王爱俭国际金融概论答案第10章

- 格式:docx

- 大小:27.94 KB

- 文档页数:13

第十章国际储备政策习题一、单选题1.()是国际货币基金组织成员国在国际货币基金组织当中拥有的提款权利,仅可用于弥补会员国国际收支逆差。

A.SDRB.国际储备C.国际清偿力D.储备头寸2.在国际储备的管理中,首要的管理原则是()。

A.流动性B.盈利性C.安全性D.可兑换性3.一国国际储备的上限是()。

A.最低储备B.保险储备C.经济储备D.最佳储备4.罗伯特特里芬认为,一国国际储备总额应保持占该国年进口额的()。

A.20%—50%B.10%—30%C.20%—30%D.20%—40%5.可以立即用于对外支付的储备资产为()。

A.一级储备B.二级储备C.三级储备D.四级储备6.对储备资产进行投资组合可以有效降低借款资产的()。

A.汇率风险B.贬值风险C.利率风险D.投机风险7.国际清偿力通常包括自有储备与借入储备两部分,而国际储备多指其中()的部分。

A.自有储备B.借入储备C.诱导储备D.以上全是8.()是一国国际储备的主体。

A.黄金储备B.外汇储备C.储备头寸D.SDR9. ( )是一国国际储备资产最主要的来源。

A.国际收支顺差B.干预外汇市场所得C.黄金存量D.储备头寸以及SDR10.我国的国际储备构成中,外汇储备占整个国际储备的()以上。

A.70%B.80%C.85%D.90%二、填空题1.目前,主要的储备币种有美元、_______、________、________等,其中美元仍为最主要的储备货币。

2.在国际货币基金组织的储备头寸主要包括两部分:________和________。

3.特别提款权又称________,通常以______计价,名义价值由日元、美元、英镑和欧元这四种主要国际货币构成的篮子所确定。

4.当本币出现升值压力时,央行大量_______,_______,以此影响外汇市场上本币的供求状况。

5.从资产等值的角度考虑,少持有期限_____的债券和多持有期限_____的债券是一样的。

典型例题一、名词解释1.商业信用2.银行信用3.公司信贷4.票据信贷5.保付代理6.开立账户信贷7.出口押汇8.再融通二、简答题1.保理业务的特点是什么?2.保理业务与贴现业务的区别?3.保理业务对出口商的好处?4.保理业务对进口商的好处?5.保理业务对保理商的好处?6.保理业务与出口信用的共同点和不同点?三、论述题试述保理业务的程序:(补充练习)对外贸易中长期信贷- 出口信贷一、名词解释题1.买方信贷2.混合信贷3.出口信贷4.福费廷5.卖方信贷6.模式利率7.商业参考利率8.伯尔尼联盟9.“存款协议”10.信用安排限额二、简答题1.买方信贷对进口商的有利之处?2.买方信贷对出口商的有利之处?3.福费廷与一般贴现的异同?4.出口信贷有哪些特点?5.买方信贷的贷款原则?6.福费廷与保理业务的异同?7.福费廷对出口商的作用?8.买方信贷的贷款条件?9、出口信贷典型例题、考题分析一、名词解释1.商业信用:在进口商和出口商之间互相提供融资属于对外贸易商业信用。

2.银行信用:如果进口商和出口商中一方信贷资金的获得是由银行或其他金融机构提供的,就构成对外贸易银行信用。

3.公司信贷:西方国家的出口商常以赊售方式销售商品,以加强商品的竞争能力,争夺销售市场,出口商对进口商提供的信贷通常称为公司信贷。

4.票据信贷:是进口商凭银行提交的单据承兑出口商汇票、或是出口商将单据直接寄交进口商,后者于一定期间支付出口商的汇票。

5.保付代理:简称“保理”,又称“承购应收账款业务”,是指出口商以商业信用形式出卖商品,在货物装船后,立即将发票、汇票、提单等有关单据,卖断给承购应收账款的财务公司或专门组织,收进全部或一部分货款,从而取得资金融通的业务。

6.开立账户信贷:是在出口商和进口商订立协议的基础上,当出口商将出口商品发运后,将进口商应付贷款借记进口商账户上,而进口商则将这笔货款贷记出口商账户,进口商在规定期限内支付货款。

7.出口押汇:出口企业的商品出口后,将全套单据提交银行,经银行审核无误后,将公司出口货款提前付给出口企业的一种融资业务。

单烦选择题第一章开放经济下的外汇与汇率()1.以下不属于外汇的是A.外国铸币B.外币银行存款凭证C.特別提款权D.普通提款权()2.狭义的外汇主要是指A.外国货币B.以外币表示的资产C.储备货币D.以储备货币表示的存款凭证()3.在金币本位制度下,汇率波动的界限是A.黄金输出点B.黄金输入点C.黄金输送点D.铸币平价()4.间接标价法以为基准单位。

