英文2005,哈佛商业评论,抗击最大的风险(战略风险地图)

- 格式:pdf

- 大小:5.03 MB

- 文档页数:12

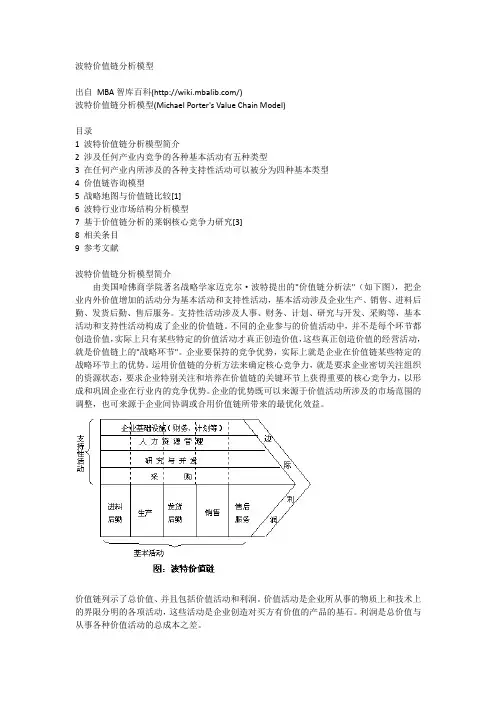

波特价值链分析模型出自MBA智库百科(/)波特价值链分析模型(Michael Porter's Value Chain Model)目录1 波特价值链分析模型简介2 涉及任何产业内竞争的各种基本活动有五种类型3 在任何产业内所涉及的各种支持性活动可以被分为四种基本类型4 价值链咨询模型5 战略地图与价值链比较[1]6 波特行业市场结构分析模型7 基于价值链分析的莱钢核心竞争力研究[3]8 相关条目9 参考文献波特价值链分析模型简介由美国哈佛商学院著名战略学家迈克尔·波特提出的"价值链分析法"(如下图),把企业内外价值增加的活动分为基本活动和支持性活动,基本活动涉及企业生产、销售、进料后勤、发货后勤、售后服务。

支持性活动涉及人事、财务、计划、研究与开发、采购等,基本活动和支持性活动构成了企业的价值链。

不同的企业参与的价值活动中,并不是每个环节都创造价值,实际上只有某些特定的价值活动才真正创造价值,这些真正创造价值的经营活动,就是价值链上的"战略环节"。

企业要保持的竞争优势,实际上就是企业在价值链某些特定的战略环节上的优势。

运用价值链的分析方法来确定核心竞争力,就是要求企业密切关注组织的资源状态,要求企业特别关注和培养在价值链的关键环节上获得重要的核心竞争力,以形成和巩固企业在行业内的竞争优势。

企业的优势既可以来源于价值活动所涉及的市场范围的调整,也可来源于企业间协调或合用价值链所带来的最优化效益。

价值链列示了总价值、并且包括价值活动和利润。

价值活动是企业所从事的物质上和技术上的界限分明的各项活动,这些活动是企业创造对买方有价值的产品的基石。

利润是总价值与从事各种价值活动的总成本之差。

价值活动分为两大类:基本活动和支持性活动。

基本活动是涉及产品的物质创造及其销售、转移买方和售后服务的各种活动。

支持性活动是辅助基本活动,并通过提供采购投入、技术、人力资源以及各种公司范围的职能支持基本活动。

哈佛商业评论简介创刊于1922年的《哈佛商业评论》( Harvard Business Review,简称HBR ),是哈佛商学院的标志性杂志。

《哈佛商业评论》的月发行量达到25万,它几乎没有新闻图片,也没有事实报道。

创刊80多年来,《哈佛商业评论》始终致力于发掘和传播工商管理领域中最前卫的思想理论、观点和方法,帮助管理者们不断更新理念、开阔视野、适应变化,与时代共进特色《商业评论》中文版的特色是:1、中文版《哈佛商业评论》与英文版保持同步出版,使中国读者基本能与美国读者同步阅读到哈佛商业评论,分享世界最新的管理思想和管理经验。

2、拥有资深的杂志编辑,他们不仅拥有丰富的管理知识和经验,而且能贴近本土读者的语言要求对文章进行精到的翻译,用深入浅出的方式把哈佛优秀的管理思想清晰的表达出来,使国内的读者可以更快更方便的进行阅读。

3、哈佛《商业评论》70%的内容是来自于《哈佛商业评论》英文版,约有30%的内容是针对中国本土进行案例分析。

本土的内容将逐渐增加,对与中国国情密切结合的,对高层管理精英比较关注的管理理念的问题进行一些探索。

本土学者和企业管理专家将针对中国存在的管理问题提出实际的解决方案,从而使该杂志的内容更加丰富并更能满足中国读者的需要。

多元化战略多元化战略又称多角化战略,是指企业同时经营两种以上基本经济用途不同的产品或服务的一种发展战略。

多元化战略是相对企业专业化经营而言的,其内容包括:产品的多元化、市场的多元化,投资区域的多元化和资本的多元化。

多元化战略的定义企业采用多元化战略,可以更多地占领市场和开拓新市场,也可以避免单一经营的风险。

所谓产品的多元化,是指企业新生产的产品跨越了并不一定相关的多种行业,且生产多为系列化的产品;所谓市场的多元化,是指企业的产品在多个市场,包括国内市场和国际区域市场,甚至是全球市场;所谓投资区域的多元化,是指企业的投资不仅集中在一个区域,而且分散在多个区域甚至世界各国;所谓资本的多元化,是指企业资本来源及构成的多种形式,包括有形资本和无形资本诸如证券、股票、知识产权、商标和企业声誉等。

波特价值链分析模型(重定向自价值链)波特价值链分析模型(Michael Porter's Value Chain Model)波特价值链分析模型简介由美国哈佛商学院著名战略学家迈克尔·波特提出的"价值链分析法"(如下图),把企业内外价值增加的活动分为基本活动和支持性活动,基本活动涉及企业生产、销售、进料后勤、发货后勤、售后服务。

