智慧树知到《金融风险管理》章节测试答案ck(优质参考)

- 格式:doc

- 大小:64.00 KB

- 文档页数:18

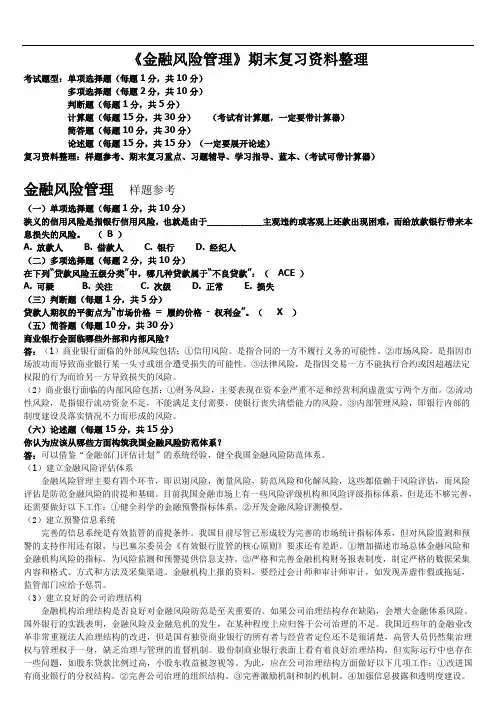

《金融风险管理》期末复习资料整理考试题型:单项选择题(每题1分,共10分)多项选择题(每题2分,共10分)判断题(每题1分,共5分)计算题(每题15分,共30分)(考试有计算题,一定要带计算器)简答题(每题10分,共30分)论述题(每题15分,共15分)(一定要展开论述)复习资料整理:样题参考、期末复习重点、习题辅导、学习指导、蓝本、(考试可带计算器)金融风险管理样题参考(一)单项选择题(每题1分,共10分)狭义的信用风险是指银行信用风险,也就是由于__________主观违约或客观上还款出现困难,而给放款银行带来本息损失的风险。

( B )A. 放款人B. 借款人C. 银行D. 经纪人(二)多项选择题(每题2分,共10分)在下列“贷款风险五级分类”中,哪几种贷款属于“不良贷款”:(ACE )A. 可疑B. 关注C. 次级D. 正常E. 损失(三)判断题(每题1分,共5分)贷款人期权的平衡点为“市场价格= 履约价格- 权利金”。

(X )(五)简答题(每题10分,共30分)商业银行会面临哪些外部和内部风险?答:(1)商业银行面临的外部风险包括:①信用风险。

是指合同的一方不履行义务的可能性。

②市场风险。

是指因市场波动而导致商业银行某一头寸或组合遭受损失的可能性。

③法律风险,是指因交易一方不能执行合约或因超越法定权限的行为而给另一方导致损失的风险。

(2)商业银行面临的内部风险包括:①财务风险,主要表现在资本金严重不足和经营利润虚盈实亏两个方面。

②流动性风险,是指银行流动资金不足,不能满足支付需要,使银行丧失清偿能力的风险。

③内部管理风险,即银行内部的制度建设及落实情况不力而形成的风险。

(六)论述题(每题15分,共15分)你认为应该从哪些方面构筑我国金融风险防范体系?答:可以借鉴“金融部门评估计划”的系统经验,健全我国金融风险防范体系。

(1)建立金融风险评估体系金融风险管理主要有四个环节,即识别风险,衡量风险,防范风险和化解风险,这些都依赖于风险评估,而风险评估是防范金融风险的前提和基础。

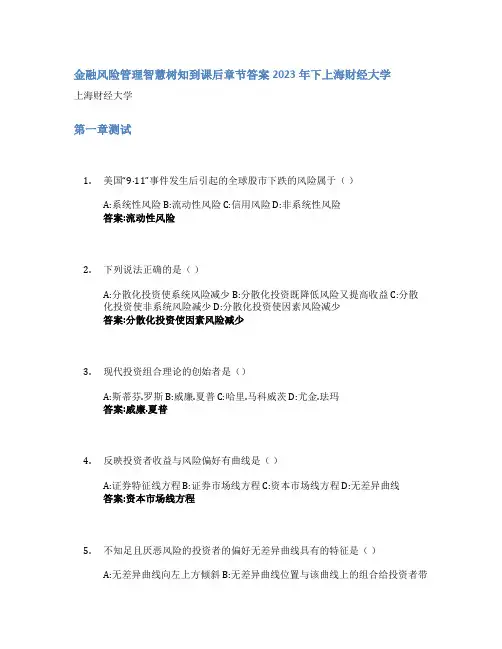

金融风险管理智慧树知到课后章节答案2023年下上海财经大学上海财经大学第一章测试1.美国“9·11”事件发生后引起的全球股市下跌的风险属于()A:系统性风险 B:流动性风险 C:信用风险 D:非系统性风险答案:流动性风险2.下列说法正确的是()A:分散化投资使系统风险减少 B:分散化投资既降低风险又提高收益 C:分散化投资使非系统风险减少 D:分散化投资使因素风险减少答案:分散化投资使因素风险减少3.现代投资组合理论的创始者是()A:斯蒂芬.罗斯 B:威廉.夏普 C:哈里.马科威茨 D:尤金.珐玛答案:威廉.夏普4.反映投资者收益与风险偏好有曲线是()A:证券特征线方程 B:证券市场线方程 C:资本市场线方程 D:无差异曲线答案:资本市场线方程5.不知足且厌恶风险的投资者的偏好无差异曲线具有的特征是()A:无差异曲线向左上方倾斜 B:无差异曲线位置与该曲线上的组合给投资者带来的满意程度无关 C:收益增加的速度快于风险增加的速度 D:无差异曲线之间可能相交答案:收益增加的速度快于风险增加的速度6.反映证券组合期望收益水平和单个因素风险水平之间均衡关系的模型是()A:特征线模型 B:资本市场线模型 C:单因素模型 D:套利定价模型答案:套利定价模型7.根据CAPM,一个充分分散化的资产组合的收益率和哪个因素相关A:再投资风险 B:非系统风险 C:个别风险 D:市场风险答案:个别风险8.在资本资产定价模型中,风险的测度是通过()进行的。

A:贝塔系数 B:收益的方差 C:个别风险 D:收益的标准差答案:收益的方差9.市场组合的贝塔系数为()。

A:-1 B:0 C:1 D:0.5答案:-110.无风险收益率和市场期望收益率分别是0.06和0.12。

根据CAPM模型,贝塔值为1.2的证券X的期望收益率为()。

A:0.144 B:0.06 C:0.132 D:0.12美元答案:0.13211.对于市场投资组合,下列哪种说法不正确()A:它是资本市场线和无差异曲线的切点 B:它在有效边界上 C:市场投资组合中所有证券所占比重与它们的市值成正比 D:它包括所有证券答案:它在有效边界上12.关于资本市场线,哪种说法不正确()A:资本市场线也叫证券市场线B:资本市场线是可达到的最好的市场配置线 C:资本市场线斜率总为正 D:资本市场线通过无风险利率和市场资产组合两个点答案:资本市场线是可达到的最好的市场配置线13.证券市场线是()。

