会计学原理约翰·J·怀尔德版上海交通大学

- 格式:pptx

- 大小:2.02 MB

- 文档页数:83

会计学入门读物哪本比较好?会计学入门读物哪本比较好?会计学入门读物哪本比较好?国内的教材感觉都比较枯燥,为了提高对此学科的兴趣,暂且决定先从国外的教材开始入门。

我自己也查阅到了一些国外的会计学教材,我先列举自己查阅到的书籍,还请会计界的各位前辈帮我做些参考。

《会计学原理》作者:约翰·J.怀尔德(貌似这两个版本是一样的,好像就是中英文的区别?)《会计学原理》韦安特《会计学》查尔斯·T·亨格瑞《会计学》查尔斯·T·亨格瑞(这两个貌似是先后版本不同,但价格差距很大,第8版是59.3,第六版是119.5,这是怎么回事?)《财务会计教程》查尔斯·T·亨格瑞《会计学基础》罗伯特·N.安东尼(这个好像也是版本相同,只是中英文的区别?)《会计学:数字意味着什么》戴维?马歇尔(这个好像也是版本相同,只是中英文的区别?)请教各位会计界的前辈以上哪本作为会计学的入门读物更好?如果还有更好的书籍作为会计学的入门读物还请各位前辈推荐指教,先谢过!(本人非专业人士!)(注:本人不是为了考证,我只是想对此学科入门之前,先提高对此学科的兴趣,而后系统性的对此学科有所认知。

因此,我非常需要一个趣味性较强而又在知识上综合连贯的书或教材或者是一份书单,谢谢!)会计学入门读物哪本比较好?国内的教材感觉都比较枯燥,为了提高对此学科的.兴趣,暂且决定先从国外的教材开始入门。

我自己也查阅到了一些国外的会计学教材,我先列举自己查阅到的书籍,还请会计界的各位前辈帮我做些参考。

《会计学原理》作者:约翰·J.怀尔德工商管理经典译丛?会计与财务系列:会计学原理(第19版)/约翰?J?怀尔德 (John J.Wild)-图书<="" bdsfid="102" i="">普通高等教育"十一五"国家级规划教材?教育部高校工商管理类教材指导委员会双语教学推荐教材?工商管理经典教材?会计与财务系列?会计学原理(第19版)(英文版)/崔学刚<="" bdsfid="104" i=""> (貌似这两个版本是一样的,好像就是中英文的区别?)《会计学原理》韦安特会计学原理(附光盘1张)/韦安特<="" bdsfid="109" i="">《会计学》查尔斯·T·亨格瑞会计学(第8版)/查尔斯·T·亨格瑞(Charles T.Horngren)-图书<=""bdsfid="113" i="">《会计学》查尔斯·T·亨格瑞会计学(第6版)(套装上下册)/享格瑞<="" bdsfid="116" i=""> (这两个貌似是先后版本不同,但价格差距很大,第8版是59.3,第六版是119.5,这是怎么回事?)《财务会计教程》查尔斯·T·亨格瑞财务会计教程(第8版)/亨格瑞<="" bdsfid="120" i="">。

