_股神_沃伦_巴菲特_英文_

- 格式:pdf

- 大小:194.83 KB

- 文档页数:3

股神巴菲特巴菲特,沃伦·爱德华(Warren Edward Buffett),美国投资银行家,伯克希尔·哈撒韦公司董事长。

2003年《福布斯》杂志最富有个人排名第二,资产360亿美(比尔·盖茨460亿美圆,名列榜首)。

2003年9月22日纽交所董事长格拉索因1亿3千万的新酬问题提出辞职,巴菲特是候选人之一。

1930年8月30日出生于美国内布拉斯加州奥马哈市的一个交易所经纪人家庭,排行第二。

1941年,刚刚跨入11岁,他便跃身股海,购买了平生第一张股票。

1947年,巴菲特进入宾夕法尼亚大学攻读财务和商业管理。

两年后便不辞而别,辗转考入哥伦比亚大学金融系,拜师于著名投资学理论学本杰明.格雷厄姆。

格雷厄姆与大卫·杜德合著的《有价证券分析》乃证券投资学的开山之作,被投资界誉为投资圣经。

他主张通过分析企业的赢利情况、资产情况及未来前景等因素来评价股票。

他教授给巴菲特丰富的知识和决窍。

富有天才的巴菲特很快成了格雷厄姆的得意门生。

26岁时回到他的家乡内布拉斯加州奥马哈,办起了自己的公司。

巴菲特合伙公司的股票在1968年增长了59%。

1969年由于对股市上扬的不安,他决定清算自己的公司,把属于每个股东的股份还给他们。

他决定要休息一段时间,等待股市下跌。

1970年,他获得了合伙公司于1965年收购的伯克希尔·哈撒韦公司的控股权,出任该公司的董事长(Chairman of Berkshire Hathaway Inc.)。

他将其改造为一家投资控股公司,以保险业为主,行业分类为金融业,控股与参股的公司横跨保险、银行、出版与新闻媒介、制造业、家具零售业等十几个行业。

从1965年到2003年,伯克希尔·哈撒韦公司的投资收益率年均增长22.2%,39年来,该公司的每股账面价值从19美圆上升到50498美圆。

巴菲特掌握着该公司35.6%的股票。

该公司现成为美国一些最大跨国集团如可口可乐公司、吉列公司、《美国快报》、沃尔特·迪斯尼制片公司、《华盛顿邮报》等的主要股东。

巴菲特经典语录英文被誉为股神的沃伦·(Warren Buffett),美国投资家、企业家、慈善家,从事股票、电子现货、基金行业。

看看股神的。

巴菲特经典语录英文“Charlie and I decided long ago that in an investment lifetime it's too hard to make hundreds of smart decisions. That judgment became ever more compelling as Berkshire's capital mushroomed and the universe of investments that could significantly affect our results shrank dramatically. Therefore, we adopted a strategy that required our being smart - and not too smart at that - only a very few times. Indeed, we'll now settle for one good idea a year.” “The fact that people will be full of greed, fear or foll y is predictable. The sequence is not predictable.”――Warren Buffett, Financial Review, 1985“I am out of step with present conditions. When the game is no longer played your way, it is only human to say the new approach is all wrong, bound to lead to trouble, and so on. On one point, however, I am clear. I will not abandon a previous approach whose logic I understand ( although I find it difficult to apply ) even though it may mean foregoing large, and apparently easy, profits to embrace an approach which I don't fully understand, have not practiced successfully, and which possibly could lead to substantial permanent loss of capital.”――Warren Buffett in a letter to his partners in the stock market frenzy of 1969.“We've long felt that the only value of sto ck forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from childrenand also from grown-ups who behave in the market l ike children.” “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”――July 1999 at Herb Allen's Sun Valley, Idaho Retreat“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”――Warren Buffett lecturing to a group of students at Columbia U“There are all kind s of businesses that Charlie and I don't understand, but that doesn't cause us to stay up at night. It just means we go on to the next one, and that's what the individual investor should do.”――Warren Buffett in a Morning star Interview“If you're an inves tor, you're looking on what the asset is going to do, if you're a speculator, you're commonly focusing on what the price of the object is going to do, and that's not our game.”――1997 Berkshire Hathaway Annual Meeting“It is our job to help our clients be fearful when others are greedy, and look at opportunities when others are fearful.” “If you understood a business perfectly and the future of the business, you would need very little in the way of a margin of safety. So, the more vulnerable the business is, assuming you still want to invest in it, the larger margin of safety you'd need. If you're driving a truck across a bridge that says it holds 10,000 pounds and you've got a 9,800 pound vehicle, if the bridge is 6 inches above the crevice it covers, you may feel okay, but if it'sover the Grand Canyon, you may feel you want a little larger margin of safety...”――1997 Berkshire Hathaway Annual Meeting“You pay a high price for a cheery consensus.” “If you understood a business perfectly and the future of the business, you would need very little in the way of a margin of safety. So, the more vulnerable the business is, assuming you still want to invest in it, the larger margin of safety you'd need. If you're driving a truck across a bridge that says it holds 10,000 pounds and you've got a 9,800 pound vehicle, if the bridge is 6 inches above the crevice it covers, you may feel okay, but if it's over the Grand Canyon, you may feel you want a little larger margin of safety...”――1997 Berkshire Hathaway Annual M eeting巴菲特经典语录中英文“What counts for most people in investing is not how much they know, but rather how realistically they define what they don't know. An investor needs to do very few things right as long as he or she avoids big mistakes.”就投资而言,人们应该注意的,不是他到底知道多少,而是应该注意自己到底有多少是不知道的,投资人不需要花太多去做对的事,只要他能够尽量避免去犯重大的错误。

