会计英语例题

- 格式:doc

- 大小:734.50 KB

- 文档页数:32

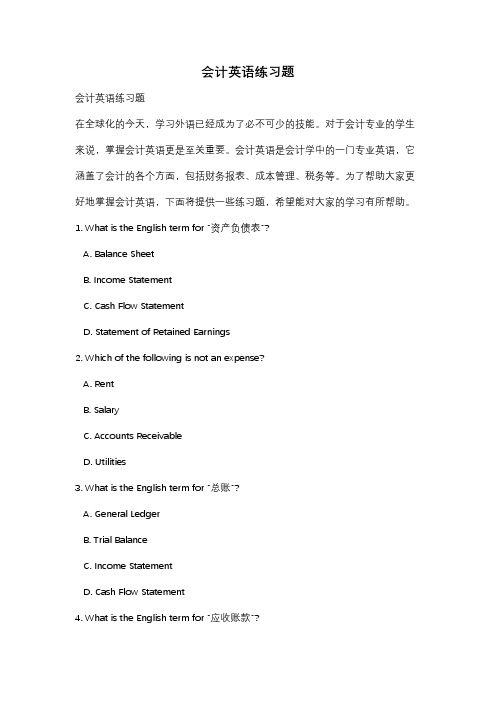

会计英语练习题会计英语练习题在全球化的今天,学习外语已经成为了必不可少的技能。

对于会计专业的学生来说,掌握会计英语更是至关重要。

会计英语是会计学中的一门专业英语,它涵盖了会计的各个方面,包括财务报表、成本管理、税务等。

为了帮助大家更好地掌握会计英语,下面将提供一些练习题,希望能对大家的学习有所帮助。

1. What is the English term for "资产负债表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings2. Which of the following is not an expense?A. RentB. SalaryC. Accounts ReceivableD. Utilities3. What is the English term for "总账"?A. General LedgerB. Trial BalanceC. Income StatementD. Cash Flow Statement4. What is the English term for "应收账款"?A. Accounts PayableB. Accounts ReceivableC. InventoryD. Prepaid Expenses5. What is the English term for "固定资产"?A. Current AssetsB. Fixed AssetsC. Intangible AssetsD. Accounts Payable6. What is the English term for "净利润"?A. Gross ProfitB. Operating IncomeC. Net IncomeD. Retained Earnings7. What is the English term for "应付账款"?A. Accounts PayableB. Accounts ReceivableC. Accrued ExpensesD. Prepaid Expenses8. What is the English term for "现金流量表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings9. What is the English term for "财务报表分析"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting10. What is the English term for "税务"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting以上是一些关于会计英语的练习题,希望大家能够认真思考并给出正确答案。

会计试题英语答案及解析1. Question: What is the purpose of the balance sheet in accounting?Answer: The balance sheet serves as a snapshot of a company's financial position at a specific point in time, showing its assets, liabilities, and equity. It is used to assess the solvency and liquidity of a business.Analysis: The balance sheet is crucial for stakeholders as it provides insights into the company's ability to meetshort-term and long-term obligations. Assets represent whatthe company owns, liabilities represent what the company owes, and equity represents the net worth of the company.2. Question: Explain the difference between revenue andprofit.Answer: Revenue is the total amount of money a company receives from its business activities, without any expenses deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue.Analysis: Understanding the distinction between revenueand profit is important for evaluating a company's financial health. While revenue indicates the total income, profit reflects the company's operational efficiency andprofitability.3. Question: What is the accounting equation?Answer: The accounting equation is Assets = Liabilities + Owner's Equity. It represents the fundamental relationship between a company's assets, liabilities, and equity.Analysis: The accounting equation is the foundation of double-entry bookkeeping, ensuring that every transaction is recorded twice, once as a debit and once as a credit, maintaining the balance of the equation.4. Question: Define the term "depreciation" in accounting.Answer: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life, reflecting the consumption of the asset's economic benefits.Analysis: Depreciation is used to match the expense of using an asset with the revenue it generates over its useful life, adhering to the matching principle in accounting.5. Question: What is the purpose of adjusting entries in accounting?Answer: Adjusting entries are made at the end of an accounting period to ensure that the financial statements accurately reflect the company's financial position and performance. They bring the accounts up to date and correct any errors or omissions.Analysis: Adjusting entries are crucial for maintaining the integrity of financial statements. They ensure that revenues and expenses are recognized in the correct accounting period, in accordance with the accrual basis ofaccounting.6. Question: Explain the concept of "cash flow" in accounting. Answer: Cash flow refers to the inflow and outflow of cash in a business over a period of time. It is a measure of the liquidity of a business and its ability to generate cash.Analysis: Cash flow is vital for assessing a company's financial health and its ability to pay debts, invest in new projects, and pay dividends. It is different from profit, asit considers the actual movement of cash rather than the accounting recognition of revenues and expenses.7. Question: What is the purpose of an income statement?Answer: An income statement, also known as a profit andloss statement, reports a company's financial performanceover a specific period of time. It shows the revenues, expenses, and net income of the business.Analysis: The income statement is essential for evaluating a company's profitability and operational efficiency. It provides information on how much profit a company has madeand where that profit came from.8. Question: Define "inventory" in accounting.Answer: Inventory is a current asset account in accounting that represents the goods available for sale in the ordinary course of business.Analysis: Inventory management is critical for businessesas it affects cost of goods sold, valuation, and the accuracyof financial statements. Proper inventory accounting ensures that the cost of goods sold is accurately matched with the revenue they generate.9. Question: What is the purpose of a statement of cash flows? Answer: The statement of cash flows provides information about a company's cash inflows and outflows during a period.It categorizes these cash flows into operating, investing,and financing activities.Analysis: The statement of cash flows is important for understanding the liquidity and solvency of a business. It helps stakeholders to see where the cash is coming from and how it is being used, which is crucial for making informed financial decisions.10. Question: Explain the concept of "cost-volume-profit (CVP) analysis."Answer: Cost-volume-profit (CVP) analysis is a financial tool used to determine the relationship between costs, sales volume, and profit. It helps in understanding how changes in sales volume affect the company's profitability.Analysis: CVP analysis is essential for making pricing decisions, setting sales targets, and evaluating the impactof cost changes on profitability. It is a valuable tool for budgeting and financial planning。

