国际会计_第2章

- 格式:ppt

- 大小:224.00 KB

- 文档页数:60

国际会计准则的发展历程和特点引言国际会计准则(International Financial Reporting Standards,缩写为IFRS)是全球范围内适用的会计准则。

随着全球化的发展,越来越多的国家和地区采用国际会计准则,以实现全球金融报告的一致性和可比性。

本文将探讨国际会计准则的发展历程和其特点。

第一章国际会计准则的起源国际会计准则的历史可以追溯到20世纪70年代,当时国际商会(International Chamber of Commerce,缩写为ICC)成立了一个特别的委员会,致力于制定全球会计准则。

该委员会最终于1973年发布了第一套国际会计准则(International Accounting Standards,缩写为IAS)。

第二章国际会计准则委员会的成立为了进一步推动全球会计准则的发展,国际会计准则委员会(International Accounting Standards Board,缩写为IASB)于2001年成立。

IASB的主要任务是制定和发布国际财务报告准则,取代之前由国际会计准则委员会制定的IAS。

第三章国际会计准则的发展历程国际会计准则的发展历程可以分为三个阶段:过渡阶段、收敛阶段和一体化阶段。

过渡阶段是从1973年到2001年,这个阶段主要由国际会计准则委员会(IASC)制定和发布会计准则。

这些准则被称为国际会计准则(IAS),被广泛应用于全球范围内的金融报告。

收敛阶段是从2001年到2011年,这个阶段是国际会计准则委员会(IASB)与美国财务会计准则委员会(Financial Accounting Standards Board,缩写为FASB)合作的结果。

两个组织致力于将国际会计准则与美国通用会计准则(Generally Accepted Accounting Principles,缩写为GAAP)接近。

一体化阶段是从2011年开始,国际会计准则已经成为全球范围内的主要会计准则。

国际会计准则ias国际会计准则(IAS)是全球范围内被广泛采纳的会计准则体系,旨在规范企业的财务报告和财务信息披露,以提高国际间财务信息的可比性和透明度。

本文将深入研究国际会计准则IAS,探讨其在全球范围内的应用情况、影响因素以及未来发展趋势。

第一章:国际会计准则IAS的概述本章将介绍国际会计准则IAS的发展历程、目标和主要内容。

首先,我们将回顾IAS的起源和发展历程,探讨其在全球范围内逐渐被采纳和应用的原因。

然后,我们将详细介绍IAS体系中包含的主要标准以及其对企业财务报告和信息披露所起到的作用。

第二章:国际会计准则IAS在全球范围内的应用情况本章将分析国际会计准则IAS在不同地区、不同类型企业中的应用情况。

我们将比较不同地区对于IAS采纳程度以及对于标准具体内容实施程度之间存在差异,并分析背后的原因。

此外,我们还将探讨IAS 在跨国公司和上市公司中的应用情况,以及IAS在发展中国家中的推广和应用挑战。

第三章:国际会计准则IAS的影响因素本章将探讨影响国际会计准则IAS应用和发展的因素。

我们将分析领导法规、金融市场、企业需求以及会计专业人员等方面对于IAS应用的影响。

此外,我们还将研究跨国公司和上市公司对于IAS采纳与实施的动机和挑战。

第四章:国际会计准则IAS与企业财务报告质量本章将研究国际会计准则IAS对企业财务报告质量的影响。

我们将分析采用IAS后企业财务报告中信息披露程度、信息可比性以及透明度等方面是否有所提高,并探讨其对投资者决策、债权人信任以及金融稳定性等方面所产生的影响。

第五章:未来发展趋势与挑战本章将展望未来国际会计准则IAS的发展趋势与面临挑战。

我们将分析全球范围内对于会计准则的统一需求以及与国际会计准则IAS的关系。

此外,我们还将探讨新兴领域和技术对于IAS的应用和发展所带来的挑战,如数字经济、云计算以及人工智能等。

结论本文通过对国际会计准则IAS的深入研究,全面探讨了其在全球范围内的应用情况、影响因素以及未来发展趋势。

第二章国际会计准则第1号——财务报表的列报1.[识记]国际会计准则第1号的制定宗旨是什么?国际会计准则第1号的制定,其宗旨是明确制定通过财务报表编制的基础,以保证某一经济主体的财务报表与其自身不同时间的财务报表及不用行业或经济主体的财务表别的可比性,在第1号准则中说明了财务报表报告的整体要求,规定财务报表结构及财务报表的基本标准。

