国际贸易专业外文翻译

- 格式:docx

- 大小:39.10 KB

- 文档页数:5

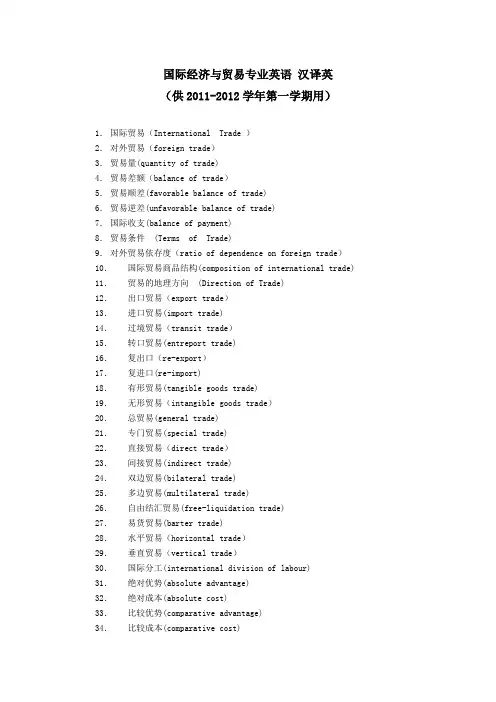

国际经济与贸易专业英语汉译英(供2011-2012学年第一学期用)1.国际贸易(International Trade )2.对外贸易(foreign trade)3.贸易量(quantity of trade)4.贸易差额(balance of trade)5.贸易顺差(favorable balance of trade)6.贸易逆差(unfavorable balance of trade)7.国际收支(balance of payment)8.贸易条件(Terms of Trade)9.对外贸易依存度(ratio of dependence on foreign trade)10.国际贸易商品结构(composition of international trade) 11.贸易的地理方向(Direction of Trade)12.出口贸易(export trade)13.进口贸易(import trade)14.过境贸易(transit trade)15.转口贸易(entreport trade)16.复出口(re-export)17.复进口(re-import)18.有形贸易(tangible goods trade)19.无形贸易(intangible goods trade)20.总贸易(general trade)21.专门贸易(special trade)22.直接贸易(direct trade)23.间接贸易(indirect trade)24.双边贸易(bilateral trade)25.多边贸易(multilateral trade)26.自由结汇贸易(free-liquidation trade)27.易货贸易(barter trade)28.水平贸易(horizontal trade)29.垂直贸易(vertical trade)30.国际分工(international division of labour)31.绝对优势(absolute advantage)32.绝对成本(absolute cost)33.比较优势(comparative advantage)34.比较成本(comparative cost)35.相互需求说(reciprocal demand doctrine)36.要素禀赋理论(treory of eadowment)37.机会成本(opportunity cost)38.生产可能性曲线(production possibility curve) 39.无差异曲线(indifference curve)40.里昂惕夫之谜(leontief paradox)41.规模经济(scale of economies)42.偏好相似理论(the preference similarity theory) 43.关税(tariff)44.关税壁垒(tariff barriers)45.财政关税(revenue tariff)46.保护关税(protective tariff)47.关税升级(tariff escalation)48.特惠税(preferential duties)49.原产地规则(rules of origin)50.出口税(export duties)国际经济与贸易专业英语汉译英(供2011-2012学年第二学期用)51.过境税(transit duties)52.进口附加税(import surtaxes)53.反倾销税(anti-dumping duties)54.反补贴税(counter vailing duties)55.差价税(variable levy)56.惩罚关税(penalty tariff)57.报复关税(retaliatory tariff)58.门槛价格(threshold price)59.从量税(specific duties)60.混合税(mixed duty)61.复合税(compound duties)62.选择税(alternative duties)63.税率(rate of duty)64.单式税则(single tariff)65.复式税则(complex tariff)66.关税水平(tariff level)67.名义保护率(nominal rate of protection-NRP)68.有效保护率(effective rate of protection-ERP)69.绝对配额(absolute quota)70.关税配额(tariff quota)71.全球配额(global quota)72.国别配额(country quota)73.自主配额(autonomous quota)74.协议配额(agreement quota)75.进口商配额(importer quota)76.“自动”出口配额(voluntary export quota)77.进口许可证制(import license system)78.外汇管制(foreign exchange control)79.进口押金(advanced deposit)80.歧视性政府采购政策(discriminatory government procurement policy) 81.海关程序(customs procedures)82.技术性贸易壁垒(technical barriers to trade)83.出口信贷(export credit)84.出口信贷国家担保制(export credit guarantee system) 85.出口补贴(export subsidy)86.关税同盟(customs union)87.普惠制 (GSP)88.经济一体化 (Economic Integration)89.绿色壁垒 (Green barriers)90.反倾销(anti-dumping)91.进口配额(import quota)92.最惠国待遇(most-favoured-nation treatment MFNT) 93.贸易额(Value of Trade)94.进口税 (Import Duties )95.非关税壁垒(Non-tarriff Barriers)96.反倾销(Anti-dumping)97.世界贸易组织(World Trade Organiztion)98.商品名称及编码协调制度(HS)99.进口配额(import quota)100.从价税 (ad valorem duties)。

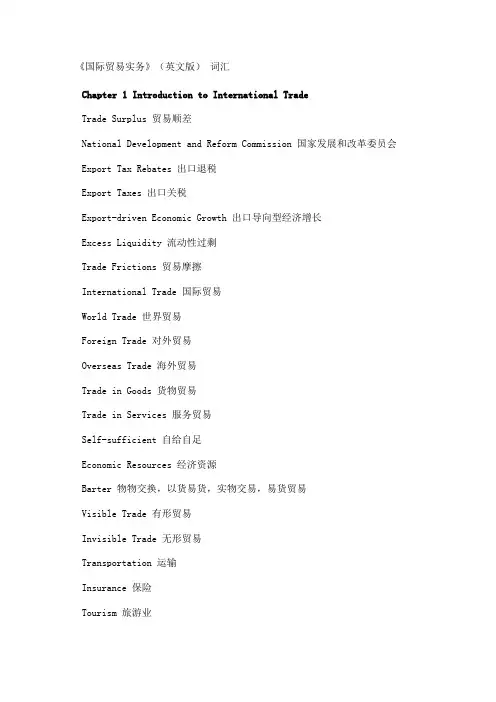

《国际贸易实务》(英文版)词汇Chapter 1 Introduction to International TradeTrade Surplus 贸易顺差National Development and Reform Commission 国家发展和改革委员会Export Tax Rebates 出口退税Export Taxes 出口关税Export-driven Economic Growth 出口导向型经济增长Excess Liquidity 流动性过剩Trade Frictions 贸易摩擦International Trade 国际贸易World Trade 世界贸易Foreign Trade 对外贸易Overseas Trade 海外贸易Trade in Goods 货物贸易Trade in Services 服务贸易Self-sufficient 自给自足Economic Resources 经济资源Barter 物物交换,以货易货,实物交易,易货贸易Visible Trade 有形贸易Invisible Trade 无形贸易Transportation 运输Insurance 保险Tourism 旅游业Balance of Trade 贸易差额A Favorable Balance of Trade 贸易顺差Trade Surplus 贸易顺差An Unfavorable Balance of Trade 贸易逆差Trade Deficit 贸易逆差Balance of Payments 国际收支平衡,国际收支差额A Favorable Balance of Payments 国际收支顺差An Unfavorable Balance of Payments 国际收支逆差International Monetary Fund(IMF)国际货币基金组织Foreign Direct Investment(FDI)对外直接投资,外商直接投资Portfolio Investment 间接投资Chapter 2 International Trade PolicyProtectionism 贸易保护主义Free Trade 自由贸易The National Interest 国家利益Doha Trade Talks 多哈贸易谈判Acquisitions 购并Trade Barriers 贸易壁垒Infant Industries 幼稚产业Tariffs 关税Subsidies 补贴Quantitative Restrictions 数量限制Encouragements 鼓励Import Tariff 进口关税Non-tariff Barriers(NTB)非关税壁垒Export Taxes 出口关税Export Subsidies 出口补贴Protective Tariffs 保护性关税Revenue Tariff 财政关税Specific Duties 从量税Ad Valorem Duties 从价税Compound Duties 复合税Harmonized Tariff Schedule of the United States(HTS)美国协调关税明细表Harmonized System 商品名称及编码协调制度International Harmonized Commodity Coding and Classification System 商品名称及编码协调制度World Customs Organization 世界海关组织Customs Tariff of Import/Export of the People’s Republic of China 中华人民共和国进出口关税条例Import Quota 进口配额Binding Quota 限制性配额Non-binding Quota不具约束力的配额Zero QuotaAbsolute Quotas 绝对配额Tariff-rate Quotas 关税配额Voluntary Export Restraint(VER)自动出口限制Multi-Fiber Arrangement 多种纤维协定Market Failures 市场失灵Domestic Content Requirements 国内成分要求Government Procurement Policies 政府采购政策Buy America Act of 1933 1933年购买美国货法案Red-tape Barriers进口环节壁垒Domestic Supply 国内供给Domestic Demand 国内需求Floor Price 最低限价Shortfall of Supply 供应短缺Export Enhancement Program(EEP)美国的出口促进计划Dairy Export Incentive Program(DEIP)奶制品出口激励项目Chapter 3 Trade Bloc and Trade BlockAsia-Pacific Economic Co-operation Organization (APEC)亚太经合组织Hanoi 河内(越南首都)Stalemate 僵局Open Regionalism 开放的区域主义Trade Liberalization 贸易自由化Most Favored Nation 最惠国Multilateralism 多边贸易Doha Round 多哈回合Free Trade Agreement of Asia and the Pacific(FTAAP)亚太自由贸易协定Free Trade Area 自由贸易区Preferential Trade Agreements(PTAs)特殊优惠贸易协议Bilateral Free Trade Agreements 双边自由贸易协定Discriminatory Tariffs 歧视性关税Tariff Rates 关税税率Trade Discrimination 贸易歧视Trade Bloc 贸易集团Trade Block 贸易禁运EU(European Union)欧盟(欧洲联盟)NAFTA(North American Free Trade Agreement)北美自由贸易协定,北美自由贸易区MERCOSUR(Mercado Comun del Cono Sur)南方共同市场SCCM(Southern Common Markets)南方共同市场ASEAN(Association of Southeast Asian Nations)东南亚国家联盟EFTA(European Free Trade Area)欧洲自由贸易区ASEAN Free Trade Area(AFTA)东盟自由贸易区Customs Union 关税同盟EEC(European Economic Community)欧洲经济共同体EC(the European Community)欧洲共同体Economic Union 经济同盟,经济联盟Trade Embargoes 贸易禁运Economic Sanctions 经济制裁United Nations 联合国Stamp Act 印花税法案Townshend Acts 汤森条例Trade Elasticity 贸易弹性Chapter 4 WTO:A Navigation GuideFranchises 特许经营World Trade Organization(WTO)世界贸易组织Uruguay Round 乌拉圭回合General Agreement on Tariffs and Trade(GATT)关税与贸易总协定Doha Development Agenda 多哈发展议程(多哈回合谈判)WTO Agreements 世界贸易组织协议The World Bank 世界银行International Monetary Fund(IMF)国际货币基金组织Appellate Body 上诉机构Dispute Settlement Panels 争端解决专门小组Plurilateral Committees 诸边协议委员会Ministerial Conference 部长会议The General Council 常务理事会The Dispute Settlement Body 争端解决机构The Trade Policy Review Body 贸易政策审议机构Goods Council 货物贸易理事会Services Council 服务贸易理事会TRIPS Council 与贸易有关的知识产权理事会The Textiles Monitoring Body 纺织品监督机构Heads of Delegations(HOD)代表团首脑The Secretariat 秘书处Sustainable Development 可持续发展Plurilateral Trade Agreement 诸边贸易协定Marrakesh Ministerial Meeting 马拉喀什部长会议(摩洛哥)TRIPS Agreement 与贸易有关的知识产权协定Trade-Related Aspects of Intellectual Property Rights(TRIPS)与贸易有关的知识产权Contracting Parties 缔约国Trade Without Discrimination 贸易无歧视Most-Favored-Nation Treatment 最惠国待遇National Treatment 国民待遇Transparency 透明度Access to Markets 市场准入Navigation Guide 导航General Agreement on Trade in Services(GATS)服务贸易总协定Trade-Related Investment Measures TRIMS 与贸易有关的投资措施Chapter 5 Terms of Commodity——QualityCommodity 商品、货物Manufactured Goods 工业制成品Name of Commodity 货物的品名Description of Goods 货物的名称,货物的描述Quality of Commodity 货物的品质Sample 样品Representative Sample 代表性样品Original Sample 原样Type Sample 标准样品Reference Sample 参考样品Duplicate Sample 复样Sale by Sell’s Sample 凭卖方样品买卖(销售)Sale by buyer’s Sample 凭买方样品买卖(销售)Return Sample 回样Counter Sample 对等样品Sealed Sample 封样The Parties to the Contract 合同的当事人Quality to be about equal to the Sample 品质与样品大致相同Specifications 规格Grade 等级Standard 标准Fair Average Quality(F.A.Q.)良好平均品质Good Merchantable Quality(G.M.Q.)上好可销品质Brand 品牌Trademark 商标Description,Drawing and Diagram 说明书,图纸和技术协议书等Quality Tolerance 品质公差Chapter 5 Terms of Commodity——QuantityQuantity of Commodity 货物的数量Unit of Measurement 计量单位The Metric System 公制The British System 英制The U.S. System 美制Numbers 个数Weight 重量Length 长度Area 面积Volume 体积Capacity 容积International Measurement Conference 国际测量会议International System of Units(SI)国际单位制Gross Weight 毛重Net Weight 净重Gross for net 以毛作净Conditioned Weight 公量Theoretical Weight 理论重量More of Less Clause 溢短装条款Chapter 5 Terms of Commodity——PackingPaking 包装Nude Cargo 裸装货Cargo in Bulk 散装货Outer Packing 外包装Baling 打包Hogsheads 美国橡木桶Inner Packing 内包装Pallet 托盘Shipping Mark 运输标志(唛头)Additional Mark 附属性标志Indicative Mark 指示性标志Warning Mark 警告性标志Neutral Packing 中性包装Neutral Packing with Designated Brand 定牌中性包装Neutral Packing without Designated Brand 无牌中性包装Chapter 6 International Trade TermsL/C Issuing Date 信用证的开证日期Partial Shipment 分批装运Transshipment 转运Shipment 装运Terms of Payment 支付条件Draft 汇票Liner 班轮Trade Terms,Price Terms,Delivery Terms 贸易术语,价格术语,交货术语Warsaw-Oxford Rules 1932 1932年华沙——牛津规则International Law Association 国际法律协会Revised American Foreign Trade Definitions 1941 1941年美国对外贸易定义修正本INCOTERMS 2000 2000年国际贸易术语解释通则International Chamber of Commerce(ICC)国际商会Carrier 承运人Frontier 边境Clear 清关Value added tax(VAT)增值税United Nations Commission on International Trade Law(UNCITRAL)联合国国际贸易法律委员会Ship’s Rail 船舷Quay 码头Multi-modal Transport 多式联运Trim 平舱Stow 理舱EXW 工厂交货FCA 货交承运人FOB 装运港船上交货FAS 货交船边CFR 成本加运费CIF 成本加保险费加运费CPT 运费付至CIP 运费、保险费付至DAF 边境交货DES 目的港船上交货DEQ 目的港码头交货DDU 未完税交货DDP 完税后交货。

