《证券投资学》课后习题答案

- 格式:pdf

- 大小:217.05 KB

- 文档页数:13

《证券投资学》课后习题答案第一章证券市场概述1、什么是投资?实体投资与金融投资、直接金融与间接金融、直接金融投资与间接金融投资的区别在哪里?答:投资是经济主体为了获得未来的收益而垫支资本转换为资产的过程,这一结果因存在风险而存在不确定性。

实体投资是指对设备、建筑物等固定资产的购置以形成新的生产能力。

其最终的结果是增加了社会物质财富和经济总量。

金融投资是指投资者为了获得收益而通过银行存款,购买股票、债券等金融资产方式让渡资金使用权以获取收入行为过程。

直接金融是融资方与投资方不通过金融中介而直接融通资金的方式,间接金融是融资方与投资方通过金融中介而间接融通资金的方式,二者的区别是资金融通过程中是否有中介机构的参与并与投资者产生契约关系,在间接融资中,投资银行只起帮助其中一方寻找或撮合适当的另一方以实现融资的委托代理关系的作用。

直接金融投资是投资者通过在资本市场直接买卖股票、债券等由筹资者发行的基础证券以获得收益的投资方式,而间接金融投资指投资者不直接购买股票、债券等有价证券,他们购买银行存单、基金、信托产品或金融衍生产品以间接的获取收益。

直接金融投资者可以参加股东大会或债权人大会,了解发行公司信息较为容易,而间接金融投资者无这些特权。

2、什么是证券?其特征有哪些?可以分成几类?答:证券是一种凭证,它表明持有人有权依凭证所记载的内容取得相应的权益并具有法律效力。

按权益是否可以带来收益,证券可以分为有价证券和无价证券。

有价证券可分为广义有价证券和狭义有价证券。

广义有价证券分为商品证券、货币市场证券、和资本证券三种,狭义有价证券仅指资本证券。

证券的基本特征主要如下:1.所有权特征。

该特征指有价证券持有人依所持有的证券份额或数量大小对相应的资产拥有一定的所有权。

2.收益性特征。

指证券持有人可以通过转让资本的使用权而获取一定数额的资本收益。

3.流通性特征。

指证券持有人可以在规定的场所按自己的意愿快速地转让证券以换取现金。

第一章股票1、什么是股份制度?它的主要功能有哪些?答:股份制度亦称股份公司制度,它是指以集资入股、共享收益、共担风险为特点的企业组织制度。

股份公司一般以发行股票的方式筹集股本,股票投资者依据他们所提供的生产要素份额参与公司收益分配。

在股份公司中,各个股东享有的权利和义务与他们所提供的生产要素份额相对应。

功能:一、筹集社会资金;二、改善和强化企业的经营管理。

2、什么是股票?它的主要特性是什么?答:股票是股份有限公司发行的,表示其股东按其持有的股份享受权益和承担义务的可转让的书面凭证。

股票作为股份公司的股份证明,表示其持有者在公司的地位与权利,股票持有者为公司股东.特性: 1 、不可返还性2、决策性3、风险性4、流动性5、价格波动性6、投机性3、普通股和优先股的区别?答:普通股是构成股份有限公司资本基础股份,是股份公司最先发行、必须发行的股票,是公司最常见、最重要的股票,也是最常见的股票。

其权利为:1、投票表决权2、收益分配权3、资产分配权4、优先认股权。

对公司优先股在股份公司中对公司利润、公司清理剩余资产享有的优先分配权的股份。

第一是领取股息优先。

第二是分配剩余财产优先。

优先股不利一面:股息率事先确定;无选举权和被选举权,无对公司决策表决权;在发放新股时,无优先认股权。

有利一面:投资者角度:收益固定,风险小于普通股,股息高于债券收益;筹资公司发行角度:股息固定不影响公司利润分配,发行优先股可以广泛的吸收资金,不影响普通股东经营管理权。

4、我国现行的股票类型有哪些?答:我国现行的股票按投资主体不同有国有股、法人股、公众股和外资股。

国有股是有权代表国家投资的部门或机构以国有资产向公司投资形成的股份,包括公司现有的国有资产折算的股份。

法人股是指企业法人或具有法人资格的事业单位和社会团体以其依法可支配的资产向股份有限公司非上市流通股权部分投资所形成的股份。

公众股即个人股,指社会个人或股份公司内部职工以个人合法财产投入公司形成的股份。

《证券投资学》习题(1-6章)一. 单项选择1.证券经纪商的收入来源是()A、买卖价差B、佣金C、股利和利息D、税金2.贴现债券的发行属于()A、平价方式B、折价方式C、溢价方式D、时价方式3.世界上历史最悠久的股价指数是()A、金融时报指数B、道琼斯股价指数C、标准普尔股价指数D、日经指数4.在我国股票发行通常采用()方式。

A、平价B、溢价C、时价D、贴现5.股份公司向股东送股体现了资本增值收益,这种送股的资金来源是()A、公积金B、税后利润C、借入资金D、社会闲置资金6.优先股票的“优先”体现在()A、对企业经营参与权的优先B、认购新发行股票的优先C、公司盈利很多时,其股息高于普通股股利D、股利分配和剩余资产清偿的优先7.以银行金融机构为中介进行的融资活动场所是()A、直接融资市场B、间接融资市场C、资本市场D、货币市场8.公司不以任何资产作担保而发行的债券是()A、信用公司债B、保证公司债C、抵押公司债D、信托公司债9.()是股份有限公司最基本的筹资工具。

A、普通股票B、优先股票C、公司债券D、银行贷款10.()的投资者可以享受税收优惠。

A、优先股票B、公司债券C、政府债券D、金融债券11.一般来讲,公司债券与政府债券比较()A、公司债券风险小,收益低B、公司债券风险大,收益高C、公司债券风险小,收益高D、公司债券风险大,收益低12.我国证券交易所实行()。

A、公司制B、会员制C、股份制D、合伙制13.股份有限公司的设立,一般有两种方法()A、公募设立和私募设立B、发起设立和募集设立C、直接设立和委托设立D、直接设立和投标设立14.贴现债券的发行属于()A、平价方式B、折价方式C、溢价方式D、时价方式15.金融机构证券是金融机构为筹集资金而发行的证券,以下不属于这类证券的是()A、大额可转让定期存单B、银行承兑汇票C、银行本票D、银行股票16.世界上第一个股票交易所是()A、纽约证券交易所B、阿姆斯特丹证券交易所C、伦敦证券交易所D、美国证券交易所17.以下不属于证券交易所的职责的是()A、提供交易场所和设施B、制定交易规则C、制定交易价格D、公布行情18.根据市场组织形式的不同,可以将证券市场划分为()。