2.[识记]核心会计准则的含义是什么?核心会计准则就是指以在国际资本市场上市财务报告披露、编报为目标,开展会计准则制定工作而产生相关的一系列会计准则。

3.[领会]财务报表列报准则使用的范围有哪些?(1)用于按照国际会计准则要求编制的所有通用的财务报表的列示。

(2)通过财务报表的含义是指为无特定要求的使用者编辑的财务报表。

(3)财务报表列表准则也适用与银行、保险等在内的企业。

(4)财务会计列报准则是反映以经营为目的,并实现利润最大化为目标的盈利性企业,其有关术语是盈利企业财务报表为对象。

4.[识记]因对财务会计目标定位的不同,形成了哪些流派?(1)受托责任学派; (2)决策有用学派。

5.[领会]会计准则制定中的不同利益集团包括哪些?(1)政府; (2)普通投资者; (3)债权人; (4)经营者6.[识记]利益集团的含义是什么?对会计信息产生需求的内在因素是需求者的利益,而这些利益者我们称之为“利益集团”,利益集团一般是指外部集团。

7.[识记]企业外部利益集团,主要包括哪些?一、企业外部投资者。

二、企业债权人,包括:1、资金债权人2、商品债权人8.[识记]债权人可以分为哪几类?(1)商业债权人:商业债权人是企业的供货商。

(2)资金债权人:资金债权人可以是金融机构、银行、企业债券的持有人。

9.[识记]在财务报表列报准则中的不确定事项包括哪些?( 1 ) 决定企业经营业绩的主要因素和影响,包括企业所面临的市场环境的变化,以及企业为维持和提高经营业绩而采取的投资政策和公司的股利政策;(2)企业融资来源、负债经营政策及风险管理策略;(3)按照国际会计准则编制的资产负债表未能包括在内反映企业价值的资源。

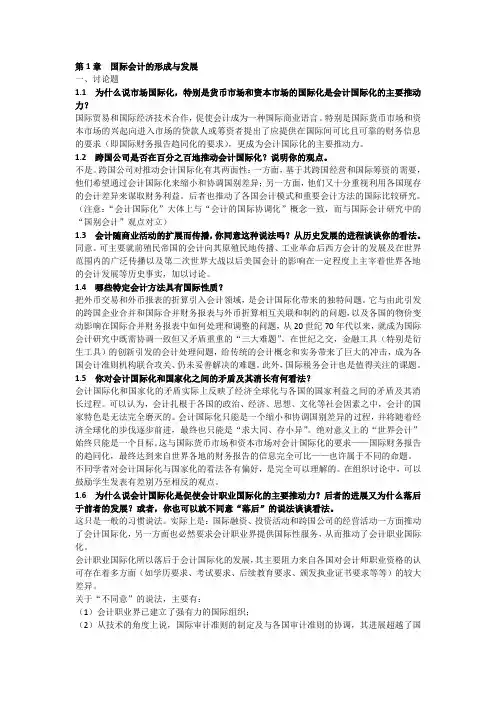

第1章国际会计的形成与发展一、讨论题1.1 为什么说市场国际化,特别是货币市场和资本市场的国际化是会计国际化的主要推动力?国际贸易和国际经济技术合作,促使会计成为一种国际商业语言。

特别是国际货币市场和资本市场的兴起向进入市场的贷款人或筹资者提出了应提供在国际间可比且可靠的财务信息的要求(即国际财务报告趋同化的要求),更成为会计国际化的主要推动力。

1.2 跨国公司是否在百分之百地推动会计国际化?说明你的观点。

不是。

跨国公司对推动会计国际化有其两面性:一方面,基于其跨国经营和国际筹资的需要,他们希望通过会计国际化来缩小和协调国别差异;另一方面,他们又十分重视利用各国现存的会计差异来谋取财务利益。

后者也推动了各国会计模式和重要会计方法的国际比较研究。

(注意:“会计国际化”大体上与“会计的国际协调化”概念一致,而与国际会计研究中的“国别会计”观点对立)1.3 会计随商业活动的扩展而传播,你同意这种说法吗?从历史发展的进程谈谈你的看法。

同意。

可主要就前殖民帝国的会计向其原殖民地传播、工业革命后西方会计的发展及在世界范围内的广泛传播以及第二次世界大战以后美国会计的影响在一定程度上主宰着世界各地的会计发展等历史事实,加以讨论。