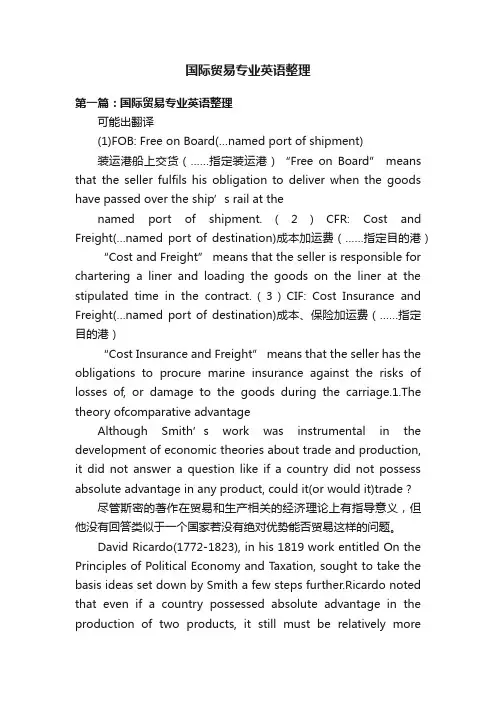

国际贸易专业英语整理第一篇:国际贸易专业英语整理可能出翻译(1)FOB: Free on Board(…named port of shipment)装运港船上交货(……指定装运港)“Free on Board” means that the seller fulfils his obligation to deliver when the goods have passed over the ship’s rail at thenamed port of shipment.(2)CFR: Cost and Freight(…named port of destination)成本加运费(……指定目的港)“Cost and Freight” means that the seller is responsible for chartering a liner and loading the goods on the liner at the stipulated time in the contract.(3)CIF: Cost Insurance and Freight(…named port of destination)成本、保险加运费(……指定目的港)“Cost Insurance and Freight” means that the seller has the obligations to procure marine insurance against the risks of losses of, or damage to the goods during the carriage.1.The theory ofcomparative advantageAlthough Smith’s work was instrumental in the development of economic theories about trade and production, it did not answer a question like if a country did not possess absolute advantage in any product, could it(or would it)trade ?尽管斯密的著作在贸易和生产相关的经济理论上有指导意义,但他没有回答类似于一个国家若没有绝对优势能否贸易这样的问题。

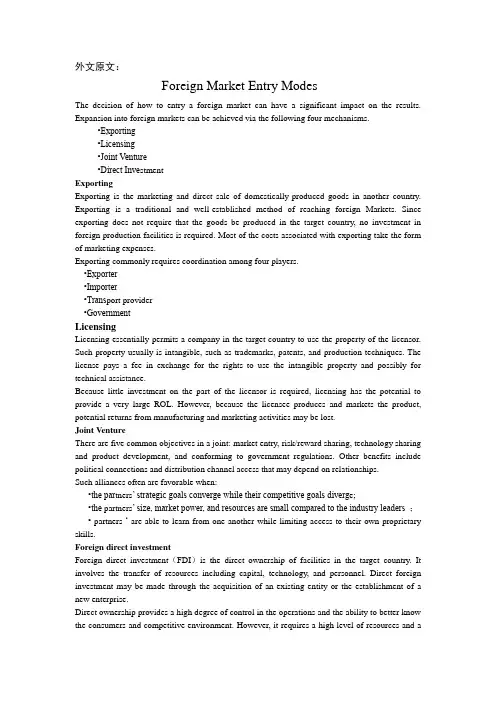

外文原文:Foreign Market Entry ModesThe decision of how to entry a foreign market can have a significant impact on the results. Expansion into foreign markets can be achieved via the following four mechanisms.•Exporting•Licensing•Joint Venture•Direct Inve stmentExportingExporting is the marketing and direct sale of domestically-produced goods in another country. Exporting is a traditional and well-established method of reaching foreign Markets. Since exporting does not require that the goods be produced in the target country, no investment in foreign production facilities is required. Most of the costs associated with exporting take the form of marketing expenses.Exporting commonly requires coordination among four players.•Exporter•Importer•Trans port provider•GovernmentLicensingLicensing essentially permits a company in the target country to use the property of the licensor. Such property usually is intangible, such as trademarks, patents, and production techniques. The license pays a fee in exchange for the rights to use the intangible property and possibly for technical assistance.Because little investment on the part of the licensor is required, licensing has the potential to provide a very large ROL. However, because the licensee produces and markets the product, potential returns from manufacturing and marketing activities may be lost.Joint VentureThere are five common objectives in a joint: market entry, risk/reward sharing, technology sharing and product development, and conforming to government regulations. Other benefits include political connections and distribution channel access that may depend on relationships.Such alliances often are favorable when:•the par tners’ strategic goals converge while their competitive goals diverg e;•the partners’ size, market power, and resources are small compared to the industry leaders ;• partners ‘ are able to learn from one another while limiting access to their own proprietary skills.Foreign direct investmentForeign direct investment(FDI)is the direct ownership of facilities in the target country. It involves the transfer of resources including capital, technology, and personnel. Direct foreign investment may be made through the acquisition of an existing entity or the establishment of a new enterprise.Direct ownership provides a high degree of control in the operations and the ability to better know the consumers and competitive environment. However, it requires a high level of resources and ahigh degree of commitment.The case of Euro DisneyDifferent modes of entry may be more appropriate under different circumstances,and the mode of entry is an important factor in the success of the project. Walt Disney Co. faced the challenge of building a theme park in Europe. Disney’s mode of entry in Japan had been licensing. However, the firm chose direct investment in its European theme park, owning 49% with the remaining 51% held publicly.Besides the mode of entry, another important element in Disney’s decision was exactly where in Europe to locate. There are many factors in the site selection decision, and a company carefully must define and evaluate the criteria for choosing a location. The problems with the euro Disney project illustrate that even if a company has been successful in the past, as Disney had been with its California, Florida, and Tokyo theme parks, futures success is not guaranteed, especially when moving into a different country and culture. The appropriate adjustments for national differences always should be made.(From:Strategic Management)中文译文:国外市场进入模式如何进入外国市场有着重大的影响。

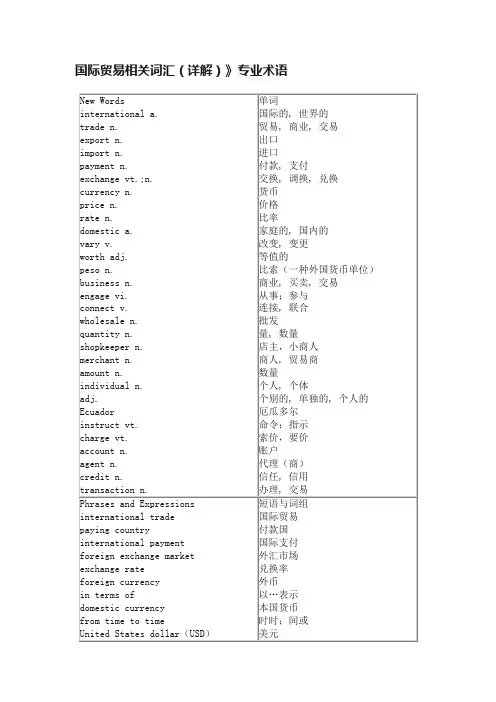

国际贸易相关词汇(详解)》专业术语Notes1.If one country has more bananas than it needs, but no trucks, it may exchange the bananas with another country that has more trucks than it can use, but no bananas. 如果一个国家生产的香蕉超过了需求,但不生产卡车,它就可能与另外一个不产香蕉,但有剩余卡车的国家进行交换。

(1)此句是一个复合句,由if引导的是条件状语从句。

(2)从句是一个复合句,此句中的if one country has more bananas than it needs包含一个由(more)…than (it needs)引导的比较状语从句。

Than是从属连词。

(3)主句中的that has more trucks than it can use是定语从句。

That是关系代词,引导定语从句。

在定语从句中又包含一个由(more)…than (it can use)引导的比较状语从句。

(4)句中的but no trucks省略了主语,完整的句子是one country has no trucks。

句中的but no bananas相同。

2.The exchange rate is the price of foreign currency in terms of domestic currency, and it varies from time to time. 外汇汇率是以本国货币表示的外国货币的价格,汇率会不时地波动。

(1)exchange rate(rate of exchange)外汇汇率;外汇汇价rate n.a measure of a part with respect to a whole; a proportion比率:部分相对整体形成的比率;比例。

