证规定支付货款的书面文件。

(2)信用证的作用:保障买卖双方的权益,简化国际贸易结算程序,提高国际贸易的信用程度。

2. 信用证申请流程(1)准备申请材料:包括信用证申请书、公司营业执照、进出口经营权证书、合同、相关单据等。

(2)填写信用证申请书:准确填写开证申请人、受益人、货物描述、数量、金额、装运期限、保险、支付方式等。

(3)提交申请:将填写好的信用证申请书和相关材料提交给银行。

(4)银行审核:银行对申请材料进行审核,确认无误后,通知申请人。

(5)开证:银行根据申请人要求,向受益人开立信用证。

(6)通知受益人:银行将信用证通知受益人。

(7)受益人提交单据:受益人在信用证有效期内,按照信用证条款提交相关单据。

(8)银行审单:银行对受益人提交的单据进行审核。

(9)支付货款:银行在确认单据符合信用证条款后,按照信用证规定支付货款。

3. 申请信用证注意事项(1)准确填写信用证申请书:确保信息准确无误,避免因信息错误导致信用证无法开立。

(2)了解信用证条款:仔细阅读信用证条款,确保了解各项规定,避免因误解条款而影响交易。

(3)注意信用证有效期:确保信用证在有效期内提交单据,避免因过期导致无法收汇。

(4)选择合适的银行:选择信誉良好、服务优质的银行办理信用证业务。

(5)加强沟通:与银行保持良好沟通,及时了解信用证办理进度。

一、实训背景在国际贸易中,信用证作为一种重要的支付方式,对于保障买卖双方的权益具有重要意义。

为了提高我对外贸信用证业务的理解和操作能力,我参加了信用证申请书实训。

通过本次实训,我对信用证申请书的填写、审核流程有了更深入的认识。

二、实训目的1. 理解信用证的概念、作用和种类。

2. 掌握信用证申请书的填写方法。

3. 学会审核信用证申请书的流程。

4. 提高在外贸业务中运用信用证的能力。

三、实训内容1. 信用证概述信用证是一种银行担保文件,由买方申请,卖方在规定期限内按照信用证条款履行合同义务后,由银行支付货款的一种支付方式。

信用证分为即期信用证和远期信用证,以及可转让信用证和不可转让信用证等。

2. 信用证申请书填写信用证申请书是申请开立信用证的重要文件,主要包括以下内容:(1)申请人信息:包括公司名称、地址、联系人等。

(2)受益人信息:包括公司名称、地址、联系人等。

(3)信用证类型:即期信用证或远期信用证。

(4)信用证金额:包括货币种类和金额。

(5)信用证有效期和到期地点:包括起止日期和到期地点。

(6)货物信息:包括品名、规格、数量、单价、总价等。

(7)装运条款:包括装运港、目的港、装运日期、运输方式等。

(8)保险条款:包括保险金额、保险险种等。

(9)其他条款:如议付银行、通知方式等。

在填写信用证申请书时,应注意以下几点:(1)信息准确无误,避免因信息错误导致信用证无法正常使用。

(2)条款清晰明了,便于各方理解和执行。

(3)根据实际情况选择合适的信用证类型和条款。

3. 信用证审核审核信用证申请书是确保信用证条款符合买卖双方利益的重要环节。

审核内容主要包括:(1)信用证金额、有效期、到期地点等基本信息是否准确。

(2)货物信息、装运条款、保险条款等是否与合同相符。

(3)信用证类型、议付银行、通知方式等条款是否合理。

(4)是否存在限制性条款,如禁止分批装运、禁止转船等。

(5)是否存在对受益人不利的条款。

审核过程中,如发现信用证申请书存在问题,应及时与申请人沟通,要求修改。

信用证开证申请书中英文对照及注释Letter of Credit Application信用证开证申请书Applicant: 申请人Supplier: 供应商Exporter: 出口商Importer: 进口商Issuing Bank: 开证行Beneficiary: 受益人Advising Bank: 通知行Letter of Credit Application Form信用证开证申请书表格Date: 日期:To: Issuing Bank致开证行:We hereby request you to issue an Irrevocable Documentary Credit in our favor for the account of 供应商(Beneficiary), available by draft at sight for 100% of the invoice value for the following goods:我们特此请求您为我方开具一份不可撤销的、可转让的即期跟单信用证,账款归属于供应商(受益人),金额为发票金额的100%,用于以下货物:Invoice No.: 发票号码:Description of Goods: 货物描述:Quantity: 数量:Unit Price: 单价:Total Amount: 总金额:Shipment: 装运:Shipping Terms: 运输条款:Port of Loading: 装货港:Port of Discharge: 卸货港:L/C Expiry Date: 信用证到期日:Latest Shipment Date: 最晚装运日期:Partial Shipment: 分批装运:Transshipment: 转运:Terms of Payment: 支付条款:Documents Required: 所需文件:Please advise us promptly of the issuance and forward the original credit to 通知行for transmission to the 供应商. 请即刻通知我们信用证开具,并将原件转交给通知行,以便转发给供应商。

