通货膨胀会计

- 格式:doc

- 大小:58.00 KB

- 文档页数:13

论如何看待通货膨胀会计随着世界经济不断发展,通货膨胀已经成为了普遍存在的现象。

为了应对通货膨胀带来的影响,越来越多的企业开始关注通货膨胀会计。

那么,如何看待通货膨胀会计呢?本文将对相关问题进行深入探讨。

什么是通货膨胀会计?通货膨胀会计,顾名思义,就是在通货膨胀环境下进行的会计工作。

随着通货膨胀不断加剧,企业资产与负债的价值会产生变化,进而影响企业的财务状况。

通货膨胀会计就是通过制定相应的会计政策和方法,记录、报告和分析企业在通货膨胀环境下的财务状况和经营业绩。

通货膨胀会计引入了通货膨胀调整、持续计量和折旧等概念,也就是说,在通货膨胀环境下,会计不再只是简单地记录资产的原始成本和赎回日的金额,而是要计算资产的通货膨胀调整、持续计量和折旧,以确保财务报告反映了通货膨胀的影响。

通货膨胀会计的意义通货膨胀对企业的影响是多方面的,包括:1.货币资产和负债的实际价值变动;2.计税基础的变化,对企业税负的影响;3.生产成本和销售价格的变化,对企业的盈利能力和市场竞争力的影响。

因此,通货膨胀会计对企业的意义也是显而易见的。

它主要有以下几个方面:1.帮助企业更准确地把握其财务状况和经营业绩。

通过通货膨胀调整、持续计量等方法,反映资产和负债的实际价值,不仅可以更准确地计算企业的总资产和总负债,还可以反映企业的运营成本和盈利状况等信息。

2.保护企业的财产。

通货膨胀是财产价值贬值的重要原因之一,通货膨胀会计可以帮助企业及时反映并应对通货膨胀的影响,从而更好地保护企业的资产。

3.辅助企业进行决策。

通货膨胀会计提供了更全面、准确的财务信息,可以帮助企业更好地进行投资决策和运营管理。

通货膨胀会计存在的问题尽管通货膨胀会计有着显著的意义,但也存在一些争议和问题,例如:1.数据和信息不完全。

通货膨胀会计需要用到一些预测和估计数据,这些数据的准确性和及时性难以保障,容易产生误差。

2.会计政策和方法难以确立。

通货膨胀会计需要完善的会计政策和方法支持,但是目前尚未制定出完全适用于各类企业的通货膨胀会计标准。

通货膨胀下的会计对策通货膨胀下的会计对策通货膨胀是造成物价上涨的一国货币贬值。

是在一定时间内一般物价水平的持续上涨现象,以下是店铺为大家整理的通货膨胀下的会计对策,希望对你有所帮助!通货膨胀下的会计对策建议1、优化选择科学的会计模式会计模式是进行财务会计的关键。

就我国目前会计运行环境而言,传统会计模式不能从根本上解决通货膨胀问题,应基于通货膨胀下各种会计模式的适应特征进行科学的比较和分析,加强协调应用。

比较现实的选择应是企业可根据实际需求,采用不同的会计模式,按照政府公布的物价指数对资产负债中的资产、负债和所有者权益以及损益表中的销售收入费用加以换算和调整,采取一系列保护性措施来减轻或揭示通货膨胀对现行会计模式的影响。

2、加强会计核算的科学合理性会计核算是会计的核心。

通货膨胀期间,对存货资产计价采用后进先出法,对固定资产实行加速折旧或不提折旧法,可使当期成本与当期营业收入配比,可以避免虚增营业收益。

相对来说,加强对资产定期进行重估价值,按重估后的价值入帐,资产重估增值部分计入资本公积,对固定资产则按重估后的价值计提折旧,既能使资产负债表的资产能反映其现时价值,也能使损益表正确地反映企业当期经营成果,在一定程度上消除物价变动对会计核算带来的影响。

