第六章外汇衍生交易答案

- 格式:ppt

- 大小:36.00 KB

- 文档页数:10

第六章1.银行与客户间的外汇交易构成了()。

A. 批发市场B. 结汇市场C. 售汇市场D. 零售市场正确答案是:零售市场2.下列属于所有权凭证的金融工具是()。

A. 公司债券B. 短期国债C. 银行承兑票据D. 股票正确答案是:股票3.中央银行通过货币市场进行(),买卖有价证券以调节货币供应量。

A. 发行国债B. 公开市场业务操作C. 实施准备金政策D. 实施再贴现政策正确答案是:公开市场业务操作4.于1613年开市的()被认为是以股票交易为中心的证券市场的开端。

A. 泛欧交易所B. 纽约证券交易所C. 伦敦证券交易所D. 阿姆斯特丹证券交易所正确答案是:阿姆斯特丹证券交易所5.同业拆借市场的形成源于中央银行对商业银行()的要求。

A. 法定存款准备金B. 盈利水平C. 信贷规模D. 资金总量正确答案是:法定存款准备金6.资本市场从广义的角度,包括哪几个部分:()。

B. 黄金市场C. 中长期债券市场D. 股票市场E. 银行间市场正确答案是:银行中长期信贷市场, 中长期债券市场, 股票市场7.按照金融交易的交割期限可以把金融市场划分为()。

A. 资本市场B. 衍生品市场C. 期货市场D. 现货市场E. 货币市场正确答案是:现货市场, 期货市场8.下列金融工具中,没有偿还期的是()。

A. 商业票据B. 大额可转让存单C. 银行定期存款D. 普通股E. 优先股正确答案是:优先股, 普通股10.金融市场的功能包括()。

A. 风险分散和规避B. 价格发现C. 资源配置D. 资源转化E. 宏观调控传导正确答案是:资源配置, 资源转化, 价格发现, 风险分散和规避, 宏观调控传导10.保险市场除了具备一般金融市场的功能外,还有如下一些特殊的功能()。

A. 可以形成较为合理的交易价格B. 提供有效的保险供给D. 可以提供最广泛的风险分散机制E. 提高保险交易的效率正确答案是:提供有效的保险供给, 提高保险交易的效率, 可以形成较为合理的交易价格, 可以提供最广泛的风险分散机制11.金融机构是金融市场上的最重要的中介机构。

第一章1、衍生工具包含几个重要类型?他们之间有何共性和差异?2、请详细解释对冲、投机和套利交易之间的区别,并举例说明。

3、衍生工具市场的主要经济功能是什么?4、“期货和期权是零和游戏。

”你如何理解这句话?第一章习题答案1、期货合约::也是指交易双方按约定价格在未来某一期间完成特定资产交易行为的一种方式。

期货合同是标准化的在交易所交易,远期一般是OTC市场非标准化合同,且合同中也不注明保证金。

主要区别是场内和场外;保证金交易。

二者的定价原理和公式也有所不同。

交易所充当中间人角色,即买入和卖出的人都是和交易所做交易。

特点:T+0交易;标准化合约;保证金制度(杠杆效应);每日无负债结算制度;可卖空;强行平仓制度。

1)确定了标准化的数量和数量单位、2)制定标准化的商品质量等级、(3)规定标准化的交割地点、4)规定标准化的交割月份互换合约:是指交易双方约定在合约有效期内,以事先确定的名义本金额为依据,按约定的支付率(利率、股票指数收益率)相互交换支付的约定。

例如,债务人根据国际资本市场利率走势,将其自身的浮动利率债务转换成固定利率债务,或将固定利率债务转换成浮动利率债务的操作。

这又称为利率互换。

互换在场外交易、几乎没有政府监管、互换合约不容易达成、互换合约流动性差、互换合约存在较大的信用风险期权合约:指期权的买方有权在约定的时间或时期内,按照约定的价格买进或卖出一定数量的相关资产,也可以根据需要放弃行使这一权利。

为了取得这一权利,期权合约的买方必须向卖方支付一定数额的费用,即期权费。

期权主要有如下几个构成因素①执行价格(又称履约价格,敲定价格〕。

期权的买方行使权利时事先规定的标的物买卖价格。

②权利金。

期权的买方支付的期权价格,即买方为获得期权而付给期权卖方的费用。

③履约保证金。

期权卖方必须存入交易所用于履约的财力担保,④看涨期权和看跌期权。

看涨期权,是指在期权合约有效期内按执行价格买进一定数量标的物的权利;看跌期权,是指卖出标的物的权利。

第六章外汇衍生工具交易6.1复习笔记一、外汇期货交易1.外汇期货合约外汇期货交易,也称货币期货,是指外汇买卖双方在有组织的交易场所内,通过公开竞价,以标准合约的形式买入或卖出标准交割日期、标准交割数量的某种外汇。

