外贸英语函电第六章 Letter of credit[精]

- 格式:ppt

- 大小:694.50 KB

- 文档页数:8

信用证信函英文范文英文回答:Letter of Credit (LOC)。

The commercial bank issues a guarantee or commitment to pay the seller (beneficiary) on behalf of the buyer (applicant) when the seller fulfills the agreed-upon terms of the transaction, such as delivering the goods or services.Components of an LOC.Applicant: The buyer or customer who requests the LOC.Beneficiary: The seller or supplier who receives the payment from the bank.Issuing Bank: The bank that issues the LOC on behalf of the applicant.Confirming Bank: A bank that adds its guarantee to the LOC, making it more secure for the beneficiary.Negotiating Bank: A bank that handles the collection and verification of documents submitted by the beneficiary.Amount: The maximum amount the bank will pay under the LOC.Tenor: The period of time during which the LOC is valid.Terms and Conditions: The specific conditions that must be met for the bank to release payment.Types of LOCs.Revocable LOC: Can be canceled or amended by the issuing bank at any time without notice to the beneficiary.Irrevocable LOC: Cannot be canceled or amended withoutthe consent of both the issuing bank and the beneficiary.Advantages of LOCs.Provides security to both the buyer and seller by guaranteeing payment.Facilitates international trade by enabling transactions between parties in different countries.Reduces the risk of non-payment for the seller.Improves the working capital position of the buyer by allowing them to defer payment.Disadvantages of LOCs.Can be costly for the buyer, as banks charge fees for issuing and confirming LOCs.May limit the buyer's flexibility to negotiate payment terms with the seller.Can be complex to understand and implement.How to Obtain an LOC.1. Approach a commercial bank.2. Provide the bank with information about the transaction, including the amount of the LOC, the tenor, and the beneficiary.3. Meet the bank's requirements, such as providing financial statements and collateral.4. Pay the bank's fees.中文回答:信用证。

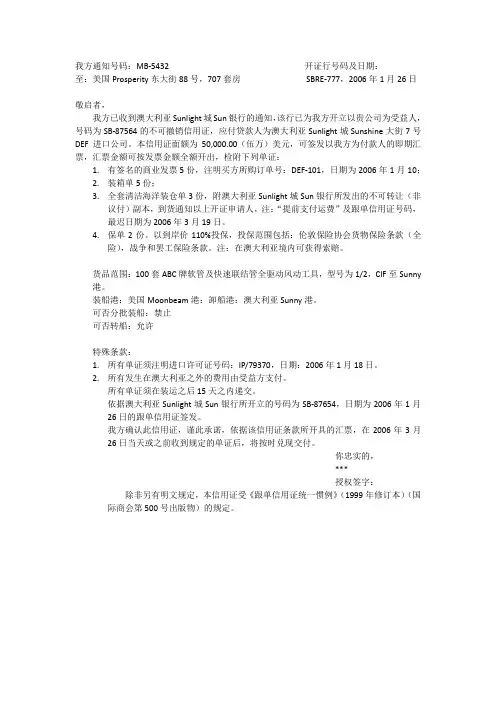

我方通知号码:MB-5432 开证行号码及日期:至:美国Prosperity东大街88号,707套房SBRE-777,2006年1月26日敬启者,我方已收到澳大利亚Sunlight城Sun银行的通知,该行已为我方开立以贵公司为受益人,号码为SB-87564的不可撤销信用证,应付贷款人为澳大利亚Sunlight城Sunshine大街7号DEF进口公司。

本信用证面额为50,000.00(伍万)美元,可签发以我方为付款人的即期汇票,汇票金额可按发票金额全额开出,检附下列单证:1.有签名的商业发票5份,注明买方所购订单号:DEF-101,日期为2006年1月10;2.装箱单5份;3.全套清洁海洋装仓单3份,附澳大利亚Sunlight城Sun银行所发出的不可转让(非议付)副本,到货通知以上开证申请人,注:“提前支付运费”及跟单信用证号码,最迟日期为2006年3月19日。