3、强化会计信息质量的控制会计信息质量影响着决策的科学性,消除通货膨胀引发的会计信息质量弱化的影响,需要重编财务报表,综合一般物价水平会计与重置成本会计的结合运用,仍以历史成本为基础,以物价指数为工具,对按历史成本为基础的财务报表进行调整,以报告时点的单位货币购买力重新表述,在报表或报表附注,不影响传统会计的各项原则,通过重编财务报表,可以提高会计报表数据的真实性、可比性和有用性,适当消除通货膨胀对企业财务状况和经营成果的影响。

通货膨胀对会计的影响通货膨胀对传统会计模式的影响我国的传统会计模式一般是采用历史成本计量模式进行的会计活动。

历史成本会计模式是建立在持续经营与币值稳定假设理论基础之上的。

通货膨胀下会计模式的比较与选择随着经济全球化和市场化程度的不断提高,通货膨胀已经成为了现代经济体系中广泛存在的问题。

通货膨胀会对会计师的工作产生影响,会计师需要根据通货膨胀的影响,选择不同的会计模式进行会计核算。

本文将从通货膨胀的影响、会计模式的选择以及比较这三个方面来讨论通货膨胀下应选择的会计模式。

一、通货膨胀对会计师的影响通货膨胀会对企业的会计核算产生两方面的影响:1、货币的购买力下降,产品价格上升,导致企业产生通货膨胀损失。

如原材料的购进价格和工资的支付价格等都会上涨,导致成本的增加,企业的利润相应减少。

2、通货膨胀下,企业固定资产的价值也会受到影响,导致资产负债表的资产价值出现偏差。

如企业拥有的不动产、设备等资产都会受到通货膨胀的影响而发生价值变化。

二、会计模式选择针对以上两方面的影响,会计师可以选择不同的会计模式进行会计核算。

1、历史成本法:历史成本法是根据购买或建造资产时的实际成本计入记账。

这种会计模式对会计师来说是最简单、最常见的会计程序。

但是,历史成本法往往不能反映出通货膨胀和物价变动的影响,不能准确反映出企业资产和负债的真实价值。

2、调整后的历史成本法:调整后的历史成本法是在历史成本法的基础上,对固定资产按照通货膨胀率进行调整。

这种会计模式可以更准确地反映企业资产负债的现实价值,并且比较简单容易操作。

3、现行价值法:现行价值法是按照当前市场价值计算资产和负债的价值。

这种会计模式可以真实反映企业资产和负债的价值,但是相对于其他两种会计模式,计算会更加复杂。

三、会计模式比较下面从三个方面比较不同会计模式的优缺点。

1、记录方法不同:历史成本法只记录企业在购买或建造资产时的实际成本,不能真实反映出资产和负债的价值;调整后的历史成本法和现行价值法都能更准确地反映企业资产和负债价值。

