公司金融复习公式

- 格式:doc

- 大小:16.09 KB

- 文档页数:5

《公司金融》课程笔记第一章公司金融导论1.1 企业组织形式企业组织形式是指企业在法律上和组织上的形式。

根据企业组织形式的不同,企业可以分为个体工商户、合伙企业、有限责任公司和股份有限公司等。

1.1.1 个体工商户个体工商户是指个人以自己的名义从事商业、工业、手工业等经营活动的自然人。

个体工商户的经营风险由个人承担,个人财产与企业财产没有明确界限。

1.1.2 合伙企业合伙企业是指两个或两个以上的合伙人共同出资、共同经营、共享收益、共担风险的企业。

合伙企业的合伙人对企业的债务承担无限连带责任。

1.1.3 有限责任公司有限责任公司是指股东以其认缴的出资额为限对公司承担责任,公司以其全部资产对公司的债务承担责任的企业。

有限责任公司的股东人数不得超过50人。

1.1.4 股份有限公司股份有限公司是指股东以其认购的股份为限对公司承担责任,公司以其全部资产对公司的债务承担责任的企业。

股份有限公司的股东人数没有限制。

1.2 公司理财活动的主要环节和目标1.2.1 主要环节公司理财活动的主要环节包括投资、融资、运营资金管理、股利分配等。

1.2.2 目标公司理财的目标是实现企业价值最大化或股东财富最大化。

为了实现这一目标,企业需要进行有效的投资决策、融资决策、运营资金管理决策和股利分配决策。

1.3 委托代理与公司治理1.3.1 委托代理问题委托代理问题是指股东与经理人之间的利益冲突。

股东希望经理人追求企业价值最大化,而经理人可能追求自己的利益最大化。

1.3.2 公司治理机制公司治理机制是指通过一系列制度安排来解决委托代理问题,包括董事会、监事会、经理人激励机制、信息披露制度等。

1.4 企业的社会责任企业的社会责任是指企业在追求利润的同时,应承担的社会责任,如环境保护、员工福利、公益活动等。

企业应遵守法律法规,遵循商业道德,为社会和利益相关者创造价值。

第二章财务现金流与财务预测2.1 公司理财与现金流现金流在公司理财中具有重要性,它反映了企业的财务状况和经营成果。

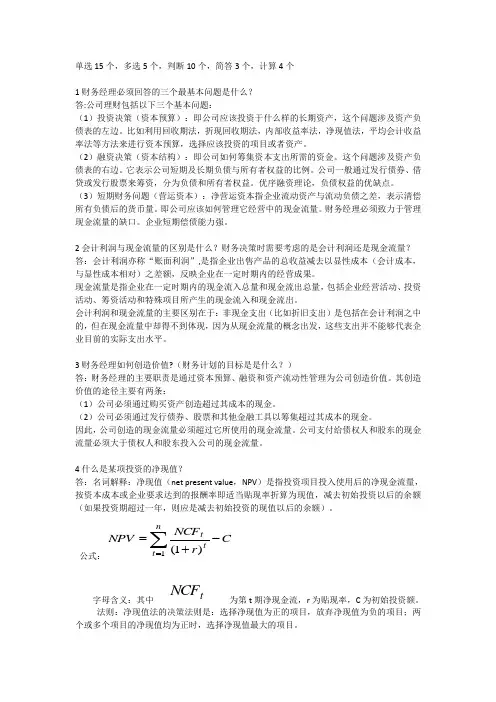

单选15个,多选5个,判断10个,简答3个,计算4个1财务经理必须回答的三个最基本问题是什么?答:公司理财包括以下三个基本问题:(1)投资决策(资本预算):即公司应该投资于什么样的长期资产,这个问题涉及资产负债表的左边。

比如利用回收期法,折现回收期法,内部收益率法,净现值法,平均会计收益率法等方法来进行资本预算,选择应该投资的项目或者资产。

(2)融资决策(资本结构):即公司如何筹集资本支出所需的资金。

这个问题涉及资产负债表的右边。

它表示公司短期及长期负债与所有者权益的比例。

公司一般通过发行债券、借贷或发行股票来筹资,分为负债和所有者权益。

优序融资理论,负债权益的优缺点。

(3)短期财务问题(营运资本):净营运资本指企业流动资产与流动负债之差,表示清偿所有负债后的货币量。

即公司应该如何管理它经营中的现金流量。

财务经理必须致力于管理现金流量的缺口。

企业短期偿债能力强。

2会计利润与现金流量的区别是什么?财务决策时需要考虑的是会计利润还是现金流量?答:会计利润亦称“账面利润”,是指企业出售产品的总收益减去以显性成本(会计成本,与显性成本相对)之差额,反映企业在一定时期内的经营成果。

现金流量是指企业在一定时期内的现金流入总量和现金流出总量,包括企业经营活动、投资活动、筹资活动和特殊项目所产生的现金流入和现金流出。

会计利润和现金流量的主要区别在于:非现金支出(比如折旧支出)是包括在会计利润之中的,但在现金流量中却得不到体现,因为从现金流量的概念出发,这些支出并不能够代表企业目前的实际支出水平。

3财务经理如何创造价值?(财务计划的目标是是什么?)答:财务经理的主要职责是通过资本预算、融资和资产流动性管理为公司创造价值。

其创造价值的途径主要有两条:(1)公司必须通过购买资产创造超过其成本的现金。

(2)公司必须通过发行债券、股票和其他金融工具以筹集超过其成本的现金。

因此,公司创造的现金流量必须超过它所使用的现金流量。

朱叶《公司⾦融》(第2版)笔记和课后习题详解(公司财务规划)【圣才出品】第⼗章公司财务规划10.1 复习笔记⼀、财务规划的主要内容财务规划是长期财务计划,规划的时间跨度⼀般为2~5年,规划的对象是整个公司的财务计划。

