【复旦大学 投资学】Section4 FamaEMH

- 格式:ppt

- 大小:568.00 KB

- 文档页数:42

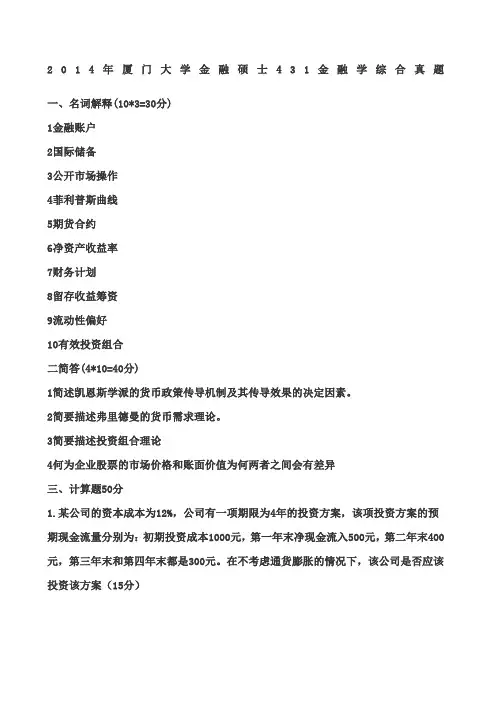

2014年厦门大学金融硕士431金融学综合真题一、名词解释(10*3=30分)1金融账户2国际储备3公开市场操作4菲利普斯曲线5期货合约6净资产收益率7财务计划8留存收益筹资9流动性偏好10有效投资组合二简答(4*10=40分)1简述凯恩斯学派的货币政策传导机制及其传导效果的决定因素。

2简要描述弗里德曼的货币需求理论。

3简要描述投资组合理论4何为企业股票的市场价格和账面价值为何两者之间会有差异三、计算题50分1.某公司的资本成本为12%,公司有一项期限为4年的投资方案,该项投资方案的预期现金流量分别为:初期投资成本1000元,第一年末净现金流入500元,第二年末400元,第三年末和第四年末都是300元。

在不考虑通货膨胀的情况下,该公司是否应该投资该方案(15分)2.某公司股票初期的股息为美元/股。

经预测该公司股票未来的股息增长率将永久性地保持在4%的水平。

假定贴现率为10%,那么,根据不变增长模型,该公司股票的内在价格是多少10分3假设公司2009年的净收益是200万元,2009年末的总资产为4500万元,并且假设公司有个确定的要求:保持债务/权益的比例为,公司经理不能借款或发行股票。

请问:(1)公司最大的可持续增长率是多少(2)假如公司将净收益中的100万元作为股利,并且计划在将来保持这种支出比例,现在公司的最大可持续增长率是多少(15分)4有一张两年内到期的债券,其票面价值为1000元,票面利率为4%,当前的价格是950元,请计算这张债券的当前收益率和到期收益率。

(10分)四.论述题(15分×2=30分)1.你认为我国金融市场有哪些跟发达国家不同的现象你对这些现象有什么样的解释2据《中国证券报》报道,相关各方已就我国民营银行试点的有关事宜达成一致,业内人士预计,入围首批试点的民营银行的牌照最快于2014年年初“出炉”.民营银行的发展是我国银行业改革的大趋势,但我国政府需要采取何种政策来规避银行业的风险面对即将异军突起的民营银行,传统商业银行要如何应对日益激烈的市场竞争2013年厦门大学金融硕士431金融学综合真题一、名词解释(10*3=30分)1.经常帐产2.国际储备3.公开市场操作4.货币乘数5.看涨期权6.资产负载表7.货币政策8.金融危机9.净现值10.抵押债券二、简答(4*10=40分)1.试简述普遍股和优先股的差异。

