管理会计答案第二章

- 格式:doc

- 大小:68.50 KB

- 文档页数:11

第二章:答案1.解:(1)将设备用于生产的机会成本为15000元;将设备用于出租的机会成本为20000元(2)生产与出租相比,差量收入为35000元,差量成本为30000,差量收益为5000元,因此,应选择将设备用于生产。

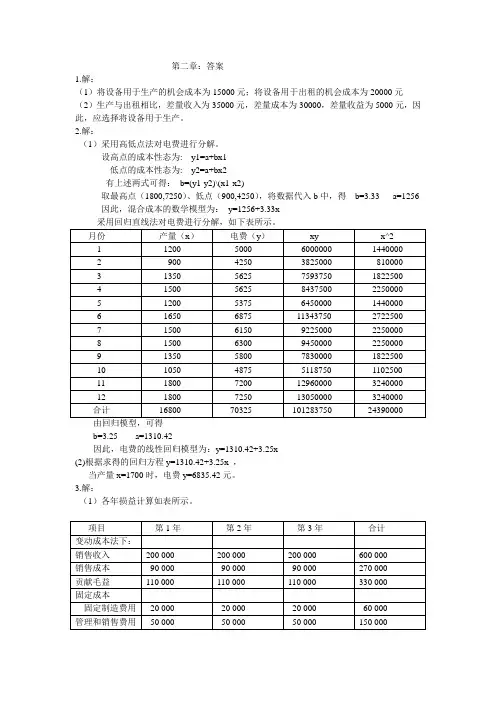

2.解:(1)采用高低点法对电费进行分解。

设高点的成本性态为: y1=a+bx1低点的成本性态为: y2=a+bx2有上述两式可得:b=(y1-y2)\(x1-x2)取最高点(1800,7250)、低点(900,4250),将数据代入b中,得b=3.33 a=1256 因此,混合成本的数学模型为:y=1256+3.33xb=3.25 a=1310.42因此,电费的线性回归模型为:y=1310.42+3.25x(2)根据求得的回归方程y=1310.42+3.25x ,当产量x=1700时,电费y=6835.42元。

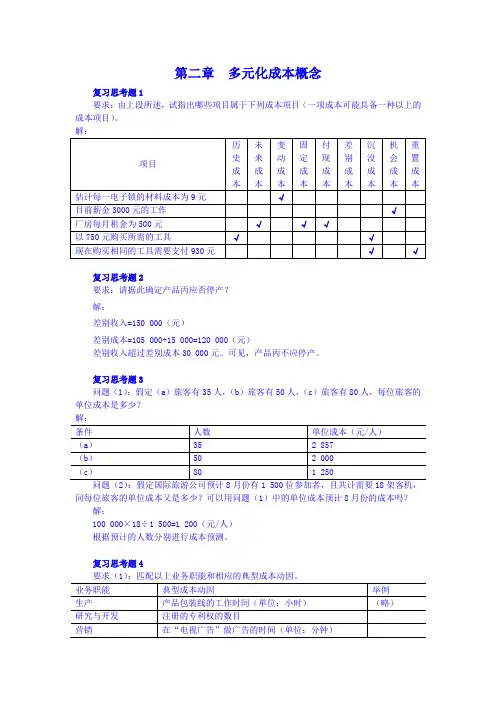

3.解:(1)各年损益计算如表所示。

(2)由上表的计算结果可以看到:当产量等于销量且无期初存货时,两种计算成本法下的利润完全相同;当产量大于销量时且无期初存货时,按变动成本法计算的利润小于完全成本法计算的利润;当产量小于销量时,按变动成本法计算的利润大于完全成本法计算的利润。

4.解、;量高于2013年生产量,使单位产品成本中的固定成本相应地更低,导致销售的产品所负担的单位固定成本也比2013年低。

因此,出现了销售量虽然大幅度上升,但是由于生产量降低,最终的营业净利反而降低的结果。

定成本,在销量一定的情况下会增加利润,因而企业会重视生产环节;相反,在变动成本法下,由于固定成本被视作期间成本,只有增加销量才能增加贡献毛益,从而增加利润,所以企业会相对重视销售环节。

《管理会计》(毛付根主编)第二章练习题答案1、解:设bx a y +=(1)高点(6,7),低点(2,4)分别代入方程:分别代入方程:îíì==Þîíì+=+=75.05.22467b a x a x a 则:x y 75.05.2+= (2)略)略(3)根据最小平方法原理,建立标准方程: ïîïíì+=+=ååååå2x b x a xy x b na y 将有关数据代入计算:将有关数据代入计算:îíì==74.071.2b a 则有:x y 74.071.2+= 也可以运用Excel2007求得。

求得。

(4)当8=x 时:根据(1),x y 75.05.2+==8.5(千元)(千元) 根据(3),x y 74.071.2+==8.65(千元)(千元)注意:结论不要用分数表示,还要有计量单位。

2、解:设bx a y +=(1)高点(20000,5000),低点(15000,4000)则:2.0150002000040005000=--=D D =x yb将高点代入方程:200002.05000´+=a 则1000=a x y 2.01000+= (2)当1800=x 时,=´+=18002.01000y 4600(元)(元)3、说明:此题“净利润”改为“税前利润”。

解:变动成本法计算:解:变动成本法计算: 利 润 表 项 目 第一年第一年第二年第二年销售收入销售收入20000×15=3000015=30000 30000×15=45000015=450000 —变动成本—变动成本 20000×5=1000005=10000030000×5=1500005=150000贡献毛益贡献毛益200000 300000 —固定成本:—固定成本:固定制造费用固定制造费用 180000 180000 固定销售与管理费用固定销售与管理费用 25000 25000 税前利润税前利润-5000 95000 完全成本法计算:完全成本法计算:第一年:单位固定制造费用=30000180000=6 单位产品生产成本=5+6=11 第二年:单位固定制造费用=24000180000=7.5 单位产品生产成本=5+7.5=12.5 利 润 表项 目 第一年第一年 第二年第二年销售收入销售收入 20000×15=3000015=30000 30000×15=45000015=450000—销售成本:—销售成本:期初存货期初存货0 110000 本期生产本期生产 30000×11=33000011=330000 24000×12.5=30000012.5=300000可供销售可供销售330000 410000 期末存货期末存货 10000×11=11000011=110000 4000×12.5=5000012.5=50000合计合计220000 360000 毛利毛利80000 90000 销售与管理费用销售与管理费用25000 25000 税前利润税前利润55000 65000 差异原因分析:差异原因分析:第一年:生产量(30000件)大于销售量(20000件),期末产成品盘存10000件“吸收”了固定性制造费用60000元(即10000×6),因而使第一年产品销售成本减少60000元,税前利润就增加60000元[即利润差异=55000-(-5000)]。

