信用证审核1

- 格式:doc

- 大小:75.00 KB

- 文档页数:3

合同和信用证物流条款的审核实训收获与心得示例文章篇一:《合同和信用证物流条款的审核实训收获与心得》嘿,同学们!你们能想象到我在参加合同和信用证物流条款的审核实训时,那心情就像坐过山车一样吗?一会儿紧张得不行,一会儿又兴奋得要命!刚开始接触这个实训的时候,我简直就是一头雾水,感觉自己像是掉进了一个巨大的迷宫。

那些密密麻麻的条款,就像无数条缠在一起的线,让我找不到头绪。

我不停地问自己:“这都是啥呀?我能搞明白吗?”不过,我们的老师可真是厉害!他就像一位超级英雄,带着我们一步步地解开这个谜团。

老师耐心地给我们讲解每个条款的含义和重要性,还举了好多生动的例子。

比如说,他把物流条款比作是一场接力赛,每个环节都不能掉链子,否则整个比赛就会输掉。

这一下就让我明白了物流条款的关键所在。

在实训的过程中,我和小组的同学们一起讨论,那场面可热闹啦!“哎呀,这个条款是不是有问题呀?”“我觉得这里好像不太对!”大家你一言我一语,都在努力地找出问题。

有时候我们会因为一个观点不同而争得面红耳赤,可这也让我们更加深入地理解了那些条款。

还记得有一次,我们小组为了一个信用证的物流条款争论了好久。

小李说:“我觉得这个时间规定太紧张了,根本不可能完成。

”小王却反驳道:“怎么不可能?只要我们合理安排,肯定没问题!”我在旁边听着,心里也在琢磨:到底谁说得对呢?最后我们经过仔细的分析和计算,发现小李的担心是有道理的。

这让我深深地感受到,团队合作和认真思考是多么重要。

经过这段时间的实训,我收获可太多啦!我不再害怕那些复杂的条款,反而能够从中找出关键的信息。

这就好像我学会了一门神奇的技能,能够看穿隐藏在文字背后的秘密。

我也明白了,做事情一定要细心、认真,不能马虎。

一个小小的错误,可能就会带来很大的麻烦。

你们说,这是不是一次超级有意义的实训呢?我觉得呀,这就像是给我打开了一扇新的大门,让我看到了一个全新的世界。

以后再遇到类似的问题,我可不会再手忙脚乱啦!总之,这次实训让我成长了许多,我会继续努力,让自己变得更强大!示例文章篇二:《合同和信用证物流条款的审核实训收获与心得》嘿,同学们!你们知道吗?最近我参加了一个超棒的实训,是关于合同和信用证物流条款的审核!这可真是让我大开眼界,收获满满呢!一开始,我就像一只无头苍蝇,面对那些密密麻麻的条款,脑袋都大了!心里不停地犯嘀咕:“这都是啥呀?怎么这么复杂?”但是,随着老师耐心地讲解和指导,我慢慢找到了门道。

信用证样本1对于很多外贸新手来说,信用证(L/C)是个不小的问题,相信有不少人可能都没见过。

对我来说,信用证也是新的东西,也需要学习。

在此,从其它地方搬来样本,供大家参考、学习。

对于原创者,表示感谢!正题:其实所有的信用证条款都大同小异,具体款项都是那些,下面列出一个样本供大家参考.有一个问题需要新手注意,一般韩国开过来的信用证经常用假远期,这也是韩国人的精明之处,可以用假信用证向开证行押汇,狡猾狡猾地!!信用证样本1SAMPLE LETTER OF CREDIT/1(See Instructions on Page 2)Name and Address of BankDate: __________________Irrevocable letter of Credit No. ______________Beneficiary: Commodity Credit Corporation Account Party: Name of ExporterAddress of ExporterGentlemen:We hereby open our irrevocable credit in your favor for the sum or sums not to exceed a total of _______________dollars ($__________), to be made available by your request for payment at sight upon the presentation of your draft accompanied by the following statement:(Insert applicable statement)/2This Letter of Credit is valid until _____________________/3, provided, however, that this Letter of Credit will be automatically extended without amendment for _________________/4 from the present or any future expiration date thereof, unless at least thirty (30) days prior to any such expiration date the Issuing Bank provides written notice to the Commodity Credit Corporation at the U.S. Department of Agriculture, 14th and Independence Avenue, S.W., Room 4503, South Building, Stop 1035, Washington, D.C. 20250-1035, of its election not to renew this Letter of Credit for such additional ______________________/5 period. The notice required hereunder will be deemed to have been given when received by you.This letter of Credit is issued subject to the Uniform Customs and Practice for Documentary Credits, 1993 Revision, International Chamber of Commerce Publication No. 500(Name of Bank)By: _______________________________________________________________-2-INSTRUCTIONS FOR LETTER OF CREDIT ISSUED FOR DEIP BID1. Send to: Treasurer, CCCU.S. Department of Agriculture14th & Independence Avenue, S.W.Room 4503 South BuildingStop 1035Washington, DC 20250-10352. If the letter of credit is to apply to any Dairy Export Incentive Program (DEIP) Invitation: “The Commodity Credit Corporation (CCC) has a right to the amount drawn in accordance with the terms and conditions of one or more Dairy Export Incentive Program (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 1494, and the applicable DEIP Invitation(s) issued by CCC.”If the letter of credit is to apply to a single DEIP Invitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in accordance with the terms and conditions of one or more Dairy Export incentive Program (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 1494, and DEIP Invitation No.________________.If the letter of credit is to apply to more than one specific DEIP Invitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in accordance with the terms and conditions of one or more Dairy Export incentive Program (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 1494, and DEIP Invitation Nos.________________, ___________________, and _________________.”3. Insert the last date of the month in which the 90th day after the date of the letter of credit falls (e.g., if the date of the letter of credit is March 15, 2002, the date to be inserted would be Jun 30, 2002).4. Insert a time period of either “one (1) year” or a specific number of whole month(s) which total less than one year (e.g., “one (1) month,” “two (2) months,” etc.).5. Insert the same time period as inserted in the previous space (e.g., “one (1) year,” “one (1) month,” etc.).信用证样本2Issue of a Documentary Credit (开证行,一般为出口商的往来银行,须示开证行的信用程度决定是否需要其他银行保兑confirmation见49)BKCHCNBJA08E SESSION: 000 ISN: 000000 BANK OF CHINA LIAONING NO. 5 ZHONGSHAN SQUARE ZHONGSHAN DISTRICT DALIAN CHINADestination Bank (通知行advising bank见57A)KOEXKRSEXXX MESSAGE TYPE: 700 KOREA EXCHANGE BANK SEOUL 178.2 KA, ULCHI RO, CHUNG-KO (一般由受益人指定往来银行为通知行,如愿意通知,其须谨慎鉴别信用证表面真实性;应注意信用证文本的生效形式和内容是否完整,如需小心信用证简电或预先通知和由开证人直接寄送的信用证或信用证申请书,因其还未生效,且信用证一般通过指定通知行来通知,可参考《出口实务操作》page237)40A Type of Documentary Credit (跟单信用证类型)IRREVOCABLE (信用证性质为不可撤消。