[Your Company Letterhead][Company Address][City, State, Zip Code][Email Address][Phone Number][Date]To:[Bank Name][Bank Address][City, State, Zip Code]Subject: Application for Issuance of Irrevocable Documentary CreditDear Sir/Madam,We are writing to formally request the issuance of an Irrevocable Documentary Credit (L/C) on behalf of [Beneficiary Company Name], for the purpose of facilitating international trade transactions with [Buyer’s Company Name]. Please find below the details of the credit, which are based on the terms and conditions outlined in our contract number [Contract Number].1. General Information- Credit Number: [To be assigned by the issuing bank]- Credit Type: Irrevocable Documentary Credit- Date of Issue: [Date of issuance requested]- Expiry Date: [Date by which documents must be presented to the bank for negotiation]- Place of Expiry: [City/Location where the credit is to be valid]2. Applicant and Beneficiary Information- Applicant: [Your Company Name][Your Company Address][City, State, Zip Code][Country][Contact Person][Contact Information]- Beneficiary: [Beneficiary Company Name][Beneficiary Company Address][City, State, Zip Code][Country][Contact Person][Contact Information]3. Description of Goods/Services- Description of Goods/Services: [Detailed description of thegoods/services to be supplied]- Total Quantity: [Total quantity of goods/services to be supplied]- Unit Price: [Unit price of goods/services]- Total Value: [Total value of the goods/services]4. Terms of Payment- Amount: [Total amount of the credit in words and figures]- Currency: [Currency code]- Payment Terms: [Details of payment terms, e.g., 100% at sight, upon presentation of documents, etc.]5. Documents Required- Commercial Invoice:- Original invoice in triplicate- Must indicate the L/C number and contract number- Must be signed by the Applicant- Bill of Lading/Delivery Order:- Original bill of lading/delivery order- Must be made out to [Notify Party] as specified below- Must indicate "Freight Prepaid" or "Freight Collect"- Must be marked "Non-negotiable" and "Not Transferable"- Insurance Policy/Certificate:- Original insurance policy/certificate- Must cover all risks as per the terms of the contract- Must indicate the amount of insurance and cover up to [Country of Destination]- Must be marked "Blank Endorsement"- Packing List/Weight Memo:- Original packing list/weight memo- Must indicate the quantity, gross and net weights of each package- Must detail the packing conditions as specified in the contract- Certificate of Origin:- Original certificate of origin- Must be issued by a recognized authority- Other Documents:- [Any other documents required as per the terms of the contract]6. Special Conditions- Partial Shipments: [Allow/Not Allow]- Transshipment: [Allow/Not Allow]- Loading Port: [Name of the port of loading]- Discharge Port: [Name of the port of discharge]- Latest Date of Shipment: [Date by which the goods must be shipped]- Documents to Be Dispatched to: [Name and address of the bank to which documents are to be dispatched]7. Instructions to the Issuing Bank- All banking charges outside the opening bank are for the account of the Beneficiary.- The documents must be presented to the issuing bank within [number of days] after the date of shipment but within the validity of the credit.- The L/C is subject to the Uniform Customs and Practice for Documentary Credits (UCP 600).- Any discrepancies in the documents presented must be notified to the Beneficiary immediately.8. Applicant’s DeclarationWe hereby confirm that all the information provided in this application is true and accurate to the best of our knowledge and belief. We understand that any misrepresentation or fraud may result in the refusal of the credit by the issuing bank and may expose us to legal action.[Signature of Authorized Person][Name of Authorized Person][Title of Authorized Person][Company Name][Company Stamp]---Additional Instructions to the Issuing Bank1. Please ensure that the credit is advised to the Beneficiary immediately upon issuance.2. The Beneficiary must submit all required documents within thevalidity of the credit.3. In case of any discrepancies in the documents, please notify us immediately.4. The issuing bank shall not be responsible for any delay in payment due to the late submission of documents by the Beneficiary.5. All disputes arising from this credit shall be settled amicably between the Applicant and the Beneficiary.---This template is intended to serve as a guide for drafting a credit application. Please ensure that all information is accurate and complete before submitting the application to the issuing bank.。