证券投资学(第四版)1、简述有价证券的种类和特征答:有价证券是一种具有一定票面金额,证明持券人有权按期取得一定收入,并可自由转让和买卖的所有权或债权证书。

有价证券多种多样,从不同的角度、按照不同的标准,可以对其进行不同的分类:(1)按发行主体的不同,可分为政府证券(公债券)、金融证券和公司证券。

(2)按所体现的内容不同,有价证券可分为货币证券、资本证券和货物证券。

(3)根据上市与否,有价证券可分为上市证券和非上市证券.划分为上市证券和非上市证券的有价证券是有其特定对象的。

这种划分一般只适用于股票和债券。

按照证券的经济性质,有价证券可分为债券、股票和证券投资基金,他们的特点分别如下:债券的特征:(1)偿还性(2)流通性(3)安全性(4)收益性股票的特征:(1)不可偿还性(2)参与性(3)收益性(4)流通性(5)价格的波动性和风险性证券投资基金的特征:(1)集合理财、专业管理;(2)组合投资、分散风险;(3)利益共享、风险共担;(4)严格监管、信息透明;(5)独立托管、保障安全2、简述普通股的基本特征和主要种类答:普通股股票的每一股份对公司财产拥有平等权益。

普通股股票具有的特征:(1)普通股股票是股份有限公司发行的最普通、最重要也是发行量最大的股票种类。

(2)这类股票是公司发行的标准股票,其有效性与股份有限公司的存续期间相一致。

股票持有者就是公司的股东,平等地享有股东权利。

股东有参与公司经营决策的权利。

(3)普通股股票是风险最大的股票。

股份有限公司根据有关法规的规定以及筹资和投资者的需要,可以发行不同种类的普通股。

(1)按股票有无记名,可分为记名股和不记名股。

(2)按股票是否标明金额,可分为面值股票和无面值股票。

(3)按投资主体的不同,可分为国家股、法人股、个人股等等.(4)按发行对象和上市地区的不同,又可将股票分为A 股、B 股、H 股和N 股等。

3、证券投资基金与股票、债券有哪些异同答:相同点:都是证券投资品种的一种;不同点:与直接投资股票或债券不同,证券投资基金是一种间接投资工具。

证券投资学(第2版)课后习题参考答案程蕾邓艳君黄健第一章导论1、证券投资与证券投机的关系?答:联系:二者的交易对象都是有价证券,都是投入货币以谋取盈利,同时承担损失的风险。