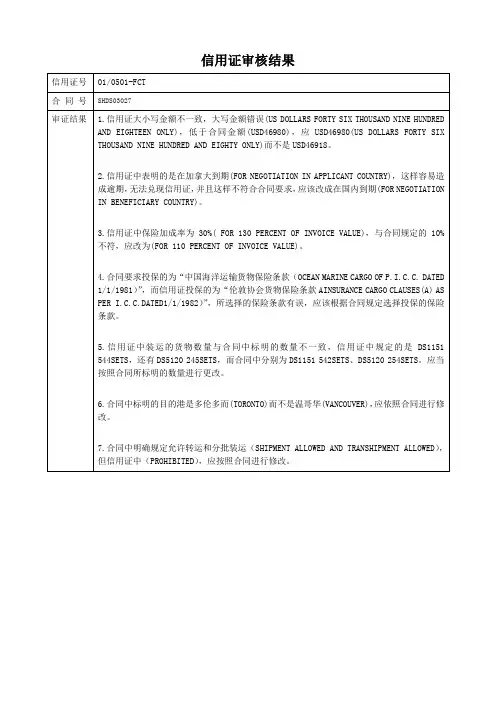

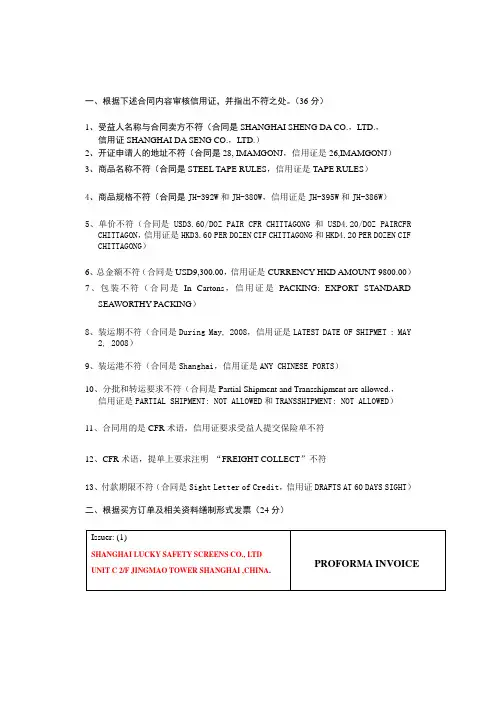

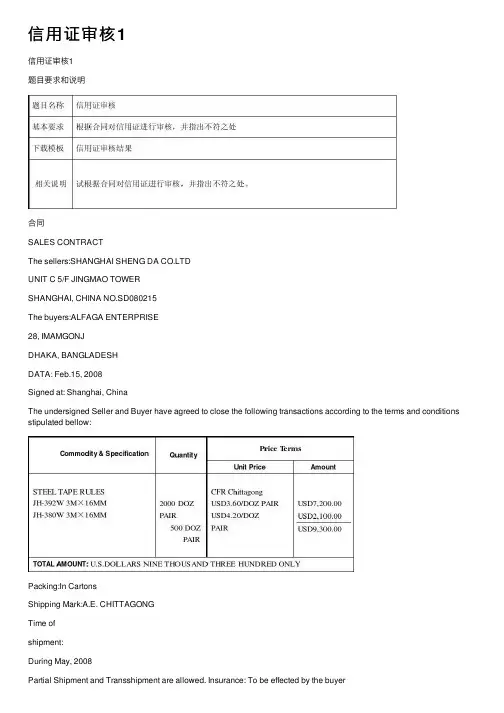

一、根据下述合同内容审核信用证,并指出不符之处。

(36分)1、受益人名称与合同卖方不符(合同是SHANGHAI SHENG DA CO.,LTD.,信用证SHANGHAI DA SENG CO.,LTD.)2、开证申请人的地址不符(合同是28, IMAMGONJ,信用证是26,IMAMGONJ)3、商品名称不符(合同是STEEL TAPE RULES,信用证是TAPE RULES)4、商品规格不符(合同是JH-392W和JH-380W,信用证是JH-395W和JH-386W)5、单价不符(合同是USD3.60/DOZ PAIR CFR CHITTAGONG和USD4.20/DOZ PAIRCFRCHITTAGON,信用证是HKD3.60 PER DOZEN CIF CHITTAGONG和HKD4.20 PER DOZEN CIF CHITTAGONG)6、总金额不符(合同是USD9,300.00,信用证是CURRENCY HKD AMOUNT 9800.00)7、包装不符(合同是In Cartons,信用证是PACKING: EXPORT STANDARDSEAWORTHY PACKING)8、装运期不符(合同是During May, 2008,信用证是LATEST DATE OF SHIPMET : MAY2, 2008)9、装运港不符(合同是Shanghai,信用证是ANY CHINESE PORTS)10、分批和转运要求不符(合同是Partial Shipment and Transshipment are allowed.,信用证是PARTIAL SHIPMENT: NOT ALLOWED和TRANSSHIPMENT: NOT ALLOWED)11、合同用的是CFR术语,信用证要求受益人提交保险单不符12、CFR术语,提单上要求注明“FREIGHT COLLECT”不符13、付款期限不符(合同是Sight Letter of Credit,信用证DRAFTS AT 60 DAYS SIGHT)二、根据买方订单及相关资料缮制形式发票(24分)(12) DETAILS OF OUR BANK:BANK OF CHINA, SHANGHAI BRANCH,NO.4 Zhongshan road, Shanghai ,P.R.CHINASWIFT CODE: BKCHCNBJ530BENEFICIARY: SHANGHAI LUCKY SAFETY SCREENS CO., LTDACCOUNT NO: 1281 2242012 7091 015ADDRESS: UNIT C 2/F JINGMAO TOWER SHANGHAI ,CHINASHANGHAI LUCKY SAFETY SCREENS CO., LTD三、根据合同、信用证及补充资料缮制商业发票、海运提单、汇票及普惠制产地证FORM A(共40分)凭信用证号Drawn under industrial bank of Japan,ltd.,head office L/C NO.LC196107800日期按…. .息…. 付款Dated Oct.15,2007 Payable with interest @… .. % per annum 号码汇票金额上海NO.YL71001Exchange for USD12630.00 Shanghai …DEC.05,2007……………见票…………………日后(本汇票之正本未付)付交At *** sight of this FIRST of Exchange (Second of Exchange being unpaid) Pay to the order of BANK OF CHINA,SHANGHAI BRANCH金额the sum of SAY US DOLLARS TWELVE THOUSAND SIX HUNDRED AND THIRTY ONLY此致To: INDUSTRIAL BANK OF JAPAN,HEAD OFFICESHANGHAI YILONG CO.,LTD.XXXSHANGHAI YILONG CO.,LTD.X X X.Shipper Insert Name, Address and PhoneSHANGHAI YILONG CO.,LTD.NO.91 NANING ROAD SHANGHAI ,CHINA.B/L No.TH14HK07596.Consignee Insert Name, Address and Phone TO ORDER中远集装箱运输有限公司COSCO CONTAINER LINESNotify Party Insert Name, Address and Phone(It is agreed that no responsibility shall attach to the Carrier or his agents for failure to notify)ABC COMPANY1-3 MACHI KU STREET OSAKA,JAPAN Port-to-Port or Combined Transport BILL OF LADINGLADEN ON BOARD THE VESSEL DATE:NOV29,2007BY KAOHSIUNG V.0707SCOSCO CONTAINER LINESCNS01 0108895。