(1)外汇期货合约的内容①交易币种与报价在外汇期货交易所内交易的货币一般是可自由兑换货币。

外币期货是以每一单位外币(日元为每100日元)兑换多少美元来报价的,美元一律作为标价货币。

②合约面额各外汇交易所都对外汇期货合约的面额做了特别规定,并且不同货币有不同的标准面额,各种货币的交易量必须是合约面额的整数倍。

③交割月份交割月份是指期货交易所规定的期货合约的到期月份。

但是,期货合同的敞口头寸在任何时候都可以通过一个相反方向的期货合同得到抵消,而不必等到到期日再进行外汇交割。

④交割日期交割日期是指进行期货合约实际交割的日期,即具体为交割月份的某一天。

如果在合约到期前,交易者未做对冲交易,则期货合约的多头有责任以当日结算时的汇率支付与外汇期货合约等额的美元,而空头要交付相等的外汇额。

⑤最小价格波动和最高限价最小价格波动是指在买卖货币期货合约时,由于供求关系使合约的货币价格产生波动的最小幅度。

在交易场内,出价和叫价只能是最小变动额的倍数。

最高限价是指每日交易价格变化的最高限度,一旦期货合约价格波动达到或超过这一限度,交易即自动停止。

(2)外汇期货交易特征①交易合约标准化外汇期货合约是标准化的远期外汇合同,除了交易价格是通过竞价形成可以变动外,交易币种、合同金额、交割时间等都有统一的规定。

而外汇远期交易的合约金额和交割日期是交易双方协商决定的。

②有组织的交易外汇期货交易是在有组织的交易所通过经纪人进行的,并且有一定的交易程序和较为严格的规章条例。

外汇期货市场实行会员制,只有交易所的会员才能进入交易所执行交易。

远期外汇交易则无上述限制。

③每日都有现金流外汇期货交易须交存保证金,清算所实行每日无债结算制,按收市结算价对每笔交易的多头方和空头方盈亏结算,从而在合同到期之前,资金每天都要易手,形成现金流。

第六章1. 基于债券组合的利率互换定价原理是什么?答:利率互换可以视为债券的多空组合。

记V 为互换的价值,fix B 为固定利率债券的价值, float B 为浮动利率债券的价值, Q 为互换协议的本金。

当前时刻为0时刻,利率互换协议约定中介银行在 时刻(1i n ≤≤ )收取固定利率利息K 美元,同时支付浮动利率利息。

如果将利率互换视为债券的多空组合,那么互换合约的价值为swap fix floatV B B =-这就是基于债券组合的利率互换定价原理。

2. 基于远期协议组合的货币互换定价原理是什么?答:利率互换可以分解为一系列的远期利率协议的和。

这种定价的过程有以下三步:1) 对决定互换现金流的每一个利率,计算远期利率2) 假设互换利率等于远期利率,计算互换现金流3) 设定互换价值等于每个互换现金流时点上FRA 净现金流的现值之和3. 简述人民币利率互换市场的发展状况。

答:人民币利率互换市场自2006 年2 月正式启动以来,逐渐成为我国衍生产品市场的主要产品,吸引了越来越多的市场成员的关注。

2008年2月18号,人民银行发布了《中国人民银行关于开展人民币利率互换业务有关事宜的通知》,人民币利率互换业务正式开展。

近年来,人民币利率互换市场的规模不断增加。

2011年全年,我国利率互换交易笔数为20202笔,交易规模达26759.60亿元,占同期中国场外利率衍生产品的市场份额分别为97.87%、96.28%,同比分别增长73.51%、78.36%。

人民币利率互换交易的交易品种也不断在增加,浮动参考利率主要有隔夜和三月期上海银行间同业拆放利率(SHIBOR -O/N 和SHIBOR -3M )、银行同业间七天回购定盘利率(FR007)、一年期定存利率、6个月和1年期的贷款利率。

