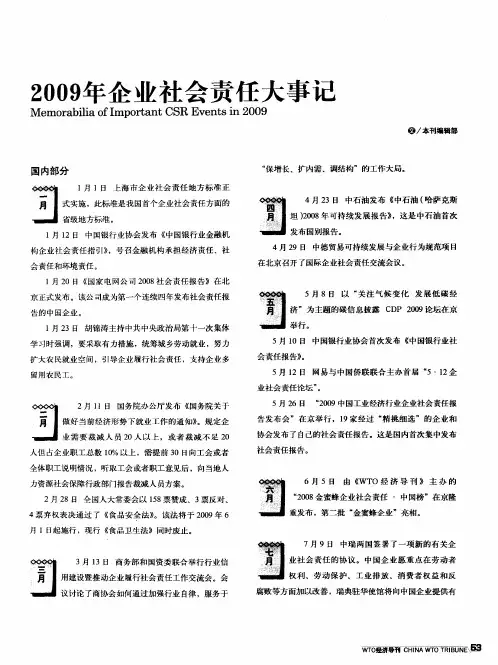

汇丰银行中国企业社会责任报告2009

- 格式:pdf

- 大小:4.77 MB

- 文档页数:27

外文翻译原文Sustainability report 2009Material Source: HSBC bank website /1/2/HSBC in ContextHSBC is “the world local bank” .we serve around 100million individual and business customers around the word .Some 300,000 people work for us in 8,000offices in Europe, the Asia-pacific region , North America , Latin America and the Middle East.Headquartered in London, HSBC has listings on the London, Hong Kong, New York, Paris and Bermuda stock exchanges, with over 220,000shareholders in 121 countries and territories.As the world’ leading international and emerging markets bank , we provide a comprehensive rang of financial services to customers in both mature and faster-growing economies .we organize our business by two customer groups, Personal Financial Services and Commercial Banking; and two global business, Global Banking and Markets and Private Banking.HSBC’s strategy is aligned with three important long-term global trends: emerging markets will grow faster than developed markets, world trade will grow faster than GDP, and longevity is increasing across the world.Financing a low Carbon EconomyThe potential opportunities presented by climate change mitigation and adaptation are already beginning to change the way we think about how we do business.In last year’s report, we acknowledged that we needed to improve our understanding of the risk and opportunities that must be addressed in the low carbon economy, to build capacity to ensure we were able to support customer needs, and to look specifically at the insurance business.HSBC has begun to address these changes not only planning a route for the Group to contribute to a low carbon world, but also by helping our customer to do so. We are examining how our own business operations will be affected, taking a closerlook at some of the key sectors that will help make this transformation a reality, and are investigation opportunities for the bank in the new’ climate business’ sector.Climate Change Benchmark IndexThe HSBC Climate Change Benchmark Index tracks the stock-market performance of global companies already profiting from the transition to a low carbon economy. It includes companies that generate revenue from products and services for both mitigating and adapting to climate change. Reviewed quarterly, the index includes more than 380 companies and is used by three of the 10 largest pension schemes in the world as well as some of the world’s largest asset managers to inform their investment choices.Leading climate change researchResearch from HSBC’s Quantitative Research team estimates that the size of the “climate business” sector –the value of products and services linked to resolving the issue of climate change—is now more than us$530billon and could exceed us$2 trillion by 2020.Investment in clean energy and other climate solutions is expected to increase over the next 12 months, prompted by continuing government support and improving credit market conditions.In 2009, the HSBC Climate Change Centre of Excellence produced 30 reports on climate change science, policy and markets. These included a comprehensive analysis of the fiscal stimulus for climate-related investments. By the end of 2009, the centre estimated that US$21billion in “green stimulus”had been allocated by government across the world, with the Asia-Pacific region leading the way with over 60 per cent of the total. The centre also produced a series of reports on the prospects for –and implications of –the UN climate summit in Copenhagen in December 2009.Finally, the centre produced the first comparative assessment of the vulnerability of the G-20 nations to climate impacts through to 2020. These reports help our clients identify risks and opportunities and make informed investment and business decisions.Valuing Our EmployeesHSBC seek to develop and maintain a culture in which our employees are open to different ideas and cultures, and connected with our customers, communities and each other. We strive to be dependable and to ‘do the right thing’ in all aspects of our business.In 2009, 91 percent of employees responded to our third employee questionnaire, the Global People Survey-one of the highest participation rates in thefinancial services industry. The Group’s employee engagement score rose from 67per cent in 2008 to 71per cent in 2009. this exceeded the 2009 target of 69 per cent and out performed the external’best in class’average for aspects related to corporate sustainability, reputation and direct line management.The ‘best in class’ score is a comparison of the top quartile employee survey scores form other large organizations and a specially commissioned research study. This is the benchmark against which HSBC measures its performance. The decline in ‘best in class’ scores in 2009 is a reflection of the impact of change in the winder business environment on those organizations.In 2010, we will focus on leadership, developing line manager capability and building a stronger customer focus in our employees.Retaining talentAn important aspect of our People Strategy is to ensure alignment of career development with strategic business requirements. We seek to integrate important people processes such as succession planning, performance management and career development with our annual business operating cycle. Development needs for talented individuals are met trough a combination of on-the-job experience, coaching and training programmers.In 2009, we clarified the type of behavior expected of all levels of HSBC’s management Based on the premise that leadership is a quality that is important at all levels of seniority; the new HSBC Leadership Capability Framework identifies the qualities of leadership needed in management to drive Group Strategy. In 2010, we are integrating this framework into learning programmers, performance management and recruitment.HSBC Group level learning programmers, designed