经典经济学入门教材英文讲义1(Principles of Economic)

- 格式:pptx

- 大小:72.05 KB

- 文档页数:26

principles of economic第一章读后感篇一 principles of economic 第一章读后感哎呀妈呀,读了这《principles of economic》的第一章,我这脑子就像开了锅似的,翻腾个不停!一开始,我觉得这玩意儿可能会枯燥得要死,就跟那些老掉牙的教科书一个样。

但读着读着,我发现好像也不是那么回事儿。

也许是我太低估它了,这里面讲的东西,咋说呢,可能不像小说那么跌宕起伏,但是细琢磨起来,还真有点意思。

书里提到的那些经济原理,我觉得就像是生活中的密码,解开了就能明白好多事儿。

比如说供求关系,这不就是咱平时买东西时的那点小心思嘛!供给多了,价格可能就跌;需求大了,价格就蹭蹭往上涨。

我就在想,那我买东西的时候是不是也能靠着这点小知识,捡个便宜啥的?不过,读着读着我又有点犯迷糊了。

这一堆的概念、图表,搞得我头都大了。

我就问自己,这东西真能在实际生活中派上用场吗?也许能,也许不能,谁知道呢!反正现在我是一知半解的。

这第一章就像是个开胃菜,让我对后面的内容既期待又有点小害怕。

期待是因为说不定能学到更多厉害的东西,害怕的是万一太难懂,我不就抓瞎了?但不管咋说,我还是决定硬着头皮继续读下去,说不定读着读着就开窍了呢!你们说是不是?嘿,朋友们!今天我要跟你们唠唠我读《principles of economic》第一章的那些事儿。

刚翻开这书的时候,我心里直犯嘀咕:“这能有意思吗?”可没想到,读着读着,我居然被吸引住了。

就好像走进了一个全新的世界,到处都是我不懂但又好奇得不行的东西。

这第一章里讲的经济原理,让我有种恍然大悟的感觉。

比如说,那个机会成本的概念,我以前可从来没想过。

做一件事的时候,可能放弃了做另一件事的机会,这放弃的就是机会成本。

我就想啊,我平时做决定的时候,是不是根本没考虑到这一点呢?也许我错过了好多更好的选择,自己还不知道呢!但是,这里面有些东西也太难懂啦!那些复杂的公式和图表,看得我眼花缭乱。

商业经济学英文教材

以下是商业经济学的一些英文教材:

1. "Principles of Economics" by Greg Mankiw。

这本书是经济学原理的

经典教材之一,涵盖了微观经济学和宏观经济学的基础知识。

2. "Business Economics" by John Butters。

这本书重点介绍了商业经济学的基本概念和应用,包括市场结构、企业战略、竞争优势等。

3. "Managerial Economics: Decision-Making in the Real World" by William J. Baumol。

这本书主要关注管理经济学,重点介绍了如何将经济

学原理应用于实际商业决策中。

4. "Economics for Business Decisions" by Robert Gibbons。

这本书强

调了如何将经济学原理应用于商业决策中,包括定价、生产、成本、市场结构等方面。

5. "Microeconomics for Business" by Gary S. Becker and Julio J. Jaumotte。

这本书是一本微观经济学教材,重点关注企业决策和市场竞争,适合商学院的学生阅读。

以上是一些常用的商业经济学英文教材,你可以根据自己的需要选择适合的教材进行阅读和学习。

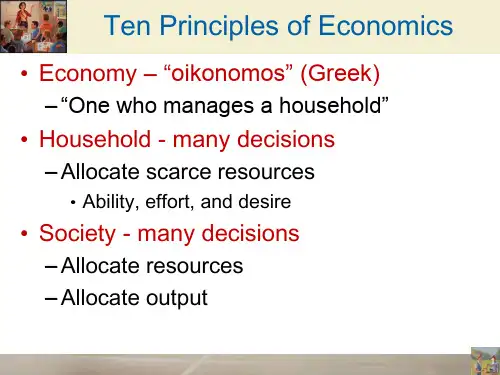

Theprinciplesofeconomics.经济学的原理(英译中)The word economy es from the Greek word for “one who manages a household.” at first, this origin might seem peculiar.经济这个字眼来自希腊语中“家庭的管理者”,一开始,这个起源似乎看上去有些特殊。