1.公司财务⽬标(1)财务⽬标与销售收⼊增长率公司财务⽬标是实现股东财富最⼤化或公司价值最⼤化,斯蒂芬·罗斯认为,⽤销售收⼊增长率描述公司财务⽬标最具普遍性,即:为了使销售收⼊增长率具有惟⼀性,假设:①公司资产随销售额成正⽐例增长;②净利润与销售额之⽐是⼀个常数;③公司股利政策稳定;④公司发⾏在外普通股股数不变;⑤债务资本与权益资本⽐率不变。

因此,在⼀系列假设条件下的销售收⼊增长率表⽰为:通常,公司根据未来的经济状况、⾏业发展前景、公司的竞争地位、产品的⽣命周期等对销售额进⾏预测,然后确定未来的增长率。

由于财务⽬标受制于很多因素,未来具有很⼤的不确定性,因此,在表述财务⽬标上,销售收⼊增长率并不具有唯⼀性。

(2)财务⽬标的类别①激进型财务⽬标激进型财务⽬标表⽰公司在未来存在很多投资机会,公司需要投⼊巨额资本,不断推出新产品,扩⼤市场份额。

公司将⼤量使⽤外部融资⽅式筹集资⾦,同时会增加留存收益。

公司将⾯临巨⼤的投资风险和融资风险。

激进型财务⽬标主要出现在经济繁荣期。

②稳健型财务⽬标稳健型财务⽬标表⽰未来市场发展平稳,公司的资本性⽀出和净营运资本⽀出视市场规模的扩⼤⽽定,公司将据此筹集必要的资⾦。

③紧缩型财务⽬标紧缩型财务⽬标表⽰公司未来的投资机会不多,市场规模萎缩,公司被迫暂缓推出新产品,减少项⽬投资,资本投⼊仅维持在最低的要求上。

紧缩型财务⽬标主要在经济萧条期。

2.经营现⾦流预测公司经营现⾦流是指公司经营活动所产⽣的现⾦净流量,它是公司的内源资⾦,即不通过向外发⾏证券所能获得的资⾦来源。

可以根据会计资料来推算经营现⾦流(CFO),即:(10.1)如果能够预测下⼀年度的销量,并确知成本占销售收⼊的⽐重,那么就可根据式(10.1)推算公司下⼀年度的经营现⾦流。

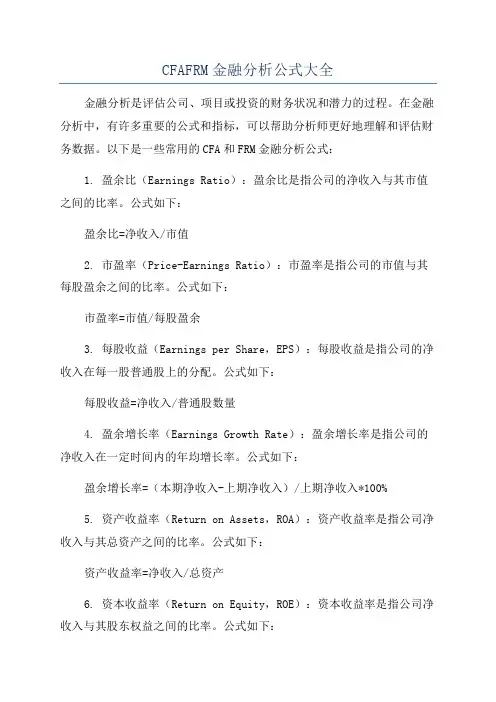

CFAFRM金融分析公式大全金融分析是评估公司、项目或投资的财务状况和潜力的过程。

在金融分析中,有许多重要的公式和指标,可以帮助分析师更好地理解和评估财务数据。

以下是一些常用的CFA和FRM金融分析公式:1. 盈余比(Earnings Ratio):盈余比是指公司的净收入与其市值之间的比率。

公式如下:盈余比=净收入/市值2. 市盈率(Price-Earnings Ratio):市盈率是指公司的市值与其每股盈余之间的比率。

公式如下:市盈率=市值/每股盈余3. 每股收益(Earnings per Share,EPS):每股收益是指公司的净收入在每一股普通股上的分配。

公式如下:每股收益=净收入/普通股数量4. 盈余增长率(Earnings Growth Rate):盈余增长率是指公司的净收入在一定时间内的年均增长率。

公式如下:盈余增长率=(本期净收入-上期净收入)/上期净收入*100%5. 资产收益率(Return on Assets,ROA):资产收益率是指公司净收入与其总资产之间的比率。