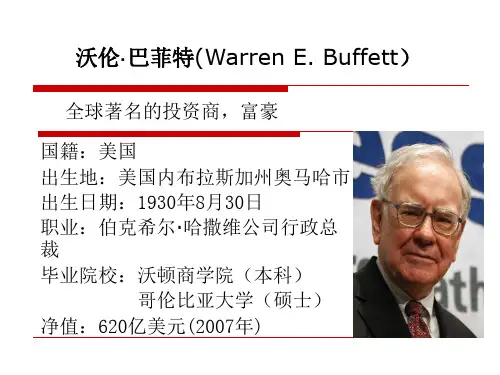

全球最大中文百科沃伦·巴菲特开放分类:世界名人人物企业家各国人物各国热点人物沃伦·巴菲特沃伦·巴菲特(Warren E. Buffett,1930年8月30日),美国投资家、企业家、慈善家。

毕业于宾夕法尼亚大学、哥伦比亚大学。

现任伯克希尔·哈撒韦公司董事长兼首席执行长及华盛顿邮报公司董事,他借由睿智地投资,汇聚了非常庞大的财富。

在2008年的《福布斯》排行榜上财富超过比尔·盖茨,成为世界首富。

2006年6月,巴菲特承诺将其资产捐献给慈善机构,其中85%将交由盖茨夫妇基金会来运用。

巴菲特此一大手笔的慈善捐赠,创下了美国有史以来的纪录。

鬼行家要投资那些始终把股东利益放在首位的企业。

目录1 人物简介2 成长经历3 投资公司4 管理风格5 慈善事业Warren Buffett 沃伦・巴菲特沃伦·爱德华·巴菲特(Warren Edward Buffett),美国投资家、企业家、及慈善家,一般人称他为股神,但这只是以讹传讹的说法,因为巴菲特本身并不非常热衷于股票操作。

正统的财经媒体尊称他为“奥玛哈的先知”、或“奥玛哈的圣人”(the "Oracle of Omaha" or the "Sage o f Omaha")。

他借由睿智地投资,汇聚了非常庞大的财富,尤其是透过他在伯克希尔·哈撒韦公司的持股。

目前巴菲特是该公司的最大股东,并担任主席及行政总裁的职务。

根据《福布斯》杂志公布的2010年度全球富豪榜,他的净资产价值为470亿美元,仅次于卡洛斯·斯利姆·埃卢和比尔·盖茨为全球第三。

2006年6月,巴菲特承诺将其资产捐献给慈善机构,其中85%将交由盖茨夫妇基金会来运用。

巴菲特此一大手笔的慈善捐赠,创下了美国有史以来的纪录。

[1]尽管巴菲特拥有庞大的财富,却以生活俭朴著称。

金融巨头的英语

金融行业是全球经济体系中最重要的一环,其影响力无可估量。

金融巨头们在这个行业里是大佬,其英语能力也是非常重要的。

下面我们来看看金融巨头的英语表现。

1.沃伦·巴菲特 (Warren Buffett)