支持性活动涉及人事、财务、计划、研究与开发、采购等,基本活动和支持性活动构成了企业的价值链。

不同的企业参与的价值活动中,并不是每个环节都创造价值,实际上只有某些特定的价值活动才真正创造价值,这些真正创造价值的经营活动,就是价值链上的"战略环节"。

企业要保持的竞争优势,实际上就是企业在价值链某些特定的战略环节上的优势。

运用价值链的分析方法来确定核心竞争力,就是要求企业密切关注组织的资源状态,要求企业特别关注和培养在价值链的关键环节上获得重要的核心竞争力,以形成和巩固企业在行业内的竞争优势。

企业的优势既可以来源于价值活动所涉及的市场范围的调整,也可来源于企业间协调或合用价值链所带来的最优化效益。

价值链列示了总价值、并且包括价值活动和利润。

价值活动是企业所从事的物质上和技术上的界限分明的各项活动,这些活动是企业创造对买方有价值的产品的基石。

利润是总价值与从事各种价值活动的总成本之差。

价值活动分为两大类:基本活动和支持性活动。

基本活动是涉及产品的物质创造及其销售、转移买方和售后服务的各种活动。

支持性活动是辅助基本活动,并通过提供采购投入、技术、人力资源以及各种公司范围的职能支持基本活动。

涉及任何产业内竞争的各种基本活动有五种类型进料后勤:与接收、存储和分配相关联的各种活动,如原材料搬运、仓储、库存控制、车辆调度和向供应商退货。

生产作业:与将投入转化为最终产品形式相关的各种活动,如机械加工、包装、组装、设备维护、检测等。

发货后勤:与集中、存储和将产品发送给买方有关的各种活动,如产成品库存管理、原材料搬运、送货车辆调度等。

迈克尔·波特价值链分析模型波特价值链分析模型波特价值链分析模型(Michael Porter's Value Chain Model)目录, 1 波特价值链分析模型简介, 2 涉及任何产业内竞争的各种基本活动有五种类型, 3 在任何产业内所涉及的各种支持性活动可以被分为四种基本类型, 4 价值链咨询模型, 5 战略地图与价值链比较[1], 6 波特行业市场结构分析模型, 7 基于价值链分析的莱钢核心竞争力研究[3], 8 相关条目, 9 参考文献波特价值链分析模型简介由美国哈佛商学院著名战略学家迈克尔?波特提出的"价值链分析法"(如下图),把企业内外价值增加的活动分为基本活动和支持性活动,基本活动涉及企业生产、销售、进料后勤、发货后勤、售后服务。

支持性活动涉及人事、财务、计划、研究与开发、采购等,基本活动和支持性活动构成了企业的价值链。

不同的企业参与的价值活动中,并不是每个环节都创造价值,实际上只有某些特定的价值活动才真正创造价值,这些真正创造价值的经营活动,就是价值链上的"战略环节"。

企业要保持的竞争优势,实际上就是企业在价值链某些特定的战略环节上的优势。

运用价值链的分析方法来确定核心竞争力,就是要求企业密切关注组织的资源状态,要求企业特别关注和培养在价值链的关键环节上获得重要的核心竞争力,以形成和巩固企业在行业内的竞争优势。

企业的优势既可以来源于价值活动所涉及的市场范围的调整,也可来源于企业间协调或合用价值链所带来的最优化效益。

价值链列示了总价值、并且包括价值活动和利润。

价值活动是企业所从事的物质上和技术上的界限分明的各项活动,这些活动是企业创造对买方有价值的产品的基石。

利润是总价值与从事各种价值活动的总成本之差。

价值活动分为两大类:基本活动和支持性活动。

基本活动是涉及产品的物质创造及其销售、转移买方和售后服务的各种活动。

支持性活动是辅助基本活动,并通过提供采购投入、技术、人力资源以及各种公司范围的职能支持基本活动。

大型商业风险英语English:Large-scale commercial risks encompass a wide range of potential threats that can adversely affect businesses across various industries. These risks can originate from both internal and external factors, including economic fluctuations, technological disruptions, regulatory changes, geopolitical instability, and natural disasters. Economic downturns, such as recessions or financial crises, can significantly impact consumer spending patterns, demand for products and services, and overall market conditions, leading to reduced revenues and profitability for businesses. Technological advancements, while offering opportunities for innovation and growth, also introduce risks such as cyberattacks, data breaches, and obsolescence of products or services. Regulatory changes, particularly in highly regulated industries such as finance, healthcare, and energy, can impose compliance burdens and operational constraints on businesses, increasing costs and affecting their competitive positions. Geopolitical instability, including trade disputes, political conflicts, and sanctions, can disrupt supply chains, hinder international trade, and create uncertainty for businessesoperating in global markets. Natural disasters, such as hurricanes, earthquakes, and pandemics, pose physical risks to assets, supply chains, and operations, potentially causing widespread damage and disruption. Mitigating these risks requires proactive risk management strategies, including comprehensive risk assessments, robust contingency planning, diversification of operations and supply chains, investment in resilience and adaptation measures, and effective communication with stakeholders.中文翻译:大型商业风险涵盖了一系列可能威胁到各行各业企业的潜在威胁。