to develop the most senior and capable in individuals, were updated in 2009 with the aim of building capability in the following areas: Strategy and Performance; Change Management; Customer Experience; People Leadership; and Risk Management.Managing changeWe support employees at risk of redundancy. We always give notice, provide severance pay and offer assistance such as helping to pursue job opportunities internally and externally. Regrettably, due to the operating economic and business environment, it was necessary to make redundancies in 2009. We provide severance pay and offer assistance such as helping to pursuer job opportunities internally and externally. Regrettably, due to the operating economic and business environment, itwas necessary to make redundancies in 2009.We provide line management with specific training to manage such difficult changeEmployee satisfaction with Corporate SustainabilityOf the 14 aspects measured in the Global People Survey, Corporate Sustainability was the highest scoring at 79 per cent. This was an improvement of 2 percentage points on 2008 and 11 percentage points on 2007. When benchmarked externally, Corporate Sustainability at HSBC is 25 per cent above the global average and 12 per cent above the global ‘best in class’average. Employees reported favorable responses (see table) in the Global People Survey to the statement: Overall I am satisfied with the actions HSBC is taking to embed sustainability (e.g. environmental and social issues) into the way we run our business.Employees also gave favorable responses (see table) to the statement: I am actively encouraged to participate in community and environmental initiatives. Significantly more employees (44 per cent in 2009 compared with 35 per cent in 2008) said that they had participated in HSBC’s Corporate Sustainability activities. Employees who participate in such activities have considerably higher levels of engagement than those who do not, and are significantly more engaged across all aspects measured. Generally, the results show that employees are highly satisfied with HSBC’s Corporate Sustainability efforts, and are increasingly encouraged to take part in these activities.Investing in communitiesEducationOur flagship global education initiative is Future First, a five-year programmer launched in 2006 to a better future for disadvantaged children around the world. We work with SOS Children’s villages, among other charities, with the shared aim of providing access to education and life skills training. So far, more than 200 projects across 45 countries have benefited some 200,000 children.Financial and business literacy is fundamental to economic growth in developed and emerging markets, promoting trust in banks, and encouraging a responsible approach to managing loans and mortgages. According to a UK charity, Personal Finance Education Group, 66 per cent of British people believe that finance lessons would have helped them deal with today’s financial challenges.JA More Than Money is our global programmer addressing financial education and business literacy. Run in partnership with Junior Achievement Worldwide, in its pilot year in 2008-09, 1,500 HSBC staff volunteers taught financial skill to over46,000 children in 14 countries and territories. In 2009-10, the project has been expanded to 32 countries. JA is one of the world’s largest organizations dedicated to educating students about workforce readiness, entrepreneurship and financial literacy.In 2009, we launched the HSBC Eco-Schools Climate Initiative in partnership with the Foundation for Environmental Education. This is a three-year project involving 1,000 HSBC staff volunteers in 10 countries and reaching an estimated 1.2 million young people aged five to 18. The aim of the programmer is to inspire action on climate change by improving schools’ environmental efficiency.EnvironmentThe HSBC Climate Partnership is our flagship global environmental programmer, launched in 2007 with The Climate Group, Earth-watch and WWF to combat climate change by inspiring individuals, businesses and governments worldwide. Our achievements in 2009 are set out below.CitiesThe Climate Group is working in Beijing, Chicago, Hong Kong, London, and Mumbai, New York and to Toronto to boost the use of low carbon technologies. For example, in 2009 The Climate Group launched the Hong Kong Carbon Reduction Campaign-the first cross-industry collaboration on climate change by companies in Hong Kong –and co-founded the Mumbai Energy efficiency projects in the city.LearningIn 2009, a further 484 HSBC employees were trained as Climate Centre across the globe. The training, which is provided by Earth watch scientist, involves conducting field research into how temperate and tropical forests are responding to climate change. Since the HSBC Climate Partnership was launched, over 10,000 days of scientific filed research have been conducted by Earth watch scientist, local communities and HSBC employees.RiversThrough the HSBC Climate Partnership, WWF has helped to increase the number of protected areas in China’ central and lower Yangtze River delta coveringa total area of 1.65 million hectares. The protected areas will not only help safeguard50 threatened species, but will also provide land where large floods-which are predicted to increase as a result of climate change-can be absorbed, thereby protecting local communities.WWF has been tasked by the Chinese government with extending the ProtectedArea Network to the entire Yangtze River by the end of 2010. HSBC has alsocontinued to support WWF’s freshwater programmers in Brazil, India and the UK.ConclusionBased on the results of our procedures, nothing has come to our attention that causes us to believe that, for the year ended 31 December 2009, the selectedinformation has not been fairly stated in all material respects in accordance withHSBC’s Reporting Guidance.译文汇丰银行2009年可持续发展报告资料来源:汇丰银行网站ht t p://ww w.h s bc.co m/1/2/ 汇丰景况汇丰是“世界本地银行”。