4.保单2份。

以到岸价110%投保,投保范围包括:伦敦保险协会货物保险条款(全险),战争和罢工保险条款。

注:在澳大利亚境内可获得索赔。

货品范围:100套ABC牌软管及快速联结管全驱动风动工具,型号为1/2,CIF至Sunny 港。

装船港:美国Moonbeam港:卸船港:澳大利亚Sunny港。

可否分批装船:禁止可否转船:允许特殊条款:1.所有单证须注明进口许可证号码:IP/79370,日期:2006年1月18日。

2.所有发生在澳大利亚之外的费用由受益方支付。

所有单证须在装运之后15天之内递交。

依据澳大利亚Sunlight城Sun银行所开立的号码为SB-87654,日期为2006年1月26日的跟单信用证签发。

我方确认此信用证,谨此承诺,依据该信用证条款所开具的汇票,在2006年3月26日当天或之前收到规定的单证后,将按时兑现交付。

你忠实的,***授权签字:除非另有明文规定,本信用证受《跟单信用证统一惯例》(1999年修订本)(国际商会第500号出版物)的规定。

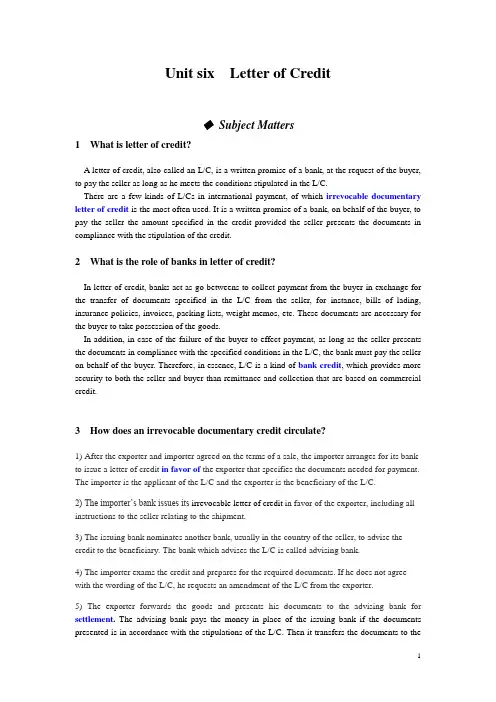

Unit six Letter of Credit◆Subject Matters1 What is letter of credit?A letter of credit, also called an L/C, is a written promise of a bank, at the request of the buyer, to pay the seller as long as he meets the conditions stipulated in the L/C.There are a few kinds of L/Cs in international payment, of which irrevocable documentary letter of credit is the most often used. It is a written promise of a bank, on behalf of the buyer, to pay the seller the amount specified in the credit provided the seller presents the documents in compliance with the stipulation of the credit.2 What is the role of banks in letter of credit?In letter of credit, banks act as go-betweens to collect payment from the buyer in exchange for the transfer of documents specified in the L/C from the seller, for instance, bills of lading, insurance policies, invoices, packing lists, weight memos, etc. These documents are necessary for the buyer to take possession of the goods.In addition, in case of the failure of the buyer to effect payment, as long as the seller presents the documents in compliance with the specified conditions in the L/C, the bank must pay the seller on behalf of the buyer. Therefore, in essence, L/C is a kind of bank credit, which provides more security to both the seller and buyer than remittance and collection that are based on commercial credit.3 How does an irrevocable documentary credit circulate?1) After the exporter and importer agreed on the terms of a sale, the importer arranges for its bank to issue a letter of credit in favor of the exporter that specifies the documents needed for payment. The importer is the applicant of the L/C and the exporter is the beneficiary of the L/C.2) The importer‟s bank issues its irrevocable letter of credit in favor of the exporter, including all instructions to the seller relating to the shipment.3) The issuing bank nominates another bank, usually in the country of the seller, to advise the credit to the beneficiary. The bank which advises the L/C is called advising bank.4) The importer exams the credit and prepares for the required documents. If he does not agree with the wording of the L/C, he requests an amendment of the L/C from the exporter.5) The exporter forwards the goods and presents his documents to the advising bank for settlement. The advising bank pays the money in place of the issuing bank if the documents presented is in accordance with the stipulations of the L/C. Then it transfers the documents to theissuing bank for reimbursement.6) The issuing bank debits the applicant with the value of the goods, plus any applicable commission and expenses, and hands over the documents to the buyer. The importer can then clear the goods through customs and import them.Some important notes on the circulation of the L/C:●As L/C is a kind of bank credit, the creditworthiness of the issuing bank should be carefullyinvestigated by the exporter. This can be done with the assistance of the exporter‟s bank, or the exporter may specify the issuing bank accepted by him.●The seller should examine the documentary credit carefully. If the seller finds that the terms ofthe credit don‟t agree with the terms of the sales contract, he will notify the buyer and ask for an amendment of the credit. If he finds it difficult to meet the conditions of the credit within the duration of the credit, he will ask for the extension of the credit.5 How important are the documents in the payment by L/CIn L/C payment, banks deal in documents and not goods. They are only c oncerned that documents presented appear on their face to comply with the terms and conditions of the credit. Any dispute as to quality or quantity of goods delivered must be settled between the importer and exporter.W ords and expressions◆letter of credit信用证信用证是一种开证银行根据申请人(进口方)的要求和申请,向受益人(出口方)开立的有一定金额、在一定期限内凭汇票和出口单据,在指定地点付款的书面保证。

