衍生产品市场 课后答案 第八章

- 格式:pdf

- 大小:122.26 KB

- 文档页数:8

资料范本本资料为word版本,可以直接编辑和打印,感谢您的下载金融衍生工具_课程习题答案(2)地点:__________________时间:__________________说明:本资料适用于约定双方经过谈判,协商而共同承认,共同遵守的责任与义务,仅供参考,文档可直接下载或修改,不需要的部分可直接删除,使用时请详细阅读内容第一章1、衍生工具包含几个重要类型?他们之间有何共性和差异?2、请详细解释对冲、投机和套利交易之间的区别,并举例说明。

3、衍生工具市场的主要经济功能是什么?4、“期货和期权是零和游戏。

”你如何理解这句话?习题答案1、期货合约::也是指交易双方按约定价格在未来某一期间完成特定资产交易行为的一种方式。

期货合同是标准化的在交易所交易,远期一般是OTC市场非标准化合同,且合同中也不注明保证金。

主要区别是场内和场外;保证金交易。

二者的定价原理和公式也有所不同。

交易所充当中间人角色,即买入和卖出的人都是和交易所做交易。

特点:T+0交易;标准化合约;保证金制度(杠杆效应);每日无负债结算制度;可卖空;强行平仓制度。

1)确定了标准化的数量和数量单位、2)制定标准化的商品质量等级、(3)规定标准化的交割地点、4)规定标准化的交割月份互换合约:是指交易双方约定在合约有效期内,以事先确定的名义本金额为依据,按约定的支付率(利率、股票指数收益率)相互交换支付的约定。

例如,债务人根据国际资本市场利率走势,将其自身的浮动利率债务转换成固定利率债务,或将固定利率债务转换成浮动利率债务的操作。

这又称为利率互换。

互换在场外交易、几乎没有政府监管、互换合约不容易达成、互换合约流动性差、互换合约存在较大的信用风险期权合约:指期权的买方有权在约定的时间或时期内,按照约定的价格买进或卖出一定数量的相关资产,也可以根据需要放弃行使这一权利。

为了取得这一权利,期权合约的买方必须向卖方支付一定数额的费用,即期权费。

期权主要有如下几个构成因素①执行价格(又称履约价格,敲定价格〕。

第一章1、衍生工具包含几个重要类型?他们之间有何共性和差异?2、请详细解释对冲、投机和套利交易之间的区别,并举例说明。

3、衍生工具市场的主要经济功能是什么?4、“期货和期权是零和游戏。

〞你如何理解这句话?第一章习题答案1、期货合约::也是指交易双方按约定价格在未来某一期间完成特定资产交易行为的一种方式。

期货合同是标准化的在交易所交易,远期一般是OTC市场非标准化合同,且合同中也不注明保证金。

主要区别是场内和场外;保证金交易。

二者的定价原理和公式也有所不同。

交易所充当中间人角色,即买入和卖出的人都是和交易所做交易。

特点:T+0交易;标准化合约;保证金制度〔杠杆效应〕;每日无负债结算制度;可卖空;强行平仓制度。

1〕确定了标准化的数量和数量单位、2〕制定标准化的商品质量等级、〔3〕规定标准化的交割地点、4〕规定标准化的交割月份互换合约:是指交易双方约定在合约有效期内,以事先确定的名义本金额为依据,按约定的支付率〔利率、股票指数收益率〕相互交换支付的约定。

例如,债务人根据国际资本市场利率走势,将其自身的浮动利率债务转换成固定利率债务,或将固定利率债务转换成浮动利率债务的操作。

这又称为利率互换。

互换在场外交易、几乎没有政府监管、互换合约不容易达成、互换合约流动性差、互换合约存在较大的信用风险期权合约:指期权的买方有权在约定的时间或时期内,按照约定的价格买进或卖出一定数量的相关资产,也可以根据需要放弃行使这一权利。