1、Who is FSC? 誰是FSC?2、What is COC and Why COC? 什么是COC,为何需要COC?3、How to certify COC? 如何认证COC?4、FSC/COC quotationdetails? FSC/COC认证报价需要了解的信息?誰是FSC?FSC(The Forest Stewardship Council),简称FSC认证。

FSC是由世界自然基金会组织1993年在加拿大多伦多创建的一个非盈利性国际组织。

在建立大会上,来自25个国家的130名代表和其他具有广泛代表性的组织(例如森林工作者组织、社会和本土组织、木材工业和国际环境组织)参加了这次会议。

FSC是一个独立的、非赢利性的非政府组织,它的总部设在德国波恩。

FSC旨在促进对环境负责、对社会有益和在经济上可行的森林经营活动,为实现这些目标它倡导自愿、独立、第三方认证为主要的方法手段。

其宗旨就是联合全世界的人们一起解决因不正当采伐而造成的森林损坏,并提倡负责任的管理和开发森林。

因此,FSC认证是世界森林贸易网络(GFTN)的入会门槛。

每个国家的认证都是建立在10个通用的准则和森林评价标准。

主要包括社会的、环境的和经济的因素。

林业管理者和评价人员依据这些因素进行认证。

►FSC认证分为森林经营(FM)和产销监管链(CoC)认证。

FSC对认证本身并不感兴趣,它关注的是认证对林地造成的影响。

FSC原则与标准描述了如何经营森林以使其满足当代人和后代人的社会、经济、生态、文化和精神的需求,其中包括管理层面,以及对环境和社会方面的要求。

►FSC就产品的可追溯性进行认证,消费者可以通过证书号码查询到所购买的木制品原材料产地。

林业单位和木质品加工与贸易企业可以通过FSC认证来获得具有社会责任感的消费群体的认可。

通过FSC认证,可以追踪木制品从森林到消费者的整个过程,从而控制木材的合法性和确保其良好的来源,以及森林生态系统的完整性。

影响。

虽然我国目前上市公司现金分红的家数比重已经有较大提高,但分红水平仍然普遍较低,使得股东回报结构中的分红收益和资本利得长期处于失衡状态,相对于资本利得,分红收益对股东的吸引力很低,投机行为盛行。

为改善股东回报结构,促进我国资本市场的健康发展,应该提高上市公司的分红水平,本文提出以下政策建议:1.监管层加强监管为了保护投资者利益,培养证券市场的长期投资理念,监管层继续推进鼓励上市公司现金分红政策,使现金分红与上市公司再融资、年度考核等联系起来;监督上市公司完善利润分配的内部决策机制;同时加强上市公司对股利分配政策和实施情况的信息披露,完善相关信息披露制度,并且提高监管检查和惩罚力度。