信用证的业务流程

信用证是国际贸易中常用的付款方式之一,它是由进口商的银

行开具,向出口商的银行承诺支付货款的一种担保工具。

信用证的

业务流程通常包括开证申请、开证、通知受益人、交单、付款和结

算等环节。

首先,进口商与其银行签订信用证合同,并向银行提交开证申请。

开证申请中包括了进口商的基本信息、交易合同、货物描述、

付款条件等内容。

银行在审核开证申请后,根据进口商的要求开立

信用证,并将信用证通知出口商的银行。

出口商收到通知后,根据信用证规定的条件,装运货物并提供

相应的单据,如发票、提单、装箱单等。

出口商将这些单据交给其

银行,银行根据信用证的规定对单据进行审核,确保单据与信用证

要求的一致性。

银行审核通过后,向进口商的银行索取付款,进口商的银行在

收到单据后,根据信用证的规定向出口商的银行支付货款。

出口商

的银行收到货款后,将单据转交给进口商,进口商凭单据提取货物。

最后,进口商根据货物的实际情况对出口商进行结算,完成整个信用证的业务流程。

在整个业务流程中,信用证作为一种支付保障工具,不仅可以保障出口商的权益,也可以降低进口商的交易风险。

同时,银行作为信用证的开证行和通知行,在业务流程中扮演着重要的角色,其审核单据的严谨性和及时性对于整个交易的顺利进行至关重要。

总的来说,信用证的业务流程涉及多个环节,需要各方严格遵守信用证的规定,确保交易的顺利进行。

同时,对于出口商、进口商和银行来说,熟悉信用证的业务流程,合理利用信用证,可以有效降低交易风险,促进国际贸易的发展。

09/04/15-13:43:46 P2XX-7963-000004 5____________________________________________________________________--------------------- Instance Type and Transmission --------------Original received from SWIFTPriority : NormalMessage Output Reference : 1343 150409CMBCCNBSAXXX7645303099Correspondent Input Reference : 1443 150409DAEBKR22AXXX7593095197 --------------------------- Message Header -------------------------Swift Output : FIN 700 Issue of a Documentary CreditSender : DAEBKR22XXXDAEGU BANK, LTD.,THEDAEGU KRReceiver : CMBCCNBSXXXCHINA MERCHANTS BANK(HEAD OFFICE)SHENZHEN CNMUR : 150409OIPS00002--------------------------- Message Text ---------------------------27: Sequence of Total电文页次1/140A: Form of Documentary CreditIRREVOCABLE20: Documentary Credit NumberM31S9504NS0004831C: Date of Issue开证日期15040940E: Applicable RulesUCP LATEST VERSION31D: Date and Place of Expiry信用证有效期和有效地150529 AT NEGOTIATING BANK50: ApplicantKUMOH EMS CO.,LTD.DAEGU CITY. KOREA922-2 WORAM-DONG, DALSEO-GUDAEGU, KOREA59: Beneficiary - Name & AddressHK RD TRADING CO., LIMITED19/F CHINA MERCHANTS BANK TOWER NO.7088 SHENNAN BOULEV ARD SHENZHENP.R. CHINA32B: Currency Code, Amount币种和金额Currency : USD (US DOLLAR)Amount : #99000,#41D: Available With...By... - Name&Addr议付行ANY BANKBY NEGOTIATION自由议付42C: Drafts at...AT SIGHT42A: Drawee - FI BIC付款人DAEBKR22XXXDAEGU BANK, LTD.,THEDAEGU KR43P: Partial ShipmentsPROHIBITED43T: TransshipmentPROHIBITED44E: Port of Loading/Airport of Dep.CHINA TIANJIN PORT44F: Port of Dischrge/Airport of DestSOUTH KOREA BUSAN PORT44C: Latest Date of Shipment15041545A: Descriptn of Goods &/or ServicesHS CODE: 8104190001. AZ91D INGOT 7.5KG +/-0.5KGQUANTITY : 40MT09/04/15-13:43:46 P2XX-7963-000004 6____________________________________________________________________ PRICE: USD2,475/MTAMOUNT:USD99,000.00CIF BUSANORIGIN:CHINA46A: Documents Required1. SIGNED COMMERCIAL INVOICE IN 3 FOLD(S)2. PACKING LIST IN 3 FOLD(S)3. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO全套清洁已装船海运提单,以,,,为抬头,标注运费预付和THE ORDER OF DAEGU BANK, LTD. MARKED 'FREIGHT PREPAID' ANDNOTIFY THE APPLICANT(此信用证被通知人与申请人一致)被通知人为申请人4. INSURANCE POLICY OR CERTIFICATE IN DUPLICATE 双份FOR110 PCT OF INVOICE V ALUE MADE OUT 被保险人TO ORDER OFDAEGU BANK, LTD. INDICATING A CLAIM SETTLING AGENTIN SOUTH KOREA 赔付地COVERING INSTITUTE CARGO CLAUSE (A) 47A: Additional Conditions1. A FEE OF USD 80 IS TO BE DEDUCTED FROM EACHDRAWING每一次交单FOR THE ACCOUNT OF BENEFICIARY. IF DOCUMENTS AREPRESENTED WITH DISCREPANCY(IES).2. IN ADDITION, IF ANY, WE WILL DEDUCT OUR REMITTANCE CHARGE汇款费用EQUIV ALENT OF USD 80 FOR EACH REMITTANCE.IT SHALL BE FOR ACCOUNT OF BENEFICIARY.3. ADD TO FIELD 59A/C NO.:OSA7559199210321014. IN THE EVENT THAT DOCUMENTS PRESENTED UNDER THIS CREDIT AREDETERMINED TO BE DISCREPANT, 信用证下所提交的单据一旦出现不符,我们可以放弃它,WE MAY SEEK A WAIVER OF SUCHDISCREPANCY(IES) FROM THE APPLICANT AT OUR SOLE DISCRETION.UNLESS PRIOR CONTRA RY INSTRUCTIONS HAVE BEEN RECEIVED FROM THEPRESENTER, WE MAY RELEASE DOCUMENTS TO THE APPLICANT WITHOUTFURTHER NOTICE TO YOU UPON THEIR WAIVER OF DISCREPANCIES.IN SUCH EVENT, THE PRESENTER AND/OR BENEFICIARY SHALL HA VE NO如果信用证中存在不符,在接到申请人接受不符点通知的情况下,银行可以考虑放弃扣款,并交给申请人,之前不会给予任何通知CLAIM AGAINST US.5. ALL DOCUMENTS MUST BEAR OUR CREDIT NUMBER.6. ALL DOCUMENTS MUST BE ISSUED IN ENGLISH UNLESS OTHERWISESTIPULATED.71B: Charges+ALL BANKING COMMISSIONS AND1118-4018-6583-4956-2486-7805CHARGES OUTSIDE SOUTH KOREA ANDREIMBURSEMENT COMMISSIONS AREFOR ACCOUNT OF BENEFICIARY在韩国以外产生的费用由受益人承担48: Period for Presentation+DOCUMENTS MUST BE PRESENTED FORNEGOTIATION WITHIN 21 DAYS AFTERDATE OF SHIPMENT BUT WITHIN CREDIT(一般15天)V ALIDITY49: Confirmation InstructionsWITHOUT78: Instr to Payg/Accptg/Negotg Bank1. THE AMOUNT OF EACH NEGOTIATION/DRAWING MUST BE ENDORSED ONTHE REVERSE OF THIS CREDIT AND NEGOTIATING/PRESENTING BANKMUST CERTIFY THE SAME ON THE COVERING SCHEDULE.2. ALL DOCUMENTS MUST BE MAILED TO DAEGU BANK, LTD.INTERNATIONAL BUSINESS DEPT 14FL,118, SUSEONG-2-GA, SUSEONG-GU,DAEGU, 706-712 SOUTH KOREAIN ONE LOT BY COURIER MAIL.3. UPON RECEIPT OF THE DRAFT AND DOCUMENTS COMPLIED WITHTHE TERMS AND CONDITIONS OF THIS CREDIT, WE SHALL REMITTHE PROCEEDS ACCORDING TO THE NEGOTIATING BANK'SINSTRUCTION.--------------------------- Message Trailer ------------------------{CHK:1BA23EDB235E}PKI Signature: MAC-Equivalent。