为了取得这一权利,期权合约的买方必须向卖方支付一定数额的费用,即期权费。

期权主要有如下几个构成因素①执行价格〔又称履约价格,敲定价格〕。

期权的买方行使权利时事先规定的标的物买卖价格。

②权利金。

期权的买方支付的期权价格,即买方为获得期权而付给期权卖方的费用。

③履约保证金。

期权卖方必须存入交易所用于履约的财力担保,④看涨期权和看跌期权。

看涨期权,是指在期权合约有效期内按执行价格买进一定数量标的物的权利;看跌期权,是指卖出标的物的权利。

cHAPTra KI betUrM M«4duxn«x<^ ar ••••• f«g ・t plM OM<a to MB ll ・—TL —▼rMdV — ■ M 9•&・ Mtw«aH 叩■厂 1—、M»A-l S*2*0«M ■■ ^7521 1*4SeM 0|«tc4WB* ap*w ^«K « <* o az «•«!io •e ・fOMHVu ・w« Aft. xW*・9«v MBMk t» W*»|w «WM !•«•••— %-V> K ・9. ■・•( •*©> T-»» ■.空竺J 马A 空兰.…计•A SK<•4 «>A7・・1・•・R ・08*・5ZE 11*.F<<O<MI4WV ■❷•waw JttM <«•<«■■ J ・I9H74・ MrtMyiiPH—W ・(VAlw«・・,•■■■>•・" M «M 4 MI « E f R —W •字•字)vfViurutMjnr^vMtai 111 A —i"・^«hW —WI4»••一 y wt 卯 v >•*♦ *» <wr* 戸 x« tv•I Mt «wM ■*■<> «W ■・vfl !• mtvwvF k» VKM »> t»l • p< c» IW Mk vtt»•••• MM• tl»>■斗・4r.•丄防| n*kw !•*J M **vWatAM)' H MB*・朴・卜:卞”・ 4tJJ• Mm K -W ・ r ・Q.・ 9-QS.M > T-«» ・4CMP»c»to« A ■a0>■!«<•(■・•《 Mkwtaa 血”•>« «WE>y«»«vP • IF —・••—■—■科M4_ <tl ・oaMalWMi .11创n 11MM ■— 一A""・v«r■n«^»a w'«•!•<.•..»■ •> i- a-k>―初|・(« _F0R »*i!<■<■« i ・9” ■*!•«••«・》MM E ・》*k>e« —«E.r ■MIC ■一* »» ■•• ”・$«s» •• ts. no ¥ wr ■5— wK ・・«■•*・•••■•••・•••• *♦"■・••••・”•・•・~•l*« f*ASK"*""b QU ,,•・"♦(■* rI・・t ・K •WR XVIM •一刪・0|«・・・<||"• 8K kfk •■>•••<• ■…m»«*w<WH ” IK* lMW«IM iewr mu ■・—A« 巧 ki j«"U >• >^*10* t••<!•.»<»• ••••(■a * 、・r R if 。

第一章选择题答案1. ABCD2. ABCD3. BC4. B5. BDE6. C7. A8. A9. D 10. ABC第一章思考题答案1. 金融衍生工具是给予交易对手的一方,在未来的某个时间点,对某种基础资产拥有一定债权和相应义务的合约。

广义上把金融衍生工具也可以理解为一种双边合约或付款交换协议,其价值取自于或派生于相关基础资产的价格及其变化。

对金融衍生工具含义的理解包含三点:① 金融衍生工具是从基础金融工具派生出来的② 金融衍生工具是对未来的交易③ 金融衍生工具具有杠杆效应3. 从微观和宏观两个方面对金融衍生工具的功能进行以下定位:① 转化功能。

转化功能是金融衍生工具最主要的功能,也是金融衍生工具一切功能得以存在的基础。

通过金融衍生工具,可以实现外部资金向内部资金的转化、短期流动资金向长期稳定资金的转化、零散小资金向巨额大资金的转化、消费资金向生产经营资金的转化。

② 定价功能。

定价功能是市场经济运行的客观要求。

在金融衍生工具交易中,市场参与者根据自己了解的市场信息和对价格走势的预期,反复进行金融衍生产品的交易,在这种交易活动中,通过平衡供求关系,能够较为准确地为金融产品形成统一的市场价格。

③ 避险功能。

传统的证券投资组合理论以分散非系统风险为目的,对于占市场风险50%以上的系统性风险无能为力。

金融衍生工具恰是一种系统性风险的转移市场,主要通过套期保值业务发挥转移风险的功能。

同时,从宏观角度看,金融衍生工具能够通过降低国家的金融风险、经济风险,起到降低国家政治风险的作用。

④ 赢利功能。

金融衍生工具的赢利包括投资人进行交易的收入和经纪人提供服务收入。

对于投资人来说,只要操作正确,衍生市场的价格变化在杠杆效应的明显作用下会给投资者带来很高的利润;对纪经人来说,衍生交易具有很强的技术性,经纪人可凭借自身的优势,为一般投资者提供咨询、经纪服务,获取手续费和佣金收入。

⑤ 资源配置功能。

金融衍生工具价格发现机制有利于全社会资源的合理配置。

第一章1.1请解释远期多头与远期空头的区别。

答:远期多头指交易者协定将来以某一确定价格购入某种资产;远期空头指交易者协定将来以某一确定价格售出某种资产。

1.2请详细解释套期保值、投机与套利的区别。

答:套期保值指交易者采取一定的措施补偿资产的风险暴露;投机不对风险暴露进行补偿,是一种“赌博行为”;套利是采取两种或更多方式锁定利润。

1.3请解释签订购买远期价格为$50的远期合同与持有执行价格为$50的看涨期权的区别。

答:第一种情况下交易者有义务以50$购买某项资产(交易者没有选择),第二种情况下有权利以50$购买某项资产(交易者可以不执行该权利)。

1.4一位投资者出售了一个棉花期货合约,期货价格为每磅50美分,每个合约交易量为50,000磅。

请问期货合约结束时,当合约到期时棉花价格分别为(a)每磅48.20美分;(b)每磅51.30美分时,这位投资者的收益或损失为多少?答:(a)合约到期时棉花价格为每磅$0.4820时,交易者收入:($0.5000-$0.4820)×50,000=$900;(b)合约到期时棉花价格为每磅$0.5130时,交易者损失:($0.5130-$0.5000) ×50,000=$6501.5假设你出售了一个看跌期权,以$120执行价格出售100股IBM的股票,有效期为3个月。

IBM股票的当前价格为$121。

你是怎么考虑的?你的收益或损失如何?答:当股票价格低于$120时,该期权将不被执行。

当股票价格高于$120美元时,该期权买主执行该期权,我将损失100(st-x)。

1.6你认为某种股票的价格将要上升。

现在该股票价格为$29,3个月期的执行价格为$30的看跌期权的价格为$2.90.你有$5,800资金可以投资。

现有两种策略:直接购买股票或投资于期权,请问各自潜在的收益或损失为多少?答:股票价格低于$29时,购买股票和期权都将损失,前者损失为$5,800$29×(29-p),后者损失为$5,800;当股票价格为(29,30),购买股票收益为$5,800$29×(p-29),购买期权损失为$5,800;当股票价格高于$30时,购买股票收益为$5,800$29×(p-29),购买期权收益为$$5,800$29×(p-30)-5,800。

