会计英语选择题

- 格式:docx

- 大小:31.83 KB

- 文档页数:4

函授点《会计英语》期末试卷姓名------ 专业------ 分数------一、单项选择题(20分)1. Listed below are some characteristics of financial information. (1) True (2) Prudence (3) Completeness (4) CorrectWhich of these characteristics contribute to reliability?A (1), (3) and (4) onlyB (1), (2) and (4) onlyC (1), (2) and (3) onlyD (2), (3) and (4) only2. In preparing its financial statements for the current year, a company’s closing inventory was understated by $300,000. What will be the effect of this error if it re mains uncorrected?A The current ye ar’s profit will be overstated and next year’s profit will be understatedB The current year’s profit will be understated but there will be no effect on nextyear’s profitC The current year’s profit will be understated and next year’s profit will be overstatedD The current year’s profit will be overstated but there will be no effect on next year’s profit.3. In preparing a company’s cash flow statement, which, if any, of the following items could form part of the calculation of cash flow from financing activities? (1) Proceeds of sale of premises (2) Dividends received (3) Issue of sharesA 1 onlyB 2 onlyC 3 onlyD None of them.4. At 31 March 2009 a company had oil in hand to be used for heating costing $8,200 and an unpaid heating oil bill for $3,600. At 31 March 2010 the heating oil inhand was $9,300 and there was an outstanding heating oil bill of $3,200. Payme nts made for heating oil during the year ended 31 March 2010 totalled $34,600.Based on these figures, what amount should appear in the co mpany’s income st atement for heating oil for the year?A $23,900B $36,100C $45,300D $33,1005. In times of inflation In times of rising prices, what effect does the use of the historical cost concept have on a company’s asset values and profit?A. Asset values and profit both undervaluedB. Asset values and profit both overvaluedC. Asset values undervalued and profit overvaluedD. Asset values overvalued and profit undervalued二、将下列报表翻译成中文(每个3分,共60分)1. ABC group the statement of financial position as at 31/Dec/2010 €2. Non-current assets3. Intangible assets4. Property, plant and equipment5. Investment in associates6. Held-for-maturity investment7. Deferred income tax assets8. Current Assets9. Trade and other receivables10. Derivative financial instruments11. Cash and cash equivalents12. Assets of discontinued operation13. Assets in total14. Current Liabilities15. Accrued payroll16. Accrued dividend17. Accrued accounts18. Non-current Liabilities19. Liabilities in total20. Net Assets三、业务题(每个4分,共20分)1) He pays a telephone bill of $800 by cheque2) The credit customer pays the balance on his account3) He returened some faulty goods to his supplier Kamen, which worth $400.4) Bank interest of $70 is received5) A cheque customer returned $400 goods to him for a refund函授点《会计英语》答案一、单项选择题1-5 ACDDC二、将下列报表翻译成中文1. 编制单位:ABC 资产负债表时间:2010年12月31日单位:欧元2. 非流动资产 3. 无形资产 4. 固定资产 5. 长期股权投资 6. 持有至到期投资7. 递延所得税资产 8. 流动资产 9. 应收账款及其他应收款 10. 货币资金 11. 非持续性经营资产 12. 资产总计 13. 负债 14. 流动负债15. 应付职工薪酬 16. 应付股利 17. 应付账款 18. 非流动负债 19. 负债总计 20. 净资产三.业务题1) Dr administrative Cr bank2) Dr bank Cr accounts receivable3) Dr bank Cr finished goods4) Dr bank Cr financial expense5) Dr sales revenue Cr bank。

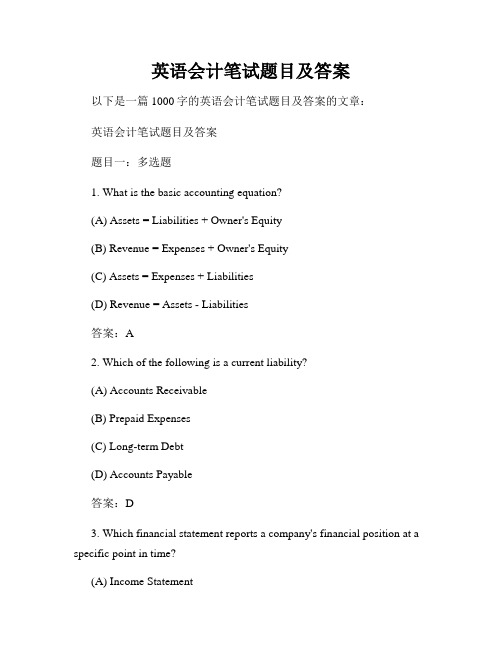

英语会计笔试题目及答案以下是一篇1000字的英语会计笔试题目及答案的文章:英语会计笔试题目及答案题目一:多选题1. What is the basic accounting equation?(A) Assets = Liabilities + Owner's Equity(B) Revenue = Expenses + Owner's Equity(C) Assets = Expenses + Liabilities(D) Revenue = Assets - Liabilities答案:A2. Which of the following is a current liability?(A) Accounts Receivable(B) Prepaid Expenses(C) Long-term Debt(D) Accounts Payable答案:D3. Which financial statement reports a company's financial position at a specific point in time?(A) Income Statement(B) Balance Sheet(C) Statement of Cash Flows(D) Statement of Retained Earnings答案:B题目二:判断题1. An increase in assets will result in a decrease in owner's equity.答案:错误2. Depreciation is an example of an operating expense.答案:正确3. The Statement of Cash Flows reports the changes in a company's cash balance over a period of time.答案:正确题目三:填空题1. The formula for calculating net income is ________________.答案:Revenue - Expenses2. The normal balance for liability accounts is ________________.答案:Credit3. The account for accumulating a company's net income or net loss is called ___________________.答案:Retained Earnings题目四:简答题1. What is the purpose of the double-entry accounting system?答案:The purpose of the double-entry accounting system is to ensure that every transaction is recorded with equal debits and credits, thus maintaining the balance of the accounting equation. It helps in accurate recording, summarizing, and reporting of financial transactions.2. Explain the accrual basis of accounting.答案:The accrual basis of accounting recognizes revenues when they are earned and expenses when they are incurred, regardless of when cash is exchanged. It provides a more accurate representation of a company's financial position and performance, as it matches revenues with the expenses incurred to generate them.3. What is the role of the trial balance in the accounting process?答案:The trial balance is a list of all the general ledger accounts and their balances. Its role is to ensure that the total debits equal the total credits, which helps in identifying any errors in the recording or posting of transactions. It acts as a preliminary step before preparing financial statements.总结:本篇文章主要介绍了英语会计笔试题目及答案。