作为全球知名的股神,沃伦·巴菲特的英语表达自然流畅,毫不拖沓。

他的语速适中,用词精准,常常以幽默的方式表达自己的看法。

他的演讲风格简捷明了,容易被听众理解。

2.拉里·菲利普斯 (Larry Fink)

拉里·菲利普斯是美国黑石集团的首席执行官,他的英语口音比较标准,讲话也比较有条理。

他在演讲中善于用例子来说明问题,让听众更容易理解他的观点。

3.贾跃亭 (Jia Yueting)

贾跃亭是中国乐视网的创始人,他的英语口音有一定的中国口音,但是他的表达能力很强。

他在演讲中常常用到一些幽默、夸张的手法,吸引了很多听众的关注。

4.马云 (Jack Ma)

作为中国电商巨头阿里巴巴的创始人,马云的英语表达能力也是很强的。

他的口音有一定的中国味道,但是他的语速适中,能够很好地传达自己的意思。

他在演讲中常常用到故事来说明问题,让听众更容易理解他的观点。

总之,金融巨头们的英语表达能力都很强,他们不仅掌握了基

本的语法和词汇,还有很强的演讲能力。

这些能力的掌握,为他们在金融行业中的成功奠定了坚实的基础。

世界投资大师:沃伦·巴菲特The Master of Investment: Warren BuffettFor someone who is such an extraordinarily successful investor, Warren Buffett comes off as a pretty ordinary guy. Born and bred in Omaha, Nebraska, for more than 40 years Buffett has lived in the same gray stucco house on Farnam Street that he bought for $31,500. He wears rumpled, nondescript suits, drives his own car, drinks Cherry Coke, and is more likely to be found in a Dairy Queen than a four-star restaurant.世界投资大师:沃伦·巴菲特作为一个如此卓越的成功投资家,沃伦·巴菲特却又是一个非常平凡、普通的人。

巴菲特在美国内布拉斯加州的奥马哈出生、长大,40多年来他一直居住的是法钠姆大街那栋自己以31500美元购置的灰色水泥墙的房子。

他穿皱巴巴的普通西装,亲自开车,常喝"樱桃可乐",多数情况下是光顾"戴瑞王后"这样的小饭馆,而不是四星级的豪华酒店。

But the 68-year-old Omaha native has led an extraordinary life. Looking back on his childhood, one can see the budding of a savvy businessman. Warren Edward Buffett was born on August 30, 1930, the middle child of three. His father, Howard Buffett, came from a family of grocers but himself became a stockbroker and later a U. S. congressman.但这位68岁、土生土长的奥马哈人却有着不平凡的生活经历。