赫尔《期权、期货及其他衍生产品》(第9版)笔记和课后习题详解目录第1章引言1.1复习笔记1.2课后习题详解第2章期货市场的运作机制2.1复习笔记2.2课后习题详解第3章利用期货的对冲策略3.1复习笔记3.2课后习题详解第4章利率4.1复习笔记4.2课后习题详解第5章如何确定远期和期货价格5.1复习笔记5.2课后习题详解第6章利率期货6.1复习笔记6.2课后习题详解第7章互换7.1复习笔记7.2课后习题详解第8章证券化与2007年信用危机8.1复习笔记8.2课后习题详解第9章OIS贴现、信用以及资金费用9.1复习笔记9.2课后习题详解第10章期权市场机制10.1复习笔记10.2课后习题详解第11章股票期权的性质11.1复习笔记11.2课后习题详解第12章期权交易策略12.1复习笔记12.2课后习题详解第13章二叉树13.1复习笔记13.2课后习题详解第14章维纳过程和伊藤引理14.1复习笔记14.2课后习题详解第15章布莱克-斯科尔斯-默顿模型15.1复习笔记15.2课后习题详解第16章雇员股票期权16.1复习笔记16.2课后习题详解第17章股指期权与货币期权17.1复习笔记17.2课后习题详解第18章期货期权18.1复习笔记18.2课后习题详解第19章希腊值19.1复习笔记19.2课后习题详解第20章波动率微笑20.1复习笔记20.2课后习题详解第21章基本数值方法21.1复习笔记21.2课后习题详解第22章风险价值度22.1复习笔记22.2课后习题详解第23章估计波动率和相关系数23.1复习笔记23.2课后习题详解第24章信用风险24.1复习笔记24.2课后习题详解第25章信用衍生产品25.1复习笔记25.2课后习题详解第26章特种期权26.1复习笔记26.2课后习题详解第27章再谈模型和数值算法27.1复习笔记27.2课后习题详解第28章鞅与测度28.1复习笔记28.2课后习题详解第29章利率衍生产品:标准市场模型29.1复习笔记29.2课后习题详解第30章曲率、时间与Quanto调整30.1复习笔记30.2课后习题详解第31章利率衍生产品:短期利率模型31.1复习笔记31.2课后习题详解第32章HJM,LMM模型以及多种零息曲线32.1复习笔记32.2课后习题详解第33章再谈互换33.1复习笔记33.2课后习题详解第34章能源与商品衍生产品34.1复习笔记34.2课后习题详解第35章章实物期权35.1复习笔记35.2课后习题详解第36章重大金融损失与借鉴36.1复习笔记36.2课后习题详解赫尔的《期权、期货及其他衍生产品》是世界上流行的证券学教材之一。

第八章金融衍生工具市场第一节金融衍生工具市场的产生与发展1.识记:金融衍生工具答:又称金融衍生产品,是指在一定的基础性金融工具的基础上派生出来的金融工具,一般表现为一些合约,其价值由作为标的物的基础性金融工具的价格决定。

套现保值答:套现保值是指交易者为了配合现货市场的交易,而在期货等金融衍生工具市场上进行与现货市场方向相反的交易,以便达到转移、规避价格变动风险的交易行为。

2.领会:⑴金融衍生工具的特点答:㈠价值受制于基础性金融工具㈡具有高杠杆性和高风险性㈢构造复杂,设计灵活。

⑵金融衍生工具市场的功能答:金融衍生工具市场是指创设与交易金融衍生工具的市场。

其主要功能有:⑴价格发现功能。

金融衍生工具交易价格是由买卖双方对交易标的物未来价格的预期来确定的。

如果市场竞争是充分和有效的,衍生工具的市场价格就是对标的物未来价格的预期。

⑵套期保值功能。

通过现货市场与期货等金融衍生工具市场的反方向操作,可形成现货与期货一盈一亏的结果,这样可以减少或规避价格变动的风险,实现套现保值功能。

⑶投机获利手段。

投机者可通过对资产价格变动的预期,买卖金融衍生工具,期望在价格出现对自己有利的变动时机对冲平仓获取利润,因此,金融衍生工具市场成了投机者投机获利的手段。

第二节金融远期合约市场1.识记:金融远期合约答:金融远期合约是指交易双方约定在未来某一确定的时间,按照某一确定的价格买卖一定数量的某种金融资产的合约。

远期利率协议答:远期利率协议是交易双方承诺在某一特定时期内按双方协议利率借贷一笔确定金额的名义本金的协议。

2.领会:⑴金融远期合约的特点答:⑵远期利率协议的功能答:第三节金融期货市场1.识记:金融期货合约答:金融期货合约是指交易双方同意在约定的将来某个日期按约定的条件买入或卖出一定标准数量的某种金融工具的标准化合约。