金融学(西安财经大学行知学院)知到章节测试答案智慧树2023年最新第一章测试1.所谓价值形式,是指一种商品的价值通过另外一种商品的价值表现出来。

参考答案:对2.称量货币在使用时以货币的数量为单位计价。

参考答案:错3.货币之所以发展为不兑现的信用货币,原因在于货币的流通手段这一职能。

参考答案:对4.货币制度中的准备制度主要目的在于稳定货币。

参考答案:对5.金属货币制度时期,货币单位这一货币制度构成要素,主要包括规定货币单位名称和()。

参考答案:单位货币价值6.金融工具的风险主要包括()和市场风险。

参考答案:违约风险7.信用的发生包括两个经济行为,分别是()和()。

参考答案:买卖行为;借贷行为8.牙买加体系下,主要发达国家实行浮动汇率,多数发展中国家实行()。

参考答案:盯住汇率9.布雷顿森林体系的的双挂钩机制是指黄金和美元保持固定比价,其他国家货币和()保持固定比价。

参考答案:美元10.人民币的发行保证包括()。

参考答案:黄金;政府债券;商业票据;外汇;商品物资第二章测试1.商业银行能够把资金从盈余者手中转移到短缺者手中,使得闲置资金得到充分运用,这种功能被称为()功能。

参考答案:信用中介2.以下属于银行被动负债的是()。

参考答案:客户存款3.在我国银行的贷款五级分类办法中,借款人偿还贷款本息没有问题,但潜在的问题若发展下去将会影响偿还的一类贷款称为()。

参考答案:关注贷款4.票据贴现属于商业银行的()业务。

参考答案:资产业务5.我国的商业银行可以投资于股市。

参考答案:错6.中间业务是指不构成商业银行表内资产、表内负债,形成银行非利息收入的业务。

参考答案:对7.法定存款准备金不构成商业银行的现金资产。

参考答案:错8.《巴塞尔协议II》的三大支柱包括()。

参考答案:市场纪律;最低资本要求;监管当局的监督检查9.根据还款保证的不同,担保贷款可以分为()。

参考答案:质押贷款;抵押贷款 ;保证贷款10.下列属于商业银行资产业务的是()。

风险管理与保险智慧树知到课后章节答案2023年下上海财经大学上海财经大学第一章测试1.风险的基本含义是损失的不确定性。

答案:对2.风险的不确定性是指有关风险发生的一切都是不确定的答案:对3.偶然性是指损失的发生时间和损失程度具有偶然性。

答案:对4.客观性是指风险的发生必然造成一定的经济损失或产生特殊的经济要求。

答案:错5.无形风险因素是指看得见摸得着的因素。

答案:错6.道德风险因素是指由于人们主观上的疏忽或过失,导致了引起或增加风险事故的发生机会、或扩大损失程度的那些非故意因素。

答案:错7.将风险分为自然风险、社会风险、经济风险和政治风险,这是根据下列哪项进行的分类?答案:根源或原因8.汽车刹车失灵会引起意外事故,这属于(D)。

A. B.C.D.答案:实质性风险因素9.风险即是指损失的不确定性。

其包括下列哪些的不确定呢?答案:损害对象;发生时间;发生状况;发生10.风险具有下列哪些特点?答案:偶然性;客观性;损失性第二章测试1.风险管理指通过对风险的识别、衡量和分析,选择经济合理的方法,通过降低风险的损失概率或损失程度,从根本上杜绝风险发生的科学和方法答案:错2.在风险管理中,没有最好的方法,只有较好的方法。

答案:对3.风险管理所管理的风险要比保险的范围更为广泛,其处理风险的手段也比保险多。

保险不是处置风险的唯一方法,更不是所有风险都可以保险。

保险只是风险管理的一种手段。

答案:对4.保险是风险管理的基础,风险管理又是保险经济效益的源泉。

答案:对5.风险管理的目标是以()成本获得()安全保障,或者以()成本将风险控制到()水平。

答案:最小、最大、最小、最小6.风险管理的步骤包括①风险评估,②风险识别,③风险管理方法的选择,④风险管理效果的评价与调整。

请为这些步骤进行排序。

答案:②①③④7.风险管理时面临的关键约束包括下列哪些项?答案:最小成本;最大安全保障8.风险管理的目标可以细化为下列哪些?答案:事中抑制;事后补救;.事前防范9.风险管理的方法包括下列哪些项?答案:回避风险 ;转移风险;损失管理;保留风险10.风险评估时主要是对下列哪些方面进行评估?答案:损失程度;损失概率第三章测试1.保险的合同性是指“一人为众,众为一人”。

《金融风险管理》期末复习资料整理考试题型:单项选择题(每题1分,共10分)多项选择题(每题2分,共10分)判断题(每题1分,共5分)计算题(每题15分,共30分)(考试有计算题,一定要带计算器)简答题(每题10分,共30分)论述题(每题15分,共15分)(一定要展开论述)复习资料整理:样题参考、期末复习重点、习题辅导、学习指导、蓝本、(考试可带计算器)金融风险管理样题参考(一)单项选择题(每题1分,共10分)狭义的信用风险是指银行信用风险,也就是由于__________主观违约或客观上还款出现困难,而给放款银行带来本息损失的风险。

( B )A. 放款人B. 借款人C. 银行D. 经纪人(二)多项选择题(每题2分,共10分)在下列“贷款风险五级分类”中,哪几种贷款属于“不良贷款”:(ACE )A. 可疑B. 关注C. 次级D. 正常E. 损失(三)判断题(每题1分,共5分)贷款人期权的平衡点为“市场价格= 履约价格- 权利金”。