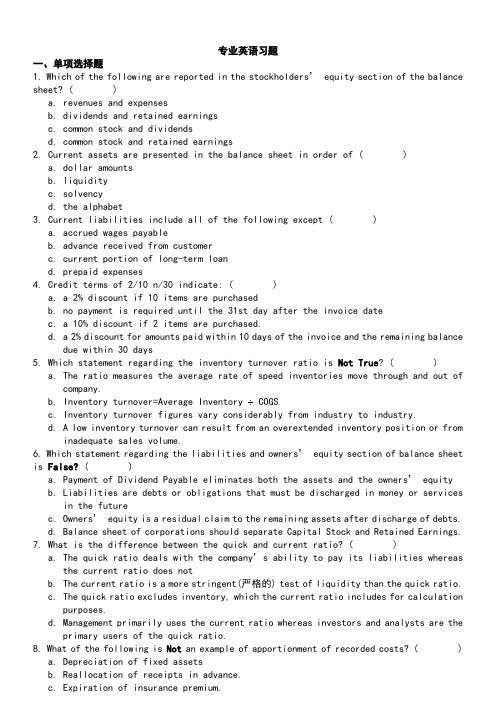

专业英语习题一、单项选择题1. Which of the following are reported in the stockholders’ equity section of the balance sheet? ( )a.revenues and expensesb.dividends and retained earningsmon stock and dividendsmon stock and retained earnings2. Current assets are presented in the balance sheet in order of ( )a.dollar amountsb.liquidityc.solvencyd.the alphabet3. Current liabilities include all of the following except ( )a.accrued wages payableb.advance received from customerc.current portion of long-term loand.prepaid expenses4. Credit terms of 2/10 n/30 indicate: ( )a. a 2% discount if 10 items are purchasedb.no payment is required until the 31st day after the invoice datec. a 10% discount if 2 items are purchased.d. a 2% discount for amounts paid within 10 days of the invoice and the remaining balancedue within 30 days5. Which statement regarding the inventory turnover ratio is Not True? ( )a.The ratio measures the average rate of speed inventories move through and out ofcompany.b.Inventory turnover=Average Inventory COGSc.Inventory turnover figures vary considerably from industry to industry.d. A low inventory turnover can result from an overextended inventory position or frominadequate sales volume.6. Which statement regarding the liabilities and owners’ equity section of balance sheetis False? ( )a.Payment of Dividend Payable eliminates both the assets and the owners’ equityb.Liabilities are debts or obligations that must be discharged in money or servicesin the futurec.Owners’ equity is a residual claim to the remaining assets after discharge of debts.d.Balance sheet of corporations should separate Capital Stock and Retained Earnings.7. What is the difference between the quick and current ratio? ( )a.The quick ratio deals with the company’s ability to pay its liabilities whereasthe current ratio does notb.The current ratio is a more stringent(严格的) test of liquidity than the quick ratio.c.The quick ratio excludes inventory, which the current ratio includes for calculationpurposes.d.Management primarily uses the current ratio whereas investors and analysts are theprimary users of the quick ratio.8. What of the following is Not an example of apportionment of recorded costs? ( )a.Depreciation of fixed assetsb.Reallocation of receipts in advance.c.Expiration of insurance premium.d.Consume of supplies.9. For its most recent year, a corporation had beginning and ending accounts receivable balances of $50,000 and $60,000, respectively. The year's sales on account were $800,000. What was the amount of cash received from customers during the year? ( )a.$790,000b.$820,000c.$810,000d.$800,00010. Sales revenue $200,000, beginning inventory $30,000, inventory purchased $100,000 and inventory sold $90,000. It is true that ( )a.goods available for sale (GAFS) equals $200,000b.gross profit equals $110,000c.ending inventory equals $30,000d.cost of goods sold (COGS) equals $40,00011. Users of financial information may be classified as internal or external. Which following statement is true regarding financial information users? ( )a.External users evaluate the performance of a company's management using managementaccounting reports.b.Financial accounting provides information to managers and external users, such aspotential investors.c.Many laws require managerial accounting reports be reported to various levels ofthe government.d.Management accounting provides information to managers and external users, such aspotential investors.12. What does the term ‘net realizable value’ mean regarding Accounts Receivable? ( ) realizable value is the balance in the Accounts Receivable account as of a givendate. realizable value is what a company’s Accounts Receivable accounts will bringif they are sold to a third party.c.Accounts Receivable less Allowance for Uncollectible Accounts will equal the netrealizable value of Accounts Receivable realizable value is the balance in the Allowance for Uncollectible Accounts asof a given date.13. Which of the following statements about a trail balance is incorrect? ( )a.It’s primary purpose is to prove the mathematical equality of debits and creditsafter postingb.It uncovers certain errors in the journalizing and postingc.It is useful in the preparation of financial statementsd.It proves that all transactions have been recorded.14. In the closing process all of the revenues and expenses account balances are transferred to the ( )a.capital accountb.income summary accountc.retained earnings accountd.dividends account15. The post-closing trial balance consists only of ( )a.Asset and liability accountsb.temporary accountsc.revenue and expense accountsd.permanent accounts16. Which of the following statements is True? ( D )a.The credit side of an account implies something favorable.b.For a given account, total debits must always equal total credits.c.Transactions are initially recorded in a ledger accountd.Journalizing means entering the economic effect of each transaction in a journalin chronological order under the double-entry system.17. Financial statements can be prepared from ( B )a.the trial balanceb.the adjusted trial balancec.the journald.the ledger18. Which of the following statements is False? ( A )a.After a bank reconciliation has been completed, the company must make journal entriesto adjust for all outstanding checks.b. A bank reconciliation for the moth of September will begin with “balance per book”and “balance per bank statement” at September 30.c. A check that is outstanding for two consecutive months should be included in bothmonths’ bank reconciliations.d. A credit memorandum on a bank statement indicates an addition to the bank balance.19. Voucher Register is ( B )a. A record of vouchers that have been paidb.The journal that contains a record of each approved voucherc. A list of debtsd. A document that authorizes payment.20. Estimated bad debts as presented on the income statement is ( C )a.Allowance for uncollectible accountsb.Creditc.Uncollectible accounts expensed.Revenue21. The GAAP assets that an item should be included in a financial statement if its omissionor misstatement would tend to mislead the users of financial statements is known as ( C )a.the cost-benefit criterionb.the going concern conventionc.the materiality conventiond.reliability22. Accounts receivable, notes receivable, and interest receivable are all classified as__________ on the balance sheet. ( A )a.assetsb.liabilitiesc.owners' equityd.receivables23. Which book or document is a list of all accounts and their balances? (B)a.the journalb.the trial balancec.the ledgerd.the chart of accounts二、多项选择题1. Three major fields of accounting activity are: ( )a.social accountingb.private accountingc.public accountingernmental accounting2. The three forms of business organizations are: ( )a.Corporationb.Enterprise.c.Single proprietorshipd.Partnership3. Specialized fields of accounting include: ( )a.cost accountingb.tax