沃尔玛的全面风险管理战略(英文版) Comprehensive Risk Management Strategy of Walmart Introduction:Risk management is an essential component of every successful business. It involves identifying potential risks, assessing their impact, and implementing strategies to mitigate them. As one of the largest retail corporations in the world, Walmart recognizes the importance of having a comprehensive risk management strategy in place. This article aims to outline Walmart's approach to risk management, highlighting its key principles and strategies.1. Risk Identification:The first step in Walmart's risk management strategy is to identify potential risks that could impact the company's operations. This involves conducting thorough risk assessments at various levels, including corporate, regional, and store levels. Walmart uses various techniques such as problem analysis, performance reviews, and trend analysis to identify areas of potential vulnerability. The company also closely monitors external factors such as market trends, regulatory changes, and geopolitical risks that could affect its business.2. Risk Assessment:Once the risks are identified, Walmart assesses their potential impact on the company's operations, financial performance, and reputation. This involves quantifying risks in terms of financial loss, operational disruption, and potential damage to the brand image. By conducting risk assessments, Walmart can prioritize risks and allocate resources effectively to mitigate them.3. Risk Mitigation Strategies:After assessing the risks, Walmart implements strategies to mitigate them and minimize their impact on the company. This includes developing and implementing robust internal controls, standard operating procedures, and policies to prevent and detect risks. Walmart also invests in state-of-the-art technology and infrastructure to ensure the security and efficiency of its operations. For example, the company uses advanced surveillance systems and cybersecurity measures to protect its stores and customer data from potential threats.Walmart also believes in fostering a culture of risk management throughout the organization. It educates and trains its employees on risk awareness and encourages them to report any potential risks or violations. This helps Walmart to proactively address risks and prevent potential issues before they escalate.4. Crisis Management:Despite careful planning and risk mitigation efforts, unexpected events can still occur. Walmart understands the importance of having a robust crisis management plan in place. The company has a dedicated crisis management team that is responsible for coordinating responses to various crises, such as natural disasters, product recalls, or public relations crises. Walmart's crisis management plan outlines clear procedures for communication, decision-making, and business continuity to ensure a swift and effective response to any crisis situation.5. Business Continuity Planning:Another critical aspect of Walmart's risk management strategy is business continuity planning. This involves developing strategies and procedures to ensure the continuous operation of key business functions in the event of a disruption. Walmart has comprehensive business continuity plans at both the corporate and individual store levels. These plans outline alternative operating procedures, backup systems, and recovery strategies to minimize downtime and mitigate the impact of any disruption.6. Continuous Improvement:Walmart recognizes that risk management is an ongoing process that requires continuous improvement and adaptation. The company regularly reviews and updates its risk management strategies to address emerging risks and changing business environments. It actively seeks feedback from employees, customers, and stakeholders to identify areas for improvement and implement necessary changes.Conclusion:Walmart's comprehensive risk management strategy demonstrates its commitment to ensuring the safety, security, and continuity of its operations. By adopting a proactive and holistic approach torisk management, Walmart can identify and mitigate potential risks, minimize their impact, and maintain its position as one of the world's leading retail corporations.Certainly! Here are some additional points to expand on Walmart's risk management strategy: 1. Supply Chain Risk Management:Walmart's risk management strategy includes a strong focus on supply chain management. The company recognizes thatdisruptions in its supply chain can have a significant impact on its operations and ability to serve customers. To mitigate supply chain risks, Walmart has implemented several strategies. Firstly, the company has diversified its supplier base to reduce dependency on a single supplier or region. This helps to minimize the impact of any potential disruptions, such as natural disasters or geopolitical issues. Secondly, Walmart closely collaborates with its suppliers to ensure they meet specific quality, safety, and compliance standards. The company also conducts regular audits and inspections to mitigate the risks associated with unethical practices or non-compliance.2. International Risk Management:As a global retail corporation, Walmart operates in various countries with different regulatory, political, and cultural environments. To manage the risks associated with international operations, Walmart has established a robust governance structure. The company has a dedicated international risk management team that monitors and assesses risks specific to each country. This allows Walmart to tailor its risk mitigation strategies to address the unique challenges and requirements of individual markets. Additionally, Walmart maintains strong relationships with local stakeholders, government agencies, and industry associations to proactively address any potential risks or issues that may arise.3. Data Privacy and Cybersecurity:The increasing reliance on technology and digital systems within the retail industry brings new risks such as data breaches and cyber-attacks. Walmart recognizes the importance of protecting customer and company data from potential threats. The companyhas invested heavily in cybersecurity measures, including firewalls, encryption, and constant monitoring of its systems. Walmart also regularly conducts vulnerability assessments and penetration tests to identify and address any potential weaknesses. In addition to technical safeguards, Walmart has implemented strict data privacy policies and procedures to ensure compliance with relevant regulations and protect customer privacy.4. Regulatory Compliance:Operating in a highly regulated industry, Walmart places a strong emphasis on compliance with applicable laws and regulations. The company has a dedicated legal and compliance team that monitors and ensures adherence to local, national, and international regulations. Walmart invests in training programs for its employees to ensure they are aware of and comply with relevant laws and regulations. The company also conducts regular internal audits to assess compliance and identify areas for improvement. Walmart's commitment to regulatory compliance helps to mitigate the risks associated with legal sanctions, reputational damage, and operational disruptions.5. Environmental Sustainability:Walmart recognizes the risks associated with climate change and environmental degradation and has integrated sustainable practices into its risk management strategy. The company has set ambitious goals to reduce greenhouse gas emissions, promote renewable energy, minimize waste, and conserve natural resources. By adopting sustainable business practices, Walmart reduces its exposure to potential regulatory, reputational, and operational risks. The company also works closely with its suppliers to promotesustainable sourcing and production practices throughout its supply chain.Conclusion:Walmart's comprehensive risk management strategy encompasses a wide range of areas, including risk identification, assessment, mitigation, crisis management, business continuity planning, and continuous improvement. Through its proactive and holistic approach, Walmart can effectively manage potential risks and ensure the safety, security, and continuity of its operations. By placing a strong emphasis on supply chain integrity, international risk management, data privacy, regulatory compliance, and environmental sustainability, Walmart demonstrates its commitment to long-term success and resilience in an ever-changing business landscape.。

什么是战略迈克尔•波特《哈佛商业评论》中文版2004年1月号一、运营效益并不是战略近20年来,各种游戏规则与管理理念层出不穷,令管理者应接不暇。

比如,企业必须保持一定的弹性,才能对瞬息万变的市场和竞争变化做出及时的反应;企业必须不断地进行基准比较,才能实现最佳实践的运作;企业必须各级发展外包,才能不断提高自己的效率;必须培养自己的核心竞争力,才能在竞争中始终一马当先。