(X )(五)简答题(每题10分,共30分)商业银行会面临哪些外部和内部风险?答:(1)商业银行面临的外部风险包括:①信用风险。

是指合同的一方不履行义务的可能性。

②市场风险。

是指因市场波动而导致商业银行某一头寸或组合遭受损失的可能性。

③法律风险,是指因交易一方不能执行合约或因超越法定权限的行为而给另一方导致损失的风险。

(2)商业银行面临的内部风险包括:①财务风险,主要表现在资本金严重不足和经营利润虚盈实亏两个方面。

②流动性风险,是指银行流动资金不足,不能满足支付需要,使银行丧失清偿能力的风险。

③内部管理风险,即银行内部的制度建设及落实情况不力而形成的风险。

(六)论述题(每题15分,共15分)你认为应该从哪些方面构筑我国金融风险防范体系?答:可以借鉴“金融部门评估计划”的系统经验,健全我国金融风险防范体系。

(1)建立金融风险评估体系金融风险管理主要有四个环节,即识别风险,衡量风险,防范风险和化解风险,这些都依赖于风险评估,而风险评估是防范金融风险的前提和基础。

目录第一章测试第二章测试第三章测试第四章测试第五章测试第六章测试第七章测试第八章测试第九章测试第一章测试1【单选题】 (2分)Which formula describe the Capital Asset Pricing Model?()A.B.C.2【多选题】 (2分)Which of the following descriptions are the assumption for Capital Asset Pricing Model?()A.All investors make the same estimates of .B.The 's of different investments are independent.C.Investors care only about expected return and standard deviation of return.D.Tax does not influence investment decisions.E.Investors focus on returns over one period.F.All investors can borrow or lend at the same risk-free rate.3【单选题】 (2分)The return from the market last year was 10% and the risk-free rate was 5%. A hedge fund manager with a beta of 0.6 has an alpha of 4%. What return did t he hedge fund manager earn?()A.0.10B.0.15C.0.124【单选题】 (2分)Suppose the S&P 500 Index has an expected annual return of 7.2% and volatilit y of 8.2%. Suppose Andromeda Fund has an expected annual return of 6.8% a nd volatility of 7.0% and is benchmarked against the S&P 500 Index. According to the CAPM, if the risk-free rate is 2.2% per year, what is the beta of the And romeda Fund?()A.0.20B.0.92C.1.23D.0.905【判断题】 (2分)If a bond issued by a company have a rating of AAA, the company generally c an not be referred to as having a rating of AA.()A.对B.错第二章测试1【单选题】 (2分)Which of the following table reflects the change of structure of banking in the U nited States between 1984 and 2017?()A.B.C.2【单选题】 (2分)________ measures the return to stockholders on their investment in the bank. I t is the product of net profit margin, asset utilization and the equity multiplier.()A.Net profit marginB.ROEC.ROA3【判断题】 (2分)Loan losses on the income statement of DLC Bank is associated with operation al risk.()A.错B.对4【判断题】 (2分)Net interest income on the income statement of DLC Bank is associated with m arket risk.()A.对B.错5【判断题】 (2分)Non-interest expense on the income statement of DLC Bank is associated with c redit risk.()A.错B.对第三章测试1【多选题】 (2分)Select one or more correct statements about the performance of hedge fund:()A.The Barclays Hedge Fund Index shows that hedge funds outperformed the market in 2008, but n ot between 2009 and 2016B.Many hedge fund strategies have low betas and therefore cannot be expected to outperform the market when it is doing wellC.The statistics may bias average hedge fund performance upward because only hedge funds that choose to report their returns are included in the statistics and these tend to be the hedge funds that are doing well2【单选题】 (2分)A fund of funds divides its money between five hedge funds that earn –5%, 1%, 10%, 15%, and 20% before fees in a particular year. The fund of funds charge s 1 plus 10% and the hedge funds charge 2 plus 20%. The hed ge funds’ incent ive fees are calculated on the return after management fees. The fund of funds incentive fee is calculated on the net (after management fees and incentive fees) average return of the hedge funds in which it invests and after its own manag ement fee has been subtracted. What is the overall return on the investments?()A.10.2%B.5.4%C.8.2%3【判断题】 (2分)Long/short funds tend to invest primarily in publicly traded equity and their deriv atives, and tend to be short biased.()A.错B.对4【判断题】 (2分)Global macro strategy involves both directional analysis, which seeks to predict t he rise or decline of a country’s economy, as well as relative analysis, evaluatin g economic trends relative to each other.()A.错B.对5【判断题】 (2分)Global macro funds are not confined to any specific investment vehicle or asset class, and can include investment in equity, debt, commodities, futures, currencie s, real estate and other assets in various countries.()A.错B.对第四章测试1【判断题】 (2分)When a trader enters into a short forward contract when the forward price is $5 0, the trader is obligated to buy the asset for $50. (The trader does not have a choice).()A.对B.错2【单选题】 (2分)An investor enters into a short forward contract to sell 100,000 British pounds fo r U.S. dollars at an exchange rate of 1.3000 U.S. dollars per pound. How much does the investor gain or lose if the exchange rate at the end of the contract i s 1.3900?()A.$9,000B.-$9,000C.-$1,0003【单选题】 (2分)A French bank enters into a 6-month forward contract with an importer to sell G BP 60 million in 6 months at a rate of EUR 1.15 per GBP 1. If in 6 months th e exchange rate is EUR 1.13 per GBP 1, what is the payoff for the bank from the forward contract?()A.EUR -1,200,000B.EUR 1,200,000C.EUR -2,000,0004【判断题】 (2分)When a trader intends to short selling, his broker would borrow the securities fr om another client and sell them in the market in the usual way.()A.错B.对5【判断题】 (2分)When a trader shorts selling a stock, he must pay dividend and other benefits t he owner of the securities receives.()A.对B.错第五章测试1【单选题】 (2分)A/An ______ is an ABS created from particular tranches (e.g., the BBB-rated tra nches) of a number of different ABSs.()A.ABS CDOB.ABSC.CDO2【判断题】 (2分)An ABS is a set of tranches created from a portfolio of loans, bonds, credit car d receivables, and so on.()A.对B.错3【单选题】 (2分)Suppose the ABSs and ABS CDO structure is just like the following table. If the loss rate on the mortgages is 12%, what is the loss rate on the mezzanine tra nche of the ABS CDO?()A.100%B.0%C.20%4【判断题】 (2分)The risks in ABS CDOs were usually misjudged by the market. Because investor s overestimated how high the default correlations between mortgages would be i n stressed market conditions.()A.对B.错5【判断题】 (2分)The risks in ABS CDOs were usually misjudged by the market. Because investor s also did not always realize that the tranches underlying ABS CDOs were usua lly quite thin so that they were either totally wiped out or untouched.()A.对B.错第六章测试1【单选题】 (2分)Suppose the delta of a call option is 0.7. How can a short position in 1,000 opt ions be made delta neutral?()A.Purchase 700 shares.B.Short 700 shares.C.Purchase 1,000 shares.2【单选题】 (2分)The graph shows the relationship between one of the Greeks of a long position of an European call option and the stock price. Can you guess which of the foll owing Greeks is for the y-axis?()A.deltaB.vegaC.gamma3【单选题】 (2分)The gamma of a delta-neutral portfolio is 30. Estimate what happens to the valu e of the portfolio when the price of the underlying asset suddenly decreases by $2.()A.The value of the portfolio increases by $60.B.The value of the portfolio increases by $120.C.The value of the portfolio decreases by $60.4【单选题】 (2分)A portfolio of stock A and options on stock A is currently delta neutral, but has a positive gamma. Which of the following actions will make the portfolio with bot h delta and gamma neutral?()A.Buy put options on stock A and buy stock AB.Buy call options on stock A and sell stock AC.Sell put options on stock A and sell stock AD.Sell call options on stock A and sell stock A5【单选题】 (2分)Which of the following statements is true regarding options' Greeks?()A.Delta of deep in-the-money put options tends towards +1.B.Theta tends to be large and positive for at-the-money options.C.Vega is greatest for at-the-money options with long times remaining to expiration.D.Gamma is greatest for in-the-money options with long times remaining to expiration.第七章测试1【单选题】 (2分)A five-year bond with a yield of 11% (continuously compounded)pays an 8% c oupon at the end of each year. What is the bond's duration?()A.3.982B.4.256C.4.5362【单选题】 (2分)A trading portfolio consists of two bonds, A1and B1. Both have modified duratio n of 3 years and face value of $1,000. Bond A1 is a zero-coupon bond, and its current price is $900. Bond B1pays annual coupons and is priced at par. What is expected to happen to the market prices of bond A1and bond B1, in dollar t erms, if there is a parallel upward shift in the yield curve of 1%?()A.Both bond prices will move up, but bond B1 will gain more than bond A1.B.Both bond prices will move down, but bond B1 will lose more than bond A1.C.Both bond prices will move down by roughly equal amounts.3【判断题】 (2分)Duration is a measure of how long the bond holder has to wait for cash flows.()A.错B.对4【单选题】 (2分)The table gives the closing prices and yields of a particular liquid bond over the past few days. What is the approximate duration of the bond?()A.18.8B.1.9C.9.45【判断题】 (2分)Modified duration is used when the yield y is expressed with compounding m ti mes per year.()A.对B.错第八章测试1【单选题】 (2分)The volatility of an asset is 2% per day. What is the standard deviation of the percentage price change in five days?()A.2.52%B.4.47%C.3.46%2【单选题】 (2分)The parameters of a GARCH(1,1) model are estimated as ω=0.000004, α=0.05, and β=0.92. What is the long-run average volatility?()A.0.00133%B.1.155%C.1.562%3【单选题】 (2分)Suppose that the price of an asset at close of trading yesterday was $300 and its volatility was estimated as 1.3% per day. The price at the close of trading to day is $298. What is the new daily volatility using the GARCH(1,1) model with ω=0.000002, α=0.04, and β=0.94?()A.1.165%B.1.275%C.1.271%4【判断题】 (2分)A variance estimate from the GARCH(1,1) model is always between the prior da y's estimated variance and the prior day's squared return.()A.对B.错5【判断题】 (2分)GARCH(1,1) is consistent with a mean-reverting variance rate model.()A.对B.错第九章测试1【单选题】 (2分)A fund manager announces that the fund's one-month 95% VaR is 6% of the si ze of the portfolio being managed. You have an investment of $100,000 in the f und. Which of the following options interpret the portfolio manager's announceme nt best?()A.There is a 5% chance that you are expected to lose $6,000 during a one-month period.B.There is a 5% chance that you will lose $6,000 at most during a one-month period.C.There is a 5% chance that you will lose $6,000 or more during a one-month period.2【单选题】 (2分)Suppose that each of two investments has a 0.9% chance of a loss of $10 milli on and a 99.1% chance of a loss of $1 million. The investments are independe nt of each other. What is the VaR for one of the investments when the confide nce level is 99%?()A.$1 millionB.$10 millionC.$9.1 million3【单选题】 (2分)Suppose that each of two investments has a 4% chance of a loss of $10 millio n, a 2% chance of a loss of $1 million, and a 94% chance of a profit of $1 mil lion. They are independent of each other. What is the VaR for one of the invest ments when the confidence level is 95%?()A.$8.2 millionB.$10 millionC.$1 million4【单选题】 (2分)If the daily, 90% confidence level, VaR of a portfolio is correctly estimated to be $5,000, one would expect that in one out of:()A.10 days, the portfolio value will decline by $5,000 or lessB.10 days, the portfolio value will decline by $5,000 or moreC.90 days, the portfolio value will decline by $5,000 or less5【单选题】 (2分)The losses for the four-index example is the right table. What is the 95% one-d ay VaR (500 scenario)?()A.$142.535B.$156.511C.$166.517。