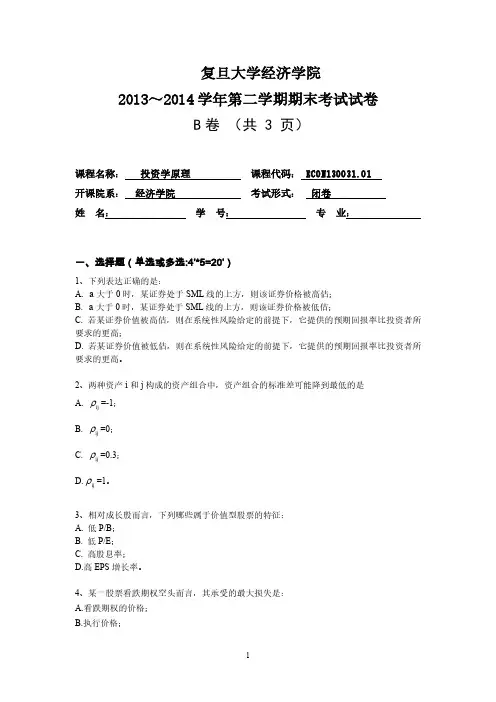

复旦大学经济学院2013~2014学年第二学期期末考试试卷B卷(共 3 页)课程名称:投资学原理课程代码: ECON130031.01开课院系:经济学院考试形式:闭卷姓名:学号:专业:一、选择题(单选或多选:4’*5=20’)1、下列表达正确的是:A. a大于0时,某证券处于SML线的上方,则该证券价格被高估;B.a大于0时,某证券处于SML线的上方,则该证券价格被低估;C. 若某证券价值被高估,则在系统性风险给定的前提下,它提供的预期回报率比投资者所要求的更高;D. 若某证券价值被低估,则在系统性风险给定的前提下,它提供的预期回报率比投资者所要求的更高。

2、两种资产i和j构成的资产组合中,资产组合的标准差可能降到最低的是ρ=-1;A.ijρ=0;B.ijρ=0.3;C.ijρ=1。

D.ij3、相对成长股而言,下列哪些属于价值型股票的特征:A. 低P/B;B. 低P/E;C. 高股息率;D.高EPS增长率。

4、某一股票看跌期权空头而言,其承受的最大损失是:A.看跌期权的价格;B.执行价格;C. 股价减去看跌期权价格;D.执行价格减去看跌期权价格。

5、根据影响期权的价值因素,下列表述错误的是:A.标的资产价格越高,看跌期权的价值越高;B.无风险利率越高,看涨期权价值越高;C.资产价格波动率越高,看涨期权价值越低;D.标的资产收益越越高,看涨期权价值越高。

二、名词(4’*5=20’)1、均值-方差准则2、经济附加值(EVA)3、债券收益率曲线4、可转换债券5、权的时间价值三、计算题(15’*2=30’)1.假定你利用两因素模型去确定一只股票的预期收益,两因素及假定的风险溢价见下表,无风险利率4.8%。

(1)如果定价合理,那么这只股票的预期收益是多少?(2)假定上表的因素风险溢价不正确,真正的因素风险溢价见下表,根据真正的风险溢价计算股票的预期收益。

(3)比较(1)和(2)的答案,根据假定的风险溢价的定价是低估还是高估了?2、已知一种面值为100元,息票率为6%的债券,每年付息一次,债券期限为3年,且到期收益率为6%,求该债券的久期、修正久期、凸度。