温尼科特简介温尼科特(Warren Buffett)是享誉全球的美国投资大亨和慈善家,被誉为“股神”、“慈善界的教父”。

他的非凡经历和投资智慧使他成为引领金融界的传奇人物。

温尼科特于1930年8月30日出生在美国内布拉斯加州奥马哈市,从小就展现了卓越的商业头脑。

在他童年时代,他就对股票和投资产生了浓厚的兴趣。

在13岁时,他开始在股票市场上进行投资,并从中获得了丰厚的回报。

在高中时期,他创办了自己的两个生意,包括卖报纸和销售自行车的生意,进一步锻炼了他的商业才能。

毕业于哥伦比亚大学的温尼科特并没有选择投身华尔街的工作,而是回到家乡奥马哈创办了他的投资公司——伯克希尔·哈撒韦(Berkshire Hathaway)。

这家公司成为了他个人财富的主要来源,并在他的领导下取得了巨大的成功。

温尼科特相信长期投资和价值投资的原则,追求稳定的利润和持续的成长,因此他坚定地持有一些看好的股票,而不是频繁交易。

这种投资策略使他成为当今世界上最富有的人之一。

除了投资界的成功,温尼科特也是一位极具影响力的慈善家。

他承诺将绝大部分财富捐赠出去,在世界各地开展慈善事业。

他与慈善合作伙伴们一起致力于解决社会问题,例如贫困、教育和医疗等。

温尼科特还积极推动富人捐赠的潮流,鼓励其他富豪加入慈善事业,以改善社会状况。

温尼科特鲜有奢侈消费,一直以简朴的生活方式示人,他的致富哲学也对人们产生了深远的影响。

他认为,投资不应该只追求短期利益,而是应该具备持久的价值。

他的投资智慧教给了人们一些重要的经验教训:要做自己信服的投资,追求长期价值;要保持理智和耐心,在市场波动中保持冷静;要注重个人的财务规划和风险管理,从长远的角度看待投资。

总之,温尼科特是一个兼具商业智慧和慈善心的杰出人物。

他用自己的成功和影响力激励和引导着无数的投资者和慈善家,在商业和社会责任方面树立了一个典范。

他的故事告诉我们,成功并不只是追逐财富和地位,更重要的是如何运用自己的影响力来改变社会和帮助他人。

世界十大顶级投资家,巴菲特、索罗斯,他们的那些经典语录一、股神——沃伦·巴菲特(Warren Buffett)全球著名的投资商。

在2008年的《福布斯》排行榜上财富超过比尔盖茨,成为世界首富。

在第十一届慈善募捐中,巴菲特的午餐拍卖达到创记录的263万美元。

2011年12月,巴菲特宣布,他的儿子霍华德会在伯克希尔哈撒韦公司中扮演继承人的角色。

巴菲特的一言一行都牵动着世界投资者们的神经。

1.要在别人贪婪的时候恐惧,而在别人恐惧的时候贪婪。

2. 如果你没有持有一种股票10年的准备,那么连10分钟都不要持有这种股票。

3. “不要把所有鸡蛋放在同一个篮子里”的谬论是错误的,投资应该像马克?吐温建议的“把所有鸡蛋放在同一个篮子里,然后小心地看好它。

”4. 如果你想要打中罕见且移动迅速的大象,那么你应该随时把枪带在身上5. 只有退潮时,你才知道谁是在裸体游泳。

6. 当一家有实力的大公司遇到一次巨大但可以化解的危机时,一个绝好的投资机会就悄然来临。

7. 投资企业而不是股票。

8. 拥有一只股票,期待它明天早晨就上涨是十分愚蠢的。

9. 即使美联储主席偷偷告诉我未来两年的货币政策,我也不会为之改变我的任何投资作为。

10. 我喜欢简单的东西。

二、金融大鳄——乔治·索罗斯(英语:George Soros)著名的货币投机家,股票投资者,慈善家和政治行动主义分子。

现在他是索罗斯基金管理公司和开放社会研究所主席,是外交事务委员会董事会前成员。

他以在格鲁吉亚的玫瑰革命中扮演的角色而闻名世界,在美国以募集大量资金试图阻止乔治?布什的再次当选总统而闻名。

他如“神”一般接受着世界所有投资人的膜拜,他的最简单的投资道理,成了大家信奉不二的真理。

1.炒作就像动物世界的森林法则,专门攻击弱者,这种做法往往能够百发百中2. 我生来一贫如洗,但决不能死时仍旧贫困潦倒。

3. 判断对错并不重要,重要的在于正确时获取了多大利润,错误时亏损了多少4. 在股票市场上,寻求别人还没有意识到的突变。

07向股神巴菲特致敬沃伦·巴菲特(Warren E. Buffett),一个具有传奇色彩的名字,他是人是神?唯物论者说他肯定是人,毫无疑问生老病死、喜怒哀乐他一样不缺,可对投资者来说就显得矛盾了,说他是人,但他的投资成就早就超出了…人‟能做到的;说他是神,造神运动带来的伤害国人已经领教过了,吃够了苦头,所以还是把“股神”当人看待吧,我想巴菲特也不希望自己上神坛。