东北财经大学智慧树知到“金融学”《基金管理》网课测试题答案(图片大小可自由调整)第1卷一.综合考核(共15题)1.市场风险主要包括()。

A.利率风险B.汇率风险C.政策风险D.购买力风险2.()是指内部控制制度应当符合国家法律法规及监管机构的监管要求,并贯穿于托管业务经营管理活动的始终。

A.合法性原则B.完整性原则C.有效性原则D.审慎性原则3.基金注册登记机构是指负责基金()业务的机构。

A、登记B、存管C、清算D、交收4.()是使投资组合中债券的到期期限集中于收益率曲线的一点。

A.子弹式策略B.两极策略C.梯式策略D.以上都不对5.基金在金融体系中的作用,下列选项中正确的有()。

A.为中小投资者拓宽投资渠道B.优化金融结构,促进经济增长C.有利于市场有效性的提高和资源的合理配置D.有利于市场合理定价6.当代表基金份额()以上的基金份额持有人就同一事项要求召开持有人大会,而管理人和托管人都不召集的时候,代表基金份额()以上的持有人有权自行召集。

A、5%、5%B、5%、10%C、10%、10%D、10%、5%7.()是决定公司内部控制运行方式和方向的关键,也是认识内部控制基本理论的出发点。

A.内部控制目标B.内部控制内容C.内部控制对象D.内部控制细则8.AIFMD要求私募股权投资基金管理机构初始资本金不应少于()万欧元。

A.20B.15C.12.5D.109.全球第一个电子交易市场是()。

A.伦敦证券交易所B.纳斯达克证券交易中心C.纽约证券交易所D.香港交易所10.QDII基金的投资范围有()等。

A.银行存款B.可转让存单C.远期合约D.互换11.营销过程的管理包括()。

A.市场营销分析B.市场营销计划C.市场营销实施D.市场营销控制12.开放式基金的赎回费在扣除手续费后,余额不能低于赎回费总额的()%,并归基金财产。

A、10B、25C、30D、5513.总风险由系统性风险和非系统性风险构成。

第一章测试1.关于商品货币和电子货币的异同,下列说法错误的是()。

A:商品货币不需要当局背书;电子货币是当局背书B:商品货币价值来源于内在价值;电子货币价值来源于信用背书C:商品货币不是他人负债;电子货币是他人负债D:商品货币没有内在价值;电子货币有内在价值答案:D2.货币流通()。

A:决定商品流通B:是以商品作为媒介C:同商品流通方向相同D:是货币作为流通手段和支付手段所形成的连续不断的运动答案:D3.以下有关货币需求说法正确的是()。

A:名义货币需求是指剔除物价变动的影响,以货币所实际对应的商品和劳务表示的货币需求B:实际货币需求是指在物价上涨的情况下,同一货币单位所能购买的商品和劳务的数量C:货币需求是一个流量概念D:微观货币需求是各个经济主体有支付能力的货币需求及需求的变化答案:D4.如果金银的法定比价是1:10,而市场比价是1:12,那么充斥市场的将是()A:银币B:金币C:金币、银币都无人使用D:金币、银币共同流通,没有区别答案:A5.在商品赊销、项付工资等活动中,货币执行的是()职能A:支付手段B:价值尺度C:贮藏手段D:流通手段答案:A第二章测试1.信用是()。