公式如下:资产收益率=净收入/总资产6. 资本收益率(Return on Equity,ROE):资本收益率是指公司净收入与其股东权益之间的比率。

公式如下:资本收益率=净收入/股东权益7. 负债比率(Debt Ratio):负债比率是指公司负债金额与其总资产之间的比率。

公式如下:负债比率=负债金额/总资产8. 流动比率(Current Ratio):流动比率是指公司流动资产与流动负债之间的比率。

公式如下:流动比率=流动资产/流动负债9. 速动比率(Quick Ratio):速动比率是指公司流动资产中的快速可变现资产与流动负债之间的比率。

公式如下:速动比率=(流动资产-存货)/流动负债10. 现金比率(Cash Ratio):现金比率是指公司现金与流动负债之间的比率。

公式如下:现金比率=现金/流动负债11. 总资产周转率(Total Asset Turnover):总资产周转率是指公司销售收入与其总资产之间的比率。

公司金融wacc计算公式好的,以下是为您生成的文章:咱今儿就来好好唠唠公司金融里那个重要的 WACC 计算公式。

您知道不,这WACC 计算公式就像是公司财务决策中的一把尺子,能帮着公司衡量投资项目的成本和收益,从而做出更明智的选择。

先给您讲讲这 WACC 到底是啥。

WACC 就是加权平均资本成本(Weighted Average Cost of Capital),它反映了公司为了筹集资金而付出的平均成本。

简单说,就是把不同来源的资金成本按照它们在公司资本结构中的比例加权计算出来的一个综合成本。

那这 WACC 咋算呢?公式是这样的:WACC = (E/V)×Re +(D/V)×Rd×(1 - Tc)。

这里面,E 是公司的股权价值,D 是债务价值,V 就是公司的总价值,等于 E + D 。

Re 是股权成本,Rd 是债务成本,Tc 是公司的所得税率。

我给您举个例子啊。

比如说有个公司,股权价值是 1000 万,债务价值是 500 万,股权成本是 15%,债务成本是 8%,所得税率是 25%。

那咱就来算算这个公司的 WACC 。

首先,总价值 V 就是 1000 + 500 = 1500 万。

然后,E/V 就是 1000/1500 = 2/3,D/V 就是 500/1500 = 1/3 。

代入公式,WACC = (2/3)×15% + (1/3)×8%×(1 - 25%),算出来大约是 12% 。

这 WACC 计算公式有啥用呢?比如说公司要投资一个新项目,就得看看这个项目的预期回报率是不是高于 WACC 。

要是高于,那这个项目可能值得干;要是低于,那可能就得再琢磨琢磨了。

我之前在一家企业里工作的时候,就碰到过跟这 WACC 相关的事儿。

那时候公司打算扩大生产规模,有两个方案摆在面前。

一个方案是新建一个工厂,投资大,但是预期收益也高;另一个方案是改造现有的生产线,投资相对小,但是收益也相对低一些。

国际金融计算公式总结国际金融计算是金融领域中重要的分支之一,它主要研究跨国公司、国际金融市场和国际金融机构等与国际金融活动相关的各种问题。

在国际金融计算中,有一些重要的公式被广泛应用于金融分析、决策和风险管理等领域。

本文将对一些常用的国际金融计算公式进行总结,以便读者更好地了解和应用这些公式。

一、货币兑换公式货币兑换公式是国际金融计算的基础公式之一、它用于计算不同货币之间的兑换率。

1、直接报价 currency A / currency B = direct exchange rate直接报价是指以一种货币来衡量另一种货币的价格。

2、间接报价 currency B / currency A = indirect exchange rate间接报价是指以一种货币来表示所需的另一种货币的价格。

3、交叉汇率 cross exchange rate = (direct exchange rate of currency A / direct exchange rate of currency B)交叉汇率是指通过两个货币直接汇率计算出的两个不同货币之间的汇率。

二、利息计算公式利息计算公式用于计算借款或存款的利息。

简单利息计算公式是利用固定利率和借贷时间计算利息的公式。

复合利息计算公式是利用不同计息方式计算出的利息。

三、现金流量计算公式现金流量计算公式用于计算现金流入和流出的金额。

1、净现值计算公式 net present value = present value of cash inflows - present value of cash outflows净现值计算公式是用于衡量项投资项目现金流量的总体价值。

2、内部收益率计算公式 internal rate of return = discount rate at which the net present value equals zero内部收益率计算公式是用于计算投资项目的收益率。

公司金融差值法计算公式公司金融差值法是一种用于计算公司金融收支差异的方法。

它可以帮助公司了解其金融活动的效益,并为决策提供有价值的信息。

本文将介绍公司金融差值法的计算公式以及其应用。

公司金融差值法的计算公式如下:公司金融差值 = 公司金融收入 - 公司金融支出其中,公司金融收入指的是公司从金融活动中获得的资金流入,包括利息收入、股息收入、投资收益等。

公司金融支出则是公司在金融活动中支付的资金流出,包括利息支出、股息支出、贷款偿还等。

通过计算公司金融差值,我们可以了解公司在金融活动中的盈亏情况,从而判断公司的金融活动是否健康、是否具备可持续性。

如果公司金融差值为正值,表明公司的金融收入超过了金融支出,公司金融活动盈利;如果公司金融差值为负值,表明公司的金融支出超过了金融收入,公司金融活动亏损。

公司金融差值法可以应用于各种类型的企业,无论是制造业、服务业还是金融业,都可以通过这种方法来评估其金融活动的盈亏情况。

通过对公司金融差值的分析,可以帮助企业管理层了解公司金融活动的效益,并作出相应的决策。

例如,一家制造业公司通过公司金融差值法计算得出,其金融收入为100万元,金融支出为80万元,那么公司的金融差值为20万元。

这意味着公司的金融活动盈利,可以为公司提供额外的资金用于发展和扩张。

公司金融差值法还可以用于评估公司金融活动的风险。

通过对金融差值的分析,可以判断公司金融活动是否存在潜在的风险因素。

如果公司金融差值波动较大或持续为负值,可能意味着公司的金融活动存在较大风险,需要采取相应的措施来降低风险。

公司金融差值法是一种评估公司金融活动盈亏情况的方法。

通过计算公司金融差值,可以帮助公司了解其金融活动的效益,并为决策提供有价值的信息。

然而,需要注意的是,公司金融差值法只是评估公司金融活动的一种方法,还需要结合其他指标和数据进行综合分析,以得出准确的结论。

同时,该方法也需要根据不同公司的具体情况进行调整和适用。

增量净利润计算公式公司金融会计报表部分:资产≡负债+所有者权益;资产-负债≡所有者权益;收入-费用≡利润;净营运资本=流动资产流动负债;企业现金流量=经营性现金流量-资本性支出-净营运资本的增加;经营性现金流量=息税前利润。

