会计基础第二章

- 格式:docx

- 大小:21.76 KB

- 文档页数:6

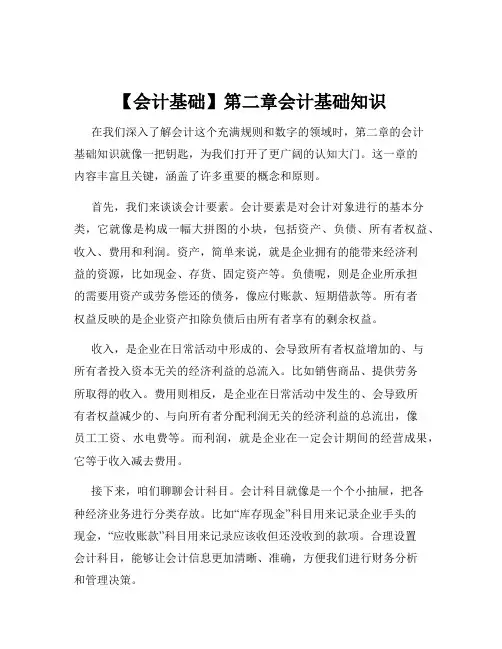

【会计基础】第二章会计基础知识在我们深入了解会计这个充满规则和数字的领域时,第二章的会计基础知识就像一把钥匙,为我们打开了更广阔的认知大门。

这一章的内容丰富且关键,涵盖了许多重要的概念和原则。

首先,我们来谈谈会计要素。

会计要素是对会计对象进行的基本分类,它就像是构成一幅大拼图的小块,包括资产、负债、所有者权益、收入、费用和利润。

资产,简单来说,就是企业拥有的能带来经济利益的资源,比如现金、存货、固定资产等。

负债呢,则是企业所承担的需要用资产或劳务偿还的债务,像应付账款、短期借款等。

所有者权益反映的是企业资产扣除负债后由所有者享有的剩余权益。

收入,是企业在日常活动中形成的、会导致所有者权益增加的、与所有者投入资本无关的经济利益的总流入。

比如销售商品、提供劳务所取得的收入。

费用则相反,是企业在日常活动中发生的、会导致所有者权益减少的、与向所有者分配利润无关的经济利益的总流出,像员工工资、水电费等。

而利润,就是企业在一定会计期间的经营成果,它等于收入减去费用。

接下来,咱们聊聊会计科目。

会计科目就像是一个个小抽屉,把各种经济业务进行分类存放。

比如“库存现金”科目用来记录企业手头的现金,“应收账款”科目用来记录应该收但还没收到的款项。

合理设置会计科目,能够让会计信息更加清晰、准确,方便我们进行财务分析和管理决策。

再说说会计账户。

会计账户是根据会计科目设置的,具有一定的格式和结构,用于分类反映会计要素增减变动情况及其结果。

账户有借方和贷方,通过借贷记账法来记录业务的发生。

借贷记账法是会计核算中非常重要的一种方法。

“借”和“贷”只是一种符号,没有实际的含义,它们所表示的增减取决于账户的性质。

比如资产类账户,借方表示增加,贷方表示减少;负债和所有者权益类账户则正好相反,贷方表示增加,借方表示减少。

然后是会计凭证。

会计凭证就像是经济业务的“通行证”,分为原始凭证和记账凭证。

原始凭证是经济业务发生时取得或填制的,用来证明经济业务发生或完成情况的书面证明,比如发票、收据等。

基础会计第二章试题及答案一、单项选择题(每题2分,共20分)1. 会计的基本职能是()。

A. 核算和监督B. 预测和决策C. 计划和控制D. 组织和领导答案:A2. 会计核算的基本前提不包括()。

A. 会计主体B. 持续经营C. 会计分期D. 货币计量答案:D3. 会计信息的质量要求中,要求企业应当合理地确认、计量和报告各项会计要素,这体现了会计信息的()。

A. 可靠性B. 相关性C. 可理解性D. 及时性答案:A4. 会计要素中,反映企业财务状况的要素包括()。

A. 资产、负债、所有者权益B. 收入、费用、利润C. 资产、负债、利润D. 资产、所有者权益、利润答案:A5. 会计等式“资产=负债+所有者权益”反映了()。

A. 资产的来源B. 资产的运用C. 资产与权益的关系D. 收入与费用的关系答案:C6. 会计核算中,下列项目中属于流动资产的是()。