每年美国内布拉斯加州一个中型城市——奥马哈,除了圣诞节,还有一个很特别的“节日”,那就是伯克希尔·哈撒韦公司的股东大会,全世界有四、五万投资人都抱着“朝圣”的心情前来参加,可千万别认为人多就一定普通,当中大多数人都很有钱,伯克希尔的股票最高时每股创记录达到15万美元,按当时对人民币汇率大约八倍算,拥有一股伯克希尔的股票就值120万人民币,按现在人民币在国内的购买力,120万也不是小数目,当时就更值钱了。

每年伯克希尔开股东年会的时候,都会为当地带来不少的消费,具体数字没有统计,但只要想想5万有钱人到一个中型城市去消费,这笔钱数目就小不了,这些人花钱去这个地方,只为参加伯克希尔·哈撒韦公司股东大会,希望知道董事长沃伦·巴菲特和副董事长查理·芒格(Charles Thomas Munger)对问题的看法,一些投资者说去“聆听伟人的教诲” 。

股东大会高潮部分在问答环节,这时股东们会提出各种各样的问题,例如经济问题、时下热点话题或事件,甚至于巴菲特和芒格的私人问题,关于巴郡掌舵继承人的问题近年来十分受关注。

提问一向非常踊跃,得到提问机会是运气到了,而会议之前巴菲特和芒格并不知道股东要问的问题,过程非事先安排,应该说是完全随意的,这是一个愉快的过程,巴菲特和芒格智慧的回答充满诙谐幽默,却往往一针见血道出问题核心,五、六个小时的会议过程都是欢声笑语,常常博得满堂喝彩。

欣赏沃伦·巴菲特的妙语连珠:01哈佛的一些大学生问我,我该去为谁工作?我回答,去为那个你最仰慕的人工作;两周后,我接到一个来自该校教务长的电话,他说:“你对孩子们说了些什么?他们都成了自我雇佣者。

巴菲特简介巴菲特是谁?巴菲特个人简介各位读友大家好,此文档由网络收集而来,欢迎您下载,谢谢沃伦·巴菲特(Warren Buffett,1930年8月30日— ) ,全球著名的投资商,生于美国内布拉斯加州的奥马哈市。

在xx年的《福布斯》排行榜上财富超过比尔盖茨,成为世界首富。

巴菲特再捐市值亿美元股票。

在第十一届慈善募捐中,巴菲特的午餐拍卖达到创记录的263万美元。

2016年7月,沃伦·巴菲特再次向5家慈善机构捐赠股票,依当前市值计算相当于亿美元。

这是巴菲特xx年开始捐出99%资产以来,金额第三高的捐款。

2016年12月,巴菲特宣布,他的儿子霍华德会在伯克希尔・哈撒韦公司中扮演继承人的角色。

巴菲特简介中文名:沃伦·巴菲特外文名:Warren E. Buffett国籍:美国出生地:美国内布拉斯加州奥马哈市出生日期:1930年8月30日职业:波克夏·哈萨威公司行政总裁毕业院校:沃顿商学院本科哥伦比亚大学硕士净值:620亿美元(xx年)人物介绍其传奇性的全球投资生涯中,著书或公开演讲他的投资与理财理念,为《中国网》专栏作家、专家等。

早年巴菲特1930年8月30日,沃伦·巴菲特出生于美国内布拉斯加州的奥马哈市,沃伦·巴菲特从小就极具投资意识,他钟情于股票和数字的程度远远超过了家族中的任何人。

他满肚子都是挣钱的想法,五岁时就在家中摆地摊兜售口香糖。

巴菲特简介稍大后他带领小伙伴到球场捡大款用过的高尔夫球,然后转手倒卖,生意颇为红火。

上中学时,除利用课余做报童外,他还与伙伴合伙将弹子球游戏机出租给理发店老板,挣取外快。

各位读友大家好,此文档由网络收集而来,欢迎您下载,谢谢。

沃伦·巴菲特个人简历以下是编辑为您整理的沃伦·巴菲特个人简历,供您参考,更多详细内容请点击(www./jianli/)查看。

【沃伦·巴菲特个人简历】沃伦·巴菲特 - 简介沃伦·巴菲特(Warren Buffett,1930年8月30日— ) ,世界著名的投資商,生于美国内布拉斯加州的奥马哈市。