accountingernmental and not-for-profit accountingd.HR accountinge.international accounting4. The interested users of financial information include: ( )a.Banks and other creditorsb.Managersc.Stockholdersd.Investment advisorsernmental agencies5. Long-term assets can be further classified into: ( )a.long-term investmentsb.fixed assetsc.intangible assets.d.capital stock6. The necessary data for preparing the balance sheet and income statement are accumulated in major categories of ledger accounts including: ( )a.assets accountsb.liabilities accountsc.owners’ equity accountsd.revenues accountse.expenses accounts7. Adjusting entries made to align revenue and expense with the appropriate periods consist of: ( )a.Apportioning recorded cost to periods benefited.b.Apportioning recorded revenue to periods in which it is earnedc.Accruing unrecorded expensesd.Accruing unrecorded revenuee.Merchandise inventory adjustment8. Assume ending inventory is overstated because some inventory is accidentally counted twice. Which of the statements below regarding this situation is true? ( ) income for this accounting period will be overstated.b.COGS for this accounting period will be overstated income in the next accounting period will be understated.d.Ending Retained Earnings in the next accounting period will be correct.9. Which statement below regarding "closing procedures" is correct? ( )a.Closing procedures only apply to temporary accounts.b.Closing the books means to prepare the accounts for next period's transactions.c.The closing process only applies to permanent accounts.d.Eventually closing entries transfer temporary account balances to Retained Earnings.三、判断题1.The normal balance of an account appears on the side for recording increases ( )2.It is customary to include any amounts received from customers but has not yet earnedas revenue in current liability. ( )3.Financial position of an organization can best be determined by referring to the incomestatement. ( )4.Managerial accounting is governed by GAAP. ( )5.Current assets are presented in the order of liquidity or convertibility into cash;while current liabilities are listed in the order that they come due. ( )6.Closing procedures only apply to permanent accounts. ( ) income or net loss in the income statement is reflected in the owners’ equity sectionon the balance sheet at the end of the accounting period. ( )8.Retained earning represents exactly what the term implies: that portion of net incomethe company has retained. ( )9.Business firms whose accounting year ends on December 31 are said to be on acalendar-year basis. ( )10.The income statement subtracts assets from revenues to determine income or loss fora period time. ( )11.Posting transfers journal entries to ledger accounts. ( )12.When interim financial statement are being prepared, usually adjustments are made onlyon the worksheet and will not be recorded in the journal and posted to the ledger account..( )13.In order to permit normal recording of subsequent payments or receipts, it is desirableto make reversing entries at the end of the accounting period. ( )14.The entry to write off a specific uncollectible account has no effect on net realizableAccount Receivable account. ( )15.In the case of corporation, the Income Summary account will be closed to the RetainedEarnings account, which is kept separately from the Capital Stock account. ( )16.COGS =Beginning inventory-Net purchase-Ending inventory ( )17.In order to permit normal recording of subsequent payment or receipts, it is desirableto make reversing entries at the beginning of next accounting period. ( )18.The entry to write off a specific uncollectible account has no effect on net incomeand on total assets. ( )19.The terms debit and credit are used to describe the right-hand and left hand sides ofany “two-column” account. ( )20.Business firms whose accounting year ends on December 31 are said to be on a fiscalyear basis. ( )21.All adjusting entries will affect one balance sheet account and one income statementaccount. ( )22.Expense accounts are closed by debiting each expense account and crediting RetainedEarnings ( )23.Closing entries produce a zero balance in revenue accounts, asset accounts and dividendaccounts. ( )24.The adjusted trial balance contains all of the data needed for preparation of the incomestatement, retained earnings statement and the balance sheet. ( )25.The balance sheet presents a company’s assets, liabilities and stockholders equityat a specific point in time. ( )26.Posting transfers ledger transaction data to journal. ( )27.The presentation of the owners’ equity section is same for three types of businessorganization. ( )四、业务题1.The night manager of Majestic Limousine Service, who had no accounting background, prepared the following balance sheet for the company at February 28, 2001. The dollar amounts were taken directly from the company’s accounting records and are correct. However, the balance sheet contains a number of errors in its headings, format, and the2.An inexperienced accountant for Fowler Company prepared the following income statementPrepare a revised income statement in accordance with generally accepted accounting principles.3.The following accounts show the first six transactions of the Gutierez. Construction Company. Prepare a journal entry (including written explanation) for each transaction.Cash Vehicles4.Louis Dixon, a dentist, begin his own dental practice. The practice was organized asa sole proprietorship. The business transactions during September are listed below. Sept. 1 Dixon opened a bank account in the name of the business by depositing $50,000 cash., which he had saved over a number of years.Sept.10 Purchased a small office building for a total price of $182,400, of which $106,000 was applicable to the land and $76,400 to the building. A cash payment of $36,500 was made and a note payable was issued for the balance of the purchase price. Sept 15 Purchased a microcomputer system from Computer Stores, inc. for $4,680 cash. Sept.19 Purchased office furnishings, at a cost of $5,760. A cash down payment of $960 was made, the balance to be paid in future.Instructionprepare journal entries to record the above transactions. Select the appropriate account titles from the following chart of accounts:cash; office furnishings; notes payable; accounts receivable;land;accounts payable; building; Louis Dixon, Capital; Computer System《专业英语习题》参考答案一、单项选择题1.d2.b3.d4.d5.b6.a7.c8.b9.a 10.b11.b 12.c 13.d 14.b 15.d二、多项选择题1.bcd2.acd3.abcde4.abcde5.abc6.abcde7.abcde8.acd9.abd三、判断题1.T2.T3.F4.F5.T6.F7.T8.T9.T 10.F11.T 12.T 13.F 14. T 15.T 16.F 17.T 18.T 19.T 20.F21.F 22.F 23.F 24.T 25.T 26.F 27.F四、业务题1.2.3. Answer:4. Answers:Sept. 1 Dr. cash 50,000 Cr.Louis Dixon, capital50,000Sept.10 Dr. Land 106,000Building 76,400Cr. Cash36,500Note payable145,900Sept 15 Dr. computer system 4,680Cr. Cash4,680Sept.19 Dr. Office furnishing5,760Cr. Cash960Accounts payable4,80010。