A.外国货币B.本国货币C.硬通货D.关键货币()5.铸币平价指A.两国货币单位代表的金量之比B.两国货币单位含金量之比C.两国货币单位购买力之比D.两国货币单位价值量之比()6.下列汇率最高的是A.电汇汇率 B.信汇汇率 C.票汇汇率 D.远期汇率()7.即期汇率指A.由外汇市场供求关系决定的汇率B.用电汇方式通知国外银行忖款的汇率C.外汇银行买卖外汇汇票的汇率D.外汇市场买卖现汇的汇率()8.其他条件不变时,以下哪种情况会导致一国货币升值?A.通货膨胀B.国际收支顺差C.收入减少D.紧缩性货币政策()9.若一国货币汇率高估,往往会出现A.外汇供给增加,外汇需求减少,国际收支顺差B.外汇供给减少,外汇需求增加,国际收支逆差C.外汇供给增加,外汇需求减少,国际收支逆差D.外汇供给减少,外汇需求增加,国际收支顺差()10.目前绝大多数国家采用的汇率标价法是A.直接标价法B.间接标价法C.美元标价法D.欧元标价法第五章外汇交易与衍生品交易实务()1.利用不同外汇市场间的汇率差价赚取利润的交易是A.套利交易B.择期交易C.掉期交易D.套汇交易()2. 目前世界上最大的外汇交易市场是A.纽约B.东京C伦敦D.香港()3.伦敦外汇市场上,即期汇率为1英镑=1.5651美元,3个月外汇远期贴水0.51美分,则3个月远期英镑/美元=A. 2.0751B. 1.0551C. 1.5702D. 1.56()4.期权市场上,期权买方买入看涨期权,其中不可预测的因素有A.期权费B.最大亏损额C.最大收益额D.期权合同量()5.在金融交易中,买卖双方的权利与义务不对等的交易有A.掉期交易B.套利交易c.期货交易D.期权交易()6.多种形式的金融衍生工具不包括A.利率互换B. 利率期货C.外汇掉期D.股票指数期权第六章外汇风险与防范实务()1.由汇率波动而引发的国际企业未来收益变化的潜在风险是A.交易风险B.会计风险C.折算风险D.经济风险()2. 由汇率变化引起的资产负债表中某些外汇项目金额变动的风险称为A.交易风险B.经济风险C.统计风险D.会计风险()3.下列没有外汇风险的情況是A.多头地位B.空头地位C.本币收付D.外币收付()4.在与出口方签订远期合同时,进口方应最先选择A.软货币B.硬货币C.本币D.对方国货币第八章国际信贷实务()1.以下不属于政府贷款特点的是A.期限较长B.利率较低C.金额较大D.有附加条件()2.国际货币基金组织最基本的贷款是A.出口波动补偿贷款B.缓冲库存贷款C.信托基金贷款D.普通贷款()3. 由出口地银行对出口商提供的信贷是A.买方信贷B.卖方信贷C.信用安排限额D.混合信贷()4.最常用的出口信贷是A.卖方信贷B.买方信贷C.福费廷D.混合信贷第九章外汇与汇率政策:汇率制度与外汇管制()1.现行人民币汇率采用制度A.固定汇率B.盯住美元C.联合浮动汇率D.有管理的浮动汇率()2. 一国外汇市场的,国际货币基金组织视为复汇率。

第十二章国际金融理论一、填空题1.当进出口商品的需求弹性之和时,贬值改善贸易收支。

2.价格—现金流动机制是由提出。

3.吸收论是以为基础,分析开放经济条件下,国民收入各变量和总量对国际收支的影响。

4.根据吸收论,国际收支顺差意味着。

5.汇率超调模型是多恩布什于1976年提出。

这一模型认为,商品市场和货币市场的调整速度是不同的,商品市场的调整速度相对资产市场要。

6.根据货币论,货币需求大于国内的货币供给时,国际收支出现。

7.购买力平价分为和。

8.根据利率平价理论,汇率的远期升贴水率等于。

9.国际收支学说的渊源是。

10.第一代货币危机模型的代表人物是。

二、判断题1.两极汇率制是指采用钉住汇率制或采用浮动汇率制。

()2.多恩布什的超调模型是粘性价格模型。

()3.如果本国利率高于外国利率,则本币在远期将贴水,如果本国利率低于外国利率,则本币将在远期升水。

()4.根据国际收支说,当本国国民收入增加时,进口会随之增加,国际收支会出现赤字,从而导致外汇市场外汇需求大于供给,本币贬值。

()5.根据国际汇率主义模型,当本国利率相对上升时,本币对外汇率上升。

()6. 中间汇率制度使企业忽视汇率风险的防范。

()7. 汇率超调模型认为商品市场和货币市场的调整速度是不同的,资产市场的调整速度相对资本市场要缓慢得多。

()8. 弹性论和吸收论都强调商品市场流量均衡在国际收支调整中的作用,而货币论则强调货币市场存量均衡的作用。

()9. 国际货币主义汇率模型是在购买力平价的基础上,采用现代货币学派的货币供求理论来进一步说明物价水平,这种理论对于说明长期汇率趋势有一定的意义。

()10. 三元悖论是指一个经济体在汇率稳定、独立的货币政策和国际资本流动上,最多可以同时实现其中的两个目标。

()三、单选题1.以下哪个理论是研究的完全竞争条件下的国际资本流动()A、麦克杜格尔模型B、垄断优势理论C、国际生产的内在说D、国际生产的综合说2.以下不是由相关信息占有的不对称状况导致的情况是()A、逆向选择B、道德风险C、羊群效应D、通货膨胀税3.以下是固定汇率理论的优点的是()A、有利于国际收支的调整B、防止通货膨胀的国际传递C、保持经济的均衡状态D、有利于经济的稳定4.以下支持资本管制是最优选择的是()A、名义工资与物价的粘性B、政府对资本收益的征税C、第二代货币危机模型D、政府对某些行业进行保护5.以下不是弹性分析法的假设条件的是()A、贸易商品的供给弹性无限大B、资本自由移动C、贬值前贸易收支处于平衡状态D、国际收支等于贸易收支6.以下哪个理论强调了货币市场存量均衡的作用()A、弹性论B、吸收论C、平价理论D、货币论7.下列哪个不是利率平价理论的缺陷()A、前提条件是资金完全套利,而且资本完全自由流动B、套利资金的供给弹性并非无限大C、忽视了市场投机这一重要因素D、从理论上说明了远期汇率取决于两国货币的相对收益8.汇率超调模型属于哪个汇率理论()A、购买力平价理论B、资产市场说C、利率平价理论D、国际收支说9.下列不属于采用两极汇率制度的原因的是()A、中间汇率制易于导致货币冲击和货币危机的发生B、开放经济条件下的三元悖论C、中间汇率制度使企业忽视汇率风险的防范D、放弃盯住汇率制10.以下不是货币论的政策主张是()A、所有国际收支不平衡都可以由国内货币政策来解决,而不需要改变汇率B、应实行紧缩货币政策,使货币增长与经济增长保持一致的速度C、在货币供给不变的情况下,收入增长和价格上升通过提高货币需求,将会带来国际收支盈余,而利率上升则将通过降低货币需求,导致国际收支逆差D、国内商品和劳务的消费大于生产,必须输入国外的商品和劳务加以弥补四、简答题1.简述两缺口理论。