A. 长期股权投资B. 固定资产C. 存货D. 无形资产答案:C7. 会计核算中,下列项目中属于流动负债的是()。

A. 长期借款B. 应付债券C. 应付账款D. 长期应付款答案:C8. 会计核算中,下列项目中属于所有者权益的是()。

A. 资本公积B. 盈余公积C. 未分配利润D. 所有上述选项答案:D9. 会计核算中,下列项目中属于收入的是()。

A. 销售商品收入B. 提供劳务收入C. 让渡资产使用权收入D. 所有上述选项答案:D10. 会计核算中,下列项目中属于费用的是()。

A. 销售费用B. 管理费用C. 财务费用D. 所有上述选项答案:D二、多项选择题(每题3分,共15分)1. 会计核算的基本前提包括()。

A. 会计主体B. 持续经营C. 会计分期D. 货币计量答案:ABC2. 会计信息的质量要求包括()。

A. 可靠性B. 相关性C. 可理解性D. 及时性答案:ABCD3. 会计要素中,反映企业经营成果的要素包括()。

A. 收入B. 费用C. 利润D. 负债答案:ABC4. 会计核算中,下列项目中属于非流动资产的是()。

基础会计第二章试题及答案解析一、单选题1. 会计的基本职能是什么?A. 核算与监督B. 决策与执行C. 计划与控制D. 组织与协调答案:A解析:会计的基本职能是核算与监督,它通过记录、分类、汇总和分析财务信息,为决策提供依据。

2. 会计要素中的资产具有哪些特征?A. 为企业提供未来经济利益B. 企业拥有或控制C. 企业能够自由支配D. 所有选项都是答案:D解析:资产是企业拥有或控制的,能够为企业提供未来经济利益的资源。

3. 负债是指企业过去的交易或事项形成的,预期会导致企业经济利益流出的义务。

这种说法正确吗?A. 正确B. 错误答案:A解析:负债确实是指企业因过去的交易或事项形成的,预期会导致经济利益流出的义务。

二、多选题1. 以下哪些属于会计信息质量要求?A. 可靠性B. 相关性C. 可理解性D. 及时性答案:A, B, C, D解析:会计信息质量要求包括可靠性、相关性、可理解性和及时性,这些要求确保了会计信息的质量和有效性。

2. 会计核算的基本前提包括哪些?A. 会计分期B. 持续经营C. 货币计量D. 历史成本答案:A, B, C解析:会计核算的基本前提包括会计分期、持续经营和货币计量,这些前提为会计核算提供了基础。

三、判断题1. 会计核算的基本原则包括历史成本原则和公允价值原则。

()答案:正确解析:会计核算的基本原则确实包括历史成本原则和公允价值原则,它们是会计核算的重要基础。

2. 会计信息的使用者只包括企业的内部管理层。

()答案:错误解析:会计信息的使用者不仅包括企业的内部管理层,还包括外部投资者、债权人、政府等。

四、简答题1. 简述会计的基本假设。

答案:会计的基本假设包括会计分期、持续经营、货币计量和历史成本。

会计分期假设将企业的经济活动划分为若干个会计期间;持续经营假设认为企业将长期存在并继续其经营活动;货币计量假设认为企业的财务交易可以用货币来衡量;历史成本假设则认为资产和负债应以其取得时的成本来计量。