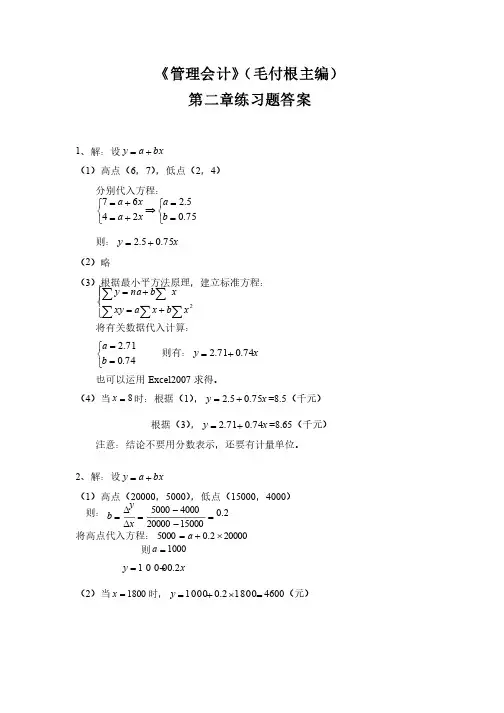

第二章习题参考答案五、业务题P77-781.解:单位:元2.解:以x、y分别表示销售额和维护保养费,b=最高点和最低点成本之差÷最高点和最低点业务量之差=(37 800-34 000)÷(560 000-480 000)=0.0475a=最高点混合成本总额-b×最高点业务量=37 800-0.0475×560 000=11 200(元)y=11 200+0.0475x3.解:实用文档实用文档33.77991639614808998961639)x (xnyx x y x a 22n1i n1i i 2in 1i n 1i n1i iiin 1i i2i ≈-⨯⨯-⨯=--=∑∑∑∑∑∑======(千元)36.4991639689699148086)x(xnyx y x n b 2n1i n1i 2i 2in1i n1i n1i iiii≈-⨯⨯-⨯=--=∑∑∑∑∑=====(千元/千人) ∴y=a+bx=77.33+4.36x六、案例分析题 P78-79实用文档32.1290232006256000097968000002320029600062560000)x (xnyx x y x a 22n1i n1i i 2in 1i n 1i n1i iiin 1i i2i ≈-⨯⨯-⨯=--=∑∑∑∑∑∑======(元)26.1223200625600009296000232007968000009)x(xnyx y x n b 2n1i n1i 2i 2in1i n1i n1i iiii≈-⨯⨯-⨯=--=∑∑∑∑∑=====(元/件)∴y=1 290.32+12.26x选择“回归直线法”的理由:“合同认定法”和“工程法”的本案例资料不可行;“账户分析法”的准确度不高;“高低点法”不适合成本变动趋势波动比较大的M 公司使用,如果使用将产生比较大的误差;“散点图法”是根据目测绘制出来的,带有一定的随意性,其准确度不高;最后“回归直线法”使用了微积分当中的极值原理,在六个方法中具有最高的精确度。

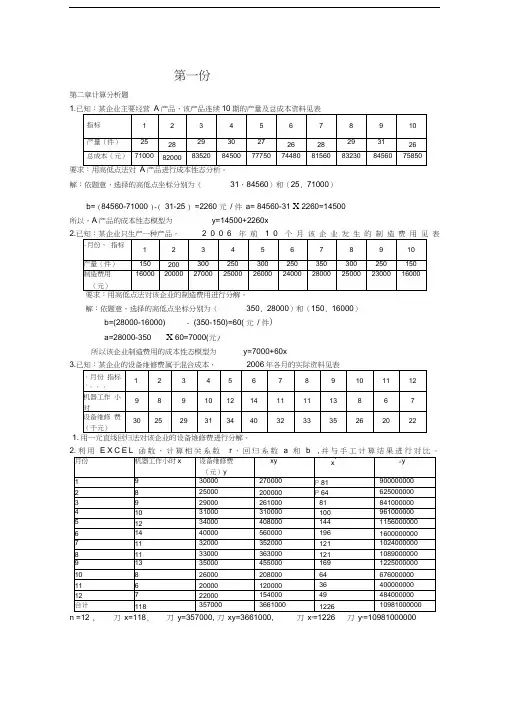

第一份第二章计算分析题1.要求:用高低点法对产品进行成本性态分析。

解:依题意,选择的高低点坐标分别为(31,84560)和(25, 71000)b= (84560-71000 )-( 31-25 ) =2260 元/ 件a= 84560-31 X 2260=14500所以,A产品的成本性态模型为y=14500+2260x2.表解:依题意,选择的高低点坐标分别为(350, 28000)和(150, 16000)b=(28000-16000) - (350-150)=60( 元/ 件)a=28000-350 X 60=7000(元)所以该企业制造费用的成本性态模型为y=7000+60x3.1. 用一元直线回归法对该企业的设备维修费进行分解。

n =12 , 刀x=118, 刀y=357000, 刀xy=3661000, 刀x2=1226 刀y2=109810000002 2r=(12 X 3661000-118 X 357000)十 (12X 1226-118 )x( 12X 10981000000-357000 )〜0.9785 T + 1 (x 与y 基本正相关)b=(12 X 3661000-118 X 357000) - (12 X 1226-118 2)=2292 元/ 小时a=(357000-2292 X 118) - 12=7212 元因此,该企业的成本性态模型为: y=7212+2292x第三章变动成本法计算成本题(注:计算变动非生产成本的业务量用销售量)1.已知:某公司从事单一产品生产, 连续三年销售量均为 1000件,而三年的产量分别为 1000件、1200件和800件。

单位产品售价为 200元,管理费用与销售费用均为固定成本,两项 费用各年总额均为50000元,单位产品变动生产成本为90元,固定性制造费用为 20000元,第一年的期初存货量为零。

(1) 分别采用变动成本法和完全成本法计算第一年的营业利润。

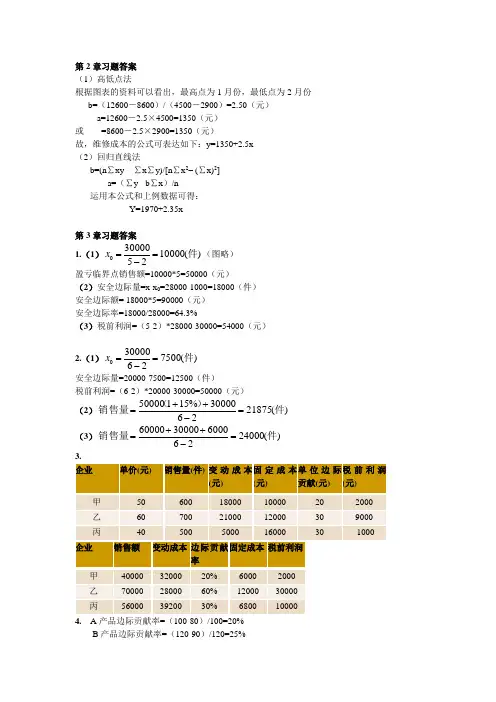

第2章习题答案 (1)高低点法根据图表的资料可以看出,最高点为1月份,最低点为2月份 b=(12600-8600)/(4500-2900)=2.50(元) a=12600-2.5×4500=1350(元) 或 =8600-2.5×2900=1350(元)故,维修成本的公式可表达如下:y=1350+2.5x (2)回归直线法b=(n ∑xy - ∑x ∑y)/[n ∑x 2– (∑x)2] a=(∑y - b ∑x )/n运用本公式和上例数据可得: Y=1970+2.35x第3章习题答案 1.(1))(1000025300000件=-=x (图略) 盈亏临界点销售额=10000*5=50000(元)(2)安全边际量=x-x 0=28000-1000=18000(件) 安全边际额= 18000*5=90000(元) 安全边际率=18000/28000=64.3%(3)税前利润=(5-2)*28000-30000=54000(元)2.(1))(750026300000件=-=x 安全边际量=20000-7500=12500(件)税前利润=(6-2)*20000-30000=50000(元)(2))(218752630000%15150000件)(销售量=-++=(3))(240002660003000060000件销售量=-++=4. A 产品边际贡献率=(100-80)/100=20%B 产品边际贡献率=(120-90)/120=25%C 产品边际贡献率=(160-112)/160=30% A 产品销售比重=600*100/200000=30% B 产品销售比重=500*120/200000=30% C 产品销售比重=500*160/200000=40%加权平均边际贡献率=20%*30%+25%*30%+30%*40%=25.5% 综合盈亏临界点销售额=45900/25.5%=180000(元) A 产品盈亏临界点销售额=18000*30%=54000(元) A 产品盈亏临界点销售量=54000/100=540(件) B 产品盈亏临界点销售额=18000*30%=54000(元) B 产品盈亏临界点销售量=54000/120=450(件) C 产品盈亏临界点销售额=18000*40%=72000(元) C 产品盈亏临界点销售量=72000/160=450(件)5.(1)盈亏临界点销售量=120000/(50-30)=6000(件) 保本点作业率=6000/8000=75%安全边际率=1-保本作业率=1-75%=25% 边际贡献率=(50-30)/50=40%销售利润率=25%*40%=安全边际率*边际贡献率=25%*40%=10% (2)令销售量为x ,则 (1-6000/x )*40%=16%X=10000(件)6.(1))(5000060/366020000元)(盈亏临界点销售额=-=税前利润=(60-36)*1000-20000=4000(元) (2)154000100060=⨯==p sx s η 94000100036-=⨯-=-=p sx b η 640001000)3660(=⨯-=⋅=p x cm x η 5400020000-=-=-=p a a η (3)TP=6000△P=6000-4000-2000(元) △P/P=2000/4000=50%△S/S=(△P/P )/s η=50%/15=3.3% S 1=60*(1+3.3%)=62(元) △b/b=(△P/P )/b η=50%/(-9)=-5.56%b1=36*(1-5.56%)=34(元)△x/x=(△P/P)/xη=50%/6=8.33%x1=1000*(1+8.33%)=1083(件)△a/a=(△P/P)/aη=50%/(-5)=-10%a1=20000*(1-10%)=18000(元)第4章习题答案1·解:(1)用算术平均法汁算,1999年彩色显像管预测销售量=(25+30+36+40+50)/5=36.2(万只)(2)用加权平均法。