(EBIT)+折旧-当期税款;资本性支出=期末固定资产净额-期初固定资产净额+折旧;向债权人支付的现金流量=支付的利息-净新借入额=支付的利息-(期末长期债务-期初长期债务);向股东支付的现金流量=支付的股利-权益筹资净额=支付的股利-(发行的股票-回收的股票);资产的现金流量(企业现金流量)=流向债权人的现金流量+流向权益投资者的现金流量;报表分析部分:短期偿债能力(流动性):流动比率=流动资产/流动负债;速动比率(酸性实验)=(流动资产-存货)/流动负债;现金比率=现金/流动负债;长期偿债能力(财务杠杆):负债比率=总负债/总资产;负债权益比=总负债/总权益;权益乘数=总资产/总权益;利息倍数=息税前利润(EBIT)/利息;现金对利息的保障倍数=(EBIT+折旧和摊销)/利息;EBITDA=EBIT+折旧和摊销;运营能力(周转率):存货周转率=产品销售成本/存货;存货周转天数=365/存货周转率;应收账款周转率=销售额/应收账款;应收账款周转天数=365/应收账款周转率;总资产周转率=销售额/总资产;盈利能力:销售利润率=净利润/销售额;息税、折旧及摊销前利=EDITDA/销售额;资产收益率(ROA)=净利润/总资产;权益收益率(ROE)=净利润/总权益;市场价值度量:每股收益(EPS)=净利润/发行在外的股份数(普通股股份数);每股股利=股利/发行在外的股份数;市盈率=每股价格/每股收益;市值面值比=每股市场价值/每股账面价值;每股账面价值=总权益/发行在外的股份数;公司市值=每股股价×发行在外的股份数;企业价值(EV)=公司市值+有息负债的市值(可用账面值做替代)-现金;企业价值乘数=EV/EBITDA。

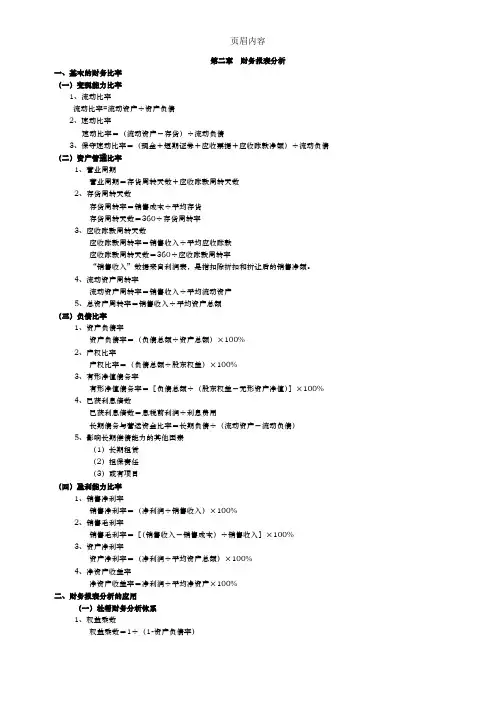

第二章财务报表分析一、基本的财务比率(一)变现能力比率1、流动比率流动比率=流动资产÷资产负债2、速动比率速动比率=(流动资产-存货)÷流动负债3、保守速动比率=(现金+短期证券+应收票据+应收账款净额)÷流动负债(二)资产管理比率1、营业周期营业周期=存货周转天数+应收账款周转天数2、存货周转天数存货周转率=销售成本÷平均存货存货周转天数=360÷存货周转率3、应收账款周转天数应收账款周转率=销售收入÷平均应收账款应收账款周转天数=360÷应收账款周转率“销售收入”数据来自利润表,是指扣除折扣和折让后的销售净额。

4、流动资产周转率流动资产周转率=销售收入÷平均流动资产5、总资产周转率=销售收入÷平均资产总额(三)负债比率1、资产负债率资产负债率=(负债总额÷资产总额)×100%2、产权比率产权比率=(负债总额÷股东权益)×100%3、有形净值债务率有形净值债务率=[负债总额÷(股东权益-无形资产净值)]×100%4、已获利息倍数已获利息倍数=息税前利润÷利息费用长期债务与营运资金比率=长期负债÷(流动资产-流动负债)5、影响长期偿债能力的其他因素(1)长期租赁(2)担保责任(3)或有项目(四)盈利能力比率1、销售净利率销售净利率=(净利润÷销售收入)×100%2、销售毛利率销售毛利率=[(销售收入-销售成本)÷销售收入]×100%3、资产净利率资产净利率=(净利润÷平均资产总额)×100%4、净资产收益率净资产收益率=净利润÷平均净资产×100%二、财务报表分析的应用(一)杜帮财务分析体系1、权益乘数权益乘数=1÷(1-资产负债率)2、权益净利率权益净利率=资产净利率×权益乘数=销售净利率×资产周转率×权益乘数(二)上市公司财务比率1、每股收益每股收益=净利润÷年末普通股份总数=(净利润-优先股股利)÷(年度股份总数-年度末优先股数)2、市盈率市盈率(倍数)=普通股每股市价÷普通股每股收益3、每股股利每股股利=股利总额÷年末普通股股份总数4、股票获利率股票获利率=普通股每股股利÷普通股每股市价×100%5、股利支付率股利支付率=(普通股每股股利÷普通股每股净收益)×100%6、股利保障倍数股利保障倍数=普通股每股净收益÷普通股每股股利=1÷股利支付率7、每股净资产每股净资产=年度末股东权益÷年度末普通股数8、市净率市净率(倍数)=每股市价÷每股净资产(三)现金流量分析1、流动性分析(1)现金到期债务比现金到期债务比=经营现金流量净额÷本期到期的债务(2)现金流动负债比现金流动负债比=经营现金流量净额÷流动负债(3)现金债务总额比现金债务总额比=经营现金流量净额÷债务总额2、获取现金能力分析(1)销售现金比率销售现金比率=经营现金流量净额÷销售额(2)每股经营现金流量净额每股经营现金流量净额=经营现金流量净额÷普通股股数(3)全部资产现金回收率全部资产现金回收率=经营现金流量净额÷全部资产×100%3、财务弹性分析(1)现金满足投资比率现金满足投资比率=近5年经营现金流量净额之和÷近5年资本支出、存货增加、现金股利之和(2)现金股利保障倍数现金股利保障倍数=每股经营现金流量净额÷每股现金股利第三章财务预测与计划一、财务预测的步骤1、销售预测财务预测的起点是销售预测。

