企业所得税年度纳税申请表中英文

- 格式:doc

- 大小:91.00 KB

- 文档页数:4

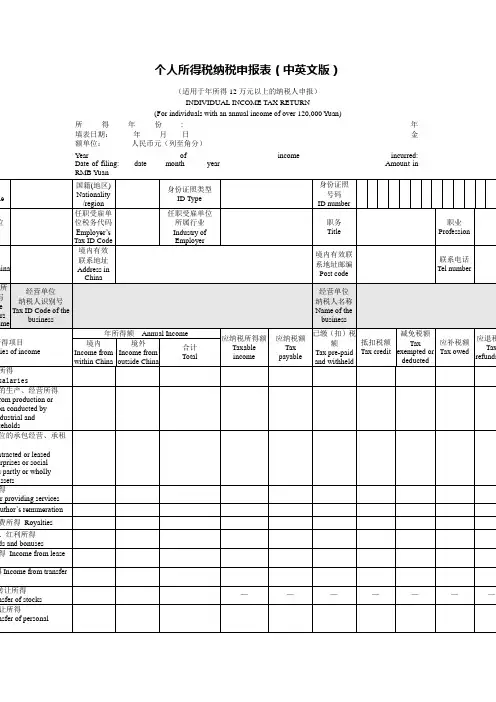

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuanof perjury , I declare that this return has been filed a ccording to THE INDIVIDUAL INCOME TAX LAW OF THE PEOPLE’S REPUBLIC OF CHINA and other rele to the best of my knowledge and belief. I guarantee the information provided is true, correct and complete.axpayer’s signatur ePreparer (Other than taxpayer)’s firme number税务机关受理人(签字):税务机关受理时间:年月日受理申报税务机关名称(盖章):Signature of responsible tax officer : Filing date: Time:Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuan章):Signature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:(一)所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

(二)身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

(三)身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

(四)任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

(五)任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

(六)任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

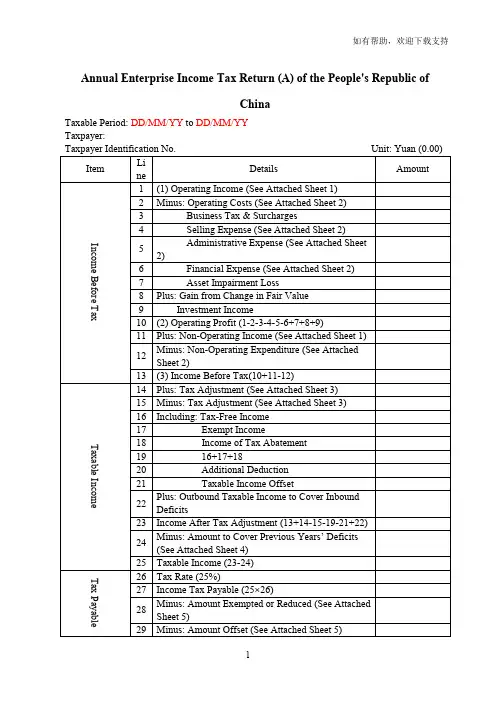

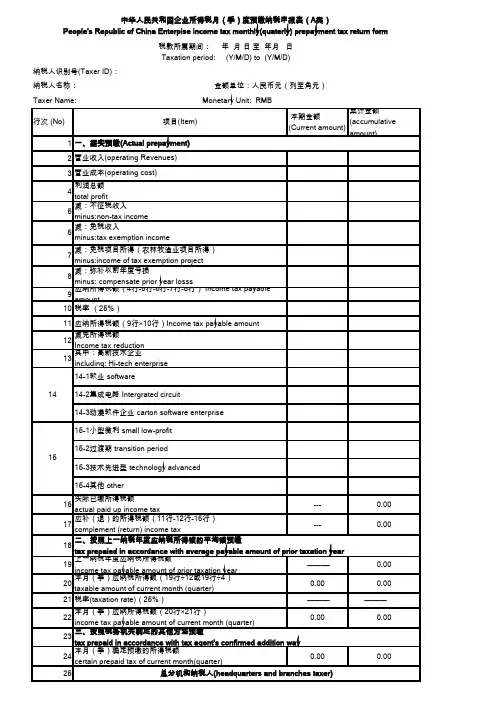

Annual Enterprise Income Tax Return (A) of the People's Republic ofChinaTaxable Period: DD/MM/YY to DD/MM/YYTaxpayer:Monthly(Quarterly)Enterprise Income Tax Return (A) of the People's Republicof ChinaTaxation Period: DD/MM/YY to DD/MM/YYTaxpayer ID:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (signature): Date: Taxpayer’s Official Seal: Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (seal): Date: Taxpayer’s Official Seal:Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (signature): Date: Taxpayer’s Official Seal: Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of Taxation。