国内信用证审单规则2021信用证审单是国际贸易中非常重要的环节,它确保了买卖双方的利益不受损害。

随着国内外经贸环境的变化,信用证审单规则也在不断演变和完善。

下面将介绍一些关于国内信用证审单规则的新变化。

首先,核查单证的要求更为严格。

根据最新规定,买卖双方在国内信用证审单时需要对相关单证进行更加详细和准确的核查。

如确认货物的产地、数量、品质等必须与合同保持一致,这样可以有效防止商业欺诈行为的发生。

此外,信用证必须在规定的期限内及时使用,过期的信用证会被拒付。

其次,相关单证的格式要求更加统一。

国内信用证审单规则要求所有的单证必须按照一定的格式进行填写,以确保其准确性和规范性。

比如,发票必须包括所有交易的详细信息,如商品的名称、价格、数量等。

其他的单据,如装船单据、保险单据等也都需要符合规定的格式,以便于审单人员的审核和处理。

再次,信用证的修改要更加灵活。

在国内信用证审单时,如果合同变更或者其他原因需要对信用证进行修改,可以由申请人或受益人提出申请,并经银行批准后进行修改。

这样在实际操作时更加灵活,便于及时应对各种变化和风险。

此外,信用证审单的电子化趋势也越来越明显。

随着信息技术的发展,越来越多的信用证审单过程在网络上进行,实现了电子单证的使用和存储,极大地提高了效率。

同时,也要求受益人在使用电子单证时要准确无误地填写信息,并按照规定的程序进行操作。

最后,对于违约行为的处罚更加严厉。

在国内信用证审单中,如发现任何违约行为,银行将对其予以处罚。

这些处罚措施包括对违约方的黑名单记录、限制其信用证使用等等,以保证信用证的适当使用和买卖双方的利益。

总之,国内信用证审单规则的变化主要体现在核查要求的严格性、单证格式的统一性、修改机制的灵活性、电子化趋势的明显性以及违约行为处罚的严厉性等方面。

这些规则的完善与优化将有助于确保信用证的合理使用,保护买卖双方的权益,促进国内贸易的发展。

信⽤证审核1信⽤证审核1题⽬要求和说明合同SALES CONTRACTThe sellers:SHANGHAI SHENG DA CO.LTDUNIT C 5/F JINGMAO TOWERSHANGHAI, CHINA NO.SD080215The buyers:ALFAGA ENTERPRISE28, IMAMGONJDHAKA, BANGLADESHDATA: Feb.15, 2008Signed at: Shanghai, ChinaThe undersigned Seller and Buyer have agreed to close the following transactions according to the terms and conditions stipulated bellow:Packing:In CartonsShipping Mark:A.E. CHITTAGONGTime ofshipment:During May, 2008Partial Shipment and Transshipment are allowed. Insurance: To be effected by the buyerT erms of Payment:he Buyer shall open through a bank acceptable to the Seller an Irrevocable Sight Letter of Credit to reach the Sellers 30 days before the month of shipment .V alid for negotiation in China until the 15th day after the month of shipment.The Seller:SHANGHAI SHENG DA CO., LTDThe Buyer:ALFAGA ENTERPRISE信⽤证LETTER OF CREDITSEQUENCE OF TOTAL27: 1 / 1FORM OF DOC. CREDIT 40 A: IRREVOCABLEDOC. CREDIT NUMBER 20: 06660801DA TE OF ISSUE 31 C: FEBRUARY 24,2008APPLICABLE RULES 40 E:UCP LATEST VERSIONDA TE AND PLACE OF EXP. 31 D:MAY 23,2008 IN BANGLADESHAPPLICANT 50: ALFAGA ENTERPRSE26,IMAMGONJDHAKA,BANGLADESHISSUING BANK 52 A: AB BANK LIMITEDIMAMGANJ BRANCH,40 IMAMGANJ,DHAKA-1211,BANGLADESH BENEFICIARY 59: SHANGHAI DA SENG CO.,LTD.UNIT C 5/F JINGMAO TOWERSHANGHAI,CHINAAMOUNT 32 B: CURRENCY HKD AMOUNT 9800.00 AVAILABLE WITH/.BY …41 D: ANY BANK IN CHINA,BY NEGOTIATIONDRAFTS A T... 42 C: DRAFTS A T 60 DAYS SIGHTFOR 100PCT INVOICE VALUEDRAWEE 42 D: AB BANK LIMITED,IMAMGANJ BRANCH PARTIAL SHIPMENT 43 P: NOT ALLOWED TRANSSHIPMENT 43 T: NOT ALLOWEDLOADING/DISPA TCHING/TAKING 44 A: ANY CHINESE PORTSLETTER OF CREDITFOR TRANSPORT TO…44 B: CHITTAGANG SEA PORT,BANGLADESHLA TEST DATE OF SHIPMENT 44 C: MAY 2,2008DESCRIPT OF GOODS. 