2019年新工资表模板(含公式)

- 格式:xlsx

- 大小:16.04 KB

- 文档页数:26

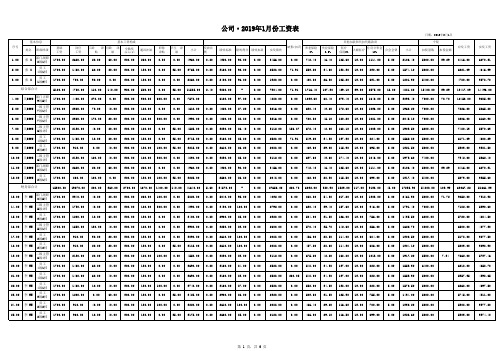

月份纳税人识别号姓名月应发工资累计工资当月额累计扣除额养老金失业金医疗保险公积金小计累计小计累计201901001张三10000100005000500075012345210201595159500 201901002李四15000150005000500085014058314232146214600 201902001张三80001800050001000075012345210201595319000 201902002李四120002700050001000085014058314232146429200 201903001张三200003800050001500075012345210201595478500 201903002李四350006200050001500085014058314232146643800一、应发工资二、基本减除费用三、专项扣除四、其他扣除仅供大家学习,请注意:1、由于具体细则尚未出台,本表仅根据现有信息,学习总结所得。

2、本表未含劳务报酬所得、稿酬所得、特许权使用费所得等预扣除个税部分。

3、大家可以预先做个统筹,测试学习!2019年个税计算方法与2018年有较大差异。

子女教育继续教育大病医疗房贷OR租金赡养费小计累计当期应纳税所得额累计应纳税所得额累计应预扣税额已预扣税金本月应预扣当月实发累计实发1000100010003000300040540512.150.0012.158392.858392.851000100010003000300048544854145.620.00145.6212708.3812708.3810001000100030006000-1595-1190012.150.006405.0014797.851000100010003000600018546708201.24145.6255.629798.3822506.7610001000100030009000104059215276.4512.15264.3018140.7032938.55100010001000300090002485431562946.86346.86600.0032254.0054760.76七、应纳税额八、实发工资五、专项附加扣除六、应纳税所得额。

说明:

1.表头项目可根据各司实际情况删减,但注意1—12月工资表如要增减表头项目,12张表要同时增减,避

2.个税计算公式简单易懂,可自行调整增减项。

但要切记不可删除任意月份的表格,否则将会影响应纳

3.新税法实施首年发生的大病医疗支出,要在2020年才能办理;

4.享受大病医疗专项附加扣除的纳税人,由其在次年3月1日至6月30日内,自行向汇缴地主管税务机关办

目,12张表要同时增减,避免因增列导致计算公式失效;的表格,否则将会影响应纳所得税额公式的计算;

行向汇缴地主管税务机关办理汇算清缴申报时扣除。

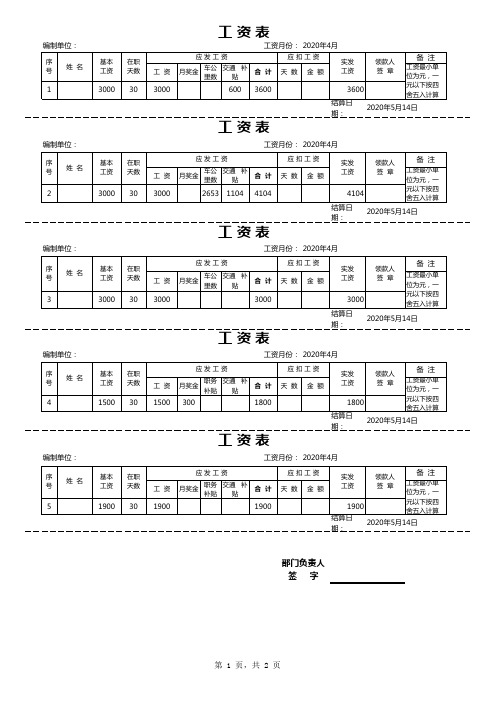

2019年5月xx公司员工工资表。

固定工资补贴绩效等收入小计基本养老保险123456=3+4+578小蚂蚁130,000.0030,000.005,000.004,500.00小蚂蚁230,000.0030,000.005,000.004,500.00小蚂蚁330,000.0030,000.005,000.004,500.00小蚂蚁430,000.0030,000.005,000.004,500.00小蚂蚁530,000.0030,000.005,000.004,500.00小蚂蚁630,000.0030,000.005,000.004,500.00小蚂蚁730,000.0030,000.005,000.004,500.00小蚂蚁830,000.0030,000.005,000.004,500.00小蚂蚁930,000.0030,000.005,000.004,500.00小蚂蚁1030,000.0030,000.005,000.004,500.00小蚂蚁1130,000.0030,000.005,000.004,500.00小蚂蚁1230,000.0030,000.005,000.004,500.00合计########0.000.00#########60,000.0054,000.001、本表适用于每月2、本表未考虑非居3、本表未考虑各种姓名身份证号费用收入基本医疗保险失业保险住房公积金专项扣除小计赡养老人子女教育9101112=8+9+10+1113144,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.004,500.002,000.000.000.000.0054,000.0024,000.000.00专项扣除继续教育住房租金住房贷款利息专项附加小计年金商业健康保险15161718=13+14+15+16+171920 2,000.002,000.002,000.002,000.002,000.002,000.002,000.002,000.002,000.002,000.002,000.002,000.000.000.000.0024,000.000.000.00专项附加扣除其他扣税延养老保险其他扣除小计当月应纳税所得额累计应纳税所得额累计应纳税额前期累计已缴税额2122=20+2123=6-7-12-18-2224=23+上月24列,1月本列等于23列25=24*预扣税率-速算扣除数26=上月25列,1月本列为零0.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.0018,500.0037,000.001,180.00555.000.000.00222,000.00444,000.0014,160.006,660.00其他扣除税款计算本月应补税额27=25-26625.00625.00625.00625.00625.00625.00625.00625.00625.00625.00625.00625.007,500.00。