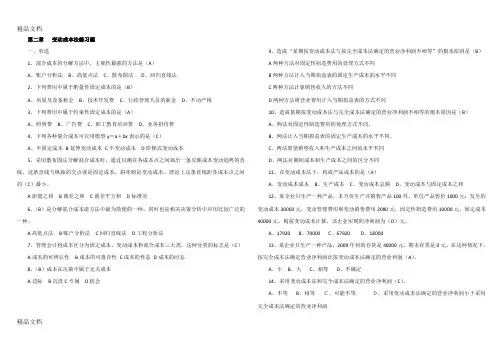

第二章变动成本法练习题一、单选1、混合成本的分解方法中,主观性最强的方法是(A)A、账户分析法B、高低点法C、散布图法D、回归直线法2、下列费用中属于酌量性固定成本的是(B)A、房屋及设备租金B、技术开发费C、行政管理人员的薪金D、不动产税3、下列费用中属于约束性固定成本的是(A)A、照明费B、广告费C、职工教育培训费D、业务招待费4、下列各种混合成本可以用模型y=a+bx表示的是(C)A、半固定成本B延伸变动成本C半变动成本D阶梯式变动成本5、采用散布图法分解混合成本时,通过目测在各成本点之间画出一条反映成本变动趋势的直线,这条直线与纵轴的交点就是固定成本,斜率则是变动成本。

理论上这条直线距各成本点之间的(C)最小。

A距离之和B离差之和C离差平方和D标准差6、(B)是分解混合成本诸方法中最为简便的一种,同时也是相关决策分析中应用比较广泛的一种。

A高低点法B账户分析法C回归直线法D工程分析法7、管理会计将成本区分为固定成本、变动成本和混合成本三大类,这种分类的标志是(C)A成本的可辨认性B成本的可盘存性C成本的性态D成本的时态8、(B)成本在决策中属于无关成本A边际B沉没C专属D机会9、造成“某期按变动成本法与按完全成本法确定的营业净利润不相等”的根本原因是(B)A两种方法对固定性制造费用的处理方式不同B两种方法计入当期损益表的固定生产成本的水平不同C两种方法计算销售收入的方法不同D两种方法将营业费用计入当期损益表的方式不同10、造成某期按变动成本法与完全成本法确定的营业净利润不相等的根本原因是(B)A、两法对固定性制造费用的处理方式不同。

B、两法计入当期损益表的固定生产成本的水平不同。

C、两法即使销售收入和生产成本之间的水平不同D、两法对期间成本和生产成本之间的区分不同11、在变动成本法下,构成产品成本的是(A)A、变动成本成本B、生产成本C、变动成本总额D、变动成本与固定成本之和12、某企业只生产一种产品,本月份生产并销售产品100件,单位产品售价1000元;发生的变动成本30000元,变动管理费用和变动销售费用2080元,固定性制造费用10000元,固定成本40000元。

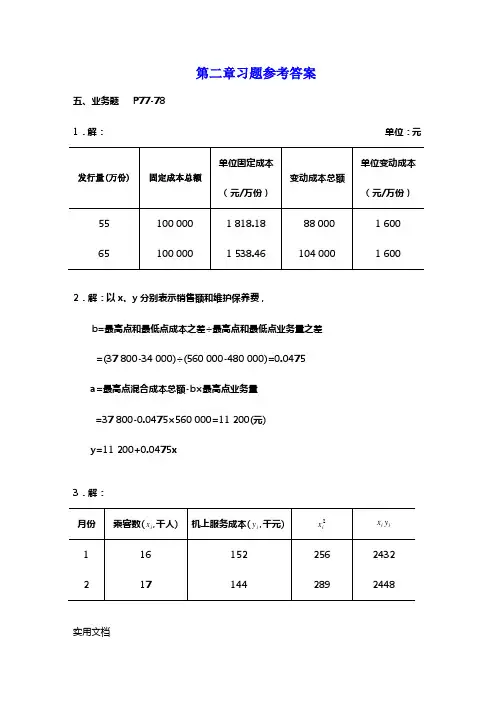

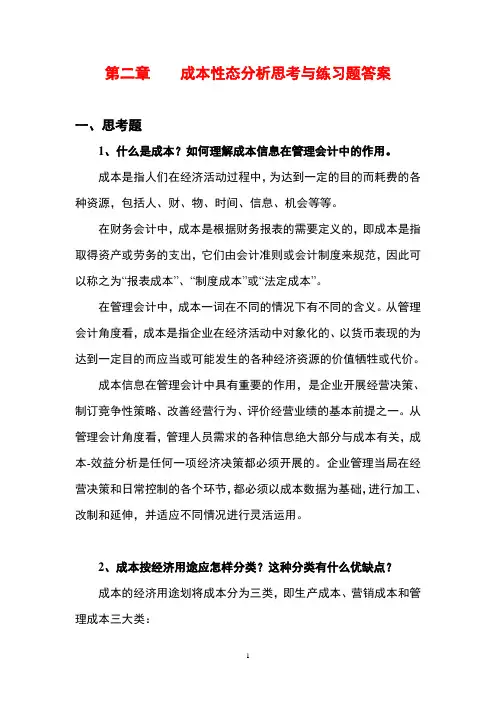

第二章成本性态分析思考与练习题答案一、思考题1、什么是成本?如何理解成本信息在管理会计中的作用。

成本是指人们在经济活动过程中,为达到一定的目的而耗费的各种资源,包括人、财、物、时间、信息、机会等等。

在财务会计中,成本是根据财务报表的需要定义的,即成本是指取得资产或劳务的支出,它们由会计准则或会计制度来规范,因此可以称之为“报表成本”、“制度成本”或“法定成本”。

在管理会计中,成本一词在不同的情况下有不同的含义。

从管理会计角度看,成本是指企业在经济活动中对象化的、以货币表现的为达到一定目的而应当或可能发生的各种经济资源的价值牺牲或代价。

成本信息在管理会计中具有重要的作用,是企业开展经营决策、制订竞争性策略、改善经营行为、评价经营业绩的基本前提之一。

从管理会计角度看,管理人员需求的各种信息绝大部分与成本有关,成本-效益分析是任何一项经济决策都必须开展的。

企业管理当局在经营决策和日常控制的各个环节,都必须以成本数据为基础,进行加工、改制和延伸,并适应不同情况进行灵活运用。

2、成本按经济用途应怎样分类?这种分类有什么优缺点?成本的经济用途划将成本分为三类,即生产成本、营销成本和管理成本三大类:生产成本也称制造成本,它是指为生产(制造)产品或提供劳务而发生的成本。