45 A: TAPE RULES(1)2000 DOZ PAIR MDEL:JH-395WSIZE:3M X 16MM@HKD3.6 PER DOZEN CIF CHITTAGONG(2)500 DOZ PAIR MODEL:JH-386WSIZE:3M X 16MM@HKD4.2 PER DOZEN CIF CHITTAGONGPACKING:EXPORT STANDARD SEAWORTHY PACKINGDOCS REQUIRED 46 A: +SIGNED COMMERCIAL INVOICE IN TRIPLICA TE+ SIGNED PACKING LIST IN TRIPLICA TE+G.S.P. CERTIFICA TE OF ORIGIN FORM A+BENEFICIARY’S CERTIFICATE STATING THA T ONE SET OF ORIGINALSHIPPING DOCUMENTS INCLUDING O RIGINAL “FORM A” HAS BEENSENT DIRECTLY TO THE APPLICANT AFTER THE SHIPMENT.+INSURANCE POLICY OR CERTIFICA TE ENDORSED IN BLANK FOR 110PCT OF CIF VALUE,COVERING W.P.A. RISK AND WAR RISK+3/3 PLUS ONE COPY OF CLEAN “ON BOARD” OCEAN BILLS OF LADINGMADE OUT TO ORDER AND BLANK ENORSED MARKED “FREIGHTCOLLECT” AND NOTIFY APPLICANT.ADDITIONAL CONDITION 47 A: +ALL DRAFTS DRAWN HEREUNDER MUST BE MARKED “DRAWN UNDER AB BANK LIMITED,IMAMGANJ BRANCH CREDIT No.06660801 DA TEDFEBRUARY 24,2008”+T/T REIMBURSEMENT IS NOT ACCEPTABLEDETAILS OF CHARGES 71 B: ALL BANKING CHARGES OUTSIDE BANGLADESH ARE FOR BENEFICIARY’S ACCOUNTPRESENTA TION PERIOD48: DOCUMENTS MUST BE PRESENTED WITHIN 15 DAYS AFTER THE DA TE OF ISSUANCE OF THE SHIPPING DOCUMENTS BUT WITHIN THEVALIDITY OF THE CREDITCONFIRMA TION49: WITHOUT78: THE AMOUNT AND DA TE OF NEGOTIA TION OF EACH DRAFT MUST BEENDORSED ON THE REVERSE OF THIS CREDITALL DOCUMENTS INCLUDING BENEFICIARY’S DRAFTS MUST BE SENTBY COURIER SERVICE DIRECTLY TO US IN ONE LOT. UPON OURRECEIPT OF THE DRAFTS AND DOCUMENTS WE SHALL MAKEPAYMENT AS INSTRUCTED BY YOU审核结果信⽤证审核结果信⽤证审核2题⽬要求和说明售货确认书SALES CONFIRMATION卖⽅(Sellers):Contract No.: AB44001 GUANGDONG FOREIGN TRADE IMP.AND EXP. CORPORA TION Date:FEB.12,2009 267 TIANHE ROAD GUANGZHOU,CHINA Signed at: GUANGZHOU买⽅(Buyers):A.B.C. TRADING CO. LTD., HONGKONG312 SOUTH BRIDGE STREET,HONGKONG兹经买卖双⽅同意按下列条款成交:The undersigned sellers and buyers have agreed to close the following transactionsWith 5 % more or less both in amount an quantity allowed at the seller’s option.总值Total V alue: HKD 1000000.00(H. K. Dollars ONE MILLION ONLY)包装Packing: 1 PC PER CARTON装运期Time of Shipment: APR. 30,2009装运⼝岸和⽬的地Loading port & Destination: FROM GUANGZHOU TO DUBAI保险由卖⽅按发票全部⾦额110%投保⾄为⽌的险。

