萨尔瓦多国际经济学件(20200905081240)

- 格式:pdf

- 大小:6.52 MB

- 文档页数:52

萨尔瓦多《国际经济学》(第12版)笔记和课后习题(含考研真题)详解完整版>精研学习网>无偿试用20%资料全国547所院校视频及题库资料考研全套>视频资料>课后答案>往年真题>职称考试试读(部分内容)隐藏第1章绪论1.1复习笔记考点一:经济全球化▼1经济全球化的含义经济全球化是世界上各国和地区之间通过商品、服务及劳动力、资本、信息、技术、管理等生产要素的跨国界流动,寻求资源最优配置的一个相互联系、相互依赖并不断深化的过程。

2经济全球化的影响经济全球化是一把“双刃剑”,对任何国家来说,它既是机遇,也是挑战。

以发展中国家经济为例,探讨经济全球化所带来的积极和消极影响。

(1)积极影响①由于信息技术使空间距离极大地缩短,世界各地的竞争关系加剧,相互争夺稀缺的生产要素。

不断加剧的竞争也激发了国家的创造力和创新精神,从而使国家富裕起来,社会福利水平不断提高。

②现代通信技术以及复杂的计算机程序,加快了信息的流通,有助于人们消除不同资本市场的时间差。

③全球化意味着世界整体福利水平的增升和机会的增加。

发达国家和发展中国家的国民财富在经济全球化进程中均实现了迅速增长,同时,由于世界范围的国际分工,每个国家都拥有机会参与国际竞争。

④全球化有利于促进资本、技术、知识等生产要素在全球范围内的优化配置,给发展中国家提供了新的发展机遇。

⑤全球化有利于促进世界和平与稳定,使各国经济的发展越来越紧密地联系在一起,促进了国家之间沟通交流,增进了彼此之间的理解与信任。

⑥全球化促使发展中国家的出口商品结构优化。

资本的流入、跨国公司的直接投资活动和本国产业结构的调整,有利于发展中国家出口商品结构的改善。

同时经济全球化有利于发展中国家的整体改革。

(2)消极影响①增大了各国特别是发展中国家经济运行的风险。

受社会历史和经济发展水平的影响,发展中国家在国际竞争中处于不利地位,经济更脆弱。

②各国各地区的发展差异有可能进一步拉大。

十万种考研考证电子书、题库、视频学习平台浮动汇率与固定汇率制度下的价格调节机制16.1 复习笔记一、汇率变动对国际收支的影响1.贬值与跌价(1)贬值贬值意味着汇率是固定的,是指货币当局把汇率从一个固定的或钉住的水平提升到另一水平。

(2)跌价跌价意味着汇率是浮动的,是指以外币表示的本币价格的降低,从汇率的定义出发,此时汇率上升。

(3)两者的联系由于贬值与跌价通常都是对价格操作以调节一国的经常项目和国际收支,它们都是价格调节机制,所以本章对它们一并讨论,即在考虑价格调节机制时,本章不做浮动汇率与固定汇率的区分。

2.贸易或弹性方法该传统的汇率模式假设没有自主的国际间个人资本流(即国际间个人资本流是为了弥补或支付临时贸易不平衡才被动发生的),一国通过变动汇率来削减其经常项目赤字(平衡十万种考研考证电子书、题库、视频学习平台收支)。

(经常项目的修正和国际收支盈余通常需要相反的技术)。

该模式以贸易流为基础,而且调节的速度取决于价格(汇率)的变化如何对进出口(弹性)做出反应,所以称之为贸易或弹性方法。

3.国际收支调节与汇率变动一国通常可以通过使其货币贬值或跌价,来调节国际收支逆差。

外汇供求曲线弹性越大,用来调节固定数额逆差所要求的贬值就越少。

其分析过程如下:如图16-1所示,当R=1美元/1欧元时,美国每年对欧元的需求量为120亿欧元,而供给量为80亿欧元,所以美国的国际收支逆差为40亿欧元(AB)。

从曲线D€和曲线S€可以看出,美元贬值20%将完全消除逆差(E点)。

对于D€*和S€*,要消除逆差,则要求100%的贬值(E*点)。

十万种考研考证电子书、题库、视频学习平台图16-1 国际收支调节与汇率变动4.外汇需求曲线与供给曲线的推导如图16-2所示,在左图中,D M(R=1美元/1欧元)和S M下,P M=1欧元而Q M=120亿单位,所以美国对欧元的需求量是120亿欧元(B′点),这相当于图16-1中的B 点。