金融期货的标准化合约是指期货合约的合约规模、交割日期、交割地点等都是标准化的,即在合约上明确规定交易的规模、交割日期、交割地点等,无须双方再商定。

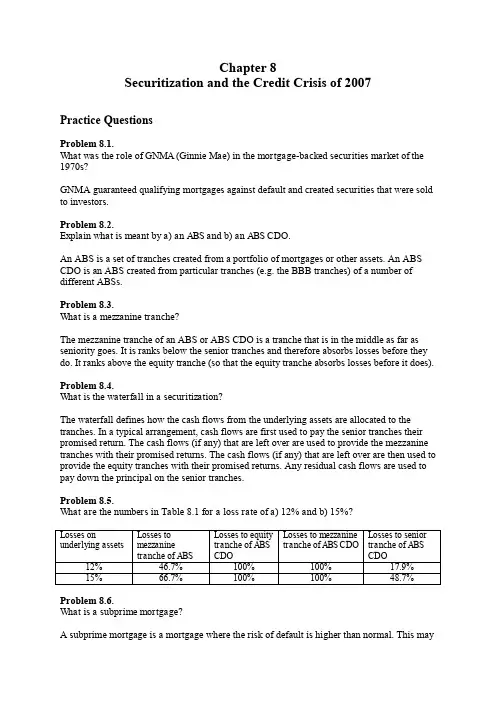

Chapter 8Securitization and the Credit Crisis of 2007Practice QuestionsProblem 8.1.What was the role of GNMA (Ginnie Mae) in the mortgage-backed securities market of the 1970s?GNMA guaranteed qualifying mortgages against default and created securities that were sold to investors.Problem 8.2.Explain what is meant by a) an ABS and b) an ABS CDO.An ABS is a set of tranches created from a portfolio of mortgages or other assets. An ABS CDO is an ABS created from particular tranches (e.g. the BBB tranches) of a number of different ABSs.Problem 8.3.What is a mezzanine tranche?The mezzanine tranche of an ABS or ABS CDO is a tranche that is in the middle as far as seniority goes. It is ranks below the senior tranches and therefore absorbs losses before they do. It ranks above the equity tranche (so that the equity tranche absorbs losses before it does). Problem 8.4.What is the waterfall in a securitization?The waterfall defines how the cash flows from the underlying assets are allocated to the tranches. In a typical arrangement, cash flows are first used to pay the senior tranches their promised return. The cash flows (if any) that are left over are used to provide the mezzanine tranches with their promised returns. The cash flows (if any) that are left over are then used to provide the equity tranches with their promised returns. Any residual cash flows are used to pay down the principal on the senior tranches.Problem 8.5.What are the numbers in Table 8.1 for a loss rate of a) 12% and b) 15%?Problem 8.6.What is a subprime mortgage?A subprime mortgage is a mortgage where the risk of default is higher than normal. This maybe because the borrower has a poor credit history or the ratio of the loan to value is high or both.Problem 8.7.Why do you think the increase in house prices during the 2000 to 2007 period is referred to as a bubble?The increase in the price of houses was caused by an increase in the demand for houses by people who could not afford them. It was therefore unsustainable.Problem 8.8.Why did mortgage lenders frequently not check on information provided by potential borrowers on mortgage application forms during the 2000 to 2007 period?Subprime mortgages were frequently securitized. The only information that was retained during the securitiza tion process was the applicant’s FICO score and the loan-to-value ratio of the mortgage.Problem 8.9.How were the risks in ABS CDOs misjudged by the market?Investors underestimated how high the default correlations between mortgages would be in stressed market conditions. Investors also did not always realize that the tranches underlying ABS CDOs were usually quite thin so that they were either totally wiped out or untouched. There was an unfortunate tendency to assume that a tranche with a particular rating could be considered to be the same as a bond with that rating. This assumption is not valid for the reasons just mentioned.Problem 8.10.What is meant by the term “agency costs”? How did agency costs play a role in the credit crisis?“Agency costs” is a term used to describe the costs in a situation where the interests of two parties are not perfectly aligned. There were potential agency costs between a) the originators of mortgages and investors and b) employees of banks who earned bonuses and the banks themselves.Problem 8.11.How is an ABS CDO created? What was the motivation to create ABS CDOs?Typically an ABS CDO is created from the BBB-rated tranches of an ABS. This is because it is difficult to find investors in a direct way for the BBB-rated tranches of an ABS.Problem 8.12.Explain the impact of an increase in default correlation on the risks of the senior tranche of an ABS. What is its impact on the risks of the equity tranche?As default correlation increases, the senior tranche of a CDO becomes more risky because it is more likely to suffer losses. As default correlation increases, the equity tranche becomes less risky. To understand why this is so, note that in the limit when there is perfect correlationthere is a high probability that there will be no defaults and the equity tranche will suffer no losses.Problem 8.13.Explain why the AAA-rated tranche of an ABS CDO is more risky than the AAA-rated tranche of an ABS.A moderately high default rate will wipe out the tranches underlying the ABS CDO so that the AAA-rated tranche of the ABS CDO is also wiped out. A moderately high default rate will at worst wipe out only part of the AAA-rated tranche of an ABS.Problem 8.14.Explain why the end-of-year bonus is sometimes r eferred to as “short-term compensation.”The end-of-year bonus usually reflects performance during the year. This type of compensation tends to lead traders and other employees of banks to focus on their next bonus and therefore have a short-term time horizon for their decision making.Problem 8.15.Add rows in Table 8.1 corresponding to losses on the underlying assets of (a) 2%, (b) 6%, (c) 14%, and (d) 18%.Further QuestionsProblem 8.16.Suppose that the principal assigned to the senior, mezzanine, and equity tranches is 70%, 20%, and 10% for both the ABS and the ABS CDO in Figure 8.3. What difference does this make to Table 8.1?‘‘Resecuritization was a badly flawed idea. AAA tranches created from the mezzanine tranches of ABSs are bound to have a higher probability of default than the AAA-rated tranches of ABSs.’’ Discuss this point of view.When the AAA-rated tranches of an ABS experiences defaults, the mezzanine tranches of the ABSs must have been wiped out. As a result the AAA tranche of the ABS CDO has also wiped out. If the portfolios underlying the different ABSs have the same default rates, it must therefore be the case the AAA-rated tranche of the ABS is safer than the AAA-rated tranche of the ABS CDO. If there is a wide variation if the default rates, it is possible for theAAA-rated tranche of the ABS CDO to fare better than some (but not all) AAA rated tranches of the underlying ABSs.Resecuritization can only be successful if the default rates of the underlying ABS portfolios are not highly correlated. The best approach would seem to be to obtain as much diversification as possible in the portfolio of assets underlying the ABS. Resecuritization then has no value.Problem 8.18.Suppose that mezzanine tranches of the ABS CDOs, similar to those in Figure 8.3, are resecuritized to form what is referred to as a “CDO squared.” As in the case of tranches created from ABSs in Figure 8.3, 65% of the principal is allocated to a AAA tranche, 25% to a BBB tranche, and 10% to the equity tranche. How high does the loss percentage have to be on the underlying assets for losses to be experienced by a AAA-rated tranche that is created in this way. (Assume that every portfolio of assets that is used to create ABSs experiences the same loss rate.)For losses to be experienced on the AAA rated tranche of the CDO squared the loss rate on the mezzanine tranches of the ABS CDOs must be greater than 35%. This happens when the loss rate on the mezzanine tranches of ABSs is 10+0.35×25 = 18.75%. This loss rate occurs when the loss rate on the underlying assets is 5+0.1875×15 = 7.81%Problem 8.19.Investigate what happens as the width of the mezzanine tranche of the ABS in Figure 8.3 is decreased with the reduction of mezzanine tranche principal being divided equally between the equity and senior tranches. In particular, what is the effect on Table 8.1?The ABS CDO tranches become similar to each other. Consider the situation where the tranche widths are 12%, 1%, and 87% for the equity, mezzanine, and senior tranches. The table becomes:Suppose that the structure in Figure 8.1 is created in 2000 and lasts 10 years. There are no defaults on the underlying assets until the end of the eighth year when 17% of the principal is lost because of defaults during the credit crisis. No principal is lost during the final two years. There are no repayments of principal until the end. Evaluate the relative performance of the tranches. Assume a constant LIBOR rate of 3%. Consider both interest and principal payments.The cash flows per $100 of principal invested in a tranche are roughly as followsThe internal rates of return for the senior, mezzanine and equity tranches are approximately 3.6%, -6%, and 16.0%. This shows that the equity tranche can fare quite well if defaults happen late in the life of the structure.。