Financial Liberalization and Monetary PolicyCooperation in East AsiaAuthor:Hwee Kwan Chow, Peter N. Kriz, Roberto S. Mariano and Augustine H. H. TanNationality: SingaporeSourse and Type: SMU Economics and Statistics Working Paper,Series Journal time: May 2007,P2-3,5-7,21It is well recognized that strong domestic financial markets can play a key role in economic growth and development. Sound financial institutions and well-functioning markets facilitate the mobilization and efficient allocation of savings, thereby improving productivity and contributing to growth (Levine 2004). This is particularly important for East Asia in view of the high saving rates of the regional countries. The limited development of local financial markets and their small fragmented nature have also led to a large part of Asian savings being intermediated outside the region. Surplus savings have mostly been channeled to the US and the funds return to Asia through US direct and portfolio investment. Fostering domestic financial markets and regional financial integration is important because it not only facilitates theintermediation of Asian savings within the region, but also attracts foreign investment in instruments denominated in the domestic currency. Such alternative sources of funding would reduce East Asia’s reliance on foreign currency borrowing and concomitantly, the risk exposure of the region to maturity and currency mismatches.However, as the countries in East Asia deregulate their financial sectors and develop their capital markets, a key issue that confronts policymakers is the greater complexity of risks that is injected into the financial system. In particular, capital account liberalization heightens the speed and magnitude of international spillovers and may potentially increase the vulnerability of individual countries to external financial shocks. Many studies have found empirical evidence that financial development and in particular, financial openness can increase a country’s vulnerability to crisis (see inter alia Rajan 2005 and Kaminsky and Reinhart 2003). In fact, considerable blame for the past financial cum currency crises has been placed on improper sequencing of liberalization.Over the past quarter century, the combination of a fixed exchange rate with an open capital account, has proven lethal in small open economies, particularly in emerging markets with weak financial systems and regulatory institutions. The fault seems to point to policies that opened the capital account prematurely while keeping the exchange rate rigid. Such a combination has often led to massive capital inflows thathave overwhelmed nascent financial systems, prompting consumption and asset boom-bust cycles. When we further combine a fixed exchange rate and premature opening of the capital account with a weakly structured and regulated domestic financial sector, currency crisis quickly turn into financial crisis and perhaps to full-blown economic and political crisis. Such a scenario plagued Latin America throughout the 1980s and 1990s. It took the crisis of 1997-98 to demonstrate that Asia was also not immune to these same policy inconsistencies.Sufficiently liberalized and developed domestic financial sectors are necessary to absorb and allocate capital inflows to their most efficient uses. Flexible exchange rates allow necessary international relative price adjustments and help allow asset markets to clear (Obstfeld 2004). Without exchange rate flexibility, economic adjustments will take place in terms of the price level, output or employment, or asset market volatility (Frankel and Rose 1995). Unless domestic financial sectors are sufficiently developed and exchange rates sufficiently flexible, capital account liberalization is premature and effectively neutralizes the stability benefits of fixed exchange rates. That this does so at a time when the domestic financial infrastructure can ill-afford massive surges and reversals in liquidity and financing, has prompted a number of economists to remind policymakers and professional economists alike of the dangers of the open-economy trilemma.Fully-open capital accountsrequire both domestic financial liberalization and exchange rate flexibility. This paper advocates the optimally cascading of financial liberalization that is consistent across three dimensions: extent of domestic financial liberalization; the degree of exchange rate flexibility; and the scope of capital account liberalization.2.1 Optimal SequencingUnder optimal sequencing, liberalization occurs sequentially. Let Ai∈[A1 ,…, An] represent the i th of n different stages of domestic financialsector liberalization. Let Bi ∈[B1,…, Bn] represent the i th of n differentdegrees of exchange rate flexibility. Here, one can think of B1as a peggedbilateral exchange rate and Bnas a fully floating exchange rate. Finally,let Ci ∈[C1,…, Cn] represent the i th of n different stages of capitalaccount liberalization. A strict interpretation of optimal sequencing suggests the following conceptual framework:That is to say, first, a domestic financial sector liberalization program must be developed and implemented, i.e. all n phases of A are completed. Once domestic financial sector liberalization is fully completed, only then should the degree of exchange rate flexibility be increased. Since it generally recommended that smaller degrees of flexibility should precede full floats, the exchange rate flexibility dimension of financial liberalization is complete when all n degrees of Bare permitted. Finally, once the domestic financial sector is liberalized(i.e., A has gone from A1 to An) and the exchange rate is fully flexible (i.e.,B has gone from B1 to Bn) then and only then, should steps be taken toliberalize the capital account, C. As with domestic financial sector liberalization, capital account liberalization has its baby steps (somethingcloser to C1) like FDI or long-term investments for infrastructural purposes, its more advanced like the full liberalization of short-term portfolio flows to its most fully liberalized and controversial phases, the allowance of short-term speculative flows, such as those from hedgefunds (something closer to Cn).In practice, sequencing is subject to considerable leakage. As markets grow and domestic financial sectors develop, there will be some degree of capital flow across borders even with the best of capital controls. But at the same time, the costs of capital controls enable disparities in productivity and competitiveness between global and insular markets to persist. Global markets are fiercely competitive and offer the truest test of productivity. It is highly unlikely that domestic financial sectors might develop the same quality and character of global financial markets on their own.2.2 Optimal CascadingIn contrast to optimal sequencing, the conceptual framework of optimal cascading requires decisions regarding the extent of domesticfinancial liberalization, the degree of exchange rate flexibility and the extent of capital account liberalization are taken simultaneously. Let theith phase of a liberalization program be given by (Ai , Bi, Ci), then thedesign of an optimal cascading program can be represented by the following rubric:During nascent stages of domestic financial development, rigid exchange rates and heavy capital controls are essential and will minimize the odds of boom-bust cycles and financial crisis. However, as the domestic financial sector matures, countries should make attempts to increase exchange rate flexibility and allow for longer term and stable capital inflows that serve to increase productivity, technology transfer and competitiveness.In latter stages, domestic financial sector liberalization will need both increased exchange rate flexibility, to help with risk management and price stability, as well as later-stage capital account liberalization, such as capital outflows for the purpose of portfolio diversification and the establishment of foreign banking branches and non-bank financial institutions. The internationalization of financial services which opens the domestic sector to foreign financial institutions frequently results in capacity building. Importantly, the commercial presence of foreign service providers normally increases the pressure to strengthensupervisory and regulatory framework.Once such a liberalization program is fully mature, the degree of exchange rate flexibility can be increased further. Mature domestic financial systems will be able to utilize exchange rate volatility to help adjust to shocks, smooth consumption, and help maintain price stability. At the same time, it is unrealistic to expect that domestic financial liberalization can ever fully mature without exposure to global financial markets and capital flows, particularly in countries without a long history of private financial banking and established access to offshore banking. In addition, deeper capital account liberalization will require increased exchange rate flexibility and liberalized domestic financial markets.China’s liberalization program represents the classic case of optimal cascading. From 1994 until late 2005, the yuan was pegged to the US Dollar at a fixed rate of 8.28RMB to US$1. Citing underdeveloped domestic financial markets and legal institutions, the Chinese central bank argued unambiguously that its banking system was not ready to handle a flexible yuan. While the yuan remained fixed to the US dollar, China did not completely restrict capital flows. China has been the recipient of considerable FDI capital flows and other types of capital flows that have leaked in through the considerable presence of foreign branch operations and outsourcing operations. Most recently, the Chinese central bank has allowed the yuan to float within a tight band while at thesame time domestic financial sector reforms and a measured relaxation of capital controls continues (Eichengreen 2005). These simultaneous and holistic policy choices characterize the measured and gradual face of optimal cascading. While it is too early to tell if the specific types of capital account liberalization enacted by China are wise given the stage of domestic sector development and limited degree of exchange rate flexibility, it is clear that China had adopted the prudent and realistic strategy of optimal cascading.8We identify the risks associated with the liberalization attempts of China—being an economically large and influential country—as representing the greatest challenge to the region. Even with successful financial liberalization in China, the massive capital flows that will be generated can destabilize the region. It is thus important for countries in East Asia, including China, to optimally cascade financial liberalization by simultaneously determining the extent of domestic financial liberalization, the degree of exchange rate flexibility and the scope of capital account liberalization consistent with underlying domestic institutional infrastructures. In addition, financial stability can be promoted via regional policy coordination. We are of the view that this will be most effective when approached as a series of nested sequencing problems that would take East Asia through increasingly intensiveinformal modes of monetary policy cooperation: starting with weak forms of cooperation that emphasize non-monetary cooperation and sovereign institutional reforms to more intensive modes of informal cooperation that can accelerate the development of deeper regionalism and synchronization, such as the adoption of common policy objectives, and finally to the most intensive mode of informal cooperation, the adoption of common policy regimes.金融自由化与货币政策东亚合作作者:周惠关等国籍:新加坡出处及类别:新加坡管理学院经济和统计工作文件系列, 发表时间及页码:2007年5月 P2-3,5-7,21人们都清楚地认识到,强有力的国内金融市场能够在经济增长和发展中发挥关键作用。

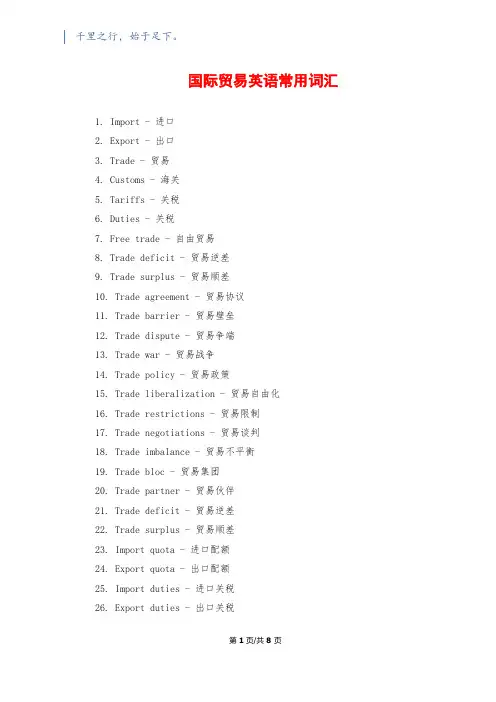

国际贸易英语常用词汇1. Import - 进口2. Export - 出口3. Trade - 贸易4. Customs - 海关5. Tariffs - 关税6. Duties - 关税7. Free trade - 自由贸易8. Trade deficit - 贸易逆差9. Trade surplus - 贸易顺差10. Trade agreement - 贸易协议11. Trade barrier - 贸易壁垒12. Trade dispute - 贸易争端13. Trade war - 贸易战争14. Trade policy - 贸易政策15. Trade liberalization - 贸易自由化16. Trade restrictions - 贸易限制17. Trade negotiations - 贸易谈判18. Trade imbalance - 贸易不平衡19. Trade bloc - 贸易集团20. Trade partner - 贸易伙伴21. Trade deficit - 贸易逆差22. Trade surplus - 贸易顺差23. Import quota - 进口配额24. Export quota - 出口配额25. Import duties - 进口关税26. Export duties - 出口关税第1页/共8页27. Import restrictions - 进口限制28. Export restrictions - 出口限制29. Trade balance - 贸易平衡30. Trade organization - 贸易组织31. International trade - 国际贸易32. Trade deficit - 贸易逆差33. Trade surplus - 贸易顺差34. Balance of trade - 贸易差额35. Import/export license - 进出口许可证36. Fair trade - 公平贸易37. Foreign trade - 外贸38. Cross-border trade - 跨境贸易39. Trade barrier - 贸易壁垒40. Trade protectionism - 贸易保护主义41. Trade representative - 贸易代表42. Trade mission - 贸易代表团43. Trade commission - 贸易委员会44. Trade associations - 贸易协会45. Trade fair - 贸易博览会46. Global trade - 全球贸易47. Bilateral trade - 双边贸易48. Multilateral trade - 多边贸易49. Trade dispute settlement - 贸易争端解决50. Trade balance sheet - 贸易收支表51. Trade deficit - 贸易逆差52. Trade surplus - 贸易顺差53. Trade finance - 贸易融资54. Trade barriers - 贸易壁垒55. Trade restrictions - 贸易限制56. Trade liberalization - 贸易自由化57. Trade negotiations - 贸易谈判58. Trade agreement - 贸易协议59. Trade route - 贸易路线60. Trade cycle - 贸易周期61. Trade services - 贸易服务62. Trade secrets - 商业秘密63. Trade name - 商标64. Trade mark - 商标65. Trade-in - 以旧换新66. Trade-off - 折中67. Trade surplus - 顺差68. Trade deficit - 逆差69. Trade war - 贸易战70. Trade relationship - 贸易关系71. Trade route - 贸易路线72. Trade center - 贸易中心73. Trade union - 工会74. Trade fair - 商品展览会75. Trade embargo - 贸易禁令76. Trade sanctions - 贸易制裁77. Trade bloc - 贸易集团78. Import/export regulations - 进出口规定79. Trade deficit - 贸易逆差80. Trade surplus - 贸易顺差81. Import duties - 进口关税82. Export duties - 出口关税83. Import restrictions - 进口限制84. Export restrictions - 出口限制85. Export subsidy - 出口补贴第3页/共8页86. Trade imbalance - 贸易不平衡87. Trade war - 贸易战争88. Trade dispute - 贸易争端89. Trade negotiations - 贸易谈判90. Trade agreement - 贸易协议91. International trade - 国际贸易92. Global trade - 全球贸易93. Bilateral trade - 双边贸易94. Multilateral trade - 多边贸易95. Trade union - 工会96. Trade fair - 贸易展97. Trade secret - 商业秘密98. Trade-off - 折衷方案99. Trade barrier - 贸易壁垒100. Trade deficit - 贸易逆差101. Trade surplus - 贸易顺差102. Trade finance - 贸易融资103. Trade barrier - 贸易壁垒104. Trade restriction - 贸易限制105. Trade liberalization - 贸易自由化106. Trade negotiation - 贸易谈判107. Trade agreement - 贸易协定108. Trade route - 贸易路线109. Trade policy - 贸易政策110. Trade deficit - 贸易逆差111. Trade surplus - 贸易顺差112. Trade relations - 贸易关系113. Trade war - 贸易战争114. Trade dispute - 贸易争端115. Trade sanctions - 贸易制裁116. Trade union - 工会117. Trade fair - 贸易展览会118. Trade secret - 商业秘密119. Trade-off - 折中120. Trade barrier - 贸易壁垒121. Trade deficit - 贸易逆差122. Trade surplus - 贸易顺差123. Trade finance - 贸易融资124. Trade barrier - 贸易壁垒125. Trade restriction - 贸易限制126. Trade liberalization - 贸易自由化127. Trade negotiation - 贸易谈判128. Trade agreement - 贸易协定129. Trade route - 贸易路线130. Trade policy - 贸易政策131. Trade deficit - 贸易逆差132. Trade surplus - 贸易顺差133. Trade relations - 贸易关系134. Trade war - 贸易战争135. Trade dispute - 贸易争端136. Trade sanctions - 贸易制裁137. Trade union - 工会138. Trade fair - 贸易展览会139. Trade secret - 商业秘密140. Trade-off - 折中141. Trade barrier - 贸易壁垒142. Trade deficit - 贸易逆差143. Trade surplus - 贸易顺差144. Trade finance - 贸易融资第5页/共8页145. Trade barrier - 贸易壁垒146. Trade restriction - 贸易限制147. Trade liberalization - 贸易自由化148. Trade negotiation - 贸易谈判149. Trade agreement - 贸易协定150. Trade route - 贸易路线151. Trade policy - 贸易政策152. Balance of trade - 贸易差额153. World Trade Organization - 世界贸易组织154. Foreign direct investment - 外国直接投资155. Intellectual property rights - 知识产权156. Dumping - 倾销157. Subsidies - 补贴158. Antidumping - 反倾销159. Countervailing duties - 反补贴关税160. Safeguard measures - 保障措施161. Non-tariff barriers - 非关税壁垒162. Technical barriers to trade - 技术贸易壁垒163. Sanitary and phytosanitary measures - 卫生和植检措施164. Trade facilitation - 贸易便利化165. Rules of origin - 原产地规则166. Most favored nation - 最惠国待遇167. National treatment - 国民待遇168. Tariff escalation - 关税递增169. Tariff peaks - 关税峰值170. Trade in services - 服务贸易171. Trade in goods - 商品贸易172. Trade in agricultural products - 农产品贸易173. Trade in digital products - 数字产品贸易174. Trade in energy - 能源贸易175. Trade in intellectual property - 知识产权贸易176. Trade in pharmaceuticals - 药品贸易177. Trade in textiles - 纺织品贸易178. Trade in services agreement - 服务贸易协议179. Trade in information technology products - 信息技术产品贸易180. Trade in financial services - 金融服务贸易181. Trade in environmental goods - 环境产品贸易182. Trade in cultural products - 文化产品贸易183. Trade in tourism services - 旅游服务贸易184. Trade in education services - 教育服务贸易185. Trade in healthcare services - 医疗保健服务贸易186. Trade in transportation services - 交通运输服务贸易187. Trade in construction services - 建筑服务贸易188. Trade in professional services - 专业服务贸易189. Trade in telecommunication services - 电信服务贸易190. WTO agreements - WTO协议191. General Agreement on Tariffs and Trade - 关税和贸易总协定192. Agreement on Agriculture - 农业协议193. Agreement on Subsidies and Countervailing Measures - 补贴和反补贴措施协议194. Agreement on Technical Barriers to Trade - 技术贸易壁垒协议195. Agreement on Sanitary and Phytosanitary Measures - 卫生和植检措施协议196. Agreement on Trade-Related Intellectual Property Rights - 与贸易有关的知识产权协议197. Agreement on Trade-Related Investment Measures - 与贸易有关的投资措施协议198. Agreement on Government Procurement - 政府采购协议199. Agreement on Customs Valuation - 关税估值协议第7页/共8页200. Agreement on Rules of Origin - 原产地规则协议。