生产成本又可根据其具体的经济用途分为料、工、费三大项目。

营销成本也称销售费用,指企业为推销产品所发生的一切费用,一般包括广告费、展览费、推销费、运输费、销售人员的差旅费和工资等费用。

管理成本指制造成本和营销成本以外的由企业管理当局或各职能科室在进行企业管理时所发生的一切费用,一般包括行政管理部门和职能科室的办公费、邮电费、水电费、管理人员薪金等。

优点:第一,能清楚地反映产品成本结构,便于与本企业历史资料或同行业数据比较,用来评价和考核目标成本的执行情况,分析成本升降原因,明确经济责任,并提出改进的措施和建议。

第二,这种分类将总成本分为生产成本、营销成本和管理成本三大类,有利于“产品成本”和“期间成本”的划分,贯彻“配比”原则。

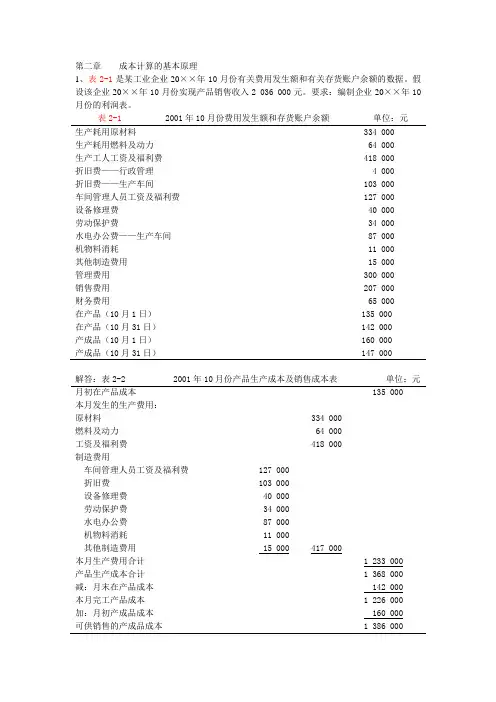

第二章成本计算的基本原理1、表2-1是某工业企业20××年10月份有关费用发生额和有关存货账户余额的数据。

假设该企业20××年10月份实现产品销售收入2 036 000元。

要求:编制企业20××年10月份的利润表。

表2-1 2001年10月份费用发生额和存货账户余额单位:元生产耗用原材料 334 000生产耗用燃料及动力 64 000生产工人工资及福利费 418 000折旧费——行政管理 4 000折旧费——生产车间 103 000车间管理人员工资及福利费 127 000设备修理费 40 000劳动保护费 34 000水电办公费——生产车间 87 000机物料消耗 11 000其他制造费用 15 000管理费用 300 000销售费用 207 000财务费用 65 000在产品(10月1日) 135 000在产品(10月31日) 142 000产成品(10月1日) 160 000产成品(10月31日) 147 000解答:表2-2 2001年10月份产品生产成本及销售成本表单位:元月初在产品成本 135 000本月发生的生产费用:原材料 334 000燃料及动力 64 000工资及福利费 418 000制造费用车间管理人员工资及福利费 127 000折旧费 103 000设备修理费 40 000劳动保护费 34 000水电办公费 87 000机物料消耗 11 000其他制造费用 15 000 417 000本月生产费用合计 1 233 000产品生产成本合计 1 368 000 减:月末在产品成本 142 000本月完工产品成本 1 226 000 加:月初产成品成本 160 000可供销售的产成品成本 1 386 000减:月末产成品成本 147 000 本月产品销售成本 1 239 000表2-3 2001年10月份利润表 单位:元 主营业务收入 2 036 000 减:主营业务成本 1 239 000 主营业务利润 797 000 减:期间费用营业费用 207 000 管理费用 304 000财务费用 65 000 576 000 营业利润 221 000从表2-2和表2-3中可以看出,产品成本同产品的实物流动相联系,而期间费用则直接归属于当期利润表,与产品的生产无关。

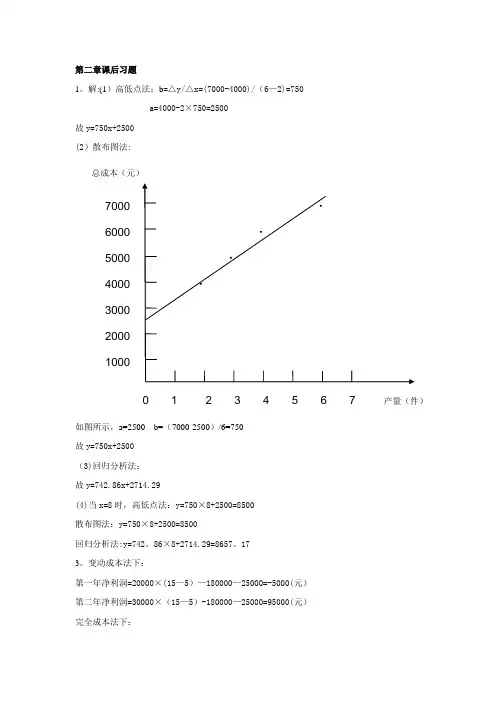

第二章课后习题1。

解:(1)高低点法:b=△y/△x=(7000-4000)/(6—2)=750a=4000-2×750=2500故y=750x+2500(2)散布图法:0 1 2 3 4 5 6 7 产量(件)如图所示,a=2500 b=(7000-2500)/6=750故y=750x+2500(3)回归分析法:故y=742.86x+2714.29(4)当x=8时,高低点法:y=750×8+2500=8500散布图法:y=750×8+2500=8500回归分析法:y=742。

86×8+2714.29=8657。

173。

变动成本法下:第一年净利润=20000×(15—5)—180000—25000=-5000(元)第二年净利润=30000×(15—5)-180000—25000=95000(元)完全成本法下:第一年净利润=20000×(15—5—180000/30000)—25000=55000(元)第二年净利润=30000×15—【10000×11+20000×(5+180000/24000)】-25000=65000(元)差异原因:完全成本法下,第一年的存货10000件,吸收了固定性制造费用60000元,使第一年的产品销售成本减少了60000元,从而使税前利润增加60000元。

到第二年,由于第一年末结转的10000件存货成本60000元成了第二年的产品销售成本,使第二年的产品销售成本增加了60000元;而第二年的存货4000件,吸收了固定性制造费用30000元,使第二年的产品销售成本减少了30000元,从而第二年的产品销售成本共增加了30000元,税前利润减少了30000元.4.变动成本法下:单位产品成本=(20000+32000)/4000+6=19(元/件)期末存货成本=500×19=9500(元)完全成本法下:单位产品成本=(20000+32000)/4000+6+28000/4000=26(元/件)期末存货成本=500×26=13000(元)第二章课堂练习1.某车间一个月的业务量为20000小时,维修成本为5000元;在业务量降低为15000小时,维修成本减少为4000元.请求出该车间维修成本的一般公式,并预计业务量为18000小时的维修成本.解:设业务量为x小时,维修成本为y元,维修成本一般公式为y=a+bx则由题可知:5000=a+b×20000 4000=a+b×15000解得a=1000 b=0.2 故y=0.2x+1000当x=18000时,y=4600(元)2。