A:各种信贷关系的总和B:买卖关系C:赠予行为D:救济行为答案:A2.信用的最基本特征是()。

A:以偿还为条件的价值单方面转移B:平等的价值交换C:无条件的价值单方面让渡D:无偿的赠予或援助答案:A3.现代信用制度的基础是()A:消费信用B:商业信用C:银行信用D:国家信用答案:B4.()在规模、范围以及期限灵活性上都大大超过了其他信用形式,在信用领域居于主导地位A:银行信用B:国家信用C:商业信用D:消费信用答案:A5.现代经济中,信用活动与货币运动紧密相联,信用的扩张意味着货币供给的()A:增加B:不变C:不确定D:减少答案:A第三章测试1.利率市场化是指中央银行完全放弃对利率的调整,利率完全由市场决定。

()A:错B:对答案:A2.利率水平变动对资金供求有重要影响,并进而影响一国宏观经济状况及其国际收支,但利率只是影响宏观经济的一个非常重要的变量,而不是全部作用变量。

公司金融(财务管理)智慧树知到课后章节答案2023年下外交学院外交学院绪论单元测试1. What are not the most common type of firm in the United States and theworld?答案:partnerships ;corporations;limited partnerships第一章测试1.Stock markets provide liquidity for a firm's shares.答案:对2.Raising new capital by issuing bonds is an example of a commercial bankingactivity.答案:错3.Financial decisions require that you weigh alternatives in strictly monetaryterms.答案:错4.Corporations have come to dominate the business world through their abilityto raise large amounts of capital by sale of ownership shares to anonymous outside investors.答案:对5.Which of the following best describes why the Valuation Principle is a keyconcept in making financial decisions?答案:It shows how to make the costs and benefits of a decision comparable so that we can weigh them properly.6.Which of the following is typically the major factor in limiting the growth ofsole proprietorships?答案:The amount of money that can be raised by such firms is limited by the fact that the single owner must make good on all debts.7. A company that produces racing motorbikes has several models that sellwell within the motorcycle racing community and which are very profitable for the company. Despite having a profitable product, why must thiscompany take care to ensure that it has sufficient cash on hand to meet its obligations?答案:New models will require a lot of money to develop and bring to market before they generate any revenue.8. A factory owner wants his workers to produce as many widgets as they canso he pays his workers based on how many widgets they produce. However, in order to make sure that the workers do not rush and produce a largenumber of poorly made widgets, he checks the widgets at random duringvarious stages of their manufacture. If a defect is found in a widget, the pay of the entire section of the factory responsible for that defect is docked. How is this factory owner seeking to solve the agency conflict problem in this case?答案:by supplying incentives so the agents act in the way principal desires 9.What is the bid-ask spread?答案:the difference in price available for an immediate sale of a stock and the immediate purchase of the stock10.In the United States, publicly traded companies can choose whether or notthey wish to release periodic financial statements.答案:错第二章测试1.The Law of One Price states that if equivalent goods or securities are tradedsimultaneously in different competitive markets, they will trade for the same price in each market.答案:对2.In general, if an action increases a firm's value by providing benefits with avalue greater than any costs involved, then that action is good for the firm'sinvestors.答案:对3.To enable costs and benefits to be compared, they are typically convertedinto cash value at the time the benefit is received.答案:错4.Whenever a good trades in a competitive market, the price determines thevalue of the good.答案:对5.An elderly relative offers to sell you their used 1958 Cadillac Eldorado for$52,000. You note that very similar cars are selling on the open market for $87,000. You don't care for classic cars and would rather buy a new FordExplorer for $35,000. What is the net value of buying the Cadillac?答案:$35,000, since this is the difference between purchase and resale price of the Cadillac.6.The price of Alaska North Slope Crude Oil (ANS) is $71.75/bbl, and the priceof West Texas Intermediate Crude Oil (WTI) is $73.06/bbl.As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,150 bbl of Alaska North Slope (ANS) crude oil for 10,000 bbl of West TexasIntermediate (WTI) crude oil. Assuming you currently have 10,000 bbl ofWTI crude, what should you do?答案:Sell 10,000 bbl WTI crude on the market and use the proceeds topurchase and refine ANS crude.7. A wholesale food retailer is offered $15.60 per two-layer carton for 5000cartons of peaches. The wholesaler can buy peaches from their growers at$13.20 per carton. Shipping costs $2.40 per carton, for the first 1000 cartons, and $1.90 per carton for every carton over that. Will taking this opportunity increase the value of the wholesale food retailer?答案:Yes, the costs are $2000 less than the benefits.8.Which of the following best explains why market prices are useful to afinancial manager when performing a cost-benefit analysis?答案:They can be used to convert different services and commodities intoequivalent cash values which can be compared.9.Walgreens Company (NYSE: WAG) is currently trading at $48.75 on the NYSE.Walgreens Company is also listed on NASDAQ and assume it is currentlytrading on NASDAQ at $48.50. Does an arbitrage opportunity exist and, if so, how would you exploit it and how much would you make on a block trade of 100 shares?答案:Yes, buy on NASDAQ and sell on NYSE, make $25.10.The present value (PV) of a stream of cash flows is just the sum of the presentvalues of each individual cash flow.答案:对第三章测试1.Preference for cash today versus cash in the future in part determines netpresent value (NPV).答案:错2. Net present value (NPV) is the difference between the present value (PV) ofthe benefits and the present value (PV) of the costs of a project or investment.答案:对3.The Net Present Value rule implies that we should compare a project's netpresent value (NPV) to zero.答案:对4.When different investment rules give conflicting answers, then decisionsshould be based on the Net Present Value rule, as it is the most reliable and accurate decision rule.答案:对5.The present value (PV) of an investment is ________.答案:The present value (PV) of an investment is ________.6.Which of the following is NOT a limitation of the payback rule?答案:It is difficult to calculate.7. A manufacturer of video games develops a new game over two years. Thiscosts $830,000 per year with one payment made immediately and the other at the end of two years. When the game is released, it is expected to make$1.20 million per year for three years after that. What is the net present value (NPV) of this decision if the cost of capital is 10%?答案:$950,3498. A mining company plans to mine a beach for rutile. To do so will cost $14million up front and then produce cash flows of $7 million per year for five years. At the end of the sixth year the company will incur shut-down andclean-up costs of $6 million. If the cost of capital is 13.0%, then what is the MIRR for this project?答案:20%9. A farmer sows a certain crop. It costs $240,000 to buy the seed, prepare theground, and sow the crop. In one year's time it will cost $93,200 to harvest the crop. If the crop will be worth $350,000, and the interest rate is 7%, what is the net present value (NPV) of this investment?答案:$010.Firms should use the most accelerated depreciation scheme allowable.答案:对第四章测试1.Rational investors may be willing to choose an investment that has additionalrisk but does not offer additional reward.答案:错2.On average, stocks have delivered higher returns than bonds in the long run.答案:对3.We should use the arithmetic average return when we are trying to estimatean investment's expected return over a future horizon based on its pastperformance.答案:对4.Independent risks can be diversified by holding a large number ofuncorrelated assets with independent risks.答案:对5.Rational investors ________ fluctuations in the value of their investments.答案:are averse to6.Independent risk is more closely related to _______答案:unsystematic risk stock prices gave a realized return of 15%, 15%, -15%, and -15%over four successive quarters. What is the annual realized return for for the year?答案:-4.45%8.Ford Motor Company had realized returns of 20%, 30%, 30%, and 20% overfour quarters. What is the quarterly standard deviation of returns for Fordcalculated from this sample?答案:5.77%9.The probability mass between two standard deviations around the mean fora normal distribution is ________.答案:95%10.The market or equity risk premium can be estimated by computing thehistorical average excess return on the market portfolio.答案:对第五章测试1.The main advantages for a firm in going public are greater liquidity andbetter access to capital.答案:对2.Equity investors in a private company usually plan to realize a return ontheir investment by selling their stock when that company is acquired byanother firm or sold to the public in a public offering.答案:对3.Because the capital investment from angel investors is often large relative tothe amount of capital already in place at the firm, they typically receive asizable equity share in the business in return for their funds.答案:对4.The announcement of an SEO usually raises a stock's price.答案:错5.Which of the following best describes a limited partnership that specializesin raising money to invest in the private equity of young firms?答案:venture capital firms6.You founded your own firm three years ago. You initially contributed$200,000 of your own money and in return you received 3 million shares of stock. Since then, you have sold an additional 2 million shares of stock toangel investors. You are now considering raising capital from a venturecapital firm. This venture capital firm would invest $5 million and wouldreceive 4 million newly issued shares in return. Suppose you sold the 2million shares to the angel investor for $500,000. What was your percentage ownership in the company immediately following the angel investor'sinvestment?答案:60.0%7.Which of the following is an activity typically taken by an underwriter duringan IPO of a company?答案:all of the above8.Which of the following statements is FALSE?答案:The SEC requires that companies prepare a registration statement, a legal document that provides financial and other information about the company to investors, prior to an IPO. Company managers work closely with the underwriters to prepare this registration statement andsubmit it to the SEC.9.The chief advantage of debt financing over financing through raising equitycapital is that the former does not dilute the current owner's share of thebusiness.答案:对10. A bond that makes payments in a certain currency contains the risk ofholding that currency and so is priced according to the yields of similarbonds in that currency.答案:对第六章测试1.Financial managers prefer to choose the same debt level no matter whichindustry they operate in.答案:对2.Even if two firms operate in the same industry, they may prefer differentchoices of debt-equity ratios.答案:对3. A project's net present value (NPV) represents the value to the new investorsof a firm created by the project.答案:错4.The presence of financial distress costs can explain why firms choose debtlevels that are too low to exploit the interest tax shield.答案:对5.The relative proportions of debt, equity, and other securities that a firm hasoutstanding constitute its ________.答案:capital structure6.By adding leverage, the returns on a firm are split between debt holders andequity holders, but equity holder risk increases because ________.答案:interest payments have first priority7. A firm has a market value of equity of $30,000. It borrows $7500 at 8%. If theunlevered cost of equity is 15%, what is the firm's cost of equity capital?答案:16.75%8.Which of the following statements is FALSE?答案:The choice of capital structure does not change the value of a firm if the cost of equity is higher than the cost of debt.9.Assume that MM's perfect capital markets conditions are met and that youcan borrow and lend at the same 5% rate as Firm X. You have $5,000 of your own money to invest and you plan on buying Firm X stock. Using homemade (un)leverage you invest enough at the risk-free rate so that the payoff of your account will be the same as a $5,000 investment in Firm Y stock. The number of shares of Firm X stock you purchased is closest to ________.答案:41710.In a perfect capital market, when a dividend is paid, the share price drops bythe amount of the dividend when the stock begins to trade ex-dividend.答案:对。