二者还可以相互转化。

区别:1)交易的动机不同。

投资者进行证券投资,旨在取得证券的利息和股息收入,而投机者则以获取价差收入为目的。

投资者通常以长线投资为主,投机者则以短线操作为主。

2)投资对象不同。

投资者一般比较稳健,其投资对象多为风险较小、收益相对较高、价格比较稳定或稳中有升的证券。

投机者大多敢于冒险,其投资对象多为价格波动幅度大、风险较大的证券。

3)风险承受能力不同。

投资者首先关心的是本金的安全,投机者则不大考虑本金的安全,一心只想通过冒险立即获得一笔收入。

4)运作方法有差别。

投资者经常对各种证券进行周密的分析和评估,十分注意证券价值的变化,并以其作为他们选购或换购证券的依据。

投机者则不大注意证券本身的分析,而密切注意市场的变化,以证券价格变化趋势作为决策的依据。

2、简述证券投资的基本步骤。

答:1)收集资料;2)研究分析;3)作出决策;4)购买证券;5)证券管理。

3、试述金融市场的分类及其特点。

答:1)按金融市场的交易期限可分为:货币市场和资本市场。

2)按金融市场的交易程序可分为:证券发行市场和证券交易市场。

3)按金融交易的交割期限可分为:现货市场和期货市场。

4)按金融交易标的物的性质可分为:外汇市场、黄金市场、保险市场和各种有价证券市场。

第二章证券投资工具1、简述债券、股票、投资基金的性质和特点。

答:债券是发行人对全体应募者所负的标准化证券,具有公开性、社会性和规范性的特点,一般可以上市流通转让。

债券具有一般有价证券共有的特征,即期限性、风险性、流动性和收益性,但它又有其独特之处。

股票只是代表股份资本所有权的证书,它本身并没有任何价值,不是真实的资本,而是一种独立于实际资本之外的虚拟资本。

股票在发行与流通中,具有收益性、风险性、非返还性、参与性、流通性、价格的波动性。

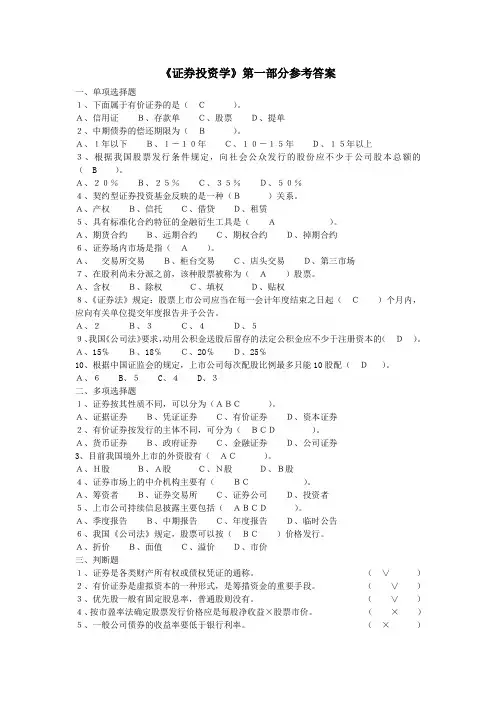

《证券投资学》第一部分参考答案一、单项选择题1、下面属于有价证券的是(C)。

A、信用证B、存款单C、股票D、提单2、中期债券的偿还期限为(B)。

A、1年以下B、1-10年C、10-15年D、15年以上3、根据我国股票发行条件规定,向社会公众发行的股份应不少于公司股本总额的( B )。

A、20%B、25%C、35%D、50%4、契约型证券投资基金反映的是一种(B)关系。

A、产权B、信托C、借贷D、租赁5、具有标准化合约特征的金融衍生工具是(A)。

A、期货合约B、远期合约C、期权合约D、掉期合约6、证券场内市场是指(A)。

A、交易所交易B、柜台交易C、店头交易D、第三市场7、在股利尚未分派之前,该种股票被称为(A)股票。

A、含权B、除权C、填权D、贴权8、《证券法》规定:股票上市公司应当在每一会计年度结束之日起(C)个月内,应向有关单位提交年度报告并予公告。

A、2B、3C、4D、59、我国《公司法》要求,动用公积金送股后留存的法定公积金应不少于注册资本的(D)。

A、15℅B、18℅C、20℅D、25℅10、根据中国证监会的规定,上市公司每次配股比例最多只能10股配(D)。

A、6B、5C、4D、3二、多项选择题1、证券按其性质不同,可以分为(ABC)。

A、证据证券B、凭证证券C、有价证券D、资本证券2、有价证券按发行的主体不同,可分为(BCD)。

A、货币证券B、政府证券C、金融证券D、公司证券3、目前我国境外上市的外资股有(AC)。

A、H股B、A股C、N股D、B股4、证券市场上的中介机构主要有(BC)。

A、筹资者B、证券交易所C、证券公司D、投资者5、上市公司持续信息披露主要包括(ABCD)。

A、季度报告B、中期报告C、年度报告D、临时公告6、我国《公司法》规定,股票可以按(BC)价格发行。

A、折价B、面值C、溢价D、市价三、判断题1、证券是各类财产所有权或债权凭证的通称。

(∨)2、有价证券是虚拟资本的一种形式,是筹措资金的重要手段。

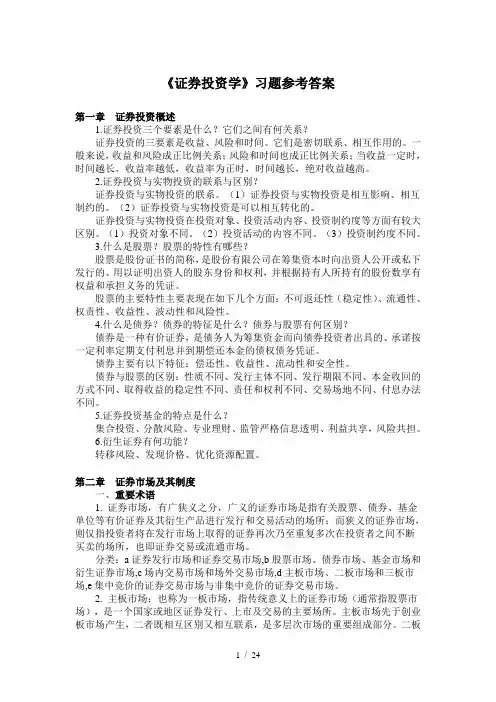

《证券投资学》习题参考答案第一章证券投资概述1.证券投资三个要素是什么?它们之间有何关系?证券投资的三要素是收益、风险和时间。

它们是密切联系、相互作用的。

一般来说,收益和风险成正比例关系;风险和时间也成正比例关系;当收益一定时,时间越长,收益率越低,收益率为正时,时间越长,绝对收益越高。

2.证券投资与实物投资的联系与区别?证券投资与实物投资的联系。

(1)证券投资与实物投资是相互影响、相互制约的。

(2)证券投资与实物投资是可以相互转化的。

证券投资与实物投资在投资对象、投资活动内容、投资制约度等方面有较大区别。

(1)投资对象不同。

(2)投资活动的内容不同。

(3)投资制约度不同。

3.什么是股票?股票的特性有哪些?股票是股份证书的简称,是股份有限公司在筹集资本时向出资人公开或私下发行的、用以证明出资人的股东身份和权利,并根据持有人所持有的股份数享有权益和承担义务的凭证。

股票的主要特性主要表现在如下几个方面:不可返还性(稳定性)、流通性、权责性、收益性、波动性和风险性。

4.什么是债券?债券的特征是什么?债券与股票有何区别?债券是一种有价证券,是债务人为筹集资金而向债券投资者出具的、承诺按一定利率定期支付利息并到期偿还本金的债权债务凭证。

债券主要有以下特征:偿还性、收益性、流动性和安全性。

债券与股票的区别:性质不同、发行主体不同、发行期限不同、本金收回的方式不同、取得收益的稳定性不同、责任和权利不同、交易场地不同、付息办法不同。

5.证券投资基金的特点是什么?集合投资、分散风险、专业理财、监管严格信息透明、利益共享,风险共担。

6.衍生证券有何功能?转移风险、发现价格、优化资源配置。

第二章证券市场及其制度一、重要术语1. 证券市场,有广狭义之分,广义的证券市场是指有关股票、债券、基金单位等有价证券及其衍生产品进行发行和交易活动的场所;而狭义的证券市场,则仅指投资者将在发行市场上取得的证券再次乃至重复多次在投资者之间不断买卖的场所,也即证券交易或流通市场。

