(完整版)耶鲁大学公开课博弈论原版资料

- 格式:doc

- 大小:255.01 KB

- 文档页数:53

第一讲导论—五个入门结论1。

通过成绩博弈模型可以知道,不选择严格劣势策略,因为每次博弈会得到更好的收益.2。

通过囚徒的困境博弈模型可以知道,理性选择导致次优的结果(协商难以达成目的的原因不是因为缺少沟通,而是没有强制力)。

3。

通过愤怒天使博弈模型可以知道,汝欲得之,必先知之;永远选择优势策略,选择非劣势策略,损失小,如果对手有优势策略则应以此作为选择策略的指导.4.如果想要赢,就应该站在别人的立场去分析他们会怎么做.第二讲学会换位思考1.构成博弈要素包括,参与人,参与人的策略以及收益.2。

所谓严格优势策略,就是指不论对方采取什么策略,采取的这个策略总比采取其他任何策略都好的策略。

3。

在博弈中剔出某些选择时需要站在别人的角度去思考结果,因为对手不会选择劣势策略;同时要考虑到对手也是一个理性的参与人。

4.在博弈中剔除某些选择是一种直接思考,同时也是作为一个理性参与人的选择。

第三讲迭代剔除和中位选民定理1。

在选民投票博弈模型中,通过不断地迭代以及剔除来决定策略,由此,我们得到了一种新的选择策略的方法:迭代剔除法。

2.选民投票博弈模型的结果与现实存在偏差,主要是因为:现实中选民并不是均匀分布的;选民通常根据候选人的性格而非政治立场来进行投票,而政治立场只是单一维度;只适用于只有两个候选人的情况;④同时存在弃权票;⑤选民未必相信候选人所声明的立场。

3.建立模型,是为了更好的描述事实以激发灵感,模型是有重要的事是抽象而来,逐步增加约束条件完善模型观察结果,比较分析结果的变化。

第四节足球比赛与商业合作之最佳对策1。

点球博弈模型告诉我们,不要选择一个在任何情况或信念下都不是最佳对策的策略。

2.最佳对策:参与人针对对手策略的定义:参与人i的策略s^i(简写成BR)是对手策略S—i的最佳对策,如果参与人i在对手的策略S-i下选S^i的收益弱优于其它对策Si`,这对参与人i的所有Si`都适用,则策略S^i是其它参与人策略S—i的最佳对策。

Principal-Agent Models&Incentive Compatibility/Participation Constraints Suppose Pat manages a large computer software company and Allen is a talented program designer.Pat would like to hire Allen to develop a new software package.If Allen works for Pat,Allen must choose whether or not to expend high effort or low effort on the job.At the end of the work cycle,Pat will learn whether the project is successful or not.A successful project yields revenue of6for thefirm,whereas the revenue is2if the project is unsuccessful.Success depends on Allen’s high effort as well as on a random factor.Specif-ically,if Allen expends high effort,then success will be achieved with probability 1/2;if Allen expends low effort,then the project is unsuccessful for sure.As-sume that,to epxend high effort,Allen must endure a personal cost of1.The parties can write a contract that specifies compensationfor Allen conditional on whether the project is successful(but it cannot be conditioned directly on Allen’s effort).Assume that Allen values money acording to the utility func-tion v A(x)=x a.Assume0<a<1.Finally,suppose Pat’s utility function is v P(x)=x.Imagine that the games interact as depicted above.At the beginning of the game,Pat offers Allen a wage and bonus package.The wage w is to be paid regardless of the project outcome,whereas the bonus b would be paid only if the project is successful.Then Allen decides whether or not to accept the contract. If he declines(N)the game ends,with Pat getting0and Allen obtaining utility of1(corresponding to his outside opportunities).If Allen accepts the contract(Y),then he decides whether to exert high(H) or low(L)effort.Low effort leads to an unsuccessful project,whereby Pat gets revenue of2minus the wage w and Allen gets his utility of the wage,w a. High effort leads to a chance node,where nature picks whether the project is successful(with probability1/2)or not(probability1/2).An unsuccessful project implies the same payoffs as with low effort,except that,in this case, Allen also pays his effort cost of1.A successful project raises Pat’s revenue to 6and trigers the bonus b paid to Allen in addition to the wage.Calculating the expected payoffs from the chance node,we can rewrite the game as shown above.To solve the game and learn about the interaction of risk and incentives, we use backward induction.Start by observing that Pat would certainly like Allen to exert high effort.In fact,it is inefficient for Allen to expend low effort, because Pat can compensate Allen for exerting high effort by increasing his pay by1(offsetting Allen’s effort cost).By doing so,Pat’s expected revenue increases by2.Another way of looking at this is that if Allen’s effort were verifiable,the parties would write a contract that induces high effort.Given that high effort is desired,we must ask whether there is a contract that induces it.Can Patfind a wage and bonus package that motivates Allen to exert high effort and Gives Pat a large payoff?What can be accomplished w/out a bonus?b=0implies Allen has no incentive to exert high effort;he gets w a when he chooses L and less(w−1)a,when he chooses H.The best that Pat can do without a bonus is to offer w=1,which Allen is willing to accept(he1will accept no less,given his outside option).Thus,the best no-bonus contract (w=1and b=0)yields the payoffvector(1,1).Next,consider a bonus contract,designed to induce high effort.In order for him to be motivated to exert high effort,Allen’s expected payofffrom H must be at least as great as is his payofffrom L:1 2(w+b−1)+12(w−1)a≥w a.In principal-agent models,this kind of inequality is usally called the effort constraint or incentive compatibility constraint.In addition to the effort con-straint,the contract must give Allen an expected payoffat least as great as the value of his outside opportunity:1 2(w+b−1)+12(w−1)a≥1Theorists call this participation constraint.Assuming she wants to motivate high effort,Pat will offer Allen the bonus contract satisfying the two inequalities above.2。

