人大《初级会计学》第7版

- 格式:ppt

- 大小:1.50 MB

- 文档页数:44

MPACC考研难度及复试分数线本内容凯程崔老师有重要贡献一、MPACC考研难度大不大,跨专业的人考上的多不多?总体来说,MPACC初试难度不高,就业形势大好,受到考生们的青睐。

据统计,MPACC专业成为凯程人数最多的专业。

随着报考人数的增多,竞争自然也在增大,由于初试只考管理类联考综合和英语二,考研难度降低,对于跨专业的考生是一大福利。

据凯程内部统计数据得知,每年MPACC考研的考生中95%是跨专业考生,在录取的学生中,基本都是跨专业考的。

在考研复试的时候,老师更看重跨专业学生自身的能力,而不是本科背景。

其次,本科会计学专业涉及分析层面的内容没有那么深,此对数学的要求没那么高,本身知识点难度并不大,跨专业的学生完全能够学得懂。

在凯程辅导班里很多这样三凯程生,都考的不错,而且每年还有很多二本院校的成功录取的学员,主要是看你努力与否。

所以记住重要的不是你之前学得如何,而是从决定考研起就要抓紧时间完成自己的计划,下定决心,就全身心投入,要相信付出总会有回报。

二、MPACC就业怎么样?MPACC就业前景不可小觑,薪资令人羡慕。

随着国家经济的发展,各大企业公司对会计的需求也变得紧迫,MPACC将会成为各大公司需求的高素质人才。

就业方向:在各类企业事业单位、会计师事务所、经济管理职能部门、金融与证券投资部门以及三资企业、外贸公司等经济部门与单位从事会计及财务管理。

三、MPACC报考院校推荐凯程考研重点为大家提供MPACC考研的北京院校详情,帮助大家更好对于MPACC 考研如何报考院校提供参考。

(一)人大,中财,外经贸这三所都很不错,不用对这三个纠结什么,基本毕业后的情况都差不多,就业集中于:1、银行---总行、五大行的北分,还有城商行的北分,也有个别外省的省分;2、央企----央企总部或是下面的二级单位,有一些是垄断行业;3、外企财务机构;4、公务员----这个也许可以进部委工作,平台高一些。