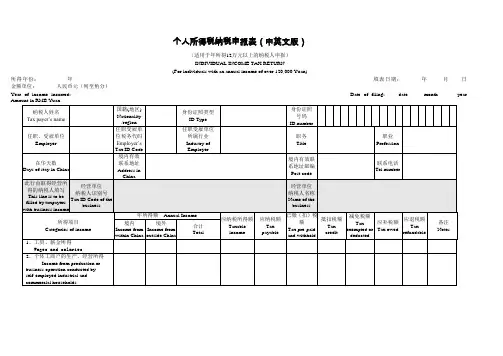

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuan章):Signature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:(一)所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

(二)身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

(三)身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

(四)任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

(五)任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

(六)任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

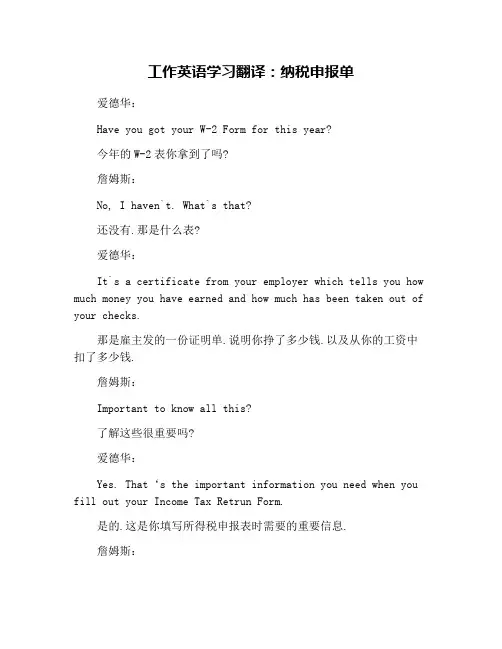

工作英语学习翻译:纳税申报单爱德华:Have you got your W-2 Form for this year?今年的W-2表你拿到了吗?詹姆斯:No, I haven`t. What`s that?还没有.那是什么表?爱德华:It`s a certificate from your employer which tells you how much money you have earned and how much has been taken out of your checks.那是雇主发的一份证明单.说明你挣了多少钱.以及从你的工资中扣了多少钱.詹姆斯:Important to know all this?了解这些很重要吗?爱德华:Yes. That‘s the important information you need when you fill out your Income Tax Retrun Form.是的.这是你填写所得税申报表时需要的重要信息.詹姆斯:Oh, it`s just like the Group Certificate we get in Australia. And we too have to fill out Income Tax Form Returns.喔.这就像我们在澳大利亚所有的集体纳税证明单.而且我们也要填写所得税申报表.爱德华:Well, paying taxes seems to be universal.是啊.纳税看来是世界性的.詹姆斯:Yes, Every government needs money. Only the amount of money and the way they take money may be different.不错.每个政府都要钱.仅仅钱款数额及收钱的方式可能不同罢了.爱德华:What`s the tax rate in Australia?澳大利亚的税率是多少?詹姆斯:Taxes in Australia are a bit heavy. The personal income tax rate is about 20%. What about the tax rate in America?澳大利亚的税收比较重.个人所得税大约是20%.美国的税率怎么样?爱德华:Well, taxes in America are rather complicated. Actually there`s no overall tax rate like the one in Australia.噢.美国的税收相当复杂.实际上没有像你们澳大利亚那样的一个总的税率.詹姆斯:Then how do you calculate your taxes?那么你们是怎样计算税收的呢?爱德华:Personal incomes are taxed a graduated rates, and we have a tax table which tells you how much tax`s required on what amount of money earned. Do you have state and local taxes in Australia?个人收入是按累进税主征税的.而且我们有一个税率表.告诉你多少收入要征多少税.你们澳大利亚有州税和地方税吗?詹姆斯:No. We`ve got national tax only in Australia. Are you telling me that you Americans have to pay state and local taxes as well?没有.我们澳大利亚只有国家征收的税.你是说你们美国人还得缴纳州税和地方税?爱德华:Denifitely. And that`s what I mean by对.这就是我所说的詹姆斯:I see. What`s the time for tax return then?我明白了.那么什么时候办所得税申报呢?爱德华:Any time between January 1 and April 15. When you get your W-2 From, you should get ready to file your tax return.月1日到4月15日期间的任何时间.当你收到W-2表时.你就应该准备申报所得税了.。