*CHAPTER 4(Core Chapter)THE HECKSCHER-OHLIN AND OTHER TRADE THEORIESOUTLINE4.1 Introduction4.2 Factor Endowments and the Heckscher-Ohlin Theory4.3 The Formal Heckscher-Ohlin ModelCase Study 4-1 The Revealed Comparative Advantage of Various Countries and Regions4.4 Factor-Price Equalization and Income DistributionCase Study 4-2 Has International Trade Increased U.S. Wage Inequalities?4.5 Empirical Tests of the Heckscher-Ohlin Theory4.6 Economies of Scale and International TradeCase Study 4-3 The New International Economies of Scale4.7 Trade Based on Product DifferentiationCase Study 4-4 Growth of Intra-Industry Trade4.8 Technological Gap and Product Cycle ModelsCase Study 4-5: The United States as the Most Competitive Economy in the World4.9 Transportation Costs and International Trade4.10 Environmental Standards and International TradeAppendix The Specific-Factors Model and Intra-Industry Trade ModelsA4.1 The Specific-Factors ModelA4.2 A Model of Intra-Industry TradeKey TermsInternationalofscaleeconomies pricesRelativefactorproducts Heckscher–Ohlin (H–O) theory DifferentiatedtradeIntra-industryHeckscher–Ohlintheorem(H–O)Factor-proportions or factor-endowment theory Technological gap modelcyclemodelProductFactor–price equalization theoremcostsTransportationStolper-Samuelsontheoremmodel Nontraded goods and services Specific-factorsparadox Environmental standardsLeontiefMonopolisticcompetitionscalereturnsIncreasingtoLecture Guide1. This is one of the most important and difficult chapters in the book. It is also a long chapter andrequires four lectures to cover adequately.2. In the first lecture, I would cover sections 1-3. Section 3 is one of the most important sections inthe book because it presents the H-O model. I would proceed slowly and carefully in explaining Figure 4.1 and compare it to the standard trade model of Figure 3.4.3. In the second lecture, I would cover sections 4 and 5. Section 4 on the factor-price equalizationtheorem and income distribution is a difficult section. Case Study 4-2 should be of great interest to the students and give rise to a great deal of class discussion.4. In third lecture, I would cover sections sections 6-7, paying a great deal of attention to section 7on trade in differentiated products.5. In fourth lecture, I would cover the rest of the chapter.Answers to Review Questions and Problems1. a. The Heckscher–Ohlin (H-0) theorem postulates that a nation will export those commodi- ties whose production requires the intensive use of the nation’s relatively abundant and cheap factor and import the commodities whose production requires the intensive useof the nation’s relatively scarce and expensive factor. In short, the relatively labor-richnation exports relatively labor-intensive commodities and imports the relativelycapital-intensive commodities.b. Heckscher and Ohlin identify the relative difference in factor endowments amongnations as the basic determinant of comparative advantage and international trade.c. The H-O Theory represent an extension of the standard trade model because it explains the basis for comparative advantage (classical economists, such as Ricardo had assumed it) and examines the effect of international trade on factor prices and income distribution (which classical economists had left unanswered).2. See Figure 1 on the next page.3. a. The factor–price equalization theorem postulates that international trade will bring about the equalization of the returns to homogeneous or identical factors across nations.b. The Stopler-Samuelson theorem postulates that free international trade reduces the realincome of the nation’s relatively scarce factor and increases the real income of the nation’s relatively abundant factor.Fig 4.1Fig 4.2XXb. The specific-factors model postulates that the opening of trade (1) benefits the specific factorused in the production of the nation’s export commodity, (2) harms the specific factor used in the production of the nation’s import-competing industry, and (3) leads to an ambiguouseffect (i.e., it may benefit or harm) the mobile factor.c. Trade acts as a substitute for the international mobility of factors of production in itseffect on factor prices. With perfect mobility, labor would migrate from the low-wagenation to the high-wage nation until wages in the two nations are equalized. Similarly,capital would move from the low-interest to the high-interest nation until the rate ofinterest was equalized in the two nations.4. a. The Leontief paradox refers to the original Leontief’s finding that U.S. import substituteswere more K-intensive than U.S. exports. This was the opposite of what the H-O theorempostulated.b. The Leontief paradox was resolved by including human capital into the calculations andexcluding industries based on natural resources. Recent research using data on many sectors, for many countries, over many years, and considering that countries could specialize in aparticular subset or group of commodities that were best suited to their specific factorendowments, provides strong support for the H-O theorem.c. The Hecksher-Olhin theory remains the centerpiece of modern trade theory for explaininginternational trade today. To be sure, there are other forces (such as economies of scale,product differentiation, and technological differences across countries) that provide additional reasons and explanations for some international trade not explained by the basic H-O model.These other trade theories complement the basic H-O model in explaining the pattern ofinternational trade in the world today.5. International trade with developing economies, especially newly industrializing economies (NIEs), contributed in two ways to increased wage inequalities between skilled and unskilled workers in the United States during the past two decades. Directly, by reducing the demand for unskilledworkers as a result of increased U.S. imports of labor-intensive manufactures and, indirectly, byspeeding up the introduction of labor-saving innovations, which further reduced the U.S.demand for unskilled workers. International trade, however, was only a small cause of increased wage inequalities in the United States. The most important cause was technological change.6. a. Economies of scale refer to the production situation where output grows proportionatelymore than the increase in inputs or factors of production. For example, output may morethan double with a doubling of inputs.b. Even if two nations were identical in every respect, there is still a basis for mutually bene-ficial trade based on economies of scale. When each nation specializes in the production of one commodity, the combined total world output of both commodities will be greater thanthan without specialization when economies of scale are present. With trade, each nationthen shares in these gains.c. The new international economies of scale refers to the increase in productivity resultingfrom firms purchasing parts and components from nations where they are made cheaperand better, and by establishing production facilities abroad-26-7. a. Product differentiation refers to products that are similar, but not identical. Intra-industrytrade refers to trade in differentiated products, as opposed to inter-industry trade incompletely different products.b. Intra-industry trade arises in order to take advantage of important economies of scale inproduction. That is, with intra-industry trade each firm or plant in industrial countries canspecialize in the production of only one, or at most a few, varieties and styles