如果你有一定的实力,并且想在北京生根,那么这几个学校都不错,哪个对于你相对好考你考哪个,区别不大。

Chapter 10: Plant Assets and Intangibles1)The cost of land includes the cost of removing unwanted buildings.Answer:TRUEDiff: 1Page Ref: 507Objective: 10-1EOC Ref: S10-12)The cost of fencing around a building is included in the cost of the building.Answer:FALSEDiff: 1Page Ref: 507Objective: 10-1EOC Ref: S10-13)Treating a capital expenditure as an expense causes an understatement of net income.Answer:TRUEDiff: 1Page Ref: 509, 510Objective: 10-1EOC Ref: S10-14)Tangible assets are assets with no physical form that have value because of the special rightsthey carry.Answer:FALSEDiff: 1Page Ref: 506, 525Objective: 10-1EOC Ref: S10-15)The three major depreciation methods are straight-line, declining-balance, and specificidentification.Answer:FALSEDiff: 1Page Ref: 511Objective: 10-2EOC Ref: S10-46)Estimated residual value is the expected cash value of an asset at the end of its useful life.Answer:TRUEDiff: 1Page Ref: 511Objective: 10-2EOC Ref: S10-47)The straight-line method of depreciation assigns a fixed amount of depreciation to each unit ofoutput produced by an asset.Answer:FALSEDiff: 1Page Ref: 512Objective: 10-2EOC Ref: S10-48)Accelerated depreciation differs from straight line depreciation in that depreciation expense isgreater in the first year and less in the later years.Answer:TRUEDiff: 1Page Ref: 513Objective: 10-2EOC Ref: S10-49)The units-of-production method of depreciation always writes off more of the assetʹs cost nearthe start of its useful life than the declining-balance method.Answer:FALSEDiff: 1Page Ref: 513Objective: 10-3EOC Ref: S10-610)The double-declining balance method of depreciation computes annual depreciation bymultiplying the assetʹs decreasing book value by a constant percent that is two times thestraight-line rate.Answer:TRUEDiff: 1Page Ref: 513Objective: 10-3EOC Ref: S10-611)The MACRS depreciation method, required for purposes of determining taxable income,computes depreciation by using 150% declining balance depreciation (rather thandouble-declining balance) for most assets with a useful life of less than 20 years.Answer:FALSEDiff: 2Page Ref: 519Objective: 10-3EOC Ref: S10-612)For tax purposes, accelerated depreciation is generally preferable to straight-line becauseaccelerated depreciation reduces taxable income and taxes due.Answer:TRUEDiff: 1Page Ref: 519Objective: 10-3EOC Ref: S10-613)A loss on the sale of a plant asset is recorded when the sales price exceeds the book value.Answer:FALSEDiff: 1Page Ref: 522Objective: 10-4EOC Ref: S10-914)If assets are junked before being fully depreciated, there is a loss equal to the book value of theasset.Answer:TRUEDiff: 1Page Ref: 521Objective: 10-4EOC Ref: S10-915)A loss occurs on the exchange of a plant asset if the market value of the new asset received isgreater than the total amount given up in the exchange.Answer:FALSEDiff: 1Page Ref: 523, 524Objective: 10-4EOC Ref: S10-1016)A gain on the exchange of a plant asset is not recorded, but results in a smaller basis in thenew asset received.Answer:TRUEDiff: 1Page Ref: 523, 524Objective: 10-4EOC Ref: S10-1017)Depletion expense is the portion of a natural resourceʹs cost used up in a particular period.Answer:TRUEDiff: 1Page Ref: 524, 525Objective: 10-5EOC Ref: S10-1118)Accumulated depletion is a contra-liability account.Answer:FALSEDiff: 1Page Ref: 524, 525Objective: 10-5EOC Ref: S10-1119)Goodwill is not amortized, but evaluated each year for a decline in value.Answer:TRUEDiff: 2Page Ref: 526, 527Objective: 10-6EOC Ref: S10-1320)A patent is an exclusive right to reproduce and sell a book, musical composition, film, otherwork of art, or computer program, and must be amortized over the useful life of the patent.Answer:FALSEDiff: 2Page Ref: 526Objective: 10-6EOC Ref: S10-1321)Which of the following are included in the cost of land?A)The cost of clearing the landB)The cost of fencingC)The cost of pavingD)The cost of outdoor lightingAnswer:ADiff: 1Page Ref: 507Objective: 10-1EOC Ref: S10-122)Which of the following is included in the cost of a plant asset?A)The purchase price of the plant assetB)The taxes paidC)Amounts paid to ready the asset for its intended useD)All of the aboveAnswer:DDiff: 1Page Ref: 506Objective: 10-1EOC Ref: S10-123)Which of the following assets groups includes fencing?A)BuildingsB)LandC)Land improvementsD)Machinery and equipmentAnswer:CDiff: 1Page Ref: 507Objective: 10-1EOC Ref: S10-124)Which of the following assets groups includes the cost of clearing land and removingunwanted buildings?A)BuildingsB)LandC)Land improvementsD)Machinery and equipmentAnswer:BDiff: 1Page Ref: 507Objective: 10-1EOC Ref: S10-125)Which of the following is NOT considered a plant asset?A)LandB)BuildingC)CopyrightD)EquipmentAnswer:CDiff: 1Page Ref: 507, 508, 526Objective: 10-1EOC Ref: S10-126)Which of the following is a characteristic of a plant asset?A)The asset is used in the production of income for the business.B)The asset is available for resale to customers in the ordinary course of business.C)The asset lacks physical form.D)Both A and B are characteristics of a plant asset.Answer:ADiff: 1Page Ref: 506Objective: 10-1EOC Ref: S10-127)Hastings Company has purchased a group of assets for $350,000. The assets and their marketvalues are listed as follows:Land $125,000Equipment 75,000Building 200,000Which of the following amounts would be debited to the Land account?A)$ 65,625B)109,375C)125,000D)175,000Answer:BDiff: 1Page Ref: 507Objective: 10-1EOC Ref: S10-228)Which of the following would be capitalized and depreciated rather than expensed?A)Repair of engineB)Replacement of tiresC)Paint jobD)Modification for new useAnswer:DDiff: 1Page Ref: 509, 510Objective: 10-1EOC Ref: S10-329)Which of the following would be expensed rather than capitalized?A)Major engine overhaulB)Modification for new useC)Oil change and lubricationD)Addition to storage capacityAnswer:CDiff: 1Page Ref: 509, 510Objective: 10-1EOC Ref: S10-330)A companyʹs accountant capitalizes a payment that should be recorded as an expense. Whichof the following is TRUE?A)Assets are overstated.B)Liabilities are overstated.C)Revenue is overstated.D)Expenses are overstated.Answer:ADiff: 1Page Ref: 509, 510Objective: 10-1EOC Ref: S10-331)A companyʹs accountant expenses a payment that should be capitalized. Which of thefollowing is TRUE?A)Assets are overstated.B)Liabilities are overstated.C)Revenue is overstated.D)Expenses are overstated.Answer:DDiff: 1Page Ref: 509, 510Objective: 10-1EOC Ref: S10-332)Which of the following expenditures would be debited to an expense account?A)The cost to overhaul the company carʹs engineB)The cost to replace the transmission of the company careC)The cost to change the company carʹs oilD)All of the aboveAnswer:CDiff: 1Page Ref: 509, 510Objective: 10-1EOC Ref: S10-333)Which of the following are expenditures that are periodic and routine?A)Capital expendituresB)Ordinary repairsC)Extraordinary repairsD)Asset expendituresAnswer:BDiff: 1Page Ref: 509, 510Objective: 10-1EOC Ref: S10-334)Roberts Construction Company paid $40,000 for equipment with a market value of $45,000. Atwhich of the following amounts should the equipment be recorded?A)$40,000B)$42,500C)$45,000D)None of the aboveAnswer:ADiff: 1Page Ref: 508Objective: 10-1EOC Ref: S10-235)A company purchased a used machine for $80,000. The machine required installation costs of$8,000 and insurance while in transit of $500. At which of the following amounts would the equipment be recorded?A)$80,000B)$80,500C)$88,000D)$88,500Answer:DDiff: 1Page Ref: 508Objective: 10-1EOC Ref: S10-236)Which of the following items should be depreciated?A)LandB)Tangible property, plant, and equipment other than landC)Intangible propertyD)Natural resourcesAnswer:BDiff: 1Page Ref: 506-508Objective: 10-2EOC Ref: S10-437)Which of the following items should NOT be depreciated because it doesnʹt wear out?A)LandB)Tangible property, plant, and equipment other than landC)Intangible propertyD)Natural resourcesAnswer:ADiff: 1Page Ref: 507Objective: 10-2EOC Ref: S10-438)Which of the following accounting principles requires depreciation?A)Entity conceptB)Reliability conceptC)The revenue conceptD)The matching conceptAnswer:DDiff: 1Page Ref: 510Objective: 10-2EOC Ref: S10-439)Which of the following items is a factor to consider when computing depreciation expense?A)The cost of the assetB)The useful life of the assetC)The residual value of the assetD)All of the aboveAnswer:DDiff: 1Page Ref: 511Objective: 10-2EOC Ref: S10-440)Which of the following factors are estimates?A)The cost of the assetB)The useful life of the assetC)The residual value of the assetD)Both B and CAnswer:DDiff: 1Page Ref: 511Objective: 10-2EOC Ref: S10-441)Which of the following depreciation methods allocates an equal amount of depreciation toeach year?A)Straight-lineB)Units-of-productionC)Declining-balanceD)All of the aboveAnswer:ADiff: 1Page Ref: 512Objective: 10-2EOC Ref: S10-442)Which of the following depreciation methods allocates a fixed amount of depreciation toeach±miles driven, copies made, or some other number of components?A)Straight-lineB)Units-of-productionC)Declining-balanceD)All of the aboveAnswer:BDiff: 1Page Ref: 513Objective: 10-2EOC Ref: S10-443)Which of the following depreciation methods writes off more depreciation near the start of anassetʹs life than in later years?A)Straight-lineB)Units-of-productionC)Declining-balanceD)All of the aboveAnswer:CDiff: 1Page Ref: 513, 514Objective: 10-2EOC Ref: S10-444)Which of the following properly describes accumulated depreciation?A)Accumulated depreciation is a contra-asset account.B)Accumulated depreciation is a contra-liability account.C)Accumulated depreciation is an expense account.D)Accumulated depreciation is a contra-equity account.Answer:ADiff: 1Page Ref: 512Objective: 10-2EOC Ref: S10-445)Which of the following is the purpose of accumulated depreciation?A)Accumulated depreciation is an expense.B)Accumulated depreciationʹs purpose is to provide details about the cost expiration ofplant assets.C)Accumulated depreciationʹs purpose is to provide details about the cost expiration ofnatural assets.D)Accumulated depreciationʹs purpose is to provide details about the cost expiration ofintangible assets.Answer:BDiff: 1Page Ref: 512Objective: 10-2EOC Ref: S10-446)Which of the following depreciation methods does NOT use a residual method in the firstyear?A)Straight-lineB)Units-of-productionC)Declining-balanceD)All of the aboveAnswer:CDiff: 1Page Ref: 513, 514Objective: 10-2EOC Ref: S10-447)Which of the following depreciation methods is used by MOST companies for their financialstatements?A)Straight-lineB)Units-of-productionC)Declining-balanceD)All of the above methods are used about equallyAnswer:ADiff: 1Page Ref: 516Objective: 10-2EOC Ref: S10-448)Which of the following is the expected cash value of an asset at the end of its useful life?A)Book valueB)Carrying valueC)Market valueD)Residual valueAnswer:DDiff: 1Page Ref: 511Objective: 10-2EOC Ref: S10-4Table 10.1On January 1, 2011, Zane Manufacturing Company purchased a machine for $40,000. The company expects to use the machine a total of 24,000 hours over the next 6 years. The estimated sales price of the machine at the end of 6 years is $4,000. The company used the machine 8,000 hours in 2011 and 12,000 in 2012.49)Refer to Table 10.1. What is depreciation expense for 2011 if the company usesdouble-declining balance depreciation?A)$6,000B)$6,667C)$12,000D)$13,333Answer:DDiff: 2Page Ref: 513, 514Objective: 10-2EOC Ref: S10-450)Refer to Table 10.1. What is depreciation expense for 2012 if the company usesdouble-declining balance depreciation?A)$6,000B)$8,889C)$10,000D)$13,333Answer:BDiff: 2Page Ref: 513, 514Objective: 10-2EOC Ref: S10-451)Refer to Table 10.1. What is the book value of the machine at the end of 2012 if the companyuses double-declining balance depreciation?A)$13,333B)$17,778C)$20,000D)$28,000Answer:BDiff: 2Page Ref: 513, 514Objective: 10-2EOC Ref: S10-452)Refer to Table 10.1. What is depreciation expense for 2011 if the company uses straight-linedepreciation?A)$6,000B)$6,667C)$12,000D)$13,333Answer:ADiff: 1Page Ref: 512, 513Objective: 10-2EOC Ref: S10-453)Refer to Table 10.1. What is depreciation expense for 2012 if the company uses straight-linedepreciation?A)$6,000B)$9,000C)$10,000D)$13,333Answer:ADiff: 2Page Ref: 512, 513Objective: 10-2EOC Ref: S10-454)Refer to Table 10.1. What is the book value of the machine at the end of 2012 if the companyuses straight-line depreciation?A)$10,000B)$17,778C)$20,000D)$28,000Answer:DDiff: 1Page Ref: 512, 513Objective: 10-2EOC Ref: S10-455)Refer to Table 10.1. What is depreciation expense for 2011 if the company usesunits-of-production depreciation?A)$6,000B)$6,667C)$12,000D)$13,333Answer:CDiff: 2Page Ref: 513Objective: 10-2EOC Ref: S10-456)Refer to Table 10.1. What is depreciation expense for 2012 if the company usesunits-of-production depreciation?A)$6,000B)$9,000C)$10,000D)$18,000Answer:DDiff: 2Page Ref: 513Objective: 10-2EOC Ref: S10-457)Refer to Table 10.1. What is the book value of the machine at the end of 2012 if the companyuses units-of-production depreciation?A)$10,000B)$17,778C)$20,000D)$28,000Answer:ADiff: 3Page Ref: 513Objective: 10-2EOC Ref: S10-458)Which of the following is TRUE when the estimate of an assetʹs useful life is increased?A)Prior yearsʹ financial statements must be restated.B)Annual depreciation expense is decreased for the remaining years of the assetʹs life.C)The new estimate is ignored until the last year of the assetʹs life.D)Annual depreciation expense is increased for the remaining years of the assetʹs life.Answer:BDiff: 3Page Ref: 520, 521Objective: 10-2EOC Ref: S10-859)Lexis Company purchased equipment on January 1, 2005 for $35,500. The estimated useful lifeof the equipment was 7 years and the estimated residual value was $4,000. After using the straight-line method of depreciation for 3 years, the estimated useful life was revised to 9 years on January 1, 2008. How much is depreciation expense for 2008.A)$2,000B)$2,444C)$3,000D)$3,667Answer:CDiff: 3Page Ref: 520, 521Objective: 10-2EOC Ref: S10-860)Which of the following depreciation methods is used by MOST companies for their taxreturns?A)Straight-lineB)Units-of-productionC)Declining-balanceD)All of the above methods are used about equallyAnswer:CDiff: 1Page Ref: 519Objective: 10-3EOC Ref: S10-661)A company purchased a computer on July 1, 2009. The computer has an estimated useful lifeof 5 years and will have no salvage value. It is estimated that the computer can be used for 5,000 hours. The computer was used for 450 hours during 2009. If the goal is to reduce taxable income to the lowest amount, which method should be elected and how much depreciation can be deducted in 2009?A)Straight-line, $1,000B)Double declining-balance, $2,000C)Units-of-production, $900D)None of the aboveAnswer:BDiff: 1Page Ref: 519Objective: 10-3EOC Ref: S10-662)A company purchased equipment for $100,000 in 2008. The machine will be used for 10,000hours and will have a residual value of $20,000. The equipment was used for 2,400 hours in 2008. How much depreciation will be deducted if the company elects the units-of-production method for tax return purposes?A)$10,000B)$19,200C)$20,000D)$24,000Answer:BDiff: 1Page Ref: 519Objective: 10-3EOC Ref: S10-663)When is a gain on disposal of an asset recorded?A)A gain is recorded when the assetʹs residual value is less than the cash received.B)A gain is recorded when the asset is sold for a price greater than the assetʹs book value.C)A gain is recorded when accumulated depreciation is less than the cash received.D)A gain is recorded when the asset is sold for a price less than the assetʹs book value.Answer:BDiff: 1Page Ref: 522, 523Objective: 10-4EOC Ref: S10-964)When is a loss on disposal of an asset recorded?A)A loss is recorded when the assetʹs residual value is less than the cash received.B)A loss is recorded when the asset is sold for a price greater than the assetʹs book value.C)A loss is recorded when accumulated depreciation is less than the cash received.D)A loss is recorded when the asset is sold for a price less than the assetʹs book value.Answer:DDiff: 1Page Ref: 522, 523Objective: 10-4EOC Ref: S10-9residual value was $2,000. How much depreciation is deducted in the fourth year of use if the straight line method of depreciation was used?A)NoneB)$667C)$1,000D)$2,000Answer:ADiff: 2Page Ref: 512, 513Objective: 10-4EOC Ref: S10-966)An asset was purchased