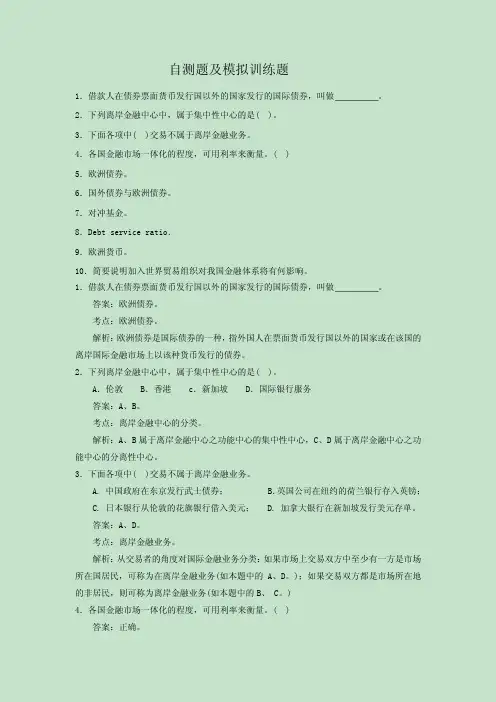

自测题及模拟训练题1.借款人在债券票面货币发行国以外的国家发行的国际债券,叫做 。

2.下列离岸金融中心中,属于集中性中心的是( )。

3.下面各项中( )交易不属于离岸金融业务。

4.各国金融市场一体化的程度,可用利率来衡量。

( )5.欧洲债券。

6.国外债券与欧洲债券。

7.对冲基金。

8.Debt service ratio.9.欧洲货币。

10.简要说明加入世界贸易组织对我国金融体系将有何影响。

1.借款人在债券票面货币发行国以外的国家发行的国际债券,叫做 。

答案:欧洲债券。

考点:欧洲债券。

解析:欧洲债券是国际债券的一种,指外国人在票面货币发行国以外的国家或在该国的离岸国际金融市场上以该种货币发行的债券。

2.下列离岸金融中心中,属于集中性中心的是( )。

A.伦敦 B.香港 c.新加坡 D.国际银行服务答案:A、B。

考点:离岸金融中心的分类。

解析:A、B属于离岸金融中心之功能中心的集中性中心,C、D属于离岸金融中心之功能中心的分离性中心。

3.下面各项中( )交易不属于离岸金融业务。

A. 中国政府在东京发行武士债券; B.英国公司在纽约的荷兰银行存入英镑;C. 日本银行从伦敦的花旗银行借入美元;D. 加拿大银行在新加坡发行美元存单。

答案:A、D。

考点:离岸金融业务。

解析:从交易者的角度对国际金融业务分类:如果市场上交易双方中至少有一方是市场所在国居民,可称为在离岸金融业务(如本题中的A、D。

);如果交易双方都是市场所在地的非居民,则可称为离岸金融业务(如本题中的B、 C。

)4.各国金融市场一体化的程度,可用利率来衡量。

( )答案:正确。

考点:国际金融市场一体化。

解析:国际资金流动飞速增长量直接的有利影响体现在它推动了国际金融市场的一体化。

所谓一体化,就是指“若干部分按一定的方式有机地联系在一起”。

反映各国金融市场一体化程度的标志是资金的价格 - 利率。

5.欧洲债券。

考点:欧洲货币市场、欧洲债券。

解析:欧洲债券(Euro-Bond)是指在欧洲货币市场上发行、交易的债券,它一般是发行者在债券面值货币发行国以外的国家的金融市场上发行。

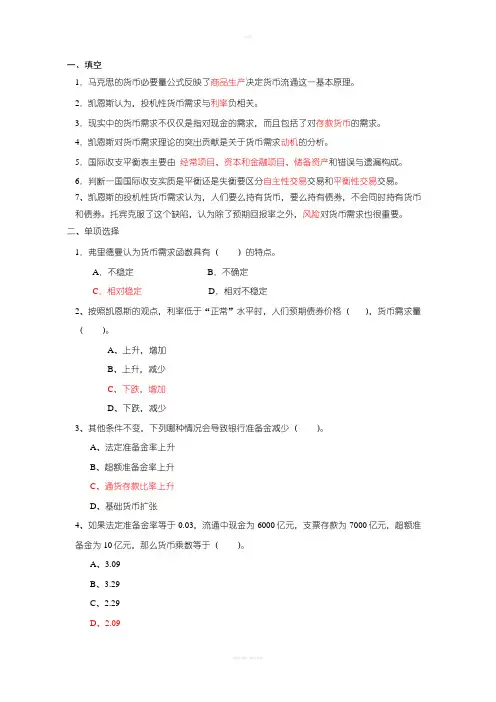

一、填空1.马克思的货币必要量公式反映了商品生产决定货币流通这一基本原理。

2.凯恩斯认为,投机性货币需求与利率负相关。

3.现实中的货币需求不仅仅是指对现金的需求,而且包括了对存款货币的需求。

4.凯恩斯对货币需求理论的突出贡献是关于货币需求动机的分析。

5.国际收支平衡表主要由_经常项目、资本和金融项目、储备资产和错误与遗漏构成。

6.判断一国国际收支实质是平衡还是失衡要区分自主性交易交易和平衡性交易交易。

7、凯恩斯的投机性货币需求认为,人们要么持有货币,要么持有债券,不会同时持有货币和债券。

托宾克服了这个缺陷,认为除了预期回报率之外,风险对货币需求也很重要。

二、单项选择1.弗里德曼认为货币需求函数具有()的特点。

A.不稳定B.不确定C.相对稳定D.相对不稳定2、按照凯恩斯的观点,利率低于“正常”水平时,人们预期债券价格(),货币需求量()。

A、上升,增加B、上升,减少C、下跌,增加D、下跌,减少3、其他条件不变,下列哪种情况会导致银行准备金减少()。

A、法定准备金率上升B、超额准备金率上升C、通货存款比率上升D、基础货币扩张4、如果法定准备金率等于0.03,流通中现金为6000亿元,支票存款为7000亿元,超额准备金为10亿元,那么货币乘数等于()。