But, in fact, households and economies have much in mon.但是,实际上,家庭和经济有许多的共同之处。

A household faces many decisions.一个家庭面临很多的决定。

It must decide which members of the household do which tasks and what each member gets in return:它必须要决定家庭成员要完成任务,并且将每个家庭中的成员都安排在内。

Who cooks dinner?谁烧正餐?Who does the laundry?谁做洗衣服?Who gets the extra dessert at dinner?谁可以得到额外的餐后甜点?Who gets to choose what TV show to watch?谁可以选择电视节目来看?In short, the household must allocate its scarce resources among its various members, taking into account each member’s abilitie s, efforts, and desires.总之,家庭必须把其缺乏的资源分配给其中的各种成员,并把每个成员能力,努力和愿望考虑进去,--Like a household, a society faces many decisions.和家庭一样,社会也面临很多的决定。

经济管理类的经典书籍经济管理类的经典书籍是帮助读者深入了解经济学与管理学原理的重要工具。

这些书籍涵盖了从经济学基础知识到管理理论和实践的广泛范围。

在这篇文章中,我们将介绍五本经典的经济管理类书籍。

1.《经济学原理》(Principles of Economics)- N. Gregory Mankiw《经济学原理》是一本经济学入门的经典教材。

著名的经济学家Mankiw以清晰、易懂的语言介绍了经济学的基本概念和原理。

书中讨论了供求关系、市场结构、税收和政府政策等重要主题。

这本书特别适合那些对经济学感兴趣,但没有相关背景知识的读者。

2.《管理学》(Management)- Stephen P. Robbins & Mary Coulter《管理学》是一本全面介绍管理学知识和实践的经典教材。

该书涵盖了组织行为、领导、决策、沟通、团队管理等关键内容。

作者通过实际案例和具体的管理经验,帮助读者理解和应用管理理论。

这本书适合希望在管理领域找到成功的专业人士和学生。

3.《创新者的窘境》(The Innovator's Dilemma)- Clayton M. Christensen《创新者的窘境》是一本关于创新和经济变革的经典著作。

克莱顿·克里斯坦森(Clayton M. Christensen)教授通过研究行业颠覆与企业成功的案例,探讨了创新中的困境和挑战。

这本书提供了对企业如何在面对不断变化的市场中生存和发展的深入思考。

4.《财富的五种境界》(The Five Levels of Economic Development)- Martin Zesmelis《财富的五种境界》是一本强调经济发展的重要性的书籍。