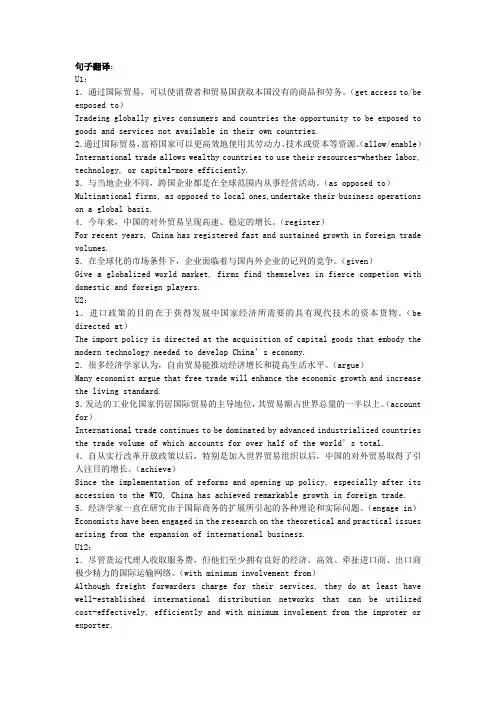

句子翻译:U1:1.通过国际贸易,可以使消费者和贸易国获取本国没有的商品和劳务。

(get access to/be exposed to)Tradeing globally gives consumers and countries the opportunity to be exposed to goods and services not available in their own countries.2.通过国际贸易,富裕国家可以更高效地使用其劳动力、技术或资本等资源。

(allow/enable)International trade allows wealthy countries to use their resources-whether labor, technology, or capital-more efficiently.3.与当地企业不同,跨国企业都是在全球范围内从事经营活动。

(as opposed to)Multinational firms, as opposed to local ones,undertake their business operations on a global basis.4.今年来,中国的对外贸易呈现高速、稳定的增长。

(register)For recent years, China has registered fast and sustained growth in foreign trade volumes.5.在全球化的市场条件下,企业面临着与国内外企业的记列的竞争。

(given)Give a globalized world market, firms find themselves in fierce competion with domestic and foreign players.U2:1.进口政策的目的在于获得发展中国家经济所需要的具有现代技术的资本货物。

国际贸易英语知识点总结一、国际贸易术语(Incoterms)1. FOB (Free on Board)- 含义:卖方在指定的装运港将货物装上买方指定的船只后,卖方即完成交货义务。

风险在货物越过船舷时转移给买方。

- 示例:We offer the goods FOB Shanghai.(我们提供上海港船上交货价的货物。

)- 相关费用:卖方负责将货物运至装运港船上之前的一切费用,包括国内运输、装卸等费用;买方负责从装运港到目的港的运费、保险费等。

2. CIF (Cost, Insurance and Freight)- 含义:卖方负责支付货物成本、保险费和运费,将货物运至指定目的港。

- 示例:The price is quoted CIF New York.(价格报的是纽约港到岸价。

)- 相关费用:卖方承担货物到达目的港之前的成本、保险费和运费;买方负责卸货后的费用,如进口关税等。

风险在货物越过装运港船舷时转移给买方。

3. CFR (Cost and Freight)- 含义:卖方负责货物成本和运费,将货物运至指定目的港。

与CIF相比,不包含保险费。

- 示例:We can supply the goods CFR London.(我们可以供应伦敦港成本加运费价的货物。

)- 相关费用:卖方承担货物运至目的港的成本和运费,买方负责保险费及卸货后的费用。

风险在货物越过装运港船舷时转移给买方。

二、商务信函写作。

1. 信头(Letterhead)- 包含公司名称、地址、联系方式(电话、传真、电子邮箱等)。

- 例如:ABC Company.123 Main Street, New York, NY 10001.Tel: +1 - 212 - 1234567.Fax: +1 - 212 - 1234568.Email:*******************.2. 称呼(Salutation)- 如果知道对方姓名,用“Dear Mr./Ms. + 姓氏”,如“Dear Mr. Smith”;如果不知道具体姓名,可用“Dear Sir/Madam”或者“To Whom It May Concern”。