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

会计英语考试题目及答案一、选择题(每题2分,共20分)1. Which of the following is a basic accounting principle?A. The Going Concern PrincipleB. The Historical Cost PrincipleC. Both A and BD. Neither A nor BAnswer: C. Both A and B2. What is the term for the systematic arrangement of accounts in a specific order?A. JournalB. LedgerC. Trial BalanceD. Chart of AccountsAnswer: D. Chart of Accounts3. What does the term "Debit" mean in accounting?A. An increase in assetsB. A decrease in liabilitiesC. An increase in equityD. A decrease in expensesAnswer: A. An increase in assets4. Which of the following is not a type of financialstatement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D. Payroll Report5. What is the purpose of an adjusting entry?A. To update the financial recordsB. To prepare for the next accounting periodC. To correct errors in the accounting recordsD. All of the aboveAnswer: D. All of the above6. Which of the following is an example of a current asset?A. InventoryB. LandC. EquipmentD. Bonds PayableAnswer: A. Inventory7. What is the formula for calculating the return on investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Net Income / Investment) * 100D. (Total Assets / Net Income) * 100Answer: C. (Net Income / Investment) * 1008. What is the accounting equation?A. Assets = Liabilities + EquityB. Liabilities - Equity = AssetsC. Assets + Liabilities = EquityD. Equity + Assets = LiabilitiesAnswer: A. Assets = Liabilities + Equity9. What is the purpose of depreciation?A. To reduce the value of an asset over timeB. To increase the value of an asset over timeC. To calculate the cost of an assetD. To determine the net income of a companyAnswer: A. To reduce the value of an asset over time10. Which of the following is not a function of a general ledger?A. To record daily transactionsB. To summarize financial informationC. To provide a detailed account of each transactionD. To prepare financial statementsAnswer: A. To record daily transactions二、简答题(每题5分,共30分)1. Explain the difference between an asset and a liability. Answer: An asset is a resource owned by a business that hasfuture economic benefit, such as cash, inventory, or property.A liability is an obligation or debt that a business owes to others, such as loans, accounts payable, or salaries payable.2. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specificpoint in time, showing the company's assets, liabilities, and equity.3. Define the term "revenue."Answer: Revenue is the income generated from the normal business operations of a company, such as the sale of goodsor services.4. What is the difference between a journal and a ledger?Answer: A journal is a book that records financialtransactions in chronological order, while a ledger is a book that summarizes and organizes the financial transactions by accounts.5. Explain the concept of accrual accounting.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.6. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to ensure that the total debits equal the total credits in the general ledger, indicating that the accounting records are in balance.三、案例分析题(每题25分,共50分)1. A company purchased equipment for $50,000 on January 1, 2023, with a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: Using the straight-line method, the annual depreciation expense is calculated as follows:Depreciation Expense = (Cost of Equipment - Residual Value) / Useful LifeDepreciation Expense = ($50,000 - $0) / 5 = $10,000 per year2. A company has the following transactions for the month of March 2023:- Sold goods for $20,000 on credit.- Purchased inventory for $15,000 in cash.- Paid $2,000 in salaries.- Received $18,。

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

会计英语综合测试二测试时间为120分钟一、英译汉(请将答案直接写在题后,每小题1分,共20分):二、汉译英(请将答案直接写在题后,每小题1分,共20分): 三、单项选择题(每道题只有一个最准确的答案,请将答案填写在要求的表格内,每小题1分,共15分)1. An estimate based on an analysis of receivables shows that $780 of accounts receivables areuncollectible. The Allowance for Doubtful Accounts has a debit balance of $110. After preparing the adjusting entry at the end of the year, the balance in the Uncollectible Accounts Expense is A. $110 B. $780 C. $670 D. $8902. What is the type of account and normal balance of Allowance for Doubtful Accounts? A. Contra asset, credit1. Liquidation2. Goodwill3. Comprehensive income4. Lower-of-cost-or-market method5. Dividend6. Stock splits7. Partnership8. Bond9. Depreciation10. Preferred stock11. Debenture bond 12. Stock dividend 13. Limited liability 14. Sink fund 15. Treasury stock16. Allowance for doubtful account 17. Weighted average cost 18. Stockholders19. Inventory turn over rate 20. Intangible assets11. 毛利率法 12. 剩余价值 13. 余额递减法 14. 实地盘存 15. 或有负债 16. 年金 17. 有价证券 18. 可赎回债券 19. 董事会 20. 面值1. 现值2. 经营租赁3. 先进先出法4. 存货5. 非常项目6. 实收资本7. 流通在外股票8. 资产减值9. 合并财务报表 10. 摊销B. Asset, debitC. Asset, creditD. Contra asset, debit3.The two methods of accounting for uncollectible receivables are the allowance method and theA. equity methodB. direct write-off methodC. interest methodD. cost method4.Merchandise inventory at the end of the year is overstated. Which of the following statementscorrectly states the effect of the error?A. owner's equity is overstatedB. cost of merchandise sold is overstatedC. gross profit is understatedD. net income is understated5.If the estimated rate of gross profit is 40%, what is the estimated cost of the merchandiseinventory on June 30, based on the following data?June 1 Merchandise inventory $ 75,000June 1-30 Purchases (net) 150,000June 1-30 Sales (net) 135,000A. $144,000B. $140,000C. $ 81,000D. $ 54,5006.The inventory data for an item for November areNov. 1. Inventory..... 20 units at $204. Sold............. 10 units10. Purchased.... 30 units at $2117. Sold............. 20 units30. Purchased.... 10 units at $22Using the perpetual system, costing by the last-in, first-out method, what is the cost of the merchandise inventory of 30 units on November 30?A. $640B. $610C. $620D. $6307. A fixed asset with a cost of $40,000 and accumulated depreciation of $36,500 is traded for asimilar asset priced at $60,000. Assuming a trade-in allowance of $3,000, the recognized loss on the trade isA. $1,000B. $3,500C. $ 500D. $1,5008.All of the following below are needed for the calculation of depreciation exceptA. costB. residual valueC. estimated lifeD. book value9.Equipment with a cost of $160,000 has an estimated residual value of $10,000 and an estimatedlife of 5 years or 12,000 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation for the first full year, during which the equipment was used 3,300 hours?A. $30,000B. $32,500C. $34,000D. $40,00010.On June 8, Acme Co. issued an $80,000, 6%, 120-day note payable to Still Co. Assume thatthe fiscal year of Still Co. ends June 30. What is the amount of interest revenue recognized by Still in the following year?A. $1,200.00B. $1,208.89C. $1,306.67D. $1,600.0011.The maturity value of an interest-bearing note payable is theA. face value plus the interestB. face value minus the interestC. interestD. face value12.The journal entry a company uses to record the payment of an ordinary note isA. debit Cash; credit Notes PayableB. debit Accounts Payable; credit CashC. debit Notes Payable and Interest Expense; credit CashD. debit Notes Payable and Interest Receivable; credit Cash13.When a stock dividend is declared, which of the following accounts is credited?A. Common SockB. Dividend PayableC. Stock Dividends DistributableD. Retained Earnings14.The excess of sales price of treasury stock over its cost should be credited toA. Treasury Stock ReceivableB. Premium on Capital StockC. Paid-In Capital from Sale of Treasury StockD. Income from Sale of Treasury Stock15.The reduction of par or stated value of stock by issuance of a proportionate number ofadditional shares is termed aA. liquidating dividendB. stock splitC. stock optionD. preferred dividend四、判断题(判断对错,正确请打√,错误请打×,将答案填入试卷第一页表格内,每小题1分,共10分)1.Of the two methods of accounting for uncollectible receivables, the allowance method providesin advance for uncollectible receivables.2.The difference between Accounts Receivable and its contra asset account is called netrealizable value.3.Title to merchandise shipped FOB shipping point passes to the buyer upon delivery of themerchandise to the buyer's place of business.4.During inflationary periods, the use of the FIFO method of costing inventory will result in agreater amount of net income than would result from the use of the LIFO cost method.5.The depreciable cost of a building is the same as its acquisition cost.6.Capital expenditures are costs of acquiring, constructing, adding, or replacing property, plantand equipment.7.The amount of money a borrower receives from the lender is called maturity value.8.The proceeds from discounting a $20,000, 60-day, note payable at 6% is $20,200.9.The declaration and issuance of a stock dividend does not affect the total amount of acorporation's assets, liabilities, or stockholders' equity.10.The main source of paid-in-capital is from issuing stock.五、填空题(请注明题号,将答案写在答题纸上,每空1分,共10分)1.Interest = ( ) * rate* time2.Accounts receivable turnover = ( ) / average accounts receivable3.Inventory turnover = ( )/( )4.Depreciation cost = ( ) - ( )5.Quick ratio = ( )/( )6.Price-earnings ratio = ( )/ ( )六、请根据描述写出正确的专业词汇:(请注明题号,将答案写在答题纸上,每小题1分,共5分)1.The operating expense incurred because of the failure to collect receivables.2.The inventory cost estimating method which is based on the relationship of the cost ofmerchandise available for sale to the retail price of the same merchandise.3. A method provides for the same amount of depreciation expense for each unit produced or eachunit of capacity used by the asset.4.The cost of acquiring fixed assets that benefit only the current period or costs incurred fornormal maintenance and repairs.5. A cash distribution of earnings by a corporation to its shareholders.七、业务题:(每个分录2分,共20分)Ditzler Company uses the allowance method of accounting for uncollectible accounts receivable. Selected transactions are as follows:1.Feb. 1, sold merchandise on account to Ames Co., $8,000. The cost of the merchandise sold was$4,500.2.Apr. 9, wrote off a $2,500 account from Dorset Co., as uncollectible.3.June 13, reinstated the account of Dorset Co., written off on April 9, and received $2,500 in fullpayment.4.Aug. 1, issued a 90-day, 12% note for $1,000 to Murray Co., for the overdue account.5.Oct. 30, the note issued to Murray Co. matured.6.Nov. 1, issued 2,000 shares of $50 par preferred stock for cash at $55.7.Nov. 16, declared a cash dividend of $1 on the 10,000 shares of common stock.8.Dec. 31, it is estimated that 2% of the balance of accounts receivable for the year ended Dec.31will be uncollectible. Before adjustment, the “allowance for doubtful accounts”has a credit balance of $200, and the accounts receivable account has a debit balance of $20,000.。