广东财经大学华商学院实验报告实验项目名称外贸英语函电课程名称外贸英语函电成绩评定良好实验类型:验证型□综合型 设计型□实验日期2014.2.25—2014.6.19 指导教师学生姓名学号专业班级一、实验项目训练方案小组合作:是□否 小组成员:实验目的:使学生通过对模拟的商务内容的处理,摸索与外商建立业务关系的方法,掌握国际商务磋商、掌握询盘、发盘、还盘、接受以及信用证环节往来函电的应用技巧。

实验场地及仪器、设备和材料:P4微型计算机,数据库服务器,外贸单证系统实验训练内容(包括实验原理和操作步骤):项目一题目名称建立业务关系基本要求请将下述建立业务关系的信函翻译成英文,要求表达清楚、内容完整。

下载模板0101_贸易函电03.doc相关说明信函内容如下:敬启者:从网上得知贵公司的名称和地址,贵公司所需要的产品正好在我们的经营范围内。

今特致函与你,希望能与你公司建立起长期的业务关系。

我公司是一家大型外贸公司,从事进出口业务已有近20年,信誉良好。

随信附上一份产品目录和价目单供贵公司参考,在收到询盘后,我们将给贵公司报最优惠价。

期待您的早日回复。

谨上Hengchi IndustriesCo. ,ltd. Room601, Tianshi Mansion, Siyuanqiao 47#, Shanghai, P. R. ChinaTel: (021)56248632 Fax:(021)56245832E-mail:**********Dear Sir,We have learned from the Internet of your company’s name and address. And we are glad to learn that we can offer the purpose of supplying which you would liketo need. Now we are writing for you in order to want to establish a long-timebusiness relationship with you.We would like to introduce ourselves to you as a wide trading firm, and we have been in business before 20 years. This kind of product in our company haswon great popularity in markets at home and abroad.We are enclosing herewith a catalogue and a price-list for your reference, so that you may acquaint yourselves with some of the items we handle. We can giveyou our best quotation upon receipt of your specific enquiries.We look forward to your favorable reply.Yours faithfully,项目二题目名称建立业务关系基本要求根据下述资料,以世格国际贸易公司业务员Minghua Zhao的名义,给加拿大NEO公司写一封与他们建立业务关系的信函,要求用英文书写,表达清楚、内容完整。

信用证申请书模板(中文)尊敬的开证行:我方在此向贵行申请开立一份不可撤销信用证,具体条款如下:1. 信用证号码:____________________2. 受益人:____________________(全名和详细地址)3. 申请人与受益人之间的合同号码:____________________4. 开证申请人:____________________(全名和详细地址)5. 开证行:____________________(全名和详细地址)6. 信用证有效期:从开证日期起算,有效期为____________________天。

7. 信用证金额:____________________(大写:____________________,小写:____________________)8. 货币代码:____________________9. 付款方式:____________________10. 装运港口:____________________11. 目的港口:____________________12. 装运日期:____________________13. 商品或服务描述:____________________14. 数量:____________________15. 单价:____________________16. 总价:____________________(大写:____________________,小写:____________________)17. 其他条款:____________________请贵行根据上述条款开立一份不可撤销信用证,并将其发送至受益人。

我们将在收到信用证后立即安排装运货物,并按照信用证规定的条款进行付款。

感谢贵行的合作与支持!申请人签名:____________________申请人单位:____________________日期:____________________信用证申请书模板(英文)Dear Issuing Bank,We hereby apply for the issuance of an irrevocable documentary credit in favor of the beneficiary, Mr./Ms. ____________________, with the following terms and conditions:1. Credit Line Number: ____________________2. Beneficiary: ____________________ (full name and address)3. Contract Number between the applicant and beneficiary:____________________4. Applicant: ____________________ (full name and address)5. Issuing Bank: ____________________ (full name and address)6. Validity of the Credit: From the date of issuance, the credit shall be valid for a period of ____________________ days.7. Amount of the Credit: ____________________ (in words:____________________, in figures: ____________________)8. Currency Code: ____________________9. Payment Method: ____________________10. Loading Port: ____________________11. Destination Port: ____________________12. Loading Date: ____________________13. Description of Goods/Services: ____________________14. Quantity: ____________________15. Unit Price: ____________________16. Total Amount: ____________________ (in words: ____________________, in figures: ____________________)17. Other Terms and Conditions: ____________________Please issue an irrevocable documentary credit in accordance with the above terms and conditions and send it to the beneficiary. We will arrange for the shipment of goods and make the payment in accordance with the terms and conditions of the credit as soon as we receive it.Thank you for your cooperation and support!Applicant's Signature: ____________________Applicant's Company: ____________________Date: ____________________。