A、3.09B、3.29C、2.29D、2.095、假定法定准备金率为0.12,通货存款比率为0.6,超额准备金率为0.03,如果中央银行减少50亿元的基础货币,那么货币供给减少()。

A、153.4亿元B、106.7亿元C、98.7亿元D、56.7亿元6、如果法定准备金率为0.10,流通中现金为10000亿元,支票存款为5000亿元,准备金总额为800亿元,那么超额准备金率等于()。

A、0.10B、0.09C、0.06D、0.047、如果中央银行计划减少基础货币,应当()。

A、提高超额准备金率B、购买政府债券C、提高通货存款比率D、减少向商业银行发放的贴现贷款8.按照国际收支平衡表的编制原理,凡引起外汇流入的项目应记入()。

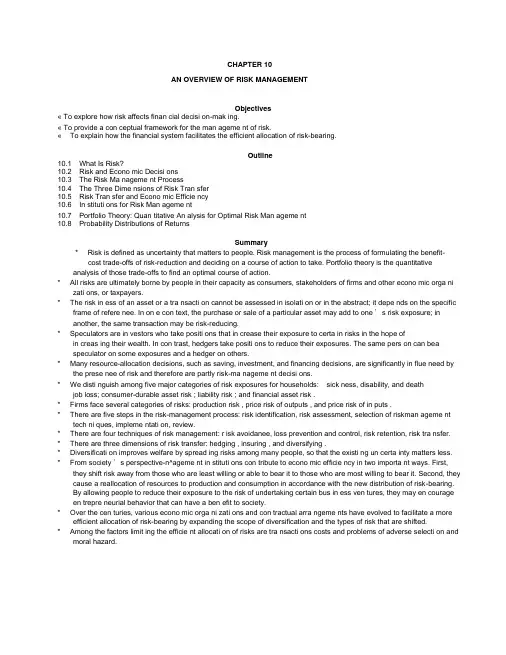

CHAPTER 10AN OVERVIEW OF RISK MANAGEMENTObjectives« To explore how risk affects finan cial decisi on-mak ing.« To provide a con ceptual framework for the man ageme nt of risk.«To explain how the financial system facilitates the efficient allocation of risk-bearing.Outline10.1 What Is Risk?10.2 Risk and Econo mic Decisi ons10.3 The Risk Ma nageme nt Process10.4 The Three Dime nsions of Risk Tran sfer10.5 Risk Tran sfer and Econo mic Efficie ncy10.6 In stituti ons for Risk Man ageme nt10.7 Portfolio Theory: Quan titative An alysis for Optimal Risk Man ageme nt10.8 Probability Distributions of ReturnsSummary* Risk is defined as uncertainty that matters to people. Risk management is the process of formulating the benefit- cost trade-offs of risk-reduction and deciding on a course of action to take. Portfolio theory is the quantitative analysis of those trade-offs to find an optimal course of action.* All risks are ultimately borne by people in their capacity as consumers, stakeholders of firms and other econo mic orga ni zati ons, or taxpayers.* The risk in ess of an asset or a tra nsacti on cannot be assessed in isolati on or in the abstract; it depe nds on the specific frame of refere nee. In on e con text, the purchase or sale of a particular asset may add to one ' s risk exposure; in another, the same transaction may be risk-reducing.* Speculators are in vestors who take positi ons that in crease their exposure to certa in risks in the hope of in creas ing their wealth. In con trast, hedgers take positi ons to reduce their exposures. The same pers on can be a speculator on some exposures and a hedger on others.* Many resource-allocation decisions, such as saving, investment, and financing decisions, are significantly in flue need by the prese nee of risk and therefore are partly risk-ma nageme nt decisi ons.* We disti nguish among five major categories of risk exposures for households: sick ness, disability, and death job loss; consumer-durable asset risk ; liability risk ; and financial asset risk .* Firms face several categories of risks: production risk , price risk of outputs , and price risk of in puts .* There are five steps in the risk-management process: risk identification, risk assessment, selection of riskman ageme nt tech ni ques, impleme ntati on, review.* There are four techniques of risk management: r isk avoidanee, loss prevention and control, risk retention, risk tra nsfer.* There are three dimensions of risk transfer: hedging , insuring , and diversifying .* Diversificati on improves welfare by spread ing risks among many people, so that the existi ng un certa inty matters less. * From society ' s perspective-n^ageme nt in stituti ons con tribute to econo mic efficie ncy in two importa nt ways. First, they shift risk away from those who are least willing or able to bear it to those who are most willing to bear it. Second, they cause a reallocation of resources to production and consumption in accordance with the new distribution of risk-bearing.By allowing people to reduce their exposure to the risk of undertaking certain bus in ess ven tures, they may en courage en trepre neurial behavior that can have a ben efit to society.* Over the cen turies, various econo mic orga ni zati ons and con tractual arra ngeme nts have evolved to facilitate a more efficient allocation of risk-bearing by expanding the scope of diversification and the types of risk that are shifted.* Among the factors limit ing the efficie nt allocati on of risks are tra nsacti ons costs and problems of adverse selecti on and moral hazard.Solutions to Problems at End of ChapterOn the Nature of Risk and Risk Management1. Suppose that you and a friend have decided to go to a movie together next Saturday. You will select any movie for which tickets are available when you get to the theater. Is this a risky situation for you? Explain. Now suppose that your friend has already purchased a ticket for a movie that is going to be released this Saturday. Why is this a risky situation? How would you deal with the risk?SOLUTION:No, the uncertainty doesn ' t represienncteriysokusdo not care which movie you see. However, if your friend has a ticket already, and if you wait till Saturday to buy yours, the show may be sold out. To eliminate the risk that you may not be able to sit with your friend and see the same movie, you might buy your ticket in advance.2. Suppose you are aware of the following investment opportunity: You could open a coffee shop around the corner from your home for $25,000. If business is strong, you could net $15,000 in after-tax cash flows each year over the next 5 years.a. If you knew for certain the business would be a success, would this be a risky investment?b. Now assume this is a risky venture and that there is a 50% chance it is a success and a 50% chance you gobankrupt within 2 years. You decide to go ahead and invest. If the business subsequently goes bankrupt, did you make the wrong decision based on the information you had at the time? Why or why not?SOLUTION:a. No, this investment would not be risky.b. No, you did not make a “ wrong ” decision. When you made your decision, you did not know for certain that thecompany would go bankrupt. You decided to invest for many reasons, including the possibility of making a lot of money.Given your tolerance for risk and the fact that you based our decision on the information available at the time, your decision was not wrong and may have been optimal at the time.3. Suppose you are a pension fund manager and you know today that you need to make a $100,000 payment in 3 months.a. What