马丁·泽斯梅利斯(Martin Zesmelis)在书中分析了五个经济发展阶段:生存、稳定、积累、财富和盈亏平衡。

通过对这些阶段的深入理解,读者可以更好地规划个人和组织的经济发展策略。

1Ten Principles of Economics1Ten Principles of Economics •Economy, “oikonomos” (Greek)–“One who manages a household”–Households and economies have much in common •Households face many decisions–Allocate scarce resources•Ability, effort, and desire•An economy consists of–the economic systems of a country or other area, the labor,capital and land resources, and the economic agents thatsocially participate in the production, exchange, distribution,and consumption of goods and services of that area.2Ten Principles of Economics•Resources are scarce•Scarcity–The limited nature of society’s resources–Society has limited resources and therefore cannotproduce all the goods and services people wish to have •Economics–is the social science concerned with how individuals,institutions, and society make optimal choices underconditions of scarcity.•Microeconomics and Macroeconomics3Scoring Components1.The course provides instruction in basic economic concepts and promotes understandingof economic decision-making factors,such as marginal analysis and opportunity costs.2.The course provides instruction in the nature and functions of product markets:Supply andDemand Model.3.The course provides instruction in the nature and functions of product markets:ConsumerChoice.4.The course provides instruction in the nature and functions of product markets:Productionand Costs.5.The course provides instruction in the nature and functions of product markets:MarketStructures.6.The course provides instruction in factor markets.7.The course provides instruction in market failure and the role of government in correctingmarket failure.8.The course teaches students how to generate graphs and charts to describe economicconcepts.9.The course teaches students how to interpret and analyze graphs, charts, and data todescribe economic concepts.4tigers seals Asian elephantsmonkeys What animals did you choose and why?This would have taken care of 7 of the 25 acres. 18 more to go.camelsCuddly tigers anyone?some core concepts of economics6Why didn’t you choose all the animals?Not enough land = lack of resources = scarcityWhy didn’t you choose cows or pigs?Benefit versus Costs (in terms of acres)Why didn’t you choose to fill your zoo with just monkeys or just tigers?Diminishing marginal utilityWhy did you choose an Asian Elephant rather than an African one?Benefit versus costsmore core concepts of economics7Which was the final animal you chose?Marginal AnalysisWhat animal just missed out on being chosen for your zoo?Opportunity Cost –the cost of the best alternative foregoneIf this was a group exercise would the choices have been the same?Individual benefits versus Social benefitsTen Principles of Economics•Economists study:–How people make decisions•Work, buy, save, invest–How people interact with one another–Analyze forces and trends that affect the economy as awhole•Growth in average income•Fraction of the population that cannot find work•Rate at which prices are rising8Ten Principles of Economics•How people make decisions1.People face trade-offs2.The cost of something is what you give up to get it3.Rational people think at the margin4.People respond to incentives9Ten Principles of Economics•How people interact5.Trade can make everyone better off6.Markets are usually a good way to organize economicactivityernments can sometimes improve market outcomes10Ten Principles of Economics•How the economy as a whole works8.A country’s standard of living depends on its ability toproduce goods and services9.Prices rise when the government prints too much money10.Society faces a short-run trade-off between inflation andunemployment11How People Make Decisions, #1Principle 1: People face trade-offs•“There ain’t no such thing as a free lunch”–To get something that we like, we usually have to give up something else that we also like•Making decisions–Trade off one goal against another•People face choices all the time.12How People Make Decisions, #1•Trade offs–Students: time–Parents: income–Society•National defense vs. consumer goods (guns vs. butter)•Clean environment vs. high level of income•Efficiency vs. equality13How People Make Decisions, #1•Efficiency–Society getting the maximum benefits from its scarceresources–Size of the economic pie•Equality–Distributing economic prosperity uniformly among themembers of society–How the pie is divided into individual slices14How People Make Decisions, #2Principle 2: The cost of something is what you give up to get it •People face trade-offs–Make decisions•Compare cost with benefits of alternatives•Opportunity cost–Whatever must be given up to obtain some item–Opportunity cost always exists as long as people make achoice.