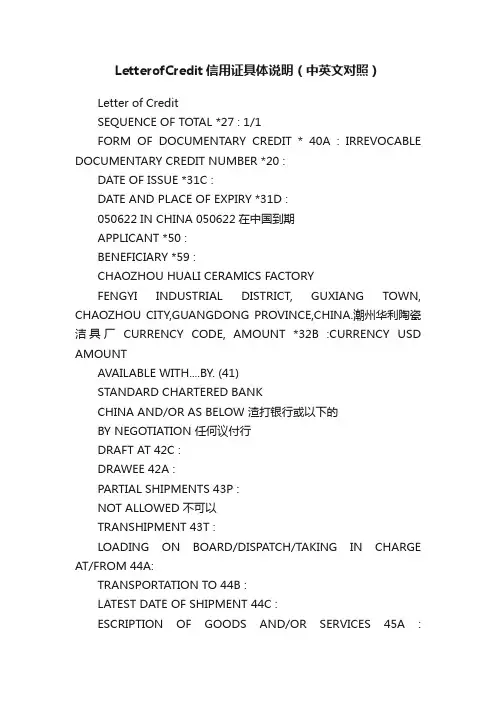

LetterofCredit信用证具体说明(中英文对照)Letter of CreditSEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT * 40A : IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 :DATE OF ISSUE *31C :DATE AND PLACE OF EXPIRY *31D :050622 IN CHINA 050622在中国到期APPLICANT *50 :BENEFICIARY *59 :CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.潮州华利陶瓷洁具厂CURRENCY CODE, AMOUNT *32B :CURRENCY USD AMOUNTAVAILABLE WITH....BY. (41)STANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行DRAFT AT 42C :DRAWEE 42A :PARTIAL SHIPMENTS 43P :NOT ALLOWED 不可以TRANSHIPMENT 43T :LOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/FROM 44A:TRANSPORTATION TO 44B :LATEST DATE OF SHIPMENT 44C :ESCRIPTION OF GOODS AND/OR SERVICES 45A :OCUMENTS REQUIRED 46A :+SIGNED COMMERCIAL INVOICE IN QUINTUPLICATE MADE OUT IN THE NAME OF APPLICANT INDICATING CIF VALUE AND THE ORIGINE OF THE GOODS SHIPPED.+PACKING LIST/WEIGHT MEMO IN QUADRUPLICATE MENTIONNING TOTAL NUMBER OF CARTONS AND GROSS WEIGHTAND MEASUREMENTS PER EXPORT CARTON.*FREIGHT PAYABLE AT DESTINATION AND BEARING THE NUMBER OF THISCREDIT.运费在目的港付注明该信用证号码*PACKING LIST IN 3 COPIES.装箱单一式三份*CERTIFICATE ISSUED BY THE SHIPPING COMPANY/CARRIER OR THEIR AGENT STATING THE B/L NO(S) AND THE VESSEL(S) NAME CERTIFYING THAT THE CARRYING VESSEL(S) IS/ARE: A) HOLDING A VALID SAFETY MANAGEMENT SYSTEM CERTIFICATE AS PER TERMS OF INTERNATIONALSAFETY MANAGEMENT CODE ANDB) CLASSIFIED AS PER INSTITUTE CLASSIFICATION CLAUSE 01/01/2001 BY AN APPROPRIATE CLASSIFICATION SOCIETY 由船公司或代理出有注明B/L号和船名的证明书证明他们的船是:A)持有根据国际安全管理条款编码的有效安全管理系统证书; 和B)由相关分级协会根据2001年1月1日颁布的ICC条款分类的.*COMMERCIAL INVOICE FOR USD11,202,70 IN 4 COPIES DULY SIGNED BYTHE BENEFICIARY/IES, STATING THAT THE GOODS SHIPPED:A)ARE OF CHINESE ORIGIN.B)ARE IN ACCORDANCE WITH BENEFICIARIES PROFORMA INVOICE NO. HL050307 DATED 07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明货物运输:A)原产地为中国B)同号码为HL050307 开立日为07/03/05的商业发票内容一致:047A: ADDITIONAL CONDITIONS附加条件* THE NUMBER AND DATE OF THE CREDIT AND THE NAME OF OUR BANK MUSTBE QUOTED ON ALL DRAFTS (IF REQUIRED).信用证号码及日期和我们的银行名必须体现在所有单据上(如果有要求)*TRANSPORT DOCUMENTS TO BE CLAUSED: ’VESSEL IS NOT SCHEDULED TOCALL ON ITS CURPENT VOYAGE AT FAMAGUSTA,KYRENTA OR KARAVOSTASSI,CYPRUS.运输单据注明" 船在其航行途中不得到塞***的Famagusta, Kyrenta or Karavostassi这些地方*INSURANCE WILL BE COVERED BY THE APPLICANTS.保险由申请人支付*ALL DOCUMENTS TO BE ISSUED IN ENGLISH LANGUAGE.所有单据由英文缮制*NEGOTIATION/PAYMENT:UNDER RESERVE/GUARANTEE STRICTLY 保结押汇或是银行保函PROHIBITED. 禁止*DISCREPANCY FEES USD80, FOR EACH SET OF DISCREPANT DOCUMENTSPRESENTED UNDER THIS CREDIT,WHETHER ACCEPTED OR NOT,PLUS OURCHARGES FOR EACH MESSAGE CONCERNING REJECTION AND/OR ACCEPTANCEMUST BE BORNE BY BENEFICIARIES THEMSELVES AND DEDUCTED FROM THEAMOUNT PAYABLE TO THEM.修改每个单据不符点费用将扣除80美元(最多40)*IN THE EVENT OF DISCREPANT DOCUMENTS ARE PRESENTED TO US ANDREJECTED,WE MAY RELEASE THE DOCUMENTS AND EFFECT SETTLEMENT UPONAPPLICANT’S WAIVER OF SUCH DISCREPANCIES,NOTWITHSTANDING ANYCOMMUNICATION WITH THE PRESENTER THAT WE ARE HOLDING DOCUMENTS ATITS DISPOSAL,UNLESS ANY PRIOR INSTRUCTIONS TO THE CONTRARY ARERECEIVED.如果不符点是由我方提出并被拒绝,我们将视为受益人放弃修改这个不符点的权利。