would be a risk-free investment for you?b. If you had to make that payment in 20 years instead, what would be a risk free investment?c. What do you conclude from your answers to Parts a and b of this question?SOLUTION:a. A risk-free investment for you would be a Treasury Bill (default risk free) which matures in exactly 3 months.b. A risk-free investment would be a zero coupon U.S. Treasury security maturing in 20 years and which would have thesame single payment of $100,000.c. Because risk is dependent upon circumstances, what is risk-free for one individual may be risky for another too. There canbe any number of risk-free investments depending upon circumstances. Your investment time horizon is critical tochoosing the best risk-free investment (so payments in can exactly match payments out so that you are left with no risk).4. Is it riskier to make a loan denominated in dollars or in yen?SOLUTION:It depends on the context. For people whose income and expenses are denominated in dollars (perhaps because they live in the U.S), denominating a loan in yen would be riskier than denominating it in dollars. But for someone whose income and expenses are denominated in yen, denominating the loan in yen would be less risky than in dollars.5. Which risk management technique has been chosen in each of the following situations?« Installing a smoke detector in your home« Investing savings in T-bills rather than in stocks« Deciding not to purchase collision insurance on your car« Purchasing a life insurance policy for yourselfSOLUTION:« Loss preve nti on and con trol.・Risk avoida nee« Risk rete nti on・Risk tran sfer6. You are considering a choice between investing $1,000 in a conventional one-year T-Bill offering an interest rate of 8% and a one-year Index 丄inked Inflation Plus T-Bill offering 3% plus the rate of inflation.a. Which is the safer investment?b. Which offers the higher expected return?c. What is the real return on the Index 丄inked Bond?SOLUTION:a. The inflation-indexed T-Bill offers a fixed real rate of return of 3% over the life of the investment. The realreturn on the conventional T- Bill ' s real return depends upon the expected rate of inflation over the life of thein vestme nt. The safer in vestme nt is the In flati on Plus T-Bill.b. The real rate of return on the conventional T-Bill depends upon the expected rate of inflation over the life of thein vestme nt. You do not know which expected retur n is higher unl ess you know what in flati on is expected to be.c. The real retur n on the in dex-l in ked T-Bill is 3%.Hedging and Insurance7. Suppose you are interested in financing your new home purchase. You have your choice of a myriad financing options. You could enter into any one of the following agreements: 8% fixed rate for 7 years, 8.5% fixed rate for 15 years, 9% fixed for 30 years. In addition, you could finance with a 30-year variable rate that begins at 5% and increases and decreases with the prime rate, or you could finance with a 30year variable rate that begins at 6% with ceilings of 2% per year to a maximum of 12% and no minimum.a. Suppose you believe that interest rates are on the rise. If you want to completely eliminate your risk of risinginterest rates for the longest period of time, which option should you choose?b. Would you consider that hedging or insuring? Why?c. What does you r risk management decision “ cost ” you in terms of quoted interest rates during the firstyear?SOLUTION:a. You would choose the 30-year fixed rate at 9%.b. That would be a hedge because you have elim in ated both the upside (decli ning rates) or dow nside ( rising rates).c. This costs me at least 4% since I could get a variable rate loa n at 5%.8. Referring to the information in problem 7, answer the following:a. Suppose you believe interest rates are going to fall, which option should you choose?b. What risk do you face in that transaction?c. How might you insure against that risk? What does that cost you (in terms of quoted interest rates?). SOLUTION:a. You would want one of the variable rate options, in particular the variable loan tied to the prime rate, currently equal to5%.b. You face the risk of rising rates.c. You could in sure aga inst that risk by purchas ing the opti on to have a 12% ceil ing on the rate (2% in crease per year.This option cost you 1% (the difference between 6% and 5%).9. Suppose you are thinking of investing in real estate. How might you achieve a diversified real estate investment?SOLUTION:« You could own several differe nt build ings in the same gen eral area.« You could own several differe nt build ings in differe nt geographic areas.« You could sell some of your equity own ership to other owners to lower your own in dividual exposure to decli ning market values.10. Suppose the following represents the historical returns for Microsoft and Lotus Development Corporation:Historical ReturnsYear MSFT LOTS110%9%215%12%3-12%-7%420%18%57%5%a. What is the mean return for Microsoft? For Lotus?b. What is the standard deviation of returns for Microsoft? For Lotus?c. Suppose the returns for Microsoft and Lotus have normally distributed returns with means and standarddeviations calculated above. For each stock, determine the range of returns within one expected standard deviation of the mean and within two standard deviations of the mean.SOLUTION:a. Mea n return Microsoft: 8.0%; Lotus: 7.4%b. If you use the formula for the sta ndard deviati on based on a sample of size n:You find that the standard deviations are: MSFT: 10.94%; Lotus: 8.357%.However, if you use the formula for the population standard deviation:You find that the standard deviations are: MSFT 12.23% and LOTS 9.34%.c. Range of returns within 1 standard deviation Microsoft: -2.94% to +18.94% Range of returns within 1 standarddeviation Lotus: -0.957% to + 15.76% Range of returns within 2 standard deviations Microsoft: -13.88% to+29.88% Range of returns within 1 standard deviation Lotus: -9.31% to + 24.11%。