自2010年保监会开启了保险机构投资利率互换的大门后,越来越多的券商也积极参与到人民币利率互换市场之中。

2014年7月1日起,按人民银行规定,金融机构之间新达成的符合条件的人民币利率互换交易均应提交上海清算所进行集中清算。

外汇交易课后习题答案外汇交易课后习题答案外汇交易是一种金融市场活动,涉及不同国家货币之间的交易。

它是全球最大的金融市场之一,每天交易额达数万亿美元。

外汇交易的复杂性和风险使得学习和理解其原理和技巧至关重要。

以下是一些常见的外汇交易课后习题及其答案,希望对您的学习和实践有所帮助。

1. 什么是外汇交易?答:外汇交易是指在金融市场上买卖不同国家货币的行为。

交易者通过购买一种货币以期望其价值上涨,或者卖出一种货币以期望其价值下跌,从而实现利润。

2. 外汇交易的主要参与者有哪些?答:外汇交易的主要参与者包括银行、企业、投资基金、个人投资者和中央银行等。

其中,银行是最主要的交易参与者,它们通过为客户提供外汇交易服务来获取利润。

3. 外汇交易的两种基本交易方式是什么?答:外汇交易有两种基本交易方式,即现货交易和期货交易。

现货交易是指交易双方在交易发生后的两个工作日内进行货币交割。

期货交易则是指交易双方约定在未来某个特定日期进行货币交割。

4. 外汇交易的主要风险因素有哪些?答:外汇交易的主要风险因素包括市场风险、汇率风险和信用风险。

市场风险是指由于市场波动导致交易损失的风险,汇率风险是指由于汇率变动导致交易损失的风险,信用风险是指交易对手方无法履约导致的风险。

5. 什么是杠杆交易?答:杠杆交易是指通过借入资金进行交易的一种方式。

交易者只需支付一小部分交易金额作为保证金,就可以进行较大规模的交易。

杠杆交易可以放大交易者的利润,但同时也会增加交易风险。

6. 外汇交易的基本分析方法有哪些?答:外汇交易的基本分析方法包括技术分析和基本面分析。

技术分析是通过研究历史价格和交易量数据来预测未来市场走势的方法。

基本面分析则是通过研究经济指标、政治事件和其他相关因素来预测货币价值的方法。

7. 如何管理外汇交易中的风险?答:管理外汇交易中的风险是交易者的关键任务之一。

一些常见的风险管理方法包括设置止损订单、合理分配资金、避免过度交易和及时调整交易策略等。

金融英语第六章答案Chapter 6The Foreign Exchange MarketExercisesⅠ. Answer the following questions in English.1. How many common methods to express a foreign exchange rate?Answer:There are two common methods to express a foreign exchange rate.2. What is usefulness of settling account?Answer:Business people will pay and recieive different currencies.Therefore, they must convert the currencies that they received into the currencies thatthey could buy commodities.3. How does stop order work?Answer: Stop orders can be used to enter the market on momentuma or to limit the potential loss of a position.4. What do you think about single currency system? Is it possible to establishsingle currency system in the world now?Answer:I think a single currency system,it means no foreign exchange market,no foreign exchange rates,no foreign exchange.It is no possible to establish single currency system in the world now. Because in our world of mainly national currencies,the foreign exchange market plays the indispensable role of providing the essential machinery for making payments across borders,transferring funds and purchasing powerfrom one currency to another,and determining thatsingularly important price,the exchange rate.5. What is limit order?Answer: A limit is an order to buy or sell a currency at a specified price or better.6. How to make money for many traders through foreign exchange market?Answer:(一)You should have trading currencies with a strategy.(1) Currency Trading is Only For Part of Your Investment Money(2)You Must Limit Your Losses in Currency Trading(3)Know the Trends of the Foreign Currency Market Before Trading(二)Decide What Type of Currency Trader You Will be.(1)Trade currendes in multiple lots(2)Lose the urge to trade currencies every day(3)Stick to your trading planⅡ.Fill in the each blank with an appropriate word or expression.l. The currency trader should also decide the time __frame__ that he will be using to trade in order to determine which trend will be the most important. 2. The bid is the price at which dealers are willing to __buy__ dollars (basecurrency) in terms of yen (quote currency) and users of our trading platform can __sell__ dollars in terms of yen.3. The order remains active until the end of the trading day (5:00 PM EST),unless it is __executed__ or canceled by the trader.4. A GTC order remains active until it is canceled by the currency trader or untilthe order is executed. It is the __trade’s__ responsibility to __cancel__ aGTC order.5. The Foreign Exchange Market is where the majority of buying and selling ofworld __currencies__ takes place.6. When placing a limit order, the trader also specifies the__duration__ for whichthe order is to remain active while it is not executed.Ⅲ.Translate the following sentences into English.1.外汇交易市场,也称为“Forex”或“FX”市场,是世界上最大的金融市场,平均每天超过1兆美元的资金在当中周转——相当于美国所有证券市场交易额总和的30倍。