Chaper 1 Accounting in BusinessMultiple Choice Quiz1-c; 2-b; 3-d; 4-a; 5-aQuick StudyQS 1-1a-E; b-E; c-I; d-E; e-E; f-I; g-E; h-E; i-E; j-E; k-I; l-EQS 1-2GAAP: Generally Accepted Accounting PrinciplesImportance: GAAP are the rules that specify acceptable accounting practices.SEC: Securities and Exchange CommissionImportance: The SEC is charged by Congress to set accounting and reporting rules for organizations that sell ownership shares to the public. The SEC delegates part of this responsibility to the FASB.FASB: Financial Accounting Standards BoardImportance: FASB is an independent group of full-time members who are responsible for setting accounting and reporting rules.IASB: International Accounting Standards BoardImportance: Its purpose is to issue standards that identify preferred practices in the desire of harmonizing accounting practices across different countries. The vast majority of countries and financial exchanges support its activities and objectives.QS 1-3Accounting professionals practice in at least four main areas. These four areas, along with a listing of some work opportunities in each, are:1. Financial accountingPreparation; Analysis; Auditing (external); Consulting; Investigation2. Managerial accountingCost accounting; Budgeting; Auditing (internal); Consulting3. Tax accountingPreparation; Planning; Regulatory; Consulting; Investigation4. Accounting-relatedLending; Consulting; Analyst; Investigator; AppraiserQS 1-4Internal controls serve several purposes:They involve monitoring an organization’s activities to promote efficiency and to prevent wrongful use of its resources.They help ensure the validity and credibility of accounting reports.They are crucial for effective operations and reliable reporting.More generally, the absence of internal controls can adversely affect the effectiveness of domestic and global financial markets.QS 1-5a. Revenue recognition principleb. Cost principle (also called historical cost)c. Business entity principleQS 1-6The choice of an accounting method when more than one alternative method is acceptable often has ethical implications. This is because accounting information can have major impacts on individuals’ (and firms’) well-being.To illustrate, many companies base compensation of managers on the amount of reported income. When the choice of an accounting method affects the amount of reported income, the amount of compensation is also affected. Similarly, if workers in a division receive bonuses based on the d ivision’s income, its computation has direct financial implications for these individuals.QS 1-7a=125,000b=250,000c=125,000QS 1-8QS 1-9(a) Examples of business transactions that are measurable include:Selling products and services.Collecting funds from dues, taxes, contributions, or investments.Borrowing money.Purchasing products and services.(b) E xamples of business events that are measurable include:Decreases in the value of securities (assets).Bankruptcy of a customer owing money.Technological advances rendering patents (or other assets) worthless.An “act of God” (casualty) that destroys assets.QS 1-10a-B; b-I; c-B; d-CF; e-I; f-B; g-B; h-CF; i-OEExcisesExcise 1-1External users and some questions they seek to answer with accounting information include:1. Shareholders (investors), who seek answers to questions such as:a. Are resources owned by a business adequate to carry out plans?b. Are the debts owed excessive in amount?c. What is the current level of income (and its components)?2. Creditors, who seek answers for questions such as:a. Does the business have the ability to repay its debts?b. Can the business take on additional debt?c. Are resources sufficient to cover current amounts owed?3. Employees, who seek answers to questions such as:a. Is the business financially stable?b. Can the business afford to pay higher salaries?c. What are growth prospects for the organization?Excise 1-21. C 5. B2. C 6. A3. A 7. B4. A 8. BExcise 1-3a. Auditing professionals with competing audit clients are likely to learn valuable information about each client that the other clients would benefit from knowing. In this situation the auditor must take care to maintain the confidential nature of information about each client.b. Accounting professionals who prepare tax returns can face situations where clients wish to claim deductions they cannot substantiate. Also, clients sometimes exert pressure to use methods not allowed or questionable under the law. Issues of confidentiality also arise when these professionals have access to clients’ personal records.c. Managers face several situations demanding ethical decision making in their dealings with employees. Examples include fairness in performance evaluations, salary adjustments, and promotion recommendations. They can also include avoiding any perceived or real harassment of employees by the manager or any other employees. It can also include issues of confidentiality regarding personal information known to managers.d. Situations involving ethical decision making in coursework include performing independentwork on examinations and individually completing assignments/projects. It can also extend to promptly returning reference materials so others can enjoy them, and to properly preparing for class to efficiently use the time and question period to not detract from others’ instructional benefits.Excise 1-41-E; 2-G; 3-A; 4-C; 5-D; 6-B; 7-F; 8-HExcise 1-5a-S; b-C; c-S; d-C; e-C; f-P; g-SExcise 1-6a=180,000b=51,000c=139,000Excise 1-71-D; 2-G; 3-B; 4-F; 5-AExcise 1-8a-27,000b-221,607c. beginning balance is 73,000; ending balance is 149,000Excise 1-9a. Business purchases equipment (or some other asset) on credit.b. Business signs a note payable to extend the due date on an account payable.c. Business pays an account payable (or some other liability) with cash (or some other asset).d. Business purchases office supplies (or some other asset) for cash (or some other asset).e. Business incurs an expense that is not yet paid (for example, when employees earn wages that are not yet paid).f. Owner invests cash (or some other asset) in the business; OR, the business earns revenue and accepts cash (or another asset).g. Cash withdrawals (or some other asset) paid to the owner of the business; OR, the business incurs an expense paid in cash.Exercise 1-10Real AnswersIncome StatementFor Month Ended October 31Exercise 1-11Real AnswersStatement of Owner ’s Equity Exercise 1-12Real Answers Balance Sheet October 31AssetsCash $ 11 500 Account receivable 12 000 Office supplies 24 437 Land 46 000 Office equipment 18 000 Total assets $ 111 937LiabilitiesAccount payables $ 25 037 Total liabilities 25 037Owner ’s EquityKeisha King, Capital 86 900 Total liabilities and equity $ 111 937Exercise 1-13Real Answers Cash Flow Statement For Month Ended October 31Excise 1-141-O; 2-O; 3-F; 4-O; 5-O; 6-O; 7-F; 8-IProblem 1-1AProblem 1-2Aa. Cash 67,000Equipment 11,000I. Lopez, Capital 78,000Owner’s investmentb. Building 144,000Cash 15,000Notes Payable 129,000 Purchased building on cash and note payable c. Equipment 12,000Cash 12,000Purchased equipment on cashd. Supplies 1,000Equipment 1,700Account Payable 2,700Purchased supplies and equipment on credite. Advertising Expense 460Cash 460Paid announcement of opening on newspaper f. Account Receivable 2,400Revenue 2,400To record revenue for service provided on account g. Cash 4,000Revenue 4,000Received revenue on cashh. I. Lopez, Withdrawals 3,025Cash 3,025Cash withdrawal by owneri. Cash 1,800Account Receivables 1,800Partially received account receivablej. Account Payables 500Cash 500Partially paid account payablesk. Wages Expense 1,800Cash 1,800Paid wages of secretary’s。