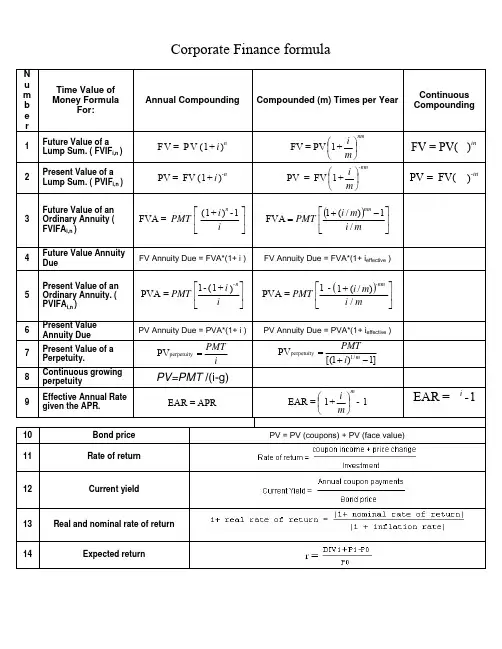

Corporate Finance formula15 Dividend Yield16Constant Growth Dividend DiscountModel17Dividend Discounted Model18Equivalent annual cost (EAC)19Estimating Expected Rates of Return with Constant GrowthDividend20 Growth rate g = ROE X plowback ratio21 Return on Equity22Present Value of GrowthOpportunity23 P/E ratio P/E = P 0/ EPS 24 NPV PV – (required investment) 25 NPV(A+B) NPV (A+B) = NPV (A) + NPV (B)26 Percentage return27 Variance σ228Standard deviation σ29 General Cost of capital30Cost of capital with only Debt andEquity31 After-tax Cost of Capital: WACC32Covariance of asset 1 and asset 233 Two assets portfolio variance34N assets portfolio variance35Beta for one asset i : βi36General portfolio β37Portfolio β with only Debt andEquity38 CAPM model r = r f + β (r m – r f ) where r m is the market return and r f is the risk free rate 39 Risk premium ( r - r f )r - r f = β (r m – r f ) where r m is the market return and r f is the risk free rate40 Expected return on preferred stock41 Arbitrage Pricing Theory Return = α + b 1(r factor1) + b 2(r factor2) + b 3(r factor3) + …+ noise42Fama-French three-factor modelr - r f =b market (r market factor )+b size (r size factor )+ b book-to-market (r book-to-market factor )i = the nominal or Annual Percentage Rate n = the number of periodsm = the number of compounding periods per year EAR = the Effective Annual Rateln = the natural logarithm, the logarithm to the base ee = the base of the natural logarithm ≈ 2.71828PMT = the periodic payment or cash flowPerpetuity = an infinite annuityg = continuous growth rateDIV=dividendEPS= earns per share P0= current priceNPV= net present valueR = return= mean of xRm market portfolio return Rf risk free returnρ12 correlation between asset 1 and 2。

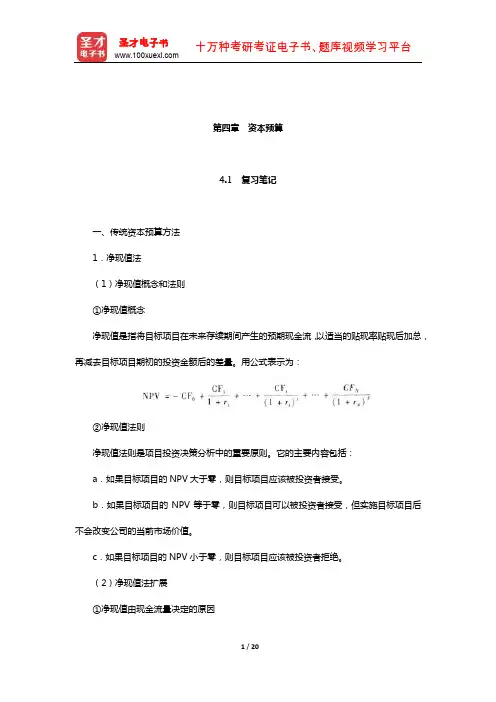

第四章资本预算4.1 复习笔记一、传统资本预算方法1.净现值法(1)净现值概念和法则①净现值概念净现值是指将目标项目在未来存续期间产生的预期现金流,以适当的贴现率贴现后加总,再减去目标项目期初的投资金额后的差量。

用公式表示为:②净现值法则净现值法则是项目投资决策分析中的重要原则。

它的主要内容包括:a.如果目标项目的NPV大于零,则目标项目应该被投资者接受。

b.如果目标项目的NPV等于零,则目标项目可以被投资者接受,但实施目标项目后不会改变公司的当前市场价值。

c.如果目标项目的NPV小于零,则目标项目应该被投资者拒绝。

(2)净现值法扩展①净现值由现金流量决定的原因a.会计利润决定净现值的局限性:一是公司当年发生的现金支出并没有从当年会计利润中完全扣除,而没有发生现金流出的费用则被完全从当年利润中扣除,因此,当年利润仅仅涉及当年一部分现金流量;二是现金支出不同的会计处置使得会计利润并不能完全反映公司当年真实的盈利水平,会高估或低估当年会计利润。

b.现金流量决定净现值的适用性:当年发生的现金支出全部作为当年现金流出,完全从当年现金净流量中扣除;当年实现的现金收入全部作为当年现金流入,增加当年现金净流量。

②现金流发生的时间现金流发生的时间主要涉及两个时间点和一个时间段。

两个时间点是指初始投资时刻和项目终止或出售时刻,一个时间段是指项目存续期。

项目初始投资时刻发生现金流出,项目终止或出售时刻一般会产生现金流入,在项目存续期内,每年均会因经营活动而发生现金流入和流出。

③现金流的估算投资项目的现金流主要有三类:一是期初投资额,二是存续期内每年的现金流入和现金流出额,三是项目到期或终止时的变现现金流(或称残值变现收入)。

在计算净现值时,主要的贴现对象是项目存续期内每年的现金流入和现金流出额。

在公司金融实践中,用自由现金流(FCF)来表示每年预期现金净流量(每年现金流入和现金流出的差额)。

在项目存续期内,自由现金流是指投资者获得的、可以自由支配的现金流。

名词解释:1. DCF (贴现现金流):用来评估一个投资机会的吸引力的方法。

指将未来某年的现金收支折算为目前的价值2. 经营现金流量(OCF ):来自企业日常生产和销售活动的现金流量,而与企业为其融资的费用不包括在内。

计算公式OCF=息税前盈余(EBIT)+折旧(D )-税3. WACC 加权平均资本成本,是指企业以各种资本在企业全部资本中所占的比重为权数,对各种长期资金的资本成本加权平均计算出来的资本总成本。