1华南农业大学期末考试试卷(B卷)考试类型:(闭卷)考试时间:120分钟学号姓名年级专业一、单选题(请将每小题的答案填在下面的答题栏中,每小题1分,共15分)1. The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2.DTK Company has a $3500 accounts rec eivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on Januar y 20 by DTK Company to rec ord this transaction inc ludes: DA. A debit to the c ash rec eivable acc ount of $2100.B. A c redit to the acc ounts rec eivable account of $2100.C. A debit to the c ash account of $1400.D. A debit to the accounts rec eivable acc ount of $1400.3. In general terms, financ ial assets appear in the balanc e sheet at: AA.Fac e value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Eac h of the follow ing measures strengthens internal control over c ash receipts exce pt: DA.The use of a vouc her system.B.Preparation of a daily listing of all c hecks rec eived through the mail.C.The deposit of c ash rec eipts intact in the bank on a daily basis.D.The use of c ash registers.5. Whic h of the follow ing items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventory6.Why do companies prefer the LIFO inventory后进先出法method during a period of rising pric es?BA.Higher reported inc omeB.Low er inc ome taxesC.Low er reported inc omeD.Higher ending inventory7. Whic h of the follow ing c harac teristics w ould pre vent an item from being inc luded in thec lassific ation of plant and equipment? DA.IntangibleB.Unlimited lifeC.Be ing sold in its useful lifeD.Not c apable of rendering benefits to the business in the future.8. Whic h account is not a c ontra-asset account? BA.Deprec iation ExpenseB.Accumulated DepletionC.Accumulated Deprec iationD.Allowanc e for Doubtful Acc ounts9.What are the tw o factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agenc y and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agenc y.D.Double taxation and mutual agency10.Whic h of the follow ing types of business owners do not take an ac tive role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a public ly ow ned corporation11. Analysts c an use the footnotes to the financ ial statements to DA.Help their analysis of financ ial statementsB.Help their understanding of financ ial statementsC.Help their chec king of financ ial statements.D.All of the above12. The current liabilit ies are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA. 0.125B. 0.208C. 0.333D. 3.013. The horizontal analysis is used mainly to AA.Analyzing financ ial trendsB.Evaluating financ ial struc tureC.Assessing the pat performanc esD.Measuring the term-paying ability14.Among the follow ing ratios, w hic h is used for long-term solvenc y analysis?长期偿债能力分析AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating c yc leD.Book value per share15.A profit-making business that is a separate legal entity and in w hic h ownership is divided into shares of stoc k is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司二、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transac tions into acc ounting journal items. It can c onsist of several items, eac h of w hic h is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanc ed". Journal entries c an rec ord unique items or rec urring items such as deprec iation or bond amortization.(2) Going c onc ern:持续经营The company w ill continue to operate in the near future, unless substantia l evidenc e to the c ontrary exists.(3) Matc hing princ iple:一致性原则(4) Working c apital:营运资金(5) Revenue expenditure:收入费用三、会计业务(共35分)1. On Dec ember 1, ME Company borrow ed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to rec ord obtaining the lo an from the bank on Dec ember 1.(2)Prepare the adjusting journal entry to rec ord accrual of the interest payable on the loan onDec ember 31.(3)Prepare the presentation of the liability to the bank on ME’s Dec ember balanc e sheet.Answer:(1)Debit: c ash $250000Credit: c urrent liabilities $250000(2)Debit: Acc rual Expense $5000 不确定Credit: Interest Payable $5000(3) P392.The follow ing information relating to the bank chec king account is available for Music Ha ll at July 31:Ba lanc e per bank statement at July 31$20 0000Ba lanc e per depositor’s rec ords18 860 Outstanding c hecks 2 000Deposits in transit 800Servic e c harge by bank 60Prepare a bank rec onc iliat ion银行对账工作fro Music Ha ll at July 31.Answer:P423. Please prepare the related entries according to the follow ing acc ounting events.1) Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollec ted at December 31. The c redit manager estimates that $12,000 of these sales w ill be unc ollectible. Please prepare the adjusting entry to rec ord the estimated unc ollectible.2) On Marc h 1, 2003 the manager of financ e of Hea ly Furniture authorizes a write-off of the $500 balanc e owed by Nic k Company. Please make the entry to rec ord the write-off.3) On July 1, Nic k Company paid the $500 amount that had been written off on March 1. Answer:(1)Debit: Unc ollectible Acc ounts Expense坏账损失$12000Credit: Allow anc e for Doubtful Acc ounts坏账准备$12000(2)Debit: Allow anc e for Doubtful Accounts $500Credit: Acc ounts Rec eivable $500(3)Debit: Acc ounts Rec eivable $500Credit: Allow anc e for Doubtful Acc ounts $500Debit: Cash $500Credit: Acc ounts Rec eivable $500四、英译汉(40分)(1) Accounting princ iples are not like physic al laws; they do not exist in nature, aw aiting disc overy man. Rather, they are developed by man, in light of w hat we consider to be the most imp ortant objectives of financ ial reporting. In many w ays generally accepted accounting princ iples are similar to the rules established for an organized sport suc h as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