Chapter 13 Factor pricing modelFan LongzhenIntroduction•The consumption-based model as a complete answer to most asset pricing question in principle, does not work well in practice;•This observation motivates effects to tie the discount factor m to other data;•Linear factor pricing models are most popular models of this sort in finance;•They dominate discrete-time empirical work.Factor pricing models•Factor pricing models replace the consumption-based expression for marginal utility growth with a linear model of the form•The key question: what should one use for factors 11'+++=t t f b a m 1+t fCapital asset pricing model (CAPM)•CAPM is the model , is the wealth portfolio return.•Credited Sharpe (1964) and Linterner (1965), is the first, most famous, and so far widely used model in asset pricing.•Theoretically, a and b are determined to price any two assets, such as market portfolio and risk free asset.•Empirically, we pick a,b to best price larger cross section of assets;•We don’t have good data, even a good empirical definition for wealth portfolio, it is often deputed by a stock index;•We derive it from discount factor model by •(1)two-periods, exponential utility, and normal returns; •(2) infinite horizon, quadratic utility, and normal returns;•(3) log utility •(4) by seeing several derivations, you can see how one assumption can be traded for another. For example, the CAPM does not require normal distributions, if one is willing to swallow quadratic utility instead.wbR a m +=w RExponential utility, Normal distributions•We present a model with consumption only in the last period, utility is•If consumption is normally distributed, we have •Investor has initial wealth w, which invest in a set of risk-free assets with return and a set of risky assets paying return R.•Let y denote the mount of wealth w invested in each asset, the budget constraint is •Plugging the first constraint into the utility function, we obtain][)]([c eE c U E α−−=2/)()(22))((c c E e c U E σαα+−−=f R f y y w Ry R y c ff f ''+=+=yy R E y R y f f e c U E Σ++−−='2/)]('[2))((ααExponential utility, Normal distributions--continued •Applying the formula to market return itself, we have•The model ties price of market risk to the risk aversion coefficient.)()(2wf w R R R E ασ=−Quadratic value function, Dynamicprogramming-continued•(1) the value function only depends on wealth. If other variables enter the value function, m would depend on other variables. The ICAPM, allows other variables in the value function, and obtain more factors.•(other variable can enter the function, so long as they do not affect marginal utility value of wealth.)•(2) the value function is quadratic, we wanted the marginal value function is linear.Why is the value function quadratic•Good economists are unhappy about a utility function that have wealth in it.•Suppose investors last forever, and have the standard sort of utility function •Investors start with wealth which earns a random return andhave no other source of income;•Suppose further that interest rate are constant and stock returns are iid over time.•Define the value function as the maximized value of the utility function in this environment•∑∞=+=0)(j j t jt c u E U β0w w R {}11;);(..)()(''110,...,...,,max11==−==++∞=+∑++vtt tw tt t w t t j j t jt w w c c t R R c W R W t s c u E W V t t t t ωωβ,Why is the value function quadratic--continued•Without the assumption of no labor income, a constant interest rate, and I.I.d returns come in, the value maybe depend on the environment.For example, if D/P indicates returns would be high for a while, the investor might be happier and have a high value.•Value functions allow you to express an infinite-period problem as a two-period problem. Breaking up the maximization into the first period and the remaining periods, as follows•Or{}{}⎪⎭⎪⎬⎫⎪⎩⎪⎨⎧⎥⎦⎤⎢⎣⎡+=∑∞=+++++++11,...,,...,,,)()()(maxmax2121jjtjtwwccttwctcuEEcuWVttttttββ{}{})()()(1,max++=tttwctWVEcuWVttβLinearizing any model •Goal of linear model: derive variables that drive the discount factor; derive a linear relation between discount factor and these variables;•Following gives three standard tricks to obtain a linear model;Linearizing any model-Talyorexpansion•From •We have)(11++=ttfgm))())((('))((11111+++++−+≈ttttttttfEffEgfEgmComments on the CAPM and ICAPM•Is CAPM conditional or unconditional? Are the parameter changes as conditional information changes ?•The two-period quadratic utility-based deviation results in a conditional CAPM, since the parameters change over time.•The log utility CAPM hold both conditionally or unconditionally.•Should CAPM price options? The quadratic utility CAPM and log utility CAPM should apply to all payoffs.•Why linearize? Why not take the log utility model whichshould price any asset? Turn it into cannot price no normally distributed payoff and must be applied at short horizons.•it is simple to use regression to estimate in CAPM.•Now with GMM approach, nolinear discount factor model is easy to estimate.tt b a ,W R m /1=W t t t t R b a m 11+++=γβ,Comments on the CAPM and ICAPM---continued •Identify the factors: it is a art!。