of the sameproduct rather than many different varieties and styles of a product and achieve economies of scale.c. With few varieties and styles, more specialized and faster machinery can be developedfor a continuous operation and a longer production run. The nation then imports othervarieties and styles from other nations. Intra-industry trade benefits consumers because ofthe wider range of choices (i.e., the greater variety of differentiated products) available atthe lower prices made possible by economies of scale in production.8. a. According to the technological gap model, a firm exports a new product until imitators incountries take away its market. In the meantime, the innovating firm will have introduced a new product or process.b. The criticism of the technological gap model are that it does not explain the size of techno- logical gaps and does not explore the reason for technological gaps arising in the first place, or exactly how they are eliminated over time.c. The five stages of the product cycle model are: the introduction of the product, expansion of production for export, standardization and beginning of production abroad through imitation, foreign imitators underselling the nation in third markets, and foreigners underselling theinnovating firms in their home market as well.9. See Figure 2 on page 25.10. A nation with lower environmental standards can use the environment as a resource endow-ment or as a factor of production in attracting polluting firms from abroad and achieving acomparative advantage in the production of polluting goods and services. This can lead totrade disputes with nations with more stringent environmental standards.-27-Multiple-Choice Questions1. The H-O model extends the classical trade model by:a. explaining the basis for comparative advantageb. examining the effect of trade on factor prices*c. both a and bd. neither a nor b2. A nation is said to have a relative abundance of K if it has a:a. greater absolute amount of Kb. smaller absolute amount of Lc. higher L/K ratio*d. lower price of K in relation to the price of L3. A difference in relative commodity prices between nations can be based on a difference in:a. technologyb. factor endowmentsc. tastes*d. all of the above4. In the H-O model, international trade is based mostly on a difference in:a. technology*b. factor endowmentsc. economies of scaled. tastes5. According to the H-O theory, trade reduces international differences in:a. commodity pricesb. in factor prices*c. both commodity and factor pricesd. neither relative nor absolute factor prices6. According to the Stolper-Samuelson theorem, international trade leads toa. reduction in the real income of the nation’s relatively abundant factor*b. reduction in the real income of the nation’s relatively scarce factorc. increase in the real income of the nation’s relatively scarce factord. none of the above7. Which of the following is false with regard to the specific factors theorem, international trade *a. harms the immobile factors that are specific to the nation’s export commodities or sectorsb. harms the immobile factors that are specific to the nation’s import-competing commoditiesc. has an ambiguous effect on the nation’s mobile factorsd. may benefit or harm the nation’s mobile factors8. Perfect international mobility of factors of productiona. leads to a reduction in international differences in the returns to homogenous factorsb. acts as a substitute for international trade in its effects on factor pricesc. operates on the supply of factors in affecting factor prices*d. all of the above9. The Leontief paradox refers to the empirical finding that U.S.*a. import substitutes were more K-intensive than exportsb. exports were more L-intensive than importsc. exports were more K-intensive than import substitutesd. all of the above10. From empirical studies, we conclude that the H-O theory:a. must be rejectedb. must be accepted without reservations*c. can generally be acceptedd. explains all international trade11. International trade can be based on economies of scale even if both nations have identical:a. factor endowmentsb. tastesc. technology*d. all of the above12. A great deal of international trade:a. is intra-industry tradeb. involves differentiated productsc. is based on monopolistic competition*d. all of the above13. Intra-industry trade takes place:a. because products are homogeneous*b. in order to take advantage of economies of scalec. because perfect competition is the prevalent form of market organizationd. all of the above14. Which of the following statements is true with regard to the product-cycle theory?a. it depends on differences in technological changes over time among countriesb. it depends on the opening and the closing of technological gaps among countriesc. it postulates that industrial countries export more advanced products to lessadvanced countries*d. all of the above15. Transport costs:a. increase the price in the importing countryb. reduces the price in the exporting countryc. falls less heavily on the nation with the more elastic demand and supply curves of the traded commodity*d. all of the above-30-ADDITIONAL ESSAYS AND PROBLEMS FOR PART ONE1. Assume that both the United States and Germany produce beef and computer chips with the following costs:United States Germany(dollars) (marks)Unit cost of beef (B) 2 8Unit cost of computer chips (C) 1 2(a) What is the opportunity cost of beef (B) and computer chips (C) in each country?(b) In which commodity does the United States have a comparative cost advantage?What about Germany?(c) What is the range for mutually beneficial trade between the United States and Germanyfor each computer chip traded?(b) How much would the United States and Germany gain if 1 unit of beef is exchangedfor 3 chips?Answ. (a) In the United States:the opportunity cost of one unit of beef is 2 chips;the opportunity cost of one chip is 1/2 unit of beef.In Germany:the opportunity cost of one unit of beef is 4 chips;the opportunity cost of one chip is 1/4 unit of beef.(b) The United States has a comparative cost advantage in beef with respect to Germany,while Germany has a comparative cost advantage in computer chips.(c) The range for mutually beneficial trade between the United States and Germany foreach unit of beef that the United States exports is2C < 1B < 4C(d) Both the United States and Germany would gain 1 chip for each unit of beef traded.2. Given: (1) two nations (1 and 2) which have the same technology but different factor costs conditions, and (3) no transportation costs, tariffs, or other obstructions to trade.Prove geometrically that mutually advantageous trade between the two nations is possible.Note: Your answer should show the autarky (no-trade) and free-trade points of production and consumption for each nation, the gains from trade of each nation, and express the equilibrium condition that should prevail when trade stops expanding.)Ans.: See the figure below.Fig 4.3Fig 4.4Nations 1 and 2 have different production possibilities curves and different community indifference maps. With these, they will usually end up with different relative commodity prices in autarky, thus making mutually beneficial trade possible.In the figure, Nation 1 produces and consumes at point A and Px/Py=P A in autarky, while Nation 2 produces and consumes at point A' and Px/Py=P A'. Since P A < P A', Nation 1 has a comparative advantage in X and Nation 2 in Y. Specialization in production proceeds until point B in Nation 1 and point B' in Nation 2, at which P