中级财务会计英选择题判断题考点一:应付票据分类,流动负债,非流动负债,非负债D 1. Liabilities area. any accounts having credit balances after closing entries are made.b. deferred credits that are recognized and measured in conformity with generallyaccepted accounting principles.c. obligations to transfer ownership shares to other entities in the future.d. obligations arising from past transactions and payable in assets or services in thefuture.D 2. Which of the following is a current liability?a. A long-term debt maturing currently, which is to be paid with cash in a sinking fundb. A long-term debt maturing currently, which is to be retired with proceeds from anew debt issuec. A long-term debt maturing currently, which is to be converted into common stockd. None of theseA 3. Which of the following is true about accounts payable?1. Accounts payable should not be reported at their present value.2. When accounts payable are recorded at the net amount, a PurchaseDiscounts account will be used.3. When accounts payable are recorded at the gross amount, a PurchaseDiscounts Lost account will be used.a. 1b. 2c. 3d. Both 2 and 3 are true.A 4. Among the short-term obligations of Lance Company as of December 31, the balancesheet date, are notes payable totaling $250,000 with the Madison National Bank.These are 90-day notes, renewable for another 90-day period. These notes should be classified on the balance sheet of Lance Company asa. current liabilities.b. deferred charges.c. long-term liabilities.d. intermediate debt.B 5. Which of the following is not true about the discount on short-term notes payable?a. The Discount on Notes Payable account has a debit balance.b. The Discount on Notes Payable account should be reported as an asset on thebalance sheet.c. When there is a discount on a note payable, the effective interest rate is higher thanthe stated discount rate.d. All of these are true.D 8. Which of the following should not be included in the current liabilities section of thebalance sheet?a. Trade notes payableb. Short-term zero-interest-bearing notes payablec. The discount on short-term notes payabled. All of these are includedC 9. Which of the following is a current liability?a. Preferred dividends in arrearsb. A dividend payable in the form of additional shares of stockc. A cash dividend payable to preferred stockholdersd. All of these11. Of the following items, the only one which should not be classified as a current liability isa. current maturities of long-term debt.b. sales taxes payable.c. short-term obligations expected to be refinanced.d. unearned revenues.D 12. An account which would be classified as a current liability isa. dividends payable in the company's stock.b. accounts payable—debit balances.c. losses expected to be incurred within the next twelve months in excess of thecompany's insurance coverage.d. none of these.D 13. Which of the following may be a current liability?a. Withheld Income Taxesb. Deposits Received from Customersc. Deferred Revenued. All of theseC 14. Which of the following items is a current liability?a. Bonds (for which there is an adequate sinking fund properly classified as a long-terminvestment) due in three months.b. Bonds due in three years.c. Bonds (for which there is an adequate appropriation of retained earnings) due ineleven months.d. Bonds to be refunded when due in eight months, there being no doubt about themarketability of the refunding issue.D 15. Which of the following statements is false?a. A company may exclude a short-term obligation from current liabilities if the firmintends to refinance the obligation on a long-term basis and demonstrates an abilityto complete the refinancing.b. Cash dividends should be recorded as a liability when they are declared by the boardof directors.c. Under the cash basis method, warranty costs are charged to expense as they are paid.d. FICA taxes withheld from employees' payroll checks should never be recorded as aliability since the employer will eventually remit the amounts withheld to theappropriate taxing authority.考点二:实际利息法下溢价和折价对摊销的影响是增加还是减少B 6. Stone, Inc. issued bonds with a maturity amount of $200,000 and a maturity ten yearsfrom date of issue. If the bonds were issued at a premium, this indicates thata. the effective yield or market rate of interest exceeded the stated (nominal) rate.b. the nominal rate of interest exceeded the market rate.c. the market and nominal rates coincided.d. no necessary relationship exists between the two rates.A 7. If bonds are initially sold at a discount and the straight-line method of amortization isused, interest expense in the earlier years willa. exceed what it would have been had the effective interest method of amortizationbeen used.b. be less than what it would have been had the effective interest method ofamortization been used.c. be the same as what it would have been had the effective interest method ofamortization been used.d. be less than the stated (nominal) rate of interest.D 8. Under the effective interest method of bond discount or premium amortization, theperiodic interest expense is equal toa. the stated (nominal) rate of interest multiplied by the face value of the bonds.b. the market rate of interest multiplied by the face value of the bonds.c. the stated rate multiplied by the beginning-of-period carrying amount of the bonds.d. the market rate multiplied by the beginning-of-period carrying amount of the bonds.D 9. When the effective interest method is used to amortize bond premium or discount, theperiodic amortization willa. increase if the bonds were issued at a discount.b. decrease if the bonds were issued at a premium.c. increase if the bonds were issued at a premium.d. increase if the bonds were issued at either a discount or a premium.考点三:普通股的优先权体现在什么地方B 2. The pre-emptive right of a common stockholder is the right toa. share proportionately in corporate assets upon liquidation.b. share proportionately in any new issues of stock of the same class.c. receive cash dividends before they are distributed to preferred stockholders.d. exclude preferred stockholders from voting rights.A 3. The pre-emptive right enables a stockholder toa. share proportionately in any new issues of stock of the same class.b. receive cash dividends before other classes of stock without the pre-emptive right.c. sell capital stock back to the corporation at the option of the stockholder.d. receive the same amount of dividends on a percentage basis as the preferredstockholders.考点四:投资证券的利得如何列示考点五:库存股份的出售利得如何列示C 10. When treasury stock is purchased for more than the par value of the stock and the costmethod is used to account for treasury stock, what account(s) should be debited?a. Treasury stock for the par value and paid-in capital in excess of par for the excess ofthe purchase price over the par value.b. Paid-in capital in excess of par for the purchase price.c. Treasury stock for the purchase price.d. Treasury stock for the par value and retained earnings for the excess of the purchaseprice over the par value.A 11. “Gains" on sales of treasury stock (using the cost method) should be credited toa. paid-in capital from treasury stock.b. capital stock.c. retained earnings.d. other income.B 13. How should a "gain" from the sale of treasury stock be reflected when usingthe cost method of recording treasury stock transactions?a. As ordinary earnings shown on the income statement.b. As paid-in capital from treasury stock transactions.c. As an increase in the amount shown for common stock.d. As an extraordinary item shown on the income statement.