金融衍生品课后思考与习题第一章期货市场基本原理(书P29)1、结合期货市场产生历程,谈谈期货市场产生的规律是什么?答:从芝加哥期货交易所的产生历程可以看到,期货市场的形成经历了从现货交易到远期交易最后到期货交易的复杂演变过程,它是人们在贸易过程中不断追求交易效率、降低交易成本与风险的结果,期货市场是现货市场发展的产物,两者相辅相成、互相补充、共同发展。

2、讨论茶叶和烟草是否能作为期货品种?答:我认为茶叶和烟草不能作为期货品种。

理由如下:并不是所有现货市场的商品都适合进行期货交易,一般而言,能够成为期货品种必须具备以下条件:商品同质性;价格波动大且频繁;现货规模大;适宜储藏。

3、期货合约主要条款有哪些?答:一、合约名称;二、交易单位;三、报价单位;四、最小变动价位;五、每日价格最大波动限制;六、合约交割月份;七、交易时间;八、最后交易日;九、交割日期;十、交割等级;十一、交割地点;十二、交易手续费;十三、交割方式。

4、期货市场的功能有哪些?答:一、价格发现,合理配置资源:1、优化资源配置功能;2、信息功能;3、定价功能二、风险管理,化解国民经济系统性风险5、期货交易的基本特征是什么?答:交易集中化、合约标准化、交易的远期性质、保证金制度与杠杆机制、每日无负债结算制度、交易所具有担保履约职责、双向交易和对冲机制。

第二章期货市场构成(书P58)1、期货交易者是如何分类的?期货交易者可以分为两大类:套期保值者和投资者,后者包括投机交易者和套利交易者2、我国期货中介机构有哪些分类?中国香港的期货中介机构有两种类型:一是经纪商,二是期货商;我国大陆期货中介机构目前包括期货公司、介绍经纪人、和居间人三类。

3、期货交易所的主要职能是什么?主要职能:(1)提供交易的场所、设施和服务。

(2)设计合约,安排合约上市。

(3)、制定期货交易规则,组织并监督交易。

(4)、监控市场风险。

(5)、发布市场信息。

4、会员制与公司制期货交易所各自的特征是什么?会员制的特征:(1)、它是由全体会员共同出资组建,缴纳一定的会员资格费,作为注册资本;(2)、会员在进行交易或代理客户交易之前必须取得会员资格;(3)、会员制期货交易所实行自律管理。

第八章1. 一个基于无红利股票的一年期的欧式看跌期权,执行价格为25欧元,期权的即期交易价格为3.19欧元。

股票的即期价格为23欧元,它的年波动率为30%。

年无风险收益率为5%。

那么基于相同股票的欧式看涨期权的价格是多少?以连续复利计算。

解:根据看跌看涨平价,c=p+S- Xe-r(T-t) =3.19+23-25e-0.05*1 =2.409美元2. 一个无红利支付股票的美式看涨期权的价格为$4。

股票价格为$31,执行价格为$30,3个月后到期。

无风险利率为8%。

请推出相同股票、相同执行价格、相同到期日的美式看跌期权的价格上下限。

解:由公式S- X < S- Xe-r(T-t),可得:31-30 < 4-P < 31-30e-0.25*0.08即 1.00 < 4.00-P < 1.59,该美式看跌期权的价格上下限为:2.41<P<3.003. 你现在要对一个两年期执行价格为45美元的欧式看涨期权定价。