会计英语案例试题及答案一、选择题1. Which of the following is not a basic accounting element?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D2. The double-entry bookkeeping system is based on the principle that:A. Every transaction has only one effect.B. Every transaction has two effects.C. Every transaction has three effects.D. Every transaction has no effect.Answer: B3. What does the term "depreciation" refer to?A. The increase in the value of an asset over time.B. The allocation of the cost of a tangible asset over its useful life.C. The decrease in the value of an asset due to market conditions.D. The sale of an asset at a loss.Answer: B二、填空题4. The financial statement that shows the financial position of a company at a particular point in time is called the________.Answer: Balance Sheet5. The process of adjusting the accounts at the end of an accounting period to ensure they reflect the actual financial status of the company is known as ________.Answer: Closing the Books6. The term "accrual accounting" refers to the method of accounting where revenues and expenses are recognized when they are ________.Answer: Earned or Incurred三、简答题7. Explain the difference between "cash accounting" and "accrual accounting".Answer: Cash accounting is a method where revenues and expenses are recognized when cash is received or paid. In contrast, accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of when cash is exchanged.8. What is the purpose of adjusting entries and why are theynecessary at the end of an accounting period?Answer: Adjusting entries are made to update the accounts for any transactions that have occurred but have not yet been recorded, or to allocate expenses and revenues to the correct accounting period. They are necessary to ensure the financial statements accurately reflect the company's financialposition and performance for the period.四、案例分析题9. A company purchased equipment on January 1st for $50,000, with an estimated useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: The annual depreciation expense is calculated as the cost of the asset divided by its useful life. In this case, it would be $50,000 / 5 years = $10,000 per year.10. A company has the following transactions in the month of March: sales revenue of $120,000, cost of goods sold of $80,000, and operating expenses of $30,000. Calculate the company's net income for March using the accrual basis of accounting.Answer: Net income is calculated as total revenues minustotal expenses. For March, the net income would be $120,000 (sales revenue) - $80,000 (cost of goods sold) - $30,000 (operating expenses) = $10,000.请注意,以上内容仅为示例,实际的试题及答案应根据具体的教学大纲和课程内容来制定。