2024年初级会计职称考试初级会计实务新大纲第二章会计基础2024年初级会计职称考试初级会计实务新大纲第二章会计基础第二章会计基础第一节会计的概念与目标一、会计的概念与特征(一)会计的概念会计是以货币为主要计量单位,运用一系列专门的方法和程序,对经济交易或事项进行连续、系统、全面地核算和监督,并向有关利益相关者提供财务信息,参与经营决策,提高经济效益的一种管理活动。

(二)会计的特征1、以货币作为主要计量单位;2、使用一系列专门的方法和程序;3、连续、系统、全面地进行核算和监督;4、向有关利益相关者提供财务信息;5、参与经营决策,提高经济效益。

二、会计的目标会计的目标是向会计信息使用者提供决策有用的财务信息,满足投资者、债权人、政府等相关方面对财务信息的需求。

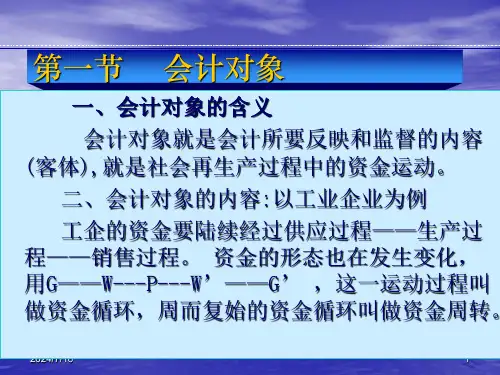

第二节会计要素与会计等式一、会计要素会计要素是对会计对象的基本分类,是会计核算对象的具体化。

它反映了会计主体的财务状况和经营成果。

会计要素包括资产、负债、所有者权益、收入、费用和利润。

(一)资产资产是指企业过去的交易或事项形成的,由企业拥有或控制的,预期会给企业带来经济利益的资源。

资产按其流动性可分为流动资产和长期资产。

(二)负债负债是指企业过去的交易或事项形成的,预期会导致经济利益流出企业的现时义务。

负债按其流动性可分为流动负债和长期负债。

(三)所有者权益所有者权益是指企业所有者在企业资产中享有的经济利益。

所有者权益按其来源可分为实收资本(或股本)、资本公积、盈余公积和未分配利润。

(四)收入收入是指企业在日常活动中形成的,会导致所有者权益增加的,与所有者投入资本无关的经济利益的总流入。

按收入的来源可分为销售商品收入和提供劳务收入。

(五)费用费用是指企业在日常活动中发生的,会导致所有者权益减少的,与向所有者分配利润无关的经济利益的总流出。

费用按其经济用途可分为制造成本和期间费用。

(六)利润利润是指企业在一定会计期间的经营成果,包括营业利润、利润总额和净利润。

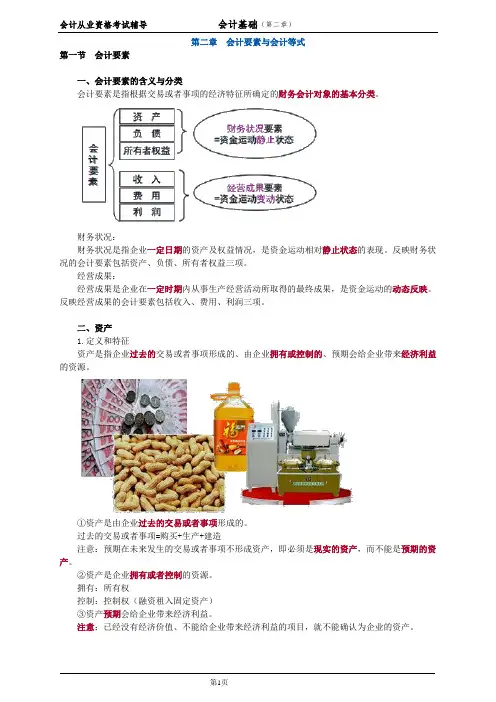

第二章会计要素与会计等式第一节会计要素一、会计要素的含义与分类会计要素是指根据交易或者事项的经济特征所确定的财务会计对象的基本分类。

财务状况:财务状况是指企业一定日期的资产及权益情况,是资金运动相对静止状态的表现。