国际贸易英文名词解释International Trade国际贸易International trade is the international exchange of goods and services between countries. This type of trade gives rise to a world economy, in which prices, or supply and demand, affect and are affected by global events.Free Trade自由贸易The main idea of free trade is that supply and demand factors, operating on a global scale, will ensure that production happens efficiently. Therefore, nothing needs to protect or promote trade and growth because market forces will do so automatically.Protectionism贸易保护主义In contrast, protectionism holds that regulation of international trade is important to ensure that markets function properly. Advocates of this theory believe that market inefficiencies may hamper the benefits of international trade and they aim to guide the market accordingly. Production Possibilities Curve /Frontier生产可能性曲线/边界A Production Possibilities Frontier is a graph that shows the various combinations of output that the economy can possibly produce, given the available factors of production and the existing technology . Opportunity Cost机会成本Opportunity Cost means whatever must be given up to obtain some item.Supply Curve供给曲线A Supply Curve is a graph that shows the relationship between the price of a good and the quantity supplied.Demand Curve 需求曲线A Demand Curve is a graph that describes the relationship between the price of a good and the quantity demanded.Excess Supply Curve出口供给曲线Because Excess Supply is a situation in which quantity supplied is greater than quantity demanded, Excess Supply Curve can be defined as a graph that depicts the relationship between the price and the available quantity for export of a product. Excess Supply Curve can be derived from subtracting a supply curve with a corresponding demand curve.Excess Demand Curve进口需求曲线Because Excess Demand is a situation in which quantity demanded is greater than quantity supplied, Excess Demand Curve can be defined as a graph that depicts the relationship between the price and the desirable quantity for import of a product. Excess Demand Curve can be derived from subtracting a demand curve with a corresponding supply curve.Consumer Surplus消费者剩余Consumer Surplus means a buyer’s willingness to pay minus the amount the buyer actually pays. Consumer surplus measures the benefit to buyers of participating in a market.Producer Surplus 生产者剩余Producer Surplus is the amount a seller is paid for a good minus the seller’s cost. Producer surplus measures the benefit to sellers of participating in a market.Economies of Scale规模经济Economies of Scale means the property whereby the long-run average cost falls as the quantity of output increases.Diseconomies of Scale规模不经济Diseconomies of Scale means the property whereby the long-run average cost rises as the quantity of output increases.Constant Returns to Scale规模报酬不变Constant Returns to Scale means the property whereby the long-run average cost stays the same as the quantity of output changes. Indifference Curve无差异曲线Indifference Curve is a curve that shows consumption bundles that give the consumer the same level of satisfaction.The Gravity Model引力模型In its basic form, the gravity model assumes that only size and distance 经济规模和距离 are important for trade in the following way:Tij = A x Yi x Yj /Dij两国之间的贸易规模与经济规模成正比,与两国之间的距离成反比;Service Outsourcing服务外包Service outsourcing occurs when a firm that provides services moves its operations to a foreign location.服务外包是指一个企业将原本由自己提供的服务转移给国外供应商;Mercantilism重商主义Belief that nation could become rich and powerful only by exporting more than it imported.Mercantilists measured wealth of a nation by stock of precious metals it possessedAbsolute Advantage绝对优势A nation has absolute advantage over another nation if it can produce a commodity more efficiently. When one nation has absolute advantage in production of a commodity, but an absolute disadvantage with respect to the other nation in a second commodity, both nations can gain by specializing in their absolute advantage good and exchanging part of the output for the commodity of its absolute disadvantage.Comparative Advantage比较优势Even if one nation is less efficient than has absolute disadvantage with respect to the other nation in production of both commodities, there is still a basis for mutually beneficial trade.Production Possibilities生产可能性The production possibility frontier PPF of an economy shows the maximum amount of a goods that can be produced for a fixed amount of resources.Factor Endowment 要素禀赋the overall amount of productive factors , such as capital, labor, and land, available to one nation.Factor Abundance要素丰裕度There are two ways to define factor abundance. One way is in terms of physical units., in terms of the overall amount of capital and labor available to each nation. Another way is in terms of relative factor price., in terms of the rental price of capital and the price of labor time in each nation.Factor Intensity 要素密集度In a world of two commodities X and Y and two factors labor and capital, at any given wage-interest, we say that commodity Y is capital intensive if the capital-labor ratio K/L used in the production of Y is greater than K/L used in the production of X.Heckscher-OhlinTheoremH-O定理An economy is predicted to export goods that are intensive in its abundant factors of production and import goods that are intensive in its scarce factors of production.一个国家将出口密集使用其相对丰富要素的商品,进口密集使用其相对稀缺要素的商品;Stolper-Samuelson theorem S-S定理:长期内,出口产品生产部门密集使用的生产要素本国的充裕要素的报酬提高;进口产品生产中密集使用的生产要素本国的稀缺要素的报酬下降;The factor price equalization theorem要素价格均等化定理Because relative output prices are equalized and because of the direct relationship between output prices and factor prices, factor prices are also equalized. 由于产品价格和要素价格的一一对应关系,贸易后,产品相对价格的趋同会导致土地和劳动的相对价格的趋同Economies of scale规模经济Economies of scale could mean either that larger firms or a larger industry is more efficient: the cost per unit of output falls as a firm or industry increases output.Internal economies of scale内部规模经济Internal economies of scale occur when the cost per unit of output depends on the size of a firm.随着工厂或企业规模的扩大,单位产品成本下降; External economies of scale外部规模经济External economies of scale occur when cost per unit of output depends on the size of the industry.是指行业规模经济,由于行业内企业数量的增加和产业集聚所引起的产业规模的扩大,使行业中的单个企业获得单位成本下降的好处;Monopolistic competition垄断竞争Monopolistic competition is a model of an imperfectly competitive industry 垄断竞争是一个不完全竞争产业模式Inter-industry Trade产业间贸易Trade occurs only between industries贸易只在产业之间发生Intra-industry Trade产业内贸易Trade occurs within the industry由于产品的多样化或经济规模的扩大等原因,贸易在产业内发生Index of intra-industrial trade, IIT产业内贸易指数表示产业内贸易在国际贸易中所占比重,用来衡量产业内贸易的发展程度; Dumping 倾销Dumping is the practice of charging a lower price for exported goods than for goods sold is an example of price discrimination价格歧视: the practice of charging different customers different prices.倾销的前提条件:imperfect competition exists: firms are able to influence market prices.不完全竞争的存在:企业能够影响价格markets are segmented so that goods are not easily bought in one market and resold in another. and Anti-Dumping;市场是分割的,以至于商品Anti-Dumping反倾销Dumping as well as price discrimination in domestic markets is widely regarded as unfair. 倾销被认为是一种不公平的贸易行为The Commerce Department may impose an “anti-dumping duty反倾销税,” or tax, as a precaution against possible injury.External Economies外部经济External economies: a country that has a large industry will have low average costs of producing that industry’s good or service.当规模经济存在于一个行业内部而不是单个厂商内部时,就被称作外部经济Dynamic Increasing Returns动态收益递增Dynamic increasing returns to scale exist if average costs fall as cumulative output over time rises.当平均成本随着累积产量而非当前产量的增加而下降的情形就是动态规模报酬递增learning curve学习曲线A graphical representation of dynamic increasing returns to scale is called a learning curve学习曲线.The efficiency case for free trade自由贸易的效率.The first case for free trade is the argument that producers and consumers allocate resources most efficiently when governments do not distort market prices through trade policy.Political argument for free trade主张自由贸易的政治依据Political argument for free trade,says that free trade is the best feasible political policy, even though there may be better policies in principle.The Terms of Trade Argument for a Tariff赞成关税的贸易条件改善论For a “large” country, a tarif f or quota lowers the price of imports in world markets and generates a terms of trade gain. In fact, a small tariff will lead to an increase in national welfare for a large country.The Optimum Tariff最优关税For a large country, there is an optimum tariff t0 at which the marginal gain from improved terms of trade just equals the marginal efficiency lossfrom production and consumption distortion.A tariff rate tp that completely prohibits imports leaves a country worse off, but tariff rate t0 may exist that maximizes national welfare: an optimum tariff.The Domestic Market Failure Argument Against Free Trade反对自由贸易的国内市场失灵论A second argument against free trade is that domestic market failures 国内市场失灵 may exist that cause free trade to be a suboptimal policy 次优政策.theory of the second best次优理论The domestic market failure argument against free trade is an example of a more general argument called the theory of the second best次优理论.次优理论认为,在任何一个市场上,只有所有其他市场都能正常发挥作用时,自由放任才是最理想的政策;如果不是这样,政府干预虽会扭曲市场激励,但有可能通过抵消市场失灵的影响而增加国家福利;Median Voter Theorem中点选民理论The median voter theorem predicts that democratic political parties may change their policies to court争取 the voter in the middle of the ideological spectrum意识形态范围 ., the median voter. 越接近中点选民意见的政策越能得到大多数选民的支持;Collective Action 集体行动While consumers as a group have an incentive to advocate free trade,each individual consumer has no incentive because his benefit is not large compared to the cost and time required to advocate free that impose large losses for society as a whole but small losses on each individual may therefore not face strong opposition.国际贸易简答题1. 贸易引力模型的主要内容及运用;在其他条件不变的情况下,两个国家间的贸易与两国的国内生产总值成正比,与两国间的距离成反比;引力模型的重要用途之一就是有助于明确国际贸易中的异常现象;运用:贸易引力模型不是万能的,对于服务贸易和资本贸易领域验证效果不显着,对于商品贸易领域的验证效果显着;实例比较:中国与日本&中国与越南的商品贸易量对比比较生产总值,中国与东盟&中国与美国的商品贸易量对比比较距离2. 重商主义、绝对优势理论、比较优势理论的贸易思想及贸易政策主张;重商主义认为,一个国家的财富由其拥有的贵金属代表,拥有的贵金属越多,这个国家就越富有;由于世界资源是有限的,因此,国与国之间的经济交往是一种零和博弈,即一方所得为另一方所失;对于国际贸易,贸易盈余是贸易所得,而贸易赤字为贸易所失,因此重商主义主张贸易要实现盈余;在当时的金属本位币制度下,贸易盈余意味着贵金属的流入,这将有助于缓解货币缺口;绝对优势理论:当两个国家生产两种商品,使用一种生产要素——劳动时,如果刚好A国家在一种商品上劳动生产率高,B国家在这种商品上劳动生产率低,则A国该商品生产上具有绝对优势;两国按各自的绝对优势进行专业生产分工并参与贸易,则两国都能从贸易中得到利益;这种贸易利益来自专业化分工促进劳动生产率的提高;比较优势理论:如果一个国家在本国生产一种产品的机会成本低于在其他国家生产该种产品的机会成本,则这个国家在生产该种产品上就拥有比较优势;贸易政策:每个国家都出口本国具有比较优势的商品;3. 衡量比较优势的主要指标;如果一个国家在本国生产一种产品的机会成本用其他产品来衡量低于在其他国家生产该种产品的机会成本的话,则这个过家在生产该种产品上就拥有比较优势;4. 要素禀赋理论的贸易思想、政策主张以及贸易对收入分配的影响;要素禀赋理论:根据生产要素禀赋理论,在各国生产同一产品的技术水平相同的情况下,两国生产同一产品的价格差来自于产品的成本差别,这种成本差别来自于生产过程中所使用的生产要素的价格差别,这种生产要素的价格差别则决定于该国各种生产要素的相对丰裕程度;一个国家供给相对多的生产要素,称为这个国家的充裕要素;供给相对少的要素,称为这个国家的稀缺要素;国际贸易收入分配效应的一般结论如下:一个国家充裕要素的所有者可以从贸易中获利,稀缺要素的所有者会因贸易而受损;5. H-O理论和S-S定理的主要内容及其运用;H-O理论:一个国家将出口密集使用其相对丰富要素的商品,进口密集使用其相对稀缺要素的商品;S-S定理:长期内,出口产品生产部门密集使用的生产要素本国的充裕要素的报酬提高;进口产品生产中密集使用的生产要素本国的稀缺要素的报酬下降;6. 要素价格均等化定理的主要内容及要素价格均等化实现的前提条件;要素价格均等化定理:由于产品价格和要素价格的一一对应关系,贸易后,产品相对价格的趋同会导致土地和劳动的相对价格的趋同前提条件:1 两个国家同时生产两种相同的产品;2 两国的技术水平相同; 3 贸易会使得两个国家的产品价格相等;7. 产业内贸易的基础;产业内贸易是产业内国际贸易的简称,是指一个国家或地区,在一段时间内,同一产业部门产品既进口又出口的现象;产业内贸易还包括中间产品的贸易,即是某项产品的半制成品、零部件在两国间的贸易;产业内贸易是建立在不完全竞争的基础上的;8. 产业内贸易发生需要具备的条件;造成产业内贸易现象的主要原因基础:1、产品差异2、规模经济3、消费者需求偏好差别 4、国家之间产品层次结构和消费层次结构的重叠10. 倾销以及反倾销需要满足的前提条件;倾销:指一国或地区的生产商或出口商以低于其正常价格或低于成本将其商品销售到另一国或地区市场的行为;确定某出口产品是否存在倾销,主要看这一产品是否以低于它的正常价格在国外市场销售;倾销实际是一种国际间的价格歧视,出口企业实施倾销必须具备三个条件:1企业在国内市场上有一定的垄断力量,有能力决定其销售价格;2本国和外国市场是分割的,本国出口产品不能回流;3出口商在国外市场面临较高的需求弹性;反倾销:是指进口国主管当局根据受到损害的国内企业的申诉,按照一定的法律程序对以低于正常价格在进口国进行销售的、并对进口国生产相似产品的产业造成法定损害的外国产品,进行立案、调查和处理的过程和措施;进口国实施反倾销措施必须满足三个条件:1 倾销成立;2 国内产业受到实质性损害;3 倾销与损害有因果关系;11.结合名义关税率和有效保护率评价关税的贸易保护作用;名义保护率:表示实施保护政策后一种商品的国内价格高于国际价格的百分率; 有效保护率:指一个国家的一整套贸易政策使某一产业每单位产出的增加值提高的百分率;评价:当最终产品的名义保护率大于原材料等中间产品的名义保护率时,最终产品的有效保护率就大于其名义保护率;当最终产品的名义保护率小于原材料等中间产品的名义保护率时,最终产品的有效保护率就小于其名义保护率;只有当最终产品的名义保护率等于原材料等中间产品的名义保护率时,最终产品的有效保护率才等于其名义保护率;研究关税结构,区分名义保护率与实际保护率的差异,具有重要的意义;当最终产品名义税率一定时,对所需的原材料等中间投入品征收的名义税率越低,则最终产品名义税率的保护作用就越大有效保护率越高;因此,如果要保护某产业,不仅要考虑对该产业最终产品的关税率,而且要把整个关税结构与该产业的生产结构结合起来进行考虑,再来制定相应的政策措施;基于有效保护率的考虑,发达国家常常采用逐步升级的关税结构关税升级:对初级产品进口免税或只征很低的关税,对半成品征收较高的关税,但对制成品,特别是劳动密集型制成品征收更高的关税;关税升级的结果是:国内加工程度越深,有效保护率超出名义保护率的比率就越大;12. 从量关税与从价关税的比较;从价关税ad valorem tariff是以进口商品的价格为标准计征的关税,其税率表现为货物价格的一定百分率;从价税随商品价格的变动而变动,商品价格上涨,从价税额也随之增加,因此其保护作用受价格变动的影响较大;在通货膨胀时,从价税有较强的保护作用;从价税不具有累进性和累退性,按照商品价格的一定比例征收;一些特殊商品如绘画等艺术品的价格相差悬殊,适合从价税;从量关税specific tariff是根据商品的的实物单位重量、数量、长度、容积和面积等征收的关税;从量税操作简单,海关人员只需要将商品按照重量、体积等进行分类即可;在征收从量税的情况下,商品价格下跌时,实际上等于增加了关税,因而从量关税对外国出口商的低价倾销有着较高的保护作用;从量税具有累退性,对发展中国家的出口不利;因为发展中国家出口的制成品和半制成品大多属于低档货,如果进口国仍按一定数量征收一定的关税,这与同一种商品中的高档货相比,等于提高了关税税率;13. 进口配额与关税的比较;进口配额import quota又称进口限额,是一国政府在个一定时期如一个季度、半年或一年内,对某些商品的进口数量或金额加以直接的数量控制;在规定的期限内,配额以内的货品可以进口,超过配额的不能进口,或者征收较高的关税或罚款;它是众多国家实行进口数量限制的重要手段之一;关税是对通过一国关境海关的贸易商品课征的税收,是历史上最重要的一类贸易壁垒;在竞争条件下,进口配额对本国生产、消费、价格的影响与征收同样数量的进口关税相似,只不过关税是通过提高进口商品的价格来减少进口和增加国内生产,而配额则从相反的途径,即先减少进口造成价格上涨从而增加国内生产;对政府收入的影响:配额对国内经济福利的影响与关税不同之处主要反映在政府税收上;关税给政府带来收益,而配额带来的“经济租”c则不一定归政府所有;“经济租”的归属取决于政府如何分配进口配额;配额相对于关税的优点:第一,配额可以比关税更有效地控制进口;第二,实施配额更灵活,政府可以通过发放进口许可证随时调节进口数量;第三,配额给政府更多的权力;第四,配额比关税承受相对小的国际贸易自由化压力;14. “自愿”出口配额的优点及其本质;国家一般都是鼓励出口的,某些国家往往用配额来限制资源性产品和农产品的出口;除了保护本国的资源供给以外,现实世界中的出口配额往往是出口国家或地区在进口国的要求或压力下“自动”制定的;所以出口配额又称“自愿”出口配额; 优点:增强企业的出口竞争力;如果企业通过获得出口许可证,将获得的额外出口利润用于再投资,则可能增强企业竞争力;实施自愿出口配额,在出口国可能形成既得利益集团;“自愿”出口配额是由出口国直接控制这些商品对指定进口国家的出口;但是就进口国单方面来说,自动出口配额象绝对进口配额一样,起到了限制商品进口的作用,因而其实质还是进口配额,具有等效进口配额的所有经济效应;15. 产业补贴政策与关税、配额的比较;出口补贴,又称出口奖金,它是政府为了降低出口商品的价格,增强出口商品在国外市场上的竞争力,在出口某种商品时给予出口厂商的补贴;包括直接补助和间接补助;直接补助是政府直接向出口商提供现金补助,或津贴;间接补助是政府对选定商品的出口给予财政税收上的优惠;关税是对通过一国关境海关的贸易商品课征的税收,是历史上最重要的一类贸易壁垒;配额是指对进出口商品的数量或金额加以限制,分为进口配额和出口配额两种; 进口配额import quota指一国政府在一定时期内,对某些商品的进口数量或金额加以直接的限制,在规定的配额内,商品可以进口,超过的则不准进口,或征收较高的关税,甚至罚款;它分为绝对配额和关税配额两种形式;关税、配额与补贴是一个国家用来保护国内市场、帮助国内厂商抵御国外对手竞争的常用措施;由于保护机制不同,关税、配额与补贴对不同利益主体的利益再分配会产生不同的影响:1.关税措施有利于生产者和政府,不利于消费者;2.配额措施有利于生产者,不利于消费者,政府利益影响则视乎配额的分配方式而定;3.补贴措施有利于生产者和消费者,不利于政府;一个国家可以根据其要保护的利益主体不同采取相应的保护措施;进口配额与关税的比较对需求变化的反应不同;进口配额将进口限定到一个确定的水平,而进口关税的贸易效果则不确定;进口配额涉及进口配额的发放,而关税则没有内在作用机制不同;对生产者的保护程度不同对消费者福利的损失程度不同16. 小国和大国征收进口关税的经济效应;所谓小国指不是某种商品的重要的进口国;大国,指某种商品的重要进口国;大小国征收关税上消费效应,生产效应和贸易效应等等;1.消费效应;小国征收关税后,国内市场价格上升造成需求下降,人们消费水平收缩或减少;大国征收关税后,因国内市场价格上涨,使消费水平减少;2.生产效应;小国征收关税后,国内市场价格因进口减少而上升,国内厂商扩大生产,产量增加;大国征收关税后,国内产品价格上升,产量提高,生产者剩余增加;3.税收效应;小国征收的税收将由政府获得,形成政府的财政收入;大国征收关税后,政府财政收入增加;4.保护效应;小国征收关税后,国内价格上升,原来在世界价格下因成本太高而退出生产的厂商,这时在较高价格下又重新进入生产,国内供给增加;而,大国征收关税,税率越高,关税的保护作用越大;除此之外,大国征收关税后产生的效应不同于小国的有:1大国征收关税后,使该进口商品的的国内价格上升,而国内该进口商品的价格上升会引导国内生产扩大,消费减少,总体效果会使进口需求下降;该大国进口的下降又使得该商品的国际市场供应量增加,直接导致该商品的世界市场价格下降;大国的贸易条件改善,即会产生贸易条件效应,这是在小国情形下所没有的效应;2大国征收关税所得财政税收效应比小国情形时大;18. 小国实施进口配额的经济效应;进口配额是指一国政府在一定时期内,对于某些商品的进口数量或金额加以直接限制的措施,它对于进口的阻碍作用是十分明晰的;一、进口配额的含义指一国政府在一定时期内,对于某些商品的进口数量或金额加以直接限制的措施; 在实践中存在着超过配额不得进口绝对配额与对超额进口部分实行惩罚性关税关税配额,以及针对国别与全球发放进口配额的做法;二、进口配额的效应1、贸易小国进口配额的效应小国模型国内价格从到;生产者剩余:增加了部分;消费者剩余减少:配额的净福利效应:配额净损失::一种垄断利润;也许归之于获得进口配额的企业,也许进入政府;2、贸易大国进口配额的效应消费者剩余:减少了图a中的P1P0FB 部分;生产者剩余:增加了图a中的P1P0CA 部分;在大国条件下,由于大国对一种商品的供求变化会影响到商品出口国的国内供求变化,因此大国实施配额限制不仅会减少本国的福利,而且还将减少外国的福利;19. 支持贸易自由化和支持贸易保护的主要观点及其理由;支持贸易自由化的主要观点:1、支持自由贸易效率的观点:生产者和消费者最有效地分配资源时,政府通过贸易政策不扭曲市场的价格;2、自由贸易的额外收益:1自由贸易避免了寻租所带来的效率损失;2在被保护的市场中,不仅生产被分割,而且由于减少了竞争和提高了利润,从而吸引了太多的厂商进入被保护的行业;在一个狭小的国内市场中拥挤着那么多的厂商,各厂商的生产规模都很小;3自由贸易后,企业可以寻求新的出口途径和参与同进口产品的竞争,从而获得比管理贸易下多得多的学习和革新的机会;3、支持自由贸易的政治依据:尽管理论上可能还有比自由贸易更好的政策,但现实中,从政治上认可和支持自由贸易的原则也许更重要;理由:自由贸易可以避免保护政策所带来的效率损失;除了消除生产与消费的扭曲,自由贸易还能产生额外的收益;即使在认为自由贸易并非绝对完美之策的经济学家中,仍有许多人相信在通常情况下自由贸易比其他任何可供采取的替代政策都要好;支持贸易保护的主要观点:1赞成关税的贸易条件改善论;支持非自由贸易政策的论据之一就直接来自成本——收益分析:对一个能够影响出口国价格的大国而言,关税可以降低进口产品的价格从而使贸易条件得到改善,但这一收益必须抵补剔除关税带来的成本,因为它扭曲了生产与消费的动因,但是,在某些情况下,贸易条件改善的收益可能会超过其成本;2反对自由贸易的国内市场失灵论;国内市场失灵论实质上是经济学中所说的次优理论的特例;该理论认为,在任何一。