个人所得税纳税申报表(中英文对照)W o r d模板个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuanof perjury , I declare that this return has been filed according to THE INDIVIDUAL INCOME TAX LAW OF THE PEOPLE’S REPUBLIC OF CHINA and other rel to the best of my knowledge and belief. I guarantee the information provided is true, correct and complete.axpayer’s signaturePreparer (Other than taxpayer)’s firm 联系电话:Phone number税务机关受理人(签字):税务机关受理时间:年月日受理申报税务机关名称(盖章):Signature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

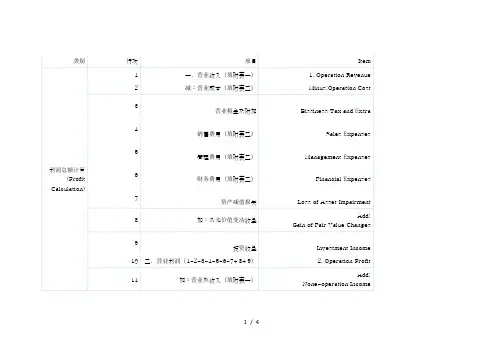

行次 (No)本期金额(Current amount)累计金额(accumulative amount)1234567891011121316---0.0017---0.001819 ———0.00200.000.0021 ——————220.000.0023240.000.002515-3技术先进型 technology advanced 实际已缴所得税额actual paid up income tax应补(退)的所得税额(11行-12行-16行)complement (return) income tax二、按照上一纳税年度应纳税所得额的平均额预缴tax prepaied in accordance with average payable amount of prior taxation year 本月(季)应纳所得税额(20行×21行)income tax payable amount of current month (quarter)三、按照税务机关确定的其他方法预缴tax prepaid in accordance with tax agent's confirmed addition way 上一纳税年度应纳税所得税额income tax payable amount of prior taxation year 本月(季)应纳税所得额(19行÷12或19行÷4)taxable amount of current month (quarter)税率(taxation rate)(25%)本月(季)确定预缴的所得税额certain prepaid tax of current month(quarter)总分机构纳税人(headquarters and branches taxer)中华人民共和国企业所得税月(季)度预缴纳税申报表(A类)People's Republic of China Enterpise income tax monthly(quaterly) prepayment tax return form税款所属期间: 年 月 日 至 年月 日Taxation period: (Y/M/D) to (Y/M/D)纳税人识别号(Taxer ID):纳税人名称: 金额单位:人民币元(列至角元)15-4其他 other1415一、据实预缴(Actual prepayment)15-1小型微利 small low-profit 15-2过渡期 transition period减:免税收入minus:tax exemption income 减:免税项目所得(农林牧渔业项目所得)minus:income of tax exemption project 减:弥补以前年度亏损minus: compensate prior year losss应纳所得税额(4行-5行-6行-7行-8行) Income tax payable amount14-2集成电路 Intergrated circuit14-3动漫软件企业 carton software enterprise 项目(Item)减:不征税收入minus:non-tax income 14-1软业 software Taxer Name: Monetary Unit: RMB 其中:高新技术企业including: Hi-tech enterprise 税率 (25%)应纳所得税额(9行×10行)Income tax payable amount 营业收入(operating Revenues)营业成本(operating cost)利润总额total profit减免所得税额Income tax reduction260.000.00270.000.00280.000.0029300.000.00代理申报中介机构公章:( Agent's company seal):经办人(Agent):经办人执业证件号码:(Agent registered ID No:代理申报日期Agent FilingDate: 年月 日(Y/M/D)谨声明:此纳税申报表是根据《中华人民共和国企业所得税法》、《中华人民共和国企业所得税法实施条例》和国家有关税收规定填报的,是真实的、可靠的、完整的。