进出口接受函电范文英文英文回答:Due to the increasing complexity of international trade and the growing importance of electronic communication, it has become essential for businesses engaged in import and export activities to have a clear understanding of the use of letters of credit (L/Cs) and other trade finance instruments. Letters of credit are one of the most important tools used in international trade, and they play a vital role in facilitating the flow of goods and services across borders.A letter of credit is a document issued by a bank at the request of an importer (the applicant) that guarantees payment to an exporter (the beneficiary) if the exporter meets certain conditions. The conditions typically include the presentation of documents that prove that the goods or services have been shipped or delivered. Letters of credit are often used in international trade because they providea level of security for both the importer and the exporter.There are two main types of letters of credit:revocable and irrevocable. A revocable letter of credit can be canceled or amended by the issuing bank at any time, without notice to the beneficiary. An irrevocable letter of credit cannot be canceled or amended without the consent of both the issuing bank and the beneficiary.Letters of credit can be used to finance a wide variety of transactions, including the purchase of goods, the provision of services, and the construction of projects. They can also be used to finance pre-export financing, such as the purchase of raw materials or the manufacturing of goods.To obtain a letter of credit, the importer must submita request to their bank. The request will typically include information about the transaction, such as the amount ofthe credit, the terms of payment, and the documents thatwill be required. The bank will then review the request and, if it is approved, will issue a letter of credit.The letter of credit will be sent to the exporter, who will then present it to their bank for payment. The exporter's bank will then review the documents presented by the exporter and, if they are in order, will release payment to the exporter.Letters of credit are a complex and important tool in international trade. They provide a level of security for both the importer and the exporter, and they can be used to finance a wide variety of transactions.中文回答:随着国际贸易的日益复杂化和电子通信的重要性日益提升,从事进出口活动的企业必须明确了解信用证 (L/C) 和其他贸易融资工具的使用方法。