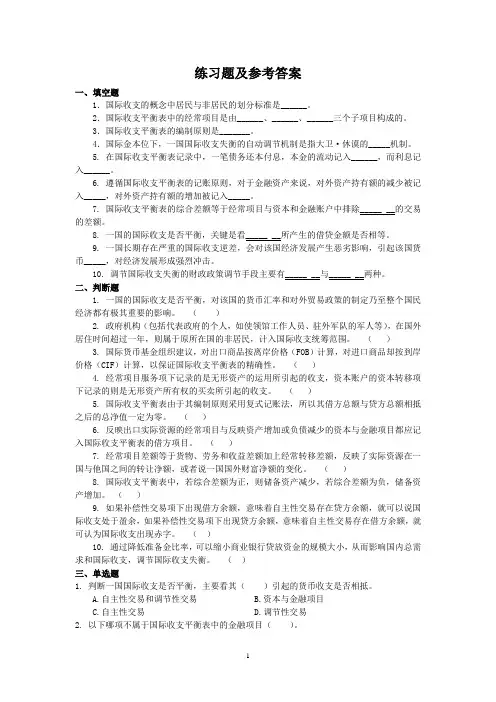

练习题及参考答案一、填空题1.国际收支的概念中居民与非居民的划分标准是______。

2.国际收支平衡表中的经常项目是由______、______、______三个子项目构成的。

3.国际收支平衡表的编制原则是_______。

4.国际金本位下,一国国际收支失衡的自动调节机制是指大卫·休谟的_____机制。

5. 在国际收支平衡表记录中,一笔债务还本付息,本金的流动记入______,而利息记入______。

6. 遵循国际收支平衡表的记账原则,对于金融资产来说,对外资产持有额的减少被记入_____,对外资产持有额的增加被记入_____。

7. 国际收支平衡表的综合差额等于经常项目与资本和金融账户中排除_____ __的交易的差额。

8. 一国的国际收支是否平衡,关键是看_____ __所产生的借贷金额是否相等。

9. 一国长期存在严重的国际收支逆差,会对该国经济发展产生恶劣影响,引起该国货币_____,对经济发展形成强烈冲击。

10. 调节国际收支失衡的财政政策调节手段主要有_____ __与_____ __两种。

二、判断题1. 一国的国际收支是否平衡,对该国的货币汇率和对外贸易政策的制定乃至整个国民经济都有极其重要的影响。

()2. 政府机构(包括代表政府的个人,如使领馆工作人员、驻外军队的军人等),在国外居住时间超过一年,则属于原所在国的非居民,计入国际收支统筹范围。

()3. 国际货币基金组织建议,对出口商品按离岸价格(FOB)计算,对进口商品却按到岸价格(CIF)计算,以保证国际收支平衡表的精确性。

()4. 经常项目服务项下记录的是无形资产的运用所引起的收支,资本账户的资本转移项下记录的则是无形资产所有权的买卖所引起的收支。

()5. 国际收支平衡表由于其编制原则采用复式记账法,所以其借方总额与贷方总额相抵之后的总净值一定为零。

()6. 反映出口实际资源的经常项目与反映资产增加或负债减少的资本与金融项目都应记入国际收支平衡表的借方项目。

王爱俭版国际金融概论-判断题判断题第一章开放经济下的外汇与汇率1.记账外汇可以对第三国进行支付。

()2.自由外汇可以自由兑换其他国家货币。

()3.银行买入外币现纱的汇率要高于买入外币现汇的汇率。

()4. 一般而言,市场汇率属于名义汇率。

()5.按外汇交易的交割期限,汇率可分为市场汇率和远期汇率。

()6.按照业务往来对象不同,外汇汇率可以划分为同业汇率和商人汇率,通常同业汇率的买卖价差小于商人汇率的买卖价差。

()7. 各国公布的外汇牌价一般都是电汇汇率。

()8. 一国资本大量流出,就会出现外汇短缺,使本币币值下降、汇率下降。

()9. 一国实行提高利率政策可以吸引国外资金的流入,从而改善国际收支。

()10. 一国货币汇率上涨,不利于减轻该国通货膨胀的压力。

()第三章开放经济下的国际金融活动1.欧洲货币市场专指在欧洲地区的国际金融市场。

()2.外国债券就是在离岸金融市场发行的债券。

()3.大额可转让定期存单是可以进行流通转让的定期存款凭证。

()4.在银行短期信贷市场上,占主导地位的是同业拆放市场。

()第四章开放经济下的国际资本流动1.国际资本流动是伴随着国际贸易的发展而发展起来的。

()2.国际资本流动的规模主要受各国经济周期的影响。

()3.国际资本流动会增加各国进行资本管制的难度。

()4.国际资本流动中,融资证券化的趋势不断增长。

()5.外债主要是指一国在一定时期的全部债务。

它包括契约性的债务,也包括借贷双方口头上形成的债务。

()6. 一国外债的偿债率达到30%时即表明该国经济存在问题。

()第五章外汇交易与衍生品交易实务1.升水表示远期外汇比即期外汇贱,贴水表示远期外汇比即期外汇贵。

()2.一般而言,利率低的货币远期汇率会贴水。

()3.商业银行在买卖外汇时,如果卖出多于买入为多头,如果买入多于卖出为空头。

()4.在择期外汇交易中,报价银行买入基准货币时,若基准货币升水,应按选择期内第—天的汇率报价。

()第六章外汇风险与防范实务1.在以外币结算时,时间越长,风险越小;时间越短,风险越大。

第一章开放经济下的外汇与汇率简答题1.何谓外汇?外汇的基本特征有哪些?静态的外汇是指一种以外币表示的支付手段,用于国际之间的结算。

国际货币基金组织曾说明:"外汇是货币行政当局(中央银行、货币管理机构、外汇平准基金组织及财政部)以银行存款、国库券、长短期政府债券等形式所保有的在国际收支逆差时可以使用的债权。