实 验 报 告 实验名称 外 贸 英 语 函 电 系 别 经 济 与 管 理 系 年级专业 学生姓名 学 号 指导老师

2012年11月15日 0

实验项目 FULL IN APPLICATION FOR L/C

实验地点 :老图书馆机房_实验日期:2012年11月12日

一、实验目的 掌握涉及付款方面的专业词汇的表达,了解信用证的内容及对信用证进行正确的审核;能够独立的书写付款和结帐方面的函电,通过真实单证处理,掌握审单要点后能正确处理信用证业务,填写各种进出口业务议付单据。

二、实验内容 (1)了解信用证的内容及对信用证进行正确的审核,根据教学软件中提供

的不同的案例内容,掌握审单要点后能正确处理信用证业务,填写各种进出口业务议付单据。 (2)根据合同及国际贸易惯例,根据资料1和资料3设计申请和审核信用证的方案与步骤,填写上述资料2信用证申请书;修改资料4信用证与合同不相符的地方。

三、实验仪器设备 (1)CPU2.0G,内存512M以上配置的计算机,安装有windows XP 操作系统

(2)进出口单证系统、进出口场景英语软件

四、实验步骤 1.实验指导老师(即任课教师)介绍外贸单证教学系统的基本组成和操作步

骤,在每节课的实验项目项目开始前,先由实验指导老师介绍本次课程的基本组成和操作步骤,然后在老师的指导与控制下,了解信用证的内容及对信用证进行正确的审核,了解与信用证与合同的关系,掌握审单要点后能正确处理信用证业务,填写各种进出口业务议付单据。 2.首先对外贸结汇单证进行填写及审核、对国际贸易真实单证进行识读;独立进行实验方案设计,完成实验方案设计报告;用英语设计单证处理系统,按自己拟定的信用证的申请和修改步骤及方案对信用证进行申请和修改。 3.先提交实验课程的实验任务的电子版,以邮件形式发给指导老师。再按照指导老师的要求打印成纸版,作为实验报告的一部分提交给实验指导老师。

实验成绩 1

五、实验记录与结论 (一)实验资料 资料1:

题目名称 Fill in application for L/C 基本要求 根据下述给出的条件填写开证申请书,要求格式清楚、条款明确、内容完整。 相关说明 相关资料: DATE: MAY 25, 2004 THE BUYER: EAST AGENT COMPANY ADDRESS: ROOM 2401,WORLDTRADE MANSION, SANHUAN ROAD 47#,BEIJING, P. R. CHINA THE SELLER: LPG INTERNATION CORPORATION ADDRESS: 333 BARRON BLVD. , INGLESIDE , ILLINOIS ( UNITED STATES ) NAME OF COMMODITY: MEN’S DENIM UTILITY SHORT SPECIFICATIONS: COLOR: MEDDEST SANDBLAS FABRIC CONTENT: 100% COTTON QUANTITY: 2000 CARTONS PRICE TERM: FOB NEW YORK USD 285/ CARTON TOTAL AMOUNT: USD570,000.00 COUNTRY OF ORIGIN AND MANUFACTURERS: UNITED STATES OF AMERICA, VICTORY FACTORY PARTIAL SHIPMENT AND TRANSSHIPMENT ARE PROHIBITTED SHIPPING MARK: ST NO.1…UP TIME OF SHIPMENT: BEFORE JULY 15,2004 PLACE AND DATE OF EXPIRY: CHINA, JULY 30,2004 PORT OF SHIPMENT: NEW YORK PORT OF DESTINATION: XINGANG PORT, TIANJING OF CHINA INSURANCE: TO BE COVERED BY BUYER. PAYMENT: BY IRREVOCABLE FREELY NEGOTIABLE L/C AGAINST SIGHT DRAFTS FOR 100PCT OF INVOICE VALUE AND THE DOCUMENTS DETAILED HEREUNDER. DOCUMETNS: 1.INVOICES IN TRIPLICATE 2.PACKING LIST IN TRIPLICATE 3.FULL SET OF CLEAN ON BOARD BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED NOTIFYING THE APPLICANT WITH FULL NAME AND ADDRESS MARKED FREIGHT COLLECT. 4.CERTIFICATE OF ORIGIN IN DUPLICATE 5.BENEFICIARY’S CERTIFIED COPY OF FAX TO THE APPLICANT WITHIN 1 DAY AFTER SHIPMENT ADVISING GOODS NAME OF VESSEL, INVOICE VALUE, DATE OF SHIPMENT, QUANTITY AND WEIGHT. OTHER TERMS AND CONDITIONS: 1.L/C TO BE ISSUED BY TELETRANSMISSION. 2.THE BUYER SHALL BEAR ALL BANKING CHARGES INCURRED INSIDE THE ISSUING BANK. 3.ALL DOCUMENTS MUST BE MAILED IN ONE LOT TO THE ISSUING BANK BY COURIER SERVICE. 4.PRESENTATION PERIOD:WITHIN 10 DAYS AFTER THE DATE OF SHIPMENT. 2