B =P B' and the quantity supplied for export of each commodity exactly equals the quantity demanded for import.Thus, Nation 1 starts at point A in production and consumption in autarky, moves to point B in production, and by exchanging BC of X for CE of Y reaches point E in consumption. E > A since it involves more of both X and Y and lies on a higher community indifference curve.Nation 2 starts at A' in production and consumption in autarky, moves to point B' in production, and by exchanging B'C' of Y for C'E' of X reaches point E'in consumption (which exceeds A').At Px/Py=P B =P B', Nation 1 wants to export BC of X for CE of Y, while Nation 2 wants to export B'C' (=CE) of Y for C'E' (=BC) of X. Thus, P B =P B' is the equilibrium relative commodity price because it clears both (the X and Y) markets.3. (a) Identify the conditions that may give rise to trade between two nations. (b) What aresome of the assumptions on which the Heckscher-Ohlin theory is based? (c) What does this theory say about the pattern of trade and effect of trade on factor prices?Ans. (a) Trade can be based on a difference in factor endowments, technology, or tastesbetween two nations. A difference either in factor endowments or technology results in a different production possibilities frontier for each nation, which, unlessneutralized by a difference in tastes, leads to a difference in relative commodity price and mutually beneficial trade. If two nations face increasing costs and have identical production possibilities frontiers but different tastes, there will also be a differencein relative commodity prices and the basis for mutually beneficial trade between the two nations. The difference in relative commodity prices is then translated into adifference in absolute commodity prices between the two nations, which is the immediate cause of trade.(b) The Heckscher-Ohlin theory (sometimes referred to as the modern theory – asopposed to the classical theory - of international trade) assumes that nations have the same tastes, use the same technology, face constant returns to scale (i.e., a givenpercentage increase in all inputs increases output by the same percentage) but differ widely in factor endowments. It also says that in the face of identical tastes or demand conditions, this difference in factor endowments will result in a difference in relative factor prices between nations, which in turn leads to a difference in relativecommodity prices and trade. Thus, in the Heckscher-Ohlin theory, the internationaldifference in supply conditions alone determines the pattern of trade. To be noted is that the two nations need not be identical in other respects in order for internationaltrade to be based primarily on the difference in their factor endowments.(c) The Heckscher-Ohlin theorem postulates that each nation will export the commodityintensive in its relatively abundant and cheap factor and import the commodityintensive in its relatively scarce and expensive factor. As an important corollary, itadds that under highly restrictive assumptions, trade will completely eliminate thepretrade relative and absolute differences in the price of homogeneous factors amongnations. Under less restrictive and more usual conditions, however, trade will reduce, but not eliminate, the pretrade differences in relative and absolute factor prices among nations. In any event, the Heckscher-Ohlin theory does say something very useful onhow trade affects factor prices and the distribution of income in each nation. Classical economists were practically silent on this point.-33-4. Suppose that tastes change in Nation 1 (the L-abundant and L-cheap nation) so that consumers demand more of commodity X (the L-intensive commodity) and less of commodity Y (the K- intensive commodity). Suppose that Nation 1 is India, commodity X is textiles, and commodi- ty Y is food. Starting from the no-trade equilibrium position and using the Heckscher-Ohlinmodel, trace the effect of this change in tastes on India's (a) relative commodity prices anddemand for food and textiles, (b) production of both commodities and factor prices, and(c) comparative advantage and volume of trade. (d) Do you expect international trade to leadto the complete equalization of relative commodity and factor prices between India and theUnited States? Why?Ans. (a) The change in tastes can be visualized by a shift toward the textile axis in India'sindifference map in such a way that an indifference curve is tangent to the steepersegment of India's production frontier (because of increasing opportunity costs) after the increase in demand for textiles. This will cause the pretrade relative commodity price of textiles to rise in India.(b) The increase in the relative price of textiles will lead domestic producers in India toshift labor and capital from the production of food to the production of textiles. Since textiles are L-intensive in relation to food, the demand for labor and therefore the wage rate will rise in India. At the same time, as the demand for food falls, thedemand for and thus the price of capital will fall. With labor becoming relative more expensive, producers in India will substitute capital for labor in the production of both textiles and food.(c) Even with the rise in relative wages and in the relative price of textiles, India stillremains the L-abundant and low-wage nation with respect to a nation such as theUnited States. However, the pretrade difference in the relative price of textilesbetween India and the United States is now somewhat smaller than before the change in tastes in India. As a result the volume of trade required to equalize relativecommodity prices and hence factor prices is smaller than before. That is, India need now export a smaller quantity of textiles and import less food than before for therelative price of textiles in India and the United States to be equalized. Similarly, the gap between real wages and between India and the United States is now smaller and can be more quickly and easily closed (i.e., with a smaller volume of trade).(d) Since many of the assumptions required for the complete equalization of relativecommodity and factor prices do not hold in the real world, great differences can be expected and do in fact remain between real wages in India and the United States.Nevertheless, trade would tend to reduce these differences, and the H-O model does identify the forces that must be considered to analyze the effect of trade on thedifferences in the relative and absolute commodity and factor prices between Indiaand the United States.-34-5. (a) Explain why the Heckscher-Ohlin trade model needs to be extended. (b) Indicate in what important ways the Heckscher-Ohlin trade model can be extended. (c) Explain what ismeant by differentiated products and intra-industry trade.Ans. (a) The Heckscher-Ohlin trade model needs to be extended because, while generallycorrect, it fails to explain a significant portion of international trade, particularly the trade in manufactured products among industrial nations.(b) The international trade left unexplained by the basic Heckscher-Ohlin trade model canbe explained by (1) economies of scale, (2) intra-industry trade, and (3) trade based on imitation gaps and product differentiation.(c) Differentiated products refer to similar, but not identical, products (such as cars,typewriters, cigarettes, soaps, and so on) produced by the same industry or broadproduct group. Intra-industry trade refers to the international trade in differentiated products.-35-。