考点六:小额股份股票A 29. The issuer of a 5% common stock dividend to common stockholders preferably shouldtransfer from retained earnings to contributed capital an amount equal to thea. market value of the shares issued.b. book value of the shares issued.c. minimum legal requirements.d. par or stated value of the shares issued.A 30. At the date of declaration of a small common stock dividend, the entry should notincludea. a credit to Common Stock Dividend Payable.b. a credit to Paid-in Capital in Excess of Par.c. a debit to Retained Earnings.d. All of these are acceptable.考点七:持有至到期投资如何分类4. A requirement for a security to be classified as held-to-maturity isa. ability to hold the security to maturity.b. positive intent.c. the security must be a debt security.d. All of these are required.考点八:未实现的利得C 8. Unrealized holding gains or losses which are recognized in income are from securitiesclassified asa. held-to-maturity.b. available-for-sale.c. trading.d. none of these.D 10. An unrealized holding gain on a company's available-for-sale securities should bereflected in the current financial statements asa. an extraordinary item shown as a direct increase to retained earnings.b. a current gain resulting from holding securities.c. a note or parenthetical disclosure only.d. other comprehensive income and included in the equity section of the balancesheet.考点九:长期工程合同会计方法时主要因素考虑哪些B 8. In selecting an accounting method for a newly contracted long-term construction project,the principal factor to be considered should bea. the terms of payment in the contract.b. the degree to which a reliable estimate of the costs to complete and extent ofprogress toward completion is practicable.c. the method commonly used by the contractor to account for other long-termconstruc-tion contracts.d. the inherent nature of the contractor's technical facilities used in construction.考点十:长期工程合同完工百分比法确认毛利C 9. The percentage-of-completion method must be used when certain conditions exist.Which of the following is not one of those necessary conditions?a. Estimates of progress toward completion, revenues, and costs are reasonablydependable.b. The contractor can be expected to perform the contractual obligation.c. The buyer can be expected to satisfy some of the obligations under the contract.d. The contract clearly specifies the enforceable rights of the parties, the considerationto be exchanged, and the manner and terms of settlement.B 10. When work to be done and costs to be incurred on a long-term contract can beestimated dependably, which of the following methods of revenue recognition is preferable?a. Installment-sales methodb. Percentage-of-completion methodc. Completed-contract methodd. None of theseB 12. In accounting for a long-term construction-type contract using thepercentage-of-completion method, the gross profit recognized during the first year would be the estimated total gross profit from the contract, multiplied by the percentage of the costs incurred during the year to thea. total costs incurred to date.b. total estimated cost.c. unbilled portion of the contract price.d. total contract price.考点十一:应税所得零碎所得B 3. Taxable income of a corporationa. differs from accounting income due to differences in intraperiod allocation betweenthe two methods of income determination.b. differs from accounting income due to differences in interperiod allocation andpermanent differences between the two methods of income determination.c. is based on generally accepted accounting principles.d. is reported on the corporation's income statement.C 4. Taxable income of a corporation differs from pretax financial income because ofPermanent TemporaryDifferences Differencesa. No Nob. No Yesc. Yes Yesd. Yes No考点十二:永久性差异D 9. Interperiod income tax allocation procedures are appropriate whena. an extraordinary loss will cause the amount of income tax expense to be less thanthe tax on ordinary net income.b. an extraordinary gain will cause the amount of income tax expense to be greaterthan the tax on ordinary net income.c. differences between net income for tax purposes and financial reporting occurbecause tax laws and financial accounting principles do not concur on the items tobe recognized as revenue and expense.d. differences between net income for tax purposes and financial reporting occurbecause, even though financial accounting principles and tax laws concur on theitem to be recognized as revenues and expenses, they don't concur on the timing ofthe recognition.B 10. Interperiod tax allocation would not be required whena. costs are written off in the year of the expenditure for tax purposes but capitalizedfor accounting purposes.b. statutory (or percentage) depletion exceeds cost depletion for the period.c. different methods of revenue recognition arise for tax purposes and accountingpurposes.d. different depreciable lives are used for machinery for tax and accounting purposes.C 11. Renner Corporation's taxable income differed from its accounting income computedfor this past year. An item that would create a permanent difference in accounting and taxable incomes for Renner would bea. a balance in the Unearned Rent account at year end.b. using accelerated depreciation for tax purposes and straight-line depreciation forbook purposes.c. a fine resulting from violations of OSHA regulations.d. making installment sales during the year.D 12. An example of a permanent difference isa. proceeds from life insurance on officers.b. interest expense on money borrowed to invest in municipal bonds.c. insurance expense for a life insurance policy on officers.d. all of these.考点十三:会计变更政策B 1. Accounting changes are often made and the monetary impact is reflected in the financialstatements of a company even though, in theory, this may be a violation of the accounting concept ofa. materiality.b. consistency.c. conservatism.d. objectivity.B 2. Which of the following is not a change in accounting principle?a. A change from LIFO to FIFO for inventory valuationb. Using a different method of depreciation for new plant assetsc. A change from full-cost to successful efforts in the extractive industryd. A change from completed-contract to percentage-of-completionC 3. An example of a change in accounting principle that should be handled currently is achange from thea. completed-contract method to the percentage-of-completion method for long-termcontracts.b. LIFO method to the FIFO method for inventory valuation.c. sum-of-the-years'-digits method to the straight-line method.d. "full cost" method to another method in the extractive industry.D 4. Pro forma amounts for changes in accounting principle should be shown in the followingsituation:a. change in the estimated useful life of plant assets.b. change from the cash basis of accounting to the accrual basis of accounting.c. change in revenue recognition from completed-contract topercentage-of-completion method.d. change in inventory valuation from average cost to FIFO.考点十四:折旧方法变更,折旧如何计提D 5. Which of the following disclosures is not required for a change fromsum-of-the-years-digits to straight-line?a. The cumulative effect on prior years, net of tax, in the current income statementb. The justification for the changec. Pro forma data on income and earnings per shared. All of these are required.D 6. A company changes from straight-line to an accelerated method of calculatingdepreciation which will be similar to the method used for tax purposes. The entry to record this change should include aa. debit to Accumulated Depreciation.b. credit to Cumulative Effect of Change in Accounting in the amount of the differenceon prior years.c. credit to Deferred Tax Asset.d. debit to Deferred Tax Liability.。