已知初始股票价格为50美元,连续无风险利率为3%。

为了确定该期权的价格范围,你考虑计算价格的上下限。

那么该期权价格的上界与下界的差是多少?解:价格的上界是S=50,下界c > S- Xe-r(T-t) =50-45 e-0.03*2 = 7.62美元那么上下界的差为50-7.62=42.38美元4. 列举影响期权价格的6个因素,并简述其影响的机理。

解:影响期权价格的6 个因素有:标的资产价格、期权的执行价格、无风险利率、资产价格的波动率、期限以及持有期间收益。

5.请解释为什么对欧式看涨期权与看跌期权之间平价关系的讨论用于美式期权不可能得到相同的结论。

解:当不可提前执行时,我们可认为若两资产价值在T 期相同,则在前几期也应相同。

当可提前执行,以上论述则不成立。

假设:P+S > C+ Xe-rT,这并不存在套利机会。

因为如果我们买看涨期权,卖空看跌期权并卖空股票,我们并不能确定其结果,因为我们并不确定看跌期权是否会被执行。

第八章1. 一个基于无红利股票的一年期的欧式看跌期权,执行价格为25欧元,期权的即期交易价格为3.19欧元。

股票的即期价格为23欧元,它的年波动率为30%。

年无风险收益率为5%。

那么基于相同股票的欧式看涨期权的价格是多少?以连续复利计算。

解:根据看跌看涨平价,c=p+S- Xe-r(T-t) =3.19+23-25e-0.05*1 =2.409美元2. 一个无红利支付股票的美式看涨期权的价格为$4。

股票价格为$31,执行价格为$30,3个月后到期。

无风险利率为8%。

请推出相同股票、相同执行价格、相同到期日的美式看跌期权的价格上下限。

解:由公式S- X < S- Xe-r(T-t),可得:31-30 < 4-P < 31-30e-0.25*0.08即 1.00 < 4.00-P < 1.59,该美式看跌期权的价格上下限为:2.41<P<3.003. 你现在要对一个两年期执行价格为45美元的欧式看涨期权定价。

已知初始股票价格为50美元,连续无风险利率为3%。

为了确定该期权的价格范围,你考虑计算价格的上下限。

那么该期权价格的上界与下界的差是多少?解:价格的上界是S=50,下界c > S- Xe-r(T-t) =50-45 e-0.03*2 = 7.62美元那么上下界的差为50-7.62=42.38美元4. 列举影响期权价格的6个因素,并简述其影响的机理。

解:影响期权价格的6 个因素有:标的资产价格、期权的执行价格、无风险利率、资产价格的波动率、期限以及持有期间收益。

5.请解释为什么对欧式看涨期权与看跌期权之间平价关系的讨论用于美式期权不可能得到相同的结论。

解:当不可提前执行时,我们可认为若两资产价值在T 期相同,则在前几期也应相同。

当可提前执行,以上论述则不成立。

假设:P+S > C+ Xe-rT,这并不存在套利机会。

因为如果我们买看涨期权,卖空看跌期权并卖空股票,我们并不能确定其结果,因为我们并不确定看跌期权是否会被执行。

第八章练习题1、奇异期权的交易是在下列哪一场所进行的?()A 纽约股票交易所B 场外交易市场C 美国股票交易所D 主要交易场所2、亚式期权区别于美式和欧式期权的地方是()A 它们只在亚洲金融市场出售B 他们从不到期C 它们的盈利建立在标的资产的平均价格上D 它们只在亚洲金融市场出售,而且盈利建立在标的资产的平均价格上3、对于支付函数是非连续的期权,最重要的结果是什么?()A 如果接近非连续点时执行就价格可以被操控,那么操作风险增加B 当标的资产价格接近于非连续点时,会有很高的GammaC 在到期时很难确定正确的期权市场价格D 上述都不正确4、平均价格期权A的执行价格基于算术平均值,而平均价格期权B的执行价格基于几何平均值,下列数据反映了至今这些期权标的资产的市场价值:$105,$106。

则这两种期权的当期执行价格是多少?()(保留两位小数)A $103.40,$103.38B $103.38 ,$103.40C $106.00,$106.00D $104.30,$104.405、反向敲出期权比标准期权更难进行对冲,这是因为()。

A 该类期权的市场流动性较差B 在障碍水平附近,该期权价格变动较大C Black-Scholes 模型不适用于为这类期权定价D 期权的Gamma值一直在相关的价格范围内不停变动6、在下列期权中,哪一种期权不能从股票价格的上涨中获利?()当前的股价为100美元,还没有达到障碍水平。

A 向下敲出看涨期权,障碍水平为90美元,执行价格为110美元B 向下敲入看涨期权,障碍水平为90美元,执行价格为110美元C 向上敲入看跌期权,障碍水平为110美元,执行价格为100美元D 向上敲入看涨期权,障碍水平为110美元,执行价格为100美元7、允许持有者根据某段时间的平均价格购买或出售某项标的资产的期权是()。

A 传染期权(contagion option )B 回望期权(lookback option)C 障碍期权(barrier option )D 亚式期权(Asian option)8、下列不属于路径依赖型期权的是()。