第二章成本性态分析课后习题答案思考练习1.成本分类标准有哪些?答:根据不同的管理目标,可以采用不同的成本分类方法。

(1)按经济职能不同划分为制造成本和期间成本。

制造成本也称生产成本,是指为制造(生产)产品或提供劳务而发生的支出,可根据其具体的经济用途分为直接人工、直接材料和制造费用。

期间成本发生的支出可以使企业整体受益,但难以描述这项支出与特定产品之间的关系。

期间成本通常可分为销售费用、管理费用和财务费用。

(2)按成本性态不同分为变动成本、固定成本和混合成本。

固定成本是指在一定时期和一定业务量范围内,成本总额与业务量的变动无关的成本。

变动成本是指在一定期间和一定业务量范围内,其成本总额随着业务量的变动而成正比例变动的成本。

混合成本是指介于固定成本和变动成本之间,其总额既随业务量变动又不成正比例变化的那部分成本。

(3)按追溯到成本对象的方式,成本可分为直接成本和间接成本。

直接成本是不需要通过复杂的分配方法,能够直接追溯到成本计算对象的成本;不能直接追溯其产生来源,由多种产品或服务共同承担,必须根据一定的分配方法才能分配到相应成本对象中的成本称为间接成本。

(4)按费用的发生是否与所决策的问题相关联,成本可以划分为相关成本和非相关成本。

相关成本是与决策制定和实施相联系的成本,它会根据决策类型和决策行为的不同而发生变化。

非相关成本是指与决策无关的、不受决策方案影响的成本,包括过去已经发生的成本和其他与决策不相关的成本。

在决策分析中区分相关成本和非相关成本,有利于分清影响可供选择方案效益的相关因素和无关因素,有助于成本预测和成本决策。

(5)按费用的发生能否为考核对象(责任中心)所控制,成本可划分为可控成本与不可控成本。

区分可控成本与不可控成本的目的在于分清各部门责任,确定其相应的责任成本,便于评价和考核其工作业绩,促使可控成本不断降低。

(6)按发生时态可分为历史成本和未来成本。

历史成本是过去实际发生的成本,是企业为生产经营业务已实际支付过的成本。

《管理会计》第⼆章练习题及答案第⼆章练习题及答案⼀、单项选择题:1、在财务会计中,应当将销售费⽤归属于下列各项中的( A.制造费⽤ B.主要成本 C. 加⼯成本 D. ⾮⽣产成本2、按照管理会计的解释,成本的相关性是指() A. 与决策⽅案有关的成本特性 B. 与控制标准有关的成本特性 C. 与资产价值有关的成本特性D. 与归集对象有关的成本特性3、阶梯式混合成本⼜可称为() A. 半固定成本 B. 半变动成本 C.延期变动成本 D.曲线式成本4、将全部成本分为固定成本、变动成本和混合成本所采⽤的分类标志是 A. 成本的⽬标 B. 成本的可辨认性 C.成本的经济⽤途 D.成本的性态5、在历史资料分析法的具体应⽤⽅法中,计算结果最为精确的⽅法是( A. ⾼低点法 B. 散布图法 C.回归直线法 D.直接分析法6、当相关系数 r 等于 +1时,表明成本与业务量之间的关系是( A. 基本正相关 B. 完全正相关 C. 完全⽆关 D. 基本⽆关7、在不改变企业⽣产经营能⼒的前提下,采取降低固定成本总额的措施通常是指降低()。

A. 约束性固定成本B. 酌量性固定成本C. 半固定成本D. 单位固定成本 8、单耗相对稳定的外购零部件成本属于()。

A. 约束性固定成本 B. 酌量性固定成本 C. 技术性变动成本 D. 约束性变动成本9、下列项⽬中,只能在发⽣当期予以补偿,不可能递延到下期的成本是()。

A. 直接成本B. 间接成本C. 产品成本D. 期间成本10、为排除业务量因素的影响,在管理会计中,反映变动成本⽔平的指标⼀般是指()。

A. 变动成本总额 B. 单位变动成本 C.变动成本的总额与单位额 D.变动成本率 11、在管理会计中,狭义相关范围是指() A.成本的变动范围 B.业务量的变动范围C.时间的变动范围D.市场容量的变动范围 12、在应⽤历史资料分析法进⾏成本形态分析时,必须⾸先确定 a ,然后才能计算出b 的⽅法时() A. 直接分析法B. ⾼低点法C.散布图法D.回归直线法13、某企业在进⾏成本形态分析时,需要对混合成本进⾏分解。

第二章课后习题思考题1.管理会计对成本就是如何进行分类得?各种分类得主要目得就是什么?管理会计将成本按各种不同得标准进行分类,以适应企业经营管理得不同需求。

1、按成本经济用途分类:制造成本与非制造成本。

主要目得就是用来确定存货成本与期间损益,满足对外财务报告得需要。

2、按性态分类:固定成本、变动成本与混合成本。

按性态进行划分就是管理会计这一学科得基石,管理会计作为决策会计得角色,其许多决策方法尤其就是短期决策方法都需要借助成本性态这一概念。

3、按可控性分类:可控成本与不可控成本4、按就是否可比分类:可比成本与不可比成本5、按特定得成本概念分类:付现成本与沉没成本、原始成本与重置成本、可避免成本与不可避免成本、差别成本与边际成本、机会成本6、按决策相关性分类:相关成本与无关成本2.按成本性态划分,成本可分为几类?各自得含义、构成与相关范围就是什么?按成本性态可以将企业得全部成本分为固定成本、变动成本与混合成本三类。

(1)固定成本就是指其总额在一定期间与一定业务量范围内,不受业务量变动得影响而保持固定不变得成本。

但就是符合固定成本概念得支出在“固定性”得强弱上还就是有差别得,所以根据这种差别又将固定成本细分为酌量性固定成本与约束性固定成本。

酌量性固定成本也称为选择性固定成本或者任意性固定成本,就是指管理当局得决策可以改变其支出数额得固定成本。

约束性固定成本与酌量性固定成本相反,就是指管理当局得决策无法改变其支出数额得固定成本,因而也称为承诺性固定成本,它就是企业维持正常生产经营能力所必须负担得最低固定成本,其支出得大小只取决于企业生产经营得规模与质量,因而具有很大得约束性,企业管理当局不能改变其数额。

固定成本得“固定性”不就是绝对得,而就是有限定条件得,这种限定条件在管理会计中叫做相关范围,表现为一定得期间范围与一定得空间范围。

就期间范围而言,固定成本表现为在某一特定期间内具有固定性。

从较长时间瞧,所有成本都具有变动性,即使“约束性”很强得约束性固定成本也就是如此。

第二章课后习题思考题1.管理会计对本钱是如何进展分类的?各种分类的主要目的是什么?管理会计将本钱按各种不同的标准进展分类,以适应企业经营管理的不同需求。

1.按本钱经济用途分类:制造本钱和非制造本钱。

主要目的是用来确定存货本钱和期间损益,满足对外财务报告的需要。

2.按性态分类:固定本钱、变动本钱和混合本钱。

按性态进展划分是管理会计这一学科的基石,管理会计作为决策会计的角色,其许多决策方法尤其是短期决策方法都需要借助本钱性态这一概念。

3.按可控性分类:可控本钱和不可控本钱4.按是否可比分类:可比本钱和不可比本钱5.按特定的本钱概念分类:付现本钱和漂浮本钱、原始本钱和重置本钱、可防止本钱和不可防止本钱、差异本钱和边际本钱、时机本钱6.按决策相关性分类:相关本钱和无关本钱2.按本钱性态划分,本钱可分为几类?各自的含义、构成和相关X围是什么?按本钱性态可以将企业的全部本钱分为固定本钱、变动本钱和混合本钱三类。