与这些新兴的管理理念相比,面对当今风云变幻的市场和日新月异的科技,曾被视为战略核心的定位(positioning)被斥为过于一成不变而遭到遗弃。

根据新的管理信条,竞争对手可以迅速复制任何市场定位,因此,任何竞争优势充其量只能是暂时的。

但是,以上这些信条有可能带来危害,因为它们只说对了一半。

而且在这些信条的指引下,越来越多的企业正在走上相互残杀、竞相毁灭的竞争之路。

我们看到,随着管制的放松和市场的日益全球化,一些横亘在公司间、阻挡它们开展竞争的障碍正在消除。

我们同时也看到,很多公司投入了相当大的精力,力图使自己的组织变得更加精干、更加敏捷,以便应对随时可能出现的竞争。

然而在许多行业,有些人津津乐道的超级竞争(hypercompetition)却完全是一种自残行为,而不是竞争模式发生根本变化的必然结果。

追根溯源,问题出在人们混淆了运营效益(operational effectiveness)和战略(strategy)这两个最基本的概念。

为了追求生产率、质量和速度,企业开发出大量的管理工具和技巧,如全面质量管理、基准比较法、时基竞争(time-based competition)、外包、合作伙伴、流程再造(reengineering)以及变革管理等。

这些管理工具和技巧虽然使企业的运营效益得到了极大的提高,但是许多企业往往会因为无法将所得转化为持久赢利而感到万分沮丧。

不知不觉中,管理工具逐渐取代了战略。

于是,当管理者全线出击、力图全面改进企业运营时,他们其实是南辕北辙――离自己原本具有竞争优势的定位越来越远了。

What Is Strategy?ContentsOperationalEffectiveness:Necessary butNot SufficientII. StrategyRests onUniqueActivitiesIII. ASustainableStrategicPositionRequiresTrade-offsIV. Fit DrivesBothCompetitiveAdvantage andSustainabilityV.RediscoveringStrategyJapaneseCompaniesRarely HaveStrategiesFinding NewPositions: TheEntrepreneurialEdgeThe Connectionwith GenericStrategiesAlternativeI. Operational Effectivene ss Is Not Strategy For almost two decades, managers have been learning to play by a new set of rules. Companies must be flexible to respond rapidlyto competitive and market changes. They must benchmarkcontinuously to achieve best practice. They must outsourceaggressively to gain efficiencies. And they must nutture a few corecompetencies in the race to stay ahead of rivals.Positioning-once the heart of strategy-is rejected as too static fortoday's dynamic markets and changing technologies. According tothe new dogma, rivals can quickly copy any market position, andcompetitive advantage is, at best, temporary.But those beliefs are dangerous half-truths, and they are leadingmore and more companies down the path of mutually destructivecompetition. True, some barriers to competition are falling asregulation eases and markets become global. True, companieshave properly invested energy in becoming leaner and morenimble. In many industries, however, what some callhypercompetition is a self-inflicted wound, not the inevitableoutcome of a changing paradigm of competition.The root of the problem is the failure to distinguish betweenoperational effectiveness and strat egy. The quest for productivity,quality, and speed has spawned a remarkable number ofmanagement tools and techniques: total quality management,`benchmarking, time-based competition, outsourcing, partnering,reengineering, change management. Although the resultingoperational improvements have often been dramatic, manycompanies have been frustrated by their inability to translate those gains into sustainable profitability. And bit by bit, almost imperceptibly, management tools have taken the place of strategy. As managers push to improve on all fronts, they move farther away from viable competitive positions. Operational Effectiveness: Necessary but Not Sufficient Operational effectiveness and strategy are both essential to superior performance, which, after all, is the primary goal of any enterprise. But they work in very different ways.A company can outperform rivals only if it can establish a difference that it can preserve. It must deliver greater value to customers or create comparable value at a lower cost, or do both. The arithmetic of superior profitability then follows: delivering greater,value allows a company to charge higher average unit prices; greater efficiency results in lower average unit costs. Views of StrategyThe Origins Strategic P ositions Types of Fit Fit and Sustainability The Failure to Choose The Grow th Trap P rofitable Growth The Role of Leadership The Implicit Strategy Model of the P ast Decade Sustainable Competitive AdvantageUltimately, all differences between companies in cost or price derive from the hundreds of activities required to create, produce, sell, and deliver their products or services, such as calling on customers, assembling final products, and training employees. Cost is generated by performing activities, and cost advantage arises from performing particular activities more efficiently than competitors. Similarly, differentiation arises from both the choice of activities and how they are performed. Activities, then, are the basic units of competitive advantage. Overall advantage or disadvantage results from all a company's activities, not only a few.'Operational effectiveness fOE) means performing similar activities better than rivals perform them. Operational effectiveness includes but is not limited to efficiency. It refers to any number of practices that allow a company to better utilize its inputs by, for example, reducing defects in products or developing better products faster. In contrast, strategic positioning means performing different activities from rivals' or performing similar activities in different ways.GRAPH: Operational Effectiveness Versus Strategic PositioningDifferences in operational effectiveness among companies are pervasive. Some companies are able to get more out of their inputs than others because they eliminate wasted effort, employ more advanced technology, motivate employees better, or have greater insight into managing particular activities or sets of activities. Such differences in operational effectiveness are an important source of differences in profitability among competitors because they directly affect relative cost positions and levels of differentiation.Differences in operational effectiveness were at the heart of the Japanese challenge to Western companies in the 1980s. The Japanese were so far ahead of rivals in operational effectiveness that they could offer lower cost and superior quality at the same time. It is worth dwelling on this point, because so much recent thinking about competition depends on it. Imagine for a moment a productivity frontier that constitutes the sum of all existing best practices at any given time. Think of it as the maximum value that a company delivering a particular product or service can create at a given cost, using the best available technologies, skills, management techniques, and purchased inputs. The productivity frontier can apply to individual activities, to groups of linked activities such as order processing and manufacturing, and to an entire company's activities. When a company improves its operational effectiveness, it moves toward the frontier. Doing so may require capital investment, different personnel, or simply new ways of managing.The productivity frontier is constantly shifting outward as new technologies and management approaches are developed and as new inputs become available. Laptop computers, mobile communications, the Internet, and software such as Lotus Notes, for example, have redefined the productivity frontier for sales-force operations and created rich possibilities for linking sales with such activities as order processing and after-salessupport. Similarly, lean production, which involves a family of activities, has allowed substantial improvements in manufacturing productivity and asset utilization.For at least the past decade, managers have been preoccupied with improving operational effectiveness. Through