Chapter 8SwapsQuestion 8.1We first solve for the present value of the cost per two barrels:2$22$2341.033.1.06(1.065)+= We then obtain the swap price per barrel by solving:241.033(1.065)1.0622.483,x x x +=⇒=which was to be shown.Question 8.21. We first solve for the present value of the cost per three barrels, based on the forward prices:23$20$21$2255.3413.1.06(1.065)(1.07)++= Hence we could spend $55.3413 today to receive 1 barrel in each of the next three years. We thenobtain the swap price per barrel by solving:2355.34131.06(1.065)(1.07)20.9519x x x x ++=⇒=2. We first solve for the present value of the cost per two barrels (Year 2 and Year 3):23$21$2236.473.(1.065)(1.07)+= Hence we could spend $36.473 today and receive 1 barrel of oil in Year 2 and Year 3. We obtain theswap price per barrel by finding two equal payments we would make in Years 2 and 3 that have the same present value:2336.473(1.065)(1.07)21.481x x x +=⇒=94 M cDonald • Fundamentals of Derivatives MarketsQuestion 8.3Since the dealer is paying fixed and receiving floating, each year she has a cash flow $20.9519.T S − She can hedge this risk by selling 1 barrel forward (i.e., short one forward) in each of the three years. Her payoffs from the swap, the short forward contracts, and the net are summarized in the following table:Year Net Swap PaymentShort ForwardsNet Position 1$20.9519S − 1$20S − −0.9519 2 2$20.9519S −2$21S −+0.0481 33$20.9519S − 3$22S −+1.0481We need to discount the net cash flows to year zero. We have:230.95190.0481 1.0481PV(net CF)0.1.06(1.065)(1.07)−=++= Indeed, the present value of the net cash flow is zero.Question 8.4The fair swap rate was determined to be $20.9519. Therefore, compared to the forward curve price of$20 in one year, we are overpaying $0.9519. In year two, with interest, this overpayment increases to $0.9519 1.070024$1.01853,×= where we used the appropriate forward rate to calculate the interest payment.In year two, we underpay by $0.0481, so that our total accumulative underpayment is $1.01856 − $0.0481 = $0.97042. In year three, using the appropriate 1-year forward rate of 8.007%, this net overpaymentincreases to $0.97046 1.08007$1.0481.×=However, in year three, we receive a fixed payment of 20.9519, which underpays relative to the forward curve price of $22 by $22$20.9519$1.0481.−=Therefore, our cumulative balance is indeed zero, which was to be shown.Question 8.5Question 8.3 showed that, at the initial yield curve, the swap has a zero present value. To look at how the yield curve affects the value of the dealer’s swap position, we repeat the hedge and then look at the present value of the hedged cash flows under the new yield curve.As in Question 8.3, the dealer is paying fixed and receiving floating; hence each year she has a cashflow $20.9519.T S − She can hedge this risk by selling 1 barrel forward (i.e., short one forward) in each of the three years. Her payoffs from the swap, the short forward contracts, and the net are summarized in the following table:Year Net Swap Payment Short ForwardsNet Position 1 1$20.9519S − 1$20S − −0.9519 2 2$20.9519S − 2$21S − +0.0481 33$20.9519S −3$22S −+1.0481Chapter 8 Swaps 95We need to discount the net positions to year zero, taking into account the uniform shift of the termstructure. We have:230.95190.0481 1.0481PV(net CF)0.0081.1.065(1.07)(1.075)−=++=−The present value of the net cash flow is negative; the dealer never recovers from the increased interestrate he faces on the overpayment of the first swap payment. When the interest rates fall, the value of the swap becomes:230.95190.0481 1.0481PV(net CF)0.00831.055(1.06)(1.065)−=++=+The present value of the net cash flow is positive. The dealer makes money, because he gets a favorableinterest rate on the loan he needs to take to finance the first overpayment.The dealer could have tried to hedge his exposure with a forward rate agreement or any other derivative protecting against interest rate risk.Question 8.6In order to answer this question, we use Equation (8.13) of the main text with the substitution: 00,().i i t f t F = With an effective quarterly interest of 1.5%, the zero-coupon price for quarter i is 1.015i . Using this result, the zero-coupon prices are:QuarterZero-coupon price1 0.9852 20.970730.956340.942250.928360.914570.901080.8877Using Equation (8.13), the 4-quarter swap price is:.985221.970721.1.956320.8.942220.520.8533.9852.9707.9563.9422R ×+×+×+×==+++A similar calculation will yield an 8-quarter swap price of $20.4284.The total costs of prepaid 4- and 8-quarter swaps are the present values of the payment obligations.Note that a simple algebra exercise shows this is just the numerator in Equation (8.13). For the 4-quarter swap, we find this is equal to:4-quarter prepaid swap price 20.8533(.9852.9707.9563.9422)$80.3768=×+++=A similar calculation will yield an 8-quarter prepaid swap price of $152.9256.96 M cDonald • Fundamentals of Derivatives MarketsQuestion 8.7In order to answer this question, we use Equation (8.13) of the main text with the substitution: 00,().i i t f t F = For example, the 3-quarter swap price is3.985221.970121.1.954620.820.9677.9852.9701.9546R ×+×+×==++Similar calculations lead to the following swap prices:Quarter Swap price1 21.00002 21.04963 20.96774 20.85365 20.72726 20.61107 20.51458 20.4304Question 