他从小就极具投资意识,1941年,11岁的巴菲特购买了平生第一张股票。

1947年巴菲特进入宾夕法尼亚大学攻读财务和商业管理。

1949年巴菲特考入哥伦比亚大学金融系,拜师于著名投资理论学家本杰明·格雷厄姆。

在格雷厄姆门下,巴菲特如鱼得水。

1956年他回到家乡创办“巴菲特有限公司”。

1964年巴菲特的个人财富达到400万美元,而此时他掌管的资金已高达2200万美元。

1965年35岁的巴菲特收购了一家名为伯克希尔·哈撒韦的纺织企业。

1994年底已发展成拥有230亿美元的伯克希尔工业王国,由一家纺纱厂变成巴菲特庞大的投资金融集团。

他的股票在30年间上涨了2000倍,而标准普尔500家指数内的股票平均才上涨了近50倍。

多年来,在《福布斯》一年一度的全球富豪榜上,巴菲特一直稳居前三名。

沃伦·巴菲特 - 成长经历沃伦·巴菲特1930年8月30日出生在美国内希拉斯加州的奥马哈。

他的父亲霍华德·巴菲特是当地的证券经纪人和共和党议员。

从最初开始,沃伦就超乎年龄地谨慎,他被母亲称为"很少带来麻烦的小孩"。

1929年美国经济大萧条使父亲霍华德的证券经纪人工作陷入困境,致使家里的生活非常桔据。

母亲常常克扣自己以便让丈夫和孩子吃得更饱些。

直到沃伦开始念书的时候,这种状况才渐渐好转。

经历了这些艰辛的岁月之后,他便怀有一种执著的愿望,想要变得非常富有。

他在5岁之前便有了这个念头,而且自那以后,这种念头就从来没被抛弃过。

1951年在哥伦比亚大学毕业后,巴菲特回到奥马哈,到父亲的交易部巴菲特一福尔克公司做股票经纪人。

2009.10College EnglishWarren Buffett“股神”沃伦·巴菲特山东路惠/编注Notes:1.Omaha,Nebraska (美国)内布拉斯加州奥马哈市。

2.stockbroker 股票经纪人。

3.congressman 国会议员。

4.homemaker 家庭主妇。

5.demonstrate ['dem 藜nstreit ]证明,示范。

6.knack [n覸k ]本事,才能。

7.acquaintance [藜'kweint 藜ns ]熟人。

8.mathematical [謣m覸夼i'm覸tik 藜l ]prodigy ['pr 蘅did 廾i ]数学奇才。

9.add large columns of numbers把一大串纵行数字相加。

10.stockbrokerage 证券经纪商的业务,证券交易。

11.chalk 用粉笔书写。

12.Cities Service Preferred 城市服务优先股。

13.tenaciously [ti'nei 蘩藜sli ]顽强地。

14.patience ['pei 蘩藜ns ]耐性。

15.paperboy 报童。

16.tip sheet 内情报告。

17.tax return 纳税申报单。

18.tax deduction [di'd 蘧k 蘩藜n ]课税减免,减免税额。

arren Edward Buffet was born on August 30,1930,in Omaha,Nebraska 1.His father Howard worked as stockbroker 2and served as U.S.Congressman 3.His mother,Leila Stahl Buffett,was a homemaker 4.Buffett was the second of threechildren and the only boy.Buffett demonstrated 5a knack 6for financial and business matters early on in his child -hood.Friends and acquaintances 7have said the young boy was a mathematical prodigy 8,and was able to add large columns of numbers 9in his head —a talent he still occasionally shows off to friends and business associates.Warren often visited his father ’s stockbro -kerage 10shop as a child,and chalked 11in thestock prices on the blackboard in the office.At 11years old he made his first investment;hebought three shares of Cities Service Preferred 12at $38per share.The stock quickly dropped to only $27,but Buffett held on tenaciously 13until they reached $40.He sold his shares at a small profit,but regretted the decision when Cities Ser -vice shot up to nearly $200a share.He later cit -ed this experience as an early lesson in patience 14in investing.By the age of 13,Buffett was running hisown businesses as a paperboy 15and selling his own horseracing tip sheet 16.That same year,he filed his first tax return 17,claiming his bike as a$35tax deduction 18.In 1942,Buffett ’s father was elected to the笤风云人物笤W182009.10College English19.the U.S.House of Representatives 美国众议院。