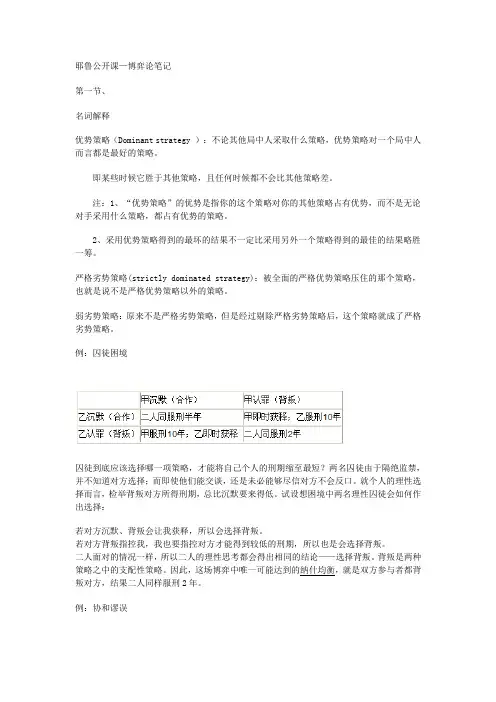

博弈论_耶鲁公开课__笔记及扩展1.博弈(game theory)构成要素:参与人players:i,j策略集strategy set:Si 策略si s-i 最优战略si*效益(目标)payoff:Ui Ui(s1,。

si。

sn)博弈game:G={S1,S2....Sn;U1,U2....Un}2.博弈论简史理论提出:1944 冯诺依曼(计算机之父、博弈论之父)与摩根斯坦恩合作出版《博弈论与经济行为》提出了博弈概念;提出了零和博弈(Zero-sum game);引进了合作博弈理论发展:a.奠定非合作博弈基石:1950 Tucker 提出了“囚徒困境”;1950-1951 纳什:引入纳什均衡,将博弈论从零和博弈推进到非零和博弈;定义非合作博弈并证明纳什均衡存在;1994年诺贝尔经济学奖(与selten harsanyi共同拿到)b.1965-1975 泽尔腾Selten 将纳什均衡推广到动态博弈并提出子博弈精炼均衡;发展了倒退归纳分析方法;提出颤抖手均衡c.1967-1968 海萨尼harsanyi将纳什均衡推广到非完全信息博弈并突出贝叶斯均衡3.博弈的分类是否合作合作博弈cooperative ganme 非合作博弈non-operative ganme 一般说博弈指后者后者又分一下四类根据:是否完全信息是否同时进行完全信息静态博弈(囚徒困境prison's dilemma)纳什均衡Nash equilibrium完全信息动态信息(抢劫博弈)子博弈精炼均衡subgame perfect Nash equilibrium非完全信息静态博弈(密封报价拍卖模型)贝叶斯纳什均衡Bayesian Nash equilibrium非完全信息动态博弈(就业市场信号黔驴技穷)精炼贝叶斯纳什均衡perfect Bayesian Nash equilibrium完全信息complete information与完美信息perfect information完全信息指每个参与者都知道其他人的可行策略以及收益(支付函数),如果一个博弈不是完全信息,那么参与者就不可能知道自己的行为对其他博弈者的影响完美信息指参与者对其他参与者行动action的完全知识的状态,并随信息的出现而更新。