Investment Styles Fan LongzhenIntroduction•Overview of investment styles;•Empirical evidence on returns of small capitalization firms and value stocks;•How to identify investment styles of a mutual fund –Characteristic-based style analysis–Return-based style analysis•Style benchmarks•Why value stock outperform growth stocks;•Earning and price momentumTypes of investment styles •Growth investing–Primarily concerned with the earning component of the P/E ratio–Look for high growth rate•Value (non-growth) investing–Primarily concerned with the price component of theP/E ratio–Look for cheap stocks•Small cap investing (as opposed to large cap)–Looking for neglected stocks–Undervalued relative to large cap equitiesInvestment styles•Value:–low price/book; low P/E; utilities industry •Growth: high EPS Growth–high profitability; health & technology •Small capitalizationWhy style analysis?•Returns of stocks in one category (e.g. growth) behave quite differently from stocks in another category (e.g. value)•Style analysis facilities–Monitoring style characteristics;–Diversification and risk control;–Performance valuation•In September 2001, a total of 3271 domestic equity managers participated in the survey–962 identify themselves as value managers;–1124 identify themselves as growth managers.Returns of small capitalization stocks•Fama and French (1992)–Rank the stocks into ten deciles based on marketcapitalization every year;–Compute the average 1-year holding period return after portfolio formation.–Found small stocks have higher returns than big stocks(1963-1991)–Fama and French do a secondary sort by beta withineach size decile, and find that beta can not explain thereturns.Return of high/low book-to-market stocks•Fama and French (1992, Journal of finance)–Rank stocks into ten deciles based on book-to-market ratio every year;–Compute the average 1-year holding periodreturn after portfolio formation;–Value stocks have higher average returns thangrowth stocks.Morningstar Fund Analysis •Market capitalization classification–Step 1: rank all stocks based market capitalization •Top 5% of the stocks as large cap;•Next 15% of the stocks are medium cap;•Remaining 80% of the stocks as small cap.---step 2:assign a score of 3 for large-cap stocks, 2 for mid-cap stocks, and 1 for small-cap stocks.---step3: calculate the weighted average of the market cap score across all stocks in the fund.---Step 4: classification•If market cap score<1.5 small cap fund •If 1.5<market cap score<2.5 medium cap fund•If market score>2.5 large cap fund ⇒⇒⇒Morningstar Fund Analysis •Growth/value classification–Step 1: estimate mediam P/E and P/B ratio of the stocks in three market-cap groups;–Step 2 compute the P/E and P/B score for each stock: divide each stock’s P/E and P/B by the median P/E and median P/B (respectively) of the stock’s market-cap group;–Step 3 calculate the average P/E and P/B score for each fund: average P/E or P/B score is 1.–Step 4 combined score=P/E score +P/B score –Step5 classification•If combined score>2.25 growth fund •If 1.75<combined score<2.25 blend fund •If combined score<1.75 value fund ⇒⇒⇒Return-based style analysis •Based on multiple factor model:•Where =return on fund •= return on style benchmark k •How to estimate the style exposure?–Regression of fund I on the return of style benchmarks;•Unconstrained regression•Constrained regression ( )•Quadratic programming ( )i K iK i i i e F b F b F b R ~~...~~~2211++++=i R ~k F ~1=∑ik b 0,1>=∑ik ik b bStyle benchmark•Six style index–S&P 500/Barra growth and value–S&P midcap 400/Barra growth and value–S&P smallcap 600/Barra growth and value•Growth and value indexes are constructed by dividing the stocks in the corresponding basic index based on book-to-price ratio. Each company in the index is assigned to either the value or growth index so that the two style add up to the full index.•The growth and value indexes are constructed so that they have the same market capitalization. Since growth companies are bigger than value companies, there are many more companies in the value index than the growth index.。