*CHAPTER 5(Core Chapter)TRADE RESTRICTIONS: TARIFFSOUTLINE5.1 Introduction5.2 Types of TariffsCase Study 5-1 Average Tariff on Industrial Products in Major Developed CountriesCase Study 5-2 Average Tariff on Industrial Products in Some Major Developing Countries 5.3 Effects of a Tariff in a Small Nation5.4 Effect of a Tariff on Consumer and Producer Surplus5.5 Costs and Benefits of a Tariff in a Small NationCase Study 5-3 The Welfare Effects of Liberalizing Trade in Some U.S. ProductsCase Study 5-4 The Welfare Effects of Liberalizing Trade in Some EU Products5.6 Costs and Benefits of a Tariff in a Large Nation5.7 The Optimum Tariff and Retaliation5.8 Theory of Tariff StructureCase Study 5-5 Rising Tariff Rates with Degree of Domestic ProcessingCase Study 5-6 Structure of Tariffs in the United States, EU, and CanadaAppendix: Optimum Tariff and Retaliation with Offer CurvesKey TermsTrade or commercial policies Revenue effect of a tariffsurplustariff ConsumerImportExport tariff Rent or producer surplustariff Protectioncost or deadweight loss of a tariff valoremAdSpecific tariff Terms of trade effect of the tarifftarifftariff OptimumCompoundConsumption effect of a tariff Prohibitive tariffProduction effect of a tariff Rate of effective protectionTrade effect of a tariffLecture Guide1. I would cover sections 1-4 in the first lecture. The most difficult part is Section 4 on themeaning and measurement of consumer and producer surplus. Since a clear understanding of the meaning and measurement of consumer and producer surplus is crucial in measuring the welfare effect of tariffs, I would explain these concepts very carefully.2. I would cover sections 5 and 6 in the second lecture. These are the most difficult sections inthe chapter and also the most important.3. The theory of tariff structure is also difficult and important. I found that the best way toexplain it is by using the simple example in the text on the suit with and without imported inputs. This section is likely to generate a great deal of discussion about the trade relations between developed and developing nations. If you do not plan to cover optional Chapter 8 on growth and development, you could spend a bit more time on this topic here , even though it will come up again in Chapter 6.Answer to Problems1. a. See Figure 1 on the next page.b. Consumption is 70X, production is 50X and imports are 20X.c. The consumption effect is –30X, the production effect is +30X, the trade effectis –60X, and the revenue effect is $30 (see Figure 1).2. a. The consumer surplus is $250 without and $l22.50 with the tariff (see Figure 1).b. Of the increase in the revenue of producers with the tariff (as compared with theirrevenues under free trade), $22.50 represents the increase in production costs andanother $22.50 represents the increase in rent or producer surplus (see Figure 1).c. The dollar value or the protection cost of the tariff is $45 (see Figure 1).3. The dollar value or the protection cost of the tariff is $45 (see Figure 2).4. The dollar value or the protection cost of the tariff is $45 (see Figure 3).5. The optimum tariff is the tariff that maximizes the net benefit resulting from theimprovement in the nation’s terms of trade against the negative effect resulting fromreduction in the volume of trade.X Fig 5.1X Fig 5.2XFig 5.36. a. When a nation imposes an optimum tariff, the trade partner’s welfare declines because ofthe lower volume of trade and the deterioration in its terms of trade.b. The trade partner is likely to retaliate and in the end both nations are likely to lose becauseof the reduction in the volume of trade.7. Even when the trade partner does not retaliate when one nation imposes the optimum tariff,the gains of the tariff-imposing nation are less than the losses of the trade partner, so that theworld as a whole is worse off than under free trade. It is in this sense that free trade maximizesworld welfare.8. a. The nominal tariff is calculated on the market price of the product or service. The rate ofeffective protection, on the other hand, is calculated on the value added in the nation. It isequal to the value of the price of the commodity or service minus the value of the importedinputs used in the production of the commodity or service.b. The nominal tariff is important to consumers because it determines by how much the priceof the imported commodity increases. The rate of effective protection is important fordomestic producers because it determines the actual rate of protection provided by thetariff to domestic processing.9. a. Rates of effective protection in industrial nations are generally much higher than thecorresponding nominal rates and increase with the degree of processing.b. The tariff structure of developed nations is of great concern for developing nationsbecause it discourages manufacturing production in developing nations.10. If a nation reduces the nominal tariff on the importation of the raw materials required toproduce a commodity but does not reduce the tariff on the importation of the finalcommodity produced with the imported raw material, then the effective tariff rates willincrease relative to the nominal tariff rate on the commodity.Multiple-choice Questions1. Which of the following statements is incorrect?a. an ad valorem tariff is expressed as a percentage of the price of the traded commodity.b. a specific tariff is expressed as a fixed sum of the value of the traded commodity.c. export tariffs are prohibited by the U.S. Constitution*d. the U.S. uses exclusively the specific tariff2. A small nation is one:a. which does not affect world price by its tradingb. which faces an infinitely elastic world supply curve for its import commodityc. whose consumers will pay a price that exceeds the world price by the amount of the tariff *d. all of the above3. If a small nation increases the tariff on its import commodity, its:a. consumption of the commodity increasesb. production of the commodity decreasesc. imports of the commodity increase*d. none of the above4. The increase in producer surplus when a small nation imposes a tariff is measured by the area: *a. to the left of the supply curve between the commodity price with and without the tariffb. under the supply curve between the quantity produced with and without the tariffc. under the demand curve between the commodity price with and without the tariffd. none of the above.5. If a small nation increases the tariff on its import commodity:*a. the rent of domestic producers of the commodity increasesb. the protection cost of the tariff decreasesc. the deadweight loss decreasesd. all of the above6. The imposition of an optimum tariff by a small nation:a. improves its terms of tradeb. reduces the volume of tradec. increases the nation's welfare*d. non of the above7. The optimum tariff for a small nation is:a. 100%b. 50%*c. 0d. depends on the elasticity of demand and supply for the import commodity in the nation8. The imposition of an optimum tariff by a large nation:a. improves its terms of tradeb. reduces the volume of tradec. increases the nation's welfare*d. all of the above9. The imposition of an optimum tariff by a large nation:a. improves the terms of trade of the trade partner*b. reduces the volume of tradec. increases the trade partner’s welfared. all of the above10. If two large countries impose an optimum tariff*a. the welfare of the both nations decreaseb. the welfare of the both nations increasec. the welfare of the larger nation will increase and that of the other nation decreasesd. the welfare of the larger nation will decrease and that of the other nation increases11. If one nation imposes an optimum tariff and the other nation does not retaliate*a. the welfare of the first nation increases and that of the welfare of the second nation fallsb. the welfare of the second nation increases and that of the welfare of the second nation fallsc. the welfare of both nations falld. the welfare of both nations increase12. If one nation imposes an optimum tariff and the other nation does not retaliatea. the welfare of the first nation increases more than the fall in the welfare of the secondnation*b. the welfare of the first nation increases more than the fall in the welfare of the secondnationc. the welfare of the second nation increases less than the fall in the welfare of the firstnationd. the welfare of the first nation increases by the same amount as the fall in the welfare of the second nation13. The nominal tariff is the tariff calculated on thea. price of the input used in the production of the commodity*b. price of the commodity or servicec. value addedd. all of the above14. The effective tariff rate is the tariff calculated on thea. price of the input used in the production of the commodityb. commodity or service*c. value added in the nationd. all of the above15. If the nominal tariff on a commodity is higher than the nominal tariff on the imported input used in the production of the commodity, then the rate of effective protection is*a. higher on the commodity than on the inputb. lower on the commodity than on the imported inputc. equal on the commodity and on the imported inputd. any of the above。