2.上市公司完善内部决策机制按照有关规定,利润分配方案需经公司董事会和股东大会的决策,由于上市公司普遍存在“一股独大”现象,且小股东实际参与投票不多,所以是否进行现金分红基本决定于大股东,存在内部人控制现象。

因此,上市公司需要完善内部决策机制,鼓励小股东积极参与决策并为其参与投票提供更加便利的条件,提高小股东对利润分配的认知和参与热情,从而保护其投资利益。

3.不同发展阶段的上市公司区别对待一味强调或要求全部上市公司进行高比例的现金分红也未必有利于保护股东的利益,应该区别对待。

对于累计盈余丰厚、现金流量充足且处于稳定发展阶段的公司应鼓励其实施较高的现金分红比例,而对于处于高速发展,急需资本扩展阶段的公司则不应强制要求高比例现金分红。

同时上市公司应对其所实施的分红政策及政策的变化有充分、合理的解释,并及时进行披露,保护广大投资者的知情权。

参考文献:[1]李光贵.国有控股上市公司现金分红行为:实践总结———基于沪深A 股国有控股上市公司的描述性分析[J].北京:经济与管理研究,2009(11).[2]陈晓,陈小悦,倪凡.我国上市公司首次股利信号传递效应的实证研究[J].经济科学,1998(5).[3]国泰安信息技术有限公司.中国A 股上市公司派息率的变化:1995—2004[J].经济与管理研究,2006(9).[4]谢军.股利政策,第一大股东和公司成长性:自由现金流理论还是掏空理论[J].会计研究,2006(4).[5]刘淑莲,胡燕鸿.中国上市公司现金分红实证分析[J].会计研究,2003(4).(作者单位:广东省理工职业技术学校教务科)国外银行社会责任信息披露的经验与启示———以美国银行业为例蒋怡雯摘要:在建设社会主义和谐社会,实现经济可持续发展的大背景下,企业作为市场经济主体,理应承担应尽的社会责任,同时不断丰富信息披露内容,提高披露准确性和科学化水平,从而满足不同受众需要。

在华外商投资企业社会责任报告研究(2002-2010)

佚名

【期刊名称】《《WTO经济导刊》》

【年(卷),期】2011(000)011

【摘要】近年来,随着企业对社会责任报告价值的认识不断深入,越来越多的企业加入到发布社会责任报告的行列。

在华外商投资企业(简称"外资企业")作为中国发布社会责任报告的先行者,对于培育中国企业发布社会责任报告的意识具有启蒙作用,是中国社会责任报告发展的积极推动力量。

【总页数】8页(P33-40)

【正文语种】中文

【相关文献】

1.中国外商投资企业内部交易税收制度供给的路径选择——基于外商投资企业在华投资特点视角的分析 [J], 伍红

2.系统描述在华外商投资企业运营状况——《中国外商投资企业运营状况》简介[J], 冯雷

3.金蜜蜂在华外商投资企业CSR报告研究2015 [J],

4.新全球化时代外企CSR报告阶段性特征及趋势展望——2002-2012在华外资企业社会责任报告研究 [J], 赵钧

5.在华跨国公司中文企业社会责任报告调研报告 [J], 本刊编辑部;殷格非;于志宏;罗曙辉;杜娟

因版权原因,仅展示原文概要,查看原文内容请购买。

汇丰可持续发展战略汇丰可持续发展战略:商业经营“企业社会责任”2009-10-17 11:05:35 来源: 经济观察报(北京) 跟贴 0 条手机看新闻经济观察网记者胡蓉萍汇丰银行近日启动了其全球第五个区域性气候中心。

这个名为“汇丰与气候伙伴同行”的项目,早在2007年斥资1亿美元揭开序幕,主要用于支持减缓气候变化对城市、水、森林和人类影响的研究工作。

经济观察网记者就该项目和汇丰全球的可持续发展战略,独家专访了汇丰银行全球企业可持续发展总监西蒙·马丁。

他认为可持续发展不是在做慈善,而是应该像经营商业一样来经营可持续发展。

这包括利用“绿色贷款”政策鼓励企业走在可持续发展的道上;另外,通过推出环球气候变化基准指数,追踪那些最可能从应对气候变化中获益的主要公司的股价表现,让机构更有把握地投资于气候变化事业。