SWIFT网络代码(一)几个交易类型名称及编码(1)认证 (MT001)认证包括签到与签退两个业务类型。

(2)开户(MT002)开户是为了实现建立证券端资金账户和银行账户之间的对应关系,包括开设资金账户或开设股票账户并建立对应关系。

(3)账户管理(MT003)账户管理包括:销户、冻结、解冻等业务类型。

(4)换卡管理(MT004)换卡管理包括更换银行卡、更换证券卡等业务类型。

(5)投资者资料修改(MT005)投资者资料修改包括:修改个人信息、修改代理人信息、修改机构信息、修改证券端投资者信息、修改银行端投资者信息等业务类型。

(6)转账请求(MT006)转账请求用来传递一个资金转账指令,转账请求由发起投资者指定的金融机构发送,直接或者通过中间机构,送给受益投资者所在的金融机构。

转账请求用来作净支付。

不能用于作支票,汇款,或者分步执行的交易。

(7)转账回执(MT 007)转账回执用作转账MT 006的回应。

(8)对账信息(MT008)对账用于请求进行明细对账或汇总对账。

对账可以由银行端发出,或证券端发出,接受方接受到MT008后应返回对账回执MT009(明细对账、汇总对账)。

(9)对账回执(MT 009)MT009用于反馈对账请求(MT008) 的请求,向传送方传送指定账户账目发生明细,合计等。

(10)查询信息(MT010)查询包括:查询资金信息、查询投资者基本信息、查询资金发生流水。

(11)查询回执(MT011)用来回应MT010的查询,包括:回答资金信息、回答投资者基本信息、回答资金发生流水、回答行情信息、回答股票余额等业务类型。

(二)MT760Swift MT760是一种银行对银行的发出的信息,用于为保证乙方在乙银行的利益,由甲银行向乙银行开出的或者被申请开出的银行保函。

根据MT760开出的保证,对甲银行的资金,封存并用做担保风险。

MT760是经对相关单证的检验,确认,查证并发送到你方后产生的一种付款责任。

7-信用证基本内容解读及审核要点单选题•1、信用证的特别条款不包括()。

(12.5 分)✔A汇率条款✔B软条款✔C电索条款✔D硬条款正确答案:D多选题•1、信用证格式项目主要包括了信用证的()。

(12.5 分)A形式B号码C当事人的名称和地址D信用证金额与币种正确答案:A B C D•2、常见的信用证的支付方式包括()。

(12.5 分)A即期付款B延期付款C承兑D议付正确答案:A B C D•3、在商品运输条款方面,需要重点关注的项目是()。

(12.5 分)A港口名称B是否转运C最迟装运日D唛头正确答案:A B C•4、信用证中,最重要的几项单据包括()。

(12.5 分)A商业发票B运输单据C保险单据D港口名称正确答案:A B C判断题•1、一切信用证应该是不可撤销的,即使对此未作出指示也是如此。

( )(12.5 分)✔A正确✔B错误正确答案:正确•2、装运日是指货物装运完毕的截止日期,而非开始装运的日期。

()(12.5 分)✔A正确✔B错误正确答案:正确•3、运输单据中最常用及最重要的单据是海运提单。

()(12.5分)✔A正确✔B错误正确答案:正确。

练习题一:1、请根据所给合同审核信用证SHANGHAI LIGHT INDUSTRIAL PRODUCTS IMPORTANG EXPORT CORPORATIONSALES CONFIRMATION128 Huqiu road Shanghai ChinaTele:86-21-23140568Fax:86-21-25467832TO:CONSOLIDATORS LIMITED NO:PLW253RM.13001-13007E,13/F, DATE:Sept.15,2003ASUA TERMINALS CENTER B.BERTH 3,KWAI CHUNG,N.T.,HONGKONGP.O.Box 531 HONGKONGWe hereby confirm having sold to you the following goods on terms and conditionsas stated belowNAME OF COMMODITY: Butterfly Brand Sewing MachineSPECIFICATION: JA-115 3 Drawers Folding CoverPACKING: Packed in wooden cases of one set each.QUANTITY: Total 5500setsUNIT PRICE: US$ 64.00 per set CIFC3% H.K.TOTAL AMOUNT: US$ 352000.00(Say U.S. dollars three hundred and fifty two thousand only.)SHIPMENT: During Oct./Nov. 2003 from Shanghai to H.K. with partialShipments and transshipment permitted.INSURANCE: To be covered by the seller for 110% of total invoice value against All risks and war risks as per the relevant ocean marine cargoclauses of the People’s Insurance Company of China datedJanuary 1st,1981.PAYMENT: The buyer should open through a bank acceptable to the seller anIrrevocable Letter of Credit at 30 days after sight to reach theSeller 30 days before the month of Shipment valid for negotiationin China until the 15th day after the date of shipment.REMARDS: Please sign and return one copy for our file.The Buyer: The Seller:CONSOLIDATORS LIMITED SHANGHAI LIGHT INDUSTRIAL PRODUCTSIMPORT & EXPORT CORPORATION信用证HONGKONG & SHANGHAI BANKING CORPORATIONQUEEN’S ROAD CENTERAL,P.O.BOX 64,H.K.TEL:822-1111 FAX:810-1112Advised through: Bank of China, NO. CN3099/714Shanghai Branch, DATE Oct.2,2003 H.K.To:Shanghai Light Industrial ProductsImport & Export Corp.128 HUQIU ROADSHANGHAI, CHINADear Sirs:We are pleased to advise that for account of Consolidators Limited,H.K.,wehereby open our L/C No. CN3099/714 in your favour for a sum not exceeding aboutUS$ 330000.00(Say US Dollars Three Hundred Thirty Thousand only) available by yourdrafts on HSBC at 30 days after date accompanied by the following documents:1.Signed commercial invoice in 6 copies.2.Packing List in quadruplicate.3.Full set of (3/3) clean on board Bs/L issued to our order notify the abovementioned buyer and marked “Freight Collect”dated not later than October31,2003.From Shanghai to Hongkong, Partial shipment are not permitted and trans-shipment is not permitted.4.Insurance policy in 2 copies covering C.I.C for 150% invoice value against All risks and war risks as per the relevant ocean marine cargo clauses of the People’sInsurance Company of China dated January 1st,1981.5.Certificate of Origin issued by China Council for the Promotion ofInternational Trade.DESCRIPTION GOODS:5500 sets Sewing Machine Art.No. JA-115 packed in wooden cases or cartons eachat US$ 64.00 CIF H.KDrafts drawn under this credit must be marked “drawn under HSBC,H.K.,”bearingthe number and date of this credit.We undertake to honour all the drafts drawn in compliance with the terms of thiscredit if such drafts to be presented at our counter on or before Oct. 31,2003.SPECIAL INSTRUCTIONS:(1)Shipment advice to be sent by telefax to the applicant immediately after theshipment stating our L/C No.,shipping marks,name of the vessel, goods descriptionand amount as well as the bill of lading No. and date. A copy of such advice mustaccompany the original documents presented for negation.(2)The negotiating bank is kindly requested to forward all documents tous(HONGKONG & SHANGHAI BANKING CORPORATION QUEEN’S ROAD CENTERAL,P.O.BOX 64,H.K.)inone lot by airmail.It is subject to the Uniform Customs and Practice for Documentary Credits (1993)Revision,International Chamber of Commerce Publication No.500.Yours faithfullyFor HONGKONG & SHANGHAI BANKING CORPORATION2、以海运为例,简述出口单证工作的流程图。