Dear Sirs,We have received your letter of Sep.17, 2012 asking us to establish credit. We are pleased to inform you that we have opened a confirmed, irrevocable letter of credit No.100 in your favor for $1000 with Bank of China, valid until Oct1. Y ou are entitled to draw a draft at sight for the amount of invoice after shipment is made. The bank will require you to present the following documents before making payment.Bill of Loading in triplicateCommercial Invoice in 5 copiesPacking ListCertificate of Insurance in 2 copiesCertificate of OriginWe are looking forward to your prompt reply.Y ours faithfullyMiss TanManagerDear Sirs,We have received your letter of Sep.19, 2012 urging us to establish the relevant letter of credit for the order for oranges.I fell very sorry to delay in establishing the credit and for the consequent trouble caused. The delay is mainly due to the bad communication that happened within our organization. We have send you the cover relevant credit in your favor immediately, believing that you can receive two days later.Please allow us to express our apology and we promise that such mistake will not take place in our future transaction. Thank you again for your understanding in advance.Y ours faithfullyMiss TanManagerDear Sirs,We have received your letter of Sep.20, 2012 informing us that the relevant letter of credit in your favor has been opened. While according to the stipulations in the covering contract, the creditshould reach us ahead of one month before shipment is made. Asyou see, there is no possibility for us to arrange for the shipment intime because of the late reaching of the relevant credit.In this issue, we have no choice but to request you to extent the date of shipment and the validity of the credit, to Sep.30 and Oct1 respectively. We await your prompt reply.Y ours faithfullyMiss TanManagerDear Sirs,We are in receipt of your letter of Sep.21, 2012 informing us the amendment of the relevant letter of credit,We regret to know that there are some discrepancies which are not in conformity with the contract. The mistake is mainly due to the carelessness of some stuff. Nevertheless, we have amended the credit and send it to you immediately.Please allow us to express our apology and we promise that such mistake will not take place in our future transaction.Y ours faithfullyMiss TanManagerDear Sirs,We have received your letter of Sep.23, 2012 asking us to extent the date of shipment and the validity of the credit respectively. Considering there are many reasons leading to this issue and recognizing the long term business relationship with your company, we decide to accept your requirement mentioned in your last letter. I wish that you can arrange for the shipment as soon as possible on receipt of the relevant credit.Thank you for your cooperation.Y ours faithfullyMiss TanManagerDear Sirs,Re: Packing for the orangeThank you for your letter of Sep, 24inquiring about packing and the shipping marks of the goods under No.88. In order to avoid any possible trouble, I would like to make the packing requirement as follows:We intent to have oranges packed in plastic boxes of 10kg, 20 boxes to a carton, 10 cartons to a wooden case, 100 cases to a FCL. On the outside of each case, HY, the initials of your company should be marked in a diamond. As the customs here are very critical, so the inner packing should be attracting and helpful to the sales.We hope you can pay a special attention to the packing and our requirement on packing will not bring you much trouble.Y ours faithfullyMiss TanManager。