for $12,000. The assetʹs estimated useful life was 3 years and itsresidual value was $2,000. How much gain or loss is reported if the asset is sold for $3,000 at the beginning of the fourth year?A)No gain or lossB)$1,000 lossC)$1,000 gainD)$2,000 lossAnswer:CDiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-967)An asset was purchased for $12,000. The assetʹs estimated useful life was 3 years and itsresidual value was $2,000. How much gain or loss is reported if the asset is sold for $3,000 at the end of the fourth year?A)No gain or lossB)$1,000 lossC)$1,000 gainD)$2,000 lossAnswer:CDiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-9residual value was $2,000. How much gain or loss is reported if the asset is sold for $1,000 at the beginning for the fourth year?A)No gain or lossB)$1,000 lossC)$1,000 gainD)$2,000 lossAnswer:BDiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-969)An asset was purchased for $12,000. The assetʹs estimated useful life was 3 years and itsresidual value was $2,000. How much gain or loss is reported if the asset is sold for $5,333 at the beginning for the third year if the straight line method of depreciation was used?A)No gain or lossB)$1,000 lossC)$1,000 gainD)$2,000 lossAnswer:ADiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-970)Which of the following items is included in the journal entry if a company sells equipment at aprice equal to its book value?A)A debit to equipment for its book valueB)A credit to accumulated depreciationC)A debit to loss on sale of equipmentD)A credit to equipment for its original costAnswer:DDiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-971)Which of the following items is included in the journal entry if a company sells equipment at aprice greater than its book value?A)A debit to equipment for its book valueB)A credit to gain on sale of equipmentC)A debit to loss on sale of equipmentD)A credit to accumulated depreciationAnswer:BDiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-972)Which of the following items is included in the journal entry if a company sells equipment at aprice less than its book value?A)A debit to equipment for its book valueB)A credit to accumulated depreciationC)A debit to loss on sale of equipmentD)A credit to gain on sale of equipmentAnswer:CDiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-973)Kelly Petroleum Products owns furniture that was purchased for $19,600. Accumulateddepreciation is $17,300. The furniture was sold for $3,800. Which of the following is the correct entry to record the transaction?A)Accumulated depreciation 17,300Cash 3,800Gain on sale of furniture 1,500Furniture 19,600B)Accumulated depreciation 17,300Cash 3,800Furniture 31,100C)Furniture 19,600Cash 2,700Gain on sale of furniture 5,000Accumulated depreciation 17,300D)Furniture 19,600Gain on sale of furniture 3,800Cash 2,700Accumulated depreciation 17,300Answer:ADiff: 2Page Ref: 522, 523Objective: 10-4EOC Ref: S10-1074)Kelly Petroleum Products owns fully depreciated equipment that was purchased for $26,500.The equipment had an estimated useful life of 8 years and an estimated residual value of $2,500. The equipment was sold for $2,700. Which of the following is the correct entry to record the transaction?A)Accumulated depreciation 26,500Cash 2,700Equipment 23,800B)Accumulated depreciation 26,500Cash 2,700Gain on sale of equipment 2,700Equipment 26,500C)Accumulated depreciation 24,000Cash 2,700Gain on sale of equipment 200Equipment 26,500D)None of the aboveAnswer:CDiff: 3Page Ref: 522, 523Objective: 10-4EOC Ref: S10-1075)Lowery Food Market owns refrigeration equipment that cost $10,000 and has accumulateddepreciation of $8,500. The company exchanges the equipment for new equipment worth $12,000. In addition to the old equipment, the company pays $10,000 for the new equipment.Which of the following is the correct entry to record the transaction?A)Refrigeration equipment 11,500Accumulated depreciation 8,500Cash 10,000Refrigeration equipment 10,000B)Refrigeration equipment 11,000Accumulated depreciation 8,500Loss on exchange of equipment 500Cash 10,000Refrigeration equipment 10,000C)Refrigeration equipment 12,000Accumulated depreciation 8,500Gain on exchange of equipment 500Cash 10,000Refrigeration equipment 10,000D)None of the aboveAnswer:ADiff: 2Page Ref: 523, 524Objective: 10-4EOC Ref: S10-1076)Lowery Food Market owns refrigeration equipment that cost $10,000 and has accumulateddepreciation of $7,400. The company exchanges the equipment for new equipment worth $12,000. In addition to the old equipment, the company pays $10,000 for the new equipment.Which of the following is the correct entry to record the transaction?A)Refrigeration equipment 12,000Accumulated depreciation 7,400Cash 10,000Refrigeration equipment 9,400B)Refrigeration equipment 12,000Accumulated depreciation 7,400Loss on exchange of equipment 600Cash 10,000Refrigeration equipment 10,000C)Refrigeration equipment 10,000Accumulated depreciation 10,000Gain on exchange of equipment 600Cash 12,000Refrigeration equipment 7,400D)None of the aboveAnswer:BDiff: 3Page Ref: 523, 524Objective: 10-4EOC Ref: S10-1077)Which of the following items should be depleted?A)LandB)Tangible property, plant, and equipment other than landC)Intangible propertyD)Natural resourcesAnswer:DDiff: 1Page Ref: 524, 525Objective: 10-5EOC Ref: S10-1178)Which of the following is the expense resulting from a decline in the utility of naturalresource?A)DepreciationB)DepletionC)AmortizationD)ObsolescenceAnswer:BDiff: 1Page Ref: 524, 525Objective: 10-5EOC Ref: S10-1179)Which of the following accounting methods is the method used to compute depletion?A)Straight-lineB)Units-of-productionC)Declining-balanceD)None of the aboveAnswer:BDiff: 1Page Ref: 524, 525Objective: 10-5EOC Ref: S10-11Table 10.2Navajo Mining Company purchased a mine in 2011 for $3,400,000. It was estimated that the mine contained 200,000 tons of ore and that the mine would be worthless after all of the ore was extracted. The company extracted 25,000 tons of are in 2011 and 30,000 tons of ore in 2012.80)Refer to Table 10.2. What is depletion expense for 2011?A)$340,000B)$425,000C)$510,000D)$680,000Answer:BDiff: 1Page Ref: 524, 525Objective: 10-5EOC Ref: S10-1181)Refer to Table 10.2. What is depletion expense for 2012?A)$340,000B)$425,000C)$510,000D)$680,000Answer:CDiff: 1Page Ref: 524, 525Objective: 10-5EOC Ref: S10-1182)Refer to Table 10.2. What is the book value of the mine at the end of 2012?A)$2,465,000B)$2,720,000C)$2,975,000D)$3,060,000Answer:ADiff: 2Page Ref: 524, 525Objective: 10-5EOC Ref: S10-1183)Which of the following is the amount capitalized as goodwill?A)The excess of the cost of an acquired company over the sum of the book value of its netassetsB)The excess of the cost of an acquired company over the sum of the book value of itsassetsC)The excess of the cost of an acquired company over the sum of the market value of its netassetsD)The excess of the cost of an acquired company over the sum of the market value of itsassetsAnswer:CDiff: 2Page Ref: 526, 527Objective: 10-6EOC Ref: S10-1284)Which of the following items should be amortized?A)LandB)Tangible property, plant, and equipment other than landC)Intangible propertyD)Natural resourcesAnswer:CDiff: 1Page Ref: 525, 526Objective: 10-6EOC Ref: S10-1285)Which of the following is the expense resulting from a decline in the utility of an intangibleasset?A)DepreciationB)DepletionC)AmortizationD)ObsolescenceAnswer:CDiff: 1Page Ref: 525, 526Objective: 10-6EOC Ref: S10-1286)Which of the following accounting methods is the method used to compute amortization?A)Straight-lineB)Units-of-productionC)Declining-balanceD)None of the aboveAnswer:ADiff: 1Page Ref: 525, 526Objective: 10-6EOC Ref: S10-1287)Which of the following is the proper accounting treatment for research and developmentcosts?A)Research and development costs must be capitalized and amortized over 20 years or less.B)Research and development costs must be capitalized and amortized over 70 years or less.C)Research and development costs must be capitalized and expensed each year to theextent that their value has declined.D)Research and development costs must be expensed.Answer:DDiff: 2Page Ref: 527Objective: 10-6EOC Ref: S10-12。