1.4 哪些特定会计方法具有国际性质?把外币交易和外币报表的折算引入会计领域,是会计国际化带来的独特问题。

它与由此引发的跨国企业合并和国际合并财务报表与外币折算相互关联和制约的问题,以及各国的物价变动影响在国际合并财务报表中如何处理和调整的问题,从20世纪70年代以来,就成为国际会计研究中既需协调一致但又矛盾重重的“三大难题”。

在世纪之交,金融工具(特别是衍生工具)的创新引发的会计处理问题,给传统的会计概念和实务带来了巨大的冲击,成为各国会计准则机构联合攻关、仍未妥善解决的难题。

此外,国际税务会计也是值得关注的课题。

1.5 你对会计国际化和国家化之间的矛盾及其消长有何看法?会计国际化和国家化的矛盾实际上反映了经济全球化与各国的国家利益之间的矛盾及其消长过程。

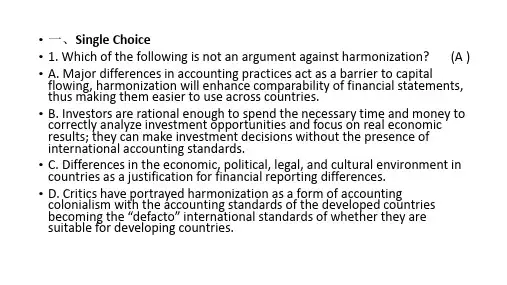

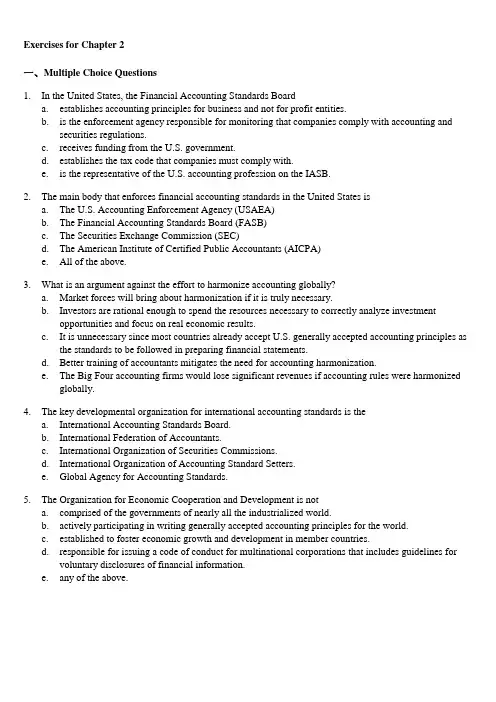

Exercises for Chapter 2一、Multiple Choice Questions1.In the United States, the Financial Accounting Standards Boarda. establishes accounting principles for business and not for profit entities.b. is the enforcement agency responsible for monitoring that companies comply with accounting andsecurities regulations.c. receives funding from the U.S. government.d. establishes the tax code that companies must comply with.e. is the representative of the U.S. accounting profession on the IASB.2. The main body that enforces financial accounting standards in the United States isa. The U.S. Accounting Enforcement Agency (USAEA)b. The Financial Accounting Standards Board (FASB)c. The Securities Exchange Commission (SEC)d. The American Institute of Certified Public Accountants (AICPA)e. All of the above.3. What is an argument against the effort to harmonize accounting globally?a. Market forces will bring about harmonization if it is truly necessary.b. Investors are rational enough to spend the resources necessary to correctly analyze investmentopportunities and focus on real economic results.c. It is unnecessary since most countries already accept U.S. generally accepted accounting principles asthe standards to be followed in preparing financial statements.d. Better training of accountants mitigates the need for accounting harmonization.e. The Big Four accounting firms would lose significant revenues if accounting rules were harmonizedglobally.4. The key developmental organization for international accounting standards is thea. International Accounting Standards Board.b. International Federation of Accountants.c. International Organization of Securities Commissions.d. International Organization of Accounting Standard Setters.e. Global Agency for Accounting Standards.5. The Organization for Economic Cooperation and Development is nota. comprised of the governments of nearly all the industrialized world.b. actively participating in writing generally accepted accounting principles for the world.c. established to foster economic growth and development in member countries.d. responsible for issuing a code of conduct for multinational corporations that includes guidelines forvoluntary disclosures of financial information.e. any of the above.6. Which of the following organizations is directly involved with developing, publishing, and advocating theuse of financial accounting standards?a. American Institute of Certified Public Accountantsb. Organization for Economic Cooperation and Development.c. Nordic Federation of Accountants.d. International Accounting Standards Board.e. International Federation of Accountants.7. Which of the following organizations is directly involved with developing, publishing, and advocating theuse of international auditing standards?a. International Accounting Standards Board.b. Institute of Chartered Accountants of England and Wales.c. United Nations.d. Asean Federation of Accountants.e. International Federation of Accountants.8. Which of the following organizations is directly involved with harmonizing accounting and auditingstandards?a. International Accounting Standards Board.b. Securities and Exchange Commission.c. American Accounting Association.d. International Federation of Accountants.e. Both (a) and (d).9. Global harmonization of accounting principles does not require:a. Complete uniformity in accounting principles globally.b. That differences in accounting standards between countries be kept at a minimum.c. That difference in accounting rules may exist in different countries as long as they can be reconciled.d. That one supra-national organization enforce global standards in all countries.e. Both (a) and (d).10. Current proponents of harmonizing accounting standards globally area. Investors.b. Multinational companies.c. The securities industry and stock exchanges.d. Developing countries.e. All of the above.11. The International Federation of Accountants (IFAC) is not involved in:a. harmonizing global auditing practices.b. providing ethical guidelines for auditors on issues such as integrity and objectivity.c. establishing public sector standards applicable to all levels of government.d. maintaining auditor independence in today's complex business environment.e. administering a worldwide uniform examination for auditors.12. The "world class issuer" approach to global accounting harmonization is not very promising because:a. it is opposed by the U.S. Securities and Exchange Commission.b. there are difficulties in establishing and agreeing upon the criteria for inclusion.c. it faces strong opposition by U.S. companies.d. there are practical difficulties in implementation.e. of all of the above.13. The G4+1 originally consisted of accounting standard-setters from the following countries plus theInternational Accounting Standards Committee:a. Australia, Canada, New Zealand, and the United Kingdomb. Bangladesh, India, Pakistan, and Sri Lankac. Indonesia, Japan, Korea, and Malaysiad. Australia, Canada, the United Kingdom and the United Statese. None of the above.14. The different types of articles found in European Union (EU) directives include:a. uniform rules to be implemented in all member countriesb. minimum rules that may be strengthened by individual governmentsc. alternative rules which give member states choicesd. All of the abovee. Only (a) and (b)15. The European Union (EU) has adopted a number of directives dealing with accounting matters. Which EUdirectives are generally regarded as the most significant on accounting issues?a. The First and Second directivesb. The Fourth and Seventh directivesc. The Second and Fourth directivesd. The Third and Seventh directivese. The Fifth and Sixth directives16. The overall lack of success of the European accounting harmonization effort can be attributed to:a. The scope of the EU directives is technically incomplete with a number of accounting topics not beingdirectly covered.b. The