〔1〕固定本钱是指其总额在一定期间和一定业务量X围内,不受业务量变动的影响而保持固定不变的本钱。

但是符合固定本钱概念的支出在“固定性〞的强弱上还是有差异的,所以根据这种差异又将固定本钱细分为酌量性固定本钱和约束性固定本钱。

酌量性固定本钱也称为选择性固定本钱或者任意性固定本钱,是指管理当局的决策可以改变其支出数额的固定本钱。

约束性固定本钱与酌量性固定本钱相反,是指管理当局的决策无法改变其支出数额的固定本钱,因而也称为承诺性固定本钱,它是企业维持正常生产经营能力所必须负担的最低固定本钱,其支出的大小只取决于企业生产经营的规模与质量,因而具有很大的约束性,企业管理当局不能改变其数额。

固定本钱的“固定性〞不是绝对的,而是有限定条件的,这种限定条件在管理会计中叫做相关X围,表现为一定的期间X围和一定的空间X围。

就期间X 围而言,固定本钱表现为在某一特定期间内具有固定性。

从较长时间看,所有成本都具有变动性,即使“约束性〞很强的约束性固定本钱也是如此。

第二章变动成本法练习题一、单选1、混合成本的分解方法中,主观性最强的方法是(A)A、账户分析法B、高低点法C、散布图法D、回归直线法2、下列费用中属于酌量性固定成本的是(B)A、房屋及设备租金B、技术开发费C、行政管理人员的薪金D、不动产税3、下列费用中属于约束性固定成本的是(A)A、照明费B、广告费C、职工教育培训费D、业务招待费4、下列各种混合成本可以用模型y=a+bx表示的是(C)A、半固定成本B延伸变动成本C半变动成本D阶梯式变动成本5、采用散布图法分解混合成本时,通过目测在各成本点之间画出一条反映成本变动趋势的直线,这条直线与纵轴的交点就是固定成本,斜率则是变动成本。

理论上这条直线距各成本点之间的(C)最小。

A距离之和B离差之和C离差平方和D标准差6、(B)是分解混合成本诸方法中最为简便的一种,同时也是相关决策分析中应用比较广泛的一种。

A高低点法B账户分析法C回归直线法D工程分析法7、管理会计将成本区分为固定成本、变动成本和混合成本三大类,这种分类的标志是(C)A成本的可辨认性B成本的可盘存性C成本的性态D成本的时态8、(B)成本在决策中属于无关成本A边际B沉没C专属D机会9、造成“某期按变动成本法与按完全成本法确定的营业净利润不相等”的根本原因是(B)A两种方法对固定性制造费用的处理方式不同B两种方法计入当期损益表的固定生产成本的水平不同C两种方法计算销售收入的方法不同D两种方法将营业费用计入当期损益表的方式不同10、造成某期按变动成本法与完全成本法确定的营业净利润不相等的根本原因是(B)A、两法对固定性制造费用的处理方式不同。

B、两法计入当期损益表的固定生产成本的水平不同。

C、两法即使销售收入和生产成本之间的水平不同D、两法对期间成本和生产成本之间的区分不同11、在变动成本法下,构成产品成本的是(A)A、变动成本成本B、生产成本C、变动成本总额D、变动成本与固定成本之和12、某企业只生产一种产品,本月份生产并销售产品100件,单位产品售价1000元;发生的变动成本30000元,变动管理费用和变动销售费用2080元,固定性制造费用10000元,固定成本40000元。

第二章课后习题思考题1.管理会计对成本是如何进行分类的各种分类的主要目的是什么管理会计将成本按各种不同的标准进行分类,以适应企业经营管理的不同需求。

1.按成本经济用途分类:制造成本和非制造成本。

主要目的是用来确定存货成本和期间损益,满足对外财务报告的需要。

2.按性态分类:固定成本、变动成本和混合成本。

按性态进行划分是管理会计这一学科的基石,管理会计作为决策会计的角色,其许多决策方法尤其是短期决策方法都需要借助成本性态这一概念。

3.按可控性分类:可控成本和不可控成本4.按是否可比分类:可比成本和不可比成本5.按特定的成本概念分类:付现成本和沉没成本、原始成本和重置成本、可避免成本和不可避免成本、差别成本和边际成本、机会成本6.按决策相关性分类:相关成本和无关成本2.按成本性态划分,成本可分为几类各自的含义、构成和相关范围是什么按成本性态可以将企业的全部成本分为固定成本、变动成本和混合成本三类。

(1)固定成本是指其总额在一定期间和一定业务量范围内,不受业务量变动的影响而保持固定不变的成本。

但是符合固定成本概念的支出在“固定性”的强弱上还是有差别的,所以根据这种差别又将固定成本细分为酌量性固定成本和约束性固定成本。

酌量性固定成本也称为选择性固定成本或者任意性固定成本,是指管理当局的决策可以改变其支出数额的固定成本。

约束性固定成本与酌量性固定成本相反,是指管理当局的决策无法改变其支出数额的固定成本,因而也称为承诺性固定成本,它是企业维持正常生产经营能力所必须负担的最低固定成本,其支出的大小只取决于企业生产经营的规模与质量,因而具有很大的约束性,企业管理当局不能改变其数额。