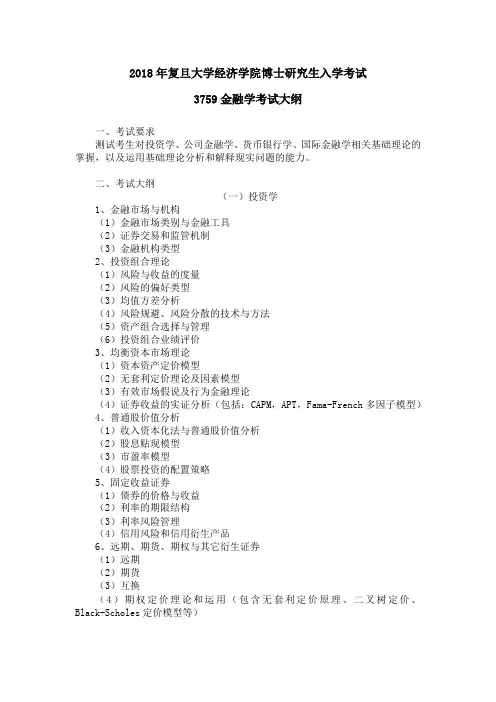

2018年复旦大学经济学院博士研究生入学考试3759金融学考试大纲一、考试要求测试考生对投资学、公司金融学、货币银行学、国际金融学相关基础理论的掌握,以及运用基础理论分析和解释现实问题的能力。

二、考试大纲(一)投资学1、金融市场与机构(1)金融市场类别与金融工具(2)证券交易和监管机制(3)金融机构类型2、投资组合理论(1)风险与收益的度量(2)风险的偏好类型(3)均值方差分析(4)风险规避、风险分散的技术与方法(5)资产组合选择与管理(6)投资组合业绩评价3、均衡资本市场理论(1)资本资产定价模型(2)无套利定价理论及因素模型(3)有效市场假说及行为金融理论(4)证券收益的实证分析(包括:CAPM,APT,Fama-French多因子模型)4、普通股价值分析(1)收入资本化法与普通股价值分析(2)股息贴现模型(3)市盈率模型(4)股票投资的配置策略5、固定收益证券(1)债券的价格与收益(2)利率的期限结构(3)利率风险管理(4)信用风险和信用衍生产品6、远期、期货、期权与其它衍生证券(1)远期(2)期货(3)互换(4)期权定价理论和运用(包含无套利定价原理、二叉树定价、Black-Scholes定价模型等)(二)公司金融学1、资本预算(1)现金流与折现(2)投资决策方法比较(3)自由现金流(4)项目净现值(5)项目系统性风险(6)实物期权2、资本成本(1)普通股成本(2)债务成本(3)加权平均资本成本(WACC)3、资本结构(1)税收、破产成本与资本结构(2)权衡理论(3)管理者动机、信息不对称与资本结构(4)优序融资理论(5)目标资本结构4、股利政策(1)股利政策理论(2)股利政策实践(3)股份回购形式及优缺点5、营运资本管理(1)营运资本政策(2)现金和有价证券管理(3)应收账款管理(4)短期融资的方式、原则和策略6、收购与兼并(1)公司估值(2)并购动因及效应(3)杠杆收购(4)并购理论7、公司治理(1)代理问题(2)剥夺问题(3)公司治理机制(三)货币银行学1、金融体系概览(1)金融体系的构成和功能(2)金融结构的经济学分析2、货币与支付体系(1)货币的本质与职能(2)支付体系的历史演变(3)货币的层次与计量3、商业银行(1)商业银行业务及其创新(2)商业银行的风险管理(3)银行业的结构与竞争(4)金融监管的经济学分析(5)巴塞尔系列协议(6)商业银行的信用创造与收缩4、中央银行与货币供给(1)中央银行职能和业务(2)中央银行的资产负债表(3)存款创造与货币供给(4)货币供给的决定因素5、金融创新与金融监管(1)金融抑制与深化(2)金融创新的原理、分类及趋势(3)金融创新与金融监管(4)金融监管的国际趋势与中国实践6、货币政策(1)货币政策的目标和工具(2)货币政策操作和传导机制(3)货币政策效果(4)中国的货币政策框架7、货币理论(1)货币需求理论(2)货币政策与财政政策(3)通货膨胀与通货紧缩(4)理性预期与货币政策(四)国际金融学1、国际收支与国际收支平衡表(1)国际收支及国际收支平衡表(2)国际收支失衡及其调节2、外汇与汇率(1)国际金融市场(2)汇率与汇率制度3、汇率理论(1)汇率水平决定理论(包含购买力平价、利率平价、国际收支说、货币分析方法等理论与实证)(2)汇率制度选择理论(包含小国及大国条件下的蒙代尔-弗莱明模型、三元悖论等理论与实证)4、国际收支内外部均衡(1)内外部均衡的冲突(2)内外部均衡冲突的调节原则(3)内外部均衡调节的经典理论(4)开放经济下的政策搭配理论5、外汇管理(1)外汇直接管制(2)汇率制度选择(3)外汇储备管理(4)外汇市场干预(5)中国的汇率政策6、国际资本流动与金融危机(1)国际资本流动(2)债务危机、银行危机、货币危机以及次贷危机理论与实践7、国际金融协调与合作(1)国际货币协调的理论(2)国际货币协调的主要问题及制度安排(3)货币国际化的理论与实践(4)区域货币协调的理论与实践。