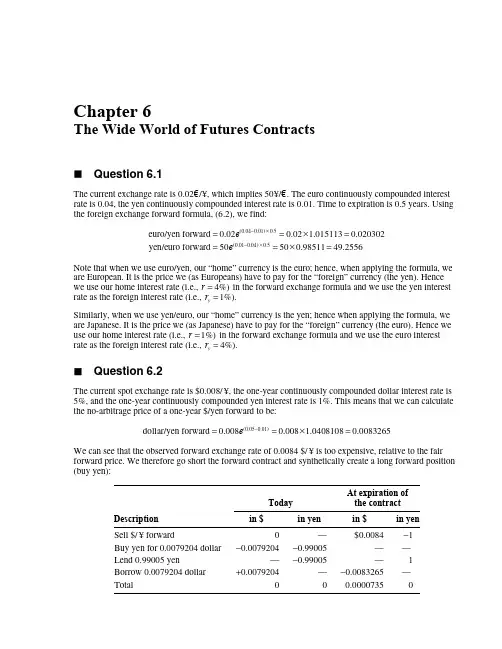

Chapter 6The Wide World of Futures ContractsQuestion 6.1The current exchange rate is 0.02€/¥, which implies 50¥/€. The euro continuously compounded interest rate is 0.04, the yen continuously compounded interest rate is 0.01. Time to expiration is 0.5 years. Using the foreign exchange forward formula, (6.2), we find:(0.040.01)0.5(0.010.04)0.5euro/yen forward 0.020.02 1.0151130.020302yen/euro forward 50500.9851149.2556e e −×−×==×===×=Note that when we use euro/yen, our “home” currency is the euro; hence, when applying the formula, we are European. It is the price we (as Europeans) have to pay for the “foreign” currency (the yen). Hence we use our home interest rate (i.e., 4%)r = in the forward exchange formula and we use the yen interest rate as the foreign interest rate (i.e., 1%).y r =Similarly, when we use yen/euro, our “home” currency is the yen; hence when applying the formula, we are Japanese. It is the price we (as Japanese) have to pay for the “foreign” currency (the euro). Hence we use our home interest rate (i.e., 1%)r = in the forward exchange formula and we use the euro interest rate as the foreign interest rate (i.e., 4%).y r =Question 6.2The current spot exchange rate is $0.008/¥, the one-year continuously compounded dollar interest rate is 5%, and the one-year continuously compounded yen interest rate is 1%. This means that we can calculate the no-arbitrage price of a one-year $/yen forward to be:(0.050.01)dollar/yen forward 0.0080.008 1.04081080.0083265e −==×=We can see that the observed forward exchange rate of 0.0084 $/¥ is too expensive, relative to the fair forward price. We therefore go short the forward contract and synthetically create a long forward position (buy yen):Today At expiration of the contract Description in $ in yen in $ in yenSell $/¥ forward 0 —$0.0084 −1Buy yen for 0.0079204 dollar −0.0079204 −0.99005— —Lend 0.99005 yen — −0.99005— 1Borrow 0.0079204 dollar +0.0079204 —−0.0083265 —Total 0 00.0000735 072 McDonald • Fundamentals of Derivatives MarketsNote that, when we enter into the short forward position, we short 1 yen. This is why we buy 0.99005 yenas .010.99005.e −= We could have done an arbitrage by buying 1 yen and shorting 1.01005 .01(i.e. )e yen forward.With the above arbitrage strategy, we’ve earned 0.0000735 dollars, without any exchange risk or initial investment involved. We have exploited the arbitrage opportunity and would like to increase the scale of this strategy as much as possible (i.e., buy as many yen on the spot market and sell them forward). With a forward exchange rate of 0.0083, the observed price is too cheap. We will buy the forward and synthetically create a short forward position.Today At expiration of the contract Description in $ in yenin $ in yen Buy $/¥ forward 0 —−0.0083$ +1 Sell yen for 0.0079204 dollar +0.0079204−0.99005—— Borrow 0.99005 yen —+0.99005—−1 Lend 0.0079204 dollar −0.0079204—+0.0083265— Total 000.00002650Therefore, we made an arbitrage profit of 0.0000265 dollars.Question 6.3We will do this on a per euro basis. Today, we borrow a euro at 4%, buy $1.25 on the spot market, and invest the $1.25 at 5%. If T x is next year’s exchange rate ($ per euro), paying back the euro loan requires .04T x e dollars. Hence our profit (in dollars) is:.05.041.25 1.3141 1.0408T T e x e x −=−1. Our zero profit sets the profit equation above equal to zero:1.3141/1.0408 1.2626T x ==2. Setting 1.3T x = in the profit equation yields a profit of1.3141 1.0408 1.3$0.0390T x =−×=−3. Setting 1.22T x = in the profit equation yields a profit of1.3141 1.0408 1.22$0.0443T x =−×=Question 6.41. The Eurodollar futures price is 93.23, i.e., a 90-day rate of 1.6925%. Using Equation (6.3) of text, we have a quarterly effective rate LIBOR rate of:911191(10093.23) 1.7113%.100490r =−×××=Chapter 6 The Wide World of Futures Contracts 732. Since we want to protect ourselves against an interest rate rise, we will short $10 million worth offuture contracts (i.e., 10 contracts). We take a short position as the Eurodollar futures price moves opposite the interest rate.3. We will have to repay principal plus interest on the loan that we are taking from the following Juneto September. Because we shorted a Eurodollar futures, we are guaranteed the interest rate wecalculated in Part (1). Therefore, we have a repayment of:91$10,000,000(1)$10,000,000 1.017113$10,171,130r ×+=×=As an example, if the 3-month LIBOR rate in June was 1.9%, the futures price would be100 − 7.6 = 92.4 and the quarterly effective rate would be 1.9211%. Our unhedged borrowingcost (interest) has gone up by approximately $20,000; however our 10 futures contracts pay10 × 100 × (93.23 − 92.4) = 20,750.Question 6.51. The Eurodollar futures price is 94.65, i.e., a 90-day rate of 1.3375%. Using Equation (6.3) of text, we have a quarterly effective rate LIBOR rate of:911191(10093.23) 1.3524%.100490r =−×××= 2. Since we want to protect ourselves against an interest rate fall, we will long $10 million worth offutures contracts (i.e., 10 contracts). We take a long position as the Eurodollar futures price moves opposite the interest rate.3. We will receive