会计硕士考研难度及复试分数线本内容凯程崔老师有重要贡献一、会计硕士考研难度大不大,跨专业的人考上的多不多?总体来说,会计硕士初试难度不高,就业形势大好,受到考生们的青睐。

据统计,会计硕士专业成为凯程人数最多的专业。

随着报考人数的增多,竞争自然也在增大,由于初试只考管理类联考综合和英语二,考研难度降低,对于跨专业的考生是一大福利。

据凯程内部统计数据得知,每年会计硕士考研的考生中95%是跨专业考生,在录取的学生中,基本都是跨专业考的。

在考研复试的时候,老师更看重跨专业学生自身的能力,而不是本科背景。

其次,本科会计学专业涉及分析层面的内容没有那么深,此对数学的要求没那么高,本身知识点难度并不大,跨专业的学生完全能够学得懂。

在凯程辅导班里很多这样三凯程生,都考的不错,而且每年还有很多二本院校的成功录取的学员,主要是看你努力与否。

所以记住重要的不是你之前学得如何,而是从决定考研起就要抓紧时间完成自己的计划,下定决心,就全身心投入,要相信付出总会有回报。

二、会计硕士就业怎么样?会计硕士就业前景不可小觑,薪资令人羡慕。

随着国家经济的发展,各大企业公司对会计的需求也变得紧迫,会计硕士将会成为各大公司需求的高素质人才。

就业方向:在各类企业事业单位、会计师事务所、经济管理职能部门、金融与证券投资部门以及三资企业、外贸公司等经济部门与单位从事会计及财务管理。

三、会计硕士报考院校推荐凯程考研重点为大家提供会计硕士考研的北京院校详情,帮助大家更好对于会计硕士考研如何报考院校提供参考。

(一)人大,中财,外经贸这三所都很不错,不用对这三个纠结什么,基本毕业后的情况都差不多,就业集中于:1、银行---总行、五大行的北分,还有城商行的北分,也有个别外省的省分;2、央企----央企总部或是下面的二级单位,有一些是垄断行业;3、外企财务机构;4、公务员----这个也许可以进部委工作,平台高一些。