”外汇的特征包括:是以外币计值或表示的用于对外支付的金融资产;具有充分的可兑换性;具有可靠的物质偿付保证。

2.举例说明汇率的两种标价方法分别是什么?直接标价法是以一定单位的外国货币作为标准,折算成一定数量的本国货币,又被称为应付标价法。

间接标价法是以一定单位的本国货币作为标准,折算成一定数量的外国货币。

例如,2015年2月3 日,100美元=625.43元人民币,在我国来看,就是直接标价法,而在美国来看就是间接标价法。

3.开放经济条件下,一国汇率的变动对国内物价是否产生影响?一国货币汇率变动,总是要间接地影响到一国货币的对内价值,影响到一国的通货膨胀程度。

在货币发行量一定的情况下,本币价值上升会引起国内物价水平下降。

因为本币升值,就会使以本币表示的进口商品在国内售价相对便宜,刺激进口增加,并带动用进口原料生产的本国产品价格下降。

另外,由于本币升值,以外币表示的出口商品在国外市场价格升高,降低了出口商品的竞争力,促使一部分出口商品转内销,增加了国内市场供给量,也会引起国内物价水平的下降。

4.简述一国汇率变动对其贸易收支的影响。

汇率稳定,有利于进出口贸易的成本及利润的计算,有利于进出口贸易的安排;汇率变动频繁,会增加对外贸易的风险,影响对外贸易的正常进行。

如果本币升值,外汇汇率上升,而国内物价尚未变动或变动不大,则外币对本国商品、劳务的购买力增强,一般会增加对本国商品的需求,从而扩大本国商品的出口规模。

在这种情况下,本国出口商收入的外币折合成本币的数额会増加,出口商有可能降低价格出售,以加强竞争,扩大销路。

精品行业资料,仅供参考,需要可下载并修改后使用!《金融基础知识》课后习题答案第10章习题答案1. 该公司应卖空的合约份数为:1.2×10,000,000/(500×270)=88.9≈89份2. 在τ时刻,期货价格和现货价格的关系为:()()f r r T F S e τττ--=假设保值比率为h, 则通过保值可以卖出的价格为:()()00()f r r T h F F S hF S hS eτττττ---+=+- 如果()()f r r T h eτ--=,则卖出的价格恒等于hF 0, 这时保值组合的方差为0。

也就证明了()()f r r T h e τ--=是最优保值比率。

3. 每份期货合约的价值为108.46875×1,000=108,468.75美元。

应该卖空的合约份数为:6,000,0008.259.760108,468.757.6⨯=≈份 4. 该银行可以与其他金融机构签订一份它支付固定利率、接受浮动利率的利率互换协议。

5. 当该投资组合的价值降到5400万美元时,你的资本损失为10%。

考虑到你在1年中得到了3%的现金红利,你的实际损失为7%。

令E (R P )表示投资组合的预期收益率,E(R I )表示指数的预期收益率,根据资本资产定价模型有:E(R P )-r f =β[E(R I )- r f ]因此当E(R P )=-7%时,E(R I )=[E(R P )-r f ]/ β+ r f =-1%。

由于指数1年的红利收益率等于3%,因此指数本身的预期变动率为-4%。

因此,当组合的价值降到5400万美元时,指数的预期值为0.96×300=288。

因此应购买协议价格等于288、期限1年的欧式看跌期权来保值。

所需的欧式看跌期权的数量为:2×60,000,000/(300×100)=4000份其中每份期权的规模为100美元乘以指数点。

《国际金融概论》习题集答案《国际金融概论》习题集thepraxisofinternationalfinance金融系国际金融教研室目录第一章外汇与汇率 (2)第二章汇率制度与外汇管制.............................................................9第三章外汇交易与外汇风险.........................................................12第四章第五章第六章第七章第八章第九章第十章国际结算............................................................................ 15国际资本流动....................................................................18国际金融市场....................................................................22国际收支............................................................................ 27国际储备............................................................................ 33国际货币制度....................................................................37国际金融机构.. (40)1第一章外汇与汇率一、选择题1、动态外汇是指(a)。

a、国际汇率风险b、外国货币c、外币现钞d、外币资产2、按《中华人民共和国外汇管理条理》的表述,外汇以外币则表示的可以看作(c)的缴付手段和资产。

第二章开放经济下的国际收支账户1.国际收支平衡表编制。

已知B国2004年共发生如下5笔国际经济交易,试编制该国当年国际收支平衡表。

(1) B国某企业从D国某公司进口了50万美元的生产原料,从而导致该企业在海外银行存款的相应减少。

(2) C国居民到B国旅游,共花费1万美元。

(3) B国某企业以价值500万美元的设备直接投资于A国,设立独资企业。

(4) B国政府动用外汇储备200万美元对F国提供无偿慈善援助,另外还提供相当于100万美元的药品进行援助。

(5) B国某企业在海外投资所得利润200万美元,其中100万美元用于当地的再投资50万美元用于购买当地的设备运回国内,50万美元调回国内结售给政府换取本国货币。

2.国际收支平衡表分析。

(2)我国2014年第二季度储备资产是增加还是减少?具体数额为多少?(3)我国2014年第二季度国际收支平衡表中净误差与遗漏一项的数字说明了哪些问题?①编制国际收支平衡表的原始统计资料来自各个方面,在原始资料的形成过程中,不可避免地会出现某些当事人故意改变、伪造某些项目数字的做法,造成了原始资料的失实或不完全。

②统计数字的重复计算和漏算,原始统计资料来自于四面八方,有的来自海关统计,有的来自银行报表,还有的来自官方主管机构的统计报表,这就难免发生统计口径不一致而造成重复计算与漏算。