会计英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting element?A. AssetsB. LiabilitiesB. RevenuesD. Equity答案:C2. The accounting equation can be expressed as:A. Assets = Liabilities + EquityB. Assets + Liabilities = EquityC. Assets - Liabilities = EquityD. Liabilities - Equity = Assets答案:A3. What does the term "Double Entry Bookkeeping" refer to?A. Recording transactions in two accountsB. Recording transactions in two different currenciesC. Recording transactions in two different formatsD. Recording transactions in two different books答案:A4. Which of the following is not a type of adjusting entry?A. AccrualB. PrepaymentC. DepreciationD. Amortization答案:B5. The purpose of closing entries is to:A. Prepare financial statementsB. Adjust for accruals and deferralsC. Record the sale of inventoryD. Record the purchase of fixed assets答案:A6. Which of the following is a measure of a company's liquidity?A. Return on Investment (ROI)B. Debt to Equity RatioC. Current RatioD. Profit Margin答案:C7. The term "Depreciation" refers to:A. The decrease in value of an asset over timeB. The increase in value of an asset over timeC. The amount of an asset that is used upD. The process of selling an asset答案:A8. What is the purpose of a trial balance?A. To calculate net incomeB. To check the accuracy of accounting recordsC. To determine the value of assetsD. To calculate the cost of goods sold答案:B9. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget答案:D10. The accounting principle that requires expenses to be recorded in the same period as the revenues they generate is known as:A. Going ConcernB. Matching PrincipleC. Historical Cost PrincipleD. Materiality答案:B二、填空题(每题2分,共20分)1. The __________ is the process of recording financial transactions in a systematic way.答案:Journalizing2. The __________ is a summary of the financial transactionsof a business during a specific period.答案:Ledger3. __________ is the accounting principle that requires all accounting information to be based on historical cost.答案:Historical Cost Principle4. The __________ is a financial statement that shows a company's financial position at a specific point in time.答案:Balance Sheet5. __________ is the process of estimating revenues and expenses for a future period.答案:Budgeting6. __________ is the accounting principle that requires all transactions to be recorded in the period in which they occur.答案:Accrual Basis Accounting7. The __________ is a financial statement that shows the results of a company's operations over a period of time.答案:Income Statement8. __________ is the process of determining the value of a company's assets and liabilities.答案:Valuation9. __________ is the accounting principle that requires alltransactions to be recorded in the order in which they occur.答案:Chronological Order10. The __________ is a financial statement that shows the sources and uses of cash during a period of time.答案:Cash Flow Statement三、简答题(每题15分,共30分)1. 描述会计信息的质量特征有哪些,并简要解释它们的含义。

会计英语考试试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Payroll Report2. What is the term for the process of recording transactions in the accounting records?A. JournalizingB. PostingC. ClosingD. Adjusting3. The matching principle is a fundamental concept in accounting that requires:A. Revenues to be recognized when earnedB. Expenses to be recognized when paidC. Expenses to be recognized in the same period as the revenues they generateD. Both A and B4. What is the formula for calculating the return on investment (ROI)?A. ROI = (Net Income / Total Assets) x 100B. ROI = (Net Income / Total Liabilities) x 100C. ROI = (Net Income / Investment) x 100D. ROI = (Total Assets / Net Income) x 1005. Which of the following is not a type of depreciation method?A. Straight-lineB. Declining balanceC. Units of productionD. FIFO (First-In, First-Out)6. What is the purpose of an audit?A. To ensure that financial statements are accurate and completeB. To provide tax adviceC. To prepare financial statementsD. To manage a company's finances7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different books8. What is the accounting equation?A. Assets = Liabilities + EquityB. Revenue - Expenses = Net IncomeC. Assets - Liabilities = Net IncomeD. Assets + Liabilities = Equity9. Which of the following is not a component of the statement of cash flows?A. Operating activitiesB. Investing activitiesC. Financing activitiesD. Non-operating activities10. What is the purpose of adjusting entries?A. To correct errors in the accounting recordsB. To update the financial statementsC. To ensure that the accounting equation is balancedD. To allocate expenses and revenues to the correct accounting periods答案:1. D2. A3. C4. C5. D6. A7. B8. A9. D10. D二、简答题(每题5分,共30分)1. 简述会计的四大基本原则。

会计英语练习题一、词汇练习1. 请将下列会计术语的英文翻译成中文:- Assets:- Liabilities:- Equity:- Revenue:- Expense:- Depreciation:2. 请将下列中文会计术语翻译成英文:- 资产负债表:- 利润表:- 现金流量表:- 折旧:- 应收账款:- 存货:二、填空题1. The balance sheet is a statement of a company's financial position at a particular point in time, showing all the company's assets, liabilities, and __________.2. The income statement, also known as the profit and loss statement, is used to calculate the __________ of a business over a certain period of time.3. When a company purchases a new piece of equipment, it will record this as an __________ on the balance sheet.4. The __________ method of accounting records transactions when the cash is actually received or paid.5. If a company has a net loss, it will decrease the__________ on the balance sheet.三、简答题1. 请简述会计的四大基本假设。