反映财务状况的会计要素包括资产、负债、所有者权益三项。

经营成果:经营成果是企业在一定时期内从事生产经营活动所取得的最终成果,是资金运动的动态反映。

反映经营成果的会计要素包括收入、费用、利润三项。

二、资产1.定义和特征资产是指企业过去的交易或者事项形成的、由企业拥有或控制的、预期会给企业带来经济利益的资源。

①资产是由企业过去的交易或者事项形成的。

过去的交易或者事项=购买+生产+建造注意:预期在未来发生的交易或者事项不形成资产,即必须是现实的资产,而不能是预期的资产。

②资产是企业拥有或者控制的资源。

拥有:所有权控制:控制权(融资租入固定资产)③资产预期会给企业带来经济利益。

注意:已经没有经济价值、不能给企业带来经济利益的项目,就不能确认为企业的资产。

船厂将船以3000万元销售给某财团,我们通过融资租赁的方式租入该船,我们虽然对该船虽然没有所有权,但是拥有控制权,我们将该船作为我们的资产。

【例题·多选题】下列项目中,属于资产要素特点的有()。

A.预期能给企业带来未来经济利益的资源B.过去的交易或事项形成的C.必须拥有所有权D.必须是有形的『正确答案』AB『答案解析』选项C错误,可以拥有其控制权;选项D错误,可以是无形的,例如专利权等。

2.资产的确认条件将一项资源确认为资产,需要符合资产的定义,还应同时满足以下两个条件:(1)与该资源有关的经济利益很可能流入企业;(2)该资源的成本或者价值能够可靠地计量。

3.分类2年的货物,1年以上的债权也属于流动资产。

流动资产:(1)预计在一个正常营业周期中变现、出售或耗用,(2)或者主要为交易目的而持有,(3)或者预计在资产负债表日起一年内(含一年)变现的资产,以及自资产负债表日起一年内交换其他资产或清偿负债的能力不受限制的现金或现金等价物。

基础会计第二章知识点

嘿,咱来讲讲基础会计第二章的知识点哈!就说会计科目吧,那可真是像一个个小盒子,把各种经济业务分类装起来呢!比如“库存现金”这个科目,就好比你钱包里的钱呀,专门用来放现金的。

而账户呢,就像给这些小盒子贴上标签,记录它们的详细情况。

比如说银行存款账户,里面会清楚地记录每一笔存进去和取出来的钱。

再看看复式记账,哇塞,这就像是走平衡木一样,有借必有贷,借贷必相等!就好像你左边口袋放了一块钱,那右边口袋就得有相应的变化,不然就不平衡啦!比如你买东西花了 50 块钱,那你的资产减少了 50 块,同时你支出也增加了 50 块,这多有意思呀!