–Absolute advantage–Comparative advantage15How People Make Decisions, #3Principle 3: Rational people think at the margin•Rational people–Systematically and purposefully do the best they can toachieve their objectives•Marginal changes–Small incremental adjustments to a plan of action16How People Make Decisions, #3•Optimal decision–rational people think at the margin (not the average).•Rational decision maker–Make decisions by comparingmarginal benefits and marginalcosts–Take action only if: •Marginal benefits > Marginal costs 17“Is the marginal benefit of this call greater thanthe marginal cost?”How People Make Decisions, #4Principle 4: People respond to incentives•Incentive–Something that induces a person to act–Higher price•Buyers -consume less•Sellers -produce more–Public policy•Change costs or benefits•Change people’s behavior18The Incentive Effects of Gasoline Prices•2005 to 2008, price of oil in world oilmarkets skyrocketed–Limited supplies–Surging demand from robust worldgrowth–Price of gasoline in the United Statesrose from about $2 to about $4 a gallon19The Incentive Effects of Gasoline Prices•Increased incentive to conserve gas–Smaller cars, scooters, bicycles, masstransit–Camels (India)–New, more fuel-efficient aircraft•Airbus A320 and Boeing 737–Moving near an Amtrak station–Online courses20How People Interact, #5Principle 5: Trade can makeeveryone better off•Trade–Allows each person tospecialize in the activities he or she does best–Enjoy a greater variety ofgoods and services at lowercost–People need self-sufficiencywithout trade 21“For $5 a week you can watch baseball without being nagged to cut the grass!”How People Interact, #6Principle 6: Markets are usually a good way to organize economic activity•Communist countries, central planning–Government officials (central planners)•Allocate economy’s scarce resources–What goods and services were produced–How much was produced–Who produced and consumed these goods and services22How People Interact, #6•Market economy, allocation of resources–Through decentralized decisions of many firms andhouseholds–As they interact in markets for goods and services–Guided by prices and self-interest23How People Interact, #6•Adam Smith’s “invisible hand”–Households and firms interacting in markets•Act as if they are guided by an “invisible hand”•Leads them to desirable market outcomes–Corollary: Government intervention•Prevents the invisible hand’s ability to coordinate the decisionsof the households and firms that make up the economy24How People Interact, #7Principle 7: Governments can sometimes improve market outcomes•We need government–Enforce rules and maintain institutions that are key to amarket economy–Enforce property rights–Promote efficiency, avoid market failure–Promote equality, avoid disparities in economic wellbeing25How People Interact, #7•Property rights–Ability of an individual to own and exercise control overscarce resources•Market failure–Situation in which the market left on its own fails toallocate resources efficiently–Externalities–Market power26How People Interact, #7•Externality–Impact of one person’s actions on the well-being of abystander–Pollution•Market power–Ability of a single economic actor (or small group ofactors) to have a substantial influence on market prices27How People Interact, #7•Disparities in economic wellbeing–Market economy rewards people•According to their ability to produce things that other people arewilling to pay for–Government intervention, public policies•Aim to achieve a more equal distribution of economic well-being•May diminish inequality•Process far from perfect28How the Economy as a Whole Works, #8 Principle 8: A country’s standard of living depends on its ability to produce goods and services•Large differences in living standards–Among countries–Over time•Average annual income, 2011–$48,000 (U.S.); $9,000 (Mexico)–$5,000 (China); $1,200 (Nigeria)29How the Economy as a Whole Works, #8•Explanation: differences in productivity•Productivity–Quantity of goods and services produced from each unit of labor input–Higher productivity•Higher standard of living–Growth rate of nation’s productivity•Determines growth rate of its average income30How the Economy as a Whole Works, #9Principle 9: Prices rise when the government prints too muchmoney•Inflation–An increase in the overall level of prices in the economy •Causes for large or persistent inflation –Growth in quantity of money –Value of money falls31“Well it mayhave been 68cents when yougot in line, butit’s 74 centsnow!”How the Economy as a Whole Works, #10 Principle 10: Society faces a short-run trade-off between inflation and unemployment•Short-run effects of monetary injections:–Stimulates the overall level of spending•Higher demand for goods and services–Firms –raise prices; hire more workers; produce moregoods and services–Lower unemployment32How the Economy as a Whole Works, #10•Short-run trade-off between unemployment and inflation –Key role –analysis of business cycle•Business cycle–Fluctuations in economic activity•Employment•Production33Table 134Ten Principles of Economics。