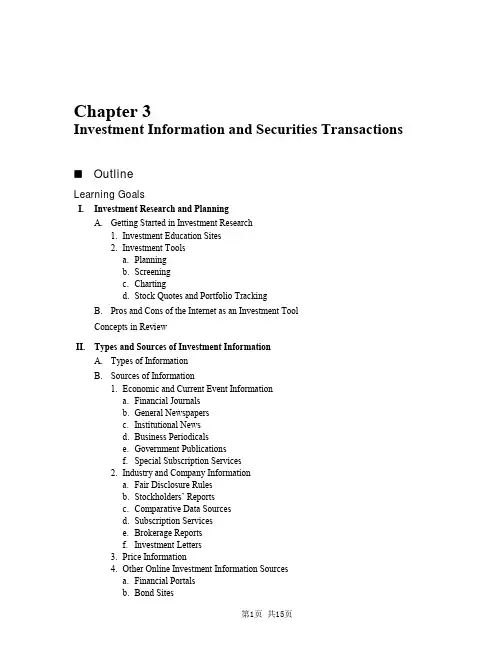

Chapter 3Investment Information and Securities TransactionsOutlineLearning GoalsI. Investment Research and PlanningA. Getting Started in Investment Research1. Investment Education Sites2. Investment Toolsa. Planningb. Screeningc. Chartingd. Stock Quotes and Portfolio TrackingB. Pros and Cons of the Internet as an Investment ToolConcepts in ReviewII. Types and Sources of Investment InformationA. Types of InformationB. Sources of Information1. Economic and Current Event Informationa. Financial Journalsb. General Newspapersc. Institutional Newsd. Business Periodicalse. Government Publicationsf. Special Subscription Services2. Industry and Company Informationa. Fair Disclosure Rulesb. Stockholders’ Reportsc. Comparative Data Sourcesd. Subscription Servicese. Brokerage Reportsf. Investment Letters3. Price Information4. Other Online Investment Information Sourcesa. Financial Portalsb. Bond Sites第1页共15页c. Mutual Fund Sitesd. International Sitese. Investment Discussion Forums5. Avoiding ScamsConcepts in ReviewIII. Understanding Market Averages and IndexesA. Stock Market Averages and Indexes1. The Dow Jones Averages2. Standard & Poor’s Indexes3. NYSE, NYSE Amex, and Nasdaq Indexes4. Value Line Indexes5. Other Averages and IndexesB. Bond Market Indicators1. Bond Yields2. Bond IndexesConcepts in ReviewIV. Making Securities TransactionsA. The Role of Stockbrokers1. Brokerage Services2. Types of Brokerage Firms3. Selecting a Stockbroker4. Opening an Accounta. Single or Jointb. Cash or Marginc. Wrap5. Odd-Lot and Round-Lot TransactionsB. Basic Types of Orders1. Market Order2. Limit Order3. Stop-Loss OrdersC. Online Transactions1. Day Trading2. Technical and Service Problems3. Tips for Successful Online TradesD. Transaction CostsE. Investor Protection: SIPC and ArbitrationConcepts in ReviewV. Investment Advisers and Investment ClubsA. Using Investment Advisers1. Regulation of Advisers2. Online Investment Advice3. The Cost and Use of Investment AdviceB. Investment ClubsConcepts in ReviewSummaryKey TermsDiscussion QuestionsProblemsCase Problems3.1 The Perezes’ Good Fortune3.2 Peter and Deborah’s Choices of Brokers and AdvisersExcel with SpreadsheetsKey Concepts1. The Internet empowers individual investors, provides savings in time and money, and offers currentinformation formerly available only to investing professionals. Tools such as financial planningcalculators and more are free, making buying and selling online convenient, relatively simple,inexpensive, and fast.2. The role, types, and uses of traditional and online investment information for making investmentdecisions3. Some of the key sources of investment information for economic and current events4. Sources of information to assess the performance of specific industries/companies5. The most commonly cited market averages and indexes, their interpretation, and their use in assessingmarket conditions; both stock and bond index covered6. The role of the stockbroker in making security transactions, the types of brokerage services available,and the various types of brokerage accounts7. A comparison of full-service, premium, and discount brokerage services8. The basic types of orders—market, limit, and stop-loss; their use in making security transactions; andtransaction costs9. The products and services offered, regulation, types, and cost of investment advisers10. The investment club as a device for pooling knowledge and money to create and manage a jointlyowned portfolio⏹Overview1. The Internet and online investing offer the individual investor advantages once enjoyed by only theprofessional investor. The number of households using online information for investment purposes is quickly expanding. The challenge now is to use the tools offered by the Internet wisely.2. Investment information is broadly classified into descriptive and analytical information. It isimportant that students understand the difference between these two kinds of information and the inves tor’s need for both types. Online investment tools help investors plan, screen, chart individual securities, and track portfolio performance.3. The chapter next mentions the benefits and costs of obtaining investment information. The instructorshould drive home the point that although an informed investor may perform better in the long run, obtaining and analyzing information costs the investor money and time. Therefore, an investor should analyze the worth of information.4. Five different types of information are delineated, and the instructor should point out that an investorusually needs all five types. For example, knowledge about a particular company alone would be insufficient for investment decision making. The investor would also require information about the economy, current events, the industry, and market prices in order to be able to make a good decision.5. The text mentions a number of specific sources of information, appropriately beginning with theWall Street Journal. Various other financial publications provide information of different types. The instructor might require students to bring their own copies of the WSJ to class and go through various sections with them. This is a good way to demonstrate how to read stock price quotations, as well as bond, option, mutual fund, commodity, and other quotations. The instructor might also find it useful to bring a company stockholder’s report to class and explain its contents. Presenting current examples of Internet sites also works well.6. The popular market averages and indexes are presented next. Movements in market averages andindexes are important indicators of the state of the economy; the instructor should describe, in class, stock market averages and indexes such as the Dow Jones, the S&P, and the NYSE Index, explaining the difference between averages and indexes and specifying what they measure and showing how to find recent listings in the print and online versions of the WSJ. The bond yield, which providesadditional information about the market and the economy, should be defined and the listing ofvarious yields pointed out in the WSJ.7. The next part examines the role of stockbrokers and the services they provide. Students usuallyencounter difficulties with the concepts of margin trading, market, limit, stop-loss orders, and short selling. Therefore, the instructor should devote adequate time to cover these topics and use examples for clarification.8. The role of the SIPC in protecting investors and procedures for settling disputes between investorsand brokerage firms is explained.9. The nature and functions of investment advisers are discussed next. The structure and regulation oftheir activities and the types of information they provide are described. The chapter closes with a discussion of investment clubs.⏹Answers to Concepts in Review1. In addition to providing low-cost investing, the Internet supplies a multitude of information sourcesdesigned to assist the individual investor in the decision-making process. Investment education sites range from the tutorials and online classes that educate the novice investors to the screening tools, financial calculators and worksheets used by experienced investors.2. The four types of online investment tools are as follows:a. Planning. Online calculators and worksheets help you find answers to your financial planningand investing questions.b. Screening. Screening tools help you sort through huge databases of stocks and mutual funds tofind those that have specific characteristics.c. Charting. This technique allows you to plot the performance of a stock or a group of stocks overa specified time period.d. Stock quotes and portfolio tracking. This tool allows the investor to track his or her investment,to be alerted whenever an analyst changes the rating, or to indicate how well the portfolio isdiversified among major asset classes.3. As for the advantages of online investing, it is now possible for even novice investors to participate inthe stock markets with a huge amount of information available at their fingertips to assist in making their decisions to invest. Commissions for online trades can be as low as $3.00 per trade, although $10 to $12 is more typical.On the con side, trading on the Internet requires that investors exercise the same caution they would if they were getting information from a human broker. Furthermore, you don’t have the safety net of dealing with a human who may be suggesting that you exercise additional caution. The ease of point-and-click investing can be the financial downfall of inexperienced investors. Transaction costs add up, and margin trading results in interest payments on a loan that will reduce possible gains.4. Descriptive information is factual information on past behavior of the economy, the market, or agiven investment vehicle. Analytical information, on the other hand, tends to analyze existing data and make projections and is quite often a source of recommendations for potential investments. The investor must evaluate whether the costs of acquiring the information are justified by the potential increase in return. Either direct or indirect costs are associated with information gathering. Direct costs include subscription fees and adviser’s fees. Indirect costs include the ti me involved to gather information.5.The Wall Street Journal, published by the Dow Jones, is perhaps the most popular source of financialnews in this country. Published daily, it provides daily price quotations on a multitude of securities. It also has a wealth of world reports, national reports, and regional and corporate news. Regular features, like “Your Money Matters,” address topics of interest to individual investors. Barron’s, on the other hand, is a weekly publication also published by Dow Jones. The articles in Barron’s are generally more in-depth and directed to financial issues than those in The Wall Street Journal. Barron’s also has special interest columns like “Up and Down Wall Street.” In addition, there are current price quotations and summary statistics on a wider variety of investments. Other sources of financial news include Investor’s Business Daily and the Financial Times.General news is available from a variety of published sources, especially daily newspapers in the local community. Many business people also rely on daily papers that have national reputations in the political and economic arena, such as the New York Times and the Los Angeles Times. USA Today isa national daily newspaper containing a “Money” section devoted to busi ness and personal financialnews. Time and Newsweek are also major periodicals in the general news category.Business news articles and statistics on general business and economic activities in the United States and abroad can be found in the Wall Street Journal and in such magazines as Newsweek, Time, U.S.News & World Report, Business Week, Fortune, The Economist, Federal Reserve Bulletin, and the Survey of Current Business. A variety of articles discussing the activities of securities markets and corporations can be found in the Wall Street Journal, Barron’s, Investor’s Business Daily, Forbes, Kiplinger’s Personal Finance, Money, and Smart Money. The last three are oriented toward individual investors and managing personal finances. Local metropolitan newspapers also provide information on securities of local interest.The distinctions between print sources and online sources has been blurring because many of the print sources now make their information available online. Two advantages of the online sources are the limited amount of advertising and the ability to be continually updated. And with the advances in mobile technology, such as smartphones and tablets, current information can be accessed quickly and easily just about anywhere.6. a. The sto ckholder’s report,also called the “annual report,” is an annual publication of publiclyheld corporations. These reports are usually free and contain a wealth of descriptive andanalytical information, including financial statements, about the firm. Stockholder reports are just one of the pieces of information that can be downloaded from company websites.b. Comparative data sources enable investors to analyze the financial condition of companies andare typically grouped by industry and size of firm. Thes e include Dun & Bradstreet’s KeyBusiness Ratios;RMA’s Annual Statement Studies; the Quarterly Financial Report for U.S.Manufacturing, Mining, and Wholesale Trade Corporations; and the Almanac of Business &Industrial Financial Ratios.c. Standard & Poor’s Stock Reports is a major service of the Standard & Poor’s Corporation. Itcontains up-to-date reports on numerous firms, including a summary of the firm’s financialhistory, its current financial situation, and for NYSE companies, an opinion on the firm’s future prospects.d.Mergent provides detailed financial information on companies and industries.e. Value Line Investment Survey offers ratings for all widely held stocks with full-page reportsincluding financial data, descriptions, analysis, and advice.7. a. The prospectus is part of the registration statement required by the SEC on a new security issue.It describes in detail the key aspects of the issuer, its management and financial position, and the security to be issued. Brokerage firms provide prospectuses at no cost to their clients. (Note: This information source is available only when a firm is making an issue of new securities.)b. Back office research reports present analyses and recommendations on the current and futureprospects for the security markets, specific industries, and specific securities. These are prepared by brokerage firm research staffs and are available (usually free of charge) to existing as well as potential clients. Several information vendors, such as Reuters and Zacks, consolidate researchfrom many companies and put it on the web.c. Investment letters provide the conclusions and recommendations of various analysts. Commonexamples of investment letters are Blue Chip Advisors, The Dines Letter,Dow Theory Letters,the Growth Stock Outlook, and Zacks Advisor. Although some investment letters concentrate on specific types of securities, others are concerned solely with assessing the economy and/orsecurity markets. There is a fee for subscription to these letters, which are generally weekly ormonthly. The Hulbert Financial Digest monitors the performance of investment letters.d. Price quotations include the current prices and price statistics for various types of securities.Almost all brokerage houses have automated devices for