2、计算方法不同:调整后的历史成本法的计算比现行价值法简单,成本也低,但准确性较低;而现行价值法的计算比较复杂,但可以真实反映企业资产和负债的价值。

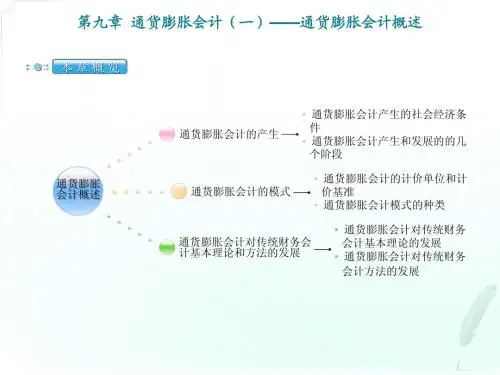

高级财务会计第9章通货膨胀会计一讲义通货膨胀是指物价水平普遍上涨的现象,是市场经济中常见的经济现象。

在面对通货膨胀时,财务会计需要采取相应的措施来应对通货膨胀对财务报表的影响。

本文将就高级财务会计第9章通货膨胀会计进行一讲义,详细介绍通货膨胀会计的相关知识和应对策略。

一、通货膨胀会计的基本概念通货膨胀会计是指在通货膨胀环境下,对财务报表进行相应调整以反映通货膨胀的影响。

通货膨胀会计的目标是确保财务报表的真实和公允,使其更准确地反映企业的财务状况和经营成果。

二、通货膨胀对财务报表的影响通货膨胀对财务报表的影响主要体现在三个方面:货币资金的贬值、固定资产的重新估价、和利润的调整。

首先,在通货膨胀下,货币的购买力下降,货币资金的实际价值会减少。

因此,在财务报表中,需要将货币资金按照通货膨胀率进行调整,以反映其实际价值。

其次,通货膨胀会导致固定资产的重新估价。

在通货膨胀下,固定资产的价格普遍上涨,其价值会随之增加。

财务会计需要将固定资产按照市场价格进行重新估价,以反映其实际价值。

最后,通货膨胀对利润的计量和分配也产生影响。

通货膨胀下,企业的销售收入会上涨,但成本也会相应增加。

财务会计需要将利润按照通货膨胀率进行调整,以反映实际利润的变化。

三、通货膨胀会计的应对策略为了应对通货膨胀对财务报表的影响,财务会计需要采取一系列的应对策略,包括“货币资金调整”、“固定资产重新评估”和“利润调整”。

首先,对于货币资金的调整,可以采用通货膨胀率调整法。

即按照通货膨胀率将货币资金进行调整,以反映其实际价值。

调整后的货币资金可以更真实地反映企业的购买力。

其次,固定资产的重新评估可以采用市场价格调整法。

财务会计可以按照市场价格对固定资产进行重新估价,以反映其实际价值。

重新估价后的固定资产可以更准确地反映企业的资产状况。

最后,在通货膨胀下,利润的调整可以采用通货膨胀调整法。

即按照通货膨胀率对利润进行调整,以反映其实际变化。

调整后的利润可以更准确地反映企业的经营成果。

国际会计准则第26号通货膨胀会计处理国际会计准则第26号:通货膨胀会计处理通货膨胀对经济和企业的影响是不可避免的。

为了准确反映通货膨胀对企业财务报表的影响,国际会计准则委员会(IASB)制定了国际会计准则第26号(IAS 26)《会计和报告中的通货膨胀》。

第26号准则主要关注通货膨胀对企业财务报表中的资产和负债的影响。

它提供了一套指导性原则,确保企业能够正确处理通货膨胀对财务报表的影响,从而提供准确的信息给利益相关者。

在通货膨胀环境中,企业资产和负债的价值会发生变化。

过去,许多企业在财务报表中未能恰当地反映这种变化,导致了财务信息的不准确。

IAS 26的引入填补了这一空白,并要求企业根据其实际情况采取适当的措施。

首先,根据该准则,企业应当根据通货膨胀水平和模式来选择合适的通货膨胀计算方法。