principal plus interest on our loan that is made from the following June to September.Because we are long in Eurodollar futures, we are guaranteed the interest rate we calculated in Part (1). Therefore, we receive a repayment of:91$10,000,000(1)$10,000,000 1.013524$10,135,240r ×+=×=Question 6.61. As the hint suggests, we have to increase our short position in the September Eurodollar futurescontract by the 91-day rate. The Eurodollar futures is a way of locking in 3-month rates, hencelocking in a 6 month rate requires borrowing for 3 months at the 91-day June rate (call it )J r and then borrowing (1)J r + at the 91-day September rate. Hence, we have to go short 1J r + more,proportionally. Using a similar calculation as 6.4.a and 6.5.a, the two 91-day rates are 1.3875%J r = and 1.3%.S r = Note that increasing our position of 10 contracts by 1.3875% is not technicallyfeasible as the contracts have $1 million principle.2. We have locked in a 182-day rate of 1.013875 1.013001 2.705%.×−=74 McDonald • Fundamentals of Derivatives MarketsQuestion 6.7A storer of corn must be compensated for the storage costs, as well as interest forgone. For example, the holder could sell corn for $3 per bushel on the spot market, invest the $3 at 1%. This would give 3 cents interest and would save 4 cents in storage. Hence the January forward price must be $3.07 for there to be storage. If it was less than $3.07, no one would store it; if it was greater than $3.07, cash and carry arbitrage would be possible.Similarly, the February price must cover two months’ interest and storage. We must also cover the interest on the first month’s storage cost. Mathematically,20,2/123(1.01).04(1.01).04$3.1407.F =++= Note we could use the January price of $3.07 and argue that one could buy in January at $3.07and store it in February. They must be rewarded with the interest and storage cost, i.e.,0,2/12 3.07(1.01).04$3.1407.F =+=March has three months’ interest and storage costs to cover. Mathematically,320,3/123(1.01).04(1.01).04(1.01).04$3.2121F =+++=We could have also used February’s price,0,3/12 3.1407(1.01).04$3.2121F =+=Question 6.8We will do this slightly different than the text’s example to demonstrate that the scale of the trade can be different. Instead of buying 0.9727 ounces on the spot market, our cash and carry will buy one ounce on the spot market. Specifically, we borrow $400 at 5% for two years, buy one ounce of gold, lend it at a lease of 1.384%, and short 0.013842 1.0281e ×= ounces forward at $430 per ounce. This has zero cost and, in two years, we receive:.0521.028********e ××−×=Note that holding gold (i.e., not lending it) in our cash and carry strategy will lose money for we can only short one unit forward, which implies a cash flow of.05243040012.070e ×−×=−<Question 6.91. The spot price of gold is $300.00 per ounce. With a continuously compounded annual risk-free rateof 5%, and at a one-year forward price of 310.686, we can calculate the lease rate according to formula (6.8):0,*01310.686ln 0.05ln 0.015300T F r T S δ⎛⎞⎛⎞=−=−=⎜⎟⎜⎟⎝⎠⎝⎠Chapter 6 The Wide World of Futures Contracts 752. Suppose gold cannot be loaned. Then our cash and carry “arbitrage” is:Transaction Time 0 Time T = 1Short forward 0 310.686TS −Buy gold −$300 TS Borrow @ 0.05 $300 −$315.38Total 0 −4.6953The forward price has an implicit lease rate. If we try to engage in a cash and carry arbitrage, but donot have access to the gold loan market, we will incur a loss.3. We will use our cash and carry as in 6.8; however, this time, we will tail our position and purchase.0150.9851e = ounces on the spot market (with borrowed money) and lend the 0.9851 ounces. In this case, we will receive 1 ounce of gold in one year. Hence we short one ounce forward. We have the following cash and carry payoff table:Transaction Time 0 Time T = 1Short forward 0310.686T S −Buy tailed gold −$295.5336T S position, lend @ 0.015Borrow @ 0.05 $295.5336−$310.686Total 00Therefore, we now break even; since the forward was fairly priced, taking the implicit lease rate intoaccount, this result should not surprise us.Question 6.10The spot price of a widget is $70.00. With a continuously compounded annual risk-free rate of 5%, we can calculate the annualized lease rates, for each delivery date T , according to the formula (6.8):0,*01ln T F r T S δ⎛⎞=−⎜⎟⎝⎠ T Forward price Annualized lease rate1/4 $70.70 0.01019871/2 $71.410.01011473/4 $72.130.01003361 $72.860.0099555The lease rate is less than the risk-free interest rate; this is equivalent to the forward curve being upward sloping, which is an example of contango.76 McDonald • Fundamentals of Derivatives MarketsQuestion 6.111. Buying gas in October at $6.85 with borrowed money (at 1% monthly interest), storing it for a month,and selling it at the November price of $7.50 yields a profit of7.50 6.85 1.01Oct Storage Cost 0.5815Oct Storage Cost −×−=−Notice that a similar analysis could be done for any of the back-to-back months. Let i SC be thestorage costs of month i . The strategy of using the futures contract to buy in month i and sell inmonth 1,i + using borrowed money, would yield to a profit withMonth i 1(1.01)i i F F +−×Oct. $0.5815 −Oct.SCNov. $0.5750 −Nov.SCDec. −$0.0315 −Dec.SCJan. −$0.0320 −Jan.SCFeb. −$0.1325 −Feb.SCMar. −$0.8320 −Mar.SCSince storage costs are greater than zero, storage is not profitable for December through March.2. From the table above, we see that marginal storage costs in October should be approximately$0.5815, and marginal storage costs in November should be approximately $0.5750. If they were greater, no one would be willing to store it during the month. If they were lower, then the storage arbitrage strategy would earn a profit (as shown in the table above).Question 6.12If you borrow natural gas, you would sell it immediately on the October spot market for $6.50. Investing this at 1% you would have $6.50(1.01)$6.565×= in November. Since you have borrowed natural gas, you have to replace it. In order to have no risk, you must also go long the November forward—note, you do this today (in October). In November, you have to pay $7.25 to replace the gas you borrowed. Hence, in the absence of a cash flow (from the person you borrowed the gas from), you would be losing7.250 − 6.565 = 0.685. Therefore you require a cash payment or $0.685 from the lender of the gas.The lender is would be willing to pay this because, by lending the gas (which will be replaced in November), she avoids storage costs. In this case, there is a negative lease rate/convenience yield due to storage costs. Question 6.13If you borrow natural gas, you would sell it immediately on the March spot market for $8.00. Investing this at 1% you would have $8.00(1.01)$8.08×= in April. Since you have borrowed natural gas, you have to replace it. In order to have no risk, you must also go long the April forward—note, you do this today (in March). In April, you have to pay $7.25 to replace the gas you borrowed. Hence, in the absence of a cash flow between you and the lender, you would be making 8.087.250.83.−= Therefore you must make a cash payment of $0.83 to the lender of the gas.Chapter 6 The Wide World of Futures Contracts 77The lender would demand a payment since, instead of lending it to you and getting the gas back in April, she could sell it in March for a relatively high price ($8) and earn interest. Note storage costs are notrelevant as storage is not expected to occur. In this case, there is a positive lease rate/convenience yield—owners of the asset are reluctant to lend their gas and must be paid a premium if they are to lend it. Question 6.14The spot price of oil is $32.00 per barrel. With a continuously compounded annual risk-free rate of 2%, we can again calculate the lease rate according to the formula:0,*01ln T F r T S δ⎛⎞=−⎜⎟⎝⎠ Time to expirationForward price Annualized lease rate 3 months$31.37 0.0995355 6 months$30.750.0996918 9 months$30.140.0998436 12 months $29.540.0999906In this case, the lease rate is higher than the risk free rate and the market is in backwardation.Question 6.15The average temperature is simply the sum of the temperatures divided by the number of days (7):(60556872605045)/7410/758.57++++++==Heating degree days (HDD) sum (absolute) deviations from 65 degrees on days that are colder than 65. Hence we sum the deviation from days 1, 2, 5, 6, and 7:HDD 5105152055=++++=Cooling degree days (CDD) sums (absolute) deviations from 65 degrees on days that are warmer than 65. Hence we sum the deviation from days 3 and 4:CDD 3710.=+=Question 6.161. By selling gas to customers at a fixed price (in advance of the heating season), the natural gascompany is worried about the case when natural gas prices are abnormally high. In this case, they are not able to raise their price to their customers and might have to buy natural gas at the higher price in order to delivery enough quantity. A natural gas futures contract (specifically, a long position) can help protect against price risk, but is unable to help the company on quantity risk. Since fixed price customers are no longer price sensitive, they are likely to consume a relatively large quantity when there is cold weather, which also happens to be when gas prices are likely to be high.78 McDonald • Fundamentals of Derivatives MarketsWhen entering in a long futures contract, the company has to set the number of contracts to go long.If they purchase a large amount of futures contracts to cover the case of very cold weather, they will suffer when the weather is relatively warm. In this case (low gas prices/warm weather), they will losea large amount of money on their futures hedge; hence their hedge has added a different risk. If theypurchase a small amount of natural gas futures, then they run the risk of having to sell a large quantity of expensive natural gas to its fixed price customers.2. Heating degree day (HDD) futures could be the ideal hedging instrument. By going long with aheating degree day futures contract (either by itself or in combination with a natural gas futurescontract), the company can hedge quantity risk. When HDD is high, their fixed price customers will be demanding a large quantity of expensive gas. The correlation between quantity sold and HDD helps the company manage total risk (not just price risk) with the HDD contract.。