obtaining up-to-the-minute quotations.Many firms still use a ticker, a lighted screen on which stock transactions made on the floor ofthe exchange are reported immediately as they occur. The stock names are shown in anabbreviated form called ticker symbols. Recently, more firms have acquired sophisticatedcomputer terminals to more efficiently provide up-to-the-minute stock price information. Themost common sources of such information, however, are the daily newspaper and the WallStreet Journal, which contains current quotations on numerous investment vehicles. Barron’sand Investor’s Daily also provide a wealth of security price quotations, which is especiallyuseful for bond quotations.8.Online investment information allows individual investors to get timely historical and currentinformation, such as stock quotes and economic and financial information. Online information is generally more timely, as it is updated more frequently, and offers more educational resources for the novice investor. The resources on the Internet provide different levels of information through various subscriptions, allowing investors to receive as little or as much information as they are willing to pay for. Print versions of publications provide deeper analysis as well as a comprehensive view of the factors that affect investments. Table 3.4 lists a number of popular sites and describes the data that can be found on each site.9.Stock market averages and indexes are used to measure the general behavior of securities markets.Averages reflect the arithmetic average price behavior of a certain group of stocks at a given point in time, whereas indexes measure the current price behavior of the group relative to a base value set at an earlier point in time.Averages and indexes provide a convenient way of capturing the general mood of the market. When the averages or indexes reflect an upward trend in prices, a bull market is said to exist. Likewise, when these measures exhibit a downward trend, a bear market exists.10. a. The four Dow Jones Averages include the Dow Jones Industrial Average (30 widely held stocksissued by large firms), the Dow Jones Transportation Average (20 transportation stocks), theDow Jones Utility Average (15 public utility stocks), and the Dow Jones U.S. Total Market Index (includes all of the above).b. The six Standard & Poor’s (S&P) Indexes include the S&P 400 Industrial Index (400 industrialfirms); the Transportation Index (20 transportation companies); the Utilities Index (40 publicutility stocks); the Financials Index (40 financial stocks); the Composite Index (includes the 500stocks in the S&P indexes mentioned above); the MidCap Index (400 medium-sized companies);the SmallCap Index(made up of 600 small-sized companies); and the 1,500 SuperComp Index,which includes all stocks in the Composite, MidCap, and SmallCap indexes.Nearly all these indexes can be found in financial newspapers such as the Wall Street Journal,Barron’s, Investor’s Business Daily, and local newspapers in major metropolitan areas.11. a. The New York Stock Exchange Index includes the 2,100 stocks listed on the New York StockExchange. It is calculated in a manner similar to the S&P indexes. This index reflects the value of the stocks listed on the NYSE relative to a base of 5,000 set on December 31, 2002.b. The American Stock Exchange Index reflects the price of shares on the American StockExchange relative to a base of 550 set on December 29, 1995.c. The Nasdaq Stock Market Indexes reflect the behavior of the Nasdaq stock market. The mostpopular, the Nasdaq Composite Index, is calculated using more than 4,000 domestic commonstocks traded on the Nasdaq system. The index is based on a value of 100 set on February 5,1971. Another popular Nasdaq index is the Nasdaq 100, which includes 100 of the largestdomestic and international nonfinancial companies that are listed on the Nasdaq.d. The Value Line Composite Average includes the approximately 1,700 stocks in the Value LineInvestment Survey, which are traded on a broad cross section of exchanges as well as in the over-the-counter market. The base of 100 reflects the June 30, 1961, average of the stocks.12. a. Bond yields capture the behavior of market interest rates and represent a type of summarymeasure of the return an investor would receive on a bond if it were held to maturity. Barron’squotes the yields on the Dow Jones bond average of 10 high-grade corporate bonds and10 medium-grade corporate bonds; a ratio of the high-grade yield to the medium-grade yield iscalculated and known as the Confidence Index.b. The Dow Jones Corporate Bond Index, quoted in the Wall Street Journal and Barron’s, is themathematical average of the closing prices of 32 industrial, 32 financial, and 32 utility/telecombonds.13. Stockbrokers help investors buy and sell securities. Besides this major role, full-service stockbrokersprovide clients with several other benefits. For example, most brokerage firms offer their clients a wide variety of information. Many of them have research staffs who periodically review published economic, market, industry, or company behavior forecasts and make recommendations to their clients as to which securities they should buy or sell. Every month, they mail investors a record of transactions for that month with a total ending balance. Some brokerage firms also makearrangements to transfer funds from the sale of securities directly to an investor’s savings account, where the funds can earn interest. Many brokers have reference libraries that clients can use toresearch securities. They can provide up-to-the-minute stock price quotations. Many brokerage firms will also hold certificates for safekeeping to protect against loss.The major role of a stockbroker is to execute a client’s transactio ns at the best possible price. While it is not necessary to know your stockbroker personally, he or she should understand your investment goals. This should avoid potential conflicts. You should also make sure that the broker does notcharge you too much for the services provided and that you are not paying for services that you do not need.14. a. A brokerage account may be either single or joint. Joint accounts are typically between marriedcouples or between parent and child.b. A custodial account is one in which a parent or a guardian will take responsibility for alltransactions undertaken on behalf of a minor.c. A cash account is one in which a customer can only use cash to make transactions. This isperhaps the most common type of account.d. A customer who wishes to trade in securities using borrowed money establishes a marginaccount. By leaving the securities with the brokerage firm as collateral, the customer can borrowa pre-specified amount to trade in securities. Needless to say, the brokerage firm will first verifythe customer’s creditworthiness before opening a margin account in that customer’s name.e. A wrap account is an account in which customers with large portfolios pay the brokerage firm aflat annual fee, typically between 2% and 3% of their portfolio’s total asset value, to cover thecombined costs of a money manager’s services and the cost of commissions on their trades.These accounts allow the wealthy investor to conveniently shift the burden of stock-selectiondecisions to a professional—either in-house or independent—money manager.15. A market order is an order to buy or sell a security at the best price available at the time the order isplaced. It is the quickest way to make securities transactions. A limit order is an order to buy stock at or below or to sell stock at or above a specified price. It is best used when securities prices fluctuate widely. A stop-loss order is an order to buy or sell the stock when its market price reaches or drops below a specified level. It is used primarily by investors who wish to protect themselves from a rapid decline in the price of the stock. The stop-loss order gives them the opportunity to sell the stock when the price declines to the stop price, thereby reducing their potential losses. It becomes a market order and may in fact be executed at a lower price than the price at which the order was initiated.16. Typically, brokers charge fixed commissions in return for facilitating the purchase or sale ofsecurities. Negotiated commissions are also available to investors who maintain large accounts with the broker. The commissions usually vary depending on the services the broker provides to theinvestor. The major difference between a full-service and discount broker is the full-service broker provides investment advice. Because investing through a discount or deep-discount broker can save from 30% to 80% on the commission, the investor must weigh the benefit of advice against the higher commission. Online brokers are typically deep-discount brokers through whom investors can execute trades electronically online. These brokers charge very low commissions but offer little orno individualized research, information, or investment advice.Full-service brokers provide personalized, timely research and information. Basic discountersprovide low costs and fast trades. Premium discount brokers are in between these extremes.17.Day trading is the opposite of a buy-and-hold strategy since true day traders do not even own stocksovernight. The method is highly risky since it often involves margin and short transactions that may result in a total loss. In addition, day traders have high expenses for brokerage commissions, training, and computer equipment.You should consider several important factors before trading securities. First, know how to place and confirm your order before you begin trading. Second, verify the stock symbol of the security you wish to buy. Third, use limit orders. Fourth, don’t ignore the online reminders that ask you to check an d recheck. Fifth, don’t get carried away. Sixth, open accounts with two brokers. Lastly, double-check orders for accuracy.Many investors set aside an amount of their capital that is designated for purely speculative purposes and not required for day-to-day survival. In this way, they are not jeopardizing themselves or their loved ones if they suffer heavy losses.18. Most firms use a fixed-commission schedule for individual investors with accounts less than $50,000.Traditional brokers generally charge on the basis of the number of shares and price per share(e.g., market value of the purchase). They sometimes charge an annual management fee and lowercommissions. Online brokers, by comparison, charge a flat rate for transactions of up to 1,000 shares.Online investors will pay a surcharge if they seek personalized broker assistance.19. The Securities Investor Protection Corporation (SIPC), a nonprofit membership corporation, wasauthorized to protect customer accounts against the consequences of financial failure of the brokerage firm.Mediation is an informal, voluntary approach in which you and the broker agree to a third party who facilitates negotiations between the two of you to resolve disputes. If mediation is not pursued or it fails, you may choose arbitration, a formal process whereby you and your broker present the two sides of the argument before a panel of third-party individuals.20.Investment advisers are individuals or firms who advise clients about portfolio management. Thismay be done on a discretionary basis, in which case the adviser has complete control over the client’s portfolio. In other cases, the adviser provides investment information and advice, and the clientmakes his or her own investment decisions. Professional investment advisers are required to register and file regular reports with the SEC under the Investment Advisers Act of 1940; a 1960 amendment gave the SEC broader powers to monitor their activities. However, those who provide investment advice in addition to their primary job responsibility—such as financial planners, stockbrokers,bankers, and accountants—are not regulated by the act. Many states have similar legislation. It is important to remember that these laws only protect against fraud and unethical practices. They do not provide the investor any indication of the quality of investment advice. Professional investmentadvice usually costs between 1/4 of 1% and 3% annually of the amount of money being managed.For larger portfolios, the fee is in the range of 1/4% to 3/4%; for small portfolios, the annual feeranges from 2% to 3% of the dollar amount of funds managed.21. Investment clubs offer the individual investor access to information and/or advice from a broad rangeof differently experienced people who have similar attitudes, investments strategies, and goals. Also, through the investment club, the individual investor can participate in a larger and probably more diversified investment portfolio, therefore increasing the probability of earning a favorable return on his or her investments. For the novice investor, a club can provide an excellent mechanism forlearning key aspects of portfolio construction and investment management.Investment clubs regularly outperform the market and the professional money managers because they buy stocks for the long term instead of trying to time the market.⏹Suggested Answers to Ethics in Investing QuestionHello, I am Tim, an Insider TraderSuppose you are on an airplane and you overhear two executives of a company talking about a merger that is about to take place. If you buy stock based on what you overheard, are you committing insider trading?Answer:No, the information was unsolicited, acquired passively, and there is no guarantee that you are interpreting it correctly. If you purchase the stock, you are still at risk. Most important, your purchase would involve no breach of fiduciary duty or promise of confidentiality. Your purchase would not seem to violate either the law or any personal, ethical obligation.⏹Suggested Answers to Discussion QuestionsQuestions 1,2,4 and 6 will have answers that will vary depending on the choices made by the student.3. The broad categories of information and some examples of sources include economy-specific andcurrent event information (newspapers, magazines, journals, government releases and databases), industry or firm-specific information (company reports, brokerage firm reports, subscription services), price information relating to specific financial instruments (internet-based financial portals, websites of major newspapers and business sections of television networks) and other information, usually available online on investment strategies and skills (websites and forums such as on Yahoo! Finance).。