第一章测试1【判断题】(10分)风险的基本含义是损失的不确定性。

A.错B.对2【判断题】(10分)风险的不确定性是指有关风险发生的一切都是不确定的A.错B.对3【判断题】(10分)偶然性是指损失的发生时间和损失程度具有偶然性。

A.对B.错4【判断题】(10分)客观性是指风险的发生必然造成一定的经济损失或产生特殊的经济要求。

A.错B.对5【判断题】(10分)无形风险因素是指看得见摸得着的因素。

A.错B.对6【判断题】(10分)道德风险因素是指由于人们主观上的疏忽或过失,导致了引起或增加风险事故的发生机会、或扩大损失程度的那些非故意因素。

A.对B.错7【单选题】(10分)将风险分为自然风险、社会风险、经济风险和政治风险,这是根据下列哪项进行的分类?A.损失后果B.影响对象C.影响范围D.根源或原因8【单选题】(10分)汽车刹车失灵会引起意外事故,这属于(D)。

A.B.C.D.A.实质性风险因素B.心理危险因素C.主观风险因素D.道德风险因素9【多选题】(10分)风险即是指损失的不确定性。

其包括下列哪些的不确定呢?A.损害对象B.发生状况C.发生时间D.发生10【多选题】(10分)风险具有下列哪些特点?A.必然性B.偶然性C.损失性D.客观性第二章测试1【判断题】(10分)风险管理指通过对风险的识别、衡量和分析,选择经济合理的方法,通过降低风险的损失概率或损失程度,从根本上杜绝风险发生的科学和方法A.对B.错2【判断题】(10分)在风险管理中,没有最好的方法,只有较好的方法。

A.对B.错3【判断题】(10分)风险管理所管理的风险要比保险的范围更为广泛,其处理风险的手段也比保险多。

保险不是处置风险的唯一方法,更不是所有风险都可以保险。

保险只是风险管理的一种手段。

A.错B.对4【判断题】(10分)保险是风险管理的基础,风险管理又是保险经济效益的源泉。

A.错B.对5【单选题】(10分)风险管理的目标是以()成本获得()安全保障,或者以()成本将风险控制到()水平。

金融风险管理智慧树知到课后章节答案2023年下西安财经大学西安财经大学第一章测试1.对风险的理解,以下选项正确的是:()答案:风险是不确定性对目标的影响;风险是各种结果发生的可能性;风险是结果的不确定性;风险是实际结果对期望值的偏离2.金融风险的特点包括:()答案:主观性;扩散性;普遍性;隐蔽性3.以下风险属于市场风险的是( )答案:投资风险;利率风险;汇率风险4.操作风险具有人为性的特点。

()答案:对5.流动性风险是一种外生风险,不存在内生性。

()答案:错6.声誉风险由于其难以衡量、控制和预测,因此巴塞尔协议还没有将其列入监管框架中。

()答案:错第二章测试1.巨额损失的出现,意味着风险管理的失效。

()答案:错2.识别金融风险的类型和受险部位,是金融风险识别的第一步。

()答案:对3.风险分散只能降低系统性风险,对非系统性风险却无能为力。

()答案:错4.金融风险识别的基本原则有()答案:系统性;成本效益;准确性;实时性5.金融风险识别的基本内容包括()答案:严重程度;风险类型;产生原因;受险部位6.“不将所有鸡蛋放在同一篮子中”体现了()思想。