directives were unevenly adopted into individual national legislation.c. The directives were static instruments that were not updated and lacked quality improvementmechanisms.d. Compliance with EU accounting rules did not prove to be sufficient to enter global capital markets.e. All of the above.17. Which of the following statements best describes accounting harmonization in Europe?a. It has been a tremendous success and is being closely studied by other regional alliances.b. There is considerable evidence of accounting harmonization among EU countries.c. The EU has decided to turn to the IASB to achieve accounting harmonization.d. The ASEAN countries are following the EU model of accounting harmonization.e. Annual reports of companies from France, Germany, and the United Kingdom have becomestandardized as a result of the European accounting harmonization initiative.18. The necessary conditions that can make regional accounting harmonization a policy objective among agroup of countries include:a. An articulated rationale and a set of values that facilitate regional accounting harmony.b. A high level of economic integration.c. A political infrastructure to pursue harmonization within a broad policy framework.d. The economic and political clout to develop a regional vision without the fear of being marginalized inthe global arena.e. All of the above.19. The reasons why regional accounting harmonization has not been seriously pursued by the membercountries of the Association of Southeast Asian Nations (ASEAN) are:a. ASEAN has not been able to articulate a clear rationale for why regional accounting harmonization isa preferred course of action for its member countries.b. ASEAN lacks a political infrastructure to pursue harmonization within a broad policy framework.c. ASEAN countries are mainly developing countries with young accounting traditions and face greaterrisks of being marginalized in the global arena by developing their distinct regional system.d. ASEAN countries are not sufficiently integrated economically to warrant regional accountingharmonization.e. All of the above.20. Which of the following countries was not a signatory of the Treaty of Rome of 1957 which led to theformation of the European Economic Community?a. The Netherlandsb. Francec. Italyd. Luxembourge. The United Kingdom二、True/False Questions1.When accounting standards vary around the world, the inherent reliability of financial statements will alsovary.2. Accounting harmonization is the process by which differences in financial reporting practices amongcountries are reduced in order to make financial statements more comparable and decision-useful across countries.3. The primary economic rationale for accounting harmonization is that major differences in accountingpractices act as a barrier to capital flowing to the most efficient users.4. There is a concern that some developing countries might adopt international accounting standards to gainglobal respectability for their financial reporting without considering whether these standards are suitable for their economies.5. Most developing countries have the time and the resources to develop their own indigenous accountingstandards.6. The adoption of international accounting standards in countries is a purely technical matter that is notsubject to political lobbying.7. Politically it is easier for countries to adopt external standards promulgated by a supranational organizationsuch as the IASB rather than to adopt the standards of another country.8. The World Bank and United Nations recently opined that the inconsistent application of auditing standardsaround the world adversely affects the comparability of financial statements from one country to the next.9. The International Accounting Standards Board was formed to develop global accounting standards;compliance with IASB standards is mandatory worldwide.10. Non-U. S. firms that issue securities in the United States must abide by the rules of the SEC.11. The Organization for Economic Cooperation and Development issues accounting directives which have thefull weight of law behind them.12. In international accounting, harmonization is a movement away from total diversity while standardizationis a movement towards uniformity.13. In international accounting, harmonization and standardization are states while harmony and uniformityare processes.14. The IASC's early standards were criticized for being too narrow and for allowing too few alternatives.15. In the 1970s, a United Nations committee produced a list of financial and non-financial disclosures (to beprovided by MNCs) which were heartily endorsed by most industrialized countries.16. The Multijurisdictional Disclosure System negotiated between Canada and the United States represe nts avery promising model for global accounting harmonization.17. The New York Stock Exchange strongly opposes the "world class issuer" approach to global accountingharmonization.18. The G4+1 presently consisted of standard-setters from Australia, Canada, New Zealand, the UnitedKingdom, the United States and the International Accounting Standards Committee.19. The basic objective of the European Union (EU) is to bring about a common market which allows for thefree mobility of capital, goods and people between member countries.20. Of the European Union (EU) directives, the Fourth Directive and the Seventh Directive are generallyregarded as the most significant on accounting matters.21. The European accounting harmonization effort has been a resounding success and is being copied in Asiaand Africa.22. The ASEAN countries have followed the regional harmonization paradigm modeled after the EuropeanUnion (EU) rather than the global harmonization paradigm represented by international accountingstandards.23. The global accounting harmonization paradigm makes more sense for ASEAN countries than the regionalharmonization paradigm because ASEAN countries are more dependent economically on their global trading partners than on other ASEAN member countries.24. Japan, Korea, Singapore, and Thailand have harmonized their accounting as a result of their membership inthe Association of Southeast Asian Nations (ASEAN).25. Global accounting harmonization has not been pursued in ASEAN because the requisite conditions thatwould make it an important policy objective are not present.。