常见的计算方法包括当前购买力和常规购买力计算法。

企业应根据其所在行业和国家的具体情况选择合适的计算方法。

其次,企业需要重新计算其财务报表中的资产和负债的价值。

通货膨胀会导致货币价值的下降,因此企业需要将当前购买力进行调整,以反映其实际价值。

这可以通过将货币金额与价格指数相乘来实现。

在财务报表中,企业还需要在重要的财务指标上提供通货膨胀调整后的数值。

这些指标包括销售额、收入、成本和利润等。

通货膨胀对这些指标的影响可能会给企业带来巨大的挑战,因此正确调整这些指标至关重要。

此外,IAS 26还要求企业披露其通货膨胀会计处理政策和假设。

这样做可以增加财务报表的透明度,使利益相关者对企业对通货膨胀的处理方式有更清晰的了解。

企业还应该披露通货膨胀对其财务状况和经营绩效的重要影响。

识别和计量通货膨胀的影响不仅仅是遵守国际会计准则的要求,更是为了提供准确的财务信息,从而帮助利益相关者做出明智的决策。

企业应当理解和运用IAS 26的要求,确保财务报表完整和准确地反映通货膨胀带来的影响。

在实施IAS 26时,企业需要谨慎处理通货膨胀会计处理过程中的相关问题。

国际会计准则通货膨胀测算1.引言1.1 概述概述部分的内容可以写作如下:概述通货膨胀是当一个国家或地区整体价格水平持续上升的现象。

它在经济中扮演着重要的角色,并对各个领域产生广泛的影响。

在国际贸易和金融活动中,通货膨胀的测算显得尤为重要,因为它影响着企业的财务报表和会计准则。

本文将着重讨论国际会计准则对通货膨胀测算的要求以及其对全球会计行业的影响。

通货膨胀的出现通常与货币供应量的增加有关。

当央行增加货币供应,推动了经济活动的增长,但也引发了产品和服务价格的上涨,从而导致了通货膨胀。

通货膨胀的程度和速度对于经济的稳定和发展至关重要。

国际会计准则对通货膨胀测算提出了一系列要求,旨在确保企业能够准确反映通货膨胀对其财务状况和经营业绩的影响。

这些要求包括确定货币调整的方式、报告货币调整的信息以及对通货膨胀的影响进行实质性分析等。

国际会计准则委员会(IASB)不断更新和发布新的准则,与此同时,各国的会计标准监管机构也在积极引入国际会计准则,以确保全球范围内的会计准则更加统一和一致。

本文将进一步探讨国际会计准则对通货膨胀测算的要求以及其对企业的影响。

我们也将对通货膨胀测算的重要性进行总结,并提出对国际会计准则的影响和建议。

通过深入研究和分析,本文旨在增进对通货膨胀测算及其在国际会计准则中的应用的理解。

1.2文章结构2.正文2.1 通货膨胀的定义和影响通货膨胀是指货币供应量持续增加,导致物价普遍上涨的现象。

通货膨胀对经济产生广泛的影响,包括金融市场、国际贸易、个人收入等方面。

它会改变市场的需求和供应关系,影响企业的经营决策以及国家的宏观经济政策。

2.2 国际会计准则对通货膨胀测算的要求国际会计准则组织(International Accounting Standards Board,IASB)制定了一系列的国际会计准则(International Financial Reporting Standards,IFRS),其中包括对通货膨胀的测算和报告要求。