mankiw principles of economics Mankiw's Principles of Economics: An In-Depth AnalysisIntroduction:In the field of economics, Gregory Mankiw's book "Principles of Economics" stands as a standard introductory text for students worldwide. This comprehensive work covers a wide range of topics, including the fundamental principles that drive economic decision-making. In this article, we will delve into Mankiw's principles, exploring each step in detail.1. The Ten Principles of Economics:Mankiw's book is built around ten fundamental principles that form the backbone of economic study. These principles provide a framework for analyzing various economic issues and making rational decisions. Let's examine each principle one by one:a. Principle 1: People Face Trade-Offs:This principle states that because resources are limited, individuals, businesses, and societies need to make choices. Investing in onearea often means sacrificing another. For example, allocating more funds to education might require cutting healthcare spending.b. Principle 2: The Cost of Something is What You Give Up to Get It: This principle highlights the concept of opportunity cost. Any decision involves giving up alternative choices, and the cost of a choice is measured by the value of the next best alternative foregone.c. Principle 3: Rational People Think at the Margin:Rational individuals make decisions by comparing marginal benefits and marginal costs. They choose the option that offers the greatest benefit while considering incremental changes.d. Principle 4: People Respond to Incentives:This principle recognizes that people's behavior is influenced by the motivations and incentives they face. For instance, a higher price for a good leads to decreased demand.e. Principle 5: Trade Can Make Everyone Better Off:Trade allows individuals or countries to specialize in producing what they are best at, thus increasing overall productivity andbenefiting all parties. This principle supports the case for international trade.f. Principle 6: Markets Are Usually a Good Way to Organize Economic Activity:A market economy allocates resources through the forces of supply and demand. This principle asserts that markets are efficient in coordinating economic activities and distributing goods and services.g. Principle 7: Governments Can Sometimes Improve Market Outcomes:This perspective acknowledges that there are situations when markets fail to allocate resources efficiently. In these cases, government interventions, such as regulations or taxes, can potentially improve outcomes.h. Principle 8: A Country’s Standard of Living Depends on Its Ability to Produce Goods and Services:Productivity is a key determinant of a country's standard of living. Economic growth can be achieved by increasing productivity through technological advancements, education, and infrastructuredevelopment.i. Principle 9: Prices Rise When the Government Prints Too Much Money:This principle recognizes the negative effects of inflation resulting from excessive money supply. The increase in money circulation reduces the value of money, leading to rising prices.j. Principle 10: Society Faces a Short-Run Trade-Off Between Inflation and Unemployment:This principle highlights the Phillips curve, which suggests a trade-off between inflation and unemployment in the short run. A government can stimulate economic growth and reduce unemployment in the short term by increasing the money supply, but this can lead to inflationary pressures.2. Applying Mankiw's Principles:Understanding and applying these principles helps individuals make informed decisions and policymakers design effective economic policies. Let's explore how these principles apply to real-world scenarios:a. Policy-Making: Policymakers can use Principle 7 to justify regulations that correct market failures. For example, the government may set emission standards to combat pollution caused by market activities.b. Personal Finance: Applying Principle 2, individuals can make better financial decisions by considering the opportunity cost. Saving for retirement may require sacrificing immediate consumption.c. International Trade: Principle 5 explains the benefits of trade. By specializing in producing goods or services in which they have a comparative advantage, countries can achieve higher productivity and overall welfare.d. Business Strategy: Rational business decision-making typically entails weighing marginal costs and benefits (Principle 3). Firms must determine whether the cost of expanding production justifies the potential increase in revenue.Conclusion:Gregory Mankiw's Principles of Economics offers a comprehensive and accessible framework for understanding economicdecision-making. These ten principles provide a solid foundation for analyzing different economic scenarios and making rational choices. By considering trade-offs, opportunity costs, incentives, and market forces, individuals, businesses, and policymakers can navigate complex economic issues and strive for optimal outcomes. Understanding and applying these principles not only helps in academic studies but also in everyday life.。