国际会计准则建造合同《国际会计准则:建造合同》第一章总则1.1 本准则规定了建造合同的会计处理原则和方法,适用于所有从事建造业务的企业。

1.2 本准则适用于所有形式的建造合同,包括固定价格合同、成本加成合同、固定时间合同等。

1.3 本准则不适用于建筑产品的购买、销售和租赁业务。

第二章建造合同的识别和初始计量2.1 企业应当根据合同的性质、条款和实际情况,识别合同是否为建造合同。

2.2 建造合同的初始计量应按照合同成本预计总收益的方法进行。

2.3 企业应当根据合同的条款和实际情况,确定合同的成本和收益。

第三章建造合同的会计处理3.1 建造合同的会计处理应当采用完成合同法或比例合同法。

3.2 完成合同法是指企业在合同完成时,根据实际发生的成本和合同总收益,确认合同收入和费用。

3.3 比例合同法是指企业根据合同完成的百分比,按照预计的总成本和总收益,确认合同收入和费用。

3.4 企业应当在每个会计期间,根据合同的实际情况,调整合同收入和费用。

第四章建造合同的变更和解除4.1 企业应当根据合同的条款和实际情况,处理合同的变更和解除。

4.2 合同变更增加的收益,应当按照完成合同法或比例合同法确认。

4.3 合同解除导致的损失,应当按照合同成本预计总收益的方法进行计量。

第五章建造合同的披露和列报5.1 企业应当在财务报表中,披露建造合同的会计处理原则和方法。

5.2 企业应当在财务报表中,列报建造合同的收入、费用、利润和现金流量的相关信息。

5.3 企业应当在每个会计期间,及时更新建造合同的相关信息,确保财务报表的真实和准确。

第六章附则6.1 本准则自发布之日起实施。

6.2 本准则由国际会计准则委员会负责解释。

《国际会计》课程教学大纲课程名称:国际会计International Accounting课程编码:6361F006 学分: 2 总学时:36说明【课程简介】本课程为应用型本科会计学专业财务会计方向课程。