国际会计准则第26号通货膨胀会计处理在当今复杂多变的经济环境中,通货膨胀是一个不可忽视的因素。

它对企业的财务状况和经营成果产生着深远的影响。

国际会计准则第26 号(IAS 26)专门针对通货膨胀会计处理提供了指导和规范,以确保企业的财务报表能够更真实、准确地反映其经济实质。

通货膨胀会计处理的重要性不言而喻。

当物价持续上涨时,传统的历史成本会计可能会导致资产低估和利润虚增。

例如,一项固定资产在购买时可能花费了 100 万元,但经过多年的通货膨胀,其实际价值可能已经大幅增加。

如果仍然按照原始成本计提折旧,那么折旧费用就会过低,从而高估了利润。

IAS 26 中规定了两种主要的通货膨胀会计处理方法:一般物价水平会计和现行成本会计。

一般物价水平会计是通过调整财务报表中的项目,以反映一般物价水平的变动。

它首先要确定一个物价指数,然后将历史成本数据按照这个物价指数进行调整。

比如,年初的存货价值为 50 万元,当年的物价指数上涨了 10%,那么调整后的存货价值就为 55 万元。

现行成本会计则是以资产的现行成本来重新计量资产和负债。

这意味着要根据当前的市场价格来评估资产的价值,并据此调整相关的会计记录。

例如,一台设备的历史成本为 80 万元,但现在市场上相同功能的设备需要 100 万元,那么在现行成本会计下,该设备的价值应调整为 100 万元。

在实际应用中,选择哪种通货膨胀会计处理方法取决于多种因素。

企业的经营特点、所处的行业环境以及管理层的决策需求等都可能影响选择。

一般来说,如果企业的资产价值受物价变动影响较大,现行成本会计可能更合适;而如果企业更关注整体经济环境对财务报表的影响,一般物价水平会计可能是更好的选择。

然而,通货膨胀会计处理也并非一帆风顺,它面临着一些挑战和问题。

首先是数据获取和准确性的问题。

无论是物价指数还是现行成本的确定,都需要可靠的数据支持。

但在某些情况下,获取准确和及时的数据可能存在困难,这可能导致会计处理的误差。

10第九章通货膨胀会计一通货膨胀会计概述通货膨胀会计一:通货膨胀会计概述通货膨胀是指一种经济现象,在这种现象下,货币的购买力下降,物价普遍上涨。

通货膨胀对企业的会计和财务管理会带来很大的影响。

本章将介绍通货膨胀会计概述,包括通货膨胀的定义、影响和应对措施。

1. 通货膨胀的定义通货膨胀是指货币供应与商品和服务的供应不平衡,导致物价普遍上涨的经济现象。

通货膨胀会导致货币的购买力下降,使得企业的成本上升,进而影响企业的盈利能力和财务状况。

2. 通货膨胀对企业会计的影响通货膨胀对企业会计产生很大的影响,主要表现在以下几个方面:a. 资产负债表的调整:通货膨胀会导致企业的资产和负债的计量面临挑战。

资产负债表上的货币资产会受到通货膨胀的影响,其实际价值下降。

因此,企业需要对资产负债表进行调整,以反映通货膨胀对资产和负债的影响。

b. 利润与损益表的调整:通货膨胀会对企业的利润产生影响。

由于成本上涨,企业的毛利率可能下降。

此外,通货膨胀还会导致非货币性资产(如土地、房产等)的价值增加。

因此,企业需要对利润与损益表进行调整,以准确反映通货膨胀对企业利润的影响。

c. 报告货币和准货币:在通货膨胀环境中,传统货币和准货币之间的差异变得更加重要。

货币的购买力下降会使企业的现金流量受到影响。

因此,企业需要及时报告货币和准货币,以便更准确地了解企业的现金流动性。

3. 应对通货膨胀的会计处理措施企业可以采取以下会计处理措施来应对通货膨胀的影响:a. 货币资产的调整:企业需要对资产进行调整,以反映通货膨胀对货币资产的影响。

可以通过使用通货膨胀指数来调整资产计量,或者使用实际购买价值进行计算。

b. 利润与损益表的调整:企业可以使用通胀调整机制来调整利润和损益表,以反映通货膨胀对成本和收入的影响。

这样可以更准确地计算企业的盈利能力。

c. 数据报告的频率和及时性:通货膨胀会导致企业现金流量的波动。

为了更好地应对这种波动,企业应该加强对数据的监控和分析,并提高报告的频率和及时性,以便更准确地了解企业的财务状况。

通货膨胀会计通货膨胀会计无历史版本编辑词条创建者:王峰更新日期:2008-11-17 13:26:00 编辑次数:1 浏览次数:什么是通货膨胀会计通货膨胀会计是在通货膨胀条件下,根据一般物价指数或现时成本数据,将传统历史成本会计加以调整,借以反映和消除物价上涨因素对传统会计报表影响,或彻底改变某些传统会计原则,从而更真实的反映企业财务状况和经营成果的一种会计程序和方法。

通货膨胀会计产生的背景通货膨胀会计是西方财务会计的一个新领域,它的产生和发展有着深刻的历史背景。

随着资本主义经济由自由竟争向垄断阶断的过渡,产生了周期性的经济危机。

尤其是第一次世界大战后,西方国家出现了通货膨胀现象,商品物价飞涨,工人大量失业,经济运行过程中的平衡和稳定被打破,通货膨胀与失业并发、资源配置的严重失调一样,成为资本主义国家经济危机深刻化与复杂化的一种反映,阻碍了资本主义经济的发展。