2. 什么是会计准则?请举例说明。

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

英语会计考试题目及答案一、选择题(每题2分,共20分)1. What is the basic equation of accounting?A. Assets = Liabilities + EquityB. Revenue - Expenses = ProfitC. Depreciation - Amortization = LossD. Cost of Goods Sold + Operating Expenses = Net Income答案:A2. Which of the following is NOT a type of intangible asset?A. TrademarkB. PatentC. CopyrightD. Inventory答案:D3. The process of allocating the cost of a tangible asset over its useful life is known as:A. AmortizationB. DepreciationC. AccrualD. Provision答案:B4. What is the purpose of adjusting entries at the end of anaccounting period?A. To increase the company's profitB. To ensure the financial statements are accurate and up-to-dateC. To reduce the company's tax liabilityD. To prepare for the next accounting period答案:B5. The term "Double Entry Bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording debits and credits for every transactionC. Keeping two sets of booksD. Using two different accounting software答案:B...二、简答题(每题10分,共30分)1. Explain the difference between "revenue recognition" and "matching principle".答案:Revenue recognition is the process of recognizing income in the accounting records as it is earned, regardless of when payment is received. The matching principle, on the other hand, is an accounting concept that requires expenses to be recognized in the same accounting period as the revenue they helped generate. This ensures that the financial statements reflect the actual performance of the business fora given period.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what the company owes, and equity represents the residual interest in the assets of the entity after deducting liabilities....三、计算题(每题15分,共30分)1. Given the following information for XYZ Corp., calculate the net income for the year ended December 31, 2023:- Sales revenue: $500,000- Cost of goods sold: $300,000- Operating expenses: $100,000- Depreciation expense: $20,000- Interest expense: $10,000答案:Net Income = Sales Revenue - (Cost of Goods Sold + Operating Expenses + Depreciation Expense + Interest Expense) Net Income = $500,000 - ($300,000 + $100,000 + $20,000 + $10,000)Net Income = $500,000 - $440,000Net Income = $60,0002. If a company purchased a machine for $50,000 and expectsit to have a useful life of 5 years with no residual value, calculate the annual depreciation expense using the straight-line method.答案:Annual Depreciation Expense = (Cost of Asset - Residual Value) / Useful LifeAnnual Depreciation Expense = ($50,000 - $0) / 5Annual Depreciation Expense = $10,000...结束语:希望这份英语会计考试题目及答案对您的学习和复习有所帮助。

一.判断:1.在权责发生制下,收入是按照它在实际发生的期间,而不是实际收取现款的期间登记入账。

()2. All inventories shall be disclosed at historical cost in accounting statement. ( )3. Long-term assets include cash, fixed assets, intangible assets and deferred assets. ( )4.Current liabilities are obligations that don’t need to be paid within one year or the operating cy cle (whichever is longer). ( )5. Total assets will be decreased by the act of borrowing money from a bank. ( )6.当一笔应收账款作为坏账被冲销时,顾客就没有偿还的义务了。

( )7.Receivables and prepayments shall be accounted for according to actual amount(实际发生额). ( )8.The values of all assets are to be recorded at historical costs at the time of acquisition(取得). ()9.The owners of a corporation(股份公司)are termed (称为) creditors.()10.The statement of cash flows reports the entity’s cash receipts and cash payments during the p eriod. ( )二.单项选择题:)1.When an amount is entered on the ( ) side of an account, it is a debit, and the account is said t o be debited.A. leftB. rightC. left or rightD. others2.If a delivery truck costs $12,000 and has an estimated residual value of $2,000 at the end of i ts estimated useful life of five years, the annual depreciation would be( ) under the straight-line method.A.$2,800B.$2,000C.$1,800D.$1,6003.Accelerated methods of depreciation doesn’t include ( )A. the sum-of-the-years’-digits methodB. the production methodC. the declining-balance methodD.A and C4. Profits ( ) the owner’s equity in the business.A. decreaseB. increaseC. don’t changeD. uncertain5. Retained earning is not an ( ); it is an element of ( ).A. asset, assetB. owners’ equity, owners’ equityC. asset, owners’ equityD. owners’ equity, asset6.()是指会计忽略通货膨胀影响,对货币价值变动不作调整。

授课内容

授课内容

江西外语外贸职业学院教案备课纸(4)

授课内容

授课内容

授课内容

授课内容

江西外语外贸职业学院教案备课纸(4)

授课内容

江西外语外贸职业学院教案备课纸(4)

授课内容

授课内容

授课内容

授课内容(2)

授课内容(2)

江西外语外贸职业学院教案备课纸(4)

江西外语外贸职业学院教案备课纸(4)

授课内容(1)

江西外语外贸职业学院教案备课纸(4)

授课内容(3)

江西外语外贸职业学院教案备课纸(4)

授课内容(1)

江西外语外贸职业学院教案备课纸(4)

授课内容(1)

授课内容(2)

江西外语外贸职业学院教案备课纸(4)

授课内容(1)

授课内容(2)

授课内容(3)

授课内容(4)

授课内容(2)

授课内容(1)

授课内容(2)

授课内容(2)

江西外语外贸职业学院教案备课纸(4)

授课内容(2)

江西外语外贸职业学院教案备课纸(4)

授课内容(2)。