1、w h i c h i s t h e f o l l o w i n g s t a t e m e n t s i s f a l s e?①A. the partnership form of business organization protects the personal assents of the owners form creditor of the business②A. Increases in assets and Increases in revenues are recorded witha debit③ ledger is a chronological listing of all transactions④2、The primary objective of financial reporting is...C. To provide information useful for investment and lending decisions3、 The principle or concept that holds an entity will remain in operation for the foreeable future is the ...A. Goning-concern concept4、which is the following statements is true ?B. Assets are economic resources that are expect to benefit future periods5、Aftin services on account . When Aftin collects the account receivable ...B. Assets do not change6、which is the following transaction would not affect owner's equity?A. Payment of an account payable7、An income statement reports...D. The difference between revenues and expense during the period8、If assents increase $80000 during the period and owners’ equity decreases $16000during the period , liabilities must have ...B . increased $960009、if net income was $1500 and there no withdrawals, how much did the owner in vest?A . $450010、The amount of net income shown on the income statement also appears on...C. Statement of owners’ equity11、which of these is an example of an asset account?C. Supplies12、Traylor company paid $2850 on account. The effect of this transaction accounting equation is to..assets and decrease liabilities13、note payable has a normal beginning balance of $30000. During the period,new borrowing total $63000 and the balance in note payable is $41000. Determine the on loans during the period...B.$520014、which of these accounts has a normal debit balance?A andB have a normal debit balance15、The journal entry to record the collection of $890 form a customer on account is..B. cash 890Accounts receivable 89018、the ending cash account balance is $57600. During the period,cash receipts equal$ the cash payments during the period total $135100,then the beginning cash amount must have ...A. $68400【+57600】19、Use the following selected information for the Alecia Company the correct cresit column total for a trial balance..C.$26500020、which of these statements is correct?D. Both B and C are correct21、When should revenue be recorded under the accrual-basis and cash-basis of...D. accrual-basis(when the service is performed) cash-basis (when received)22、During 20*4,Bustamante Co,incurred salary expense of $240000,beginning and ending salary Payable was $4000 and $8000, 20*4,bustamante paid salaries of ..C. $23600020、During 20*4,Bustamante received $600000 for service has not received $30000 for services already performed in 20* also invested $20000 into the should report service revenue for 20*4 of ...D. $63000021、Recording an expense when it is paid instead of when incurred isa violation of ..A. The matching principle22、On july31,$3600 is paid for a one-year insurance policy. On December31, the adjusting entry for prepaid insurance would include....C. a debit to Insurance Expense,$150023、Failure to record an adjusting entry for an accrued expense,will result in the following ...B. Liabilities-understate,net income-overstate24、An adjusting entry could contain all of the following except...B. a credit of cash25、which is the following statements best describes the purpose of internal control?A. To provide assurance that the entire business operates in accordance with management’a plans and policies26、Note and interest collected by the bank for the company,$500 (plus$25 interest ..)A. Add to the book balance27、Deposit in transit,$400...B. Add to the book balance28、Check for which should have been written for $730 was incorrectlyreceiable by the bank as $370...C. deduct from the book balance29、If a bank reconciliation includes an NSF check for $45,the journal entry to this reconciling item would include...A. Credit to cash30、All of the following are controls over cash received in a store except...A . The clerk should have access to the cash register tape to make corrections when ...31、which is the following statements related to receivable..?C. When a notes receivable is not paid at maturity,the principal plus any into should be charged back to the customer’s accounts receivable.32、Refer to Exhibit4-1. Compute days’sales in receivable(365/net sale counts receivable).D. 37days33、The weighted average for the year inventory cost flow method is applicable to the following inventory system?B. Periodic-Yes,perpetual-No.34、The LIFO inventory cost flow method may be applied to which of the following inventory systems ?C. Periodic-Yes,perpetual-Yes.35、The company use a periodic inventory system and the ending inventory consists of 60pnits,20 from each of the last three purchases. Determine the ending inventory assuming costs are assigned on a weighted-average basis...D. $1022.36、A company use a inventory system and made an error at the end of year caused its year I ending inventory to be understated by $ effect does this have on the company’s financial statements?A. Net income is understated;assets are understated.37、The estimate of the cost of the inventory on June 30 would be ..C. $8950038、Which of the following factors would not be considered in the selecting of LIFO as ventory costing method ...?C. Physical flow39、Which of the following methods of inventory valuation is allowable at interim date not at year-end?B. Estimated gross profit rates40、A physical inventory taken on December31,20*2,resulted in an ending inventory $’s gross profit on sales has remained constant at 25% in recent year suspects some inventory may have been taken by a new December31 what is the estimated cost of missing inventory?A. $2500041、Which of the following is not affected by the inventory valuation method user ..?C. Amounts paid to acquire merchandise.42、Under the retail inventory method,freight-in would be include the goods available for sale for which of the following?C. Cost-Yes,Retail-No.43、Charging the cost of ordinary repairs to the machinery and equipment asset account during the current year would..D. Not affect the total liabilities at the end of the current year44、M S CO. Exchanged nonmonetary exchange did not culminate an earning process for either M or paid cash to S in connection with the the extent that the amount of cash exceeds a proportionate share of the carrying amount of the asset surrendered,a realized gain on the exchange should be recognized by... ... If the transaction lacks commercial substance.D. NO-M,NO-S45、Depreciation of a plant asset is the process of ...B. Allocating the cost of the asset to the periods of use46、Which of the following statements is true regarding capitalization of interest?B. The amount of interest cost capitalized during the period should not exceed the interest cost incurred47、ABC is considering acquiring Z following information relates to Z company....B. $450 00048、The Ray Company exchanged its used bottle-capping machine for a new old machine cost $14000,and the new one had a cash price of $ had taken gain or loss should be recorded on the exchange?A. $1500 loss49、Accelerated depreciation methods are used primarily in...A. Income tax returns。