20.Fredricksburg,Virginia (美国)弗吉尼亚州弗雷德里克斯堡市。

21.plot 策划,密谋。

22.tenure ['tenju 藜]期限,占有期。

23.pinball machine 弹球机。

24.barbershop 理发店。

25.war veteran ['vet 藜r 藜n ]经历过战争的老兵。

26.University of Pennsylvania 宾夕法尼亚大学。

27.University of Nebraska (美国)内布拉斯加大学。

28.emerge [i'm 藜蘼d 廾]出现,形成。

29.Columbia University 哥伦比亚大学。

30.advanced degree 高级学位。

31.Buffett Partnership 巴菲特合伙公司。

32.undervalued 售价过低的。

33.sobriquet ['s 藜ubrikei ]绰号。

34.rescue ['reskju 蘼]援救,营救。

35.Salomon Brothers 所罗门兄弟公司,华尔街一投资银行。

36.corporate raider 公司蓄意收购者。

37.in the wake of 尾随,紧跟。

38.insider 会员,知情人,权威人士。

39.scandal ['sk覸ndl ]丑行,丑闻。

40.amass [藜'm覸s ]积累,积聚。

41.Berkshire Hathaway 伯克希尔·哈撒韦公司。

U.S.House of Representatives 19,and his family moved to Fredricksburg,Virginia 20,to be closer to the congressman ’s new post.Buffett attended Woodrow Wilson High School in Washington,D.C.,where he continued plotting 21new ways to make money.During his high school tenure 22,he and a friend purchased a used pinball machine 23for $25.They in -stalled it in a Washington,D.C.barbershop 24and,within a few months,the profits of the machine allowed Buffett and his friend to buy other machines.Buffett owned three ma -chines in three different locations before he sold the busi -ness to a war veteran 25for $1,200.Buffett enrolled at the University of Pennsylvania 26at the age of 16to study business.He stayed two years,moved to the Uni -versity of Nebraska 27to finish up his degree,and emerged 28from college at age 20with nearly $10,000from his child -hood businesses.Buffet attended Columbia Universi -ty 29for his advanced degree 30and in 1956,shortly after graduation,he formed thefirm Buffett Partnership 31in his hometown of Omaha.His investment successes,par -ticularly in buying undervalued 32compa -nies whose stocks shortly began to rise,made him extremely rich and gained him the sobriquet 33,“Oracle of Omaha ”.Other notable career successes include helping rescue 34Salomon Brothers 35from corporate raiders 36(1987)and taking charge of the New York City house (1992)in the wake of 37an insider 38trading scandal 39.The majority of Buffett ’s consider -able fortune was amassed 40through Berk -shire Hathaway 41,a company for which he is the largest shareholder and CEO.Ranked as Forbes ’wealthiest man in笤风云人物笤192009.10College English笤轻松一刻笤1.At least 5people in this world love you so much they would die for you.2.At least 15people in this world love you in some way.3.The only reason anyone would ever hate you is because they want to be just like you.4.A smile from you can bring happiness to anyone,even if they don ’t like you.5.Every night,SOMEONE thinks about you before they go to sleep.6.You mean the world to someone.7.If not for you,someone may not be living.8.You are special and unique 1.9.Someone that you don ’t even know loves you.10.When you make the biggest mistake ever,something good comes from it.11.When you think the world has turned its back on you,take a look:you most likely turnedyour back on the world.12.When you think you have no chance of getting what you want,you probably won ’t get it,but if you believe in yourself,probably,sooner or later 2,you will get it.13.Always remember the compliments 3you received.Forget about the rude remarks.14.Always tell someone how you feel about them;you will feel much better when they know.15.If you have a great friend,take the time to let them know that they are great.大学英语15Things You Never Knew or Thought About你不知道的15件事By B.Afonja雨文/选注Notes:1.unique [ju 蘼'ni 蘼k ]唯一的,仅有的。