(二)申请开立信用证 申请开立信用证的方案与步骤:

(1)、申请开立信用证的步骤见下列图示:

说明: 1.进口商向银行申请开证要依照合同各项有关规定填写开证申请书,并交付押金或其他保证金。 2.开证行根据申请书要求开立信用证,正本寄送通知行,副本交进口企业。

(2)、通知行审核信用证 通知行收到信用证,立即审核开证行的业务往来情况、政治背景、资信能力、付款责任和索汇路线等,并鉴别信用证的真伪。经审查无误,则在信用证正本上加盖“证实书”戳印,并将其随信用证通知书交出口方审核。

资料2:APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDIT

IRREVOCABLE DOCUMENTARY CREDIT APPLICATION TO: BANK OF CHINA BEIJING BRANCH Date: MAY 25, 2004 Issue by airmail With brief advice by teletransmission Credit No. Issue by express delivery

Issue by teletransmission (which shall be the operative instrument) Date and place of expiry JULY 30, 2004 IN CHINA Applicant Beneficiary (Full name and address) EAST AGENT COMPANY ROOM 2401,WORLDTRADE MANSION, SANHUAN ROAD 47#,BEIJING, P. R. CHINA LPG INTERNATION CORPORATION 333 BARRON BLVD. , INGLESIDE , ILLINOIS ( UNITED STATES )

Advising Bank Amount USD 570,000.00 SAY U.S.DOLLARS FIVE HUNDRED AND SEVENTY THOUSAND ONLY 3

Credit available with Partial shipments Transhipment ANY BANK allowed not allowed allowed not allowed By Loading on board/dispatch/taking in charge at/from sight payment acceptance negotiation NEW YORK deferred payment at

not later than JULY 15, 2004 against the documents detailed herein

For transportation to: XINGANG PORT, TIANJING OF CHINA and beneficiary's draft(s) for 100 % of invoice value FOB CFR CIF at **** sight

or other terms drawn on BANK OF CHINA BEIJING BRANCH Documents required: (marked with X) 1. ( X ) Signed commercial invoice in 3 copies indicating L/C No. and Contract No. 2. ( X ) Full set of clean on board Bills of Lading made out to order and blank endorsed, marked "freight [ X ] to collect / [ ] prepaid [ ] showing freight amount" notifying THE APPLICANT WITH FULL NAME AND ADDRESS . ( ) Airway bills/cargo receipt/copy of railway bills issued by showing “freight [ ] to collect/[ ] prepaid [ ] indicating freight amount" and consigned to____________________________. 3. ( ) Insurance Policy/Certificate in copies for % of the invoice value showing claims payable in in currency of the draft, blank endorsed, covering All Risks, War Risks and . 4. ( X ) Packing List/Weight Memo in 3 copies indicating quantity, gross and weights of each package. 5. ( ) Certificate of Quantity/Weight in copies issued by __________________. 6. ( ) Certificate of Quality in copies issued by [ ] manufacturer/[ ] public recognized surveyor_________________. 7. ( X ) Certificate of Origin in 2 copies . 8. ( X ) Beneficiary's certified copy of fax / telex dispatched to the applicant within 1 days after shipment advising L/C No., name of vessel, date of shipment, name, quantity, weight and value of goods. Other documents, if any