经济观察网:你觉得可持续发展战略项目的工作问题和挑战是什么?Simon Martin:事实上,这份工作和其他商业部门的工作很相像。

我客观地向我们的主席汇报工作,关于我们需要做什么,多少钱我们需要花出去,尤其是那些慈善基金。

我们应该去哪里,我们如何计算和应用这些支出,这是比较难做的工作,预算不像商业业务部门,目标很明确,比如就是花一百,赚一百一十。

但是可持续发展不一样,你肯定不会想一百块要生出个一百一来。

很显然,我们会更加看重我们所做的影响有多大,影响到了多少人,起到了多大的作用,但是这些都很难量化。

这就是另一个挑战。

另一方面,我的背景是一个商业人士,所以很显然我所领导的汇丰可持续发展的部门,也是商业倾向的,可以说,我们像经营商业一样在经营可持续发展,在各地有分支机构。

经济观察网:可持续发展部的工作如何影响了其他业务部门?比如说多大程度上影响了哪些公司银行、个人银行、贷款政策这方面。

能不能举例?Simon Martin:两个方面。

一是贷款政策方面,我们看哪个领域是环境敏感领域,然后我说好,我们必须看清楚如果我们贷款给我们客户,会造成环境恶化。

中国工商银行2009年企业社会责任报告案例介绍分析本文通过介绍中国工商的2009年企业社会责任报告,介绍了商业银行承担企业社会责任的作用:一是有助于商业银行自身的长远发展,例如文中的支持“三农”,可以拓展企业自身的业务,占领新的市场领域;在增大电子银行业务量的同时,率先占领了新的市场;二是可以向社会公众展示商业银行的经济实力、带来良好的广告效应;例如文中介绍的资助建立希望小学、对灾区进行捐款、志愿者活动等;三是还可能赢得政府的支持,例如成为广州亚运会唯一的银行业的合作伙伴,提高了企业的知名度。

同时提出政府应建立相应机制增强商业银行企业承担社会责任的动力,例如建立商业银行企业社会责任信息披露机制,健全问责机制、建立我国商业银行企业社会责任评价体系,推进我国商业银行企业社会责任法制化建设。

一、商业银行企业社会责任的定义根据国内外学者对企业社会责任理论的研究并结合实际,把商业银行企业社会责任定义为:商业银行在追求股东利润最大化过程中,维护非股东利益相关者的利益,包括政府利益、员工的利益、金融消费者的利益、债务人的利益、社区的利益等。

[1] [2]2010年3月25日,中国工商银行公开发布了《中国工商银行股份有限公司2009年度社会责任报告》[3],这是中国工商银行行连续第三年编制和发布社会责任报告。

报告依据参照《全球报告倡议组织(GRI)可持续发展报告指南》的结构指引编制,主要包括战略与概况、经济层面、环境层面、社会层面以及未来展望五个部分,重点介绍了工商银行在支持经济平稳发展、扶助中小企业、推行绿色信贷、推广电子银行、实施绿色办公、投身社会公益、关爱员工、诚信经营及优化服务等方面所做出的积极努力。

二、中国工商银行概况中国工商银行成立于1984 年1月1日,总部在北京。

2005年10月整体改制为股份公司。

2006年10月27日,在上海证券交易所和香港联合交易所同日挂牌上市。

工商银行向361万户公司客户和2.16亿个人客户提供广泛的金融服务,不仅在存贷款及结算等传统业务领域稳居国内同业首位,在大多数新兴业务领域也保持着领先优势,已成为中国最大的电子银行、结算银行、托管银行、年金银行、财富管理银行、基金分销行和信用卡发卡行。

汇丰银行:以身作则创造可持续发展未来

王先知

【期刊名称】《《WTO经济导刊》》

【年(卷),期】2009(000)009

【摘要】在接受《WTO经济导刊》记者采访时,汇丰银行亚太区企业可持续发展总监区佩儿坦言,企业社会责任是一个很大的话题,不是三言两语就能说清楚,也不仅仅只有慈善捐款才是履行社会责任。

据区佩儿介绍,环境保护是汇丰企业履行社会责任的重点,汇丰相信可持续发展离不开环境和资源的保护,企业必须确保其行动和决策符合人类的长远利益。

在中国,汇丰的环保实践主要体现在支持社区环保项目,运营管理和环境风险管理三个方面。

她还表示:"作为全球首家实现碳中和的大型银行,汇丰肩负领导角色,向员工、供应商、业务伙伴、客户、市民大众等,广泛推广环保理念,使经济、社会及环境得以平衡及和谐地发展。