还有会计凭证,那可是会计信息的“证据”呀!像发票、收据这些,就好像是你做了某件事的“证据”一样。

比如说你买东西拿到的发票,不就是证明你花钱买了这个东西嘛。

基础会计第二章的这些知识点真的太重要啦!它们就像是搭建会计大厦的基石,没有它们可不行呀!咱可得好好掌握,才能在会计的世界里游刃有余呀!。

第二章会计要素与会计科目第一节会计要素一、会计要素的概念及分类会计要素是会计对象按经济特征所作的最基本分类,也是会计核算对象的具体化。

企业会计要素分为六大类,即资产、负债、所有者权益、收入、费用和利润。

事业单位会计要素分为五大类,即资产、负债、净资产、收入和支出。

资产、负债、所有者权益=静止状态=财务状况收入、费用和利润=运动状态=经营成果【例题·单选题】下列属于反映企业财务状况的会计要素是()。

A.收入B.所有者权益C.费用D.利润『正确答案』B(一)反映财务状况的会计要素财务状况是指企业一定日期的资产及权益情况,是资金运动相对静止状态时的表现。

反映财务状况的会计要素包括资产、负债、所有者权益三项。

1.资产(1)资产的定义及基本特征资产是指企业过去的交易或者事项形成的、由企业拥有或者控制的、预期会给企业带来经济利益的资源。

①资产能够直接或间接地给企业带来经济利益。

【例2-1】某企业的某工序上有两台机床,其中G机床型号较老,自H机床投入使用后,一直未再使用;H机床是G机床的替代产品,目前承担该工序的全部生产任务。

G、H机床是否都是企业的固定资产?G机床不应确认为该企业的固定资产。

该企业原有的G机床已长期闲置不用,不能给企业带来经济利益,因此不应作为资产反映在资产负债表中。

②资产是为企业拥有的,或者即使不为企业所拥有,也是企业能够控制的。

【例2-2】甲企业的加工车间有两台设备。

A设备系从乙企业融资租入获得,B设备系从丙企业以经营租入方式获得,目前两台设备均投入使用。

A、B设备是否为甲企业的资产?经营租入:甲企业对经营租入的B设备既没有所有权也没有控制权,因此B设备不应确认为甲企业的资产。

融资租入:甲企业对融资租入的A设备虽然没有所有权,但享有与所有权相关的风险和报酬的权利,即拥有实际控制权,因此应将A设备确认为甲企业的资产。

③资产是由过去的交易或事项形成的。

资产是过去已经发生的交易或事项所产生的结果,资产必须是现实的资产,而不能是预期的资产。

会计基础第二章试题及答案一、选择题1. 会计的基本职能是()。

A. 记账、算账、报账B. 计划、组织、领导、控制C. 预测、决策、控制、评价D. 核算、监督答案:D2. 会计要素中的资产是指()。

A. 企业拥有或控制的资源B. 企业预期会给企业带来经济利益的资源C. 企业拥有或控制的、预期会给企业带来经济利益的资源D. 企业预期会减少经济利益的资源答案:C3. 下列哪项不是会计信息质量要求()。

A. 可靠性B. 相关性C. 及时性D. 可理解性答案:D二、判断题1. 会计的基本假设包括会计主体、持续经营、货币计量和会计分期。

()答案:正确2. 会计准则要求企业在编制财务报表时,应遵循历史成本原则。

()答案:正确3. 会计的监督职能是确保企业的所有经济活动都符合国家法律法规。

()答案:错误(会计的监督职能主要是确保会计信息的真实性、合法性和合规性)三、简答题1. 简述会计信息的使用者及其需求。

答案:会计信息的使用者主要包括投资者、债权人、政府及其相关部门、企业管理者等。

投资者需要会计信息来评估企业的盈利能力、风险水平,以做出投资决策;债权人利用会计信息来评估企业的偿债能力和财务状况,以决定是否提供贷款或信贷;政府及其相关部门需要会计信息进行税收征管、经济调控等;企业管理者则利用会计信息进行日常管理决策和战略规划。

2. 解释会计要素中的负债和所有者权益的区别。

答案:负债是指企业因过去的交易或事项形成的、预期会导致经济利益流出企业的现时义务。

所有者权益则是指企业所有者对企业净资产的权益,包括投入的资本、留存收益等。

两者的主要区别在于负债是企业的债务,需要偿还;而所有者权益是企业所有者的资产,不需要偿还,可以分享企业的盈利。

四、计算题1. 某企业在2023年1月1日的资产总额为500万元,负债总额为200万元。

如果该企业在1月31日的资产总额增加到550万元,负债总额增加到220万元,请计算该企业的1月31日的所有者权益总额。

第二章会计要素与会计科目一、单项选择1、企业在日常活动中形成的、会导致所有者权益增加的、与所有者投入资本无关的经济利益的总流入称为()。

A、资产B、利得C、收入D、利润2、由企业非日常活动所发生的,会导致所有者权益减少的、与向所有者分配利润无关的经济利益的流出称为()。

A、费用B、损失C、负债D、所有者权益3、广义的权益一般包括( )A、资产和所有者权益B、债权人权益和所有者权益C、所有者权益D、资产和债权人权益4、下列属于资产项目的是()。