加权平均资本成本可用来确定具有平均风险投资项目所要求收益率。

4. ROE 权益报酬率 计量的一年中股东的回报。

因为使股东获利是我们的目的,所以从会计的角度看,ROE是业绩计量的真正底线。

计算公式:权益报酬率=净利润/权益总额5. 净营运资本(NWC )净营运资本变动根据考察期内流动资产超过流动负债金额的净变动的加以计量,它代表用于净营运资本上的金额。

公式:NWC=流动资产-流动负债 一个正常运转的企业,它的NWC 应该是正值。

6. 利率期限结构 短期利率和长期利率的关系。

更精确地说,利率的期间结构告诉我们各种不同到期期限的无违约风险.纯折价债券的名义利率。

由实际利率。

通货膨胀率和利率风险三个因素决定7. 财务保本点 就是净现值NPV=0的销售量Q=FC+OCF*/P —v (OCF *是NPV=0时的OCF )8. 内部增长率:在没有任何形式的外部筹资情况下所能达到的最大增长率.公式:内部增长率=ROA ×b/1-ROA×b9. 可持续增长率:企业在保持固定的债务权益率、同时没有任何外部筹资的情况下所能达到的最大增长率。

公式:可持续增长率= ROE ×b/1—ROE ×b10. 息税前盈余(EBIT):EBIT 通过剔除所得税和利息,可以使投资者评价项目时不用考虑项目适用的所得税率和融资成本,这样方便投资者将项目放在不同的资本结构中进行考察。

公式:EBIT=销售收入—成本—折旧=净利润+折旧+利息支出11. EBITD :利息、税、折旧和摊销前盈余12. 永续年金:指每年都有相同的现金流量,一直持续到永远.没有终值,只有现值。

罗斯公司金融复习重点第一章细节:独资企业和合伙制企业最要紧的优点是创办成本低,而企业成立之后缺点也会专门突出,要紧缺点如下:(1)无限责任(2)有限的企业寿命(3)所有权转让困难这三个缺点将导致第四个缺点(4)融资困难。

财务治理更全面的目标:使公司现有的所有者权益的市场价值最大化。

第二章资产负债表结构:反应公司拥有的资产及其来源左侧:从上到下按流淌性从大到小列出公司拥有的资产项目(分账面价值和市场价值)右侧:上半部分从下到下按短期到长期列出公司的负债下半部分列出公司的所有者权益编制基础:资产≡负债+所有者权益细节:一家企业资产的流淌性越高,越不可能面临短期负债偿付能力;从某种程度上来说,企业投资于流淌资产,就牺牲了投资于更高收益投资工具的机会。

净营运资本=流淌资产-流淌负债净营运资本为正,说明净营运资本显现溢余,以后能得到的现金将超过要付出的现金。

净营运资本为负,说明净营运资本显现短缺,以后能得到的现金将少于要付出的现金。

细节:在一家成长型企业中,净营运资本的变动额通常是正数。

第三章P40 表3-5 常见财务比率Ⅰ.短期偿债能力或流淌性比率流动负债流动资产流动比率= 流动负债存货流动资产速动比率-= 流动负债现金现金比率=Ⅱ.长期偿债能力或财务杠杆总资产总权益总资产总负债比率-= 总权益总负债负债权益比= 总权益总资产权益乘数= 利息息税前利润利息倍数= 利息折旧息税前利润现金保障倍数+=Ⅲ.资产利用或周转比率存货销货成本存货周转率= 存货周转率天存货周转天数365=应收账款销售收入应收账款周转率= 应收账款周转率天应收账款周转天数365= 总资产销售收入总资产周转率= 销售收入总资产资本密集度=Ⅳ.获利能力比率 销售收入净利润利润率= 总资产净利润)资产收益率(=ROA 总权益净利润)股东权益收益率(=ROE 负债权益比)(权益乘数权益总资产总资产销售收入销售收入净利润+⨯=⨯=⨯⨯=1ROA ROA ROE Ⅴ.市场价值比率每股收益每股价格市盈率= 每股账面价值每股市场价值市净率=杜邦恒等式:权益乘数总资产周转率利润率股东权益收益率⨯⨯=细节:ROE 受以下3个因素阻碍:1.经营效率(由利润率衡量)2.资产利用率(由总资产周转率衡量)3.财务杠杆(由权益乘数衡量)第四章现值,终止,复利(连续复利),利率提取,名义年利率,实际年利率书上例题 ( ̄▽ ̄)~*所有的投资法则…额…熟知?净现值法则,回收期法,贴现的回收期法,平均会计收益法,内部收益率法则(内含酬劳率法则),获利指数。