"

【总页数】2页(P42-43)

【作者】王先知

【作者单位】(Missing)

【正文语种】中文

【相关文献】

1.中国终于有了像GE一样牛的企业:不预测未来,但创造未来!不预测未来,但创造未来!中国终于有了像GE一样牛的企业: [J], 杨京宁

2.“贷款授信和可持续发展是并行不悖的”——访汇丰银行全球企业可持续发展总监西蒙·马丁 [J],

3.教育为可持续发展服务通过教育创造亚太地区可持续发展未来 [J], 阿部秋;法因.约翰;等

4.以永续循环产品创造美好未来

——访赛得利集团传播和可持续发展副总裁孙剑 [J], 王秋蓉

5.陶氏环保产品保障绿色未来——降低全球温室气体排放,陶氏以身作则坚持可持续发展道路 [J],

因版权原因,仅展示原文概要,查看原文内容请购买。

新疆金风科技股份有限公司2009年度社会责任报告企业是社会的细胞,是社会的重要组成部分,也是社会发展的重要推动力。

金风科技在成长道路上受到政府、股东、社会各界的大力支持,公司在享用社会资源获取利润的同时,时刻不忘回报股东、回馈社会,承担对政府、客户、员工、社区等利益相关者以及对环境的责任。

金风科技积极履行各项社会责任,致力于成为一个受全社会尊重的优秀“企业公民”。

现将2009年金风科技社会责任履行情况汇报如下:第一章 股东和债权人权益保护股东是企业生存的根本,股东的认可和支持是促进企业良性发展的动力,保障股东权益、公平对待所有股东是公司的义务和职责。

公司依据《公司法》、《证券法》、《上市公司章程指引》、《上市公司股东大会规范意见》等有关规定,不断健全和完善法人治理结构,形成了股东大会、董事会、监事会和经营层相互分离、相互制衡的公司治理结构,使各层次在各自的职责和权限范围内,各司其职,各负其责,确保了公司的规范运作,使公司股东和债权人的权益得到切实保护。

在股东大会召开时合理安排召开时间,积极选用网络投票等形式,以方便全体股东参与公司经营管理,在选举董、监事时实行累积投票制度,充分保障中、小股东的合法权益。

公司在经营中诚实守信、规范经营,近年来公司经营业绩持续增长,资产规模不断扩大,综合实力迅速提高,抵御风险能力也得到加强。

2009年度,在全球金融危机的严峻形势下,公司团结奋进、攻坚克难,生产、经营等方面都取得良好成绩。

实现营业收入 107.38亿元,同比增长66.28%;归属母公司股东净利润17.46亿元,同比增长92.58%; 公司在自身成长与发展的同时,高度重视和积极回报股东,自上市以来,累计派发现金红利3.3亿元,派送红股9亿股。

公司严格按照相关法律法规的规定和要求,自觉自愿履行信息披露义务,做好信息披露工作,确保信息披露的真实、准确、及时、完整和公平,以利于公司股东和债权人及时了解、掌握公司经营动态、财务状况及所有重大事项的进展情况。

2009第一财经•企业社会责任榜(环境友好奖)获得环境友好奖的公司是:通用电气(中国)有限公司、西门子(中国)有限公司、上海通用汽车有限公司、安利(中国)日用品有限公司、广汽丰田汽车有限公司、梅赛德斯-奔驰(中国)汽车销售有限公司获得员工关怀奖的公司:陶氏化学(中国)有限公司、上海海立集团股份有限公司、交通银行股份有限公司、东风日产乘用车公司获得杰出企业奖之社会贡献奖的公司:万科企业股份有限公司、中国民生银行股份有限公司、中国平安保险(集团)股份有限公司、中国工商银行股份有限公司、大众汽车集团(中国)获得杰出企业奖之产业创新奖的公司:夏普商贸(中国)、富士胶片(中国)投资有限公司、IBM国际商业机器(中国)有限公司、广汽本田汽车有限公司、联想集团有限公司优秀实践奖:金龙精密铜管集团股份有限公司、飞利浦(中国)投资有限公司、荷兰皇家飞利浦电子公司、德勤永华会计事务所有限公司、金地(集团)股份有限公司、金地集团上海公司、广州富力地产股份有限公司、联合技术国际公司、宝洁(中国)有2010中国企业社会责任榜杰出企业奖获奖名单[郎永淳]首先我公布2010中国·企业社会责任榜杰出企业奖的获奖企业名单,获奖企业分别是中国中钢集团、中国石油化工股份有限公司、中国石油天然气公司、中国五矿集团、丽江华坪永兴煤炭有限责任公司、美的集团、中国三星集团、中国东方航空公司、中国建设银行、华夏银行、北京汽车集团有限公司、内蒙古伊利集团有限公司、多美滋婴幼儿食品有限公司、福建七匹狼实业股份有限公司、连天红(福建)家具有限公司、华硕集团、康宝莱保健品有限公司,我们用掌声向以上的获奖企业表示祝贺。