A、原材料B、预收账款C、实收资本D、资本公积5、( )是对会计对象的基本分类.A、会计科目B、会计原则C、会计要素D、会计方法6、流动资产是指预计变现、出售或耗用期限在()的资产.A、一年以内B、一个正常营业周期以内C、超过一年的一个营业周期以内D、超过两年的一个营业周期以内7、下列属于企业的流动资产的是( )。

A、存货B、厂房C、机器设备D、专利权8、所有者权益在数量上等于().A、全部资产减去全部负债后的净额B、所有者的投资C、实收资本与资本公积之和D、实收资本与未分配利润之和9、下列各项中,不属于收入要素内容的是()。

A、销售商品取得的收入B、提供劳务取得的收入C、出租固定资产取得的收入D、营业外收入10、下列各项中,不属于费用要素内容的是()。

A、销售费用B、管理费用C、财务费用D、预付账款11、下列项目中,属于所有者权益的是()。

A、长期借款B、银行存款C、预收账款D、实收资本12、下列项目中,属于货币资金的是()。

A、商业承兑汇票B、银行承兑汇票C、银行本票存款D、可转换债券13、以下说法中正确的是().A、收入是在日常活动中形成的、会导致所有者权益增加的、与所有者投入资本无关的经济利益的总流入B、经济利益的流入必然是由收入形成的C、只有日常经营活动才会产生支出D、费用就是成本14、会计科目是指对( )的具体内容进行分类核算的项目。