8.8We use Formula (8.4), and replace the forward interest rate with the forward oil prices. In particular, we calculate:60,363(0,).954620.8.938820.5.923120.2.90752020.3807.9546.9388.9231.9075(0,)iit i ii P t FR P t ==×+×+×+×===+++∑∑Therefore, the swap price of a 4-quarter oil swap with the first settlement occurring in the third quarter is $20.3807.Question 8.9We use Equation (8.6) of the main text to answer this question:80,1801(0,),where [1,2,1,2,1,2,1,2](0,)iiit it i t ii Q P t FR Q Q P t ====∑∑After plugging in the relevant variables given in the exercise, we obtain a value of $20.4099 for the swap price. Note that it is probably easiest to set up a spreadsheet with 0(0,)i t i Q P t × as one column and 0,i t F as another column. Then use the SUMPRODUCT function for the numerator and SUM function for the denominator.Chapter 8 Swaps 97Question 8.10We are now asked to invert our equations. The swap prices are given, and we want to back out the forwardprices. We do so recursively. For a one-quarter swap, the swap price and the forward price are identical. Given the one-quarter forward price, we can find the second quarter forward price, etc. For example,0,10,220,120,2(0,1)(0,2)[(0,1)(0,2)](0,1)(0,1)(0,2)(0,2)P F P F R P P P F R F P P P ++−=⇒=+Hence0,2 2.4236 1.9553.9852 2.252.60.9701F ×−×==Doing a similar calculation for Years 3, 4, etc. yields the following forward prices:Quarter Forward price1 2.252 2.603 2.204 1.905 2.206 2.507 2.158 1.80Question 8.11From the given zero-coupon bond prices, we can calculate the one-quarter forward interest rates(i.e., 01(,)i i r t t +). For instance, the forward interest rate factor for Quarter 4 is0(0,3)0.9546(3,4)11 1.6830%(0,4)0.9388P r P ===−=The forward interest factors for the quarters are:QuarterForward interest rate1 1.5022%2 1.5565%3 1.6237%4 1.6830%5 1.7008%6 1.7190%7 1.7491%8 1.7802%98 M cDonald • Fundamentals of Derivatives MarketsNow, we can calculate the deferred swap price according to the formula:61262(0,)(,)1.6553%(0,)i i i i ii P t r tt X P t −====∑∑Question 8.12From the given zero-coupon bond prices, we can calculate the one-quarter forward interest rates (i.e., 01(,)i i r t t +). For instance, the forward interest rate factor for Quarter 4 is0(0,3)0.9546(3,4)11 1.6830%(0,4)0.9388P r P ===−=The forward interest factors for the quarters are:QuarterForward interest rate1 1.5022%2 1.5565%3 1.6237%4 1.6830%5 1.7008%6 1.7190%7 1.7491%8 1.7802%Now, we can calculate the swap prices for 4 and 8 quarters according to the formula:111(0,)(,),where 4 or 8(0,)ni i i i nii P t r tt X n P t −====∑∑This yields the following prices:4-quarter fixed swap price: 1.59015% 8-quarter fixed swap price: 1.66096%Note that it is probably easiest to set up a spreadsheet with 0(0,)i P t as one column and 01(,)i i r t t − as another column. Then use the SUMPRODUCT function for the numerator and SUM function for the denominator.Chapter 8 Swaps 99Question 8.13We can calculate the value of an 8-quarter dollar annuity that is equivalent to an 8-quarter Euro annuity byusing Equation (8.8) of the main text. We have:8*0,1*81(0,)where1 euro (0,),iit i ii P t R FX R P t ====∑∑Plugging in the forward price for one unit of Euros delivered at time t i , which are given in the price table, yields a dollar annuity value of $0.9277.Question 8.14The dollar zero-coupon bond prices for the three years are:0,10,220,3310.94341.0610.8900(1.06)10.8396(1.06)P P P ======R * is 0.035, the Euro-bond coupon rate. The current exchange rate is 0.9$/€. Plugging all the above variables into Formula (8.9) indeed yields 0.06, the dollar coupon rate:3*0,0,00,30,0131/(/1)0.0980550.0623170.0602.673(0,)ii n t t t i ii PR F x P F x R P t ==+−+===∑∑Question 8.15We can use the standard swap price formula for this exercise, but we must use the euro zero-coupon bonds and the derived quarterly forward interest rates. From the given euro zero-coupon bond prices, we can calculate the one-quarter forward interest rates. For example, the quarterly euro forward rate with maturity in Quarter 4 is0(0,3)0.9735(3,4)110.9541%(0,4)0.9643P r P =−=−=100 M cDonald • Fundamentals of Derivatives MarketsThe euro denominated quarterly forward rates are:QuarterEuro denominated impliedforward interest rate1 0.8776%2 0.8957%3 0.9245%4 0.9541%5 0.9632%6 0.9726%7 0.9822%8 1.0028%Now, we can calculate the swap prices for 4 and 8 quarters according to the formula:111(0,)(,)where 4 or 8(0,),ni i i i nii P t r tt R n P t −====∑∑Using the euro forward rates in the table above with the euro zero coupon bond prices in the formula yields the following euro fixed swap rates:4-quarter fixed swap rate:0.91267%8-quarter fixed swap rate:0.94572%Question 8.16Equation (8.9) requires the following ingredients: • The euro fixed swap rate, which from Question 8.15 is *0.94572%R =.• The forward exchange rates in dollars per euro; i.e., 0,.i t F These are found in the Table 8.9. • The dollar denominated zero coupon bond prices. These are found in the Table 8.9. •The spot exchange rate, which is given as 00.9x =. Again this is in dollars per euro.With these substitutions, we have:8*0,0,0/0.0726,ii t t iPR F x =∑80,0,0(/1)0.05102,i t t P F x ×−=and80,7.4475it iP=∑Hence (.0726.05102)/7.4475 1.66%R =+= which agrees with our previous dollar denominated 8-quarter fixed swap rate.。