Theprinciplesofeconomics.经济学的原理(英译中)Theprinciplesofeconomics.经济学的原理(英译中)The word economy es from the Greek word for “one who manages a household.” at first, this origin might seem peculiar.经济这个字眼来⾃希腊语中“家庭的管理者”,⼀开始,这个起源似乎看上去有些特殊。

But, in fact, households and economies have much in mon.但是,实际上,家庭和经济有许多的共同之处。

A household faces many decisions.⼀个家庭⾯临很多的决定。

It must decide which members of the household do which tasks and what each member gets in return:它必须要决定家庭成员要完成任务,并且将每个家庭中的成员都安排在内。

Who cooks dinner?谁烧正餐?Who does the laundry?谁做洗⾐服?Who gets the extra dessert at dinner?谁可以得到额外的餐后甜点?Who gets to choose what TV show to watch?谁可以选择电视节⽬来看?In short, the household must allocate its scarce resources among its various members, taking into account each member’s abilitie s, efforts, and desires.总之,家庭必须把其缺乏的资源分配给其中的各种成员,并把每个成员能⼒,努⼒和愿望考虑进去,--Like a household, a society faces many decisions.和家庭⼀样,社会也⾯临很多的决定。

principles of economics 金融学入门课[A Step-By-Step Guide to Principles of Economics: Introduction to Finance]Introduction:In today's complex and interconnected world, understanding the principles of economics is crucial for individuals and businesses alike. One fundamental aspect of economics is finance, which deals with the management of funds and the allocation of resources. This article will provide a step-by-step guide to the principles of economics, specifically focusing on the introduction to finance.Step 1: Understanding the BasicsTo begin our journey into the world of finance, it is essential to understand some basic concepts. Finance primarily revolves around the concepts of money, time, risk, and return. Money acts as a medium of exchange, unit of account, and a store of value. Time is a critical factor in finance as it determines the value of money and assets over time. Risk refers to the uncertainty associated with an investment or a financial decision. Return, onthe other hand, is the gain or loss generated through an investment.Step 2: Exploring Financial MarketsFinancial markets play a crucial role in the world of finance. They are platforms where buyers and sellers meet to trade financial assets, such as stocks, bonds, and currencies. Understanding the various types of financial markets, including capital markets, money markets, and foreign exchange markets, is essential. Moreover, comprehending the functions of these markets, such as providing liquidity, allocating resources, and facilitating risk management, will enhance our understanding of finance.Step 3: Analyzing Financial StatementsFinancial statements are documents that provide an overview of a company's financial performance. There are three primary financial statements: the balance sheet, the income statement, and the cash flow statement. The balance sheet provides a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time. The income statement shows a company's revenue,expenses, and profits over a given period. The cash flow statement demonstrates the inflow and outflow of cash from operating, investing, and financing activities. Analyzing these statements helps us assess a company's financial health and make informed investment decisions.Step 4: Evaluating Risk and ReturnUnderstanding the relationship between risk and return is crucial in finance. Generally, higher returns are associated with higher risks. Different investment options offer a varying degree of risk and potential return. Evaluating risk involves assessing factors such as volatility, market conditions, and regulatory changes. It also involves measuring the probability of a negative outcome. By comprehending the trade-off between risk and return, we can make informed investment decisions that align with our risk appetite and financial goals.Step 5: Studying Financial InstrumentsFinancial markets offer a wide range of instruments that enable individuals and businesses to raise capital or invest funds. Somecommon financial instruments include stocks, bonds, derivatives, and mutual funds. Understanding the characteristics, benefits, and risks associated with each instrument is crucial for effective financial decision-making. For instance, stocks represent ownership in a company and offer potential capital appreciation but come with market volatility. Bonds, on the other hand, are debt instruments issued by governments or corporations and offer fixed interest payments but carry credit risk.Step 6: Recognizing the Role of Financial InstitutionsFinancial institutions, such as banks, insurance companies, and investment firms, play a vital role in the functioning of the economy. They provide services like financing, risk management, and financial intermediation. Understanding the functions and importance of financial institutions helps us comprehend the overall financial system and its impact on economic growth and stability. Additionally, recognizing the role of central banks in controlling money supply, interest rates, and maintaining financial stability is crucial in understanding the broader economic context.Step 7: Applying Economic Principles to Personal FinanceLastly, understanding the principles of economics and finance should also be applied at an individual level. Personal finance encompasses budgeting, saving, investing, and managing debt. By applying economic principles such as opportunity cost, time value of money, and diversification, individuals can make informed financial decisions in their day-to-day lives. Moreover, understanding concepts like inflation, interest rates, and tax planning can help individuals plan for their future financialwell-being.Conclusion:The principles of economics and finance are essential for comprehending the complexities of the modern financial world. By following this step-by-step guide, we have explored the basics of finance, financial markets, financial statements, risk and return, financial instruments, financial institutions, and personal finance. With this foundation, individuals and businesses can make informed decisions, mitigate risks, and capitalize on opportunitiesin an ever-changing economic landscape.。