证券投资学课后作业答案文档编制序号:[KK8UY-LL9IO69-TTO6M3-MTOL89-FTT688]一、名词解释(每题3分,共24分)1. 投资——是特定经济主体为了在未来可预见的时期内获得收益或是资金增值,在一定时期内向一定领域投放足够数额的资金或实物的货币等价物的经济行为。

可分为实物投资、资本投资和证券投资。

2. 债券——是一种金融契约,是政府、金融机构、工商企业等直接向社会借债筹措资金时,向投资者发行,同时承诺按一定利率支付利息并按约定条件偿还本金的债权债务凭证。

3. 股票——是股份公司发行的所有权凭证,是股份公司为筹集资金而发行给各个股东作为持股凭证并借以取得股息和红利的一种有价证券。

4. 证券投资基金——是指通过公开发售基金份额募集资金,由基金托管人托管,由基金管理人管理和运作资金,为基金份额持有人的利益,以资产组合方式进行证券投资的一种利益共享、风险共担的集合投资方式。

5. 股票的市场价格——股票价格又叫股票行市,是指股票在证券市场上买卖的价格。

股票价格分为理论价格与市场价格。

股票的理论价格不等于股票的市场价格,两者甚至有相当大的差距。

但是,股票的理论价格为预测股票市场价格的变动趋势提供了重要的依据,也是股票市场价格形成的一个基础性因素。

6. 股票的发行价格——股票发行价格是指股份有限公司出售新股票的价格。

在确定股票发行价格时,可以按票面金额确定,也可以超过票面金额确定,但不得以低于票面金额的价格发行。

7. 股票的内在价格——内在价值又称为:非使用价值,定义为股票在其余下的寿命之中可以产生的现金的折现值8. 证券市场——证券是多种经济权益凭证的统称,因此,广义上的证券市场指的是所有证券发行和交易的场所,狭义上,也是最活跃的证券市场指的是资本证券市场、货币证券市场和商品证券市场。