第一章1、衍生工具包含几个重要类型?他们之间有何共性和差异?2、请详细解释对冲、投机和套利交易之间的区别,并举例说明。

3、衍生工具市场的主要经济功能是什么?4、“期货和期权是零和游戏。

”你如何理解这句话?第一章习题答案1、期货合约::也是指交易双方按约定价格在未来某一期间完成特定资产交易行为的一种方式。

期货合同是标准化的在交易所交易,远期一般是OTC市场非标准化合同,且合同中也不注明保证金。

主要区别是场内和场外;保证金交易。

二者的定价原理和公式也有所不同。

交易所充当中间人角色,即买入和卖出的人都是和交易所做交易。

特点:T+0交易;标准化合约;保证金制度(杠杆效应);每日无负债结算制度;可卖空;强行平仓制度。

1)确定了标准化的数量和数量单位、2)制定标准化的商品质量等级、(3)规定标准化的交割地点、4)规定标准化的交割月份互换合约:是指交易双方约定在合约有效期内,以事先确定的名义本金额为依据,按约定的支付率(利率、股票指数收益率)相互交换支付的约定。

例如,债务人根据国际资本市场利率走势,将其自身的浮动利率债务转换成固定利率债务,或将固定利率债务转换成浮动利率债务的操作。

这又称为利率互换。

互换在场外交易、几乎没有政府监管、互换合约不容易达成、互换合约流动性差、互换合约存在较大的信用风险期权合约:指期权的买方有权在约定的时间或时期内,按照约定的价格买进或卖出一定数量的相关资产,也可以根据需要放弃行使这一权利。

为了取得这一权利,期权合约的买方必须向卖方支付一定数额的费用,即期权费。

期权主要有如下几个构成因素①执行价格(又称履约价格,敲定价格〕。

期权的买方行使权利时事先规定的标的物买卖价格。

②权利金。

期权的买方支付的期权价格,即买方为获得期权而付给期权卖方的费用。

③履约保证金。

期权卖方必须存入交易所用于履约的财力担保,④看涨期权和看跌期权。

看涨期权,是指在期权合约有效期内按执行价格买进一定数量标的物的权利;看跌期权,是指卖出标的物的权利。

《外汇交易与实务》习题参考答案——基本训练+观念应用(注:以下蓝色表示删减,粉红色表示添加)第一章外汇与外汇市场一、填空题1、汇兑2、即期外汇远期外汇3、比价4、间接标价法5、国际清偿6、外币性普遍接受性可自由兑换性7、国家或地区货币单位8、外汇市场的4个参与者:外汇银行、经纪人、一般客户、中央银行。

(原8、9、10删除)二、判断题1、F2、T3、F4、T5、T6、T7、F8、F案例分析:太顺公司是我国一家生产向美国出口旅游鞋的厂家,其出口产品的人民币底价原来为每箱5500元,按照原来市场汇率USDI=RMB6.56,公司对外报价每箱为838.41美元。

但是由于外汇市场供求变动,美元开始贬值,美元对人民币汇率变为USDl=RMB6.46,此时太顺公司若仍按原来的美元价格报价,其最终的人民币收入势必减少。

因此,公司经理决定提高每箱旅游鞋的美元定价,以保证最终收入。

问:太顺公司要把美元价格提高到多少,才能保证其人民币收入不受损失?若公司为了保持在国际市场上的竞争力而维持美元价格不变,则在最终结汇时,公司每箱旅游鞋要承担多少人民币损失?解答:⑴为保证人民币收入不受损失,美元价格需提高至:5500/6.46≈851.39(USD)⑵如维持美元价格不变,公司需承担人民币损失为:5500-838.41*6.46=5500-5425.12 ≈83.87(CNY)第二章外汇交易原理二、填空1、汇率交割日货币之间2、高3、大4、止损位5、买入价卖出价6、大高7、多头8、空头9、售汇10、低9、外汇交易双方必须恪守信用,遵循“一言为定”的原则,无论通过电话或电传,交易一经达成就不得反悔。

三、单项选择1、A2、C3、D4、B5、C6、A7、B8、D9、C 10、D四、多项选择1、ABCD2、BD3、ABCD4、ABCD5、AC五、判断题1、T2、F3、T4、F5、T案例分析与计算1.下列为甲、乙、丙三家银行的报价,就每一个汇率的报价而言,若询价者要购买美元,哪报价有竞争力的是丙、丙、丙、丙、乙丙、乙2.市场USD/JPY= 101.45/50,现:A行持美元多头,或市场超买,该行预卖出美元头寸,应如何报价?并说明理由。