![[耶鲁大学开放课程:博弈论].Problem.Set.4](https://uimg.taocdn.com/979168e3524de518964b7d49.webp)

耶鲁公开课—博弈论笔记第一节、名词解释优势策略(Dominant strategy ):不论其他局中人采取什么策略,优势策略对一个局中人而言都是最好的策略。

即某些时候它胜于其他策略,且任何时候都不会比其他策略差。

注:1、“优势策略”的优势是指你的这个策略对你的其他策略占有优势,而不是无论对手采用什么策略,都占有优势的策略。

2、采用优势策略得到的最坏的结果不一定比采用另外一个策略得到的最佳的结果略胜一筹。

严格劣势策略(strictly dominated strategy):被全面的严格优势策略压住的那个策略,也就是说不是严格优势策略以外的策略。

弱劣势策略:原来不是严格劣势策略,但是经过剔除严格劣势策略后,这个策略就成了严格劣势策略。

例:囚徒困境囚徒到底应该选择哪一项策略,才能将自己个人的刑期缩至最短?两名囚徒由于隔绝监禁,并不知道对方选择;而即使他们能交谈,还是未必能够尽信对方不会反口。

就个人的理性选择而言,检举背叛对方所得刑期,总比沉默要来得低。

试设想困境中两名理性囚徒会如何作出选择:若对方沉默、背叛会让我获释,所以会选择背叛。

若对方背叛指控我,我也要指控对方才能得到较低的刑期,所以也是会选择背叛。

二人面对的情况一样,所以二人的理性思考都会得出相同的结论——选择背叛。

背叛是两种策略之中的支配性策略。

因此,这场博弈中唯一可能达到的纳什均衡,就是双方参与者都背叛对方,结果二人同样服刑2年。

例:协和谬误20世纪60年代,英法两国政府联合投资开发大型超音速客机,即协和飞机。

该种飞机机身大、装饰豪华并且速度快,其开发可以说是一场豪赌,单是设计一个新引擎的成本就可能高达数亿元。

难怪政府也会被牵涉进去,竭力要为本国企业提供更大的支持。

项目开展不久,英法两国政府发现:继续投资开发这样的机型,花费会急剧增加,但这样的设计定位能否适应市场还不知道;但是停止研制也是可怕的,因为以前的投资将付诸东流。

随着研制工作的深入,他们更是无法做出停止研制工作的决定。

中文名: 耶鲁大学开放课程:博弈论英文名: Open Yale course:Game Theory版本: 更新完毕[MOV]发行时间: 2009年地区: 美国对白语言: 英语文字语言: 英文简介:课程类型:经济课程介绍:这门课程是系统介绍有关博弈论和战略思想。

比如支配思想、落后的感应、纳什均衡、进化稳定性、承诺,信誉,信息不对称,逆向选择等。

并在课堂上提供了各种游戏以及经济、政治,电影和其他方面的案例来讨论。

关于课程主讲人:Ben Polak教授任职于耶鲁大学管理学院经济系。

他在剑桥大学Trinity College 获得学士学位,在西北大学获得硕士学位,在哈佛大学获得博士学位。

他是微观经济理论和经济史方面的专家。

他的论文在Economic Letters、Journal of Economic Theory、Journal of Economic History、Journal of Legal Studies、Journal of Theoretical and Institutional Economics、Econometrica等学术期刊多次发表。

他最近的研究是“广义功利主义和海萨尼的公正观察员定理”和“平均分散的偏好”课程结构:本耶鲁大学课程每周在学校上两次课,每次75分钟,2007年秋季拍摄作为耶鲁大学开放课程之一。