A、经济业务B、会计要素C、会计账户D、会计信息15、会计科目按其所( )不同,分为总分类科目和明细分类科目。

Chapter 2 NotesEach business transaction is recorded in the accounting equation under a specific account. Different accounts are used for each of the subdivisions of the accounting equation: asset accounts, liabilities accounts, expense accounts, revenue accounts, and so on. What is needed is a way to record the increases and decreases in specific account categories and yet keep them together in one place. The answer is the standard account form (see Figure 2.1). A standard account is a formal account that includes columns for date, item, posting reference, debit, and credit. Each account has a separate form, and all transactions affecting that account are recorded on the form.What is needed is a way to record the increases and decreases in specific account categories and yet keep them together in one place. The answer is the standard account form (see Figure 2.1). A standard account is a formal account that includes columns for date, item, posting reference, debit, and credit. Each account has a separate form, and all transactions affecting that account are recorded on the form.Each account has a separate form, and all transactions affecting that account are recorded on th e form. All the business… account forms (often referred to as ledger accounts) are then placed in a ledger. Each page of the ledger contains one account. The ledger may be in the form of a bound or a loose-leaf book. If computers are used, the ledger m ay be part of a computer file. For simplicity‟s sake, we use the T account form. This form got its name because it looks like the letter T. Generally, T accounts are used for demonstration purposes.Each T account contains three basic parts:•Title of account•Left sideRight sideAll T accounts have this structure. In accounting, the left side of any T account is called the debit side.Just as the word left has many meanings, the word debit for now in accounting means a position, the left side of an account. Do not think of it as good (+) or bad (-). Amounts entered on the left side of any account are said to be debited to an account. The abbreviation for debit, Dr., is from the Latin debere.The right side of any T account is called the credit side. Amounts entered on the right side of an account are said to be credited to an account. The abbreviation for credit, Cr., is from the Latin credere.At this point do not associate the definition of debit and credit with the words increase or decrease. Think of debit or credit as only indicating a position (left or right side) of a T account.Balancing an AccountNo matter which individual account is being balanced, the procedure used to balance it is the same.In the “real” world, the T account would also include the date of the transaction. The date would appear to the left of the entry.Note that on the debit (left) side the numbers add up to $5,600. On the credit (right) side the numbers add up to $900. The $5,600 and the $900 written in small type are called footings. Footings help in calculating the new (or ending) balance. The ending balance ($4,700) is placed on the debit or left side, because the balance of the debit side is greater than that of the credit side.Remember that the ending balance does not tell us anything about increase or decrease. It only tells us that we have an ending balance of $4,700 on the debit side. Instead of first trying to understand all the rules of debit and credit and how they were developed in accounti ng, it is easier to learn the rules by “playing the game.”Have patience. Learning the rules of debit and credit is like learning to play any game: the more you play, the easier it becomes. Table 2.1 shows the rules for the side on which you enter an increase or a decrease for each of the separate accounts in the accounting equation:•Assets are increased with debits and decreased with credits•Liabilities are increased with credits and decreased with debits•Owners‟ Equity Capital account is increased wit h credits and decreased with debits•Withdrawals are increased with debits and decreased with credits•Revenues are increased with credits and decreased with debits•Expenses are increased with debits and decreased with creditsA normal balance of an account is the side that increases by the rules of debit and credit. For example, the balance of cash is a debit balance, because an asset is increased by a debit. We discuss normal balances further in Chapter 3.It might be easier to visualize these rules of debit and credit if we look at them in the T account form, using + to show increase and - to show decrease.Rules for Assets Work in the Opposite Direction to Those for Liabilities When you look at the equation you can see that the rules for assets work in the opposite direction to those for liabilities. That is, for assets the increases appear on the debit side and the decreases are shown on the credit side; the opposite is true for liabilities. As for the owner‟s equity, the rules for withdrawals and e xpenses, whichdecrease owner‟s equity, work in the opposite direction to the rules for capital and revenue, which increase owner‟s equity.This setup may help you visualize how the rules for withdrawals and expenses are just the opposite of those for capital and revenue.Balancing the EquationIt is important to remember that any amount(s) entered on the debit side of a T account or accounts also must be on the credit side of another T account or accounts. This approach ensures that the total amount added to the debit side will equal the total amount added to the credit side, thereby keeping the accounting equation in balance.Our job is to analyze business transactions using a system of accounts guided by the rules of debit and credit that will summarize increases and decreases of individual accounts in the ledger. The goal is to prepare an income statement, statement of owner‟s equity, and balance sheet.The chart of accounts is a numbered list of all of the business' accounts. It allows accounts to be located quickly. In business, for example, 100s are assets, 200s are liabilities, and so on. As you see in Table 2.2, each separate asset and liability account has its own number. Note that the chart may be expanded as the business grows.We will analyze the transactions using a teaching device called a transaction analysis chart to record these five steps. Keep in mind that the transaction analysis chart is not a part of