税收报表英语词汇Withholding Tax Form (代扣所得税表)English Language Word or Term Chinese Language Word or Term INDIVIDUAL INCOME TAX WITHHOLDING RETURN 扣缴个人所得税报告表Withholding agent's file number 扣缴义务人编码Date of filing 填表日期Day 日Month 月Year 年Monetary Unit 金额单位RMB Yuan 人民币元This return is designed in accordance with the provisions of Article 9 of INDIVIDUAL INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA. The withholding agents should turn the tax withheld over to the State Treasury and file the return with the local tax authorities within seven days after the end of the taxable month.根据《中华人民共和国个人所得税法》第九条的规定,制定本表,扣缴义务人应将本月扣缴的税款在次月七日内缴入国库,并向当地税务机关报送本表。

Withholding agent's name 扣缴义务人名称Address 地址Telephone Number 电话Tax payer's name 纳税义务人姓名Tax payer's file number 纳税人编码Unit's name and Address 工作单位及地址Categories of income 所得项目Income period 所得时间Revenue 收入额Renminbi (RMB)人民币Foreign currency 外币Name of currency 货币名称Amount 金额Exchange rate 外汇牌价Renminbi (RMB)converted into 折合人民币Total 人民币合计Deductions 减费用额Taxable Income 应纳税所得额Tax rate 税率Quick calculation deduction 速算扣除数Amount of tax withheld 扣缴所得税额Tax certificate number 完税证字号Date of tax payment 纳税日期In case the tax certificate is filled out by withholding agent, this returnshould be submitted together with 如果由扣缴义务人填写完税证,应在送此表时附完税证副联——份Withholding total amount yuan 合计扣缴金额——元Declaration by Withholding agent 扣缴义务人声明I declare that the return is filled out in accordance with the INDIVIDUAL INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA, and I believe that the Statements contained in this return are true, correct and complete.我声明:此扣缴申报报表是根据《中华人民共和国个人所得税法》的规定填报的,我确信它是真实的,可靠的,完整的。

附件个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB YuanSignature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax office填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:1、所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

2、身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

3、身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

4、任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

5、任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

6、任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

月(季)度预缴纳税申报表中英文Quarterly Prepayment Tax Return Form in Chinese and English税务局税务申报表申报期:2022 年第一季度报表类型:月(季)度预缴纳税申报表一、表格说明:本表由纳税人根据税法规定填报,按真实、准确、完整的原则填写。

如有更正,应在更正声明框内填写清楚,并在本表上签名。

若填写过程中有任何疑问,请咨询税务机关。

二、填报纳税人信息:1. 纳税人姓名:_________________________2. 纳税人识别号:_______________________3. 纳税人地址:_________________________4. 纳税人联系电话:_____________________三、填报所属期间:报送月份/季度:_________________________四、税款计算:1. 全年预计销售额:_______________________(填报单位:人民币)2. 税率适用情况:- 增值税率:___________________________(填报百分比)- 企业所得税率:________________________(填报百分比) - 个人所得税率:________________________(填报百分比)3. 销售额应纳税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)4. 实际预缴税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)5. 本期应补(退)税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)五、附注:填写附注以说明填报表格中出现的特殊情况或异常情形。

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuanof perjury , I declare that this return has been filed according to THE INDIVIDUA L INCOME TAX LAW OF THE PEOPLE’S REPUBLIC OF CHINA and other rele to the best of my knowledge and belief. I guarantee the information provided is true, correct and complete.axpayer’s signaturePreparer (Ot her than taxpayer)’s firme number税务机关受理人(签字):税务机关受理时间:年月日受理申报税务机关名称(盖章):Signature of responsible tax officer : Filing date: Time:Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份:年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuanof perjury , I declare that this return has been filed according to THE INDIVIDUAL INCOME TAX LAW OF THE PEOPLE ' S REPUBLIC OF CHINA and other rele to the best of my knowledge and belief. I guarantee the information provided is true, correct and complete.axpayer ' s signaturPreparer (Other than taxpayer)' s firme number税务机关受理人(签字):税务机关受理时间: 年月日受理申报税务机关名称(盖章):Signature of responsible tax officer : Filing date: Time:Year/Month/Date填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。