西方经济学界为了控制严重通货膨胀的爆发,进行了长期不懈地探索与研究,但一直无法从根本上消除通货膨胀现象。

正是由于通货膨胀的出现,给企业界财务会计信息带来了种种冲击,应用传统会计假设和会计原则处理会计事项显出许多弱点。

在通货膨胀时期,企业的资产、负债和收益必然受到物价变动的影响。

在通货膨胀时期,如以币值不变假设和历史成本原则去处理帐务,编制会计报表,必然不能真实反映财务状况和经营业绩。

尤其是包括几年数据的比较,分析报表不仅难以作为企业管理当局制定决策的依据,也会引起投资者、债权人和其他会计信息使用的误解。

我们知道,长期以来,西方会计界均按照币值不变的基本假设和历史成本原则来处理会计事项。

币值不变假设在西方财务会计中称货币计量假设,这种假设是以假定货币本身的价值稳定不变为基础的,它是会计的计量单位,称为名义货币计量单位。

即使有变动,也是极其微弱,不足以影响会计计量和财务信息的正确性。

正是因为币值不变假设本身所具有的特点,在通货膨胀环境下,这一币值稳定的假设就无法避免会计上所提供的信息背离经营的实际情况,有时甚至会出现虚盈的经营假象。

通货膨胀会计的名词解释通货膨胀是一个经济学概念,它指的是货币供应量持续增加而导致物价普遍上涨的现象。

在通货膨胀下,购买力下降,消费者需要支付更多的货币来购买相同数量的商品和服务。

为了更好地理解通货膨胀,本文将重点解释一些与通货膨胀相关的会计术语。

1. 价格指数价格指数是衡量物价变化的常用指标之一。

它通过将一篮子代表性商品和服务的价格与基准年份的价格进行比较来计算。

通常,价格指数基准年份被设定为100,而随着时间的推移,价格指数将上升或下降。

价格指数的上升意味着通货膨胀,而下降则意味着通货紧缩。

2. 通货膨胀率通货膨胀率是衡量通货膨胀水平的指标。

它表示在一定时间内物价水平的增长速度。

通货膨胀率通常以百分比形式呈现。

例如,如果通货膨胀率为5%,意味着一年内物价上涨了5%。

3. 货币贬值通货膨胀导致货币购买力下降,这被称为货币贬值。

当通货膨胀率高于人民的工资增长率时,他们需要支付更多的货币来购买相同数量的商品和服务。

这种情况下,人们的富裕感会减少,生活成本上升。

4. 通胀调整在会计中,通胀调整指的是为了考虑通货膨胀对财务报表的影响而对其进行调整。

由于通货膨胀的存在,会计报表上的数字可能会失真。

为了反映物价的变化,会计人员使用通胀调整方法,将历史数据的数值调整为当前货币购买力的等值。

5. 净通货膨胀利润净通货膨胀利润是一个会计概念,它指的是将通货膨胀调整纳入考虑后的净利润。

通货膨胀会导致企业的成本上升,但也可能使其销售价格上涨。

因此,净通货膨胀利润的计算考虑了这种影响,以更准确地反映公司经营业绩。

6. 资本盈余率资本盈余率是衡量公司的利润水平的指标。

通货膨胀通常会导致公司成本的上升,这可能对利润产生负面影响。

因此,考虑通货膨胀后的资本盈余率可能是更准确的衡量指标。

7. 通胀税通胀税是指通货膨胀对国民经济的一种“隐性税收”影响。

当通货膨胀发生时,人们需要支付更多的货币购买商品和服务,这相当于额外的税费。

因此,通胀税实际上减少了人们的可支配收入。

Inflation AccountingByDr. Kirti JainLecturerR.B.S. College, Agra Agra AgraVivek GuptaLecturerINC, AgraInflationSince we started understanding things around us, we all used to listen from our Grandparents about the things and articles especially Gold & Ghee being cheaper in their times.That tim e we used to think that why the things were cheaper in our Grandparents' time and why had they started becom ing costlier. So this question would keep us puzzled.But now as we have grown in our knowledge and understanding, we have com e to know about the phenomenon of Inflation which in laym an's language is known as the state of rising pricing or the falling value of m oney was the greatest reason behind this.Now em erges the question that what exactly is t he Inflation? Inflation is a global phenomenon in present day tim es. There is hardly any country in the capitalist world today which is not afflicted by the spectre of inflation.Different economists have defined inflation in different words like Prof. Crowther has defined inflation "as a state in which the value of m oney is falling, i.e., prices are rising." In the words of Prof. Paul Einzig, "Inflation is that state of disequilibrium in which an expansion of purchasing power tends to cause or is the effect of an increase of the price level." Both the definition have em phasized on the rising prices of the goods.The basic factors behind the inflation are either the rising demand or the shortening of supply due to any reason.Effect of Inflation on BusinessThe im pact of inflation on business can be bifurcated into two parts like1. Impact on costs and revenue2. Impact on assets and liabilitiesAs far as im pact of inflation on costs and revenues is concerned, definitely both will rise but whether they result into extraordinary profits will be determined by that how much opening stock was available at old prices with the com pany and how much later the dem and for increasing wages is entertained by the com pany.I n case of monetary assets and liabilities, a company will lose in case of being creditor and gain in case of being debtor in real terms.If we talk about other assets like building, land and other securities, the company will be having holding gains in monetary terms but m ay have neutral impact in real term s due to the rise in prices on the one hand but fall in value of m oney on the other.Inflation Accounting and its significanceThe im pact of inflation com es in the form