③有的统计数字本身就是估算的。

第五章外汇交易与衍生品交易实务1.已知:美元/日元:117.78;美元/加拿大元=1.1234。

求:加拿大/日元=?2. 已知:美元/瑞士法郎=0. 9698; 澳大利亚/美元=0. 8670。

求:瑞士法郎/澳大利亚元=?3. 已知:美元/日元= 117.70/117.81;美元/港元=7.7561/72;英镑/美元= 1.5653/56。

求:日元/港元=?英镑/港元=?4. 已知美元对瑞士法郎的即期汇率为0.9696-0.9700,3个月远期汇水30-60,求美元对瑞士法郎3个月远期汇率是多少?5. 已知某日纽约外汇市场美元对加拿大元即期汇率为1.1229—1.1239,3个月远期加拿大元升水60一40,求美元对加拿大元的3个月远期汇率。

国际⾦融习题答案(全)第⼀章三、名词解释1、国际收⽀:在⼀定时期内,⼀国居民与⾮居民之间经济交易的系统记录。

2、国际收⽀平衡表:⼀国将其⼀定时期内的全部国际经济交易,根据交易的内容与范围,按照经济分析的需要设置账户或项⽬编制出来的统计报表。

3、居民是指⼀个国家的经济领⼟内具有经济利益的经济单位。

在国际收⽀统计中判断⼀项交易是否应当包括在国际收⽀的范围内,所依据的不是交易双⽅的国籍,⽽是依据交易双⽅是否有⼀⽅是该国居民。

4、⼀国的经济领⼟:⼀般包括⼀个政府所管辖的地理领⼟,还包括该国天空、⽔域和邻近⽔域下的⼤陆架,以及该国在世界其他地⽅的飞地。

依照这⼀标准,⼀国的⼤使馆等驻外机构是所在国的⾮居民,⽽国际组织是任何国家的⾮居民。

5、经常账户:是指对实际资源在国际间的流动⾏为进⾏记录的账户,它包括以下项⽬:货物、服务、收⼊和经常转移。

反映进⼝实际资源的记⼈经常项⽬借⽅;反映出⼝实际资源的记⼈经常项⽬贷⽅。

6、经常转移包括各级政府的转移(如政府间经常性的国际合作、对收⼊和财政⽀付的经常性税收等)和其他转移(如⼯⼈汇款)。

当⼀个经济体的居民实体向另⼀个⾮居民实体⽆偿提供了实际资源或⾦融产品时,按照复式记账法原理,需要在另⼀⽅进⾏抵消性记录以达到平衡,也就是需要建⽴转移账户作为平衡项⽬。

7、贸易收⽀:⼜称有形贸易收⽀,是国际收⽀中的⼀个项⽬,指由商品输出⼊所引起的收⽀。

出⼝记为贷⽅,进⼝记为借⽅。

IMF规定,在国际收⽀的统计⼯作中,进出⼝商品都以离岸价格(FOB)计算。

若进⼝商品以到岸价格(CIF)计算时,应把货价中的运费、保险费等贸易的从属费⽤减除,然后列⼊劳务收⽀项⽬中。

8、服务交易:是经常账户的第⼆个⼤项⽬,它包括运输、旅游以及在国际贸易中的地位越来越重要的其他项⽬,如通讯、⾦融、计算机服务、专有权征⽤和特许以及其他商业服务。

将服务交易同收⼊交易明确区分开来是《国际收⽀⼿册》第五版的重要特征。

9、收⼊交易:包括居民和⾮居民之间的两⼤类交易:①⽀付给⾮居民⼯⼈(例如季节性的短期⼯⼈)的职⼯报酬;②投资收⼊项下有关对外⾦融资产和负债的收⼊和⽀出。

《国际金融》参考答案复习思考题参考答案第一章一、名词解释国际收支:广义的国际收支是指一个国家或地区在一定时期(1年、1季或1个月)内,各种对外往来所产生的全部国际经济交易的统计。

国际收支平衡表:一个国家的国际收支状况可以用国际收支平衡表来表示。

国际收支平衡表是一个国家在一定时期内(1年、1季或1个月)全部经济交易的统计表。

经常项目:经常项目是国际收支平衡表中最重要、最基本的项目,它包括以下几个子项目:商品、劳务、收益和经常转移。

资本项目:资本项目主要记录以下一些内容:(1)资本转移,主要包括债务减免和移民的转移支付;(2)非生产、非金融资产的收买与出售,包括不是由生产创造出来的有形资产(如土地和地下资产)和无形资产(专利、版权、商标、经销权等)的购买或出售。

金融项目:是国际收支平衡表的重要组成部分,又分为直接投资、证券投资和和其他投资。

自主性交易:或称事前交易,是经济实体或个人出于某种经济动机和目的、独立自主进行的经济交易。

补偿性交易:或称调节性交易。

由于自主性交易不可避免要出现借方差额或贷方差额,就要运用另一种交易来弥补自主性交易所造成的外汇供求缺口,这个交易就是调节性交易。

线上项目:包括经常项目,资本和金融项目以及净误差与遗漏。

弹性:弹性是一种比例关系,描述的是价格变动对需求和供给数量的影响。

马歇尔—勒纳条件:马歇尔—勒纳条件研究的是货币贬值改善贸易收支的必要条件。

马歇尔-勒纳条件指的是货币贬值只有在出口商品的需求弹性和进口商品的需求弹性之和大于1的情况下,才能使贸易收支得到改善。

即,贬值取得成功的必要条件但不充分条件是: Ex+ Em>1。

J曲线效应:即使马歇尔—勒纳条件能够满足,货币贬值对贸易收支的影响也不能立竿见影。

本币贬值所带来的贸易收支改善需要一定的时间,在这段时间里,贸易收支有可能进一步恶化,从而形成一条类似于英文字母“J”的曲线,故又称为J曲线效应。

米德冲突:如果政府只运用开支变更政策而不同时运用开支转换政策和直接管制,不仅不能实现内部平衡与外部平衡,而且还会导致这两种平衡之间发生冲突,这种冲突称为“米德冲突”。