any formal accounting system.) The five steps to analyzing each business transaction include the following:Step 1 Determine which accounts are affected.Example: Cash, Accounts Payable, Rent Expense. A transaction always affects at least two accounts.Step 2 Determine which categories the accounts belong to: assets, liabilities, capital, withdrawals, revenue, or expenses.Example: Cash is an asset.Step 3 Determine whether the accounts increase or decrease.Example: If you receive cash, that account increases.Step 4 What do the rules of debit and credit say (Table 2.1)?Step 5 What does the T account look like? Place amounts into accounts either on the left or right side depending on the rules in Table 2.1.The following chart shows the five-step analysis from another perspective:1.Accounts affected2.Category3.Decrease or increase4.Rules of Dr. and Cr.5.Appearance of T AccountsDo not try to debit or credit an account until you go through the first three steps of the transaction analysis.A transaction that involves more than one debit or more than one credit is called a compound entry. This first transaction of Mia Wong‟s law firm is a compound entry; it involves a debit of $6,000 to Cash and a debit of $200 to Office Equipment (as well as a credit of $6,200 to Mia Wong, Capital).The name for this double-entry analysis of transactions, where two or more accounts are affected and the total of debits and credits is equal, is double-entry bookkeeping. This double-entry system helps in checking the recording of business transactions.As we saw in Learning Unit 2-2, when all the transactions are recorded in the accounts, the total of all the debits should be equal to the total of all the credits. If they are not, the accountant must go back and find the error by checking the numbers and adding every column again.The Trial BalanceFootings are used to obtain the totals of each side of every T account that has more than one entry. The footings are used to find the ending balance. The ending balances are used to prepare a trial balance. The trial balance is not a financial statement, although it is used to prepare financial statements. The trial balance lists all the accounts with their balances in the same order as they appear in the chart of accounts. It proves the accuracy of the ledger.The trial balance lists all the accounts with their balances in the same order as they appear in the chart of accounts. It proves the accuracy of the ledger.Keep in mind that the figure for capital might not be the beginning figure if any additional investment has taken place during the period. You can tell by looking at the capital account in the ledger.A more detailed discussion of the trial balance is provided in the next chapter. For now, notice the heading, how the accounts are listed, the debits in the left column, the credits in the right, and that the total of debits is equal to the total of credits.The trial balance is used to prepare the financial statements.The trial balance is a list of accounts and their ending balances. Each accountwill have either a debit or credit balance (but not both). When a trial balance is complete the total of all the debits must equal the total of all the credits. When preparing a trial balance you list out assets, liabilities, capital, withdrawals, revenue, and expenses.Income StatementOnce the trial balance is complete the first report to make is the income statement, which is made up of only revenue and expense. Remember that there are no debits or credits on financial reports. All we are taking are the ending balances of each title from the trial balance.Statement of Owner’s EquityThe second report to prepare is the statement of owner‟s equity, which shows how to calculate a new figure for capital.Balance SheetThe third report is the balance sheet, which lists out each asset, liability, and the new figure for capital.The chart of accounts aids in locating and identifying accounts quickly.Remember that the rules of debit and credit only tell us on which side to place information. Whether the debit or credit represents increases or decreases depends on the account category: assets, liabilities, capital, and so on. Think of a business transaction as an exchange: you get something and you give or part with something.A transaction that involves more than one debit or more than one credit is called a compound entry.You will notice that assets, withdrawals, and expenses increase when you put amounts on the left, or debit, side of these accounts. The accounting system balances because liabilities, capital, and revenue increase when you put amounts on the right, or credit, side of these accounts. The increase side of any account will represent its normal balance.Footings are used to obtain the totals of each side of every T account that has more than one entry. The footings are used to find the ending balance. The ending balances are used to prepare a trial balance. The trial balance is not a financial statement, although it is used to prepare financial statements. The trial balance lists all the accounts with their balances in the same order as they appear in the chart of accounts.The trial balance is a list of ending balances of ledger accounts. These balances are used to prepare the three financial reports. Financial reports have no debits or credits. The inside columns are used to subtotal numbers. Revenue and expensesgo on the income statement. Withdrawals and either net income or net loss go on the statement of owner‟s equity to calculate a new figu re for capital. The balance sheet is a list of assets, liabilities, and the new amount for ending capital. Remember that the trial balance has debit or credits, not the financial reports.Once the trial balance is complete, the first statement to make is the income statement, which is made up of only revenue and expenses. Remember that there are no debits or credits on financial statements. All we are taking are the ending balances of each title from the trial balance. For the income statement, we list fees as the revenue and then list the expense titles in the inside column. Total operating expenses are then subtracted from the fees to arrive at a net income or a net loss.The second statement to prepare is the statement of owner‟s equity, which s hows how to calculate a new figure for capital. The third report is the balance sheet, which lists out each asset, liability, and the new figure for capital.。