![[经济学]国际经济学 萨尔瓦多 英文PPTchapter](https://uimg.taocdn.com/d0fc87a6b9d528ea81c779dc.webp)

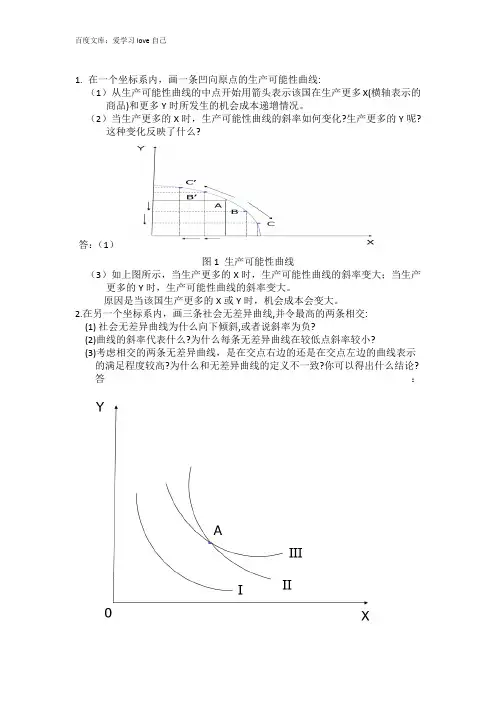

1.在一个坐标系内,画一条凹向原点的生产可能性曲线:(1)从生产可能性曲线的中点开始用箭头表示该国在生产更多X(横轴表示的商品)和更多Y时所发生的机会成本递增情况。

(2)当生产更多的X时,生产可能性曲线的斜率如何变化?生产更多的Y呢?这种变化反映了什么?答:(1)图1 生产可能性曲线(3)如上图所示,当生产更多的X时,生产可能性曲线的斜率变大;当生产更多的Y时,生产可能性曲线的斜率变大。

原因是当该国生产更多的X或Y时,机会成本会变大。

2.在另一个坐标系内,画三条社会无差异曲线,并令最高的两条相交:(1) 社会无差异曲线为什么向下倾斜,或者说斜率为负?(2)曲线的斜率代表什么?为什么每条无差异曲线在较低点斜率较小?(3)考虑相交的两条无差异曲线,是在交点右边的还是在交点左边的曲线表示的满足程度较高?为什么和无差异曲线的定义不一致?你可以得出什么结论?答:图2 社会无差异曲线(1)社会无差异曲线之所以会向下倾斜是因为为了维持社会福利水平不变,随着X商品消费的增加必须减少Y的消费。