课程视频截图:课程安排:1 Introduction: five first lessons 简介:五年前的教训2 Putting yourselves into other people's shoes 设身处地为他人着想3 Iterative deletion and the median-voter theorem 迭代删除和位数选民定理4 Best responses in soccer and business partnerships 最佳反应在足球和商业伙伴关系5 Nash equilibrium: bad fashion and bank runs 纳什均衡:坏时尚及银行挤兑6 Nash equilibrium: dating and Cournot 什均衡:约会和诺7 Nash equilibrium: shopping, standing and voting on a line 纳什均衡:购物,并参加表决的常委会上线8 Nash equilibrium: location, segregation and randomization 纳什均衡:定位,隔离和随机9 Mixed strategies in theory and tennis 混合战略的理论和网球10 Mixed strategies in baseball, dating and paying your taxes 混合战略棒球,约会和支付您的税11 Evolutionary stability: cooperation, mutation, and equilibrium 进化稳定:合作,突变,与平衡12 Evolutionary stability: social convention, aggression, and cycles 进化稳定:社会公约,侵略,和周期13 Sequential games: moral hazard, incentives, and hungry lions 顺序游戏:道德风险,奖励和饥饿的狮子14 Backward induction: commitment, spies, and first-mover advantages 落后的感应:承诺,间谍,和先行者优势15 Backward induction: chess, strategies, and credible threats 落后的感应:国际象棋,战略和可信的威胁16 Backward induction: reputation and duels 落后的感应:声誉和决斗17 Backward induction: ultimatums and bargaining 落后的感应:最后通牒和讨价还价18 Imperfect information: information sets and sub-game perfection 不完全信息:信息集和子博弈完美19 Subgame perfect equilibrium: matchmaking and strategic investments 子博弈完美均衡:招商引资和战略投资20 Subgame perfect equilibrium: wars of attrition 子博弈完美均衡:战争的消耗21 Repeated games: cooperation vs. the end game 重复博弈:合作与结局22 Repeated games: cheating, punishment, and outsourcing 重复博弈:作弊,惩罚和外包23 Asymmetric information: silence, signaling and suffering education 信息不对称:沉默,信令和苦难教育24 Asymmetric information: auctions and the winner's curse 信息不对称:拍卖和获奖者的诅咒学校介绍:耶鲁大学(Yale University),旧译“耶劳大书院”,是一所坐落于美国康乃狄格州纽黑文市的私立大学,始创于1701年,初名“大学学院”(Collegiate School)。

耶鲁博弈论24讲全笔记第一部分:博弈论的基础知识1、博弈论的定义及其在现实生活中的应用《耶鲁博弈论24讲全笔记》“1、博弈论的定义及其在现实生活中的应用”博弈论,这个引人入胜的学科,是一门研究决策问题的独特学科。