programs such as TQM, time-based competition, and benchmarking, they have changed how they perform activities in order to eliminate inefficiencies, improve customer satisfaction, and achieve, best practice. Hoping to keep up with shifts in the productivity 'frontier, managers have embraced continuous improvement, empowerment, change management, and the so-called learning organization. The popularity of outsourcing and the virtual corporation reflect the growing recognition that it is difficult to perform all activities as productively as specialists.As companies move to the frontier, they can often improve on multiple dimensions of performance at the same time. For example, manufacturers that adopted the Japanese practice of rapid changeovers in the 1980s were able to lower cost and improve differentiation simultaneously. What were once believed to be real trade-offs- between defects and costs, for example- turned out to be illusions created by poor operational effectiveness. Managers have learned to reject such false trade-offs.Constant improvement in operational effectiveness is necessary to achieve superior profitability. However, it is not usually sufficient. Few companies have competed successfully on the basis of operational effectiveness over an extended period, and staying ahead of rivals gets harder every day. The most obvious reason for that is the rapid diffusion of best practices. Competitors can quickly imitate management techniques, new technologies, input improvements, and superior ways of meeting customers' needs. The most generic solutions- those that can be used in multiple settings- diffuse the fastest. Witness the proliferation of OE techniques accelerated by support from consultants.OE competition shifts the productivity frontier outward, effectively raising the bar for everyone. But although such competition produces absolute improvement in operational effectiveness, it leads to relative improvement for no one. Consider the $5 billion-plus U.S. commercial-printing industry. The major players- R.R. Donnelley & Sons Company, Quebecor, World Color Press, and Big Flower Press-are competing head to head, serving all types of customers, offering the same array of printing technologies (gravure and web offset), investing heavily in the same new equipment, running their presses faster, and reducing crew sizes. But the resulting major productivity gains are being captured by customers and equipment suppliers, not retained in superior profitability. Evenindustry-leader Donnelley's profit margin, consistently higher than 7% in the 1980s, fell to less than 4.6% in 1995. This pattern is playing itself out in industry after industry. Even the Japanese, pioneers of the new competition, suffer from persistently low profits. (See the insert "Japanese Companies Rarely Have Strategies.")The second reason that improved operational effectiveness is insufficient- competitiveconvergence- is more subtle and insidious. The more benchmarking companies do, the more they look alike. The more that rivals outsource activities to efficient third parties, often the same ones, the more generic those activities become. As rivals imitate one another's improvements in quality, cycle times, or supplier partnerships, strategies converge and competition becomes a series of races down identical paths that no one can win. Competition based on operational effectiveness alone is mutually destructive, leading to wars of attrition that can be arrested only by limiting competition.The recent wave of industry consolidation through mergers makes sense in the context of OE competition. Driven by performance pressures but lacking strategic vision, company after company has had no better idea than to buy up its rivals. The competitors left standing are often those that outlasted others, not companies with real advantage.After a decade of impressive gains in operational effectiveness, many companies are facing diminishing returns. Continuous improvement has been etched on managers' brains. But its tools unwittingly draw companies toward imitation and homogeneity. Gradually, managers have let operational effectiveness supplant strategy. The result is zerosum competition, static or declining prices, and pressures on costs that compromise companies' ability to invest in the business for the long term.II. Strategy Rests on Unique ActivitiesCompetitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value.Southwest Airlines Company, for example, offers short-haul, low-cost, point-to-point service between midsize cities and secondary airports in large cities. Southwest avoids large airports and does not fly great distances. Its customers include business travelers, families, and students. Southwest's frequent departures and low fares attract pricesensitive customers who otherwise would travel by bus or car, andconvenience-oriented travelers who would choose a full-service airline on other routes.Most managers describe strategic positioning in terms of their customers:"Southwest Airlines serves price- and convenience-sensitive travelers," for example. But the essence of strategy is in the activities-choosing to perform activities differently or to perform different activities than rivals. Otherwise, a strategy is nothing more than a marketing slogan that will not withstand competition.A full-service airline is configured to get passengers from almost any point A to any pointB. To reach a large number of destinations and serve passengers with connecting flights, full-service airlines employ a hub-and-spoke system centered on major airports. To attract passengers who desire more comfort, they offer first-class or businessclass service. To accommodate passengers who must change planes, they coordinate schedules and check and transfer baggage. Because some passengers will be traveling for many hours, full-service airlines serve meals.Southwest, in contrast, tailors all its activities to deliver low-cost, convenient service on its particular type of route. Through fast turnarounds at the gate of only 15 minutes, Southwest is able to keep planes flying longer hours than rivals and provide frequent departures with fewer aircraft. Southwest does not offer meals, assigned seats, interline baggage checking, or premium classes of service. Automated ticketing at the gate encourages customers to bypass travel agents, allowing Southwest to avoid their commissions. A standardized fleet of 737 aircraft boosts the efficiency of maintenance.Southwest has staked out a unique and valuable strategic position based on a tailored set of activities. On the routes served by Southwest, a full-service airline could never be as convenient or as low cost.Ikea, the global furniture retailer based in Sweden, also has a clear strategic positioning. Ikea targets young furniture buyers who want style at low cost. What turns this marketing concept into a strategic positioning is the tailored set of activities that make it work. Like Southwest, Ikea has chosen to perform activities differently from its rivals.Consider the typical furniture store. Showrooms display samples of the merchandise. One area might contain 25 sofas; another will display