是股票、债券,商品期货、股票期货、期权、利率期货等证券产品发行和交易的场所。

二、简答题(每题4分,共60分)1.投资者进行投资的目的有哪些?答:1、本金保障。

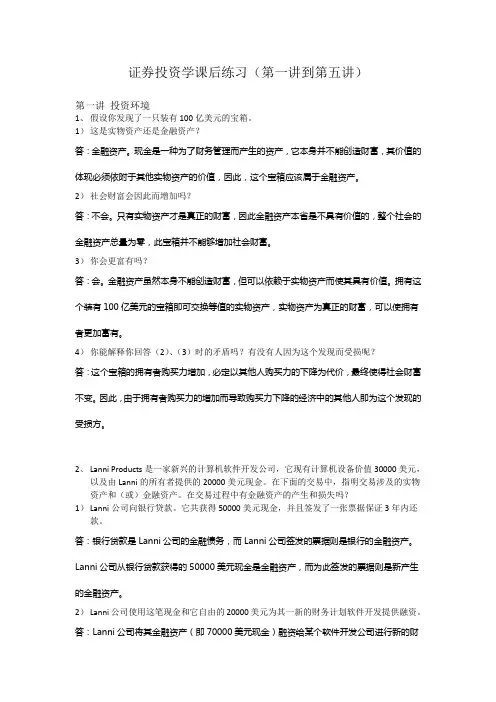

证券投资学课后练习(第一讲到第五讲)第一讲投资环境1、假设你发现了一只装有100亿美元的宝箱。

1)这是实物资产还是金融资产?答:金融资产。

现金是一种为了财务管理而产生的资产,它本身并不能创造财富,其价值的体现必须依附于其他实物资产的价值,因此,这个宝箱应该属于金融资产。

2)社会财富会因此而增加吗?答:不会。

只有实物资产才是真正的财富,因此金融资产本省是不具有价值的,整个社会的金融资产总量为零,此宝箱并不能够增加社会财富。

3)你会更富有吗?答:会。

金融资产虽然本身不能创造财富,但可以依赖于实物资产而使其具有价值。

拥有这个装有100亿美元的宝箱即可交换等值的实物资产,实物资产为真正的财富,可以使拥有者更加富有。

4)你能解释你回答(2)、(3)时的矛盾吗?有没有人因为这个发现而受损呢?答:这个宝箱的拥有者购买力增加,必定以其他人购买力的下降为代价,最终使得社会财富不变。

因此,由于拥有者购买力的增加而导致购买力下降的经济中的其他人即为这个发现的受损方。

2、Lanni Products是一家新兴的计算机软件开发公司,它现有计算机设备价值30000美元,以及由Lanni的所有者提供的20000美元现金。

在下面的交易中,指明交易涉及的实物资产和(或)金融资产。

在交易过程中有金融资产的产生和损失吗?1)Lanni公司向银行贷款。

它共获得50000美元现金,并且签发了一张票据保证3年内还款。

答:银行贷款是Lanni公司的金融债务,而Lanni公司签发的票据则是银行的金融资产。

Lanni 公司从银行贷款获得的50000美元现金是金融资产,而为此签发的票据则是新产生的金融资产。

2)Lanni公司使用这笔现金和它自由的20000美元为其一新的财务计划软件开发提供融资。

答:Lanni公司将其金融资产(即70000美元现金)融资给某个软件开发公司进行新的财务计划的软件开发,而作为回报,Lanni公司则获得了实物资产,即为软件公司所开发的软件成品。

证券投资学第三版丁忠明课后答案一、判断题1.现代证券投资理论是为解决证券投资中收益-风险关系而诞生的理论。

答案:是2.以马柯维茨为代表的经济学家在19世纪50年代中期创立了名为“资本资产定价模型”的新理论。

答案:非3.证券组合理论由哈里·马柯维茨创立,该理论解释了最优证券组合的定价原则。

答案:非4.证券投资收益的最大化和投资风险的最小化这两个目标往往是矛盾的。

答案:是5.证券组合的预期收益率仅取决于组合中每一证券的预期收益率。

答案:非6.证券投资组合收益率的标准差可以测定投资组合的风险。

答案:是7.有效组合在各种风险条件下提供最大的预期收益率的组合。

答案:是8.投资者如何在有效边界中选择一个最优的证券组合,取决于投资者对风险的偏好程度。

9、投资者所选择的最优组合不一定在有效边界上。

答案:非10.马柯维茨认为,证券投资过程可以分为四个阶段,首先应考虑各种可能的证券组合;然后要计算这些证券组合的收益率、标准差和协方差;通过比较收益率和方差决定有效组合;利用无差异曲线与有效边界的切点确定对最优组合的选择。

答案:是11.CAPM的一个假设是存在一种无风险资产,投资者可以无限的以无风险利率对该资产进行借入和贷出。

答案:是12.无风险资产的收益率为零,收益率的标准差为零,收益率与风险资产收益率的协方差也为零。

答案:非13.根据资本资产定价理论,引入无风险借贷后,所有投资者的最优组合中,对风险资产的选择是相同的。

答案:是14.在市场的均衡状态下,有些证券在切点组合T中有一个非零的比例,有些证券在该组合中的比例为零。

答案:非15.资本市场线上的每一点都表示由市场证券组合和无风险借贷综合计算出的收益率与风险的集合。

16.资本市场线没有说明非有效组合的收益和风险之间的特定关系。

答案:是17.单项证券的收益率可以分解为无风险利率、系统性收益率和非系统性收益率。

答案:是18、在实际操作中,由于不能确切地知道市场证券组合的构成,我们往往可以用某一市场指数来代替市场证券组合。

1、有价证券的种类和特征:按证券的经济性质可分为股票、债券和其他证券三大类有价证券的特征:1)、产权性。

有价证券的产权性是指它记载着权利人的财产权内容,代表着一定的财产所有权,拥有证券就意味着享有财产的占有、使用、收益和处分的权利。

2)、收益性。

收益性是指持有证券本身可以获得一定数额的收益,这是投资者转让资金使用权的回报。

3)、流动性。

证券的流动性又称变现性,是指证券持有人可按自己的需要,灵活地转让证券以换取现金。

4)、风险性。

证券的风险性是指证券持有者面临着预期投资收益不能实现,甚至使本金也受到损失的可能。

2. 股票的主要类型----------------课本P313. 普通股股票的基本特征和主要种类基本特征:(1) 持有普通股的股东有权获得股利,但必须是在公司支付了债息和优先股的股息之后才能分得。

普通股的股利是不固定的,一般视公司净利润的多少而定。

当公司经营有方,利润不断递增时普通股能够比优先股多分得股利,股利率甚至可以超过50%;但赶上公司经营不善的年头,也可能连一分钱都得不到,甚至可能连本也赔掉。

(2) 当公司因破产或结业而进行清算时,普通股东有权分得公司剩余资产,但普通股东必须在公司的债权人、优先股股东之后才能分得财产,财产多时多分,少时少分,没有则只能作罢。