LETTER OF CREDITRCVD *FIN/Session/OSN: F01 430429526RCVD *Own Address: COMMCNSELXXXX BANK OF COMMUNICATIONSRCVD *SHANGHAIRCVD *(HEAD OFFICE)RCVD *Output Message Type: 700ISSUE OF A DOCUMENTARY CREDITRCVD *Input Time: 1322RCVD *MIR: 001115BKKBTHBKBXXX51958227342RCVD *Send by: BKKBTHBKBXXX BANGKOK BANK PUBLIC COMPANY LIMITED RCVD *BANGKOKRCVD *Output Date/Time: 001115/1422RCVD *Priority: NormalRCVD *RCVD *RCVD *27/SEQUENCE OF TOTALRCVD *1/1RCVD *40A/FORM OF DOCUMENTARY CREDITRCVD *IRREVOCABLERCVD *20/DOCUMENTARY CREDIT NUMBERRCVD *329898871232RCVD *31C/DATE OF ISSUERCVD *001115RCVD *NOV-15-2000RCVD *31D/DATE AND PLACE OF EXPIRYRCVD *001230BENEFICIARIES’ COUNTRYRCVD *DEC-30-2000RCVD *50/APPLICANTRCVD *MOUN NO., LTD.RCVD *NO.443, 249, ROAD,RCVD *BANGKOKRCVD *THAILANDRCVD *59/BENEFICIARYRCVD *SHANGHAI FOREIGN TRADE CORP.RCVD *SHANGHAI, CHINARCVD *32/CURRENCY CODE AMOUNTRCVD *USD18112,RCVD *US DOLLAR 18112,00RCVD *41D/AVAILABLE WITH…BY…-NAME/ADDRRCVD *ANY BANK INRCVD *CHINARCVD *BY NEGOTIATIONRCVD *42C/DRAFTS AT…RCVD */SEE 47A/RCVD *42D/DRAWEE-NAME AND ADDRESSRCVD *ISSUING BANKRCVD *43P/PARITIAL SHIPMENTSRCVD *NOT ALLOWEDRCVD *43T/TRANSSHIPMENTRCVD *ALLOWEDRCVD *44A/ON BOARD/DISP/TAKING CHARGERCVD *CHINARCVD *44B/FOR TRANSPORTATION TORCVD *BANGKOK, THAILANDRCVD *44C/LATEST DATE OF SHIPMENTRCVD *001210RCVD *DEC-10-2000RCVD *45A/DESC OF GOODS AND/OR SERVICESRCVD *RCVD *16,000KGS.METHAMIDOPHOS 70 PCT.MIN TECH.RCVD *AT USD1.132 PER KG.CIF BANGKOK, THAILANDRCVD *PACKING IN 200 KGS/IRON DRUMRCVD *(DETAILS AS PER PROFORMA INVOICE NO.33745)RCVD *46A/DOCUMENTS REQUIREDRCVD *+ORIGINAL SIGNED COMMERCIAL INVOICE IN DUPLICATERCVD *+ORIGINAL PAKCING LIST IN DUPLICATERCVD *+FULL SET CLEAN ON BOARD MARINE BILL OF LADING CONSIGNED TO RCVD *THE ORDER OF BANGKOKO BANK PUBLIC COMPANY LIMITED, BANGKOK RCVD *BANGKOK MARKED PREPAID AND NOTIFY APPLICANTRCVD *NAME OF SHIPPING AGENT IN BANGKOK WITH FULL ADDRESS ANDRCVD *TELEPHONE NUMBER, INDICATING THIS L/C NUMBER.RCVD *+ORIGINAL CERTIFICATE OF ORIGIN IN DUPLICATERCVD *47A/ADDITIONAL CONDITIONSRCVD */DRAFTS IN DUPLICATE AT 120 DAYS AFTER SHIPMENT DATE, INTEREST/ RCVD *DISCOUNT AND INDICATING THIS L/C NUMBERRCVD * A DISCREPANCY FEE OF USD50.00 WILL BE IMPOSED ON EACH SET OF RCVD *DOCUMENTS PRESENTED FOR NEGOTIATION UNDER THIS L/C WITH RCVD *DISCREPANCY. THE FEE WILL BE DEDUCTED FROM THE BILL AMOUNT. RCVD *71B/CHARGESRCVD *ALL BANK CHARGES OUTSIDERCVD *THAILAND INCLUDING REIMBURSINGRCVD *BANK COMMISSION AND DISCREPANCYRCVD *FEE(IF ANY) ARE FORRCVD *BENEFICIARIES’ ACCOUNT.RCVD *49/CONFIREMATION INSTRUCTIONSRCVD *WITHOUTRCVD *53D/REIMBURSING BANK-NAME/ADDRESSRCVD *BANGKOK BANK PUBLIC COMPANYRCVD *LIMITED, NEW YORK BRANCHRCVD *AT MATURITYRCVD *78/INSTRUCS TO PAY/ACCPT/NEGOT BANKRCVD *DOCUMENTS TO BE DISPATCHED IN ONE SET BY COURIERRCVD *ALL CORRESPONDENCE TO BE SENT TO BANGOKOK BANK PUBLIC COMPANY RCVD *LIMITED HEAD OFFICE, 333 SILOM ROAD, BANGKOK 10500, AHAILAND. RCVD *ATTN: L/C MP/1011027792163 IMPORT L/C SECTION 6.RCVD *信用证(Letter of Credit,简称L/C)又称信用状,是银行(开证行)根据申请人(一般是进口商)的要求,向受益人(一般是出口商)开立的一种有条件的书面付款保证。