汇总|货币金融学的公式汇总在复习货币金融学和公司理财的过程中会有各种公式需要学习,这里我们对于这两本书中出现的公式做了一个总结归纳,以供大家复习参考。

【货币金融学】1.计算现值公式,CF为未来的现金流量,i为利率:2.计算固定支付贷款(分期偿还贷款),FP为每年固定偿还金额:3.该公式计算息票债券价格,C为每年偿还利息,F为债券面值:4.该公式计算贴现发行债券(零息债券-仅偿还面值,折现发行),F为债券面值,i 为到期收益率:5.该公式计算永续债券,C为每一期利息,i为到期收益率:6.该公式计算回报率,ic为当期收益率,g为资本利得率:7.费雪方程式,名义利率等于实际利率与预期通货膨胀率之和:8.预期理论,表明n阶段利率等于该债券在n阶段的期限中,所有1阶段利率预期的平均值:9.流动性溢价理论,实现对预期理论的修正,lnt为n阶段债券在时间t的流动性(期限)溢价:10.戈登增长模型,假定股利增长率不变,ke高于g,其中g为股利增长率,ke为股票投资要求回报率:11.ROE为股权回报率,ROE=税后净利润/股权资本,ROA为资产回报率,ROA=税后净利润/资产,EM为股本乘数,EM=资产/股权资本:12.基础货币等于流通中的现金加上银行体系的准备金总额:13.M为货币供给,m为货币乘数,e为超额准备金比率,rr为法定准备金率,rd为定期存款利率,t为定期存款所占比例:14.泰勒规则,认为联邦基金利率应该等于通货膨胀率加上一个“均衡”的实际联邦基金利率:15.交易方程式,P代表物价水平,Y代表总产出(收入),P*Y看作经济体的名义总收入,M代表货币供给,V为货币流通速度:16.现金余额方程式,k=1/V,为常量,由既定水平名义收入PY支持的交易规模决定人们的货币需求量:17.凯恩斯货币需求理论,实际货币余额需求与名义利率i负相关,与实际收入Y正相关:18.弗里德曼货币需求理论,货币需求与永久性收入,预期回报率以及替代性资产影响:19.总需求等于消费支出,计划投资支出,政府购买和净出口之和:【公司理财】1.杜邦恒等式,说明ROE受经营效率、资产运用效率、财务杠杆三个因素影响:2.外部融资需要量计算公式,其中PM=净利润/销售额,为销售利润率,d为股利支付率:3.内部增长率为EFN为零时可以实现的最大增长率,可持续增长率是公司在没有外部股权融资且保持负债权益比不变的情况下可能实现的最大增长率:4.实际年利率计算公式,r为名义利率,m为每年按照复利计息的次数:5.分别为复利计息的终值和连续复利的终值:6.永续增长年现值计算公式,r为折现率,g为每期的增长率:7.年金现值计算公式,年金是指一系列稳定有规律、持续一段固定时期的现金收付活动:8.增长年金现值计算公式,C为第一期末开始支付的金额、r为折现率、g为每期的增长率、T为年金支付的持续期:9.通过增长机会计算公司股票价格,NPVGO为增长机会的(每股)净现值,EPS为每股盈利,第一部分时公司满足现状作为现金牛的价值,第二部分时公司将盈利留存并用于投资新项目时新增价值;市盈率PE与增长机会正相关,与风险负相关:10.净现值法,NPV大于零接受项目,小于零拒绝项目:11.内部收益率计算公式,IRR超过必要报酬率时接受项目:12.经营性现金流量计算公式,此外还有三种公式,分别为自上而下法、自下而上法和税盾法:13.现值的盈亏平衡点计算公式,EAC为约当年均成本:14.会计利润的盈亏平衡点计算公式:15.经营杠杆(OCF可用EBIT代替):DOL=1+FC/OCF16.CAPM模型公式,Rf为无风险利率,Rm-Rf为市场风险溢价,其中Rm为市场组合期望收益率:17.β计算公式,后者为权益β系数计算公式:18.加权平均资本成本计算公式:19.加权发行成本计算公式:20.分别为无税MM定理1和有税MM定理1:21.分别为无税MM定理2和有税的MM定理2:22.调整净现值(APV)法,UCFt为无杠杆企业第t期流向权益所有者的现金流量:23.权益现金流量(FTE)法,LCFt为杠杆企业第t期属于权益所有者的现金流量:24.加权平均资本成本(WACC)法:25.期权平价:标的股票价格+看跌期权价格=看涨期权价格+行权价的现值26.二叉树定价(了解):27.Black-Sholes模型(了解):28.信用条件的成本:29.经济订购批量(EOQ)模型(现金需求的平方根公式):30.国际费雪效应,表明各个国家的真实利率应该是相等的:需要注意的是,本篇文章是按照米什金《货币金融学》和罗斯《公司理财》阐释的总结(教材版本不同可能会有差异),大家还要结合相应概念、定理做相应深化。

金融硕士硕备考431之《解读现金流量OCF、FCFF、FCFE、UCF、LCF》关于OCF、FCFF、FCFE、UCF、LCF大家都了解是什么吗?为了帮助报考19金融专硕的考家更好的备考,凯程考研蒙蒙费劲千辛万苦找到了关于OCF、FCFF、FCFE、UCF、LCF的相关知识点。

一、我们先来说说OCF:OCF的公式有五个1)OCF=EBIT+折旧-税2)OCF=净利润+折旧3)0CF=收入-现金成本-税收4)OCF=(收入-现金支出)(1-t)+折旧*t5)OCF=EBIT(1-t)+折旧罗斯课本里,最原始的公式是第一个,第二个是自下而上法,第三个是自上而下法,第四个是税盾法,第五个公式哪里来的呢,就是FCFF表达式里前半部分:FCFF=EBIT(1-t)+折旧-资本化支出-NWC的增加(黑体加粗部分)市面上这么多公司理财/公司财务/公司金融的教材,算OCF用的公式基本都在上边的五个公式里,那这五个公式的联系和区别在哪里呢?我们用一个例题作为引子讲这个话题。