five dining tables. But those items represent only a fraction of the choices available to customers. Dozens of books displaying fabric swatches or wood samples or alternate styles offer customers thousands of product varieties to choose from. Salespeople often escort customers through the store, answering questions and helping them navigate this maze of choices. Once a customer makes a selection, the order is relayed to a third-party manufacturer. With luck, the furniture will be delivered to the customer's home within six to eight weeks. This is a value chain that maximizes customization and service but does' so at high cost.In contrast, Ikea serves customers who are happy to trade off service for cost. Instead of having a sales associate trail customers around the stor e, Ikea uses a self-service model based on clear, instore displays. Rather than rely solely on thirdparty manufacturers, Ikea designs its own low-cost, modular, ready-to-assemble furniture to fit its positioning. In huge stores, Ikea displays every product . it sells in room-like settings, so customers don't need a decorator to help them imagine how to put the pieces together. Adjacent to the furnished showrooms is a warehouse section with the products in boxes on pallets. Customers are expected to do their own pickup and delivery, and Ikea will even sell you a roof rack for your car that you can return for a refund on your next visit.DIAGRAM: Mapping Activity SystemsAlthough much of its low-cost position comes from having customers "do it themselves," Ikea offers a number of extra services that its competitors do not. In-store child care is one. Extended hours are another. Those services are uniquely aligned with the needs of its customers, who are young, not wealthy, likely to have children (but no nanny), and, because they work for a living, have a need to shop at odd hours.The Origins Strategic PositionsStrategic positions emerge from three distinct sources, which are not mutually exclusive and often overlap. First, positioning can be based on producing a subset of an industry's products or services. I call this variety-based positioning because it is based on the choice of product or service varieties rather than customer segments. Variety-based positioning makes economic sense when a company. can best produce particular products or services using distinctive sets of activities.Jiffy Lube International, for instance, specializes in automotive lubricants and does not offer other car repair or maintenance services. Its value chain produces faster servic e at a lower cost than broader line repair shops, a combination so attractive that many customers subdivide their purchases, buying oil changes from the focused competitor, Jiffy Lube, and going to rivals for other services.The Vanguard Group, a leader in the mutual fund industry, is another example ofvariety-based positioning. Vanguard provides an array of common stock, bond, and money market funds that offer predictable performance and rock-bottom expenses. The company's investment approach deliberately sacrifices the possibility of extraordinary performance in any one year for good relative performance in every year. Vanguard is known, for example, for its index funds. It avoids making bets on interest rates and steers clear of narrow stock groups. Fund managers keep trading levels low, which holds expenses down; in addition, the company discourages customers from rapid buying and selling because doing so drives up costs and can force a fund manager to trade in order to deploy new capital and raise cash for redemptions. Vanguard also takes a consistent low-cost approach to managing distribution, customer service, and marketing. Many investors include one or more Vanguard funds in their portfolio, while buying aggressively managed or specialized funds from competitors.The people who use Vanguard or Jiffy Lube are responding to a superior value chain for a particular type of service. A variety-based positioning can serve a wide array of customers, but for most it will meet only a subset of their needs.A second basis for positioning is that of serving most or all the needs of a particular group of customers. I call this needs-based positioning, which comes closer to traditional thinking about targeting a segment of customers. It arises when there are groups of customers with differing needs, and when a tailored set of activities can serve those needs best. Some groups of customers are more price sensitive than others, demand different product features, and need varying amounts of information, support, and services. Ikea's customers are a good example of such a group. Ikea seeks to meet all the home furnishing needs of its target customers, not just a subset of them.A variant of needs-based positioning arises when the same customer has different needs on different occasions or for different types of transactions. The same person, for example, may have different needs when traveling on business than when traveling forpleasure with the family. Buyers of cans-beverage companies, for example-will likely have different needs from their primary supplier than from their secondary source.It is intuitive for most managers to conceive of their business in terms of the customers' needs they are meeting.. But a critical element of needs-based positioning is not at all intuitive and is often overlooked. Differences in needs will not translate into meaningful positions unless the best set of activities to satisfy them also differs. If that were not the case, every competitor could meet those same needs, and there would be nothing unique or valuable about the positioning.In private banking, for example, Bessemer Trust Company targets families with a minimum of $5 million in investable assets who want capital preservation combined with wealth accumulation. By assigning one sophisticated account officer for every 14 families, Bessemer has configured its activities for personalized service. Meetings, for example, are more likely to be held at a client's ranch or yacht than in the office. Bessemer offers a wide array of customized services, including investment management and estate administration, .oversight of oil and gas investments, and accounting for racehorses and aircraft. Loans, a staple of most private banks, are rarely needed by Bessemer's clients and make up a tiny fraction of its client balances and income. Despite the most generous compensation of account officers and the highest personnel cost as a percentage of operating expenses, Bessemer's differentiation with its target families produces a return on equity estimated to be the highest of any private banking competitor.Citibank's private bank, on the other hand, serves clients with minimum assets of about $250,000 who, in contrast to Bessemer's clients, want convenient access to loans-from jumbo mortgages to deal financing. Citibank's account managers are primarily lenders. When clients need other services, their account manager refers them to other Citibank specialists, each of whom handles prepackaged products. Citibank's system is less customized than Bessemer's and allows it to have a lower