丽江华坪永兴煤炭有限责任公司高度重视员工企业的培养,经本次组委会商议,特别授予丽江华坪永兴煤炭有限责任公司获得企业社会责任榜员工关怀奖,有请刘仪主席为毛凯先生颁奖。

汇丰银行“投资”可持续作者:来源:《中国慈善家》2013年第09期汇丰银行认为,从投资的角度看待企业社会责任,有利于实现项目的社会效益最大化在中国银行业,连续七年获得“中国慈善奖”的企业只有一家,就是汇丰银行。

“汇丰把企业视作社会的一分子。

企业的经营与社会、环境、经济三要素息息相关,若这三个维度不可持续,企业的经营也将不可持续。

”汇丰银行可持续发展总监张惠峰告诉《中国慈善家》。

在汇丰银行内部,专门负责履行企业社会责任的部门名为企业可持续发展部,是汇丰银行全球十大核心部门之一,寄托着其对企业社会责任的更高层次理想。

对于汇丰银行来说,履行企业社会责任,是一项投资,而非简单的捐赠。

每隔六周,张惠峰就带着他和他的团队筛选出来的项目,从北京奔赴上海汇丰中国总部,向汇丰中国企业可持续发展委员会汇报项目计划和进展,委员会成员们会对项目的风险和社会效益进行严密评估。

在环保、教育领域投资可持续发展项目,是汇丰银行履行企业社会责任的主要方向。

2012年6月15日,汇丰银行联合世界自然基金会、地球观察共同发起“汇丰水资源计划”,汇丰银行为之投资1亿美元。

该项目跨度5年,将致力于应对中国长江流域的水资源管理问题,加强公众对水资源保护的认知,推动水资源的可持续发展和利用。

此前,汇丰银行已经发起过几次系统性解决环境问题的环保计划。

自2002年开始,汇丰银行启动了为期5年的“投资大自然”全球环境保护项目,汇丰第一期出资3000万元保护长江中游生态。

到2006年年底项目结束时,450平方公里的湿地因该项目得到有效保护,多片湖面渔网鱼杆遍布的景象消失了,湖面重新回到了水草丰茂、水鸟翱翔的状态。

为了进一步推进环境保护行动,2007年,汇丰银行斥资1亿美元,在全球范围内启动了为期5年的“汇丰与气候伙伴同行”项目。

除了系统的环保项目,汇丰在环境教育方面也不遗余力。

2009年,汇丰出资250万美元,与国际环境教育基金会合作,开展“汇丰生态学校气候变化项目”,为包括中国在内的11个国家的5至18岁青少年提供生态学校环境教育。

汇丰(中国)企业社会责任报告2008(环境部分)

佚名

【期刊名称】《世界环境》

【年(卷),期】2009(000)004

【摘要】汇丰银行(中国)有限公司(下称“汇丰中国”)于2007年4月2日

正式开业,总行设于上海,是香港上海汇丰银行有限公司全资拥有的外商独资银行,其前身是香港上海汇丰银行有限公司的原中国内地分支机构。

【总页数】2页(P65-66)

【正文语种】中文

【相关文献】

1.和谐共成长——中国移动通信集团公司2008企业社会责任报告(环境部分) [J],

2.把环保作为安利的天职——安利2008企业社会责任报告(环境部分) [J],

3.2007年安赛乐米塔尔企业社会责任报告(环境部分) [J],

4.中国航天科工集团公司向社会发布《2008年度企业社会责任报告》 [J], 孙建平

5."金蜜蜂2008企业社会责任报告·中国榜"即将出炉 [J], 张墨宁

因版权原因,仅展示原文概要,查看原文内容请购买。