2013年复旦大学金融专硕431金融学考研真题及答案一、名词解释(25分)1.汇率超调2.Sharp指数3.在险价值value at risk4.实物期权5.资本结构均衡理论二、选择题(20分)1.马克维茨组合的假设中哪个正确A证券市场有效B存在一种无风险资产,投资者可以不受限制借贷。

C投资者都是风险规避的D投资者在期望收益率和风险的基础上选择投资组合2.以下几个中收益率最高A半年复利率10% B年复利率10% C连续复利率10% D年复利率8%3.完美市场,如果再仅仅考虑税收,高股利政策是()?如果仅仅考虑信息不对称,高股利政策()?A有益;有害B有害;有益C有害;有害D有益;有益4.无税MM,甲乙公司财务杠杆不一样,其他都一样。

甲负债权益50%:50%,乙40%:60%,投资者有8%甲股票,什么情况下继续持有甲股票A:甲公司价值大于乙公司 B:无套利均衡 C:有收益率高的项目 D:忘了5.当一国处于通货膨胀和国际收支逆差的经济状况时,应采用的政策搭配A紧缩国内支出,本币升值B扩张国内支出,本币升值C紧缩国内支出,本币贬值D扩张国内支出,本币贬值三、计算题(20+20分)1.运用CAPM求两只股票的期望收益率,然后求出超常收益率,并分析X,Y两只股票,方差X大于方差Y,收益率X大于Y,哪只股票符合下面两个方案:a:一个风险被充分分散了的组合b:单独持有一只股票的组合2.求净现值和财务盈亏平衡点,题目含折直线折旧法(就是朱叶《公司金融》P111那道例题,就是数据不一样)四、解答题(10+10分)1.简述现代经济金融系统的功能和作用2.为什么NPV法净现值法是最不容易犯错的资本预算法?五、论述题(20+25分)1.本杰明、格雷厄姆说证券市场是投票器不是称重仪。

投资人是非理性的。

有人说美国2007金融危机的原因是因为基于“有效市场价假说”的治理理念,你是否同意此观点,理由。

2. 汇率在调节国际收支的作用,为什么部分国家愿意建立统一货币,运用国际金融基础理论的知识分析欧元危机的原因,谈谈你的看法!2013年复旦大学431金融学综合真题答案一、名词解释(每题5分,共5题)1、汇率超调【答案】汇率超调模式是美国麻省理工学院教授多恩布什于1976年提出的,它同样强调货币市场均衡对汇率变动的作用。