答案:风险分散7.对发生频率高、单体损失程度低且风险事件近乎独立的风险,可使用()。

答案:风险承担策略第三章测试1.信用风险与市场风险的区别之一是防范信用风险工作中会遇到法律方面的障碍,而市场风险方面的法律限制很少。

()答案:对2.由外在不确定性导致的信用风险等金融风险称为非系统性风险。

()答案:错3.某项金融资产的方差越大,说明金融风险越小。

()答案:错4.巴塞尔协议III包括三大支柱:核心资本、监管当局的监督检查和信息披露。

()答案:错5.[多项选择题]1.下列说法正确的是()。

答案:信用风险是最古老也是最重要的一种风险;信用风险具有明显的非系统性风险特征;信用风险又被称为违约风险;信用风险存在于一切信用交易活动中6.信用风险度量的基本概念有()答案:信用风险暴露;预期损失;违约损失率;非预期损失;违约概率7.不出资的信用风险转移工具有()。

金融风险管理知到章节测试答案智慧树2023年最新哈尔滨金融学院第一章测试1.商业银行在业务经营中的非预期损失需要银行的()来覆盖。

参考答案:经济资本2.下列关于信用风险的说法,正确的是()。

参考答案:信用风险包括违约风险、结算风险等主要形式3.20世纪80年代,商业银行进入()。

参考答案:全面风险管理模式阶段4.在商业银行的下列活动中,不属于风险管理流程的是()。

参考答案:风险承担能力确定5.某商业银行在给甲企业发放贷款时,乙企业为甲企业提供了第三方担保,此商业银行运用了()策略。

参考答案:风险转移6.下列关于经风险调整的业绩评估方法的说法,正确的有()。

参考答案:使用经风险调整的业绩评估方法,有利于在银行内部建立正确的激励机制,从根本上改变银行忽视风险、盲目追求利润的经营方式;在资产组合层面上,商业银行在考量单笔业务的风险和资产组合效应之后,可依据经风险调整的资本收益率衡量资产组合的风险与收益是否匹配;在经风险调整的业绩评估方法中,目前被广泛接受和普遍使用的是经风险调整的资本收益率;在单笔业务层面上,经风险调整的资本收益率可用于衡量一笔业务的风险与收益是否匹配,为商业银行是否开展该笔业务以及如何定价提供依据7.金融风险对宏观经济产生的影响包括()。

参考答案:引起实际收益率、产出率、消费和投资的下降;引起金融市场秩序混乱,破坏社会正常的生产和生活秩序;影响着宏观经济政策的制定和实施;直接影响着一个国家的国际收支;影响该国国际经贸活动和金融活动的进行和发展8.巴塞尔委员会的宗旨是加强金融机构监管的国际合作,共同防范和控制金融机构风险,保证国际金融业的安全和发展。

()参考答案:错9.《巴塞尔协议Ⅱ》引入了计量信用风险的内部评级法,银行既可以采用外部评级公司的评级结果确定风险权重,也可以用各种内部风险计量模型计算资本要求。

()参考答案:对10.经济资本的重要意义在于强调资本的有偿占有,即占有资本来防范风险是需要付出成本的。

东北财经大学智慧树知到“金融学”《金融风险管理X》网课测试题答案(图片大小可自由调整)第1卷一.综合考核(共15题)1.一般情况下,在下列投资中,风险最小的是()。

A.投资政府债券B.购买企业债券C.购买股票D.投资开发项目2.以下()模型是针对市场风险的计量模型。

A.CreditMetricsB.KMVC.VaRD.高级计量法3.以下关于期权和期货的说法,正确的是()。

A.关于保证金,期权仅向买方收取,期货的买卖双方均收取B.期权与期货的买卖双方均有义务C.期权与期货的买卖双方到期都必须履约D.期权与期货的买卖双方权利与义务对等4.不确定性是风险的基本特征。

()A.正确B.错误5.对下列期权交易描述正确的有()。

A.期权的卖方可能的亏损是有限的B.期权的买方可能的亏损是有限的C.期权买卖双方的权利与义务是对称的D.期权卖方最大的收益是权利金6.随着期货合约到期日的临近,期货价格和现货价格逐渐聚合,在到期日,基差接近于零,两价格大致相等。

()A.正确B.错误7.你持有一份4月份到期的多头玉米期货合约,为冲销你的玉米期货合约的头寸,在交割日前必须()。

A.买一份5月份的玉米期货合约B.买两份4月份的玉米期货合约C.卖一份4月份的玉米期货合约D.卖一份5月份的玉米期货合约8.远期合约是在未来某一时刻以特定价格买入或者卖出某种资产的协议。

()A.正确B.错误9.()是预期损失。

A.以历史平均损失和监管要求为依据预测未来平均损失,是商业银行可以预见的损失,一般通过商业银行的核心资本抵补B.以历史平均损失和监管要求为依据预测未来平均损失,是商业银行不可预见的损失,一般通过计提损失准备金进行抵补,直接计入银行业务成本C.以历史平均损失和监管要求为依据预测未来平均损失,是商业银行可以预见的损失,一般通过计提损失准备金进行递补,直接计入银行业务成本D.以上说法均不正确10.期权的买方既享有权利又承担义务。

()A.正确B.错误11.考虑两个因素的经济中,一个充分分散化的资产组合A,无风险利率为6%。

第一章测试1.金融风险的特点包括()A:传导性B:普遍性C:不可管理性D:双重性E:隐蔽性答案:ABDE2.在对风险进行管理时,人们更多地强调它的损失,但实际中,风险的存在提供了获得额外收益的可能性,这说明金融风险具有双重性。

()A:对B:错答案:A3.()是指获得银行信用支持的债务人由于种种原因不能或不愿遵照合同规定按时偿还债务而使银行遭受损失的可能性。

A:市场风险B:信用风险C:操作风险D:流动性风险答案:B4.银行风险管理的流程是( )。

A:风险识别→风险控制→风险监测→风险计量B:风险控制→风险识别→风险计量→风险临测C:风险控制→风险识别→风险监测→风险计量D:风险识别→风险计量→风险监测→风险控制答案:D5.监事会的职责为:确保商业银行有效识别、计量、监测和控制各项业务所承担的各种风险,并承担商业银行风险管理的最终责任。

()A:错B:对答案:A第二章测试1.一家商业银行对所有客户的贷款政策均一视同仁,对信用等级低以及高的均适用同样的贷款利率,为改进业务,此银行应采取以下风险管理措施( )。

A:风险转移B:风险规避C:风险分散D:风险对冲答案:C2.根据马可维茨的资产组合理论,分散投资可降低风险。

如果投资于两种资产,下列情况中开始抵消风险的是()。

A:两种资产收益率的相关系数小于1B:两种资产收益率的相关系数为-1C:两种资产收益率的相关系数为0D:两种资产收益率的相关系数为1答案:A3.RAROC是指经预期损失和以()计量的非预期损失调整后的收益率。