manager-to-client ratio of1:125. Biannual office meetings are offered only for the largest clients. Both Bessemer and Citibank have tailored their activities to meet the needs of a different group of private banking customers. The same value chain cannot profitably meet the needs of both groups.The third basis for positioning is that of segmenting customers who are accessible in different ways. Although their needs are similar to those of other customers, the best configuration of activities to reach them is different. I call this access-based positioning. Access can be a function of cus, tomer geography or customer scale-or of anything that requires a different set of activities to reach customers in the best way.Segmenting by access is less common and less well understood than the other two bases. Carmike Cinemas, for example, operates movie theaters exclusively in cities and towns with populations un-der 200,000. How does Carmike make money in markets that are not only small but also won't support big-city ticket prices? It does so through a set ofactivities that result in a lean cost structure. Carmike,s small-town customers can be served through standardized, low-cost theater complexes requiring fewer screens and less sophisticated projection technology than big-city theaters. The company's proprietary information system and management process eliminate the need for local administrative staff beyond a single theater manager. Carmike also reaps advantages from centralized purchasing, lower rent and payroll costs (because of its locations), and rock-bottom corporate overhead of 2% (the industry average is 5%). Operating in small communities also allows Carmike to practice a highly personal form of marketing in which the theater manager knows patrons and promotes attendance through personal contacts. By being the dominant if not the only theater in its markets-the main competition is often the high school football team-Carmike is also able to get its pick of films and negotiate b etter terms with distributors.Rural versus urban-based customers are one example of access driving differences in activities. 'Serving small rather than large customers or densely rather than sparsely situated customers are other examples in which the best way to configure marketing, order processing, logistics, and after-sale service activities to meet the similar needs of distinct groups will often differ.Positioning is not only about carving out a niche. A position emerging from any of the sources can be broad.or narrow. A focused competitor, such as Ikea, targets the special needs of a subset of customers and designs its activities accordingly. Focused competitors thrive on groups of customers who are over-served (and hence overpriced) by more broadly targeted competitors, or underserved (and hence underpriced). A broadly targeted competitor,for example, Vanguard or Delta Air Lines- serves a wide array of customers, performing a set of activities designed to meet their common needs. It ignores or meets only partially the more idiosyncratic needs of particular customer groups.Whatever the basis- variety, needs, access, or some combination of the three- positioning requires a tailored set of activities because it is always a function of differences on the supply side; that is, of differences in activities. However, positioning is not always a function of differences on the demand, or customer, side. Variety and access positionings, in particular, do not rely on any customer differences. In practice, howeve r, variety or access differences often accompany needs differences. The tastes-that is, the needs-of Carmike's small-town customers, for instance, run more toward comedies, Westerns, action films, and family entertainment. Carmike does not run any films rated NC- 17.Having defined positioning, we can now begin to answer the question, "What is strategy?" Strategy is the creation of a unique and valuable position, involving a different set of activities. If there were only one ideal position, there would be no need for strategy. Companies would face a simple imperative-win the race to discover and preempt it. The essence of strategic positioning is to choose activities that are different from rivals'. If thesame set of activities were best to produce all varieties, meet all needs, and access all customers, companies could easily shift among them and operational effectiveness would determine performance.III. A Sustainable Strategic Position Requires Trade-offsChoosing a unique position, however, is not enough to guarantee a sustainable advantage. A valuable position will attract imitation by incum bents, who are likely to copy it in one of two ways.First, a competitor can reposition itself to.match the superior performer. J.C. Penney, for instance, has been repositioning itself from a Sears clone to a more upscale,fashion-oriented, soft-goods retailer. A second and far more common type of imitation is straddling. The straddler seeks to match the benefits of a successful position while maintaining its existing position. It grafts new features, services, or technologies onto the activities it already performs.For those who argue that competitors can copy any market position, the airline industry is a perfect test case. It would seem that nearly any competitor could imitate any other airline's activities. Any airline can buy the same planes, lease the gates, and match the menus and ticketing and baggage handling services offered by other airlines.Continental Airlines saw how well Southwest was doing and decided to straddle. While maintaining its position as a full-service airline, Continental also set out to match Southwest on a number of point-to-point routes. The airline dubbed the new service Continental Lite. It eliminated meals and first-class service, increased departure frequency, lowered fares, and shortened turnaround time at the gate. Because Continental remained a full-service airline on other routes, it continued to use travel agents and its mixed fleet of planes and to provide baggage checking and seat assignments.But a strategic position is not sustainable unless there are trade-offs with other positions. Trade-offs occur when activities are incompatible. Simply put, a trade-off means that more of one thing necessitates less of another. An airline can choose to serve meals- adding cost and slowing turnaround time at the gate-or it can choose not to, but it cannot do both without bearing major inefficiencies.Trade-offs create the need for choice and protect against repositioners and straddlers. Consider Neutrogena soap. Neutrogena Corporation's Variety-based positioning is built on a "kind to the skin," residue-free soap formulated for pH balance. With a large detail force calling on dermatologists, Neutrogena's marketing strategy looks more like a drug company's than a soap maker's. It advertises in medical journals, sends direct mail to doctors, attends medical conferences, and performs research at its own Skincare Institute. To reinforce its positioning, Neutrogena originally focused its distribution on drugstores and avoided price promotions. Neutrogena uses a slow, more expensive。