如果你有一定的实力,并且想在北京生根,那么这几个学校都不错,哪个对于你相对好考你考哪个,区别不大。

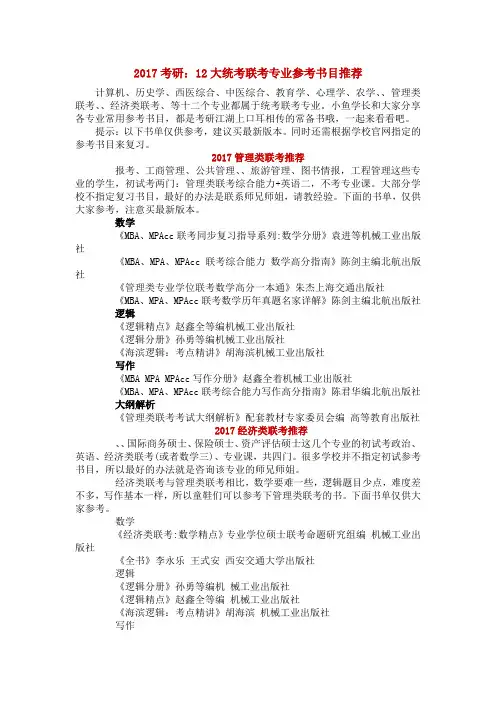

2017考研:12大统考联考专业参考书目推荐计算机、历史学、西医综合、中医综合、教育学、心理学、农学、、管理类联考、、经济类联考、等十二个专业都属于统考联考专业。

小鱼学长和大家分享各专业常用参考书目,都是考研江湖上口耳相传的常备书哦,一起来看看吧。

提示:以下书单仅供参考,建议买最新版本。

同时还需根据学校官网指定的参考书目来复习。

2017管理类联考推荐报考、工商管理、公共管理、、旅游管理、图书情报,工程管理这些专业的学生,初试考两门:管理类联考综合能力+英语二,不考专业课。

大部分学校不指定复习书目,最好的办法是联系师兄师姐,请教经验。

下面的书单,仅供大家参考,注意买最新版本。

数学《MBA、MPAcc联考同步复习指导系列:数学分册》袁进等机械工业出版社《MBA、MPA、MPAcc 联考综合能力数学高分指南》陈剑主编北航出版社《管理类专业学位联考数学高分一本通》朱杰上海交通出版社《MBA、MPA、MPAcc联考数学历年真题名家详解》陈剑主编北航出版社逻辑《逻辑精点》赵鑫全等编机械工业出版社《逻辑分册》孙勇等编机械工业出版社《海滨逻辑:考点精讲》胡海滨机械工业出版社写作《MBA MPA MPAcc写作分册》赵鑫全着机械工业出版社《MBA、MPA、MPAcc联考综合能力写作高分指南》陈君华编北航出版社大纲解析《管理类联考考试大纲解析》配套教材专家委员会编高等教育出版社2017经济类联考推荐、、国际商务硕士、保险硕士、资产评估硕士这几个专业的初试考政治、英语、经济类联考(或者数学三)、专业课,共四门。

很多学校并不指定初试参考书目,所以最好的办法就是咨询该专业的师兄师姐。

经济类联考与管理类联考相比,数学要难一些,逻辑题目少点,难度差不多,写作基本一样,所以童鞋们可以参考下管理类联考的书。

下面书单仅供大家参考。

数学《经济类联考:数学精点》专业学位硕士联考命题研究组编机械工业出版社《全书》李永乐王式安西安交通大学出版社逻辑《逻辑分册》孙勇等编机械工业出版社《逻辑精点》赵鑫全等编机械工业出版社《海滨逻辑:考点精讲》胡海滨机械工业出版社写作《MBA MPA MPAcc写作分册》赵鑫全着机械工业出版社《经济类、管理类联考综合能力写作套路化训练》王诚北京理工大学出版社2017推荐提示:以下书单仅供参考,建议买最新版本。

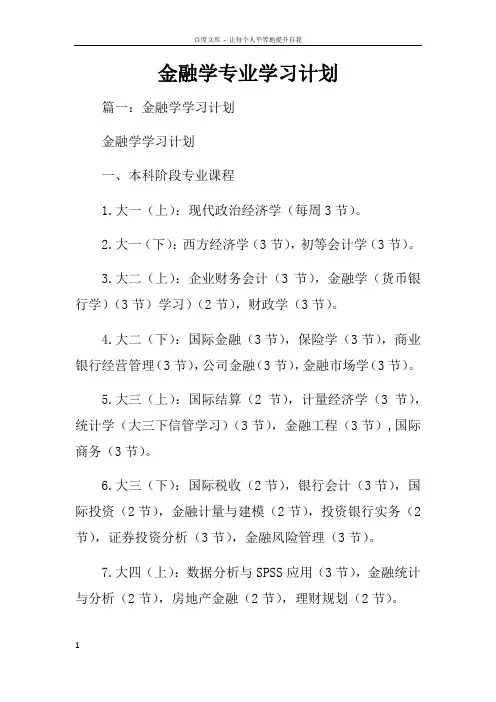

金融学专业学习计划篇一:金融学学习计划金融学学习计划一、本科阶段专业课程1.大一(上):现代政治经济学(每周3节)。

2.大一(下):西方经济学(3节),初等会计学(3节)。

3.大二(上):企业财务会计(3节),金融学(货币银行学)(3节)学习)(2节),财政学(3节)。

4.大二(下):国际金融(3节),保险学(3节),商业银行经营管理(3节),公司金融(3节),金融市场学(3节)。

5.大三(上):国际结算(2节),计量经济学(3节),统计学(大三下信管学习)(3节),金融工程(3节),国际商务(3节)。

6.大三(下):国际税收(2节),银行会计(3节),国际投资(2节),金融计量与建模(2节),投资银行实务(2节),证券投资分析(3节),金融风险管理(3节)。

7.大四(上):数据分析与SPSS应用(3节),金融统计与分析(2节),房地产金融(2节),理财规划(2节)。

8.大四(下):现代金融理论专题(1~9周,4节)。

二、素质提升课程1.中文写作与沟通2.文化素质教育课:a.文学与艺术b.历史与文化c.哲学与伦理d.基础社会科学(心理学导论)e.中国与世界f.国际社会g.物质科学(物理学概论)h.生命科学(现代生物学导论)[括号内为必修]。