A:核心资本B:附属资本C:经济资本D:监管资本答案:C4.经风险调整的资本收益率(RAROC)的计算公式是( )。

A:RAROC=(收益-预期损失)/非预期损失B:RAR0C=(预期损失-非预期损失)/收益C:RAROC=(非预期损失-预期损失)/收益D:RAROC=(收益-非预期损失)/预期损失答案:A5.全面风险管理体系有三个维度,下列选项属于这三个维度的是()。

金融学知到章节测试答案智慧树2023年最新西北师范大学绪论单元测试1.金融是货币流通和信用活动以及与之相联系的经济活动的总称。

()参考答案:对2.金融学是以融通货币和货币资金的经济活动为研究对象的学科,主要研究金融领域各要素及其基本关系与运行规律。

()参考答案:对3.货币政策是主要的宏观经济调控手段。

()参考答案:对第一章测试1.()的出现是金融史的开端?参考答案:货币2.与货币起源密不可分的是()。

参考答案:商品交换3.货币最初的形态是()参考答案:牲畜、盐、茶叶4.作为记账单位被用来计算其他商品和劳务价值时,货币发挥什么职能()参考答案:价值尺度5.金本位制度下,汇价的基本决定因素是()参考答案:铸币平价6.第一次世界大战前,主要的国际储备货币是()参考答案:英镑7.以下关于人民币货币制度的论述正确的有()。

参考答案:人民币是我国法定计价、结算的货币单位;目前人民币汇率实行以市场供求为基础、参考一篮子货币进行调节、有管理的浮动汇率制度8.马克思关于货币职能的论述是以纸币为研究对象。

()参考答案:错9.《布雷顿森林协定》的产生,形成了以英镑为中心的国际货币体系。

()参考答案:错第二章测试1.商业信用最典型的形式是()。

参考答案:赊销2.一年以内的短期政府债券称为( )。

参考答案:国库券3.下列经济行为中属于间接融资的是()。

参考答案:银行发放贷款4.工商企业之间以赊销方式提供的信用是()。

参考答案:商业信用5.国家信用的主要形式有()。

参考答案:发行专项债券;发行国库券;财政透支或借款;发行国家公债6.下列属于消费信用范畴的有()。

参考答案:个人持信用卡到指定商店购物;个人获得住房贷款;企业将商品赊卖给个人7.与间接融资相比,直接融资的局限性体现为()。

参考答案:资金供给者的风险较大;在资金数量、期限等方面受到较多限制8.银行信用是银行或其他金融机构以货币形态提供的信用,它属于间接信用。

()参考答案:对9.信用是在私有制的基础上产生的。

第一章概述一、名词解释风险:指未来的不确定性对组织实现其既定目标的影响。

操作风险:指由内部流程、人员行为和系统的不完善或失败,以及外部事件导致直接和间接损失的风险。

金融风险管理:金融机构用于识别、测量、监管和控制其风险的一整套政策和程序。

即识别、衡量并控制各种风险的过程。

法律风险:是指金融机构签署的交易合同因不符合法律而得不到实际履约,从而给金融机构造成损失的风险。

风险补偿:一是指损失发生之前的价格补偿,如提高贷款利率、期权费、保险费,其核心是风险定价。

二是指事后的抵押、担保与保险等形式获取的资金补偿。

流动性风险:是指金融机构持有的资产流动性差和对融资能力枯竭而造成的损失或破产的可能性。

投机风险:既能带来损失又能带来收益的风险战略风险:指由于经营决策失误、决策执行不当或对外部环境变化的束手无策,从而对银行形成长期负面影响。

结算风险:是指不能按期收到交易对手支付现金或其他金融工具而造成损失的风险。

国家风险:指经济主体与非本国居民进行国际贸易与金融往来中,由于别国宏观经济、政治环境和社会环境等方面变化而遭受损失的可能性。

系统风险:对所有资产(或主体)的收益都起影响的事件所导致的风险。

特定风险:只对单个资产(或主体)收益有影响的事件所导致的风险。

事件风险:该概念的提出最初与新兴市场有关,指由重要的政治或经济事件造成可能损失的风险,后又将自然灾难与信誉风险包括进来。

其中,最重要的是国家(政治)风险。

合规风险:指由于违犯法律法规和监管规定而可能遭受法律制裁或监管处罚,造成重大财务损失或声誉损失的风险。

风险管理文化:指金融机构对待风险的态度以及在风险管理方面采取的常规性制度和指导性文件。

二、单项选择1.按弗兰克.奈特(Knight)爵士对风险的定义,风险是指()。

A.确定性;B.不确定性;C.可能性;D.既知道未来发生的所有可能状态,而且知道各种状态发生概率的大小。

2.只能带来损失而不能带来收益的风险是()。

智慧树知到《金融风险管理》2019章节测试答案

第一章

1、【单选题】 (2分)

美国“9·11”事件发生后引起的全球股市下跌的风险属于(系统性风险)

2、【单选题】 (2分)

下列说法正确的是(分散化投资使非系统风险减少)

3、【单选题】 (2分)

现代投资组合理论的创始者是(哈里.马科威茨)

4、【单选题】 (2分)

反映投资者收益与风险偏好有曲线是(无差异曲线)

5、【单选题】 (2分)

不知足且厌恶风险的投资者的偏好无差异曲线具有的特征是(收益增加的速度快于风险增加的速度)

6、【单选题】 (2分)

反映证券组合期望收益水平和单个因素风险水平之间均衡关系的模型是(单因素模型)

7、【单选题】 (2分)

根据CAPM,一个充分分散化的资产组合的收益率和哪个因素相关(市场风险)

8、【单选题】 (2分)

在资本资产定价模型中,风险的测度是通过(贝塔系数)进行的。

9、【单选题】 (2分)

市场组合的贝塔系数为(1)。

10、【单选题】 (2分)

无风险收益率和市场期望收益率分别是0.06和0.12。

根据CAPM模型,贝塔值为1.2的证券X的期望收益率为(0.132)。

11、【单选题】 (2分)

对于市场投资组合,下列哪种说法不正确(它是资本市场线和无差异曲线的切点)

12、【单选题】 (2分)

关于资本市场线,哪种说法不正确(资本市场线也叫证券市场线)

13、【单选题】 (2分)

证券市场线是(描述了单个证券(或任意组合)的期望收益与贝塔关系的线)。

14、【单选题】 (2分)

根据CAPM模型,进取型证券的贝塔系数(大于1)

第二章

1、【单选题】 (2分)

按金融风险的性质可将风险划分为(系统性风险和非系统性风险)。

2、【单选题】 (2分)

(信用风险)是指获得银行信用支持的债务人由于种种原因不能或不愿遵照合同规定按时偿还债务而使银行遭受损失的可能性。

3、【单选题】 (2分)

以下不属于代理业务中的操作风险的是(代客理财产品由于市场利率波动而造成损失)

4、【单选题】 (2分)

所谓的“存贷款比例”是(贷款/存款)

5、【单选题】 (2分)

金融机构的流动性需求具有(刚性特征)。

6、【单选题】 (2分)。