外汇交易课后习题答案外汇交易是一种涉及货币兑换的金融活动,它允许个人和企业在全球范围内进行货币交易。

以下是一些外汇交易课后习题的答案,供学生参考:1. 外汇市场的主要参与者有哪些?答案:外汇市场的主要参与者包括银行、金融机构、跨国公司、中央银行、基金经理、个人投资者和投机者。

2. 解释什么是基础货币和报价货币。

答案:基础货币是货币对中的第一种货币,报价货币是第二种货币。

例如,在EUR/USD货币对中,EUR是基础货币,USD是报价货币。

3. 什么是杠杆交易?答案:杠杆交易是指投资者使用借来的资金进行交易,以期放大潜在的利润。

在外汇交易中,杠杆可以高达50:1或更高,这意味着投资者可以控制比实际投资金额大得多的货币量。

4. 如何计算外汇交易中的点差?答案:点差是货币对中买价和卖价之间的差额。

例如,如果EUR/USD的买价是1.1500,卖价是1.1505,那么点差就是0.0005或5点。

5. 解释什么是止损订单和限价订单。

答案:止损订单是一种自动执行的订单,当市场价格达到特定水平时,它会关闭一个未平仓的头寸以限制损失。

限价订单是一种设置在特定价格或更好价格上买入或卖出货币的订单。

6. 什么是外汇交易中的“滑点”?答案:滑点是指订单执行价格与预期价格之间的差异。

这可能是由于市场波动或流动性不足造成的。

7. 描述货币对的四种主要类型。

答案:主要货币对、次要货币对、异类货币对和稀有货币对。

主要货币对包括美元与其他主要货币的组合,如EUR/USD、USD/JPY等。

次要货币对通常涉及美元和一种次要货币,如USD/CAD。

异类货币对不包括美元,如EUR/GBP。

稀有货币对则涉及较少交易的货币,如USD/ZAR。

8. 解释什么是外汇储备。

答案:外汇储备是一个国家的中央银行持有的外国货币资产,通常用于支持其货币价值,管理国际收支,以及作为紧急资金来源。

9. 什么是技术分析和基本面分析?答案:技术分析是研究历史价格数据和交易量来预测未来市场趋势的方法。

《外汇交易与实务》习题参考答案——基本训练+观念应用(注:以下蓝色表示删减,粉红色表示添加)第一章外汇与外汇市场一、填空题1、汇兑2、即期外汇远期外汇3、比价4、间接标价法5、国际清偿6、外币性普遍接受性可自由兑换性7、国家或地区货币单位8、外汇市场的4个参与者:外汇银行、经纪人、一般客户、中央银行。

(原8、9、10删除)二、判断题1、F2、T3、F4、T5、T6、T7、F8、F案例分析:太顺公司是我国一家生产向美国出口旅游鞋的厂家,其出口产品的人民币底价原来为每箱5500元,按照原来市场汇率USDI=RMB6.56,公司对外报价每箱为838.41美元。

但是由于外汇市场供求变动,美元开始贬值,美元对人民币汇率变为USDl=RMB6.46,此时太顺公司若仍按原来的美元价格报价,其最终的人民币收入势必减少。

因此,公司经理决定提高每箱旅游鞋的美元定价,以保证最终收入。

问:太顺公司要把美元价格提高到多少,才能保证其人民币收入不受损失?若公司为了保持在国际市场上的竞争力而维持美元价格不变,则在最终结汇时,公司每箱旅游鞋要承担多少人民币损失?解答:⑴为保证人民币收入不受损失,美元价格需提高至:5500/6.46≈851.39(USD)⑵如维持美元价格不变,公司需承担人民币损失为:5500-838.41*6.46=5500-5425.12 ≈83.87(CNY)第二章外汇交易原理二、填空1、汇率交割日货币之间2、高3、大4、止损位5、买入价卖出价6、大高7、多头8、空头9、售汇10、低9、外汇交易双方必须恪守信用,遵循“一言为定”的原则,无论通过电话或电传,交易一经达成就不得反悔。

三、单项选择1、A2、C3、D4、B5、C6、A7、B8、D9、C 10、D四、多项选择1、ABCD2、BD3、ABCD4、ABCD5、AC五、判断题1、T2、F3、T4、F5、T案例分析与计算1.下列为甲、乙、丙三家银行的报价,就每一个汇率的报价而言,若询价者要购买美元,哪报价有竞争力的是丙、丙、丙、丙、乙丙、乙2.市场USD/JPY= 101.45/50,现:A行持美元多头,或市场超买,该行预卖出美元头寸,应如何报价?并说明理由。