现代管理学大师中的大师——德鲁克1954年,德鲁克首次提出‚管理学‛概念被西方学界尊为‚大师中的大师‛!现代管理学之父德鲁克去世美国当地时间2005年11月11日上午,95岁高龄的现代管理学教父彼得〃德鲁克‚因自然原因‛在洛杉矶附近的家中辞世。

出生于1909年11月19日的德鲁克最终没能等来自己96岁的生日,却在人们不经意间撒手人寰。

永远的管理大师——德鲁克无论是第五项修炼的倡导者彼得.圣吉,市场营销之父菲利浦.科特勒,领导力大师约翰.科特,还是英特尔公司总裁安迪.格鲁夫,微软董事长比尔.盖茨,通用电气公司CEO杰克.韦尔奇……以上这些大家耳熟能详的人物,在管理思想和管理实践方面都受到了彼得.德鲁克的启发和影响。

德鲁克先生被称为大师中的大师,不仅因为他是现代管理学的奠基人,目标管理的创建者,他在市场、创新、变革、战略、知识管理、21世纪管理者的挑战等方面的真知灼见,也让诸多管理大师和成功企业家从中受益。

德鲁克在企业界的影响‚只要一提到彼得〃德鲁克的名字,在企业的丛林中就会有无数双耳朵竖起来听。

‛——《哈佛商业评论》深受德鲁克影响的企业领袖在所有的管理学书籍中,德鲁克的著作对我影响最深。

——微软总裁比尔〃盖茨德鲁克是我心目中的英雄。

他的著作和思想非常清晰,在那些对时髦思想狂热的人群中独树一臶。

——英特尔主席安德鲁〃格鲁夫彼得〃德鲁克生平(1)1909年11月19日生于维也纳,父亲为奥国财务官员,曾创办萨尔茨堡音乐节,母亲是奥国率先读医科的妇女之一。

1938年父母因反对纳粹,逃往美国,父亲任大学教授,1967年逝世。

1931年德鲁克获法兰克福法学博士。

1942年受聘为通用汽车公司顾问。

1946年出版《公司的概念》,对成功的大企业有细腻而独到的分析。

1954年出版《管理实践》,奠定大师的地位,并标志着管理学的诞生。

彼得〃德鲁克生平(2)1966年出版《卓有成效的管理者》成为经典之作。

1973年出版《管理:任务、责任、实践》巨著,该书被誉为‚管理学‛的‚圣经‛。

波特价值链分析模型波特价值链分析模型(Michael Porter's Value Chain Model)[编辑]波特价值链分析模型简介由美国哈佛商学院著名战略学家迈克尔·波特提出的"价值链分析法"(如下图),把企业内外价值增加的活动分为基本活动和支持性活动,基本活动涉及企业生产、销售、进料后勤、发货后勤、售后服务。

支持性活动涉及人事、财务、计划、研究与开发、采购等,基本活动和支持性活动构成了企业的价值链。

不同的企业参与的价值活动中,并不是每个环节都创造价值,实际上只有某些特定的价值活动才真正创造价值,这些真正创造价值的经营活动,就是价值链上的"战略环节"。

企业要保持的竞争优势,实际上就是企业在价值链某些特定的战略环节上的优势。

运用价值链的分析方法来确定核心竞争力,就是要求企业密切关注组织的资源状态,要求企业特别关注和培养在价值链的关键环节上获得重要的核心竞争力,以形成和巩固企业在行业内的竞争优势。

企业的优势既可以来源于价值活动所涉及的市场范围的调整,也可来源于企业间协调或合用价值链所带来的最优化效益。

咨询工具安索夫矩阵案例面试分析工具/框架ADL矩阵安迪·格鲁夫的六力分析模型波士顿矩阵标杆分析法波特五力分析模型波特价值链分析模型波士顿经验曲线波特钻石理论模型贝恩利润池分析工具波特竞争战略轮盘模型波特行业竞争结构分析模型波特的行业组织模型价值链列示了总价值、并且包括价值活动和利润。

价值活动是企业所从事的物质上和技术上的界限分明的各项活动,这些活动是企业创造对买方有价值的产品的基石。

利润是总价值与从事各种价值活动的总成本之差。

价值活动分为两大类:基本活动和支持性活动。

基本活动是涉及产品的物质创造及其销售、转移买方和售后服务的各种活动。

支持性活动是辅助基本活动,并通过提供采购投入、技术、人力资源以及各种公司范围的职能支持基本活动。

解读平衡计分卡和战略地图江苏广播电视大学武进学院江苏城市职业学院武进校区张蓉[摘要]企业的战略管理无法直接创造有形成果,平衡计分卡和战略地图作为战略管理工具之一,做出了突破性贡献,使战略管理可以衡量、可以描绘。

本文将平衡计分卡和战略地图结合在一起,包括了四点内容:1、介绍平衡计分卡和战略地图;2、平衡计分卡和战略地图的发展历程;3、平衡计分卡和战略地图的共同点;4、平衡计分卡和战略地图的不同点。

[关键词]平衡计分卡战略地图“如果你不能衡量,那么你就不能管理;如果你不能描述,那么你就不能衡量。

”[1]平衡计分卡(Balanced Scorecard)和战略地图(strategy m ap)是罗伯特·卡普兰与大卫·诺顿为战略管理提供的有力工具,平衡计分卡关注战略衡量,战略地图关注战略描述。

罗伯特·卡普兰教授与大卫·诺顿博士提出平衡计分卡这个管理工具,这套管理工具将战略提到了管理流程的中心地位,促进各类组织迅速有效地执行战略,被《哈佛商业评论》评为过去75年来最重要的管理工具之一。

战略地图就是平衡计分卡的延展工具,它可以让员工清楚地看到他们的工作与组织的总体目标有何联系,并能使他们在工作中协调合作,朝着公司既定目标前进。

本文包括四点内容:1、介绍平衡计分卡和战略地图;2、平衡计分卡和战略地图的发展历程;3、平衡计分卡和战略地图的共同点;4、平衡计分卡和战略地图的不同点。

一、介绍平衡计分卡和战略地图1992年,罗伯特·卡普兰教授与大卫·诺顿博士提出平衡计分卡这个管理工具,受到了企业界的热烈追捧,很多企业将这一理论运用于企业管理的实践。

为了了解实践结果,两位大师用四年的时间跟踪了这些公司的业绩,研究发现,那些实施平衡计分卡成功的公司,都拥有着共同的特质,即保持所有的组织资源协调一致,聚精会神地专注于实施公司的战略。

根据这些研究结果,两位大师在2000年出版了《战略中心型组织》,以更好地指导企业实践。

Discounts Can Be Dangerous打折很危险by Jeffrey M. Stibel and Peter DelgrossoDuring tough economic times, companies often rush to reduce prices on their products and services. That seems like common sense: People can’t afford to spend as much, so charge less to keep them buying. But discounting has its perils.每当步入经济困难期,许多公司都会争先恐后地降低产品及服务的价格。

这似乎也合乎常理:既然消费者花不起那么多钱,那就降价促销。

殊不知,打折蕴藏着诸多风险。

To be sure, discounting is effective when done wisely and strategically. It can get consumers excited about a product, encourage them to buy more, and help your short-term bottom line. However, whether the purchase is a hot dog, a handbag, or a stay at a five-star hotel, customers want good value for their hard-earned money. The price of something is often an important determinant of its perceived value, as Dan Ariely points out in Predictably Irrational. Often, the more consumers pay, the more value they ascribe to a purchase. If you discount prices purely to boost sales, buyers may begin to question that value.毋庸置疑,如果能站在战略的高度,以高明的手段打折,那肯定有效果。