目录1 外文文献图片 (1)2 外文文献译文 (6)3外文文献原文 (12)外文文献译文总结:在最近的这几年来,贸易自由化对于国内的影响一直受到严密的监控。

贸易自由化和全球化的其它方面被指责成造成美国的收入不均和欧洲的失业率的根本原因。

问题的关键还在于低工资发展中国家的贸易。

虽然经济学家一直都在研究这个问题,但是却并没有找到明确的答案。

本文探讨了这种模棱两可的问题的一些原因。

内生性和同时性虽然可以产生主要的问题,但这引起业内人士指责,还是应该应该适当地归因于其他因素的发展。

但是即使仅仅针对贸易自身,它也有不能确定的影响。

这只是在最简单的赫克歇尔-俄林理论下,批评者对贸易自由化可以预测的明确结果。

1介绍在最近几年来,贸易和经济开放一直在增长,于是各个利益集团的获利影响一直被争论。

低技能工人的工资和薪水在因为全球化可能引起的潜在后果,受到特别的关注。

由于工业化国家与发展中低薪水国家的贸易份额得到增加,导致这场争论已经愈演愈烈。

在美国以及欧洲,人们对于工作,工资和生活标准时刻处于风险当中而感到恐惧的情况普遍存在,尤其是在和那些从底薪国家来的工人直接与直接竞争的地区尤为严重。

在经济学家中,争论集中在美国收入显著不平等的兴起和欧洲的失业率持续增加引起的贸易和技术变革的相对贡献。

贸易经济学家们倾向于应该减少在这些发达国家的交易规则,而大量的劳动经济学家则抱持着相反的意见。

尽管这场争论远远没有解决争端,但是它在理论和实证两个方面揭示了极其复杂的问题。

第二节列出了基本问题以及在所有商品自由流通的基础上交易的两个产品-三个要素模型对工资和就业影响的后果。

第三节部分认为最终产品就是非流通股,但它的一些部件和组件可以流通,从而可以从境外进行采购。

境外采购可能涉及海上生产和对外直接投资。

第四节探讨了资本流动的影响。

第五部分在讲述潜在的失业问题。

第六节提供了一些结论性的意见。

2海外采购和相对工资传统贸易理论的奠基石之一是在因素比例在测定专业化和贸易时的作用。

FDI (对外直接投资):making a physical investment by building a factory in another country.Trade surplus( 贸易顺差)when the value of a country’s export is more than that of its imports. Trade deficit(贸易逆差)when the value of a country’s export is less than that of its imports. Barter(物物交换 ):buy or sell goods or services without the use of money. Duping (倾销) :sell the goods with a price lower than its cost or lower than its domestic price to a foreign market. Free trade (自由贸易): the movement of goods and services among nations without political or economic barriers. Export tax rebate (出口退税):government pays back the tax for the export commodities to encourage export. Export subsidies (出口补贴):payments given by the government to domestic companies to encourage export.Import quota(进口配额): a limit on the quantity of a certain import in a specific period. Trade Protectionism(贸易保护主义):the use of government regulations to limit the import of goods and services. Advocates of protectionism believe it allows domestic producers to survive, grow and produce jobs. Embargo(贸易禁运):a complete ban on the import or export of a certain product or the stopping of all trade with a particular country. Contract(合同): is an agreement signed by the seller and the buyer which regulates t he both parties’ right and obligation as well as the detailed information on the transaction. Time regulation of submitting the Documents: the original documents must be presented within 21 working days after the date of shipment, and before the expiry date of L/C in any case. Commission(佣金):commission is a payment given to the middleman for his service.Time charter (定期租船):rent a ship for a period of time. Time of shipment (发货时间):the time for loading the goods on board at the port of shipment. Partial shipment(分批运输):means goods in one contract would be shipped in more than one lot. Transshipment (转运):means the goods should be transferred to another ship during the transportation. Lay time (装卸时间):the time used for loading or unloading the goods. Demurrage(逾期费):the money paid by the charterer to the ship owner for the delay of loading or unloading .B/E (汇票):is a payment advice made by the exporter (drawer) to the importer (drawee),Drawee should pay the money to payee when he receive the B/E. Sight B/E(即期汇票):Drawee should pay money to the payee when he receives the B/E immediately. B/E(远期汇票):Drawee should pay money to payee in a specific date in future.Drawee should accept the time B/E. L/C(信用证):is a conditional written promise for payment of bank .L/C is issued by the bank to the seller. Sight L/C(即期信用证):the bank should pay the money immediately when the exporter provides the qualified documents . Usance L/C(远期信用证):bank would pay the money in a specific date in future. Collection (托收):The exporter authorizes the bank to collect the payment from the importer by drawing a draft. Packing list(装箱单):is adocument made by the exporter to indicate the detailed information on shipment. Pro forma invoice(形式发票):is an informal invoice made by exporter indicating the transaction information. Commercial invoice(商业发票)formal. Customs invoice(海关发票)is the invoice made by the exporter based on the special form regulated by the importer’s customs. B\E(汇票)is a payment advice made by the exporter to the importer. Drawee should pay the money to the payee when he receives the B\E.Bill of Lading(提单): Bill of Lading is a receipt from the shipping company giving detailed information about shipment issued by shipping company to shipper.Shipped BL(已装船提单): showing the goods have been shipped on board. Received BL(备运提单): showing the goods received by the shipping company but have not shipped on board. Endorsement(背书): The document would be transferred by its owner signing the name on the back of the document. Insurance Document(保险单据):It‘s the insurance contract made by the insurer and the insured:the insurer would take the insurance responsibility according to the insurance coverage. Certificate of Inspection(检验证书):It‘s a document certifying the result of commodity inspection insured by an inspection institution. Certificate of Origin(原产地证书):It‘s a document issued by governmental institution to certify the place where the goods have been produced.公式:insurance amount (保额)=CIF×(1+10%)Premium(保险费)=CIF×(1+10%)×premium rateCFR=CIF×(1-1,1×Premium rate)Net price =C-included price ×(1-commission rate)Commission=C-included price×commission rateFreight =W/M(choose the higher one )Total freight =unit price ×units×(1+surcharge)。