它的基本思想在于,把复杂多变的真实世界简化为具有明确规则和目标的多人决策问题。

在这个世界里,每一个参与者都需要根据其他参与者的策略来调整自己的决策,以期达到各自的目标。

博弈论起源于棋类游戏,如国际象棋和围棋,这些游戏的规则明确,且每个玩家都有可能成为赢家或输家。

然而,博弈论的应用远不止于此。

在现实世界中,博弈论的原理被广泛应用于政治、经济、生物、国际关系等多个领域。

在政治领域,博弈论可以帮助我们理解权力平衡和国际关系。

例如,囚徒困境就是一个经典的博弈论模型,它描述了两个囚犯因共同犯罪而受审的情况。

在这个情境中,两个囚犯都需要做出决策,是否选择揭发对方。

这个模型不仅可以解释为什么有时候合作会带来更大的利益,也可以揭示为什么有时候,即使个人利益最大化的选择也会导致集体的非最优结果。

在经济领域,博弈论更是具有广泛的应用。

例如,拍卖中的博弈论可以帮助我们理解为什么拍卖可以带来高昂的成交价,以及为什么有时候最低价拍卖可以带来最大的社会利益。

此外,博弈论还可以帮助我们理解市场垄断、价格竞争等复杂的市场行为。

在生物学领域,博弈论被用来解释生物种群的进化策略,如猎物的捕食者与被捕食者之间的动态关系。

在医学领域,博弈论也被用来理解和预测疾病的发展和传播。

总的来说,博弈论是一种独特的思考方式,它可以帮助我们理解真实世界中的决策和策略行为。

它的应用广泛,无论是在政治、经济、生物还是其他领域,都可以找到博弈论的应用实例。

通过学习博弈论,我们可以更好地理解真实世界中的决策过程,并找到更优的决策策略。

2、博弈的参与者、策略和结果《耶鲁博弈论24讲全笔记》是一本介绍博弈论的经典教材,第二讲“博弈的参与者、策略和结果”是其中的重要部分。

Syllabusby (course_default) — last modified 10—14-2008 04:00 PMDocument Actions•This course is an introduction to game theory and strategic thinking. Ideas such as dominance, backward induction, Nash equilibrium, evolutionary stability,commitment, credibility, asymmetric information, adverse selection, and signaling are discussed and applied to games played in class and to examples drawn from economics,politics, the movies, and elsewhere.ECON 159: Game Theory (Fall, 2007)SyllabusProfessor:Ben Polak, Professor of Economics and Management, Yale UniversityDescription:This course is an introduction to game theory and strategic thinking. Ideas such as dominance, backward induction, Nash equilibrium, evolutionary stability, commitment,credibility, asymmetric information, adverse selection, and signaling are discussed and applied to games played in class and to examples drawn from economics, politics, the movies, and elsewhere.Texts:A。

Syllabusby (course_default) — last modified 10-14-2008 04:00 PMDocument Actions•This course is an introduction to game theory and strategic thinking. Ideas such as dominance, backward induction, Nash equilibrium, evolutionary stability, commitment, credibility, asymmetric information, adverse selection, and signaling are discussed and applied to games played in class and to examples drawn from economics, politics, the movies, and elsewhere.ECON 159: Game Theory (Fall, 2007)SyllabusProfessor:Ben Polak, Professor of Economics and Management, Yale University Description:This course is an introduction to game theory and strategic thinking. Ideas such as dominance, backward induction, Nash equilibrium, evolutionary stability, commitment, credibility, asymmetric information, adverse selection, and signaling are discussed and applied to games played in class and to examples drawn from economics, politics, the movies, and elsewhere.Texts:A. Dixit andB. Nalebuff. Thinking Strategically, Norton 1991J. Watson. Strategy: An Introduction to Game Theory, Norton 2002P.K. Dutta. Strategies and Games: Theory And Practice, MIT 1999 Requirements:Who should take this course?This course is an introduction to game theory. Introductory microeconomics (115 or equivalent) is required. Intermediate micro (150/2)is not required, but it is recommended. We will use calculus (mostly one variable) in this course. We will also refer to ideas like probability and expectation. Some may prefer to take the course next academic year once they have more background. Students who have already taken Econ 156b should not enroll in this class.Course Aims and Methods.Game theory is a way of thinking about strategic situations. One aim of the course is to teach you some strategic considerations to take into account making your choices. A second aim is to predict how other people or organizations behave when they are in strategic settings. We will see that these aims are closely related. We will learn new concepts, methods and terminology. A third aim is to apply these tools to settings from economics and from elsewhere. The course will emphasize examples. We will also play several games in class.Outline and Reading.Most of the reading for this course comes from the first ten chapters of Dutta or from the first two parts of Watson. There will be a reading packet for weeks 6-7. The readings are not compulsory, but they will help back up the class material.Grading:Problem sets: 30%Midterm examination: 30%Final examination: 40%Transcript 1 - Introduction: five first lessonsby mvd4 — last modified 09-15-2011 09:34 AMDocument Actions•We introduce Game Theory by playing a game. We organize the game into players, their strategies, and their goals or payoffs; and we learn that we should decide what our goals are before we make choices. With some plausible payoffs, our game is a prisoners' dilemma. We learn that we should never choose a dominated strategy; but that rational play by rational players can lead to bad outcomes. We discuss some prisoners' dilemmas in the real world and some possible real-world remedies. With other plausible payoffs, our game is a coordination problem and has very different outcomes: so different payoffs matter. We often need to think, not only about our own payoffs, but also others' payoffs. We should put ourselves in others' shoes and try to predict what they will do. This is the essence of strategic thinking.Game Theory: Lecture 1 TranscriptSeptember 5, 2007 << backChapter 1. What Is Strategy? [00:00:00]Professor Ben Polak:So this is Game Theory Economics 159. If you're here for art history, you're either in the wrong room or stay anyway, maybe this is the right room; but this is Game Theory, okay. You should have four handouts; everyone should have four handouts. There is a legal release form--we'll talk about it in a minute--about the videoing. There is a syllabus, which is a preliminary syllabus: it's also online. And there are two games labeled Game 1 and Game 2. Can I get you all to look at Game 1 and start thinking about it. And while you're thinking about it, I am hoping you can multitask a bit. I'll describe a bit about the class and we'll get a bit of admin under our belts. But please try and lookat--somebody's not looking at it, because they're using it as a fan here--so look at Game 1 and fill out that form for me, okay?So while you're filling that out, let me tell you a little bit about what we're going to be doing here. So what is Game Theory? Game Theory is a。