例题:A公司销售额为14900美元,成本为5800美元,折旧为1300美元,利息支出为780美元,如果税率为40%,请问公司的营运现金流(OCF)为多少?EBIT=14900-5800-1300=7800税=(7800-780)*0.4=28081)OCF=EBIT+折旧-税=7800+1300-2808=62922)OCF=净利润+折旧=7800-780-2808+1300=55123)0CF=收入-现金成本-税收=14900-5800-2808=62924)OCF=(收入-现金支出)(1-t)+折旧*t=(14900-5800)*0.6+1300*0.4=5460+520=59805)OCF=EBIT(1-t)+折旧=7800*0.6+1300=5980看出数字差别了吗?这里关键影响因素就是利息的存在,课本如果严谨的话,在交代“OCF=净利润+折旧”这个公式的时候应该备注“只有不存在利息的时候才能用这个公式”,存在利息的情况下怎么办?6292和5980两个数差在哪里,差量=I*t=780*0.4=312=6292-5980.综上所述,净利润+折旧要小心用,至于其他四个公式,1)和3)是一个,只是数学变换,4)和5)是一个,也只是数学变换,差别在于前一个公式里利息是税前利息,后一个公式里利息是税后利息,这也是罗斯和博迪两本教材有歧义的地方之一,罗斯课本企业的现金流量总额=OCF-资本化支出-NWC的增加,对比上边的FCFF公式,罗斯企业的现金流量总额其实和FCFF是很相似的一个概念,只是利息一个是税前,一个是税后。

公司金融复习 第二章:财务报表、税收和现金表

The balance sheet(资产负债表)

Assets= Liabilities + shareholders' equity current assets; fixed assets :AssetsCurrent assets: cash; accounts receivable; inventory current liabilities; long-term debt Liabilities:Current Liabilities: Accounts payable; Notes

payable Owners' equity: common stock and paid-in surplus; retained earnings The income statement(损益表) Revenues – expenses = income EBIT= net sales – cost of goods sold – depreciation Taxable income = EBIT – interest paid Net income = taxable income – taxes=dividends + addition to retained earnings Earnings per share = net income/ total shares outstanding Dividends per share = total dividends/ total shares outstanding Average versus Marginal Tax Rates(平均税率和边际税率) Average tax rate=total taxes paid/ total taxable income Marginal tax rate: the amount of tax payable on the next dollar earned Cash flow(现金流量) NWC=current assets-current liabilities Cash flow from assets = cash flow to creditors + cash flow to stockholders 1 / 6 Cash flow from assets = operating cash flow-net investment in fixed assets-change in NWC operating cash flow=EBIT +depreciation-taxes net investment in fixed asset=ending net fixed assets-beginning net fixed assets + depreciation change in NWC=ending NWC – beginning NWC cash flow to creditors=interesting paid – net new borrowing cash flow to stockholders=dividends paid – net new equity raised 第三章:与财务报表相关的工作 Standardized financial statements(标准化的财务报表)

Common-Size Balance sheets(共同比报表):用百分比代替具体金额的报表 Common-Size Income sheets(共同比损益表):同上 Ratio analysis (比率分析) 短期偿债能力比率 Current ratio = current assets / current liabilities(流动比率)

Quick ratio = (current assets - inventory)/current liabilities(速动比率) Cash ratio = cash/current liabilities 长期偿债能力比率 Total debt ratio = (total assets – total equity)/total assets

Debt-equity ratio=total debt/total equity Equity multiplier = total assets/ total equity Times interest earned=EBIT/interest 2 / 6 Cash coverage ratio= (EBIT+ depreciation)/interest 资产管理比率或周转率 Inventory turnover=cost of good sold/inventory

Days' sales in inventory=365 days/inventory turnover Receivables turnover=sales/accounts receivable Days' sales in receivable =365 day/ receivable turnover Total asset turnover = sales/total assets Capital intensity=total assets/sales 获利能力比率 Profit margin = net income/sales

Return on assets (ROA)= net income/total assets Return on equity(ROE)= net income/total equity ROE=(net income/sales)*(sales/assets)*(assets/equity)(杜邦等式) 市场价值比率 EPS=net income/shares outstanding

Price-earnings ratio=price per share/earnings per share Price-sales ratio=price per share/sales per share Market-to-book ratio = market value per share/book value per share book value per share=book value of equity/shares 内部增长率和可持续增长率 Dividend payout ratio=cash dividends/net income(股利支付率)

Retention ratio=addition to retained earnings/net income=1- Dividend payout ratio 3 / 6 b) 盈利留存率 () 内部增长率 Internal growth rate=(ROA*b)/(1-ROA*b) () Sustainable growth rate==(ROE*b)/(1-ROE*b) ( 可持续增长率ROE=profit margin * total assets turnover * equity multiplier 第四章:货币的时间价值Future value factor=(1+r)t Present value factor=1/(1+r)t Basic present value equation: pv=fv/(1+r)t

15enter

3 1000 FVPVPMTN1/Y -657.50 Solve for So we need invest 657.50 today 答题格式 第五章:折现现金流的价值评估 多重现金流的终值和现值根据贴现率计算即可-1)/r fv=c*((1+r)t))/r pv=c*(1-(1/(1+r)t 年金(区别普通年金和预付年金付款时间)pv=c/r 永续年金 -1

(名义利率)有效年利率EAR()=(1+quoted rate/m)m4 / 6 EAR(有效年利率)=(1+APR(贷款的年百分率)/12)-1 12贷款类型: Pure discount loans(纯贴现贷款) Interest-only loans(仅付息贷款) Amortized loans (分期摊销贷款) 第六章:利率与债券价值 用好这个公式即可 名义收益率与实际收益率(费雪效应)

1+R=(1+r)(1+h) R:名义收益率 r:实际收益率 h:通货膨胀率 第七章:股票市场与股票定价 P=D/(R-g) g为股利增长率 R为要求收益率 t+1t 考试有关事项 1 零息债券必出题 2 债券面值若未指出默认1000 3 未给出付息频次则默认年付息 4 计算结果统一保留两位小数 5 P198 T23 会考类似 个人建议选做习题 第二章 4 5 6 8 9 11 14 15 19 20 22

第三章 1 2 3 4 5 6 7 13 16 17 22 23 25 27 30 34 36 38 42 44 第四章 1 4 7 18 26(熟练掌握财务计算器用法即可) 5 / 6 第五章 1 2(各做一问即可)10 13 19 20 22 23 30 31 35 44 46 48 55 58 第六章 3 4 5 9 11 15 16 18 20 21 22 23 25 26 28 31 32

6 / 6