随着中国加入世贸组织以及经济全球化进程的加快,学生不应仅把眼光局限在国内的会计实务的处理上,更应该立足于全球角度,应对会计国际化的发展趋势,因此,本课程在会计学人才培养中有着重要位置。

作为会计学的一个独立的分支,国际会计有着自己相对独立的理论和方法体系,是一门专业性很强的课程。

通过本课程学习,培养学生利用此课程中的理论和方法分析和解决问题的能力。

【课程性质】专业方向课程【适用专业】会计学专业【教学目标】通过该课程的教学,能使学生了解国际会计产生、基本知识、发展动态和会计准则的国际协调,掌握国际比较会计、国际税务筹划的不同特点、具体要求和核算方法。

通过本课程的学习,能比较完整地掌握国际会计学的基本理论框架,并能把它们运用于实践当中。

【先修课程要求】《经济学》、《管理学》、《基础会计》、《中级财务会计》、《财务管理》、《税法》等课程。

这些课程的基本原理、理论及其分析方法,是学习本课程的基础。

【能力培养要求】可以对典型国家的会计模式进行比较,对常见的国际税务问题可以分析判断。

【学习总量】总学时36学时,其中理论36学时。

学生自主学习12学时,另行安排。

【教学方法与环境要求】教学方法:依托多媒体教学环境,在讲授基础上,结合教材思考题组织课堂讨论和主题发言。

用国际会计准则与实际业务相结合的方法帮助学生借鉴和吸收国际上一切优秀的成果;联系实际发展我国的会计准则;熟悉和掌握国际通用的商用语言。

环境要求:多媒体教室。

【学时分配】【教材与主要参考书】教材:《国际会计》,常勋;常亮,东北财经大学出版社,2015年1月,第7版参考书:【1】《国际会计前沿》,王松年,上海财经大学出版社,2013年【2】《国际会计学》,徐经长、杜胜利、陈轲,中国人民大学出版社,2015年【3】《国际会计研究》,常勋,中国金融出版社,2015年【4】《国际财务报告准则—阐释与应用》(中国版),本哈德. 裴仁斯等,上海财经大学出版社,2014年【5】《国际会计学》,[美]弗雷德里克·D. S. 乔伊、卡罗尔·安·福罗斯特、加利·K. 米克著,周晓苏、方红星译,东北财经大学出版社,2010年7月【6】《国际会计》,王建新,上海财经大学出版社,2013年5月大纲内容第一章国际会计的形成与发展【教学目的和要求】了解:(1)国际会计师大会的由来与发展(2)早期国际会计定义的区别理解:(1)市场国际化对会计国际化的影响(2)跨国公司兴起对会计国际化的影响(3)会计遗产对会计国际化的影响掌握:(1)国际会计的三大问题(2)会计职业国际化的三个层次(3)各国会计师职业资格考试的差异(4)“世界会计”观的定义(5)“国别会计”观的定义(6)“实务主义”观的定义(7)崔和缪勒的定义(8)伊克彼、麦尔科和伊利马拉夫的定义(9)国际会计的主要内容运用:(1)理论联系实际能够区分会计职业界提供国际性服务的三个层次(2)通过学习各学者的观点,能够评价和比较国际会计的不同定义【内容提要】第一节会计的国际化一、市场的国际化,特别是货币、资本市场的国际化二、跨国公司的兴起和壮大三、会计世袭遗产的国际性四、特定会计方法的国际性质五、会计的国际化与国家化第二节会计职业界的国际化一、会计职业界提供国际性服务的三个层次二、会计职业界的国际组织三、会计职业国际化的阻力第三节国际会计的定义一、国际会计学家在早期对国际会计所下的定义二、20世纪70年代国际会计研究中的三种不同观点三、20世纪80年代至90年代国际会计学家对国际会计所下的定义四、国际会计的主要内容【教学重点与难点问题】教学重点:市场国际化、特别是货币市场和资本市场的国际化,是会计国际化的最主要的推动力量;跨国公司的兴起和壮大对会计国际化的双面影响;国际会计的定义。