三、金融课程详解1. 货币银行学:3学分,54学时,适用本科一年级;先修课程:西方经济学;选用教材:《金融学》蓸龙祺(高等教育出版社);参考书目:《货币银行学》黄达(中国人民大学出版社),《货币银行学》姚长辉(北京大学出版社)2.金融市场学:3学分,54学时,适用本科二年级;先修课程:宏微观经济学、货币银行学、财政学、高等数学;选用教材:《金融市场学》张亦春(高等教育出版社);参考书目:《金融市场学》谢百三(北京大学出版社),《金融市场学》夏德仁、王振山(东北财经大学出版社)3.国际金融学(双语):3学分,54学时,适用本科二年级;先修课程:宏微观经济学、货币银行学;选用教材:《International monetary and financial economics》Joseph and David (影印本);参考书目:《International finance》Thomas (中国人民大学出版社),《International finance》Ephraim Clark(北京大学出版社),《国际金融》姜波克(高等教育出版社)4.西方货币金融理论:3学分,54学时,适用本科三年级;先修课程:经济学、货币银行学、金融市场学;选用教材:《西方货币金融理论》伍海华(中国金融出版社);参考书目:《20世纪西方货币金融理论进展与述评》王广谦(经济科学出版社),《就业利息和货币通论》凯恩斯(商务印书馆),《经济发展中的金融深化》罗纳德I麦金农(上海三联书店),《管制、放松管制与重新管制》艾伦·加特(经济科学出版社),《利息理论与政策》胡维熊(上海财经大学出版社)5.金融监管理论与实务:3学分,54学时,适用本科三四年级;先修课程:保险学、商业银行经营与管理、证券投资学;选用教材:《金融监管教程》郭田勇(中国金融出版社);参考书目:《金融监管》韩汉君、王振富、丁忠明(上海财经大学出版社),《金融监管学》陈学彬、邹平座(高等教育出版社),《金融监管学》卫新江(中国金融出版社),《金融监管学》李成(科学出版社)6.金融风险管理:3学分,54学时,适用本科三年级;先修课程:西方经济学、货币银行学、商业银行学、金融市场学、证券投资学、概率与统计;选用教材:《金融风险管理学》朱忠明(中国人民大学出版社),参考书目:《金融风险管理师手册》Philippe Jorion(中国人民大学出版社),《金融风险管理手册》马克·洛尔(机械工业出版社),《金融数量方法》特里·J·沃特沙姆(上海人民出版社),《风险管理与衍生产品》勒内·M·斯塔此(机械工业出版社),《银行全面风险管理体系》赵志宏(中国金融出版社),7.商业银行经营学:3学分,54学时,适用本科二年级;先修课程:货币银行学、西方经济学、初级财务会计(银行会计);选用教材:《商业银行经营学》戴国强(高等教育出版社);参考书目:《商业银行管理》彼得·S·罗斯,《商业银行财务管理》毛秋荣(科学出版社)8.金融会计学:3学分,54学时;先修课程:初级会计学、货币银行学、银行经营管理、中央银行理论;适用本科二年级;选用教材:《新编银行会计》王允平(立信会计出版社);参考书目:《银行会计》丁元霖(立信会计出版社),《商业银行会计实务》张维新(海天出版社),《商业银行会计》王允平、李晓梅(立信会计出版社),《支付结算制度汇编》中国人民银行会计司,《现代银行会计基础》严华麟(中国物价出版社)9.财务管理学:2学分,36学时;先修课程:初级会计学;选用教材:《财务管理学》荆新(中国大学出版社);参考书目:《财务管理》陈国欣(南开大学出版社),《财务管理学》王庆成(中国财政经济出版社),《公司财务管理》道格拉斯·R·艾默瑞(中国人民大学出版社)10.初等会计学:3学分,42学时;适用本科一年级;选用教材:《初等会计学》朱小平(中国人民大学出版社);参考书目:《基础会计》管一民(上海财经大学出版社),《会计学基础》魏振雄(中国社会科学出版社)11.银行信贷管理:3学分,54学时;先修课程:货币银行学、商业银行经营管理、企业财务分析、经济学;选用教材:《银行信贷管理学》汪其务(中国金融出版社);参考书目:《商业银行管理》彼得·S·罗斯,《商业银行财务管理》毛秋荣(科学出版社)12.证券投资学:3学分,54学时;先修课程:高等数学、货币银行学、金融市场学;适用本科三四年级;选用教材:《证券投资学》吴晓求(中国人民大学出版社);参考书目:《证券投资学》曹凤岐(北京大学出版社),《股票操作学》张松龄(中国大百科全书出版社),《证券投资学》任淮秀(高等教育出版社)13.保险学:3学分,54学时;先修课程:经济学、金融学、高等数学;选用教材:《保险学》林宝清;参考书目:《保险学》孙祁祥(北京大学出版社),《保险法教程》(高等教育出版社),《财产保险学》郝演苏(中央财经大学出版社),《风险管理与保险》詹姆斯·S·特里斯曼(东北财经大学出版社)14.人身保险:3学分,54学时;先修课程:保险学、统计学、经济学;选用教材:《人身保险》张洪涛(中国人民大学出版社);参考书目:《人身保险案例分析》张洪涛(中国人民大学出版社)15.保险精算学:3学分,54学时;先修课程:经济学、高等数学、保险概论;选用教材:《保险精算学》王晓军(中国人民大学出版社);参考书目:《保险精算》李秀芳(中国金融出版社)16.中央银行学:3学分,54学时;适用本科二三年级;先修课程:银行货币学、商业银行学、国际金融学;选用教材:《中央银行学》王广谦(高等教育出版社);参考书目:《中央银行学概论》徐刚(上海财经大学出版社),《中央银行通论》孔祥毅(中国金融出版社),《中央银行概论》万解秋(复旦大学出版社),《现代金融监管》李早航(中国金融出版社),《中国金融改革研究》李扬(江苏人民出版社)17.国际结算:3学分,54学时;先修课程:货币银行学、商业银行学、国际金融学;适用本科三年级;选用教材:《国际结算》苏宗祥(中国金融出版社);参考书目:《国际贸易结算》李晓洁(上海财经大学出版社),《国际结算》梁琦(高等教育出版社)四、本科阶段各月阅读计划一月:生命科学(现代生物学导论)(1)中国资本市场实务(1)精算学基础(1)二月:物质科学(物理学概论)(1)商务案例分析(1)投资组合管理(1)三月:中国与世界近代经济史(1)随机过程与随机分析初步(2)四月:基础社会科学(心理学导论)(4)五月:哲学与伦理(逻辑学与道德)(4)六月:美育学(2)现代金融理论简史(1)(两专题同步进行)七月:文学与艺术(中文写作与沟通、音乐及美术基本知识)(2)新兴市场金融(1)八月:中国与世界宏观经济分析(3)九月:博弈论(3)十月:管理学原理(1)金融数据库理论(1)公司财务案例(1)十一月:金融学理论与实践(1)固定收益证券分析(1)风险管理与保险概论(1)十二月:金融经济学导论(1)保险经济学(1)工业生产概论(1)五、金融学保研夏令营的准备1.在大三下3月开始关注相关学校招生简章,并填报。