of rising prices of output and assets. As the financial accounts are kept on Historical cost basis, so they don't take into consideration the im pact of rise in the prices of assets and output. This m aysom etimes result into the overstated profits, under priced assets and misleading picture of Business etc.So, the financial statem ents prepared under historical accounting are generally proved to be statem ents of historical facts and do not reflect the current worth of business. This deprives the users of accounts like management, shareholders, and creditors etc. to have a right picture of business to m ake appropriate decisions.Hence, this leads towards the need for Inflation Accounting. Inflation accounting is a term describing a range of accounting system s designed to correct problems arising from historical cost accounting in the presence of inflation.The significance of inflation accounting em erges from the inherent limitations of the historical cost accounting system. Following are the limitations of historical accountin g:1. Historical accounts do not consider the unrealised holding gains arising from the rise in the m onetary value of the assets due to inflation.2. The objective of charging depreciation is to spread the cost of the asset over its useful life and make reserve for its replacem ent in the future. But it does not take into account the im pact of inflation over the replacem ent cost which m ay result into the inadequate charge of depreciation.3. Under historical accounting, inventories acquired at old prices are m atchedagainst revenues expressed at current pric es. In the period of inflation, this may lead to the overstatem ent of profits due mixing up of holding gains and operating gains.4. Future earnings are not easily projected from historical earnings.History of Inflation AccountingIn the last few years, inflation accounting has been adopted as a supplementary financial statem ent in the United States and the United Kingdom. This com es after more than 50 years of debate about m ethods of adjusting financial accounts for inflation.Accountants in the United Kingdom and the United States have discussed the effect of inflation on financial statem ents since the early 1900s, beginning with index number theory and purchasing power. Irving Fisher's 1911 book The Purchasing Power of Money was used as a source by Henry W. Sweeney in his 1936 book Stabilized Accounting, which was about Constant Purchasing Power Accounting. This m odel by Sweeney was used by The Am erican Institute of Certified Public Accountants for their 1963 research study (ARS6) Reporting the Financ ial Effects of Price-Level Changes, and later used by the Accounting Principles Board (USA), the Financial Standards Board (USA), and the Accounting Standards Steering Committee (UK). Sweeney advocated using a price index that covers everything in the gross national product. In March 1979, the Financial Accounting Standards Board (FASB) wrote Constant Dollar Accounting, which advocated using the Consumer Price Index for All Urban Consumers (CPI-U) to adjust accounts because it is calculated every m onth.During the Great Depression, som e corporations restated their financial statem ents to reflect inflation. At tim es during the past 50 years standard-setting organizations have encouraged com panies to supplem ent cost-based financial statem ents with price-level adjusted statem ents. During a period of high inflation in the 1970s, the FASB was reviewing a draft proposal for price-level adjusted statem ents when the Securities and Exchange Commission (SEC) issued ASR 190, which required approximately 1,000 of the largest US corporations to provide supplemental information based on replacem ent cost. The FASB withdrew the draft proposal.Still to cater to the needs of an Inflation