中英专业名词对照表1.对外贸易:Foreign Trade2.国际贸易:International Trade3.国内贸易:Internal Trade4.国际贸易额:Value of International Trade5.离岸价格:FOB(Free on Board)6.到岸价格:CIF(Cost,Insurance and Freight)7.国际贸易量:Quantum of International Trade8.国际贸易商品结构:Composition of International Trade9.对外贸易商品结构:Composition of Foreign Trade10.对外贸易依存度:Ratio of Dependence on Foreign Trade11.贸易差额:Balance of Trade12.国际贸易地理方向:International Trade by Regions13.对外贸易地理方向:Direction of International Trade14.贸易条件:Terms of Trade15.净贸易条件:Net Barter Terms of Trade16.出口贸易:Export Trade17.进口贸易:Import Trade18.复出口:Re-Export19.复进口:Re-Import20.净出口:Net Export21.净进口:Net Import22.过境贸易:Transit Trade23.总贸易体系:General Trade System24.专门贸易体系:Special Trade System25.有形贸易:Visible Trade26.无形贸易:Invisible Trade27.直接贸易:Direct Trade28.间接贸易:Indirect Trade29.转口贸易:Entrepot Trade30.自由结汇方式贸易:Free Liquidation Trade31.易货贸易:Barter Trade32.重商主义:Mercantilism33.零和游戏:Zero-Sum Game34.国富论:An Inquiry into the Nature and Causes of the Wealth of Nations35.绝对优势理论:Theory of Absolute Advantage/Theory of Absolute Cost36.自由放任:Laissez-Faire37.自然禀赋:Natural Endowment38.有利条件:Acquired Endowment39.政治经济学及赋税原理:Principles of Political Economy and Taxation40.比较优势理论:Theory of Comparative Advantage41.劳动价值论:Labor Theory of Value42.机会成本:Opportunity Cost43.替代成本:Substitution Cost44.机会成本理论:Opportunity Cost Theory45.生产可能性曲线:Production Possibility Curve/Production Possibility Frontier46.边际转换率:MRT(Marginal Ratio of Transformation)47.社会无差异曲线:Community Indifference Curve48.边际替代率:MRS(Marginal Ratio of Substitution)49.边际效率递减:Diminishing Marginal Utility50.孤立均衡:Equilibrium in Isolation51.贸易均衡的商品相对价格:Equilibrium Relative Commodity Price with Trade52.交易所得:Gains from Exchange53.分工所得:Gains from Specialization54.专业化分工:Complete Specialization55.要素禀赋理论:Factor Endowment Theory56.要素丰裕度:Factor Abundance57.生产要素:Factor of Production58.要素密集度:Factor Intensity59.要素密集型产品:Factor Intensive Commodity60.资本密集型产品:Capital-intensive Commodity61.劳动密集型产品:Labor-intensive Commodity62.要素价格均等化定理:Factor-price Equalization Theory63.斯托尔帕-萨缪尔森定理:The Stolper-Samuelson Theorem64.里昂惕夫之谜:Leontief Paradox65.人力资本说:Human Capital Theory66.人力技能说:Skilled Labor Theory/Human Skill Theory67.生产要素密集型逆转:Factor Intensity Reversal68.替代弹性:Elasticity of Substitution69.规模报酬递增论:Theory of Increasing Returns to Scale70.规模报酬递增:Increasing Returns to Scale71.内部规模经济:Internal Economies of Scale72.外部规模经济:External Economies of Scale73.干中学:Learning-by-Doing74.先行优势:First Mover Advantage75.产业间贸易:Inter-Industry Trade76.产业内贸易:Intra-Industry Trade77.不完全竞争:Imperfect Competition78.垄断性竞争:Monopolistic Competition79.寡占:Oligopoly80.独占:Monopoly81.技术差距论(创新与模仿理论):Technological Gap Theory(Innovation and Imitation Theory)82.产品生命周期理论:Product Cycle Model83.爬梯:Ladder and Queue84.偏好相似理论:Theory of Preference Similarity85.国家竞争优势理论:The Theory of Competitive Advantage of Nations86.幼稚工业保护论:Infant-Industry Argument87.对外贸易乘数理论:The Theory of Foreign Trade Multiplier88.公平贸易论:Fair-Trade Argument89.国际收支论:Balance-of-payment Argument90.贸易条件论:Terms-of-trade Argument91.政府收入论(关税收入论):Government Revenue Argument(Tariff Revenue Argument)92.收入再分配论:Income-Redistribution Argument93.国内扭曲论:Domestic Distortion Argument94.保护就业论:Employment-protection Argument95.国家安全论:National Security Argument96.经济多样化论:Theory of Diversification of Economy97.关税:Custom Duties/Tariff98.从量税:Specific Tariff99.从价税:Ad Valorem Tariff100.混合税:Compound Tariff101.选择税:Select Tariff102.进口税:Import Tariff103.出口税:Export Tariff104.过境税:Transit Tariff105.进口附加税:Import Surtax106.反倾销税:Anti-dumping Tariff107.反补贴税:Counter Vailing Tariff108.紧急关税:Emergency Tariff109.惩罚关税:Penalty Tariff110.报复关税:Retaliatory Tariff111.差价税:Variable Levy112.滑动关税:Sliding Duty113.目标价格:Target Price114.门槛价格:Threshold Price115.特惠税:Preferential Duty116.普遍优惠制:GSP(Generalized System of Preferences)117.免责条款:Escape Clause118.预定限额:Prior Limitation119.毕业条款:Graduation Clause120.原产地标准:Origin Criteria121.直接运输规则:Rule of Direct Consignment122.原产地证书:Certificate of Origin123.价格效应:Price Effect124.消费效应:Consumption Effect125.生产效应:Production Effect126.贸易效应:Trade Effect127.财政效应:Revenue Effect128.收入再分配效应:Income-Redistribution Effect129.福利效应:Welfare Effect130.关税水平:Tariff Level131.名义保护率:NRP(Nominal Rate of Protection)132.有效保护率:ERP(Effective Rate of Protection)133.关税升级/瀑布式结构:Cascading Tariff Structure 134.非关税壁垒:NTB(Non-Tariff Barriers)135.进口配额:Import Quotas136.绝对配额:Absolute Quotas137.关税配额:Tariff Quotas138.全球配额:Global Quotas/Unallocated Quotas139.国别配额:Country Quotas140.进口商配额:Importer Quotas141.自动出口配额(自动出口限制):Voluntary Export Quotas(Voluntary Export Restriction)142.进口许可证制:Import License System143.公开一般许可证:OGL(Open General License)144.特种商品进口许可证:SL(Specific License)145.外汇管制:Foreign Exchange Control146.官方汇率:Official Exchange Rate147.最低限价:Minimum Price148.闸门价:Sluice Gate Price149.禁止进口:Prohibitive Import150.国内税:Internal Taxes151.进出口国家垄断/国营贸易:State Monopoly/State Trade152.歧视性政府采购政策:Discriminatory Government Procurement Policy 153.海关估价制度:Customs Valuation System154.技术性贸易堡垒:TBT(Technical Barriers to Trade)155.商品包装与标签的规定:Packing and Labeling Regulation156.技术标准:Technical Standard157.环境贸易壁垒:Environment Trade Barriers158.区域经济一体化:Regional Economic Integration159.优惠贸易安排;Preferential Trade Arrangements160.自由贸易区:Free Trade Area161.关税同盟:Customs Union162.共同市场:Common Market163.经济同盟:Economic Union164.完全经济一体化:Complete Economic Integration165.部门一体化:Sectoral Integration166.全盘一体化:Overall Integration167.水平一体化:Horizontal Integration168.垂直一体化:Vertical Integration169.贸易创造效应:Trade Creation Effect170.贸易转移效应:Trade Diversion Effect171.欧盟:EU(European Union)172.北美自由贸易区:NAFTA(North American Free Trade Area)173.亚太经合组织:APEC(Asia-Pacific Economic Cooperation)174.东南亚国家联盟:ASEAN(Association of Southeast Asian Nations)175.国际资本流动:International Capital Flow176.国际劳动力流动:International Labor Flow177.跨国公司:MNC(Multi-national Cooperation)178.公司内贸易:Intra-firm Trade179.垄断优势理论:Ownership Advantage Theory180.内部化理论:Internalization Advantage Theory181.国际生产折衷理论:The Eclectic Theory182.区位优势理论:Location Theory183.边际产业扩张理论:Theory of Marginal Industry Dilation184.投资发展阶段理论:Investment Development Path185.剩余出路论:Vent-for Surplus Theory186.贸易条件恶化论:Deteriorating Trade Terms Theory187.收入贸易条件:Income Terms of Trade188.单因素贸易条件:Single Factorial Terms of Trade189.双因素贸易条件:Double Factorial Terms of Trade190.进口替代战略:Import Substitution Strategy191.出口导向战略:Export Orientation Strategy192.贸易条约与协定:Commercial Treaties and Agreements193.通商航海条约:Treaty of Commerce and Navigation194.贸易协定:Trade Agreement195.贸易议定书:Trade Protocol196.支付协定:Payment Agreement197.最惠国待遇条款:MFNT(Most-favored Nation Treatment)198.国民待遇条款:National Treatment199.国际商品协定:ICA(International Commodity Agreement)200.商品综合方案:Integrate Programmer for Commodity201.石油输出国组织:OPEC(Organization of Petroleum Exporting Countries)202.关税与贸易总协定:GATT(General Agreement on Tariffs and Trade)203.世界贸易组织:WTO(World Trade Organization)204.非歧视原则:Non-discrimination Principle205.自由贸易原则:Free Trade Principle206.公平竞争原则:Fair Trade Principle207.透明度原则:Transparency Principle208.可兑换货币:Convertible Currency209.资本外逃:Capital Flight210.国际开发协会:IDA(International Development Association)211.紧缩信贷:Tighten Credit Creation212.增值税:Value Added Tax213.成本推进型通货膨胀:Cost-Push Inflation214.需求推动型通货膨胀:Demand-Pull Inflation215.储备货币:Reserve Currency216.远期汇率:Forward Exchange Rate217.即期汇率:Spot Rate218.远期升水:Forward Premium219.远期降水:Forward Discount220.经常账户:Current Account221.资本账户:Capital Account222.补偿贸易:Compensatory Trade223.出口信贷:Export Credit224.出口补贴:Export Subsidy225.外汇倾销:Exchange Dumping226.贸易顺差:Favorable Balance of Trade227.贸易逆差:Unfavorable Balance of Trade 228.自由贸易区:Free Trade Zone。

国际贸易英文术语中英对照This model paper was revised by LINDA on December 15, 2012.(1)FCA (Free Carrier) 货交承运人(2)FAS (Free Alongside Ship) 装运港船边交货(3)FOB (Free on Board) 装运港船上交货(4)CFR (Cost and Freight) 成本加运费(5)CIF (Cost,Insurance and Freight) 成本、保险费加运费(6)CPT (Carriage Paid To) 运费付至目的地(7)CIP (Carriage and Insurance Paid To) 运费、保险费付至目的地(8)DAF (Delivered At Frontier) 边境交货(9)DES (Delivered Ex Ship) 目的港船上交货(10)DEQ (Delivered Ex Quay) 目的港码头交货(11)DDU (Delivered Duty Unpaid) 未完税交货(12)DDP (Delivered Duty Paid) 完税后交货主要船务术语简写:(1)ORC (Origen Recevie Charges) 本地收货费用(广东省收取)(2)THC (Terminal Handling Charges) 码头操作费(香港收取)(3)BAF (Bunker Adjustment Factor) 燃油附加费(4)CAF (Currency Adjustment Factor) 货币贬值附加费(5)YAS (Yard Surcharges)码头附加费(6)EPS (Equipment Position Surcharges) 设备位置附加费(7)DDC (Destination Delivery Charges) 目的港交货费(8)PSS (Peak Season Sucharges) 旺季附加费(9)PCS (Port Congestion Surcharge) 港口拥挤附加费(10)DOC (DOcument charges) 文件费(11)O/F (Ocean Freight) 海运费(12)B/L (Bill of Lading) 海运提单(13)MB/L(Master Bill of Lading) 船东单(14)MTD (Multimodal Transport Document) 多式联运单据(15)L/C (Letter of Credit) 信用证(16)C/O (Certificate of Origin) 产地证(17)S/C (Sales Confirmation)销售确认书(Sales Contract) 销售合同(18)S/O (Shipping Order)装货指示书(19)W/T (Weight Ton)重量吨(即货物收费以重量计费)(20)M/T (Measurement Ton)尺码吨(即货物收费以尺码计费)(21)W/M(Weight or Measurement ton)即以重量吨或者尺码吨中从高收费(22)CY (Container Yard) 集装箱(货柜)堆场(23)FCL (Full Container Load) 整箱货(24)LCL (Less than Container Load) 拼箱货(散货)(25)CFS (Container Freight Station) 集装箱货运站(26)TEU (Twenty-feet Equivalent Units) 20英尺换算单位(用来计算货柜量的多少)(27)A/W (All Water)全水路(主要指由美国西岸中转至东岸或内陆点的货物的运输方式)(28)MLB(Mini Land Bridge) 迷你大陆桥(主要指由美国西岸中转至东岸或内陆点的货物的运输方式)(29)NVOCC(Non-Vessel Operating Common Carrier) 无船承运人出口国交货的贸易术语三组在进口国交货的贸易术语有五种:一、装运港船上交货价(FOB)英文是:Free on Board.装运港船上交货价是国际贸易中常用的价格术语之一。