由此可见,普通股东与公司的命运更加息息相关,荣辱与共。

当公司获得暴利时,普通股东是主要的受益者;而当公司亏损时,他们又是主要的受损者。

(3) 普通股东一般都拥有发言权和表决权,即有权就公司重大问题进行发言和投票表决。

普通股东持有一股便有一股的投票权,持有两股者便有两股的投票权。

任何普通股东都有资格参加公司最高级会议枣每年一次的股东大会,但如果不愿参加,也可以委托代理人来行使其投票权。

(4) 普通股东一般具有优先认股权,即当公司增发新普通股时,现有股东有权优先(可能还以低价)购买新发行的股票,以保持其对企业所有权的原百分比不变,从而维持其在公司中的权益。

第九章证券投资技术分析主要理论与方法二、名词解释K线、开盘价、收盘价、最高价、最低价、阳线、阴线、影线、跳空、空头、多头、支撑线、压力线、趋势线、轨道线、黄金分割线、百分比线、速度线、甘氏线、反转形态、整理形态、头肩顶、头肩底、双重底、双重顶、三重底、三重顶、圆形底、圆形顶、三角形、矩形、楔形、旗形、喇叭形、菱形、V形、突破、随机漫步理论、循环周期理论、相反理论。

1. K线:K线图最早是日本德川幕府时代大阪的米商用来记录当时一天、一周或一月中米价涨跌行情的图示法,后被引入股市。

K线图有直观、立体感强、携带信息量大的特点,蕴涵着丰富的东方哲学思想,能充分显示股价趋势的强弱、买卖双方力量平衡的变化,预测后市走向较准确,是应用较多的技术分析手段。

2. 开盘价:目前我国股票市场采用集合竞价的方式产生开盘价。

3. 收盘价:是多空双方经过一段时间的争斗后最终达到的共识,是供需双方最后的暂时平衡点,具有指明价格的功能。

4. 最高价:是交易过程中出现的最高的价格。

5. 最低价:是交易过程中出现的最低的价格。

6. 阳线:收盘价高于开盘价时用空(或红)实体表示,称为阳线。

7. 阴线:开盘价高于收盘价时用黑(或蓝)实体表示,称为阴线。

8. 影线:影线表示高价和低价。

9.跳空:股价受利多或利空影响后,出现较大幅度上下跳动的现象。

大小所决定.10、空头:空头是投资者和股票商认为现时股价虽然较高,但对股市前景看坏,预计股价将会下跌,于是把借来的股票及时卖出,待股价跌至某一价位时再买进,以获取差额收益。

空头指的是变为股价已上涨到了最高点,很快便会下跌,或当股票已开始下跌时,认为还会继续下跌,趁高价时卖出的投资者。

采用这种先卖出后买进、从中赚取差价的交易方式称为空头。

人们通常把股价长期呈下跌趋势的股票市场称为空头市场,空头市场股价变化的特征是一连串的大跌小涨。

11、多头:多头是指投资者对股市看好,预计股价将会看涨,于是趁低价时买进股票,待股票上涨至某一价位时再卖出,以获取差额收益。

证券投资学课后答案:第一章:一:名词解释1. 证券:是各种财产所有权或债券凭证的统称,是用来证明证券持有人有权取得相应权益的凭证。

2. 债券具有一般有价证券共有的特征:即期限性、风险性、流动性和收益性,但它又有其独特之处3. 金融债券:广义地说,由金融机构发行的债券即为金融债券。

金融债券多为中长期债券,是金融机构利用自身较好的资信筹集更多的中、长期资金的手段,一般要经特别的法律许可, 有由特别的金融机构发行。

发行金融债券的银行或财务公司对金融债券持有人作出债务承诺,在一定期间还本付息。

4. 机构投资者:主要是指一些金融机构,包括银行、保险公司、投资信托公司、信用合作社、国家或团体设立的退休基金等组织5. 场外交易市场:是指证券交易所以外的证券交易市场的总称。

证券场外市场是一个分散的无形市场。

它没有固定的、集中的交易场所,而是由许多各自独立的证券公司分别进行交易。

6. 一级市场:指股票的初级市场也即发行市场,在这个市场上投资者可以认购公司发行的股票7. 二级市场:指流通市场,是已发行股票进行买卖交易的场所。

8. 场内交易市场:指由证券交易所组织的集中交易市场,有固定的交易场所和交易活动时间。

证券交易所接受和办理符合有关法令规定的证券上市买卖,投资者则通过证券商在证券交易所进行证券买卖。

二,简答1. 证券市场有哪些基本特征?答:第一,证券市场是价值直接交换的场所。

有价证券是价值的直接代表,其本质上只是价值的一种直接表现形式。

虽然证券交易的对象是各种各样的有价证券,但由于它们是价值的直接表现形式,所以证券市场本质上是价值的直接交换场所。

第二,证券市场是财产权利直接交换的场所。

证券市场上的交易对象是作为经济权益凭证的股票、债券、投资基金券等有价证券,它们本身仅是一定量财产权利的代表,所以,代表着对一定数额财产的所有权或债权以及相关的收益权。

证券市场实际上是财产权利的直接交换场所。

第三,证券市场是风险直接交换的场所。

证券投资学课后习题答案证券投资学是一门研究股票、债券等金融资产投资方法和策略的学科。

课后习题是帮助学生巩固理论知识和提高实际分析能力的重要手段。

以下是一些证券投资学课后习题的参考答案:一、选择题1. 股票的内在价值是指:A. 股票的市场价格B. 股票的账面价值C. 股票的清算价值D. 股票的预期收益的现值答案:D2. 以下哪项不是证券投资分析的基本方法?A. 基本分析B. 技术分析C. 宏观经济分析D. 心理分析答案:D3. 债券的到期收益率是指:A. 债券的票面利率B. 债券的购买价格C. 债券的市场价格D. 债券的年利息收入与购买价格的比率答案:D二、简答题1. 简述基本分析和技术分析的区别。

基本分析关注的是影响证券价格的基本面因素,如公司的财务状况、行业地位、宏观经济状况等。

它试图通过评估证券的内在价值来预测其价格走势。

技术分析则不考虑基本面因素,而是通过分析历史价格和交易量数据来预测证券价格的未来走势,它基于市场行为反映所有信息的假设。

2. 什么是有效市场假说(EMH)?有效市场假说认为在一个信息传递无阻的市场中,证券的价格总是反映其所有可获得的信息。

根据这一假说,任何新信息都会迅速被市场吸收,导致证券价格的即时调整,使得任何人都无法通过分析来获得超额回报。

三、计算题1. 假设你购买了一张面值为1000元,票面利率为5%,期限为5年的债券,如果市场利率为6%,计算债券的当前价格。

债券的年利息收入为1000元 * 5% = 50元。

使用现值公式计算债券的当前价格:\[ P = \frac{50}{(1+0.06)^1} + \frac{50}{(1+0.06)^2} + ... + \frac{50}{(1+0.06)^5} + \frac{1000}{(1+0.06)^5} \]通过计算,我们可以得到债券的当前价格。

2. 如果某公司的股票当前价格为50元,预计未来一年每股收益为5元,市场预期的股息支付率为40%,计算该股票的股息率和市盈率。