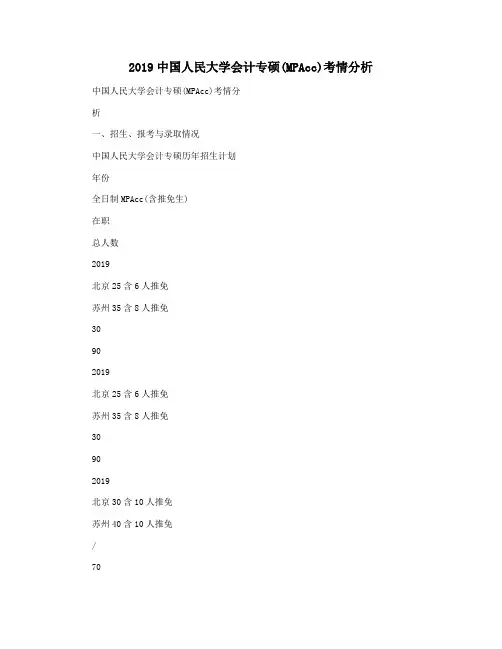

2019中国人民大学会计专硕(MPAcc)考情分析中国人民大学会计专硕(MPAcc)考情分析一、招生、报考与录取情况中国人民大学会计专硕历年招生计划年份全日制MPAcc(含推免生)在职总人数2019北京25含6人推免苏州35含8人推免30902019北京25含6人推免苏州35含8人推免30902019北京30含10人推免苏州40含10人推免/70中国人民大学会计专硕(全日制)报考及录取人数年份报考人数录取人数报录比2019北京235苏州225北京74(在职45)苏州4525.43%2019北京626苏州213北京56苏州3510.85%2019北京423苏州460北京31苏州509.17%二、初试与复试情况1、初试(1)初试科目①204英语二《英语二》(100分)②199管理类联考综合能力《管理类联考综合能力》(200分),其中数学基础75分,逻辑推理60分,写作65分)(2)参考书目《会计硕士(MPAcc)专业学位联考考试大纲及考试指南》2、复试(1)复试分数线国家复试分数线(A类)年份总分英语二管综201916041822019155418220191504182201935055110中国人民大学会计专硕复试分数线年份应届分数线往届分数线20192252052019北京230苏州220170(50、100)2019北京230苏州220/(2)复试内容复试主要包括:①专业综合课笔试(100分)、②外语笔试(50分)、③专业课和综合素质面试(150分)、④外语听力、口语测试(50分)、⑤政治面貌(100分,不计入复试总成绩)、⑥体检。

此外,同等学力考生还需对本科主干课程和实验技能进行笔试考查。

(3)复试专业能力笔试科目①会计学②审计学③成本管理会计④财务管理(4)复试笔试参考书目①《初级会计学》,朱小平、徐泓,中国人民大学出版社;②《财务会计学》,戴德明等,中国人民大学出版社;③《财务管理学》,荆新、王化成、刘俊彦,中国人民大学出版社;④《管理会计学》,孙茂竹,中国人民大学出版社;(5)复试规则:复试采取差额复试的办法进行。

2012--2014全国会计硕士复试分数线及录取情况序号招生院校招生办电话2012年招生人数(含推免)、最低录取分数线2013年招生人数(含推免)、复试线最低录取分数线2014年招生人数(含推免),复试线复试内容及参考书目学费、学制备注1 中国人民大学(985)010-62515340商学院82509175、62516871录取人数82人,含20个推免。

北京录取线230分,苏州220分北京全日制25苏州全日制35。

北京录取线230分,苏州220分。

北京报名人数626人,联考录取人数50人,推免人数6人,合计录取人数56人;苏州报名人数213人,联考录取人数27人,推免8人,合计录取人数35人北京全日制25苏州全日制35北京推免生2人;北京:235;苏州225无指定参考书目,会在复试前发布考试大纲。

《会计学》、《财务管理》《审计学》《财务会计》等人大出版社第五版教材2年,35000每年不招收外校推免生2 清华大学(985)会计硕士01062789967220分。

2012年计划招生人数2人,复试名单5人,实际录取3人,最高分235分225分。

复试名单5人,录取2人,最高分239235分;1人,不含推免生无参考书目。

复试时专业综合考试内容主要考核对经济管理现象的分析。

如2012年考讨论财务报表对中国炒股人的作用学制2年学费2万3 北京国家会计学院(010)64505152、64505024200分。

计划招生40人207分。

计划招生50人,推免人数4人,录取人数46人。

215分;50人,含推免生1人无官方参考书目。

《会计》(2013年度注册会计师全国统一考试辅导教材)、《财务成本管理》(2013年度注册会计师全国统一考试辅导教材)1.9万每年,学制2年面试内容1.英语2.专业知识,除笔试参考教材外,还需参考:⑴ 经济学基础(21世纪经济学系列教材),高鸿业主编,中国人民大学出版社,2013年1月出版⑵ 近一年财经热点问题4 北京交通大学(工科211)51684065、51684719经济管理学院联系电话:010-51687171张老师215。