- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Big Mac in China costs ¥11.00, while the same Mac in U.S. costs $3.41. The actual exchange rate was ¥7.6/$ at the time. The implied exchange rate according to absolute PPP should be: ¥11/$3.41 = ¥3.23/$ The dollar was overvalued. An overvalued currency is a currency in which the actual value is higher than the value it is supposed to be. Otherwise, it is an undervalued currency.

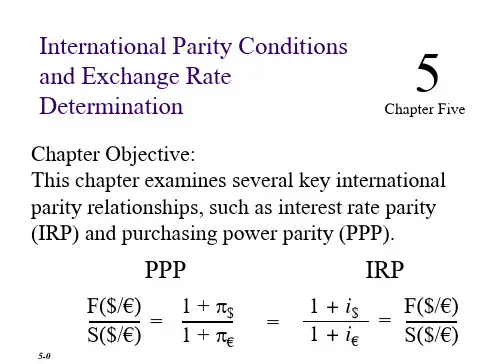

%ΔS = πd – πf

πd, πf: domestic and foreign inflation rate

The equation shows if domestic inflation is high than foreign inflation, the foreign currency will appreciate against the domestic currency by the percent consistent with the inflation differencial.

Price index is an index number of the prices of goods of some given type. PC = (∑i PitWit)/(∑i Pi0Wi0)

Absolute PPP Exchange rates between currencies are determined in long run by the amount of goods and services that each currency can buy. Sd/f = Pd / Pf

A change in price results in the movement along the supply curve. A change in supply shifts the supply curve to the right or left. A change in supply can be: increase or decrease in German income German taste in favor of Japanese goods or services rise or fall in Japanese prices

A change in demand and supply

A change in demand (Increase in demand) ¥/€ S€

A change in supply (Increase in supply) ¥/€ S1€ S2€

¥130 ¥120

¥130 ¥120

D2€

of euros

10,910 16,000 20,308

The supply of euros is in essence the German demand for yens. $/€ ¥130 ¥120 ¥110 Q of €s 10,910 16,000 20,308 S€

A change in price results in the movement along the demand curve. A change in demand shifts the demand curve to the right or left. A change in demand can be: rise or fall in Japanese income Japanese taste in favor of German goods or services rise or fall in the price of German goods

D1€ Q1 Q2 Q of €s Q1 Q2

D€

Q of €s

Equilibrium exchange rate is an exchange rate at which the demand for and supply of the foreign exchange are equal. ¥/€ S€ ¥120 D€

The undervaluation of the RMB is calculated by: (1/7.6 – 1/3.23)/(1/3.23) = -57.5%

Or equivalently, it can also apply the following formula: Implied exchange rate – Actual exchange rate Actual exchange rate (3.23 – 7.6)/7.6 = -57.5% The actual value of RMB is undervalued against the dollar by 57.5%. The Big Mac Index is not perfect because the burgers cannot be traded across borders and prices are different due to the differences in taxes or cost of inputs.

The Big Mac Index

The Big Mac Index (cont.)

The Hamburger Standard

The “Big Mac Index” as it has been nicknamed by the Economist is a prime example of the purchasing power parity. Assuming that the Big Mac is identical in all countries, it serves as a comparison point as to whether or not currencies are trading at market prices.

16,000

Q of €s

Market Intervention

Central banks buy and sell foreign exchanges in the market to influence the exchange rate. ¥/$ S 1$ 7.00 S 2$ 6.80 E 6.60 E’

Exchange

Price of German

Quantity

Demand

German export Good in €s

10 10 10

rate ¥/€

export good in ¥s

1,100 1,200 1,300

of German exports

2,000 1,600 1,200

for euros

Chapter 5

Exchange Rate Determination and Forecasting Exchange Rates

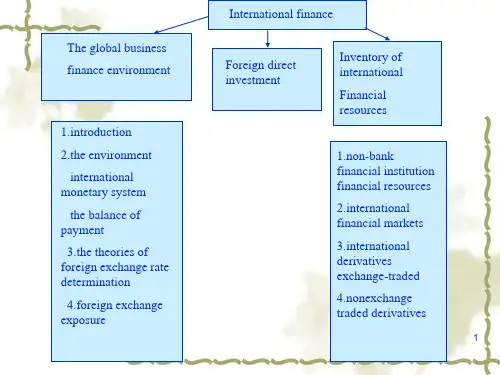

A Simple Model of the Determination of the Foreign Exchange Rate

Assumptions for the model: 1) No obstructions or controls on foreign exchange transactions 2) No government interferences to manipulate the exchange rate

The foreign exchange rate is determined by the market forces of supply and demand.

The demand for foreign exchange is a derived demand. That is to say, the foreign exchange is not demanded because it has an intrinsic value in itself, but rather because of what it can buy.

Quantity

Supply

Japanese export rate ¥/€ good in ¥s

1,200 1,200 1,200 ¥110/€ ¥120/€ ¥130/€

export good in €s

10.91 10.00 9.23

of Japanese exports

1,000 1,600 2,200

20,000 16,000 12,000

¥110/€ ¥120/€ ¥130/€

The demand for euros

¥/€

¥130 ¥120 ¥110 D€ Q of €s 12,000 16,000 20,000

The supply of euros

Price of

Exchange

Price of Japanese

The following example shows the demand for and supply of euro determines the value of .

The demand for euros

Price of

Quantity of $s