(2)曲线的斜率代表一国在保持处在同一条无差异曲线的前提下,多消费一单位x而必须少消费Y的数量。

一国消费X越多,则其消费Y越少。

对该国来说,一单位Y的效用会逐渐增大。

因此,该国每多消费一单位X,只会放弃越来越少的Y商品。

所以,无差异曲线在较低点斜率较小。

(3)无差异曲线的定义表明每条无差异曲线意味着一个给定的满足程度,无差异曲线互不相交。

无差异曲线II显示了比交点右边更高的满足程度,无差异曲线II显示了比交点左边更高的满足程度。

因此,这个图是不合理。

3.在一个坐标系内,画一条生产可能性曲线,再画一条无差异曲线切于生产可能性曲线较平坦的地方,在另一个坐标系内,面另一条生产可能性曲线,再画另一条无差异曲线切于生产可能性曲线较陡直的地方。

(1)画一条表示各国孤立均衡相对价格的直线。

(2)各国具有比较优势的商品分别是什么?(3)在什么(极端)情况下,两国之间不存在比较优势或比较劣势?答:国家1 国家2图3 孤立均衡(1)如图3所示,P A和P A’是两国在孤立均衡情况下的价格。

第15章汇率的决定一、概念题1.绝对购买力平价理论(absolute purchasing-power parity theory)答:绝对购买力平价是指两国货币的汇率等于两国价格水平的比率,即R=P/P*,其中R等于两国货币的汇率或即期汇率,P和P*分别为本国和外国总的价格水平。

绝对购买力平价认为,如果一价定律有效,在物价指数中各种可贸易商品所占的权重相等,那么,一国货币对外汇率主要是由两国货币在其本国所具有的购买力决定的,两种货币购买力之比决定了两国货币的兑换比率。

在自由贸易的条件下,通过自由贸易竞争,使两国汇率与两国物价水平保持相对稳定,国际收支趋向平衡。

2.巴拉萨-萨缪尔森效应(Balassa-Samuelson effect)答:巴拉萨-萨缪尔森效应是由巴拉萨与萨缪尔森1964年首次提出的,是指在经济增长率越高的国家,工资实际增长率也越高,实际汇率的上升也越快的现象。

当贸易产品部门(制造业)生产效率迅速提高时,该部门的工资增长率也会提高。

国内无论哪个产业,工资水平都有平均化的趋势,所以尽管非贸易部门(服务业)生产效率提高并不大,但是其他行业工资也会以大致相同的比例上涨。

这会引起非贸易产品对贸易产品的相对价格上升。

假定贸易产品(按外汇计算)的价格水平一定,这种相对价格的变化在固定汇率的条件下,会引起非贸易产品价格的上涨,进而引起总体物价水平(贸易产品与非贸易产品的加权平均)的上涨。

如果为了稳定国内物价而采取浮动汇率的话,则会引起汇率的上升。

无论哪种情况都会使实际汇率下降。

3.货币需求(demand for money)答:货币需求是指社会各部门在既定的收入或财富范围内能够而且愿意以货币形式持有的数量。

在现代高度货币化的经济社会里,社会各部门需要持有一定的货币去媒介交换、支付费用、偿还债务、从事投资或保存价值,因此便产生了货币需求。

货币需求通常表现为一国在既定时间上社会各部门所持有的货币量。

第1 章绪论1.国际经济学的重要性1.产品的国际化。

2.全球经济一体化。

2.国际贸易与一国的生活水平1.许多小国生活要依赖别的国家2.国际间的依存关系非常密切3.一个国家的经济政策会影响到另外一个国家。

3、国际经济学的主要问题研究国家之间的相互依存性。

是宏观经济学与微观经济学在国家间的运用。

4、国际经济理论和政策的目的经济理论的目的一般在于预测与解释,是具体活动的高度概括。

5、当前的国际问题第2 章比较优势原理1.他认为分工可以提高劳动生产率Z 分工能提高劳动者的熟练程度Z 使每一个人从事专业生产,节省与劳动没有关系的时间Z 有利于发明创造2.贸易可以引起国际分工,国际分工的基础是天然禀赋或后天的有利条件。

如果每一个国家都按照有利的条件进行分工,然后进行交换,将使得资源与劳动力得到极大的利用。

从而提高劳动生产率,增加财富。

3.引言贸易基础贸易所得贸易模式4.、重商主义的贸易观点经济学开始于亚当密斯。

重商主义的观点:尽量使出口大于进口。

国家的财富是金银等稀有金属。

政府应该严格控制经济活动。

贸易是一种零和游戏。

除了1815-1914 年的英国,没有一个西方国家彻底摆脱过重商主义。

5、绝对优势理论他认为分工可以提高劳动生产率Z 分工能提高劳动者的熟练程度Z 使每一个人从事专业生产,节省与劳动没有关系的时间Z 有利于发明创造,贸易可以引起国际分工,国际分工的基础是天然禀赋或后天的有利条件。