国际贸易基础英语词汇International Trade 国际贸易World Trade 世界贸易Foreign Trade 对外贸易Overseas Trade 海外贸易Domestic Trade 国内贸易WTO(World Trade Organization)世界贸易组织The Ministerial Conference 部长会议The General Council 总理事会Goods Council 货物贸易理事会Service Council 服务贸易理事会TRIPS Council 知识产权理事会Non-discrimination 非歧视原则/无差别原则DSB (Dispute Settlement Body) WTO争端解决实体(机构) IMF(International Monetary Fund)国际货币基金组织World Bank 世界银行Value of Foreign Trade 对外贸易额(值)Quantum of Foreign 对外贸易量Value of International Trade 国际贸易额Quantum of International Trade 国际贸易量FOB(Free On Board)离岸价格CIF(Cost Insurance and Foreign)到岸价格Re-Export Trade 复出口贸易Re-Import Trade 复进口贸易Net Export 净出口Net Import 净进口Balance of Trade 贸易差额Balance of Payments 国际收支差额Composition of Trade 贸易结构Composition of Foreign Trade 对外贸易结构Composition of Foreign Goods Trade 对外货物贸易结构Composition of Service Trade 对外服务贸易结构Composition of International Trade 国际贸易结构Composition of International Goods Trade 国际货物贸易结构Composition of International Service Trade 国际服务贸易结构Geographic Distribution of Foreign Trade 对外贸易地理方向Geographic Distribution of International Trade 国际贸易地理方向Goods Trade 货物贸易Visible / Tangible Goods Trade 有形贸易Technology Trade 技术贸易Export Trade 出口贸易Import Trade 进口贸易Transit Trade 过境贸易Spot Trade 自由结汇贸易Cash-liquidation Trade 现汇贸易Barter Trade易货贸易/ 无形贸易Direct Trade直接贸易Indirect Trade 间接贸易General Export 总出口General Import 总进口Special Trade System 专门贸易体系International Division of Labor 国际分工Adam Smith 亚当·斯密Theory of Absolute Cost 绝对成本理论Theory of Absolute Advantage 绝对优势理论Theory of Territorial Division of Labour地域分工说David Ricardo 大卫·李嘉图The Labour Theory of Value 劳动价值论Bertil Ohlin贝蒂·俄林Eli F Heckscher 伊·菲·赫克歇尔Factor Endowments Theory 资源/要素禀赋理论The Heckscher—Ohlin 赫克歇尔—俄林理论The Leontief Paradox 里昂惕夫之迷(里昂惕夫反论)GDP(Gross Domestic Product)国内生产总值GNP(Gross National Product)国民生产总值World Market 世界市场International Market 国际市场Terms of Trade 贸易条件Economic Integration 经济一体化Regional Economic Integration 地区经济一体化Preferential Trade Arrangements优惠贸易安排Free Trade Area 自由贸易区Customs Union 关税同盟Common Market 共同市场Complete Economic Integration 完全经济一体化Sectoral Integration 部门一体化Overall Integration 全盘一体化Horizontal Integration 水平一体化Vertical Integration 垂直一体化GATT (General Agreement On Tariffs and Trade)关税及贸易总协定GATS (General Agreement On Trade In Services)服务贸易总协定ITO (International Trade Organization) 国际贸易组织EU (European Union) 欧盟EC (European Communities)欧洲共同体APEC (Asia-Pacific Economic Cooperation) 亚太经济合作组织NAFTA (North American Free Trade Agreement/Area) 北美贸易协定/区CESDP (Common European Security and Defense Policy)欧盟共同安全与防务政策European Commission 欧盟委员会Council of European Union 欧盟理事会European of Council 欧洲理事会European Parliament 欧洲议会European Court of Justice 欧洲法院European Court of Auditors 欧洲审计院Trade Creating Effect 贸易创造效果Trade Diversing Effect 贸易转移效果Foreign Indirect Investment 对外间接投资Short-Term Credit 短期贷款Medium-Term Credit 中期贷款Long-Term Credit 长期贷款Free Trade Policy 自由贸易政策Protective Trade Policy 保护贸易政策Customs Duties / Tariff 关税Import Duties 进口税Export Duties 进口税Transit Duties 过境税Revenue Tariff 财政关税Protective Tariff 保护关税Prohibited Duty 禁止关税MFN Duties ( Most Favored Nation Duties ) 最惠国税GSP(Generalized System of Preferences普遍优惠制)普惠制Escape Clause 免责条款Prior Limitation 预定限额Competitive Need Criterion 竞争需要标准Graduation Clause 毕业条款Rule of Origin 原产地规则Process Criterion 加工标准Value-Added Criterion 增值标准Preferential Duties 特定优惠关税Import Surtaxes 进口附加税Counter-Vailling Duty 反补贴税And-Dumping Duties 反倾销税Comparable Price 可比价格Normal Price 正常价格Target Price 目标价格Threshold Price 门槛价格Variab Lelevy 差价税Specific Duties 从量税Ad Valorem Duties 从价税Mixed Or Compound Duties 混合税/复合税Alternative Duties 选择税Sliding Duties 滑动关税Customs Tariff 海关税则Tariff No、Heading No、Tariff Item 税则号列Description of Goods 货物分类目录Rate of Duty 税率Customs Cooperation Council Nomenclature 《海关合作理事会税则目录》HS(The Harmonized Commodity Description and Coding System)商品名称及编码协调制度Single Tariff 单式税则Complex Tariff 复式税则Autonomous Tariff 自主税、国定税、通用税则Automatic Single Tariff System 自助单式税则Automatic Complex Tariff System 自主复式税则Maximum and Minimum Tariff System 最高最低税率制/双重税率制Conventional Tariff 协定税则Import Declaration 进口报关单NTB’s(Non-tariff Barriers)非关税壁垒Import Quotas System 进口配额制/进口限额制Global/Unallocated Quotas 全球配额Absolute Quotas 绝对配额Country Quotas 自主配额Autonomous Quotas 自主配额Agreement Quotas 协议配额/双边配额V oluntary Export Quotas 自动出口配额Import Licence System 进口许可证制度Foreign Exchange Control 外汇管制Advanced Deposit 进口押金制Internal Taxes 国内税Minimum Price 最低限价TBT (Technical Barriers To Trade) 技术性贸易壁垒Technical Regulations 技术法规Technical Standards 技术标准Conformity Assessment Procedures 合格评定程序ISO(International Organization for Standardization)国际标准化组织SAC(Standardization Administration of China)中国国家标准化管理委员会Packaging and Labeling Regulation 商品包装和标准规定Export Credit 出口信贷Supplier’s Credit 卖方信贷Buyer’s Credit 买方信贷Export Credit Guarantee System 出口信贷国家担保制Export Subsidy 出口补贴Direct Subsidies 直接补贴Indirect Subsidies 简介补贴Dumping 商品倾销Export Control 出口管制General License 一般许可证Validated License 特殊许可证Free Port 自由港/自由口岸Free Trade Zone 自由贸易区Bonded Area 保税区Export Processing Zone 出口加工区Free Perimeter 自由边境区Transit Zone 过境区Commercial Treaties and Agreement 贸易跳越和协定Most-Favored-Nation Treatment 最惠国待遇条款National Treatment 国民待遇条款Treaty of Commerce and Navigation 通商航海条约Trade Agreement 贸易协定Payment Agreement 支付协定Single Account 单边账户Bilateral Account 多边账户International Commodity Agreement 国际商品协定Buffer Stock 缓冲存货Multilingual Contracts 多边合同Integrate Programme for Commodities 国际商品综合方案Common Fund 共同基金Multilateral Trade Negotiation 多边贸易谈判Cross-border Supply 跨境交付Consumption Abroad 境外消费Commercial Presence 商业存在Movement of Personal 自然人流动2010年11月17日。

国际贸易专业英语单词1. Import - 进口2. Export - 出口3. Trade - 贸易4. Goods - 商品5. Services - 服务6. Tariff - 关税7. Duty - 关税8. Customs - 海关9. Free trade - 自由贸易10. Balance of trade - 贸易平衡11. Trade deficit - 贸易赤字12. Trade surplus - 贸易顺差13. Trade barrier - 贸易壁垒14. Quota - 进口限额15. Embargo - 禁运16. Dumping - 倾销17. Dumping margin - 倾销幅度18. Anti-dumping duty - 反倾销税19. Subsidy - 补贴20. Trade agreement - 贸易协议21. World Trade Organization (WTO) - 世界贸易组织22. Free trade agreement - 自由贸易协议23. Preferential trade agreement - 优惠贸易协议24. Trade dispute - 贸易争端25. Trade war - 贸易战争26. Bilateral trade - 双边贸易第1页/共6页27. Multilateral trade - 多边贸易28. Exchange rate - 汇率29. Currency - 货币30. Foreign exchange - 外汇31. Importer - 进口商32. Exporter - 出口商33. Trade deficit - 贸易赤字34. Trade surplus - 贸易顺差35. Inflation - 通货膨胀36. Deflation - 通货紧缩37. Cross-border trade - 跨境贸易38. Trade finance - 贸易融资39. Letter of credit - 信用证40. Bill of lading - 提单41. Incoterms - 货物贸易术语42. FOB (Free On Board) - 离岸价43. CIF (Cost, Insurance, and Freight) - 到岸价44. EXW (Ex Works) - 工厂交货价45. Port of entry - 入境口岸46. Port of exit - 出境口岸47. Shipping - 运输48. Logistics - 物流49. Clearing agent - 清关代理商50. Inbound logistics - 入境物流51. Outbound logistics - 出境物流52. Customs duty - 海关税53. Import license - 进口许可证54. Export license - 出口许可证55. Import quota - 进口配额56. Export quota - 出口配额57. Import restrictions - 进口限制58. Export restrictions - 出口限制59. Trade policy - 贸易政策60. Trade negotiations - 贸易谈判61. Market access - 市场准入62. Non-tariff barriers - 非关税壁垒63. Intellectual property rights - 知识产权64. Counterfeit - 仿冒65. Trademark - 商标66. Patent - 专利67. Copyright - 版权68. Royalties - 版权使用费69. Anti-counterfeiting - 打击假冒70. Dumping investigation - 倾销调查71. Import substitution - 进口替代72. Export promotion - 出口促进73. Trade facilitation - 贸易便利化74. Trade dispute settlement - 贸易争端解决75. Trade remedy - 贸易救济措施76. Dumping margin - 倾销幅度77. Safeguard measures - 保障措施78. Countervailing duty - 反补贴税79. Anti-dumping duty - 反倾销税80. Tariff escalation - 关税递增81. Product standards - 产品标准82. Technical barriers to trade - 技术贸易壁垒83. Sanitary and phytosanitary measures - 卫生和植物检疫措施84. Trade remedy investigation - 贸易救济调查85. Dispute settlement mechanism - 争端解决机制第3页/共6页86. Preferential tariffs - 优惠关税87. Most favored nation (MFN) - 最惠国待遇88. General Agreement on Tariffs and Trade (GATT) - 关税与贸易总协定89. Regional trade agreement (RTA) - 区域贸易协定90. Free trade area - 自由贸易区91. Customs union - 关税同盟92. Common market - 共同市场93. Economic integration - 经济一体化94. North American Free Trade Agreement (NAFTA) - 北美自由贸易协定95. European Union (EU) - 欧盟96. Single market - 单一市场97. Customs union - 关税同盟98. European Economic Community (EEC) - 欧洲经济共同体99. Association of Southeast Asian Nations (ASEAN) - 东南亚国家联盟100. Pacific Alliance - 太平洋联盟101. Trans-Pacific Partnership (TPP) - 跨太平洋伙伴关系102. World Bank - 世界银行103. International Monetary Fund (IMF) - 国际货币基金组织104. International trade law - 国际贸易法105. International trade finance - 国际贸易融资106. International trade dispute resolution - 国际贸易争端解决107. Import substitution industrialization (ISI) - 进口替代工业化108. Outward processing trade - 外加工贸易109. Offshore trade - 离岸贸易110. Advance payment - 预付款111. Documentary credit - 跟单信用证112. Documentary collection - 跟单托收113. Factoring - 让与114. Forfaiting - 福费廷115. Letter of indemnity - 不足保证书116. Standby letter of credit - 保函117. Open account - 开立账户118. Bill of exchange - 汇票119. Commercial invoice - 商业发票120. Packing list - 装箱单121. Certificate of origin - 原产地证书122. Import declaration - 进口申报123. Export declaration - 出口申报124. Insurance certificate - 保险凭证125. Bill of lading - 提单126. Bill of lading - 佣提单127. Bill of lading - 非佣提单128. Air waybill - 空运提单129. Phytosanitary certificate - 植物检疫证书130. Certificate of inspection - 检验证书131. Certificate of conformity - 符合性证明132. Certificate of quality - 质量证明书133. Country of origin - 原产国134. Harmonized System (HS) code - 统一编码135. Tariff code - 关税编码136. Value-added tax (VAT) - 增值税137. Excise tax - 特别消费税138. Withholding tax - 扣缴税139. Customs valuation - 海关估价140. Transfer pricing - 转让定价141. Import duty - 进口关税第5页/共6页142. Export duty - 出口关税143. Import restrictions - 进口限制144. Export restrictions - 出口限制145. Inventory - 库存146. Supply chain - 供应链147. Market research - 市场调查148. Trade show - 贸易展览会149. Market segmentation - 市场细分150. Market entry strategy - 进入市场策略。