固定成本的“固定性”不是绝对的,而是有限定条件的,这种限定条件在管理会计中叫做相关范围,表现为一定的期间范围和一定的空间范围。

就期间范围而言,固定成本表现为在某一特定期间内具有固定性。

从较长时间看,所有成本都具有变动性,即使“约束性”很强的约束性固定成本也是如此。

CHAPTER 2BASIC MANAGEMENT ACCOUNTING CONCEPTS QUESTIONS FOR WRITING AND DISCUSSION1.Product costing accuracy means assigning the cost of the resources consumed by a cost object tothat cost object.2. A cost object is any item for which costs are measured and assigned, including such things as prod-ucts, plants, projects, departments, and activities.3.An activity is a basic unit of work performed within an organization. Examples include material han-dling, inspection, purchasing, billing, and maintenance.4. A direct cost is a cost that can be traced to a cost object. An indirect cost is a cost that cannot betraced to cost objects.5.Traceability is the ability to assign a cost directly to a cost object in an economically feasible way usinga causal relationship. Tracing is the assignment of costs to cost objects using either an observablemeasure of the cost object’s resource consumption or factors that allegedly capture the causal rel a-tionship.6.Allocation is the assignment of indirect costs to cost objects based on convenience or assumed lin-kages.7.Drivers are factors that cause changes in resource usage, activity usage, costs, and revenues. Re-source drivers measure the demands placed on resources by activities and are used to assign the cost of resources to activities. Example: time used to assign the cost of supervision to individual activi-ties. Activity drivers measure the demands placed on activities by cost objects and are used to assign the cost of activities to cost objects. Example: number of inspection hours used to assign the cost of inspection to individual products.8.Direct tracing is the process of assigning costs to cost objects based on physically observable causalrelationships. Driver tracing is assigning costs using drivers, which are causal factors. The driver ap-proach relies on identification of factors that allegedly capture the causal relationship. Direct tracing relies on physical observation of the causal relationship and, therefore, is more reliable.9.Driver tracing is the use of drivers to trace costs to cost objects. Often, this means that costs are firsttraced to activities using resource drivers and then to cost objects using activity drivers.10. A tangible product is a good that is made by converting raw materials through the use of labor andcapital inputs.11. A service is a task or activity performed for a customer or an activity performed by a customer usingan organization’s products or facilities.12.Services differ from tangible products on four important dimensions: intangibility, perishability, insepa-rability, and heterogeneity. Intangibility means that buyers of services cannot see, feel, taste, or hear a service before it is bought. Perishability means that services cannot be stored. Inseparability means that producers of services and buyers of services must be in direct contact (not true for tangible prod-ucts). Heterogeneity means that there is a greater chance of variation in the performance of services than in the production of products.13.Three examples of product cost definitions are value-chain, operating, and traditional definitions. Thevalue-chain definition includes cost assignments for all value-chain activities. Operating product costs include all costs except for research and development. Traditional product costs include only produc-tion costs. Different costs are needed because they serve different managerial objectives.14.The three cost elements that determine the cost of making a product are direct materials, direct labor,and overhead.15.The income statement for a service firm does not need a supporting cost of goods manufacturedschedule. Because services cannot be stored, the cost of services produced equals the cost of ser-vices sold (not necessarily true for a manufacturing firm).16.There are six essential differences. Activity-based cost management systems use more drivers; aretracing intensive instead of allocation intensive; use broad, flexible product cost definitions; focus on managing activities instead of managing costs; emphasize systemwide performance over individual unit performance; and use both nonfinancial and financial performance measures. Functional-based cost management systems emphasize only finan-cial measures.17.For companies that have increased decision error costs and decreased measurement costs, a moveto an activity-based cost management system is called for. Factors that affect the decision to move to an activity-based cost management system include more powerful and cheaper computing capabili-ties, increased competition, more focused production by competitors, deregulation, and JIT manufac-turing.EXERCISES2–11. Part #172CSteel* $ 12.00 $ 18.00Setup cost** 6.00 6.00Total $ 18.00 $ 24.00*($1.00 ⨯ 12; $1.00 ⨯ 18)**($60,000/10,000)Steel cost is assigned by calculating a cost per ounce and then multiplying this by the ounces used by each part:Cost per ounce = $3,000,000/3,000,000 ounces= $1.00 per ounceSetup cost is assigned by calculating the cost per setup and then dividing this by the number of units in each batch (there are 20 setups per year): Cost per setup = $1,200,000/20= $60,0002. The cost of steel is assigned using direct tracing. The cost of the setups isassigned through driver tracing using number of setups as the driver.3. The assumption underlying number of setups as the driver is that each partuses an equal amount of setup time. Since Part #72A uses double the setup time of Part #172C, it makes sense to assign setup costs based on setup time instead of number of setups. This illustrates the importance of identifying drivers that reflect the true underlying consumption pattern. Using setup hours [(40 ⨯ 10) + (20 ⨯ 10)], we get the following rate per hour:Cost per setup hour = $1,200,000/600= $2,000 per hourThe cost per unit is obtained by dividing each part’s total setup costs by the number of units:Part #72A = ($2,000 ⨯ 400)/100,000 = $8.00Part #172C = ($2,000 ⨯ 200)/100,000 = $4.00Thus, Part #72A has its unit cost increased by $2.00, while Part #172C has its unit cost decreased by $2.00.2–2Value-chain activity category: Design; Develop; Produce; Market; Distri-bute; Service.a. Marketingb. Servicingc. Designingd. Producinge. Distributingf. Producingg. Marketingh. Designing and developingi. Servicingj. Producingk. Developingl. Designingm. Marketingn. Distributingo. Producing2–31. B rown CompanyS tatement of Cost of Goods ManufacturedDirect materials:Beginning inventory ....................................... $ 176,000Add: Purchases .............................................. 283,800Materials available ......................................... $ 459,800Less: Ending inventory .................................. 87,120Direct materials used .......................................... $ 372,680D irect labor .......................................................... 191,400Manufacturing overhead ..................................... 478,590Total manufacturing costs added ...................... $ 1,042,670Add: Beginning work in process ........................ 92,400Total manufacturing costs .................................. $ 1,135,070Less: Ending work in process ............................ 143,000Cost of goods manufactured .............................. $ 992,0702. B rown CompanyS tatement of Cost of Goods SoldF or the Month Ended February 28, 20XXBeginning finished goods inventory .................. $ 52,080Add: Cost of goods manufactured ..................... 992,070Cost of goods available for sale ......................... $ 1,044,150Less: Ending finished goods inventory ............. 95,240Cost of goods sold .............................................. $ 948,9102–41. Given the description provided, we can conclude that Cariari uses a function-al-based accounting system. First, evidence exists that product costs are on-ly determined by production costs. Apparently, the financial accounting sys-tem is driving the type of product cost information being produced. Second, only direct labor hours, a unit-level driver, are used to assign overhead costs.Since many overhead costs are likely to be caused by nonunit-level drivers, this also suggests a strong reliance on allocation for cost assignment. Third, the company attempts to control costs by encouraging departmental manag-ers to meet budgeted levels of expenditures. The focus is on departmental performance rather than systemwide performance. Further, departmental per-formance is measured only by financial instruments. An ABM system empha-sizes controlling costs by managing activities and their causes; it also uses nonfinancial measures of performance.2. Setup cost per direct labor hour = $100,000/100,000= $1.00 per DLHSetup cost assigned:Automatic Model Manual Model $1.00 ⨯ 30,000 DLH $ 30,000 $ —$1.00 ⨯ 70,000 DLH —70,000 Total $ 30,000 $ 70,000 Units produced ÷60,000 ÷40,000Setup cost per unit $ 0.50 $ 1.75It is not direct tracing because there is no exclusive physical association. If direct labor hours is a causal factor that measures the consumption of setup resources, then it could be classified as driver tracing. However, there ap-pears to be little association between direct labor hours and setup cost con-sumption. The automatic model uses more setup resources and less direct labor hours than the manual model uses, respectively. Thus, this assignment should be classified as allocation.PROBLEMS2–51. Nursing hours required per year: 4 ⨯ 24 hours ⨯ 364 days* = 34,944*Note: 364 days = 7 days ⨯ 52 weeksNumber of nurses = 34,944 hrs./2,000 hrs. per nurse = 17.472Annual nursing cost = (17 ⨯ $45,000) + $22,500= $787,500Cost per patient day = $787,500/10,000 days= $78.75 per day (for either type of patient)2. Nursing hours act as the driver. If intensive care uses half of the hours andnormal care the other half, then 50 percent of the cost is assigned to each pa-tient category. Thus, the cost per patient day by patient category is as fol-lows:Intensive care = $393,750*/2,000 days= $196.88 per dayNormal care = $393,750/8,000 days= $49.22 per day*$525,000/2 = $262,500The cost assignment reflects the actual usage of the nursing resource and, thus, should be more accurate. Patient days would be accurate only if inten-sive care patients used the same nursing hours per day as normal care pa-tients.3. The salary of the nurse assigned only to intensive care is a directly traceablecost. To assign the other nursing costs, the hours of additional usage would need to be measured. Thus, both direct tracing and driver tracing would be used to assign nursing costs for this new setting.4. It would be very difficult to use direct tracing for laundry costs. Segregatinglaundry by patient is possible but impractical. For one thing, the amount of laundry for each patient likely would not justify running separate loads. Fur-thermore, if we add to this the fact that laundry also operates to service other areas such as surgery and the emergency room, then the impracticality be-comes even more evident. Driver tracing is recommended. A measure of usage such as pounds of laundry is more feasible. Total laundry costs di-vided by total pounds of laundry provides a rate that can be used to assign the laundry cost. For the two patient types, the pounds used by each type would be needed so that the rate can be applied. In a practical sense, a sam-ple could be taken and the average pounds per patient type per day could be used to assign the cost to avoid repetitive weighing.2–61. B ella Obra CompanyS tatement of Cost of Services SoldF or the Year Ended June 30, 2006Direct materials:Beginning inventory ....................................... $ 300,000Add: Purchases .............................................. 