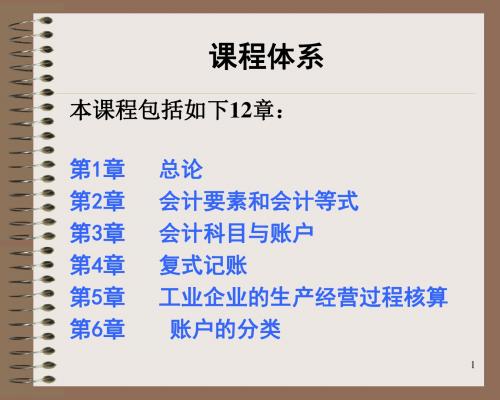

《会计学原理》教学大纲一、基本信息课程名称会计学原理课程编号B0800250、B0800260 英文名称Accounting principle 课程类型专业必修课总学时48 授课学时42 实验学时 6 实践学时学分 3 预修课程微观经济学、管理学适用对象会计学、会计学(CPA)、财务管理专业课程负责人唐国平课程简介《会计学原理》课程是国家级精品课程。

会计学作为经济管理学科的一个重要分支,已经发展形成了一个完整的学科体系。

该课程主要围绕会计确认、会计计量、会计记录和会计报告等内容,阐述会计的基本理论、基本方法和基本技能。

该课程是我校会计学专业(含注册会计师方向)和财务管理专业开设的专业基础课,其为该专业学生后续的中级财务会计、高级财务会计以及财务管理等课程的学习提供了理论和方法基础。

同时也为其他经济管理类专业提供了必要的会计学基础知识。

二、教学目标及任务《会计学原理》课程主要围绕会计确认、会计计量、会计记录和会计报告等内容,阐述会计的基本理论、基本方法和基本技能。

通过本课程的学习,应当使学生掌握会计的基本理论与方法以及会计的基本技能。

(一)会计的基本理论主要包括:认识会计的本质及其在社会经济发展过程中的基本功能与特征;掌握会计目标、会计信息使用者的要求以及会计信息的质量要求;掌握企业经济活动的基本特征与资金运动的基本规律;掌握会计要素、会计科目与会计账户设置的基本理论及其关系;掌握会计确认和会计计量的基本理论;掌握复式记账的基本原理;掌握财务报告体系及其内容、基本财务报表的结构原理以及相互关系;了解我国会计规范体系的结构以及基本规范的主要内容。

(二)会计的基本方法主要包括:掌握会计确认和会计计量的基本方法;掌握会计记录的基本程序与方法。

(三)会计的基本技能主要包括:掌握企业基本经济交易与事项会计分录的编制方法;掌握主要会计凭证的填制与审核的基本方法;掌握主要会计账簿的设置、登记、对账、结账和错账更正的基本方法;掌握资产价值计量与收益计量的基本方法;掌握主要财务报表编制的基本方法。