如果每一个国家都按照有利的条件进行分工,然后进行交换,将使得资源与劳动力得到极大的利用。

从而提高劳动生产率,增加财富。

3-1 分工后的例(另外P24)3-3 绝对比较优势的适用范围非常一小部分贸易。

主要是发达国家与发展国家。

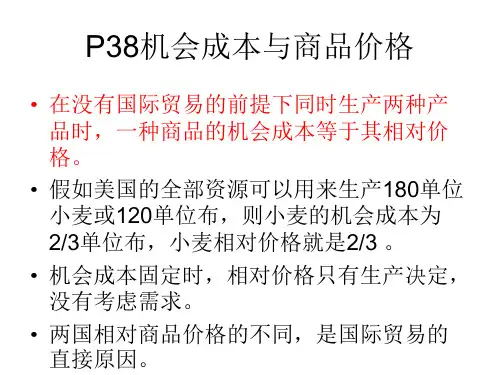

7.比较优势理论7-3 贸易所得的证明♦4C 小于6W 小于12C。

♦现实生活中的例子。

7-4 例外的情况比例相同的情况。

7-5 考虑货币的比较优势♦绝对劣势还可以进行分工的原因是工资的差异。

(P27)7-6 比较优势与机会成本♦李嘉图的比较优势建立在许多假设的基础上。

第3章国际贸易的标准理论一、概念题1.自给自足(autarky)答:自给自足特指在经济上完全依靠自己的力量来满足各种需要,而不与外部世界发生任何贸易关系。

在工业社会以前,大部分国家都处于自给自足的状态,经济发展落后,彼此间交流沟通很少。

这种情况的自给自足是狭隘的,因为本国的生产要素使用没有达到最优状态,且人民物质生活比较贫乏。

当前,随着经济的发展,有些国家由于要素禀赋的充裕以及技术的革新,有些产品生产上已经实现了自给自足。

2.社会无差异曲线(community indifference curve)答:社会无差异曲线是表明一个国家或经济体保持等量的国民消费水平或福利水平的两种商品的各种消费量组合点的轨迹。

或者说,它是显示社会福利水平为一常数的各种消费选择。

每一条社会无差异曲线都代表一定的社会效用水平,曲线上的每一点的斜率表示社会对两种商品的边际替代率;较高的曲线反映较高的满足程度,较低的曲线反映较低的满足程度。

社会无差异曲线凸向原点,斜率为负,而且互不相交。

3.去工业化(deindustrialization)答:去工业化又称为非工业化、逆工业化,指制造业就业比重持续下降。

它有两个主要特点:制造业发展停滞;制造业大规模裁员,就业从第二产业转向服务行业,制造业就业比重急剧下降。

去工业化现象最早始于美国。

一般来说,去工业化现象是出现在一些大城市地区以及那些以资源为基础、传统的衰退产业相对集中的老工业基地。

这主要是因为:①大城市地区土地租金和工资等生产成本较高,劳动和环境保护意识较强,加上市中心区生活和环境质量的下降,导致企业家把制造工厂由发达国家大城市迁移到中小城镇和农村地区,甚至迁移到国外。

②由于资源的枯竭和生产成本的上升,工业发达国家的一些传统产业如钢铁、造船、工程机械和纺织等,逐步走向衰退。

这些衰退产业主要集中在一些老工业基地,由此导致这些地区制造业出现严重的下降。

③随着技术发展,企业可以把生产过程的某些部分,尤其是劳动密集型的加工装配环节,分散到国外工资成本相对低廉的地区,而发展中国家提供的各种优惠政策又加剧了这种趋势。

国际经济学(第十版)多米尼克.萨尔瓦多(著)P16页练习题6.(1)根据消费者需求理论,当其他条件不变时,一种商品价格的提高(如由于税率的上浮所致),会带来需求量的什么变化?答:根据消费者需求理论,当其他条件不变时,一种商品价格的提高,则该商品的需求量将会下降。

(2)根据消费者需求理论,一种进口商品价格的提高(如由于进口关税的上浮所致),会带来需求量的什么变化?答:根据消费者需求理论,一种进口商品价格的提高,则该商品的出口量将会下降。

7.(1)一国政府如何能消除或减少预算赤字?答:一国政府可以通过减少政府支出、增加税收,来消除或者减少预算赤字。

(2)一个国家如何能消除或减少贸易逆差?答:一个国家要消除或减少其贸易逆差的方式有:对进口商品增税、补贴出口,借如更多的国外债券、减少借出外国债券,降低该国的国民收入水平。

8.(1)国际经济关系与地区经济关系有何区别?答:在国际经济关系下,国家通常限制在国际间的自由流动的货物、服务和因素,不同的语言、消费习惯和法律规定同样也阻碍了它们在国际间的流动,此外,国际收支会在各种货币收据和付款中流通。

而在地区经济关系下,就关税和进行相同的货币而言,区际流动的货物、服务和因素没有面临这样的限制因素,它们经常是在同样的语言环境下,在类似的消费习惯和法律规定下进行的,这就与国际经济关系形成了鲜明对比。

(2)它们在哪方面相似?答:国际经济关系和地区经济关系的相似点:两者都跨越了空间距离,事实上,它们都是在远距离贸易下的产物,把经济看待成在一个进行着生产、交换和消费的空间中的单一点,这也是从经济学的复位空间将它们区分。

10.如果说一个国家可以从国际贸易中获益,那么你如何解释为什么许多国家又要对国际贸易施加某些限制?答:国际贸易给本国消费者带来的是更低的价格,这样就会对本国的同种商品的生产商造成不利,挤兑了本国生产商的销售份额。

通常在这种情况下,本国的生产商就会失去大量的订单,并且向政府提议限制进口。