根据合同内容审核信用证,指出不符之处并提出修改意见。

SALES CONTRACT

THE SELLER: NO. YH08039 SHANDONG YIHAI IMP. & EXP. CO.,L TD. DATE: DEC.1, 2008 NO. 51 JINSHUI ROAD, QINGDAO, CHINA SIGNED AT:

QINGDAO,CHINA

THE BUYER:

LINSA PUBLICIDAD, S.A.

V ALENCIA, 195 BAJOS. 08011. BARCELONA, SPAIN

This Sales Contract is made by and between the Sellers and the Buyers, whereby the sellers agree to sell and the buyers agree to buy the under-mentioned goods according to the terms and conditions stipulated below:

Packing: 1PC/POL YBAG, 500PCS/CTN Shipping Mark: L.P. Time of Shipment: DURING JAN. 2009 BY SEA BARCELONA

NOS.1-26 Loading Port and Destination: FROM QINGDAO TO BARCELONA

Partial Shipment and Transshipment: ALLOWED

Insurance: TO BE EFFECTED BY THE BUYER.

Terms of Payment: THE BUYER SHALL OPEN THROUGH A BANK ACCEPTABLE TO THE SELLER AN IRREVOCABLE SIGHT LETTER OF CREDIT TO

REACH THE SELLER 30 DAYS BEFORE THE MONTH OF

SHIPMENT AND TO REMAIN V ALID FOR NEGOTIATION IN

CHINA UNTIL THE 15th DAY AFTER THE FORESAID TIME OF

SHIPMENT.

DOCUMENTARY CREDIT

27: SEQUENCE OF TOTAL:1/1

40A: FORM OF DOC.CREDIT :IRREVOCABLE

20: DOC.CREDIT NUMBER :103CD137273

31C: DATE OF ISSUE :081215

40E: APPLICABLE RULES :UCP LATEST VERSION

31D: DATE AND PLACE OF EXPIRY :DATE 090202 PLACE IN SPAIN

51D:APPLICANT BANK:BANCO SANTANDER, S.A.

28660 BOADILLA DEL BARCELONA, SPAIN

50: APPLICANT :LINSA PUBLICIDAD, S.A.

V ALENCIA, 195 BAJOS. 08011. BARCELONA, SPAIN

59: BENEFICIARY :SHANDONG YIHAN IMP. & EXP. CO., LTD.

NO. 51 JINSHUI ROAD, QINGDAO, CHINA

32B: AMOUNT :CURRENCY EUR AMOUNT 19250.00

41A:A V AILABLE WITH…BY ANY BANK IN CHINA BY NEGOTIATION

42C:DRAFTS AT…30 DAYS AFTER SIGHT

42A:DRAWEE :LINSA PUBLICIDAD, S.A.

43P:PARTIAL SHIPMTS:NOT ALLOWED

43T:TRANSSHIPMENT:NOT ALLOWED

44E:PORT OF LOADING:ANY CHINESE PORT

44F:PORT OF DISCHARGE :V ALENCIA, SPAIN

44C:LATEST DATE OF SHIPMENT:090115

45A:DESCRIPTION OF GOODS

GOODS AS PER S/C NO. YH08036 DATED ON DEC. 1,

2008 CARDHOLDER DYED COW LEATHER

BLACK COLOUR/8000PCS AT USD1.45/PC FOB

QINGDAO BROWN COLOUR/5000PCS AT USD1.50/PC

FOB QINGDAO PACKING: 200PCS/CTN

46A:DOCUMENTS REQUIRED

1.SIGNED COMMERCIAL INVOICE IN 3 COPIES

2.CERTIFICATE OF ORIGIN GSP FORM A ISSUED BY OFFICIAL AUTHORITIES

3.PACKING LIST IN 3 COPIES

4.FULL SET CLEAN ON BOARD BILLS OF LADING MADE OUT TO ORDER

MARKED FREIGHT PREPAID AND NOTIFY APPLICANT

5.INSURANCE POLICY/CERTIFICATE IN DUPLICATE ENDORSED IN BLANK FOR

110% INVOICE V ALUE COVERING ALL RISKS AND WAR RISK AS PER CIC.

47A: ADDITIONAL CONDITIONS

BILL OF LADING ONLY ACCEPTABLE IF ISSUED BY ONE OF THE FOLLOWING SHIPPING COMPANIES: KUEHNE-NAGEL (BLUE ANCHOR LINE) VIL TRANS (CHINA) INT’L FORWARDING L TD. OR VIL TRANS SHIPPING (HK) CO., LTD.

71B: CHARGES:ALL CHARGES ARE TO BE BORN BY BENEFICIARY

48: PERIOD FOR PRESENTA TION:WITHIN 5 DAYS AFTER THE DATE OF SHIPMENT, BUT WITHIN THE V ALIDITY OF THIS CREDIT

49: CONFIRMATION INSTRUCTION:WITHOUT

根据合同审证,指出不符之处并提出修改意见:。