Chapter 15 the equity market (cross-section patternsand time-series patterns)Fan LongzhenIntroduction•In this class, we again look at the stock return data, but with a very different view point;•Previously, we examined the data through the “eyes”of CAPM. We had a noble intension, although it didn’t work very well;•Now we are going to get our hands “dirty”, and plunge right into the data, without a formal model;•In particular, we will look at some well-established patterns---size,value, and momentum—that have beensuccessful in explaining the cross-sectional stock returns.Multifactor-regressions•For each asset i, we use a multi-factor time-series regression to quantify the asset’s tendency to move with multiple risk factors:• 1. Systematic factors:•:risk premium•:risk premium • 2 idiosyncratic factors:•: no risk premium • 3. Factor loadings:•beta(i): sensitivity to market risk;•: sensitivity to the factor risk.i tt i f t M t i i f t i t e F f r r r r ++−+=−)(βαM t r )(f t M t M r r E −=λtF )(t F F E =λi t e 0)(=i t e E i fThe pricing relation•Given the risk premia of the systematic factors, the determinants of expected returns:•What are the additional systematic factors?FiM i f t i t f r r E λλβ+=−)(Size: small or big•We sort the socks by their market capitalization: share price* number of shares outstandingValue or growth•We can sort the cross-section of stocks by their book-to-market ratios: growth stocks:firm with low book-to-market ratios;•Value stocks:firms with high book-to-market ratios.Other factors•Price-to-earining ratios,•The market skewness fcator•---Havey and Siddique(JF,2000) report that systematic skewness is economically important and commands an average risk premium of 3.6% per year.Time-series behavior•For the time-series behavior of stock returns, we focus in particular on the time-varying nature of expected return and volatility;•We are interested in building dynamic models that explicitly incorporate conditioning information to best describe the behavior of future stock returns.Predictability and marketefficiency•In addition to the random walk test, there is mounting evidence that stock returns are predictable;•Some argue that predictability implies market inefficiency. What do you think?•Others contend it is simple a result of rational variation in expected returns;•Suppose this is true. Can we find a coherent story that relates the variation through time of expected returns to business conditionsWhat cause expected returns to vary?•Using the intuition of CAPM, expected returns canvary for two reasons:• 1. Varying risk aversion;• 2. Varying exposure to market risk, or varying market risk.•When income is high, investor want save more, higher saving lead to lower expected returns;•Empirical implication?Variables related to business condition •Default spreads: difference in yields between defaultable bonds and treasury bonds with similar maturities. When the business condition is bad, the systematic default risk increases, widening the default spread.•Term premiums: difference in yields between long-and short-term treasury bonds. This is a forward-looking variable predictive of future inflation, and is found to be important in forecasting real economic activity.•Financial ratios: book-to-market, dividend yields, ect. Variables that are important in fundamental valuationTime-varying volatility---volatility also changes with time •If the rate of information arrival is time-varying, so is the rate of price adjustment, causing the volatility to change over time;•The time-varying volatility of the market return is related to the time-varying volatility of a variety of economic variables, includinginflation, money growth, and industrial production;•Stock market volatility increases with financial leverage: a decrease in stock price causes an increase in financial leverage, cause volatility to increase;•Investors’s sudden changes of risk attitudes, changes in market liquidity, and temporary imbalance of supply and demand could all cause market volatility to change over time.•What are the testable empirical implications?Stochastic volatility•More generally, volatility is a stochastic process of its own, this is an active area of research in academics and in industry.•Some well-known facts about stochastic volatility:• 1. It is persistent: volatile periods are followed by volatile periods;• 2. It is mean-reverting: over time, volatility converges to its long-run mean.• 3. There is a negative correlation between volatility and return: large negative price jumps are coupled with large positive volatility jumps.。