600,000Materials available ......................................... $ 900,000Less: Ending inventory .................................. 450,000*Direct materials used .......................................... $ 450,000 Direct labor ........................................................... 12,000,000 Overhead .............................................................. 1,500,000 Total service costs added ................................... $ 13,950,000 Add: Beginning work in process ........................ 900,000 Total production costs ........................................ $ 14,850,000 Less: Ending work in process ............................ 1,500,000 Cost of services sold .......................................... $ 13,350,000 *Materials available less materials used2. The dominant cost is direct labor (presumably the salaries of the 100 profes-sionals). Although labor is the major cost of providing many services, it is not always the case. For example, the dominant cost for some medical services may be overhead (e.g., CAT scans). In some services, the dominant cost may be materials (e.g., funeral services).3. B ella Obra CompanyI ncome StatementF or the Year Ended June 30, 2006Sales ..................................................................... $ 21,000,000 Cost of services sold .......................................... 13,350,000 Gross margin ....................................................... $ 7,650,000 Less operating expenses:Selling expenses ............................................ $ 900,000Administrative expenses ............................... 750,000 1,650,000 Income before income taxes .............................. $ 6,000,000 4.intangibility, (2) perishability, (3) inseparability, and (4) heterogeneity. Intangi-bility means that the buyers of services cannot see, feel, hear, or taste a ser-vice before it is bought. Perishability means that services cannot be stored.This property affects the computation in Requirement 1. Inability to store ser-vices means that there will never be any finished goods inventories, thus making the cost of services produced equivalent to cost of services sold. In-separability simply means that providers and buyers of services must be in direct contact for an exchange to take place. Heterogeneity refers to thegreater chance for variation in the performance of services than in the pro-duction of tangible products.2–71. Direct materials:M agazine (5,000 ⨯ $0.40) $ 2,000B rochure (10,000 ⨯ $0.08) 800 $ 2,800Direct labor:Magazine [(5,000/20) ⨯ $10] $ 2,500Brochure [(10,000/100) ⨯ $10] 1,000 3,500 Manufacturing overhead:Rent $1,400D epreciation [($40,000/20,000) ⨯ 350*] 700S etups 600I nsurance 140P ower 350 3,190Cost of goods manufactured $ 9,490*Production is 20 units per printing hour for magazines and 100 units per printing hour for brochures, yielding monthly machine hours of 350 [(5,000/20) + (10,000/100)]. This is also monthly labor hours, as machine la-bor only operates the presses.2. Direct materials $ 2,800Direct labor 3,500Total prime costs $ 6,300Magazine:Direct materials $ 2,000Direct labor 2,500Total prime costs $ 4,500Brochure:Direct materials $ 800Direct labor 1,000Total prime costs $ 1,800Direct tracing was used to assign prime costs to the two products.3. Total monthly conversion cost:Direct labor $ 3,500Overhead 3,190Total $ 6,690Magazine:Direct labor $ 2,500Overhead:Power ($1 ⨯ 250) $ 250Depreciation ($2 ⨯ 250) 500Setups (2/3 ⨯ $600) 400Rent and insurance ($4.40 ⨯ 250 DLH)* 1,100 2,250Total $ 4,750 Brochure:Direct labor $ 1,000Overhead:Power ($1 ⨯ 100) $ 100Depreciation ($2 ⨯ 100) 200Setups (1/3 ⨯ $600) 200Rent and insurance ($4.40 ⨯ 100 DLH)* 440 940Total $ 1,940 *Rent and insurance cannot be traced to each product so the costs are as-signed using direct labor hours: $1,540/350 DLH = $4.40 per direct labor hour. The other overhead costs are traced according to their usage. Depre-ciation and power are assigned by using machine hours (250 for magazines and 100 for brochures): $350/350 = $1.00 per machine hour for power and $40,000/20,000 = $2.00 per machine hour for depreciation. Setups are as-signed according to the time required. Since magazines use twice as much time, they receive twice the cost: Letting X = the proportion of setup time used for brochures, 2X + X = 1 implies a cost assignment ratio of 2/3 for magazines and 1/3 for brochures.4. Sales [(5,000 ⨯ $1.80) + (10,000 ⨯ $0.45)] ........... $13,500Less cost of goods sold ..................................... 9,490Gross margin ....................................................... $ 4,010Less operating expenses:Selling ............................................................. $ 500aAdministrative ................................................ 1,500b2,000 Income before income taxes .............................. $ 2,010a Distribution of goods is a selling expense.b A case could be made for assigning part of her salary to production. Howev-er, since she is responsible for coordinating and managing all business functions, an administrative classification is more convincing.MANAGERIAL DECISION CASES2–81. P roduction Selling Administrative(DL) Machine operators Utilities(DL) Other direct labor Rent(OH) Supervisory salaries CPA fees(DM) Pipe Adm. salaries Adm. salaries (OH) Tires and fuel Advertising(OH) Depreciation(OH) Salaries of mechanics2. G ateway Construction CompanyI ncome StatementF or the Year Ended December 31, 2006Sales ..................................................................... $ 3,003,000 Cost of services sold:Direct materials .............................................. $ 1,401,340Direct labor ..................................................... 483,700Supervisory salaries ...................................... 70,000Tires and fuel .................................................. 418,600Depreciation, equipment ............................... 198,000Salaries of mechanics ................................... 50,000 2,621,640 Gross margin ....................................................... $ 381,360 Administrative expenses:Utilities ............................................................ $ 24,000Rent, office building ....................................... 24,000CPA fees ......................................................... 20,000Administrative salaries* ................................. 57,000 (125,000) Selling expenses:Sales salaries* ................................................ $ 57,000Advertising...................................................... 15,000 (72,000) Income before income taxes .............................. $ 184,360 *1/2 $114,000Average cost per equipment hour: $2,621,640/18,200 = $144.05 (rounded) 3. Traceable costs using equipment hours:Machine operators $ 218,000Other direct labor 265,700Pipe 1,401,340Tires and fuel 418,600Depreciation, equipment 198,000Salaries of mechanics 50,000Total $ 2,551,640Machine operators, tires and fuel, and depreciation are all directly caused by equipment usage, which is measured by equipment hours. One can also ar-gue that the maintenance required is also a function of equipment hours and so the salaries of mechanics can be assigned using equipment hours. Pipe and other direct labor can be assigned using equipment hours because their usage should be highly correlated with equipment hours. That is, equipment hours increase because there is more pipe being laid. As hours increase, so does the pipe usage. A similar argument can be made for other direct labor.Actually, it is not necessary to use equipment hours to assign pipe or other direct labor because these two costs are directly traceable to jobs.Traceable cost per equipment hour = $2,551,640/18,200= $140.20 per hour2–91. Leroy should politely and firmly decline the offer. The offer includes an impli-cit request to use confidential information to help Jean win the bid. Use of such information for personal advantage is wrong. Leroy has a professional and personal obligation to his current employer. This obligation must take precedence over the opportunity for personal financial gain.2. If Leroy agrees to review the bid, he will likely use his knowledge of his cur-rent employer’s position to help Jean win the bid. In fact, an agreement to help probably would reflect a desire for the bonus and new job with the asso-ciated salary increase. Helping would likely ensure that Jean would win the bid. Leroy was concerned about the political fallout and subsequent investi-gation revealing his involvement—especially if he sent up a red flag by switching to his friend’s firm. An investigation may reveal the up-front bonus and increase the suspicion about Leroy’s involvement. There is a real poss i-bility that Leroy could be implicated. Whether this would lead to any legal dif-ficulties is another issue. At the very least, some tarnishing of his profes-sional reputation and personal character is possible. Some risk to Leroy exists. The amount of risk, though, should not be a factor in Leroy’s decision.What is right should be the central issue, not the likelihood of getting caught.3. Leroy has a responsibility to refrain from disclosing confidential informationacquired in the course of his work except when authorized, unless legally obligated to do so (II-1), and to refrain from using or appearing to use confi-dential information acquired in the course of his work for unethical or illegal advantage either personally or through a third party (II-3). He also has a re-sponsibility to avoid actual or apparent conflicts of interest and advise all appropriate parties of any potential conflict (III-1); to refuse any gift, favor, or hospitality that would influence his actions (III-3); and to refrain from ei-ther actively or passively subverting the attainment of the orga nization’s l e-gitimate and ethical objectives.。