Accounting, the IASB cam e out with an Accounting Standard known as IAS 29.Last.Techniques of Inflation AccountingTo m easure the impact of inflation on financial statem ents, following are the techniques used:Current Purchasing Power (CPP) MethodUnder this m ethod of adjusting accounts to price changes, all item s in the financial statem ents are restated in term s of a constant unit of m oney i.e. in term s of general purchasing power. For m easuring changes in the price level and incorporating the changes in the financial statem ents we use General Price Index, which m ay be considered to be a barometer m eant for the purpose. The index is used to convert the values of various item s in the Balance Sheet and Profit and Loss Account. This method takes into account the changes in the general purchasing power of m oney and ignores the actual rise or fall in the price of the given item. CPP method involves the refurnishing of historical figures at current purchasing power. For this purpose, historical figures are converted into value of purchasing power at the end of the period. Two index numbers are re quired: one showing the general price level at the end of the period and the other reflecting the sam e at the date of the transaction.Profit under this m ethod is an increase in the value of the net asset over a period, all valuations being m ade in term s of current purchasing power.Current Cost Accounting (CCA) MethodThe Current Cost Accounting is an alternative to the Current Purchasing Power Method. The CCA m ethod m atches current revenues with the current cost of the resources which are consum ed in earning them.Changes in the general price level are m easured by Index Numbers. Specific price change occurs if price of a particular asset changes without any general price change. Under this m ethod, asset are valued at current cost which is the cost at which asset can be replaced as on a date.While the Current Purchasing Power (CPP) method is known as the General Price Level approach, the Current Cost Accounting (CCA) method is known as Specific Price Level approach or Replacem ent Cost Accounting.Limitations of Inflation AccountingThough Inflation Accounting is more practical approach for the true reflection of financial status of the com pany, there are certain limitations which are not allowing this to be a popular system of accounting. Following are the limitations:1. Change in the price level is a continuous process.2. This system makes the calculations a tedious task because of too m any conversions and calculations.3. This system has not been given preference by tax authorities.ConclusionEvery person on this earth has been affected by Inflation, som e positively but most of the people negatively because the Inflation leads to the erosion of general purchasing power. The Inflation spares none and it equally influences the Businesses like the people.Historical cost accounting does not take into account the changes in the rise in the value of assets and its im pact on Balance Sheet and P&L Account due to inflation and does not reflect the real worth of the business which is very required for effective decision m aking.Inflation Accounting has removed this drawback by providing m ethods for adjusting the figure according to General or Specific Price levels.Despite a right m ethod of presenting financial statem ents, Inflation Accounting is still not widely prevalent due to certain limitations. But with m ore research and development of accounting software in this field, there is no doubt that Inflation adjusted accounting is the future of Financial Accounting.References:1. M.L. Seth, Money, Banking & Public Finance2. Ravi M. Kishore, Advance Accountancy3. 4. 5. http://invest m 6. http://newm 通货膨胀会计Dr. Kirti Jain自从我们开始认识身边的人和事,我们都用来听取有关的事情和文章,尤其是黄金和酥油是在我们的祖父母的时代更便宜。